FOR IMMEDIATE RELEASE June 9, 2025 Warner Bros. Discovery Announces Commencement of Cash Tender Offer and Consent Solicitation New York, New York -- Warner Bros. Discovery, Inc. (NASDAQ: WBD) (“Warner Bros. Discovery,” “WBD,” the “Company,” “we,” “our” or “us”) today announced that, its wholly-owned subsidiaries, Discovery Communications, LLC (“DCL”), WarnerMedia, LLC (“WML”), WarnerMedia Holdings, Inc. (“WMH”) and Historic TW Inc. (“TWI”) (each, an “Issuer” and together, the “Issuers”), have commenced offers to purchase (each an “Offer” and, collectively, the “Offers”) substantially all of their outstanding notes and debentures (“Notes”) for an aggregate purchase price of up to $14.6 billion, subject to the Pool Tender Caps and Pool Tender SubCaps as described in the table below. Concurrently with the Offers, the Issuers are soliciting consents (each, a “Consent Solicitation” and, collectively, the “Consent Solicitations”) from holders of certain series of the Notes listed in the table below to adopt certain proposed amendments to the indentures governing such Notes, as described in the Offer to Purchase and Consent Solicitation Statement, dated June 9, 2025 (the “Offer to Purchase and Consent Solicitation Statement”). Capitalized terms used but not defined in this press release have the meanings given to them in the Offer to Purchase and Consent Solicitation Statement. Each Offer will expire at 5:00 p.m., New York City time, on July 9, 2025, unless extended by us in our sole discretion or earlier terminated (the “Expiration Time”). To be eligible to receive the applicable Total Consideration, which is inclusive of the Early Tender Premium, holders of Notes must validly tender their Notes and not validly withdraw their Notes at or prior to 5:00 p.m., New York City time, on June 23, 2025, unless extended by us in our sole discretion or earlier terminated (the “Early Tender Deadline”). Holders who validly tender their Notes after the Early Tender Deadline, and before the Expiration Time will be eligible to receive the applicable “Tender Offer Consideration” per $1,000 or €1,000, as applicable, of principal amount of Notes tendered by such holders that are accepted for purchase, which is equal to the applicable Total Consideration minus the Early Tender Premium. Holders of Tendered Consent Fee Eligible Notes (as defined below) are eligible to receive a Consent Payment (as defined herein) if such Holders validly tender and do not validly withdraw their Tender Instructions at or prior to 5:00 p.m., New York City Time, on June 13, 2025, unless extended or earlier terminated by us (the “Consent Expiration Time”). Holders of the Notes that validly deliver and do not validly revoke Consent Only Instructions at or prior to the Consent Expiration Time are eligible to receive a Consent Payment. The Total Consideration (other than for each series of TWI Fixed Price Notes) will be determined at 9:30 a.m., New York City time, on June 24, 2025, unless extended (the “Price Determination Time”). The “Consent Revocation Deadline” is the earlier of (i) the Consent Expiration Time and (ii) the satisfaction of the applicable Requisite Consent Condition. Consents may not be revoked after the Consent Revocation Deadline.

