UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended |

December 31, 2024 |

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from |

to |

|

Commission File No. |

001-41051 |

|

BLACKBOXSTOCKS INC. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

45-3598066 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

5430 LBJ Freeway, Suite 1485, Dallas, Texas |

75240 |

|

(Address of principal executive offices) |

(Zip Code) |

|

Registrant’s telephone number, including area code |

(972) 726-9203 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, par value $0.001 |

BLBX |

The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

|

None |

|

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect a correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates (2,632,689 shares of common stock) as of June 28, 2024 was $7,108,260 (computed by reference to the price at which the common equity was last sold ($2.70) as of the last business day of the registrant’s most recently completed second fiscal quarter). For purposes of the foregoing calculation only, directors, executive officers, and holders of 10% or more of the issuer’s common capital stock have been deemed affiliates.

As of March 20, 2025, 3,602,874 shares of common stock, par value $0.001 per share, were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

|

Page |

||

|

Item 1. |

||

|

Item 1A. |

||

|

Item 1B. |

||

|

Item 1C. |

||

|

Item 2. |

||

|

Item 3. |

||

|

Item 4. |

||

|

Item 5. |

||

|

Item 6. |

||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

Item 7A. |

||

|

Item 8. |

||

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

|

Item 9A. |

||

|

Item 9B. |

||

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

Item 10. |

||

|

Item 11. |

||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

|

Item 14. |

||

|

Item 15. |

||

|

Item 16. |

||

Throughout this Annual Report on Form 10-K (the “Report”), the terms “we,” “us,” “our,” “Blackbox,” “Blackboxstocks,” or the “Company” refers to Blackboxstocks Inc., a Nevada corporation.

“Blackboxstocks,” the Blackboxstocks design logo and the trademark or service marks of Blackboxstocks, Inc. appearing in this Report are the property of Blackboxstocks, Inc. Trade names, trademarks and service marks of other companies that may appear in this report are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this Report.

When used in this Report, the words “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “intend,” and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) regarding events, conditions and financial trends which may affect the Company’s future plans of operations, business strategy, operating results and financial position. Such statements are not guarantees of future performance and are subject to risks and uncertainties described herein and actual results may differ materially from those included within the forward-looking statements. Additional factors are described in the Company’s other public reports and filings with the Securities and Exchange Commission (the “SEC”). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revision of these forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

This Report contains certain estimates and plans related to us and the industry in which we operate, which assume certain events, trends and activities will occur and the projected information based on those assumptions. We do not know that all of our assumptions are accurate. If our assumptions are wrong about any events, trends and activities, then our estimates for future growth for our business may also be wrong. There can be no assurance that any of our estimates as to our business growth will be achieved.

The following discussion and analysis should be read in conjunction with our financial statements and the notes associated with them contained elsewhere in this Report. This discussion should not be construed to imply that the results discussed in this Report will necessarily continue into the future or that any conclusion reached in this Report will necessarily be indicative of actual operating results in the future. The discussion represents only the best assessment of management.

|

Business |

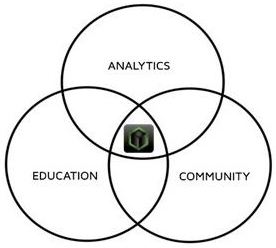

Overview of Business

We have developed a financial technology and social media hybrid platform offering real-time proprietary analytics and news for stock and options traders of all levels combined with a social media element and educational materials. Our web-based platform and native iOS and Android applications (the “Blackbox System”) employ “predictive technology” enhanced by artificial intelligence to find volatility and unusual market activity that may result in the rapid change in the price of a stock or option. We continuously scan the New York Stock Exchange (“NYSE”), NASDAQ, Chicago Board Options Exchange (the “CBOE”) and other options markets, analyzing over 10,000 stocks and over 1,500,000 options contracts multiple times per second. We provide our subscribing members with a fully interactive audio and text based social media platform that is integrated into our dashboard, enabling our members to exchange information and ideas quickly and efficiently through a common network. We believe that the Blackbox System is a disruptive financial technology platform that uniquely integrates proprietary analytics with a community supported by a broadcast enabled social media system which connects traders of all kinds worldwide on an intuitive and user-friendly platform.

Our goal is to provide retail investors with the type of sophisticated trading tools that were previously available only to large institutional hedge funds and high-frequency traders together with an interactive community of traders and investors of all levels at an affordable price. We also strive to provide these trading tools in a user-friendly format that does not require complicated configurations by the user.

We employ a subscription-based Software as a Service (“SaaS”) business model and maintain a growing base of members that spans over 40 countries. We currently offer monthly subscriptions to our platform for $99 per month and annual subscriptions for $959 per year.

Our Mission

Our mission is to provide powerful proprietary analytics in a simple and concise format to level the playing field for the average retail investor. We strive to educate our members through our live trading community as well as our scheduled, calendared classes with live instructors. We want every member to feel they are part of a team with the goal of improving financial literacy. We believe that we are the antithesis of the “trading guru” platforms that feature a trading or investing expert that charges for what are often expensive courses. We do not charge for our classes. We do not upsell our members. All education and community programs are free with the subscription to our platform.

Revenue Model

We generate revenue from a software as a service (or SaaS) model whereby members pay either an annual or monthly fee for a subscription to our platform. We do not currently offer more than one level of subscription with varying levels of features. All members have full access to all of the features and educational resources of our platform.

Monthly subscriptions are currently priced at $99 and annual subscriptions are currently priced at $959 (a discount of $241). We occasionally offer gift cards and promotional discounts on our subscriptions.

In March of 2025, we initiated a program to expand our product offerings through educational courses targeted to not only current Blackbox members but also non-members including former members. Courses are offered as either free webinars or as paid courses and consist of a series of classes on a specific topic regarding trading in equities or options markets. Free webinars are designed to attract potential members by providing them introductions to trading strategies at no cost. We believe that members who participate in our educational offerings are more likely to be successful traders and therefore more likely to be longer term members. We offer these paid courses for both members and non-members. These classes are expected to be offered to various level of traders (from novice to experienced) of either stocks or options and will become a significant additional revenue stream..

We also intend to provide products for professional traders and institutions including customs trading solutions and application program interface API access to our data. We have not historically focused on non-retail traders but we believe that we can offer professional traders unique tools driven off of the Blackbox System. Although the professional market may be more difficult to penetrate, we believe that it will support high margins and greater stability.

Development of the Blackbox System

The Blackbox System was launched and made available for use to subscribing customers worldwide in September 2016. The initial product was a web-based platform focused on providing proprietary analytics and broadcast enabled social media for our community of members. In 2022 we launched full-featured native iOS and Android applications. Our product offering is comprised of three key elements: stock and options trading analytics, social media interaction, and educational programs and resources.

Stock and Options Trading Analytics

Our preconfigured dashboard is designed to be simple and easy to navigate and includes real-time proprietary alerts, stock and options scanners, financial news, institutional grade charting, and our proprietary analytics that can be utilized by traders of all levels. Our Blackbox System populates the stock and option data in real time and provides a wide range analytics and tools for traders. We offer many of the standard market tool features used by traders but differentiate our product with an array of unique proprietary features and derived data. These proprietary features are designed to filter out “market noise” and locate, in real-time, specific stocks and options that are likely to become market movers.

