UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: March 25, 2023

or

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to ______

Commission File Number: 000-03905

TRANSCAT, INC.

(Exact name of registrant as specified in its charter)

| Ohio |

16-0874418 |

|

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

35 Vantage Point Drive, Rochester, New York 14624

(Address of principal executive offices) (Zip Code)

(585) 352-7777

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

| Common Stock, $0.50 par value |

TRNS |

Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☒ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on September 23, 2022 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $488.1 million. The market value calculation was determined using the closing sale price of the registrant’s common stock on September 23, 2022, as reported on the Nasdaq Global Market.

The number of shares of common stock of the registrant outstanding as of June 1, 2023 was 7,642,916.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be held on September 6, 2023 have been incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this report.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Forward-Looking Statements. This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to expectations, estimates, beliefs, assumptions and predictions of future events and are identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “goal,” “seek,” “strategy,” “target,” “intends,” “could,” “may,” “will,” “would,” “tends,” and other similar words. Forward-looking statements are not statements of historical fact and thus are subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or those expressed in such forward-looking statements. You should evaluate forward-looking statements in light of important risk factors and uncertainties that may affect our operating and financial results and our ability to achieve our financial objectives. These factors include, but are not limited to, general economic conditions applicable to our business, inflationary impacts, the impact of widespread public health crises, the highly competitive nature of the industries in which we compete and in the nature of our two business segments, the concentration of Service segment customers in the life science and other FDA-regulated and industrial manufacturing industries, the significant competition we face in our Distribution segment, any impairment of our goodwill or intangible assets, tariffs and trade relations, our ability to successfully complete and integrate business acquisitions, cybersecurity risks, the risk of significant disruptions in our information technology systems, our ability to recruit, train and retain quality employees, skilled technicians and senior management, fluctuations in our operating results, our ability to achieve or maintain adequate utilization and pricing rates for our technical service providers, the prices we are able to charge for our services in our Service segment, competition in the rental market, our ability to adapt our technology, reliance on our enterprise resource planning system, technology updates, supply chain delays or disruptions, the risks related to current and future indebtedness, foreign currency rate fluctuations, risks related to our intellectual property, adverse weather events or other catastrophes or natural disasters, the volatility of our stock price, the relatively low trading volume of our common stock, changes in tax rates, changes in accounting standards, legal requirements and listing standards, and legal and regulatory risks related to our international operations. These risk factors and uncertainties are more fully described by us under the heading “Risk Factors” in Item IA. of Part I of this report. You should not place undue reliance on our forward-looking statements. Except as required by law, we undertake no obligation to update, correct or publicly announce any revisions to any of the forward-looking statements contained in this report, whether as a result of new information, future events or otherwise.

BUSINESS OVERVIEW

Transcat, Inc. (“Transcat”, the “Company,” “we” or “us”) is a leading provider of accredited calibration services, enterprise asset management services, and value-added distributor of professional grade handheld test, measurement and control instrumentation. We are focused on providing services and products to highly regulated industries, particularly the life science industry, which includes pharmaceutical, biotechnology, medical device and other FDA-regulated businesses. Additional industries served include FAA-regulated businesses, including aerospace and defense industrial manufacturing; energy and utilities, including oil and gas and alternative energy; and other industries that require accuracy in their processes, confirmation of the capabilities of their equipment, and for which the risk of failure is very costly.

We conduct our business through two operating segments: service (“Service”) and distribution (“Distribution”). See Note 7 to our Consolidated Financial Statements in this report for financial information for these segments. We concentrate on attracting new customers in each segment, retaining existing customers and cross-selling to customers to increase our total revenue. We serve approximately 30,000 customers through our Service and Distribution segments, with approximately 20% to 25% of those customers transacting with us through both of our business segments.

Through our Service segment, we offer calibration, repair, inspection, analytical qualifications, preventative maintenance, consulting and other related services, a majority of which are processed through our proprietary asset management system, CalTrak® and our online customer portal, C3®. Our Service model is flexible, and we cater to our customers’ needs by offering a variety of services and solutions including permanent and periodic onsite services, mobile calibration services, pickup and delivery and in-house services. As of the end of our fiscal year ended March 25, 2023 (“fiscal year 2023”), we operated twenty-seven calibration service centers (“Calibration Service Centers”) strategically located across the United States, Puerto Rico, Canada and Ireland. We also serve our customers onsite at their facilities for daily, weekly or longer-term periods. In addition, we have several imbedded customer-site locations that we refer to as “client-based labs,” where we provide calibration services, and in some cases other related services, exclusively for the customer and where we reside and work every day. We also have a fleet of mobile calibration laboratories that can provide service at customer sites which may not have the space or utility capabilities we require to service their equipment.

Through the Company’s acquisition strategy, we have been focused on building out our Services segment by entering adjacent and complimentary markets. This has been demonstrated by the acquisitions of Elite Calibration, LLC ("Elite"), Galium Limited (d/b/a Complete Calibrations) ("Complete Calibrations"), e2b Calibration ("e2b"), and Charlton Jeffmont Inc., Raitz Inc. and Toolroom Calibration Inc. d/b/a Alliance Calibration ("Alliance") in fiscal year 2023, and the acquisitions of Tangent Labs, LLC ("Tangent"), Cal OpEx Limited (d/b/a Transcat Ireland) which owns all of the issued and outstanding capital stock of its U.S. based subsidiary, Cal OpEx Inc. (d/b/a NEXA EAM), a Delaware corporation (collectively, "NEXA"), and Upstate Metrology Inc. ("Upstate Metrology") in our fiscal year ended March 26, 2022 ("fiscal year 2022").

NEXA provides asset management services to the biopharmaceutical industry by leveraging its six service tracks: (i) calibration, (ii) maintenance and spare, (iii) reliability, (iv) computerized maintenance management systems solutions (“CMMS”), (v) quality and compliance, and (vi) validation. By delivering these services, NEXA is able to provide unique value to their end customers in managing their asset portfolios, avoiding asset downtime and helping to accelerate delivery of their life changing products to market, ultimately driving significant cost savings and improved reliability. This NEXA suite of services, combined with the existing Transcat service offerings, provides a very comprehensive and robust value proposition to existing and new customers, which allows us to manage the complexity that is tied to doing business in these highly regulated industries.

All of our Calibration Service Centers have obtained ISO/IEC 17025:2017 scopes of accreditation. Our accreditations are the cornerstone of our quality program, which we believe is among the best in the industry. Our dedication to quality is highly valued by businesses that operate in the industries we serve, particularly those in life science and other regulated industries, and our accreditations provide our customers with confidence that they will receive a consistent and uniform service, regardless of which of our service centers completes the service.

