Warner Bros. Discovery Reports Third-Quarter 2025 Results Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Distribution $ 4,702 $ 4,920 (4) % (4) % Advertising 1,407 1,682 (16) % (17) % Content 2,649 2,721 (3) % (3) % Other 287 300 (4) % (7) % Total revenues $ 9,045 $ 9,623 (6) % (6) % Net (loss) income available to Warner Bros. Discovery, Inc. (148) 135 NM NM Adjusted EBITDA(*) 2,470 2,413 2 % 2 % Cash provided by operating activities 979 847 16 % Free cash flow(*) 701 632 11 % NM - Not Meaningful (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Q3 2025 Highlights • Total revenues were $9.0 billion, a 6% ex-FX(1) decrease from the prior year quarter. Total revenues excluding the impact of the 2024 Olympics in Europe were flat ex-FX(2)(*) compared to the prior year quarter. • Distribution revenues decreased 4% ex-FX, as dynamic underlying growth in global streaming subscribers was more than offset by continued domestic linear pay TV subscriber declines and the first full quarter impact of the HBO Max domestic distribution deal renewal with a former related party, previously disclosed in Q2. • Advertising revenues decreased 17% ex-FX, as ad-lite streaming subscriber growth was more than offset by domestic linear audience declines. • Content revenues decreased 3% ex-FX, primarily driven by the sublicensing of Olympic sports rights to broadcast networks throughout Europe in the prior year partially offset by the stronger performance of the theatrical releases in the current year quarter. Content revenues excluding the impact of the 2024 Olympics in Europe increased 23% ex-FX.(2)(*) • Net loss available to Warner Bros. Discovery, Inc. was $148.0 million, which includes $1.3 billion of pre-tax acquisition- related amortization of intangibles, content fair value step-up, and restructuring expenses. • Total Adjusted EBITDA(3)(*) was $2.5 billion, a 2% ex-FX increase compared to the prior year quarter, primarily due to growth in the Streaming and Studios segments, partially offset by a decline in the Global Linear Networks segment. • Cash provided by operating activities was $1.0 billion. Free cash flow(4)(*) was $0.7 billion. Free cash flow was unfavorably impacted by approximately $500 million of separation-related items. • The Company repaid $1.2 billion of debt during the quarter, including $1.0 billion of the bridge loan facility. • The Company ended the quarter with $4.3 billion of cash on hand, $34.5 billion of gross debt(5)(*), and 3.3x net leverage.(6)(*) • The Company ended the quarter with 128.0 million streaming subscribers(7), an increase of 2.3 million subscribers vs. Q2. Q3 2025 Earnings Press Release | November 6, 2025 1

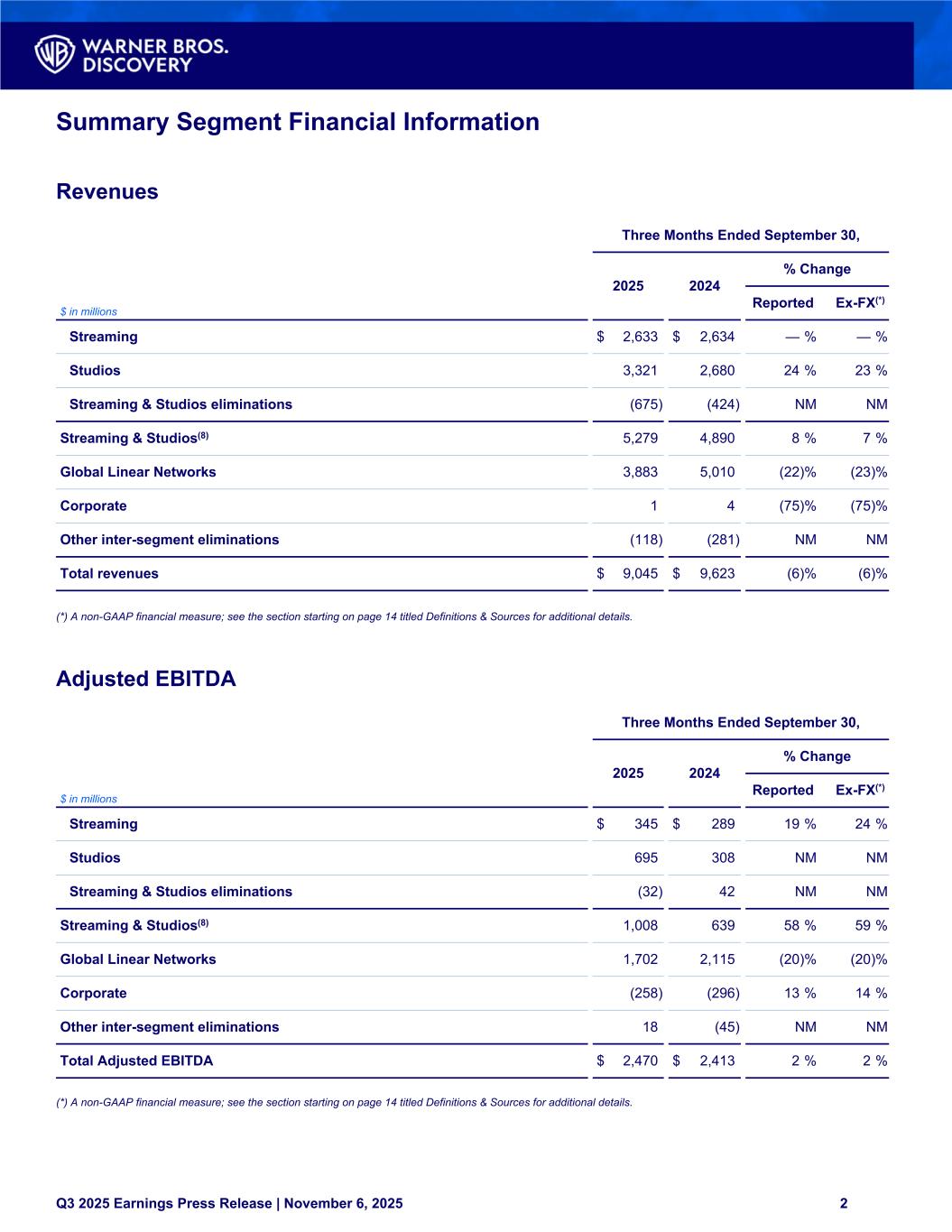

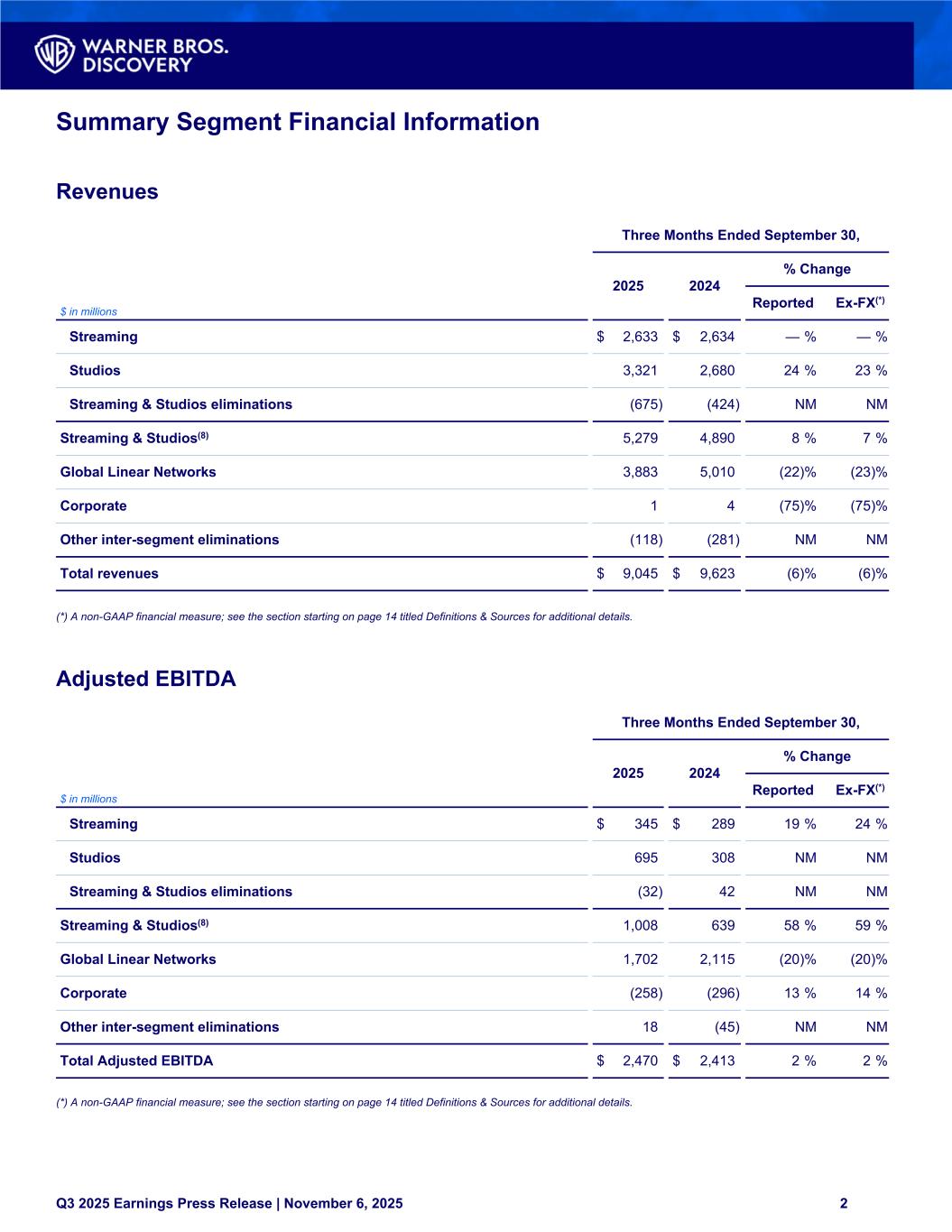

Summary Segment Financial Information Revenues Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Streaming $ 2,633 $ 2,634 — % — % Studios 3,321 2,680 24 % 23 % Streaming & Studios eliminations (675) (424) NM NM Streaming & Studios(8) 5,279 4,890 8 % 7 % Global Linear Networks 3,883 5,010 (22) % (23) % Corporate 1 4 (75) % (75) % Other inter-segment eliminations (118) (281) NM NM Total revenues $ 9,045 $ 9,623 (6) % (6) % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Adjusted EBITDA Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Streaming $ 345 $ 289 19 % 24 % Studios 695 308 NM NM Streaming & Studios eliminations (32) 42 NM NM Streaming & Studios(8) 1,008 639 58 % 59 % Global Linear Networks 1,702 2,115 (20) % (20) % Corporate (258) (296) 13 % 14 % Other inter-segment eliminations 18 (45) NM NM Total Adjusted EBITDA $ 2,470 $ 2,413 2 % 2 % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Q3 2025 Earnings Press Release | November 6, 2025 2