Standard Features

(Including but not limited to)

|

● |

Real Time NYSE/NASDAQ Market Data |

|

|

● |

Real Time OPRA Options Trade Data |

|

|

● |

Real Time Streaming Market News Feed |

|

|

● |

Symbol Specific News |

|

|

● |

Options News and Upgrades/Downgrades |

|

|

● |

Institutional Grade Charts |

|

|

● |

Multi-Chart Capability |

|

|

● |

Earnings and Dividend Dates |

|

|

● |

Daily Advancers / Decliners Scanner |

|

|

● |

User-specific Watch List |

Proprietary and Advanced Features

(Including but not limited to)

|

● |

Real Time Algorithm Driven Stock & Options Alerts |

|

|

● |

User Defined Symbol Specific Alert Criteria |

|

|

● |

Options Flow Scanner / Heatmap |

|

|

● |

Pre-Configured Pre/Post Market Scanners |

|

|

● |

Stock and Option Volume Ratio Scanner |

|

|

● |

Volatility Indicator |

|

● |

Dark Pool Analysis |

|

|

● |

Insider Buying Analysis |

|

|

● |

Gamma Exposure |

|

|

● |

FINRA Short Interest Analysis |

|

|

● |

Net Options Delta and Dollar Flow |

|

|

● |

Feature Rich Text- and Audio-based Social Media Components |

Added in 2024:

|

● |

Enhanced options flow downloads to only include items on a member’s watch list |

|

● |

Additional open interest filters for exchange traded funds (ETFs) |

|

● |

Added real-time go / no-go indicators to alert log |

|

● |

Added ability to download options alert history |

|

● |

Added additional security features |

|

● |

Operational infrastructure enhancements |

|

● |

New alerts on options when the trade has been closed |

|

● |

Real time volatility indicator module |

The Blackbox System includes several proprietary and advanced studies to help both options and stock traders. These studies encompass advanced data tools with real time data that are easy for traders of all levels to use.

Dark Pool Analysis: we added dark pool trades on our charting system that updates in real time. Dark Pools are privately organized financial forums or exchanges for securities trading. Using our system, traders can easily see levels where large institutions or funds are trading. The Dark Pool Volume Profile is an indicator that visually displays a Dark Pool transaction directly on to the chart. The Volume Profile bar is overlayed at the price level at which the Dark Pool transaction is executed. The length of the volume profile is a visual representation of the share size of the dark pool transaction. The Dark Pool Volume Profile will also display historical activity when you change the time frame.

Insider Buying Analysis: we use the EDGAR portal to access all Form 4’s filed and update our charts where you find insiders buying stocks. This is a powerful tool for traders to easily see where the insiders or management are buying.

Gamma Exposure (GEX): Gamma is a measure of the rate of change of an options delta and it represents the rate at which an options delta will change as the price of the underlying changes. This proprietary study tracks the Gamma levels of all strike prices in real time by displaying a green/red bar at the strike prices. The day opens with the gamma levels from Open Interest and will adjust accordingly throughout the day as options are bought and sold. Finding the largest levels of Gamma Exposure (GEX) can serve as potential levels of support and/or resistance.

FINRA Short Interest Analysis: all the FINRA short interest data for stocks is plotted on our charts to let traders see how the shorting ratio of trades in the dark pools has changed over time.

Net Options Delta and Dollar Flow: This BlackBox proprietary study shows you the daily Net Options Delta (NOD) on a ticker. The delta of a net options position is the ratio of the change in the value of the position to the change in the price of the underlying asset. In other words, it is a measure of how much the value of the options position will change for a small change in the price of the underlying asset. Every single option trade is calculated in real time and the NOD of the stock is updated. This is further broken down into Put and Call NOD. Options dollar flow is a metric that measures the net flow of money into or out of options contracts. It is calculated by taking the difference between the total premium paid for call options and the total premium paid for put options. Positive dollar flow indicates a bullish sentiment, where in turn a negative dollar flow would indicate a bearish sentiment. This proprietary BlackBox study breaks down the dollar flow into three expiration time frames from near term, monthly and total.

Go/No-Go Study: The GoNoGo Trend ® indicator provides a simple colored study available in our charts that displays the strength of a stock’s momentum using multiple technical factors.

Team Trade Push Alerts: We provided access to push alert notifications so that our members could get real time alerts on their mobile devices of the trades made by their favorite Blackbox Team Trader(s).

Watchlists for our Mobile Application: We improved our mobile application to include the capability to add watchlists. This feature allows our members to quickly analyze their specific portfolio positions using our powerful mobile application while on the go.

Pro Tier Capability: We added a pro-tier capability allowing professional traders to subscribe to our platform. Professional traders are required to pay substantially higher fees than retail traders for the exchange data we provide them. Due to these higher fees, most applications such as Blackbox are unable to provide access to their systems as it is not economically viable. We now have a new onboarding system that allows us to provide professional traders the ability to use our system.

Education

We offer all members full access to our curriculum of classes, orientations, and live market sessions. All of our education programs are free to our members. Our curriculum includes classes for beginner, intermediate, and advanced-level traders. We believe education is vital to increasing the probability of our members long term success in the markets. We have many regularly calendared live webinars, Q&A sessions, as well as recorded classes. In addition to our regularly calendared classes, we often feature ad hoc classes taught by seasoned members of our community. The educators of these classes often specialize in specific market sectors or trading strategies. Classes and webinar events offered to our members include but are not limited to:

|

Beginner |

Intermediate |

Advanced |

|

Blackbox Intro Live |

Dark Pool Basics |

Options Adjustments |

|

Intro to the Market |

Technical Analysis 101 |

Understanding options for a Bull & Bear Market |

|

Charting 101 |

Blackbox Trading System -Stocks |

Options Strategies for Higher Volatility |

|

Stock Basics |

Blackbox Trading System -Options |

Insights for Options Core Concepts |

|

Understanding Options Flow |

Short Term Options Explained |

|

|

Implied & Historical Volatility |

||

|

Options Pricing Explained |

In addition to our internal curriculum, we have partnered with the Options Industry Council (OIC), a nonprofit organization funded by the Options Clearing Corporation (OCC) with the mission of providing the investing public a better understanding of the options markets. Classes taught by the OIC to our members include but are not limited to:

|

● |

The Greeks Part I |

|

|

● |

The Greeks Part II |

|

|

● |

Implied Volatility |

|

|

● |

Short Term Options Explained |

|

|

● |

Options Pricing Explained |

One of the most attractive aspects of our education program is that the classes are taught by members of our community. The student members who take these are often familiar with the instructor from following them in live trading channels on our platform. We believe this familiarity often brings an element of authenticity and heightened engagement increasing the success of these educational endeavors as well as adding to the community aspect of our platform.