Through our Distribution segment, we sell and rent national and proprietary brand instruments to customers globally. Through our website, in-house sales team and printed and digital marketing materials, we offer access to more than 140,000 test, measurement and control instruments, including products from approximately 550 leading brands. Most instruments we sell and rent require calibration service to ensure that they maintain the most precise measurements. By having the capability to calibrate these instruments at the time of sale and at regular post-sale intervals, we can give customers a value-added service that most of our competitors are unable to provide. Calibrating before shipping means the customer can place their instruments into service immediately upon receipt, reducing downtime. Other value-added options we offer through our Distribution segment include equipment kitting (which is especially valued in the power generation sector), equipment rentals and used equipment sales.

Our commitment to quality goes beyond the services and products we deliver. Our sales, customer service and support teams provide expert advice, application assistance and technical support to our customers. Since calibration is an intangible service, our customers rely on us to uphold high standards and provide integrity in our people and processes.

Our customers include leading manufacturers in the life science/pharmaceutical, energy, defense, aerospace and industrial process control sectors. We believe our customers do business with us because of our integrity and commitment to quality service, our broad range of product and service offerings, our proprietary asset management system, CalTrak®, and our online customer portal, C3®. In our fiscal years 2023 and 2022, no customer or controlled group of customers accounted for 5% or more of our total revenue. The loss of any single customer would not have a material adverse effect on our business, cash flows, balance sheet, or results of operations.

Transcat was incorporated in Ohio in 1964. We are headquartered in Rochester, New York. Our executive offices are located at 35 Vantage Point Drive, Rochester, New York 14624. Our telephone number is 585-352-7777. Our website is www.transcat.com. Information available on our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K. We trade on the Nasdaq Global Market under the ticker symbol “TRNS”.

OUR STRATEGY

Our two operating segments are highly complementary in that their offerings are of value to customers within the same industries. Our strategy is to leverage the complementary nature of our operating segments in ways that add value for all customers who select Transcat as their source for test and measurement equipment and/or calibration and laboratory instrument services. We strive to differentiate ourselves within the markets we serve and build barriers to competitive entry by offering a broad range of products and services and by integrating these solutions in a value-added manner to benefit our customers’ operations.

During fiscal year 2023, we continued our commitment to capital, people and leadership investments, advancing our “Operational Excellence” initiative. This initiative is resulting in increased productivity and operational efficiency and further differentiation from our competitors as we leverage technology, automation, and process improvements to enhance our effectiveness and our customers’ experiences. We also continued Transcat University’s build-a-tech program. This program attracts fresh talent to the organization and provides training and career advancement opportunities for our existing employees. Our Operational Excellence initiative is a multi-year, ever-evolving program designed to create an infrastructure that supports our strategic goals over a longer timeframe.

Within the Service segment, our strategy is to drive double-digit revenue growth through both organic expansion and acquisitions. We have adopted an integrated sales model to drive sales and capitalize on the cross-selling opportunities between our two segments, especially leveraging our Distribution relationships to develop new Service relationships. We leverage these relationships with our unique value proposition which resonates strongly with customers who rely on accredited calibration services and/or laboratory instrument services to maintain the integrity of their processes and/or meet the demands of regulated business environments. Our customer base values our superior quality programs and requires precise measurement capability in their processes to minimize risk, waste and defects. We execute this strategy by leveraging our quality programs, metrology expertise, geographical footprint, qualified technicians, breadth of capabilities, and tailored service delivery options. Together, this allows us to meet the most rigorous quality demands of our most highly regulated customers while simultaneously being nimble enough to meet their business needs.

We expect to continue to grow our Service business organically by taking market share from other third-party providers and original equipment manufacturers (“OEMs”), as well as by targeting the outsourcing of in-house calibration labs as multi-year client-based lab contracts. We believe an important element in taking market share is our ability to expand into new technical capabilities and adjacent service solutions that are in demand by our current and target customer base.

The other component to our Service growth strategy is acquisitions. There are three drivers of our acquisition strategy: geographic expansion, increased capabilities and infrastructure leverage. The majority of our acquisition opportunities have been in the $500 thousand to $10 million annual revenue range, and we are disciplined in our approach to selecting target companies. One focus of our Operational Excellence initiative is to strengthen our acquisition integration process, allowing us to capitalize on acquired sales and cost synergies at a faster pace.

Our Distribution segment strategy is to be the premier distributor and rental source of leading test and measurement equipment while also providing cross-selling opportunities for our Service segment. Through our vendor relationships we have access to more than 140,000 products, which we market to our existing and prospective customers both with and without value-added service options that are unique to Transcat. In addition to offering pre-shipment value-added services, we offer our customers the options of renting selected test and measurement equipment or buying used equipment, furthering our ability to answer all of our customers’ test and measurement equipment needs. We continuously evaluate our offerings to add new in-demand vendors or products, or remove less relevant vendors and products. Our equipment rental business continues to be a strong growth segment for us and helps support our distribution and service segment growth strategies. Having new, used and rental equipment further differentiates us from our Service segment competitors.

We see these various methods of meeting our Distribution customers’ needs as a way to differentiate ourselves and to diversify this segment’s customer base from its historically niche market. This differentiation and diversification strategy has been deliberately instituted in recent years as a means to mitigate the effect of price-driven competition and to lessen the impact that any particular industry or market will have on the overall performance of this segment.

As part of our growth strategy, we completed four acquisitions during our fiscal year 2023 and three acquisitions during our fiscal year 2022:

| ● | Effective February 2, 2023, Transcat acquired substantially all of the assets of Elite, a California based provider of pipette calibration services. | |

| ● |

Effective September 28, 2022, Transcat purchased all of the outstanding capital stock of Complete Calibrations, an Irish company. Complete Calibrations is an ISO 17025 accredited calibration company specializing in calibration services for the life sciences industry. |

|

| ● | Effective September 27, 2022, Transcat acquired substantially all of the assets of e2b, an Ohio based provider of calibration services. | |

| ● | Effective May 31, 2022, Transcat acquired substantially all of the assets of Alliance, an Ohio based provider of calibration services. | |

| ● |

Effective December 31, 2021, Transcat purchased all of the outstanding membership units of Tangent, a privately-held company. Tangent provides in-house and on-site calibrations of precision measurement and control instrumentation to customers in the life science, aerospace and other regulated industries, and has lab locations in Indianapolis, Indiana and Huntsville, Alabama. |

| ● |

Effective August 31, 2021, Transcat purchased all of the outstanding capital stock of NEXA. NEXA provides calibration optimization and other technical solutions to improve asset and reliability management programs to pharmaceutical, biotechnology, and medical device companies worldwide. |

| ● |

Effective April 29, 2021, Transcat acquired substantially all of the assets of Upstate Metrology, a New York based provider of calibration services. |

