UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT |

Commission File Number: 000-55838

Wrap Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

98-0551945 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

1817 W 4th Street

Tempe, Arizona 85281

(Address of principal executive offices) (Zip Code)

(800) 583-2652

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, par value $0.0001 per share |

WRAP |

Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☐Yes ☒ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “accelerated filer,” “large accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 USC. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) was $59,512,072 based on the closing price as reported on the Nasdaq Capital Market (“Nasdaq”) on June 30, 2023. Shares of the registrant’s common stock held by each officer and director and each person known to the registrant to own 10% or more of the outstanding voting power of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not a determination for other purposes.

As of August 26, 2024 45,860,545 shares of common stock, par value $0.0001 per share, were outstanding.

Documents Incorporated by Reference

None.

|

Page |

||

|

PART I |

||

|

ITEM 1. |

2 | |

|

ITEM1A. |

14 | |

|

ITEM 1B. |

28 | |

|

ITEM 1C. |

29 | |

|

ITEM 2. |

29 | |

|

ITEM 3. |

29 | |

|

ITEM 4. |

29 | |

|

PART II |

||

|

ITEM 5. |

30 | |

|

ITEM 6. |

30 | |

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

31 |

|

ITEM 7A. |

43 | |

|

ITEM 8. |

43 | |

|

ITEM 9. |

Changes in and Disagreement with Accountants on Accounting and Financial Disclosure |

44 |

|

ITEM 9A. |

44 | |

|

ITEM 9B. |

44 | |

|

PART III |

||

|

ITEM 10. |

45 | |

|

ITEM 11. |

50 | |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

56 |

|

ITEM 13. |

Certain Relationships and Related Transactions and Director Independence |

58 |

|

ITEM 14. |

59 | |

|

PART IV |

||

|

ITEM 15. |

60 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K may contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements are based upon management’s assumptions, expectations, projections, intentions and beliefs about future events. In some cases, predictive, future-tense or forward-looking words such as “intend,” “plan,” “predict,” “may,” “will,” “project,” “target,” “strategy,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity,” “forecast,” “should” and similar expressions, whether in the negative or affirmative, that reflect our current views with respect to future events and operational, economic and financial performance are intended to identify such forward-looking statements, but are not the exclusive means of identifying such statements. Such forward-looking statements are only predictions, and actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of risks and uncertainties, including, without limitation, the Company's ability to successfully implement training programs for the use of its products; the Company's ability to manufacture and produce its products; the Company's ability to develop sales for its new products; the acceptance of existing and future products, including the acceptance of the BolaWrap 150, Wrap Reality, our Body-Worn Camera and our Digital Evidence Management system; the risk that distributor and customer orders for future deliveries are modified, rescheduled or cancelled in the normal course of business; the availability of funding to continue to finance operations; the complexity, expense and time associated with sales to law enforcement and government entities; the lengthy evaluation and sales cycle for the Company's product solution; product defects; litigation risks from alleged product-related injuries; risks of government regulations; the impact resulting from geopolitical conflicts and any resulting sanctions; the ability to obtain export licenses for countries outside of the US; the ability to obtain patents and defend IP against competitors; the impact of competitive products and solutions; and the Company's ability to maintain and enhance its brand, the ability to maintain compliance with the Nasdaq Stock Market’s listing standards; the ability of the Company to timely and effectively implement controls and procedures required by Section 404 of the Sarbanes-Oxley Act of 2002; and risks resulting from the Company’s status as an emerging growth company, including that reduced disclosure requirements may make shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) less attractive to investors. Additional factors that could cause actual results to differ materially from the results anticipated in these forward-looking statements are described in this Annual Report, including under the section entitled “Risk Factors,” and in our other reports filed with the Securities and Exchange Commission (the “SEC”). We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K. The Company cautions readers that the forward-looking statements included in, or incorporated by reference into, this Annual Report on Form 10-K represent our beliefs, expectations, estimates and assumptions only as of the date hereof and are not intended to give any assurance as to future results. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the effect of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in, or incorporated by reference into, this Annual Report to reflect any new information or future events or circumstances or otherwise, except as required by the federal securities laws.

Use of Market and Industry Data

This Annual Report on Form 10-K includes market and industry data that we have obtained from third party sources, including industry publications, as well as industry data prepared by our management based on its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this Annual Report on Form 10-K are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, references in this Annual Report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Annual Report on Form 10-K.

Forecasts and other forward-looking information obtained from these sources involve risks and uncertainties and are subject to change based on various factors, including those discussed in sections entitled “Cautionary Note Regarding Forward-Looking Statements,” “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Our trademarks include Wrap, the Wrap logo, BolaWrap®, and Wrap Reality™, Intrensic, and Evidence on A Cloud, some of which are registered trademarks in the US and certain other jurisdictions. They, along with our other common law trademarks, service marks or trade names appearing in this Annual Report are the property of the Company. Other trademarks, service marks or trade names appearing in this Annual Report are the property of their owners. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement of or sponsorship of us by, any other companies. Solely for convenience, we have omitted the ® and ™ designations, as applicable, for the trademarks used in this Annual Report, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and trade names.

PART I

Overview

We are a global public safety technology and services company that delivers safe and effective policing solutions to law enforcement and security personnel worldwide. We are leading the movement for safer outcomes by equipping law enforcement with safer, non-painful compliance tools, and immersive training fit for modern society. We began sales of our first public safety product, the BolaWrap 100 remote restraint device, in late 2018. In the first quarter of 2022, we delivered a new generation product, the BolaWrap 150. The BolaWrap 150 is electronically deployed and is more robust, smaller, lighter and simpler to deploy than the BolaWrap 100 that has since been phased out. In late 2020 we added a new solution to our public safety technologies, our virtual reality (“VR”) training platform, Wrap Reality, and in August 2023 we acquired Intrensic, LLC, a Delaware limited liability company (“Intrensic”), which added a Body-Worn Camera (“BWC”) and Digital Evidence Management (“DEM”) solution to our portfolio of policing solutions. Wrap Reality is now sold to law enforcement agencies for simulation training as well as corrections departments for the societal reentry scenarios.

Our target market for our solutions includes approximately 900,000 full-time sworn law enforcement officers in over 18,000 federal, state, and local law enforcement agencies in the U.S. and over 12 million police officers in more than 100 countries. Additionally, we are exploring opportunities in other domestic markets, such as military and private security. Our international focus is on countries with the largest police forces. According to 360iResearch, a market research consulting firm, our non-lethal products are part of a global market segment expected to grow to $16.1 billion by 2027.

We focus our efforts on the following products and services:

BolaWrap Remote Restraint Device – a hand-held remote restraint device that discharges a seven and half-foot Kevlar tether to entangle an individual at a range of 10-25 feet. BolaWrap assists law enforcement to safely and effectively control encounters early without resorting to painful force options.