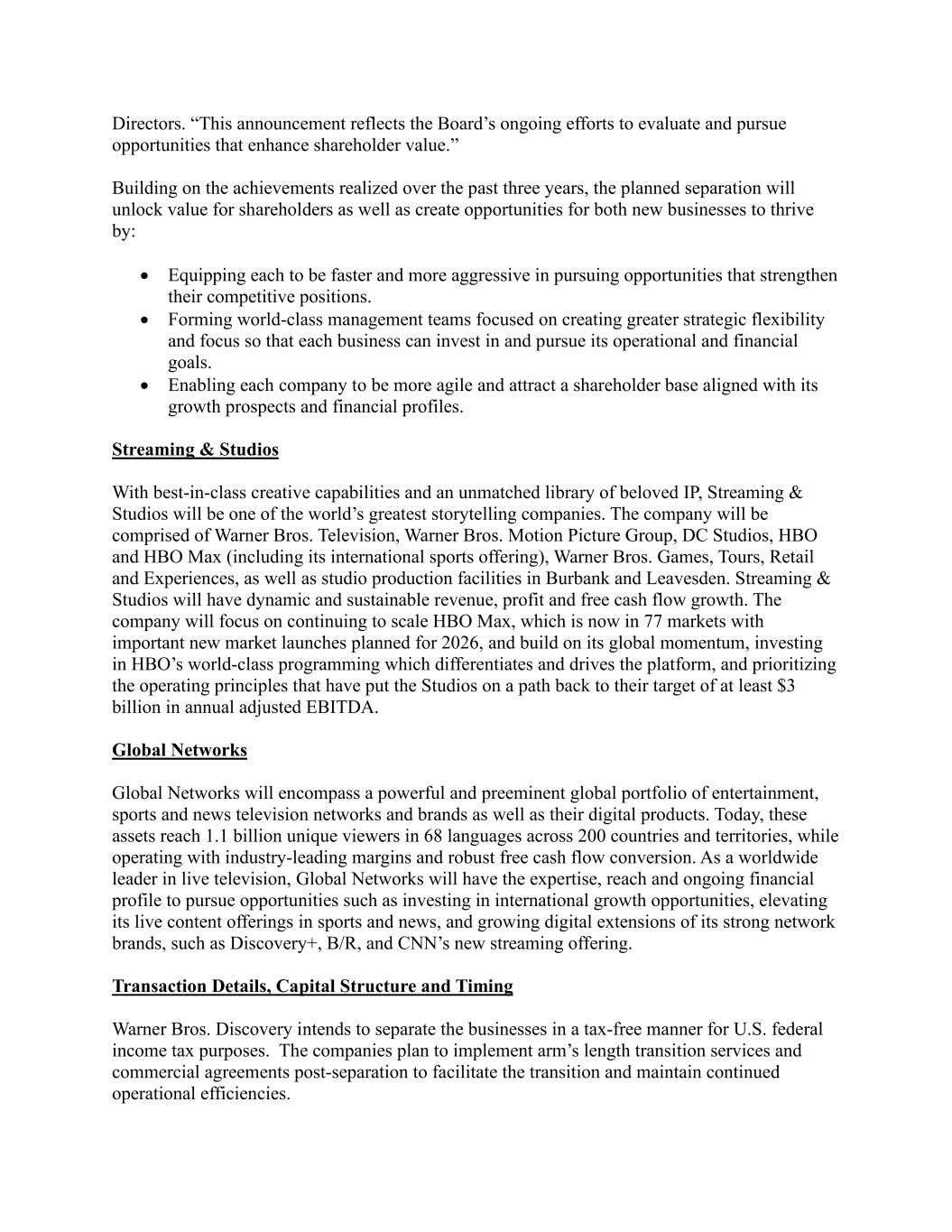

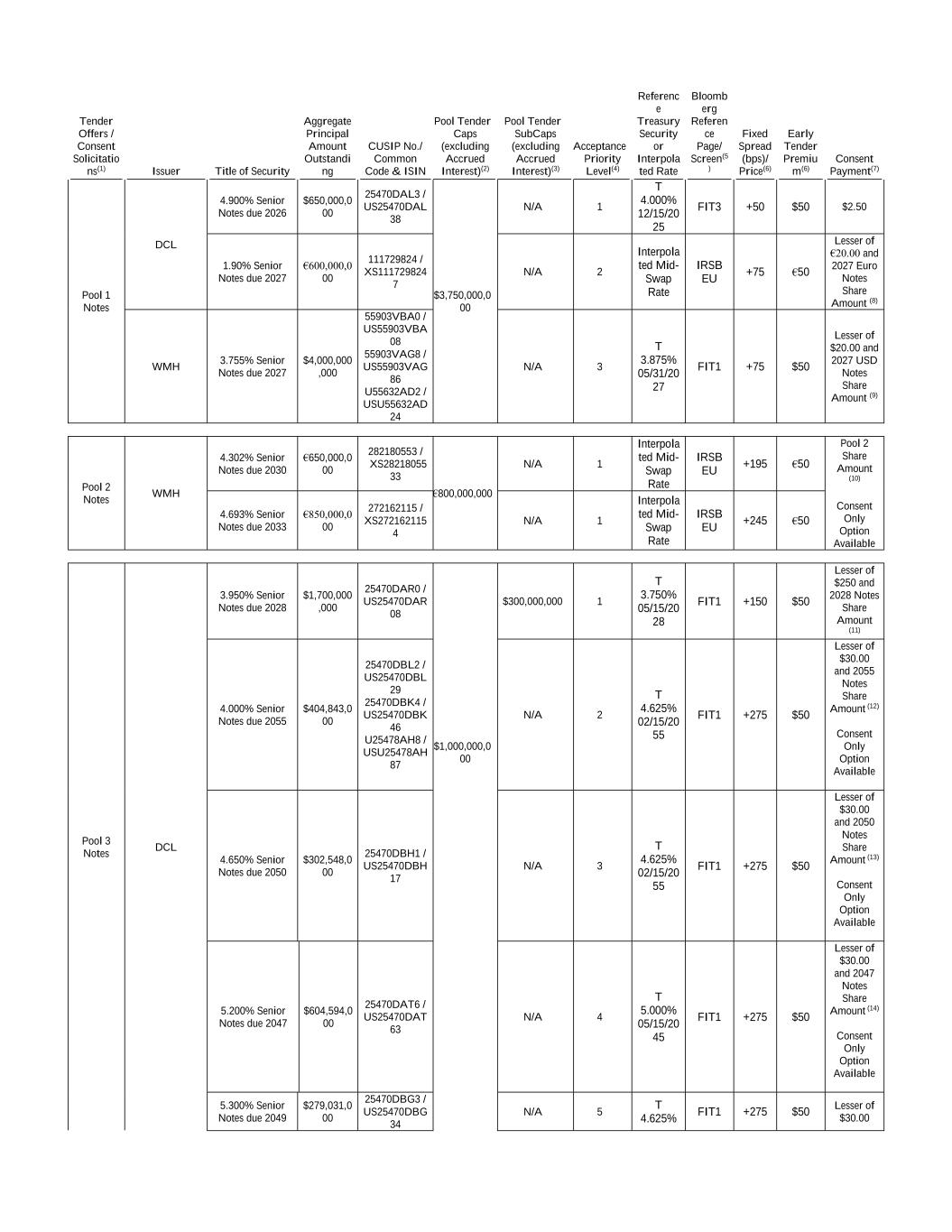

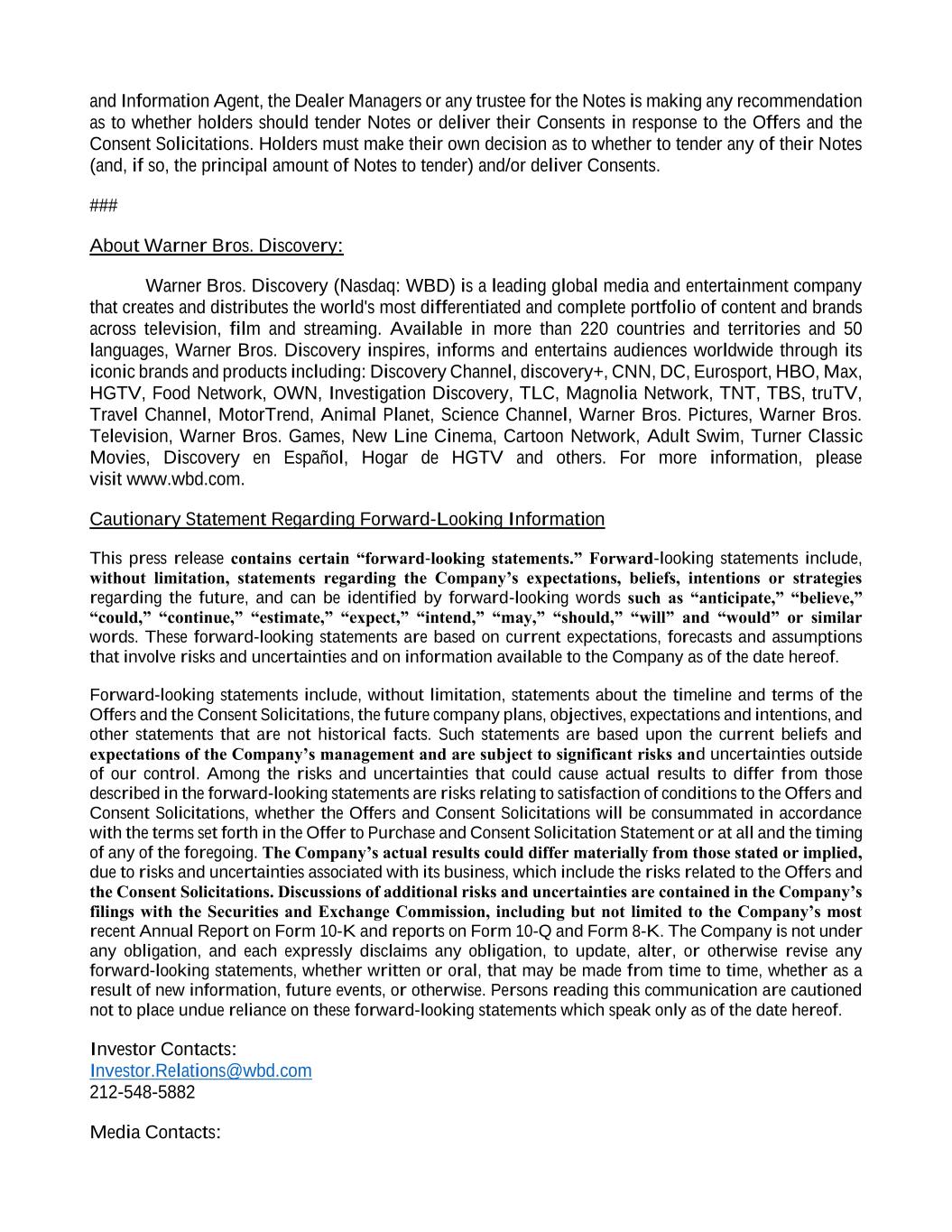

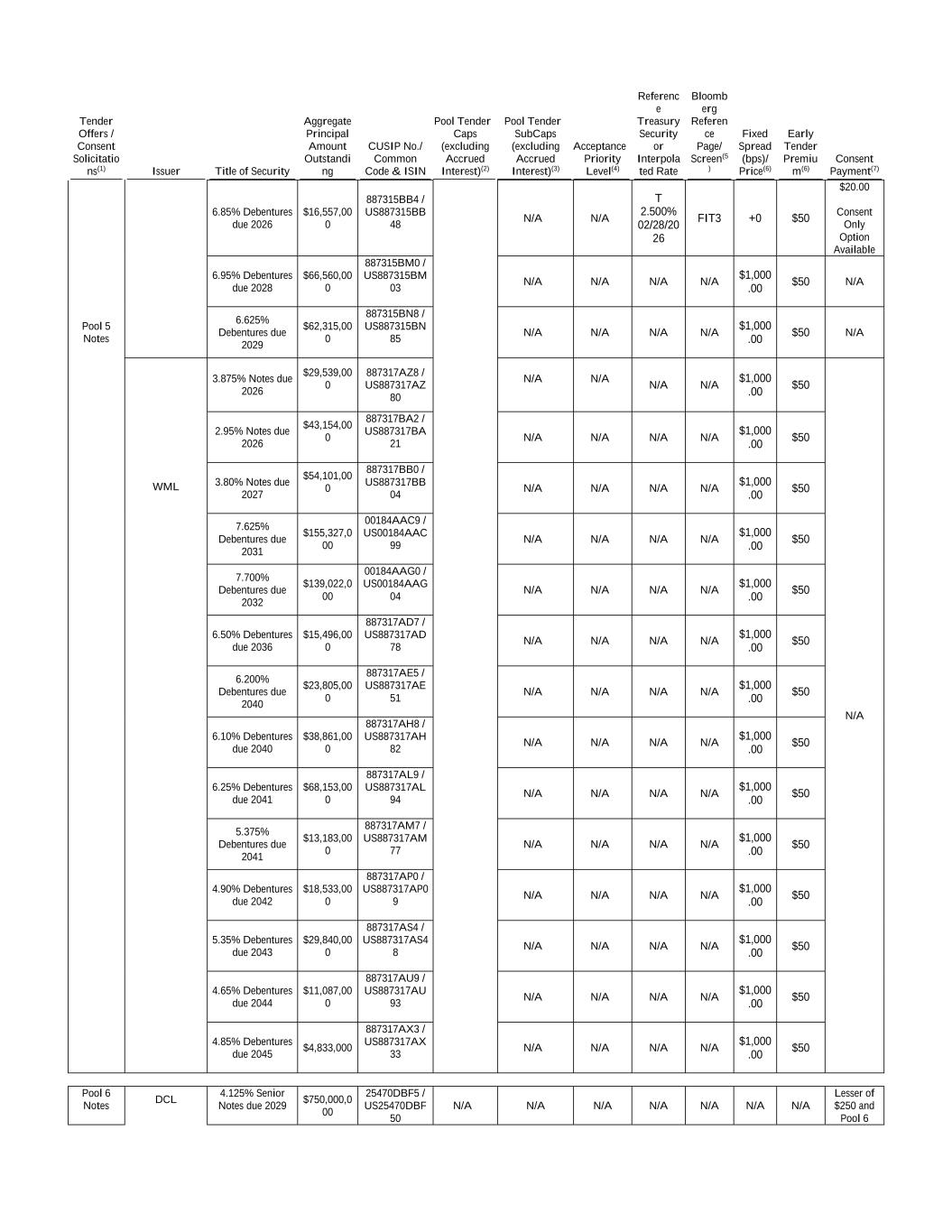

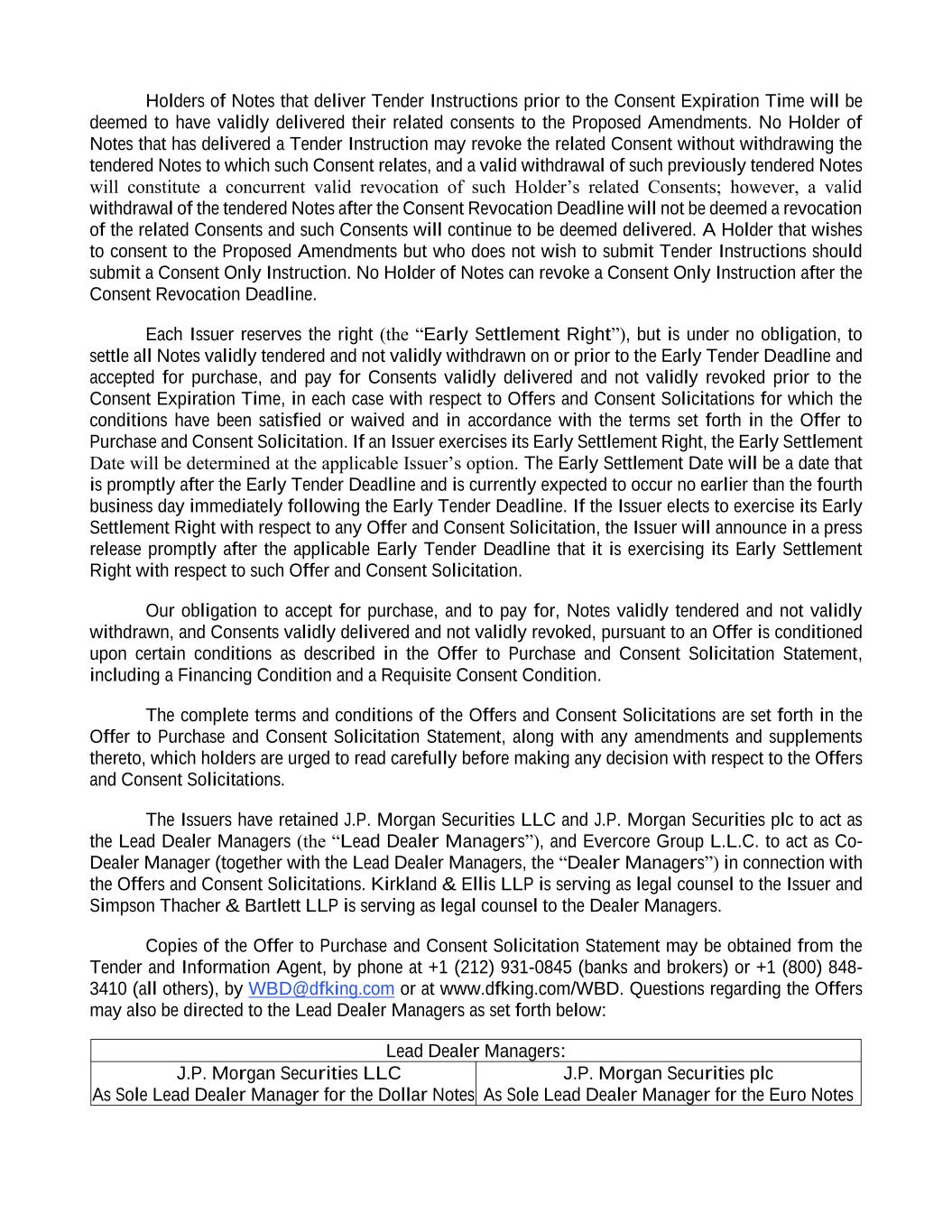

Tender Offers / Consent Solicitatio ns(1) Issuer Title of Security Aggregate Principal Amount Outstandi ng CUSIP No./ Common Code & ISIN Pool Tender Caps (excluding Accrued Interest)(2) Pool Tender SubCaps (excluding Accrued Interest)(3) Acceptance Priority Level(4) Referenc e Treasury Security or Interpola ted Rate Bloomb erg Referen ce Page/ Screen(5 ) Fixed Spread (bps)/ Price(6) Early Tender Premiu m(6) Consent Payment(7) Pool 1 Notes DCL 4.900% Senior Notes due 2026 $650,000,0 00 25470DAL3 / US25470DAL 38 $3,750,000,0 00 N/A 1 T 4.000% 12/15/20 25 FIT3 +50 $50 $2.50 1.90% Senior Notes due 2027 €600,000,0 00 111729824 / XS111729824 7 N/A 2 Interpola ted Mid- Swap Rate IRSB EU +75 €50 Lesser of €20.00 and 2027 Euro Notes Share Amount (8) WMH 3.755% Senior Notes due 2027 $4,000,000 ,000 55903VBA0 / US55903VBA 08 55903VAG8 / US55903VAG 86 U55632AD2 / USU55632AD 24 N/A 3 T 3.875% 05/31/20 27 FIT1 +75 $50 Lesser of $20.00 and 2027 USD Notes Share Amount (9) Pool 2 Notes WMH 4.302% Senior Notes due 