Our acquisition strategy primarily targets service businesses that expand our geographic reach, increase the depth and/or breadth of our service capabilities and expertise and leverage our infrastructure. The table below illustrates the strategic drivers for the acquisitions described above:

| Geographic |

Increased |

Leveraged |

|

| Elite | ✓ | ||

| Complete Calibrations | ✓ | ✓ | |

| e2b | ✓ | ✓ | |

| Alliance | ✓ | ✓ | |

| Tangent |

✓ |

✓ |

|

| NEXA |

✓ |

✓ |

|

| Upstate Metrology |

✓ |

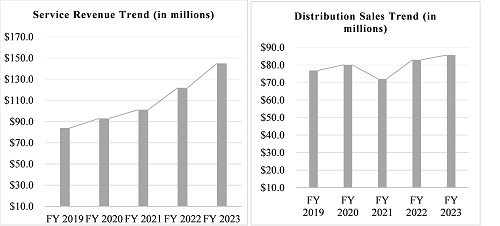

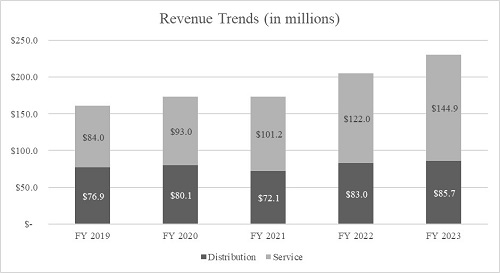

We believe our combined Service and Distribution segment offerings, experience, technical expertise and integrity create a unique and compelling value proposition for our customers, and we intend to continue to grow our business through organic revenue growth and business acquisitions. We consider the attributes of our Service segment, which include higher gross margins and recurring revenue streams from customers in regulated industries to be more compelling and scalable than our legacy Distribution segment. For this reason, we expect our Service segment to be the primary source of revenue and earnings growth in future fiscal years. The charts below illustrate Service, Distribution and consolidated revenue over the past five years:

SEGMENTS

Service Segment

Calibration. Calibration is the act of comparing a unit or instrument of unknown value to a standard of known value and reporting the result in some specifically defined form. After the calibration has been completed, a decision is made, based on rigorously defined parameters, regarding what, if anything, should be done to the unit to conform to the required standards or specifications. The decision may be to adjust, optimize or repair a unit; limit the use, range or rating of a unit; scrap the unit; or leave the unit as is. The purpose of calibration is to significantly reduce the risk of product or process failures caused by inaccurate measurements. In addition to its being an element of quality control and risk management, calibration improves an operation’s productivity and efficiency to optimal levels by assuring accurate, reliable instruments and processes.

The need for calibration is often driven by regulation, which identifies a requirement for quality calibration and laboratory instrument services as a critical component of a company’s business operation. We specifically target industries and companies that are regulated by the U.S. FDA, FAA or other regulatory bodies. As a result of the various levels of regulation within our target industries, our customers’ calibration and laboratory instrument service sourcing decisions are generally made based on the provider’s quality systems, accreditation, reliability, trust, customer service and documentation of services. To maintain our competitive position in this segment, we maintain internationally recognized third-party accredited quality systems, further detailed in the section entitled “Service Quality” below, and provide our customers with access to proprietary asset management software solutions, which offer tools to manage their internal calibration programs and provide them with visibility to their service records.

Through our Service segment, we perform recurring periodic calibrations (typically ranging from three-month to twenty-four month intervals) on new and customer-owned instruments. We perform approximately 800,000 calibrations annually and can address a significant majority of the items requested to be calibrated with our in-house capabilities. For customers’ calibration needs in less common and highly specialized disciplines, we subcontract some calibrations to third-party vendors that have unique or proprietary capabilities. While typically representing approximately 13% to 15% of our Service segment revenue, we believe the management of these items is highly valued by our customers and providing this service has enabled us to continue our pursuit of having the broadest calibration offerings in these targeted markets. We regularly review outsourced services to identify opportunities for in-house capability expansion.

Continuous Improvement. Through NEXA we provide technical, consulting, and staffing solutions in the US, Canada, Ireland, Europe, and Asia Pacific to improve asset management programs for our most highly-regulated customers, especially those in the pharmaceutical, biotechnology, and medical device industries. NEXA offers six service tracks that support the creation or optimization of our client’s enterprise asset management program. Whether a facility is in preconstruction, operational or decommissioning stage, NEXA’s experienced teams can deliver results in all phases of the asset lifecycle. NEXA’s full suite of services or combination solutions are customizable to meet our customer’s unique needs.

Other Services. We provide other services to our customers such as inspection, repair and consulting services, which appeal to customers across all sectors in our customer base. These are generally value-added services and allow us to provide “one-stop shopping” for our customers.

Service Value Proposition. Our calibration services strategy encompasses multiple ways to manage a customer’s calibration and laboratory instrument service needs:

| ● |

We offer an “Integrated Calibration Service Solution” that provides a complete wrap-around service, which can be delivered in the following ways: |

| ● |

in-house services: services are performed at one of our twenty-seven Calibration Service Centers (often accompanied by pick-up and delivery services); |

|

| ● |

periodic onsite services: Transcat technicians travel to a customer’s location, including aboard vessels docked at shipyards, and provide bench-top or in-line calibration or laboratory services on predetermined service cycles; |

|

| ● |

client-based-laboratory services: Transcat establishes and manages a calibration service program within a customer’s facility; and |

|

| ● |

mobile calibration services: services are completed on a customer’s property within one of our mobile calibration units. |

| ● |

For companies that maintain an internal calibration operation, we can provide: |

| ● |

calibration of their primary calibration assets, also called “standards”; and |

|

| ● |

overflow capability, either onsite or at one of our Calibration Service Centers, during periods of high demand. |

| ● |

Enterprise Asset Management |

| ● |

Calibration – criticality risk assessment; calibration interval analysis; calibration plans/task lists; planning and scheduling. |

|

| ● |

Maintenance and Spares – PM optimization; spares/BOM management; PM plans/task lists; planning and scheduling. |

|

| ● |

Reliability – asset criticality assessments; asset hierarchy development; PdM plans/task lists; FMECA/RCA. |

|

| ● |

CMMS – implementation and migration; data optimization; business intelligence; CMMS KPIs/reporting. |

|

| ● |

Quality and Compliance – technical writing; compliance audits; remediation; compliance management. |

|

| ● |

Validation – validation master plan; confidence assessment model; validation interval analysis; validation method/process optimization. |

Inclusive with all the above services, we provide total program management including logistics, remediation and consultation services when needed.

We strive to provide the broadest accredited calibration offering to our targeted markets, which includes certification of our technicians pursuant to the American Society for Quality standards, complete calibration management encompassing the entire metrology function, and access to our complementary service and product offerings. We believe our calibration services are of the highest technical and quality levels, with broad ranges of accreditation.

