Document

DISCOVERY COMMUNICATIONS, LLC,

Issuer

WARNER BROS. DISCOVERY, INC.,

Parent Guarantor

WARNERMEDIA HOLDINGS, INC. (f/k/a Magallanes, Inc.)

and

SCRIPPS NETWORKS INTERACTIVE, INC.,

each, a Subsidiary Guarantor

and

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION,

Trustee

TWENTY-THIRD SUPPLEMENTAL INDENTURE

DATED AS OF JUNE 13, 2025

TO

INDENTURE

DATED AS OF AUGUST 19, 2009

Relating To

4.900% Senior Notes due 2026

1.90% Senior Notes due 2027

3.950% Senior Notes due 2028

4.125% Senior Notes due 2029

3.625% Senior Notes due 2030

5.000% Senior Notes due 2037

6.350% Senior Notes due 2040

4.95% Senior Notes due 2042

4.875% Senior Notes due 2043

5.200% Senior Notes due 2047

5.300% Senior Notes due 2049

4.650% Senior Notes due 2050

4.000% Senior Notes due 2055

TWENTY-THIRD SUPPLEMENTAL INDENTURE

TWENTY-THIRD SUPPLEMENTAL INDENTURE, dated as of June 13, 2025 (the “Twenty-Third Supplemental Indenture”), to the Base Indenture (defined below) among Discovery Communications, LLC, a Delaware limited liability company (the “Company”), Warner Bros. Discovery, Inc. (f/k/a Discovery, Inc.), a Delaware corporation (the “Parent Guarantor”), WarnerMedia Holdings, Inc. (f/k/a Magallanes, Inc.), a Delaware corporation (“WMH”), Scripps Networks Interactive, Inc., an Ohio corporation (“Scripps” and, together with WMH, the “Subsidiary Guarantors”), and U.S. Bank Trust Company, National Association, as Trustee (the “Trustee”).

RECITALS

WHEREAS, the Company has executed and delivered to the Trustee the Indenture, dated as of August 19, 2009 (the “Base Indenture”, and, as amended, supplemented or otherwise modified to the date hereof (but for the avoidance of doubt, excluding this Twenty-Third Supplemental Indenture), the “Indenture”), providing for the issuance from time to time of its Securities;

WHEREAS, the Company has previously established a series of its Securities designated as the “6.350% Senior Notes due 2040” (the “2040 Notes”) and issued $850,000,000 aggregate principal amount of the 2040 Notes, pursuant to the Second Supplemental Indenture, dated as of June 3, 2010, to the Base Indenture (the “Second Supplemental Indenture”);

WHEREAS, the Company has previously established a series of its Securities designated as the “4.95% Senior Notes due 2042” (the “2042 Notes”) and issued $500,000,000 aggregate principal amount of the 2042 Notes, pursuant to the Fourth Supplemental Indenture, dated as of May 17, 2012, to the Base Indenture (the “Fourth Supplemental Indenture”);

WHEREAS, the Company has previously established a series of its Securities designated as the “4.875% Senior Notes due 2043” (the “2043 Notes”) and issued $850,000,000 aggregate principal amount of the 2043 Notes, pursuant to the Fifth Supplemental Indenture, dated as of March 19, 2013, to the Base Indenture (the “Fifth Supplemental Indenture”);

WHEREAS, the Company has previously established a series of its Securities designated as the “1.90% Senior Notes due 2027” (the “2027 Notes”) and issued €600,000,000 aggregate principal amount of the 2027 Notes, pursuant to the Eighth Supplemental Indenture, dated as of March 19, 2015, to the Base Indenture (the “Eighth Supplemental Indenture”);

WHEREAS, the Company has previously established a series of its Securities designated as the “4.900% Senior Notes due 2026” (the “2026 Notes”) and issued $500,000,000 aggregate principal amount of the 2026 Notes, pursuant to the Ninth Supplemental Indenture, dated as of March 11, 2016, to the Base Indenture (the “Ninth Supplemental Indenture”);

WHEREAS, the Company has previously (i) established a series of its Securities designated as the “3.950% Senior Notes due 2028” (the “2028 Notes”) and issued $1,700,000,000 aggregate principal amount of the 2028 Notes, (ii) established a series of its Securities designated as the “5.000% Senior Notes due 2037” (the “2037 Notes”) and issued $1,250,000,000 aggregate principal amount of the 2037 Notes and (iii) established a series of its Securities designated as the “5.200% Senior Notes due 2047” (the “2047 Notes”) and issued $1,250,000,000 aggregate principal amount of the 2047 Notes, in each case pursuant to the Eleventh Supplemental Indenture, dated as of September 21, 2017, to the Base Indenture (the “Eleventh Supplemental Indenture”);

WHEREAS, the Company has previously (i) established a series of its Securities designated as the “4.125% Senior Notes due 2029” (the “2029 Notes”) and issued $750,000,000 aggregate principal amount of the 2029 Notes and (ii) established a series of its Securities designated as the “5.300% Senior Notes due 2049” (the “2049 Notes”) and issued $750,000,000 aggregate principal amount of the 2049 Notes, in each case pursuant to the Seventeenth Supplemental Indenture, dated as of May 21, 2019, to the Base Indenture (the “Seventeenth Supplemental Indenture”);

WHEREAS, the Company has previously (i) established a series of its Securities designated as the “3.625% Senior Notes due 2030” (the “2030 Notes”) and issued $1,000,000,000 aggregate principal amount of the 2030 Notes and (ii) established a series of its Securities designated as the “4.650% Senior Notes due 2050” (the “2050 Notes”) and issued $1,000,000,000 aggregate principal amount of the 2050 Notes, in each case pursuant to the Eighteenth Supplemental Indenture, dated as of May 18, 2020, to the Base Indenture (the “Eighteenth Supplemental Indenture”);

WHEREAS, the Company has previously established a series of its Securities designated as the “4.000% Senior Notes due 2055” (the “2055 Notes” and together with the 2026 Notes, the 2027 Notes, the 2028 Notes, the 2029 Notes, the 2030 Notes, the 2037 Notes, the 2040 Notes, the 2042 Notes, the 2043 Notes, the 2047 Notes, the 2049 Notes and the 2050 Notes, collectively, the “Notes”) and issued $1,732,036,000 aggregate principal amount of the 2055 Notes, pursuant to the Nineteenth Supplemental Indenture, dated as of September 21, 2020, to the Base Indenture (the “Nineteenth Supplemental Indenture”);

