United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

☑ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended April 27, 2024

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to _________

Commission file number 1-14170

NATIONAL BEVERAGE CORP.

(Exact name of Registrant as specified in its charter)

| Delaware |

59-2605822 |

| (State of incorporation) |

(I.R.S. Employer Identification No.) |

8100 SW Tenth Street, Suite 4000, Fort Lauderdale, Florida 33324

(Address of principal executive offices including zip code)

Registrant’s telephone number, including area code: (954) 581-0922

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $.01 per share |

FIZZ |

The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.: Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☑

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the common stock held by non-affiliates of Registrant computed by reference to the closing sale price of $45.22 on October 27, 2023 was approximately $1.1 billion.

The number of shares of Registrant’s common stock outstanding as of June 24, 2024 was 93,580,046.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2024 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

| PAGE |

|||

| ITEM 1. |

|||

| ITEM 1A. |

|||

| ITEM 1B. | Unresolved Staff Comments | 10 | |

| ITEM 1C. |

|||

| ITEM 2. |

|||

| ITEM 3. |

|||

| ITEM 4. |

|||

| ITEM 5. |

|||

| ITEM 6. |

|||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

||

| ITEM 7A. |

|||

| ITEM 8. |

|||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

||

| ITEM 9A. |

|||

| ITEM 9B. |

|||

| ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

||

| ITEM 10. |

|||

| ITEM 11. |

|||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

||

| ITEM 14. |

|||

| ITEM 15. |

|||

| ITEM 16. |

|||

| ITEM 1. |

BUSINESS |

GENERAL

National Beverage Corp. innovatively refreshes America with a distinctive portfolio of sparkling waters, juices, energy drinks and, to a lesser extent, carbonated soft drinks. We believe our creative product designs, innovative packaging and imaginative flavors, along with our corporate culture and philosophy, make National Beverage unique as a stand-alone entity in the beverage industry.

Points of differentiation include the following:

Healthy Transformation – We focus on developing and delighting consumers with healthier beverages in response to the global shift in consumer buying habits and lifestyles. We believe our portfolio satisfies the preferences of a diverse mix of consumers including ‘crossover consumers’ – a growing group desiring healthier alternatives to artificially sweetened or high- calorie beverages.

Creative Innovations – Building on a rich tradition of flavor and brand innovation with more than a 135- year history of development with iconic brands such as Shasta® and Faygo®, we have extended our flavor and essence leadership and technical expertise to the sparkling water category. Proprietary flavors and our naturally-essenced beverages are developed and tested in-house and made commercially available only after extensive concept and sensory evaluation. Our variety of distinctive flavors provides us with a unique advantage with today’s consumers who demand variety and refreshing beverage alternatives.

Innovation Ethic – We believe that innovative marketing, packaging and consumer engagement is more effective in today’s marketplace than traditional higher-cost national advertising. In addition to our cost-effective social media platforms, we utilize regionally-focused marketing programs and in-store “brand ambassadors” to interact with and obtain feedback from our consumers. We also believe the design of our packages and the overall optical effect of their placement on the shelf (“shelf marketing”) has become more important as millennials and younger generations become increasingly influential consumers and are now influencing baby boomers and older generations.

Creative Dynamics – In a beverage industry dominated by the “cola giants”, we pride ourselves on being able to respond faster and more creatively to consumer trends than competitors burdened by legacy production and distribution complexity and costs. The ability to identify consumer trends and create new market-leading concepts defines our new product development model. Speed to market with the appropriate concept, unique flavor creation and trend forward ‘better-for-you’ ingredients continues to be our goal. Internal development teams are responsible for concept creation, packaging and design, which allow for rapid ‘go to market’ timing and reduced development costs. We strive to provide retailers and consumers with the most innovative flavors and packaging in the industry. Two of our LaCroix distinctive variety packs, as well as Zero Sugar Shasta and three new flavors of Rip It, were recently honored as top recipients of the International Davey Awards for creativity.

Presently, our primary market focus is the United States and Canada. Certain of our products are also distributed on a limited basis in other countries and options to expand distribution to other regions are being considered.

National Beverage Corp. is incorporated in Delaware and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

BRANDS

| Our brands consist of beverages geared to the active and health-conscious consumer (“Power+ Brands”) including sparkling waters, energy drinks and juices. Our portfolio of Power+ Brands includes LaCroix®, LaCroix Cúrate® and LaCroix NiCola® sparkling water products; Clear Fruit®; Rip It® energy drinks and shots; and Everfresh®, Everfresh Premier Varietals™ and Mr. Pure® 100% juice and juice- based products. Additionally, we produce and distribute carbonated soft drinks (“CSDs”) including Shasta® and Faygo®, iconic brands whose consumer loyalty spans more than 100 years. |

|

POWER+ BRANDS –

LaCroix

|

LaCroix Sparkling Water, our most significant brand, has uniquely redefined the Sparkling Water category that is rapidly becoming the alternative to traditional carbonated soda. With zero calories, zero sweeteners and zero sodium, LaCroix leads the premium domestic sparkling water category. Naturally-essenced, LaCroix has gained the support of national retailers in multiple channels, including mass-merchandisers, club stores, drug stores, mainstream supermarkets and natural and specialty food retailers. In 2024, Newsweek once again named LaCroix as one of "The Most Trusted Brands in America” based on a survey of U.S. shoppers. Additionally, the classic flavor of LaCroix Lime claimed the top spot in the sparkling water category in the 2024 AllRecipes Golden Cart Awards. Renowned for their culinary expertise, the All Recipes' Allstars praised the fresh flavor of LaCroix Lime as “super thirst-quenching”.

Continual flavor and packaging innovations for LaCroix in recent years include the newest LaCroix flavor, Mojito. Mojito, launched in the third quarter of the fiscal year ended April 27, 2024 (“Fiscal 2024”), brings the sensory feel of paradise to consumers. Mojito joins the most recent addition of Cherry Blossom – a botanical twist of sweet and just a ‘kiss’ of tart. |

| Other successful LaCroix recent additions include Beach Plum with its delectable coolness of the luscious fruit native to the east coast of the U.S; Black Razzberry’s decadent, smooth and irresistible fruit flavor; the sweet tropical delicacy of Guava São Paulo; Hi-Biscus, a unique flavor that adds the delicate essence of the hibiscus flower to sparkling water; the enticing savor of LimonCello, which instantly transports fans to the Italian Riviera; and the refreshing taste of Pastèque, which captures the lusciousness of a sweet picnic watermelon.

These innovative new varieties are part of the LaCroix family of 30 refreshingly innocent flavors.

LaCroix’s dynamic ‘theme’ LaCroix Cúrate® (‘Cure Yourself’) celebrates French sophistication with Spanish zest and bold flavor pairings. Packaged in sleek 12 oz. tall cans, popular flavors include Cerise Limón, which pairs sweet cherry with tangy lime for a tasteful infusion that tickles the senses; Piña Fraise, an aromatic combination of pineapple and ripe strawberries that creates a tropical blend delight; and Múre Pepino, which combines sweet and sour blackberry notes with crisp cucumber to create a sensory and taste sensation.

Additional LaCroix flavors are in development that will continue to feature unique packaging and flavor concepts designed to capitalize on LaCroix brand loyalty and popularity of the sparkling water category. |

|

Everfresh and Mr. Pure

|

Everfresh and Mr. Pure 100% juice and juice drinks are available in a variety of flavors, from such classics as Orange, Cranberry and flavored lemonades to exotics that include Papaya, Pineapple Mango, Peach Watermelon and Island Punch. The brands’ signature package is a hot-filled, 16 oz. glass bottle designed for single-serve consumption.