2030 €650,000,0 00 282180553 / XS28218055 33 €800,000,000 N/A 1 Interpola ted Mid- Swap Rate IRSB EU +195 €50 Pool 2 Share Amount (10) Consent Only Option Available 4.693% Senior Notes due 2033 €850,000,0 00 272162115 / XS272162115 4 N/A 1 Interpola ted Mid- Swap Rate IRSB EU +245 €50 Pool 3 Notes DCL 3.950% Senior Notes due 2028 $1,700,000 ,000 25470DAR0 / US25470DAR 08 $1,000,000,0 00 $300,000,000 1 T 3.750% 05/15/20 28 FIT1 +150 $50 Lesser of $250 and 2028 Notes Share Amount (11) 4.000% Senior Notes due 2055 $404,843,0 00 25470DBL2 / US25470DBL 29 25470DBK4 / US25470DBK 46 U25478AH8 / USU25478AH 87 N/A 2 T 4.625% 02/15/20 55 FIT1 +275 $50 Lesser of $30.00 and 2055 Notes Share Amount (12) Consent Only Option Available 4.650% Senior Notes due 2050 $302,548,0 00 25470DBH1 / US25470DBH 17 N/A 3 T 4.625% 02/15/20 55 FIT1 +275 $50 Lesser of $30.00 and 2050 Notes Share Amount (13) Consent Only Option Available 5.200% Senior Notes due 2047 $604,594,0 00 25470DAT6 / US25470DAT 63 N/A 4 T 5.000% 05/15/20 45 FIT1 +275 $50 Lesser of $30.00 and 2047 Notes Share Amount (14) Consent Only Option Available 5.300% Senior Notes due 2049 $279,031,0 00 25470DBG3 / US25470DBG 34 N/A 5 T 4.625% FIT1 +275 $50 Lesser of $30.00