Our compliance services strategy is to identify and establish long-term relationships with life science research and development and manufacturing customers who require analytical qualifications, validation, remediation and/or preventative maintenance services. In most cases, these customers are life science companies, including pharmaceutical and biotechnology companies engaged in research and development and manufacturing, which are subject to extensive government regulation. The services we provide to these regulated customers are typically a critical component of the customer’s overall compliance program. Because many laboratory instrument service customers operate in regulated industries, these same customers typically also require accredited calibration services. This requirement allows a natural synergy between our laboratory instrument and calibration services. Our strategy includes cross-selling our services within our customer accounts to maximize our revenue opportunities with each customer.

Proprietary Asset Management Software. CalTrak® is our proprietary documentation and asset management software which is used to integrate and manage both the workflow of our Calibration Service Centers and our customers’ assets. With CalTrak®, we are able to provide our customers with timely and consistent calibration service while optimizing our own efficiencies. CalTrak® has been validated to U.S. federal regulations 21 CFR Part 820.75 and 21 CFR Part 11, as applicable. This validation is important to pharmaceutical and other FDA-regulated industries where federal regulations can be particularly stringent.

Additionally, C3® provides our customers with web-based asset management capability and a safe and secure off-site archive of calibration and other service records that can be accessed 24 hours a day through our secure password-protected website. C3® stands for Compliance, Control and Cost, and we see these as the major areas of focus for our clients within the regulatory environment as it relates to instrument calibration. We specifically designed C3® to assist our customers in increasing efficiency, driving compliance to quality system and enhancing control of instrumentation, all while bringing their overall metrology costs down. Understanding the regulated environments that our clients operate within, we customized the platform to allow for single system of record utilization via capabilities that allow clients to track and manage instruments maintained internally in addition to instruments supported by Transcat. C3® is validated to 21 CFR Part 820.75 and 21 CFR Part 11 to meet stringent FDA requirements.

Through CalTrak® and C3®, each customer calibration is tracked and automatically cross-referenced to the assets used to perform the calibration, providing traceability.

Service Marketing and Sales. Under our integrated sales model, we have both inside and outside sales teams that seek to acquire new customers in our targeted markets by leveraging our unique value proposition, including our broad geographic footprint and comprehensive suite of services. We target regulated, enterprise customers with multiple manufacturing operations throughout North America and Europe. We leverage our ability to manage the complete life cycle of instrumentation from purchase of calibrated equipment to long-term service and maintenance requirements. Connecting all the dots by using new and used product sales, rentals, and repair and calibration services is the goal of our marketing and sales initiatives. We also have a team of customer success managers focused on delivering ever-increasing value for our existing customers. We utilize print media, trade shows and web-based initiatives to market our services to customers and prospective customers with a strategic focus in the highly regulated industries including life science and other FDA-regulated industries, aerospace and defense, energy and utilities, and chemical manufacturing. We also target industrial manufacturing and other industries that appreciate the value of quality calibrations.

Service Competition. The calibration services industry is highly fragmented and is composed of companies ranging from internationally recognized and accredited OEMs to non-accredited sole proprietors as well as companies that perform their own calibrations in-house, resulting in a tremendous range of service levels and capabilities. A large percentage of calibration companies are small businesses that generally do not have a range of capabilities as broad as ours. There are also several companies with whom we compete that have national or regional operations.

We differentiate ourselves from our competitors by demonstrating our commitment to quality, expanding upon the largest 17025 scope of accreditation and calibration capabilities of any commercial calibration laboratory that are tailored to the markets we serve, leveraging a geographical footprint that spans North America and Puerto Rico providing a comprehensive suite of services that spans many disciplines and hundreds of manufacturers which is not limited to certain product lines or brands. Our unique ability to bundle our products with our compliance and calibration services also provides a high level of differentiation from our competitors. As one of the only North American compliance and calibration service providers who also distributes product, our customers can seamlessly replace instruments that cannot be calibrated or are otherwise deemed to be at end of life. Our close knowledge of the products we distribute also allows our service staff to consult and advise customers on what products are best suited for their in-house calibration needs. We also believe that our proprietary software is a key differentiator from our competitors. CalTrak® and C3® are utilized by our customers in an integrated manner, providing a competitive barrier as customers realize synergies and efficiencies as a result of this integration.

Competition for laboratory instrument services is composed of both small local and regional service providers and large multi-national OEMs. We believe we are generally financially stronger, service a larger customer base and are typically able to offer a larger suite of services than many of the small local and regional competitors. The large OEMs may offer specialized services and brand-specific expertise which we do not offer, but they are generally focused on providing specialized services only for their proprietary brands and product lines, rather than servicing an array of brands and product lines as we do. We believe our competitive advantages in the laboratory instrument services market are our financial and technical resources, turnaround time, and flexibility to react quickly to customers’ needs. The breadth of our suite of laboratory instrument service, combined with our calibration service offerings, also differentiates us from our competitors by allowing us to be our customers’ one-source accredited services provider for their entire calibration and compliance programs.

Service Quality. The accreditation process is the only system currently in existence that validates measurement competence. To ensure that the quality and consistency of our calibrations are consistent with the global metrology network, designed to standardize measurements worldwide, we have sought and achieved international levels of quality and accreditation to provide uniformity across all locations with advanced levels of training for our technical staff. Our Calibration Service Centers are accredited to ISO/IEC 17025:2017 by ANSI-ASQ National Accreditation Board (“ANAB”) and other accrediting bodies. These accrediting bodies are International Laboratory Accreditation Cooperation Mutual Recognition Arrangement (“ILAC MRA”) signatories, are proficient in the technical aspects of the chemistry and physics that underlie metrology, and provide an objective, third-party, internationally accepted evaluation of the quality, consistency, and competency of our calibration processes. Accreditation also requires that all measurement standards used for accredited measurements have a fully documented path, known as Metrological Traceability, through the National Institute of Standards and Technology or the National Research Council (the National Measurement Institutes for the United States and Canada, respectively), or to other national or international standards bodies, or to measurable conditions created in our Calibration Service Centers, or accepted fundamental and/or natural physical constants, ratio type of calibration, or by comparison to consensus standards, all inclusive of measurement uncertainties.

The importance of this international oversight to our customers is the assurance that our service documentation will be accepted worldwide, removing one of the barriers to trade that they may experience if using a calibration laboratory provider whose accrediting body is not an ILAC MRA signatory. To provide the widest range of services to our customers in our target markets, our ISO/IEC 17025:2017 accreditations extend across many technical disciplines, including working-level and reference-level capabilities. We believe our scope of accreditation to ISO/IEC 17025:2017 to be the broadest for the industries we serve.

To reinforce our belief in the importance of calibration quality, we are leveraging a branding campaign for our Service segment that is centered around three simple words – “Calibrated by Transcat®”. We believe we have established a strong, differentiated brand that has a deep and meaningful association with quality, compliance and control. We want the phrase “Calibrated by Transcat®” to be synonymous with risk reduction and quality compliance.

