false

0000814676

0000814676

2023-05-05

2023-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): May 5, 2023

CPS TECHNOLOGIES CORP.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

0-16088

|

|

04-2832509

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

111 South Worcester Street

|

|

02766

|

|

Norton,

|

|

MA

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (508) 222-0614

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value

|

|

CPSH

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

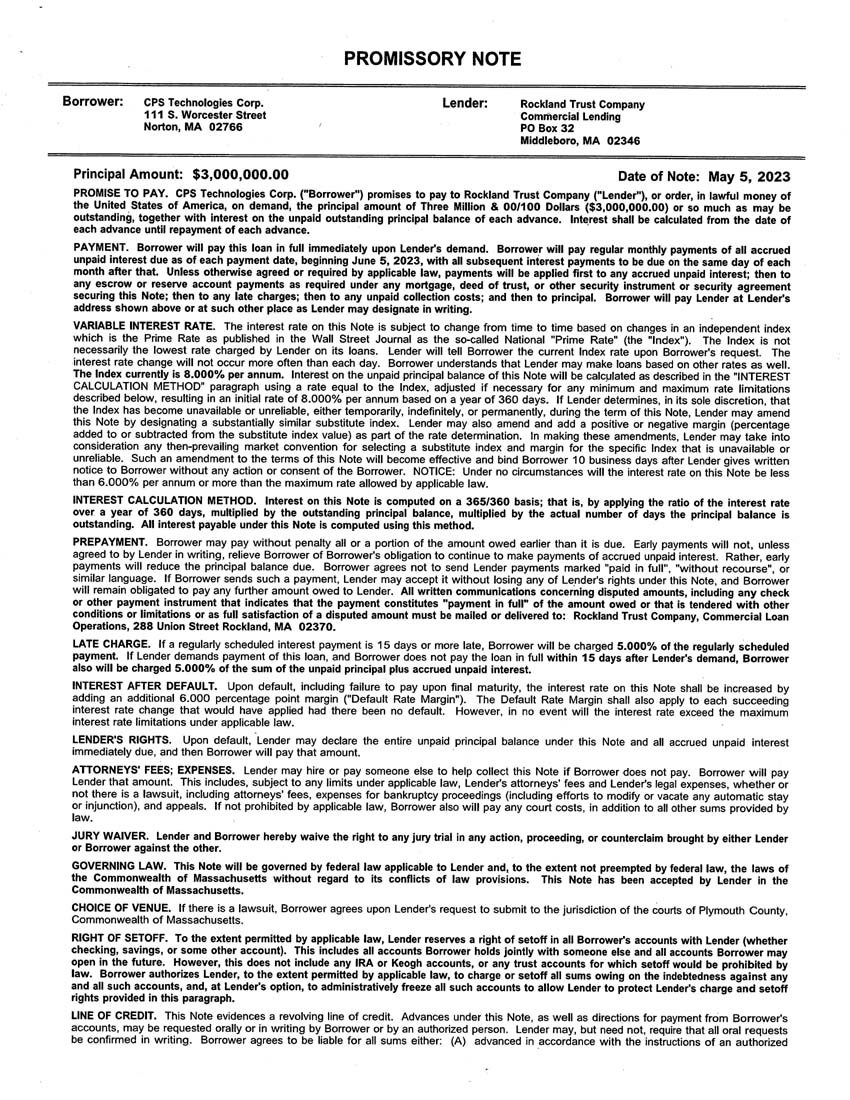

On May 5, 2023, CPS Technologies Corp. (the “Company”) entered into a Business Loan Agreement (Asset Based) (the “Loan Agreement”) by and between the Company, as borrower, and Rockland Trust Company, as lender (the “Lender”). The Loan Agreement provides for a revolving line of credit to the Company of the lesser of $3.0 million and 80% of the aggregate of eligible accounts, such amounts to be disbursed by Lender to the Company from time to time pursuant to certain promissory notes.

The Loan Agreement replaced the Company’s previous $2.5 million line of credit (the “Prior Loan Agreement”) entered into on September 15, 2019, by and between the Company, as borrower, and The Massachusetts Business Development Corporation, as lender. The Company’s obligations under the Prior Loan Agreement were satisfied in full and the Prior Loan Agreement was terminated in connection with the entrance into the Loan Agreement.

