|

New York

|

1-10299

|

13-3513936

|

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number)

|

(IRS Employer

Identification No.) |

|

330 West 34th Street, New York, New York

(Address of principal executive offices)

|

10001

(Zip Code)

|

| Registrant’s telephone number, including area code: (212) 720-3700 | |

| N/A | |

|

(Former name or former address, if changed since last report.)

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

||||

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on

which registered

|

||

|

Common Stock, par value $0.01 per share

|

FL

|

New York Stock Exchange

|

||

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 99.1 | Press Release, dated December 4, 2024. | |

| 99.2 | Investor Presentation, dated December 4, 2024. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

|

FOOT LOCKER, INC.

|

|||

|

Date: December 4, 2024

|

By:

|

/s/ Michael Baughn

|

|

| Name: | Michael Baughn | ||

| Title: |

Executive Vice President and

Chief Financial Officer

|

||

Exhibit 99.1

N E W S R E L E A S E

| Contacts: |

Kate Fitzsimons Investor Relations ir@footlocker.com

Dana Yacyk Corporate Communications mediarelations@footlocker.com |

FOOT LOCKER, INC. REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS;

UPDATES 2024 OUTLOOK

● Total Sales Down 1.4% Year-over-Year and Comparable Sales Up 2.4%

● Gross Margin Expansion of 230 Basis Points Year-over-Year

● Loss of $0.34 per Share and Non-GAAP Earnings of $0.33 per Share

● Inventory Decreased 6.3% Year-over-Year

● Updating Full-Year Sales and Non-GAAP EPS Outlook

NEW YORK, NY, December 4, 2024 – Foot Locker, Inc. (NYSE: FL) today reported financial results for its third quarter ended November 2, 2024.

Mary Dillon, President and Chief Executive Officer, said, “Our team’s continued focus on execution drove positive comparable sales trends and meaningful gross margin expansion in the quarter. However, our third quarter top- and bottom-line performance fell short of our expectations. Consumer spending trends softened following the peak Back-to-School period in August, and the promotional environment was more elevated than anticipated. At the same time, we continued to demonstrate progress with our Lace Up Plan, including further cementing our leadership position at the heart of basketball and sneaker culture. In the quarter, we continued the rollout of our Foot Locker ‘Home Court’ experience in collaboration with Nike and Jordan Brand, and we also announced a multi-year partnership with the legendary Chicago Bulls franchise.”

Ms. Dillon continued, “While our trends in early November landed below our expectations as consumers held back their spending ahead of the holiday season, we saw a meaningful and positive acceleration over the key Thanksgiving week period, especially in stores. Despite that strong performance, we are taking a more cautious view and are lowering our full-year sales and earnings outlook due to a more promotional environment and softer consumer demand outside of key selling periods. We remain focused on unlocking opportunities through our new Reimagined stores and refresh program, revamped digital experience, including the recent launch of our new mobile app, and stronger customer engagement through our enhanced FLX Rewards Program. We are confident that our strategies will drive sustainable shareholder value creation as we progress towards our 8.5-9% EBIT margin target by 2028.”

Third Quarter Results

|

● |

Total sales were down 1.4%, to $1,958 million, as compared with sales of $1,986 million in the third quarter of 2023. Excluding the effect of foreign exchange rate fluctuations, total sales for the third quarter decreased by 2.2%. |

|

● |

Comparable sales increased by 2.4%, including global Foot Locker and Kids Foot Locker comparable sales growth of 2.8%. Notably, the Champs Sports and WSS banners saw positive comparable sales growth of 2.8% and 1.8%, respectively. |

Please refer to the Sales by Banner table below for detailed sales performance by banner and region.

|

● |

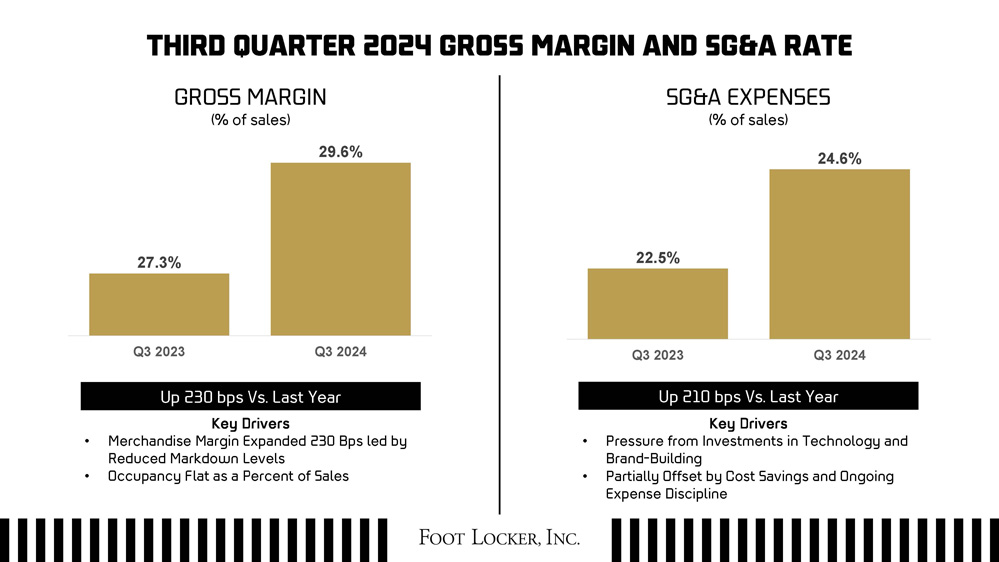

Gross margin increased by 230 basis points as compared with the prior-year period, which was led by reduced markdown levels. Gross margin trends accelerated from the second quarter of 2024, but performance was below expectations given an elevated promotional environment. |

|

● |

SG&A as a percentage of sales increased by 210 basis points as compared with the prior-year period, driven by technology and brand-building investments, partially offset by savings from the cost optimization program and ongoing expense discipline. |

|

● |

Third quarter net loss was $33 million, as compared with net income of $28 million in the corresponding prior-year period. On a Non-GAAP basis, net income was $31 million for the third quarter, as compared with net income of $28 million in the corresponding prior-year period. |

|

● |

Third quarter loss per share was $0.34, as compared with earnings of $0.30 per share in the third quarter of 2023. Non-GAAP earnings were $0.33 per share in the third quarter, as compared with Non-GAAP earnings per share of $0.30 in the corresponding prior-year period. |

|

● |

Non-GAAP results exclude, among other items, non-cash impairment charges of $25 million related to the atmos tradename following a strategic review of the atmos business and a charge of $35 million related to impairment to the carrying value of a minority investment, which is regularly assessed whenever events or circumstances indicate that the carrying value may not be recoverable. |

See the tables below for the reconciliation of Non-GAAP measures.