Acquired calibration labs might use other quality registration systems. We continually evaluate when to integrate acquired quality systems with the focus on minimizing business disruptions and disruptions to our customers while maintaining our commitment to quality.

Our scopes of accreditation can be found at http://www.transcat.com/calibration-services/accreditation/calibration-lab-certificates.

Distribution Segment

Distribution Summary. We distribute professional grade test, measurement and control instrumentation throughout North America and internationally. Our customers use test and measurement instruments to ensure that their processes, and ultimately their end products, are within specification. Utilization of such diagnostic instrumentation also allows for continuous improvement processes to be in place, increasing the accuracies of their measurements. The industrial test and measurement instrumentation market, in those geographic areas where we predominately operate, has historically been serviced by broad-based national equipment distributors and niche or specialty-focused organizations such as Transcat. We offer value-added services such as calibration/certification of equipment purchases, equipment rentals, used equipment for sale, and equipment kitting.

We believe that a customer chooses a distributor based on a number of different criteria, including product availability, price, ease of doing business, timely delivery and accuracy of orders, consistent product quality, technical competence of the representative serving them and availability of value-added services. The decision to buy is generally made by plant engineers, quality managers, or their purchasing personnel, and products are typically obtained from one or more distributors as replacements, upgrades, or for expansion of manufacturing and research and development facilities. As a result, sales to Distribution customers are somewhat unpredictable and potentially non-recurring. Our online presence, including our website and e-newsletters, master catalog, supplemental mailings, and other sales and marketing activities are designed to create interest and maintain a constant presence in front of our customers to ensure we receive the order when they are ready to purchase.

We provide our customers with value-added services, including technical support, to ensure our customers receive the right product for their application, and more comprehensive instrument suitability studies to customers in regulated industries who are concerned about the technical uncertainties that their testing or in-process instruments may bring to a process. We consider our biggest value-added service for our Distribution customers is the option to have calibration service performed on their new product purchases prior to shipment, allowing them to place newly acquired equipment directly into service upon receipt, saving downtime. We also offer online procurement, credit card payment options, same day shipment of in-stock items, kitted products, the option to rent, training programs and a variety of custom product offerings. Items are regularly added to and deleted from our product offerings on the basis of customer demand, recommendations of suppliers, sales volumes and other factors. Because of the breadth of our product and service offerings, we are often a “one-stop shop” for our customers who gain operational efficiency by dealing with just one distributor for most or all of their test and measurement instrumentation needs.

We continue to focus on higher margin channels such as rentals to bolster profitability in the Distribution segment. To remain competitive, we are focusing on brand consolidation along with inventory investments to support our overall strategy of being a value-added distributor that supports our customers and Service segment. Additional areas of focus include consumable products within the life science market which is intended to offset competitive pressures in our legacy distribution business.

Distribution Marketing and Sales. We market, create demand and sell to our customers through multiple direct sales channels including our website, digital and print advertising, proactive outbound sales and an inbound call center. Our outbound and inbound sales teams are staffed with technically trained personnel who are available to help guide product selection. Our website serves as a sales channel for our products and services, and provides search capability, detailed product information, in-stock availability, selection guides, demo videos and downloadable product specification sheets. We have made investments in our website to implement the latest marketing technologies which allow us to provide an intuitive customer experience, with simple product comparison and quoting, ease at checkout and automated post-order follow-up. We also operate and maintain several industry-specific service websites, obtained through recent acquisitions. For example, the URL www.pipettes.com was obtained in connection with the acquisition of TTE Laboratories, Inc. (now known as pipettes.com). Pipettes.com focuses on selling pipettes, pipette supplies and related services to customers.

We use a multichannel approach to reach our customers and prospective customers including our master catalog, periodic supplemental catalogs, website, e-newsletters, and other direct sales and marketing programs. Our digital marketing strategy includes ongoing investment in search engine optimization, application-specific digital content, pay-per-click search engine advertising, and product listings on online marketplaces such as Amazon and Google Shopping. We continue to invest in back-end technologies designed to provide a seamless customer experience across all our marketing channels.

As a result of strong relationships with our product vendors and our historical marketing program results, we have the opportunity to carry out co-branded marketing initiatives, aimed at our existing customers and our prospective customer base, for which we receive cooperative advertising support. These co-branded marketing initiatives typically feature specific vendors, new products or targeted product categories and take the form of direct mailers, web-based initiatives or outbound sales efforts.

Distribution Competition. The distribution market for industrial test and measurement instrumentation is fragmented and highly competitive. Our competitors range from large national distributors and manufacturers that sell directly to customers to small local distributors and online distributors. Key competitive factors typically include customer service and support, quality, lead time, inventory availability, brand recognition and price. To address our customers’ needs for technical support and product application assistance, we employ a staff of highly trained technical sales specialists. In order to maintain this competitive advantage, technical training is an integral part of developing our sales staff. To differentiate ourselves from competitors, we offer pre-shipment calibration or performance data reports which allow customers to receive our products and immediately place them into service, saving them downtime and money.

Online distributors, including Amazon which typically sells lower price-point products, have become prominent competitors for sales of handheld test and measurement equipment, competing primarily on price. While online competitors lack the value-added services we offer in our Distribution segment, they have been successful in capturing some market share in the worldwide market for test and measurement instruments. To stay ahead of growing competition from these online distributors and in keeping with the general trend of increased use of e-commerce, we continue to invest in our digital platform including a well-indexed website with improved design and functionality. In addition, we have diversified our offerings by expanding the brands and product lines that we offer and adding higher gross margin equipment rentals and used equipment sales, which we believe makes Transcat unique among our competitors.

Distribution Suppliers and Purchasing. We believe that effective purchasing is a key element to maintaining and enhancing our position as a provider of high-quality test and measurement instruments. We frequently evaluate our purchase requirements and suppliers’ offerings to obtain products at the best possible cost. We obtain our products from approximately 550 suppliers of brand name and private-labeled equipment. In fiscal year 2023, our top 10 vendors accounted for approximately 60% of our aggregate Distribution sales. In fiscal year 2023, lead times for the supply of products from our vendors was still challenging as the backlog increased year-over-year.

We plan our product mix and inventory stock to best serve the anticipated needs of our customers, whose individual purchases vary in size. We can usually ship our top selling products to our customers the same day they are ordered.

Distribution Vendor Rebates. We have agreements with certain product vendors that provide for rebates based on meeting a specified cumulative level of purchases and/or incremental distribution sales. These rebates are recorded as a reduction of cost of distribution sales. Purchase rebates are calculated and recorded quarterly based upon our volume of purchases with specific vendors during the quarter. Point of sale rebate programs that are based on year-over-year sales performance on a calendar year basis are recorded as earned, on a quarterly basis, based upon the estimated level of annual achievement. Point of sale rebate programs that are based on year-over-year sales performance on a quarterly basis are recorded as earned in the respective quarter. During fiscal year 2022, the volume of our Distribution sales resulted in an increase in the rebates earned from our vendors. During fiscal year 2023, we saw a decrease in the rebates offered by our vendors. The Company recorded vendor rebates of $0.6 million and $1.0 million in fiscal years 2023 and 2022, respectively, as a reduction of cost of distribution sales.