Everfresh Premier Varietals, a unique theme from Everfresh, is positioned as a stand-alone brand for display in the produce section of supermarkets. Everfresh Premier Varietals is a premium line of apple juice derived from a variety of apples specific to the taste of the varietal, such as Granny Smith, McIntosh, Honey Crisp, Golden Delicious, Fuji and Pink Lady. |

| Clear Fruit

Clear Fruit is a crisp, clear, non-carbonated water beverage enhanced with fruit flavors. Clear Fruit is available in 13 delicious flavors, including consumer favorites Cherry Blast, Strawberry Watermelon and Fruit Punch. Clear Fruit is available in 20-ounce and 16.9-ounce bottles with consumer-favored sports caps. |

|

Rip It

|

RIP It Energy Fuel offers ‘Flavors for All!’ with 19 unique flavors and four sugar-free options. In addition to all-time consumer favorites, Tribute, Citrus X, Cherry Lime and Power, newly launched ‘Re-Energizzed’ Rip It flavors include Skr’eech In with its luscious strawberry-peach taste and the exotic and mysterious flavor of Dragon Fire. These newest additions join pineapple YOLO; watermelon-flavored Melon Hi; and the sweet and wild cotton candy experience of Can’D Man. Building on the flavor tradition of original Rip It, a 2 oz. sugar- free shot version in six flavors is marketed in displayable package configurations. RIP It proudly supports military and first responder heroes at home and abroad. |

Carbonated Soft Drinks –

|

Currently celebrating its 135th Anniversary, Shasta is recognized as a bottling industry pioneer and innovator. Shasta features multiple flavors and has earned consumer loyalty by delivering value and convenience with unique taste. In the first quarter of Fiscal Year 2024, Shasta launched three all-time consumer favorites reformulated with Zero Sugar — Shasta Zero Sugar Tiki Punch, Zero Sugar California Dreamin’ and Zero Sugar Mountain Rush. Additional Zero Sugar Shasta flavors will be on shelves late Summer 2024. | |||||

|

|

||||||

| With more than 135 years of brand history, Faygo products include numerous unique flavors such as Red Pop, Moon Mist, Cotton Candy and Rock’n’Rye. Faygo is celebrated in the Midwest as the “The One True Pop.”

Many of our carbonated soft drink brands enjoy a regional identification that we believe fosters long-term consumer loyalty and makes them more competitive as a consumer choice. In addition, products produced locally often generate retailer- sponsored promotional activities and receive media exposure through community activities rather than costly national advertising.

In recent years, we reformulated many of our brands to reduce caloric content while still preserving their time-tested flavor profiles. Our brands, optically and ingredient-wise, are continually evolving. We always strive to make all our drinks healthier while maintaining their iconic taste profiles. |

|

|||||

|

PRODUCTION

|

Our philosophy emphasizes vertical integration; our production model integrates the procurement of raw materials and crafting flavors and concentrates with the production of finished products. Our twelve strategically located production facilities are near major metropolitan markets across the continental United States. The locations of our facilities enable us to efficiently produce and distribute beverages to substantially all geographic markets in the United States, including the top 25 metropolitan statistical areas. Each facility is generally equipped to produce both canned and bottled beverage products in a variety of package sizes.

We believe the innovative and controlled vertical integration of our production facilities provides an advantage over certain of our competitors that rely on independent third-party bottlers to manufacture and market their products. Since we control all production, distribution and marketing of our brands, we believe we can more effectively manage quality control and consumer appeal while responding quickly to changing market conditions. |

We craft a substantial portion of our flavors and concentrates. By controlling our own formulas throughout our bottling network, we are able to produce beverages in accordance with uniform quality standards while innovating flavors to meet changing consumer preferences. We believe the combination of a Company-owned bottling network, together with uniform standards for packaging, formulations and customer service, provides us with a strategic advantage in servicing national retailers and mass-merchandisers. We also maintain research and development laboratories at multiple locations. These laboratories continually test products for compliance with our strict quality control standards as well as conduct research for new products and flavors.

DISTRIBUTION

| To service a diverse customer base that includes numerous national retailers, as well as thousands of smaller “up-and-down-the-street” accounts, we utilize a hybrid distribution system to deliver our products through three primary distribution channels: take-home, convenience and food-service.

The take-home distribution channel consists of national and regional grocery stores, club stores, mass- merchandisers, wholesalers, e-commerce stores, drug stores and dollar stores. We distribute our products to this channel primarily through the warehouse distribution system and, to a lesser extent, the direct-store delivery system.

Warehouse distribution system products are shipped from our production facilities to the retailer’s centralized distribution centers and then distributed by the retailer to each of its store locations with other goods. This method allows our retail partners to further maximize their assets by utilizing their ability to pick up product at our warehouses, thus lowering their/our product costs. Products sold through the direct-store delivery system are distributed directly to the customer’s retail outlets by our direct-store delivery fleet and by independent distributors. |

|

|

We distribute our products to the convenience channel through our own direct-store delivery fleet and those of independent distributors. The convenience channel consists of convenience stores, gas stations and other smaller “up-and-down-the-street” accounts. Because of the higher retail prices and margins that typically prevail, we have developed packaging and graphics specifically targeted to this market.

Our food-service division distributes products to independent, specialized distributors who sell to hospitals, schools, military bases, hotels and food- service wholesalers. Also, our Company-owned direct store delivery fleet distributes products to schools and food-service locations. |

Our take-home, convenience and food-service operations use vending machines and glass-door coolers as marketing and promotional tools for our brands. We provide vending machines and coolers on a placement or purchase basis to our customers. We believe vending and cooler equipment expands on site visual trial, thereby increasing sales and enhancing brand awareness.

SALES AND MARKETING

|

We sell and market our products through an internal sales force as well as specialized broker networks. Our sales force is organized to serve a specific market, focusing on one or more geographic territories, distribution channels or product lines. We believe this focus allows our sales group to provide high level, responsive service and support to our customers and markets.

Our marketing emphasizes programs designed to reach consumers directly through innovative digital marketing, digital social marketing, social media engagement, sponsorships and creative content. We are focused on increasing our digital presence and capabilities to further enhance the consumer experience across our brands. We periodically retain agencies to assist with social media content creative and platform selection for our brands.

Additionally, we maintain and enhance consumer brand recognition and loyalty through a combination of participation in regional events, special event marketing, endorsements, consumer coupon distribution and product sampling. We also offer numerous promotional programs to retail customers, including cooperative advertising support, ‘BrandED’ ambassadors, in-store promotional activities and other incentives. These elements allow marketing and other consumer programs to be tailored to meet local and regional demographics. Additionally, the Company’s ‘MerchMx’ representatives work to develop a rapport with store managers for the purpose of optimizing shelf space, building displays, placing point-of-sale materials and expanding distribution. |

RAW MATERIALS

| Our centralized procurement group maintains relationships with numerous suppliers of ingredients and packaging. By consolidating the purchasing function for our production facilities, we believe we procure more competitive arrangements with our suppliers, thereby enhancing our ability to compete as an efficient producer of beverages.

The products we produce and sell are made from various materials including aluminum cans, glass and plastic bottles, water, carbon dioxide, juice and flavor concentrates, sweeteners, cartons and closures. We craft a substantial portion of our flavors and concentrates while purchasing the remaining raw materials from multiple suppliers.