Balance Sheet

At quarter-end, the Company’s cash and cash equivalents totaled $211 million, while total debt was $445 million.

As of November 2, 2024, the Company’s merchandise inventories were $1.7 billion, 6.3% lower than at the end of the third quarter last year. Excluding the effect of foreign currency fluctuations, merchandise inventories decreased by 6.9% as compared with the third quarter of last year.

Store Base Update

During the third quarter, the Company opened 10 new stores and closed 24 stores. Also during the quarter, the Company remodeled or relocated 20 stores and refreshed 167 stores to our updated design standards, which incorporate key elements of our current brand design specifications.

As of November 2, 2024, the Company operated 2,450 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 214 licensed stores were operating in the Middle East and Asia.

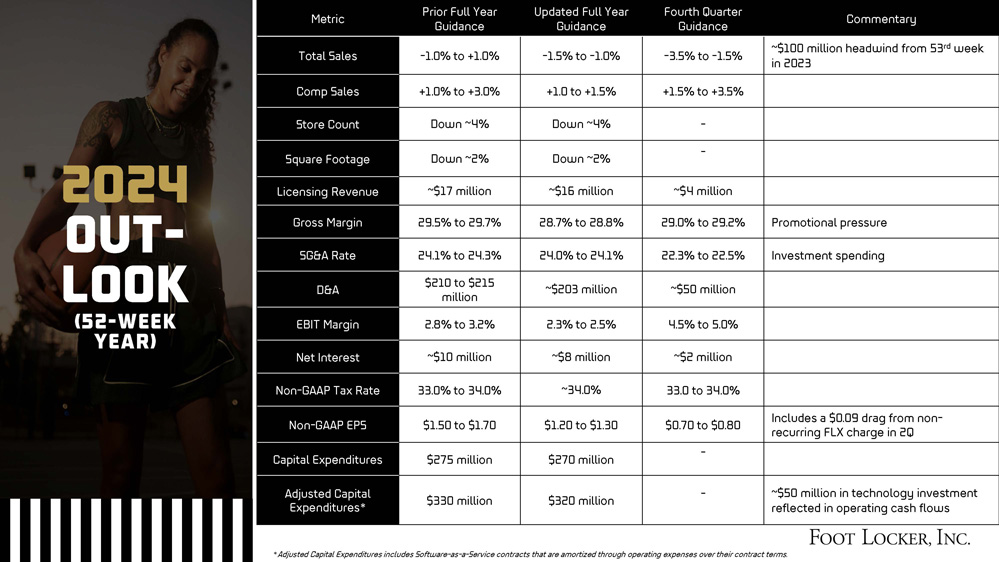

Lowering 2024 Sales and Non-GAAP EPS Outlook

The Company’s full year 2024 outlook, representing the 52 weeks ending February 1, 2025, is summarized in the table below.

| Metric | Prior Full Year Guidance | Updated Full Year Guidance | Fourth Quarter Guidance | Commentary |

| Sales Change | -1.0% to +1.0% | -1.5% to -1.0% | -3.5% to -1.5% | ~$100 million headwind from 53rd week in 2023 |

| Comparable Sales Change | +1.0% to +3.0% | +1.0% to +1.5% | +1.5% to +3.5% | |

| Store Count Change | Down ~4% | Down ~4% | ||

| Square Footage Change | Down ~2% | Down ~2% | ||

| Licensing Revenue | ~$17 million | ~$16 million | ~$4 million | |

| Gross Margin | 29.5% to 29.7% | 28.7% to 28.8% | 29.0% to 29.2% | Promotional pressure |

| SG&A Rate | 24.1% to 24.3% | 24.0% to 24.1% | 22.3% to 22.5% | Investment spending |

| D&A | $210 to $215 million | ~$203 million | ~$50 million | |

| EBIT Margin | 2.8% to 3.2% | 2.3% to 2.5% | 4.5% to 5.0% | |

| Net Interest | ~$10 million | ~$8 million | ~$2 million | |

| Non-GAAP Tax Rate | 33.0% to 34.0% | ~34.0% | 33.0% to 34.0% | |

| Non-GAAP EPS | $1.50 to $1.70 | $1.20 to $1.30 | $0.70 to $0.80 | Includes $0.09 drag from non-recurring FLX charge in 2Q |

| Capital Expenditures | $275 million | $270 million | ||

| Adj. Capital Expenditures* | $330 million | $320 million | Includes ~$50 million in technology investment reflected in operating cash flows |

* Adjusted Capital Expenditures includes Software-as-a-Service contracts that are amortized through operating expenses over their contract terms.

The Company provides earnings guidance only on a non-GAAP basis and does not provide a reconciliation of the Company’s forward-looking EBIT, non-GAAP tax rate, and diluted earnings per share guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. ET today, December 4, 2024, to review its third quarter 2024 results and provide an update on the business. An investor presentation will be available on the Investor Relations section of the Company’s corporate website before the start of the conference call. The call may be accessed live by calling toll-free 1-844-701-1163 or international toll 1-412-317-5490, or via footlocker-inc.com. Please log on to the website 15 minutes prior to the call to register. An archived replay of the conference call will be accessible approximately one hour following the end of the call through December 18, 2024, by calling 1-877-344-7529 in the U.S., 1-855-669-9658 in Canada, and 1-412-317-0088 internationally with passcode 6919734. A webcast replay will also be available at footlocker-inc.com.

Disclosure Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Other than statements of historical facts, all statements which address activities, events, or developments that the Company anticipates will or may occur in the future, including, but not limited to, such things as future capital expenditures, expansion, strategic plans, financial objectives, dividend payments, stock repurchases, financial outlook, and other such matters, are forward-looking statements. These forward-looking statements are based on many assumptions and factors, which are detailed in the Company’s filings with the U.S. Securities and Exchange Commission.

These forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. For additional discussion regarding risks and uncertainties that may affect forward-looking statements, see “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended February 3, 2024, filed on March 28, 2024, and subsequent filings. Any changes in such assumptions or factors could produce significantly different results. The Company undertakes no obligation to update the forward-looking statements, whether as a result of new information, future events, or otherwise.

