|

Delaware

|

||

|

(State or other jurisdiction of incorporation)

|

||

|

000-05131

|

42-0920725

|

|

|

(Commission File Number)

|

(IRS Employer

|

|

|

Identification No.)

|

||

|

5556 Highway 9

Armstrong, Iowa 50514

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

(712) 208-8467

|

||

|

(Registrant’s telephone number, including area code)

|

||

|

Not Applicable

|

||

|

(Former name or former address, if changed since last report.)

|

||

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock $0.01 par value

|

ARTW

|

The Nasdaq Stock Market LLC

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(a)

|

Financial statements: None

|

|

(b)

|

Pro forma financial information: None

|

|

(c)

|

Shell Company Transactions: None

|

|

(d)

|

Exhibits:

|

|

1.01

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

ART’S-WAY MANUFACTURING CO., INC.

|

|||

|

/s/ Michael W. Woods

|

|||

|

Michael W. Woods

Chief Financial Officer

|

Exhibit 1.01

|

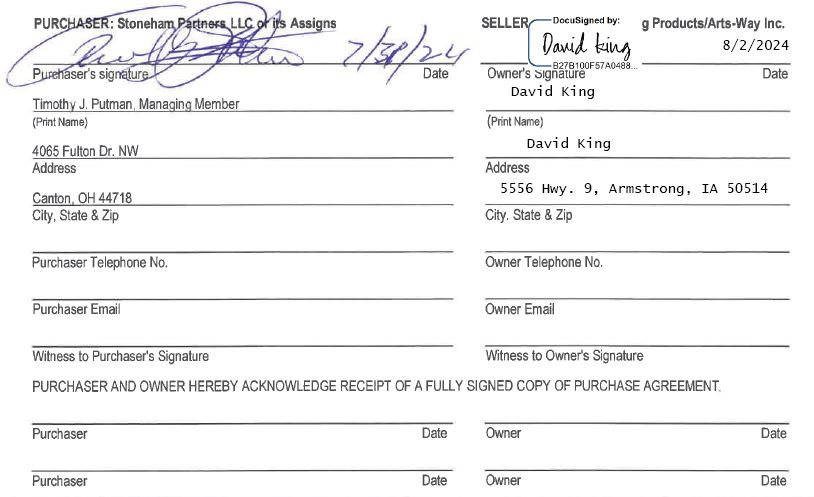

4065 Fulton Dr NW, Canton, Ohio 44718 P: 330-498-4400 4 F: 330-498-3800 WEBSITE: putmanproperties.com EMAIL: info@putmanproperties.com COMMERCIAL/INDUSTRIAL REAL ESTATE PURCHASE AGREEMENT |

| 1. |

The undersigned agrees to buy the following real estate situated in Stark County, Ohio, said premises being known as Parcel Number(s) 305722 and further known as street & no 3620 Progress St, NW., Canton. OH 44705 with an approximate lot size of 4.64 acres further described as: approximately 39,000.00 square foot industrial warehouse. |

|

PAYMENT: The Purchaser agrees to pay: |

$ | 1,800,000.00 | ||

|

Earnest Money Deposit with this agreement (To be deposited upon acceptance of this agreement): |

$ | 50,000.00 | ||

|

Additional deposit on or before ,20 |

$ | 0.00 | ||

|

Balance of down payment when executed deed is delivered to Purchaser or escrow agent: |