WHEREAS, each of the Second Supplemental Indenture, the Fourth Supplemental Indenture, the Fifth Supplemental Indenture, the Eighth Supplemental Indenture, the Ninth Supplemental Indenture, the Eleventh Supplemental Indenture, the Seventeenth Supplemental Indenture, the Eighteenth Supplemental Indenture and the Nineteenth Supplemental Indenture, in each case, as amended, supplemented or otherwise modified to the date hereof, is referred to herein as an “Existing Supplemental Indenture”;

WHEREAS, the Company desires to amend the Indenture as set forth in Article 2 of this Twenty-Third Supplemental Indenture (the “Amendments”);

WHEREAS, Section 8.02 of the Base Indenture, as amended by each of the Existing Supplemental Indentures relating to the Notes, provides that with the consent (evidenced as provided in Article 7 of the Base Indenture) of the Holders of not less than a majority in aggregate principal amount of the Securities at the time Outstanding of all series affected by such supplemental indenture (voting as one class), the Company, when authorized by a Consent of the Sole Member, the Guarantor, when authorized by a Guarantor Authorizing Resolution, and the Trustee may, from time to time and at any time, enter into an indenture or indentures supplemental to the Base Indenture for the purpose of adding any provisions to or changing in any manner or eliminating any of the provisions of the Base Indenture or of any supplemental indenture or of modifying in any manner the rights of the Holders of the Securities of each such series, other than with respect to certain provisions and rights of the Holders of the Securities which, as set forth in Section 8.02 of the Base Indenture (as amended by each of the Existing Supplemental Indentures), require the consent of the Holder of each Security so affected;