The Blackbox Advantage

A principal component to our platform is the flexibility to provide members intuitive yet powerful technical analytics that scale with user knowledge. Our preconfigured dashboard defaults to a general setting that is designed to be easy for new members to navigate. Within this same dashboard we provide a multitude of toggles and filters for more sophisticated traders to allow them to implement custom features for their more advanced trading strategies. Most importantly, our live community consisting of thousands of traders creates a real-time community curated support system whereby seasoned traders often mentor newer members. We believe this is one of the primary strengths and differentiators of our platform. Although we offer a complete curriculum of scheduled classes weekly, the live interaction amongst our members proves to be invaluable. We believe this is due to the level of excitement created when new members can watch seasoned members of the community making trades in real time and providing an accompanying narrative. In addition to the educational component, the community element of our platform harnesses a powerful dynamic that can be described as “the best of man and machine”. Our powerful algorithm technology scans the NYSE, NASDAQ, CBOE and other options exchanges to find market volatility and anomalies and displays them on a common dashboard shared across the globe. With thousands of eyes on this data, our members can quickly interact and form a consensus on the trading opportunity at hand.

Our Market Opportunity

We believe the global COVID-19 pandemic of 2020 stimulated significant change for online technologies including financial and trading related companies such as Blackbox. More than 10 million new brokerage accounts were opened by individuals in 2020 — more than ever in one year, according to Devin Ryan, an analyst at JMP Securities. This newfound interest in the market was very positive for us as our user base grew rapidly in 2021. The combination of an influx of new investors as well as the tendency for those new investors to gravitate towards innovative financial technology have been positive long-term macro-economic trends for us.

It is difficult to quantify the number of people that can be classified as day traders, since the term is somewhat ambiguous, especially since there has been a large influx of self-directed investors in 2020 and 2021. The two types of traders often overlap and separating these demographics can be difficult. Recent data suggest the following size for this growing market:

|

● |

20%: One in 5 people in the U.S. invested in stocks, or mutual funds, in the final three months of 2020, up from 15% in the second quarter, a Conference Board survey showed. Harry Robertson, Business Insider, Feb 10, 2021 |

|

|

● |

31 YEARS: The median age of user of Robinhood, one of the original commission-free online brokerages. More young adults are joining. Apex Clearing, which helps facilitate trades for brokerages, told Reuters around 1 million of new accounts it opened last year belonged to Gen Z investors, with an average age of 19. John McCrank, Reuters Jan 29, 2021 |

|

|

● |

~$15.5 TRILLION: Total client assets at two of the top retail-focused brokerages. Fidelity Investments had $8.8 trillion in customer assets at the end of the third quarter, up from $8.3 trillion at the end of 2019. Schwab had $6.69 trillion in client assets as of Dec. 31, and 29.6 million brokerage accounts, up 66% and 140%, respectively, from a year earlier. John McCrank, Reuters Jan 29, 2021 |

We believe that the market opportunity for the technology that we have developed and targeted towards day traders can be utilized for self-directed investors as well as institutions -a substantially broader market. We intend to develop mobile applications for self-directed investors that provide them with financial information and data that is not commonly provided by retail brokers. Our first product aimed at this initiative will be Stock Nanny (see “New Products” below). We also intend to market our technologies to institutional financial companies for integration into their existing products or for sub-licensing to their customers.

Recent Technology and Development Initiatives

We continually upgrade our platform to provide the best user experience and maximum value for our members. Many of the new features or improvements to our existing features are suggested by our members. Much of our platform is community curated and we take pride in collaborating with and implementing the suggestions from our members that use our system every day. Our development efforts in 2023 and 2024 were largely focused on enhancing core parts of our applications and fine-tuning the overall architecture to improve cost efficiencies, eliminate remaining technical debt, and provide our members with a more stable, scalable, and performant system

Development of Native Applications for iOS and Android

We currently have fully-featured native applications for iOS and Android devices which were released in April of 2022. We believe that our mobile applications provide our members additional flexibility in their ability to access our platform when away from a desktop computer.

Platform Upgrades

Since the end of 2021, we have made significant upgrades and changes to our platform. We launched version 2.0 of the application which was a complete rewrite of the application front-end and overhaul of the backend to take advantage of modern technology capabilities that were widely unavailable when the product was initially released. This resulted in much better performance, a smaller resource footprint, and improved reliability and scale.

We believe that technological developments to the Blackbox System and platform have been and will continue to be critical to the success of our company. Although we have experienced significant growth and received positive feedback from our members, we believe adding these new technology sets in parallel will be significant drivers of future growth.

New Products

We intend to leverage our existing financial technology platform and data resources for the creation of new and unique products to serve our existing subscribers, as well as address a broader market. We currently have a vast array of derived data that we believe will be extremely useful to self-directed investors as well the day traders and swing traders that we currently cater to. We believe the self-directed investor demographic is significantly larger than that of day traders and swing traders and presents an enormous opportunity for our growth.

Stock Nanny

In 2024, we completed a soft launch of Stock Nanny. Stock Nanny is a mobile app for iOS and Android that provides real-time portfolio alerts for a broad demographic of investors. Many of these alerts are a product of derived data currently generated on the Blackbox platform. This app integrates with online brokerage platforms and allows the user to import their current stock positions and stocks on their watchlist into our app. We believe these alerts will be extremely useful for portfolio management, loss mitigation, and other investment strategies. The app provides extensive menu options to allow the user to customize this application to their specific needs. This is a stand-alone product and targets all self-directed retail investors, not just day traders or swing traders allowing the Company to address a much broader segment of the market. We plan to more aggressively market this product in 2025 after we have raised sufficient capital to fund a comprehensive marketing plan.

Enterprise Products for Professionals

We have not historically marketed our product to persons or entities deemed by the exchanges as “professional traders” or financial institutions. A professional trader is generally defined by the exchanges as a person that:

|

● |

Is registered or qualified with the Securities and Exchange Commission, the Commodities Futures Trading Commission, any state securities agency, any securities exchange or association, or any commodities or futures contract market or association. |

|

|

● |

Is engaged as an “investment advisor” as that term is defined in Section 201(11) of the Investment Advisor's Act of 1940 (whether or not registered or qualified under that Act). |

|

|

● |

Is employed by a bank or another organization that is exempt from registration under Federal and/or state securities laws to perform functions that would require him or her to be so registered or qualified if he or she were to perform such functions for an organization not so exempt. |

The exchanges charge a substantial premium for their data to users who meet the criteria described above. In addition to the higher rates, the onboarding and subsequent approval process by these exchanges is cumbersome and not easily accomplished solely through an online process.

In 2023 we developed a streamlined digital onboarding process allowing financial professionals to be able to use our product. We believe that this is an important first step to not only marketing our existing products to financial professionals but also developing new and even bespoke products for this market segment. We are targeting financial institutions to utilize our products, subsets of our systems or even creating bespoke products on their behalf. In order to provide different and more stable revenue streams, we believe it is important for us to use our existing technology base as a basis to develop new revenue streams from professional and institutional customers.

