0001437107false00014371072025-06-122025-06-120001437107us-gaap:CommonClassAMember2025-06-122025-06-120001437107disca:SeniorNotesDue20304.302Member2025-06-122025-06-120001437107disca:SeniorNotesDue20304.693Member2025-06-122025-06-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2025

Warner Bros. Discovery, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34177

|

|

|

|

|

|

|

|

|

Delaware |

|

35-2333914 |

(State or other jurisdiction of incorporation) |

|

(IRS Employer Identification No.) |

230 Park Avenue South

New York, New York 10003

(Address of principal executive offices, including zip code)

212-548-5555

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Series A Common Stock |

|

WBD |

|

Nasdaq Global Select Market |

| 4.302% Senior Notes due 2030 |

|

WBDI30 |

|

Nasdaq Global Market |

| 4.693% Senior Notes due 2033 |

|

WBDI33 |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On June 12, 2025, Warner Bros. Discovery, Inc. (“we,” “us,” “our,” “WBD” or the “Company”) and our wholly-owned subsidiary Discovery Communications, LLC (“DCL”) entered into employment agreements with David Zaslav, our Chief Executive Officer (“CEO”), and Gunnar Wiedenfels, our Chief Financial Officer (individually, the “Zaslav Agreement” and the “Wiedenfels Agreement,” and collectively, the “Agreements”).

We entered into the Agreements in connection with our recently announced plans to separate our Streaming & Studios division from our Global Networks division in a tax-free transaction (the “Separation”), following which the Streaming & Studios division and the Global Networks division will become two publicly traded companies (referred to herein, respectively, as “Streaming & Studios” and “Global Networks”). The Zaslav Agreement amends and restates Mr. Zaslav’s prior employment agreement (the “Prior Agreement”) with certain terms that only become effective upon the Separation, when Mr. Zaslav is anticipated to become the CEO of Streaming & Studios. The Wiedenfels Agreement is contingent upon, and only effective on, the Separation and provides for the terms and conditions of his employment as the CEO of Global Networks after the Separation. The Compensation Committee (“Committee”) of the Board of Directors (the “Board”) of the Company approved and recommended to the Board to enter into, and the Board approved such entry into, the Agreements so that we may secure the leadership of Messrs. Zaslav and Wiedenfels through the initial stages of the two new companies. The following summary description of certain provisions of the Agreements does not purport to be complete and is qualified in its entirety by the actual text of the Zaslav Agreement, form of David Zaslav Non-Qualified Stock Option Grant Agreement and Wiedenfels Agreement, which have been filed with this Current Report as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Zaslav Employment Agreement

Introduction

With respect to the Zaslav Agreement, the Committee took the opportunity to redesign Mr. Zaslav’s compensation package following the effective time of the Separation, which the Committee believes will achieve the following goals:

•Secure Mr. Zaslav’s continued leadership and incentivize his critical contributions to position WBD for success until the Separation and to build a strong foundation for long-term stockholder value creation at Streaming & Studios;

•Address stockholder feedback and preferences with respect to CEO compensation structure; and

•Foster a stronger pay-for-performance alignment by allocating a significant portion of Mr. Zaslav’s target annual compensation to be at-risk in long-term equity incentives.

In considering Mr. Zaslav’s new compensation package, the Committee, in consultation with its independent compensation consultant, assessed a range of inputs, including stockholder feedback obtained over the last few years, peer group practices and benchmarks, strategic priorities of WBD and the value creation opportunities presented by the proposed Separation. Additionally, the Committee considered Mr. Zaslav’s deep understanding of our strategy and operations, extensive industry experience and leadership, as well as his role in developing the vision for the separation of the two companies, which we believe uniquely positions him to lead us through the consummation of the Separation and serve at the helm of Streaming & Studios through its initial formative period as a standalone company.

Beginning upon the completion of the Separation, the Zaslav Agreement will significantly reduce his target annual compensation, including lowering his annual cash compensation opportunity and reorienting the total pay mix toward long-term incentives, which the Committee believes will foster a stronger alignment with stockholders and incentivize sustained, long-term value creation, as further described below. Following the Separation, the Zaslav Agreement will no longer specify performance metric weighting that apply to the annual cash incentive opportunity or annual performance equity awards or performance periods for the annual performance equity awards. This will provide the Committee with flexibility to determine appropriate performance metrics and periods, as applicable, for the annual cash incentive opportunity and the annual performance equity awards.

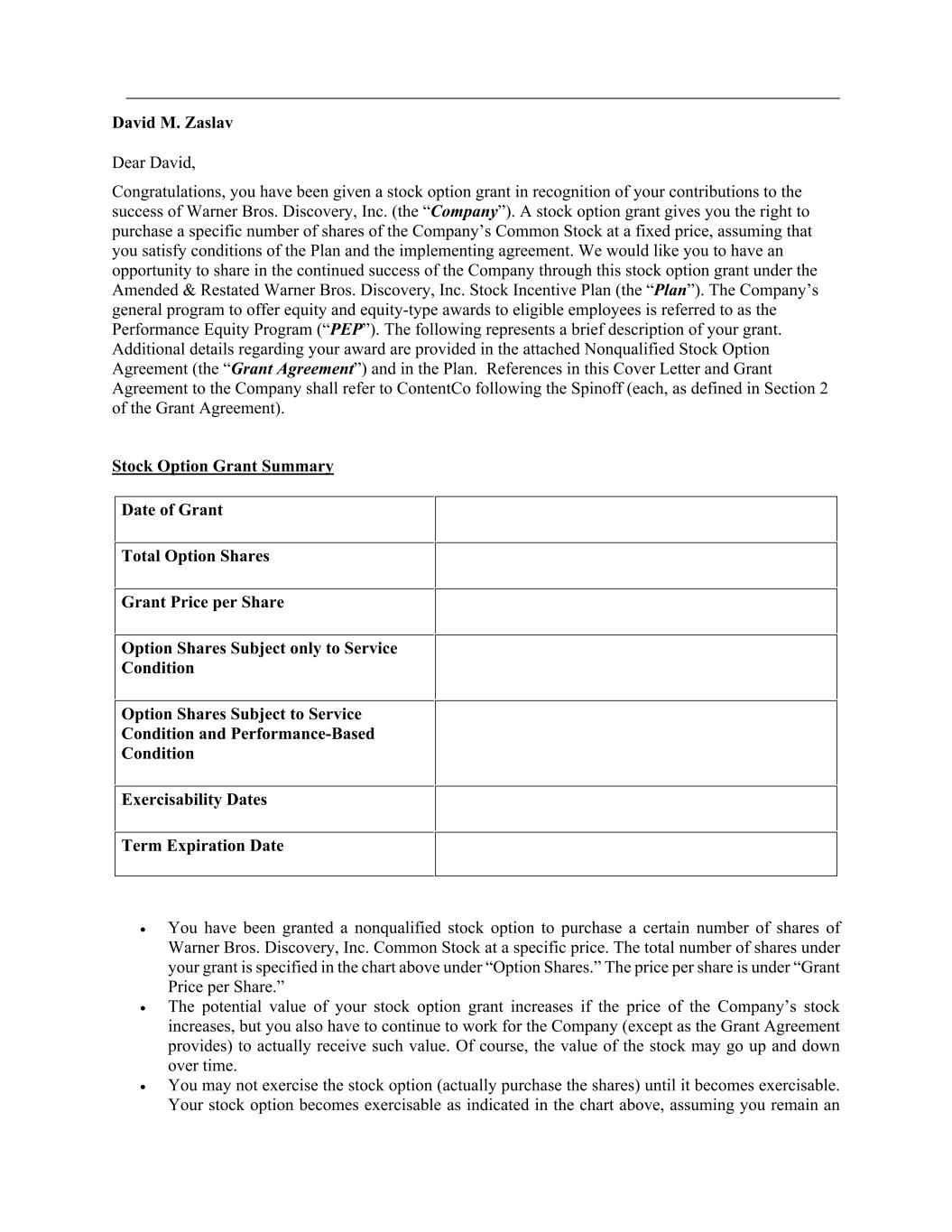

Under the Zaslav Agreement, as a one-time inducement that the Committee believes will incentivize the successful completion of the Separation and stockholder value creation, Mr. Zaslav received on June 12, 2026 a stock option award consisting of 20,898,776 stock options in the form of 60% performance-vesting stock options and 40% time-based stock options, as further described below. In addition, as described below, under the terms of the Zaslav Agreement, Mr. Zaslav will receive 3,052,734 stock options on January 2, 2026, which will be subject to the same split of performance-vesting and time-based vesting conditions, provided that he remains employed on that date. As described further below, 92% of the stock option grant is subject to forfeiture if a Separation or a Qualifying Transaction (as defined below) does not occur prior to December 31, 2026.