Distribution Operations. Our Distribution operations primarily take place at our 48,500 square-foot facility in Rochester, New York which includes 17,000 square feet of warehouse space. The Rochester location also serves as our corporate headquarters, houses our customer service, sales and administrative functions, and is a Calibration Service Center. We also have two smaller warehouse facilities. Our Wisconsin warehouse fulfills orders for certain large industrial scales and our Houston, Texas warehouse fulfills orders for used equipment and rental equipment. In fiscal year 2023, we shipped approximately 30,000 product orders.

Distribution Backlog. Distribution orders include orders for instruments that we routinely stock in our inventory, customized products, and other products ordered less frequently, which we do not stock. Pending product shipments are primarily backorders, but also include products that are requested to be calibrated in one of our Calibration Service Centers prior to shipment, orders required by the customer to be shipped complete or at a future date, and other orders awaiting final credit or management review prior to shipment. Our total backlog was $8.1 million and $7.7 million as of March 25, 2023 and March 26, 2022, respectively.

CUSTOMER SERVICE AND SUPPORT

Key elements of our customer service approach are our business development sales team, outbound sales team, account management team, inbound sales and customer service organization. To ensure the quality of service provided, we monitor our customer service through customer surveys, call monitoring and daily statistical reports.

Customers may place orders via:

| ● |

Mail to Transcat, Inc., 35 Vantage Point Drive, Rochester, NY 14624; |

| ● |

Telephone at 1-800-828-1470; |

| ● |

Email at sales@transcat.com; |

| ● |

Online at www.transcat.com; or |

| ● |

Fax at 1-800-395-0543 |

INFORMATION REGARDING EXPORT SALES

In fiscal year 2023, approximately 10% of our total revenue resulted from sales to customers outside the United States. Of those export sales in fiscal year 2023, approximately 7% were denominated in U.S. dollars, 69% were denominated in Canadian dollars and 24% were denominated in Euros. Our revenue is subject to the customary risks of operating in an international environment, including the potential imposition of trade or foreign exchange restrictions, tariff and other tax increases, fluctuations in exchange rates and unstable political situations, any one or more of which could have a material adverse effect on our business, cash flows, balance sheet or results of operations. See “Foreign Currency” in Item 7A. of Part II and Note 7 to our Consolidated Financial Statements in this report for further details.

INFORMATION SYSTEMS

We utilize a turnkey enterprise software solution from Infor, Inc. (“Infor”) called Application Plus to manage our business and operations segments. This software includes a suite of fully integrated modules to manage our business functions, including customer service, warehouse management, inventory management, financial management, customer relations management and business intelligence. This solution is a fully mature business package and has been subject to more than 20 years of refinement. We utilize customer relationship management (“CRM”) software offered by SalesForce.com, Inc., which is strategically partnered with Infor, allowing us to fully integrate the CRM software with our Infor enterprise software.

We also utilize CalTrak®, our proprietary document and asset management system, to manage documentation, workflow and customers’ assets within and amongst most of our Calibration Service Centers. In addition to functioning as an internal documentation, workflow, and asset management system, CalTrak®, through C3®, provides customers with web-based calibration cycle management service and access to documentation relating to services completed by Transcat. Certain recent acquisitions utilize either third-party or their own proprietary calibration management systems. We continually evaluate when to integrate these acquired systems with a focus on obtaining operational synergies while imposing minimal disruption to customers.

INTELLECTUAL PROPERTY

We have federally registered trademarks for Transcat®, CalTrak®, C3® and Procision® which we consider to be of material importance to our business. The registrations for these trademarks are in good standing with the U.S. Patent & Trademark Office. Our CalTrak® trademark is also registered in Canada for one class with the Canada Intellectual Property Office and in Puerto Rico. Our trademark registrations must be renewed at various times, and we intend to renew our trademarks, as necessary, for the foreseeable future.

In addition, we own www.transcat.com, www.transcat.ca and pipettes.com among other Internet domain names. As with phone numbers, we do not have, and cannot acquire any property rights to an Internet address. The regulation of domain names in the United States and in other countries is also subject to change. Regulatory bodies could establish additional top-level domains, appoint additional domain name registrars or modify the requirements for holding domain names. As a result, we might not be able to maintain our domain names or obtain comparable domain names, which could harm our business.

SEASONALITY

Our business has certain historical seasonal factors. Historically, our fiscal third and fourth quarters have been stronger than our fiscal first and second quarters due to the operating cycles of our industrial sector customers. Our Distribution segment has historically been strongest in our third fiscal quarter while Service has historically been strongest in our fourth fiscal quarter.

FISCAL YEAR

We operate on a 52/53-week fiscal year, ending the last Saturday in March. In a 52-week fiscal year, each of the four quarters is a 13-week period. In a 53-week fiscal year, the last quarter is a 14-week period. Fiscal years 2023 and 2022 each consisted of 52 weeks. Fiscal year 2024 which ends on March 30, 2024 (“fiscal year 2024”) will have 53 weeks.

ENVIRONMENTAL MATTERS

We believe that we are in compliance with federal, state, and local provisions relating to the protection of the environment, and that continued compliance will not have any material effect on our capital expenditures, earnings, or competitive position.

HUMAN CAPITAL MANAGEMENT

As of March 25, 2023, we had 1,030 employees, 899 of whom were employed in the United States and 131 employed outside the United States. None of our employees are covered by collective bargaining agreements or work councils. Overall, we consider our employee relations to be good and believe our culture to be central to the success of the Company.

Health and Safety The health and safety of our employees is of utmost importance to us. We are enhancing our Safety Program with additional training and internal risk and hazard assessments. We conduct policy and procedure reviews to ensure compliance with health and safety guidelines and regulatory requirements. We provide protective gear (e.g., eye protection, masks, and gloves) as required by applicable standards and as appropriate. Our goal is to achieve a level of work-related injuries as close to zero as possible through continuous investment in our safety program.

Hiring Practices We seek to recruit and hire the most qualified people for our open positions without regard to protected status (age, color, creed, disability, domestic violence victim status, gender identity, genetic predisposition or carrier status, marital status, national origin, pregnancy, race religion, sex, sexual orientation, status as a protected veteran or as a member of any other protected group or status).

Diversity and Inclusion Recognizing and respecting our employees’ backgrounds and experiences, and our international presence, we strive to maintain a diverse workforce and inclusive work environment everywhere we operate. Our diversity and inclusion principles are reflected in our employee training, in particular with respect to our policies against harassment and bullying and the elimination of bias in the workplace.