Marketing of the Blackbox System

We launched our Blackbox System and platform for use in the United States and made it available to subscribers in September 2016. Use of the platform is sold on a monthly or annual subscription basis to individual consumers through our website at https://blackboxstocks.com. We believe our Blackbox System subscriptions are priced competitively with similar web-based trading tools although the number of competitors offering limited aspects of what our system provides at lower prices has increased in 2023 and 2024. We primarily use a combination of digital marketing campaigns and customer referral compensation plans in our advertising program. Our digital advertising efforts are comprised of display and video ads, along with banner and text ads across multiple search and social platforms. We also utilize targeted email marketing and a strategic global marketing campaign for brand awareness. We believe that this form of advertising has been and will continue to be effective in attracting subscribers. We continuously monitor and evaluate the effectiveness of specific social media platforms and allocate marketing funds accordingly. We also promote our subscriptions through an established compensated customer referral program. We offer certain subscribers the right to promote the Blackbox System and receive referral fees for subscribers generated from such subscribers’ effort. Generally, we pay referring subscribers $25 for each subscription generated and $25 for each month the subscriber continues their subscription. We incurred $93,826 and $187,781 in customer referral expenditures in each of the years ended December 31, 2024 and 2023, respectively. We expect to continue utilizing the customer referral sales program as it has proven to be an efficient form of advertising. Our advertising and marketing expense was $436,456 and $629,984 for the years ended December 31, 2024 and 2023, respectively. We significantly reduced the amount of our digital marketing spend during 2023 and 2024 as part of an overall expense reduction as well as a review of the effectiveness of certain marketing strategies. We intend to continue to deploy a significant amount of marketing funds on both digital campaigns and customer referral programs in the future. In addition, we may also utilize television and radio advertising.

Our marketing of products targeted toward institutional customers is anticipated to rely less on the current digital marketing that we have historically utilized and is not expected to utilize affiliate marketing strategies.

Industry Partners and Relationships

We have several arrangements and agreements with financial industry partners that encompass marketing partnerships, educational resources and licenses. We believe our relationship with large well-known brokerage firms enhance our credibility and provide added value to our members. Among these partnerships are marketing agreements with firms that provide us with a referral fee for new accounts that we bring to them as well as offering our members discounted commissions on options trades. The referral fees are not currently material to our revenue but we believe the that our initial relationship with these firms is significant and provides us with an opportunity to expand these relationships to bring greater value to our members.

Industry partnerships such as the one we have with Options Industry Council, a non-profit entity funded by the Options Clearing Corp. also help provide our members with added educational benefits.

Data Suppliers

We contract with data suppliers and aggregators to provide our subscribers real time access to most major newswires, historical charting data and the real time stock and options data that drive the backend algorithms.

Intellectual Property

We rely on a combination of trademark and copyright laws, trade secrets, confidentiality provisions and other contractual provisions to protect our proprietary rights, which are primarily our brand names, product coding and marks. The Company has registered its name and logo with the United States Patent and Trademark Office (“USPTO”) and is pursuing registration of other brand names and marks. The proprietary portion of the Blackbox System including its coding and methodology is protected by contractual confidentiality provisions of both employees and independent contractors.

Government Regulation and Approvals

We offer our subscribing customers a trading tool and not a trading platform, broker dealer or exchange, and therefore we do not believe we are subject to regulatory oversight by the SEC, FINRA or other financial regulatory agencies. We are not aware of any governmental regulations or approvals required for the marketing or use of our Blackbox System or the services provided.

We are subject to a variety of laws and regulations in the United States and abroad that involve matters central to our business. Many of these laws and regulations are still evolving and being tested in courts, and could be interpreted in ways that could harm our business including, but not limited to, privacy, data protection and personal information, rights of publicity, content, intellectual property, advertising, marketing, distribution, data security, data retention and deletion, and other communications, protection of minors, consumer protection, telecommunications, product liability, taxation, economic or other trade prohibitions or sanctions, anti-corruption law compliance and securities law compliance. In particular, we are subject to federal, state and foreign laws regarding privacy and protection of people's data. Foreign data protection, privacy, content and other laws and regulations can impose different obligations or be more restrictive than those in the United States. U.S. federal and state and foreign laws and regulations, which in some cases can be enforced by private parties in addition to government entities, are constantly evolving and can be subject to significant change. As a result, the application, interpretation and enforcement of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate and may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices.

Competition

We operate in a highly competitive environment. Although, we believe that our Blackbox System is the only platform that has successfully merged a comprehensive analytics system or “scanner” and a social media platform within the same “dashboard” allowing members to view the same real-time data in parallel, there are a number of companies that offer one or more features that are similar to or attempt to address the same market as we do. Some of these competitors have financial and other resources that are significantly greater than ours. The greatest amount of competition exists within products that provide trading analytics often referred to as “scanners”. We compete with these entities based on a number of factors including price, ease of use, standard features and proprietary features (if applicable). Ultimately, we believe the primary factor used in evaluating the trading analytics by any platform is the user’s ability to derive actionable information from that platform. This is where we believe our proprietary features differentiate the Blackbox System.

In addition to these technical tools, there are also a number of social media platforms that provide forums for traders and investors at little or no cost. The integration of our social media component within our platform creates a community that we believe is significantly superior to stand alone social media sites. Our members are able to interact and discuss ideas while viewing the same dashboard as opposed to having to switch back and forth between applications.

The final component to our platform is education. There are numerous standalone investment and trading applications, books, seminars and courses offered at many different price points. These products compete based on price, perceived value, level of sophistication and reputation among other factors. We offer our courses at no additional charge to our subscribers. In addition, we believe that our social media community provides our more experienced traders the opportunity to mentor newer traders which in turn contributes to the community environment we have developed.

In spite of these factors that differentiate us, we believe the following companies may be considered competitors due to similar product features and retail price points: Trade Ideas, Flow Algo, Unusual Whales and Trade Alert. Companies with social media platforms dedicated to financial markets include Stock Twits and Wall Street Bets.

Employees

As of March 20, 2025, the Company had ten full-time employees. We also currently have nine contract workers that primarily serve as team traders on our Blackbox System platform or developers.

None of our employees are represented by a labor organization, and we are not a party to any collective bargaining agreement. We have not experienced any work stoppages and consider our relations with our employees to be good.

We believe that our future success will depend in part on our continued ability to hire, motivate and retain qualified management, sales, marketing, and technical personnel. To date, we have not experienced significant difficulties in attracting or retaining qualified employees.

Recent Developments

Termination of Share Exchange Agreement with Evtec Aluminium Limited

On January 13, 2025, the Company and Evtec Aluminium Limited (“Evtec”) entered into a termination agreement (the “Termination Agreement”) pursuant to which the parties mutually agreed to terminate the Share Exchange Agreement executed on December 12, 2023, as amended by that certain First Amendment to Share Exchange Agreement dated July 3, 2024 (the “Share Exchange Agreement”), the closing of which would have resulted in Evtec becoming a wholly owned subsidiary of the Company.