Wrap Reality – a law enforcement 3D training system employing immersive computer graphics VR with proprietary software-enabled content. It allows up to two participants to enter a simulated training environment simultaneously, and customized weapons controllers enable trainees to engage in strategic decision making along the force continuum. Wrap Reality has 45 scenarios for law enforcement and corrections and 15 scenarios for societal reentry. Wrap Reality is one of the most robust 3D Virtual Reality solutions on the market for law enforcement and societal reentry today.

Wrap Intrensic – a Body-Worn Camera and Digital Evidence Management solutions provider. BWC and DEM play crucial roles in capturing, storing, and managing digital evidence, such as video and audio recordings for various purposes, including criminal investigations and maintaining transparency in public interactions. The Wrap Intrensic X2 camera hardware and storage and data management capability, along with awareness of front-line operations, provides customers with a solution to meet their challenges. Wrap Intrensic Evidence on our cloud-based video storage platform provides an unlimited video storage platform that includes video and other evidence uploading, search, retrieval, redaction, and evidence sharing while reducing the need for resources required to manage this evidence.

In addition to the US law enforcement market, we have shipped our restraint products to 62 countries. We have established an active distributor network representing 50 states and one dealer representing the US territory of Puerto Rico. We have distribution agreements with 35 international distributors covering 75 countries. We focus significant sales, training and business development efforts to support our distribution network in addition to our internal sales team.

We focus significant resources on research and development innovations and continue to enhance our products and plan to introduce new products. We believe we have established a strong brand and market presence globally and have established significant competitive advantages in our markets.

Industry Background

The market for non-lethal and less-lethal products and devices serves law enforcement agencies, correctional facilities, military agencies, private security guard companies, and retail consumers. As thought leaders in new public safety products, we focus on the law enforcement agency segment of the market with our BolaWrap remote restraint solution, Wrap Reality virtual reality system, and our Body-Worn Camera and Digital Evidence Management solutions. Recent trends, such as the rise in mental health cases, police reform, and reorganization of police departments, have started a growing conversation across the country on the need for de-escalation before applying a pain-compliance policing policy. As this de-escalation movement unfolds, there are thousands of law enforcement, police, and sheriff’s offices focusing on training, policies, and the use of more non-lethal restraining solutions. This movement highlights a growing need for new approaches, which we believe will drive demand for our innovative and safe law enforcement solutions.

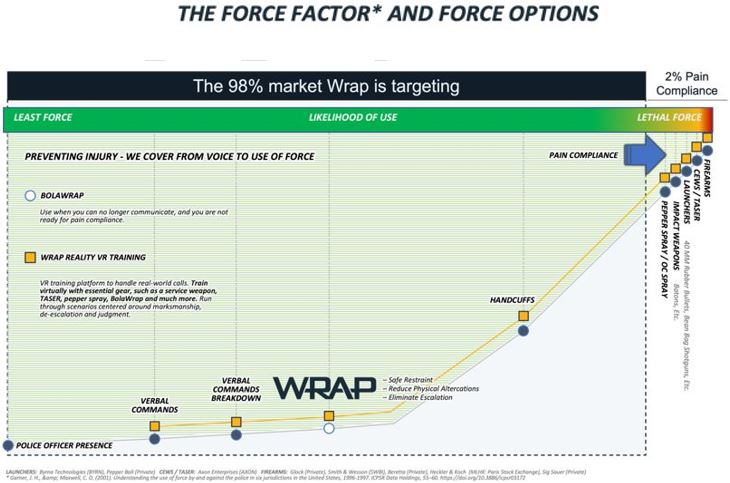

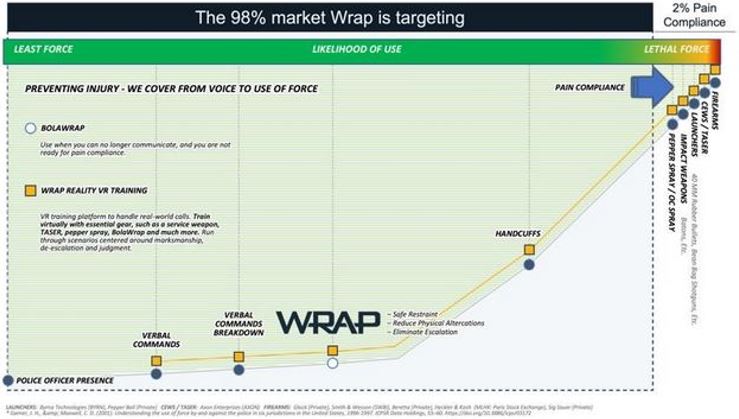

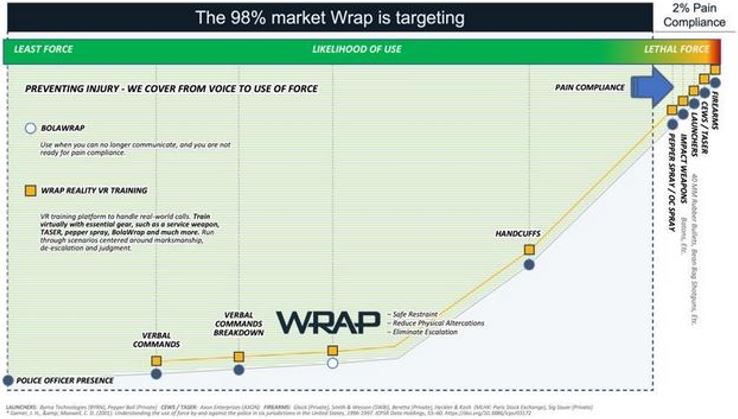

When law enforcement seeks to detain an individual, there usually is a use of force continuum that an agency follows, starting with officer presence and verbal commands. If verbal commands break down, agencies may authorize the use of less lethal pain inducing compliance tools, such as pepper spray, pepper ball, wooden batons or metal collapsible batons, launchers and bean bags, and conducted energy weapons, such as Taser®. Our BolaWrap product offers an alternative. It can be used in many cases to restrain an individual after verbal commands break down and prior to the need to use pain-inducing compliance tools. The use of nonlethal solutions like BolaWrap potentially could lead to a reduction in use of force incidents that result in ending careers as well as the number of legal cases filed against agencies for excessive use of force, wrongful death, and injury, thus decreasing expensive litigation, settlements, and insurance costs.

We anticipate that use of the BolaWrap by public safety agencies can increase goodwill between public safety agencies and their communities, especially in a time when interactions with public safety officers are increasingly subject to public and media scrutiny. We believe the law enforcement community’s response to BolaWrap demonstrates the need for the product and its utility in safely detaining individuals. Our goal is to equip every public safety officer with a BolaWrap remote restraint solution that they carry with them each day.

Markets

We participate in the global non-lethal market that, according to the January 2022 report by 360iResearch, was expected to grow to $16.1 billion by 2027. The following segments are our target markets:

Domestic and International Law Enforcement

Our products and services are primarily targeted at federal, state, and local law enforcement agencies in the U.S. As of 2018, there were over 18,000 law enforcement agencies and 800,000 full-time local and state law enforcement officers in the US, while the US Department of Justice reported over 100,000 full-time federal officers based on 2016 data. Our product line, including BolaWrap, can be an effective tool for safe detention of individuals under the jurisdiction of these agencies.