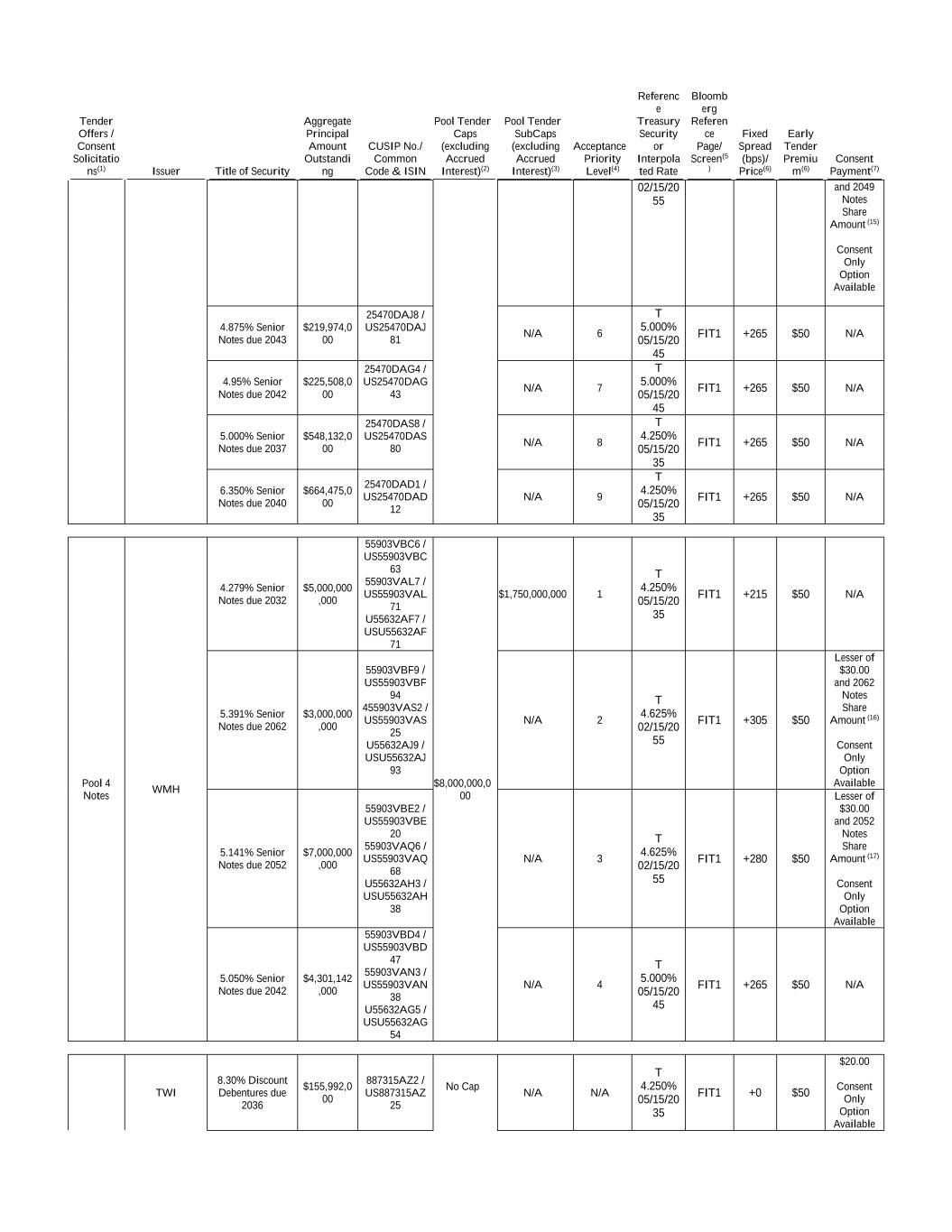

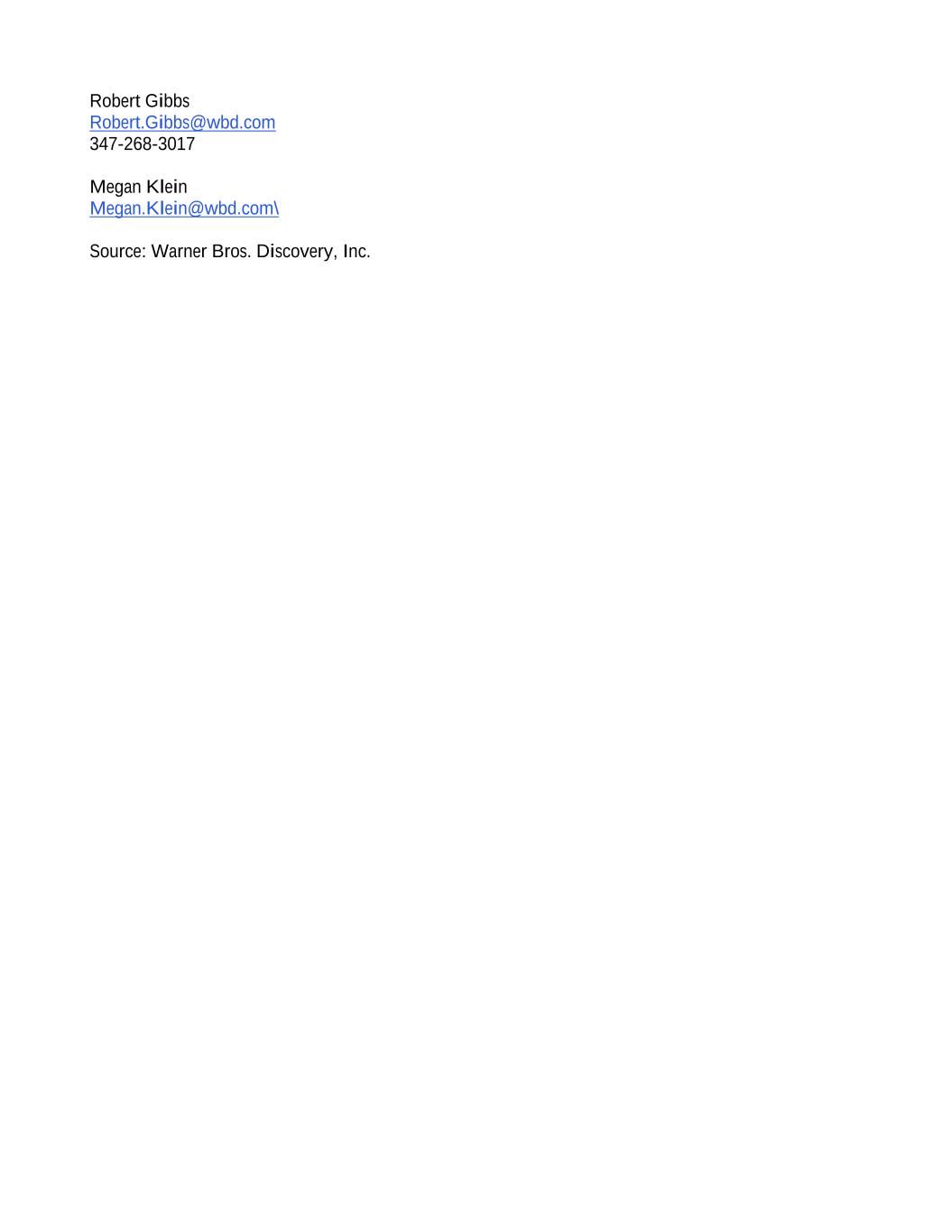

Tender Offers / Consent Solicitatio ns(1) Issuer Title of Security Aggregate Principal Amount Outstandi ng CUSIP No./ Common Code & ISIN Pool Tender Caps (excluding Accrued Interest)(2) Pool Tender SubCaps (excluding Accrued Interest)(3) Acceptance Priority Level(4) Referenc e Treasury Security or Interpola ted Rate Bloomb erg Referen ce Page/ Screen(5 ) Fixed Spread (bps)/ Price(6) Early Tender Premiu m(6) Consent Payment(7) 02/15/20 55 and 2049 Notes Share Amount (15) Consent Only Option Available 4.875% Senior Notes due 2043 $219,974,0 00 25470DAJ8 / US25470DAJ 81 N/A 6 T 5.000% 05/15/20 45 FIT1 +265 $50 N/A 4.95% Senior Notes due 2042 $225,508,0 00 25470DAG4 / US25470DAG 43 N/A 7 T 5.000% 05/15/20 45 FIT1 +265 $50 N/A 5.000% Senior Notes due 2037 $548,132,0 00 25470DAS8 / US25470DAS 80 N/A 8 T 4.250% 05/15/20 35 FIT1 +265 $50 N/A 6.350% Senior Notes due 2040 $664,475,0 00 25470DAD1 / US25470DAD 12 N/A 9 T 4.250% 05/15/20 35 FIT1 +265 $50 N/A Pool 4 Notes WMH 4.279% Senior Notes due 2032 $5,000,000 ,000 55903VBC6 / US55903VBC 63 55903VAL7 / US55903VAL 71 U55632AF7 / USU55632AF 71 $8,000,000,0 00 $1,750,000,000 1 T 4.250% 05/15/20 35 FIT1 +215 $50 N/A 5.391% Senior Notes due 2062 $3,000,000 ,000 55903VBF9 / US55903VBF 94 455903VAS2 / US55903VAS 25 U55632AJ9 / USU55632AJ 93 N/A 2 T 4.625% 02/15/20 55 FIT1 +305 $50 Lesser of $30.00 and 2062 Notes Share Amount (16) Consent Only Option Available 5.141% Senior Notes due 2052 $7,000,000 ,000 55903VBE2 / US55903VBE 20 55903VAQ6 / US55903VAQ 68 U55632AH3 / USU55632AH 38 N/A 3 T 4.625% 02/15/20 55 FIT1 +280 $50 Lesser of $30.00 and 2052 Notes Share Amount (17) Consent Only Option Available 5.050% Senior Notes due 2042 $4,301,142 ,000 55903VBD4 / US55903VBD 47 55903VAN3 / US55903VAN 38 U55632AG5 / USU55632AG 54 N/A 4 T 5.000% 05/15/20 45 FIT1 +265 $50 N/A TWI 8.30% Discount Debentures due 2036 $155,992,0 00 887315AZ2 / US887315AZ 25 No Cap N/A N/A T 4.250% 05/15/20 35 FIT1 +0 $50 $20.00 Consent Only Option Available