Company Financing

Securities Purchase Agreement

On January 17, 2025, the Company entered into a Securities Purchase Agreement (the “Original Purchase Agreement”) with Five Narrow Lane LP (the “Purchaser”), and Five Narrow Lane LP, as collateral agent for the Purchaser (the “Agent”), pursuant to which the Purchaser agreed to purchase from the Company a senior debenture having an aggregate principal amount of $250,000 (the “Initial Debenture”) and an amended and restated senior secured convertible debenture having an aggregate principal amount of up to $2,000,000 (the “Additional Debenture”, and together with the Initial Debenture, the “Debentures”) upon certain closing conditions applicable to the Initial Debenture and Additional Debenture, respectively.

The closing of Initial Debenture (the “Initial Closing”) took place concurrent with the execution and delivery of the Original Purchase Agreement by the parties thereto, upon satisfaction of certain customary covenants and closing conditions outlined in the Original Purchase Agreement. The closing of the Additional Debenture, (the “Additional Closing”), was agreed to take place upon satisfaction of certain customary closing conditions outlined in the Original Purchase Agreement, including, but not limited to, the execution and delivery of (i) a Security Agreement (as further described below), (ii) a Subsidiary Guarantee (as further described below), (iii) a Registration Rights Agreement (as further described below), and (iv) a Merger Agreement (as further described below).

The Original Purchase Agreement contains customary representations, warranties, covenants, confidentiality and indemnification obligations customary for a transaction of the size and type contemplated by the Original Purchase Agreement.

Initial Debenture

The Initial Closing was consummated on January 17, 2025. The Initial Debenture was to bear interest at a rate of 7.00% per annum and mature on the earlier to occur of the date on which a definitive agreement relating to any “Merger Transaction” (as defined in the Original Purchase Agreement) (the “Merger Agreement”) was duly executed by the parties signatory thereto (the “Initial Debenture Trigger Date”) or March 15, 2025 (the “Initial Debenture Maturity Date”). At any time prior to the Initial Debenture Maturity Date, the Company could elect to prepay all or a portion of the outstanding amounts due under the Initial Debenture.

On the Initial Debenture Trigger Date, the Company agreed to pay in cash to the Purchaser of the Initial Debenture the outstanding principal amount of the Initial Debenture, together with all accrued and unpaid interest thereon, an exit fee in an amount equal to 15% of the outstanding principal amount of the Initial Debenture (the “Initial Debenture Exit Fee”) and any other amounts due thereunder; provided that, if the “Trigger Conditions” are satisfied as of the Initial Debenture Trigger Date, it was agreed that the Initial Debenture would be exchanged for an Additional Debenture. As defined in the Initial Debenture, “Trigger Conditions” means (a) no event of default has occurred or is continuing or would result from the effectiveness of the Merger Transaction, (b) no event or condition has resulted in, or could be reasonably expected to cause, either individually or in the aggregate, a material adverse effect or to result in a material adverse effect from the effectiveness of the Merger Transaction, (c) the Company has executed and delivered such documents as the holder may reasonably request in connection with the exchange of the Initial Debenture for the Additional Debenture, and (d) the satisfaction of any additional covenants and conditions set forth in the Original Purchase Agreement.

The Initial Debenture also included customary representations and warranties, as well as events of default, the occurrence of which would cause the Initial Debenture to bear interest at a default rate of 18% per annum.

Additional Debenture

At the Additional Closing, it was agreed that the Initial Debenture would be exchanged for the Additional Debenture as senior indebtedness secured by a first priority security interest on substantially all of the assets of the Company. The aggregate principal amount of the Additional Debenture was initially agreed to be $2,000,000, to be funded by the Purchasers with (i) $250,000 in principal amount credited from the exchange of Initial Debenture, (ii) $500,000 upon execution and delivery of a Merger Agreement, (iii) $750,000 upon the filing with the Securities and Exchange Commission (the “SEC”) of a registration statement on Form S-4 (the “Merger Registration Statement”) in connection with the Merger Transaction , and (iv) $500,000 upon the SEC declaring the Merger Registration Statement effective. The Additional Debenture bears interest at a rate of 7.00% per annum and will mature on the earlier of the closing of the Merger Transaction (as defined in the Original Purchase Agreement) or 12 months following the issuance of the Additional Debenture (the “Additional Debenture Maturity Date”).

On the Additional Debenture Maturity Date, the Company is, with the consent of the holder, entitled to repay the aggregate accrued interest and principal amount of the Additional Debenture. In the event the Additional Debenture is repaid in cash, the holder is entitled to receive a premium equal to 115% of the outstanding principal and accrued interest balance due on such date. In the event the Additional Debenture is not repaid on the Maturity Date, subject to certain limitations and absence of an event of default, the holder is entitled to convert the aggregate principal amount and accrued interest of the Additional Debenture into Company common stock at the conversion price, which will be 175% of the closing price of the Company’s common stock (as quoted by the Nasdaq Stock Market, LLC) on the trading day immediately prior to the execution of the Additional Debenture with a minimum price of $5.00 per share of common stock. Notwithstanding the foregoing, the Additional Debenture will not be convertible into Company common stock if, after such conversion, the holders would beneficially own more than 9.9% of the Company common stock outstanding. The holder may elect to reduce such 9.9% beneficial ownership limitation to 4.9%, effective immediately upon such election.

The Additional Debenture also includes customary representations and warranties, as well as events of default, the occurrence of which will cause the Additional Debenture to bear interest at a default rate of 18% per annum. The Additional Debenture includes a most favored nation clause in favor of the holder thereof.

Palladium Capital Group, LLC served as placement agent for the Debentures. The Company agreed to pay a placement agent fee upon closing of the Debentures equal to 8% of the gross proceeds from the sale of the Debentures. Such fee will be payable through the issuance by the Company of a debenture to Palladium Capital Group, LLC on identical terms to the Additional Debenture, provided that such debenture will be unsecured.

Registration Rights Agreement

In connection with the Original Purchase Agreement, and as a condition to the Additional Closing, the Company and the Purchasers agreed to enter into a Registration Rights Agreement (the “Registration Rights Agreement”). Under the Registration Rights Agreement, the Company must file with the SEC an initial registration statement within 15 days to register the maximum number of Registrable Securities to be issued upon conversion of the Additional Debenture (as defined in the Registration Rights Agreement) in accordance with applicable SEC rules, and obtain effectiveness thereof within 30 days (or in the event of a “full review” by the SEC, 45 days).

The Registration Rights Agreement includes certain other restrictions on piggyback rights, obligations of the Company and the Purchasers, and indemnification obligations of the parties, each as described in greater detail therein

Security Agreement

In connection with the Original Purchase Agreement, and as a condition to the Additional Closing, the Company, Blackbox.io Inc., a wholly-owned subsidiary of the Company (the “Subsidiary” or “Blackbox Operating”), and the Agent agreed to enter into a Security Agreement (the “Security Agreement”) which grants the Agent and Purchaser a first priority security interest in substantially all of the assets of the Company to secure the prompt payment, performance and discharge in full of all of the Company’s obligations under the Additional Debenture. Pursuant to the Security Agreement, the Subsidiary will act as a guarantor with respect to the Company’s obligations under the Additional Debenture.