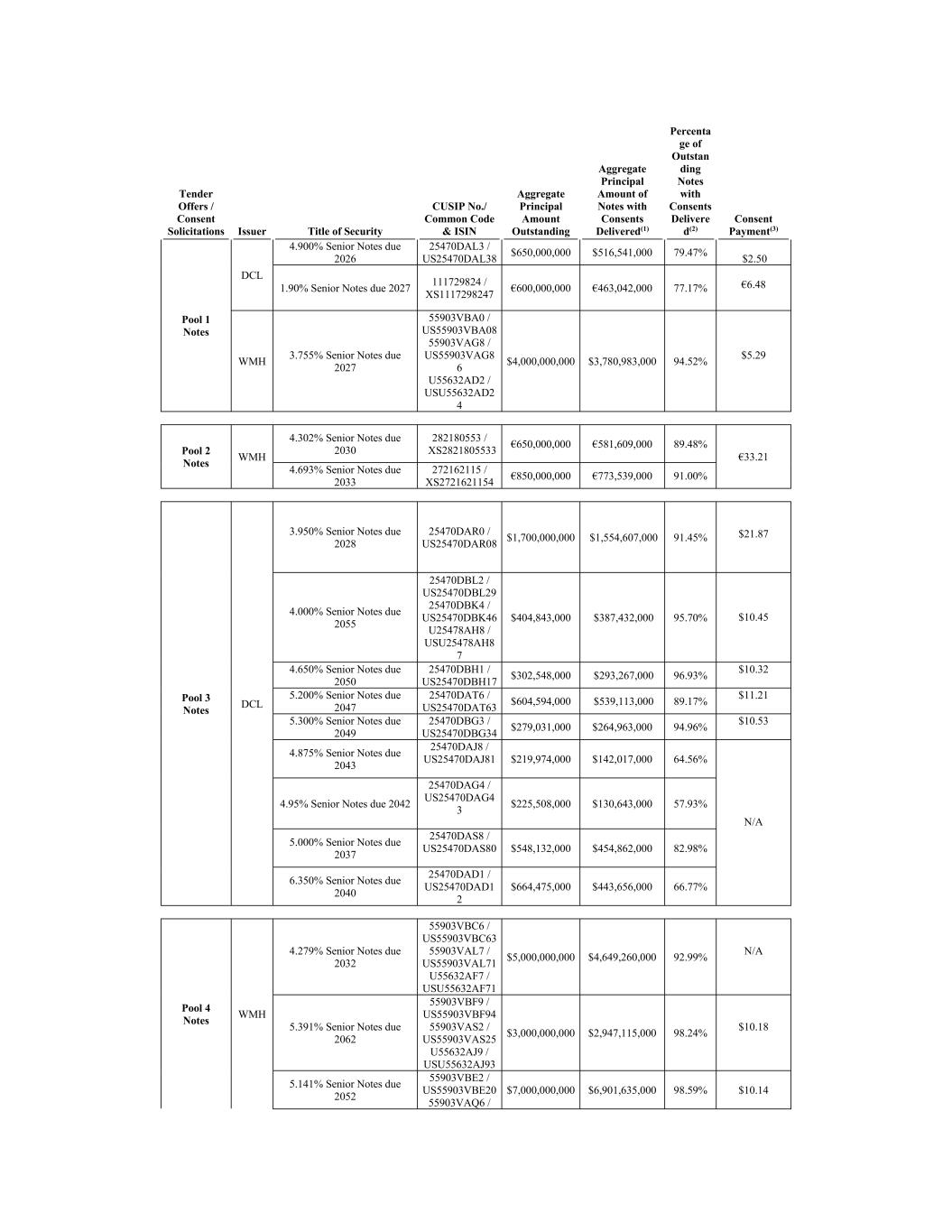

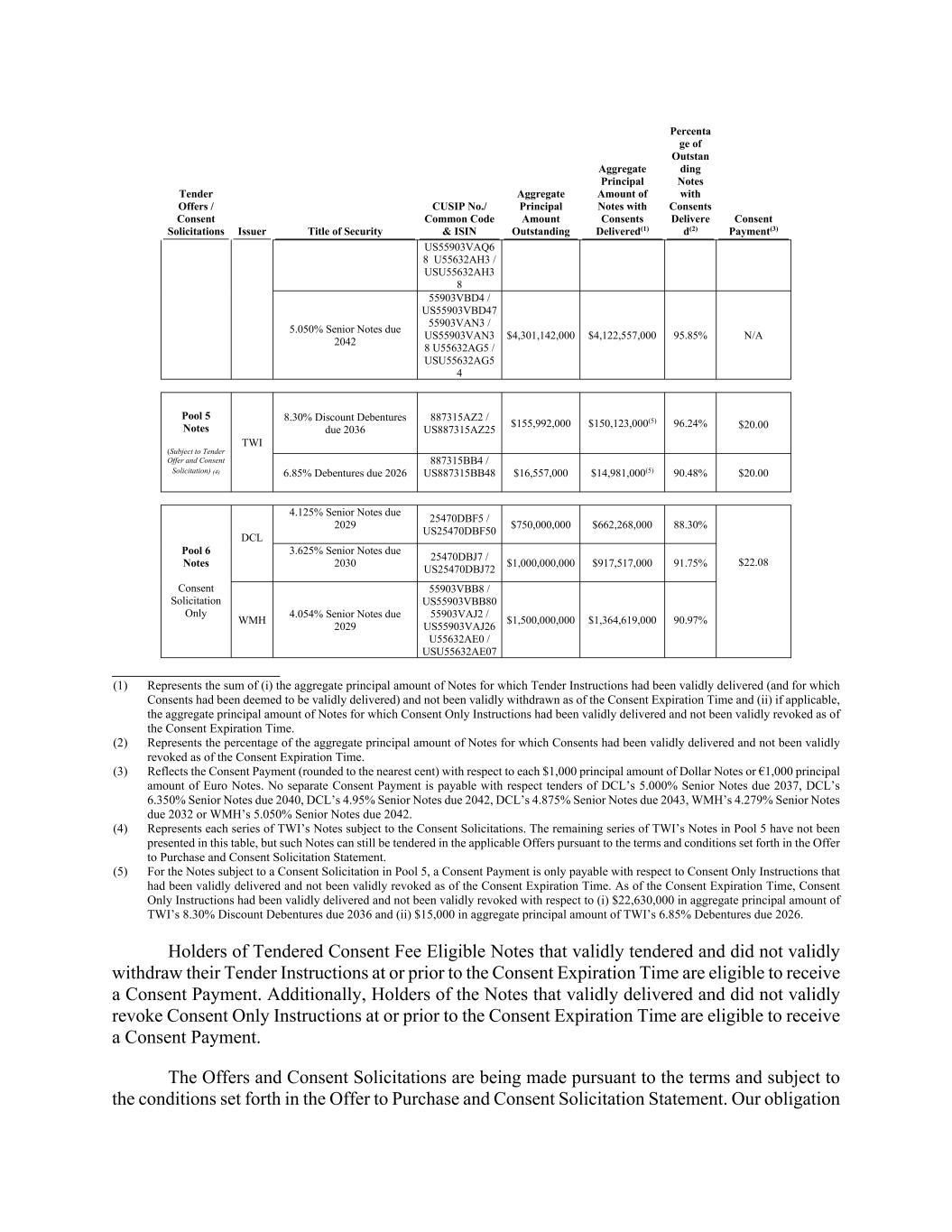

WHEREAS, the Company has solicited consents from the Holders of the Notes for the Amendments to the Indenture, in accordance with the terms and subject to the conditions set forth in the offer to purchase and consent solicitation statement, dated as of June 9, 2025 (the “Offer to Purchase and Consent Solicitation Statement”);

WHEREAS, as of 5:00 p.m., New York city time, on June 13, 2025, the Company has received, and delivered to the Trustee, (i) the consents from Holders of not less than a majority in aggregate principal amount of all series of outstanding Notes to the Amendments to the Indenture as set forth in Article 2 (other than Section 2.01(b)) hereof, voting as one class and (ii) the consents from Holders of not less than a majority in aggregate principal amount of outstanding 2028 Notes, 2029 Notes, 2030 Notes, 2037 Notes, 2047 Notes, 2049 Notes, 2050 Notes and 2055 Notes with respect to the Amendments to the Indenture as set forth in Section 2.01(b) hereof, voting as one class, in each case as evidenced by a certified report from D.F. King & Co., Inc.;

WHEREAS, the Company has requested that the Trustee execute and deliver this Twenty-Third Supplemental Indenture, and complete all requirements necessary to make this Twenty-Third Supplemental Indenture a valid, binding and enforceable instrument in accordance with its terms, and all acts and things necessary have been done and performed to make this Twenty-Third Supplemental Indenture enforceable against the parties hereto in accordance with its terms, and the execution and delivery of this Twenty-Third Supplemental Indenture has been duly authorized by the parties hereto in all respects.

WITNESSETH:

NOW, THEREFORE, for and in consideration of the premises contained herein, each party agrees for the benefit of each other party and for the equal and ratable benefit of the Holders of the Notes, as follows:

Article 1

DEFINITIONS

Section 1.01Capitalized terms used but not defined in this Twenty-Third Supplemental Indenture shall have the meanings ascribed to them in the Base Indenture. Terms defined in the preamble or recitals hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Twenty-Third Supplemental Indenture refer to this Twenty-Third Supplemental Indenture as a whole and not to any particular section hereof.

Section 1.02References in this Twenty-Third Supplemental Indenture to article and section numbers shall be deemed to be references to article and section numbers of this Twenty-Third Supplemental Indenture unless otherwise specified.

Article 2

AMENDMENTS TO THE INDENTURE

Section 2.01Deletion.

(a)Solely with respect to the Notes, the Indenture shall hereby be amended by deleting the following Clauses, Sections or Articles of the Indenture in their entirety, and such Clauses, Sections or Articles shall be of no further force and effect, and shall no longer apply to the Notes, and the words “[INTENTIONALLY DELETED]” shall be inserted, in each case, in place of the deleted text:

•Base Indenture

oClause (c) of Section 5.01 (“Event of Default Defined; Acceleration of Maturity; Waiver of Default”)

oArticle 9 (“Consolidation, Merger, Sale or Conveyance”)

•Second Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Fourth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Fifth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Eighth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 6.01 (“Events of Default”)

•Ninth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Eleventh Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Seventeenth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Eighteenth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

•Nineteenth Supplemental Indenture

oSection 3.01 (“Limitation on Liens”)

oSection 3.02 (“Limitation on Sale and Leasebacks”)

oSection 3.03 (“Consolidation, Sale, Merger or Conveyance”)

oSection 4.02 (“Purchase of Notes Upon a Change of Control Triggering Event”)

oClause (a)(iv) of Section 5.01 (“Events of Default”)