$ | 400,000.00 | ||

|

Amount to be financed by 75 % Loan To Value: |

$ | 1.350.000.00 |

| 2. |

INCLUDED IN THE SALE: The Real Estate shall include, without limitation, the following: all electrical, plumbing, heating, air conditioning equipment, and permanently attached fixtures. |

| 3. |

PERSONAL PROPERTY: The following personal property shall be included in the sale: N/A. |

|

4. |

ADDITIONAL TERMS AND CONDITIONS: |

|

a. |

DUE DILIGENCE: Subject to a 45-day "due diligence" to perform any inspections Purchaser deems necessary. Inspections may include, but not be limited to: Roof, HVAC, electrical, plumbing, environmental, and any other inspection deemed necessary by the buyer. All inspections are at the sole cost and discretion of the buyer. |

|

|

b. |

DOCUMENTS PROVIDED BY SELLER: The seller shall provide copies of all leases, security deposit agreements,and all service contracts for the property within five (5) days of execution date. The buyer shall have 15 days AFTER the documents have been provided to review and approve all documents. |

|

|

c. |

ASSIGNMENT OF LEASES: Seller agrees, as part of this purchase agreement, to execute an assignment of all leases on a form mutually agreed upon by the parties acting reasonably at time of closing. |

|

|

d. |

APPRAISAL: Seller to provide a copy of any existing Appraisals for land and building for Purchaser to review. |

|

|

e. |

ENVIRONMENTAL ASSESSMENTS. The Owner shall provide copies of any environmental assessments it may have in its possession for information purposes only and the Purchaser agrees it will not rely on the content of such assessments provided by the Owner. |

|

|

f. |

OTHER: Seller shall continue to mow grass and otherwise maintain the building and property through the date of closing. |

|

5. |

CONTINGENCIES: |

|

(a.) |

ENVIRONMENTAL INSPECTION: Owner agrees to permit the Purchaser, the Purchaser's lender and the qualified professional environmental consultant of either of them to enter the premises to conduct, at the expense of the Purchaser, an environmental site assessment. This Assessment report must be completed within 30 days of the execution of this Agreement. Purchaser agrees if such assessment is obtained and the consultant recommends further inspection to determine the extent of suspected contamination or recommends remedial action, the Purchaser, at Purchaser's option, may notify the Owner in writing, with a copy of the report attached, within five (5) business days after receipt by Purchaser of a copy of the environmental site assessment report, that the Contract is null and void. Does Apply ✓ Does Not Apply |

|

(b.) |

MORTGAGE. Purchaser will need the loan described in paragraph 1 above to finance this transaction Purchaser agrees to use his best efforts to obtain such loan, including complying with lender's requests. Purchaser will make loan application within 5 days after date of receipt by Purchaser of fully executed copy of this Agreement, and Purchaser shall obtain a written loan commitment within 90 days after date of such receipt. If Purchaser has failed either to make loan application or obtain a written loan commitment within the time periods set forth above, this agreement, at Seller's election, shall be deemed null and void and all monies in trust shall be returned to Purchaser without further liability by, between and among Seller, Purchaser and REALTOR. If financing cannot be arranged, all monies shall be returned to Purchaser. |

| 6. |

"AS IS" CLAUSE: By initialling this paragraph, Purchaser agrees and acknowledges that the property is being conveyed "as is" and that Purchaser is relying solely upon his own examination of the Real Estate and inspections herein required, if any, for its physical condition and character, and the Real Estate's suitability for Purchaser's intended use thereof, and that neither Owner, broker, nor agent have made any representations or warranties, either express or implied, regarding the property, including, but not limited to, the condition of roof, basements, (structural or water seepage) furnace, air conditioner, well, septic or sewer system, electrical, plumbing a appliances, except for these representations made by said agents or Owner directly to the Purchaser, in writing, as follows: N/A. |

|

7. |

DEED AND CLOSING: Owner shall pay transfer taxes and shall convey marketable title by general warranty deed, or fiduciary deed, if appropriate with release of dower, if any, and the entire transaction shall be closed (CLOSING SHALL BE DATE OF DELIVERY OF DEED; DELIVERY OF DEED TO BE DEFINED AS DATE OF COMPLETED SETTLEMENT STATEMENT) not later than ninety (90) days from the date of acceptance. |