We have also identified an international market opportunity of over 12.1 million police officers in the 100 largest police forces outside the US. We have delivered products to 62 countries and have entered into agreements with international distributors, with international sales representing a significant portion of our revenues in 2023. We anticipate that sales attributable to international markets will continue to represent a significant portion of our sales in the future due in part to the centralized purchase decision-making process at the national level in these markets. Often, the international markets have large national police forces. Conversely, in the US, the market is more fragmented with many smaller agencies and longer procurement and sales cycles. We expect international sales to continue to be lumpy due the timing of purchase decisions and relatively large size of orders.

Correctional Facilities

In 2019, the US Bureau of Justice statistics (“Census of State and Federal Correctional Facilities, 2019,” US Department of Justice, Bureau of Justice Statistics, published November 2022) estimated that there were 240,000 correctional officers in over 1,000 federal and state correctional facilities in the U.S., representing a large potential market for our products and services. Most correctional facilities fall under federal, state or local law enforcement jurisdiction and we believe these facilities could leverage Wrap Reality for law enforcement and societal reentry platforms as well as BolaWrap inside and outside of the correctional facility.

Private Security Firms and Guard Services

According to the 2019 Bureau of Labor Statistics estimates (“Occupational Employment Statistics,” US Department of Labor), there were 1.1 million privately employed security guards in the U.S. They represent a broad range of individuals, including those employed by investigation and security services, hospitals, schools, local government, and others. We believe that the use of BolaWrap by security personnel could effectively de-escalate some encounters without eliminating other devices available today. Providing security personnel with the BolaWrap may also reduce the potential liability of private security companies and personnel in such encounters.

Today, ATF classifications play a role in restricting Wrap's ability to transfer easily to non-government security firms. We believe the classification is overly onerous and we will continue to work with the ATF and others to change our nonlethal product's classification. It is important to note that countries in which we have international customers do not have any transfer or possession restrictions on the non-lethal BolaWrap devices and we believe this should be the future for BolaWrap in the United States.

Virtual Reality Training Market

The virtual training and simulation market is projected to reach $602 billion by 2027, according to a 2019 report by Allied Market Research. We expect the growth of virtual reality and simulation to continue expanding into many nascent industries, including law enforcement, corrections, military, school, and private security although it currently represents a relatively small segment of the overall market. The law enforcement and military sectors are important segments of the market, and increasing awareness of the benefits of virtual training and simulation is driving market growth. Advancements in technology now enable virtual reality to recreate real-world scenarios in a 360-degree immersive environment.

Wrap Products and Services

BolaWrap Remote Restraint

Our BolaWrap product line includes the BolaWrap 100, which was our first remote restraint product and which has been phased out, and the BolaWrap 150, delivered to the market in the first quarter of 2022. The BolaWrap 150 offers electronic deployment and is more robust, smaller, lighter, and simpler to use than the BolaWrap 100. The BolaWrap is a handheld remote restraint device that discharges a seven and a half-foot Kevlar tether, entangling an individual from a range of 10-25 feet. Developed in collaboration with law enforcement professionals, this device enables safe and effective control of low-force encounters, providing a valuable tool for law enforcement officers.

The BolaWrap is a remote restraint device that safely wraps around an individual's arms and/or legs to impede movement and prevent harm to themselves or others. The device provides a valuable tool for law enforcement officers to safely and humanely take subjects into custody without injury, especially when verbal commands are ineffective.

With a wide effectiveness zone and a guiding seven dot green laser for accurate placement of the Kevlar tether, the BolaWrap mitigates the risk of injury to the subject, officer and potential bystanders. Its small, light, and rugged design allows officers to maintain other use of force continuum options while providing a non-lethal alternative to potentially injurious less-lethal forces or firearms.

BolaWrap's effectiveness in restraining individuals and hindering their ability to flee or fight has been proven. Not only does it allow officers to act safely and effectively in difficult situations by minimizing the need for other uses of force, including hand-to-hand combat and other more injurious less lethal or lethal weapons, but also it helps minimize injury and prevent a force frenzy that can occur after chasing a fleeing subject.

Unlike other less-lethal tools that rely on pain compliance and may lead to escalation of incidents and serious injuries, the BolaWrap does not rely on pain or electricity-enabled neuromuscular incapacitation. BolaWrap does not induce paralyzed falls or recovery time, making the BolaWrap an ideal non-lethal tool for law enforcement officers. Additionally, the fight or flight response that comes from less lethal tools that cause pain and injury is minimized by being wrapped by a BolaWrap device.

We spend significant resources training law enforcement on the safe and effective use of the BolaWrap in conjunction with de-escalation and apprehension techniques. However, like any restraining action, some injuries may result from the use of BolaWrap. Our training includes primary use cases that fall into the three broad categories routinely encountered by law enforcement and security personnel:

|

● |

To remotely restrain and limit the mobility of an individual who is experiencing a mental health crisis, narcotics-induced psychosis, or other crisis condition rendering them incapable of responding to law enforcement’s verbal commands but that presents a danger to law enforcement, the public or themselves if not restrained; |

|

● |

To remotely restrain and limit the mobility of an individual attempting to evade arrest or questioning, as well as individuals ignoring verbal commands from law enforcement. These individuals are commonly referred to as passively resistant or non-compliant; and |

|

● |

To assist in subduing individuals actively resisting arrest by limiting mobility, possibly making other engagement options less risky to officers and less injurious to individuals. |

Law enforcement encounters involving individuals experiencing a behavioral health crisis can be challenging, resulting in public controversy and costly consequences. The Treatment Advocacy Center: Office of Research & Public Affairs reported that one in ten police encounters involve individuals with mental illness, with at least one in four fatal police encounters involving individuals with mental illness (Overlooked in the Undercounted: The Role of Mental Illness in Fatal Law Enforcement Encounters (2015)).

A field deployment should be considered successful by law enforcement agencies if compliance is achieved, and no additional higher-level use of force tool is required after the BolaWrap is displayed or used. Agencies have reported achieving compliance by utilizing the BolaWrap in the following ways:

|

● |

by pointing the BolaWrap’s seven dot green line dot laser at the suspect in conjunction with verbal commands; |

|

● |

by the sound emitted by the BolaWrap upon deployment and causing a distraction; |

|

● |

through the feeling of being wrapped and/or the restraint of the Kevlar cord around the suspect’s legs, arms, or torso; and |

|

● |

when used in conjunction with other less-lethal tools. |

While we encourage all law enforcement agencies to fill out a Use of Device Report when the BolaWrap is used during an encounter in the field, agencies do not always report all field deployments. Some agencies consider the deployment of the BolaWrap to be a non-use of force or a de minimis use of force that does not require any reporting. While some deployments have been captured on bodycam and shared with the public, others were reported by the agency or the media but were not captured on bodycam. Some agencies capture deployments on body worn cameras but do not allow the sharing of the video or allow them to be shared for learning purposes but not publicized for other marketing purposes. Some local jurisdictions have department policies, collective bargaining agreements, and city, county or state laws regarding the distribution of body worn camera video.