Substantially all of the materials and ingredients we purchase are available from several suppliers, although strikes, weather conditions, utility shortages, governmental control or regulations, national emergencies, quality, price or supply fluctuations or other events outside our control could adversely affect the supply of specific materials. A significant portion of our raw material purchases, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, are derived from commodities. Therefore, pricing and availability tend to fluctuate based upon worldwide commodity market conditions. In certain cases, we may elect to enter into multi-year agreements for the supply of these materials with one or more suppliers, the terms of which may include variable or fixed pricing, minimum purchase quantities and/or the requirement to purchase all supplies for specified locations. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs. |

|

SEASONALITY

|

Our operating results are affected by numerous factors, including fluctuations in costs of raw materials, holiday and seasonal programming and weather conditions. Beverage sales are seasonal with higher volume realized during summer months when outdoor activities are more prevalent.

|

COMPETITION

| While LaCroix Sparkling Water is the brand of choice as the number one premium domestic sparkling water throughout the United States, the beverage industry is highly competitive and our competitive position may vary by market area. Our products compete with many varieties of liquid refreshment, including water products, soft drinks, juices, fruit drinks, energy drinks and sports drinks, as well as powdered drinks, coffees, teas, dairy- based drinks, functional beverages and various other nonalcoholic beverages. We compete with bottlers and distributors of national, regional and private label products. Several competitors, including those that dominate the beverage industry, such as Nestlé S.A., PepsiCo and The Coca-Cola Company, have greater financial resources than we have and aggressive promotion of their products may adversely affect sales of our brands. | ||

|

Competitive factors in the beverage industry include price and promotional activity, advertising and marketing programs, point-of-sale merchandising, retail space management, customer service, product differentiation, packaging innovations and distribution methods. We believe our Company differentiates itself through novel innovation, key brand recognition, focused social media, innovative flavor variety, attractive packaging, efficient distribution methods and, for some product lines, value pricing. |

|

|

TRADEMARKS

We own numerous trademarks for our brands that are significant to our business. We intend to continue to maintain all registrations of our significant trademarks and use the trademarks in the operation of our businesses.

GOVERNMENTAL REGULATION

The production, distribution and sale of our products in the United States are subject to the Federal Food, Drug and Cosmetic Act; the Dietary Supplement Health and Education Act of 1994; the Occupational Safety and Health Act; the Clean Air Act, the Clean Water Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Resource Conservation and Recovery Act; various environmental statutes; and various other federal, state and local statutes regulating the production, transportation, sale, safety, advertising, labeling and ingredients of such products. We believe that we are in compliance, in all material respects, with such existing legislation.

Certain states and localities require a deposit or tax on the sale of certain beverages. These requirements vary by each jurisdiction. Similar legislation has been or may be proposed in other states or localities or by Congress. We are unable to predict whether such legislation will be enacted but believe its enactment would not have a material adverse impact on our business, financial condition or results of operations.

All of our facilities in the United States are subject to federal, state and local environmental laws and regulations. Compliance with these provisions has not had any material adverse effect on our financial or competitive position. We believe our current practices and procedures for the control and disposition of toxic or hazardous substances comply in all material respects with applicable law.

HUMAN CAPITAL

As of April 27, 2024, we employed approximately 1,559 people, of which 392 are covered by collective bargaining agreements. These collective bargaining agreements generally address working conditions, as well as wage rates and benefits, and expire over varying terms over the next several years. We believe these agreements can be renegotiated on terms satisfactory to us as they expire and we believe we maintain good relationships with our employees and their representative organizations.

We support a culture of diversity and inclusion that mirrors the markets we serve. We take a comprehensive view of diversity and inclusion across different races, ethnicities, religions and gender identity. Approximately 62 percent and 24 percent of our employee base identify as persons of color or female, respectively.

Our compensation programs are designed to ensure we attract and retain talent while maintaining alignment with market compensation. We utilize a mix of short term incentive programs throughout the organization and provide long-term incentive programs to more senior employees generally through stock-based compensation programs. We offer competitive employee benefits that are effective in attracting and retaining talent and are designed to support the physical, mental and financial health of our employees. Our employee benefits program includes comprehensive health, dental, life and disability and profit-sharing benefits.

Our operating philosophy emphasizes the health and safety of our employees. Our operations personnel, supplemented by risk management professionals, review all aspects of employee tasks and work environment to minimize risk. We strive to achieve an injury-free work environment in our operations. Key to these efforts are data analysis and preventative actions. We measure and benchmark lost-time incident rate, a reliable indication of total recordable injuries rate and severity and use a risk- reduction process that thoroughly analyzes injuries and near misses.

SUSTAINABILITY

National Beverage Corp. adheres to responsible business practices and continually strives to improve the sustainability of its operations. All our beverage products are produced in the U.S., providing thousands of jobs in local communities and boasting a lower carbon footprint than imported brands. The majority of our products are delivered through the warehouse distribution system which provides more efficient and lower greenhouse gas emissions than direct store delivery systems. Additionally, we are undertaking measures to reduce our carbon footprint which include transitioning from LP gas to electric powered forklifts and purchasing electricity from renewable sources.

Water is critical to our business and we periodically conduct water quality assessments on a variety of measurements. All of our packaging is recyclable and we continually focus on reducing packaging content. More than 80% of our products are in aluminum cans, which generally contain approximately 73% recycled material. Each of our facilities has programs in place designed to minimize the use of water, energy and other natural resources.

AVAILABLE INFORMATION

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports are available free of charge on our website at www.nationalbeverage.com as soon as reasonably practicable after such reports are electronically filed with the Securities and Exchange Commission. In addition, our Code of Ethics is available on our website. The information on the Company’s website is not part of this Annual Report on Form 10-K or any other report that we file with, or furnish to, the Securities and Exchange Commission.

| ITEM 1A. |

RISK FACTORS |

In addition to other information in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating the Company’s business. Our business, financial condition, results of operations and cash flows could be materially and adversely affected by any of these risks. Additional risks and uncertainties, including risks and uncertainties not presently known to the Company, or that the Company currently deems immaterial, may also impair our business, financial position, results of operations and cash flows.

Brand image and consumer preferences. Our beverage portfolio is comprised of a number of unique brands with reputations and consumer loyalty that have been built over time. Our investments in social media and marketing as well as our strong commitment to product quality are intended to have a favorable impact on brand image and consumer preferences. Unfavorable publicity, or allegations of quality issues, even if false or unfounded, may tarnish our reputation and brand image and cause consumers to choose other products. In addition, if we do not adequately anticipate and react to changing demographics, consumer trends, health concerns and product preferences, our financial position could be adversely affected.

Competition. The beverage industry is extremely competitive. Our products compete with a broad range of beverage products, most of which are manufactured and distributed by companies with substantially greater financial, marketing and distribution resources. Discounting and other actions by our competitors could adversely affect our ability to sustain revenues and profits.

Customer relationships. Our retail customer base has been consolidating over many years resulting in fewer customers with increased purchasing power. This increased purchasing power can limit our ability to increase pricing for our products with certain of our customers. Additionally, e-commerce transactions and value stores are experiencing rapid growth. Our inability to adapt to customer requirements could lead to a loss of business and adversely affect our financial position.

Raw materials and energy sources. The production of our products is dependent on certain raw materials, including aluminum, resin, corn, linerboard, water and fruit juice. In addition, the production and distribution of our products is dependent on energy sources, including natural gas, diesel fuel, carbon dioxide and electricity. These items are subject to supply chain disruptions and price volatility caused by numerous factors. Commodity price increases ultimately result in a corresponding increase in the cost of raw materials and energy. We may be limited in our ability to pass these price increases on to our customers or may incur a loss in sales volume to the extent we increase prices. Strikes, weather conditions (including conditions caused by climate change), governmental controls, tariffs, national emergencies, natural disasters, supply shortages or other events could also affect our continued supply and cost of raw materials and energy. If raw materials or energy costs increase, or their availability is limited, our financial position could be adversely affected.

Governmental regulation. Our business and properties are subject to various federal, state and local laws and regulations, including those governing the production, packaging, quality, labeling and distribution of beverage products and those governing environmental laws and regulations. In addition, various governmental agencies have enacted or are considering changes in corporate tax laws as well as additional taxes on soft drinks and other sweetened beverages. Continuing concern over environmental, social and governance matters, including climate change, is expected to continue to result in new or increased legal and regulatory requirements to reduce emissions to mitigate the potential effects of greenhouse gases, to limit or impose additional costs on commercial water use due to local water scarcity concerns or to expand mandatory reporting of certain environmental, social and governance metrics. Compliance with or future changes in existing laws or regulations could require material expenses and or capital expenditures and negatively affect our financial position.

Sustained increases in the cost of employee wages and benefits. Our profitability is affected by the cost of employee wages as well as health insurance and other benefits provided to employees, including employees covered under collective bargaining agreements and multi-employer pension plans. Competition in the labor marketplace for qualified employees has led to increased costs, such as higher wages and benefit costs in order to recruit and retain employees. A prolonged labor shortage or inflation in labor costs could adversely impact our financial results.

Unfavorable weather conditions, changing weather patterns and natural disasters Unfavorable weather conditions in the geographic regions in which the Company or its suppliers operate could have an adverse impact on our revenue and profitability. Unusually cold or rainy weather may temporarily reduce demand for our products and contribute to lower sales, which could adversely affect our profitability for such periods. Prolonged drought conditions in the geographic regions in which we do business could lead to restrictions on the use of water, which could adversely affect our ability to produce and distribute products. Additionally, hurricanes, earthquakes, floods or other natural disasters may damage our physical facilities or those of our suppliers or customers.

Climate change may increase the frequency or severity of weather-related events. Climate change may also have a negative effect on agricultural production resulting in decreased availability or less favorable pricing for certain commodities utilized in certain of our products. In addition, any perception of a failure to act responsibly with respect to the environment or to effectively respond to regulatory requirements concerning climate change could lead to adverse publicity, which could result in reduced demand for our products, damage to our reputation or increase the risk of litigation.

Dependence on key personnel. Our performance significantly depends upon the continued contributions of our executive officers and key employees, both individually and as a group and our ability to retain and motivate them. Our officers and key personnel have many years of experience with us and in our industry and it may be difficult to replace them. If we lose key personnel or are unable to recruit qualified personnel, our operations and ability to manage our business may be adversely affected.

Future cyber incidents and dependence on information technology and third-party service providers. We depend on information systems and technology, including public websites and cloud-based services, for many activities important to our business, including communications within our Company, interfacing with customers and consumers; ordering and managing inventory; managing and operating our facilities; protecting confidential information, including personal data we collect; maintaining accurate financial records and complying with regulatory, financial reporting, legal and tax requirements. Our business has in the past and could in the future be negatively affected by system shutdowns, degraded systems performance, systems disruptions or security incidents. These disruptions or incidents may be caused by cyberattacks and other cyber incidents, network or power outages, software, equipment or telecommunications failures, the unintentional or malicious actions of employees or contractors, natural disasters, fires or other catastrophic events.

Similar risks exist with respect to our business partners and third-party providers, including suppliers, software and cloud-based service providers, that we rely upon for aspects of various business activities.

Although the cyber incidents and other systems disruptions that we have experienced to date have not had a material effect on our business, such incidents or disruptions could have a material adverse effect on us in the future. If we are unable to timely respond to or resolve the issues related to such incidents and disruptions, such issues could have a material adverse effect on our business, financial condition, results of operations, cash flows and the timeliness with which we report our internal and external operating results.

Material weaknesses in our internal control over financial reporting. Material weaknesses in our internal control over financial reporting which could, if not remediated, result in material misstatements in our consolidated financial statements.

As discussed in Part II, Item 9A, “Controls and Procedures” of this Form 10-K, management has concluded that our internal controls related to certain review processes and disclosure controls and procedures were not effective as of April 27, 2024 due to the identified material weaknesses.

| ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

None.

| ITEM 1C. |

CYBERSECURITY |

Cybersecurity Risk Management and Strategy. We have developed and continue to evolve our cybersecurity risk management strategy designed to protect our data and ensure the availability of our critical information systems.

Key components of our cybersecurity risk management strategy include:

| ● |

the use of current cybersecurity systems and technologies providing a multi-tier approach to identifying, assessing and mitigating current and emerging cybersecurity risks. |

| ● |

an experienced internal security team responsible for managing our cybersecurity risk assessment processes, security controls and our response to cybersecurity incidents. |

| ● |

the use of external service providers that augment our internal cybersecurity resources. |

| ● |

cybersecurity awareness training of our employees, incident response personnel and senior management. |

In addition, the Company has established response procedures to address cyber events that do occur. Our incident response plan coordinates the activities we take to prepare for, detect, respond to and recover from cybersecurity incidents and includes a contractual relationship with an external and cybersecurity response team. We also maintain insurance coverage that, subject to its terms and conditions, is intended to reimburse certain costs associated with cyber incidents and information systems failures.

During Fiscal 2024, there were no identified cybersecurity risks or threats, including as a result of previous cybersecurity incidents, that had, or were reasonably likely to have, a material effect on our business strategy, results of operations or financial condition. We continue to monitor potential cybersecurity threats and incorporate findings into our risk management strategies. See “Item 1A. Risk Factors” for a discussion of cybersecurity risks.

Cybersecurity Governance. Our Board considers cybersecurity risk as part of its risk oversight function and has delegated to the Audit Committee oversight of cybersecurity and other information technology risks. The Audit Committee oversees management’s implementation of our cybersecurity risk management program and receives periodic reports from management on our cybersecurity risk management. Our management team, led by our Director of Information Technology who has 30 years of Information Technology leadership experience, is responsible for assessing, identifying and managing material cybersecurity risks to our business.

| ITEM 2. |

PROPERTIES |

Our principal properties include twelve production facilities located in ten states, which aggregate approximately two million square feet. We own ten production facilities in the following states: California (2), Georgia, Kansas, Michigan (2), Ohio, Texas, Utah and Washington. Two production facilities, located in Maryland and Florida, are leased subject to agreements that expire through 2025. We believe our facilities are generally in good condition and sufficient to meet our present needs.

The production of beverages is capital intensive but is not characterized by rapid technological change. The technological advances that have occurred have generally been of an incremental cost-saving nature, such as the industry’s conversion to lighter weight containers or improved blending processes that enhance ingredient yields. We are not aware of any anticipated industry-wide changes in technology that would adversely impact our current physical production capacity or cost of production.

We own and lease trucks, vans and automobiles used in the sale, delivery and distribution of our products. In addition, we lease warehouse and office space, transportation equipment, office equipment and certain manufacturing equipment.

| ITEM 3. |

LEGAL PROCEEDINGS |

The Company has been named in certain legal proceedings, including those containing class action allegations. The Company is vigorously defending all legal proceedings and believes litigation will not have a material adverse effect on the Company’s financial position, cash flows or results of operations.

| ITEM 4. |

MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The common stock of National Beverage Corp., par value $.01 per share, (“Common Stock”) is listed on The NASDAQ Global Select Market under the symbol “FIZZ”.

At June 17, 2024, there were approximately 41,700 holders of our Common Stock, the majority of which hold their shares in the names of banks, brokers and other financial institutions.

On June 12, 2024, the Company's board of directors declared a special cash dividend of $3.25 per share. The special cash dividend will be paid on or before July 24, 2024 to shareholders of record on June 24, 2024. The Company paid special cash dividends of $279.9 million ($3.00 per share) on January 29, 2021 and December 29, 2021, respectively.

Our Board of Directors has authorized a program to repurchase 3.2 million shares of our common stock of which approximately 1.9 million shares remain available and authorized for repurchases.

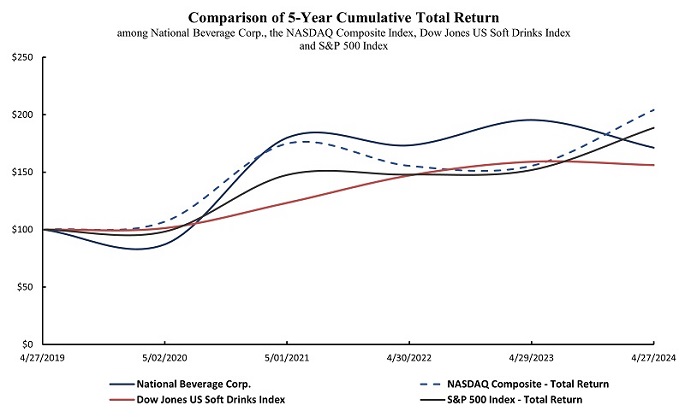

Performance Graph

The following graph shows a comparison of the five-year cumulative return of an investment of $100 cash on April 27, 2019, assuming reinvestment of dividends, of our Common Stock with the NASDAQ Composite Index, the Dow Jones US Soft Drinks Index and the S&P 500 Index.

| Total Returns Index For: |

4/27/2019 |

5/02/2020 |

5/01/2021 |

4/30/2022 |

4/29/2023 |

4/27/2024 |

||||||

| National Beverage Corp. |

$100.00 |

$87.08 |

$179.79 |

$173.24 |

$195.33 |

$171.20 |

||||||

| NASDAQ Composite - Total Return |

100.00 |

106.94 |

174.88 |

155.50 |

155.53 |

204.22 |

||||||

| Dow Jones US Soft Drinks Index |

100.00 |

101.32 |

123.31 |

147.14 |

159.11 |

156.16 |

||||||

| S&P 500 Index - Total Return |

100.00 |

98.25 |

147.55 |

147.87 |

151.80 |

188.57 |

| ITEM 6. |

RESERVED |

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

The following Management’s Discussion and Analysis of Operations is intended to provide information about the Company’s operations and business environment and should be read in conjunction with our Consolidated Financial Statements and the accompanying Notes contained in Item 8 of this report.

National Beverage Corp. is incorporated in Delaware and began trading as a public company on the NASDAQ Stock Market in 1991. In this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries unless indicated otherwise.

National Beverage Corp. innovatively refreshes America with a distinctive portfolio of sparkling waters, juices, energy drinks (Power+ Brands) and, to a lesser extent, carbonated soft drinks. We believe our creative product designs, innovative packaging and imaginative flavors, along with our corporate culture and philosophy, make National Beverage unique as a stand-alone entity in the beverage industry.

National Beverage Corp., in recent years, has transformed into an innovative, healthier refreshment company. From our corporate philosophy, development of products and marketing to manufacturing, we are converting consumers to a ‘Better for You’ thirst quencher that compassionately cares for their nutritional health. We are committed to our quest to innovate for the joy, benefit and enjoyment of our consumers’ healthier lifestyle.

The majority of our brands are geared to the active and health-conscious consumer including sparkling waters, energy drinks and juices. Our portfolio of Power+ Brands includes LaCroix®, LaCroix Cúrate® and LaCroix NiCola® sparkling water products; Clear Fruit® non-carbonated water beverages enhanced with fruit flavor; Rip It® energy drinks and shots; and Everfresh®, Everfresh Premier Varietals™ and Mr. Pure® 100% juice and juice-based products. Additionally, we produce and distribute carbonated soft drinks including Shasta® and Faygo®, iconic brands whose consumer loyalty spans more than 135 years.

Our strategy seeks the profitable growth of our products by (i) developing healthier beverages in response to the global shift in consumer buying habits and tailoring our beverage portfolio to the preferences of a diverse mix of ‘crossover consumers’ – a growing group desiring a healthier alternative to artificially sweetened and high- caloric beverages; (ii) emphasizing unique flavor development and variety throughout our brands that appeal to multiple demographic groups; (iii) maintaining points of difference through innovative marketing, packaging and consumer engagement and (iv) responding faster and more creatively to changing consumer trends than larger competitors who are burdened by legacy production and distribution complexity and costs.

Presently, our primary market focus is the United States and Canada. Certain of our beverages are also distributed on a limited basis in other countries and options to expand distribution to other regions are being pursued. To service a diverse customer base that includes numerous national retailers, as well as thousands of smaller “up-and-down-the-street” accounts, we utilize a hybrid distribution system consisting of warehouse and direct-store delivery. The warehouse delivery system allows our retail partners to further maximize their assets by utilizing their ability to pick up beverages at our warehouses, further lowering their/our product costs.

Our operating results are affected by numerous factors, including fluctuations in the costs of raw materials, supply chain disruptions, holiday and seasonal programming and weather conditions. Beverage sales are seasonal with higher sales volume realized during the summer months when outdoor activities are more prevalent. See “Item 1A. Risk Factors” in Part I of this report for additional information about risks and uncertainties facing our Company. Also, see Note 14 - Restatements for certain cash flow restatements. Management believes these corrections did not in any way limit investment opportunities during these periods.

RESULTS OF OPERATIONS

The following section generally discusses the fiscal years ended April 27, 2024 (“Fiscal 2024”) and April 29, 2023 (“Fiscal 2023”) results and year-to-year comparisons between Fiscal 2024 and Fiscal 2023. Discussions of fiscal year ended April 30, 2022 (“Fiscal 2022”) results and year-to-year comparisons between Fiscal 2023 and Fiscal 2022 can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our Annual Report on Form 10-K for the year ended April 29, 2023, which is available free of charge on our website at www.nationalbeverage.com.

Net Sales

Net sales for Fiscal 2024 increased 1.6% to $1,191.7 million compared to $1,172.9 million for Fiscal 2023. The increase in sales resulted from a 1.8% increase in average selling price per case, partially offset by a 0.2% decline in case volume. The volume decline primarily impacted Power+Brands, partially offset by an increase in carbonated soft drink brands.

Gross Profit

Gross profit for Fiscal 2024 increased to $428.5 million compared to $396.8 million for Fiscal 2023. The increase in gross profit was primarily due to the increased average selling price per case and a decline in packaging costs. The cost of sales per case decreased 1.7% and gross margin increased to 36.0% compared to 33.8% for Fiscal 2023.

Shipping and handling costs are included in selling, general and administrative expenses, the classification of which is consistent with many beverage companies. However, our gross margin may not be comparable to companies that include shipping and handling costs in cost of sales. See Note 1- Significant Accounting Policies, of Notes to the Consolidated Financial Statements.

Selling, General and Administrative Expenses

Selling, general and administrative expenses for Fiscal 2024 decreased $0.2 million to $209.9 million from $210.1 million for Fiscal 2023. The decrease was primarily due to a decrease in shipping costs, partially offset by an increase in marketing and selling costs. As a percentage of net sales, selling, general and administrative expenses decreased to 17.6% compared to 17.9% in Fiscal 2023.

Other Income (Expense), net

Other income (expense), net includes primarily interest income of $12.2 million for Fiscal 2024 and $2.3 million for Fiscal 2023. The increase in interest income is due to increased average invested balances and higher yields.

Income Taxes

For Fiscal 2024 and Fiscal 2023, our effective tax rates were 23.1% and 23.7%, respectively. The differences between the effective rate and the federal statutory rate of 21% were primarily due to the effects of state income taxes.

LIQUIDITY AND FINANCIAL CONDITION

Liquidity and Capital Resources

Our principal sources of liquidity are our existing cash and cash-equivalents, cash generated from operations and borrowing capacity available under our revolving credit facilities. At April 27, 2024, we had $327.0 million in cash and cash equivalents and maintained unsecured revolving credit facilities totaling $150 million, under which no borrowings were outstanding and $2.2 million was reserved for standby letters of credit. We believe that existing capital resources will be sufficient to meet our liquidity and capital requirements for the next twelve months. See Note 5 - Debt, of Notes to the Consolidated Financial Statements.

Pursuant to a management agreement, we incurred fees to Corporate Management Advisors, Inc. (“CMA”) of $11.9 million and $11.7 million for Fiscal 2024 and Fiscal 2023, respectively. At April 27, 2024 and April 29, 2023, current liabilities included amounts due to CMA of $3.0 million and $2.9 million, respectively. See Note 6 - Capital Stock and Transactions with Related Parties, of Notes to the Consolidated Financial Statements.

Cash Flows

The Company’s cash position increased $169.0 million for Fiscal 2024 compared to an increase of $110.0 million for Fiscal 2023. Net cash provided by operating activities for Fiscal 2024 was $197.9 million compared to $161.7 million for Fiscal 2023. For Fiscal 2024, cash flow provided by operating activities was principally provided by an increase in operating income, a reduction in working capital other than cash, an increase in net interest income, partially offset by an increase in tax and lease payments.

Net cash used in investing activities for Fiscal 2024 reflects capital expenditures of $30.2 million, compared to capital expenditures of $22.0 million for Fiscal 2023. Expenditures for property, plant and equipment in Fiscal 2024 were primarily for capital projects to expand our capacity, enhance sustainability and packaging capabilities and improve efficiencies at our production facilities. We intend to continue such projects in Fiscal 2025 and anticipate Fiscal 2025 capital expenditures to be comparable to Fiscal 2024.

Financial Position

During Fiscal 2024, our working capital increased $176.9 million to $398.9 million. The increase in working capital primarily resulted from increased cash and cash equivalents generated by operations of $169.0 million and other net working capital increases of $7.9 million. Trade receivables decreased $2.1 million and days sales outstanding was 31.5 days at April 27, 2024 compared to 33.3 days at April 29, 2023. Inventories decreased $9.0 million as a result of the reduced quantities of finished goods and raw materials. Annual inventory turns increased to 8.6 times from 7.9 times. At April 27, 2024, the current ratio was 3.9 to 1 compared to 2.5 to 1 at April 29, 2023.

CONTRACTUAL OBLIGATIONS

Contractual obligations at April 27, 2024 are payable as follows:

| (In thousands) | ||||||||||||||||||||

| Total |

1 Year Or less |

2 to 3 Years |

4 to 5 Years |

More Than 5 Years |

||||||||||||||||

| Operating leases |

$ | 61,169 | $ | 15,068 | $ | 25,229 | $ | 12,716 | $ | 8,156 | ||||||||||

| Purchase commitments |

39,106 | 39,007 | 99 | - | - | |||||||||||||||

| Total |

$ | 100,275 | $ | 54,075 | $ | 25,328 | $ | 12,716 | $ | 8,156 | ||||||||||

We contribute to certain pension plans under collective bargaining agreements and to a discretionary profit-sharing plan. Annual contributions were $3.8 million for Fiscal 2024 and Fiscal 2023, respectively. See Note 11- Pension Plans, of Notes to Consolidated Financial Statements.

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Other long-term liabilities include known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience. Since the timing and amount of claim payments vary significantly, we are not able to reasonably estimate future payments for specific periods and therefore such payments have not been included in the table above. Standby letters of credit aggregating $2.2 million have been issued in connection with our self-insurance programs. These standby letters of credit expire through March 2025 and are expected to be renewed.

OFF-BALANCE SHEET ARRANGEMENTS AND ESTIMATES

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material effect on our financial condition.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on management’s knowledge of current events and actions it may undertake in the future, they may ultimately differ from actual results. We believe that the critical accounting policies described in the following paragraphs comprise the most significant estimates and assumptions used in the preparation of our consolidated financial statements. For these policies, we caution that future events rarely develop exactly as estimated and the best estimates routinely require adjustment.

Credit Risk

We sell products to a variety of customers and extend credit based on an evaluation of each customer’s financial condition, generally without requiring collateral. Exposure to credit losses varies by customer principally due to the financial condition of each customer. We monitor our exposure to credit losses and maintain allowances for anticipated credit losses based on our experience with past due accounts, collectability and our analysis of customer data.

Impairment of Long-Lived Assets

All long-lived assets, excluding goodwill and intangible assets not subject to amortization, are evaluated for impairment on the basis of undiscounted cash flows whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Goodwill and intangible assets not subject to amortization are evaluated for impairment annually or sooner if we believe such assets may be impaired. An impairment loss is written down to its estimated fair value based on discounted future cash flows.

Income Taxes

The Company’s effective income tax rate is based on estimates of taxes which will ultimately be payable. Deferred taxes are recorded to give recognition to temporary differences between the tax bases of assets or liabilities and their reported amounts in the financial statements. Valuation allowances are established to reduce the carrying amounts of deferred tax assets when it is deemed, more likely than not, that the benefit of deferred tax assets will not be realized.

Insurance Programs

We maintain self-insured and deductible programs for certain liability, medical and workers’ compensation exposures. Accordingly, we accrue for known claims and estimated incurred but not reported claims not otherwise covered by insurance based on actuarial assumptions and historical claims experience.

Revenue Recognition

We recognize revenue upon delivery to our customers, based on written sales terms that do not allow a right of return except in rare instances. Our products are typically sold on credit; however smaller direct-store delivery accounts may be sold on a cash basis. Our credit terms normally require payment within 30 days of delivery and may allow discounts for early payment. We estimate and reserve for credit losses based on our experience with past due accounts, collectability and our analysis of customer data.

