UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 000-41092

| FIREFLY NEUROSCIENCE, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

54-1167364 |

|

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| 1100 Military Road, Kenmore, NY |

14217 |

|

| (Address of principal executive offices) |

(Zip Code) |

| (888) 237-6412 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, par value $0.0001 per share |

AIFF |

Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of March 25, 2025, there were a total of 11,622,952 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FIREFLY NEUROSCIENCE, INC.

Annual Report on Form 10-K

Year Ended December 31, 2024

INTRODUCTORY NOTES

Use of Terms

“2024 Plan” means the Firefly Neuroscience, Inc. 2024 Long-Term Incentive Plan.

“AI” means artificial intelligence.

“Arena” refers to Arena Business Solutions Global SPC II, Ltd, an exempted company limited by shares incorporated under the laws of the Cayman Islands.

“BNA Platform” means Firefly’s FDA-510(k) cleared Brain Network Analytics software platform.

“Board” means the Board of Directors of Firefly.

“Broker Warrants” means the warrants to purchase shares of Common Stock issued to certain brokers as compensation in connection with certain transactions consummated prior to the Merger.

“Bylaws” means the Amended and Restated Bylaws of Firefly Neuroscience, Inc.

“Charter” means the Amended and Restated Certificate of Incorporation of Firefly Neuroscience, Inc.

“Closing Date” means August 12, 2024, the closing date of the Merger.

“Common Stock” means the shares of common stock of Firefly Neuroscience, Inc., par value $0.0001 per share.

“December 2024 Purchase Agreement” means that certain Securities Purchase Agreement, dated as of December 20, 2024, between the Company and Helena.

“EEG” means electroencephalograms.

“Effectiveness Date” means February 6, 2024, the date on which the SEC declared the registration statement on Form S-4 (File No. 333-276649) effective.

“ELOC Purchase Agreement” means that Purchase Agreement, dated as of December 20, 2024, by and between the Company and Arena.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Exchange Ratio” means 0.1040, the ratio in which the shares of WaveDancer Common Stock were converted to shares of Firefly Common Stock.

“FDA” means the U.S. Food and Drug Administration.

“GAAP” means U.S. generally accepted accounting principles.

“Helena” refers to Helena Special Opportunities LLC, an affiliate of Helena Partners Inc., a Cayman-Islands based advisor and investor.

“Merger” means the reverse merger transaction contemplated by the Merger Agreement.

“Merger Agreement” means that certain Agreement and Plan of Merger, dated as of November 15, 2023, as amended by that certain Amendment No. 1 on January 12, 2024, and that certain Amendment No. 2 on June 17, 2024, by and among Firefly Neuroscience, Inc. (formerly known as WaveDancer, Inc.), FFN Merger Sub, Inc. and Firefly Neuroscience 2023, Inc. (formerly known as Firefly Neuroscience, Inc.)

“Nasdaq” means the Nasdaq Capital Market.

“FFN” or “Merger Sub” means FFN Merger Sub, Inc., a Delaware corporation.

“Firefly” means Firefly Neuroscience, Inc., a Delaware corporation (formerly known as WaveDancer, Inc. prior to the consummation of the Merger).

“PIPE Investors” means the investors signatory to the Securities Purchase Agreement in the Private Placement.

“PIPE Shares” means the shares of Common Stock issued and sold in the Private Placement pursuant to the Securities Purchase Agreement.

“Pre-Funded Warrants” means the pre-funded warrants to purchase up to an aggregate of 504,324 shares of Common Stock at an exercise price of $0.0001 per share, issued to the PIPE Investors in the Private Placement.

“Private Firefly” means Firefly Neuroscience, Inc. a company incorporated under the State of Delaware

“Private Placement” means the private placement transaction contemplated by the Securities Purchase Agreement, which closed on August 12, 2024, simultaneously with the closing of the Merger.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Securities Purchase Agreement” means that certain Securities Purchase Agreement to purchase shares of Common Stock, Pre-Funded Warrants and Warrants of Firefly, dated as of July 26, 2024, by and between Firefly and the purchasers named therein.

“Series C Financing” means a series of private placement transactions of Series C Units conducted by Private Firefly between October 17, 2023, and June 30, 2024.

“Series C Preferred Stock” means the shares of Series C Preferred Stock, par value $0.0001 per share, issued to investors to Series C Financing.

“Series C Units” means the shares of Series C Preferred Stock and Series C Warrants issued in connection with the Series C Financing.

“Series C Warrants” means the warrants to purchase shares of Common Stock issued as part of the Series C Units to investors in Series C Financing.

“Series D Warrants” means the warrants to purchase shares of Common Stock issued as compensation to certain consultants of Private Firefly for prior consulting services rendered.

“Warrants” means the warrants to purchase up to an aggregate of 823,530 shares of Common Stock at an exercise price of $0.71 per share, issued to the PIPE investors in the Private Placement.

“Warrant Shares” means, collectively, the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, the Warrants, the Series C Warrants, the Series D Warrants and the Broker Warrants.

“WaveDancer” means WaveDancer, Inc., a Delaware corporation (which was renamed Firefly Neuroscience, Inc. in connection with the Merger).

Note Regarding Trademarks, Trade Names and Service Marks

We use various trademarks, trade names and service marks in our business. For convenience, we may not include the ℠, ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this report are the property of their respective owners.

Note Regarding Industry and Market Data

We are not responsible for the information contained in this report. This report includes industry and market data that we obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on historical market data, and there is no assurance that any of the forecasts or projected amounts will be achieved. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. The market and industry data used in this report involve risks and uncertainties that are subject to change based on various factors, including those discussed in Part II. Item 1A. “Risk Factors”. These and other factors could cause results to differ materially from those expressed in, or implied by, the estimates made by independent parties and by us. Furthermore, we cannot assure you that a third party using different methods to assemble, analyze or compute industry and market data would obtain the same results.

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● |

fluctuation and volatility in market price of our Common Stock due to market and industry factors, as well as general economic, political and market conditions; |

|

| ● | the availability of and our ability to continue to obtain sufficient funding to conduct planned operations and realize potential profits; | |

| ● |

the impact of dilution on our stockholders, including through the issuance of additional equity securities in the future; |

|

| ● |

the impact of our ability to realize the anticipated tax impact of the Merger; |

|

| ● |

the outcome of litigation or other proceedings may become subject to in the future; |

|

| ● |

delisting of our Common Stock from Nasdaq or the failure for an active trading market to develop; |

|

| ● |

the failure of our altered business operations, strategies and focus to result in an improvement for the value of our Common Stock; |

|

| ● |

the availability of and our ability to continue to obtain sufficient funding to conduct planned operations and realize potential profits; |

|

| ● |

our limited operating history; |

|

| ● |

the impact of the complexity of the regulatory landscape on our ability to seek and obtain regulatory approval for its BNA Platform, both within and outside of the U.S.; |

|

| ● |

challenges that we may face with maintaining regulatory approval, if achieved; |

|

| ● |

the impact of the concertation of capital stock ownership with our insiders on stockholders’ ability to influence corporate matters. |