The Committee also took the opportunity to adopt a double-trigger cash severance provision for Mr. Zaslav in the event of a change in control transaction, eliminating the legacy single-trigger provision effective as of June 12, 2026, in response to stockholder feedback and in line with leading market practices, as further described below. The Committee believes the changes reflected in the Zaslav Agreement are responsive to stockholder feedback and represent the Board’s commitment to furthering the alignment of our compensation structure with our strategic priorities as we execute on our transformation into two leading media companies.

Summary

Prior to the Separation, Mr. Zaslav will continue to serve as our CEO with an annual base salary, annual cash bonus opportunity and annual grants of performance based restricted stock units (“PRSUs”) on the terms set forth in the Prior Agreement. If a Separation does not occur prior to December 31, 2026, those terms will continue while Mr. Zaslav remains our CEO until December 31, 2027. The material terms of the Prior Agreement are described in our Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 20, 2021 and March 6, 2023.

Upon completion of the Separation, Mr. Zaslav will become the CEO of Streaming & Studios with a term of employment that runs through December 31, 2030 and a base salary of $3,000,000 per annum for the duration of the term. Following the Separation, Mr. Zaslav’s target annual cash bonus opportunity will be reduced to $6,000,000, with the actual payout based on the achievement of performance goals established by Streaming & Studios’ compensation committee. The annual bonus payout is subject to a cap of 200% of the target amount. Mr. Zaslav will also be eligible to receive annual equity awards following the Separation under Streaming & Studios’ equity incentive plan (the “Streaming & Studios Plan”) with a target value of $15,500,000 in the first year that Mr. Zaslav receives an equity grant from Streaming & Studios and which will be reduced to an annual target value of $7,500,000 per year thereafter during the term of employment.

The larger initial annual equity award in such first year is intended to incentivize performance results and enhance retention, in regard to the important transition period immediately following the Separation. Fifty percent (50%) of the value of any Streaming & Studios annual equity grant will be in the form of PRSUs and the remaining fifty percent (50%) will be in the form of time-based restricted stock units (“RSUs”), with the terms and conditions of such awards and the performance objectives for the PRSUs established based on Streaming & Studios’ then-standard practices and procedures for awards to other senior executives of Streaming & Studios. In the year that the Separation occurs, Mr. Zaslav’s annual bonus target will be prorated based on the target amount in effect under the Prior Agreement and his reduced annual bonus target under the Zaslav Agreement and he will only receive one annual equity award in such year, which will either be based on the terms of his Prior Agreement or the Zaslav Agreement, depending on whether the Separation has occurred prior to or following the normal time when annual equity grants are made.