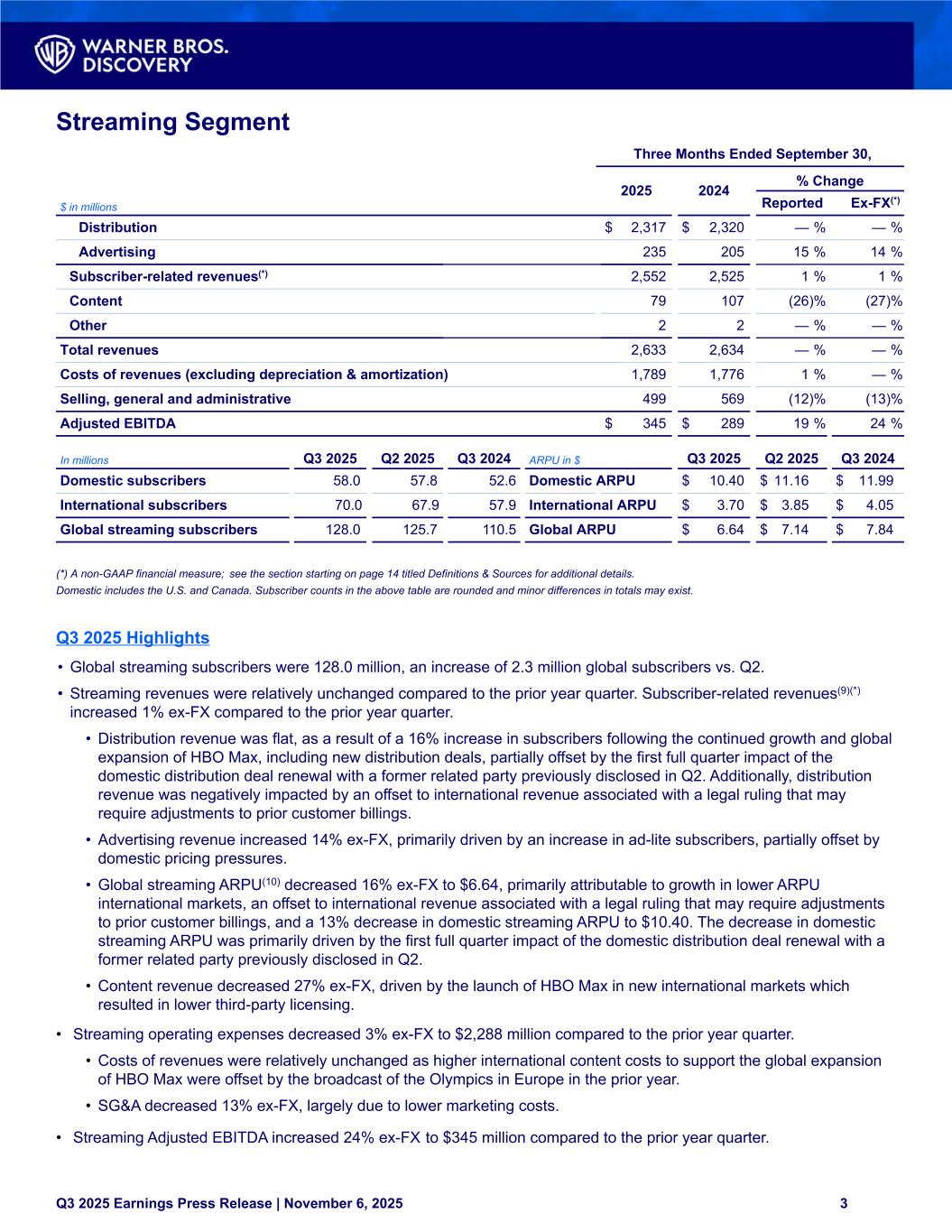

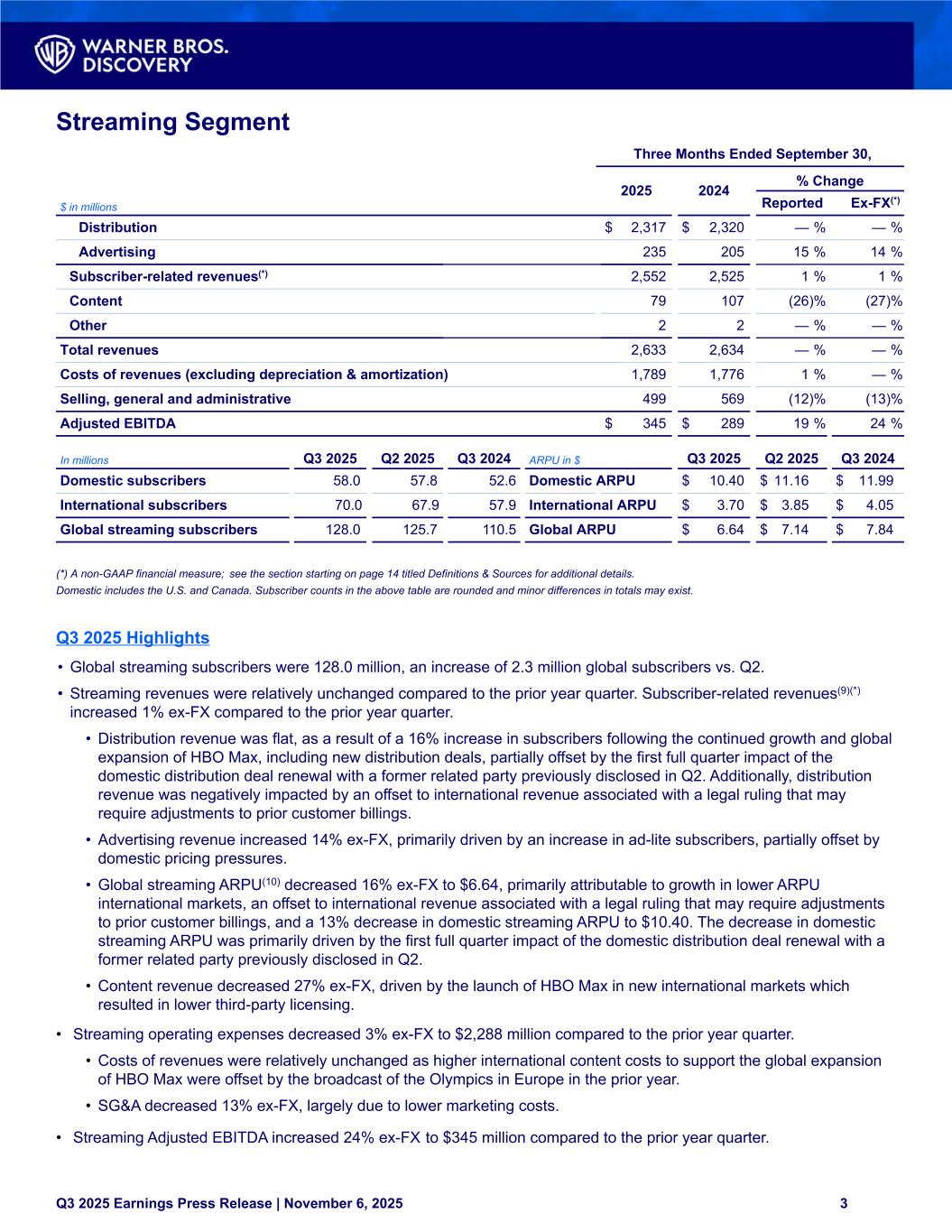

Streaming Segment Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Distribution $ 2,317 $ 2,320 — % — % Advertising 235 205 15 % 14 % Subscriber-related revenues(*) 2,552 2,525 1 % 1 % Content 79 107 (26) % (27) % Other 2 2 — % — % Total revenues 2,633 2,634 — % — % Costs of revenues (excluding depreciation & amortization) 1,789 1,776 1 % — % Selling, general and administrative 499 569 (12) % (13) % Adjusted EBITDA $ 345 $ 289 19 % 24 % In millions Q3 2025 Q2 2025 Q3 2024 ARPU in $ Q3 2025 Q2 2025 Q3 2024 Domestic subscribers 58.0 57.8 52.6 Domestic ARPU $ 10.40 $ 11.16 $ 11.99 International subscribers 70.0 67.9 57.9 International ARPU $ 3.70 $ 3.85 $ 4.05 Global streaming subscribers 128.0 125.7 110.5 Global ARPU $ 6.64 $ 7.14 $ 7.84 (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Domestic includes the U.S. and Canada. Subscriber counts in the above table are rounded and minor differences in totals may exist. Q3 2025 Highlights • Global streaming subscribers were 128.0 million, an increase of 2.3 million global subscribers vs. Q2. • Streaming revenues were relatively unchanged compared to the prior year quarter. Subscriber-related revenues(9)(*) increased 1% ex-FX compared to the prior year quarter. • Distribution revenue was flat, as a result of a 16% increase in subscribers following the continued growth and global expansion of HBO Max, including new distribution deals, partially offset by the first full quarter impact of the domestic distribution deal renewal with a former related party previously disclosed in Q2. Additionally, distribution revenue was negatively impacted by an offset to international revenue associated with a legal ruling that may require adjustments to prior customer billings. • Advertising revenue increased 14% ex-FX, primarily driven by an increase in ad-lite subscribers, partially offset by domestic pricing pressures. • Global streaming ARPU(10) decreased 16% ex-FX to $6.64, primarily attributable to growth in lower ARPU international markets, an offset to international revenue associated with a legal ruling that may require adjustments to prior customer billings, and a 13% decrease in domestic streaming ARPU to $10.40. The decrease in domestic streaming ARPU was primarily driven by the first full quarter impact of the domestic distribution deal renewal with a former related party previously disclosed in Q2. • Content revenue decreased 27% ex-FX, driven by the launch of HBO Max in new international markets which resulted in lower third-party licensing. • Streaming operating expenses decreased 3% ex-FX to $2,288 million compared to the prior year quarter. • Costs of revenues were relatively unchanged as higher international content costs to support the global expansion of HBO Max were offset by the broadcast of the Olympics in Europe in the prior year. • SG&A decreased 13% ex-FX, largely due to lower marketing costs. • Streaming Adjusted EBITDA increased 24% ex-FX to $345 million compared to the prior year quarter. Q3 2025 Earnings Press Release | November 6, 2025 3

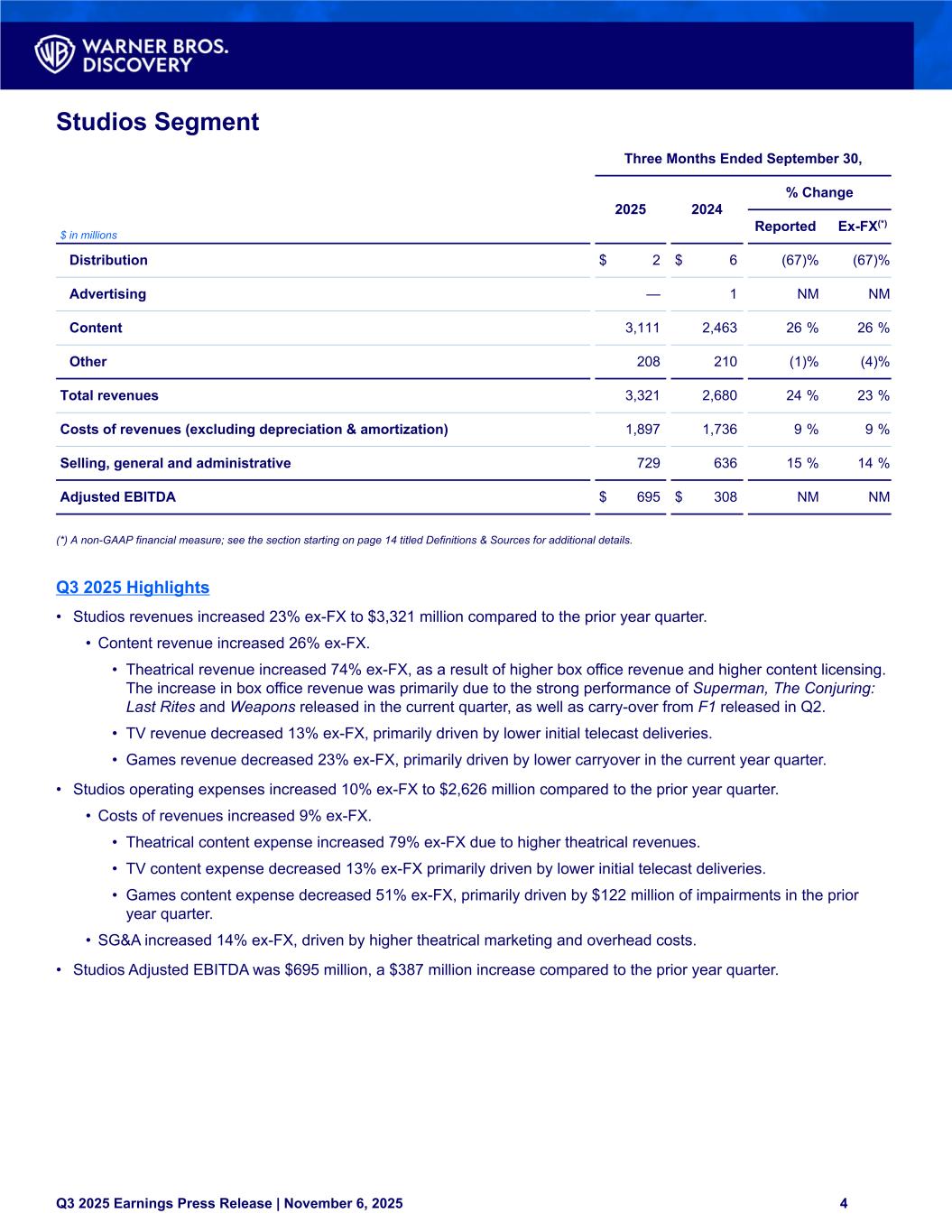

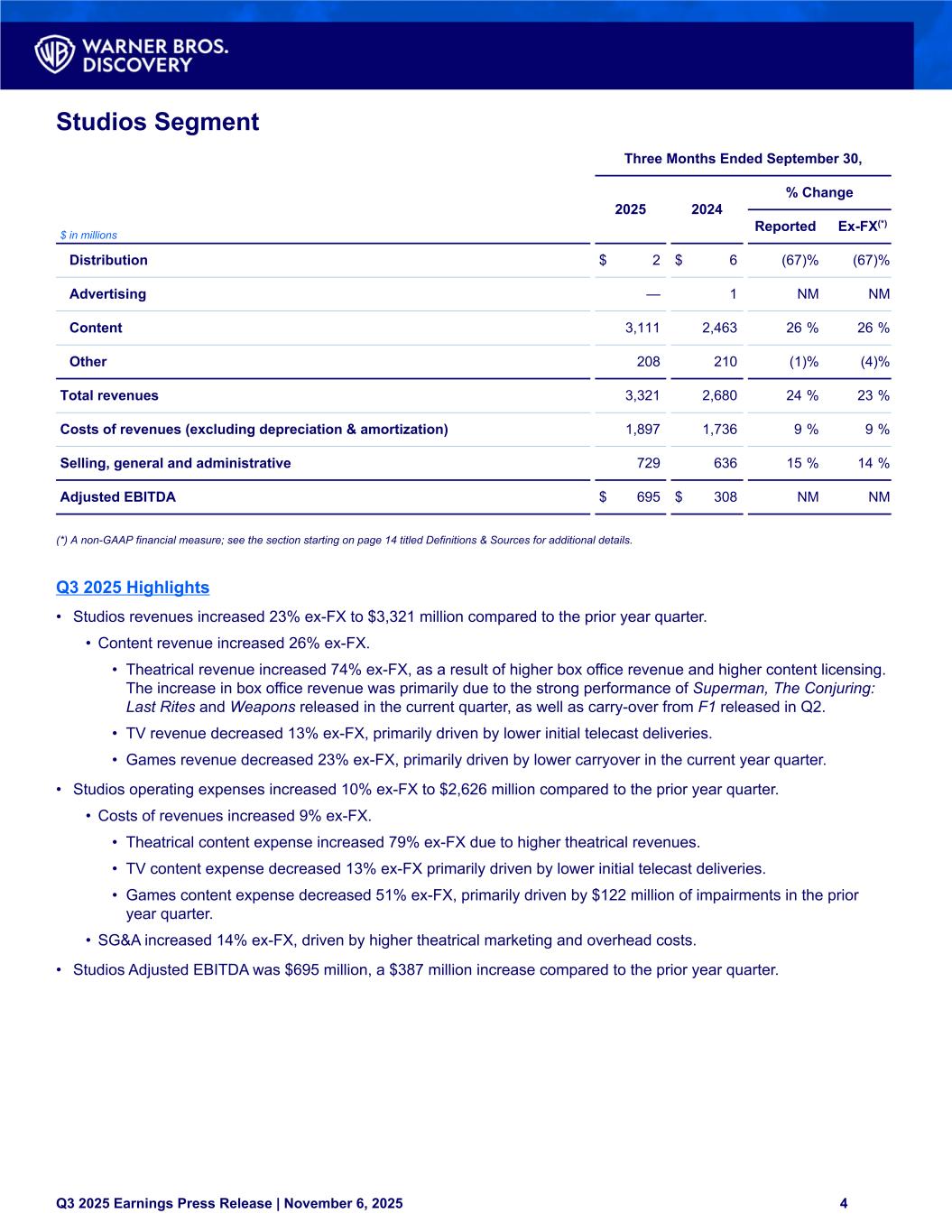

Studios Segment Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Distribution $ 2 $ 6 (67) % (67) % Advertising — 1 NM NM Content 3,111 2,463 26 % 26 % Other 208 210 (1) % (4) % Total revenues 3,321 2,680 24 % 23 % Costs of revenues (excluding depreciation & amortization) 1,897 1,736 9 % 9 % Selling, general and administrative 729 636 15 % 14 % Adjusted EBITDA $ 695 $ 308 NM NM (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Q3 2025 Highlights • Studios revenues increased 23% ex-FX to $3,321 million compared to the prior year quarter. • Content revenue increased 26% ex-FX. • Theatrical revenue increased 74% ex-FX, as a result of higher box office revenue and higher content licensing. The increase in box office revenue was primarily due to the strong performance of Superman, The Conjuring: Last Rites and Weapons released in the current quarter, as well as carry-over from F1 released in Q2. • TV revenue decreased 13% ex-FX, primarily driven by lower initial telecast deliveries. • Games revenue decreased 23% ex-FX, primarily driven by lower carryover in the current year quarter. • Studios operating expenses increased 10% ex-FX to $2,626 million compared to the prior year quarter. • Costs of revenues increased 9% ex-FX. • Theatrical content expense increased 79% ex-FX due to higher theatrical revenues. • TV content expense decreased 13% ex-FX primarily driven by lower initial telecast deliveries. • Games content expense decreased 51% ex-FX, primarily driven by $122 million of impairments in the prior year quarter. • SG&A increased 14% ex-FX, driven by higher theatrical marketing and overhead costs. • Studios Adjusted EBITDA was $695 million, a $387 million increase compared to the prior year quarter. Q3 2025 Earnings Press Release | November 6, 2025 4