|

| ● |

the impacts of future acquisitions of businesses or products and the potential to fail to realize intended benefits of such acquisition; |

|

| ● |

the potential impact of changes in the legal and regulatory landscape, both within and outside of the U.S.; |

|

| ● |

our dependence on third parties; |

|

| ● |

challenges we may face with respect to our BNA Platform achieving market acceptance; |

|

| ● |

the impact of pricing of our BNA Platform; |

|

| ● | patient and product variability may produce misleading BNA results | |

| ● |

emerging competition and rapidly advancing technology in our industry; |

|

| ● |

our ability to obtain, maintain and protect its trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on its proprietary rights; |

|

| ● |

our ability to maintain adequate cyber security and information systems; |

|

| ● |

our ability to generate sufficient revenue to achieve and sustain profitability; |

|

| ● |

the risk that our significant increased expenses and administrative burdens as a public company could have an adverse effect on our business, financial condition and results of operations; and |

|

| ● |

the other factors set forth in the section of this report in Part II. Item 1A. “Risk Factors”. |

In some cases, you can identify forward-looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Part II. Item 1A. “Risk Factors” and elsewhere in this report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

Summary of Risk Factors

The following is a summary of material risks that could affect our business. This summary may not contain all of our material risks, and it is qualified in its entirety by the more detailed risk factors set forth under Part II. Item 1A. “Risk Factors”.

| ● |

We are in the development stage with minimum revenues and have no operating history in the broad commercialization of medical devices or platforms for consumer use. |

|

| ● |

Our financial statement footnotes and auditors opinion include disclosure regarding the substantial doubt about our ability to continue as a going concern. |

|

| ● |

We may be unable to raise additional capital, which could harm our ability to compete. |

|

| ● |

We are subject to operating risks, including excess or constrained capacity and operational inefficiencies, which could adversely affect our results of operations. |

|

| ● |

If we are not successful in enhancing awareness of our BNA platform, driving adoption across our current target population and expanding the population of eligible patients, our sales, business, financial condition and results of operations will be negatively affected. |

|

| ● |

Our commercial success will depend on the future adoption of the BNA platform into patient work streams in clinics. If we are unable to successfully drive interest in our BNA Platform, our business, financial condition and results of operations would be harmed. |

|

| ● |

We may be unable to compete successfully with competitive technologies, which could harm our sales, business, financial condition and results of operations. |

|

| ● |

Use of our BNA Platform requires appropriate training and inadequate training may lead to negative clinician experiences, which could harm our business, financial condition, and results of operations. |

|

| ● |

We are highly dependent on our senior management team and key personnel, and our business could be harmed if we are unable to attract and retain personnel necessary for our success. |

|

| ● |

We may not be able to achieve or maintain satisfactory pricing and margins for our BNA Platform, which could harm our business and results of operations. |

|

| ● |

Future sales of our BNA Platform may depend on healthcare providers’ or patients’ ability to obtain reimbursement from third-party payors, such as insurance carriers. |

|

| ● |

Complying with regulations enforced by FDA and other regulatory authorities is expensive and time consuming, and failure to comply could result in substantial penalties. |

|

| ● |

We may not receive the necessary authorizations to market our BNA Platform or any future new products, and any failure to timely do so may adversely affect our ability to grow our business. |

|

| ● |

Since our BNA Platform uses cloud-based information systems and the exchange of information between patents and doctors, we will be subject to numerous U.S. federal and state laws and regulations related to the privacy and security of personally identifiable information, including health information. |

|

| ● | The implementation of tariffs on foreign countries may increase operating costs and costs to acquire necessary equipment | |

| ● | The formation of the Department of Government Efficiency ("DOGE") may impact the FDA and other agencies that could have a negative impact on our product development |

|

| ● | The formation of the Department of Government Efficiency ("DOGE") may impact funding our customers rely upon | |

| ● |

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our Common Stock. |

|

| ● |

Our success depends in part on our proprietary technology, and if we are unable to successfully enforce our intellectual property rights, our competitive position may be harmed. |

|

| ● |

We use AI in our business, and challenges with properly managing its use could result in reputational harm, competitive harm, and legal liability, and adversely affect our results of operations. |

|

| ● |

It is not possible to predict the actual number of shares of the Common Stock we will sell under the ELOC Purchase Agreement to Arena, or the actual gross proceeds resulting from those sales. |

|

| ● |

The sale and issuance of our Common Stock to Arena will cause dilution to our existing shareholders, and the sale of Common Stock acquired by Arena or the perception that such sales may occur could cause the price of our Common Stock to fall. |

|

| ● |

Arena will pay less than the then-prevailing market price for the Common Stock, which could cause the price of the Common Stock to decline. |

|

| ● |

Our management team will have broad discretion over the use of the net proceeds from the sales of our Common Stock to Arena, if any, and investors may not agree with how we use the proceeds, and the proceeds may not be invested successfully. |

|

| ● |

Substantial future sales or issuances of the Common Stock or securities convertible into, or exercisable or exchangeable for, the Common Stock, or the perception in the public markets that these sales or issuances may occur, may depress our stock price. Also, future issuances of the Common Stock or rights to purchase Common Stock could result in additional dilution of the percentage ownership of our shareholders and could cause our stock price to fall. |

Overview

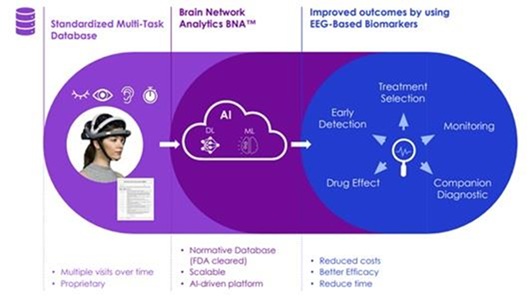

We are an Artificial Intelligence (“AI”) technology company developing innovative neuroscientific solutions with goals to improve brain health outcomes for patients with mental illnesses and neurological disorders. Our FDA-510(k) cleared BNA™, or Brain Network Analytics, is an advanced neurophysiological assessment tool that uses AI and machine learning to analyze EEG data recorded during rest and cognitive activity. It may enhance neurological assessments by providing objective, data-driven insights that allow for the early and longitudinal detection of neurophysiological deviations. These insights into brainwave patterns underlying cognitive function may help in tailoring personalized treatment plans and improving patient outcomes more effectively than traditional EEG analysis.