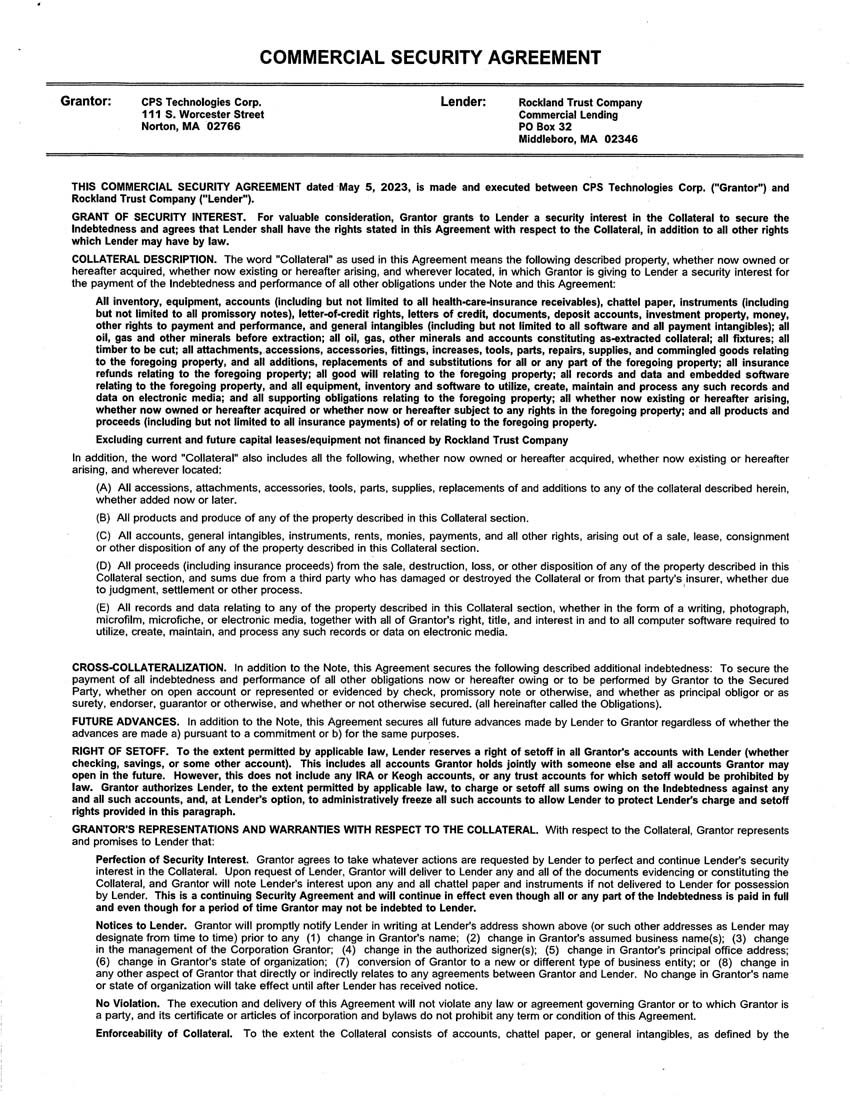

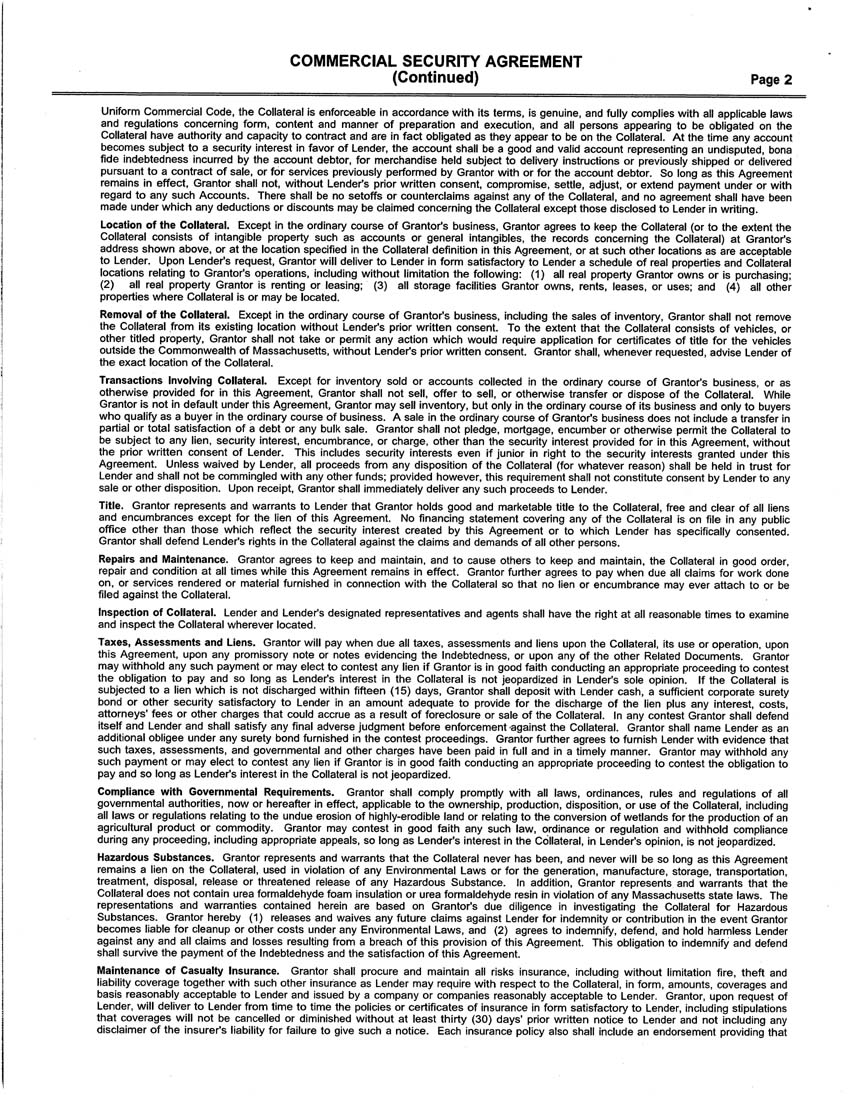

The outstanding principal amount of any advance shall accrue interest at a variable interest rate based on changes in an independent index, which is the prime rate as published in the Wall Street Journal as the National Prime Rate (the “Index”), which current Index is eight percent (8.0%) per annum. The Company’s obligations under the Loan Agreement are secured by substantially all of the Company’s assets, excluding any current and future capital leases or equipment not financed by Rockland Trust Company. The Lender has agreed to make advances under the Loan Agreement to the Company until May 5, 2024, unless extended by the Lender. As of May 5, 2023, nothing was outstanding under the Loan Agreement.

The Loan Agreement also contains affirmative and negative covenants, including a requirement that the Company furnish to the Lender by the fifteenth (15th) day of each month an aging of the Company’s accounts receivable aging details and accounts payable details, insurance policy/rider for foreign account receivables and a borrowing base certificate with supporting detail and any other documentation the Lender deems necessary. The Company has also agreed to deliver to the Lender within one hundred twenty (120) days after the end of each fiscal year a balance sheet, a statement of income and expense for the year, and a statement of change in financial position with an unqualified audit level report prepared by an independent public accountant.