Condensed Consolidated Statements of Operations

(unaudited)

Periods ended November 2, 2024 and October 28, 2023

(In millions, except per share amounts)

|

Third Quarter |

Year-to-Date |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Sales |

$ | 1,958 | $ | 1,986 | $ | 5,728 | $ | 5,774 | ||||||||

|

Licensing revenue |

3 | 3 | 12 | 10 | ||||||||||||

|

Total revenue |

1,961 | 1,989 | 5,740 | 5,784 | ||||||||||||

|

|

|

|

|

|

||||||||||||

|

Cost of sales |

1,378 | 1,443 | 4,086 | 4,149 | ||||||||||||

|

Selling, general and administrative expenses |

482 | 446 | 1,419 | 1,319 | ||||||||||||

|

Depreciation and amortization |

51 | 47 | 153 | 148 | ||||||||||||

|

Impairment and other |

38 | 6 | 61 | 59 | ||||||||||||

|

Income from operations |

12 | 47 | 21 | 109 | ||||||||||||

|

|

|

|

|

|

||||||||||||

|

Interest expense, net |

(2 | ) | (2 | ) | (6 | ) | (7 | ) | ||||||||

|

Other (expense) income, net |

(35 | ) | 2 | (41 | ) | (1 | ) | |||||||||

|

(Loss) income before income taxes |

(25 | ) | 47 | (26 | ) | 101 | ||||||||||

|

Income tax expense |

8 | 19 | 11 | 42 | ||||||||||||

|

Net (loss) income |

$ | (33 | ) | $ | 28 | $ | (37 | ) | $ | 59 | ||||||

|

|

|

|

|

|||||||||||||

|

Diluted (loss) earnings per share |

$ | (0.34 | ) | $ | 0.30 | $ | (0.38 | ) | $ | 0.63 | ||||||

|

Weighted-average diluted shares outstanding |

95.0 | 94.7 | 94.9 | 94.9 | ||||||||||||

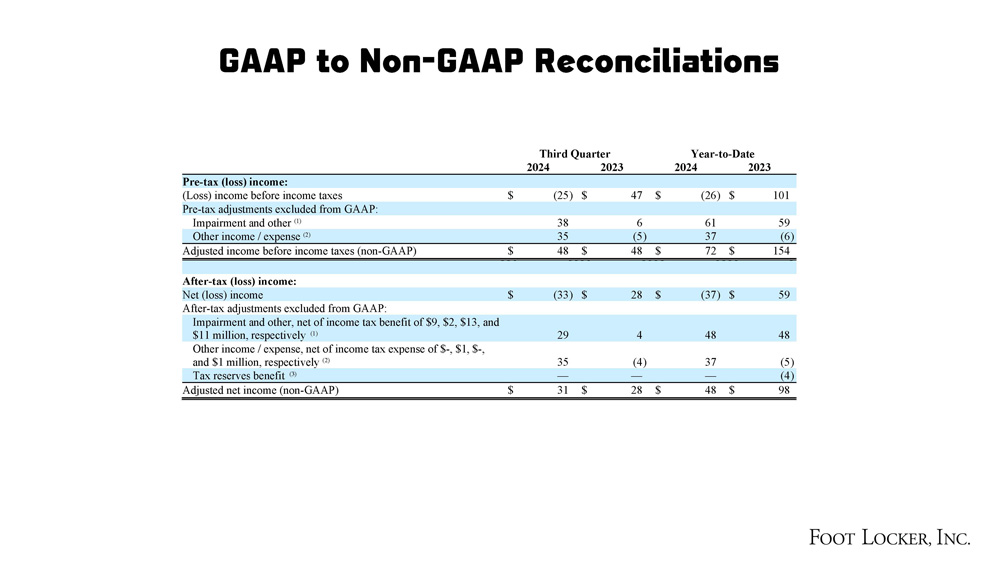

Non-GAAP Financial Measures

In addition to reporting the Company’s financial results in accordance with generally accepted accounting principles (“GAAP”), the Company reports certain financial results that differ from what is reported under GAAP. Non-GAAP financial measures that will be presented will exclude (i) gains or losses related to our minority investments, (ii) impairments and other, and (iii) certain tax matters that we believe are nonrecurring or unusual in nature.

Certain financial measures are identified as non-GAAP, such as sales changes excluding foreign currency fluctuations, adjusted income before income taxes, adjusted net income, and adjusted diluted earnings per share. We present certain amounts as excluding the effects of foreign currency fluctuations, which are also considered non-GAAP measures. Where amounts are expressed as excluding the effects of foreign currency fluctuations, such changes are determined by translating all amounts in both years using the prior-year average foreign exchange rates. Presenting amounts on a constant currency basis is useful to investors because it enables them to better understand the changes in our business that are not related to currency movements.

These non-GAAP measures are presented because we believe they assist investors in allowing a more direct comparison of our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core business or affect comparability. In addition, these non-GAAP measures are useful in assessing our progress in achieving our long-term financial objectives and are consistent with how executive compensation is determined.

We estimate the tax effect of all non-GAAP adjustments by applying a marginal tax rate to each item. The income tax items represent the discrete amount that affected the period. The non-GAAP financial information is provided in addition, and not as an alternative, to our reported results prepared in accordance with GAAP. The various non-GAAP adjustments are summarized in the tables below.

Non-GAAP Reconciliation

(unaudited)

Periods ended November 2, 2024 and October 28, 2023

(In millions, except per share amounts)

Reconciliation of GAAP to non-GAAP results:

|

Third Quarter |

Year-to-Date |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Pre-tax (loss) income: |

||||||||||||||||

|

(Loss) income before income taxes |

$ | (25 | ) | $ | 47 | $ | (26 | ) | $ | 101 | ||||||

|

Pre-tax adjustments excluded from GAAP: |

|

|||||||||||||||

|

Impairment and other (1) |

38 | 6 | 61 | 59 | ||||||||||||

|

Other income / expense (2) |

35 | (5 | ) | 37 | (6 | ) | ||||||||||

|

Adjusted income before income taxes (non-GAAP) |

$ | 48 | $ | 48 | $ | 72 | $ | 154 | ||||||||

|

After-tax (loss) income: |

||||||||||||||||

|

Net (loss) income |

$ | (33 | ) | $ | 28 | $ | (37 | ) | $ | 59 | ||||||

|

After-tax adjustments excluded from GAAP: |

|

|||||||||||||||

|

Impairment and other, net of income tax benefit of $9, $2, $13, and $11 million, respectively (1) |