As more agencies incorporate the BolaWrap onto their duty belts and carry it every day on shift we expect to see an increase in the rate of field deployments, which we believe will contribute to even further adoption of the device by law enforcement agencies worldwide. In 2022, following the release of our strategic roadmap in mid 2022 Q3, we focused our customer service team on modifying their approach to become a customer success operation. As part of this strategic change, our team focuses on reaching out to drive agency wide adoption. We made this pivot in part because many agencies in the first few years of BolaWrap only deployed a small number of trial units without the immediate follow-up to grow their deployment to agency-wide. We have trained our sales team to focus on agency-wide deployment to drive the highest level of immediate success with the device and to integrate it into department-wide use of force polices. In January 2023, we launched our Use of Force Reduction Guarantee whereby we will buy back an agency’s devices when they deploy agency wide and do not see a reduction in Use –of -Force by at least 10%, after meeting certain criteria.

BolaWrap 150

In late Q1 2022, we delivered the latest generation of our BolaWrap device, the BolaWrap 150. Production of the previous model, the BolaWrap 100, ceased in 2021. We intend to continue to supply cartridges for the BolaWrap 100 to our customers for the foreseeable future. Unlike the BolaWrap 100, the BolaWrap 150 utilizes cassettes that are unique to the device and cannot be interchanged between models. We have positioned the BolaWrap 150 as our primary product and plan to support it for 5 to 10 years from the product launch date.

To support the increased production volume for the BolaWrap 150, we implemented a more automated supply chain in the production, quality control, and testing lines in 2022.

We believe the BolaWrap 150 offers important benefits, including:

|

● |

Modern electronic deployment |

|

● |

Smaller size and less weight |

|

● |

Reduced production costs |

|

● |

LED status indicator for ease of operation |

|

● |

Long laser battery life |

|

● |

LED target illumination to improve accuracy |

|

● |

Hardened plastic for increased durability |

|

● |

Enhanced water resistance for harsh environments |

The BolaWrap 150 employs two micro-gas generators to individually expel each entangling projectile. Micro-gas generators are micro explosive parts used in a variety of industrial products, including automobile airbags.

See “Risk Factors” included below in this Annual Report for additional information regarding risks and uncertainties associated with our business.

Wrap Reality

In 2019, we partnered with an independent technology company to create a virtual reality system with training scenarios. We acquired NSENA Inc. in December 2020, a provider of law enforcement training employing immersive computer graphics virtual reality with proprietary software-enabled content. We branded the system as Wrap Reality Virtual Training and kept building and improving that platform and today it offers 38 built out scenarios targeting law enforcement. Countless additional scenarios can be made by using the Wrap Reality adapt functionality to pick and choose key components to build a scenario. It takes advantage of advanced virtual reality hardware and allows up to two participants to enter the simulated training environment simultaneously.

In August 2021, we announced the development of an expanded Wrap Reality Virtual Training platform through a collaboration with Amazon Web Services (AWS). This new platform combines our law enforcement simulator with secure cloud services to track training progress and provide the ability to replay recorded training sessions. We continue to upgrade scenarios and develop de-escalation techniques into new scenarios and seek to enhance the Wrap Reality experience through continued software and platform innovation.

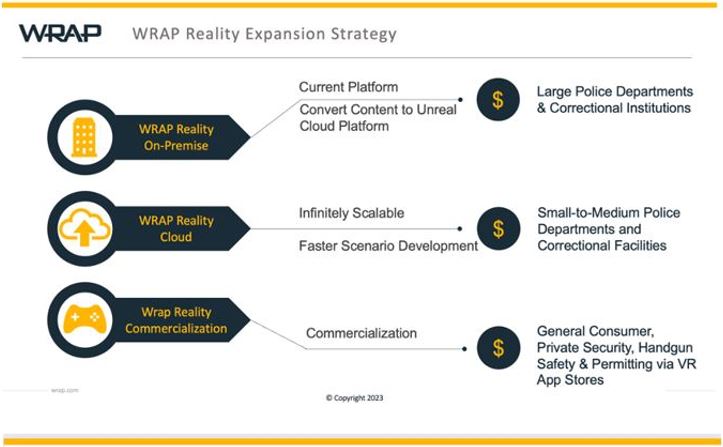

We are optimistic about the potential for future growth of WRAP Reality by public safety agencies, given our early adoption and deployment of robust virtual reality training technology. By leveraging our existing platform and our investment in cloud software, we now will have the opportunity to develop and offer critical training scenarios at very competitive price points.

We have the ability to offer both on-premises and full cloud capabilities with multiple hardware options. This expansion enables us to deliver the platform to a broad range of customers, including law enforcement agencies, public and private security, corrections and the general public for firearms, concealed weapon, and safety training.

Wrap Intensic

In August 2023, Wrap entered into the Intrensic Purchase Agreement (as defined herein) for the acquisition of Intrensic, an innovator of DEMS and body-worn cameras. The integration of Intrensic’s offerings into the Company’s product suite allows the Company to expand its relationship with existing customers, increase its addressable market, and further innovate its technology offering. The acquisition helps the Company broaden its addressable market by appealing to a wider range of law enforcement and public safety agencies that are looking for integrated solutions combining non-lethal devices and digital evidence management. By offering a more comprehensive set of tools and technologies, the Company strengthened its position in the public safety technology market by differentiating itself from competitors that only offer single solutions.

Wrap Intrensic offers a robust digital evidence management platform that enables law enforcement agencies to securely store, manage, and share digital evidence, including body-worn camera footage, dashboard camera videos, and other digital files. The platform is equipped with features such as secure cloud storage, easy file retrieval, evidence tagging, chain of custody documentation, and sharing capabilities to streamline workflows and ensure data integrity. Wrap Intrensic also provides body-worn camera solutions designed to capture high-quality video evidence in various law enforcement scenarios. These cameras feature HD recording, night vision, and secure data upload capabilities and seamlessly integrate with the digital evidence management platform for efficient video uploading and management.

Since completing the acquisition in August 2023, Wrap has launched a host of new features and functionality to the Intrensic platform including WrapAI, a suite of artificial intelligence-powered functionality for Wrap Intrensic BWC and DEMS. This suite includes AI video redaction, AI video transcription, and AI assisted contextual content search, keeping Wrap Intrensic on the cutting edge of innovation in the DEMS and BWC marketplace.

By offering comprehensive solutions for video evidence management, Wrap Intrensic enhances accountability and transparency within law enforcement agencies. The technology facilitates improved documentation of interactions and incidents, which is critical in investigations and when building public trust. The solutions are used in various settings, including routine patrols, traffic stops, and large-scale public events. Wrap Intrensic's platform simplifies digital evidence management, reducing the administrative burden on law enforcement personnel. Secure cloud storage and rigorous chain-of-custody protocols protect digital evidence against unauthorized access and tampering. The integration of non-lethal tools like BolaWrap with digital evidence solutions contributes to safer interactions between law enforcement officers and the community, strengthening Wrap Technologies' position in the public safety technology market by offering an end-to-end solution that combines innovative de-escalation devices with state-of-the-art evidence management.