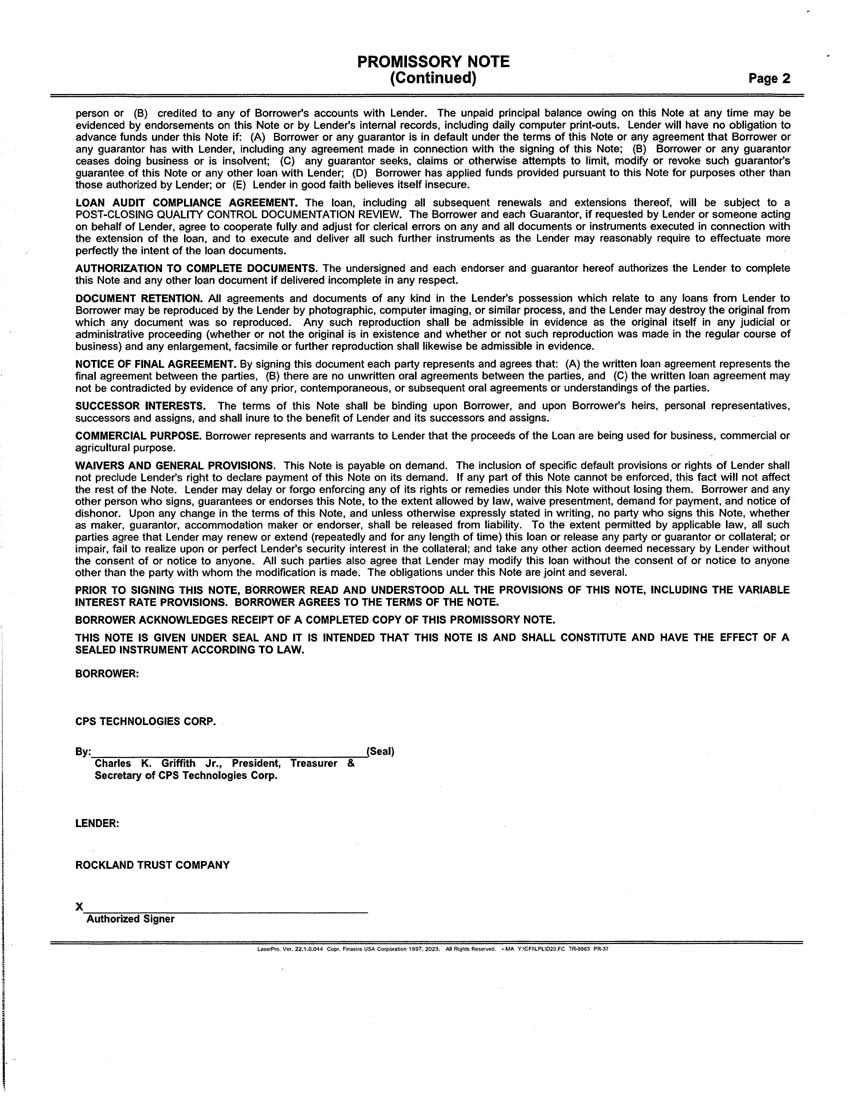

In connection with the Loan Agreement, the Company has also entered into that certain Promissory Note (the “Note”) in the principal amount of $3 million. The Company shall make monthly payments of accrued interest on the principal amount of the Note, and payment of the Note is on demand of the Lender.

The Company has also entered into that certain Commercial Security Agreement (the “Security Agreement”) with the Lender, pursuant to which the Lender was granted a security interest in the Company’s assets.

The foregoing descriptions of the Loan Agreement, Note and Security Agreement do not purport to be complete and are qualified in their entireties by reference to the full texts of each of the Loan Agreement, Note and Security Agreement, which are attached hereto as Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, and incorporated by reference herein.

Item 1.02 Termination of a Material Definitive Agreement.

On May 5, 2023, the Company voluntarily terminated the Prior Loan Agreement. The Company did not incur any early termination penalties in connection with the termination of the Prior Loan Agreement.

The credit line under the Prior Loan Agreement bore interest at the rate of LIBOR plus 6.50% and was secured by substantially all of the assets of the Company. The Prior Loan Agreement included a financial covenant requiring the Company to meet quarterly income/loss targets provided at least on an annual basis by the Company for the following year.

The information set forth in Item 1.01 of this Form 8-K above regarding the Prior Loan Agreement is incorporated by reference in response to this Item 1.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

|

Description

|

| |

|

|

10.1

|

|

| |

|

|

10.2

|

|

| |

|

|

10.3

|

|

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

CPS TECHNOLOGIES CORP.

|

| |

|

|

|

DATE: May ___, 2023

|

By:

|

|

/s/ Charles K. Griffith, Jr.

|

| |

|

|

Charles K. Griffith, Jr.

|

| |

|

|

Chief Financial Officer and acting President

Chdd

|

| |

|

|

|

EX-10.1

2

ex_517409.htm

EXHIBIT 10.1 LOAN AGREEMENT

Image Exhibit

Exhibit 10.1

EX-10.2

3

ex_517411.htm

EXHIBIT 10.2 PROMISSORY NOTE

Image Exhibit

Exhibit 10.2

EX-10.3

4

ex_517412.htm

EXHIBIT 10.3 SECURITY AGREEMENT

Image Exhibit

Exhibit 10.3