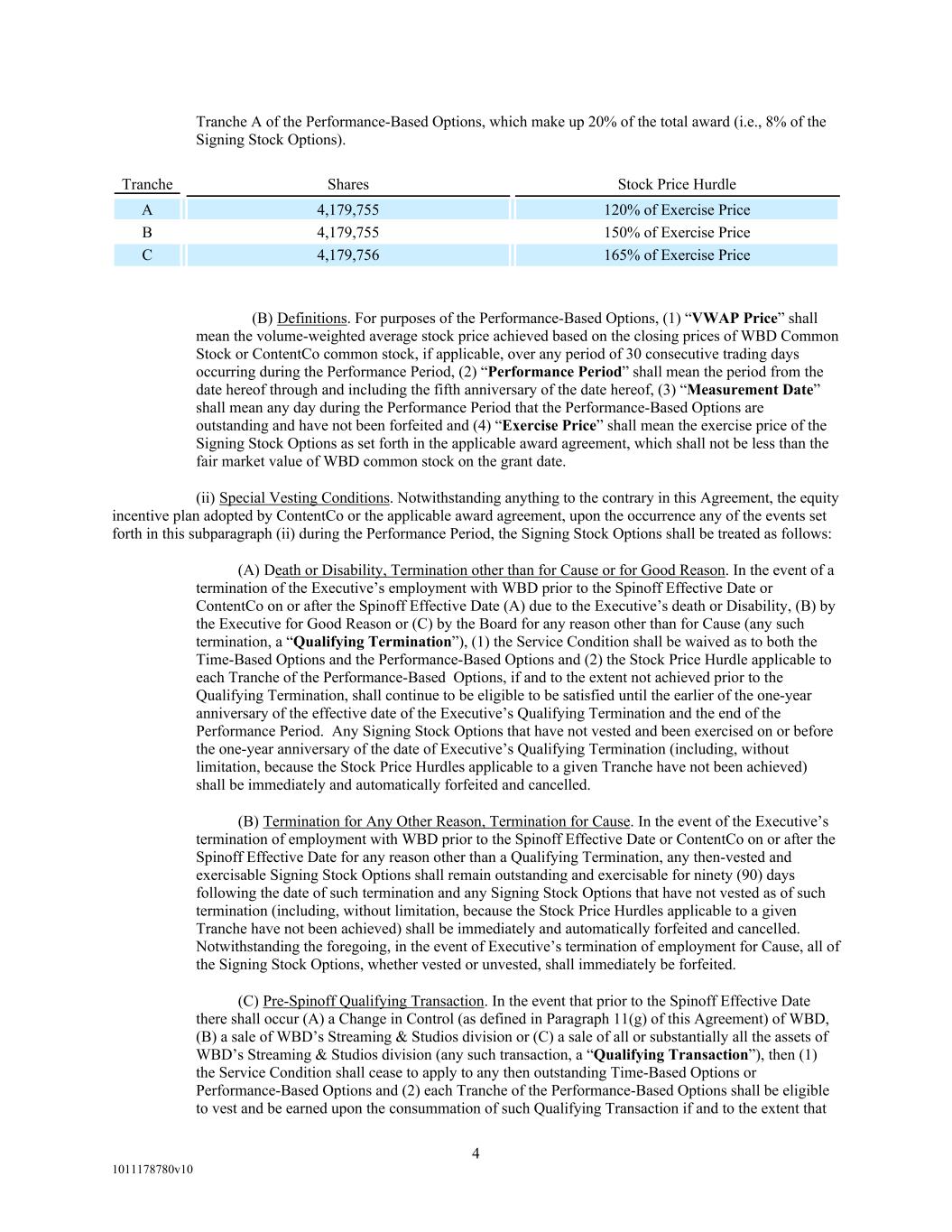

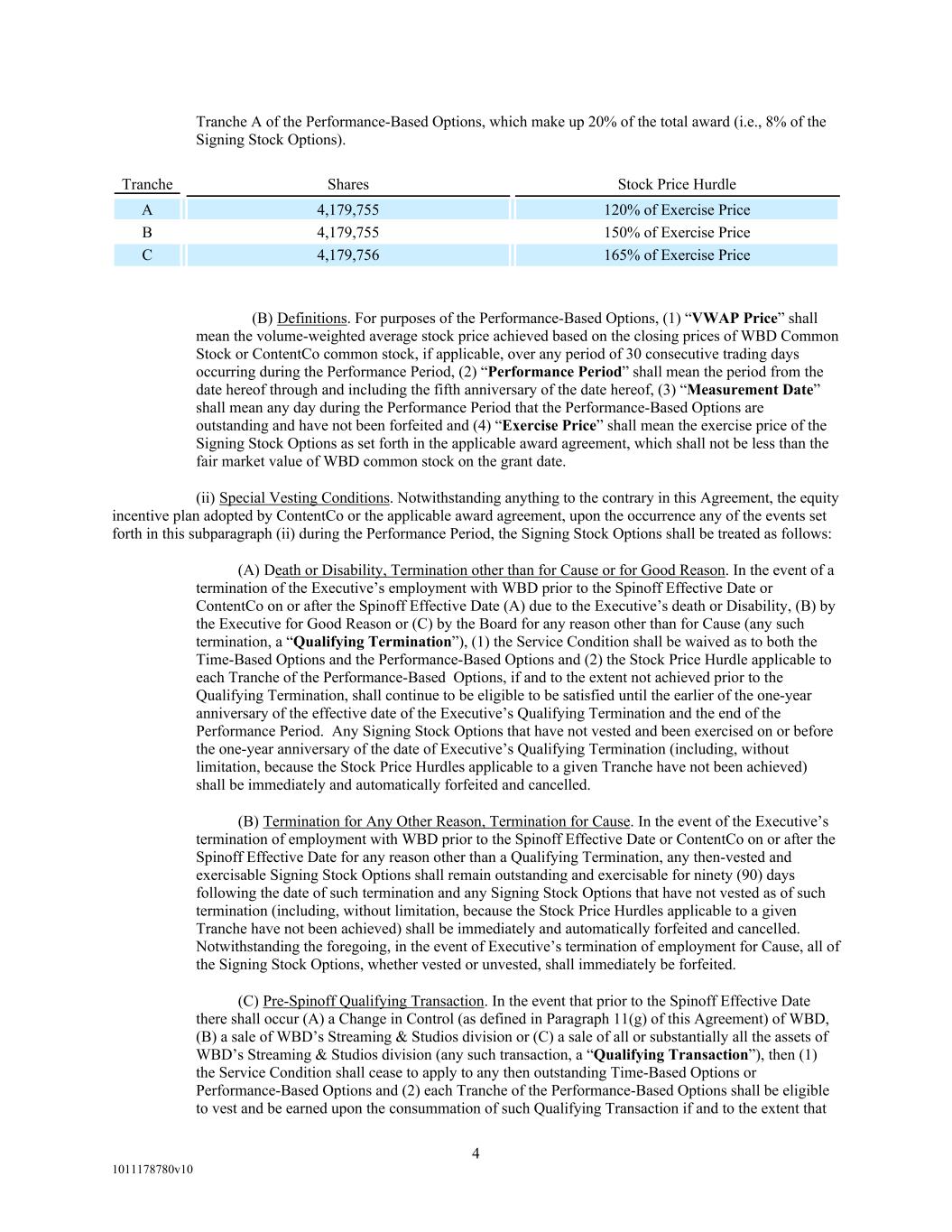

Under the Zaslav Agreement, Mr. Zaslav received on June 12, 2026 a special grant of stock options under the Amended and Restated Warner Bros. Discovery Stock Incentive Plan (“WBD Plan”) to purchase 20,898,776 shares of our common stock (the “Signing Options”), 92% of which is subject to forfeiture if a Separation or a Qualifying Transaction (as defined below) does not occur prior to December 31, 2026, as further described below. Forty percent (40%) of the Signing Options are subject to time-based vesting requirements (the “Time-Based Options”), with one-fifth of the Time-Based Options eligible to vest on each of the first five anniversaries of June 12, 2025, provided that Mr. Zaslav remains employed by WBD or Streaming & Studios. This is referred to as the “service condition”. The remaining sixty percent (60%) of the Signing Options (the “Performance-Based Options”) will vest if, in addition to Mr. Zaslav satisfying the service condition, a performance goal related to the price of our common stock relative to each Signing Option’s exercise price of $10.16 is achieved. The Performance-Based Options are divided into three equal tranches of 4,179,755 stock options each with the following performance goals, which must be achieved before June 12, 2030 (or earlier in the case of certain transactions or terminations, as described below):

•Tranche A: achievement over a period of 30 consecutive days of a volume-weighted average stock price (a “VWAP Price”) equal to or exceeding 120% of the exercise price ($12.19)

•Tranche B: achievement of a VWAP price equal to or exceeding 150% of the exercise price ($15.24)

•Tranche C: achievement of a VWAP price equal to or exceeding 165% of the exercise price ($16.76)

In addition, on January 2, 2026, Mr. Zaslav will receive a grant of additional options under the WBD Plan to purchase 3,052,734 shares of WBD common stock, which will have the same terms as the Signing Options above (including the same performance goals), provided he remains a full-time employee of WBD through such date. If our stock price exceeds $10.16 on January 2, 2026, additional awards will be made to address the lost economic value attributable to the higher exercise price.

The Signing Options are subject to special vesting rules in the event of certain transactions, including the Separation. If a Separation does not occur prior to December 31, 2026, then Mr. Zaslav will retain only the then-vested Time-Based Options (i.e., 8% of the total award). The remaining portion of the Time-Based Options and all of the Performance-Based Options will be forfeited on December 31, 2026, regardless of whether the Performance-Based Options have satisfied the service condition or the performance goals. Based on the stated service conditions, this means that only 20% of the Time-Based Options would be expected to become vested on or before December 31, 2026 and remain outstanding if the Separation does not occur prior to that date and all other Signing Options would be forfeited.

In addition, if prior to a Separation, there occurs a “change in control” (as defined in the WBD Plan) of the Company or we otherwise sell our Streaming & Studios division (or all or substantially all of its assets) (any such transaction, a “Qualifying Transaction”) prior to December 31, 2026, then all of the Time-Based Options will become vested and each tranche of Performance-Based Options will vest, if and to the extent that the price of our common stock on or immediately prior to the occurrence of the Qualifying Transaction equals or exceeds the applicable performance goal for such tranche. Any Performance-Based Options that do not become vested in connection with a Qualifying Transaction will be forfeited.

Upon a Separation, the Signing Options will be converted solely into options to purchase shares of Streaming & Studios common stock using the methodology determined by the Committee, and the exercise price and all performance goals will be adjusted using such methodology to be measured relative to Streaming & Studios common stock. If there occurs a change in control of Streaming & Studios following the Separation, then the Signing Options will be treated as described above for a Qualifying Transaction except that the measurement of performance goals that determine the vesting of each tranche of Performance-Based Options will be based on the price of Streaming & Studios common stock on or immediately prior to the change in control of Streaming & Studios. Change in control for these purposes will be defined in the Streaming & Studios Plan.

If Mr. Zaslav’s employment is terminated without “Cause” or for “Good Reason”, or on account of death or disability (as such terms are defined below), all of the outstanding Time-Based Options will become fully vested and exercisable and the Performance-Based Options will remain outstanding and eligible to satisfy the performance goals for a period of one year (or until June 12, 2030 for any termination after June 12, 2029), following which any Signing Options which have not vested and been exercised will be forfeited. Mr. Zaslav will forfeit all of the Signing Options, whether vested or unvested, upon a termination for Cause. If Mr. Zaslav’s employment is terminated for any other reason, any then-vested Signing Options will be exercisable for 90 days following such termination and all the remaining unvested Signing Options will be forfeited immediately upon such termination.

Under the Zaslav Agreement, Mr. Zaslav’s right to voluntarily terminate his employment between 30 and 60 days following a change in control and receive substantial severance benefits – a so-called “walk away right” – has been eliminated effective upon execution of the Zaslav Agreement and regardless of whether the Separation occurs.

Until the Separation, Mr. Zaslav will continue to be required to hold 1,500,000 shares of our common stock and following the Separation, Mr. Zaslav will be required to hold an equivalent number of shares of Streaming & Studios common stock.

Prior to the Separation, Mr. Zaslav will be eligible for the same employee benefits that he was entitled to under the Prior Agreement, including his use of the Company’s aircraft under the terms of the Prior Agreement. If the Separation does not occur prior to December 31, 2026, Mr. Zaslav will continue to be eligible for those benefits until December 31, 2027. Effective upon completion of the Separation, Mr. Zaslav will be eligible to participate in all employee benefit plans and arrangements sponsored by Streaming & Studios for the benefit of its senior executive group, including insurance and retirement plans, and will be entitled to four weeks of vacation each year. Consistent with the Prior Agreement, as the CEO of Streaming & Studios, Mr. Zaslav will receive a car allowance of $1,400 per month and will be entitled to use Streaming & Studios’ aircraft (or other private aircraft) for up to 125 hours of personal use per year paid for by Streaming & Studios. Personal use will include Mr. Zaslav’s spouse traveling separately on the aircraft if such travel is to join Mr. Zaslav at a location where he has travelled for business purposes. Consistent with the Prior Agreement, if Streaming & Studios requests that a family member or guest accompany Mr. Zaslav on a business trip, such use shall not be considered personal use, and to the extent Streaming & Studios imputes income to Mr.

Zaslav for such family member or guest travel, Streaming & Studios may, consistent with company policy, pay Mr. Zaslav a lump sum “gross-up” payment sufficient to make Mr. Zaslav whole for the amount of federal, state and local income and payroll taxes due on such imputed income as well as the federal, state and local income and payroll taxes with respect to such gross-up payment.

Prior to a Separation, Mr. Zaslav’s entitlements upon termination of employment (other than with respect to the Signing Options), regardless of the reason for such termination, will be consistent with the terms of the Prior Agreement. Following the Separation, the Zaslav Agreement provides for the following treatment upon termination, depending on the reason for termination.

If, following the Separation, Mr. Zaslav is terminated for “Cause” or he resigns without “Good Reason”, he shall be entitled to receive only amounts or benefits that have been earned, accrued or vested at the time of his termination and all other benefits or payments due or owing Mr. Zaslav will be forfeited.

“Cause” means (i) a material adverse effect on the business of Streaming & Studios as a result of Mr. Zaslav’s gross neglect, willful malfeasance or willful gross misconduct in connection with his employment which has a material adverse effect on the business of Streaming & Studios, unless Mr. Zaslav reasonably believed in good faith that such act or non-act was in or not opposed to the best interests of Streaming & Studios; (ii) Mr. Zaslav is convicted of, or pleads guilty or nolo contendre to, or fails to defend against, a felony; (iii) Mr. Zaslav substantially and continuously refuses to perform his duties under the Zaslav Agreement or to follow the lawful directions of the Streaming & Studios Board (provided such directions do not include meeting any specific financial performance metrics); (iv) Mr. Zaslav breaches the restrictive covenants contained in the Zaslav Agreement; (v) Mr. Zaslav violates any policy of Streaming & Studios that is generally applicable to all employees or all of the officers of Streaming & Studios or Streaming & Studios’ code of conduct, that Mr. Zaslav knows or reasonably should know could reasonably be expected to result in a material adverse effect on Streaming & Studios; or (vi) Mr. Zaslav fails to cooperate, if requested by the Streaming & Studios Board, with any investigation or inquiry into his or Streaming & Studios’ business practices.

