|

Nevada

|

20-3464383

|

|

(State or other jurisdiction of incorporation

or organization)

|

(IRS Employer Identification No.)

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

FTLF

|

Nasdaq Capital Market

|

|

Exhibit

No.

|

Description

|

|

|

99.1

|

||

|

99.2

|

||

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

FitLife Brands, Inc.

|

||

|

Date: March 13, 2025

|

By:

|

/s/ Dayton Judd

|

|

Dayton Judd

|

||

|

Chief Executive Officer

|

||

Exhibit 99.1

FitLife Brands Announces its Participation at the 37th Annual Roth

Conference and Provides Financial and Operational Update

OMAHA, NE – March 13, 2025 – FitLife Brands, Inc. (“FitLife,” or the “Company”) (Nasdaq: FTLF), a provider of innovative and proprietary nutritional supplements and wellness products, today announced that it will participate in the 37th Annual Roth Conference on Monday and Tuesday, March 17-18, 2025. Investors who are interested in meeting with FitLife management should submit their requests through their Roth representative.

In conjunction with its participation in the conference, the Company has prepared an updated investor presentation which will be filed with the Securities and Exchange Commission on Form 8-K in advance of the conference.

The Company plans to report its financial performance for the fourth quarter and full year of 2024 with the Securities and Exchange Commission on Form 10-K on March 27, 2025. However, in order to facilitate upcoming investor discussions, the Company is providing the following financial and operational update regarding the Company’s recent performance:

|

● |

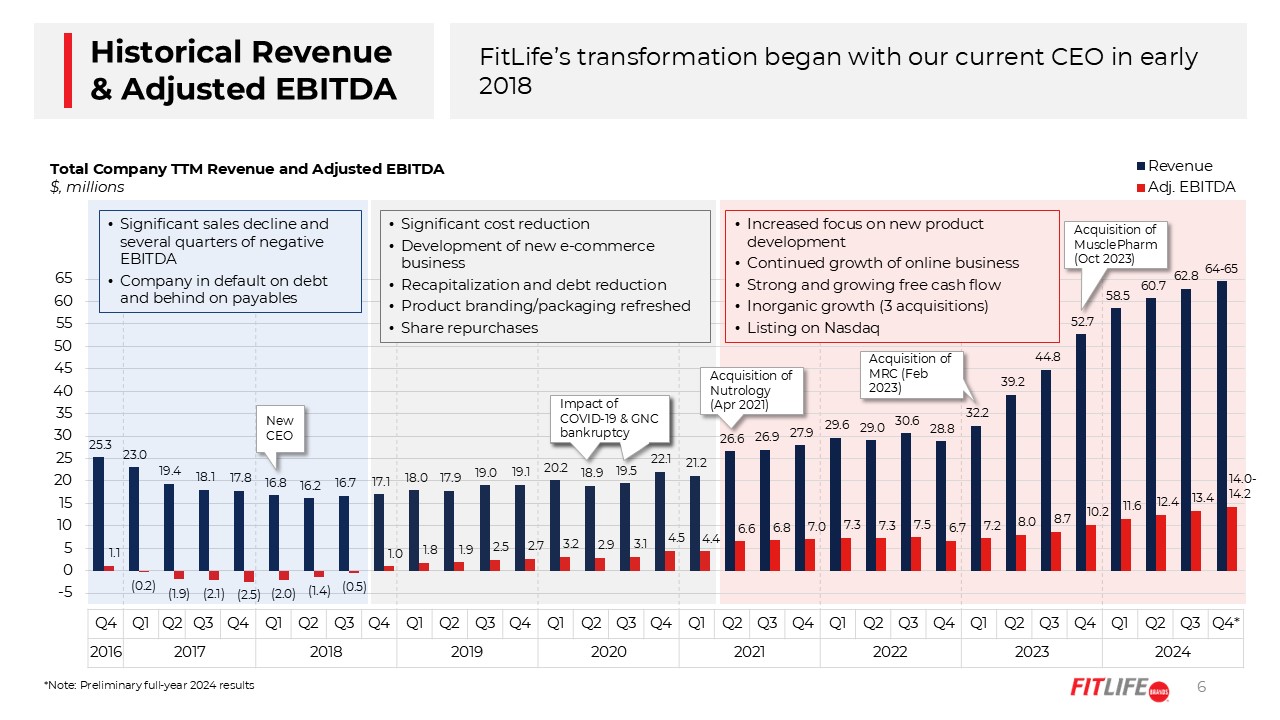

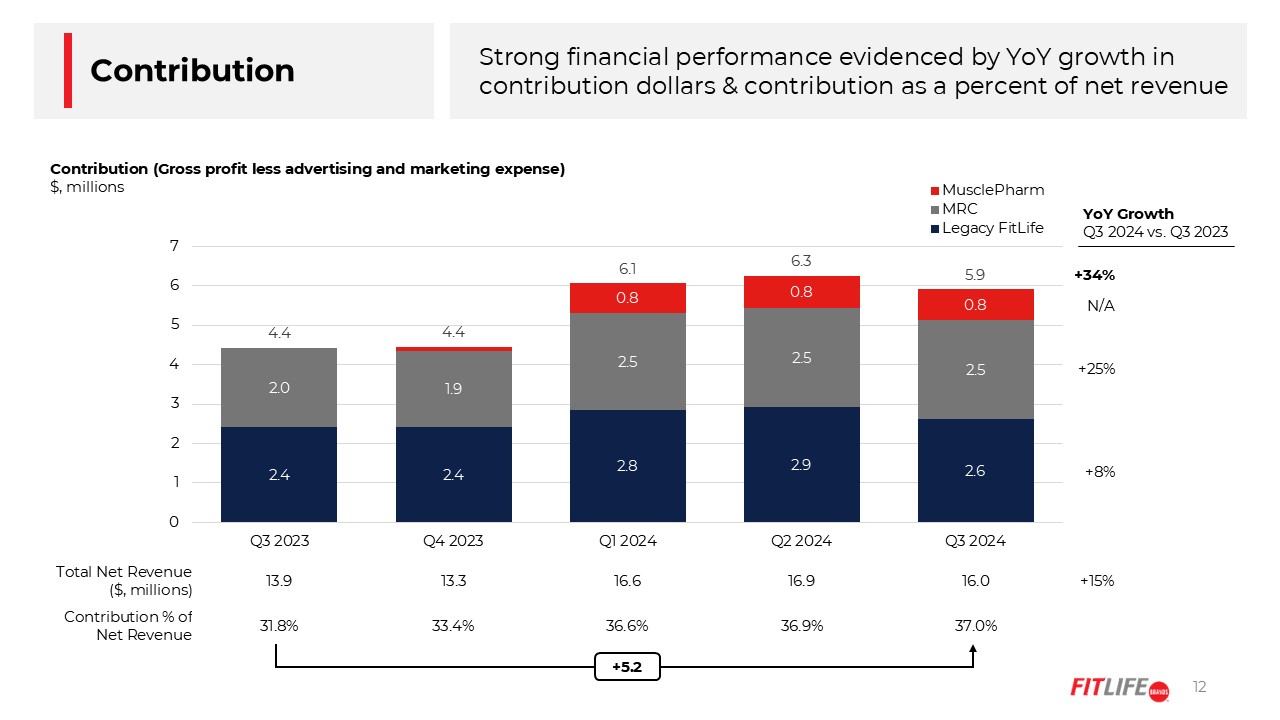

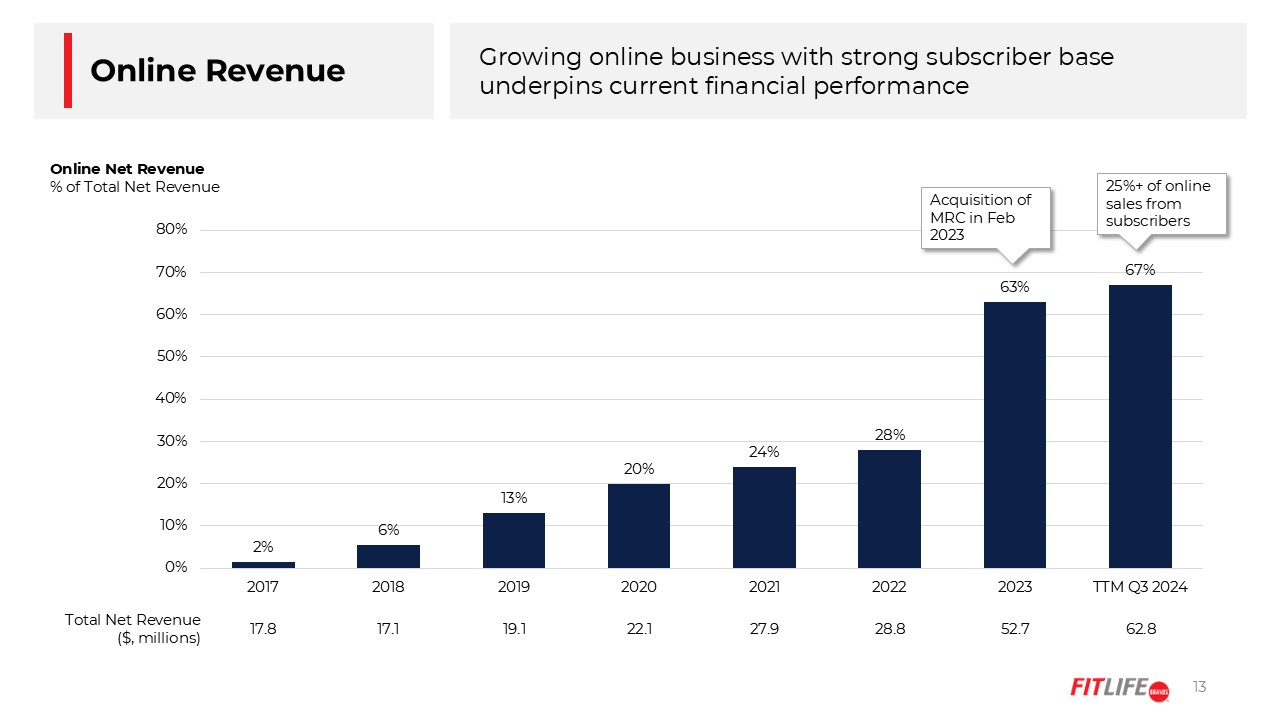

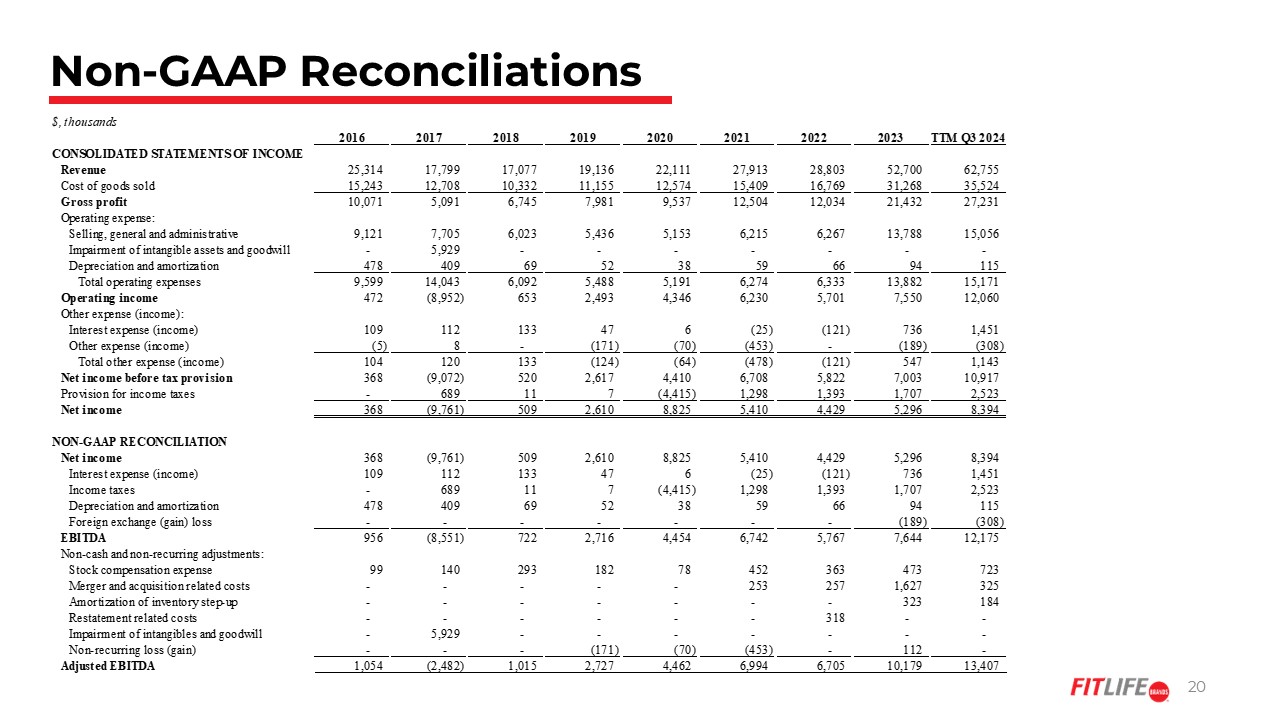

Net revenue for the full year 2024 is anticipated to be between $64-65 million, an increase of 21-23% compared to 2023. |

|

● |

Adjusted EBITDA for the full year 2024 is anticipated to be between $14.0-14.2 million, an increase of 38-40% compared to 2023. |

|

|

● |

Net income for the full year 2024 is anticipated to be between $8.9-9.1 million, an increase of 68-72% compared to 2023. |