We offer various sales incentive arrangements to our customers that require customer performance or achievement of certain sales volume targets. Sales incentives are accrued over the period of benefit or expected sales. When the incentive is paid in advance, the aggregate incentive is recorded as a prepaid asset and amortized over the period of benefit. The recognition of these incentives involves the use of judgment related to performance and sales volume estimates that are made based on historical experience and other factors. Sales incentives are accounted for as a reduction of sales and actual amounts ultimately realized may vary from accrued amounts. Such differences are recorded once determined and have historically not been significant.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

See Note 1 – Significant Accounting Policies – Recently Issued Accounting Pronouncements, of Notes to the Consolidated Financial Statements, for a full description of recent accounting pronouncements including the respective expected dates of adoption and expected effects on the Company’s consolidated financial position, results of operations or liquidity.

FORWARD-LOOKING STATEMENTS

National Beverage Corp. and its representatives may make written or oral statements relating to future events or results relative to our financial, operational and business performance, achievements, objectives and strategies. These statements are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995 and include statements contained in this report and other filings with the Securities and Exchange Commission and in reports to our stockholders. Certain statements including, without limitation, statements containing the words “believes,” “anticipates,” “intends,” “plans,” “expects,” “estimates”, ”may,” “will,” “should,” “could,” and similar expressions constitute “forward- looking statements” and involve known and unknown risk, uncertainties and other factors that may cause the actual results, performance or achievements of our Company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Such factors include, but are not limited to, the following: general economic and business conditions, pricing of competitive products, success of new product and flavor introductions, fluctuations in the costs and availability of raw materials and packaging supplies, ability to pass along cost increases to our customers, labor strikes or work stoppages or other interruptions in the employment of labor, continued retailer support for our products, changes in brand image, consumer demand and preferences and our success in creating products geared toward consumers’ tastes, success in implementing business strategies, changes in business strategy or development plans, technology failures or cyberattacks on our technology systems or our effective response to technology failures or cyberattacks on our customers’, suppliers’ or other third parties’ technology systems, government regulations, taxes or fees imposed on the sale of our products, unfavorable weather conditions, changing weather patterns and natural disasters, climate change or legislative or regulatory responses to such change and other factors referenced in this report, filings with the Securities and Exchange Commission and other reports to our stockholders. We disclaim any obligation to update any such factors or to publicly announce the results of any revisions to any forward- looking statements contained herein to reflect future events or developments.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Commodities

We purchase various raw materials, including aluminum cans, plastic bottles, high fructose corn syrup, corrugated packaging and juice concentrates, the prices of which fluctuate based on commodity market conditions. Our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. At times, we manage our exposure to this risk through the use of supplier pricing agreements that enable us to establish all, or a portion of, the purchase prices for certain raw materials. Additionally, we use derivative financial instruments to partially mitigate our exposure to changes in certain raw material costs.

Interest Rates

At April 27, 2024, the Company had no borrowings outstanding. We are also subject to interest rate risk related to our investment in highly liquid short-duration investment securities which are considered cash equivalents. These investments are managed with the guidelines of the Company’s investment policy. Our policy requires investments to be investment grade, within the primary objective of minimizing the risk of principal loss. In addition, our policy limits the amount of exposure to any one issue.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

| April 27, |

April 29, |

|||||||

| 2024 |

2023 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 327,047 | $ | 158,074 | ||||

| Trade receivables, net |

102,837 | 104,918 | ||||||

| Inventories |

84,603 | 93,578 | ||||||

| Prepaid and other assets |

22,385 | 9,835 | ||||||

| Total current assets |

536,872 | 366,405 | ||||||

| Property, plant and equipment, net |

159,730 | 148,423 | ||||||

| Operating lease right-of-use assets |

53,498 | 39,506 | ||||||

| Goodwill |

13,145 | 13,145 | ||||||

| Intangible assets |

1,615 | 1,615 | ||||||

| Other assets |

5,293 | 5,248 | ||||||

| Total assets |

$ | 770,153 | $ | 574,342 | ||||

| Liabilities and Shareholders' Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 78,283 | $ | 85,106 | ||||

| Accrued liabilities |

46,565 | 47,318 | ||||||

| Operating lease liabilities |

13,079 | 11,745 | ||||||

| Income taxes payable |

- | 152 | ||||||

| Total current liabilities |

137,927 | 144,321 | ||||||

| Deferred income taxes, net |

23,247 | 19,814 | ||||||

| Operating lease liabilities |

41,688 | 29,782 | ||||||

| Other liabilities |

7,779 | 7,938 | ||||||

| Total liabilities |

210,641 | 201,855 | ||||||

| Commitments and contingencies |

||||||||

| Shareholders' equity: |

||||||||

| Preferred stock, $1 par value - 1,000,000 shares authorized Series C - 150,000 shares issued |

150 | 150 | ||||||

| Common stock, $.01 par value - 200,000,000 shares authorized; 101,942,658 and 101,727,658 shares issued, respectively |

1,019 | 1,017 | ||||||

| Additional paid-in capital |

42,588 | 40,393 | ||||||

| Retained earnings |

535,077 | 358,345 | ||||||

| Accumulated other comprehensive income (loss) |

4,911 | (3,185 | ) | |||||

| Treasury stock - at cost: |

||||||||

| Series C preferred stock - 150,000 shares |

(5,100 | ) | (5,100 | ) | ||||

| Common stock - 8,374,112 shares |

(19,133 | ) | (19,133 | ) | ||||

| Total shareholders' equity |

559,512 | 372,487 | ||||||

| Total liabilities and shareholders' equity |

$ | 770,153 | $ | 574,342 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

| Fiscal Year Ended |

||||||||||||

| April 27, |

April 29, |

April 30, |

||||||||||

| 2024 |

2023 |

2022 |

||||||||||

| Net sales |

$ | 1,191,694 | $ | 1,172,932 | $ | 1,138,013 | ||||||

| Cost of sales |

763,243 | 776,143 | 720,208 | |||||||||

| Gross profit |

428,451 | 396,789 | 417,805 | |||||||||

| Selling, general and administrative expenses |

209,941 | 210,105 | 209,949 | |||||||||

| Operating income |

218,510 | 186,684 | 207,856 | |||||||||

| Other income (expense), net |

11,338 | (242 | ) | (260 | ) | |||||||

| Income before income taxes |

229,848 | 186,442 | 207,596 | |||||||||

| Provision for income taxes |

53,116 | 44,278 | 49,084 | |||||||||

| Net income |

$ | 176,732 | $ | 142,164 | $ | 158,512 | ||||||

| Earnings per common share: |

||||||||||||

| Basic |

$ | 1.89 | $ | 1.52 | $ | 1.70 | ||||||

| Diluted |

$ | 1.89 | $ | 1.52 | $ | 1.69 | ||||||

| Weighted average common shares outstanding: |

||||||||||||

| Basic |

93,429 | 93,347 | 93,323 | |||||||||

| Diluted |

93,630 | 93,608 | 93,599 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

| Fiscal Year Ended |

||||||||||||

| April 27, |

April 29, |

April 30, |

||||||||||

| 2024 |

2023 |

2022 |

||||||||||

| Net income |

$ | 176,732 | $ | 142,164 | $ | 158,512 | ||||||

| Other comprehensive income (loss), net of tax: |

||||||||||||

| Cash flow hedges |

7,910 | (10,130 | ) | 3,882 | ||||||||

| Other |

186 | 27 | 19 | |||||||||

| Total |

8,096 | (10,103 | ) | 3,901 | ||||||||

| Comprehensive income |

$ | 184,828 | $ | 132,061 | $ | 162,413 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(In thousands)