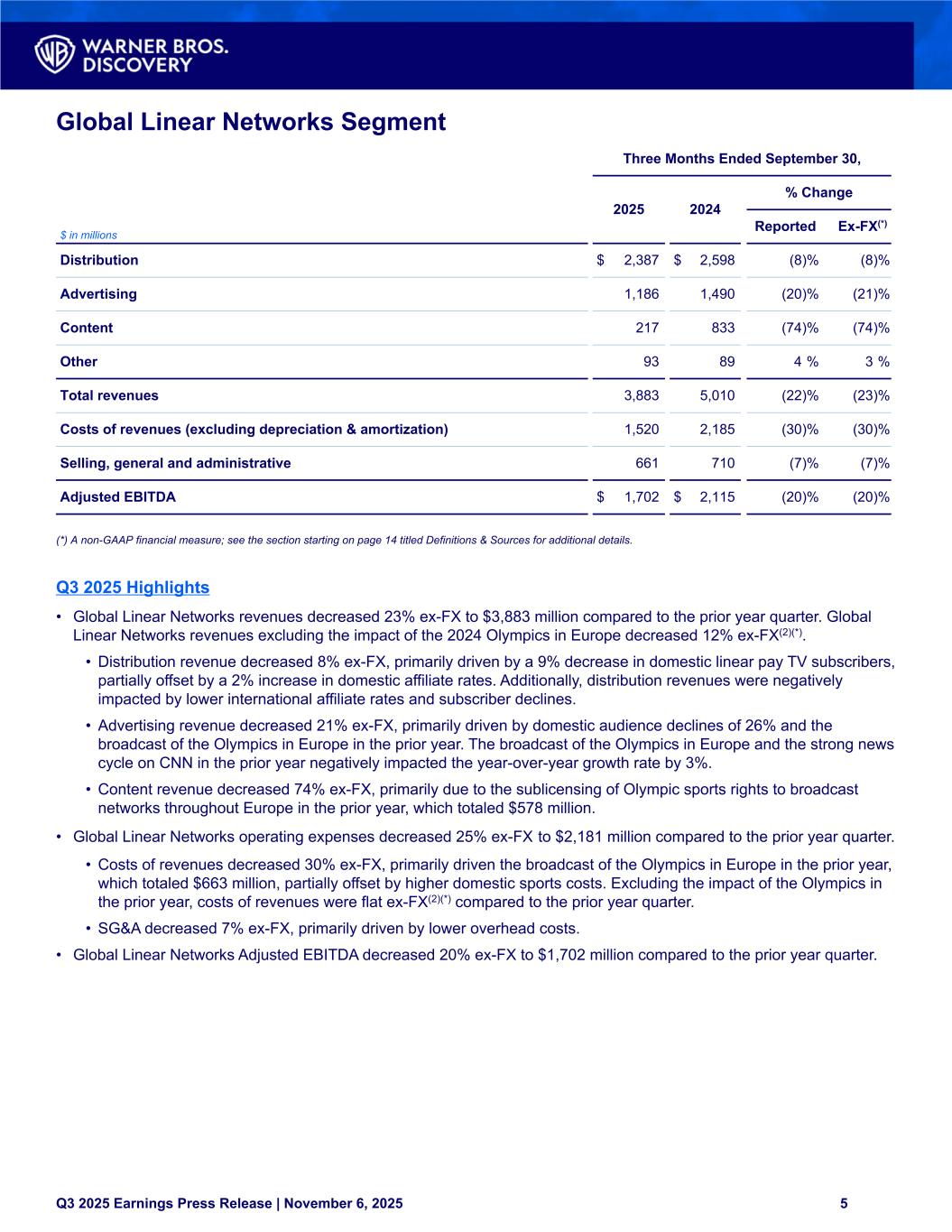

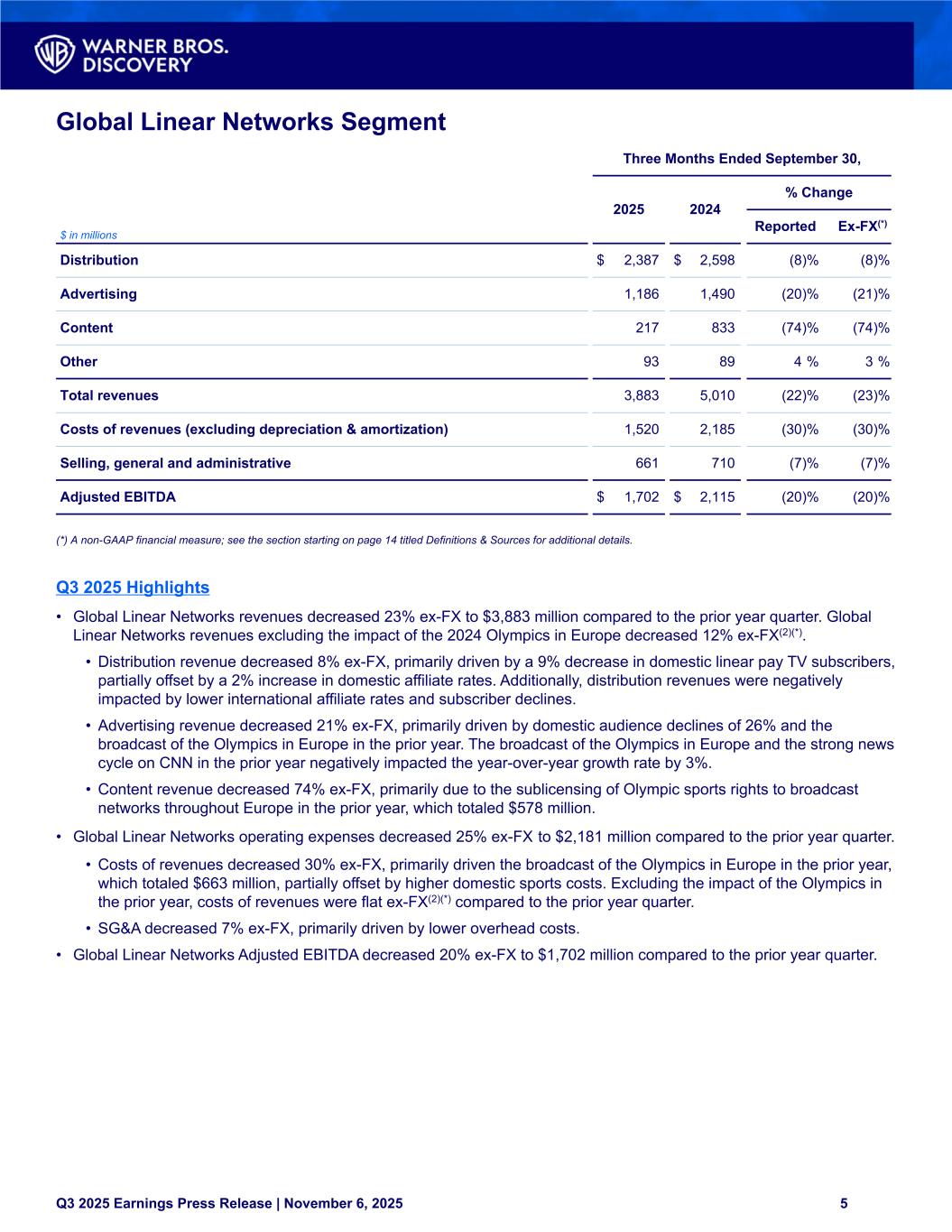

Global Linear Networks Segment Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Distribution $ 2,387 $ 2,598 (8) % (8) % Advertising 1,186 1,490 (20) % (21) % Content 217 833 (74) % (74) % Other 93 89 4 % 3 % Total revenues 3,883 5,010 (22) % (23) % Costs of revenues (excluding depreciation & amortization) 1,520 2,185 (30) % (30) % Selling, general and administrative 661 710 (7) % (7) % Adjusted EBITDA $ 1,702 $ 2,115 (20) % (20) % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. Q3 2025 Highlights • Global Linear Networks revenues decreased 23% ex-FX to $3,883 million compared to the prior year quarter. Global Linear Networks revenues excluding the impact of the 2024 Olympics in Europe decreased 12% ex-FX(2)(*). • Distribution revenue decreased 8% ex-FX, primarily driven by a 9% decrease in domestic linear pay TV subscribers, partially offset by a 2% increase in domestic affiliate rates. Additionally, distribution revenues were negatively impacted by lower international affiliate rates and subscriber declines. • Advertising revenue decreased 21% ex-FX, primarily driven by domestic audience declines of 26% and the broadcast of the Olympics in Europe in the prior year. The broadcast of the Olympics in Europe and the strong news cycle on CNN in the prior year negatively impacted the year-over-year growth rate by 3%. • Content revenue decreased 74% ex-FX, primarily due to the sublicensing of Olympic sports rights to broadcast networks throughout Europe in the prior year, which totaled $578 million. • Global Linear Networks operating expenses decreased 25% ex-FX to $2,181 million compared to the prior year quarter. • Costs of revenues decreased 30% ex-FX, primarily driven the broadcast of the Olympics in Europe in the prior year, which totaled $663 million, partially offset by higher domestic sports costs. Excluding the impact of the Olympics in the prior year, costs of revenues were flat ex-FX(2)(*) compared to the prior year quarter. • SG&A decreased 7% ex-FX, primarily driven by lower overhead costs. • Global Linear Networks Adjusted EBITDA decreased 20% ex-FX to $1,702 million compared to the prior year quarter. Q3 2025 Earnings Press Release | November 6, 2025 5