“Good Reason” means Streaming & Studios’: (i) reduction of Mr. Zaslav’s base salary; (ii) material reduction in the amount of the annual bonus which Mr. Zaslav is eligible to earn; (iii) relocation of Mr. Zaslav’s primary office at Streaming & Studios to a facility or location that is more than 40 miles away from Mr. Zaslav’s primary office location immediately prior to such relocation and is further away from Mr. Zaslav’s residence; (iv) material reduction of Mr. Zaslav’s duties, which for purposes of clarity includes no longer reporting to the board of directors of a public company; or (v) material breach by Streaming & Studios of the Zaslav Agreement.

If, following the Separation, Mr. Zaslav’s employment is terminated by Streaming & Studios without Cause, or if Mr. Zaslav resigns for Good Reason, Mr. Zaslav shall be entitled to receive termination benefits, including (i) a pro-rated bonus for the year of termination (subject to the applicable performance metrics); (ii) an amount equal to one-twelfth (1/12) of the average annual base salary Mr. Zaslav was earning in the calendar year of the termination and the immediately preceding calendar year, multiplied by the applicable number of months in the “Severance Period” (as defined below), which amount shall be paid in substantially equal payments over the course of the Severance Period in accordance with the Company’s normal payroll practices during such period; plus (iii) an amount equal to one-twelfth (1/12) of the average annual bonus paid to Mr. Zaslav for the immediately preceding two years (excluding the amount of any annual bonus in excess of $12,000,000), multiplied by the number of months in the Severance Period, which amount shall be paid in substantially equal payments over the course of the Severance Period in accordance with Streaming & Studios’ normal payroll practices during such period; plus (iv) reimbursement of COBRA premiums for up to the maximum applicable COBRA period. The “Severance Period” shall be a period of 24 months commencing on the termination of Mr.

Zaslav’s employment. In addition, if following the Separation, Mr. Zaslav’s employment is terminated by Mr. Zaslav for Good Reason or by Streaming & Studios other than for Cause, the Signing Options will be treated as described above, any outstanding RSUs will become fully vested and Mr. Zaslav will be eligible to earn a pro-rata portion (based on the time worked in the performance period plus the Severance Period) of any PRSUs granted by Streaming & Studios based on actual performance through the end of the applicable performance period. PRSUs granted by us prior to the Separation that are unvested and outstanding at the time of such a termination will vest as provided under the Prior Agreement.

Under the Zaslav Agreement, if Mr. Zaslav is terminated other than for Cause or he resigns for Good Reason within the 12-month period following a Change in Control of Streaming & Studios (which will be defined in the Streaming & Studios Plan), then (i) any outstanding RSUs shall become fully vested, (ii) any outstanding PRSUs granted by us prior to the Separation for which the performance period has not expired will be deemed earned at the maximum level of performance and (iii) any PRSUs granted by Streaming & Studios will be deemed to have vested at the greater of target or actual performance.

If, following the Separation, Mr. Zaslav’s employment is terminated because of his death or “disability” (as defined below), Mr. Zaslav or his heirs, as applicable, shall be entitled to receive termination benefits, including a pro-rated bonus for the year of termination and, in the case of disability, reimbursement of COBRA premiums for up to the maximum applicable COBRA period. Mr. Zaslav will be deemed to have a “disability” if he is unable to perform substantially all of his duties under the Zaslav Agreement in the normal and regular manner due to physical or mental illness or injury and has been unable to do so for 150 days or more during the 12 consecutive months then ending. In addition, the Signing Options will be treated as described above, any outstanding RSUs will become fully vested and a pro-rata portion of PRSUs for which the performance period has not yet expired (based on the number of days Mr. Zaslav was employed in the performance period) will be eligible to vest based on actual performance through the end of the applicable performance period.

In the event of the termination of Mr. Zaslav’s employment upon the expiration of the Zaslav Agreement on December 31, 2030, Streaming & Studios shall pay to Mr. Zaslav termination benefits, including (i) reimbursement of COBRA premiums for up to the maximum applicable COBRA period plus (ii) an amount equal to the sum of (1) the annualized base salary Mr. Zaslav was earning upon expiration of the term, plus (2) the maximum annual bonus payable to Mr. Zaslav under the Zaslav Agreement (i.e., $12,000,000), which amount shall be paid in substantially equal payments over the course of the 12 months immediately following termination, in accordance with Streaming & Studios’ normal payroll practices. In addition, the Signing Options will be treated as described above, any outstanding RSUs will become fully vested and Mr. Zaslav will be eligible to earn a pro-rata portion (based on the time worked in the performance period plus 12 months) of any PRSUs that are unvested and outstanding based on actual performance through the end of the applicable performance period.

To be eligible for the severance benefits described above, including any cash severance, pro-rated bonus or additional equity award vesting, upon a termination under the circumstances described above other than death, Mr. Zaslav must execute a release in favor of Streaming & Studios.

Pursuant to the Zaslav Agreement, Mr. Zaslav is subject to customary restrictive covenants, including those relating to non-solicitation, non-interference, non-competition and confidentiality, during the term of the Zaslav Agreement and for a period of two years thereafter, unless Mr. Zaslav’s employment is terminated without Cause or for Good Reason, in which case the restricted period would be reduced to one year following termination.

Wiedenfels Employment Agreement

Introduction

Mr. Wiedenfels’ new compensation package, which will take effect only upon successful completion of the Separation, was designed to reflect his expanded responsibilities as the go-forward CEO of Global Networks, market practices and peer group benchmarks for new CEO compensation packages.

Summary

Prior to the Separation, Mr. Wiedenfels will continue to serve as our Chief Financial Officer (“CFO”) under the terms of his existing employment agreement (the “CFO Agreement”). The Wiedenfels Agreement will only become effective upon, and is contingent on, completion of the Separation. If the Separation does not occur prior to December 31, 2026, then the Wiedenfels Agreement will become null and void and Mr. Wiedenfels will continue to be our CFO under the terms of the CFO Agreement (which expires on July 11, 2026, but may be extended by mutual agreement of the parties).

Following the Separation, Mr. Wiedenfels will serve as the CEO of Global Networks under the terms of the Wiedenfels Agreement. The term of the Wiedenfels Agreement will end on December 31, 2031 unless the parties then agree to renew the Wiedenfels Agreement.

Under the Wiedenfels Agreement, Mr. Wiedenfels’ base salary will be $2,500,000 per annum and he will be eligible for an annual cash bonus opportunity with a target equal to 350% of his annual base salary, with the actual payout based on achievement of performance goals established by Global Networks’ compensation committee. The annual bonus payout is subject to a cap of 200% of the target amount. Mr. Wiedenfels will also be eligible to receive annual equity awards under Global Networks’ equity incentive plan (the “Global Networks Plan”) with an annual target value of $16,000,000. Fifty percent (50%) of the value of any annual equity award will be made in the form of time-based restricted stock units (“RSUs”) and the remaining fifty percent (50%) will be in the form determined by Global Networks’ compensation committee. The terms and conditions of such awards will be based on Global Networks’ then-standard practices and procedures for awards to other senior executives of Global Networks. In the year the Separation occurs, Mr. Wiedenfels’ annual bonus will be prorated based on the target amount in effect under the CFO Agreement and his new annual bonus target under the Wiedenfels Agreement and, if he receives his annual equity grant in such year under the CFO Agreement, he will receive a top-up equity grant that reflects the higher target value of his annual equity award as Global Networks CEO, prorated for the time served as the Global Networks CEO in such year.

Following the Separation, Mr. Wiedenfels will also be granted a one-time inducement equity award under the Global Networks Plan with a target grant date value of $15,000,000 intended to reward Mr. Wiedenfels for post-Separation value creation and provide enhanced retention. Fifty percent (50%) of this award will be made in the form of RSUs and the remaining fifty percent (50%) will be made in the form of options to purchase Global Networks common stock. This award will vest ratably over a five-year period and will be subject to other terms and conditions as determined by Global Networks’ compensation committee.

If Mr. Wiedenfels’ employment is terminated for “Cause” or he resigns without “Good Reason”, he will be entitled to receive only the amounts or benefits that have been earned, accrued or vested at the time of his termination.