29 | 4 | 48 | 48 | ||||||||||||

|

Other income / expense, net of income tax expense of $-, $1, $-, and $1 million, respectively (2) |

35 | (4 | ) | 37 | (5 | ) | ||||||||||

|

Tax reserves benefit (3) |

— | — | — | (4 | ) | |||||||||||

|

Adjusted net income (non-GAAP) |

$ | 31 | $ | 28 | $ | 48 | $ | 98 | ||||||||

|

Third Quarter |

Year-to-Date |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

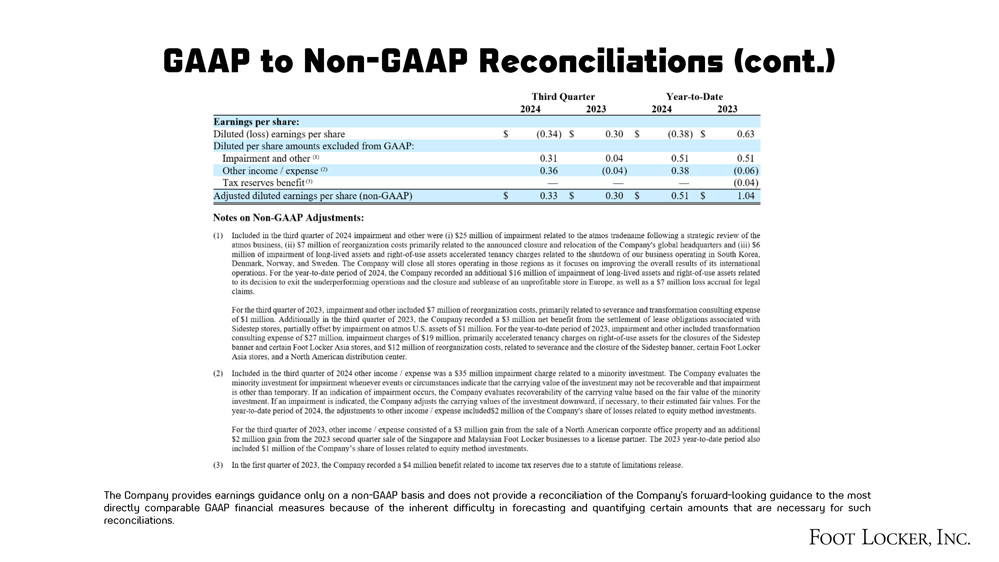

Earnings per share: |

||||||||||||||||

|

Diluted (loss) earnings per share |

$ | (0.34 | ) | $ | 0.30 | $ | (0.38 | ) | $ | 0.63 | ||||||

|

Diluted per share amounts excluded from GAAP: |

||||||||||||||||

|

Impairment and other (1) |

0.31 | 0.04 | 0.51 | 0.51 | ||||||||||||

|

Other income / expense (2) |

0.36 | (0.04 | ) | 0.38 | (0.06 | ) | ||||||||||

|

Tax reserves benefit (3) |

— | — | — | (0.04 | ) | |||||||||||

|

Adjusted diluted earnings per share (non-GAAP) |

$ | 0.33 | $ | 0.30 | $ | 0.51 | $ | 1.04 | ||||||||

Notes on Non-GAAP Adjustments:

|

(1) |

Included in the third quarter of 2024 impairment and other were (i) $25 million of impairment related to the atmos tradename following a strategic review of the atmos business, (ii) $7 million of reorganization costs primarily related to the announced closure and relocation of the Company's global headquarters and (iii) $6 million of impairment of long-lived assets and right-of-use assets accelerated tenancy charges related to the shutdown of our business operating in South Korea, Denmark, Norway, and Sweden. The Company will close all stores operating in those regions as it focuses on improving the overall results of its international operations. For the year-to-date period of 2024, the Company recorded an additional $16 million of impairment of long-lived assets and right-of-use assets related to its decision to exit the underperforming operations and the closure and sublease of an unprofitable store in Europe, as well as a $7 million loss accrual for legal claims.

For the third quarter of 2023, impairment and other included $7 million of reorganization costs, primarily related to severance and transformation consulting expense of $1 million. Additionally in the third quarter of 2023, the Company recorded a $3 million net benefit from the settlement of lease obligations associated with Sidestep stores, partially offset by impairment on atmos U.S. assets of $1 million. For the year-to-date period of 2023, impairment and other included transformation consulting expense of $27 million, impairment charges of $19 million, primarily accelerated tenancy charges on right-of-use assets for the closures of the Sidestep banner and certain Foot Locker Asia stores, and $12 million of reorganization costs, related to severance and the closure of the Sidestep banner, certain Foot Locker Asia stores, and a North American distribution center. |

|

(2) |

Included in the third quarter of 2024 other income / expense was a $35 million impairment charge related to a minority investment. The Company evaluates the minority investment for impairment whenever events or circumstances indicate that the carrying value of the investment may not be recoverable and that impairment is other than temporary. If an indication of impairment occurs, the Company evaluates recoverability of the carrying value based on the fair value of the minority investment. If an impairment is indicated, the Company adjusts the carrying values of the investment downward, if necessary, to their estimated fair values. For the year-to-date period of 2024, the adjustments to other income / expense included $2 million of the Company's share of losses related to equity method investments.

For the third quarter of 2023, other income / expense consisted of a $3 million gain from the sale of a North American corporate office property and an additional $2 million gain from the 2023 second quarter sale of the Singapore and Malaysian Foot Locker businesses to a license partner. The 2023 year-to-date period also included $1 million of the Company’s share of losses related to equity method investments. |

|

(3) |

In the first quarter of 2023, the Company recorded a $4 million benefit related to income tax reserves due to a statute of limitations release. |

Sales by Banner

(unaudited)