Wellness Our Calibrated Wellness Program prioritizes our employees’ well-being and is designed to enhance their health. Our program includes wellness resources, health education, pharmaceutical cost guidance, and a no-cost Employee Assistance Program, which includes worldwide access to visits with mental health care providers. Our program also incentivizes health and well-being by providing reduced health insurance premiums for employees who complete certain actions that encourage health and wellness.

Compensation and Benefits Our compensation and benefits program is designed to attract and reward individuals who demonstrate the ability and desire to enhance our workplace culture, support our values, drive our operational and strategic goals, and create long-term value for our shareholders.

We provide employees with competitive compensation packages that include base salary and may also include annual incentive bonuses and/or long-term incentive awards, depending upon the employee’s position. We believe that a compensation program with both short-term and long-term incentive awards provides fair and competitive compensation and aligns employee and shareholder interests. In addition to cash and equity compensation, we also offer employees benefits including health (medical, dental and vision), life, and disability insurance, paid time off, paid parental leave, tuition benefits, and a 401(k) plan.

AVAILABLE INFORMATION

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our filings with the SEC are available on the SEC’s website at www.sec.gov. We also maintain a website at www.transcat.com. We make available, free of charge, in the Investor Relations section of our website, documents we file with or furnish to the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports. We make this information available as soon as reasonably practicable after we electronically file such materials with, or furnish such information to, the SEC. The information found on our website is not part of this or any other report we file with, or furnish to, the SEC. Copies of such documents are available in print at no charge to any shareholder who makes a request. Such requests should be made to our corporate secretary at our corporate headquarters, 35 Vantage Point Drive, Rochester, New York 14624.

You should carefully consider the following risks and all other information included in this report. The risks and uncertainties described below and elsewhere in this report are not the only ones facing our business. If any of the following risks were to actually occur, our business, financial condition or results of operations would likely suffer.

Macroeconomic and Business Risks

Adverse changes in economic and market conditions, including rising inflation, or uncertainty about future market conditions, may result in increased costs of operations and negatively impact the credit and securities markets generally, which could have a material adverse effect on our results of operations and the market price of our common stock. Our results of operations and the implementation of our business strategy could be materially and adversely affected by general conditions in the U.S. and global economy, including financial and economic conditions that are outside of our control. We are subject to risks arising from adverse changes in general economic market conditions, including supply chain delays or interruptions, labor shortages, wage pressures, rising inflation, volatility in the banking industry, geopolitical events, global health crises, including epidemics and pandemics such as the COVID-19 pandemic, or interruptions and other force majeure events.

Inflation has accelerated in the U.S. and globally due in part to global supply chain issues, a rise in energy prices, and strong consumer demand. An inflationary environment can increase our cost of labor as well as our energy and other operating costs which may have a material adverse impact on our financial results. In addition, economic conditions could impact and reduce the number of customers who purchase our products or services as credit becomes more expensive or unavailable. Although interest rates have increased and are expected to increase further, inflation may continue. Further, increased interest rates could have a negative effect on the securities markets generally which may, in turn, have a material adverse effect on the market price of our common stock. Further, uncertainty about future economic conditions could negatively affect our current and prospective customers causing them to delay purchase of services or test and measurement instruments. Poor economic conditions could materially and adversely impact our business, financial condition, operating results and cash flows.

The impact of widespread public health crises, pandemics or other epidemics is difficult to predict and could materially and adversely affect our business and results of operations. Any adverse widespread public health developments in locations where we conduct business, as well as any governmental restrictive measures implemented to control such outbreaks and consumer responses to such outbreaks, could have a material adverse impact on our business and results of operations. These impacts, which are highly uncertain and cannot be accurately predicted, could be significant and long term. Further, any actions taken to mitigate any health crises could lead to an economic recession. For example, the COVID-19 pandemic and the efforts to control it caused significantly increased economic uncertainty, inflationary pressure in the U.S. and globally, supply chain disruptions, volatility in the capital markets, a decline in consumer confidence, changes in consumer behavior, significant economic deterioration, and an increasingly competitive labor market.

The ultimate impact of the COVID-19 pandemic or any other widespread public health crisis on our business and results of operations will depend on, among other things, the severity and length of the health crisis, the duration, effectiveness and extent of the mitigation measures and actions designed to contain the outbreak, the emergence, contagiousness and threat of new and different strains of the disease, the availability and efficacy of vaccines and effective treatments, public acceptance of vaccines and treatments for the disease, if any, changes in customer and consumer behavior as a result of the crisis, as well as the resulting economic conditions and how quickly and to what extent normal economic and operating conditions resume, all of which are highly uncertain. Such extraordinary events and their aftermaths can cause investor fear and panic, which could further materially and adversely affect our operations, the economies in which we operate, and the financial markets generally in ways that cannot necessarily be predicted.

The effects of the COVID-19 pandemic, or any future public health crisis, and mitigation measures taken in response, could have a material and adverse impact on our business and results of operations and may amplify many of the other risk factors disclosed elsewhere in this "Item 1A. Risk Factors."

The industries in which we compete are highly competitive, and we may not be able to compete successfully. Within our Service segment, we provide calibration services and compete in an industry that is highly fragmented and is composed of companies ranging from internationally recognized and accredited corporations to non-accredited sole proprietors, resulting in a tremendous range of service levels and capabilities. Also, within our Service segment, we provide compliance services and compete in an industry that is composed of both small local and regional service providers and large multi-national companies who are also OEMs. Within our Service segment, some of our larger competitors may have broader service capabilities and may have greater name recognition than us. Some manufacturers of the products we sell may also offer calibration and compliance services for their products.

Within our Distribution segment, we compete with numerous companies, including several major manufacturers and distributors. Most of our products are available from several sources and our customers tend to have relationships with several distributors. Competitors in the product distribution industry could also obtain exclusive rights to market particular products, which we would then be unable to market. Manufacturers could also increase their efforts to sell directly to end-users and bypass distributors like us. Industry consolidation among distributors, the unavailability of products, whether due to our inability to gain access to products or interruptions in supply from manufacturers, or the emergence of new competitors could also increase competition and adversely affect our business or results of operations.

In each of the industries in which we compete, some of our competitors have greater financial and other resources than we do, which could allow them to compete more successfully. In the future, we may be unable to compete successfully and competitive pressures may reduce our sales.

Our Service segment has a concentration of customers in the life science and other FDA-regulated and industrial manufacturing industries. A number of our Service segment customers operate in the life science, pharmaceutical and other FDA-regulated or industrial manufacturing industries. This concentration of our customer base affects our overall risk profile, since a significant portion of our customers would be similarly affected by changes in economic, political, regulatory, and other industry conditions. An abrupt or unforeseen change in conditions in these industries could adversely affect customer demand for our services, which could have a material adverse effect on our financial results.