We have taken a period of 15 years and an investment of more than $60 million, to develop the software, compile the requisite database of brain wave tests, gain patent protection, and receive Federal Drug Administration (“FDA”) clearance to market and sell the BNA Platform. The BNA Platform is a software as a medical solution that was developed using AI through unsupervised machine learning (via clustering analysis) on our extensive proprietary database of standardized, high-definition longitudinal electroencephalograms (“EEG”) of over 18,000 patients representing twelve disorders, as well as clinically healthy normal patients. The AI algorithms underlying the BNA platform play a crucial role throughout the workflow by automating complex computational tasks during the following steps of data analysis: (1) data pre-processing, (2) data segmentation, (3) clustering data, (4) functional modeling of the data and (5) single subject matching and scoring. These algorithms find and measure patterns of brain activity, identify locations and measure intensity over time and lastly compare the data generated to an age-matched normative database. Clustering data further aids in breaking down the dataset by grouping subjects based on EEG outputs and identifying key characteristics of the cluster such as age, gender, alertness or dominant hand.

As of the date of this filing, the BNA Platform has been developed and is in the early stages of a commercial launch. We believe there is potential for such commercialization, both with respect to pharmaceutical companies in their drug research and clinical trial activities, as well as medical practitioners in their clinics. In concert with the commercialization of BNA Platform, we are collaborating with neuroscience drug development companies to support their clinical strategies. We plan to generate revenue through two segments: through the use of BNA Platform by United States health care professionals and through collaborations with pharmaceutical companies in support of neuroscience drug development. The proposed business model for healthcare provider clinics consists of a base service fee for licensing the product and a per use fee based on volume. The proposed business model for pharmaceutical companies will be tailored to each customer based on the volume and costs associated to provide such services. In order to commercially launch to the medical community, the company has hired sales staff, conducted soft launches into a number of strategic accounts and plans to continue marketing efforts to secure new accounts. In the first half of 2025, the company will focus on targeted outreach and client engagement to commercialize the BNA Platform in the clinics segment. Using its database of potential customers and external lead generating services, the company will identify key targets in select markets and connect with them through personalized emails and calls to schedule meetings with decision-makers. The sales team, equipped with marketing materials, case studies, peer-reviewed publications, and knowledge gained from our current research partners, will present the platform’s benefits and practical applications during these meetings. Follow-up efforts, including addressing questions and offering assistance by our Clinical Support Team, will aim to build strong client relationships and drive adoption of the platform.

The clinical utility of EEG technology to support better outcomes for patients with mental illnesses and cognitive disorders has been well documented. Historically, clinical adoption of EEG by medical professionals, including psychiatrists, neurologists, nurse practitioners and general practitioners, has been limited due to the complexity of interpreting EEG recordings and the inability to practically compare a patient’s brain electrophysiology to that of a clinically normal age-matched patient. Firefly believes that without defining a standard deviation to the norm, it is not possible to objectively assess brain electrophysiology. By establishing an objective baseline measurement of brain electrophysiology, the BNA Platform enables clinicians to optimize patient care, leading to improved outcomes for people suffering from mental illnesses and cognitive disorders.

Our value proposition is supported by real-world use of the BNA Platform. Incorporating the BNA Platform as part of a patient management protocol demonstrated improved response rates, enhanced therapy compliance, reduced non-responder rates and a reduction in need for medication switching among patients. Further, we believe that our extensive clinical database, when combined with advanced AI, provides the opportunity to identify clinically relevant biomarkers that will support better patient outcomes through precision medicine and companion diagnostics. We expect to gather additional data through the clinical deployments and clinical studies conducted by drug companies. This additional data should allow us to discover new biomarkers and objectively measure the impact of therapeutic interventions on patients of different types, further enhancing our platform’s effectiveness. We believe that we will be able to enhance accurate diagnosis and predict what therapy or drug, or a combination thereof, is best suited to optimize patient outcomes. This represents a paradigm shift in how clinicians manage patients with mental illnesses and cognitive disorders holding the potential to transform brain health.

Our Strategy

We are dedicated to transforming brain health with the goal of advancing diagnostic and treatment approaches for people suffering from neurodegenerative diseases, disorders, and cognitive impairment and injuries. Firefly’s strategy is to develop state-of-the-art technologies that bridge the gap between neuroscience and clinical practice. Firefly’s next steps to realize this strategy include: Commercially launching the BNA Platform to medical professionals, including neurologists, psychiatrists, nurse practitioners, and general practitioners in the United States. Firefly believes that there are significant clinical, societal, and economic benefits that maybe realized when BNA Platform is used as part of a regular patient management protocol. Firefly aims to realize these benefits by providing medical professionals and their patients with objective, comparative data of brain electrophysiology. Poor outcomes associated with the treatment of disorders often result from the subjective, trial and error approach to patient treatment.

Firefly believes that by providing clinicians with the ability to compare a patient’s brain electrophysiology (as defined by BNA results to its FDA-cleared normative age-matched database will give both the clinician and the patient an objective baseline comparison of their brain electrophysiology that could aid in the diagnosis and optimization of the patient’s treatment pathway. This strategy is supported by the fact that real-world clinical use of the BNA Platform has shown that, when used as part of a patient management protocol, patients showed improved response rates, enhanced therapy compliance, and reduced non-responder rates and a reduction in the need for medication switching.

There is a strong motivation for medical professionals, looking to improve outcomes, to integrate the BNA Platform into their clinics. The BNA Platform could be new recurring revenue stream opportunity for the medical practitioner while providing new patient management strategies. In addition, the adoption of the BNA Platform represents an opportunity to offer a perceived competitive advantage in their market.

Performing research and clinical studies to identify clinically relevant biomarkers that could support diagnosis and possibly identify patients who are most likely to positively respond to a certain drug or treatment. Firefly is continuously improving the BNA Platform by actively analyzing its comprehensive database, which includes clinical and behavioral data, to discover biomarkers that may support diagnosis and optimize patient care pathways. In doing so, Firefly intends to empower the practitioners to apply principles of precision medicine to improve outcomes for people suffering from mental illnesses and cognitive disorders. By utilizing the Company’s ML pipeline to analyze its database, it could be possible to identify patterns (EEG-based biomarkers) that are useful for predicting treatment outcomes (predictive biomarkers), predicting disease progression (prognostic biomarkers) and monitoring treatment effects (monitoring biomarkers). Leveraging such biomarkers could inform patient selection and stratification in clinical trials in a way that could optimize trial design, leading to improved outcomes while reducing the cost and time it takes to obtain approval for the drug.

Partnering with leading drug development companies in the central nervous system (“CNS”) space in support of clinical research and companion diagnostics. Firefly is focused on growing its CNS pharmaceutical company partnerships for drug development. Based on the work Firefly has done with pharmaceutical companies like Novartis, Takeda Pharmaceutical Company Limited, Bright Mind Bioscience and others, Firefly believes that EEG data, processed by the BNA Platform, may be effective in CNS drug development by providing objectively measured brain activations that indicate normal or pathological neuronal processes. The BNA-based EEG data may be used as objective endpoints for pharmacokinetic-pharmacodynamic modelling. Moreover, by measuring electrophysiology commonly associated with cognitive functions, BNA biomarkers may also assist in understanding the drug’s effects in the cognitive domain and identifying adverse cognitive events. By enabling a quantitative and objective measurement of the change in brain electrophysiology following a treatment, drug developers could further optimize dose selection for next phases of development.