|

8. |

EVIDENCE OF TITLE: Owner shall provide to Purchaser a title insurance commitment for an Owner's Title Policy in the amount of the purchase price, which shall be certified to the date of filing of deed. Should Purchaser require a Mortgagee's Policy, Owner shall furnish a simultaneous issue of same. The title of property shall be good and marketable in fee simple and shall be in accordance with the standards of The Ohio State Bar Association and acceptable to Purchaser's lender Owner and Purchaser shall share equally the cost of the evidence of title, which Owner is required to provide hereunder; including without limitation, the cost of title search, policy commitment, and escrow fee. Any endorsements requested by Purchaser or Purchaser's lender shall be at Purchaser's expense. Simultaneous issue? Yes ✓ No Location survey to be paid by Purchaser and deed to be paid by Owner. Title and escrow services to be provided by American Title Associates Agency,Inc.. |

|

9. |

TAXES, UTILITIES AND DEPOSITS: Real Estate taxes, instalments of assessments, rents and operating expenses shall be prorated as of the date of Closing. Owner shall pay all taxes and assessments which are owing, including delinquencies and penalties, prorated to date of settlement statement, and utilizing a 365-day pro rate basis. Proration shall be based upon the last available current tax duplicate subject to any agricultural tax recoupment. Purchaser agrees to pay the amount of such recoupment. Purchaser shall pay all taxes, instalments of assessments, and operating expenses which may become due and payable following date of Closing. Any security and/or damage deposits held by Owner shall be transferred to Purchaser at Closing. REAL ESTATE TAXES AND ASSESSMENTS ARE SUBJECT TO CHANGE BY GOVERNMENTAL AUTHORITY. Utilities shall be borne by Owner to the later of the date Owner vacates premises or settlement statement. |

|

10. |

POSSESSION: Owner agrees to deliver complete possession subject to tenants' rights on date of completed settlement statement. |

|

11. |

DAMAGE OR DESTRUCTION OF PROPERTY: Owner agrees that upon delivery of deed, the improvements constituting part of the Real Estate shall be in the same condition as they are on the date of this offer, reasonable wear and tear excepted. Risk of loss to the property subject to this Contract shall be borne by Owner until delivery of deed provided that if any property is substantially damaged or destroyed prior to delivery to deed, Purchaser may (1) proceed with transactions and be entitled to all insurance money payable to Owner, or (2) rescind the Contract, and thereby release all parties from liability hereunder by giving written notice to Owner and Broker within 10 days after Purchaser has written notice of damage or destruction. Failure by Purchaser to so notify shall constitute an election to proceed with the transaction. |

|

12. |

INDEMNITY: Owner and Purchaser recognize that the REALTORS involved in the sale are relying on all information provided herein or supplied by Owner or his sources in connection with the Real Estate, and agree to indemnify and hold harmless the REALTORS, their agents and employees, from any claims, demands, damage suits, liabilities, costs and expenses (including reasonable attorney's fees) arising out of any misrepresentation or concealment of facts by Owner or his sources. |

|

13. |

MISCELLANEOUS: This Contract constitutes the entire agreement and no oral or implied agreement exists. Any amendments to this Contract shall be in writing, signed by Purchaser(s) and Owner(s) and copies provided to them. This contract shall be binding upon the parties, their heirs, administrators, executors, successors and assigns. All provisions of this contract shall survive the closing. In compliance with fair housing laws, no party shall in any manner discriminate against any Purchaser or Purchasers because of race, color, religion, sex, familial status, handicap or national origin. Paragraph captions are for identification only and are not a part of this Contract. Ohio Law to apply. |

|

14. |

EXPIRATION AND ACCEPTANCE: This offer shall remain open for acceptance until 6:00 p.m., Canton, Ohio time on August 9th, 2024 and a signed copy shall be returned to Purchaser upon acceptance. |

|

15. |

COMMISSION: Owner to pay a commission of sale to Putman Properties, Inc. equal to three percent (3%) of the Purchase Price. |

TIME IS OF THE ESSENCE IN ALL PROVISIONS OF THIS CONTRACT.