“Cause,” means (i) the conviction of, or nolo contendere or guilty plea, to a felony (whether any right to appeal has been or may be exercised); (ii) conduct constituting embezzlement, misappropriation or fraud, whether or not related to Mr. Wiedenfels’ employment with Global Networks; (iii) conduct constituting a financial crime, material act of dishonesty or conduct in material violation of Global Networks’ Code of Ethics or other written policies; (iv) willful and improper conduct substantially prejudicial to Global Networks’ business (whether financial or otherwise); (v) willful unauthorized disclosure or use of Global Networks confidential information; (vi) material improper destruction of Global Networks property; or (vii) willful misconduct in connection with the performance of Mr. Wiedenfels’ duties.

“Good Reason” means without Mr. Wiedenfels’ consent, Global Networks’ (a) material reduction in Mr. Wiedenfels’ duties or responsibilities; (b) material change in the location of the office where Mr. Wiedenfels works (i.e., relocation outside the New York, NY metropolitan area); (c) reduction in Mr. Wiedenfels’ base salary; (d) material reduction in the amount of the annual bonus which Mr. Wiedenfels is eligible to earn; or (e) material breach by Global Networks of the Wiedenfels Agreement.

If Mr. Wiedenfels’ employment is terminated without “Cause” or by Mr. Wiedenfels for “Good Reason” , he will be entitled to termination benefits, including: (i) a pro-rated bonus for the year of termination (subject to the applicable performance metrics), (ii) an amount equal to two times the sum of (x) his base salary plus (y) his annual target bonus to be paid over a severance period of 24 months, (iii) continued vesting of then-outstanding equity awards granted after the Separation over such severance period, (a) with payment of any prorated performance-based equity awards to be based on actual performance (b) any vested options as of the termination date to be exercisable for one-year following termination and (c) any options that vest in the severance period to be exercisable for 90 days following the severance period and (iv) reimbursement of up to 18 months of COBRA premiums. Any equity awards granted by us prior to the Separation that are unvested and outstanding at the time of such a termination will vest as provided under the WBD Plan and applicable award agreements. If Mr. Wiedenfels is terminated other than for Cause or resigns for Good Reason within the 18-month period following a change in control of Global Networks (which will be defined in the Global Networks Plan), then any equity awards granted by Global Networks following the Separation will become fully vested, with any performance-based awards deemed to have vested at the greater of target or actual performance.

If Mr. Wiedenfels’ employment is terminated as a result of his death or “disability” (as defined below), Mr. Wiedenfels or his heirs, as applicable, shall be entitled to receive termination benefits, including a pro-rated bonus for the year of termination and, in the case of disability, reimbursement of COBRA premiums for up to the maximum applicable COBRA period Mr. Wiedenfels will be deemed to have a “disability” if he is unable to perform substantially all of his duties under the Wiedenfels Agreement due to physical or mental illness or injury and has been unable to do so for (i) a period of six consecutive months or (ii) shorter periods that add up to six months in any eight-month period. In addition, his then-outstanding equity awards granted after the Separation will have the same treatment as provided above for a termination without Cause or Good Reason, except that the vesting of any time-based awards will fully accelerate on the termination date and any options that vest as a result of such termination will remain exercisable for one-year following the termination date.

If Mr. Wiedenfels and Global Networks do not agree to renew the Wiedenfels Agreement at the end of the term, Mr. Wiedenfels will be entitled to any accrued benefits, including payment of the annual bonus for the year of termination, and nonrenewal noncompetition benefits in consideration of Mr. Wiedenfels’ continued compliance with his restrictive covenants. These benefits include (i) an amount equal to the sum of (x) his base salary plus (y) target bonus to be paid over a period of 12 months following Mr. Wiedenfels’ termination date and (ii) the same treatment of his then-outstanding equity awards granted after the Separation as provided above for a termination without Cause or Good Reason, except the period for which the awards continue to vest will be reduced to 12 months.

To be eligible for the severance benefits or nonrenewal noncompetition benefits described above on a termination under the circumstances described above other than death or disability, Mr. Wiedenfels must execute a release in favor of Global Networks.

Pursuant to the Wiedenfels Agreement, Mr. Wiedenfels is subject to customary restrictive covenants, including noncompetition and nonsolicitation covenants effective during Mr. Wiedenfels’ employment and for a period of 24 months and 18 months, respectively, thereafter, unless Mr. Wiedenfels’ employment is terminated without Cause, for Good Reason, disability or the expiration of the employment term, in which case the restricted period for the noncompetition clause would be reduced to one year following termination.

If Mr. Wiedenfels ceases to comply with the noncompetition or nonsolicitation clauses in the Wiedenfels Agreement, any severance benefits or nonrenewal noncompetition benefits described above would be terminated and subject to repayment on demand (as applicable).

Cautionary Statement Regarding Forward- Looking Information

This Current Report on Form 8-K (including the exhibits attached hereto) contains certain “forward-looking statements.” Forward-looking statements include, without limitation, statements regarding the Company’s expectations, beliefs, intentions or strategies regarding the future, and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. These forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties and on information available to the Company as of the date hereof.

Forward-looking statements include, without limitation, statements about the benefits of the Separation, including future financial and operating results, the future company plans, objectives, expectations and intentions, and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties outside of our control. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: the occurrence of any event, change or other circumstances that could give rise to the abandonment of the Separation or pursuit of a different structure; risks that any of the conditions to the Separation may not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed Separation is not obtained; risks related to potential litigation brought in connection with the Separation; uncertainties as to the timing of the Separation; risks and costs related to the Separation, including risks relating to changes to the configuration of the Company’s existing businesses; the risk that implementing the Separation may be more difficult, time consuming or costly than expected; risks related to financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industry in which it operates; risks related to disruption of management time from ongoing business operations due to the Separation; failure to realize the benefits expected from the Separation; the final terms and conditions of the Separation, including the terms of any ongoing commercial agreements and arrangements, and the relationship, between Streaming & Studios and Global Networks following the Separation; the nature and amount of any indebtedness incurred by Streaming & Studios or Global Networks; effects of the announcement, pendency or completion of the Separation on the ability of the Company to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally; risks related to the potential impact of general economic, political and market factors on the Company as it implements the Separation; and risks related to obtaining permanent financing and risks related to the tender offers and consent solicitations, in each case as described in the Current Report on Form 8-K filed with the SEC on June 9, 2025.

The Company’s actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include the risks related to the Separation. Discussions of additional risks and uncertainties are contained in the Company’s filings with the SEC, including but not limited to the Company’s most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K.

The Company is not under any obligation, and expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

| Exhibit Number |

Description |

| 10.1 |

|

| 10.2 |

|

| 10.3 |

|

| 101 |

Inline XBRL Instance Document - the instance document does not appear in the Interactive Date File because its XBRL tags are embedded within the Inline XBRL document |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Certain exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K and will be supplementally provided to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warner Bros. Discovery, Inc. |

|

|

|

|

|

|

|

Date: June 16, 2025 |

|

|

By: |

/s/ Tara L. Smith |

|

|

|

|

|

|

Tara L. Smith |

|

|

|

|

|

|

Executive Vice President and Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EX-10.1

