UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number: 001-42001

Contineum Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

27-1467257 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

10578 Science Center Drive, Suite 200 San Diego, California |

92121 |

| (Address of principal executive offices) |

(Zip Code) |

(858) 333-5280

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Class A Common Stock, $0.001 par value per share |

CTNM |

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 13, 2024, the registrant had 18,994,104 shares of Class A common stock, $0.001 par value per share, outstanding and 6,729,172 shares of Class B common stock, $0.001 par value per share, outstanding.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that are in some cases beyond our control and may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these terms or other similar expressions are intended to identify forward looking statements. Forward-looking statements contained in this report include, but are not limited to, statements about:

• the likelihood of our clinical trials demonstrating the safety and efficacy of our drug candidates;

• the timing and progress of our current clinical trials, the expected results of these clinical trials and the timing of initiation of our future clinical trials;

• our plans relating to the clinical development of our current and future drug candidates, including the size, number and disease areas to be evaluated;

• Johnson & Johnson's ("J&J") plans related to the clinical development of PIPE-307;

• our clinical translational approach, and our ability to identify and develop drug candidates that can potentially treat neuroscience, inflammation and immunology ("NI&I") diseases by targeting biological pathways associated with specific clinical impairment to alter the course of disease;

• the size of the market opportunities for our drug candidates;

• the rate and degree of market acceptance and clinical utility of our drug candidates;

• our plans relating to commercializing our drug candidates, if approved;

• the success of competing therapies and technologies that are or may become available;

• the beneficial characteristics, safety, efficacy, therapeutic effects and potential advantages of our drug candidates;

• the timing or likelihood of regulatory filings and approval for our drug candidates;

• our ability to obtain and maintain regulatory approval of our drug candidates and our drug candidates to meet existing or future regulatory standards;

• our plans relating to the further development and manufacturing of our drug candidates, including additional indications for which we may pursue;

• our ability to successfully identify and complete transactions to in-license or otherwise acquire additional drug candidates, technologies, products or businesses;

• our ability to attract and to enter into commercial arrangements with third parties who have development, regulatory, manufacturing and commercialization expertise;

• our plans and ability to obtain or protect intellectual property rights, including extensions of existing patent terms where available, as well as our ability to secure and maintain intellectual property regulatory rights and regulatory protections;

• our ability to retain our senior management;

• the need to hire additional personnel and our ability to attract and retain such personnel;

• the accuracy of our estimates regarding our operating runway and our expenses, capital requirements and needs for additional financing; • the sufficiency of our existing capital resources to fund our future operating expenses and capital expenditure requirements;

• the period during which we expect we will qualify as an emerging growth company under the Jumpstart Our Business Startups Act of 2012 or a smaller reporting company;

• our anticipated use of our existing cash, cash equivalents and marketable securities; and

• other risks and uncertainties, including those described under Part II, Item 1A, “Risk Factors” of this Quarterly Report on Form 10-Q.

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Part II, Item 1A, “Risk Factors” of this Quarterly Report on Form 10-Q. Given these uncertainties, you should not place undue reliance on these forward-looking statements or rely on forward-looking statements as predictions of future events. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

Unless the context otherwise indicates, references in this Quarterly Report on Form 10-Q to the terms, “Contineum,” the "Company,” “we,” “our,” and “us” refer to Contineum Therapeutics, Inc. and references to our “common stock” refer to our voting Class A common stock.

TABLE OF CONTENTS

| Page |

||

| PART I. |

||

| Item 1. |

||

| Condensed Statements of Operations and Comprehensive Income (Loss) |

||

| Condensed Statements of Convertible Preferred Stock and Stockholders’ Equity (Deficit) |

||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 3. |

||

| Item 4. |

||

| PART II. |

||

| Item 1. |

||

| Item 1A. |

||

| Item 2. |

||

| Item 3. |

||

| Item 4. |

||

| Item 5. |

||

| Item 6. |

||

PART I — FINANCIAL INFORMATION

CONDENSED BALANCE SHEETS

(unaudited)

(in thousands, except share and par value data)

| June 30, 2024 |

December 31, 2023 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 77,230 | $ | 15,526 | ||||

| Marketable securities |

141,423 | 109,664 | ||||||

| Prepaid expenses and other current assets |

1,667 | 2,516 | ||||||

| Total current assets |

220,320 | 127,706 | ||||||

| Property and equipment, net |

801 | 678 | ||||||

| Other long-term assets |

3 | 1,283 | ||||||

| Operating lease right-of-use assets |

231 | 719 | ||||||

| Total assets |

$ | 221,355 | $ | 130,386 | ||||

| Liabilities, convertible preferred stock and stockholders' equity (deficit) |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 734 | $ | 635 | ||||

| Accrued expenses |

2,521 | 4,385 | ||||||

| Current portion of operating lease liabilities |

484 | 464 | ||||||

| Total current liabilities |

3,739 | 5,484 | ||||||

| Other long-term liabilities |

— | 110 | ||||||

| Operating lease liabilities, net of current portion |

113 | 108 | ||||||

| Total liabilities |

3,852 | 5,702 | ||||||

| Convertible preferred stock, $0.001 par value; no shares authorized, issued, or outstanding at June 30, 2024; authorized shares—16,940,594 at December 31, 2023; issued and outstanding shares—15,906,236 shares at December 31, 2023 |

— | 192,620 | ||||||

| Stockholders' equity (deficit): |

||||||||

| Class A common stock, $0.001 par value; authorized shares—200,000,000 and 39,630,511 at June 30, 2024 and December 31, 2023, respectively; issued and outstanding shares—18,994,104 and 2,349,554 at June 30, 2024 and December 31, 2023, respectively |

19 | 2 | ||||||

| Class B common stock, $0.001 par value; authorized shares—20,000,000 at June 30, 2024; issued and outstanding shares—6,729,172 at June 30, 2024; no shares authorized, issued, or outstanding at December 31, 2023 |

7 | — | ||||||

| Preferred stock, $0.001 par value; authorized shares—10,000,000 at June 30, 2024; no shares issued or outstanding at June 30, 2024; no shares authorized, issued, or outstanding at December 31, 2023 |

— | — | ||||||

| Additional paid-in-capital |

310,174 | 7,098 | ||||||

| Accumulated deficit |

(92,570 | ) | (75,144 | ) | ||||

| Accumulated other comprehensive income (loss) |

(127 | ) | 108 | |||||

| Total stockholders' equity (deficit) |

217,503 | (67,936 | ) | |||||

| Total liabilities, convertible preferred stock and stockholders' equity (deficit) |

$ | 221,355 | $ | 130,386 | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(unaudited)

(in thousands, except share and per share data)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2024 |

2023 |

2024 |

2023 |

|||||||||||||

| Revenue: |

||||||||||||||||

| License revenue |

$ | — | $ | 50,000 | $ | — | $ | 50,000 | ||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

7,901 | 9,460 | 15,679 | 13,092 | ||||||||||||

| General and administrative |

3,043 | 1,603 | 5,195 | 3,086 | ||||||||||||

| Total operating expenses |

10,944 | 11,063 | 20,874 | 16,178 | ||||||||||||

| Income (loss) from operations |

(10,944 | ) | 38,937 | (20,874 | ) | 33,822 | ||||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