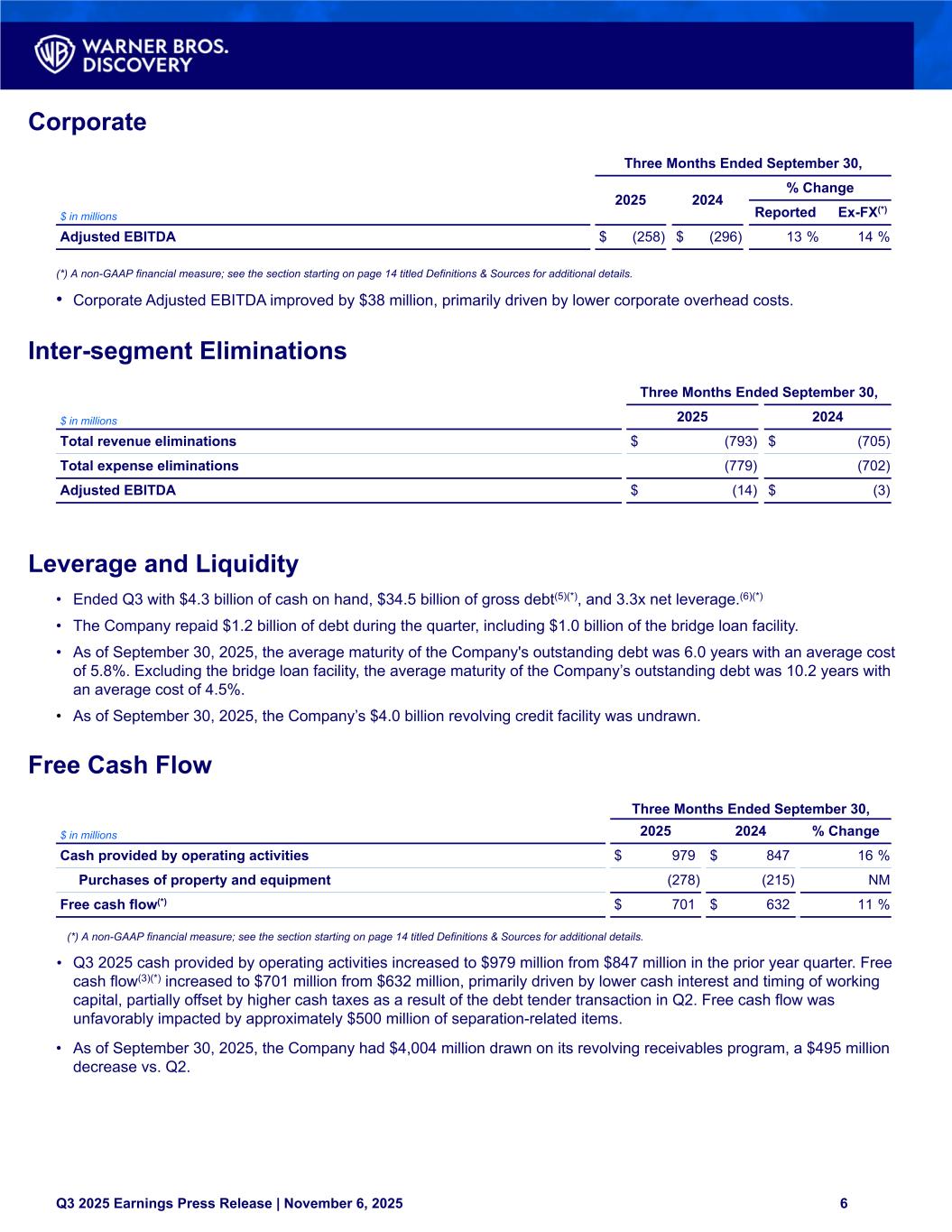

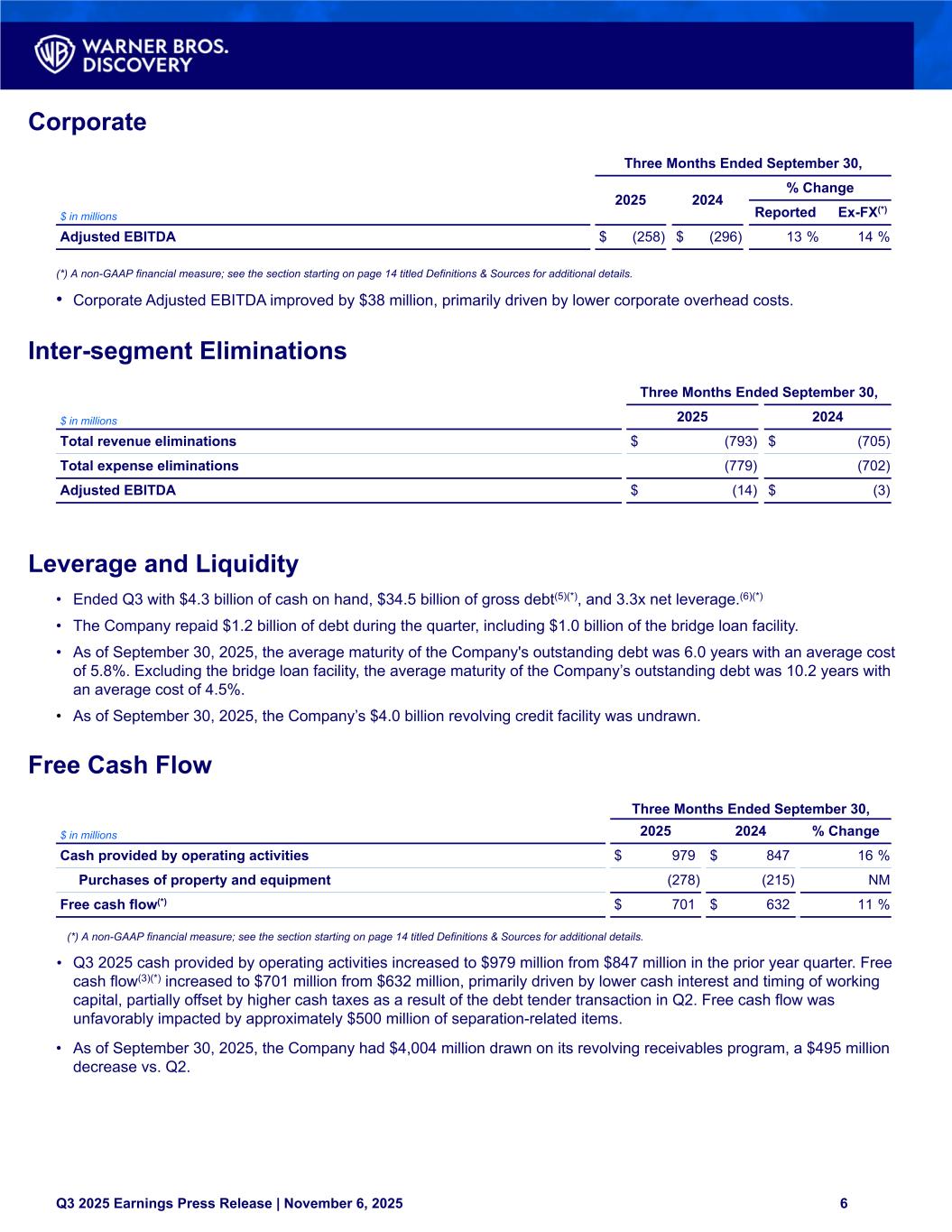

Corporate Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Adjusted EBITDA $ (258) $ (296) 13 % 14 % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. • Corporate Adjusted EBITDA improved by $38 million, primarily driven by lower corporate overhead costs. Inter-segment Eliminations Three Months Ended September 30, $ in millions 2025 2024 Total revenue eliminations $ (793) $ (705) Total expense eliminations (779) (702) Adjusted EBITDA $ (14) $ (3) Leverage and Liquidity • Ended Q3 with $4.3 billion of cash on hand, $34.5 billion of gross debt(5)(*), and 3.3x net leverage.(6)(*) • The Company repaid $1.2 billion of debt during the quarter, including $1.0 billion of the bridge loan facility. • As of September 30, 2025, the average maturity of the Company's outstanding debt was 6.0 years with an average cost of 5.8%. Excluding the bridge loan facility, the average maturity of the Company’s outstanding debt was 10.2 years with an average cost of 4.5%. • As of September 30, 2025, the Company’s $4.0 billion revolving credit facility was undrawn. Free Cash Flow Three Months Ended September 30, $ in millions 2025 2024 % Change Cash provided by operating activities $ 979 $ 847 16 % Purchases of property and equipment (278) (215) NM Free cash flow(*) $ 701 $ 632 11 % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details. • Q3 2025 cash provided by operating activities increased to $979 million from $847 million in the prior year quarter. Free cash flow(3)(*) increased to $701 million from $632 million, primarily driven by lower cash interest and timing of working capital, partially offset by higher cash taxes as a result of the debt tender transaction in Q2. Free cash flow was unfavorably impacted by approximately $500 million of separation-related items. • As of September 30, 2025, the Company had $4,004 million drawn on its revolving receivables program, a $495 million decrease vs. Q2. Q3 2025 Earnings Press Release | November 6, 2025 6

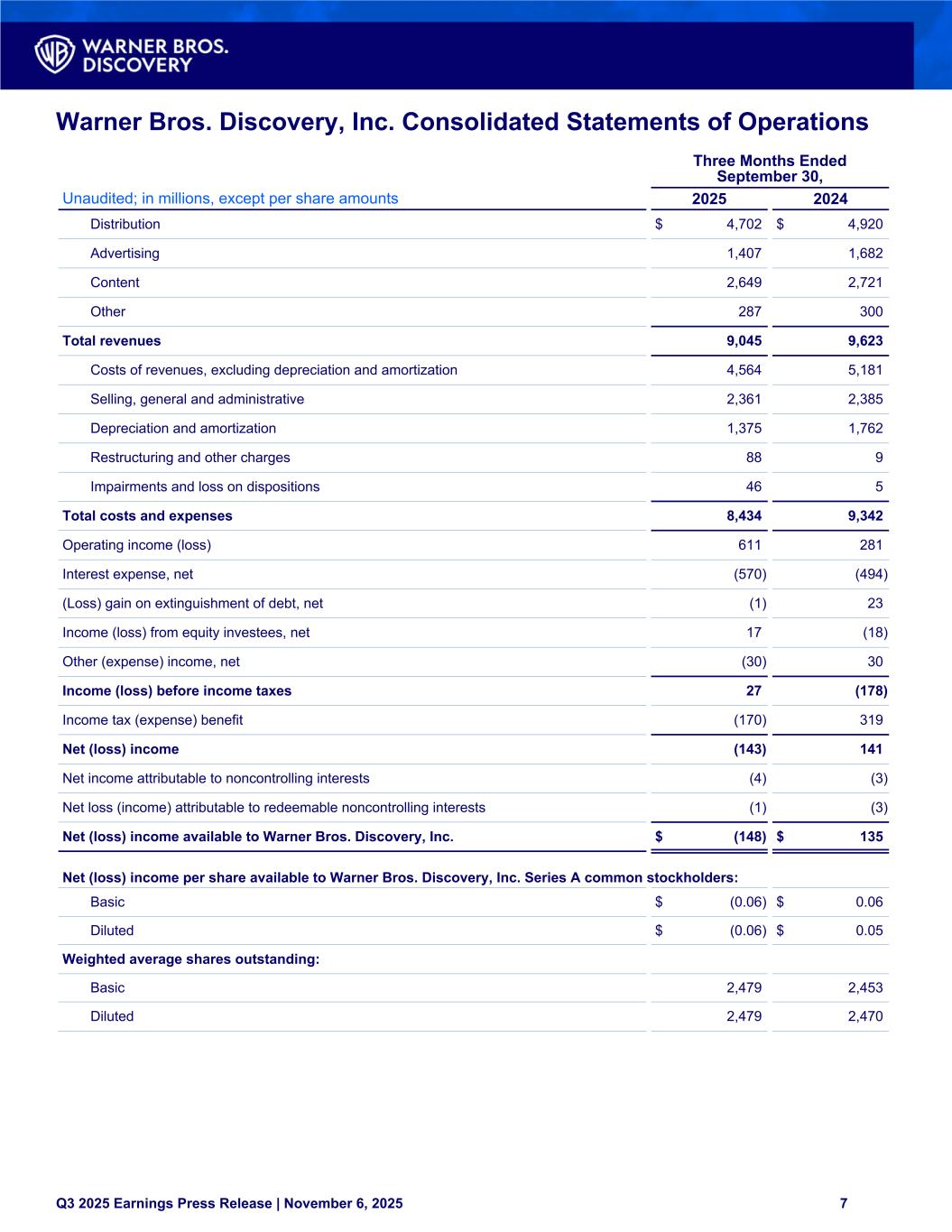

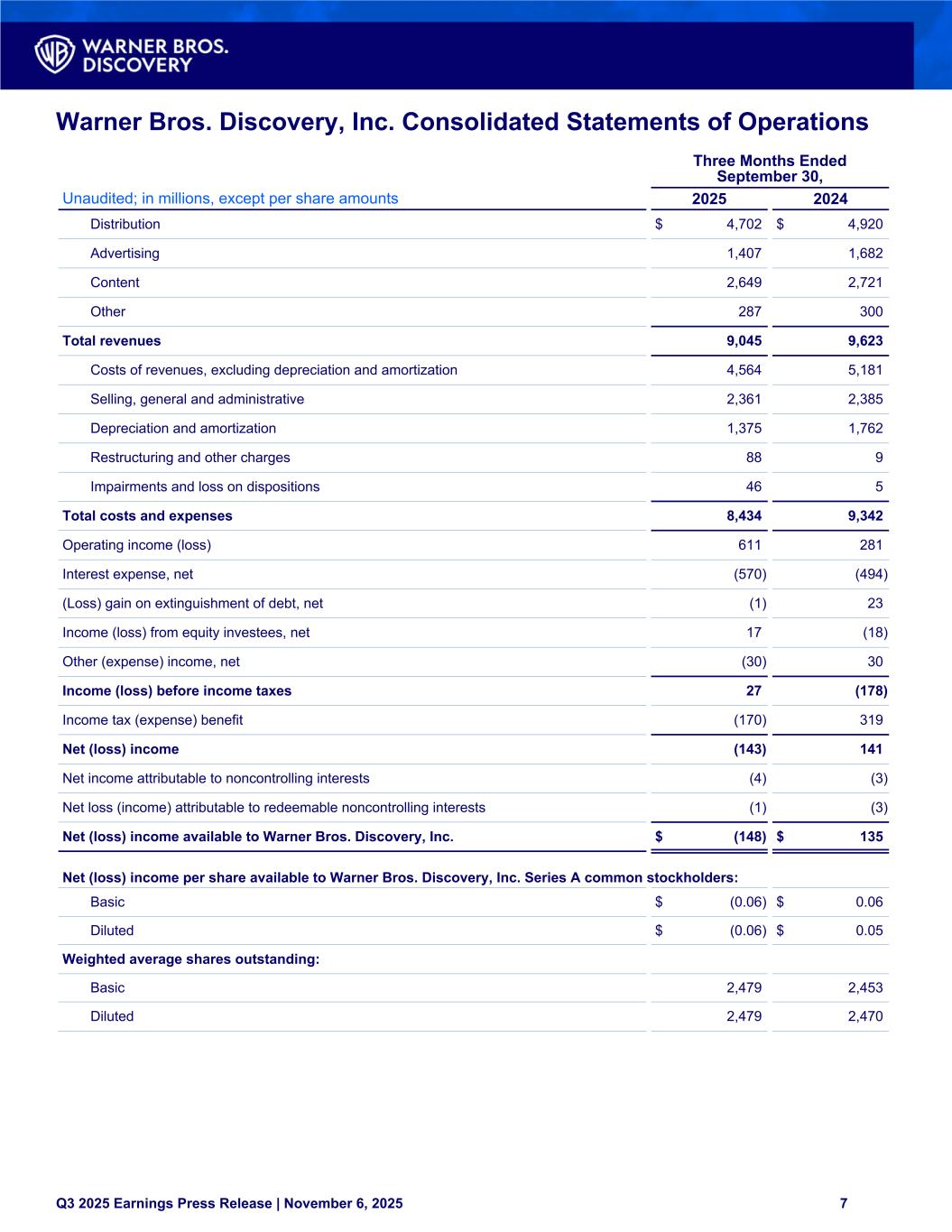

Warner Bros. Discovery, Inc. Consolidated Statements of Operations Three Months Ended September 30, Unaudited; in millions, except per share amounts 2025 2024 Distribution $ 4,702 $ 4,920 Advertising 1,407 1,682 Content 2,649 2,721 Other 287 300 Total revenues 9,045 9,623 Costs of revenues, excluding depreciation and amortization 4,564 5,181 Selling, general and administrative 2,361 2,385 Depreciation and amortization 1,375 1,762 Restructuring and other charges 88 9 Impairments and loss on dispositions 46 5 Total costs and expenses 8,434 9,342 Operating income (loss) 611 281 Interest expense, net (570) (494) (Loss) gain on extinguishment of debt, net (1) 23 Income (loss) from equity investees, net 17 (18) Other (expense) income, net (30) 30 Income (loss) before income taxes 27 (178) Income tax (expense) benefit (170) 319 Net (loss) income (143) 141 Net income attributable to noncontrolling interests (4) (3) Net loss (income) attributable to redeemable noncontrolling interests (1) (3) Net (loss) income available to Warner Bros. Discovery, Inc. $ (148) $ 135 Net (loss) income per share available to Warner Bros. Discovery, Inc. Series A common stockholders: Basic $ (0.06) $ 0.06 Diluted $ (0.06) $ 0.05 Weighted average shares outstanding: Basic 2,479 2,453 Diluted 2,479 2,470 Q3 2025 Earnings Press Release | November 6, 2025 7