Periods ended November 2, 2024 and October 28, 2023

(In millions)

|

Third Quarter |

Year-to-Date |

|||||||||||||||||||||||||||||||

|

2024 |

2023 |

Constant Currencies |

Comparable Sales |

2024 |

2023 |

Constant Currencies |

Comparable Sales |

|||||||||||||||||||||||||

|

Foot Locker |

$ | 769 | $ | 796 | (3.3 | )% | 1.6 | % | $ | 2,282 | $ | 2,244 | 1.8 | % | 2.6 | % | ||||||||||||||||

|

Champs Sports |

286 | 311 | (8.0 | ) | 2.8 | 821 | 932 | (11.8 | ) | (5.1 | ) | |||||||||||||||||||||

|

Kids Foot Locker |

183 | 189 | (3.2 | ) | 3.2 | 520 | 502 | 3.6 | 3.2 | |||||||||||||||||||||||

|

WSS |

167 | 163 | 2.5 | 1.8 | 482 | 458 | 5.2 | (3.4 | ) | |||||||||||||||||||||||

|

Other |

— | 1 | n.m. | n.m. | 1 | 1 | — | n.m. | ||||||||||||||||||||||||

|

North America |

1,405 | 1,460 | (3.7 | ) | 2.1 | 4,106 | 4,137 | (0.7 | ) | 0.3 | ||||||||||||||||||||||

|

Foot Locker |

445 | 407 | 6.1 | 6.4 | 1,284 | 1,202 | 6.0 | 5.3 | ||||||||||||||||||||||||

|

Sidestep |

— | — | n.m. | n.m. | — | 26 | (100.0 | ) | n.m. | |||||||||||||||||||||||

|

EMEA |

445 | 407 | 6.1 | 6.4 | 1,284 | 1,228 | 3.7 | 5.3 | ||||||||||||||||||||||||

|

Foot Locker |

77 | 81 | (8.6 | ) | (5.6 | ) | 236 | 281 | (15.7 | ) | (5.5 | ) | ||||||||||||||||||||

|

atmos |

31 | 38 | (18.4 | ) | (11.2 | ) | 102 | 128 | (13.3 | ) | (6.2 | ) | ||||||||||||||||||||

|

Asia Pacific |

108 | 119 | (11.8 | ) | (7.3 | ) | 338 | 409 | (14.9 | ) | (5.7 | ) | ||||||||||||||||||||

|

Total |

$ | 1,958 | $ | 1,986 | (2.2 | )% | 2.4 | % | $ | 5,728 | $ | 5,774 | (0.7 | )% | 1.0 | % | ||||||||||||||||

Condensed Consolidated Balance Sheets

(unaudited)

(In millions)

|

November 2, |

October 28, |

|||||||

|

2024 |

2023 |

|||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 211 | $ | 187 | ||||

|

Merchandise inventories |

1,744 | 1,862 | ||||||

|

Assets held for sale |

10 | — | ||||||

|

Other current assets |

421 | 325 | ||||||

| 2,386 | 2,374 | |||||||

|

Property and equipment, net |

906 | 884 | ||||||

|

Operating lease right-of-use assets |

2,102 | 2,182 | ||||||

|

Deferred taxes |

135 | 91 | ||||||

|

Goodwill |

761 | 763 | ||||||

|

Other intangible assets, net |

365 | 407 | ||||||

|

Minority investments |

115 | 630 | ||||||

|

Other assets |

92 | 89 | ||||||

| $ | 6,862 | $ | 7,420 | |||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 501 | $ | 593 | ||||

|

Accrued and other liabilities |

428 | 369 | ||||||

|

Current portion of long-term debt and obligations under finance leases |

5 | 6 | ||||||

|

Current portion of lease obligations |

492 | 491 | ||||||

|

Liabilities held for sale |

6 | — | ||||||

| 1,432 | 1,459 | |||||||

|

Long-term debt and obligations under finance leases |

440 | 443 | ||||||

|

Long-term lease obligations |

1,898 | 1,994 | ||||||

|

Other liabilities |

224 | 319 | ||||||

|

Total liabilities |

3,994 | 4,215 | ||||||

|

Total shareholders' equity |

2,868 | 3,205 | ||||||

| $ | 6,862 | $ | 7,420 | |||||

Condensed Consolidated Statement of Cash Flows

(unaudited)

(In millions)

|

|

Thirty-nine weeks ended |

|||||||

|

|

November 2, |

October 28, |

||||||

|

($ in millions) |

2024 |

2023 |

||||||

|

From operating activities: |

||||||||

|

Net (loss) income |

$ | (37 | ) | $ | 59 | |||

|

Adjustments to reconcile net (loss) income to net cash from operating activities: |

||||||||

|

Non-cash impairment and other |

47 | 20 | ||||||

|

Fair value adjustment to minority investment |

35 | — | ||||||

|

Depreciation and amortization |

153 | 148 | ||||||

|

Deferred income taxes |

(35 | ) | (5 | ) | ||||

|

Share-based compensation expense |

19 | 9 | ||||||

|

Gain on sales of businesses |

— | (4 | ) | |||||

|

Gain on sale of property |

— | (3 | ) | |||||

|

Change in assets and liabilities: |

||||||||

|

Merchandise inventories |

(243 | ) | (249 | ) | ||||

|

Accounts payable |

137 | 110 | ||||||

|

Accrued and other liabilities |

29 | (131 | ) | |||||

|

Other, net |

(7 | ) | (52 | ) | ||||

|

Net cash provided by (used in) operating activities |

98 | (98 | ) | |||||

|

From investing activities: |

||||||||

|

Capital expenditures |

(185 | ) | (165 | ) | ||||

|

Minority investments |

(1 | ) | (2 | ) | ||||

|

Proceeds from minority investments |

1 | — | ||||||

|

Proceeds from sales of businesses |

— | 16 | ||||||

|

Proceeds from sale of property |

— | 6 | ||||||

|

Net cash used in investing activities |

(185 | ) | (145 | ) | ||||

|

From financing activities: |

||||||||

|

Payment of debt issuance costs |

(4 | ) | — | |||||

|

Dividends paid on common stock |

— | (113 | ) | |||||

|

Shares of common stock repurchased to satisfy tax withholding obligations |

(5 | ) | (10 | ) | ||||

|

Payment of obligations under finance leases |

(4 | ) | (5 | ) | ||||

|

Proceeds from exercise of stock options |

5 | 5 | ||||||

|

Treasury stock reissued under employee stock plan |

2 | 3 | ||||||

|

Net cash used in financing activities |

(6 | ) | (120 | ) | ||||

|

Effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash |

1 | 4 | ||||||

|

Net change in cash, cash equivalents, and restricted cash |

(92 | ) | (359 | ) | ||||

|

Cash, cash equivalents, and restricted cash at beginning of year |

334 | 582 | ||||||

|

Cash, cash equivalents, and restricted cash at end of period |

$ | 242 | $ | 223 | ||||

Store Count and Square Footage

(unaudited)

Store activity is as follows:

|

February 3, |

November 2, |

Relocations/ |

||||||||||||||||||

|

2024 |

Opened |

Closed |

2024 |

Remodels |

||||||||||||||||

|

Foot Locker U.S. |

723 | 1 | 33 | 691 | 123 | |||||||||||||||

|

Foot Locker Canada |

85 | — | 1 | 84 | 22 | |||||||||||||||

|

Champs Sports |

404 | — | 14 | 390 | 2 | |||||||||||||||

|

Kids Foot Locker |

390 | 2 | 16 | 376 | 77 | |||||||||||||||

|

WSS |

141 | 7 | — | 148 | 3 | |||||||||||||||

|

Footaction |

1 | — | — | 1 | — | |||||||||||||||

|

North America |

1,744 | 10 | 64 | 1,690 | 227 | |||||||||||||||

|

Foot Locker Europe (1) |

637 | 8 | 25 | 620 | 55 | |||||||||||||||

|

EMEA |

637 | 8 | 25 | 620 | 55 | |||||||||||||||

|

Foot Locker Pacific |

98 | 1 | 2 | 97 | 13 | |||||||||||||||

|

Foot Locker Asia |

13 | — | — | 13 | — | |||||||||||||||

|

atmos |

31 | — | 1 | 30 | 2 | |||||||||||||||

|

Asia Pacific |

142 | 1 | 3 | 140 | 15 | |||||||||||||||

|

Total |

2,523 | 19 | 92 | 2,450 | 297 | |||||||||||||||

Selling and gross square footage are as follows:

|

October 28, 2023 |

November 2, 2024 |

|||||||||||||||

|

(in thousands) |

Selling |

Gross |

Selling |

Gross |

||||||||||||

|

Foot Locker U.S. |

2,383 | 4,063 | 2,366 | 3,999 | ||||||||||||

|

Foot Locker Canada |

250 | 412 | 257 | 423 | ||||||||||||

|

Champs Sports |

1,778 | 2,792 | 1,491 | 2,345 | ||||||||||||

|

Kids Foot Locker |

760 | 1,271 | 767 | 1,282 | ||||||||||||

|

WSS |

1,332 | 1,600 | 1,531 | 1,844 | ||||||||||||

|

Footaction |

3 | 6 | 3 | 6 | ||||||||||||

|

North America |

6,506 | 10,144 | 6,415 | 9,899 | ||||||||||||

|

Foot Locker Europe (1) |

1,190 | 2,433 | 1,192 | 2,422 | ||||||||||||

|

EMEA |

1,190 | 2,433 | 1,192 | 2,422 | ||||||||||||

|

Foot Locker Pacific |

235 | 356 | 250 | 377 | ||||||||||||

|

Foot Locker Asia |

52 | 98 | 52 | 98 | ||||||||||||

|

atmos |

35 | 61 | 28 | 47 | ||||||||||||

|

Asia Pacific |

322 | 515 | 330 | 522 | ||||||||||||

|

Total |

8,018 | 13,092 | 7,937 | 12,843 | ||||||||||||

(1) Includes 13 and 8 Kids Foot Locker stores, and the related square footage, operating in Europe for February 3, 2024 and November 2, 2024, respectively.

Exhibit 99.2

Foot Locker, Inc. THIRD QUARTER 2024 EARNINGS RESULTS

DECEMBER 4, 2024

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This investor presentation includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks,” “continues,” “feels,” “forecasts,” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could,” “may,” “aims,” “intends,” or “projects.” Statements may be forward looking even in the absence of these particular words.

Examples of forward-looking statements include, but are not limited to, statements regarding our financial position, business strategy, and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained herein are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate.

We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to, a change in the relationship with any of our key suppliers, including access to premium products, volume discounts, cooperative advertising, markdown allowances, or the ability to cancel orders or return merchandise; inventory management; our ability to fund our planned capital investments; a recession, volatility in the financial markets, and other global economic factors, including inflation; difficulties in appropriately allocating capital and resources among our strategic opportunities; our ability to realize the expected benefits from acquisitions; business opportunities and expansion; investments; expenses; dividends; share repurchases; cash management; liquidity; cash flow from operations; our ability to access the credit markets at competitive terms; borrowing capacity under our credit facility; repatriation of cash to the United States; supply chain issues; labor shortages and wage pressures; consumer spending levels and expectations; licensed store arrangements; the effect of certain governmental assistance programs; the success of our marketing and sponsorship arrangements; expectations regarding increasing global taxes and tariffs; the effect of increased government regulation, compliance, and changes in law; the effect of the adverse outcome of any material litigation or government investigation that affects us or our industry generally; the effects of weather; ESG risks, including, but not limited to climate change; increased competition; geopolitical events; the financial effect of accounting regulations and critical accounting policies; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors set forth in the section entitled “Risk Factors” of our most recent Annual Report on Form 10-K and subsequent filings.

All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak to our views only as of the date of this investor presentation. Additional risks and uncertainties that we do not presently know about or that we currently consider to be insignificant may also affect our business operations and financial performance.

Please refer to “Item 1A. Risk Factors” in the Annual Report and subsequent filings for a discussion of certain risks relating to our business and any investment in our securities. Given these risks and uncertainties, you should not rely on forward-looking statements as predictions of actual results. Any or all of the forward-looking statements contained in this investor presentation, or any other public statement made by us, including by our management, may turn out to be incorrect.

We are including this cautionary note to make applicable, and take advantage of, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Measures – Amounts used in this presentation are on a Non-GAAP basis, a reconciliation is included in the Appendix.

Third Quarter 2024 RESULTS Foot Locker, Inc.

THIRD QUARTER 2024 HIGHLIGHTS

Comp Detail Global FL/KFL +2.8% NA +2.1% EMEA +6.4% APAC (7.3%)

COMP SALES +2.4% Total sales -1.4%

Gross margin +230 bps Reduced Markdown Levels

SG&A rate +210 bps Investments in Technology and Brand-Building

Controlled Inventory Levels Headed into 4Q24 (6.3%) Year-over-year

GAAP EPS ($0.34) Non-GAAP EPS* $0.33

* A reconciliation to GAAP is provided in the Appendix Foot Locker, Inc.

3Q GLOBAL COMP DETAIL

Footwear Up High-Single Digits Up High-Single Digits August

Apparel Down Low- Twenties Down Low-Single Digits September

Accessories Up High-Single Digits Down Low-Single Digits October

Monthly comp percentages include WSS and atmos, however information by family of business excludes those businesses. Foot Locker, Inc.