2,001 | 679 | 3,637 | 1,080 | ||||||||||||

| Interest expense |

— | (116 | ) | — | (208 | ) | ||||||||||

| Change in fair value of warrant liability |

11 | 2 | (107 | ) | 2 | |||||||||||

| Change in fair value of investor rights and obligations liability |

— | 2,867 | — | 2,867 | ||||||||||||

| Other expense, net |

(77 | ) | (76 | ) | (82 | ) | (94 | ) | ||||||||

| Total other income |

1,935 | 3,356 | 3,448 | 3,647 | ||||||||||||

| Income (loss) before income taxes |

(9,009 | ) | 42,293 | (17,426 | ) | 37,469 | ||||||||||

| Provision for income taxes |

— | (729 | ) | — | (729 | ) | ||||||||||

| Net income (loss) |

$ | (9,009 | ) | $ | 41,564 | $ | (17,426 | ) | $ | 36,740 | ||||||

| Other comprehensive income (loss): |

||||||||||||||||

| Unrealized gain (loss) on marketable securities |

(69 | ) | (56 | ) | (235 | ) | 11 | |||||||||

| Comprehensive income (loss) |

$ | (9,078 | ) | $ | 41,508 | $ | (17,661 | ) | $ | 36,751 | ||||||

| Net income (loss) attributable to common stockholders, basic |

$ | (9,009 | ) | $ | 5,869 | $ | (17,426 | ) | $ | 5,521 | ||||||

| Net income (loss) attributable to common stockholders, diluted |

$ | (9,009 | ) | $ | 2,949 | $ | (17,426 | ) | $ | 2,601 | ||||||

| Net income (loss) per share, basic (a) |

$ | (0.39 | ) | $ | 2.56 | $ | (1.35 | ) | $ | 2.42 | ||||||

| Net income (loss) per share, diluted (a) |

$ | (0.39 | ) | $ | 0.84 | $ | (1.35 | ) | $ | 0.74 | ||||||

| Weighted-average shares of common stock outstanding, basic |

23,355,588 | 2,291,866 | 12,862,328 | 2,284,750 | ||||||||||||

| Weighted-average shares of common stock outstanding, diluted |

23,355,588 | 3,511,757 | 12,862,328 | 3,513,596 | ||||||||||||

_____________

| (a) | Basic and diluted per share amounts are the same for Class A and Class B shares. |

The accompanying notes are an integral part of these unaudited condensed financial statements.

CONDENSED STATEMENTS OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT)

(unaudited)

(in thousands, except share data)

| Class A and Class B | Additional |

Accumulated Other |

Total Stockholders' |

|||||||||||||||||||||||||||||

| Convertible Preferred Stock |

Common Stock |

Paid-in |

Comprehensive |

Accumulated |

Equity |

|||||||||||||||||||||||||||

| Shares |

Amount |

Shares |

Amount |

Capital |

Income (Loss) |

Deficit |

(Deficit) |

|||||||||||||||||||||||||

| Balance at December 31, 2023 |

15,906,236 | $ | 192,620 | 2,349,554 | $ | 2 | $ | 7,098 | $ | 108 | $ | (75,144 | ) | $ | (67,936 | ) | ||||||||||||||||

| Exercise of stock options |

— | — | 34,872 | — | 122 | — | — | 122 | ||||||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | 768 | — | — | 768 | ||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | (8,417 | ) | (8,417 | ) | ||||||||||||||||||||||

| Unrealized loss on marketable securities |

— | — | — | — | — | (166 | ) | — | (166 | ) | ||||||||||||||||||||||

| Balance at March 31, 2024 |

15,906,236 | $ | 192,620 | 2,384,426 | $ | 2 | $ | 7,988 | $ | (58 | ) | $ | (83,561 | ) | $ | (75,629 | ) | |||||||||||||||

| Issuance of common stock in connection with initial public offering, net of issuance costs of $10,912 |

— | — | 7,423,682 | 7 | 107,860 | — | — | 107,867 | ||||||||||||||||||||||||

| Conversion of convertible preferred stock to common stock upon initial public offering |

(15,906,236 | ) | (192,620 | ) | 15,906,236 | 17 | 192,603 | — | — | 192,620 | ||||||||||||||||||||||

| Reclassification of warrant from liability to equity |

— | — | — | — | 216 | — | — | 216 | ||||||||||||||||||||||||

| Exercise of stock options |

— | — | 8,932 | — | 13 | — | — | 13 | ||||||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | 1,494 | — | — | 1,494 | ||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | (9,009 | ) | (9,009 | ) | ||||||||||||||||||||||

| Unrealized loss on marketable securities |

— | — | — | — | — | (69 | ) | — | (69 | ) | ||||||||||||||||||||||

| Balance at June 30, 2024 |

— | $ | — | 25,723,276 | $ | 26 | $ | 310,174 | $ | (127 | ) | $ | (92,570 | ) | $ | 217,503 | ||||||||||||||||

| Additional |

Accumulated Other |

Total |

||||||||||||||||||||||||||||||

| Convertible Preferred Stock |

Class A Common Stock |

Paid-in |

Comprehensive |

Accumulated |

Stockholders' |

|||||||||||||||||||||||||||

| Shares |

Amount |

Shares |

Amount |

Capital |

Loss |

Deficit |

Deficit |

|||||||||||||||||||||||||

| Balance at December 31, 2022 |

11,889,674 | $ | 132,482 | 2,259,734 | $ | 2 | $ | 4,726 | $ | (76 | ) | $ | (97,864 | ) | $ | (93,212 | ) | |||||||||||||||

| Vesting of shares of common stock subject to repurchase |

— | — | 5,245 | — | 5 | — | — | 5 | ||||||||||||||||||||||||

| Exercise of stock options |

— | — | 7,146 | — | 8 | — | — | 8 | ||||||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | 494 | — | — | 494 | ||||||||||||||||||||||||

| Net loss |

— | — | — | — | — | — | (4,824 | ) | (4,824 | ) | ||||||||||||||||||||||

| Unrealized gain on marketable securities |

— | — | — | — | — | 67 | — | 67 | ||||||||||||||||||||||||

| Balance at March 31, 2023 |

11,889,674 | $ | 132,482 | 2,272,126 | $ | 2 | $ | 5,233 | $ | (9 | ) | $ | (102,688 | ) | $ | (97,462 | ) | |||||||||||||||

| Vesting of shares of common stock subject to repurchase |

— | — | 14,584 | — | 14 | — | — | 14 | ||||||||||||||||||||||||

| Issuance of Series C convertible preferred stock, net of offering costs of $103 |

3,333,239 | 49,896 | — | — | — | — | — | — | ||||||||||||||||||||||||

| Exercise of stock options |

— | — | 36,715 | — | 47 | — | — | 47 | ||||||||||||||||||||||||

| Stock-based compensation |

— | — | — | — | 489 | — | — | 489 | ||||||||||||||||||||||||

| Repurchase of stock options |

— | — | (2,680 | ) | — | (28 | ) | — | — | (28 | ) | |||||||||||||||||||||

| Net income |

— | — | — | — | — | — | 41,564 | 41,564 | ||||||||||||||||||||||||

| Unrealized loss on marketable securities |

— | — | — | — | — | (56 | ) | — | (56 | ) | ||||||||||||||||||||||

| Balance at June 30, 2023 |

15,222,913 | $ | 182,378 | 2,320,744 | $ | 2 | $ | 5,755 | $ | (65 | ) | $ | (61,124 | ) | $ | (55,432 | ) | |||||||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

CONDENSED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

| Six Months Ended June 30, |

||||||||

| 2024 |

2023 |

|||||||

| Operating activities |

||||||||

| Net income (loss) |

$ | (17,426 | ) | $ | 36,740 | |||

| Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: |

|

|||||||

| Depreciation and amortization |

121 | 115 | ||||||

| Non-cash operating lease expense |

488 | 467 | ||||||

| Stock-based compensation |

2,262 | 983 | ||||||

| Accretion of debt discount and debt issuance costs |

— | (197 | ) | |||||

| Accretion of premiums/discounts on investments, net |

(2,092 | ) | (480 | ) | ||||

| Change in fair value of warrant liability |

107 | (2 | ) | |||||

| Gain on marketable securities |

— | 24 | ||||||

| Change in fair value of investor rights and obligations liability |

— | (2,867 | ) | |||||

| Changes in operating assets and liabilities |

||||||||

| Prepaid expenses and other current assets |

846 | (14 | ) | |||||

| Other long-term assets |

936 | 34 | ||||||

| Accounts payable |

100 | (31 | ) | |||||

| Accrued expenses |

(1,841 | ) | 1,175 | |||||

| Operating lease liabilities |

25 | (517 | ) | |||||

| Net cash provided by (used in) operating activities |

(16,474 | ) | 35,430 | |||||

| Investing activities |

||||||||

| Purchase of property and equipment |

(266 | ) | (83 | ) | ||||

| Purchases of marketable securities |

(99,649 | ) | (67,794 | ) | ||||

| Sales and maturities of marketable securities |

69,747 | 32,775 | ||||||

| Net cash used in investing activities |

(30,168 | ) | (35,102 | ) | ||||

| Financing activities |

||||||||

| Proceeds from issuance of common stock upon initial public offering, net of underwriting discounts and commissions and other offering costs |