IN ORDER TO CREATE AN ENFORCEABLE AGREEMENT BETWEEN PURCHASER AND OWNER, THIS OFFER, OR ANY COUNTEROFFERS MUST BE IN WRITING AND SIGNED BY PURCHASER AND OWNER, WITH ALL CHANGES, ADDITIONS OR DELETIONS TO BE INITIALLED BY PURCHASER AND OWNER, AND DATED, PRIOR TO ACCEPTANCE.

FACSIMILE (FAX) SIGNATURES CONSTITUTE A VALID SIGNING OF THIS AGREEMENT.

PURCHASER TO ADVISE OWNER IN WRITING HOW TITLE WILL BE TAKEN.

|

Purchaser has deposited with Broker the sum receipted for below which shall be returned to Purchaser, upon Purchaser's request, if no contract shall have been entered into. Upon acceptance of this contract by both parties, Broker shall deposit such amount in its non-interest-bearing trust account to be disbursed, subject to collection by Broker's depository, as follows: (a) deposit shall be applied on purchase price or returned to Purchaser when transaction is closed; (b) if Owner fails or refuses to perform, or any contingency is not satisfied or waived, the deposit shall be returned; (c) if Purchaser fails or refuses to perform, this deposit shall be paid to owner, which payment, or the acceptance thereof, shall not in any way prejudice the rights of Owner or Broker in any action for damages or specific performance; (d) in the event of a dispute over the disposition of the deposit, Broker shall retain the deposit until (i) Purchaser and Owner have settled the dispute; (ii) disposition has been ordered by a final court order; or (iii) Broker deposits said amount with a court pursuant to applicable court procedures. We hereby acknowledge the deposit of $10,000.00 which will be deposited upon acceptance and together with any additional cash payments made by the Purchasers before date of delivery of deed is to be delivered and held in escrow by Listing AGENT, until closing of this transaction according to the terms of the foregoing Amendment. AGENCY DISCLOSURE FORM ATTACHED: YES ✓ NO

Selling Agent Savior Putman By: Putman Properties. Inc.