Management believes that through integration of the BNA Platform into drug development strategies, CNS pharmaceutical companies may realize significant savings of both cost and time by understanding a drug’s effect better and targeting patients who will respond better to the drug (patient enrichment). Improving patient targeting and effects on patient populations segments could lead to demonstrable improvement in clinical efficacy.

Many new CNS drugs being developed are considered to be high cost, often having annual costs of tens of thousands of dollars. There is considerable resistance from healthcare providers, governments, and Insurers to absorb the high cost of new CNS drugs without knowing who is most likely to benefit from the drug. Firefly believes that biomarkers represent a significant opportunity for drug development companies and practicing medical professionals. For drug development companies, conducting clinical trials with patients who are more likely to respond positively to the drug (patient enrichment) may reduce the clinical trial size required to show positive clinical outcomes (efficacy) and significantly reduce the cost and speed of clinical trials. Furthermore, the ability to show increased efficacy of the drug within a targeted patient group could expedite regulatory approval and provide justification for the cost of the new drug with payors. In concert with Firefly’s commercialization strategy, medical professionals who integrate the BNA Platform into their clinic maybe able to prescribe the drug to their patients who will benefit the most based on the companion diagnostic criteria.

Considering strategic acquisitions. Firefly may consider strategic acquisition opportunities where such transactions may accelerate Firefly’s market positioning through horizontal or vertical integration, expanding capacity, or gaining intellectual property that strengthens its competitive advantage.

Firefly believes that it is in a position to drive the adoption of objective assessment of brain electrophysiology in clinical practice by making the BNA Platform accessible to medical professionals in the United States and other countries around the world. Initial clinical use of the BNA Platform has demonstrated improvements in patient outcomes. Based on this, Firefly believes that the BNA Platform has the potential to deliver benefits within the healthcare system to a broad range of stakeholders - patients, clinicians, and payors.

Our Solution - The BNA Platform

Our Database

The BNA Platform is an FDA 510(k) cleared product and is a direct result of applying data science AI and ML expertise to Firefly’s extensive proprietary database of standardized, high-definition longitudinal EEG recordings of over 18,000 (80,000 BNA assessments) patients spanning 35,000 visits representing twelve disorders, as well as clinically normal patients.

Firefly’s proprietary database will continue to grow with each use of the BNA Platform in the clinical and research settings, which, through its application of AI and ML, allow for insights to continuously evolve and improve with the goal of continually increasing the value proposition of the BNA Platform to clinicians and pharmaceutical company clients. Firefly believes that this virtuous cycle could result in future product development, like biomarkers that can potentially drive the commercial adoption of the BNA Platform to a wider universe of medical professionals, and also enhance its value proposition to drug development companies.

The BNA Platform

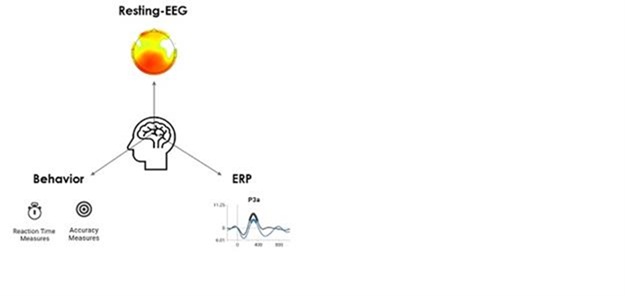

The BNA Platform is intended for the post-hoc statistical analysis of the human electroencephalogram (EEG), utilizing both resting-state EEG and Event-Related Potentials (“ERP”) in a patient’s response to outside stimuli during various states of alertness, disease, diagnostic testing, treatment, surgery, or drug related dysfunction. An ERP is an electrical potential recorded from the nervous system following the presentation of a stimulus (e.g., as part of a cognitive task). An ERP signal consists of typical ERP components - positive or negative voltage spatiotemporal peaks within the ERP waveform that are measured within one second post-stimulus presentation. Each ERP component reflects the activity of brain networks responsible for different cognitive functions.

The system consists of the following components: a computer environment; EEG data input software algorithms for BNA calculations; a report generator and a functionality for data transfer and storage. In the first step EEG data is measured using a dedicated, commercially available, and FDA-cleared EEG system, which complies with the BNA Platform specifications. The BNA Platform processes and analyzes the data using Firefly’s BNA Algorithm (as further described below). Lastly, the results are compiled into individualized reports that provide clinicians with objective insight into brain electrophysiology. Each incremental scan further supports the growth of Firefly’s reference database. The steps are described in further detail below.

Figure 1. Overview of the BNA Platform Process

Measure - EEG Data

The BNA Platform is intended to analyze EEG data recorded at rest (“Resting-EEG”) and during the performance of two conventionally used ERP tasks: the Auditory Oddball (“AOB”) and the Visual Go-No-Go (“VGNG”). The EEG is recorded continuously while the patient is at rest with eyes-closed or performs one of the ERP tasks. The acquisition site is asked to provide reliable samples of artifact-free digital EEG for purposes of analysis. After the recording, the artifact-free EEG data is automatically imported into the BNA™ Platform This is useful to clinicians as the information from the Resting-EEG and ERP tasks are complementary to each other in many ways. The BNA Platform thus empowers clinicians by providing them with a multi-perspective, objective evaluation of the patient’s brain function in one product.

Figure 2. EEG Data Inputs

Analyze - The BNA Algorithm

After the recording, the artifact-free EEG data is imported into the BNA Platform and is automatically analyzed by the algorithm (the “BNA Algorithm”). EEG and ERP data quality is assessed through an automatic calculation of various metrics (e.g., correct response, noisy/flat electrodes, length of clean signal, test-retest reliability), followed by a manual review of major issues detected during the previous process.

The BNA Algorithm detects and quantifies the characteristics of EEG and ERP peaks, and behavioral performance: (AOB task: P50, N100, P200, P3a, P3b; VGNG task: P200, N200, P3a, P3b).

EEG spectral analysis – absolute and relative power in delta, theta, alpha and beta frequency bands, and alpha peak frequency.

| ● |

Absolute power: the average of the raw PSD within the frequency band of interest, calculated per electrode. |

| ● |

Relative power: calculated by dividing the power in each frequency band by the total power of all frequencies, per electrode. |

| ● |

Alpha peak frequency: calculated as the weighted average of the frequency sample points within the alpha band (8-12 Hz), taking the power values as weights, per electrode. |

AOB and VGNG Tasks – Event-Related Potential (ERP) and behavioral performance analysis.

| ● |

Brain Network Analytics (BNA) is used to detect the following ERP components: |

| ● |

VGNG: N200, P200, P3a, P3b |

| ● |

AOB: P50, N100, P200, P3a, P3b |

| ● |

BNA scores represent these ERP components in terms of amplitude (in microvolts) and latency (in milliseconds), and Neural Consistency (1- ERP variability). |

| ● |

Behavioral performance measurements are extracted from the AOB and VGNG tasks, including mean of accuracy, response times (with standard deviation), omission (missed responses to stimuli that required a response) and commission (incorrect responses to stimuli that did not require a response) errors. These behavioral measures complement the ERP measures in assessing cognitive function and are included in the analysis. |

The BNA Algorithm then leverages Firefly’s normative database to extract potentially clinically meaningful clinical information from EEG data.