Subsidiary Guarantee

In connection with the Original Purchase Agreement, and as a condition the Additional Closing, our Subsidiary agreed to enter into a Subsidiary Guarantee (the “Subsidiary Guarantee”) in favor of the Purchaser, pursuant to which the Subsidiary agrees to guarantee all of the Company’s obligations under the Additional Debenture.

Amendment to Securities Purchase Agreement

On January 27, 2025, the Company, the Purchasers and the Agent entered into an Amendment to Securities Purchase Agreement (the “Amendment”, and together with the Original Purchase Agreement, the “Purchase Agreement”) to, among other things, increase the aggregate principal and subscription amount of the Initial Debenture and Additional Debenture to up to $550,000 and $2,300,000, respectively. The Amendment amends certain provisions within the Purchase Agreement to reflect such increase in the aggregate principal and subscription amounts of the Debenture.

Merger Agreement with REalloys Inc.

On March 10, 2025, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with RABLBX Merger Sub Inc., a Nevada corporation and wholly owned subsidiary of the Company (“Merger Sub”), and REalloys Inc., a Nevada corporation (“REalloys”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, REalloys will merge with and into Merger Sub, Merger Sub will cease to exist and REalloys will become a wholly-owned subsidiary of the Company (the “Merger”). At the closing of the Merger (the “Closing”), the holders of capital stock and outstanding instruments convertible into or exercisable for capital stock of REalloys will receive shares of common and preferred stock of the Company, $0.001 par value, based on an exchange ratio formula in the Merger Agreement (the “Exchange Ratio”) or as otherwise agreed to in the Merger Agreement, which is subject to adjustment in the event the parties raise capital in excess of certain thresholds. Immediately following Closing, based upon the Exchange Ratio, pre-Closing stockholders of the Company are expected to collectively retain approximately 7.3% of the post-Close aggregate common stock of the Company, par value $0.001 (the “Company Common Stock”) and holders of REalloys capital stock and instruments convertible into or exercisable for capital stock of the REalloys will receive as merger consideration newly issued shares of Company Common Stock representing approximately 92.7% of the post-Close aggregate as common and preferred stock of the Company.

The Merger Agreement contains customary representations, warranties and covenants of the Company, Merger Sub and the REalloys, including, among others, (i) covenants requiring each of the Company and REalloys to conduct its business in the ordinary course during the period between the execution of the Merger Agreement and the Closing or earlier termination of the Merger Agreement, subject to certain exceptions, (ii) a covenant prohibiting the Company from engaging in certain kinds of transactions during such period (without the prior written consent of the REalloys), and (iii) a covenant restricting Company and REalloys from activities relating to the soliciting, initiating, encouraging, inducing or facilitating the communication, making, submission or announcement of any alternative acquisition proposals or inquiries.

The Merger Agreement also requires the Company, in cooperation with the REalloys, to prepare and file with the SEC a registration statement on Form S-4 that will contain a proxy statement relating to a Company stockholder meeting to be held in connection with the Merger (the “Merger Registration Statement”) pursuant to which shares of Company Common Stock will be registered under the Securities Act, to be issued by virtue of the Merger and the contemplated transactions thereunder. The Company shall use commercially reasonable efforts to (i) cause the Merger Registration Statement to comply with applicable rules and regulations promulgated by the SEC, (ii) cause the Merger Registration Statement to become effective as promptly as practicable, and (iii) respond promptly to any comments or requests of the SEC or its staff related to the Merger Registration Statement. In addition, under the Merger Agreement, the parties agreed to other customary provisions including (i) obtaining requisite stockholder approval to consummate the Merger and the contemplated transactions thereunder, (ii) obtaining regulatory approvals from relevant governmental authorities, (iii) indemnifying the directors and officers of the Company for a period of six years following the Closing, (iv) completing certain disclosure obligations required by the SEC and listing requirements promulgated by Nasdaq, (v) electing or appointing to the positions of officers and directors of Company and the surviving corporation certain persons designated by REalloys, (vi) executing employment agreements between the Company and Lipi Sternheim and David Argyle, (vii) Company adopting a new stock incentive plan reserving not more than 15% of the fully-diluted, outstanding interest of the Company immediately following the Merger for issuance, and (viii) allocating funds received by Company pursuant to sales, issuances, grants or other dispositions of Company Common Stock, during the period between the Merger Agreement and Closing, under that certain Registration Statement on Form S-3 (File No. 333-284626) filed with the SEC on January 31, 2025 which became effective on February 10, 2025.

Closing of the Merger is subject to various customary closing conditions. Each party’s obligations to effect the Merger and otherwise consummate the contemplated transactions thereunder are conditioned upon (i) the effectiveness of the Merger Registration Statement on Form S-4, (ii) expiration or termination of applicable regulatory waiting periods, (iii) no restraints from any governmental authority preventing the consummation of the contemplated transactions under the Merger Agreement, (iv) the Company and REalloys obtaining their respective requisite stockholder votes to consummate the transactions contemplated by the Merger Agreement, (v) Nasdaq’s approval of the Company’s Nasdaq listing application for the post-Merger entity, (vi) execution of Lock-Up Agreements, (vii) execution of a Stock Purchase Agreement by and between Gust Kepler and Lipi Sternheim whereby Gust Kepler shall agree to sell 1,634,999 shares of Company Series A Convertible Preferred Stock to Lipi Sternheim contingent upon and effective concurrently with Closing, and (viii) the filing of an amendment to Company’s charter with the Secretary of State of the State of Nevada, containing such amendments necessary to consummate the transactions contemplated by the Merger Agreement. Company’s and Merger Sub’s obligations to effect the Merger and otherwise consummate the contemplated transactions thereunder are further conditioned upon customary closing conditions as well as REalloys having sufficient stockholder’s equity as necessary for the Company to meet Nasdaq listing requirements. REalloy’s obligations to effect the Merger and otherwise consummate the contemplated transactions thereunder are further conditioned upon customary closing conditions as well as (i) the Company’s execution of the Option Agreement (as further described below), (ii) the Company’s consummation of a Company Financing and issuance of $2,300,000 of Additional Debenture to the satisfaction of the REalloys (as further described above and below), (iii) the Company having net cash (as defined in the Merger Agreement) equal to or in excess of negative $2.69 million, and (iv) the Company filing the Certificate of Designations establishing a class of Company preferred stock to be designated Series C Convertible Preferred Stock (as further described below).

Following the Closing, the Company is expected to be renamed “REalloys Inc.,” and it is expected that the shares of Company Common Stock will continue to be listed on Nasdaq.

Stockholder Support Agreements

As a condition to the parties’ execution of the Merger Agreement, prior to Closing, Company and Gust Kepler will execute an Option Agreement (the “Option Agreement”), pursuant to which the Company shall have the right to call for redemption and Gust Kepler shall have the right to cause Company to redeem all of the issued and outstanding Series A Convertible Preferred Stock of Parent held by Gust Kepler in exchange for shares of Series A Convertible Preferred Stock of Blackbox.io, Inc. (“Blackbox Operating”), a Delaware corporation and wholly owned subsidiary of the Company, which was organized to conduct its historical operations .