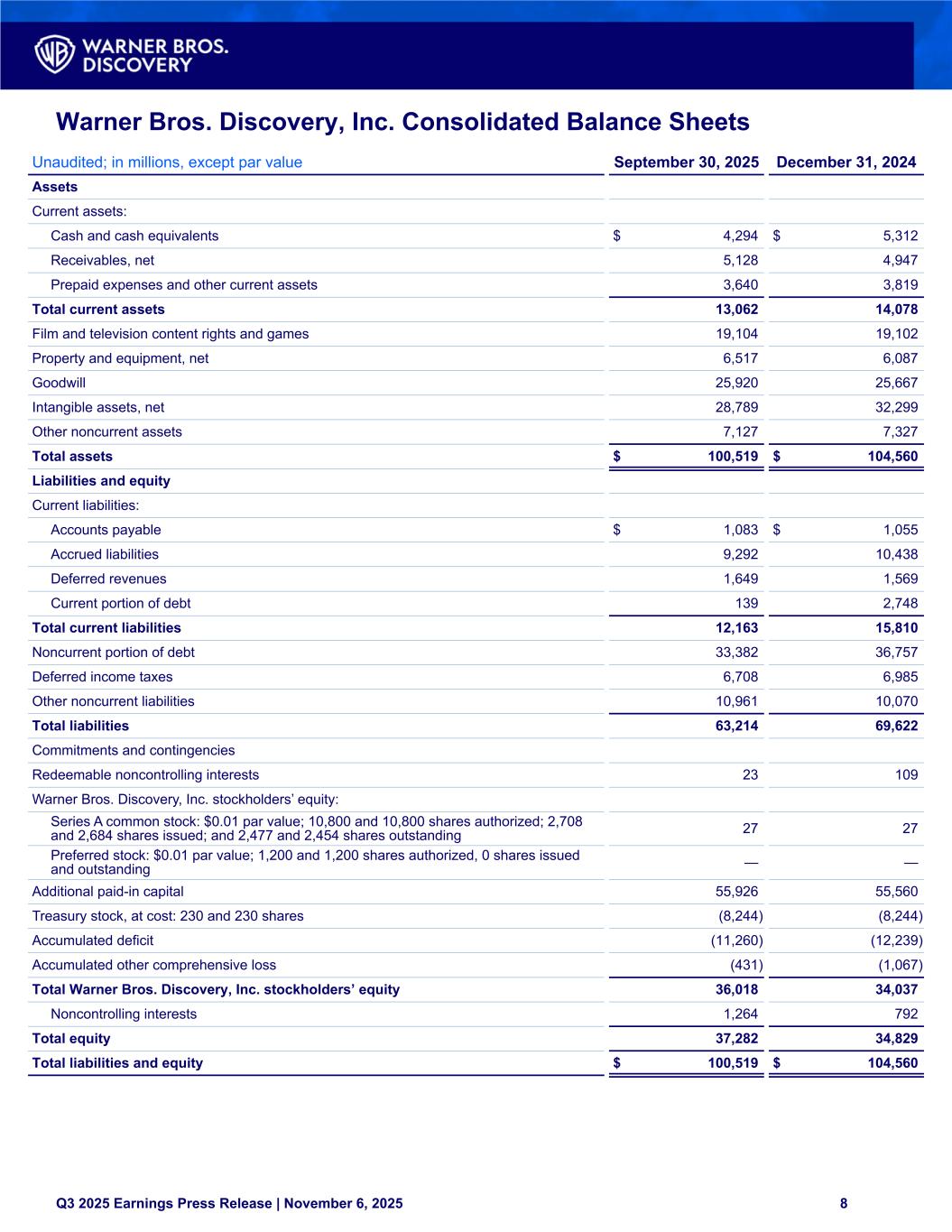

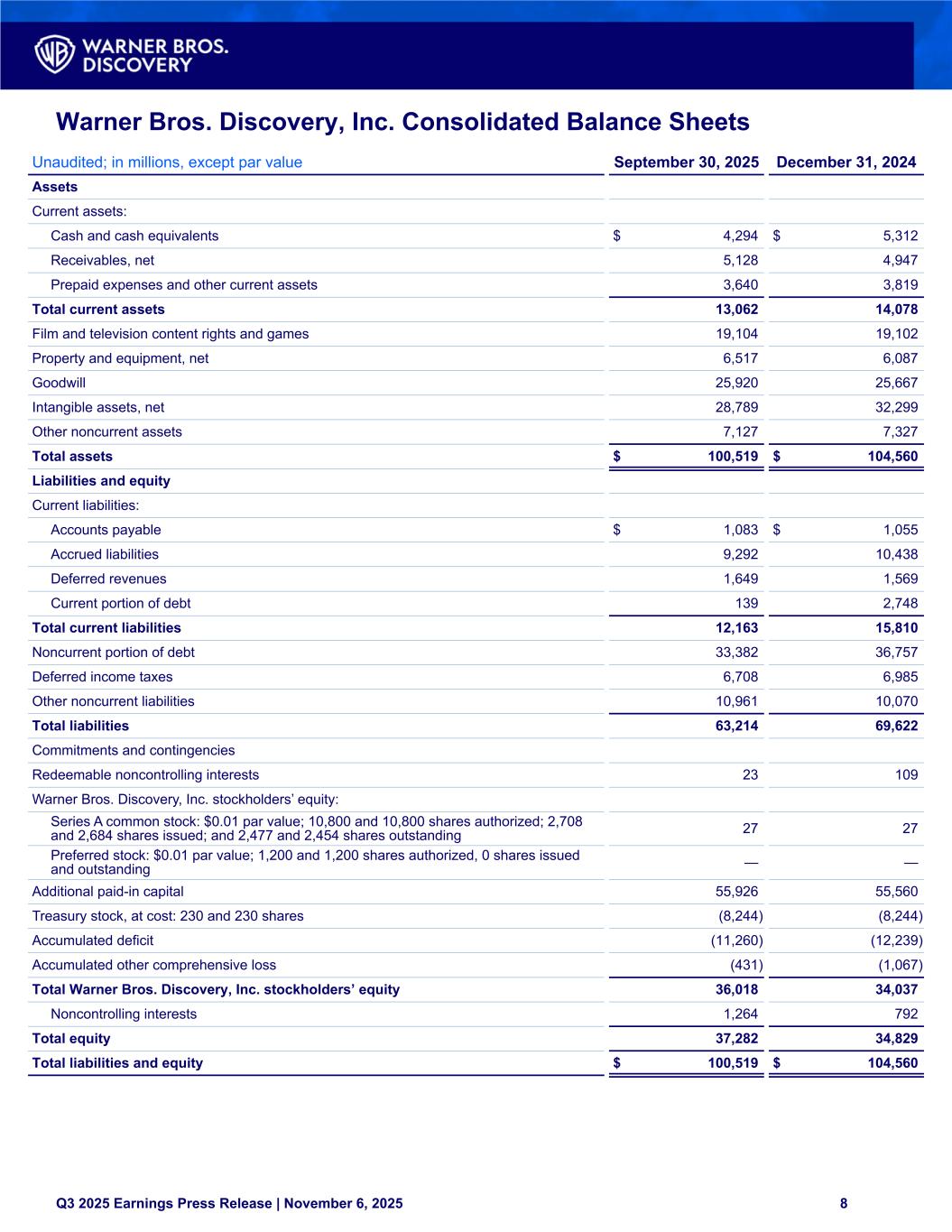

Warner Bros. Discovery, Inc. Consolidated Balance Sheets Unaudited; in millions, except par value September 30, 2025 December 31, 2024 Assets Current assets: Cash and cash equivalents $ 4,294 $ 5,312 Receivables, net 5,128 4,947 Prepaid expenses and other current assets 3,640 3,819 Total current assets 13,062 14,078 Film and television content rights and games 19,104 19,102 Property and equipment, net 6,517 6,087 Goodwill 25,920 25,667 Intangible assets, net 28,789 32,299 Other noncurrent assets 7,127 7,327 Total assets $ 100,519 $ 104,560 Liabilities and equity Current liabilities: Accounts payable $ 1,083 $ 1,055 Accrued liabilities 9,292 10,438 Deferred revenues 1,649 1,569 Current portion of debt 139 2,748 Total current liabilities 12,163 15,810 Noncurrent portion of debt 33,382 36,757 Deferred income taxes 6,708 6,985 Other noncurrent liabilities 10,961 10,070 Total liabilities 63,214 69,622 Commitments and contingencies Redeemable noncontrolling interests 23 109 Warner Bros. Discovery, Inc. stockholders’ equity: Series A common stock: $0.01 par value; 10,800 and 10,800 shares authorized; 2,708 and 2,684 shares issued; and 2,477 and 2,454 shares outstanding 27 27 Preferred stock: $0.01 par value; 1,200 and 1,200 shares authorized, 0 shares issued and outstanding — — Additional paid-in capital 55,926 55,560 Treasury stock, at cost: 230 and 230 shares (8,244) (8,244) Accumulated deficit (11,260) (12,239) Accumulated other comprehensive loss (431) (1,067) Total Warner Bros. Discovery, Inc. stockholders’ equity 36,018 34,037 Noncontrolling interests 1,264 792 Total equity 37,282 34,829 Total liabilities and equity $ 100,519 $ 104,560 Q3 2025 Earnings Press Release | November 6, 2025 8

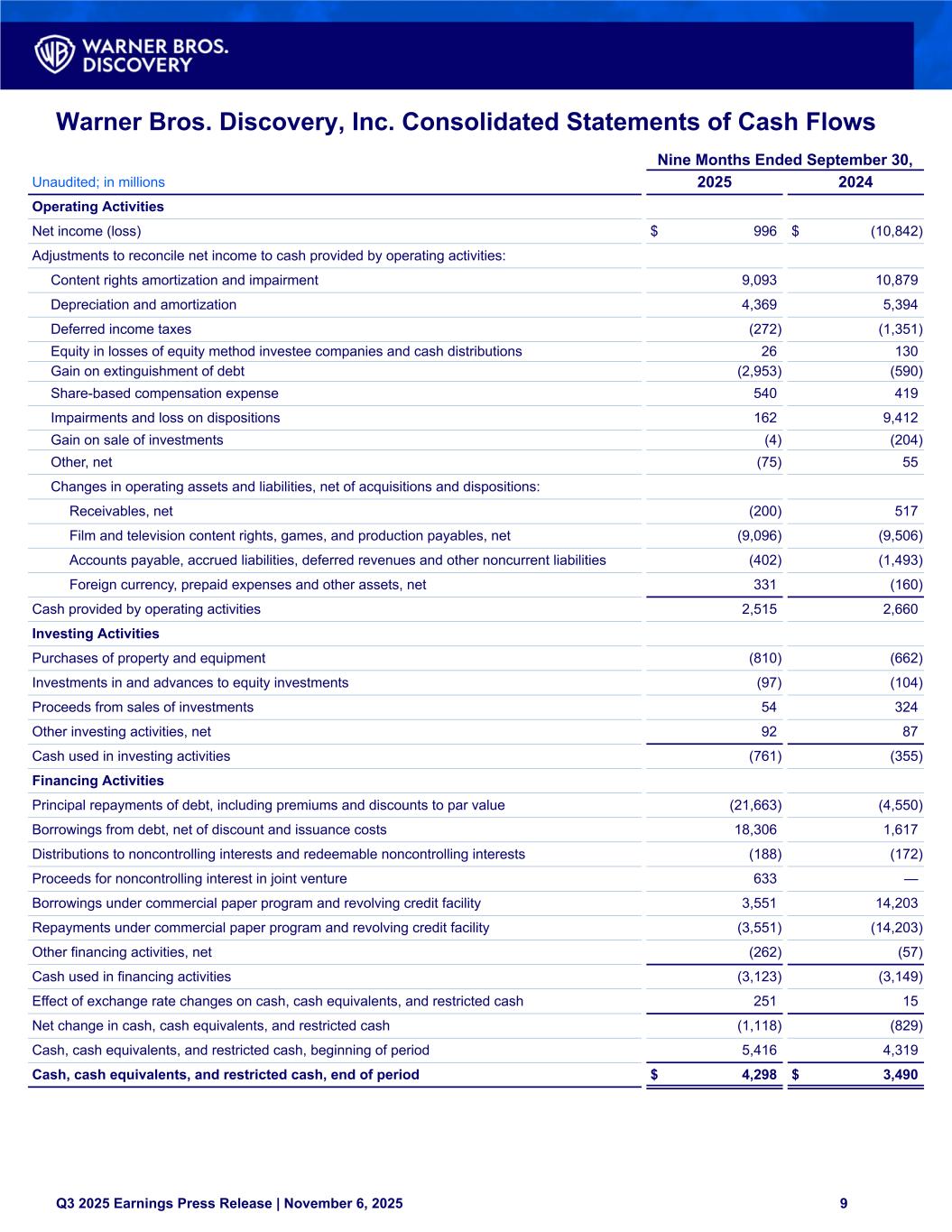

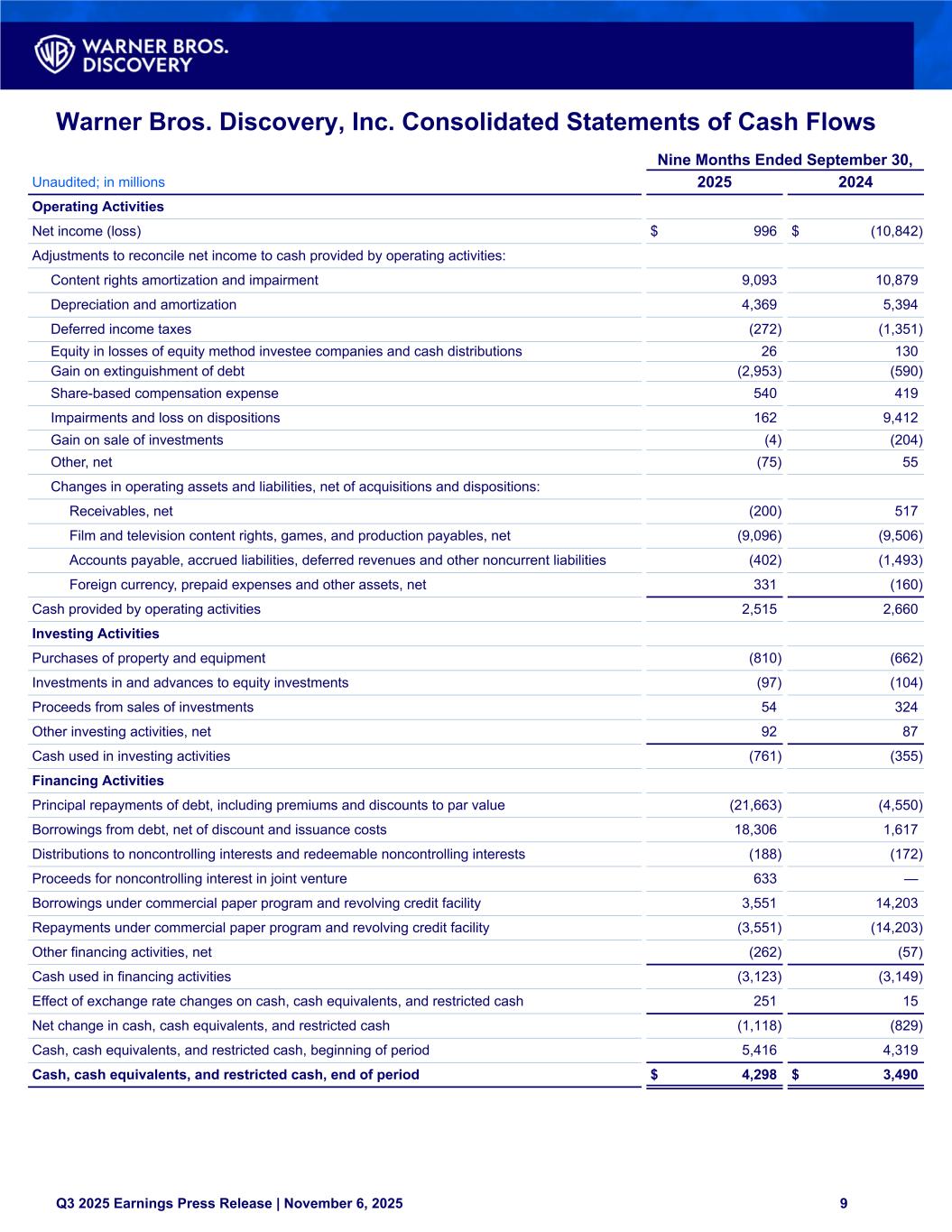

Warner Bros. Discovery, Inc. Consolidated Statements of Cash Flows Nine Months Ended September 30, Unaudited; in millions 2025 2024 Operating Activities Net income (loss) $ 996 $ (10,842) Adjustments to reconcile net income to cash provided by operating activities: Content rights amortization and impairment 9,093 10,879 Depreciation and amortization 4,369 5,394 Deferred income taxes (272) (1,351) Equity in losses of equity method investee companies and cash distributions 26 130 Gain on extinguishment of debt (2,953) (590) Share-based compensation expense 540 419 Impairments and loss on dispositions 162 9,412 Gain on sale of investments (4) (204) Other, net (75) 55 Changes in operating assets and liabilities, net of acquisitions and dispositions: Receivables, net (200) 517 Film and television content rights, games, and production payables, net (9,096) (9,506) Accounts payable, accrued liabilities, deferred revenues and other noncurrent liabilities (402) (1,493) Foreign currency, prepaid expenses and other assets, net 331 (160) Cash provided by operating activities 2,515 2,660 Investing Activities Purchases of property and equipment (810) (662) Investments in and advances to equity investments (97) (104) Proceeds from sales of investments 54 324 Other investing activities, net 92 87 Cash used in investing activities (761) (355) Financing Activities Principal repayments of debt, including premiums and discounts to par value (21,663) (4,550) Borrowings from debt, net of discount and issuance costs 18,306 1,617 Distributions to noncontrolling interests and redeemable noncontrolling interests (188) (172) Proceeds for noncontrolling interest in joint venture 633 — Borrowings under commercial paper program and revolving credit facility 3,551 14,203 Repayments under commercial paper program and revolving credit facility (3,551) (14,203) Other financing activities, net (262) (57) Cash used in financing activities (3,123) (3,149) Effect of exchange rate changes on cash, cash equivalents, and restricted cash 251 15 Net change in cash, cash equivalents, and restricted cash (1,118) (829) Cash, cash equivalents, and restricted cash, beginning of period 5,416 4,319 Cash, cash equivalents, and restricted cash, end of period $ 4,298 $ 3,490 Q3 2025 Earnings Press Release | November 6, 2025 9