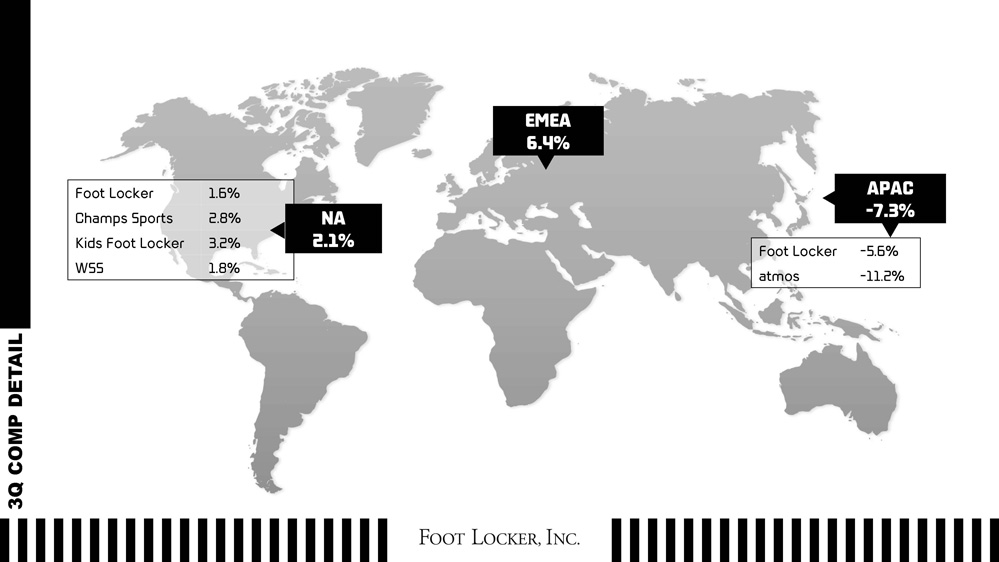

3Q COMP DETAIL

Foot Locker 1.6% Champs Sports 2.8% Kids Foot Locker 3.2% WSS 1.8%

NA 2.1% EMEA 6.4% APAC -7.3%

Foot Locker -5.6% atmos -11.2% Foot Locker, Inc.

THIRD QUARTER 2024 GROSS MARGIN AND SG&A RATE

GROSS MARGIN (% of sales) 27.3% Q3 2023 29.6% Q3 2024

Up 230 bps Vs. Last Year Key Drivers

• Merchandise Margin Expanded 230 Bps led by Reduced Markdown Levels

• Occupancy Flat as a Percent of Sales

SG&A EXPENSES (% of sales) 22.5% Q3 2023 24.6% Q3 2024

Up 210 bps Vs. Last Year Key Drivers

• Pressure from Investments in Technology and Brand-Building

• Partially Offset by Cost Savings and Ongoing Expense Discipline Foot Locker, Inc.

2024 OUT-LOOK (52-WEEK YEAR)

Metric Prior Full Year Guidance Updated Full Year Guidance Fourth Quarter Guidance Commentary

Total Sales -1.0% to +1.0% -1.5% to -1.0% -3.5% to -1.5% ~$100 million headwind from 53rd week in 2023

Comp Sales +1.0% to +3.0% +1.0 to +1.5% +1.5% to +3.5%

Store Count Down ~4% Down ~4% -

Square Footage Down ~2% Down ~2% -

Licensing Revenue ~$17 million ~$16 million ~$4 million

Gross Margin 29.5% to 29.7% 28.7% to 28.8% 29.0% to 29.2% Promotional pressure

SG&A Rate 24.1% to 24.3% 24.0% to 24.1% 22.3% to 22.5% Investment spending

D&A $210 to $215 million ~$203 million ~$50 million

EBIT Margin 2.8% to 3.2% 2.3% to 2.5% 4.5% to 5.0%

Net Interest ~$10 million ~$8 million ~$2 million

Non-GAAP Tax Rate 33.0% to 34.0% ~34.0% 33.0 to 34.0%

Non-GAAP EPS $1.50 to $1.70 $1.20 to $1.30 $0.70 to $0.80 Includes a $0.09 drag from non- recurring FLX charge in 2Q

Capital Expenditures $275 million $270 million -

Adjusted Capital Expenditures* $330 million $320 million - ~$50 million in technology investment reflected in operating cash flows

*Adjusted Capital Expenditures includes Software-as-a-Service contracts that are amortized through operating expenses over their contract terms. Foot Locker, Inc.

Our Lace Up Plan Foot Locker, Inc.

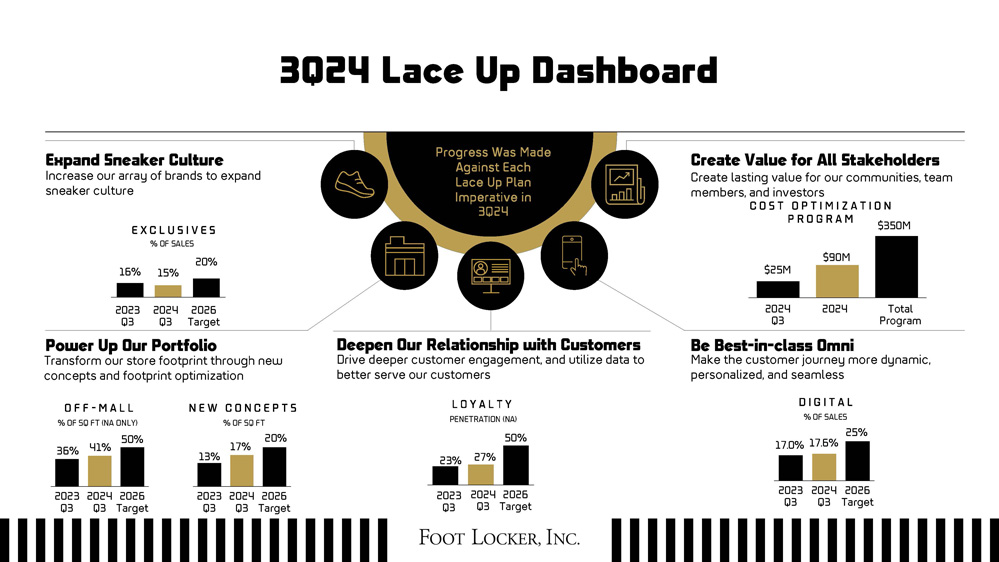

3Q24 Lace Up Dashboard

Expand Sneaker Culture Increase our array of brands to expand sneaker culture

Progress Was Made Against Each Lace Up Plan Imperative in 3Q24

Create Value for All Stakeholders Create lasting value for our communities, team members, and investors

