|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

IRS Employer Identification No.)

|

|

500 North Shoreline, Ste. 800,

Corpus Christi, Texas, U.S.A. |

78401

|

|

|

(U.S. corporate headquarters)

|

(Zip Code)

|

|

|

1830 – 1030 West Georgia Street

Vancouver, British Columbia, Canada |

V6E 2Y3

|

|

|

(Canadian corporate headquarters)

|

(Zip Code)

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

|

●

|

Electrical testing of variable frequency drives, booster pumps, heaters, wellfield recovery pumps, satellite plant pumps and module buildings (header houses);

|

|

●

|

Testing of programmable logic controllers, electronics, auto-valves and communications software for wellfield and plant operations;

|

|

●

|

Testing of leak detection systems;

|

|

●

|

Reattachment of wellfield piping in module buildings;

|

|

●

|

Conversion of lighting in plants and wellfield module buildings to energy efficient LED;

|

|

●

|

Assessment and repair of lines, piping, Ion Exchange (“IX”) columns and valves in the satellite plant;

|

||

|

●

|

IX resin cleaning and testing;

|

|

●

|

Mechanical integrity testing of all wells to be used in resumption of operations;

|

|

●

|

Trunklines pressurized and leak checked; and

|

|

●

|

Preparation of wellfield patterns for operational testing, as described below.

|

|

●

|

Electronic communications between wells and plant (programmable logic controllers, wiring);

|

|

●

|

O2 and CO2 addition rates for optimizing uranium recovery in previously mined areas;

|

|

●

|

Status of leak detection systems at wellheads, Module buildings and trunklines;

|

|

●

|

Well flow rates with a goal to adjust pump sizes to maximize flow and to determine the need for well stimulation processes, if required; and

|

|

●

|

Information on potential requirements for all wellfield Modules for resumption of operations.

|

|

Exhibit

|

Description

|

|

|

99.1

|

||

|

104

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

| URANIUM ENERGY CORP. | |||

| DATE: July 12, 2023. | By: | /s/ Pat Obara | |

| Pat Obara, Secretary and | |||

| Chief Financial Officer | |||

Exhibit 99.1

|

NYSE AMERICAN: UEC |

Uranium Energy Corp Completes Restart Program at its Christensen Ranch ISR Project in Wyoming

Corpus Christi, TX, July 12, 2023 - Uranium Energy Corp (NYSE American: UEC; “UEC” or the “Company”) is pleased to announce the Company’s plan to accelerate the steps required for a resumption of operations has been completed, enabling a faster restart at the Christensen Ranch in-situ recovery (“ISR”) Project in Wyoming.

Amir Adnani, President and CEO stated: “With demand increasing for uranium supply from stable geopolitical jurisdictions and U.S. national security objectives, we foresee an increasingly urgent need for domestic uranium supply. The fundamental drivers of supply and demand, including pending legislation to ban Russian uranium imports to the United States, are translating into rising uranium prices that have accelerated UEC’s production readiness program. In that regard, we have been working towards restarting production to fulfill the need for domestic uranium and are pleased to provide an update on activities related to resuming operations at the Company’s Christensen Ranch ISR uranium operations in Johnson County, Wyoming.”

Background: UEC acquired Uranium One Americas, Inc. (“U1A”) from Russia’s State Atomic Energy Corporation, Rosatom, in December 2021. The repatriation of the assets to U.S. ownership has been a transformative acquisition for UEC, positioning the Company as the largest, fully permitted, low-cost ISR project resource base of any U.S. based producer.

The U1A U.S. portfolio was assembled starting in 2007 with the acquisition of Energy Metals Corp. and subsequently Cogema Resources Inc. The portfolio is anchored by the Irigaray Central Processing Plant (“CPP”) and includes over 20 uranium projects, 100,000 acres of land and 4 fully permitted ISR projects. These assets include Christensen Ranch ISR Operations that, combined with early Irigaray production, produced over six million lbs. of uranium before being placed on standby in 2018 in care and maintenance. During this period, key production infrastructure, including its wellfields and the satellite ion exchange plant, have been maintained, and now upgraded and refurbished to facilitate a fast restart. Uranium recovered from Christensen Ranch will be processed at UEC’s Irigaray CPP.

The Irigaray CPP is the centerpiece of the Company’s Wyoming ISR Hub and Spoke operations. The Irigaray CPP was originally constructed by Westinghouse Electric Corporation and was later expanded by U1A in 2010, adding two resin elution circuits and additional precipitation capacity. The Irigaray CPP is one of the largest uranium CPPs in the U.S., licensed for 2.5 million lbs. of uranium production per year with pending plans to increase the licensed capacity to 4 million lbs. per year.

Irigaray CPP Exterior

|

NYSE AMERICAN: UEC |

Irigaray CPP Interior, North and South Elution Circuits

Irigaray Filter Press and Yellowcake Thickener

The first Company project (“Spoke”) to feed the Irigaray CPP Hub will be the Christensen Ranch Project. The Company has been working steadily at Christensen Ranch since the beginning of this year to move out of care and maintenance and advance towards resuming production.