Lock-Up Agreements

As a condition to the parties’ execution of the Merger Agreement, prior to Closing, all officers, directors and stockholders of the REalloys will execute lock-up agreements (the “Lock-Up Agreements”), which among other things (i) prohibit such parties from engaging in certain sale and other transfer transactions relating to the Company Common Stock and securities convertible, exercisable or exchangeable therefor, without the prior written consent of the Company for a period of 180 days after the Closing and (ii) for 180 days thereafter, further prohibits such parties from engaging certain transactions representing more than 10% of each party’s record or beneficial ownership of the Company in any one month.

Option Agreement

As a condition to the parties’ execution of the Merger Agreement, prior to Closing, Company and Gust Kepler will execute an Option Agreement (the “Option Agreement”), pursuant to which the Company shall have the right to call for redemption and Gust Kepler shall have the right to cause Company to redeem all of the issued and outstanding Series A Convertible Preferred Stock of Parent held by Gust Kepler in exchange for shares of Series A Convertible Preferred Stock of Blackbox.io, Inc. (“Blackbox Operating”), a Delaware corporation and wholly owned subsidiary of the Company, which was organized to conduct its historical operations .

Contingent Value Rights Agreements

At the Closing, the Company, a representative of the Company stockholders, and a to be appointed Rights Agent, will enter into a Contingent Value Rights Agreement (the “CVR Agreement”). Pursuant to the Merger Agreement and the CVR Agreement, each share of Company Common Stock held by Parent stockholders as of a record date immediately prior to the Closing will receive a dividend of one contingent value right (“CVR”) entitling such holders to receive, in connection with certain transactions involving Blackbox Operating (a “CVR Transaction”), an amount equal to the net proceeds actually received by the Company at the closing of such transaction. A CVR Transaction is generally a transaction pursuant to which (i) the Company or Blackbox Operating grants, sells, licenses or otherwise transfers some or all of the rights to the Blackbox Operating assets, or other monetizing event of all or any part of the Blackbox Operating assets and (ii) the Company receives or Blackbox Operating determines to distribute net proceeds from such transaction as a dividend to its stockholders.

The CVR payment obligations will expire the date that is 24 months following the Closing. The CVRs will not be transferable, except in certain limited circumstances, will not be certificated or evidenced by any instrument, will not accrue interest and will not be registered with the SEC or listed for trading on any exchange. There is no guarantee that any CVR Transaction or payment pursuant thereto will be earned.

Certificate of Designations for Series C Convertible Preferred Stock

Under the terms of the Merger Agreement, as a condition to Closing, the Company will file a Certificate of Designations (the “Certificate of Designations”) with the Secretary of State of the State of Nevada establishing a class of Company preferred stock to be designated Series C Convertible Preferred Stock, par value $.001 per share (the “Series C Stock”), which is expected to be issued as partial consideration in the Merger. Under the agreed form of the Certificate of Designations, all shares of capital stock of the Company rank pari passu or junior to the Series C Stock, with respect to preferences as to dividends, distributions and payments upon the liquidation, dissolution and winding up of the Company. The Series C Stock is convertible into shares of Company Common Stock at the election of the holder at any time at a conversion price to be equal to 100% of the lesser of (i) the closing price of the Company Common Stock on the trading day immediately prior to the closing of the Merger and (ii) the closing price of the Company Common Stock on the date the Companies obtain stockholder approval for issuance of the Series C Stock and Company Common Stock into which it convert (the “Series C Stockholder Approval”). The conversion price is subject to customary adjustments for stock dividends, stock splits, reclassifications, stock combinations and the like (subject to certain exceptions). At any time after issuance of the Series C Stock, to the extent the Company raises capital in any financing with gross proceeds in excess of $3 million, the Company is required to use one-third of such gross proceeds to redeem all or any portion of the Series C Stock then outstanding. The amortization payments due upon such redemption are payable by the Company in cash at a price equal to the product of (i) 110% and (ii) the stated value of the shares of Series C Stock being redeemed plus any and all accrued and unpaid dividends on such shares of Series C Stock.

The holders of the Series C Stock are entitled to dividends of 2.5% per annum, compounded each calendar month, which are payable in arrears monthly in cash, “in kind” in the form of additional shares of Series C Stock, or in a combination thereof, at the holder’s discretion, in accordance with the terms of the Certificate of Designations. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations and described below), the Series C Stock accrues dividends at a rate of 15% per annum. Upon conversion or redemption, the holders of shares of Series C Stock are also entitled to receive a dividend make-whole payment, assuming for calculation purposes that stated value of such Series C Stock remained outstanding through and including the date of conversion or redemption of all the shares of Series C Stock. The holders of Series C Stock are entitled to vote with holders of the Company Common Stock on an as-converted basis, with the number of votes to which each holder of Series C Stock is entitled to be calculated as the stated value of such share of Series C Stock divided by the Nasdaq Minimum Price (as defined in Nasdaq Listing Rule 5635(d)) immediately preceding the subscription date (as defined in the Certificate of Designations), subject to certain beneficial ownership limitations as set forth in the Certificate of Designations.

Notwithstanding the foregoing, the Company’s ability to settle conversions and make amortization payments and dividend make-whole payments using shares of Company Common Stock is subject to certain limitations set forth in the Certificate of Designations, including a limit on the number of shares that may be issued until the time, if any, that the Company has obtained the Series C Stockholder Approval. Further, the Certificate of Designations contains a certain beneficial ownership limitation after giving effect to the issuance of shares of Company Common Stock issuable upon conversion of the Series C Stock or as part of any amortization payment or dividend make-whole payment under the Certificate of Designations.

The Certificate of Designations includes certain Triggering Events (as defined in the Certificate of Designations), including, among other things, the suspension from trading or failure of the Company Common Stock to be trading or listed on an Eligible Market (as defined in the Certificate of Designations) for a period of five consecutive trading days and the Company’s failure to pay any amounts due to the holders of Series C Stock when due. In connection with a Triggering Event, each holder of Series C Stock will be able to require the Company to redeem in cash any or all of the holder’s shares of Series C Stock at a premium set forth in the Certificate of Designations.

The Company will be subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, the existence of liens, the maturity of indebtedness, preservation of existence, maintenance of properties, maintenance of insurance, transactions with affiliates, among other matters.

There is no established public trading market for the Series C Stock and the Company does not intend to list the Series C Stock on any national securities exchange or nationally recognized trading system.

As described below, Series C Stock will be issued upon consummation of the Merger as consideration for certain outstanding shares of Series X Stock of REalloys and, at the option of the holders of the Additional Debenture issued in connection with the Company Financing (described below), in exchange for satisfaction of certain Company obligations under the terms of the Additional Debenture.