The Company remains optimistic on the outlook of Wrap Intrensic as a competitive and innovative solution set in the marketplace.

Selling, Marketing and Training

Our sales, marketing and training organizations work together closely to drive revenue growth by enhancing market awareness of our solutions, generating leads, building a strong sales pipeline, and cultivating customer and distributor relationships. Our training not only supports our sales, but it also provides revenue due to the extreme value our customers place on our training services. We started charging for our training services in the third quarter of 2022.

Sales

Our primary target market is law enforcement agencies in the US and globally. The purchasing decision for our BolaWrap products and accessories is typically made by a group including agency heads, procurement, training staff, and use of force experts, and may involve political decision-makers such as city council members. The decision-making process may take several weeks to over a year due to budget constraints and other considerations.

We use product demonstrations as a primary sales tool and follow up with sales activities. Our goal is to convert demonstration and training deliveries into sales and long-term expansion. We provide fee-based training services to agencies, as we believe that departments with knowledgeable instructors are more likely to purchase our products.

In 2019, we adopted a channel distribution approach, in tandem with our internal sales team, where we supply our products to independent regional police equipment distributors, who in turn sell to local law enforcement agencies. Our current focus is on cultivating partnerships with major agencies and providing active assistance to our distributors through our dedicated sales, business development, and support teams. We sell through distributors in most cases and go direct to our end customers where the right distributor skill set, and capability is not available.

We currently have distribution agreements with a network of distributors representing 50 states and one dealer representing Puerto Rico. These agreements provide certain territorial rights to distributors and allow us to sell direct to certain agencies under certain terms.

We have distribution agreements with 35 international distributors covering 75 countries. These agreements generally require minimum sales and follow up performance and allow us to sell direct to customers if performance is not being met. We focus significant sales and business development efforts to support our international distributors.

We have invested in training our sales, distribution, demonstration, training, and customer success teams, as well as our distributors, to build awareness and drive sales of our BolaWrap and our Wrap Reality virtual reality training product. Additionally, we are actively seeking partnerships with other organizations to further enhance our sales, marketing, and technology efforts. We engage with other industry experts to ensure our virtual reality scenarios align with industry standards of engagement.

Marketing

Prospective customers become aware of Wrap solutions through a variety of marketing channels such as social media, paid advertising, media coverage, press releases, web searches, sales calls, and public relations. We also distribute body and dash camera videos of successful BolaWrap use in policing encounters to generate leads. Once a lead is generated, it is qualified by our inside sales team, and a sales representative or distributor communicates with the prospective customer to discuss their needs and the solutions we offer.

We track our marketing and sales activities to provide immediate insight into activities, leads, quotes, and pipeline opportunities. Our marketing staff engages with law enforcement agencies, personnel, and risk management organizations to educate them on the benefits of BolaWrap remote restraint, as well as Wrap Reality and we participate in various domestic and international trade shows and conferences to promote our brands. We intend to increase the use of our trademarks throughout our product distribution chain to enhance brand awareness and believe our strong reputation as a pioneer in remote restraint, with excellent training and product support, gives us a competitive edge.

Demonstration, Training and Customer Success

As part of its sales and marketing activities, the Company has a department dedicated to conducting demonstrations and training. The Company offers in-person, webinar, and online demonstrations, as well as paid use of force and de-escalation training, to law enforcement agencies. The training can take place before or after the initial or subsequent purchase or deployment of the Company's products. The Company believes that providing training and demonstrations to law enforcement officers and trainers increases their support for purchasing and deploying the products within their departments.

Generally, agencies will adapt their use of force policy to incorporate remote restraint and the BolaWrap into a key new area of their policy for non-invasive tools that often did not previously exist. BolaWrap is typically not a categorical use of force, or if classified as force, and is typically at the lowest level on a department policy, below all other less lethal weapons like pepper spray, pepperball, batons, bean bags, Tasers® and conducted energy weapons.

In order to provide comprehensive training and sales support, we initiated the Wrap “Train the Trainer” program in October 2018. The program is structured such that our Master BolaWrap Instructors educate BolaWrap Instructors at local agencies, who then train front-line officers in compliance with the agency's policies.

BolaWrap Instructors are typically sworn law enforcement officers, who are commonly department trainers, defensive tactic instructors, or SWAT officers. They undergo a five-hour BolaWrap Instructor certification course, which includes passing a written exam and demonstrating proficiency in deploying and using the BolaWrap. We provide support to the instructors to share lessons learned and best practices for teaching line officers in the use of BolaWrap. Instructor certification is valid for two years and requires renewal afterward. BolaWrap training curriculum is submitted by departments to their Post Officers Standards and Training (POST) for credit for in-service training hours. Most departments who leverage the BolaWrap across all field officers incorporate BolaWrap training into most other training materials and in service training throughout the year. An example would be officers doing an in-service training on Driving under the Influence (DUI) arrests using the BolaWrap during the arrest portion of training on individuals under the influence of alcohol or drugs. If departments are conducting in-service training on responding to those in a mental health crisis, they also need to train and have ongoing practice on deploying BolaWrap on those in crisis and practice taking these individuals safely into protective custody. Another in service training example would be when departments practice warrant service, and during the arrest and apprehension efforts, they leverage BolaWrap after verbal commands breakdown but before they are justified in using pain compliance tools such as pepper spray, pepperball, batons, Tasers or conducted electrical weapons.

In order to schedule and organize training events, registration, and training records, we utilize a cloud-based software system called the Wrap Learning Management System. This system is also home to a Resource Library which we highly encourage distributors and purchasers to use to educate themselves on the use of BolaWrap.

In the modern world of policing, we understand that it is crucial to provide equipment and services that are well-supported, and that officers receive proper training and procedures to perform their duties effectively and safely. As a result, we have developed a professional team dedicated to training and sales support, as well as the necessary systems to provide this support. This approach not only gives us a competitive edge but also creates a significant barrier to new competition. We are confident that our training and support teams are equipped to assist agencies of all sizes.

Our Strategy

In the world of law enforcement, defense, public safety, and security, our product and training solutions are gaining recognition and worldwide awareness. We have a strong global brand and product foundation that we are continuously expanding to reach new markets and customers, thereby contributing to significant business growth. We are confident that we can capitalize on the growing demand for non-lethal policing in the world, particularly as non-compliant individuals continue to pose a threat. Our training programs and virtual reality platform are also well positioned to grow rapidly in global markets.

Our commercialization strategy concentrates on the immediately addressable domestic market, comprising more than 18,000 federal, state, and local law enforcement agencies, with approximately 900,000 full-time sworn officers in just the US alone. We also aim to target the 100 largest police forces internationally, which have over 12 million police officers. Our objective is to unlock the full potential of our technology solutions suite, which targets law enforcement and security personnel on a global scale.