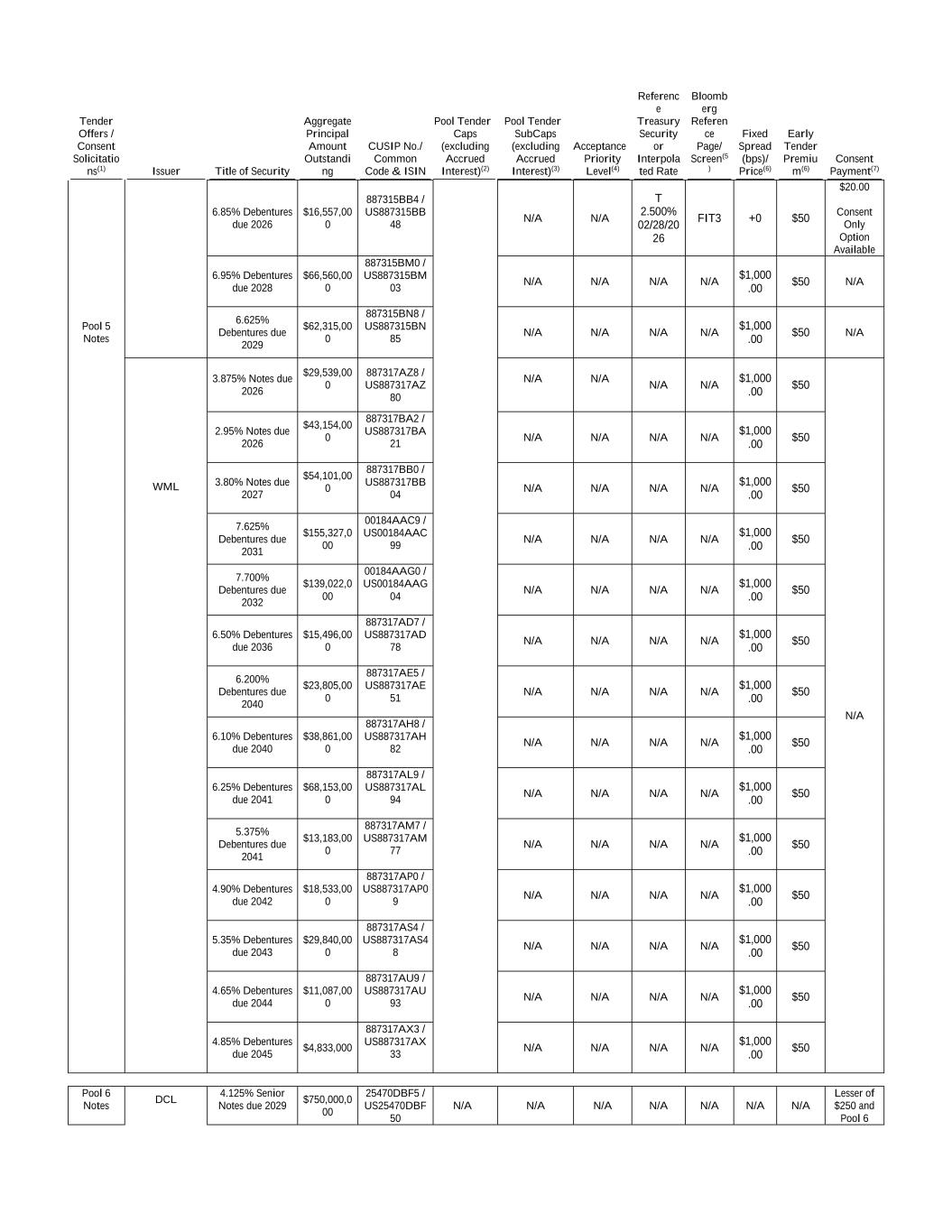

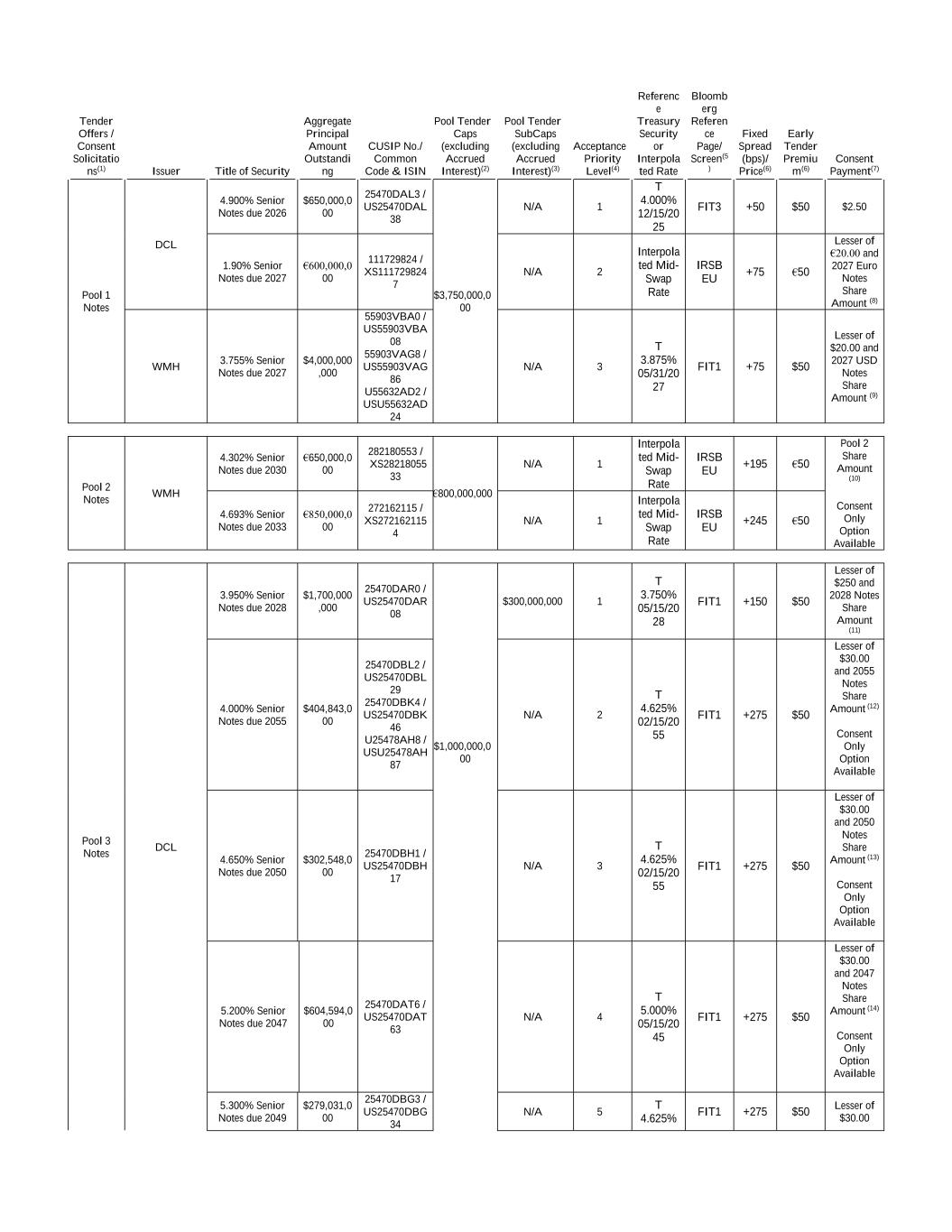

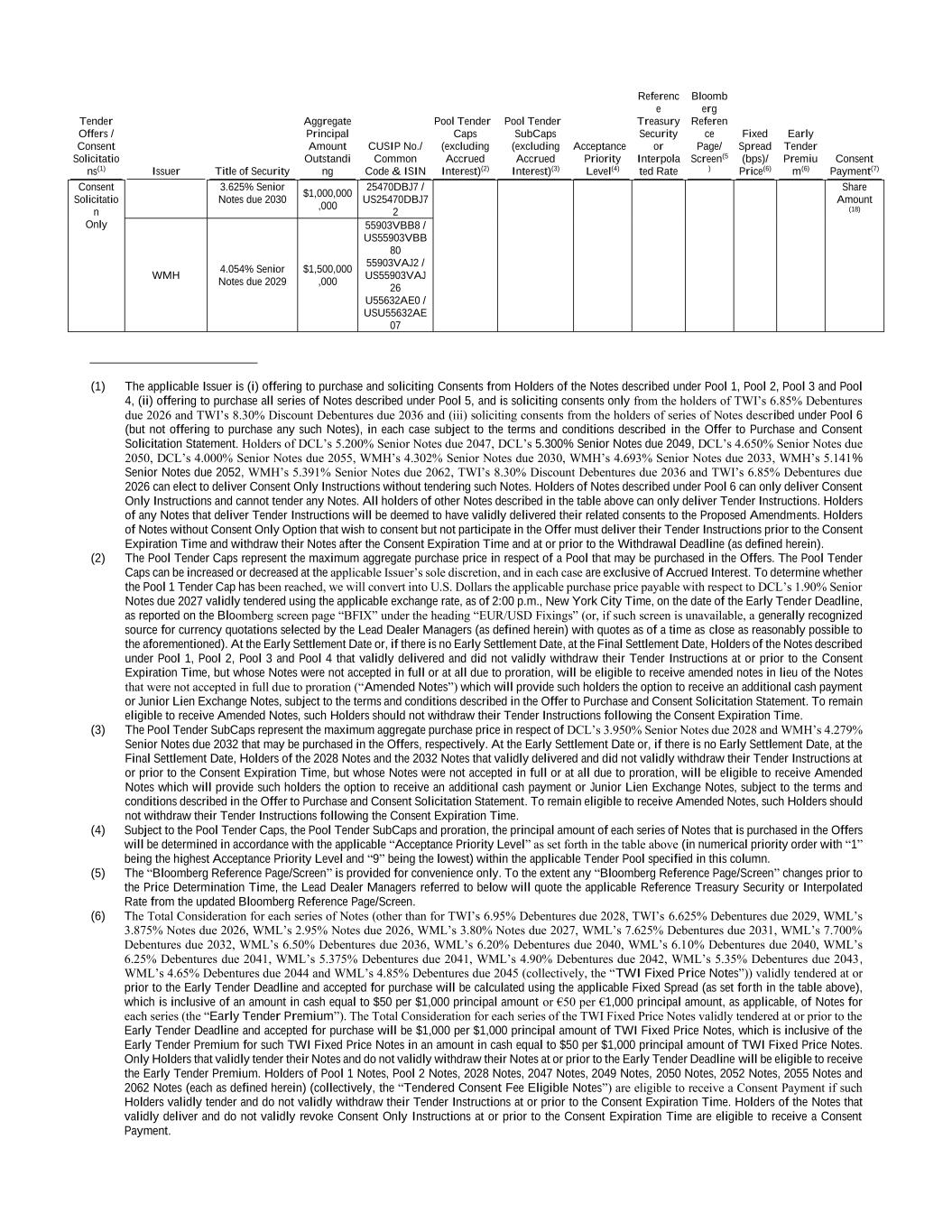

Tender Offers / Consent Solicitatio ns(1) Issuer Title of Security Aggregate Principal Amount Outstandi ng CUSIP No./ Common Code & ISIN Pool Tender Caps (excluding Accrued Interest)(2) Pool Tender SubCaps (excluding Accrued Interest)(3) Acceptance Priority Level(4) Referenc e Treasury Security or Interpola ted Rate Bloomb erg Referen ce Page/ Screen(5 ) Fixed Spread (bps)/ Price(6) Early Tender Premiu m(6) Consent Payment(7) 6.85% Debentures due 2026 $16,557,00 0 887315BB4 / US887315BB 48 N/A N/A T 2.500% 02/28/20 26 FIT3 +0 $50 $20.00 Consent Only Option Available 6.95% Debentures due 2028 $66,560,00 0 887315BM0 / US887315BM 03 N/A N/A N/A N/A $1,000 .00 $50 N/A Pool 5 Notes 6.625% Debentures due 2029 $62,315,00 0 887315BN8 / US887315BN 85 N/A N/A N/A N/A $1,000 .00 $50 N/A WML 3.875% Notes due 2026 $29,539,00 0 887317AZ8 / US887317AZ 80 N/A N/A N/A N/A $1,000 .00 $50 N/A 2.95% Notes due 2026 $43,154,00 0 887317BA2 / US887317BA 21 N/A N/A N/A N/A $1,000 .00 $50 3.80% Notes due 2027 $54,101,00 0 887317BB0 / US887317BB 04 N/A N/A N/A N/A $1,000 .00 $50 