EEG recordings are high-dimensional and complex. This is the result of the dynamic spatiotemporal nature of the neurophysiological signals. For example, the event-related potential wave measured at first, at a relatively focal location in time and space on the scalp, and then it evolves and propagates in the cortex while its amplitude changes simultaneously.

Traditional methods for EEG and ERP analysis follow waveform morphology over time at selected electrode locations, using either time-domain or frequency-domain tools, while neglecting the spatiotemporal dynamics associated with the electric field at the scalp. Moreover, focusing on a specific electrode or subset of electrodes, the traditional methods ignore the expected variability between patients in terms of where the ERP component appears on the scalp due to natural differences between cortex and scalp anatomy. The aim of the BNA Algorithm is to improve the accuracy of the ERP component detection by considering the spatiotemporal nature of the signal. It achieves this improvement by parceling the EEG activity into major spatiotemporal events - ERP peaks and their surrounding - spatiotemporal parcels.

The key strengths of the BNA Algorithm are:

| 1. |

Adaptive peak detection - the ERP peaks are detected in a more patient-specific way, by incorporating some degree of freedom in both time and space in a way that is proportional to the normal variability in time and space of the ERP peaks. |

| 2. |

Displaying ERP-peak location - due to the adaptive peak detection by the BNA Algorithm, the ERP peak is identified and displayed in the BNA report on a topographical map together with the group ERP-peak position. This adds potentially clinically useful information to the physician. |

| 3. |

Neural-Consistency score - another unique feature of the BNA report is the presentation of the Neural-Consistency score. Since this is a differentiating score, the Company will describe here shortly what this score is and why Firefly believes it is important. |

Since the ERP signal is an average of multiple single-trial ERP signals which can differ largely from each other, assessing the consistency between them may provide complementary functional information to the average measure. As part of the new peak-analysis, the algorithm calculates a new score - ‘Neural Consistency’ based on the similarity of the amplitude activation between single-ERP trials. The score is calculated based on averaging the inter-single trials variability of the ERP-peak and its surrounding points.

Act - Individualized Reports

The results of the data processed by the BNA Algorithm are compiled into individualized easy-to-read reports that provide clinicians with objective insight into brain electrophysiology:

| ● |

ERP Report |

| ● |

Behavioral Report |

| ● |

Summary Report |

| ● |

Resting-EEG Report |

Scores are presented as z-scores based on comparing the patient to an age-matched relevant reference group based on Firefly’s proprietary standardized longitudinal normative database. This presentation expresses the differences between the patient and the reference group. The reports are intended to be used by clinicians to enable the evaluation of the patient’s brain activity during a specific task compared to an age-range matched reference group.

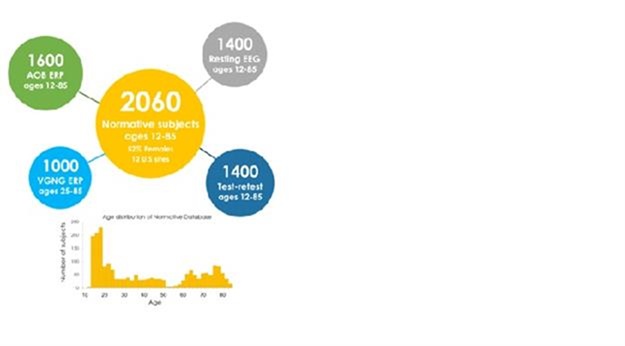

The following diagram breaks down the components of Firefly’s normative database that underpins the BNA Platform:

Figure 4. Components of the BNA Platform normative database.

The BNA Platform is a clinical decision support software tool that assists with the interpretations of Resting-State EEG and ERP results, where EEG- and ERP-based examinations are indicated and carried out by a qualified health care professional.

The core of the BNA Platform is a unique reference dataset to which the individual patient is compared. The reference database contains ERP recordings in response to the Auditory Oddball (AOB) and Visual Go No-Go (VGNG) tasks and Resting-State EEG collected from healthy volunteers. The database also includes demographic data and relevant clinical data (based on patient self-report and medical records, neuro-psychological questionnaires when problems were suspected, urine tests to rule out drug abuse and breath tests to rule out alcohol use) enabling adjudication of brain health status.

The Reference group was generated so that each age-bin contained a sample size of at least 120 eligible cases. For ERP analysis, groups were divided to reflect normality for similar electrophysiology The Reference-Group Database for the AOB and VGNG tasks is divided into the following age groups: 25-35, 35-50, 50-65, 65-75, and 75-85 years for VGNG, and 12-14, 14-16, 16-18, 18-25, 25-35, 35-50, 50-65, 65-75, and 75-85 years for AOB.

For the Resting-State EEG, the high volume of samples permitted the creation of reference groups in a higher 0.5-year resolution. Each reference group includes at least 200 individuals selected by their age proximity to the declared age-range of the group. This resulted in 133 reference groups for the ages 12-85 years. Patients are compared to the reference group based on their age proximity to the group.

Wherever the data was normally distributed, the reports present scores as Z-Scores indicating the differences between the patient and the age-matched reference group selected from Firefly’s reference database. A Z-Score is a statistical measure indicating how far a specific value is from the mean of the reference group. A positive or negative Z-Score suggests that a score is bigger or smaller than the mean of the group, respectively.

The 68%, 95%, 99.7% rule specifies the percentage of scores that fall within the ranges of ± 1, ± 2, ± 3, respectively. Figure 24 illustrates this concept. A score outside a range of ± 2 is commonly considered potentially meaningful in the clinic. Only about 5% of the population would have a result outside this range.

Often a score outside the range of ± 2 is considered potentially meaningful in the clinic. The rationale for this is the statistical definition of the central 95% of a distribution as the "normal" range, causing scores to fall outside this range to be considered “extreme” ( (Crawford, 2002); (Curtis, 2016)).

Most of the scores presented in the Behavioral Report showed a skewed distribution within the reference groups. As a conversion into Z-Scores is not appropriate for skewed distributions, the corresponding scores are presented as raw scores and the 25th-percentile limit is marked on the report as a reference value.

Figure 5. The BNA Platform Database

Real-World Evidence for the BNA Platform Clinical Utility

The findings presented in 2023 white paper study “Brain Network Analytics (BNA) in the Psychiatric Practice: Real-Life Data Analysis” by Charlotte Baumeister, Ph.D., with analysis by Offir Laufer, Ph.D., support the potential of the BNA Platform to transform psychiatric care by automating the analysis of EEG data. The comprehensive research involved a cohort of 2,253 patients seeking treatment at a prominent psychiatric and multispecialty clinic in the United States. The study demonstrated that the BNA Platform improved disease management in psychiatric patients suffering from major depressive disorder (MDD), generalized anxiety disorder (“GAD”), and ADHD.