Preparations for Resumption of Operations:

Production readiness activities at Christensen Ranch have included, among others:

|

● |

Electrical testing of variable frequency drives, booster pumps, heaters, wellfield recovery pumps, satellite plant pumps and module buildings (header houses); |

|

● |

Testing of programmable logic controllers, electronics, auto-valves and communications software for wellfield and plant operations; |

|

● |

Testing of leak detection systems; |

|

● |

Reattachment of wellfield piping in module buildings; |

|

● |

Conversion of lighting in plants and wellfield module buildings to energy efficient LED; |

|

NYSE AMERICAN: UEC |

|

● |

Assessment and repair of lines, piping, Ion Exchange (“IX”) columns and valves in the satellite plant; |

|

● |

IX resin cleaning and testing; |

|

● |

Mechanical integrity testing of all wells to be used in resumption of operations; |

|

● |

Trunklines pressurized and leak checked; and |

|

| ● | Preparation of wellfield patterns for operational testing, as described below. |

Christensen Ranch Satellite Plant Exterior

Christensen Ranch Satellite Plant Interior

|

NYSE AMERICAN: UEC |

The orebody at Christensen Ranch ISR Project is divided into tracts of injection and recovery wells. These tracts of wells are called “Mine Units” for production management. Each Mine Unit is then subdivided into groups of injection and recovery wells that are operated individually; these groups are called “Modules”, also known as “header-houses”, where each well is connected to a manifold that connects to pipelines that carry the recovery solutions to the satellite IX plant.

Each Mine Unit typically contains 600 to 800 injection and recovery wells, depending upon the orebody configuration, with each Module having an average of 90 to 100 injection and recovery wells. This configuration allows great flexibility in operations, allowing operation of all Modules in a Mine Unit, or just one Module, as well as individual wells in each Module, and as many Modules in the various Mine Units as desired. All wells are controlled electronically and can be started and stopped in the Module buildings and at the satellite plant operations control room.

Christensen Ranch Mine Unit 10, showing wells and two Module Buildings

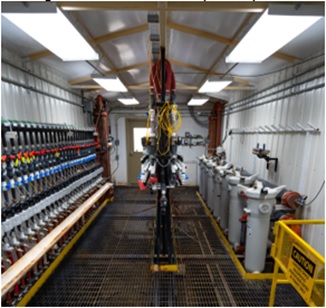

Christensen Ranch Module 10-6 Building Interior

|

NYSE AMERICAN: UEC |

UEC has also conducted a series of operational tests in the Mine Units at Christensen Ranch. Two Modules located in Mine Units 8 and 10 have had testing completed to establish operating parameters for each Mine Unit. UEC has operated these Modules by circulating recovered mining solutions to test injection and recovery systems while adding oxygen (“O2”) and carbon dioxide (“CO2”) to the injection stream at varying rates during the testing. The tests evaluated:

|

● |

Electronic communications between wells and plant (programmable logic controllers, wiring); |

|

● |

O2 and CO2 addition rates for optimizing uranium recovery in previously mined areas; |

|

● |

Status of leak detection systems at wellheads, Module buildings and trunklines; |

|

● |

Well flow rates with a goal to adjust pump sizes to maximize flow and to determine the need for well stimulation processes, if required; and |

|

● |

Information on potential requirements for all wellfield Modules for resumption of operations. |

This work will allow UEC to rapidly resume operations in the existing and partially mined areas of Mine Units 7, 8 and 10.

Installation of New Wellfield

The Company is also pleased to announce plans for the completion of well installation at Christensen Ranch in Modules 10-7 and 10-8 that will complete Mine Unit 10. Previous development drilling in Mine Unit 10 was terminated through six Modules (10-6). The drilling and well installation program for Modules 10-7 and 10-8 consists of the completion of 180 recovery and injection wells and is planned to commence in August of this year. Although not required for initial startup, these new wellfield Modules will be installed and available for ramp up to meet production requirements.

About Uranium Energy Corp

Uranium Energy Corp is the fastest growing supplier of the fuel for the green energy transition to a low carbon future. UEC is the largest, diversified North American focused uranium company, advancing the next generation of low-cost, environmentally friendly ISR mining uranium projects in the United States and high-grade conventional projects in Canada. The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming. These two production platforms are anchored by fully operational central processing plants and served by seven U.S. ISR uranium projects with all their major permits in place. Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of U.S. warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp., the only royalty company in the sector; and (3) a pipeline of resource stage uranium projects. The Company’s operations are managed by professionals with decades of hands-on experience in the key facets of uranium exploration, development and mining.

For additional information, please contact:

Uranium Energy Corp Investor Relations

Toll Free: (866) 748-1030

Fax: (361) 888-5041

E-mail: info@uraniumenergy.com

Twitter: @UraniumEnergy

Stock Exchange Information:

NYSE American: UEC

Frankfurt Stock Exchange Symbol: U6Z

WKN: AØJDRR

ISN: US916896103

|

NYSE AMERICAN: UEC |

Safe Harbor Statement

Except for the statements of historical fact contained herein, the information presented in this news release constitutes “forward-looking statements” as such term is used in applicable United States and Canadian securities laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, variations in the underlying assumptions associated with the estimation or realization of mineral resources, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labor disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Many of these factors are beyond the Company’s ability to control or predict. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the SEC. For forward-looking statements in this news release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.