(b)Solely with respect to the 2028 Notes, 2029 Notes, 2030 Notes, 2037 Notes, 2047 Notes, 2049 Notes, 2050 Notes and 2055 Notes, each of the Eleventh Supplemental Indenture, the Seventeenth Supplemental Indenture, the Eighteenth Supplemental Indenture and the Nineteenth Supplemental Indenture shall hereby be amended by deleting the following Clauses, Sections or Articles of such Existing Supplemental Indentures and all references and definitions related thereto (to the extent not otherwise used in any other Clauses, Sections or Articles of such Existing Supplemental Indentures or the Securities not affected by this Twenty-Third Supplemental Indenture) in their entirety, and such Clauses, Sections or Articles shall be of no further force and effect, and shall no longer apply to the 2028 Notes, the 2029 Notes, the 2030 Notes, the 2037 Notes, the 2047 Notes, the 2049 Notes, the 2050 Notes and the 2055 Notes, and the words “[INTENTIONALLY DELETED]” shall be inserted, in each case, in place of the deleted text:

•Eleventh Supplemental Indenture

oSection 3.04 (“Guarantee by Subsidiaries of the Guarantor”)

oSection 3.05 (“Certain Subsidiaries”)

•Seventeenth Supplemental Indenture

oSection 3.04 (“Guarantee by Subsidiaries of the Parent Guarantor”)

oSection 3.05 (“Certain Subsidiaries”)

•Eighteenth Supplemental Indenture

oSection 3.04 (“Guarantee by Subsidiaries of the Parent Guarantor”)

oSection 3.05 (“Certain Subsidiaries”)

•Nineteenth Supplemental Indenture

oSection 3.04 (“Guarantee by Subsidiaries of the Parent Guarantor”)

oSection 3.05 (“Certain Subsidiaries”)

Section 2.02Additional Covenants.

(a)Solely with respect to the 2040 Notes, the provisions set forth on Annex A hereto are hereby added as new Section 3.04, new Section 3.05 and new Section 3.06 to the Second Supplemental Indenture.

(b)Solely with respect to the 2042 Notes, the provisions set forth on Annex B hereto are hereby added as new Section 3.04, new Section 3.05 and new Section 3.06 to the Fourth Supplemental Indenture.

(c)Solely with respect to the 2043 Notes, the provisions set forth on Annex C hereto are hereby added as new Section 3.04, new Section 3.05 and new Section 3.06 to the Fifth Supplemental Indenture.

(d)Solely with respect to the 2027 Notes, the provisions set forth on Annex D hereto are hereby added as new Section 3.04 and new Section 3.05 to the Eighth Supplemental Indenture.

(e)Solely with respect to the 2026 Notes, the provisions set forth on Annex E hereto are hereby added as new Section 3.04 and new Section 3.05 to the Ninth Supplemental Indenture.

(f)Solely with respect to the 2028 Notes, the 2037 Notes and the 2047 Notes, the provisions set forth on Annex F hereto are hereby added as new Section 3.06, new Section 3.07 and new Section 3.08 to the Eleventh Supplemental Indenture.

(g)Solely with respect to the 2029 Notes and the 2049 Notes, the provisions set forth on Annex G hereto are hereby added as new Section 3.06, new Section 3.07 and new Section 3.08 to the Seventeenth Supplemental Indenture.

(h)Solely with respect to the 2030 Notes and the 2050 Notes, the provisions set forth on Annex H hereto are hereby added as new Section 3.06, new Section 3.07 and new Section 3.08 to the Eighteenth Supplemental Indenture.

(i)Solely with respect to the 2055 Notes, the provisions set forth on Annex I hereto are hereby added as new Section 3.06 and new Section 3.07 to the Nineteenth Supplemental Indenture.

Section 2.03Definitions. Solely with respect to the Notes, the definitions set forth below hereby are added to Section 1.03 of each Existing Supplemental Indenture in alphanumeric order:

“Amended Notes” means all or part of a series of Notes assigned and placed into a CUSIP and ISIN that is separate from the CUSIP and ISIN for the applicable Existing Notes of such series, but shall otherwise be substantially the same as the applicable series of Existing Notes, in each case on the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date). For the avoidance of doubt, the Amended Notes shall be consolidated and form a single series with the applicable series of Existing Notes and shall have the same terms as to status, redemption or otherwise as such series of Existing Notes.

“Early Settlement Date” has the meaning assigned to such term in the Offer to Purchase and Consent Solicitation Statement.

“Eligible Holders” means Holders of Amended Notes that properly complete and return an eligibility letter certifying that such Holder is either (i) a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act) or (ii) a person that is not a “U.S. person” (as defined in Regulation S under the Securities Act) outside the United States.

“Exchange Offer Deadline” means the earlier of (i) a date that is no later than five business days following the completion of the Transactions (as defined in the Offer to Purchase and Consent Solicitation Statement) and (ii) the 18-month anniversary of the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) for the Notes.

“Existing Notes” means Notes of any series outstanding immediately prior to the settlement of the tender offers and/or consent solicitations with respect to such series of Notes pursuant to the terms of the Offer to Purchase and Consent Solicitation Statement.

“Final Settlement Date” has the meaning assigned to such term in the Offer to Purchase and Consent Solicitation Statement.

“Junior Lien Exchange Notes” means new junior lien secured notes that may be issued by the Company, with such terms as are determined by the Company (in its sole discretion); provided that such terms are not inconsistent with the terms expressly set forth under the “Brief Description of the Junior Lien Exchange Notes” section of the Offer to Purchase and Consent Solicitation Statement.

“Offer and Consent Solicitation” means the tender offer and consent solicitation conducted pursuant to the terms of Offer to Purchase and Consent Solicitation Statement.

“Offer to Purchase and Consent Solicitation Statement” means the Offer to Purchase and Consent Solicitation Statement, dated June 9, 2025, as amended, supplemented or modified from time to time.

“Permitted Offer” means any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for the Notes of any series issued under the Indenture or any notes issued under the WMH 2022 Indenture, in each case, that were subject to the Offer and Consent Solicitation but that were not validly tendered (or that were withdrawn) or with respect to which valid consents were not delivered (or which were revoked) in the Offer and Consent Solicitation; provided that (i) any Amended Notes of any series with the same maturity must be included and prioritized in any such offer, (ii) holders of Amended Notes of any series with the same maturity must be offered equal or greater consideration in any such offer (it being understood that any cash consideration offered to holders of such Amended Notes must be equal or greater than the cash consideration offered to holders of such series of Notes), (iii) in the case of any exchange offer, (a) the notes or any other indebtedness offered in exchange for Notes of such series shall be unsecured and by its terms expressly subordinated in right of payment to the Notes and (b) the indenture, agreement or other instrument governing such indebtedness offered in exchange for Notes of such series shall not include any covenant or other agreement to secure such indebtedness unless the liens securing such indebtedness rank junior to the liens securing the Junior Lien Exchange Notes pursuant to a customary intercreditor agreement and such liens are incurred on or after the issue date of the Junior Lien Exchange Notes.