Updates to Company Financing

In connection with the Merger, the Company agreed to make certain changes to the Additional Debenture and Registration Rights Agreement. Among other things, the Additional Debenture was revised to require the Company, upon consummation of the Merger, to either (i) pay to the holders in cash the entire principal amount of the Additional Debenture then outstanding, together with all accrued and unpaid interest thereon, the Exit Fee (as defined in the Additional Debenture) and any other amounts due thereunder, or (ii) issue to the holders such number of shares of Series C Stock for aggregate stated value equal to (x) 3.0 multiplied by (y) the entire principal amount of the Additional Debenture then outstanding, together with all accrued and unpaid interest thereon, the Exit Fee (as defined in the Additional Debenture) and other amounts due thereunder. Additionally, the agreed form of the Registration Rights Agreement was revised to reflect that filing date for the resale registration statement registering the Company Common Stock issuable upon conversion of the Additional Debenture was extended to April 15, 2025 (the “Filing Date”), and that the Company is required to have such registration statement declared by the SEC by the 30th calendar day following the Filing Date (or 45 calendar days in the event of a “full review”).

On March 10, 2025, the Company issued an Additional Debenture to Five Narrow Lane LP with an outstanding principal amount of $1,050,000. Pursuant to the Security Agreement, the obligations under the Additional Debenture are secured by security interest in certain property of the Company and certain subsidiaries of the Company. In connection with the issuance of Additional Debenture, the parties executed the Registration Rights Agreement, Security Agreement and Blackbox.io Inc. executed a Subsidiary Guarantee.

REalloys Financing

REalloys Securities Purchase Agreement

In connection with the Merger, REalloys entered into a Securities Purchase Agreement (the “REalloys Purchase Agreement”), dated as of March 6, 2025, with Five Narrow Lane LP (the “Buyer”), pursuant to which REalloys agreed to sell to the Buyer (i) an aggregate of 5,000 shares of REalloys’ Series X Preferred Stock, par value $0.0001 per share (the “Series X Stock”), with a stated value of $1,000 per share (the “Stated Value”) and (ii) warrants (the “REalloys Warrants”) to acquire up to 5,000,000 shares of common stock of REalloys, par value $0.0001 per share (the “REalloys Common Stock”) (collectively, the “REalloys Financing”). REalloys will also issue to the Buyer an aggregate number of shares of REalloys Common Stock representing 5.0% of the fully diluted outstanding capital of REalloys (the “Commitment Shares”), which shall be adjusted as necessary immediately prior to the consummation of the Merger to the extent that the Commitment Shares represent less than 5.0% of the fully diluted outstanding capital of REalloys. The aggregate gross proceeds from the REalloys Financing are expected to be $5,000,000 (or up to $55,000,000 if the REalloys Warrants are exercised in full for cash). REalloys expects to use the net proceeds from the REalloys Financing for general corporate purposes and for transaction expenses incurred in connection with the Merger.

The REalloys Purchase Agreement contains certain representations and warranties, covenants and indemnities customary for similar transactions. The representations, warranties and covenants contained in the REalloys Purchase Agreement were made solely for the benefit of the parties to the REalloys Purchase Agreement and may be subject to limitations agreed upon by the contracting parties. The REalloys Financing is exempt from the registration requirements of the Securities Act pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws. The Buyer has represented to REalloys that it is an accredited investor within the meaning of Rule 501(a) of Regulation D and that it is acquiring the securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The Series X Stock and REalloys Warrants are being offered without any general solicitation by the Company or its representatives.

Certificate of Designations

The terms of the Series X Stock are set forth in a certificate of designations (the “REalloys Certificate of Designations”) which will be filed with the Secretary of State of Nevada prior to the closing of the REalloys Purchase Agreement. All shares of capital stock of REalloys rank pari passu or junior to the Series X Stock, with respect to preferences as to dividends, distributions and payments upon the liquidation, dissolution and winding up of REalloys. At any time after issuance of the Series X Stock, to the extent (i) the Merger Agreement is terminated for any reason before the Merger is consummated and (ii) REalloys raises capital in any financing, REalloys is required to use 50% of the aggregate gross proceeds from such financing to redeem all or any portion of the Series X Stock then outstanding. The amortization payments due upon such redemption are payable by REalloys in cash at a price equal to the product of (i) 110% and (ii) the Stated Value of the shares of Series X Stock being redeemed plus any and all accrued and unpaid dividends on such shares of Series X Stock.

The holders of the Series X Stock are entitled to dividends of 8.0% per annum, compounded each calendar quarter, which are payable in arrears quarterly on the Maturity Date (as defined in the REalloys Certificate of Designations) in cash, “in kind” in the form of additional shares of Series X Stock, or in a combination thereof, at the holder’s discretion, in accordance with the terms of the REalloys Certificate of Designations. Upon the occurrence and during the continuance of a Triggering Event (as defined in the REalloys Certificate of Designations and described below), the Series X Stock accrues dividends at a rate of 15% per annum. Upon redemption or other repayment, the holders of shares of Series X Stock are also entitled to receive a dividend make-whole payment, assuming for calculation purposes that the Stated Value of such Series X Stock remained outstanding through and including the date of redemption of all the shares of Series X Stock. The holders of Series X Stock are entitled to vote with holders of the REalloys Common Stock on an as-converted basis, with each share of Series X Stock entitling the holder thereof to cast one vote per share of Series X Stock.

The REalloys Certificate of Designations includes certain Triggering Events (as defined in the REalloys Certificate of Designations), including, among other things, REalloys’ failure to pay any amounts due to the holders of Series X Stock when due. In connection with a Triggering Event, each holder of Series X Stock will be able to require REalloys to redeem in cash any or all of the holder’s shares of Series X Stock at a premium set forth in the REalloys Certificate of Designations.

REalloys will be subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, the existence of liens, restricted payments and investments, restrictions on redemption and cash dividends, restrictions on transfer of assets, the maturity of indebtedness, change in nature of business, preservation of existence, maintenance of properties, intellectual property and insurance, transactions with affiliates, restricted issuances and restrictions on acquisitions, among other matters. There is no established public trading market for the Series X Stock and REalloys does not intend to list the Series X Stock on any national securities exchange or nationally recognized trading system.

Pursuant to the Merger Agreement, each share of Series X Stock outstanding will be converted solely into the right to receive shares of the Company’s Series C Stock at a ratio of 1 to 1.

Warrants

The REalloys Warrants are exercisable for shares of REalloys Common Stock immediately upon issuance, at an exercise price of $10.00 per share (the “Exercise Price”) and expire two years from the date of issuance. The Exercise Price is subject to customary adjustments for stock dividends, stock splits, reclassifications, and the like. There is no established public trading market for the REalloys Warrants and REalloys does not intend to list the REalloys Warrants on any national securities exchange or nationally recognized trading system.

Pursuant to the Merger Agreement, the REalloys Warrants are to be assumed by the Company at Closing and will be exercisable for the purchase of Company Common Stock in an amount and at an adjusted Exercise Price based upon the Exchange Ratio.

Corporate Information

Our principal executive offices are located at 5430 LBJ Freeway, Suite 1485, Dallas, Texas 75240, and our telephone number is (972) 726-9203. Our website is https://blackboxstocks.com. The information on, or that can be accessed through, our website is not part of this Report on Form 10-K. We have included our website address as an inactive textual reference only.

Additional Information