2

ex101dzemploymentagmt.htm

EX-10.1

ex101dzemploymentagmt

Execution Version 1 1011178780v10 AMENDED AND RESTATED EMPLOYMENT AGREEMENT This EMPLOYMENT AGREEMENT is made as of this 12th day of June, 2025 (this “Agreement”), by and between Warner Bros. Discovery, Inc. (“WBD”), Discovery Communications, LLC (the “Company”), a wholly- owned subsidiary of WBD, and David Zaslav (the “Executive”), (collectively, the “Parties”), and amends and restates the prior Employment Agreement between the Executive and Discovery, Inc. dated as of May 16, 2021 (as amended, the “Prior Agreement”). WHEREAS, the Executive is currently employed by the Company and serves as the President and Chief Executive Officer (“CEO”) of WBD; WHEREAS, WBD has announced plans to effectuate a separation of its Global Networks division from its Streaming & Studios division through a spin-off (the “Spinoff”) of the Streaming & Studios division as a standalone public company (“ContentCo”); WHEREAS, unless and until the consummation of the Spinoff, WBD desires to continue to have access to the Executive’s services as President and CEO of WBD, and the Executive is willing to continue to provide such services, and the Parties desire to enter into this Agreement to secure the Executive’s employment during the term hereof, on the terms and conditions set forth herein; and WHEREAS, in the event that the Spinoff is consummated, the parties intend that this Agreement would be assigned to and assumed by ContentCo, with Executive serving as the President and CEO of ContentCo, on the terms and conditions set forth herein. NOW, THEREFORE, the Parties agree as follows: 1. Employment Terms Prior to Consummation of the Spinoff. Other than as set forth in Paragraph 6(d) and Paragraph 11(g) hereof, prior to the consummation of the Spinoff, the Executive shall continue to serve as the President and CEO of WBD on the terms and conditions set forth in Paragraphs 1 through 10 of the Prior Agreement (the “Pre-Spinoff Terms”), including the compensation terms set forth in Paragraph 4 of the Prior Agreement and the employee benefits and other perquisites set forth in Paragraphs 5 through 9 of the Prior Agreement. Effective as of the date hereof, Paragraph 10(g) of the Prior Agreement is deleted in its entirety except for the PRSU Treatment provided in Paragraph 11(g) hereof. 2. Employment Terms From and After Consummation of the Spinoff Or If No Spinoff Occurs by December 31, 2026. Other than as set forth in Paragraph 6(d) and Paragraph 11(g) hereof, Paragraphs 3 through 11 of this Agreement (the “Post-Spinoff Terms”) shall only be and become effective upon, and are contingent on, the consummation of the Spinoff. If the Spinoff is not consummated prior to December 31, 2026, then the Post-Spinoff Terms (other than Paragraph 6(d) and Paragraph 11(g)) shall be null and void, without further action on the part of any of the Parties, and Executive’s employment as the President and CEO of WBD shall continue to be subject to the Pre-Spinoff Terms until December 31, 2027, unless (i) earlier terminated pursuant to Paragraph 10 of the Prior Agreement or (ii) otherwise agreed by the Parties. For the avoidance of doubt, if the Executive’s employment is terminated for any reason prior to the consummation of the Spinoff, then the Post-Spinoff Terms shall be of no force or effect and Executive’s rights and entitlements upon such termination shall be governed solely by the Pre-Spinoff Terms and Paragraphs 6(d) and 11(g) hereof. The date that the Spinoff is consummated shall be referred to hereunder as the “Spinoff Effective Date”. 3. Title. Effective upon the Spinoff Effective Date, the Executive and WBD agree that the Executive will serve ContentCo as President and CEO, on the terms and conditions as specified in Paragraph 2, and the Executive will have the right to be nominated to the Board of Directors of ContentCo (the “Board”) while serving as the CEO,

2 1011178780v10 primarily based in ContentCo’s New York, New York offices, provided, however, that the Executive may from time to time render his services remotely from other ContentCo offices or a personal residence. 4. Employment Term. Effective as of the Spinoff Effective Date, the Executive’s employment shall be with ContentCo, and shall continue thereafter until December 31, 2030, unless sooner terminated pursuant to Paragraph 11 hereof (the “Term of Employment”). From and after the Spinoff Effective Date, references in this Agreement to the “expiration of the Term of Employment” shall refer to the expiration of the Term of Employment on December 31, 2030. 5. Duties. Effective from and after the Spinoff Effective Date, the Executive shall report directly and solely to the Board. The Executive shall have all of the power, authority and responsibilities customarily attendant to the position of President and CEO of ContentCo, including the supervision and responsibility for all operations and management of ContentCo and its subsidiaries (the “ContentCo Entities”). The Executive shall be the most senior executive having management responsibilities for the assets and day-to-day operations of ContentCo. During the Term of Employment, the Board shall not give another employee of ContentCo a title which includes the word “chairman”. The Executive shall work under the direction and control of the Board. The Executive agrees to render his services to ContentCo under this Agreement loyally and faithfully, to the best of his abilities and in substantial conformance with all laws, rules and ContentCo policies. The Executive shall be subject to all of ContentCo’s policies, including conflicts of interest. 6. Compensation. (a) Base Salary. Effective upon the Spinoff Effective Date, ContentCo shall pay the Executive a base salary (the “Base Salary”), to be paid on the same payroll cycle as other U.S.-based executive officers of ContentCo (which shall be not less frequently than bi-monthly), at an annual rate of Three Million Dollars ($3,000,000). (b) Annual Bonus. Effective upon the Spinoff Effective Date, the Executive shall be eligible to participate in ContentCo’s annual incentive compensation plan (the “Annual Plan”), as in effect from time to time, with an annual incentive payment target during each full fiscal year of the Term of Employment of 200% of Base Salary (the “Target”) with a maximum award equal to 200% of Target. The actual amount payable to the Executive as an “Annual Bonus” under the Annual Plan, including the portion of the Annual Bonus, if any, above Target, shall be dependent upon the achievement of performance objectives established in accordance with the Annual Plan by the Board or the committee of the Board responsible for administering such Annual Plan (the “Compensation Committee”) in good faith consultation with the Executive. So long as the Executive remains continuously employed under this Agreement through the end of each calendar year (or as otherwise specifically provided in Paragraph 11 following termination of employment), the Annual Bonus shall be earned by Executive and shall be paid in accordance with past practice, but in no event later than March 15 of the calendar year following the year of performance. In the calendar year, if any, in which the Spinoff Effective Date occurs (the “Consummation Year”), the Executive’s target bonus for the Consummation Year shall be calculated on a prorated basis as the sum of (i) the Executive’s target bonus as in effect at the beginning of the Consummation Year based on the Target set forth in the Prior Agreement (i.e., $22,000,000) and subject to the achievement in the period from January 1 of such Consummation Year through the Spinoff Effective Date of the applicable qualitative and quantitative objectives established for such year under the Prior Agreement, pro-rated for the portion of the Consummation Year occurring prior to the Spinoff Effective Date (with the applicable quantitative objectives measured on a pro-rated basis as well, taking into account performance through the Spinoff Effective Date and subject to reasonable adjustments for when the Spinoff Effective Date occurs in the Consummation Year, as determined in the good faith discretion of the Compensation Committee of WBD’s Board of Directors) and (ii) the Executive’s Annual Bonus on and after the Spinoff Effective Date based on the Target set forth in this Agreement (i.e., $6,000,000) and subject to the achievement of the applicable performance objectives established under the Annual Plan for such period, pro-rated for the portion of the Consummation Year following the Spinoff Effective Date. For the avoidance of doubt, (1) any Annual Bonus calculated in accordance with the immediately preceding sentence shall be paid at the time prescribed for bonuses in respect of the Consummation Year under the Annual Plan and (2) upon a termination of employment under Paragraph 11 of this Agreement following the Spinoff Effective Date that occurs in the Consummation Year, any partial bonus for the year of termination shall be calculated in accordance with the immediately preceding

3 1011178780v10 sentence, with a portion of such partial bonus calculated based on the Target set forth in the Prior Agreement (i.e., $22,000,000) and a portion of such partial bonus calculated based on the Target set forth in this Agreement (i.e., $6,000,000). (c) Annual Equity Program. So long as the Term of Employment has not terminated and provided that the Executive has not given notice of intent to terminate employment, except as expressly provided in the next sentence, for each calendar year during the Term of Employment and following the Spinoff Effective Date, whenever ContentCo grants its regular annual long-term incentive awards each year, the Executive will be eligible to receive an annual long-term incentive compensation award (the “Annual ContentCo LTI Award”) with a target value equal to (i) $15,500,000 in the first calendar year in which an Annual ContentCo LTI Award and (ii) $7,500,000 per year in each subsequent calendar year during the term of this Agreement. Notwithstanding the immediately preceding sentence, if the Spinoff Effective Date occurs after the Executive has already received an annual PRSU award in the Consummation Year pursuant to the terms of the Prior Agreement, then the Executive shall not be entitled to an Annual ContentCo LTI Award hereunder for the Consummation Year. Fifty percent (50%) of the value of any Annual ContentCo LTI Award made under this Paragraph 6(c) on or following the Spinoff Effective Date shall be made in the form of time-based restricted stock units (“RSUs”) and the remaining fifty percent (50%) of the value of such Annual ContentCo LTI Award shall be made in the form of performance-based restricted stock units (“PRSUs”). The terms and conditions of, and calculation of number of awards subject to, the Annual ContentCo LTI Award made following the Spinoff Effective Date shall be based on ContentCo’s then-standard practices and procedures for awards to other senior executives of ContentCo, as determined by the Compensation Committee; provided that upon the Executive’s termination of employment pursuant to Paragraph 11(a), (c) or (d) hereof, any outstanding RSUs or PRSUs then held by the Executive shall be treated as provided in such Paragraph. (d) 2025 Signing Awards. Effective as of the date hereof (June 12, 2025), the Executive shall receive a grant of 20,898,776 options to purchase WBD common stock (the “Signing Stock Options”) under the Warner Bros. Discovery Stock Incentive Plan (as amended and restated from time to time, the “WBD Incentive Plan”). Except as specifically stated herein, the Signing Stock Options shall have terms and conditions consistent with the Company’s standard award agreement, including a maximum term of seven (7) years from the date of grant. If a Spinoff is consummated, (x) upon the Spinoff Effective Date, the Signing Stock Options shall be converted solely into options to purchase shares of ContentCo stock based on the applicable methodology determined by WBD’s Compensation Committee at the time of the Spinoff (the “Adjustment Methodology”) and the Exercise Price and corresponding Stock Price Hurdles of the Signing Stock Options shall accordingly be adjusted based on the Adjustment Methodology and, (y) on and following the Spinoff Effective Date, all references in this Paragraph 6(d) to employment with WBD shall be deemed to refer to Executive’s employment with ContentCo and all references to WBD shall be deemed to be references to ContentCo. In the event that a Spinoff or other Qualifying Transaction (as defined below) is not consummated prior to December 31, 2026, the Signing Stock Options shall be treated as set forth in subparagraph (iii) hereof. (i) Vesting Generally. Subject to subparagraph (ii) and (iii) below, forty percent (40%) of the Signing Stock Options (the “Time-Based Options”) shall vest in five equal annual installments on each of the first five anniversaries of the date hereof, so long as Executive is employed by WBD or ContentCo, as applicable, on the applicable anniversary date (the “Service Condition”). The remaining 60% of the Signing Stock Options (the “Performance-Based Options”) shall be divided into three approximately equal tranches (each, a “Tranche”) as set forth in the table below, with the exercisability of the options subject to each Tranche subject to the satisfaction of a comparable Service Condition and to the achievement of the following “Performance-Based Conditions”: (A) Performance-Based Conditions. Each Tranche of Performance-Based Options shall be deemed to satisfy the applicable Performance-Based Conditions upon the achievement on any Measurement Date of a VWAP Price equal to or exceeding the applicable “Stock Price Hurdle” for such Tranche set forth in the table below. For example, if following the second anniversary of the date hereof, the Stock Price Hurdle for Tranche A of the Performance-Based Options is achieved (and assuming that the Spinoff has then been consummated, Executive remains employed with ContentCo and no other Qualifying Transaction or Change in Control of ContentCo has occurred), the Executive would then be vested in 24% of the Signing Stock Options, calculated as 40% of the Time-Based Options, which make up 40% of the total award (i.e., 16% of the Signing Stock Options) plus 40% of