“WMH 2022 Indenture” means that certain indenture, dated as of March 15, 2022 (as amended, supplemented, waived or otherwise modified from time to time), among WMH, as the issuer, the guarantors from time to time party thereto, and U.S. Bank Trust Company, National Association, as trustee.

Section 2.04Any of the terms or provisions present in the Notes that relate to any of the provisions of the Indenture as amended by this Twenty-Third Supplemental Indenture shall also be amended, mutatis mutandis, so as to be consistent with the amendments made by this Twenty-Third Supplemental Indenture.

Section 2.05The Indenture is hereby amended by deleting any definitions from the Indenture with respect to which references would be eliminated as a result of the amendments to the Indenture pursuant to Section 2.01 above. The definition of any defined term used in the Indenture or the Notes where such definition is set forth in any of the sections or subsections of the Indenture that are eliminated by this Twenty-Third Supplemental Indenture and the term it defines is still used elsewhere in the Indenture or the Notes after the amendments hereby become operative shall be deemed to become part of, and defined in, Section 1.01 of the Base Indenture or Section 1.03 of each Supplemental Indenture, as applicable. Such defined terms are to be in alphanumeric order within Section 1.01 of the Base Indenture or Section 1.03 of each Supplemental Indenture, as applicable.

Section 2.06None of the Company, the Parent Guarantor, the Subsidiary Guarantors, the Trustee or other parties to or beneficiaries of the Indenture shall have any rights, obligations or liabilities under the Clauses, Sections or Articles of the Indenture deleted pursuant to Section 2.01 above.

The failure to comply with such Clauses, Sections or Articles of the Indenture shall no longer constitute a Default or Event of Default under the Indenture with respect to the Notes, shall no longer have any consequence under the Indenture with respect to the Notes, and the Holders of the Notes shall be deemed to have waived any Default or Event of Default under the Indenture with respect to such failure (whether before or after the date of this Twenty-Third Supplemental Indenture).

Article 3

MISCELLANEOUS

Section 3.01Forms of Amended Notes. The Amended Notes of each series shall be substantially in such form (not inconsistent with the Indenture) as shall be established by or pursuant to one or more Consents of the Sole Member (as set forth in a Consent of the Sole Member or, to the extent established pursuant to (rather than set forth in) a Consent of the Sole Member, an Officer’s Certificate detailing such establishment).

Section 3.02Ratification of Base Indenture. The Base Indenture, as supplemented by this Twenty-Third Supplemental Indenture, is in all respects ratified and confirmed, and this Twenty-Third Supplemental Indenture shall be deemed part of the Base Indenture in the manner and to the extent herein and therein provided. Every Holder of Notes heretofore or hereafter authenticated and delivered shall be bound hereby.

Section 3.03Trust Indenture Act Controls. If any provision, covenant or restriction contemplated by this Twenty-Third Supplemental Indenture limits, qualifies or conflicts with another provision that is required to be included in this Twenty-Third Supplemental Indenture or the Indenture by the Trust Indenture Act of 1939, as amended, as in force at the date such Supplemental Indenture is executed, the provisions required by such Trust Indenture Act shall control.

Section 3.04Conflict with Indenture; Severability. To the extent not expressly amended or modified by this Twenty-Third Supplemental Indenture, the Base Indenture shall remain in full force and effect. If any provision of this Twenty-Third Supplemental Indenture relating to the Notes is inconsistent with any provision of the Base Indenture, the provision of this Twenty-Third Supplemental Indenture shall control. In case any provision, covenant or restriction contemplated by this Twenty-Third Supplemental Indenture is held to be invalid, illegal or unenforceable in any jurisdiction, such covenant or restriction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions, covenants or restrictions; and the invalidity of a particular provision, covenant or restriction in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

Section 3.05Governing Law. THIS TWENTY-THIRD SUPPLEMENTAL INDENTURE AND THE NOTES SHALL BE DEEMED TO BE A CONTRACT UNDER THE LAWS OF THE STATE OF NEW YORK, AND FOR ALL PURPOSES SHALL BE CONSTRUED IN ACCORDANCE WITH THE LAWS OF SUCH STATE, EXCEPT AS MAY OTHERWISE BE REQUIRED BY MANDATORY PROVISIONS OF LAW. THE TRUSTEE, THE COMPANY, ANY OTHER OBLIGOR IN RESPECT OF THE NOTES AND (BY THEIR ACCEPTANCE OF THE NOTES) THE HOLDERS AGREE TO SUBMIT TO THE JURISDICTION OF ANY UNITED STATES FEDERAL OR STATE COURT LOCATED IN THE BOROUGH OF MANHATTAN, IN THE CITY OF NEW YORK IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS TWENTY-THIRD SUPPLEMENTAL INDENTURE.

Section 3.06Successors. All agreements of the Company, the Parent Guarantor and the Subsidiary Guarantors in the Base Indenture, this Twenty-Third Supplemental Indenture and the Notes shall bind their respective successors. All agreements of the Trustee in the Base Indenture and this Twenty-Third Supplemental Indenture shall bind its successors.

Section 3.07Counterparts. This instrument may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument. Signatures of the parties hereto transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes. Electronic signatures believed by the Trustee to comply with the ESIGN Act of 2000 or other applicable law (including electronic images of handwritten signatures and digital signature provided by DocuSign, Orbit, Adobe Sign or any other digital signature provider acceptable to Trustee) shall also be deemed original signatures for all purposes hereunder. Any communication or documents sent to the Trustee hereunder must be in the form of a document that is signed manually or by way of a digital signature provided by DocuSign (or such other digital signature provider as specified in writing to the Trustee by the authorized representative of the Company). Notwithstanding the foregoing, Trustee may in any instance and in its sole discretion require that an original document bearing a manual signature be delivered to Trustee in lieu of, or in addition to, any such electronic method. The Company agrees to assume all risks arising out of the use of using digital signatures and electronic methods to submit communications to the Trustee, including without limitation the risk of the Trustee acting on unauthorized instructions, and the risk of interception and misuse by third parties.

Section 3.08Trustee Disclaimer. The Trustee makes no representation as to the validity or sufficiency of this Twenty-Third Supplemental Indenture other than as to the validity of its execution and delivery by the Trustee. The recitals and statements herein are deemed to be those of the Company, the Parent Guarantor and the Subsidiary Guarantors and not the Trustee.