|

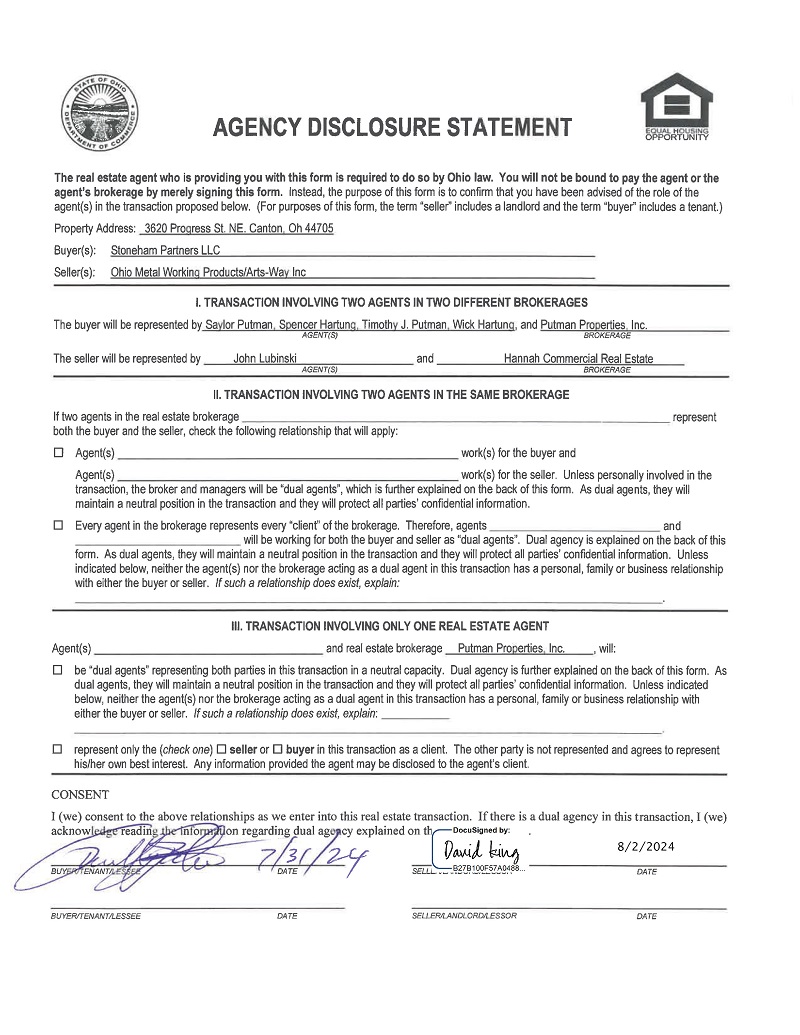

DUALAGENCY

Ohio law permits a real estate agent and brokerage to represent both the seller and buyer in a real estate transaction as long as this is disclosed to both parties and they both agree. This is known as dual agency. As a dual agent, a real estate agent and brokerage represent two clients whose interests are, or at times could be, different or adverse. For this reason, the dual agent(s) may not be able to advocate on behalf of the client to the same extent the agent may have if the agent represented only one client.

As a dual agent, the agent(s) and brokerage shall:

|

• |

Treat both clients honestly; |

|

|

• |

Disclose latent (not readily observable} material defects to the purchaser, if known by the agent(s) or brokerage; |

|

|

• |

Provide information regarding lenders, inspectors and other professionals, if requested; |

|

|

• |

Provide market information available from a property listing service or public records, if requested; |

|

|

• |

Prepare and present all offers and counteroffers at the direction of the parties; |

|

|

• |

Assist both parties in completing the steps necessary to fulfill the terms of any contract, if requested. |

As a dual agent, the agent(s) and brokerage shall not:

|

• |

Disclose information that is confidential, or that would have an adverse effect on one party's position in the transaction, unless such disclosure is authorized by the client or required by law; |

|

|

• |

Advocate or negotiate on behalf of either the buyer or seller; |

|

|

• |

Suggest or recommend specific terms, including price, or disclose the terms or price a buyer is willing to offer or that a seller is willing to accept; |

|

|

• |

Engage in conduct that is contrary to the instructions of either party and may not act in a biased manner on behalf of one party. |

Compensation: Unless agreed otherwise, the brokerage will be compensated per the agency agreement.

Management Level Licensees: Generally the broker and managers in a brokerage also represent the interests of any buyer or seller represented by an agent affiliated with that brokerage. Therefore, if both buyer and seller are represented by agents in the same brokerage, the broker and manager are dual agents. There are two exceptions to this. The first is where the broker or manager is personally representing one of the parties. The second is where the broker or manager is selling or buying his own real estate. These exceptions only apply if there is another broker or manager to supervise the other agent involved in the transaction.

Responsibilities of the Parties: The duties of the agent and brokerage in a real estate transaction do not relieve the buyer and seller from the responsibility to protect their own interests. The buyer and seller are advised to carefully read all agreements to assure that they adequately express their understanding of the transaction. The agent and brokerage are qualified to advise on real estate matters. IF LEGAL OR TAX ADVICE IS DESIRED, YOU SHOULD CONSULT THE APPROPRIATE PROFESSIONAL.

Consent: By signing on the reverse side, you acknowledge that you have read and understand this form and are giving your voluntary, informed consent to the agency relationship disclosed. If you do not agree to the agent(s) and/or brokerage acting as a dual agent, you are not required to consent to this agreement and you may either request a separate agent in the brokerage to be appointed to represent your interests or you may terminate your agency relationship and obtain representation from another brokerage.

Any questions regarding the role or responsibilities of the brokerage or its agents should be directed to an attorney or to: