|

VERSABANK

|

|||

|

Date: August 30, 2023

|

By:

|

/s/ Shawn Clarke

|

|

|

Name: Shawn Clarke

|

|||

|

Title: Chief Financial Officer

|

|||

| Exhibit

No.

|

|

Description

|

|

|

||

| 99.1 |

|

|

| 99.2 |

|

|

| 99.3 |

|

|

| 99.4 |

|

|

| 99.5 |

|

|

| 99.6 |

|

Exhibit 99.1

Interim Consolidated Financial Statements

July 31, 2023

(Unaudited)

VERSABANK

Consolidated Balance Sheets

(Unaudited)

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| As at |

2023 |

2022 |

2022 |

|||||||||

| Assets |

||||||||||||

| Cash |

$ | 87,726 | $ | 88,581 | $ | 84,214 | ||||||

| Securities (note 4) |

182,944 | 141,564 | 133,682 | |||||||||

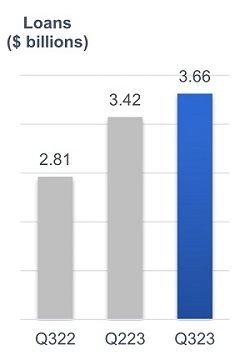

| Loans, net of allowance for credit losses (note 5) |

3,661,672 | 2,992,678 | 2,814,121 | |||||||||

| Other assets (note 6) |

48,503 | 43,175 | 43,326 | |||||||||

| $ | 3,980,845 | $ | 3,265,998 | $ | 3,075,343 | |||||||

| Liabilities and Shareholders' Equity |

||||||||||||

| Deposits |

$ | 3,328,017 | $ | 2,657,540 | $ | 2,475,063 | ||||||

| Subordinated notes payable (note 7) |

101,585 | 104,951 | 98,706 | |||||||||

| Other liabilities (note 8) |

186,200 | 152,832 | 154,926 | |||||||||

| 3,615,802 | 2,915,323 | 2,728,695 | ||||||||||

| Shareholders' equity: |

||||||||||||

| Share capital (note 9) |

228,191 | 239,629 | 241,321 | |||||||||

| Contributed surplus |

2,339 | 1,612 | 1,189 | |||||||||

| Retained earnings |

134,461 | 109,335 | 104,071 | |||||||||

| Accumulated other comprehensive income |

52 | 99 | 67 | |||||||||

| 365,043 | 350,675 | 346,648 | ||||||||||

| $ | 3,980,845 | $ | 3,265,998 | $ | 3,075,343 | |||||||

The accompanying notes are an integral part of these interim Consolidated Financial Statements.

VERSABANK

Consolidated Statements of Income and Comprehensive Income

(Unaudited)

| (thousands of Canadian dollars, except per share amounts) |

||||||||||||||||

| for the three months ended |

for the nine months ended |

|||||||||||||||

| July 31 |

July 31 |

July 31 |

July 31 |

|||||||||||||

| 2023 |

2022 |

2023 |

2022 |

|||||||||||||

| Interest income: |

||||||||||||||||

| Loans |

$ | 56,206 | $ | 33,165 | $ | 153,765 | $ | 83,151 | ||||||||

| Other |

3,883 | 1,012 | 9,480 | 1,594 | ||||||||||||

| 60,089 | 34,177 | 163,245 | 84,745 | |||||||||||||

| Interest expense: |

||||||||||||||||

| Deposits and other |

33,725 | 12,727 | 85,100 | 26,435 | ||||||||||||

| Subordinated notes |

1,435 | 1,388 | 4,333 | 4,121 | ||||||||||||

| 35,160 | 14,115 | 89,433 | 30,556 | |||||||||||||

| Net interest income |

24,929 | 20,062 | 73,812 | 54,189 | ||||||||||||

| Non-interest income |

1,930 | 1,177 | 5,650 | 3,951 | ||||||||||||

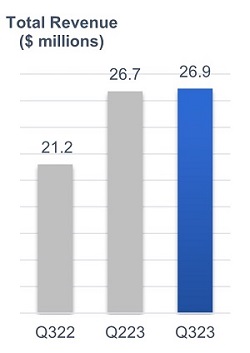

| Total revenue |

26,859 | 21,239 | 79,462 | 58,140 | ||||||||||||

| Provision for credit losses (note 5) |

171 | 166 | 793 | 246 | ||||||||||||

| 26,688 | 21,073 | 78,669 | 57,894 | |||||||||||||

| Non-interest expenses: |

||||||||||||||||

| Salaries and benefits |

7,453 | 6,768 | 24,139 | 19,577 | ||||||||||||

| General and administrative |

4,446 | 5,519 | 10,888 | 13,162 | ||||||||||||

| Premises and equipment |

980 | 929 | 2,913 | 2,880 | ||||||||||||

| 12,879 | 13,216 | 37,940 | 35,619 | |||||||||||||

| Income before income taxes |

13,809 | 7,857 | 40,729 | 22,275 | ||||||||||||

| Income tax provision (note 10) |

3,806 | 2,137 | 11,046 | 6,046 | ||||||||||||

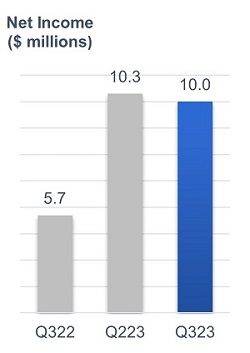

| Net income |

$ | 10,003 | $ | 5,720 | $ | 29,683 | $ | 16,229 | ||||||||

| Other comprehensive income (loss): |

||||||||||||||||

| Items that may subsequently be reclassified to net income: Foreign exchange gain (loss) on translation of foreign operations |

(42 | ) | 24 | (47 | ) | 71 | ||||||||||

| Comprehensive income |

$ | 9,961 | $ | 5,744 | $ | 29,636 | $ | 16,300 | ||||||||

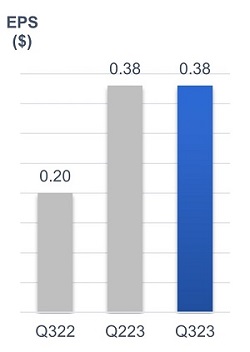

| Basic and diluted income per common share (note 11) |

$ | 0.38 | $ | 0.20 | $ | 1.10 | $ | 0.56 | ||||||||

The accompanying notes are an integral part of these interim Consolidated Financial Statements.

VERSABANK

Consolidated Statements of Changes in Shareholders’ Equity

(Unaudited)

| (thousands of Canadian dollars) |

||||||||||||||||

| for the three months ended |

for the nine months ended |

|||||||||||||||

| July 31 |

July 31 |

July 31 |

July 31 |

|||||||||||||

| 2023 |

2022 |

2023 |

2022 |

|||||||||||||

| Common shares (note 9): |

||||||||||||||||

| Balance, beginning of the period |

$ | 215,233 | $ | 227,674 | $ | 225,982 | $ | 227,674 | ||||||||

| Purchased and cancelled during the period |

(689 | ) | - | (11,438 | ) | - | ||||||||||

| Balance, end of the period |

$ | 214,544 | $ | 227,674 | $ | 214,544 | $ | 227,674 | ||||||||

| Preferred shares (note 9): |

||||||||||||||||

| Series 1 preferred shares |

||||||||||||||||

| Balance, beginning and end of the period |

$ | 13,647 | $ | 13,647 | $ | 13,647 | $ | 13,647 | ||||||||

| Total share capital |

$ | 228,191 | $ | 241,321 | $ | 228,191 | $ | 241,321 | ||||||||

| Contributed surplus: |

||||||||||||||||

| Balance, beginning of the period |

$ | 2,147 | $ | 765 | $ | 1,612 | $ | 145 | ||||||||

| Stock-based compensation (note 9) |

192 | 424 | 727 | 1,044 | ||||||||||||

| Balance, end of the period |

$ | 2,339 | $ | 1,189 | $ | 2,339 | $ | 1,189 | ||||||||

| Retained earnings: |

||||||||||||||||

| Balance, beginning of the period |

$ | 125,398 | $ | 99,285 | $ | 109,335 | $ | 90,644 | ||||||||

| Adjustment for purchased and cancelled common shares |

(45 | ) | - | (1,854 | ) | - | ||||||||||

| Net income |

10,003 | 5,720 | 29,683 | 16,229 | ||||||||||||

| Dividends paid on common and preferred shares |

(895 | ) | (934 | ) | (2,703 | ) | (2,802 | ) | ||||||||

| Balance, end of the period |

$ | 134,461 | $ | 104,071 | $ | 134,461 | $ | 104,071 | ||||||||

| Accumulated other comprehensive income: |

||||||||||||||||

| Balance, beginning of the period |

$ | 94 | $ | 43 | $ | 99 | $ | (4 | ) | |||||||

| Other comprehensive income (loss) |

(42 | ) | 24 | (47 | ) | 71 | ||||||||||

| Balance, end of the period |

$ | 52 | $ | 67 | $ | 52 | $ | 67 | ||||||||

| Total shareholders' equity |

$ | 365,043 | $ | 346,648 | $ | 365,043 | $ | 346,648 | ||||||||

The accompanying notes are an integral part of these interim Consolidated Financial Statements.

VERSABANK

Consolidated Statements of Cash Flows

(Unaudited)

| (thousands of Canadian dollars) |

|||||||||

| for the nine months ended |

|||||||||

| July 31 |

July 31 |

||||||||

| 2023 |

2022 |

||||||||

| Cash provided by (used in): |

|||||||||

| Operations: |

|||||||||

| Net income |

$ | 29,683 | $ | 16,229 | |||||

| Adjustments to determine net cash flows: |

|||||||||

| Items not involving cash: |

|||||||||

| Provision for credit losses | 793 | 246 | |||||||

| Stock-based compensation | 727 | 1,044 | |||||||

| Income tax provision | 11,046 | 6,046 | |||||||

| Interest income | (163,245 | ) | (84,745 | ) | |||||

| Interest expense | 89,433 | 30,556 | |||||||

| Amortization |

1,348 | 1,431 | |||||||

| Accretion of discount on securities | (126 | ) | (255 | ) | |||||

| Foreign exchange rate change on assets and liabilities | (667 | ) | 3,300 | ||||||

| Interest received |

157,430 | 77,970 | |||||||

| Interest paid |

(68,786 | ) | (24,919 | ) | |||||

| Income taxes paid |

(13,276 | ) | (5,207 | ) | |||||

| Change in operating assets and liabilities: |

|||||||||

| Securities |

(42,155 | ) | (133,427 | ) | |||||

| Loans |

(664,618 | ) | (704,607 | ) | |||||

| Deposits |

651,238 | 617,589 | |||||||

| Change in other assets and liabilities |

33,997 | 19,426 | |||||||

| 22,822 | (179,323 | ) | |||||||

| Purchase of investment: |

|||||||||

| Purchase of property and equipment |

(350 | ) | (746 | ) | |||||

| (350 | ) | (746 | ) | ||||||

| Financing: |

|||||||||

| Purchase and cancellation of common shares |

(13,292 | ) | - | ||||||

| Dividends paid |

(2,703 | ) | (2,802 | ) | |||||

| Repayment of lease obligations |

(527 | ) | (469 | ) | |||||

| (16,522 | ) | (3,271 | ) | ||||||

| Change in cash |

5,950 | (183,340 | ) | ||||||

| Effect of exchange rate changes on cash |

(6,805 | ) | (3,969 | ) | |||||

| Cash, beginning of the period |

88,581 | 271,523 | |||||||

| Cash, end of the period |

$ | 87,726 | $ | 84,214 | |||||

The accompanying notes are an integral part of these interim Consolidated Financial Statements.

| 1. | Reporting entity: |

VersaBank (the “Bank”) operates as a Schedule I bank under the Bank Act (Canada) and is regulated by the Office of the Superintendent of Financial Institutions Canada (“OSFI”). The Bank, whose shares trade on the Toronto Stock Exchange and Nasdaq Stock Exchange, provides commercial lending and banking services to select niche markets in Canada and the United States, as well as cybersecurity services and banking and financial technology development services through the operations of its wholly owned subsidiary DRT Cyber Inc. (“DRTC”). The Bank is incorporated and domiciled in Canada, and maintains its registered office at Suite 2002, 140 Fullarton Street, London, Ontario, Canada, N6A 5P2.

| 2. | Basis of preparation: |

a) Statement of compliance:

These interim Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and have been prepared in accordance with International Accounting Standard (“IAS”) 34 – Interim Financial Reporting and do not include all of the information required for full annual financial statements. These interim Consolidated Financial Statements should be read in conjunction with the Bank’s audited Consolidated Financial Statements for the year ended October 31, 2022.

The interim Consolidated Financial Statements for the three and nine months ended July 31, 2023 and 2022 were approved by the Audit Committee of the Board of Directors on August 28, 2023.

b) Basis of measurement:

These interim Consolidated Financial Statements have been prepared on the historical cost basis except the investment in Canada Stablecorp Inc. (note 6) and an interest rate swap (note 12), which are measured at fair value in the Consolidated Balance Sheets.

c) Functional and presentation currency:

These interim Consolidated Financial Statements are presented in Canadian dollars, which is the Bank’s functional currency. Functional currency is also determined for each of the Bank’s subsidiaries, and items included in the interim financial statements of the subsidiaries are measured using their functional currency.

d) Use of estimates and judgements:

In preparing these interim Consolidated Financial Statements, management has exercised judgement and developed estimates in applying accounting policies and generating reported amounts of assets and liabilities at the date of the financial statements and income and expenses during the reporting periods. Areas where judgement was applied include assessing significant changes in credit risk on financial assets and in the selection of relevant forward-looking information in assessing the Bank’s allowance for expected credit losses on its financial assets as described in note 5 – Loans. Estimates are applied in the determination of the allowance for expected credit losses on financial assets, the fair value of stock options granted as described in note 9, the fair value of the investment in Canada Stablecorp Inc. as described in note 6, and the measurement of deferred taxes as described in note 10. It is reasonably possible, on the basis of existing knowledge, that actual results may vary from those expected in the development of these estimates. This could result in material adjustments to the carrying amounts of assets and/or liabilities affected in the future.

Available forward-looking information, including forecast macroeconomic indicator and industry performance trend data continues to be influenced by a number of factors, including, but not limited to, higher interest rates and inflation trends, consumer spending trends, the strength of household balance sheets, housing prices, the strength of the labour market as well as geo-political risk resulting from the crisis in Ukraine and the impact of the crisis on global supply chains. The dynamic nature of these macroeconomic factors and activities and their influence on the available forward looking information results in the assumptions, judgements and estimates made by management in the preparation of these interim Consolidated Financial Statements being subject to some uncertainty.

Estimates and their underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are applied prospectively once they are known.

| 3. | Significant accounting policies and future accounting changes: |

The accounting policies applied by the Bank in these interim Consolidated Financial Statements are the same as those applied by the Bank as at and for the year ended October 31, 2022 and are detailed in note 3 of the Bank’s 2022 audited Consolidated Financial Statements. During the current fiscal year, the Bank updated or incorporated the following significant accounting policies:

Derivative instruments:

Derivatives are reported as other assets when they have a positive fair value and as other liabilities when they have a negative fair value. Derivatives may be embedded in other financial instruments. Derivatives embedded in other financial instruments are valued as separate derivatives when: the economic characteristics and risks associated are not clearly and closely related to those of the host contract; the terms of the embedded derivative would meet the definition of a derivative if it was a stand-alone, independent instrument; and the combined contract is not held for trading or designated at fair value through profit or loss. For financial statement disclosure purposes, embedded derivatives are combined with the host contract.

Hedge accounting:

The Bank has elected, as permitted, to apply the hedge accounting requirements of IAS 39. Interest rate swap agreements are entered into for asset liability management purposes. When hedge accounting criteria are met, derivative contracts are accounted for as described below.

To meet the criteria for hedge accounting, the Bank documents all relationships between hedging instruments and hedged items, how hedge effectiveness is assessed, as well as its risk management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives to specific assets or liabilities on the Consolidated Balance Sheet. The Bank also formally assesses, both at the inception of the hedge and on an ongoing basis, whether the derivatives that are used in hedging transactions are effective in offsetting changes in fair values or cash flows of the hedged items.

There are three main types of hedges: (i) fair value hedges, (ii) cash flow hedges and (iii) net investment hedges.

The Bank has only fair value hedges outstanding. In a fair value hedge, the change in the fair value of the hedging derivative is recognized in non-interest income in the Consolidated Statements of Income and Comprehensive Income. The change in the fair value of the hedged item attributable to hedge risk is recorded as part of the carrying value of the hedged item (basis adjustment) and is also recognized in non-interest income in the Consolidated Statements of Income and Comprehensive Income. The Bank utilizes fair value hedges primarily to convert fixed rate financial assets to floating rate financial assets. The primary financial instruments designated in fair value hedging relationships are loans. If the derivative expires or is sold, terminated, no longer meets the criteria for hedge accounting, or the designation is revoked, hedge accounting is discontinued. Any basis adjustment up to that point made to a hedged item for which the effective interest method is used is amortized to the Consolidated Statements of Income and Comprehensive Income as part of the recalculated effective interest rate of the item over its remaining term. If the hedged item is derecognized, the unamortized fair value is recognized immediately in the Consolidated Statements of Income and Comprehensive Income.

In fair value hedges, ineffectiveness arises to the extent that the change in fair value of the hedging items differs from the change in fair value of the hedge risk in the hedged item. Any hedge ineffectiveness is measured and recorded in non-interest income in the Consolidated Statements of Income and Comprehensive Income.

Derivative contracts which do not qualify for hedge accounting are marked-to-market and the resulting net gains or losses are recognized in non-interest income in the Consolidated Statement of Income and Comprehensive Income.

| 4. | Securities: |

As at July 31, 2023, the Bank held securities totalling $182.9 million ( October 31, 2022 - $141.6 million), comprised of a Government of Canada Treasury Bill for $181.8 million with a face value of $182.0 million at maturity on August 3, 2023, yielding 4.89%, and a Government of Canada Bond for $990,000 with a face value totaling $1.0 million, yielding 4.73%, with a 3.75% coupon and maturing on May 1, 2025.

| 5. | Loans, net of allowance for credit losses: |

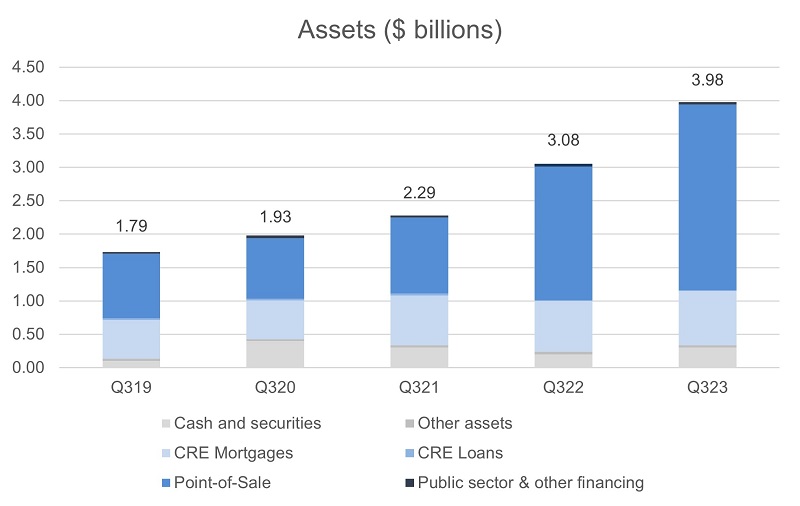

The Bank organizes its lending portfolio into the following four broad asset categories: Point-of-Sale Loans and Leases, Commercial Real Estate Mortgages, Commercial Real Estate Loans, and Public Sector and Other Financing. These categories have been established in the Bank’s proprietary, internally developed asset management system and have been designed to catalogue individual lending assets as a function primarily of their key risk drivers, the nature of the underlying collateral, and the applicable market segment.

The Point-of-Sale Loans and Leases (“POS Financing”) asset category is comprised of Point of Sale Loan and Lease Receivables acquired from the Bank’s broad network of origination and servicing partners in Canada and the US as well as Warehouse Loans that provide bridge financing to the Bank’s origination and servicing partners for the purpose of accumulating and seasoning practical volumes of individual loans and leases prior to the Bank purchasing the cashflow receivables derived from same.

The Commercial Real Estate Mortgages (“CRE Mortgages”) asset category is comprised primarily of Residential Construction, Term, Insured and Land Mortgages. All of these loans are business-to-business loans with the underlying credit risk exposure being primarily consumer in nature given that the vast majority of the loans are related to properties that are designated primarily for residential use. The portfolio benefits from diversity in its underlying security in the form of a broad range of such collateral properties.

The Commercial Real Estate Loans (“CRE Loans”) asset category is comprised primarily of Condominium Corporation Financing loans.

The Public Sector and Other Financing (“PSOF”) asset category is comprised primarily of Public Sector Loans and Leases, a small balance of Corporate Loans and Leases and Single Family Residential Conventional and Insured Mortgages.

Summary of loans and allowance for credit losses:

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| 2023 |

2022 |

2022 |

||||||||||

| Point-of-sale loans and leases |

$ | 2,776,126 | $ | 2,220,894 | $ | 1,998,993 | ||||||

| Commercial real estate mortgages |

810,630 | 710,369 | 755,042 | |||||||||

| Commercial real estate loans |

9,298 | 13,165 | 13,510 | |||||||||

| Public sector and other financing |

49,627 | 35,452 | 35,605 | |||||||||

| 3,645,681 | 2,979,880 | 2,803,150 | ||||||||||

| Allowance for credit losses |

(2,697 | ) | (1,904 | ) | (1,699 | ) | ||||||

| Accrued interest |

18,688 | 14,702 | 12,670 | |||||||||

| Total loans, net of allowance for credit losses |

$ | 3,661,672 | $ | 2,992,678 | $ | 2,814,121 | ||||||

The following table provides a summary of loan amounts, expected credit loss allowance amounts, and expected loss rates by lending asset category:

| As at July 31, 2023 |

As at October 31, 2022 |

|||||||||||||||||||||||||||||||

| (thousands of Canadian dollars) |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

||||||||||||||||||||||||

| Point-of-sale loans and leases |

$ | 2,770,509 | $ | 5,617 | $ | - | $ | 2,776,126 | $ | 2,215,388 | $ | 5,227 | $ | 279 | $ | 2,220,894 | ||||||||||||||||

| ECL allowance |

646 | - | - | 646 | 545 | - | - | 545 | ||||||||||||||||||||||||

| EL % |

0.02 | % | 0.00 | % | 0.00 | % | 0.02 | % | 0.02 | % | 0.00 | % | 0.00 | % | 0.02 | % | ||||||||||||||||

| Commercial real estate mortgages |

$ | 746,771 | $ | 48,752 | $ | 15,107 | $ | 810,630 | $ | 599,113 | $ | 111,256 | $ | - | $ | 710,369 | ||||||||||||||||

| ECL allowance |

1,655 | 251 | - | 1,906 | 1,150 | 137 | - | 1,287 | ||||||||||||||||||||||||

| EL % |

0.22 | % | 0.51 | % | 0.00 | % | 0.24 | % | 0.19 | % | 0.12 | % | 0.00 | % | 0.18 | % | ||||||||||||||||

| Commercial real estate loans |

$ | 9,298 | $ | - | $ | - | $ | 9,298 | $ | 13,165 | $ | - | $ | - | $ | 13,165 | ||||||||||||||||

| ECL allowance |

50 | - | - | 50 | 54 | - | - | 54 | ||||||||||||||||||||||||

| EL % |

0.54 | % | 0.00 | % | 0.00 | % | 0.54 | % | 0.41 | % | 0.00 | % | 0.00 | % | 0.41 | % | ||||||||||||||||

| Public sector and other financing |

$ | 45,060 | $ | 4,567 | $ | - | $ | 49,627 | $ | 35,273 | $ | 179 | $ | - | $ | 35,452 | ||||||||||||||||

| ECL allowance |

74 | 21 | - | 95 | 17 | 1 | - | 18 | ||||||||||||||||||||||||

| EL % |

0.16 | % | 0.46 | % | 0.00 | % | 0.19 | % | 0.05 | % | 0.56 | % | 0.00 | % | 0.05 | % | ||||||||||||||||

| Total loans |

$ | 3,571,638 | $ | 58,936 | $ | 15,107 | $ | 3,645,681 | $ | 2,862,939 | $ | 116,662 | $ | 279 | $ | 2,979,880 | ||||||||||||||||

| Total ECL allowance |

2,425 | 272 | - | 2,697 | 1,766 | 138 | - | 1,904 | ||||||||||||||||||||||||

| Total EL % |

0.07 | % | 0.46 | % | 0.00 | % | 0.07 | % | 0.06 | % | 0.12 | % | 0.00 | % | 0.06 | % | ||||||||||||||||

The Bank’s maximum exposure to credit risk is the carrying value of its financial assets. The Bank holds security against the majority of its loans in the form of mortgage interests over property, other registered securities over assets, guarantees or cash reserves on loan and lease receivables included in the POS Financing portfolio (see note 8).

Allowance for credit losses

The Bank must maintain an allowance for expected credit losses (“ECL”) that is adequate, in management’s opinion, to absorb all credit related losses in the Bank’s lending and treasury portfolios. Under IFRS 9, the Bank’s ECL is estimated using the expected credit loss methodology and is comprised of expected credit losses recognized on both performing loans, and non-performing, or impaired loans even if no actual loss event has occurred.

Assessment of significant increase in credit risk (“SICR”)

At each reporting date, the Bank assesses whether or not there has been a SICR for loans since initial recognition by comparing, at the reporting date, the risk of default occurring over the remaining expected life against the risk of default at initial recognition.

SICR is a function of the loan’s internal risk rating assignment, internal watchlist status, loan review status and delinquency status which are updated as necessary in response to changes including, but not limited to, changes in macroeconomic and/or market conditions, changes in a borrower’s credit risk profile, and changes in the strength of the underlying security, including guarantor status, if a guarantor exists.

Quantitative models may not always be able to capture all reasonable and supportable information that may indicate a SICR. As a result, qualitative factors may be considered to supplement such a gap.

Examples include changes in adjudication criteria for a particular group of borrowers or asset categories or changes in portfolio composition as well as changes in Canadian and US macroeconomic trends attributable to changes in monetary policy, inflation, employment rates, consumer behaviour and geo-political risks.

Expected credit loss model - Estimation of expected credit losses

Expected credit losses are an estimate of a loan’s expected cash shortfalls discounted at the effective interest rate, where a cash shortfall is the difference between the contractual cash flows that are due to the Bank and the cash flows that the Bank actually expects to receive. The ECL calculation is a function of the credit risk parameters; probability of default, loss given default, and exposure at default associated with each loan, sensitized to future market and macroeconomic conditions through the incorporation of forward-looking information derived from multiple economic forecast scenarios, including baseline, upside, and downside scenarios.

The Bank’s ECL model develops contractual cashflow profiles for loans as a function of a number of underlying assumptions and a broad range of input variables. The expected cashflow schedules are subsequently derived from the contractual cashflow schedules, adjusted for incremental default amounts, forgone interest, and recovery amounts. The finalized contractual and expected cashflow schedules are subsequently discounted at the effective interest rate to determine the expected cash shortfall or expected credit losses for each individual loan or other financial instrument.

The ECL model estimates 12 months of expected credit losses for performing loans that have not experienced a SICR since initial recognition and estimates lifetime expected credit losses on performing loans that have experienced a SICR since initial recognition. Further, individual allowances are estimated for loans that are determined to be credit impaired.

Loans or other financial instruments that have not experienced a SICR since initial recognition are designated as stage 1, while loans or other financial instruments that have experienced a SICR since initial recognition are designated as stage 2, and loans or other financial instruments that are determined to be credit impaired are designated as stage 3.

Individual allowances are estimated for loans or other financial instruments that are determined to be credit impaired and that have been designated as stage 3. A loan or other financial instrument is classified as credit impaired when the Bank becomes aware that, before taking into consideration collateral or credit enhancements, all of, or a portion of the contractual cashflows associated with the loan or other financial instrument may be impacted and as a result may not be realized by the Bank under the repayment schedule set out in the contractual terms associated with the loan or other financial instrument. Loans or other financial instruments for which interest or principal is contractually past due 90 days are automatically recognized as stage 3, however in estimating expected credit losses for stage 3 loans or other financial instruments, management takes into consideration whether the loan or other financial instrument is fully secured or is in the process of collection and whether collection efforts are reasonably expected to result in repayment of the loan or other financial instrument.

Forward-looking Information

The Bank incorporates the impact of future economic conditions, or more specifically forward-looking information into the estimation of expected credit losses at the credit risk parameter level. This is accomplished via the credit risk parameter models and proxy datasets that the Bank utilizes to develop probability of default (“PD”), and loss given default (“LGD”), term structure forecasts for its loans. The Bank has sourced credit risk modeling systems and forecast macroeconomic scenario data from Moody’s Analytics, a third-party service provider for the purpose of computing forward-looking credit risk parameters under multiple macroeconomic scenarios that consider both market-wide and idiosyncratic factors and influences. These systems are used in conjunction with the Bank’s internally developed ECL models. Given that the Bank has experienced very limited historical loan losses and, therefore, does not have available statistically significant loss data inventory for use in developing internal, forward looking expected credit loss trends, the use of unbiased, third-party forward-looking credit risk parameter modeling systems is particularly important for the Bank in the context of the estimation of expected credit losses.

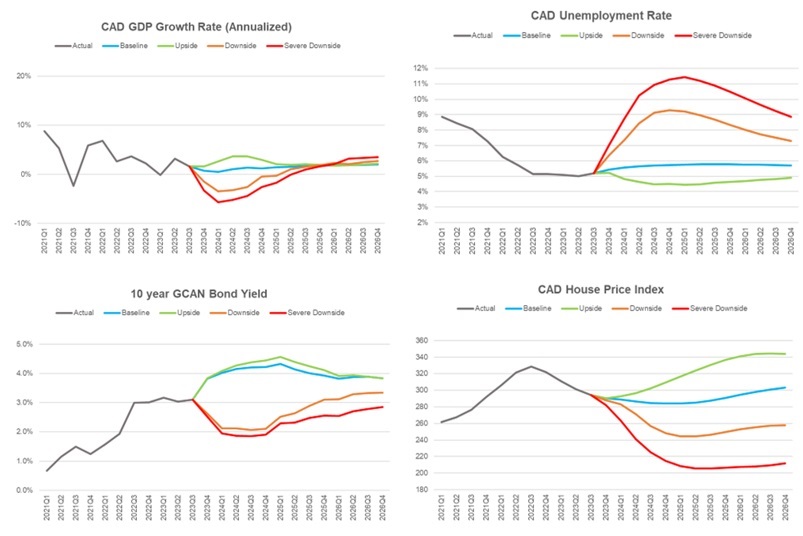

The Bank utilizes macroeconomic indicator data derived from multiple macroeconomic scenarios in order to mitigate volatility in the estimation of expected credit losses, as well as to satisfy the IFRS 9 requirement that future economic conditions are to be based on an unbiased, probability-weighted assessment of possible future outcomes. More specifically, the macroeconomic indicators set out in the macroeconomic scenarios are used as inputs for the credit risk parameter models utilized by the Bank to sensitize the individual PD and LGD term structure forecasts to the respective macroeconomic trajectory set out in each of the scenarios (see Expected Credit Loss Sensitivity below). Currently the Bank utilizes upside, downside and baseline forecast macroeconomic scenarios, and assigns discrete weights to each for use in the estimation of its reported ECL. The Bank has also applied expert credit judgement, where appropriate, to reflect, amongst other items, uncertainty in the Canadian and US macroeconomic environments.

The macroeconomic indicator data utilized by the Bank for the purpose of sensitizing PD and LGD term structure data to forward economic conditions include, but are not limited to: GDP, the Canadian national unemployment rate, long term interest rates, the consumer price index, the S&P/TSX Index and the price of oil. These specific macroeconomic indicators were selected in an attempt to ensure that the spectrum of fundamental macroeconomic influences on the key drivers of the credit risk profile of the Bank’s balance sheet, including but not limited to: corporate, consumer and real estate market dynamics; corporate, consumer and SME borrower performance; geography; as well as collateral value volatility, are appropriately captured and incorporated into the Bank’s forward macroeconomic sensitivity analysis.

Key assumptions driving the base case macroeconomic forecast trends this quarter include: interest rates straining household finances but wage growth continues to support consumer spending; higher interest rates cause housing prices to continue to retreat, albeit modestly; real GDP slows measurably by the end of 2023 but a recession is avoided and unemployment increases only modestly due to the strength of the labour market; inflation continues to decline but lingers and results in the Bank of Canada undertaking a protracted process to returning to a neutral policy rate in late 2025; the impact of the crisis in Ukraine on global commodity prices and trade continues to diminish; public health restrictions do not return even as new COVID-19 case counts occasionally spike; and, supply-chain stress continues to ease.

Management developed ECL estimates using credit risk parameter term structure forecasts sensitized to individual baseline, upside and downside forecast macroeconomic scenarios, each weighted at 100%, and subsequently computed the variance of each to the Bank’s reported ECL as at July 31, 2023 in order to assess the alignment of the Bank’s reported ECL with the Bank’s credit risk profile, and further, to assess the scope, depth and ultimate effectiveness of the credit risk mitigation strategies that the Bank has applied to its lending portfolios.

Expected credit loss sensitivity:

The following table presents the sensitivity of the Bank’s estimated ECL to a range of individual macroeconomic scenarios, that in isolation may not reflect the Bank’s actual expected ECL exposure, as well as the variance of each to the Bank’s reported ECL as at July 31, 2023:

| (thousands of Canadian dollars) |

||||||||||||||||

| Reported |

100 | % | 100 | % | 100 | % | ||||||||||

| ECL |

Upside |

Baseline |

Downside |

|||||||||||||

| Allowance for expected credit losses |

$ | 2,697 | $ | 1,751 | $ | 2,242 | $ | 3,117 | ||||||||

| Variance from reported ECL |

(946 | ) | (455 | ) | 420 | |||||||||||

| Variance from reported ECL (%) |

(35 | %) | (17 | %) | 16 | % | ||||||||||

The following table provides a reconciliation of the Bank’s ECL allowance by lending asset category for the three months ended July 31, 2023:

| (thousands of Canadian dollars) |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

||||||||||||

| Point-of-sale loans and leases |

||||||||||||||||

| Balance at beginning of period |

$ | 627 | $ | - | $ | - | $ | 627 | ||||||||

| Transfer in (out) to Stage 1 |

52 | (52 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(85 | ) | 85 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

52 | (33 | ) | - | 19 | |||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

19 | - | - | 19 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 646 | $ | - | $ | - | $ | 646 | ||||||||

| Commercial real estate mortgages |

||||||||||||||||

| Balance at beginning of period |

$ | 1,647 | $ | 120 | $ | - | $ | 1,767 | ||||||||

| Transfer in (out) to Stage 1 |

14 | (14 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(106 | ) | 106 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

138 | 44 | - | 182 | ||||||||||||

| Loan originations |

56 | - | - | 56 | ||||||||||||

| Derecognitions and maturities |

(94 | ) | (5 | ) | - | (99 | ) | |||||||||

| Provision for (recovery of) credit losses |

8 | 131 | - | 139 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 1,655 | $ | 251 | $ | - | $ | 1,906 | ||||||||

| Commercial real estate loans |

||||||||||||||||

| Balance at beginning of period |

$ | 59 | $ | - | $ | - | $ | 59 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

(5 | ) | - | - | (5 | ) | ||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

(4 | ) | - | - | (4 | ) | ||||||||||

| Provision for (recovery of) credit losses |

(9 | ) | - | - | (9 | ) | ||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 50 | $ | - | $ | - | $ | 50 | ||||||||

| Public sector and other financing |

||||||||||||||||

| Balance at beginning of period |

$ | 70 | $ | 3 | $ | - | $ | 73 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

(8 | ) | 8 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

(4 | ) | 10 | - | 6 | |||||||||||

| Loan originations |

16 | - | - | 16 | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

4 | 18 | - | 22 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 74 | $ | 21 | $ | - | $ | 95 | ||||||||

| Total balance at end of period |

$ | 2,425 | $ | 272 | $ | - | $ | 2,697 | ||||||||

The following table provides a reconciliation of the Bank’s ECL allowance by lending asset category for the three months ended July 31, 2022:

| (thousands of Canadian dollars) |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

||||||||||||

| Point-of-sale loans and leases |

||||||||||||||||

| Balance at beginning of period |

$ | 419 | $ | - | $ | - | $ | 419 | ||||||||

| Transfer in (out) to Stage 1 |

16 | (16 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(45 | ) | 45 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

138 | (29 | ) | - | 109 | |||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

109 | - | - | 109 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 528 | $ | - | $ | - | $ | 528 | ||||||||

| Commercial real estate mortgages |

||||||||||||||||

| Balance at beginning of period |

$ | 948 | $ | 101 | $ | - | $ | 1,049 | ||||||||

| Transfer in (out) to Stage 1 |

16 | (16 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(88 | ) | 88 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

49 | (38 | ) | - | 11 | |||||||||||

| Loan originations |

64 | - | - | 64 | ||||||||||||

| Derecognitions and maturities |

(10 | ) | (18 | ) | - | (28 | ) | |||||||||

| Provision for (recovery of) credit losses |

31 | 16 | - | 47 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 979 | $ | 117 | $ | - | $ | 1,096 | ||||||||

| Commercial real estate loans |

||||||||||||||||

| Balance at beginning of period |

$ | 40 | $ | - | $ | - | $ | 40 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

9 | - | - | 9 | ||||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

9 | - | - | 9 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 49 | $ | - | $ | - | $ | 49 | ||||||||

| Public sector and other financing |

||||||||||||||||

| Balance at beginning of period |

$ | 24 | $ | 1 | $ | - | $ | 25 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

1 | - | - | 1 | ||||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

1 | - | - | 1 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 25 | $ | 1 | $ | - | $ | 26 | ||||||||

| Total balance at end of period |

$ | 1,581 | $ | 118 | $ | - | $ | 1,699 | ||||||||

The following table provides a reconciliation of the Bank’s ECL allowance by lending asset category for the nine months ended July 31, 2023:

| (thousands of Canadian dollars) |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

||||||||||||

| Point-of-sale loans and leases |

||||||||||||||||

| Balance at beginning of period |

$ | 545 | $ | - | $ | - | $ | 545 | ||||||||

| Transfer in (out) to Stage 1 |

122 | (122 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(257 | ) | 257 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

236 | (135 | ) | - | 101 | |||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

101 | - | - | 101 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 646 | $ | - | $ | - | $ | 646 | ||||||||

| Commercial real estate mortgages |

||||||||||||||||

| Balance at beginning of period |

$ | 1,150 | $ | 137 | $ | - | $ | 1,287 | ||||||||

| Transfer in (out) to Stage 1 |

93 | (93 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(224 | ) | 224 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | (13 | ) | 13 | - | |||||||||||

| Net remeasurement of loss allowance |

560 | 6 | (13 | ) | 553 | |||||||||||

| Loan originations |

205 | - | - | 205 | ||||||||||||

| Derecognitions and maturities |

(129 | ) | (10 | ) | - | (139 | ) | |||||||||

| Provision for (recovery of) credit losses |

505 | 114 | - | 619 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 1,655 | $ | 251 | $ | - | $ | 1,906 | ||||||||

| Commercial real estate loans |

||||||||||||||||

| Balance at beginning of period |

$ | 54 | $ | - | $ | - | $ | 54 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

- | - | - | - | ||||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

(4 | ) | - | - | (4 | ) | ||||||||||

| Provision for (recovery of) credit losses |

(4 | ) | - | - | (4 | ) | ||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 50 | $ | - | $ | - | $ | 50 | ||||||||

| Public sector and other financing |

||||||||||||||||

| Balance at beginning of period |

$ | 17 | $ | 1 | $ | - | $ | 18 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

(8 | ) | 8 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

6 | 12 | - | 18 | ||||||||||||

| Loan originations |

59 | - | - | 59 | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

57 | 20 | - | 77 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 74 | $ | 21 | $ | - | $ | 95 | ||||||||

| Total balance at end of period |

$ | 2,425 | $ | 272 | $ | - | $ | 2,697 | ||||||||

The following table provides a reconciliation of the Bank’s ECL allowance by lending asset category for the nine months ended July 31, 2022:

| (thousands of Canadian dollars) |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

||||||||||||

| Point-of-sale loans and leases |

||||||||||||||||

| Balance at beginning of period |

$ | 275 | $ | - | $ | - | $ | 275 | ||||||||

| Transfer in (out) to Stage 1 |

68 | (68 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(130 | ) | 130 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

315 | (62 | ) | - | 253 | |||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

253 | - | - | 253 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 528 | $ | - | $ | - | $ | 528 | ||||||||

| Commercial real estate mortgages |

||||||||||||||||

| Balance at beginning of period |

$ | 980 | $ | 134 | $ | - | $ | 1,114 | ||||||||

| Transfer in (out) to Stage 1 |

38 | (38 | ) | - | - | |||||||||||

| Transfer in (out) to Stage 2 |

(92 | ) | 92 | - | - | |||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

(48 | ) | (49 | ) | - | (97 | ) | |||||||||

| Loan originations |

224 | - | - | 224 | ||||||||||||

| Derecognitions and maturities |

(123 | ) | (22 | ) | - | (145 | ) | |||||||||

| Provision for (recovery of) credit losses |

(1 | ) | (17 | ) | - | (18 | ) | |||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 979 | $ | 117 | $ | - | $ | 1,096 | ||||||||

| Commercial real estate loans |

||||||||||||||||

| Balance at beginning of period |

$ | 45 | $ | - | $ | - | $ | 45 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

4 | - | - | 4 | ||||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

- | - | - | - | ||||||||||||

| Provision for (recovery of) credit losses |

4 | - | - | 4 | ||||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 49 | $ | - | $ | - | $ | 49 | ||||||||

| Public sector and other financing |

||||||||||||||||

| Balance at beginning of period |

$ | 16 | $ | 3 | $ | - | $ | 19 | ||||||||

| Transfer in (out) to Stage 1 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 2 |

- | - | - | - | ||||||||||||

| Transfer in (out) to Stage 3 |

- | - | - | - | ||||||||||||

| Net remeasurement of loss allowance |

10 | (2 | ) | - | 8 | |||||||||||

| Loan originations |

- | - | - | - | ||||||||||||

| Derecognitions and maturities |

(1 | ) | - | - | (1 | ) | ||||||||||

| Provision for (recovery of) credit losses |

9 | (2 | ) | - | 7 | |||||||||||

| Write-offs |

- | - | - | - | ||||||||||||

| Recoveries |

- | - | - | - | ||||||||||||

| Balance at end of period |

$ | 25 | $ | 1 | $ | - | $ | 26 | ||||||||

| Total balance at end of period |

$ | 1,581 | $ | 118 | $ | - | $ | 1,699 | ||||||||

| 6. | Other assets: |

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| 2023 |

2022 |

2022 |

||||||||||

| Accounts receivable |

$ | 3,177 | $ | 3,774 | $ | 3,744 | ||||||

| Prepaid expenses and other |

14,017 | 10,213 | 10,010 | |||||||||

| Property and equipment |

6,687 | 6,868 | 6,965 | |||||||||

| Right-of-use assets |

3,602 | 4,122 | 4,296 | |||||||||

| Deferred tax asset |

2,641 | 2,128 | 2,248 | |||||||||

| Interest rate swap |

1,118 | - | - | |||||||||

| Investment (note 6a) |

953 | 953 | 953 | |||||||||

| Goodwill |

5,754 | 5,754 | 5,754 | |||||||||

| Intangible assets (note 6b) |

10,554 | 9,363 | 9,356 | |||||||||

| $ | 48,503 | $ | 43,175 | $ | 43,326 | |||||||

| a) |

In February 2021, the Bank acquired an 11% investment in Canada Stablecorp Inc. (“Stablecorp”) for cash consideration of $953,000. The Bank has made an irrevocable election to designate this investment at fair value through other comprehensive income at initial recognition and any future changes in the fair value of the investment will be recognized in other comprehensive income (loss). Amounts recorded in other comprehensive income (loss) will not be reclassified to profit and loss at a later date. |

| b) |

As at July 31, 2023, total intangible assets were $10.6 million ( October 31, 2022 - $9.4 million), which includes, $7.7 million ( October 31, 2022 - $6.2 million) in development costs that have been capitalized. |

| 7. | Subordinated notes payable: |

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| 2023 |

2022 |

2022 |

||||||||||

| Issued March 2019, unsecured, non-viability contingent capital compliant, subordinated notes payable, principal amount of $5.0 million, $500,000 is held by related party (note 14), effective interest rate of 10.41%, maturing March 2029. |

$ | 4,916 | $ | 4,908 | $ | 4,906 | ||||||

| Issued April 2021, unsecured, non-viability contingent capital compliant, subordinated notes payable, principal amount of US $75.0 million, effective interest rate of 5.38%, maturing |

96,669 | 100,043 | 93,800 | |||||||||

| $ | 101,585 | $ | 104,951 | $ | 98,706 | |||||||

| 8. | Other liabilities: |

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| 2023 |

2022 |

2022 |

||||||||||

| Accounts payable and other |

$ | 7,265 | $ | 7,662 | $ | 8,317 | ||||||

| Current income tax liability |

4,527 | 5,797 | 3,157 | |||||||||

| Deferred tax liability |

659 | 786 | 769 | |||||||||

| Lease obligations |

3,944 | 4,471 | 4,644 | |||||||||

| Cash collateral and amounts held in escrow |

9,657 | 8,006 | 10,992 | |||||||||

| Cash reserves on loan and lease receivables |

160,148 | 126,110 | 127,047 | |||||||||

| $ | 186,200 | $ | 152,832 | $ | 154,926 | |||||||

| 9. | Share capital: |

a) Common shares:

At July 31, 2023, there were 25,924,424 ( October 31, 2022 - 27,245,782) common shares outstanding.

On August 5, 2022, the Bank received approval from the Toronto Stock Exchange (“TSX”) to proceed with a Normal Course Issuer Bid (“NCIB”) for its common shares. Further, on September 21, 2022, the Bank received approval from the Nasdaq to proceed with a NCIB for its common shares. Pursuant to the NCIB, the Bank may purchase for cancellation up to 1,700,000 of its common shares representing approximately 9.54% of its public float. The Bank’s directors and management believe that the market price of the Bank’s common shares does not reflect the value of the business and its future prospects, and further, reflects a material discount to book value; as such, the purchase of common shares for cancellation at such time is a prudent corporate measure and represents an attractive investment for the Bank.

The Bank was eligible to make purchases commencing on August 17, 2022 and ending on August 16, 2023, or such earlier date as the Bank may complete its purchases pursuant to the NCIB. The purchases will be made by the Bank through the facilities of the TSX and alternate trading systems and in accordance with the rules of the TSX or such alternate trading systems, as applicable, and the prices that the Bank will pay for any common shares will be the market price of such shares at the time of purchase. The Bank will make no purchases of common shares other than open market purchases. All shares purchased under the NCIB will be cancelled.

For the quarter ended July 31, 2023, the Bank purchased and cancelled 79,562 common shares for $734,000, reducing the Bank’s Common Share capital value by $689,000 and retained earnings by $45,000.

For the nine month period ended July 31, 2023, the Bank purchased and cancelled 1,321,358 common shares for $13.3 million, reducing the Bank’s Common Share capital value by $11.4 million and retained earnings by $1.9 million.

b) Preferred shares:

At July 31, 2023, there were 1,461,460 ( October 31, 2022 - 1,461,460) Series 1 preferred shares outstanding. These shares are Basel III compliant, non-cumulative rate reset preferred shares and include non-viability contingent capital (“NVCC”) provisions. As a result, these shares qualify as Additional Tier 1 Capital (see note 15).

c) Stock options

Stock option transactions during the three and nine month periods ended July 31, 2023 and 2022:

| for the three months ended |

for the nine months ended |

|||||||||||||||||||||||||||||||

| July 31, 2023 |

July 31, 2022 |

July 31, 2023 |

July 31, 2022 |

|||||||||||||||||||||||||||||

| Weighted |

Weighted |

Weighted |

Weighted |

|||||||||||||||||||||||||||||

| Number of |

average |

Number of |

average |

Number of |

average |

Number of |

average |

|||||||||||||||||||||||||

| options |

exercise price |

options |

exercise price |

options |

exercise price |

options |

exercise price |

|||||||||||||||||||||||||

| Outstanding, beginning of period |

952,776 | $ | 15.53 | 953,730 | $ | 15.53 | 965,766 | $ | 15.53 | 40,000 | $ | 7.00 | ||||||||||||||||||||

| Granted |

- | - | - | - | 1,500 | 15.90 | 913,730 | 15.90 | ||||||||||||||||||||||||

| Exercised |

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Forfeited/cancelled |

(26,000 | ) | 15.90 | - | - | (40,490 | ) | 15.90 | - | - | ||||||||||||||||||||||

| Expired |

- | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Outstanding, end of period |

926,776 | $ | 15.52 | 953,730 | $ | 15.53 | 926,776 | $ | 15.52 | 953,730 | $ | 15.53 | ||||||||||||||||||||

For the three and nine month periods ended July 31, 2023, the Bank recognized $192,000 ( July 31, 2022 - $424,000) and $727,000 ( July 31, 2022 - $1.0 million) in compensation expense related to the estimated fair value of options granted.

| 10. | Income tax provision: |

Income tax provision for the three and nine months ended July 31, 2023 was $3.8 million ( July 31, 2022 - $2.1 million) and $11.0 million ( July 31, 2022 - $6.0 million) respectively. The current quarter and year to date income tax provisions reflects a deferred tax asset, not previously recognized, associated with DRTC’s non-capital loss carryforwards which is anticipated to be applied to future taxable earnings as well as lower non-deductible expenses over the comparatives. The Bank’s combined statutory federal and provincial income tax rate is approximately 27% (2022 - 27%). The effective rate is affected by certain items not being taxable or deductible for income tax purposes.

| 11. | Income per common share: |

| (thousands of Canadian dollars, except shares outstanding and per share amounts) |

||||||||||||||||

| for the three months ended |

for the nine months ended |

|||||||||||||||

| July 31 |

July 31 |

July 31 |

July 31 |

|||||||||||||

| 2023 |

2022 |

2023 |

2022 |

|||||||||||||

| Net income |

$ | 10,003 | $ | 5,720 | $ | 29,683 | $ | 16,229 | ||||||||

| Less: dividends on preferred shares |

(247 | ) | (247 | ) | (741 | ) | (741 | ) | ||||||||

| 9,756 | 5,473 | 28,942 | 15,488 | |||||||||||||

| Weighted average number of common shares outstanding |

25,957,755 | 27,441,082 | 26,386,915 | 27,441,082 | ||||||||||||

| Income per common share: |

$ | 0.38 | $ | 0.20 | $ | 1.10 | $ | 0.56 | ||||||||

Common shares associated with the Series 1 NVCC preferred shares are contingently issuable shares and would only have a dilutive impact upon issuance. There are 40,000 outstanding employee stock options that are dilutive; however, the impact on the Bank’s income per share calculation is de minimis.

| 12. | Derivative instruments: |

At July 31, 2023, the Bank had an outstanding contract established for asset liability management purposes to swap between fixed and floating interest rates with a notional amount totalling $15.5 million ( October 31, 2022 - $nil), of which $15.5 million ( October 31, 2022 - $nil) qualified for hedge accounting. The Bank enters into interest rate swap contracts for its own account exclusively and does not act as an intermediary in this market. As required under the accounting standard relating to hedges, at July 31, 2023, $1.1 million ( October 31, 2022 - $nil) relating to this contract was included in other assets and the offsetting amount included in the carrying values of the assets to which they relate. Approved counterparties are limited to major Canadian chartered banks.

| 13. | Commitments and contingencies: |

The amount of credit-related commitments represents the maximum amount of additional credit that the Bank could be obligated to extend.

| (thousands of Canadian dollars) |

||||||||||||

| July 31 |

October 31 |

July 31 |

||||||||||

| 2023 |

2022 |

2022 |

||||||||||

| Loan commitments |

$ | 341,679 | $ | 382,851 | $ | 315,757 | ||||||

| Letters of credit |

82,847 | 60,273 | 58,732 | |||||||||

| $ | 424,526 | $ | 443,124 | $ | 374,489 | |||||||

| 14. |

Related party transactions: |

The Bank’s Board of Directors and Senior Executive Officers represent key management personnel and are related parties. At July 31, 2023, amounts due from these related parties totalled $1.5 million ( October 31, 2022 - $1.3 million) and an amount due from a corporation controlled by key management personnel totalled $2.7 million ( October 31, 2022 - $3.9 million). The interest rates charged on loans and advances to related parties are based on mutually agreed-upon terms. Interest income earned on the above loans for the three and nine months ended July 31, 2023, was $26,000 ( July 31, 2022 - $24,000) and $75,000 ( July 31, 2022 - $71,000) respectively. There were no specific provisions for credit losses associated with loans issued to key management personnel ( October 31, 2022 - $nil), and all loans issued to key management personnel were current as at July 31, 2023. $500,000 of the Bank’s $5.0 million subordinated notes payable, issued in March 2019, are held by a related party (note 7).

| 15. | Capital management: |

| a) |

Overview: |

The Bank’s policy is to maintain a strong capital base so as to retain investor, creditor and market confidence as well as to support the future growth and development of the business. The impact of the level of capital held on shareholders’ return is an important consideration, and the Bank recognizes the need to maintain a balance between the higher returns that may be possible with greater leverage and the advantages and security that may be afforded by a more robust capital position.

OSFI sets and monitors capital requirements for the Bank. Capital is managed in accordance with policies and plans that are regularly reviewed and approved by the Board of Directors and that take into account, amongst other items, forecasted capital requirements and current and anticipated financial market conditions.

The goal is to maintain adequate regulatory capital for the Bank to be considered well capitalized, protect consumer deposits and provide capacity to support organic growth as well as to capitalize on strategic opportunities that do not otherwise require accessing the public capital markets, all the while providing a satisfactory return to shareholders. The Bank’s regulatory capital is comprised of share capital, retained earnings and unrealized gains and losses on fair value through other comprehensive income securities (Common Equity Tier 1 capital), preferred shares (Additional Tier 1 capital) and subordinated notes (Tier 2 capital).

The Bank monitors its capital adequacy and related capital ratios on a daily basis and has policies setting internal targets and thresholds for its capital ratios. These capital ratios consist of the leverage ratio and the risk-based capital ratios.

The Bank makes use of the Standardized Approach for credit risk as prescribed by OSFI and, therefore, may include eligible ECL allowance amounts in its Tier 2 capital, up to a maximum of 1.25% of its credit risk-weighted assets calculated under the Standardized Approach.

During the period ended July 31, 2023, there were no material changes in the Bank’s management of capital.

| b) |

Risk-based capital ratios: |

The Basel Committee on Banking Supervision has published the Basel III rules on capital adequacy and liquidity (“Basel III”). OSFI requires that all Canadian banks must comply with the Basel III standards on an “all-in” basis for the purpose of determining their risk-based capital ratios. Required minimum regulatory capital ratios are a 7.0% Common Equity Tier 1 capital ratio (“CET1”), an 8.5% Tier 1 capital ratio and a 10.5% Total capital ratio, all of which include a 2.50% capital conservation buffer.

OSFI also requires banks to measure capital adequacy in accordance with guidelines for determining risk- adjusted capital and risk-weighted assets including off-balance sheet credit instruments as specified in the Basel III regulations. Based on the deemed credit risk for each type of asset, both on and off-balance sheet assets of the Bank are assigned a weighting ranging between 0% to 150% to determine the Bank’s risk- weighted equivalent assets and its risk-based capital ratios.

The Bank’s risk-based capital ratios are calculated as follows:

| (thousands of Canadian dollars) |

||||||||

| July 31 |

October 31 |

|||||||

| 2023 |

2022 |

|||||||

| Common Equity Tier 1 (CET1) capital |

||||||||

| Directly issued qualifying common share capital |

$ | 214,544 | $ | 225,982 | ||||

| Contributed surplus |

2,339 | 1,612 | ||||||

| Retained earnings |

134,461 | 109,335 | ||||||

| Accumulated other comprehensive income |

52 | 99 | ||||||

| CET1 before regulatory adjustments |

351,396 | 337,028 | ||||||

| Regulatory adjustments applied to CET1 |

(11,502 | ) | (11,371 | ) | ||||

| Common Equity Tier 1 capital |

$ | 339,894 | $ | 325,657 | ||||

| Additional Tier 1 capital |

||||||||

| Directly issued qualifying Additional Tier 1 instruments |

$ | 13,647 | $ | 13,647 | ||||

| Total Tier 1 capital |

$ | 353,541 | $ | 339,304 | ||||

| Tier 2 capital |

||||||||

| Directly issued Tier 2 capital instruments |

$ | 103,827 | $ | 107,367 | ||||

| Tier 2 capital before regulatory adjustments |

103,827 | 107,367 | ||||||

| Eligible stage 1 and stage 2 allowance |

2,697 | 1,904 | ||||||

| Total Tier 2 capital |

$ | 106,524 | $ | 109,271 | ||||

| Total regulatory capital |

$ | 460,065 | $ | 448,575 | ||||

| Total risk-weighted assets |

$ | 3,047,172 | $ | 2,714,902 | ||||

| Capital ratios |

||||||||

| CET1 capital ratio |

11.15 | % | 12.00 | % | ||||

| Tier 1 capital ratio |

11.60 | % | 12.50 | % | ||||

| Total capital ratio |

15.10 | % | 16.52 | % | ||||

As at July 31, 2023 and October 31, 2022, the Bank exceeded all of the minimum Basel III regulatory capital requirements prescribed by OSFI.

| c) |

Leverage ratio: |

The leverage ratio, which is prescribed under the Basel III Accord, is a supplementary measure to the risk-based capital requirements and is defined as the ratio of Tier 1 capital to the Bank’s total exposures. The Basel III minimum leverage ratio is 3.0%. The Bank’s leverage ratio is calculated as follows:

| (thousands of Canadian dollars) |

||||||||

| July 31 |

October 31 |

|||||||

| 2023 |

2022 |

|||||||

| On-balance sheet assets |

$ | 3,980,845 | $ | 3,265,998 | ||||

| Assets amounts adjusted in determining the Basel III |

||||||||

| Tier 1 capital |

(11,502 | ) | (11,371 | ) | ||||

| Total on-balance sheet exposures |

3,969,343 | 3,254,627 | ||||||

| Total off-balance sheet exposure at gross notional amount |

$ | 424,526 | $ | 443,124 | ||||

| Adjustments for conversion to credit equivalent amount |

(247,001 | ) | (251,101 | ) | ||||

| Total off-balance sheet exposures |

177,525 | 192,023 | ||||||

| Tier 1 capital |

353,541 | 339,304 | ||||||

| Total exposures |

4,146,868 | 3,446,650 | ||||||

| Leverage ratio |

8.53 | % | 9.84 | % | ||||

As at July 31, 2023 and October 31, 2022, the Bank was in compliance with the leverage ratio prescribed by OSFI.

| 16. |

Interest rate risk position: |

The Bank is subject to interest rate risk, which is the risk that a movement in interest rates could negatively impact net interest margin, net interest income and the economic value of assets, liabilities and shareholders’ equity. The following table provides the duration difference between the Bank’s assets and liabilities and the potential after-tax impact of a 100 basis point shift in interest rates on the Bank’s earnings during a 12 month period.

| (thousands of Canadian dollars) |

||||||||||||||||

| July 31, 2023 |

October 31, 2022 |

|||||||||||||||

| Increase 100 bps |

Decrease 100 bps |

Increase 100 bps |

Decrease 100 bps |

|||||||||||||

| Increase (decrease): |

||||||||||||||||

| Impact on projected net interest income during a 12 month period |

$ | 5,114 | $ | (5,123 | ) | $ | 4,304 | $ | (4,261 | ) | ||||||

| Duration difference between assets and liabilities in months |

(2.3 | ) | 1.4 | |||||||||||||

| 17. |

Fair value of financial instruments: |

Fair values are based on management’s best estimates of market conditions and valuation policies at a certain point in time. The estimates are subjective and involve particular assumptions and judgement and, as such, may not be reflective of future fair values. The Bank’s loans and deposits lack an available market as they are not typically exchanged and, therefore, the book value of these instruments is not necessarily representative of amounts realizable upon immediate settlement. See note 18 of the October 31, 2022 audited Consolidated Financial Statements for more information on fair values.

| (thousands of Canadian dollars) |

||||||||||||||||

| As at |

July 31, 2023 |

October 31, 2022 |

||||||||||||||

| Carrying |

Fair |

Carrying |

Fair |

|||||||||||||

| (thousands of Canadian dollars) |

Value |

Value |

Value |

Value |

||||||||||||

| Assets |

||||||||||||||||

| Cash |

$ | 87,726 | $ | 87,726 | $ | 88,581 | $ | 88,581 | ||||||||

| Securities |

182,944 | 182,944 | 141,564 | 141,564 | ||||||||||||

| Loans |

3,661,672 | 3,636,974 | 2,992,678 | 2,963,676 | ||||||||||||

| Other |

5,248 | 5,248 | 4,727 | 4,727 | ||||||||||||

| Liabilities |

||||||||||||||||

| Deposits |

$ | 3,328,017 | $ | 3,238,741 | $ | 2,657,540 | $ | 2,561,421 | ||||||||

| Subordinated notes payable |

101,585 | 103,827 | 104,951 | 107,367 | ||||||||||||

| Other |

181,014 | 181,014 | 146,249 | 146,249 | ||||||||||||

| 18. | Operating segmentation: |

The Bank has established two reportable operating segments, those being Digital Banking and DRTC (cybersecurity services). The two operating segments are strategic business operations providing distinct products and services to different markets and are separately managed as a function of the distinction in the nature of each business. The following summarizes the operations of each of the reportable segments:

Digital Banking – The Bank employs a branchless business-to-business model using its proprietary financial technology to address underserved segments in the Canadian and US banking markets. VersaBank obtains its deposits and provides the majority of its loans and leases electronically via innovative deposit and lending solutions for financial intermediaries.

DRTC (cybersecurity services and banking and financial technology development) – Leveraging its internally developed IT security software and capabilities, VersaBank established a wholly owned subsidiary, DRT Cyber Inc., to pursue significant large-market opportunities in cybersecurity and develop innovative solutions to address the rapidly growing volume of cyber threats challenging financial institutions, multi-national corporations and government entities.

The basis for the determination of the reportable segments is a function primarily of the systematic, consistent process employed by the Bank’s chief operating decision maker, the Chief Executive Officer, and the Chief Financial Officer in reviewing and interpreting the operations and performance of each segment. The accounting policies applied to these segments are consistent with those employed in the preparation of the Bank’s Consolidated Financial Statements, as disclosed in note 3 of the Bank’s 2022 audited Consolidated Financial Statements.

Performance is measured based on segment net income, as included in the Bank’s internal management reporting. Management has determined that this measure is the most relevant in evaluating segment results and in the allocation of resources.

The following table sets out the results of each reportable operating segment as at and for the three and nine months ended July 31, 2023 and 2022:

| (thousands of Canadian dollars) |

||||||||||||||||||||||||||||||||

| for the three months ended |

July 31, 2023 |

July 31, 2022 |

||||||||||||||||||||||||||||||

| Digital |

DRTC |

Eliminations/ |

Consolidated |

Digital |

DRTC |

Eliminations/ |

Consolidated |

|||||||||||||||||||||||||

| Banking |

Adjustments |

Banking |

Adjustments |

|||||||||||||||||||||||||||||

| Net interest income |

$ | 24,929 | $ | - | $ | - | $ | 24,929 | $ | 20,062 | $ | - | $ | - | $ | 20,062 | ||||||||||||||||

| Non-interest income |

101 | 2,020 | (191 | ) | 1,930 | 12 | 1,206 | (41 | ) | 1,177 | ||||||||||||||||||||||

| Total revenue |

25,030 | 2,020 | (191 | ) | 26,859 | 20,074 | 1,206 | (41 | ) | 21,239 | ||||||||||||||||||||||

| Provision for (recovery of) credit losses |

171 | - | - | 171 | 166 | - | - | 166 | ||||||||||||||||||||||||

| 24,859 | 2,020 | (191 | ) | 26,688 | 19,908 | 1,206 | (41 | ) | 21,073 | |||||||||||||||||||||||

| Non-interest expenses: |

||||||||||||||||||||||||||||||||

| Salaries and benefits |

5,891 | 1,562 | - | 7,453 | 5,600 | 1,168 | - | 6,768 | ||||||||||||||||||||||||

| General and administrative |

4,257 | 380 | (191 | ) | 4,446 | 5,217 | 343 | (41 | ) | 5,519 | ||||||||||||||||||||||

| Premises and equipment |

610 | 370 | - | 980 | 610 | 319 | - | 929 | ||||||||||||||||||||||||

| 10,758 | 2,312 | (191 | ) | 12,879 | 11,427 | 1,830 | (41 | ) | 13,216 | |||||||||||||||||||||||

| Income (loss) before income taxes |

14,101 | (292 | ) | - | 13,809 | 8,481 | (624 | ) | - | 7,857 | ||||||||||||||||||||||

| Income tax provision |

3,999 | (193 | ) | - | 3,806 | 2,099 | 38 | - | 2,137 | |||||||||||||||||||||||

| Net income (loss) |

$ | 10,102 | $ | (99 | ) | $ | - | $ | 10,003 | $ | 6,382 | $ | (662 | ) | $ | - | $ | 5,720 | ||||||||||||||

| Total assets |

$ | 3,971,781 | $ | 25,485 | $ | (16,421 | ) | $ | 3,980,845 | $ | 3,076,611 | $ | 21,796 | $ | (23,064 | ) | $ | 3,075,343 | ||||||||||||||

| Total liabilities |

$ | 3,609,832 | $ | 29,123 | $ | (23,153 | ) | $ | 3,615,802 | $ | 2,725,820 | $ | 24,794 | $ | (21,919 | ) | $ | 2,728,695 | ||||||||||||||

| (thousands of Canadian dollars) |

||||||||||||||||||||||||||||||||

| for the nine months ended |

July 31, 2023 |

July 31, 2022 |

||||||||||||||||||||||||||||||

| Digital |

DRTC |

Eliminations/ |

Consolidated |

Digital |

DRTC |

Eliminations/ |

Consolidated |

|||||||||||||||||||||||||

| Banking |

Adjustments |

Banking |

Adjustments |

|||||||||||||||||||||||||||||

| Net interest income |

$ | 73,812 | $ | - | $ | - | $ | 73,812 | $ | 54,189 | $ | - | $ | - | $ | 54,189 | ||||||||||||||||

| Non-interest income |

225 | 5,999 | (574 | ) | 5,650 | 14 | 4,061 | (124 | ) | 3,951 | ||||||||||||||||||||||

| Total revenue |

74,037 | 5,999 | (574 | ) | 79,462 | 54,203 | 4,061 | (124 | ) | 58,140 | ||||||||||||||||||||||

| Provision for (recovery of) credit losses |

793 | - | - | 793 | 246 | - | - | 246 | ||||||||||||||||||||||||

| 73,244 | 5,999 | (574 | ) | 78,669 | 53,957 | 4,061 | (124 | ) | 57,894 | |||||||||||||||||||||||

| Non-interest expenses: |

||||||||||||||||||||||||||||||||

| Salaries and benefits |

19,505 | 4,634 | - | 24,139 | 16,625 | 2,952 | - | 19,577 | ||||||||||||||||||||||||

| General and administrative |

10,250 | 1,212 | (574 | ) | 10,888 | 12,460 | 826 | (124 | ) | 13,162 | ||||||||||||||||||||||

| Premises and equipment |

1,845 | 1,068 | - | 2,913 | 1,851 | 1,029 | - | 2,880 | ||||||||||||||||||||||||

| 31,600 | 6,914 | (574 | ) | 37,940 | 30,936 | 4,807 | (124 | ) | 35,619 | |||||||||||||||||||||||

| Income (loss) before income taxes |

41,644 | (915 | ) | - | 40,729 | 23,021 | (746 | ) | - | 22,275 | ||||||||||||||||||||||

| Income tax provision |

11,779 | (733 | ) | - | 11,046 | 5,805 | 241 | - | 6,046 | |||||||||||||||||||||||

| Net income (loss) |

$ | 29,865 | $ | (182 | ) | $ | - | $ | 29,683 | $ | 17,216 | $ | (987 | ) | $ | - | $ | 16,229 | ||||||||||||||

| Total assets |

$ | 3,971,781 | $ | 25,485 | $ | (16,421 | ) | $ | 3,980,845 | $ | 3,076,611 | $ | 21,796 | $ | (23,064 | ) | $ | 3,075,343 | ||||||||||||||

| Total liabilities |

$ | 3,609,832 | $ | 29,123 | $ | (23,153 | ) | $ | 3,615,802 | $ | 2,725,820 | $ | 24,794 | $ | (21,919 | ) | $ | 2,728,695 | ||||||||||||||

The Bank has operations in the US, through both its Digital Banking and DRTC businesses, however as at July 31, 2023, substantially all of the Bank’s earnings and assets are based in Canada.

| 19. | Comparative balances: |

Certain comparative balances have been reclassified to conform with the financial statement presentation adopted in the current period.

Exhibit 99.2

Management’s Discussion and Analysis