Section 3.09Effectiveness. This Twenty-Third Supplemental Indenture shall become effective and binding on the Company, the Parent Guarantor, the Subsidiary Guarantors, the Trustee and every Holder of the Notes of each series heretofore or hereafter authenticated and delivered under the Indenture upon the execution and delivery by the parties of this Twenty-Third Supplemental Indenture; provided, however, that the Amendments shall become operative with respect to a series of Notes only upon the Settlement Date (as defined in the Offer to Purchase and Consent Solicitation Statement) of the Offer with respect to such series of Notes in accordance with the terms and conditions set forth in the Offer to Purchase and Consent Solicitation Statement.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the parties hereto have caused the Supplemental Indenture to be duly executed as of the day and year first above written.

DISCOVERY COMMUNICATIONS, LLC

|

|

|

|

|

|

By: |

/s/ Fraser Woodford |

Name: |

Fraser Woodford |

Title : |

Executive Vice President and Treasurer |

WARNER BROS. DISCOVERY, INC.

|

|

|

|

|

|

By: |

/s/ Fraser Woodford |

Name: |

Fraser Woodford |

Title : |

Executive Vice President and Treasurer |

WARNERMEDIA HOLDINGS, INC.

|

|

|

|

|

|

By: |

/s/ Fraser Woodford |

Name: |

Fraser Woodford |

Title : |

Executive Vice President and Treasurer |

SCRIPPS NETWORKS INTERACTIVE, INC.

|

|

|

|

|

|

By: |

/s/ Fraser Woodford |

Name: |

Fraser Woodford |

Title : |

Executive Vice President and Treasurer |

[Signature Page to DCL Twenty-Third Supplemental Indenture]

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION,

as Trustee,

|

|

|

|

|

|

By: |

/s/ Michelle Mena-Rosado |

Name: |

Michelle Mena-Rosado |

Title : |

Vice President |

[Signature Page to DCL Twenty-Third Supplemental Indenture]

Annex A

Section 3.04. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.04, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.05. Exchange Offer.

(a)At or prior to the Exchange Offer Deadline, the Company shall, in its sole discretion, commence and complete an offer (the “Exchange Offer”) to exchange Amended Notes held by Eligible Holders for the same principal amount of Junior Lien Exchange Notes. If the Exchange Offer is not commenced by the Company by the Exchange Offer Deadline or is not completed within 60 days of commencement thereof, the Company shall within ten (10) Business Days of such failure make a payment of $100 per $1,000 principal amount of Amended Notes to Holders of Amended Notes as of the date of the Exchange Offer Deadline and all outstanding Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes.

(b)If the Exchange Offer is commenced by the Company:

(i) Holders of the Amended Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended Notes held by such holders (“Cash Pay Option”) or (ii) participate in the Exchange Offer; and

(ii)Holders of Amended Notes that are not Eligible Holders shall not be entitled to participate in the Exchange Offer, but may elect the Cash Pay Option;

(iii)provided that, Holders of the Amended Notes that (x) do not certify their eligibility as described under the definition of “Eligible Holders,” (y) choose not to participate in the Exchange Offer or (z) elect for the Cash Pay Option, as applicable, shall not receive any additional consideration, and such Holders of the Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes (provided that there has been no “significant modification” with respect to such Amended Notes for U.S. federal income tax purposes).

(c)The delivery, registration, transfer and exchange of any Amended Notes or Existing Notes shall be pursuant to such procedures as are established upon the order of the Company or pursuant to such procedures acceptable to the Trustee or, in the case of any Notes evidenced by a Global Security, the applicable procedures of the Depositary.

(d)If the Exchange Offer is commenced, the Company will comply, to the extent applicable, with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws or regulations, in each case, to the extent applicable in connection with the Exchange Offer. To the extent that the provisions of any securities laws or regulations conflict with provisions of the Indenture, the Company will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations described in the Indenture by virtue of the conflict.

The provisions of this Section 3.05 are solely for the benefit of Holders of Amended Notes; provided that, without the consent of the Holders of any series of Notes, the Company, the Parent Guarantor, the Subsidiary Guarantors and the Trustee may from time to time and at any time enter into an indenture supplemental hereto to modify the provisions of this Section 3.05 such that Holders of all Notes of a series (including any Existing Notes) would benefit from these provisions.

Section 3.06. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex B

Section 3.04. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.04, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.05. Exchange Offer.

(a)At or prior to the Exchange Offer Deadline, the Company shall, in its sole discretion, commence and complete an offer (the “Exchange Offer”) to exchange Amended Notes held by Eligible Holders for the same principal amount of Junior Lien Exchange Notes. If the Exchange Offer is not commenced by the Company by the Exchange Offer Deadline or is not completed within 60 days of commencement thereof, the Company shall within ten (10) Business Days of such failure make a payment of $100 per $1,000 principal amount of Amended Notes to Holders of Amended Notes as of the date of the Exchange Offer Deadline and all outstanding Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes.

(b)If the Exchange Offer is commenced by the Company:

(i) Holders of the Amended Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended Notes held by such holders (“Cash Pay Option”) or (ii) participate in the Exchange Offer; and

(ii)Holders of Amended Notes that are not Eligible Holders shall not be entitled to participate in the Exchange Offer, but may elect the Cash Pay Option;

(iii)provided that, Holders of the Amended Notes that (x) do not certify their eligibility as described under the definition of “Eligible Holders,” (y) choose not to participate in the Exchange Offer or (z) elect for the Cash Pay Option, as applicable, shall not receive any additional consideration, and such Holders of the Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes (provided that there has been no “significant modification” with respect to such Amended Notes for U.S. federal income tax purposes).

(c)The delivery, registration, transfer and exchange of any Amended Notes or Existing Notes shall be pursuant to such procedures as are established upon the order of the Company or pursuant to such procedures acceptable to the Trustee or, in the case of any Notes evidenced by a Global Security, the applicable procedures of the Depositary.

(d)If the Exchange Offer is commenced, the Company will comply, to the extent applicable, with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws or regulations, in each case, to the extent applicable in connection with the Exchange Offer. To the extent that the provisions of any securities laws or regulations conflict with provisions of the Indenture, the Company will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations described in the Indenture by virtue of the conflict.