Power Up Our Portfolio Transform our store footprint through new concepts and footprint optimization

Deepen Our Relationship with Customers Drive deeper customer engagement, and utilize data to better serve our customers

Be Best-in-class Omni Make the customer journey more dynamic, personalized, and seamless

EXCLUSIVES % OF sales 16% 2023 Q3 15% 2024 Q3 20% 2026 Target

COST OPTIMIZATION PROGRAM $25M 2024 Q3 $90M 2024 $350M Total Program

OFF - MALL % OF SQ FT (NA ONLY) 36% 2023 Q3 41% 2024 Q3 50% 2026 Target

NEW CONCEPTS % OF SQ FT 13% 2023 Q3 17% 2024 Q3 20% 2026 Target

LOYALTY PENETRATION (NA) 23% 2023 Q3 27% 2024 Q3 50% 2026 Target

DIGITAL % OF SALES 17.0% 2023 Q3 17.6% 2024 Q3 25% 2026 Target Foot Locker, Inc.

MISSION Foot Locker unlocks the “inner sneakerhead” in all of us

VISION To be known as the go-to destination for discovering and buying sneakers globally

Foot Locker Bring the best of sneaker culture to all

Kids Foot Locker Recruit the next generation

Champs Sports Head-to-toe sport style

WSS Celebrate the Hispanic community

atmos Share and celebrate Japanese street and sneaker culture

Our Lace Up Plan

EXPAND SNEAKER CULTURE POWER UP OUR PORTFOLIO DEEPEN OUR RELATIONSHIP WITH CUSTOMERS BE BEST-IN-CLASS OMNI

CREATE VALUE FOR ALL STAKEHOLDERS (CUSTOMERS, Brand partners, Community, Team Members, & INVESTORS) Foot Locker, Inc.

APPENDIX Foot Locker, Inc.

GAAP to Non-GAAP Reconciliations

Third Quarter Year-to-Date

2024 2023 2024 2023

Pre-tax (loss) income:

(Loss) income before income taxes $ (25) $ 47 $ (26) $ 101

Pre-tax adjustments excluded from GAAP:

Impairment and other (1) 38 6 61 59

Other income / expense (2) 35 (5) 37 (6)

Adjusted income before income taxes (non-GAAP) $ 48 $ 48 $ 72 $ 154

After-tax (loss) income:

Net (loss) income $ (33) $ 28 $ (37) $ 59

After-tax adjustments excluded from GAAP:

Impairment and other, net of income tax benefit of $9, $2, $13, and $11 million, respectively (1) 29 4 48 48

Other income / expense, net of income tax expense of $-, $1, $-, and $1 million, respectively (2) 35 (4) 37 (5)

Tax reserves benefit (3) — — — (4)

Adjusted net income (non-GAAP) $ 31 $ 28 $ 48 $ 98 Foot Locker, Inc.

GAAP to Non-GAAP Reconciliations (cont.)

Third Quarter Year-to-Date

2024 2023 2024 2023

Earnings per share: Diluted (loss) earnings per share $ (0.34) $ 0.30 $ (0.38) $ 0.63

Diluted per share amounts excluded from GAAP: Impairment and other (1) 0.31 0.04 0.51 0.51

Other income / expense (2) 0.36 (0.04) 0.38 (0.06)

Tax reserves benefit (3) — — — (0.04)

Adjusted diluted earnings per share (non-GAAP) $ 0.33 $ 0.30 $ 0.51 $ 1.04

Notes on Non-GAAP Adjustments:

(1) Included in the third quarter of 2024 impairment and other were (i) $25 million of impairment related to the atmos tradename following a strategic review of the atmos business, (ii) $7 million of reorganization costs primarily related to the announced closure and relocation of the Company's global headquarters and (iii) $6 million of impairment of long-lived assets and right-of-use assets accelerated tenancy charges related to the shutdown of our business operating in South Korea, Denmark, Norway, and Sweden. The Company will close all stores operating in those regions as it focuses on improving the overall results of its international operations. For the year-to-date period of 2024, the Company recorded an additional $16 million of impairment of long-lived assets and right-of-use assets related to its decision to exit the underperforming operations and the closure and sublease of an unprofitable store in Europe, as well as a $7 million loss accrual for legal claims. For the third quarter of 2023, impairment and other included $7 million of reorganization costs, primarily related to severance and transformation consulting expense of $1 million. Additionally in the third quarter of 2023, the Company recorded a $3 million net benefit from the settlement of lease obligations associated with Sidestep stores, partially offset by impairment on atmos U.S. assets of $1 million. For the year-to-date period of 2023, impairment and other included transformation consulting expense of $27 million, impairment charges of $19 million, primarily accelerated tenancy charges on right-of-use assets for the closures of the Sidestep banner and certain Foot Locker Asia stores, and $12 million of reorganization costs, related to severance and the closure of the Sidestep banner, certain Foot Locker Asia stores, and a North American distribution center.

(2) Included in the third quarter of 2024 other income / expense was a $35 million impairment charge related to a minority investment. The Company evaluates the minority investment for impairment whenever events or circumstances indicate that the carrying value of the investment may not be recoverable and that impairment is other than temporary. If an indication of impairment occurs, the Company evaluates recoverability of the carrying value based on the fair value of the minority investment. If an impairment is indicated, the Company adjusts the carrying values of the investment downward, if necessary, to their estimated fair values. For the year-to-date period of 2024, the adjustments to other income / expense included$2 million of the Company's share of losses related to equity method investments. For the third quarter of 2023, other income / expense consisted of a $3 million gain from the sale of a North American corporate office property and an additional $2 million gain from the 2023 second quarter sale of the Singapore and Malaysian Foot Locker businesses to a license partner. The 2023 year-to-date period also included $1 million of the Company’s share of losses related to equity method investments.

(3) In the first quarter of 2023, the Company recorded a $4 million benefit related to income tax reserves due to a statute of limitations release.

The Company provides earnings guidance only on a non-GAAP basis and does not provide a reconciliation of the Company’s forward-looking guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Foot Locker, Inc.