We face significant competition in our Distribution segment, including from suppliers and web-based distributors. We may not be able to compete successfully. We face substantial and increased competition throughout the world, especially in our Distribution segment. The competition is changing, with certain of our vendors engaging directly with customers and web-based distributors continuing to be a presence with increasing their market share. Some of our competitors are much larger than us. Changes in the competitive landscape pose new challenges that could adversely affect our ability to compete. Entry or expansion of other vendors into this market may establish competitors that have larger customer bases and substantially greater financial and other resources with which to pursue marketing and distribution of products. Their current customer base and relationships, as well as their relationships and ability to negotiate with manufacturers, may also provide them with a competitive advantage. Additionally, our vendors who decide to sell directly to customers, may choose to not to sell to us or to provide products to us on less favorable and more costly terms, any of which could have a material and adverse impact on our results of operations. If we are unable to effectively compete with our current and future competitors, our ability to sell products could be harmed and could result in a negative impact on our Distribution segment. Any erosion of our competitive position could have a material adverse effect on our business, results of operations, and financial condition.

Any impairment of goodwill or intangible assets could negatively impact our results of operations. Our goodwill and intangible assets are subject to an impairment test on an annual basis and are also tested whenever events and circumstances indicate that goodwill and/or intangible assets may be impaired. Any excess goodwill and/or indefinite-lived intangible assets value resulting from the impairment test must be written-off in the period of determination. Intangible assets (other than goodwill and indefinite-lived intangible assets) are amortized over the useful life of such assets. In addition, from time to time, we may acquire or make an investment in a business that will require us to record goodwill based on the purchase price and the value of the acquired tangible and intangible assets. We may subsequently experience unforeseen issues with the businesses we acquire, which may adversely affect the anticipated returns of the business or value of the intangible assets and trigger an evaluation of the recoverability of the recorded goodwill and intangible assets for such business. Future determinations of significant write-offs of goodwill or intangible assets because of an impairment test or any accelerated amortization of other intangible assets could have a material negative impact on our results of operations and financial condition.

Tariffs imposed by the U.S. and other countries, as well as changing trade relations, could have a material adverse effect on our business and results of operations. Changes in U.S. and foreign governments’ trade policies have resulted in, and may continue to result in, tariffs on imports into and exports from the U.S. Tariffs on certain products can increase our costs of doing business. If we are unable to recover these costs, our profit margins may be negatively impacted. Diminished trade relations between the U.S. and other countries, as well as any escalation of tariffs, could have a material adverse effect on our financial performance and results of operations.

Risks Related to Acquisitions

We may not successfully integrate business acquisitions. We completed four acquisitions during fiscal year 2023 and three acquisitions during fiscal year 2022. If we fail to accurately assess and successfully integrate any recent or future business acquisitions, we may not achieve the anticipated benefits, which could result in lower revenues, unanticipated operating expenses, reduced profitability and dilution of our book value per share. Successful integration of acquisitions involves many challenges, including:

| ● |

The difficulty of integrating acquired operations and personnel with our existing operations; |

| ● |

Implementation or remediation of controls, procedures, and policies at the acquired company; |

| ● |

Integration of the acquired company’s accounting and other administrative systems; |

| ● |

In the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks associated with specific countries; |

| ● |

Currency and regulatory risks associated with operations in foreign countries; |

| ● |

The difficulty of developing and marketing new products and services; |

| ● |

The diversion of our management’s attention as a result of evaluating, negotiating and integrating acquisitions; |

| ● |

Our exposure to unforeseen liabilities of acquired companies; and |

| ● |

The loss of key employees of an acquired operation. |

In addition, an acquisition could adversely impact cash flows and/or operating results, and dilute shareholder interests, for many reasons, including:

| ● |

Charges to our income to reflect the impairment of acquired intangible assets, including goodwill; |

| ● |

Contingent consideration payments; |

| ● |

Agreements to provide indemnification for certain potential liabilities; |

| ● |

Interest costs and debt service requirements for any debt incurred in connection with an acquisition or new business venture; and |

| ● |

Any issuance of securities in connection with an acquisition or new business venture that dilutes or lessens the rights of our current shareholders. |

If the integration of any or all of our acquisitions or future acquisitions is not successful, it could have a material adverse impact on our operating results and stock price.

Our future business acquisition efforts may not be successful, which may limit our growth or adversely affect our results of operations, and financing of any future acquisitions could result in shareholder dilution and/or increase our leverage. Business acquisitions are an important part of our growth strategy. If we identify an appropriate acquisition candidate, we may not be able to successfully negotiate terms or finance the acquisition. If economic downturns or other matters of national or global concern continue for an extensive period of time or recur, our ability to pursue and consummate potential acquisitions could be materially adversely affected. In addition, to successfully complete targeted acquisitions, we may issue additional equity securities that could dilute our stockholders’ ownership, or we may incur additional debt, which could increase our leverage and our risk of default under our existing credit facility. If we fail to successfully acquire businesses, our growth and results of operations could be materially and adversely affected.

Operational Risks

Cybersecurity incidents could adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information and/or damage to our business relationships, all of which could negatively impact our business, results of operations or financial condition. We rely extensively on information technology (“IT”) systems, some of which are provided by third parties, to support our business activities, including for orders and the storage, processing and transmission of our electronic, business-related, information assets used in or necessary to conduct business. The data we store and process may include customer payment information, personal information concerning our employees, confidential financial information and other types of sensitive business-related information. Numerous and evolving cybersecurity threats pose potential risks to the security of our IT systems, networks and services, as well as the confidentiality, availability and integrity of our data. Some of our office personnel work in remote environments which may exacerbate various cybersecurity risks to our business, including an increased risk of phishing and other social engineering attacks, and an increased risk of unauthorized dissemination of sensitive personal, proprietary or other confidential information. Global cybersecurity threats can range from uncoordinated individual attempts to gain unauthorized access to our IT systems to sophisticated and targeted measures known as advanced persistent threats. The techniques used in these attacks change frequently and may be difficult to detect for periods of time and we may face difficulties in anticipating and implementing adequate preventative measures. While we employ comprehensive measures to prevent, detect, address and mitigate these threats (including access controls, data encryption, vulnerability assessments, management training, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems), cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data or proprietary information and the disruption of business operations. The potential consequences of a material cybersecurity incident include reputational damage, compromised employee, customer, or third-party information, litigation with third parties, regulatory actions, and increased cybersecurity protection and remediation costs, which in turn could adversely affect our business and results of operations. We maintain insurance intended to cover certain cybersecurity events, but such insurance may not cover all risks and losses that we experience. In addition, the laws and regulations governing security of data on IT systems and otherwise held by companies is evolving and adding layers of complexity in the form of new requirements and increasing costs of attempting to protect IT systems and data and complying with new cybersecurity regulations.