4 1011178780v10 Tranche A of the Performance-Based Options, which make up 20% of the total award (i.e., 8% of the Signing Stock Options). Tranche Shares Stock Price Hurdle A 4,179,755 120% of Exercise Price B 4,179,755 150% of Exercise Price C 4,179,756 165% of Exercise Price (B) Definitions. For purposes of the Performance-Based Options, (1) “VWAP Price” shall mean the volume-weighted average stock price achieved based on the closing prices of WBD Common Stock or ContentCo common stock, if applicable, over any period of 30 consecutive trading days occurring during the Performance Period, (2) “Performance Period” shall mean the period from the date hereof through and including the fifth anniversary of the date hereof, (3) “Measurement Date” shall mean any day during the Performance Period that the Performance-Based Options are outstanding and have not been forfeited and (4) “Exercise Price” shall mean the exercise price of the Signing Stock Options as set forth in the applicable award agreement, which shall not be less than the fair market value of WBD common stock on the grant date. (ii) Special Vesting Conditions. Notwithstanding anything to the contrary in this Agreement, the equity incentive plan adopted by ContentCo or the applicable award agreement, upon the occurrence any of the events set forth in this subparagraph (ii) during the Performance Period, the Signing Stock Options shall be treated as follows: (A) Death or Disability, Termination other than for Cause or for Good Reason. In the event of a termination of the Executive’s employment with WBD prior to the Spinoff Effective Date or ContentCo on or after the Spinoff Effective Date (A) due to the Executive’s death or Disability, (B) by the Executive for Good Reason or (C) by the Board for any reason other than for Cause (any such termination, a “Qualifying Termination”), (1) the Service Condition shall be waived as to both the Time-Based Options and the Performance-Based Options and (2) the Stock Price Hurdle applicable to each Tranche of the Performance-Based Options, if and to the extent not achieved prior to the Qualifying Termination, shall continue to be eligible to be satisfied until the earlier of the one-year anniversary of the effective date of the Executive’s Qualifying Termination and the end of the Performance Period. Any Signing Stock Options that have not vested and been exercised on or before the one-year anniversary of the date of Executive’s Qualifying Termination (including, without limitation, because the Stock Price Hurdles applicable to a given Tranche have not been achieved) shall be immediately and automatically forfeited and cancelled. (B) Termination for Any Other Reason, Termination for Cause. In the event of the Executive’s termination of employment with WBD prior to the Spinoff Effective Date or ContentCo on or after the Spinoff Effective Date for any reason other than a Qualifying Termination, any then-vested and exercisable Signing Stock Options shall remain outstanding and exercisable for ninety (90) days following the date of such termination and any Signing Stock Options that have not vested as of such termination (including, without limitation, because the Stock Price Hurdles applicable to a given Tranche have not been achieved) shall be immediately and automatically forfeited and cancelled. Notwithstanding the foregoing, in the event of Executive’s termination of employment for Cause, all of the Signing Stock Options, whether vested or unvested, shall immediately be forfeited. (C) Pre-Spinoff Qualifying Transaction. In the event that prior to the Spinoff Effective Date there shall occur (A) a Change in Control (as defined in Paragraph 11(g) of this Agreement) of WBD, (B) a sale of WBD’s Streaming & Studios division or (C) a sale of all or substantially all the assets of WBD’s Streaming & Studios division (any such transaction, a “Qualifying Transaction”), then (1) the Service Condition shall cease to apply to any then outstanding Time-Based Options or Performance-Based Options and (2) each Tranche of the Performance-Based Options shall be eligible to vest and be earned upon the consummation of such Qualifying Transaction if and to the extent that

5 1011178780v10 the per-share price attained at or immediately prior to the consummation of such Qualifying Transaction equals or exceeds the corresponding Stock Price Hurdle for such Tranche of Performance- Based Options. Any Tranche of Performance-Based Options that has not or does not become vested and earned at or before any such Qualifying Transaction shall be immediately and automatically forfeited and cancelled. (D) Post-Spinoff Change in Control. Following the Spinoff Effective Date, in the event of a Change in Control (as defined in Paragraph 11(g) of this Agreement) of ContentCo during the Performance Period, (1) the Service Condition shall cease to apply to any then outstanding Time- Based Options or Performance-Based Options and (2) each Tranche of the Performance-Based Options shall vest and be earned upon the consummation of such Change in Control if and to the extent that the per-share price received by holders of ContentCo common stock at or immediately prior to the consummation of such Change in Control equals or exceeds the corresponding Stock Price Hurdle (as adjusted in the Spinoff using the Adjustment Methodology) for such Tranche of Performance-Based Options. Any Tranche of Performance-Based Options that has not or does not become vested and earned at or before any such Change in Control shall be immediately and automatically forfeited and cancelled. (iii) Failure to Consummate a Spinoff or Qualifying Transaction. Notwithstanding any other provision in this Agreement to the contrary, if neither a Spinoff has been consummated nor a Qualifying Transaction has occurred, in either case, prior to December 31, 2026, then (1) any Time-Based Options that have satisfied the Service Condition as of such date shall remain outstanding and (2) the remaining portion of the Time-Based Options for which the Service Condition has not been satisfied, and all of the Performance-Based Options (regardless of the extent to which the applicable Service Condition and/or the Stock Price Hurdles have been satisfied or achieved), shall be immediately and automatically forfeited as of such date. (iv) Additional Options. On January 2, 2026, the Executive shall receive an additional grant of options under the WBD Incentive Plan to purchase 3,052,734 shares of WBD common stock (“Follow-on Grant”), provided he is employed by the Company on such date. Such award is intended to supplement the Signing Stock Options. Except as stated herein, such options shall have terms and conditions consistent with the Company’s standard award agreement, with 40% of such options vesting on the same schedule as the Time-Based Options and the remaining 60% vesting on the same schedule and subject to the same Stock Price Hurdles as the Performance- Based Options (i.e., 20% of the Follow-on Grant subject to the 120% Stock Price Hurdle, 20% of the Follow-on Grant subject to the 150% Stock Price Hurdle and 20% of the Follow-on Grant subject to the 165% Stock Price Hurdle). Notwithstanding the foregoing, if the value of WBD common stock on the date of grant exceeds the Exercise Price of the Signing Stock Options, the exercise price of the options subject to the Follow-On Grant shall be the closing price of WBD common stock on the date of grant and the Parties shall discuss how to make up for the lost economic value attributable to the higher exercise price (e.g., through the grant of additional stock options which have a Black Scholes value equal to the difference between the Black Scholes value of the option promised in the first sentence hereof and the option with the higher exercise price than the Signing Stock Options, or a grant of a full value award for a number of shares equal to the difference between the exercise prices on the 3,052,734 shares). For purposes of clarity, the Stock Price Hurdles applicable to the Performance-Based Options of the Follow-on Grant shall be based on the same Exercise Price as the Signing Stock Options. (v) Exercisability. Notwithstanding any other provision in this Agreement to the contrary, no Performance-Based Option may be exercised prior to the earlier to occur of the consummation of a Spinoff or the occurrence of a Qualifying Transaction. (vi) Broker-Assisted Exercise. The Executive shall have the right to pay the exercise price for the Signing Stock Options, as well as the taxes on the compensation recognized upon such exercise (up to his estimated marginal tax rate), through a contemporaneous broker-assisted sale of shares by the Executive (subject to all applicable securities laws). (e) Stockholding Requirements. Effective as of the Spinoff Effective Date, the Executive has agreed to hold a number of shares of ContentCo’s common stock, which is equal to the number of shares of WBD common stock the Executive is required to hold as of immediately prior to the Spinoff under the Prior Agreement (i.e., 1,500,000