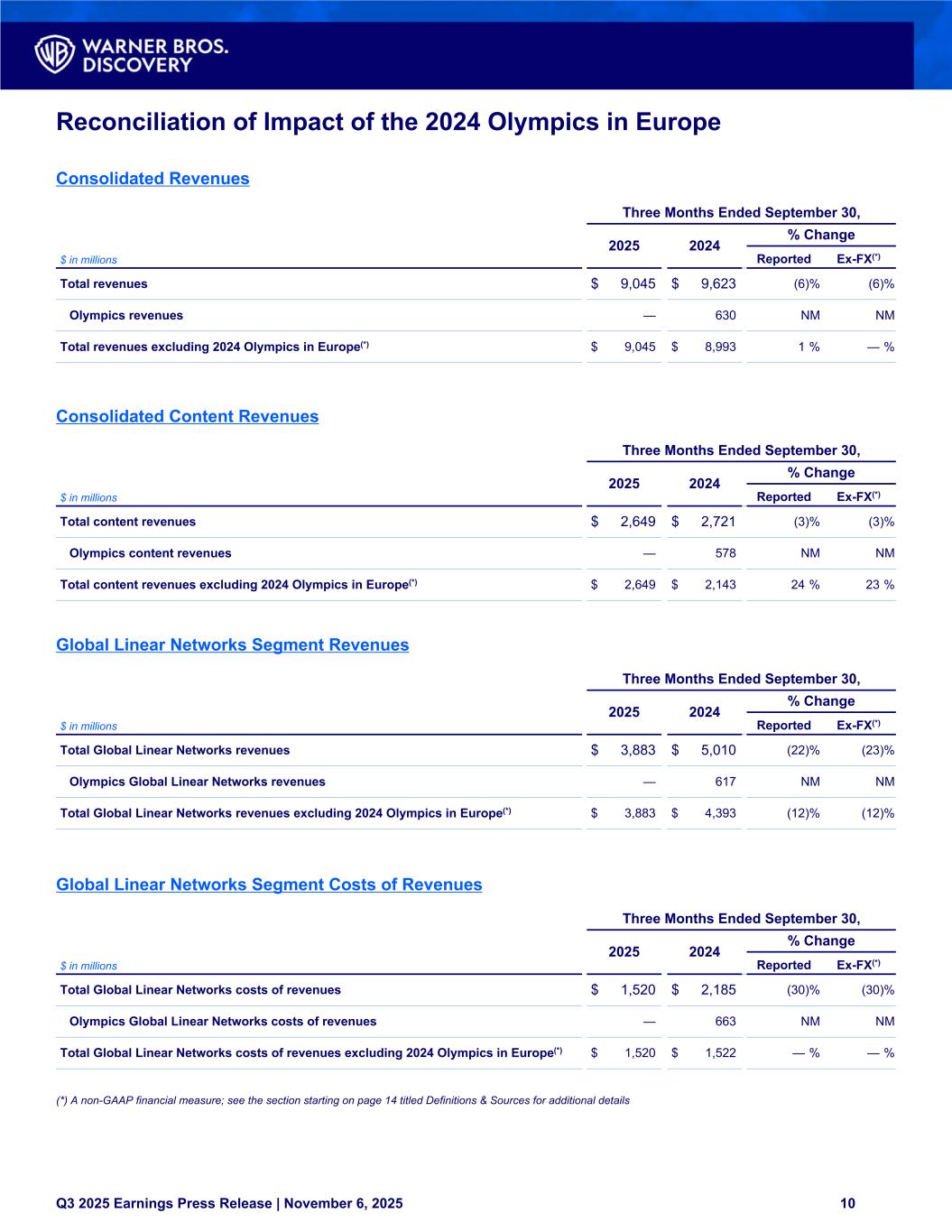

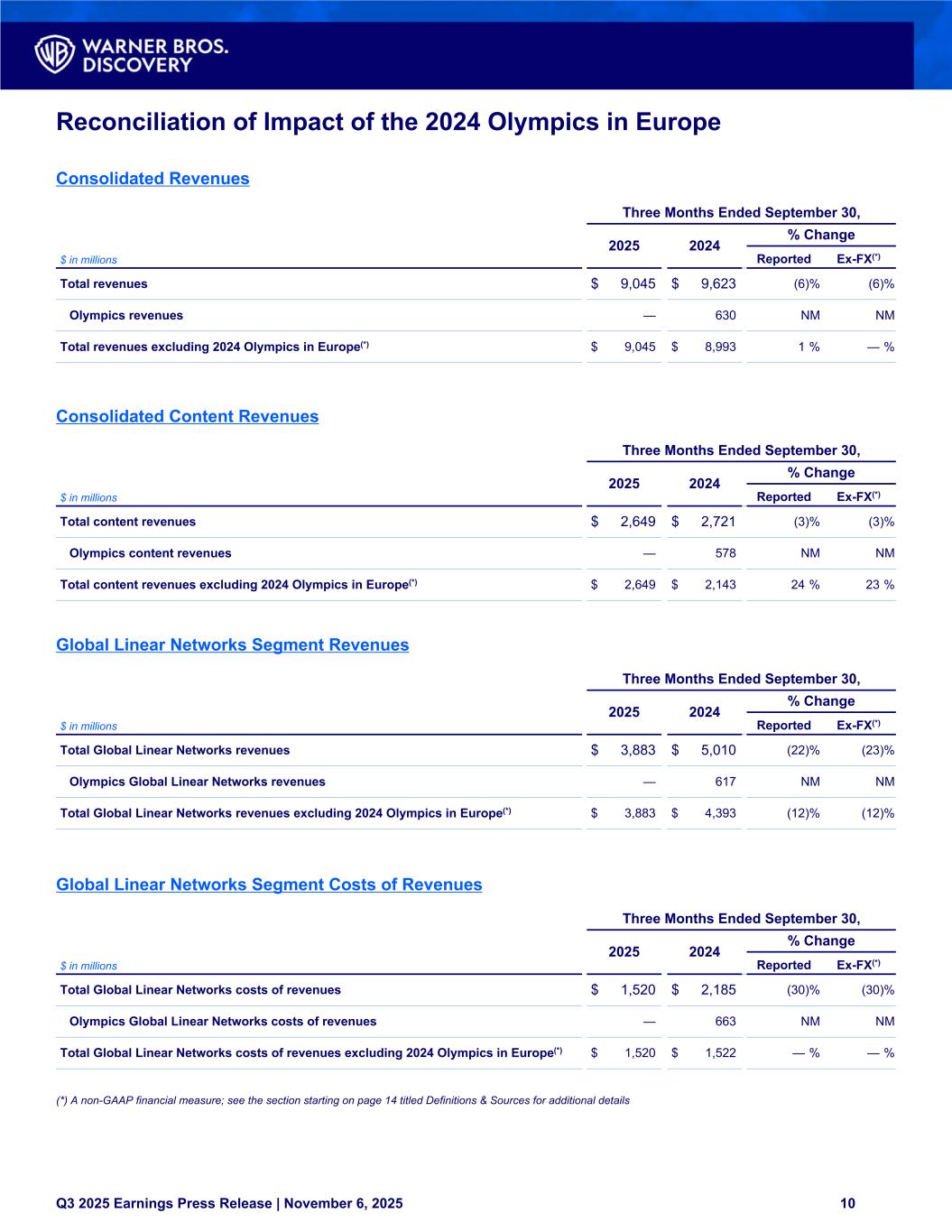

Reconciliation of Impact of the 2024 Olympics in Europe Consolidated Revenues Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Total revenues $ 9,045 $ 9,623 (6) % (6) % Olympics revenues — 630 NM NM Total revenues excluding 2024 Olympics in Europe(*) $ 9,045 $ 8,993 1 % — % Consolidated Content Revenues Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Total content revenues $ 2,649 $ 2,721 (3) % (3) % Olympics content revenues — 578 NM NM Total content revenues excluding 2024 Olympics in Europe(*) $ 2,649 $ 2,143 24 % 23 % Global Linear Networks Segment Revenues Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Total Global Linear Networks revenues $ 3,883 $ 5,010 (22) % (23) % Olympics Global Linear Networks revenues — 617 NM NM Total Global Linear Networks revenues excluding 2024 Olympics in Europe(*) $ 3,883 $ 4,393 (12) % (12) % Global Linear Networks Segment Costs of Revenues Three Months Ended September 30, 2025 2024 % Change $ in millions Reported Ex-FX(*) Total Global Linear Networks costs of revenues $ 1,520 $ 2,185 (30) % (30) % Olympics Global Linear Networks costs of revenues — 663 NM NM Total Global Linear Networks costs of revenues excluding 2024 Olympics in Europe(*) $ 1,520 $ 1,522 — % — % (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details Q3 2025 Earnings Press Release | November 6, 2025 10

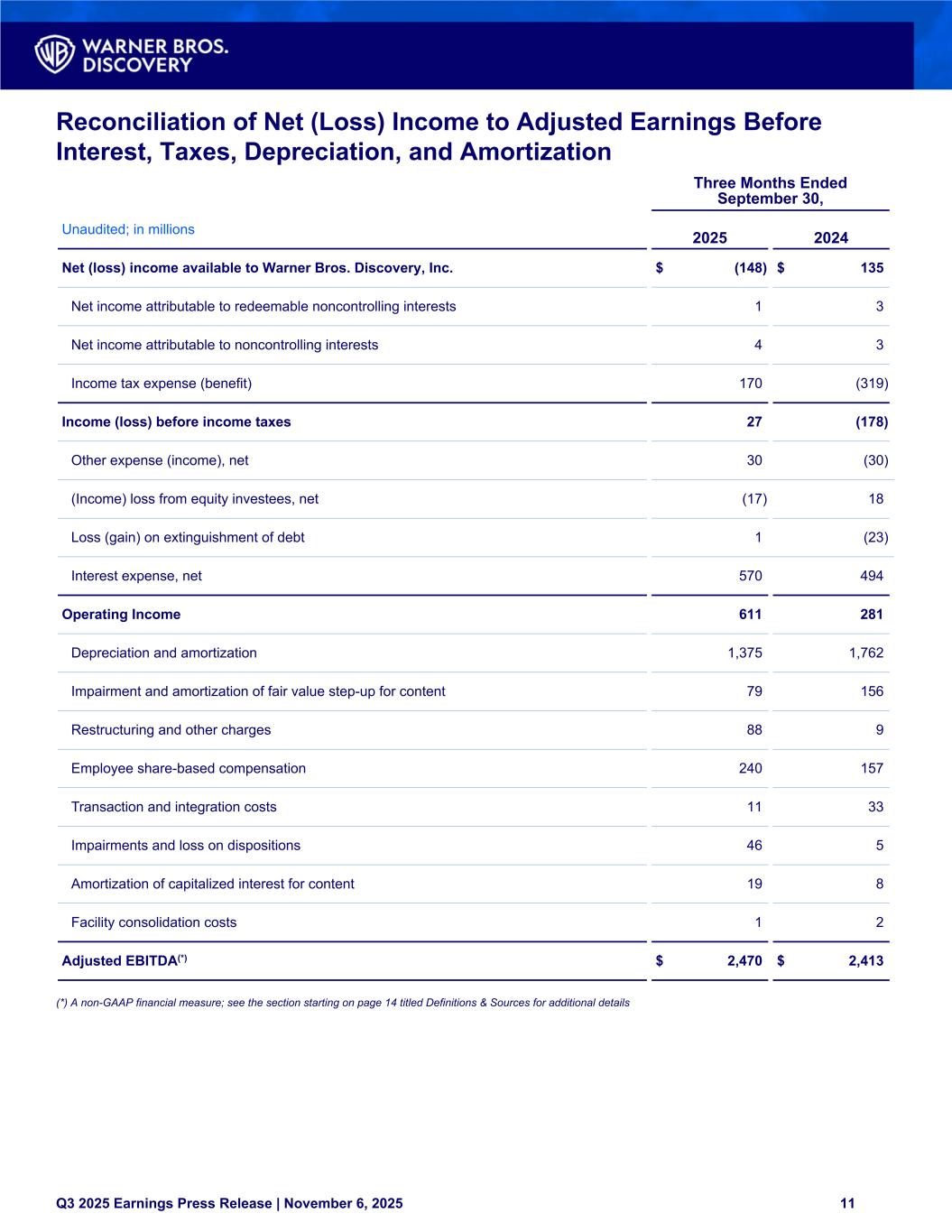

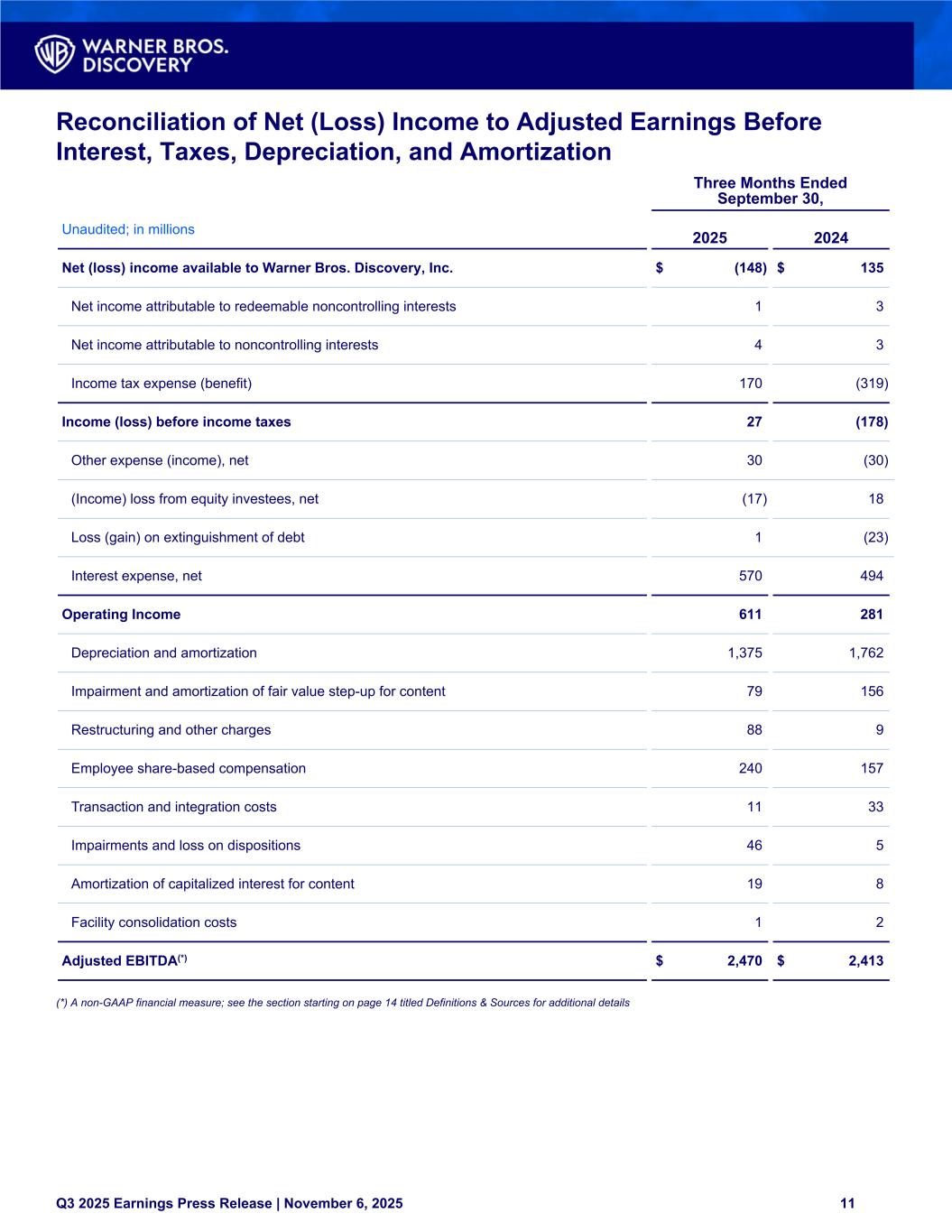

Reconciliation of Net (Loss) Income to Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization Three Months Ended September 30, Unaudited; in millions 2025 2024 Net (loss) income available to Warner Bros. Discovery, Inc. $ (148) $ 135 Net income attributable to redeemable noncontrolling interests 1 3 Net income attributable to noncontrolling interests 4 3 Income tax expense (benefit) 170 (319) Income (loss) before income taxes 27 (178) Other expense (income), net 30 (30) (Income) loss from equity investees, net (17) 18 Loss (gain) on extinguishment of debt 1 (23) Interest expense, net 570 494 Operating Income 611 281 Depreciation and amortization 1,375 1,762 Impairment and amortization of fair value step-up for content 79 156 Restructuring and other charges 88 9 Employee share-based compensation 240 157 Transaction and integration costs 11 33 Impairments and loss on dispositions 46 5 Amortization of capitalized interest for content 19 8 Facility consolidation costs 1 2 Adjusted EBITDA(*) $ 2,470 $ 2,413 (*) A non-GAAP financial measure; see the section starting on page 14 titled Definitions & Sources for additional details Q3 2025 Earnings Press Release | November 6, 2025 11