We plan to maintain financial prudence and deliver value to our shareholders. Our focus will remain on expanding our revenues through pursuing business opportunities both domestically and internationally. In addition to enhancing our current product portfolio, we aim to develop new and improved products, which can be utilized by security personnel and related professionals. We also seek to pursue strategic business initiatives and collaborations, including potential acquisitions, to complement our existing offerings and sales network.

Manufacturing and Suppliers

Manufacturing

We believe that maintaining scalable assembly capabilities is crucial to the performance of our products and the growth of our business. Our assembly processes involve unique systems and materials, and we contract with third-party suppliers to produce various parts, components, and subassemblies. We established initial startup production in Las Vegas in 2018, and in October 2019, we completed a move to and began production at our current facility in Arizona. In this facility, we perform manufacturing, final assembly, testing, and shipping of our products. We have refined our internal processes to improve how we design, test, and qualify products, and we continue to implement rigorous manufacturing and quality processes to track production and field issues. We periodically implement design and component changes to reduce our product costs and improve product reliability and manufacturability. We aim to continually improve our operations to meet the growing demand for our products and better serve our customers.

Suppliers

We have established strong relationships with our key suppliers, and their timely and reliable delivery is crucial to our ability to meet customer demand. However, we are subject to challenges in our global supply chain, such as component shortages, increased lead times, cost fluctuations, and logistics constraints, which can affect our production schedules and have a negative impact on our financial performance. In late 2022, we started to ensure we have more final product inventory on hand to meet new business needs. While we anticipate supply chain challenges to improve in the remainder of 2024, we recognize that future supplier shortages and logistics issues could have a material adverse effect on our operations and financial results.

Backlog

As of December 31, 2023, we had backlog of approximately $209 thousand that was delivered in the first quarter of 2024. The amount of backlog at any point in time is dependent upon order timing, scheduled delivery dates to our customers and product lead times. Most orders are shipped shortly after order and backlog is typically associated with larger police agency orders. Because of our history of shipping shortly after order, we do not currently believe backlog at any period end is predictive of future order volume or revenues beyond the reported amount. Distributor and customer orders for future deliveries are generally subject to modification, rescheduling or in some instances, cancellation in the normal course of business.

Warranties

Our products come with a warranty that guarantees their quality and performance for up to one year from the date of purchase. This warranty is generally limited and may include certain shipping costs for the customer. We also offer the option for our customers to purchase additional one-year warranty increments for their products.

Competition

The Company positions the BolaWrap product as a new non-invasive remote restraint solution for law enforcement rather than a replacement for other devices currently in use. When looking at the use of force continuum, we place our solution in a category completely separate from common less lethal solutions that use pain compliance and can cause serious injuries or even death in some circumstances. We believe every law enforcement officer in the world who carries handcuffs should carry a BolaWrap at the same time as BolaWrap is leveraged just prior to handcuffs.

However, we do compete with other use of force products for budget allocations. The BolaWrap product may also be perceived as an alternative to other solutions despite our valuable and separate positioning. Because we believe the BolaWrap may be used more often than certain other tools given, we expect to stand in a category of our own. Many agencies with the BolaWrap do not consider it a use-of-force tool, which uniquely distinguishes it from every other tool on an officer's belt. The most common interactions officers have with the public revolve around de-escalating situations. In such scenarios, the BolaWrap stands out as one of the safest de-escalation tool available. Given these factors, we believe the BolaWrap may be used more often than certain other tools, positioning us to be widely recognized as standing in a category of our own.

Indirectly, other use of force devices such as tasers (CEWs), pepper spray, pepperball, batons, and impact weapons may try to compete with the BolaWrap product. However, many law enforcement personnel consider these to be distinct tools, each best-suited to a particular set of higher use of force circumstances. Purchasing one tool does not preclude the purchase of others, but budgetary considerations and space limitations on officer’s belts may limit the number of devices purchased and carried. The BolaWrap's unique remote restraint use, effectiveness, and low possibility of injury positions it as an effective competitor against all other alternatives. We believe that in time the non-invasive BolaWrap will be prioritized over these other less lethal devices for its ease of use, safety, and high probability of use throughout a given year to officers in the field.

In the virtual reality training space, there are numerous competitors offering simulators for law enforcement, including established video-based 2D simulators. Furthermore, other virtual reality providers and developers focused on other applications may choose to compete in the law enforcement training market in the future.

We recognize that some of our competitors have substantially greater resources to devote to compete in the law enforcement market and may introduce products with features and performance competitive to our product. However, we believe that our unique positioning, strong product and technology foundation, and dedicated professional training and sales support team provide a competitive advantage.

Overall, we believe that the depth and capability of our 3D Virtual Reality (VR) Wrap Reality Capability will prove to be impressive. We have 38 fully formed law enforcement scenarios and 25 corrections and societal reentry scenarios in 3D in addition to the customizability of Wrap Reality Adapt which we believe provides more robust 3D options than our competitors. The largest capitalized competitor in this space currently offers only three 3D scenarios and is selling subscriptions of more than six million dollars a year.

Government Regulation

As a global company, we are subject to a wide range of domestic, federal, state, and local laws and regulations, as well as international laws and regulations regarding shipments, customs, import, export, safe working conditions, manufacturing practices, environmental protection, and hazardous substances disposal. Compliance with these laws and regulations may entail significant costs, and failure to comply may result in penalties or other enforcement actions.

Our BolaWrap products are classified as firearms and AOWs by the ATF, and we hold the necessary licenses to manufacture and deal in such firearms. We believe these devices have been classified as AOW due to the lack of updates to outdated statutes and firearms regulations. We are actively working to improve the legislation and to allow our products to be directly transferred to private security forces and private individuals due to its safe effective capabilities standing alone in the non-invasive non-lethal category.

We are also subject to state and international regulations, which may vary. We comply with shipping regulations for dangerous goods, and our products comply with standard safety requirements in the US and international markets. We follow data protection laws and have a privacy policy in place. We work with distributors and advisors familiar with applicable import regulations in our international markets.

Intellectual Property Rights and Proprietary Information

We have a policy of protecting our intellectual property assets, which include issued domestic and international patents, pending patents, trademarks, copyrights, trade secrets, and contractual obligations. We enter into confidentiality and nondisclosure agreements with employees, consultants, and third parties to whom we disclose proprietary information. These agreements prohibit disclosure of confidential information both during and after the duration of the working relationship. However, we recognize that such agreements may not always prevent disclosure or provide adequate remedies for any breach. We rely on copyrights, trade secrets, and other proprietary rights to protect the content of our training services, including the Wrap Reality VR training software and content.

We believe that strong product offerings that are continually upgraded and enhanced, combined with factors such as innovation, technological expertise, and experienced personnel, will keep us competitive. Therefore, we seek patent and other intellectual property protection on important technological improvements that we make. Before filing for patents, we disclose key features to patent counsel and maintain these features as trade secrets prior to product introduction. However, patent applications may not result in issued patents covering all important claims, and there is a risk that they could be denied in their entirety.