7.625% Debentures due 2031 $155,327,0 00 00184AAC9 / US00184AAC 99 N/A N/A N/A N/A $1,000 .00 $50 7.700% Debentures due 2032 $139,022,0 00 00184AAG0 / US00184AAG 04 N/A N/A N/A N/A $1,000 .00 $50 6.50% Debentures due 2036 $15,496,00 0 887317AD7 / US887317AD 78 N/A N/A N/A N/A $1,000 .00 $50 6.200% Debentures due 2040 $23,805,00 0 887317AE5 / US887317AE 51 N/A N/A N/A N/A $1,000 .00 $50 6.10% Debentures due 2040 $38,861,00 0 887317AH8 / US887317AH 82 N/A N/A N/A N/A $1,000 .00 $50 6.25% Debentures due 2041 $68,153,00 0 887317AL9 / US887317AL 94 N/A N/A N/A N/A $1,000 .00 $50 5.375% Debentures due 2041 $13,183,00 0 887317AM7 / US887317AM 77 N/A N/A N/A N/A $1,000 .00 $50 4.90% Debentures due 2042 $18,533,00 0 887317AP0 / US887317AP0 9 N/A N/A N/A N/A $1,000 .00 $50 5.35% Debentures due 2043 $29,840,00 0 887317AS4 / US887317AS4 8 N/A N/A N/A N/A $1,000 .00 $50 4.65% Debentures due 2044 $11,087,00 0 887317AU9 / US887317AU 93 N/A N/A N/A N/A $1,000 .00 $50 4.85% Debentures due 2045 $4,833,000 887317AX3 / US887317AX 33 N/A N/A N/A N/A $1,000 .00 $50 Pool 6 Notes DCL 4.125% Senior Notes due 2029 $750,000,0 00 25470DBF5 / US25470DBF 50 N/A N/A N/A N/A N/A N/A N/A Lesser of $250 and Pool 6