The provisions of this Section 3.05 are solely for the benefit of Holders of Amended Notes; provided that, without the consent of the Holders of any series of Notes, the Company, the Parent Guarantor, the Subsidiary Guarantors and the Trustee may from time to time and at any time enter into an indenture supplemental hereto to modify the provisions of this Section 3.05 such that Holders of all Notes of a series (including any Existing Notes) would benefit from these provisions.

Section 3.06. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex C

Section 3.04. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.04, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.05. Exchange Offer.

(a)At or prior to the Exchange Offer Deadline, the Company shall, in its sole discretion, commence and complete an offer (the “Exchange Offer”) to exchange Amended Notes held by Eligible Holders for the same principal amount of Junior Lien Exchange Notes. If the Exchange Offer is not commenced by the Company by the Exchange Offer Deadline or is not completed within 60 days of commencement thereof, the Company shall within ten (10) Business Days of such failure make a payment of $100 per $1,000 principal amount of Amended Notes to Holders of Amended Notes as of the date of the Exchange Offer Deadline and all outstanding Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes.

(b)If the Exchange Offer is commenced by the Company:

(i) Holders of the Amended Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended Notes held by such holders (“Cash Pay Option”) or (ii) participate in the Exchange Offer; and

(ii)Holders of Amended Notes that are not Eligible Holders shall not be entitled to participate in the Exchange Offer, but may elect the Cash Pay Option;

(iii)provided that, Holders of the Amended Notes that (x) do not certify their eligibility as described under the definition of “Eligible Holders,” (y) choose not to participate in the Exchange Offer or (z) elect for the Cash Pay Option, as applicable, shall not receive any additional consideration, and such Holders of the Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes (provided that there has been no “significant modification” with respect to such Amended Notes for U.S. federal income tax purposes).

(c)The delivery, registration, transfer and exchange of any Amended Notes or Existing Notes shall be pursuant to such procedures as are established upon the order of the Company or pursuant to such procedures acceptable to the Trustee or, in the case of any Notes evidenced by a Global Security, the applicable procedures of the Depositary.

(d)If the Exchange Offer is commenced, the Company will comply, to the extent applicable, with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws or regulations, in each case, to the extent applicable in connection with the Exchange Offer. To the extent that the provisions of any securities laws or regulations conflict with provisions of the Indenture, the Company will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations described in the Indenture by virtue of the conflict.

The provisions of this Section 3.05 are solely for the benefit of Holders of Amended Notes; provided that, without the consent of the Holders of any series of Notes, the Company, the Parent Guarantor, the Subsidiary Guarantors and the Trustee may from time to time and at any time enter into an indenture supplemental hereto to modify the provisions of this Section 3.05 such that Holders of all Notes of a series (including any Existing Notes) would benefit from these provisions.

Section 3.06. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex D

Section 3.04. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.04, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.05. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex E

Section 3.04. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.04, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.05. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex F

Section 3.06. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.06, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.07. Exchange Offer.

(a)At or prior to the Exchange Offer Deadline, the Company shall, in its sole discretion, commence and complete an offer (the “Exchange Offer”) to exchange Amended Notes held by Eligible Holders for the same principal amount of Junior Lien Exchange Notes. If the Exchange Offer is not commenced by the Company by the Exchange Offer Deadline or is not completed within 60 days of commencement thereof, the Company shall within ten (10) Business Days of such failure make a payment of $100 per $1,000 principal amount of Amended Notes to Holders of Amended Notes as of the date of the Exchange Offer Deadline and all outstanding Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes.

(b)If the Exchange Offer is commenced by the Company:

(i) Holders of the Amended 2028 Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $1.00 per $1,000 of principal amount of Amended 2028 Notes held by such holders (“2028 Notes Cash Pay Option”) or (ii) participate in the Exchange Offer;

(ii)Holders of the Amended 2037 Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended 2037 Notes held by such holders (“2037 Notes Cash Pay Option”) or (ii) participate in the Exchange Offer;

(iii)Holders of the Amended 2047 Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended 2047 Notes held by such holders (“2047 Notes Cash Pay Option” and together with the 2028 Notes Cash Pay Option and the 2037 Notes Cash Pay Option, the “Cash Pay Options”) or (ii) participate in the Exchange Offer;

(iv)Holders of Amended Notes that are not Eligible Holders shall not be entitled to participate in the Exchange Offer, but may elect the Cash Pay Options;

(v)provided that, Holders of the Amended Notes that (x) do not certify their eligibility as described under the definition of “Eligible Holders,” (y) choose not to participate in the Exchange Offer or (z) elect for the Cash Pay Options, as applicable, shall not receive any additional consideration, and such Holders of the Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes (provided that there has been no “significant modification” with respect to such Amended Notes for U.S. federal income tax purposes).

(c)The delivery, registration, transfer and exchange of any Amended Notes or Existing Notes shall be pursuant to such procedures as are established upon the order of the Company or pursuant to such procedures acceptable to the Trustee or, in the case of any Notes evidenced by a Global Security, the applicable procedures of the Depositary.

(d)If the Exchange Offer is commenced, the Company will comply, to the extent applicable, with the requirements of Rule 14e-1 under the Exchange Act and any other securities laws or regulations, in each case, to the extent applicable in connection with the Exchange Offer. To the extent that the provisions of any securities laws or regulations conflict with provisions of the Indenture, the Company will comply with the applicable securities laws and regulations and will not be deemed to have breached its obligations described in the Indenture by virtue of the conflict.

(e)For purposes of this Section 3.07, the following definitions are applicable:

“Amended 2028 Notes” means all or part of the 2028 Notes assigned and placed into a CUSIP and ISIN that is separate from the CUSIPand ISIN for the Existing 2028 Notes, but shall otherwise be substantially the same as the Existing 2028 Notes, in each case on the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date). For the avoidance of doubt, the Amended 2028 Notes shall be consolidated and form a single series with the Existing 2028 Notes and shall have the same terms as to status, redemption or otherwise as the Existing 2028 Notes.

“Amended 2037 Notes” means all or part of the 2037 Notes assigned and placed into a CUSIP and ISIN that is separate from the CUSIP and ISINfor the Existing 2037 Notes, but shall otherwise be substantially the same as the Existing 2037 Notes, in each case on the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date). For the avoidance of doubt, the Amended 2037 Notes shall be consolidated and form a single series with the Existing 2037 Notes and shall have the same terms as to status, redemption or otherwise as the Existing 2037 Notes.