The study has unveiled valuable insights into how the BNA Platform may revolutionize disease management in the field of psychiatry. Key highlights from the research include:

| ● |

Enhanced Treatment Compliance: Patients grappling with depression, who underwent therapy guided by BNA, exhibited a significant 15% increase in their adherence to MDD treatment protocols, encompassing both antidepressant medications and Transcranial Magnetic Stimulation (TMS). |

| ● |

Decreased Medication Alteration Necessity: The study demonstrated a noteworthy reduction of over 50% in the requirement to switch antidepressant medications among the patient population. This emphasizes the potential of the BNA Platform in optimizing medication selection and dosing. |

| ● |

Amplified Improvements in General Functionality: Individuals diagnosed with MDD, GAD, and ADHD experienced more than double the improvement in their overall general functioning when receiving BNA-guided interventions. This suggests that BNA Platform has the potential to comprehensively enhance patients' quality of life and daily functioning. |

| ● |

Elevated Rates of Antidepressant Response: The application of the BNA Platform was associated with a notable 10% increase in antidepressant response rates, signaling its potential to augment the effectiveness of traditional treatment approaches. |

| ● |

Reduction in Non-Responder Rates: Among MDD patients, the study observed a significant 17% decrease in the rate of treatment non-responders, indicating that the BNA Platform holds promise in mitigating treatment resistance and improving positive outcomes. |

The study thus demonstrated that the BNA Platform represents a potentially significant advancement in patient care in a real world setting and addresses some of the challenges associated with EEG utilization by medical professionals.

By automating EEG analysis and providing comprehensive insights into brain electrophysiology, the BNA Platform has the potential to revolutionize disease management, enhance treatment outcomes, and improve the overall well-being of patients with mental illnesses and cognitive disorders. Based on the real-world results highlighted above, Management believes that the societal impact of better outcomes for patients suffering from mental illnesses and cognitive disorders is substantial and the associated cost savings to healthcare systems and payors could be significant. Firefly intends to study the potential health economic benefits associated with the above findings to support rapid adoption of the BNA Platform into standard patient management protocols.

Research and Development

Firefly focuses its research and development efforts on advancing the treatment of patients suffering from mental illnesses and cognitive disorders. These efforts may be enhanced by the relationships that Firefly has developed with neurologists, psychiatrists, neuroscientists, and other experts. Firefly believes the BNA Platform may drive a better standard of care for patients suffering from mental illnesses and cognitive disorders.

Firefly’s research and development activities may encompass basic research and product development. Firefly’s research and development team has biomedical engineering, neuroscience, software development, project management, data science, and AI and ML expertise. Firefly believes the strength and strategic vision of its research and development team will continue to drive Firefly’s leadership position in the category of advancing the understanding of brain electrophysiology in support of better outcome for Firefly’s target patient population leveraging EEG hardware with the BNA Platform.

Firefly’s near-term research and development efforts are focused on continuing to improve the BNA Platform, enhancing the patient and provider experience, and expanding the population of patients that can be assessed with the BNA Platform. Since inception, Firefly’s research and development activities have resulted in significant improvements to the BNA Platform, Firefly’s first clearance and predicate device to the BNA Platform dates back to 2014 when Firefly received Class II medical device 510(k) clearance from FDA for the BNA Analysis System, with indication for use in individuals 14 to 24 years of age. In December 2020, Firefly received Class II medical device 510(k) clearance from the FDA for Firefly’s current product, the BNA Platform, with indication for use in individuals 12 to 85 years of age.

Additionally, Firefly’s near-term development pipeline includes potential enhancements that leverage its normative database, growing the database, advanced data analysis, ML and AI capabilities to enable medical professionals to enhance their clinical assessments, and to enable drug development companies to improve the success of their drug development programs, potentially bringing new drugs to market faster while reducing the cost and risk.

Market Opportunity

The market for the BNA Platform and Firefly’s future products is vast and growing significantly. According to the World Health Organization, in 2019, 1 in every 8 people, or 970 million people around the world were living with a mental disorder, with anxiety and depressive disorders being the most common. The economic burden of people suffering from depression alone in the United States was estimated at $326.2 billion for the year 2020. As our societies age, the number of cases of mental illness and cognitive disorders is projected to increase, along with the associated economic costs. For example, the number of people with dementia is estimated to increase from 57.3 million cases globally in 2019 more than 150 million cases in 2050. Yet, despite the growing need for effective treatment and substantial unmet treatment needs, CNS drug development remains costly, with the cost of developing a new drug typically ranging from $10 to 15 billion per drug, with CNS drugs having the lowest success rate of all other drug categories.

One of our initial areas of commercial focus will be on the sale of the BNA Platform to neurologists in the United States. Based on assumptions regarding the use of the BNA Platform by neurologists in the United States, this market segment potentially represents a total addressable market (TAM) of approximately $800,000,000 based on the following figures (based on the number of neurologists in the United States currently performing EEGs, the number of times such neurologists may perform a BNA analysis and approximate number of working days per year, summarized as follows).

According to data from Definitive Healthcare for 2023, there are 22,115 neurologists in the United States, of which 8,278 are currently performing EEGs. Our business model and TAM assumes that neurologists in the United Sates currently performing EEGs will perform a BNA analysis on average of two times per day over approximately 250 working days per year. Currently, our model assumes that a clinician will be invoiced approximately $200 for each BNA analysis.

Firefly believes that improving outcomes for people suffering from mental illnesses and cognitive disorders requires objective measurement. The clinical benefit of using EEG to understand how a person’s brain is functioning has been studied for decades. However, Firefly believes that, due to the complexity and time required to analyze and interpret EEG recordings, the inability to compare EEG recordings to what is clinically normal, and the inability to track changes over time, the clinical use of EEG has been limited. The BNA Platform holds the potential to transform brain health by allowing integration of EEG testing and analysis into patient care pathways to provide clinicians with an objective tool that may help them diagnosis and assess treatment efficacy, objectively and quickly. In addition, through Firefly’s research and development initiatives, the Company believes that by introducing biomarkers that could diagnose illnesses or disorders, it would assist in identifying what treatment will provide the most benefit for the patient and may drive adoption by clinicians and payors.

Through ongoing research of Firefly’s growing database, using the BNA Platform, Firefly aspires to enter other markets including, executive medical health and wellness for consumers who want to more actively manage their healthcare and lifestyles.

Firefly plans to offer its BNA Platform on a recurring revenue model basis. In addition, Firefly plans to provide EEG recording equipment on a monthly rental or purchase basis or as part of a bundle price. Driving adoption in the specialty of neurology may enable Firefly to reach its full potential. For this reason, Firefly plans to initially adopt a direct selling model that is supported by field based clinical specialists and medical affairs personnel. As adoption progresses, supported by clinical validation, biomarkers and improvements to the BNA Platform, Firefly aims to partner with national distributors that complement Firefly’s target markets, including EEG companies and installed bases of EEG systems in use today by medical professionals.