We currently have twenty-two issued US patents related to the BolaWrap technology and six additional US patents pending. In September 2018, we commenced filing our foreign patent applications selectively targeting the members of the European Patent Office (39 countries) and seventeen other countries, of which forty-five patents have been issued to date. To date we have a total of sixty-seven issued domestic and international patents for our small global company. During 2023 we filed nine patent applications, seven of which were US filings. We feel the investment in patent protection in the US and abroad strengthens our intellectual property and creates value in Wrap Technologies. The failure to obtain patent protection or the loss of patent protection on our existing and future technologies or the circumvention of our patents by competitors could have a material adverse effect on our ability to compete successfully.

We have been granted trade name protection for “BolaWrap” and “Wrap” in multiple countries and expect to employ a combination of registered and common law trade names, trademarks and service marks in our business. We rely on a variety of intellectual property protections for our products and technologies, including contractual obligations, and we intend to pursue a policy of vigorously enforcing such rights.

The law enforcement product and services industries are characterized by frequent litigation regarding patent and other intellectual property rights. Others, including academic institutions and competitors, hold numerous patents in less lethal and related technologies. Although we are not aware of any existing patents that would materially inhibit our ability to commercialize our technology, others may assert claims in the future. Such claims, with or without merit, may have a material adverse effect on our financial condition, results of operations or cash flows.

Research and Development

Our research and development initiatives are led by our internal personnel and make use of specialized consultants when necessary. These initiatives include basic research, mechanical and electrical engineering design and testing. Future development projects will focus on new versions of the BolaWrap technology, virtual reality and new public safety technologies that focus on safe and effective policing, especially in our strategic space that does not use pain compliance.

For the fiscal years ended December 31, 2023, and 2022, we spent approximately $3.3 million and $5.1 million, respectively, on company-sponsored research and development. This equates to 53% of revenue in 2023 and 63% of revenue in 2022. Future levels of research and development expenditure will vary depending on the timing of further new product development and the availability of funds to carry on new and additional research and development on currently owned technologies or in other areas. During 2024, in addition to continued development and enhancement of our remote restraint products, we expect to incur additional costs improving our training systems including enhancing our Wrap Reality on premise and cloud platforms and related content. As mentioned earlier we believe we are ahead of many in the law enforcement 3D virtual reality training space and have built up significant capability to compete globally in the law enforcement and corrections VR space.

Related Party License and Royalties

We are obligated to pay royalties pursuant to an exclusive Amended and Restated Intellectual Property License Agreement (the “License Agreement”), dated as of September 30, 2016, with Syzygy Licensing, LLC (“Syzygy”), a private technology invention, consulting and licensing company owned and controlled by Elwood G. Norris, a founder and former officer and current stockholder of the Company, and James A. Barnes, a former officer and stockholder of the Company. Syzygy has no ongoing operations, and does not engage in any manufacturing, production or other related activities.

The License Agreement provides for the payment of royalties of 4% of revenue from products employing the licensed device technology up to the earlier to occur of (i) the payment by the Company of an aggregate of $1.0 million in royalties, or (ii) September 30, 2026. All development and patent costs have been paid by us and patent applications and the technology related to the BolaWrap 100 and the BolaWrap 150 have been completely and solely assigned to the Company, subject to this royalty obligation. As of December 31, 2023, $919 thousand has been paid out under this royalty obligation, leaving a maximum of $81 thousand to be paid out in the future.

Seasonality

Local and international law enforcement has seasonality with respect to when they purchase and expend funds. Many local law enforcement agencies in the US are on a July 1 to June 30 calendar year resulting in increased spending in the third and fourth quarter of the fiscal year. The US federal government is on an October 1 to September 30 budget year, resulting in use or lose spending that often occurs in in the third quarter of the fiscal year. Some domestic and international budgets are on a calendar fiscal year resulting in the fourth quarter typically being the largest buying quarter of the year.

Financial Information about Customer Concentration and Geographic Areas

Financial information regarding customer concentration and geographic areas in which we operate is contained in Note 18.

Employees

We employ 52 full-time employees with 50 in the U.S. and two located in the United Kingdom. In addition to our two executive officers, we had 20 personnel engaged in sales, marketing, sales support and training, 12 in production, seven in research and development and 10 in administration. In addition, we engage consultants from time to time to provide additional sales, marketing, training and research and development services, and anticipate engaging consultants going forward to supplement our full- and part-time personnel.

In our commitment to operational excellence and maintaining a favorable employer reputation, we strive to create a work environment that attracts, develops, and retains the best talents in the industry. Our employees are offered an engaging work experience that contributes to their professional growth and career advancement. We acknowledge that the success of our business is dependent on the collective talents and dedication of our employees, and we are committed to investing in their professional growth and success.

Available Information

As a public company, we are required to file our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A and other information (including any amendments) with the Securities and Exchange Commission (the “SEC”). The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. You can find our SEC filings at the SEC’s website at www.sec.gov.

Our Internet address is www.wrap.com. Information contained on our website is not part of this Annual Report. Our SEC filings (including any amendments) are also made available free of charge on www.wrap.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

An investment in our Company involves a high degree of risk. In addition to the other information included in this Annual Report, you should carefully consider the following risk factors in evaluating an investment in our Company. You should consider these matters in conjunction with the other information included or incorporated by reference in this Annual Report. If any of the following risks actually occurs, our business, reputation, financial condition, results of operations, revenue, and future prospects could be negatively impacted. In that event, the market price of our Common Stock could decline, and you could lose part or all of your investment.

Risk Factors Relating to Our Business and Industry

We have a history of operating losses, expect additional losses and may not achieve or sustain profitability.

We have a history of operating losses and expect to incur additional losses until we achieve sufficient revenue and resulting margins to offset our operating costs. Our net loss for the years ended December 31, 2023 and 2022 was $30.2 million and $17.6 million, respectively. Our increase in net losses in 2023 was primarily attributable to a non-cash charge of approximately $12.0 million related to the change in value of our warrant liability initially recorded as part of the preferred stock issuance in July 2023.Our ability to achieve future profitability is dependent on a variety of factors, many of which are outside of our control. Failure to achieve profitability or sustain profitability, if achieved, may require us to raise additional capital, which could have a material negative impact on the market value of our Common Stock.

We may need additional capital to execute our business plan, and raising additional capital, if possible, by issuing additional equity securities may cause dilution to existing stockholders. In addition, raising additional capital by issuing additional debt instruments may restrict our operations.

Although we believe we have adequate financial resources to fund our operations and capital needs for at least the next twelve months, and that we may be able to generate funds from product sales during that time, existing working capital may not be sufficient to achieve profitable operations due to product introduction costs, operating losses and other factors. Principal factors affecting the availability of internally generated funds include:

|

● |

failure of product sales and services to meet planned projections; |

|

● |

government spending levels impacting sales of our products; |

|

● |

working capital requirements to support business growth; |

|

● |

our ability to integrate acquisitions; |

|

● |

our ability to control spending; |

|

● |

our ability to collect accounts receivable; and |

|

● |

acceptance of our products and services in planned markets. |

In the event we are required to raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be diluted significantly, and such newly issued securities may have rights, preferences or privileges senior to those of our existing stockholders. In addition, the issuance of any equity securities could be at a discount to the market price.