108,211 | — | ||||||

| Proceeds from issuance of Series C convertible preferred stock, net of offering costs |

— | 49,895 | ||||||

| Principal payments on debt |

— | (3,750 | ) | |||||

| Proceeds from exercise of stock options |

135 | 27 | ||||||

| Net cash provided by financing activities |

108,346 | 46,172 | ||||||

| Net increase in cash and cash equivalents |

61,704 | 46,500 | ||||||

| Cash and cash equivalents at beginning of period |

15,526 | 5,569 | ||||||

| Cash and cash equivalents at end of period |

$ | 77,230 | $ | 52,069 | ||||

| Supplemental disclosure of noncash investing and financing activities |

||||||||

| Conversion of convertible preferred stock to common stock upon initial public offering |

$ | 192,620 | $ | — | ||||

| Reclassification of warrant from liability to equity |

$ | 216 | $ | — | ||||

| Reclassification of deferred offering costs paid in prior year to equity | $ | 343 | $ | — | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

NOTES TO UNAUDITED CONDENSED FINANCIAL STATEMENTS

1. Organization and Basis of Presentation

Organization and Nature of Operations

Contineum Therapeutics, Inc. (the “Company”), is a clinical stage biopharmaceutical company focused on discovering and developing novel, oral small molecule therapies for neuroscience, inflammation and immunology indications with high unmet need. The Company, formerly named Sirocco Therapeutics, Inc. (“Sirocco” or “legacy Sirocco”), Inception 3, Inc. (“Inception”) and Versense Pharmaceuticals, Inc. (“Versense”), was incorporated in the state of Delaware in 2009 as Versense. Versense changed its name to Inception on October 25, 2011, and commenced active operations on July 13, 2012. In May 2018, Inception changed its name to Sirocco. A separate entity named Pipeline Therapeutics, Inc. (“legacy Pipeline”) was founded and incorporated in the state of Delaware on May 9, 2017. On May 7, 2019, legacy Sirocco acquired legacy Pipeline in a merger transaction. As of December 31, 2019, legacy Pipeline was a wholly owned subsidiary of legacy Sirocco. In January 2020, legacy Pipeline was merged into legacy Sirocco and ceased to exist, and legacy Sirocco changed its name to Pipeline Therapeutics, Inc. In November 2023, Pipeline Therapeutics, Inc. changed its name to Contineum Therapeutics, Inc.

Reverse Stock Split

On April 1, 2024, the Company filed an amendment to its fourth amended and restated certificate of incorporation as amended and effected a 1-for-5.5972 reverse stock split of its capital stock. All share and per-share amounts presented in the financial statements and related notes have been retroactively adjusted to reflect the reverse stock split.

Initial Public Offering

On April 9, 2024, the Company closed its initial public offering (“IPO”), pursuant to which it issued and sold an aggregate of 6,875,000 shares of its common stock at a public offering price of $16.00 per share and on April 19, 2024, the Company issued and sold 548,682 additional shares of its common stock to the underwriters of the IPO pursuant to the partial exercise of their option to purchase additional shares, resulting in net proceeds of approximately $107.9 million, after deducting underwriting discounts, commissions and other offering expenses. Upon the closing of the IPO, the Company’s outstanding convertible preferred stock automatically converted into Class A common stock or Class B common stock, as applicable. Converted redeemable convertible preferred stock outstanding as of the date of the IPO consisted of 15,906,236 shares that were outstanding immediately prior to the closing of the IPO. Following the closing of the IPO, no shares of redeemable convertible preferred stock were authorized or outstanding.

In connection with the closing of its IPO, on April 9, 2024, the Company’s certificate of incorporation was amended and restated to (i) authorize 220,000,000 shares of common stock of which 200,000,000 are designated as Class A common stock and 20,000,000 of which are designated as Class B common stock; (ii) eliminate all references to the previously existing series of preferred stock; and (iii) authorize 10,000,000 shares of undesignated preferred stock that may be issued from time to time by the Company’s board of directors in one or more series.

Liquidity and Capital Resources

Since its inception, the Company has devoted substantially all its resources to research and development activities, business planning, establishing and maintaining its intellectual property portfolio, hiring personnel, raising capital to support and expand such activities and providing general and administrative support for these operations. The Company incurred a net loss of $9.0 million and $17.4 million for the three and six months ended June 30, 2024, respectively. The Company had an accumulated deficit of $92.6 million as of June 30, 2024. From its inception through June 30, 2024, the Company has financed its operations primarily through issuance of convertible promissory notes, convertible preferred stock financings, a term loan, a global license and development agreement (the “J&J License Agreement”) the Company entered in February 2023 with Janssen Pharmaceutica NV, one of the Janssen Pharmaceutical Companies of Johnson & Johnson, and net proceeds of approximately $107.9 million received in April 2024 from the Company's IPO.

As of June 30, 2024, the Company had cash, cash equivalents and marketable securities of $218.7 million. The Company believes its existing cash, cash equivalents and marketable securities will be sufficient to support operations for at least 12 months from the issuance of these unaudited condensed financial statements.

As the Company continues to pursue its business plan, it expects to finance its operations through both public and private sales of equity, debt financings or other commercial arrangements, which could include income from collaborations, strategic partnerships or marketing, distribution, licensing or other strategic arrangements with third parties. However, there can be no assurance that any additional financing or strategic transactions will be available to the Company on acceptable terms, if at all. If events or circumstances occur such that the Company does not obtain additional funding, it may need to delay, reduce or eliminate its product development or future commercialization efforts, which could have a material adverse effect on the Company’s business, results of operations, financial condition and cash flows. Further, if the Company raises funds through licensing or other similar arrangements with third parties, it may be required to relinquish valuable rights to its technology, future revenue streams, research programs or drug candidates or may be required to grant licenses on terms that may not be favorable to it and/or may reduce the value of its common stock.

Unaudited Interim Condensed Financial Statements

The condensed balance sheet as of June 30, 2024, condensed statements of operations and comprehensive income (loss) and condensed statements of convertible preferred stock and stockholders’ equity (deficit) for the three and six months ended June 30, 2024 and 2023, and condensed statements of cash flows for the six months ended June 30, 2024 and 2023, and related notes to condensed financial statements are unaudited. These unaudited interim condensed financial statements have been prepared on the same basis as the Company’s annual financial statements and, in the opinion of management, reflect all adjustments (consisting only of normal recurring adjustments) that are necessary for the fair statement of the Company’s financial position, results of operations and cash flows for the periods presented. The condensed results of operations for the three and six months ended June 30, 2024 are not necessarily indicative of the results to be expected for the full year or for any other future annual or interim period. The condensed balance sheet as of December 31, 2023 included herein was derived from the audited financial statements as of that date. These interim unaudited condensed financial statements should be read in conjunction with the Company’s audited financial statements for the year ended December 31, 2023 included in the Company’s Form S-1, as amended (File No. 333-278003) as filed with the Securities and Exchange Commission ("SEC") pursuant to Rule 424(b) of the Securities Act of 1933, as amended, on April 1, 2024 and declared effective by the SEC on April 4, 2024 (the "Registration Statement").