In concert with the commercialization of the BNA Platform to medical professionals, Firefly plans to actively engage with drug development companies and develop extensive strategic partnerships to support their drug development strategies. As of January 1, 2023, there were 187 trials assessing 141 unique treatments for Alzheimer’s disease. As of January 4, 2023, there were more than 160 pharmaceutical companies developing drugs to treat mental illnesses. In order to take full advantage of the opportunity in the CNS drug development market, Firefly intends to invest in business development resources focused on the CNS drug development sector.

Competition

Firefly’s industry is competitive and has been evolving rapidly with the introduction of new products and technologies as well as the market activities of industry participants. The BNA Platform is indicated for use in individuals 12 to 85 years of age for the post-hoc statistical analysis of the human electroencephalogram, including event-related potentials and Firefly currently markets its device to qualified medical professionals. Firefly competes against other companies that have developed AI-driven platforms, in the target market of neurological disorders.

Firefly believes that the BNA Platform is a paradigm shift on the approach to treating cognitive disorders, mental illnesses, injuries to the brain and degenerative diseases. Firefly’s believes its BNA Platform offers distinct advantages, including its FDA-cleared BNA Algorithm for data analysis, its proprietary extensive normative age matched database underpinning the BNA Platform, and the ability of the BNA Platform to generate individual reports that clinicians may use to optimize patient care. Firefly believes the BNA Platform may become a standard of care tool in addressing the primary unmet needs in mental illness and cognitive disorders today. Firefly also believes that the BNA Platform has a wide range of additional applications, including the ability to leverage data gathered through BNA sessions for additional clinical insight, pharmaceutical drug development and new product development. The longitudinal nature of the data, along with clinical disease context, provides many future development opportunities.

Furthermore, EEG technology, in concert with BNA Platform, represents a scalable, low-cost solution when compared to other imaging technologies that assess brain electrophysiology, such as functional magnetic resonance imaging (fMRI).

Intellectual Property

Firefly’s commercial success depends in part on its ability to obtain and maintain intellectual property protection for the BNA Platform and any future products, to prevent others from infringing, misappropriating, or otherwise violating its intellectual property rights, to defend and enforce its intellectual property rights, and to operate without infringing, misappropriating, or otherwise violating valid and enforceable intellectual property rights of others. Firefly actively seeks to protect intellectual property that it believes is important to its business, which includes patents covering the components of the BNA Platform and the methods used for optimizing the therapy that the BNA Platform delivers. Firefly also seeks patent protection for other processes and inventions that are commercially or strategically important to developing and maximizing the value of its enterprise. Firefly takes steps to build and maintain the integrity of its brand, for example, with trademarks and service marks, and Firefly seeks to protect the confidentiality of trade secrets that may be important to the development of its business. Firefly relies on a strategy that combines the use of patents, trademarks, trade secrets, know-how, and license agreements, as well as other intellectual property laws, employment, confidentiality and invention assignment agreements, and contractual protections, to establish and protect its intellectual property rights.

Patents

Our patents and patent applications assert claims generally related methods and systems. Specifically, there are multiple patent families relating to (i) ERP processing algorithms and the comparison to a reference group and estimation of brain electrophysiology based on the comparison; (ii) prediction of TMS treatment outcome; (iii) method and system for estimating brain concussion; (iv) method and system for managing pain; (v) method for brain stimulation tool configuration. As of December 31, 2023, we owned eight issued U.S. patents, which have expiration dates ranging from November 2028 to November 2037. We own one issued patent in Japan and there are currently patent applications pending in each of Australia, Canada, China, European Union and Israel, which, if issued, are expected to expire in 2037.

The anticipated expiration dates are without taking into account all possible patent term adjustments, extensions, or abandonments, and assuming payment of all appropriate maintenance, renewal, annuity, and other governmental fees. We continue to evaluate our intellectual property portfolio as patents reach end of life to determine the optimal course for continuing to protect our technology. We cannot ensure that patents will issue from any of our pending applications or that, if patents are issued, they will be of sufficient scope or strength to provide meaningful protection for our technology.

We recognize that the ability to obtain patent protection and the degree of such protection depends on a number of factors. The patent positions of medical device companies like ours are generally uncertain and involve complex legal, scientific, and factual questions. The protection afforded by a patent varies on a product-by-product basis, from jurisdiction-to-jurisdiction, and depends upon many factors, including the type of patent, the scope of its coverage, the availability of patent term adjustments and extensions, the availability of legal remedies, and the validity and enforceability of the patent.

In addition, the coverage claimed in a patent application can be significantly narrowed before the patent is issued, and patent claims can be reinterpreted or further altered even after patent issuance. We cannot predict whether the patent applications we are currently pursuing will issue as patents or whether the claims of any issued patents will provide sufficient protection from competitors. A competitor could develop systems, devices, or methods of manufacture or treatment that are not covered by our patents. Accordingly, our ability to stop third parties from commercializing any of our patented inventions, either directly or indirectly, will depend in part on our success in obtaining, maintaining, defending, and enforcing patent claims that adequately cover our inventions.

Our commercial success will also depend, in part, on not infringing, misappropriating, or otherwise violating the intellectual property rights of third parties. Third parties own numerous patents in the U.S. and in jurisdictions outside the U.S. with claims directed to inventions in the fields in which we operate or plan to operate. It is uncertain whether the issuance of any third-party patent would require us to alter our development or commercial strategies, seek licenses, cease certain activities, or participate in US Patent and Trademark Office ("USPTO") proceedings. Moreover, such licenses may not be available on commercially reasonable terms or at all. Our breach of any license agreements or failure to obtain a license necessary to our business may have a material adverse impact on us.

Trademarks

Our trademark portfolio is designed to protect the brands of our BNA Platform and any future products. As of December 31, 2024, we own one trademark registration for “BNA” in the United States and other countries, including Israel, Switzerland, European Union, Canada, and India. The trademark is also registered with World Intellectual Property Organization.

Trade Secrets

We also rely on trade secrets relating to our product and technology, including our data processing algorithms, and we maintain the confidentiality of such proprietary information to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection. We seek to protect our trade secrets and know-how by entering into confidentiality and invention assignment agreements with employees, contractors, consultants, suppliers, customers, and other third parties, who have access to such information. These agreements generally provide that all confidential information concerning our business or financial affairs developed or made known to the individual during the course of the individual’s relationship with us are to be kept confidential and not disclosed to third parties except in specific circumstances.

For more information regarding the risks related to our intellectual property, please see “Risk Factors-Risks Related to Our Intellectual Property.”

Manufacturing

Our BNA Platform is hardware-agnostic and we do not manufacture any compatible hardware.

Employees

As of March 31, 2025, we have thirteen full-time employees and one contractor.

None of Firefly’s employees are represented by a labor union or covered by collective bargaining agreements, and Firefly considers its relationship with its employees to be good.