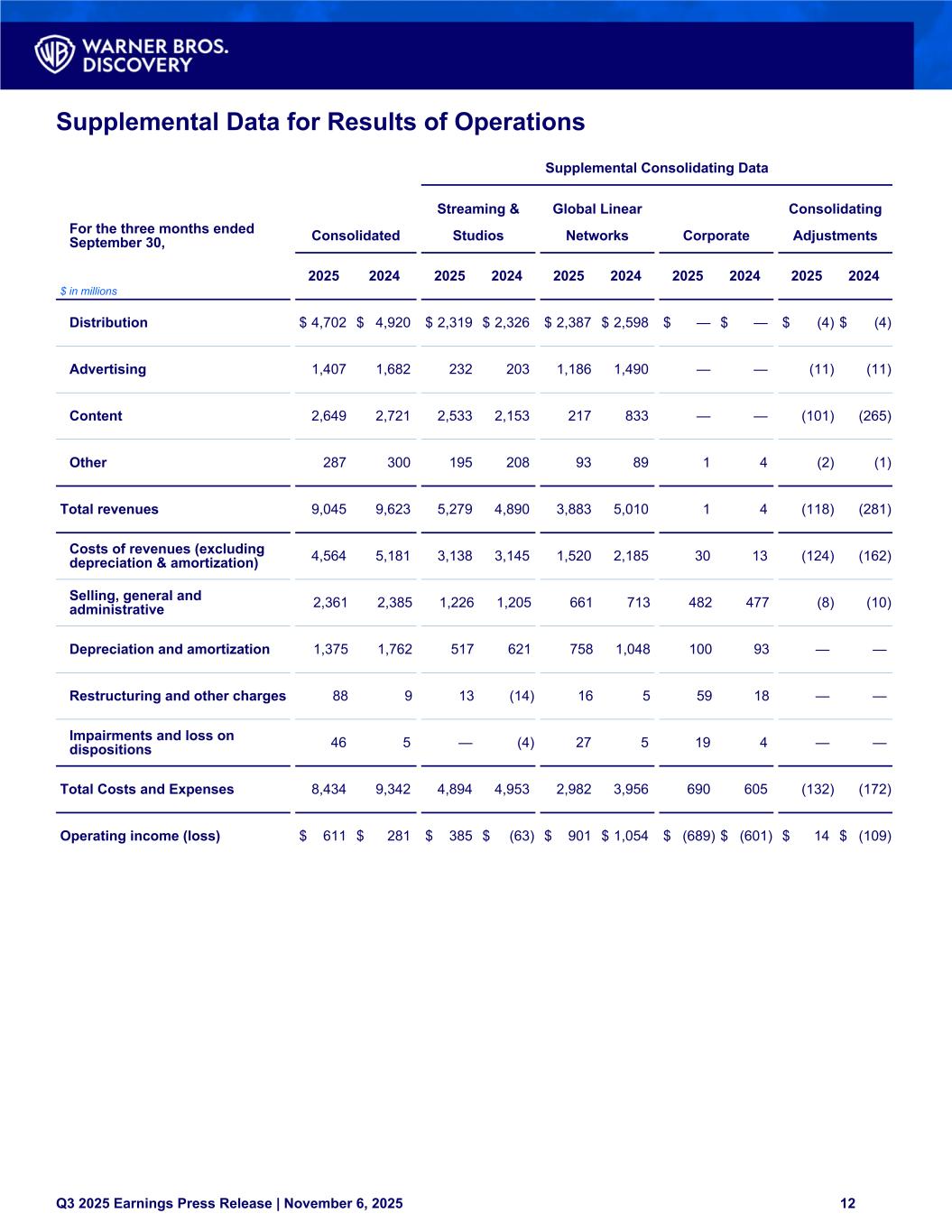

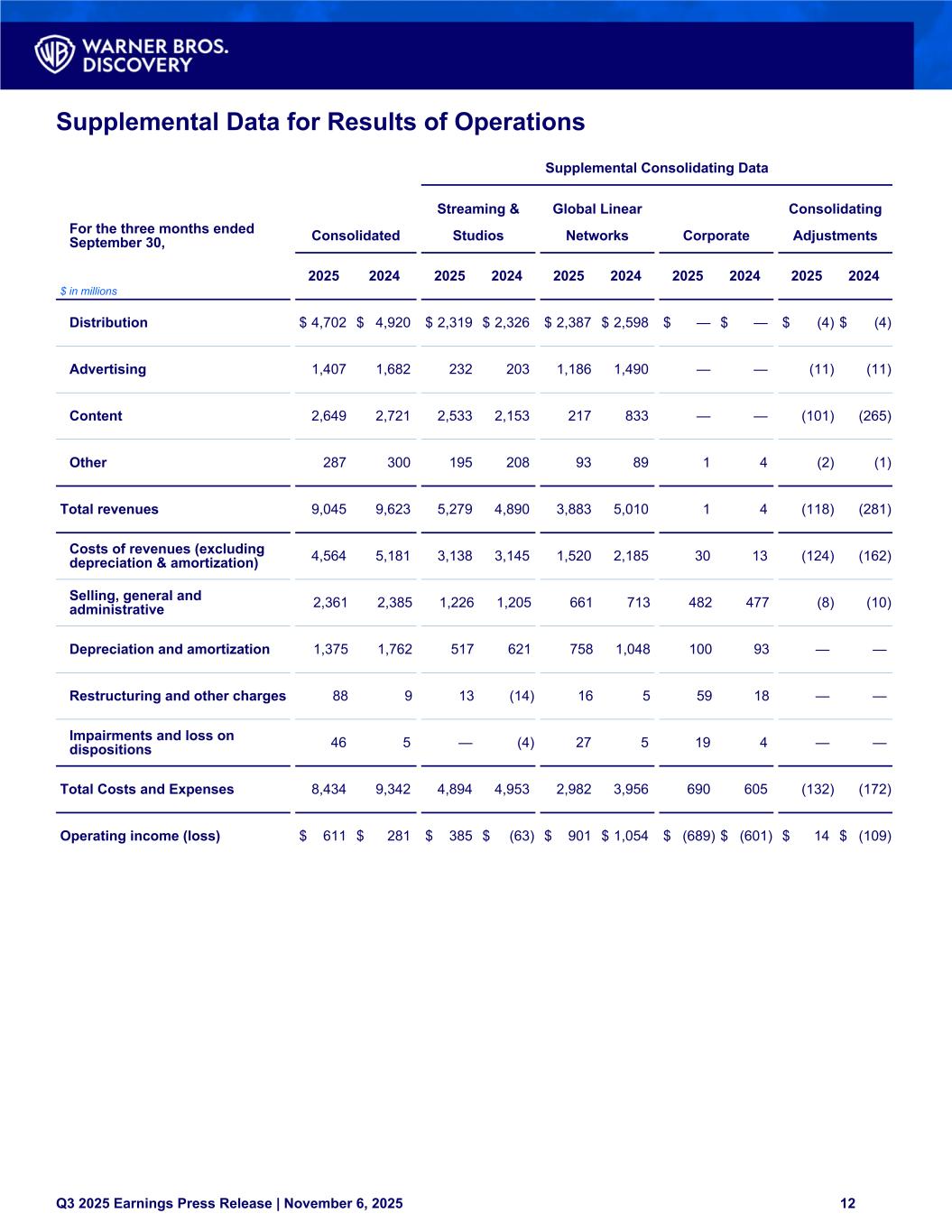

Supplemental Data for Results of Operations Supplemental Consolidating Data Streaming & Global Linear Consolidating For the three months ended September 30, Consolidated Studios Networks Corporate Adjustments $ in millions 2025 2024 2025 2024 2 2025 2024 2025 2024 2025 2024 Distribution $ 4,702 $ 4,920 $ 2,319 $ 2,326 $ 2,387 $ 2,598 $ — $ — $ (4) $ (4) Advertising 1,407 1,682 232 203 1,186 1,490 — — (11) (11) Content 2,649 2,721 2,533 2,153 217 833 — — (101) (265) Other 287 300 195 208 93 89 1 4 (2) (1) Total revenues 9,045 9,623 5,279 4,890 3,883 5,010 1 4 (118) (281) Costs of revenues (excluding depreciation & amortization) 4,564 5,181 3,138 3,145 1,520 2,185 30 13 (124) (162) Selling, general and administrative 2,361 2,385 1,226 1,205 661 713 482 477 (8) (10) Depreciation and amortization 1,375 1,762 517 621 758 1,048 100 93 — — Restructuring and other charges 88 9 13 (14) 16 5 59 18 — — Impairments and loss on dispositions 46 5 — (4) 27 5 19 4 — — Total Costs and Expenses 8,434 9,342 4,894 4,953 2,982 3,956 690 605 (132) (172) Operating income (loss) $ 611 $ 281 $ 385 $ (63) $ 901 $ 1,054 $ (689) $ (601) $ 14 $ (109) Q3 2025 Earnings Press Release | November 6, 2025 12

2025 Outlook Warner Bros. Discovery, Inc. ("Warner Bros. Discovery", "WBD", the "Company", "we", "us", or "our" ) may provide forward-looking commentary in connection with this earnings announcement on its quarterly earnings conference call. Details on how to access the audio webcast are included below. Q3 2025 Prepared Earnings Remarks Conference Call Information In conjunction with this release, Warner Bros. Discovery will post a Shareholder Letter and host a conference call today, November 6, 2025 at 8:00 a.m. ET, to discuss its third quarter 2025 financial results. To access the Shareholder Letter and webcast of the earnings call, please visit the Investor Relations section of the Company's website at www.wbd.com. Cautionary Statement Concerning Forward-Looking Statements Information set forth in this communication constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding the Company’s expectations, beliefs, intentions or strategies regarding the future, and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. These forward-looking statements are based on current expectations, forecasts, and assumptions that involve risks and uncertainties and on information available to Warner Bros. Discovery as of the date hereof. Forward-looking statements include, without limitation, statements about the benefits of the planned separation, including future financial and operating results, in the case of a separation, either companies’ future company plans, objectives, expectations and intentions, the WBD’s review of strategic alternatives, and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of WBD’s management and are subject to significant risks and uncertainties outside of our control. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: whether we will be able to identify or develop any strategic alternatives to our planned separation; our ability to execute on material aspects of any strategic alternatives that are identified and pursued, whether we can achieve the potential benefits of any strategic alternatives; the occurrence of any event, change or other circumstances that could give rise to the abandonment of the planned separation or pursuit of a different structure or strategic alternative; risks that any of the conditions to the planned separation may not be satisfied in a timely manner; risks that the anticipated tax treatment of the planned separation is not obtained; risks related to potential litigation brought in connection with the planned separation, any unsolicited proposal, or the review of strategic alternatives; uncertainties as to the timing of the planned separation and the review of strategic alternatives; risks and costs related to the planned separation, the receipt of unsolicited proposals, and the review of strategic alternatives, including risks relating to changes to the configuration of WBD’s existing businesses; the risk that implementing the planned separation may be more difficult, time consuming or costly than expected; risks related to financial community and rating agency perceptions of WBD and its business, operations, financial condition and the industry in which it operates; risks related to disruption of management time from ongoing business operations due to the planned separation, any unsolicited proposal, or the review of strategic alternatives; failure to realize the benefits expected from the planned separation; the final terms and conditions of the planned separation, including the terms of any ongoing commercial agreements and arrangements, and the relationship between Warner Bros. and Discovery Global following the planned separation; the nature and amount of any indebtedness incurred by Warner Bros. or Discovery Global; effects of the announcement, pendency or completion of the planned separation and the review of strategic alternatives on the ability of WBD to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally; risks related to the potential impact of general economic, political and market factors on WBD as it implements its planned separation; and risks related to obtaining permanent financing. WBD's actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include the risks related to the separation. Discussions of additional risks and uncertainties are contained in WBD’s filings with the Securities and Exchange Commission, including but not limited to WBD’s most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. WBD is not under any obligation, and expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. Non-GAAP Financial Measures In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this communication may also contain certain non-GAAP financial measures, identified with an "(*)". Reconciliations between the non-GAAP financial measures and the closest GAAP financial measures are available in the financial schedules in this release and in the "Quarterly Results" section of the Warner Bros. Discovery, Inc. investor relations website at: https://ir.wbd.com. About Warner Bros. Discovery Warner Bros. Discovery is a leading global media and entertainment company that creates and distributes the world’s most differentiated and complete portfolio of branded content across television, film, streaming and gaming. Warner Bros. Discovery inspires, informs and entertains audiences worldwide through its iconic brands and products including: Discovery Channel, HBO Max, discovery+, CNN, DC, TNT Sports, Eurosport, HBO, HGTV, Food Network, OWN, Investigation Discovery, TLC, Magnolia Network, TNT, TBS, truTV, Travel Channel, Animal Planet, Science Channel, Warner Bros. Motion Picture Group, Warner Bros. Television Group, Warner Bros. Pictures Animation, Warner Bros. Games, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies, Discovery en Español, Hogar de HGTV and others. For more information, please visit www.wbd.com. Contacts Media Robert Gibbs Megan Klein (347) 268-3017 (310) 210-5018 robert.gibbs@wbd.com megan.klein@wbd.com Investor Relations Andrew Slabin Peter Lee (212) 548-5544 (212) 548-5907 andrew.slabin@wbd.com peter.lee@wbd.com Q3 2025 Earnings Press Release | November 6, 2025 13