|

● |

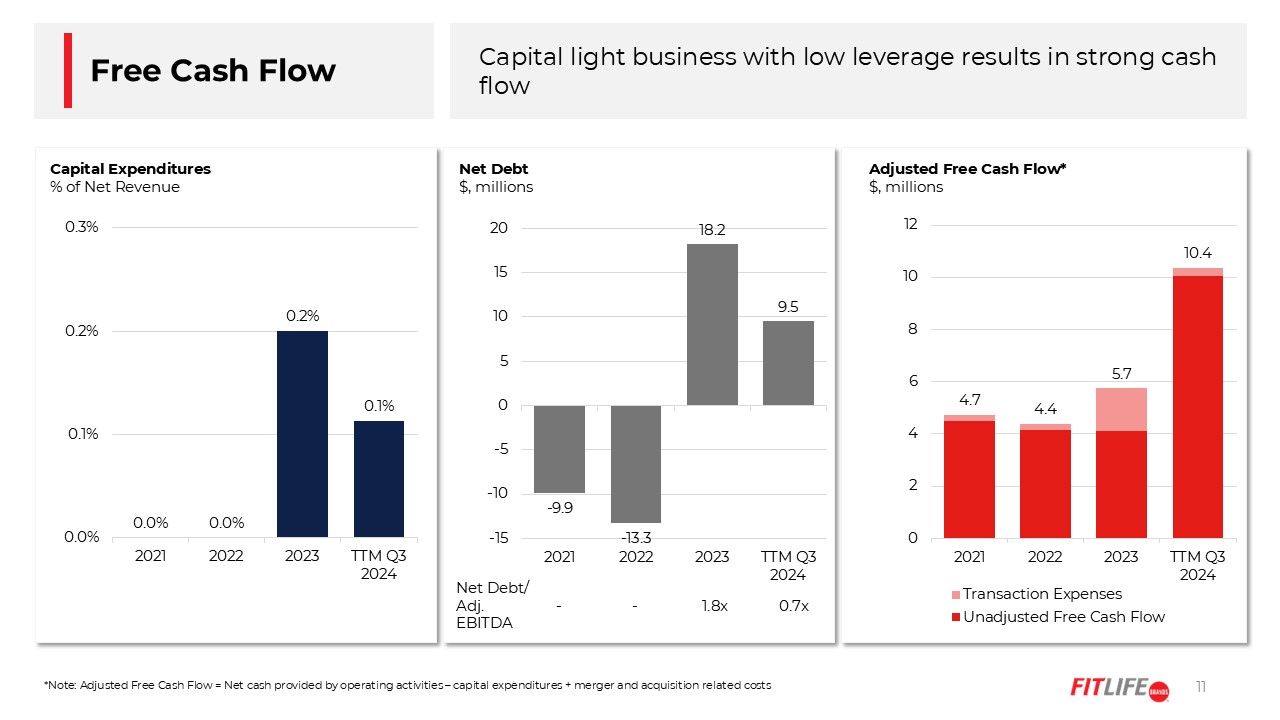

As of December 31st, 2024, the Company had $13.1 million outstanding on its term loan and no balance outstanding on its revolver. |