Government Regulation

Our products (including our BNA Platform) are considered medical devices, and, accordingly, are subject to rigorous regulation by government agencies in the United States and other countries in which we intend to sell our products. These regulations vary from country to country but cover, among other things, the following activities with respect to medical devices:

| ● |

design, development and manufacturing; |

|

| ● |

testing, labeling, content and language of instructions for use and storage; |

|

| ● |

product storage and safety; |

|

| ● |

marketing, sales and distribution; |

|

| ● |

pre-market clearance and approval; |

|

| ● |

record keeping procedures; |

|

| ● |

advertising and promotion; |

|

| ● |

recalls and field safety corrective actions; |

|

| ● |

post-market surveillance; |

|

| ● |

post-market approval studies; and |

|

| ● |

product import and export. |

FDA Regulation

In the U.S., numerous laws and regulations govern the processes by which medical devices are developed, manufactured, brought to market and marketed. These include the Federal Food, Drug, and Cosmetic Act (“FD&C Act”) and its implementing regulations issued by FDA, among others. Unless an exemption applies, each medical device commercially distributed in the United States requires FDA clearance of a 510(k) premarket notification (“510(k) clearance”), granting of a de novo request, or approval of an application for premarket approval (“PMA”). In general, under the FD&C Act, medical devices are classified in one of three classes on the basis of the controls necessary to reasonably assure their safety and effectiveness. A medical device’s classification determines the level of FDA review and approval to which the device is subject before it can be marketed to consumers:

| ● |

Class I devices, the lowest-risk FDA device classification, include devices with the lowest risk to the patient and are those for which safety and effectiveness can be assured by adherence to FDA’s medical device general controls, including labeling, establishment registration, device product listing, adverse event reporting, and, for some products, adherence to good manufacturing practices through FDA’s Quality System Regulations. |

|

| ● |

Class II devices, moderate-risk devices, also require compliance with general controls and in some cases, special controls as deemed necessary by FDA to ensure the safety and effectiveness of the device. These special controls may include performance standards, particular labeling requirements, or post-market surveillance obligations. While most Class I devices are exempt from the 510(k) premarket notification requirement, typically a Class II device also requires pre-market review and 510(k) clearance as well as adherence to the Quality System Regulations/good manufacturing practices for devices. |

|

| ● |

Class III devices, high-risk devices that are often implantable or life-sustaining, also require compliance with the medical device general controls and Quality System Regulations, and generally must be approved by FDA before entering the market through a PMA application. Approved PMAs can include post-approval conditions and post-market surveillance requirements, analogous to some of the special controls that may be imposed on Class II devices. |

Our BNA Platform is a Class II medical device, which was cleared by FDA for commercialization in the U.S. pursuant to the 510(k) notification process for the post-hoc statistical analysis of the human electroencephalogram, including ERP in December 2020. The marketing and distribution of the BNA Platform, is subject to continuing regulation and enforcement by FDA and other government authorities, which includes product listing requirements, medical device reporting regulations. If FDA finds that we have failed to comply with any legal or regulatory requirements, it or other government agencies may institute a wide variety of enforcement actions against us, ranging from Warning Letters to more severe sanctions, including but not limited to financial penalties, withdrawal of 510(k) clearances already granted, and criminal prosecution.

The 510(k) Process

Under the 510(k) process, the applicant must submit to FDA a premarket notification demonstrating that the device is “substantially equivalent” to either a device that was legally marketed prior to May 28, 1976, the date upon which the Medical Device Amendments of 1976 were enacted, and for which a PMA is not required, a device that has been reclassified from Class III to Class II or Class I, or another commercially available device that was cleared through the 510(k) process. To be “substantially equivalent,” the proposed device must have the same intended use as the predicate device, and either have the same technological characteristics as the predicate device or have different technological characteristics and not raise different questions of safety or effectiveness than the predicate device. Clinical data is sometimes required to support substantial equivalence.

After a 510(k) premarket notification is submitted, FDA determines whether to accept it for substantive review. If it lacks necessary information for substantive review, FDA will refuse to accept the 510(k) notification. If it is accepted for filing, FDA begins a substantive review. By statute, FDA is required to complete its review of a 510(k) notification within 90 days of receiving the 510(k) notification. As a practical matter, clearance often takes longer, and clearance is never assured. FDA may require further information, including clinical data, to make a determination regarding substantial equivalence, which may significantly prolong the review process. If FDA agrees that the device is substantially equivalent to a predicate device currently on the market, it will grant 510(k) clearance to commercially market the device.

Post-Market Regulation

After a device is cleared or approved for marketing, numerous and extensive regulatory requirements may continue to apply. These include but are not limited to:

| ● |

annual and updated establishment registration and device listing with FDA; |

|

| ● |

restrictions on sale, distribution, or use of a device; |

|

| ● |

labeling, advertising, promotion, and marketing regulations, which require that promotion is truthful, not misleading, and provide adequate risk disclosures and directions for use and that all claims are substantiated, and also prohibit the promotion of products for unapproved or “off-label” uses (i.e., indications that are inconsistent with or beyond the scope of the applicable FDA approval or clearance) and impose other restrictions on labeling; |

|

| ● |

clearance or approval of product modifications to legally marketed devices that could significantly affect safety or effectiveness or that would constitute a major change in intended use; |

|

| ● |

correction, removal, and recall reporting regulations, and FDA’s recall authority; |

|

| ● |

complying with the federal law and regulations requiring Unique Device Identifiers on devices; and |

|

| ● |

post-market surveillance activities and regulations, which apply when deemed by FDA to be necessary to protect the public health or to provide additional safety and effectiveness data for the device. |

|

| ● |

FDA has broad regulatory compliance and enforcement powers. If FDA determines that we failed to comply with applicable regulatory requirements, it can take a variety of compliance or enforcement actions, which may result in any of the following sanctions: |

|

| ● |

warning letters, untitled letters, fines, injunctions, consent decrees, and civil penalties; |

|

| ● |

recalls, withdrawals, or administrative detention, or seizure of our products; |

|

| ● |

operating restrictions or partial suspension or total shutdown of production; |

|

| ● |

refusing or delaying requests for 510(k) marketing clearance or PMA approvals of new products or modified products; |

|

| ● |

withdrawing 510(k) clearances or PMA approvals that have already been granted; |

|

| ● |

refusal to grant export or import approvals for our products; or |

|

| ● |

criminal prosecution. |

International Regulation

Many countries throughout the world have established regulatory frameworks for marketing and commercialization of medical devices. As a designer and marketer of medical devices, we are obligated to comply with the respective frameworks of these countries to obtain and maintain access to these global markets. The frameworks often define requirements for marketing authorizations which vary by country. Failure to obtain appropriate marketing authorization and to meet all local requirements, including specific quality and safety standards in any country in which we currently market our products, could cause commercial disruption and/or subject us to sanctions and fines. Delays in receipt of, or a failure to receive, such marketing authorizations, or the loss of any previously received authorizations, could have a material adverse effect on our business, financial condition and results of operations.