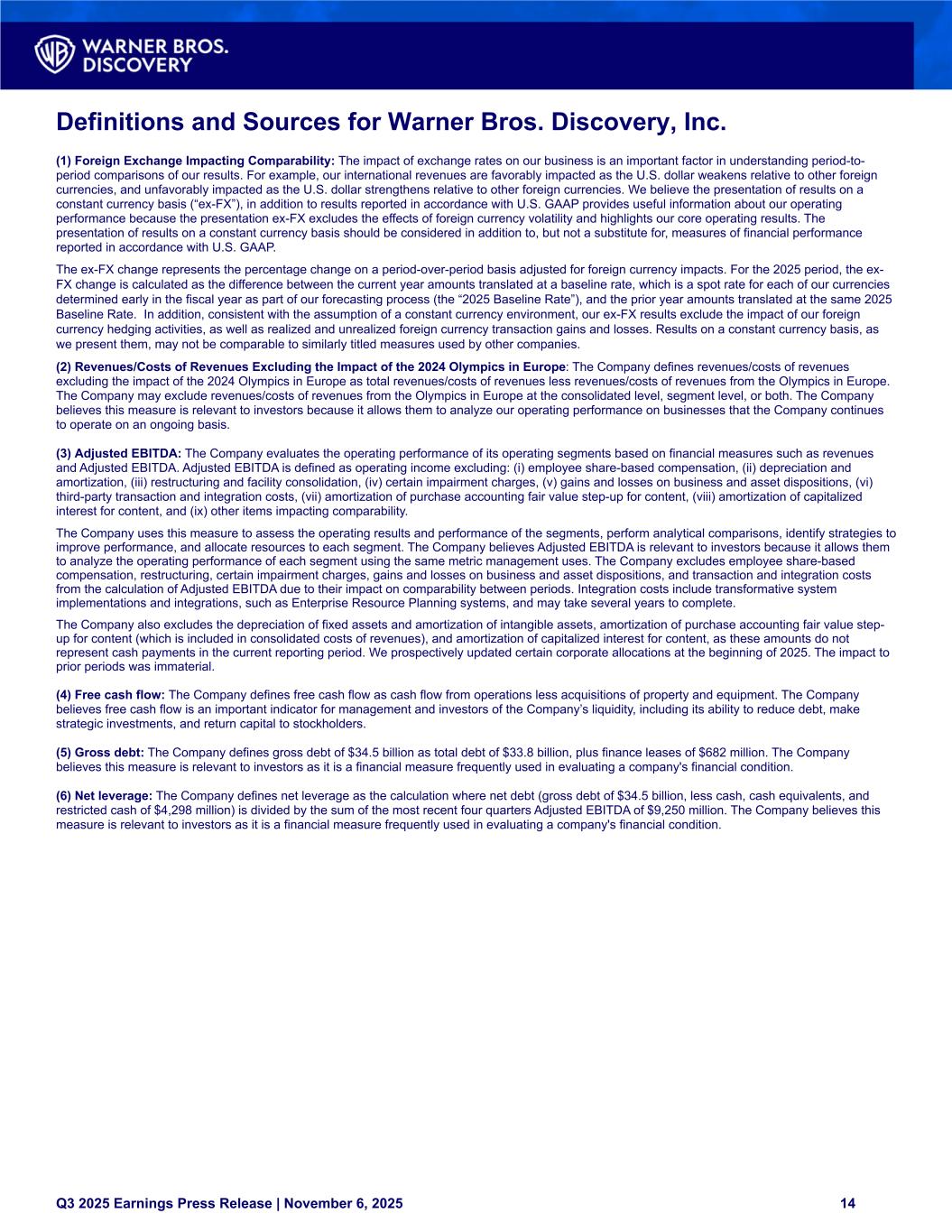

Definitions and Sources for Warner Bros. Discovery, Inc. (1) Foreign Exchange Impacting Comparability: The impact of exchange rates on our business is an important factor in understanding period-to- period comparisons of our results. For example, our international revenues are favorably impacted as the U.S. dollar weakens relative to other foreign currencies, and unfavorably impacted as the U.S. dollar strengthens relative to other foreign currencies. We believe the presentation of results on a constant currency basis (“ex-FX”), in addition to results reported in accordance with U.S. GAAP provides useful information about our operating performance because the presentation ex-FX excludes the effects of foreign currency volatility and highlights our core operating results. The presentation of results on a constant currency basis should be considered in addition to, but not a substitute for, measures of financial performance reported in accordance with U.S. GAAP. The ex-FX change represents the percentage change on a period-over-period basis adjusted for foreign currency impacts. For the 2025 period, the ex- FX change is calculated as the difference between the current year amounts translated at a baseline rate, which is a spot rate for each of our currencies determined early in the fiscal year as part of our forecasting process (the “2025 Baseline Rate”), and the prior year amounts translated at the same 2025 Baseline Rate. In addition, consistent with the assumption of a constant currency environment, our ex-FX results exclude the impact of our foreign currency hedging activities, as well as realized and unrealized foreign currency transaction gains and losses. Results on a constant currency basis, as we present them, may not be comparable to similarly titled measures used by other companies. (2) Revenues/Costs of Revenues Excluding the Impact of the 2024 Olympics in Europe: The Company defines revenues/costs of revenues excluding the impact of the 2024 Olympics in Europe as total revenues/costs of revenues less revenues/costs of revenues from the Olympics in Europe. The Company may exclude revenues/costs of revenues from the Olympics in Europe at the consolidated level, segment level, or both. The Company believes this measure is relevant to investors because it allows them to analyze our operating performance on businesses that the Company continues to operate on an ongoing basis. (3) Adjusted EBITDA: The Company evaluates the operating performance of its operating segments based on financial measures such as revenues and Adjusted EBITDA. Adjusted EBITDA is defined as operating income excluding: (i) employee share-based compensation, (ii) depreciation and amortization, (iii) restructuring and facility consolidation, (iv) certain impairment charges, (v) gains and losses on business and asset dispositions, (vi) third-party transaction and integration costs, (vii) amortization of purchase accounting fair value step-up for content, (viii) amortization of capitalized interest for content, and (ix) other items impacting comparability. The Company uses this measure to assess the operating results and performance of the segments, perform analytical comparisons, identify strategies to improve performance, and allocate resources to each segment. The Company believes Adjusted EBITDA is relevant to investors because it allows them to analyze the operating performance of each segment using the same metric management uses. The Company excludes employee share-based compensation, restructuring, certain impairment charges, gains and losses on business and asset dispositions, and transaction and integration costs from the calculation of Adjusted EBITDA due to their impact on comparability between periods. Integration costs include transformative system implementations and integrations, such as Enterprise Resource Planning systems, and may take several years to complete. The Company also excludes the depreciation of fixed assets and amortization of intangible assets, amortization of purchase accounting fair value step- up for content (which is included in consolidated costs of revenues), and amortization of capitalized interest for content, as these amounts do not represent cash payments in the current reporting period. We prospectively updated certain corporate allocations at the beginning of 2025. The impact to prior periods was immaterial. (4) Free cash flow: The Company defines free cash flow as cash flow from operations less acquisitions of property and equipment. The Company believes free cash flow is an important indicator for management and investors of the Company’s liquidity, including its ability to reduce debt, make strategic investments, and return capital to stockholders. (5) Gross debt: The Company defines gross debt of $34.5 billion as total debt of $33.8 billion, plus finance leases of $682 million. The Company believes this measure is relevant to investors as it is a financial measure frequently used in evaluating a company's financial condition. (6) Net leverage: The Company defines net leverage as the calculation where net debt (gross debt of $34.5 billion, less cash, cash equivalents, and restricted cash of $4,298 million) is divided by the sum of the most recent four quarters Adjusted EBITDA of $9,250 million. The Company believes this measure is relevant to investors as it is a financial measure frequently used in evaluating a company's financial condition. Q3 2025 Earnings Press Release | November 6, 2025 14

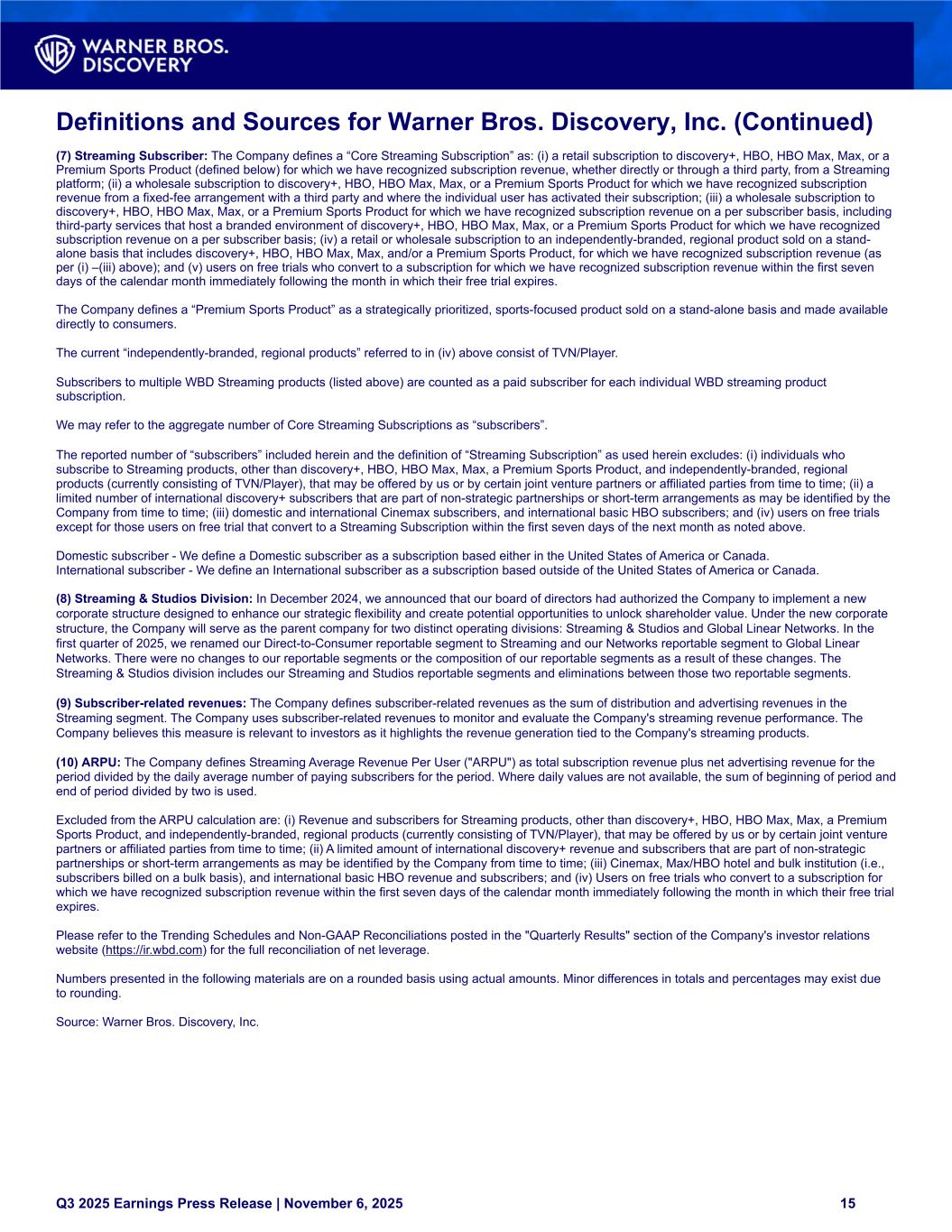

Definitions and Sources for Warner Bros. Discovery, Inc. (Continued) (7) Streaming Subscriber: The Company defines a “Core Streaming Subscription” as: (i) a retail subscription to discovery+, HBO, HBO Max, Max, or a Premium Sports Product (defined below) for which we have recognized subscription revenue, whether directly or through a third party, from a Streaming platform; (ii) a wholesale subscription to discovery+, HBO, HBO Max, Max, or a Premium Sports Product for which we have recognized subscription revenue from a fixed-fee arrangement with a third party and where the individual user has activated their subscription; (iii) a wholesale subscription to discovery+, HBO, HBO Max, Max, or a Premium Sports Product for which we have recognized subscription revenue on a per subscriber basis, including third-party services that host a branded environment of discovery+, HBO, HBO Max, Max, or a Premium Sports Product for which we have recognized subscription revenue on a per subscriber basis; (iv) a retail or wholesale subscription to an independently-branded, regional product sold on a stand- alone basis that includes discovery+, HBO, HBO Max, Max, and/or a Premium Sports Product, for which we have recognized subscription revenue (as per (i) –(iii) above); and (v) users on free trials who convert to a subscription for which we have recognized subscription revenue within the first seven days of the calendar month immediately following the month in which their free trial expires. The Company defines a “Premium Sports Product” as a strategically prioritized, sports-focused product sold on a stand-alone basis and made available directly to consumers. The current “independently-branded, regional products” referred to in (iv) above consist of TVN/Player. Subscribers to multiple WBD Streaming products (listed above) are counted as a paid subscriber for each individual WBD streaming product subscription. We may refer to the aggregate number of Core Streaming Subscriptions as “subscribers”. The reported number of “subscribers” included herein and the definition of “Streaming Subscription” as used herein excludes: (i) individuals who subscribe to Streaming products, other than discovery+, HBO, HBO Max, Max, a Premium Sports Product, and independently-branded, regional products (currently consisting of TVN/Player), that may be offered by us or by certain joint venture partners or affiliated parties from time to time; (ii) a limited number of international discovery+ subscribers that are part of non-strategic partnerships or short-term arrangements as may be identified by the Company from time to time; (iii) domestic and international Cinemax subscribers, and international basic HBO subscribers; and (iv) users on free trials except for those users on free trial that convert to a Streaming Subscription within the first seven days of the next month as noted above. Domestic subscriber - We define a Domestic subscriber as a subscription based either in the United States of America or Canada. International subscriber - We define an International subscriber as a subscription based outside of the United States of America or Canada. (8) Streaming & Studios Division: In December 2024, we announced that our board of directors had authorized the Company to implement a new corporate structure designed to enhance our strategic flexibility and create potential opportunities to unlock shareholder value. Under the new corporate structure, the Company will serve as the parent company for two distinct operating divisions: Streaming & Studios and Global Linear Networks. In the first quarter of 2025, we renamed our Direct-to-Consumer reportable segment to Streaming and our Networks reportable segment to Global Linear Networks. There were no changes to our reportable segments or the composition of our reportable segments as a result of these changes. The Streaming & Studios division includes our Streaming and Studios reportable segments and eliminations between those two reportable segments. (9) Subscriber-related revenues: The Company defines subscriber-related revenues as the sum of distribution and advertising revenues in the Streaming segment. The Company uses subscriber-related revenues to monitor and evaluate the Company's streaming revenue performance. The Company believes this measure is relevant to investors as it highlights the revenue generation tied to the Company's streaming products. (10) ARPU: The Company defines Streaming Average Revenue Per User ("ARPU") as total subscription revenue plus net advertising revenue for the period divided by the daily average number of paying subscribers for the period. Where daily values are not available, the sum of beginning of period and end of period divided by two is used. Excluded from the ARPU calculation are: (i) Revenue and subscribers for Streaming products, other than discovery+, HBO, HBO Max, Max, a Premium Sports Product, and independently-branded, regional products (currently consisting of TVN/Player), that may be offered by us or by certain joint venture partners or affiliated parties from time to time; (ii) A limited amount of international discovery+ revenue and subscribers that are part of non-strategic partnerships or short-term arrangements as may be identified by the Company from time to time; (iii) Cinemax, Max/HBO hotel and bulk institution (i.e., subscribers billed on a bulk basis), and international basic HBO revenue and subscribers; and (iv) Users on free trials who convert to a subscription for which we have recognized subscription revenue within the first seven days of the calendar month immediately following the month in which their free trial expires. Please refer to the Trending Schedules and Non-GAAP Reconciliations posted in the "Quarterly Results" section of the Company's investor relations website (https://ir.wbd.com) for the full reconciliation of net leverage. Numbers presented in the following materials are on a rounded basis using actual amounts. Minor differences in totals and percentages may exist due to rounding. Source: Warner Bros. Discovery, Inc. Q3 2025 Earnings Press Release | November 6, 2025 15