|

Delaware

|

001-39648

|

85-2732947

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

136 Tower Road, Suite 205

Westchester County Airport

White Plains, NY

|

10604

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

Class A common stock, par value $0.0001 per share

|

SKYH

|

NYSE American LLC

|

||

|

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

SKYH WS

|

NYSE American LLC

|

|

Exhibit Number

|

Exhibit Title

|

|

99.1

|

Press Release dated March 27, 2024 |

| 99.2 | Investor Presentation dated March 27, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

|

SKY HARBOUR GROUP CORPORATION

|

||

|

By:

|

/s/ Tal Keinan

|

|

|

Name:

|

Tal Keinan

|

|

|

Title:

|

Chief Executive Officer

|

|

Exhibit 99.1

Sky Harbour Group Corporation Announces its 2023 Financial Results; Updates on New Ground Leases, Construction and Hangar Leasing; Injects Equity into Obligated Group and Files Various Registration Statements with SEC

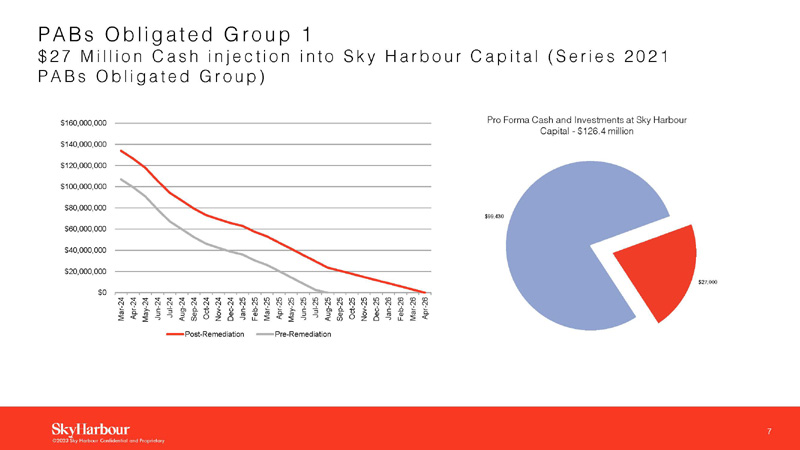

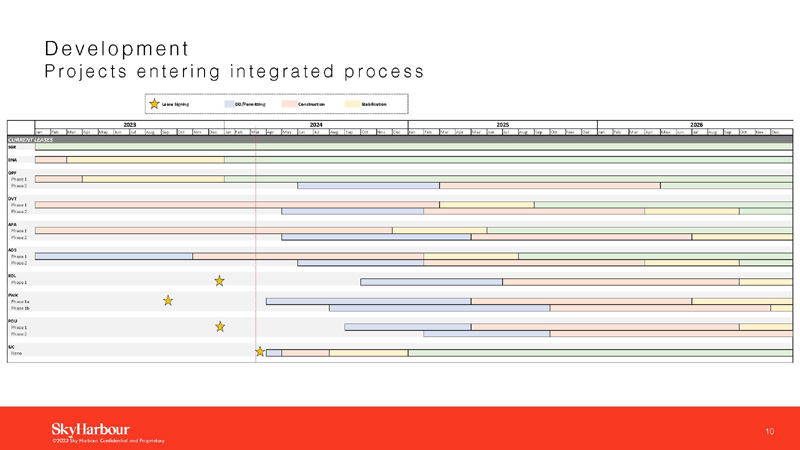

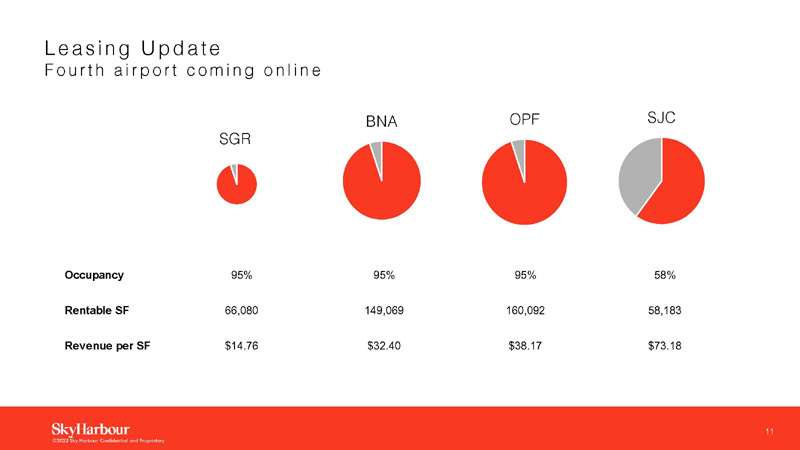

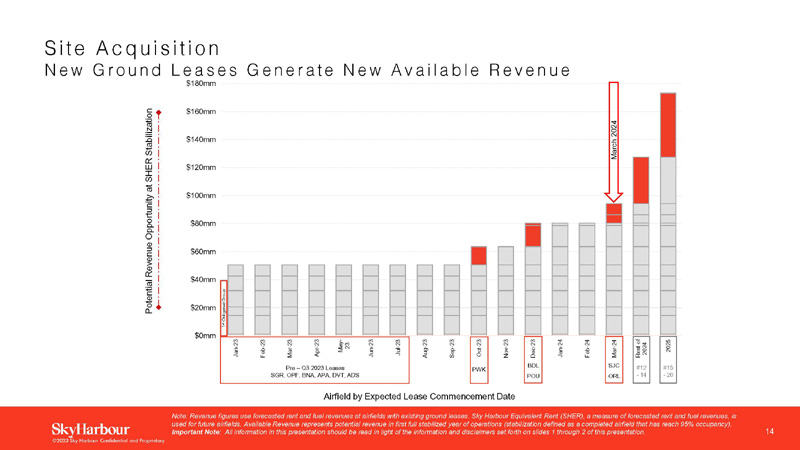

West Harrison, New York – March 27th, 2024 – Sky Harbour Group Corporation (NYSE American: SKYH, SKYH WS) (“SHG” or the “Company”), an aviation infrastructure company building the first nationwide network of Home-Basing campuses for business aircraft, announced the release of its financial results for the year ended December 31, 2023 and Annual Report on Form 10-K. The Company also announced new ground leases at San Jose, California’s San Jose Mineta International Airport (“SJC”) (Ground Lease #10), and at Orlando Executive Airport (“ORL”) (Ground Lease #11). The Company released its recently completed remediation estimate for addressing previously announced design flaws at its Denver and Phoenix construction projects as well as associated revisions to its Dallas Addison pre-construction designs, and injected $27 million of cash equity into the Series 2021 PABs Obligated Group construction fund. The Company provided a hangar leasing update marking near-full occupancy at its Houston, Nashville and Miami campuses, and announced approximately 58% pre-leasing at its new San Jose campus. The Company filed registration statements with the SEC, including a Form S-3 for PIPE shares and warrants issued in November 2023, and replaced its Stand-by Stock Purchase Agreement with an at-the-market (ATM) program of similar size. Please see the following links to access the SEC filings:

10-K: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001823587/000143774924009585/ysac20231231_10k.htm

S-3 (ATM): https://www.sec.gov/Archives/edgar/data/1823587/000143774924009600/ysac20240326_s3.htm

S-3 (PIPE): https://www.sec.gov/Archives/edgar/data/1823587/000143774924009599/ysac20240325_s3.htm

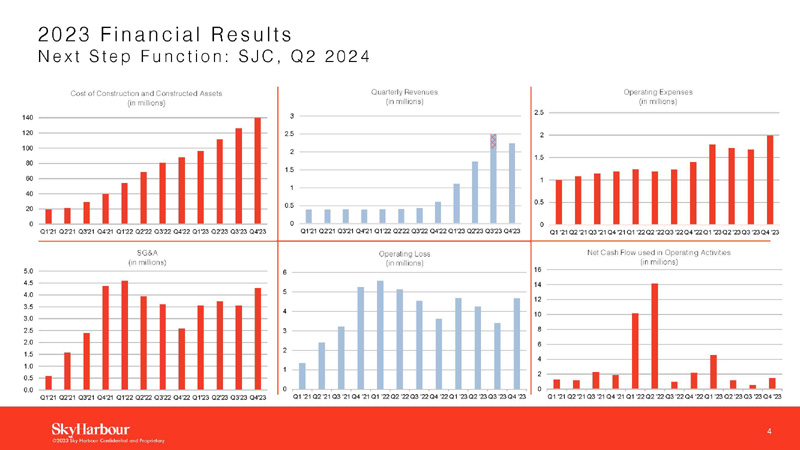

Financial Highlights include:

|

● |

2023 revenues increased 311% as compared to 2022. |

|

● |

2023 SG&A expenses increased 2.8% as compared to 2022. |

|

● |

Net cash used in operating activities during 2023 improved to $7.7 million from $27.5 million during 2022. |

|

● |

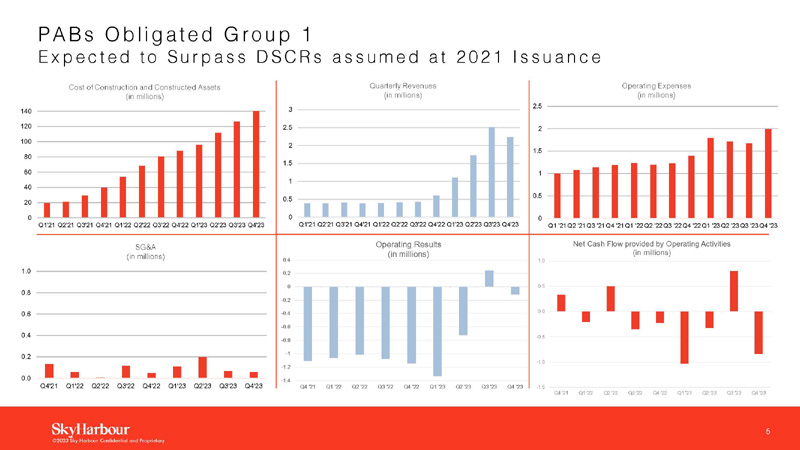

Please see the link below for the Q4 2023 quarterly report as filed by Sky Harbour Capital LLC (“SH Capital” or the “Obligated Group”) in MSRB/EMMA: https://emma.msrb.org/P21785011-P21370409-P21809128.pdf |

|

● |

The Company continues to maintain strong liquidity and capital resources. As of December 31, 2023, cash, restricted cash, and US Treasury investments amounted to approximately $172 million, of which $99 million resided at SH Capital. |

Recent noteworthy events include:

|

● |

New ground lease at SJC, encompassing an existing hangar facility to be made operational over the coming several weeks, and land for additional future development. |

|

● |

New ground lease at ORL, with expected construction commencement in Q2 2025. |

|

● |

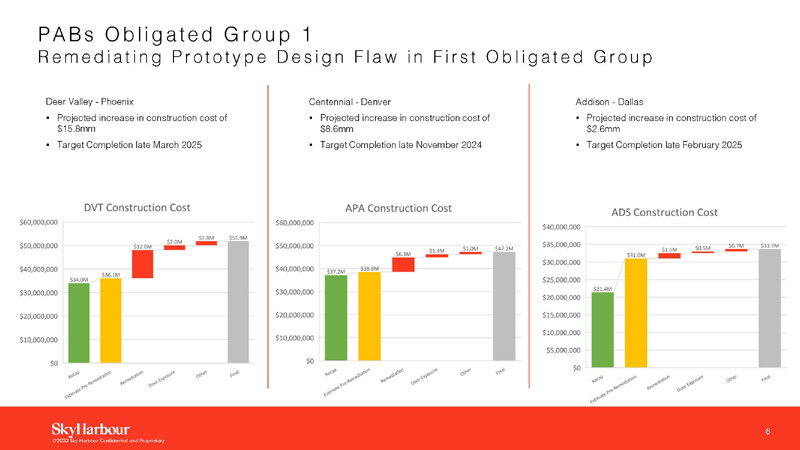

Construction of Phases 1 in Denver, Phoenix, and Dallas delayed by 3-4 months, with an estimated $26 - $28 million non-recurring remediation cost. Revised expected completion dates are December 2024, February 2025, and March 2025, respectively. |

|

● |

Houston, Nashville, and Miami campuses are stabilized at 95% leased, with potential full occupancy expected at over 100%. The San Jose facility is 58% pre-leased, with an expected operations start date of April 1, 2024. |

Site Acquisition Update

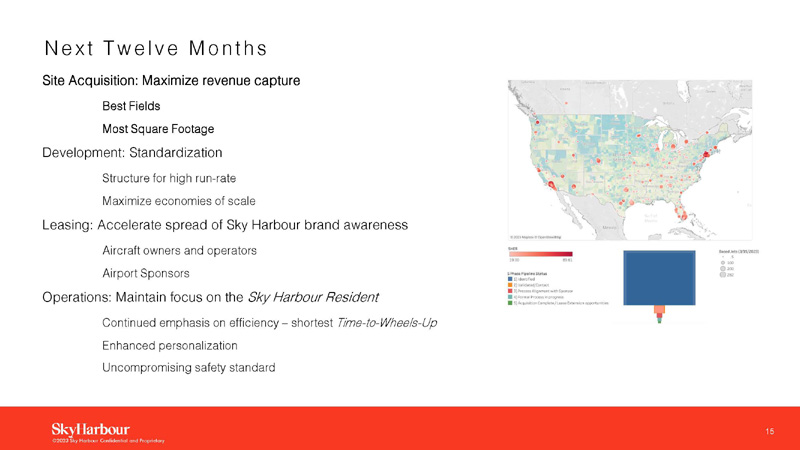

The Company and the City of San Jose, California executed a 7-acre ground lease at SJC (lease #10) which includes approximately 60,000 square feet of existing hangar and office space, over 100,000 square feet of aviation ramp, and 120 land-side automobile parking stalls. The initial term of the lease is twenty years, and future development is expected to increase hangar square footage by approximately 75%. San José Mineta International Airport serves the south San Francisco Bay Area, including Silicon Valley.

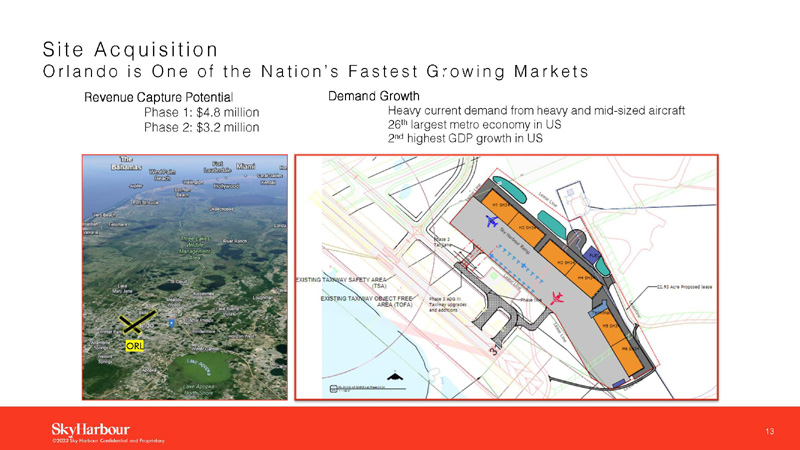

The Company and the Greater Orlando Airport Authority executed a ground lease at Orlando Executive Airport (ORL) (lease #11). The 50-year ground lease encompasses twenty acres, accommodating more than 200,000 square feet of hangar, with Phase 1 construction expected to begin in summer 2025. The Orlando Executive Airport is the premier general aviation airport in Central Florida and is located approximately three miles east of downtown Orlando. The Greater Orlando area is the second-fastest growing metro center in the country by GDP.

Exclusive ground-lease negotiations are underway at five new target airports. Formal ground lease proposals have been submitted or are pending at an additional eight new target airports.

The Company expects to have executed ground leases at three additional airports by the end of 2024 and an additional six airports by end of year 2025 representing an additional aggregate rentable square footage of more than 2 million square feet, primarily in markets with higher per-square-foot tenant rents than those in the first Obligated Group’s six airports.

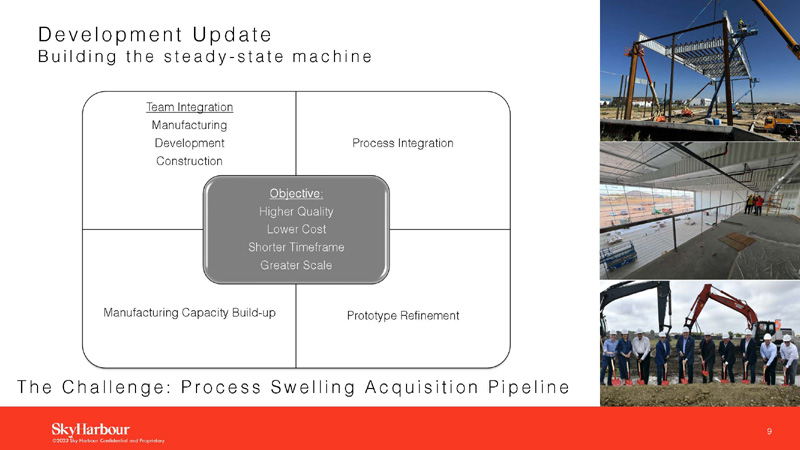

Construction Update

As previously announced, in December 2023 the Company discovered a flaw in the prototype design employed in the construction of Phases I at Phoenix Deer Valley Airport (“DVT”) and Denver Centennial Airport (“APA”), and that was planned to be employed in Phase I at Dallas Addison Airport (“ADS”).

Having completed a comprehensive review and prototype-redesign process with a leading national structural engineering firm, the Company is executing a remediation plan, including:

|

A. |

Retrofitting significant elements of the DVT and APA structures currently under construction, |

|

B. |

Modifying the design of ADS structures in pre-construction to conform with Sky Harbour prototype requirements, and |

|

C. |

Applying the amended SH34 and SH16C prototype design to future projects with the intention of: |

|

a. |

Delivering best-in-class 100-year structures of the highest quality and |

|

b. |

Standardizing and streamlining procurement, manufacturing and construction in pursuit of shorter development time frames and lower development costs. |

Expected remediation costs are between $26 and $28 million, including approximately $16 million at DVT, approximately $8.5 million at APA, and approximately $2.5 million at ADS. Expected delivery dates of these projects are now November 2024 (APA), and February 2025 (ADS) and March 2025 (DVT).

Leasing Update

Sky Harbour’s first three campus phases (SGR, BNA and OPF 1) are approximately 95% occupied. Total potential economic occupancy is expected to exceed 100% due to successes in semi-private leasing.

SJC is expected to commence operations on April 1, 2024, and is approximately 58% preleased. SJC tenant rents are reflective of Sky Harbour’s tier-1 target markets, with expected revenues from certain initial tenants exceeding $80 per rentable square foot.

Registration of prior PIPE Shares, Replacement of Stand-By Share Sale Program and New “Shelf” Registration

As required under the registration rights agreement with the PIPE common stock investors which closed in November 2023, we have filed a registration statement on Form S-3 registering the Class A common shares, the associated PIPE warrants, and the Class A common shares underlying those warrants. Similarly, the Company has terminated its 10 million share Stock Purchase Agreement, originally dated August 18, 2022, and replaced it with a Stock Selling Agreement (“at the market” or “ATM”) with an affiliate of the same broker-dealer of slightly smaller size. The Company did not sell any shares under the original agreement and only intends to sell shares under the new ATM if attractive market opportunities arise.

Equity Cash Infusion into PABs Series 2021 Obligated Group

On March 27, 2024, the Company contributed an additional $27 million of cash equity into its wholly-owned subsidiary Sky Harbour Capital LLC (the Obligated Group) to address the anticipated net funding gap associated with the one-time remediation costs at DVT, APA and ADS.

CEO Remarks

Tal Keinan, Chairman and Chief Executive Officer, commented on 2023 Full year results and other recent events:

“Sky Harbour’s efforts to ramp up site acquisition in 2023 are bearing fruit today and should accelerate throughout 2024 and 2025. Having established our baseline unit economics, the Site Acquisition team’s focus is shifting to the country’s tier-1 metro markets, where excess demand for business aviation hangar space most acutely manifests in higher hangar rents. With prototype design weaknesses addressed rigorously and rectified, we are structuring and growing the Sky Harbour Development Team to accommodate the anticipated scale-up in manufacturing and construction. The Airfield Operations team continues to focus on delivering the most efficient and personalized service suite in business aviation. Sky Harbour took good strides in 2023 in pursuit of its ambition to provide Sky Harbour Residents with the best service at the best facilities on the best airfields in business aviation. We are now gearing up to perform at scale.”

Webcast Conference Call

Sky Harbour will host a live conference call and concurrent webcast at 5 p.m. ET on March 27th, 2024. To join the webcast, please use the following link:

https://events.q4inc.com/attendee/844843790

For audio-only conference call, please use the following participant details:

North America Toll-Free: (888) 660-6739

North America Toll: (929) 203-0875

International Toll: +1(929) 203-0875

Conference ID 3259957

Please note that questions may only be submitted in writing during the webcast through the platform link above.

A replay of the webcast may be found starting on March 28th at https://ir.skyharbour.group/events-and-presentations/events/

About Sky Harbour Group Corporation

Sky Harbour Group Corporation is an aviation infrastructure company developing the first nationwide network of Home-Basing campuses for business aircraft. The company develops, leases and manages general aviation hangars across the United States. Sky Harbour’s Home-Basing offering aims to provide private and corporate customers with the best physical infrastructure in business aviation, coupled with dedicated service tailored to based aircraft, offering the shortest time to wheels-up in business aviation. To learn more, visit www.skyharbour.group.

Forward Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements about the financial condition, results of operations, earnings outlook and prospects of SHG may include statements for the period following the consummation of the business combination. When used in this press release, the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of SHG as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in the public filings made or to be made with the SEC by SHG, including the filings described above, regarding the following: expectations regarding SHG’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and SHG’s ability to invest in growth initiatives; SHG’s ability to scale and build the hangars currently under development or planned in a timely and cost-effective manner; the implementation, market acceptance and success of SHG’s business model and growth strategy; the success or profitability of SHG’s hangar facilities; SHG’s future capital requirements and sources and uses of cash; SHG’s ability to obtain funding for its operations and future growth; developments and projections relating to SHG’s competitors and industry; the ability to recognize the anticipated benefits of the business combination; geopolitical risk and changes in applicable laws or regulations; the possibility that SHG may be adversely affected by other economic, business, and/or competitive factors; operational risk; risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on SHG’s business operations, as well as SHG’s financial condition and results of operations. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of SHG prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. SHG undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

Investor Relations:

investors@skyharbour.group

Attn: Francisco X. Gonzalez, CFO

Exhibit 99.2