| Fiscal Year Ended |

||||||||||||||||||||||||

| April 27, 2024 |

April 29, 2023 |

April 30, 2022 |

||||||||||||||||||||||

| Shares |

Amount |

Shares |

Amount |

Shares |

Amount |

|||||||||||||||||||

| Series C Preferred Stock |

||||||||||||||||||||||||

| Beginning and end of year |

150 | $ | 150 | 150 | $ | 150 | 150 | $ | 150 | |||||||||||||||

| Common Stock |

||||||||||||||||||||||||

| Beginning of year |

101,727 | 1,017 | 101,712 | 1,017 | 101,676 | 1,016 | ||||||||||||||||||

| Stock options exercised |

215 | 2 | 15 | - | 36 | 1 | ||||||||||||||||||

| End of year |

101,942 | 1,019 | 101,727 | 1,017 | 101,712 | 1,017 | ||||||||||||||||||

| Additional Paid-In Capital |

||||||||||||||||||||||||

| Beginning of year |

40,393 | 39,405 | 38,375 | |||||||||||||||||||||

| Stock options exercised |

1,314 | 311 | 335 | |||||||||||||||||||||

| Stock-based compensation expense |

881 | 677 | 695 | |||||||||||||||||||||

| End of year |

42,588 | 40,393 | 39,405 | |||||||||||||||||||||

| Retained Earnings |

||||||||||||||||||||||||

| Beginning of year |

358,345 | 216,181 | 337,672 | |||||||||||||||||||||

| Net income |

176,732 | 142,164 | 158,512 | |||||||||||||||||||||

| Common stock cash dividend |

- | - | (280,003 | ) | ||||||||||||||||||||

| End of year |

535,077 | 358,345 | 216,181 | |||||||||||||||||||||

| Accumulated Other Comprehensive Income (Loss) |

||||||||||||||||||||||||

| Beginning of year |

(3,185 | ) | 6,918 | 3,017 | ||||||||||||||||||||

| Cash flow hedges |

7,910 | (10,130 | ) | 3,882 | ||||||||||||||||||||

| Other |

186 | 27 | 19 | |||||||||||||||||||||

| End of year |

4,911 | (3,185 | ) | 6,918 | ||||||||||||||||||||

| Treasury Stock - Series C Preferred |

||||||||||||||||||||||||

| Beginning and end of year |

150 | (5,100 | ) | 150 | (5,100 | ) | 150 | (5,100 | ) | |||||||||||||||

| Treasury Stock - Common |

||||||||||||||||||||||||

| Beginning and end of year |

8,374 | (19,133 | ) | 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | |||||||||||||||

| Repurchase of common stock |

- | - | - | - | - | - | ||||||||||||||||||

| 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | 8,374 | (19,133 | ) | ||||||||||||||||

| Total Shareholders' Equity |

$ | 559,512 | $ | 372,487 | $ | 239,438 | ||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| Fiscal Year Ended |

||||||||||||

| April 27, |

April 29, |

April 30, |

||||||||||

| 2024 |

2023 |

2022 |

||||||||||

| (As Restated) |

(As Restated) |

|||||||||||

| Operating Activities: |

||||||||||||

| Net income |

$ | 176,732 | $ | 142,164 | $ | 158,512 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Depreciation and amortization |

20,161 | 20,041 | 18,544 | |||||||||

| Deferred income taxes |

907 | (821 | ) | 5,326 | ||||||||

| Loss (gain) on disposal of property, plant and equipment, net |

12 | 141 | (7 | ) | ||||||||

| Stock-based compensation expense |

881 | 677 | 695 | |||||||||

| Non-cash operating lease expense |

14,039 | 13,240 | 13,258 | |||||||||

| Changes in assets and liabilities: |

||||||||||||

| Trade receivables |

2,081 | (11,326 | ) | (7,150 | ) | |||||||

| Inventories |

8,975 | 9,740 | (31,838 | ) | ||||||||

| Prepaid and other assets |

(8,151 | ) | 8,275 | (13,797 | ) | |||||||

| Accounts payable |

(6,823 | ) | (10,193 | ) | 6,545 | |||||||

| Accrued and other liabilities |

3,885 | 2,941 | (3,731 | ) | ||||||||

| Operating lease liabilities |

(14,792 | ) | (13,214 | ) | (13,224 | ) | ||||||

| Net cash provided by operating activities |

197,907 | 161,665 | 133,133 | |||||||||

| Investing Activities: |

||||||||||||

| Purchases to property, plant and equipment |

(30,300 | ) | (21,979 | ) | (29,015 | ) | ||||||

| Proceeds from sale of property, plant and equipment |

52 | 27 | 11 | |||||||||

| Net cash used in investing activities |

(30,248 | ) | (21,952 | ) | (29,004 | ) | ||||||

| Financing Activities: |

||||||||||||

| Borrowing under Loan Facility |

- | - | 50,000 | |||||||||

| Repayments under Loan Facility |

- | (30,000 | ) | (20,000 | ) | |||||||

| Dividends paid on common stock |

- | - | (280,003 | ) | ||||||||

| Proceeds from exercises of stock options |

1,314 | 311 | 335 | |||||||||

| Net cash provided by (used in) financing activities |

1,314 | (29,689 | ) | (249,668 | ) | |||||||

| Net Increase (Decrease) in Cash and Equivalents |

168,973 | 110,024 | (145,539 | ) | ||||||||

| Cash and Cash Equivalents - Beginning of Year |

158,074 | 48,050 | 193,589 | |||||||||

| Cash and Cash Equivalents - End of Year |

$ | 327,047 | $ | 158,074 | $ | 48,050 | ||||||

| Supplemental Cash Flow Information: |

||||||||||||

| Interest paid |

$ | 228 | $ | 315 | $ | 371 | ||||||

| Income taxes paid |

$ | 55,971 | $ | 37,831 | $ | 51,958 | ||||||

| Non-Cash Activities: |

||||||||||||

| Right-of- use assets obtained in exchange for lease liabilities |

$ | 28,039 | $ | 23,495 | $ | 6,054 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

NATIONAL BEVERAGE CORP. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

National Beverage Corp. develops, produces, markets and sells a distinctive portfolio of sparkling waters, juices, energy drinks and carbonated soft drinks primarily in the United States and Canada. Incorporated in Delaware in 1985, National Beverage Corp. is a holding company for various operating subsidiaries. When used in this report, the terms “we,” “us,” “our,” “Company” and “National Beverage” mean National Beverage Corp. and its subsidiaries.

| 1. |

SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The consolidated financial statements have been prepared in accordance with United States Generally Accepted Accounting Principles (“GAAP”) and rules and regulations of the Securities and Exchange Commission. The consolidated financial statements include the accounts of National Beverage Corp. and all subsidiaries. All significant intercompany transactions and accounts have been eliminated. Our fiscal year ends the Saturday closest to April 30 and, as a result, an additional week is added every five or six years. The fiscal year ended April 27, 2024 (“Fiscal 2024”), April 29, 2023 (“Fiscal 2023”) and April 30, 2022 (“Fiscal 2022”) and all consisted of 52 weeks. The fiscal year ending May 3, 2025 (“Fiscal 2025”) will consist of 53 weeks.

Segment Reporting

The Company operates as a single operating segment for purposes of presenting financial information and evaluating performance. As such, the accompanying consolidated financial statements present financial information in a format that is consistent with the internal financial information used by management.

Use of Estimates

The preparation of our financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on management’s knowledge of current events and anticipated future actions, actual results may vary from reported amounts.

Fair Value of Financial Instruments