2. Summary of Significant Accounting Policies

During the six months ended June 30, 2024, there were no significant changes to the Company's significant accounting policies as described in the Company's Registration Statement.

Basis of presentation

The Company has prepared the accompanying condensed financial statements in accordance with accounting principles generally accepted accounting principles (“GAAP”) and the requirements of the SEC for interim reporting. As permitted under those rules, certain footnotes or other financial information that are normally required by GAAP can be condensed or omitted. The financial statements are presented in U.S. dollars. Any reference in these notes to applicable guidance is meant to refer to U.S. GAAP as found in the Accounting Standards Codification ("ASC") and Accounting Standards Updates ("ASU") promulgated by the Financial Accounting Standards Board ("FASB").

Use of estimates

During the six months ended June 30, 2024, there were no significant changes to the Company's accounting estimates as described in the Company's Registration Statement.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures ("ASU 2023-07"). This standard requires a public entity to disclose significant segment expenses and other segment items on an interim and annual basis. Additionally, it requires a public entity to disclose the title and position of the Chief Operating Decision Maker. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. A public entity should apply the amendments in this ASU retrospectively to all prior periods presented in the financial statements. The Company is currently evaluating the impact of this guidance on its financial statements.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures ("ASU 2023-09"). This standard requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 is effective for public entities with annual periods beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact of this guidance on its financial statements.

3. Marketable Securities

The Company invests its excess cash in marketable securities, including debt securities, commercial paper, asset-backed securities, Yankee debt and U.S. government agency securities.

The following table summarizes the amortized cost and fair value of the Company’s marketable securities by major investment category (in thousands):

| As of June 30, 2024 |

||||||||||||||||

| Unrealized |

||||||||||||||||

| Amortized Cost |

Gains |

Losses |

Fair Value |

|||||||||||||

| US Government agency securities |

$ | 20,526 | $ | — | $ | (64 | ) | $ | 20,462 | |||||||

| Certificate of deposit |

11,531 | 2 | (2 | ) | 11,531 | |||||||||||

| Corporate debt securities |

67,530 | 9 | (53 | ) | 67,486 | |||||||||||

| Commercial paper |

29,180 | 1 | (19 | ) | 29,162 | |||||||||||

| Yankee debt |

3,926 | — | (5 | ) | 3,921 | |||||||||||

| Asset-backed securities |

8,857 | 7 | (3 | ) | 8,861 | |||||||||||

| $ | 141,550 | $ | 19 | $ | (146 | ) | $ | 141,423 | ||||||||

| As of December 31, 2023 |

||||||||||||||||

| Unrealized |

||||||||||||||||

| Amortized Cost |

Gains |

Losses |

Fair Value |

|||||||||||||

| US Government agency securities |

$ | 18,883 | $ | 11 | $ | — | $ | 18,894 | ||||||||

| Certificate of deposit |

5,232 | 13 | — | 5,245 | ||||||||||||

| Corporate debt securities |

52,310 | 65 | (6 | ) | 52,369 | |||||||||||

| Commercial paper |

28,108 | 19 | (1 | ) | 28,126 | |||||||||||

| Yankee debt |

2,445 | 3 | — | 2,448 | ||||||||||||

| Asset-backed securities |

2,576 | 7 | (1 | ) | 2,582 | |||||||||||

| $ | 109,554 | $ | 118 | $ | (8 | ) | $ | 109,664 | ||||||||

The Company regularly reviews the securities in an unrealized loss position and evaluates the current expected credit loss by considering factors such as historical experience, market data, issuer-specific factors, current and expected future economic conditions. As of June 30, 2024, the Company did not record an allowance for credit loss related to its investment portfolio.

4. Fair Value Measurements

The accounting guidance defines fair value, establishes a consistent framework for measuring fair value and expands disclosure for each major asset and liability category measured at fair value on either a recurring or nonrecurring basis. Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, the accounting guidance establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1—Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

Level 2—Quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3—Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e. supported by little or no market activity).

Assets and liabilities measured at fair value on a recurring basis are as follows (in thousands):

| Fair Value Measurements Using |

||||||||||||||||

| Quoted Prices in |

Significant |

|||||||||||||||

| Active Markets |

Significant Other |

Unobservable |

||||||||||||||

| for Identical |

Observable |

Inputs |

||||||||||||||

| Total |

Assets (Level 1) |

Inputs (Level 2) |

(Level 3) |

|||||||||||||

| As of June 30, 2024: |

||||||||||||||||

| Assets: |

||||||||||||||||

| Cash equivalents |

$ | 16,005 | $ | 16,005 | $ | — | $ | — | ||||||||

| US Government agency securities |

20,462 | 19,833 | 629 | — | ||||||||||||

| Certificates of deposits |

11,531 | — | 11,531 | — | ||||||||||||

| Corporate debt securities |

67,486 | — | 67,486 | — | ||||||||||||

| Commercial paper |

29,162 | — | 29,162 | — | ||||||||||||

| Yankee debt |

3,921 | — | 3,921 | — | ||||||||||||

| Asset-backed securities |

8,861 | — | 8,861 | — | ||||||||||||

| Total financial assets |

$ | 157,428 | $ | 35,838 | $ | 121,590 | $ | — | ||||||||

| As of December 31, 2023: |

||||||||||||||||

| Assets: | ||||||||||||||||

| Cash equivalents |

$ | 14,646 | $ | 14,646 | $ | — | $ | — | ||||||||

| US Government agency securities |

18,894 | 16,360 | 2,534 | — | ||||||||||||

| Certificates of deposits |

5,245 | — | 5,245 | — | ||||||||||||

| Corporate debt securities |

52,369 | — | 52,369 | — | ||||||||||||

| Commercial paper |

28,126 | — | 28,126 | — | ||||||||||||

| Yankee debt |

2,448 | — | 2,448 | — | ||||||||||||

| Asset-backed securities |

2,582 | — | 2,582 | — | ||||||||||||

| Total financial assets |

$ | 124,310 | $ | 31,006 | $ | 93,304 | $ | — | ||||||||

| Liabilities: |

||||||||||||||||

| Preferred stock warrant liability |

(109 | ) | — | — | (109 | ) | ||||||||||

| Total financial liabilities |

$ | (109 | ) | $ | — | $ | — | $ | (109 | ) | ||||||

The carrying amounts of the Company’s financial instruments, including cash, cash equivalents and marketable securities, prepaid and other current assets, accounts payable, and accrued liabilities, approximate fair value due to their short maturities. Included in cash and cash equivalents at June 30, 2024 and December 31, 2023 are money market funds with a carrying value and fair value of $11.3 million and $11.8 million, respectively, based upon a Level 1 fair value assessment.

Warrant

Upon the closing of the IPO, the warrant to purchase shares of Series B preferred stock converted to a warrant to purchase shares of Class A common stock, and upon conversion the warrant met the equity classification requirements and was reclassified to equity. The warrant was remeasured to fair value immediately prior to the conversion to a common stock warrant and the Company recognized changes in the fair value of the warrant liability until April 9, 2024.

As of December 31, 2023, the Company had preferred stock warrant liability (included on the balance sheet under other long-term liabilities), which consisted of the fair value of a warrant to purchase Series B convertible preferred stock and was based on significant unobservable inputs, which represent a Level 3 measurement within the fair value hierarchy. The Company classified this warrant as a liability on its balance sheets and remeasured to fair value at each reporting date, and the Company recognized changes in the fair value of the warrant liability as a component of other income (expense) in its condensed statements of operations and comprehensive income (loss).