If we incur debt financing, the payment of principal and interest on such indebtedness may limit funds available for our business activities, and we could be subject to covenants that restrict our ability to operate our business and make distributions to our stockholders. These restrictive covenants may include limitations on additional borrowing and specific restrictions on the use of our assets, as well as prohibitions on our ability to create liens, pay dividends, redeem stock or make investments. There is no assurance that any equity or debt financing transaction will be available on acceptable terms, if at all.

As a result of our failure to timely file our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, we are currently ineligible to file a registration statement on Form S-3, which may impair our ability to raise capital on terms favorable to us, in a timely manner or at all.

Form S-3 permits eligible issuers to conduct registered offerings using a short form registration statement that allows the issuer to incorporate by reference its past and future filings and reports made under the Exchange Act. In addition, Form S-3 enables eligible issuers to conduct primary offerings “off the shelf” under Rule 415 of the Securities Act. The shelf registration process, combined with the ability to forward incorporate information, allows issuers to avoid delays and interruptions in the offering process and to access the capital markets in a more expeditious and efficient manner than raising capital in a standard registered offering pursuant to a Registration Statement on Form S-1. The ability to register securities for resale may also be limited as a result of the loss of Form S-3 eligibility.

As a result of our failure to timely file our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, we are currently ineligible to file registration statements on Form S-3. Our inability to use Form S-3 may impair our ability to raise necessary capital to fund our operations and execute our strategy. If we seek to access the capital markets through a registered offering during the period of time that we are unable to use Form S-3, we may be required to publicly disclose the proposed offering and the material terms thereof before the offering commences, we may experience delays in the offering process due to SEC review of a Form S-1 registration statement and we may incur increased offering and transaction costs and other considerations. Disclosing a public offering prior to the formal commencement of an offering may result in downward pressure on the stock price of our Common Stock. If we are unable to raise capital through a registered offering, we would be required to conduct our equity financing transactions on a private placement basis, which may be subject to pricing, size and other limitations imposed under the Nasdaq rules, or seek other sources of capital. The foregoing limitations on our financing approaches could have a material adverse effect on our results of operations, liquidity, and financial position.

We expect to be dependent on sales of our BolaWrap product line for the foreseeable future, and if this product is not widely accepted, our growth prospects will be diminished.

We expect to depend on sales of the BolaWrap product line and related cassettes for the foreseeable future. A lack of demand for this product, or its failure to achieve broader market acceptance, would significantly harm our growth prospects, operating results and financial condition. To execute our business plan successfully, we will need to execute on the following objectives, either on our own or with strategic collaborators:

|

● |

Grow our commercialization of the BolaWrap product, and develop additional future products and accessories for commercialization; |

|

● |

Maintain required regulatory approvals for our products in global market locations; |

|

● |

Expand, and as required, enforce our intellectual property portfolio for the BolaWrap product and other future products; |

|

● |

Maintain sales, distribution and marketing capabilities, and/or enter into strategic partnering arrangements to access such capabilities; and |

|

● |

Grow market acceptance for the BolaWrap product line and/or other future products. |

We face risks commercializing our virtual reality training platform and may be unsuccessful in growing revenues.

We continue to invest substantial funds in further developing and commercializing our Wrap Reality product line which is highly competitive. The commercial launch of the Wrap Reality Virtual Training product is in the early stages in a new marketplace for 3D Virtual Reality training that competes with a legacy 2D virtual training environment. We expect 2D virtual training companies to either try to buy out companies like ours or choose to have to build 3D Virtual reality to compete with us. As one of the only companies with both on premise 3D Virtual Reality and full cloud 3D Virtual Reality we plan to compete on both fronts; however, our ability to commercialize this 3D Virtual Reality product line may be influenced by many factors, including:

|

● |

our ability to continue to develop new products and new content; |

|

● |

our ability to obtain, set up and service new VR customers; |

|

● |

our ability to achieve and maintain market acceptance; |

|

● |

the impact of competition; and |

|

● |

our ability to attract and retain talent. |

We face competition from companies with greater financial, technical, sales, marketing and other resources, and, if we are unable to compete effectively with these competitors, our business could be harmed.

We face competition from other established companies. A number of our competitors have longer operating histories, larger customer bases, significantly greater financial, technological, sales, marketing and other resources than we do. As a result, our competitors may be able to respond more quickly than we can to new or changing opportunities, technologies, standards or client requirements, more quickly develop new products or devote greater resources to the promotion and sale of their products and services than we can. Likewise, their greater capabilities in these areas may enable them to better withstand periodic downturns in the global public safety industry and compete more effectively on the basis of price and production. In addition, new companies may enter the markets in which we compete, further increasing competition in the global public safety solutions industry.

We believe that our ability to compete successfully depends on a number of factors, including the type and quality of our products and the strength of our brand names, as well as many factors beyond our control. We may not be able to compete successfully against current or future competitors, and increased competition may result in price reductions, reduced profit margins, loss of market share and an inability to generate cash flows that are sufficient to maintain or expand the development and marketing of new products, any of which would adversely impact our results of operations and financial condition.

We are materially dependent on the acceptance of our product by the law enforcement market. If law enforcement agencies do not purchase our product or we do not meet their expectations, our revenue will be adversely affected and we may not be able to expand into other markets, or otherwise continue as a going concern.

A substantial number of law enforcement agencies may not purchase our remote restraint product. In addition, if our product is not widely accepted by the law enforcement market or we do not meet their expectations, we may not be able to expand sales of our product into other markets. Law enforcement agencies may be influenced by claims or perceptions that our product is not effective or may be used in an abusive manner. Our reputation could be damaged if we do not meet customer expectations for performance, value and quality. Sales of our product to agencies may be delayed or limited by such claims or perceptions or to any negative publicity or damage to our reputation. We now receive earned media that is often positive and helps our sales and growth and having negative earned media will create the opposite effect.

We may incur significant and unpredictable warranty costs as our products are produced, sold, and used.

We warrant our products to be free from defects in materials and workmanship for a period of up to one year from the date of purchase. Additional one-year warranties can be purchased by the customer. We may incur substantial and unpredictable warranty costs from post-production product or component failures. Future warranty costs could further adversely affect our financial position, results of operations and business prospects.

We could incur charges for excess or obsolete inventory and incur production costs for improvements or model changes.

While we strive to effectively manage our inventory, rapidly changing technology, and uneven customer demand may result in short product cycles and the value of our inventory may be adversely affected by changes in technology that affect our ability to sell the products in our inventory. If we do not effectively forecast and manage our inventory, we may need to write off inventory as excess or obsolete, which in turn can adversely affect cost of sales and gross profit.

We have experienced, and may in the future experience, improvement and model changes and unusual production costs associated with implementing production for our products. We currently have no reserve for slow moving or obsolete inventory but may incur future charges for obsolete or excess inventory.

Our international operations could be harmed by factors including natural disasters, fluctuations in currency exchange rates, and changes in regulations that govern international transactions.