|

|

● |

As of December 31st, 2024, the Company had $4.5 million of cash. |

|

|

● |

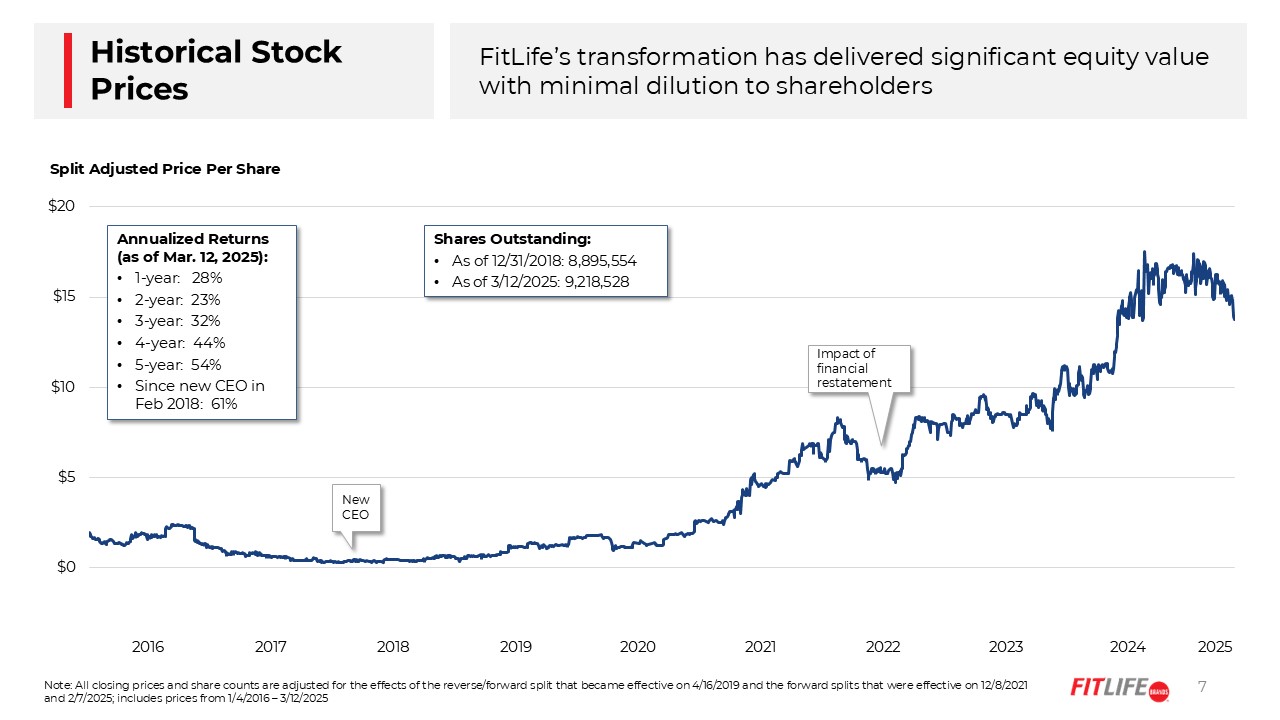

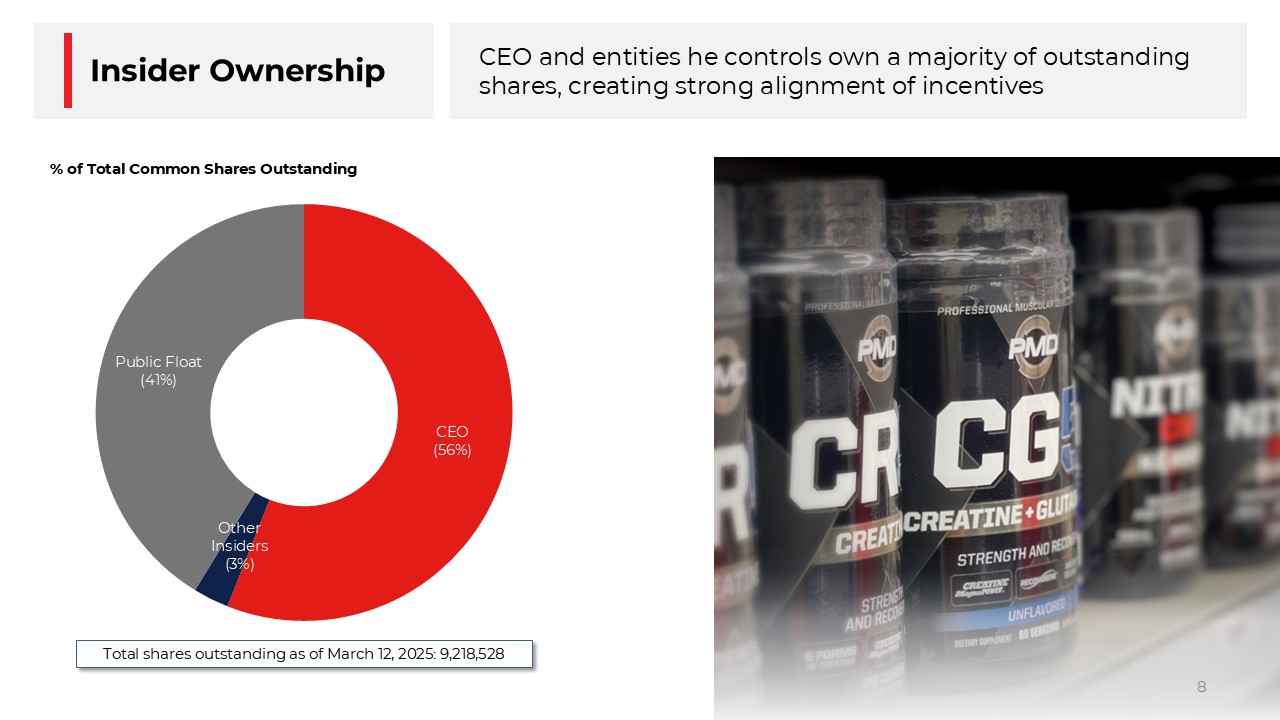

Shares outstanding as of March 12, 2025 were 9,218,528. |

About FitLife Brands

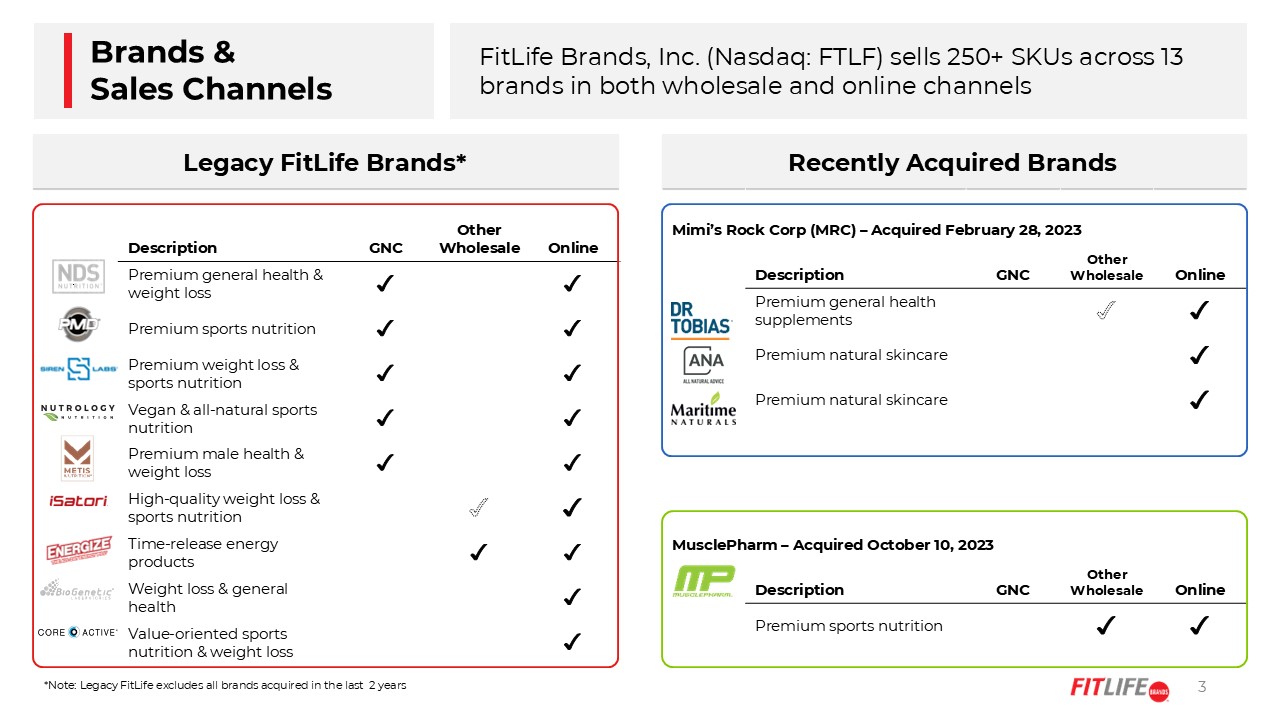

FitLife Brands is a developer and marketer of innovative and proprietary nutritional supplements and wellness products for health-conscious consumers. FitLife markets more than 250 different products primarily online, but also through domestic and international GNC® franchise locations as well as through various other retail locations. FitLife is headquartered in Omaha, Nebraska. For more information, please visit our website at www.fitlifebrands.com.

Forward-Looking Statements

Statements in this release that are forward-looking involve known and unknown risks and uncertainties, which may cause the Company's actual results in future periods to be materially different from any future performance that may be suggested in this news release. Such factors may include, but are not limited to, the ability of the Company to continue to grow revenue, and the Company's ability to continue to achieve positive cash flow given the Company's existing and anticipated operating and other costs. Many of these risks and uncertainties are beyond the Company's control. Reference is made to the discussion of risk factors detailed in the Company's filings with the Securities and Exchange Commission including its reports on Form 10-K and 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

Non-GAAP Financial Measures

This press release contains certain financial measures defined as “non-GAAP financial measures” by the SEC, including non-GAAP adjusted EBITDA. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

As presented herein, non-GAAP EBITDA excludes interest, foreign exchange gains and losses, income taxes, and depreciation and amortization. Adjusted non-GAAP EBITDA excludes, in addition to interest, foreign exchange gains and losses, taxes, depreciation and amortization, equity-based compensation, M&A/integration activities, and non-recurring gains or losses. The Company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expenses and other items that may not be indicative of its core operating results and business outlook. The Company believes that the inclusion of non-GAAP measures in the financial presentation herein allows investors to compare the Company’s financial results with the Company’s historical financial results and is an important measure of the Company’s comparative financial performance.

Exhibit 99.2