The Company’s valuation of the preferred stock warrant as of April 9, 2024 and December 31, 2023 utilized the Black-Scholes option-pricing model. The quantitative elements associated with the Company’s Level 3 inputs impacting the fair value measurement of the preferred stock warrant liability include the fair value per share of the underlying Series B convertible preferred stock, the remaining contractual term of the warrant, risk-free interest rate, expected dividend yield and expected volatility of the price of the underlying preferred stock. The most significant assumption in the Black-Scholes option-pricing model impacting the fair value of the preferred stock warrant is the fair value of the Company’s Series B convertible preferred stock as of each remeasurement date. The Company determines the fair value per share of the underlying preferred stock by taking into consideration its most recent sales of its convertible preferred stock as well as additional factors that the Company deems relevant. The Company historically has been a private company and lacks company-specific historical and implied volatility information of its stock. Therefore, it estimates its expected stock volatility based on the historical volatility of publicly traded peer companies for a term equal to the remaining contractual term of the warrant.

The risk-free interest rate is determined by reference to the U.S. Treasury yield curve for time periods approximately equal to the remaining contractual term of the warrant. The Company has estimated a 0% dividend yield based on the expected dividend yield and the fact that the Company has never paid or declared dividends.

Significant increases or decreases in any of these inputs in isolation would result in a significantly different fair value measurement. An increase in the risk-free interest rate, and/or an increase in the remaining contractual term or expected volatility, and/or an increase in the fair value of the convertible preferred stock would result in an increase in the fair value of the warrant.

The following table summarizes the change in fair value of the preferred stock warrant liability, a Level 3 recurring fair value measurement, for the six months ended June 30, 2024 (in thousands):

| Warrant Liability |

||||

| Balance at December 31, 2023 |

$ | 109 | ||

| Change in fair value of warrant liability |

107 | |||

| Balance at April 9, 2024 |

$ | 216 | ||

| Reclassification to equity |

$ | (216 | ) | |

| Balance at June 30, 2024 |

$ | — | ||

5. Accrued Expenses

Accrued expenses consisted of the following (in thousands):

| June 30, |

December 31, |

|||||||

| 2024 |

2023 |

|||||||

| Accrued compensation expenses |

$ | 1,402 | $ | 1,904 | ||||

| Accrued research and development expenses |

973 | 1,546 | ||||||

| Accrued professional and consulting expenses |

94 | 834 | ||||||

| Other accrued expenses |

52 | 101 | ||||||

| Total accrued expenses |

$ | 2,521 | $ | 4,385 | ||||

6. Convertible Preferred Stock and Stockholders’ Equity (Deficit)

Upon the closing of the IPO, the Company’s outstanding convertible preferred stock automatically converted into 9,177,064 shares of Class A common stock and 6,729,172 shares of Class B common stock. Converted preferred stock outstanding as of the date of the IPO consisted of 15,906,236 shares. Each share of outstanding Series A, Series A-1, Series B, and Series C convertible preferred stock was convertible into one share of common stock at the option of the holder, subject to certain anti-dilution adjustments.

Convertible Preferred Stock

As of December 31, 2023, the Company’s Series A, Series A-1, Series B, and Series C convertible preferred stock were classified as temporary equity in the accompanying condensed balance sheet given that a majority of the Company’s board of director seats were held and/or voted upon by convertible preferred stockholders and they could cause certain events to occur requiring redemption of the preferred stock that were outside of the Company’s control. The Company did not adjust the carrying values of the convertible preferred stock to the respective liquidation preferences of such shares as the instruments were not currently redeemable and it was not probable that the instruments would become redeemable.

The authorized, issued, and outstanding shares of convertible preferred stock as of December 31, 2023 consisted of the following:

| Shares Authorized |

Shares Issued and Outstanding |

Liquidation Preference (in thousands) |

||||||||||

| Series A |

1,786,607 | 1,786,604 | $ | 10,000 | ||||||||

| Series A-1 |

1,429,286 | 1,423,119 | 11,179 | |||||||||

| Series B |

3,362,377 | 3,346,607 | 32,034 | |||||||||

| Series C |

10,362,324 | 9,349,906 | 140,249 | |||||||||

| 16,940,594 | 15,906,236 | $ | 193,462 | |||||||||

Common Stock

The Company has two classes of common stock: Class A common stock and Class B common stock. Class A common stock has one vote per share and Class B common stock has no votes per share. As of June 30, 2024, of the authorized 200,000,000 shares of Class A common stock, 18,994,104 shares of Class A common stock were issued and outstanding, and of the authorized 20,000,000 shares of Class B common stock, 6,729,172 shares of Class B common stock were issued and outstanding.

Voting, dividend, and liquidation rights of the holders of the common stock were subject to, and qualified by, the rights, preferences and privileges of the holders of the convertible preferred stock. The holders of the common stock are entitled to one vote for each share of common stock held at all meetings of stockholders.

Class A common stock reserved for future issuance consisted of the following:

| As of June 30, |

December 31, |

|||||||

| 2024 |

2023 |

|||||||

| Convertible preferred stock |

— | 15,906,236 | ||||||

| Common stock options granted and outstanding |

4,090,030 | 2,674,405 | ||||||

| Shares available for issuance under the 2024 Plan |

2,824,492 | — | ||||||

| Shares available for issuance under the 2012 Plan |

— | 502,491 | ||||||

| Preferred stock warrant |

— | 15,764 | ||||||

| Common stock warrant |

15,764 | — | ||||||

| Common stock reserved under the 2024 ESPP |

280,000 | — | ||||||

| Total common stock reserved for future issuance |

7,210,286 | 19,098,896 | ||||||

There are no shares of Class B common stock reserved for future issuance.

Stock Options

In March 2024, the Company's board of directors and its stockholders adopted and approved the 2024 Equity Incentive Plan (the "2024 Plan"). The 2024 Plan is the successor of the Company's 2012 Equity Incentive Plan (the "2012 Plan"). However, awards outstanding under the 2012 Plan will continue to be governed by their existing terms. The 2024 Plan allowed for the issuance of incentive stock options, nonstatutory stock options, stock appreciation rights, restricted shares, restricted stock units, and other stock awards to the Company's employees, members of its board of directors, and consultants.

The number of shares initially reserved for issuance under the 2024 Plan was 2,700,000. As of June 30, 2024, there were 2,824,492 shares of the Company’s common stock reserved and available for issuance under the 2024 Plan. The aggregate number of shares reserved for issuance under the 2024 Plan will automatically increase on the first day of each fiscal year of the Company, commencing in 2025 and ending in (and including) 2034, by a number equal to the lesser of (a) 5% of the aggregate shares of Class A common stock and Class B common stock issued and outstanding as of the last day of the prior fiscal year, or (b) a number of shares of Class A common stock determined by the Company's board of directors.

Under the 2024 Plan, the exercise price for options granted under the 2024 Plan may not be less than 100% of the fair market value of the Class A common stock on the grant date. Optionees will be permitted to pay the exercise price in cash or, with the consent of the compensation committee (i) with shares of common stock that the optionee already owns, (ii) by an immediate sale of shares through a broker approved by the Company, (iii) by instructing the Company to withhold a number of shares otherwise deliverable upon exercise having an aggregate fair market value that does not exceed the exercise price; or (iv) by other methods permitted by applicable law.

The Company's board of directors (or a committee thereof to which the Company's board of directors has delegated authority) may amend or terminate the 2024 Plan at any time. If the Company's board of directors amends the 2024 Plan, it does not need stockholder approval of the amendment unless required by applicable law, regulation or rules. The 2024 Plan will terminate automatically ten years after the date when the Company's board of directors adopted the 2024 Plan.

In March 2024, the Company's board of directors and its stockholders adopted and approved the 2024 Employee Stock Purchase Plan (the "2024 ESPP"). The 2024 ESPP became effective as of April 9, 2024. The purpose of the 2024 ESPP is to provide eligible employees with an opportunity to increase their interest in the success of the Company by purchasing shares of Class A common stock from the Company on favorable terms and to pay for such purchases through payroll deductions or other approved contributions. The new payroll deduction rate may be any whole percentage of the participant’s compensation, but not less than 1% nor more than 15%.

As of June 30, 2024, there were 280,000 shares of the Company’s common stock reserved and available for issuance under the 2024 ESPP. The number of shares reserved for issuance under the 2024 ESPP will automatically increase on the first day of each fiscal year of the Company, commencing in 2025 and ending in (and including) 2044, by a number equal to the lesser of (i) 280,000 shares, (ii) 1% of the aggregate shares of Class A common stock and Class B common stock issued and outstanding on the last day of the prior fiscal year, or (iii) a number of shares determined by the Company's board of directors. The number of shares reserved under the 2024 ESPP will automatically be adjusted in the event of a stock split, stock dividend or a reverse stock split (including an adjustment to the per-purchase period share limit).

During the six months ended June 30, 2024, there were no shares purchased under the 2024 ESPP and the recorded expense was not material.

Stock option activity under the 2024 Plan and 2012 Plan is as follows:

| Options Outstanding |

Weighted- Average Exercise Price |

Weighted- Average Remaining Contractual Term |

Aggregate Intrinsic Value (in thousands) |

|||||||||||||

| Balance at December 31, 2023 |

2,674,457 | $ | 5.93 | 7.22 | $ | 13,453 | ||||||||||

| Options granted |

1,459,382 | 16.01 | — | — | ||||||||||||

| Options exercised |

(43,809 | ) | 3.09 | — | — | |||||||||||

| Options cancelled and forfeited |

— | — | — | — | ||||||||||||

| Options expired |

— | — | — | — | ||||||||||||

| As of June 30, 2024 |

4,090,030 | $ | 9.55 | 7.82 | $ | 33,050 | ||||||||||

| Options vested and expected to vest as of June 30, 2024 |

4,090,030 | $ | 9.55 | 7.82 | $ | 33,050 | ||||||||||

| Options exercisable as of June 30, 2024 |

1,930,408 | $ | 4.35 | 5.91 | $ | 25,592 | ||||||||||

The aggregate intrinsic value of options exercised during the period ended June 30, 2024 was $0.1 million, determined as of the date of exercise. Options exercisable include options which are not vested, but are available to be early exercised as of June 30, 2024. As of June 30, 2024, there were 133,058 options exercisable that are available to be early exercised.

The Company estimated the fair value of stock options using the Black-Scholes valuation model. The Company accounts for any forfeitures of options when they occur. Previously recognized compensation expense for an award is reversed in the period that the award is forfeited. The fair value of stock options was estimated using the following weighted-average assumptions:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2024 |

2023 |

2024 |

2023 |

|||||||||||||

| Assumptions: |

||||||||||||||||

| Expected term (in years) |

6.05 | — | 6.03 | 6.08 | ||||||||||||

| Expected volatility |

110 | % | — | 110 | % | 90 | % | |||||||||

| Risk free interest rate |

4.49 | % | — | 4.44 | % | 3.40 | % | |||||||||

| Dividend yield |

— | — | — | — | ||||||||||||

The weighted-average grant-date fair value per share of stock options granted during the three and six months ended June 30, 2024 was $13.53 and $13.55 per share, respectively.

There were no stock options granted during the three months ended June 30, 2023.

The Company recorded $0.9 million and $0.6 million in stock-based compensation in general and administrative and research and development, respectively, for the three months ended June 30, 2024. The Company recorded $0.3 million and $0.2 million in stock-based compensation in general and administrative and research and development, respectively, for the three months ended June 30, 2023.

The Company recorded $1.3 million and $1.0 million in stock-based compensation in general and administrative and research and development, respectively, for the six months ended June 30, 2024. The Company recorded $0.5 million and $0.5 million in stock-based compensation in general and administrative and research and development, respectively, for the six months ended June 30, 2023.

As of June 30, 2024 there was approximately $24.1 million of total unrecognized stock-based compensation related to nonvested stock-based compensation arrangements, which is expected to be recognized over a weighted-average period of approximately 3.2 years. As of June 30, 2023 there was approximately $2.9 million of total unrecognized stock-based compensation related to nonvested stock-based compensation arrangements, which is expected to be recognized over a weighted-average period of approximately 1.0 years.

7. Income Taxes

The Company’s interim income tax provision consists of U.S. federal and state income taxes based on the estimated annual effective tax rate that the Company expects for the full year together with the tax effect of discrete items. Each quarter the Company updates its estimate of the annual effective tax rate and records cumulative adjustments as necessary.

For the three and six months ended June 30, 2024, the Company did not record a U.S. federal or state income tax provision due to current and expected annual net operating losses for the year ended December 31, 2024.

As of June 30, 2023, the estimated annual effective tax rate for 2023, exclusive of discrete items, was approximately 1.94% of projected pre-tax income. The estimated annual tax expense consists of a provision for federal and state income taxes. For the three months ended June 30, 2023, due to statutory limitations on the ability to utilize research and development credits and net operating losses to offset year to date taxable income, the Company recorded a tax expense of $0.7 million, on a pre-tax income of $42.3 million. For the six months ended June 30, 2023, due to statutory limitations on the ability to utilize research and development credits and net operating losses to offset year to date taxable income, the Company recorded a tax expense of $0.7 million, on a pre-tax income of $37.5 million.

Under Section 382 and 383 of the Internal Revenue Code ("IRC"), if a corporation undergoes an ownership change (generally defined as a greater than 50% change in its equity ownership over a three-year period), the corporation’s ability to use its pre-change net operating loss carryforwards and other pre-change tax attributes to offset its post-change income may be limited. The Company has completed an ownership change analysis pursuant to IRC Section 382 for the periods prior to February 9, 2021. On July 13, 2012, April 29, 2018, March 15, 2019, and February 9, 2021 the Company experienced ownership changes. Accordingly, the Company’s ability to utilize net operating loss and tax credit carryforwards attributable to periods prior to February 9, 2021 is subject to substantial limitations. An ownership change analysis pursuant to IRC Section 382 has not been performed for the periods after February 9, 2021 and therefore additional ownership changes may have occurred which may limit the Company’s ability to use its pre-change net operating loss carryforwards and other pre-change tax attributes.

In assessing the realizability of deferred tax assets, the Company evaluates whether it is more likely than not that some portion or all of the deferred tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income in those periods in which temporary differences become deductible and/or net operating losses can be utilized. The Company assesses all positive and negative evidence when determining the amount of the net deferred tax assets that are more likely than not to be realized. This evidence includes, but is not limited to, prior earnings history, scheduled reversal of taxable temporary differences, tax planning strategies and projected future taxable income. Significant weight is given to positive and negative evidence that is objectively verifiable. Based on these factors, including cumulative losses in recent years, the Company continues to maintain a full valuation allowance against its net deferred tax assets as of June 30, 2023.

8. License Agreement

In February 2023, the Company entered into the J&J License Agreement, pursuant to which the Company granted J&J an exclusive, worldwide license to develop, manufacture and commercialize PIPE-307 in all indications. The J&J License Agreement allows the Company to elect, at its sole discretion and cost, to conduct a Phase 2 trial of PIPE-307 for patients with multiple sclerosis. After such trial, J&J may, at its sole discretion, further develop PIPE-307 for patients with multiple sclerosis. Additionally, upon J&J deciding to conduct a first Phase 3 clinical trial for a product using PIPE-307, the J&J License Agreement allows the Company the option to co-fund a portion of all Phase 3 and subsequent development costs for PIPE-307, with such costs capped annually. If the Company opts to fund such development costs, then the royalties the Company is eligible to receive will increase. Pursuant to the terms of the J&J License Agreement, the Company received an upfront, non-refundable and non-creditable payment of $50.0 million upon transferring the license and know-how, existing inventory and manufacturing technology. The Company is also eligible to receive approximately $1.0 billion in non-refundable, non-creditable milestone payments. Additionally, the Company is eligible to receive tiered royalties in the low-double digit to high-teen percent range on net sales of products containing PIPE-307.

The Company sold approximately 1.7 million shares of series C convertible preferred stock to Johnson & Johnson Innovation - JJDC, Inc., an affiliate of J&J, at $15.00 per share, for an aggregate purchase price of approximately $25.0 million, in April 2023. The Company determined that this preferred stock purchase was at fair value as other new investors purchased shares of preferred stock at the same price.

The Company concluded that J&J represented a customer and applied relevant guidance from ASC 606 to evaluate the appropriate accounting for the J&J License Agreement. The Company evaluated the J&J License Agreement and concluded that it had promises to transfer a license of functional intellectual property, know-how, existing inventory and manufacturing technology (each of which was determined to be a distinct performance obligation). Control of the promised goods was transferred to J&J in the second quarter of 2023, and the $50.0 million upfront payment was recognized in May 2023 upon satisfaction of the performance obligations. The remaining consideration consists of future contingent milestone-based payments and sales-based royalties. As of June 30, 2024, all variable consideration under the J&J License Agreement was fully constrained.

In August 2023, the Company elected to conduct a Phase 2 trial using PIPE-307 for patients with multiple sclerosis, which was considered a contract modification under the accounting guidance that added promised goods or services that are distinct at a price that is below the standalone selling price. Therefore, the Company accounted for the modification as a termination of the existing contract and creation of a new contract. Accordingly, the amount of consideration to be allocated to the remaining performance obligations consists of future contingent milestone-based payments and sales-based royalties, all of which were constrained. The only remaining performance obligation is the promise to conduct the Phase 2 trial, as the other performance obligations had been satisfied prior to the modification date. Accordingly, the variable consideration allocated to the Phase 2 trial will be recognized as the study is completed using a cost-based measure of progress and when the amounts are no longer probable of a significant reversal. As of June 30, 2024, no amounts had been recognized related to the Phase 2 trial as no additional variable consideration as been received subsequent to the contract modification.

9. Net Loss Per Share

The following table sets forth the computation of the basic and diluted net income (loss) per share (in thousands, except share and per share amounts):

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2024 |

2023 |

2024 |

2023 |

|||||||||||||

| Numerator, basic: |

||||||||||||||||

| Net income (loss) |

$ | (9,009 | ) | $ | 41,564 | $ | (17,426 | ) | $ | 36,740 | ||||||

| Allocation of earnings to participating preferred stockholders |

— | 35,695 | — | 31,219 | ||||||||||||

| Net income (loss) applicable to common stockholders |

$ | (9,009 | ) | $ | 5,869 | $ | (17,426 | ) | $ | 5,521 | ||||||

| Denominator, basic: |

||||||||||||||||

| Weighted average common shares issued |

23,355,588 | 2,295,378 | 12,862,328 | 2,291,887 | ||||||||||||

| Less: weighted average unvested common stock issued upon early exercise of stock options |

— | (3,512 | ) | — | (7,137 | ) | ||||||||||

| Weighted average shares used to compute net income (loss) per common share, basic |

23,355,588 | 2,291,866 | 12,862,328 | 2,284,750 | ||||||||||||

| Numerator, diluted: |

||||||||||||||||

| Net income (loss) attributable to common stockholders |

$ | (9,009 | ) | $ | 5,869 | $ | (17,426 | ) | $ | 5,521 | ||||||

| Change in fair value of put option |

— | (2,920 | ) | — | (2,920 | ) | ||||||||||

| Net income (loss) applicable to common stockholders |

$ | (9,009 | ) | $ | 2,949 | $ | (17,426 | ) | $ | 2,601 | ||||||

| Denominator, diluted: |

||||||||||||||||

| Weighted average shares used to compute net income (loss) per common share, diluted |

23,355,588 | 2,291,866 | 12,862,328 | 2,284,750 | ||||||||||||

| Common stock options |

— | 1,036,729 | — | 1,042,226 | ||||||||||||

| Unvested common stock issued upon early exercise of stock options |

— | 3,512 | — | 7,137 | ||||||||||||

| Preferred stock warrant (as converted to common stock) |

— | 1,752 | — | 1,585 | ||||||||||||

| Preferred stock put option (common stock issued) |

— | 177,898 | — | 177,898 | ||||||||||||

| Weighted average shares used to compute net income (loss) per common share, diluted |

23,355,588 | 3,511,757 | 12,862,328 | 3,513,596 | ||||||||||||

| Net income (loss) per share, basic |

$ | (0.39 | ) | $ | 2.56 | $ | (1.35 | ) | $ | 2.42 | ||||||

| Net income (loss) per share, diluted |

$ | (0.39 | ) | $ | 0.84 | $ | (1.35 | ) | $ | 0.74 | ||||||

For the three and six months ended June 30, 2024, net loss is attributable equally to each share of Class A common stock and Class B common stock and is determined based on the weighted average number of the respective class of common stock outstanding. Weighted-average common shares include shares of the Company's Class A common stock and Class B common stock. The basic and diluted net loss per share amounts are the same for Class A common stock and Class B common stock.

For the three and six months ended June 30, 2023, there were no shares of Class B common stock outstanding.

The Company’s potentially dilutive securities, which include convertible preferred stock, a common stock warrant, common stock options, common stock reserved under the 2024 ESPP, and a preferred stock warrant have been excluded from the computation of diluted net loss per share for the three and six months ended June 30, 2024 as the effect would reduce the net loss per share. Therefore, the weighted-average number of shares of common stock outstanding used to calculate both basic and diluted net loss per share attributable to common stockholders is the same.

The Company excluded the following potentially dilutive securities, presented based on amounts outstanding at each period end, from the computation of diluted net income (loss) per share attributable to common stockholders for the periods indicated because including them would have had an anti-dilutive effect:

| As of June 30, | As of June 30, | |||||||

| 2024 |

2023 |

|||||||

| Convertible preferred stock | — | 15,222,937 | ||||||

| Common stock options |

4,090,030 | 2,141,367 | ||||||

| Common stock warrant |

15,764 | — | ||||||

| Unvested common stock issued upon early exercise of stock options | — | 3,202 | ||||||

| Common stock reserved under the 2024 ESPP |

280,000 | — | ||||||

| Preferred stock warrant | — | 15,764 | ||||||

| 4,385,794 | 17,383,271 | |||||||

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited financial statements and related notes included in this Quarterly Report on Form 10-Q and the audited condensed financial statements and notes thereto as of and for the year ended December 31, 2023 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are included in our final prospectus filed with the Securities and Exchange Commission (“SEC”) pursuant to Rule 424(b) under the Securities Act of 1933, as amended (“Securities Act”) on April 8, 2024 (“Prospectus”) that forms a part of our registration statement on Form S-1 (File No. 333-278003).

This Quarterly Report on Form 10-Q may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements, which represent our intent, belief, or current expectations, involve risks and uncertainties. We use words such as “may,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “predict,” “potential,” “believe,” “should” and similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Such statements may include, but are not limited to, statements concerning projections about our accounting and finances, our clinical trial and product development plans and timelines, the indications, anticipated benefits of, and market opportunities for our drug candidates, our operating runway, our business strategies and plans, and other statements regarding future performance. Although we believe the expectations reflected in these forward-looking statements are reasonable, such statements are inherently subject to risk and we can give no assurances that our expectations will prove to be correct. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Quarterly Report on Form 10-Q. As a result of many factors, including without limitation those set forth under “Risk Factors” under Item 1A of Part II below, and elsewhere in this Quarterly Report on Form 10-Q, our actual results may differ materially from those anticipated in these forward-looking statements. We undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this report or to reflect actual outcomes.

Overview

We are a clinical stage biopharmaceutical company focused on discovering and developing novel, oral small molecule therapies that target biological pathways associated with specific clinical impairments for the treatment of neuroscience, inflammation and immunology (“NI&I”) indications with high unmet need.

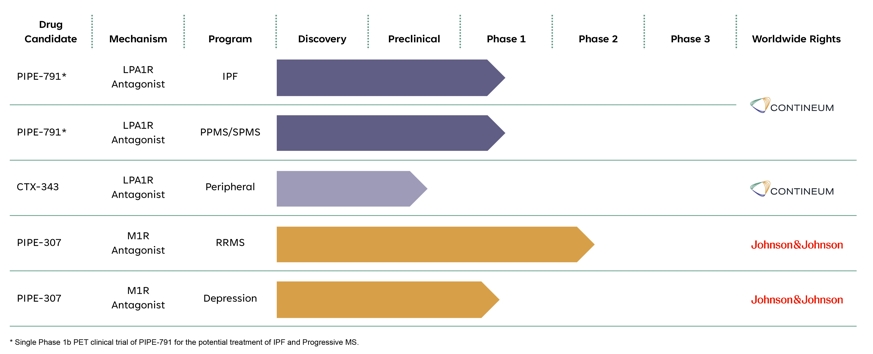

We have focused our efforts on developing selective compounds targeting challenging molecular pathways, and through these efforts, have built a portfolio of small molecule drug candidates.

Our wholly-owned lead asset, PIPE-791, is a novel, brain penetrant, small molecule inhibitor of lysophosphatidic acid 1 receptor (“LPA1R”) in development for idiopathic pulmonary fibrosis (“IPF”) and Progressive multiple sclerosis (“Progressive MS”). LPA1R antagonism is a clinically validated mechanism, and we believe that our preclinical studies and Phase 1 healthy volunteer data support the continued development of PIPE-791 for both IPF and Progressive MS. Specifically, based on its high bioavailability, low plasma protein binding, and long receptor residence time in our preclinical studies compared to the preclinical data of other LPA1R antagonists that we know are currently in development, we also believe PIPE-791 has the potential to be a differentiated LPA1R therapy. We completed a Phase 1 clinical trial of PIPE-791 in healthy volunteers in support of clinical development in both IPF and Progressive MS. We plan to submit a clinical trial application to the Medicines and Healthcare products Regulatory Agency to commence a Phase 1b open-label trial of PIPE-791 to measure the relationship of pharmacokinetics to lung and brain receptor occupancy by positron emission tomography imaging in 2024. This Phase 1b trial will inform dose selection for our planned future Phase 2 trials of PIPE-791 in IPF and Progressive MS.

Our second drug candidate, PIPE-307, is a novel, small molecule selective inhibitor of the muscarinic type 1 M1 receptor (“M1R”), in development for depression and relapse-remitting multiple sclerosis (“RRMS”). M1R antagonism has been clinically validated in third-party trials in both depression and RRMS by scopolamine and clemastine, respectively. We have completed two Phase 1 trials of PIPE-307 in healthy volunteers and have initiated a Phase 2 trial of PIPE-307 for the potential treatment of RRMS. To our knowledge, PIPE-307 is the most clinically advanced selective M1R antagonist in development. We are developing PIPE-307 in collaboration with Johnson & Johnson ("J&J").

In addition, we are leveraging our drug discovery capabilities synergistically with our clinical portfolio. In January 2024, we nominated and commenced preclinical studies for CTX-343, a peripherally-restricted (unable to cross the blood brain barrier) LPA1R antagonist. In parallel, we are actively conducting preclinical and discovery-phase experiments targeting other NI&I indications where our internally-discovered molecules may have therapeutic potential.

We are currently focused on developing the following product candidates in our pipeline:

We expect our operating expenses to significantly increase as we continue to develop, conduct clinical trials, and seek regulatory approvals for our drug candidates, engage in other research and development activities to expand our pipeline of drug candidates, expand our operations and headcount, maintain and expand our intellectual property portfolio, and, if we obtain approval for one or more of our drug candidates, launch commercial activities. We also expect to incur additional operating expenses as we begin operating as a public company. Our net losses may fluctuate significantly from quarter-to-quarter and year-to-year, depending on the timing and scope of our clinical trials and our expenditures on other research and development activities.

As we continue to pursue our business plan, we expect to finance our operations through both public and private sales of equity, debt financings or other commercial arrangements, which could include income from collaborations, strategic partnerships or marketing, distribution, licensing or other strategic arrangements with third parties. However, there can be no assurance that any additional financing or strategic transactions will be available to us on acceptable terms, if at all. If events or circumstances occur such that we do not obtain additional funding, we may need to delay, reduce or eliminate our product development or future commercialization efforts, which could have a material adverse effect on our business, results of operations or financial condition. Further, if we raise funds through licensing or other commercial arrangements with third parties, we may be required to relinquish valuable rights to our technology, future revenue streams, research programs or drug candidates or may be required to grant licenses on terms that may not be favorable to us and/or may reduce the value of our common stock.

Collaboration

In February 2023, we entered into the license agreement with J&J (the "J&J License Agreement"), pursuant to which we granted J&J an exclusive, worldwide license to develop, manufacture and commercialize PIPE-307 in all indications.

J&J is generally responsible for all development, manufacturing and commercialization activities for PIPE-307. Upon J&J conducting a first Phase 3 clinical trial for a product using PIPE-307, we have an opt-in right to fund a portion of all Phase 3 and subsequent development costs for PIPE-307. If we opt to fund such development costs, then the royalties we are eligible to receive will increase by one to two percentage points.

We are conducting, at our own expense, a Phase 2 clinical trial of PIPE-307 in patients with RRMS. J&J has the right to discontinue our clinical trial if it has good faith concerns that this trial presents safety risks or could have a material adverse effect on its development or commercialization of PIPE-307. In addition, J&J has the right, in its sole discretion, to further develop or to elect not to develop PIPE-307 for this indication.

The J&J License Agreement expires on a licensed product-by-product and country-by-country basis upon the last to occur of: (i) the expiration of the last-to-expire licensed patent claim covering the composition of matter of the licensed compound in such licensed product in such country; (ii) the expiration of exclusive marketing rights conferred by a regulatory authority or applicable law (other than patent exclusivity) for such licensed product in such country; and (iii) ten years after the first commercial sale of such licensed product in such country. Either party may terminate the J&J License Agreement in the event of an uncured material breach by the other party or a bankruptcy or insolvency of the other party. J&J may terminate the J&J License Agreement without cause upon prior written notice to us. Upon any termination, all license rights granted to J&J terminate.

Financial Operations Overview

Revenue

We recognize license revenues as identified performance obligations are satisfied or other events occur, specifically related to our J&J License Agreement. Pursuant to the terms of the J&J License Agreement, we received an upfront payment of $50.0 million in May 2023. We are also eligible to receive approximately $1.0 billion in non-refundable, non-creditable milestone payments, pursuant to the terms of the J&J License Agreement. Additionally, we are eligible to receive tiered royalties in the low-double digit to high-teen percent range on net sales of products containing PIPE-307.

Operating Expenses

Research and Development

Research and development expenses consist primarily of costs incurred for our internal research and development activities.

Direct costs include:

| • |

employee-related expenses, including salaries, related benefits, and travel that can be directly attributable to each research project; |

| • |

expenses incurred in connection with research, laboratory consumables and preclinical studies; |

| • |

expenses incurred in connection with conducting clinical trials, including investigator grants and site payments for time and pass-through expenses and expenses incurred under agreements with clinical research organizations ("CROs"), other vendors or central laboratories and service providers engaged to conduct our trials; |

| • |

the cost of consultants engaged in research and development related services; |

| • |

the cost to manufacture drug products for use in our preclinical studies and clinical trials; and |

| • |

costs related to regulatory compliance. |