6 1011178780v10 shares of WBD common stock as of the date hereof), as adjusted upon the consummation of the Spinoff by applying the applicable adjustment methodology, to be determined by the Compensation Committee. Upon the Spinoff Effective Date, the foregoing holding requirements will supersede any holding requirements applicable to the Executive under the Prior Agreement. PRSU awards are not counted until shares are delivered; similarly, Stock Options are not counted until exercised and shares are delivered. These holding requirements shall expire with the Term of Employment. (f) Withholding. WBD, or after the Spinoff Effective Date, ContentCo (or any of their respective affiliates) will have the right to withhold from payments otherwise due and owing to the Executive, an amount sufficient to satisfy any federal, state, and/or local income and payroll taxes, any amount required to be deducted under any employee benefit plan in which the Executive participates or as required to satisfy any valid lien or court order. 7. Employee Benefits. Effective as of the Spinoff Effective Date, the Executive shall be eligible during the Term of Employment for the Employee Benefits set forth in this Paragraph 7. (a) Group Benefits. The Executive shall be eligible to participate in all employee benefit plans and arrangements sponsored or maintained by ContentCo for the benefit of its senior executive group, including, without limitation, all group insurance plans (term life, medical and disability) and retirement plans, as long as any such plan or arrangement remains generally applicable to its senior executive group. The Executive shall be entitled to four (4) weeks of vacation in each calendar year of employment; the Executive may take vacation in accordance with ContentCo policy, consistent with the best interests of ContentCo; and annual leave not taken during a calendar year shall be carried forward and/or forfeited in accordance with ContentCo policy. (b) Office. ContentCo will provide the Executive with office space and such other facilities, support staff (Executive Assistant) and services suitable to his position, adequate for the performance of his duties and reasonably acceptable to Executive. (c) Equipment. ContentCo will provide and pay all such reasonable expenses related to Executive’s use of mobile technology during the Term of Employment, including monthly fees for business use of a cellular telephone, a wireless email device (e.g., an IPhone), a personal digital assistant (PDA), and a laptop computer, in each case as approved by ContentCo, to allow Executive to perform his job duties outside of ContentCo’s offices. 8. Business Expenses. From the date hereof and continuing on the Spinoff Effective Date, the Executive shall be reimbursed for all reasonable expenses incurred by him in the discharge of his duties, including, but not limited to, expenses for entertainment and travel, provided the Executive shall account for and substantiate all such expenses in accordance with WBD’s, or after the Spinoff, ContentCo’s, written policies for its senior executive group. Effective as of the Spinoff Effective Date, Executive shall be entitled to travel via ContentCo aircraft, pursuant to ContentCo policy (which is initially expected to be consistent with WBD’s past practice), or first class air transportation. 9. Car Allowance. Continuing on the Spinoff Effective Date, during the Term of Employment the Executive will receive a car allowance of $ 1,400 per calendar month. 10. Airplane. Effective as of the Spinoff Effective Date, the Executive shall cease to be eligible to use WBD’s aircraft as provided under the Prior Agreement and shall instead be eligible during the Term of Employment to use ContentCo’s aircraft or any other private aircraft for up to 125 hours of personal use during each calendar year for which ContentCo shall pay for such use; provided that for the Consummation Year, ContentCo shall receive credit for any hours of personal use provided by WBD. Executive shall have the right to permit his spouse to travel separate and apart from Executive, provided such travel is to join the Executive at a location where he has travelled for business purposes, which spousal travel shall be considered personal use. If ContentCo requests that a family member or guest accompany the Executive on a business trip such use shall not be considered personal use, and to the extent ContentCo imputes income to the Executive for such requested family member or guest travel, ContentCo may, consistent with company policy, pay the Executive a lump sum “gross-up” payment sufficient to make the

7 1011178780v10 Executive whole for the amount of federal, state and local income and payroll taxes due on such imputed income as well as the federal, state and local income and payroll taxes with respect to such gross- up payment. 11. Termination. Prior to the Spinoff, Executive’s employment with WBD may be terminated in accordance with Paragraph 10 of the Prior Agreement and Executive shall, except as expressly set forth in Paragraph 11(g) hereof, be entitled to the payments and benefits set forth in Paragraph 10 of the Prior Agreement, subject to the applicable release requirement set forth in Paragraph 10 of the Prior Agreement. Notwithstanding the provisions of Paragraph 4 of this Agreement, following the Spinoff Effective Date, the Executive’s employment with ContentCo under this Agreement and the Term of Employment hereunder shall terminate on the earliest of the following dates: (a) Death. Upon the date of the Executive’s death. In such event, ContentCo shall pay to the Executive’s legal representatives or named beneficiaries (as the Executive may designate from time to time in a writing delivered to ContentCo): (i) the Executive’s accrued but unpaid Base Salary through the date of termination, plus (ii) any Annual Bonus for a completed year which was earned but not paid as of the date of termination; plus (iii) any accrued but unused vacation leave pay as of the date of termination; plus (iv) any accrued vested benefits under ContentCo’s employee welfare and tax-qualified retirement plans, in accordance with the terms of those plans; plus (v) reimbursement of any business expenses in accordance with Paragraph 8 hereof ((i), (ii), (iii), (iv) and (v) hereinafter, the “Accrued Benefits”). In addition, (x) ContentCo shall pay an amount equal to a fraction of the Annual Bonus the Executive would have received for the calendar year of the Executive’s death, where the numerator of the fraction is the number of calendar days the Executive was actively employed during the calendar year and the denominator of the fraction is 365, which amount shall be payable at the time ContentCo normally pays the Annual Bonus and (y) the Executive’s family may elect to (1) continue to receive coverage under ContentCo’s group health benefits plan to the extent permitted by, and under the terms of, such plan and to the extent such benefits continue to be provided to the survivors of ContentCo executives at Executive’s level in ContentCo generally, or (2) receive COBRA continuation of the group health benefits previously provided to the Executive’s family pursuant to Paragraph 7 (provided his family timely elects such COBRA coverage) in which case ContentCo shall pay the premiums for such COBRA coverage up to the maximum COBRA period, provided that if ContentCo determines that the provision of continued group health coverage at ContentCo’s expense may result in Federal taxation of the benefit provided thereunder to Executive’s family (e.g., because such benefits are provided on a self- insured basis by ContentCo), or if other penalties applied to ContentCo, then the family shall be obligated to pay the full monthly premium for such coverage and, in such event, ContentCo shall pay Executive’s surviving spouse, in a lump sum (or, if such lump sum would violate IRC 409A, in monthly installments), an amount equivalent to the monthly premium for COBRA coverage for the remaining balance of the maximum COBRA period. In addition, upon the Executive’s death, any outstanding RSUs shall become fully vested and the Signing Stock Options shall be treated as set forth in Paragraph 6(d). If the Executive dies during the Term of Employment and prior to the last day of the performance period for any tranche of PRSUs (including any PRSUs granted under the Prior Agreement), then the Executive shall be entitled to a pro-rata portion (based on the number of days Executive was employed during the performance period) of such tranche of PRSUs, based upon actual performance through the end of the applicable performance period, as certified by the Compensation Committee, as if the Executive’s employment had not terminated. The payment in respect of the PRSUs shall be distributed to the Executive’s designated beneficiary (or estate, if there is no designated beneficiary or the designated beneficiary did not survive the Executive) in a lump sum at the same time as the Executive would have been paid in respect of the PRSUs if he had continued to be employed by ContentCo. (b) Cause. Upon the date specified in a written notice from the Board terminating the Executive’s employment for “Cause.” In such event, ContentCo shall pay to the Executive the Accrued Benefits, and all other benefits or payments due or owing the Executive shall be forfeited. ContentCo shall have “Cause”: (i) As a result of the Executive’s gross neglect, willful malfeasance or willful gross misconduct in connection with his employment hereunder which has had a material adverse effect on the business of ContentCo, unless the Executive reasonably believed in good faith that such act or non-act was in or not opposed to the best interests of ContentCo;