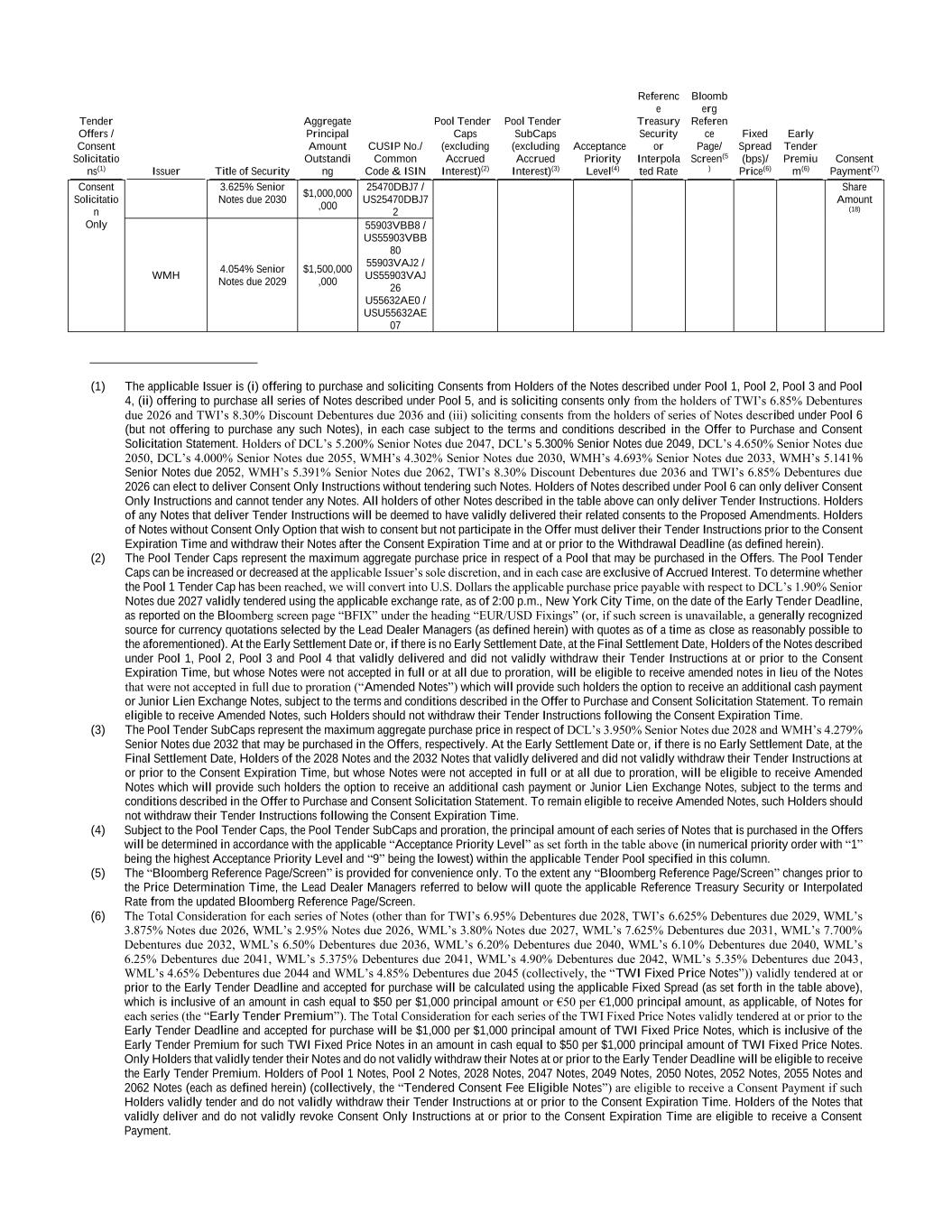

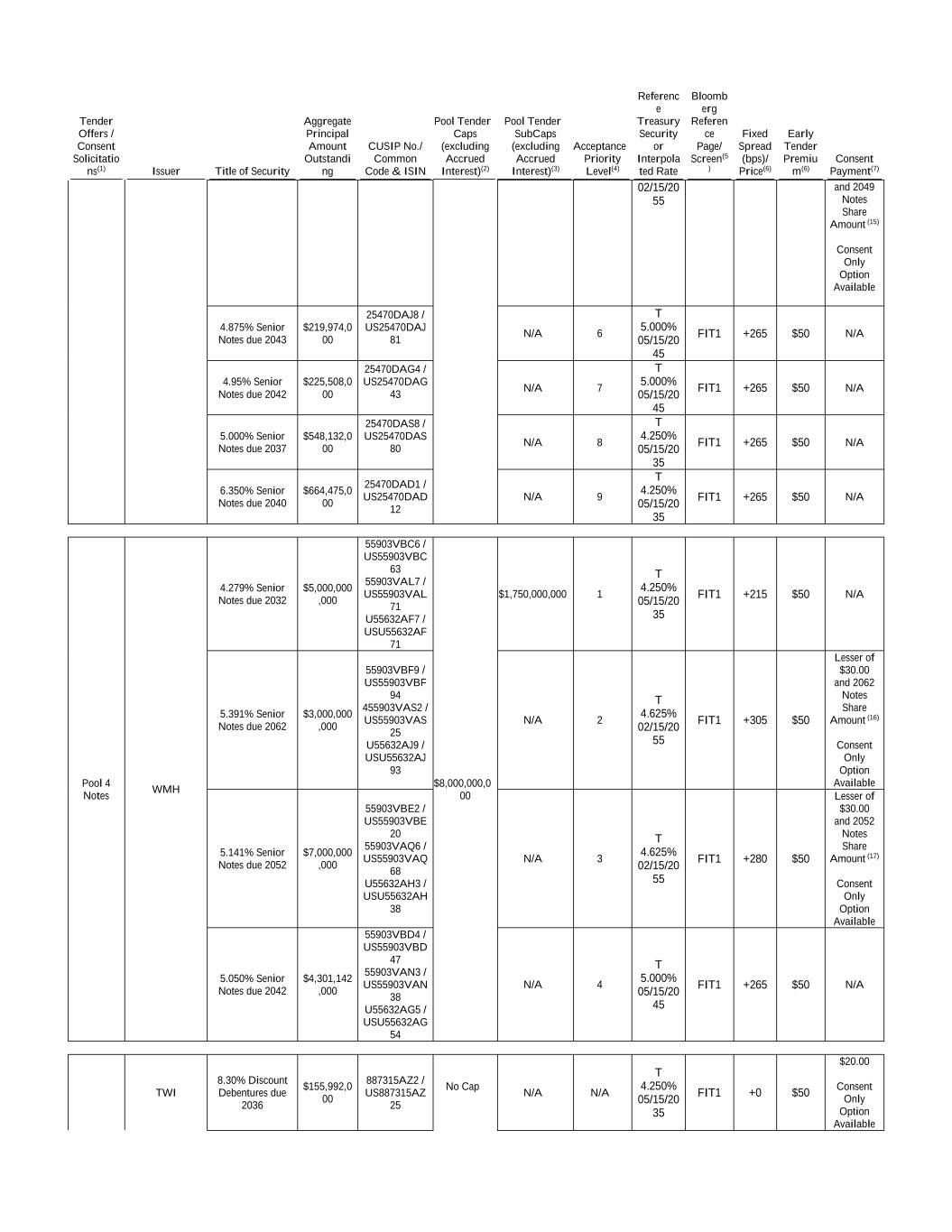

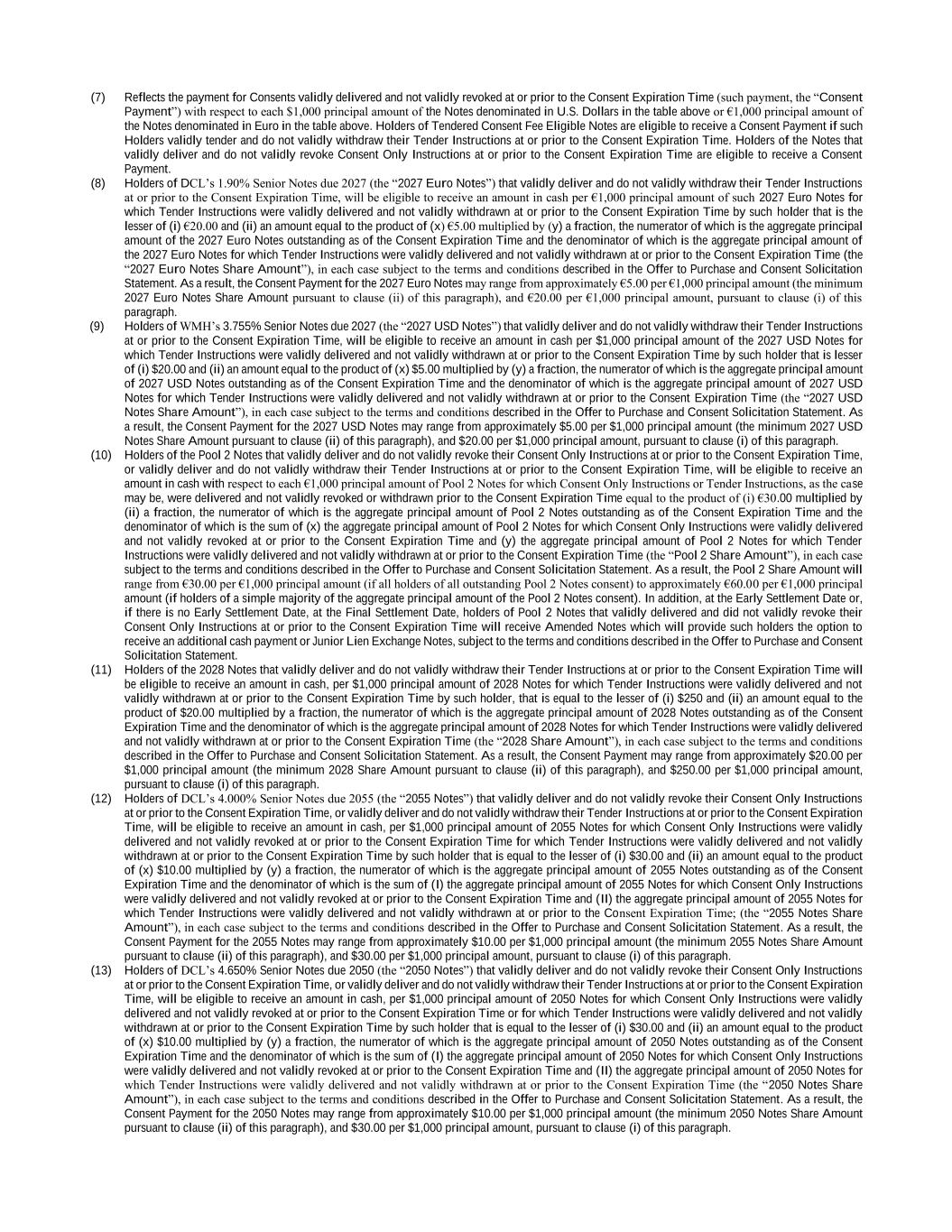

Tender Offers / Consent Solicitatio ns(1) Issuer Title of Security Aggregate Principal Amount Outstandi ng CUSIP No./ Common Code & ISIN Pool Tender Caps (excluding Accrued Interest)(2) Pool Tender SubCaps (excluding Accrued Interest)(3) Acceptance Priority Level(4) Referenc e Treasury Security or Interpola ted Rate Bloomb erg Referen ce Page/ Screen(5 ) Fixed Spread (bps)/ Price(6) Early Tender Premiu m(6) Consent Payment(7) Consent Solicitatio n Only 3.625% Senior Notes due 2030 $1,000,000 ,000 25470DBJ7 / US25470DBJ7 2 Share Amount (18) WMH 4.054% Senior Notes due 2029 $1,500,000 ,000 55903VBB8 / US55903VBB 80 55903VAJ2 / US55903VAJ 26 U55632AE0 / USU55632AE 07 (1) The applicable Issuer is (i) offering to purchase and soliciting Consents from Holders of the Notes described under Pool 1, Pool 2, Pool 3 and Pool 4, (ii) offering to purchase all series of Notes described under Pool 5, and is soliciting consents only from the holders of TWI’s 6.85% Debentures due 2026 and TWI’s 8.30% Discount Debentures due 2036 and (iii) soliciting consents from the holders of series of Notes described under Pool 6 (but not offering to purchase any such Notes), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. Holders of DCL’s 5.200% Senior Notes due 2047, DCL’s 5.300% Senior Notes due 2049, DCL’s 4.650% Senior Notes due 2050, DCL’s 4.000% Senior Notes due 2055, WMH’s 4.302% Senior Notes due 2030, WMH’s 4.693% Senior Notes due 2033, WMH’s 5.141% Senior Notes due 2052, WMH’s 5.391% Senior Notes due 2062, TWI’s 8.30% Discount Debentures due 2036 and TWI’s 6.85% Debentures due 2026 can elect to deliver Consent Only Instructions without tendering such Notes. Holders of Notes described under Pool 6 can only deliver Consent Only Instructions and cannot tender any Notes. All holders of other Notes described in the table above can only deliver Tender Instructions. Holders of any Notes that deliver Tender Instructions will be deemed to have validly delivered their related consents to the Proposed Amendments. Holders of Notes without Consent Only Option that wish to consent but not participate in the Offer must deliver their Tender Instructions prior to the Consent Expiration Time and withdraw their Notes after the Consent Expiration Time and at or prior to the Withdrawal Deadline (as defined herein). (2) The Pool Tender Caps represent the maximum aggregate purchase price in respect of a Pool that may be purchased in the Offers. The Pool Tender Caps can be increased or decreased at the applicable Issuer’s sole discretion, and in each case are exclusive of Accrued Interest. To determine whether the Pool 1 Tender Cap has been reached, we will convert into U.S. Dollars the applicable purchase price payable with respect to DCL’s 1.90% Senior Notes due 2027 validly tendered using the applicable exchange rate, as of 2:00 p.m., New York City Time, on the date of the Early Tender Deadline, as reported on the Bloomberg screen page “BFIX” under the heading “EUR/USD Fixings” (or, if such screen is unavailable, a generally recognized source for currency quotations selected by the Lead Dealer Managers (as defined herein) with quotes as of a time as close as reasonably possible to the aforementioned). At the Early Settlement Date or, if there is no Early Settlement Date, at the Final Settlement Date, Holders of the Notes described under Pool 1, Pool 2, Pool 3 and Pool 4 that validly delivered and did not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, but whose Notes were not accepted in full or at all due to proration, will be eligible to receive amended notes in lieu of the Notes that were not accepted in full due to proration (“Amended Notes”) which will provide such holders the option to receive an additional cash payment or Junior Lien Exchange Notes, subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. To