“Amended 2047 Notes” means all or part of the 2047 Notes assigned and placed into a CUSIP and ISIN that is separate from the CUSIP and ISIN for the Existing 2047 Notes, but shall otherwise be substantially the same as the Existing 2047 Notes, in each case on the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date). For the avoidance of doubt, the Amended 2047 Notes shall be consolidated and form a single series with the Existing 2047 Notes and shall have the same terms as to status, redemption or otherwise as the Existing 2047 Notes.

“Existing 2028 Notes” means the 2028 Notes outstanding immediately prior to the settlement of the tender offers and/or consent solicitations with respect to the 2028 Notes pursuant to the terms of the Offer to Purchase and Consent Solicitation Statement.

“Existing 2037 Notes” means the 2037 Notes outstanding immediately prior to the settlement of the tender offers and/or consent solicitations with respect to the 2037 Notes pursuant to the terms of the Offer to Purchase and Consent Solicitation Statement.

“Existing 2047 Notes” means the 2047 Notes outstanding immediately prior to the settlement of the tender offers and/or consent solicitations with respect to the 2047 Notes pursuant to the terms of the Offer to Purchase and Consent Solicitation Statement.

The provisions of this Section 3.07 are solely for the benefit of Holders of Amended Notes; provided that, without the consent of the Holders of any series of Notes, the Company, the Parent Guarantor, the Subsidiary Guarantors and the Trustee may from time to time and at any time enter into an indenture supplemental hereto to modify the provisions of this Section 3.07 such that Holders of all Notes of a series (including any Existing Notes) would benefit from these provisions.

Section 3.08. Interim Restricted Debt Purchases. After the Early Settlement Date (or if there is no Early Settlement Date, the Final Settlement Date) but prior to the consummation of the Exchange Offer, the Parent Guarantor shall not, and shall not permit any of its Subsidiaries to, make any tender offer subject to the requirements of Rule 14e-1 of the Exchange Act or exchange offer subject to the requirements of Rule 14e-1 of the Exchange Act for any of the Notes or any notes issued under the WMH 2022 Indenture, other than pursuant to a Permitted Offer for such Notes.

Annex G

Section 3.06. Non-Boycott.

(a)Each Holder, Notes Beneficial Owner and any affiliate of the foregoing persons (other than Screened Affiliates) (such persons, the “Subject Persons”) is prohibited from entering into or becoming subject to or bound by any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from (i) purchasing for cash any newly-issued debt or securities issued by the Parent Guarantor and its Subsidiaries or (ii) making any loans in cash to the Parent Guarantor and its Subsidiaries, in the case of clauses (i) and (ii), from time to time after the date hereof (the “Boycott Agreement”). Moreover, any person that is party to or otherwise bound by a Boycott Agreement is prohibited from purchasing or otherwise acquiring the Notes.

(b)Any Holder or Notes Beneficial Owner that enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement (or if an affiliate thereof (other than a Screened Affiliate) enters into, becomes subject to or otherwise becomes bound by a Boycott Agreement) shall be in breach of the Indenture and shall be liable to the Company for any damages at law or in equity that the Parent Guarantor and its Subsidiaries may suffer as a result of such breach. Without prejudice to any remedies available to the Company, the Company may enforce the prohibition on Boycott Agreements through specific performance without the posting of any bond or otherwise.

(c)For purposes of this Section 3.06, the following definitions are applicable.

“Notes Beneficial Owner” means a Person who is a beneficial owner of interests in the Notes.

“Screened Affiliate” means any affiliate of a Holder or Notes Beneficial Owner (i) that makes investment decisions independently from such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate, (ii) that has in place customary information screens between it and such Holder or Notes Beneficial Owner and any other affiliate of such Holder or Notes Beneficial Owner that is not a Screened Affiliate and such screens prohibit the sharing of information with respect to the Parent Guarantor or its Subsidiaries, (iii) whose investment policies are not directed by such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such Holder or Notes Beneficial Owner in connection with its investment in the Notes, and (iv) whose investment decisions are not influenced by the investment decisions of such Holder or Notes Beneficial Owner or any other affiliate of such Holder or Notes Beneficial Owner that is acting in concert with such holder in connection with its investment in the Notes.

(d)For the avoidance of doubt, this Non-Boycott provision shall not be construed to prohibit any Holder or Notes Beneficial Owner or affiliate of the foregoing persons from entering into any boycott agreement, cooperation agreement, support agreement, lock-up agreement, coordination agreement or other similar agreement that restricts, limits, conditions or otherwise prohibits in any manner any Subject Person party thereto or otherwise bound thereby from transacting with the Parent Guarantor and its Subsidiaries with respect to any existing indebtedness of the Parent Guarantor and its Subsidiaries.

Section 3.07. Exchange Offer.

(a)At or prior to the Exchange Offer Deadline, the Company shall, in its sole discretion, commence and complete an offer (the “Exchange Offer”) to exchange Amended Notes held by Eligible Holders for the same principal amount of Junior Lien Exchange Notes. If the Exchange Offer is not commenced by the Company by the Exchange Offer Deadline or is not completed within 60 days of commencement thereof, the Company shall within ten (10) Business Days of such failure make a payment of $100 per $1,000 principal amount of Amended Notes to Holders of Amended Notes as of the date of the Exchange Offer Deadline and all outstanding Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes.

(b)If the Exchange Offer is commenced by the Company:

(i) Holders of the Amended 2029 Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $1.00 per $1,000 of principal amount of Amended 2029 Notes held by such holders (“2029 Notes Cash Pay Option”) or (ii) participate in the Exchange Offer;

(ii)Holders of the Amended 2049 Notes that are Eligible Holders shall have the option to (i) elect to receive a cash payment in an amount equal to $2.50 per $1,000 of principal amount of Amended 2049 Notes held by such holders (“2049 Notes Cash Pay Option” and together with the 2029 Notes Cash Pay Option, the “Cash Pay Options”) or (ii) participate in the Exchange Offer;

(iii)Holders of Amended Notes that are not Eligible Holders shall not be entitled to participate in the Exchange Offer, but may elect the Cash Pay Options;

(iv)provided that, Holders of the Amended Notes that (x) do not certify their eligibility as described under the definition of “Eligible Holders,” (y) choose not to participate in the Exchange Offer or (z) elect for the Cash Pay Options, as applicable, shall not receive any additional consideration, and such Holders of the Amended Notes shall be assigned and placed into the applicable CUSIP and ISIN of the applicable series of Existing Notes (provided that there has been no “significant modification” with respect to such Amended Notes for U.S. federal income tax purposes).