remain eligible to receive Amended Notes, such Holders should not withdraw their Tender Instructions following the Consent Expiration Time. (3) The Pool Tender SubCaps represent the maximum aggregate purchase price in respect of DCL’s 3.950% Senior Notes due 2028 and WMH’s 4.279% Senior Notes due 2032 that may be purchased in the Offers, respectively. At the Early Settlement Date or, if there is no Early Settlement Date, at the Final Settlement Date, Holders of the 2028 Notes and the 2032 Notes that validly delivered and did not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, but whose Notes were not accepted in full or at all due to proration, will be eligible to receive Amended Notes which will provide such holders the option to receive an additional cash payment or Junior Lien Exchange Notes, subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. To remain eligible to receive Amended Notes, such Holders should not withdraw their Tender Instructions following the Consent Expiration Time. (4) Subject to the Pool Tender Caps, the Pool Tender SubCaps and proration, the principal amount of each series of Notes that is purchased in the Offers will be determined in accordance with the applicable “Acceptance Priority Level” as set forth in the table above (in numerical priority order with “1” being the highest Acceptance Priority Level and “9” being the lowest) within the applicable Tender Pool specified in this column. (5) The “Bloomberg Reference Page/Screen” is provided for convenience only. To the extent any “Bloomberg Reference Page/Screen” changes prior to the Price Determination Time, the Lead Dealer Managers referred to below will quote the applicable Reference Treasury Security or Interpolated Rate from the updated Bloomberg Reference Page/Screen. (6) The Total Consideration for each series of Notes (other than for TWI’s 6.95% Debentures due 2028, TWI’s 6.625% Debentures due 2029, WML’s 3.875% Notes due 2026, WML’s 2.95% Notes due 2026, WML’s 3.80% Notes due 2027, WML’s 7.625% Debentures due 2031, WML’s 7.700% Debentures due 2032, WML’s 6.50% Debentures due 2036, WML’s 6.20% Debentures due 2040, WML’s 6.10% Debentures due 2040, WML’s 6.25% Debentures due 2041, WML’s 5.375% Debentures due 2041, WML’s 4.90% Debentures due 2042, WML’s 5.35% Debentures due 2043, WML’s 4.65% Debentures due 2044 and WML’s 4.85% Debentures due 2045 (collectively, the “TWI Fixed Price Notes”)) validly tendered at or prior to the Early Tender Deadline and accepted for purchase will be calculated using the applicable Fixed Spread (as set forth in the table above), which is inclusive of an amount in cash equal to $50 per $1,000 principal amount or €50 per €1,000 principal amount, as applicable, of Notes for each series (the “Early Tender Premium”). The Total Consideration for each series of the TWI Fixed Price Notes validly tendered at or prior to the Early Tender Deadline and accepted for purchase will be $1,000 per $1,000 principal amount of TWI Fixed Price Notes, which is inclusive of the Early Tender Premium for such TWI Fixed Price Notes in an amount in cash equal to $50 per $1,000 principal amount of TWI Fixed Price Notes. Only Holders that validly tender their Notes and do not validly withdraw their Notes at or prior to the Early Tender Deadline will be eligible to receive the Early Tender Premium. Holders of Pool 1 Notes, Pool 2 Notes, 2028 Notes, 2047 Notes, 2049 Notes, 2050 Notes, 2052 Notes, 2055 Notes and 2062 Notes (each as defined herein) (collectively, the “Tendered Consent Fee Eligible Notes”) are eligible to receive a Consent Payment if such Holders validly tender and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time. Holders of the Notes that validly deliver and do not validly revoke Consent Only Instructions at or prior to the Consent Expiration Time are eligible to receive a Consent Payment.

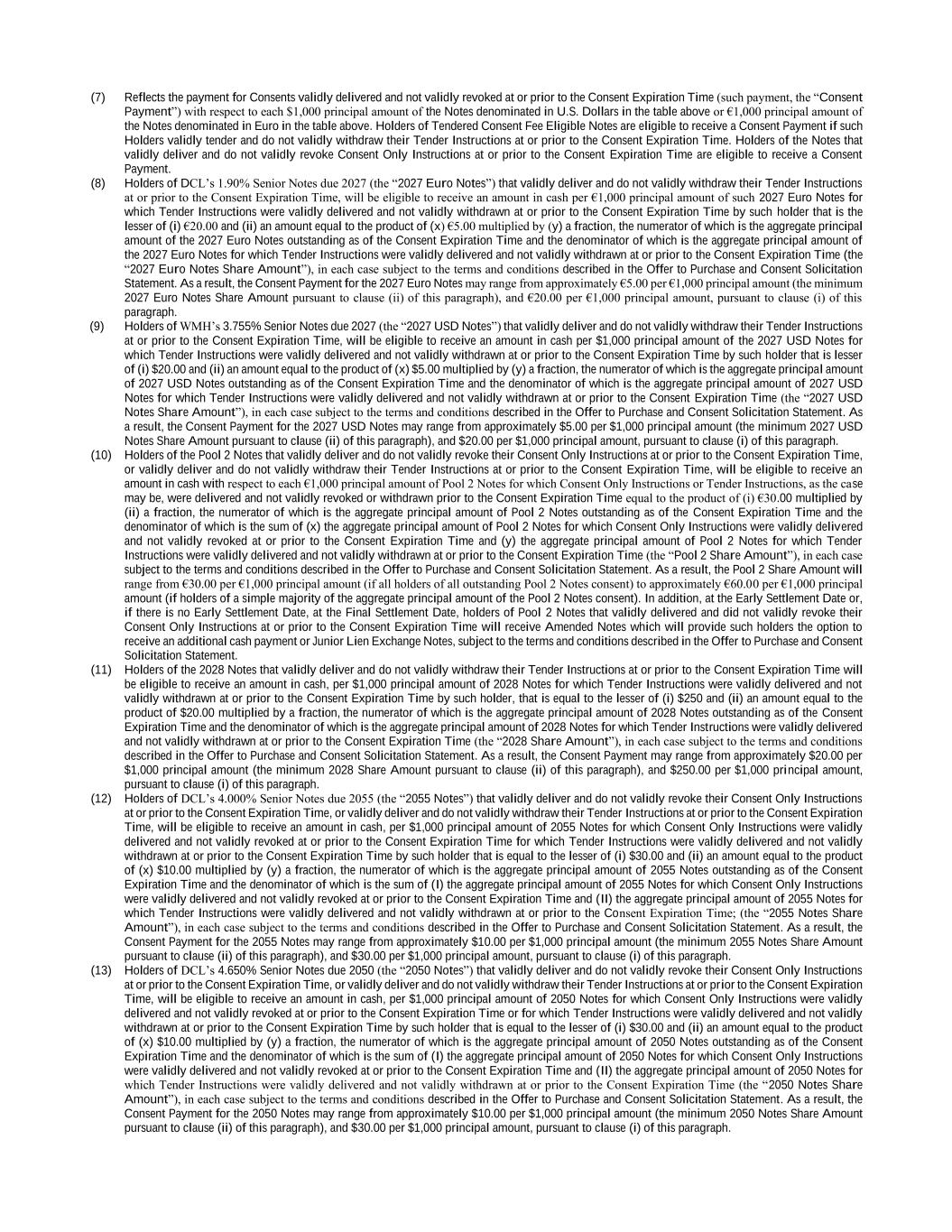

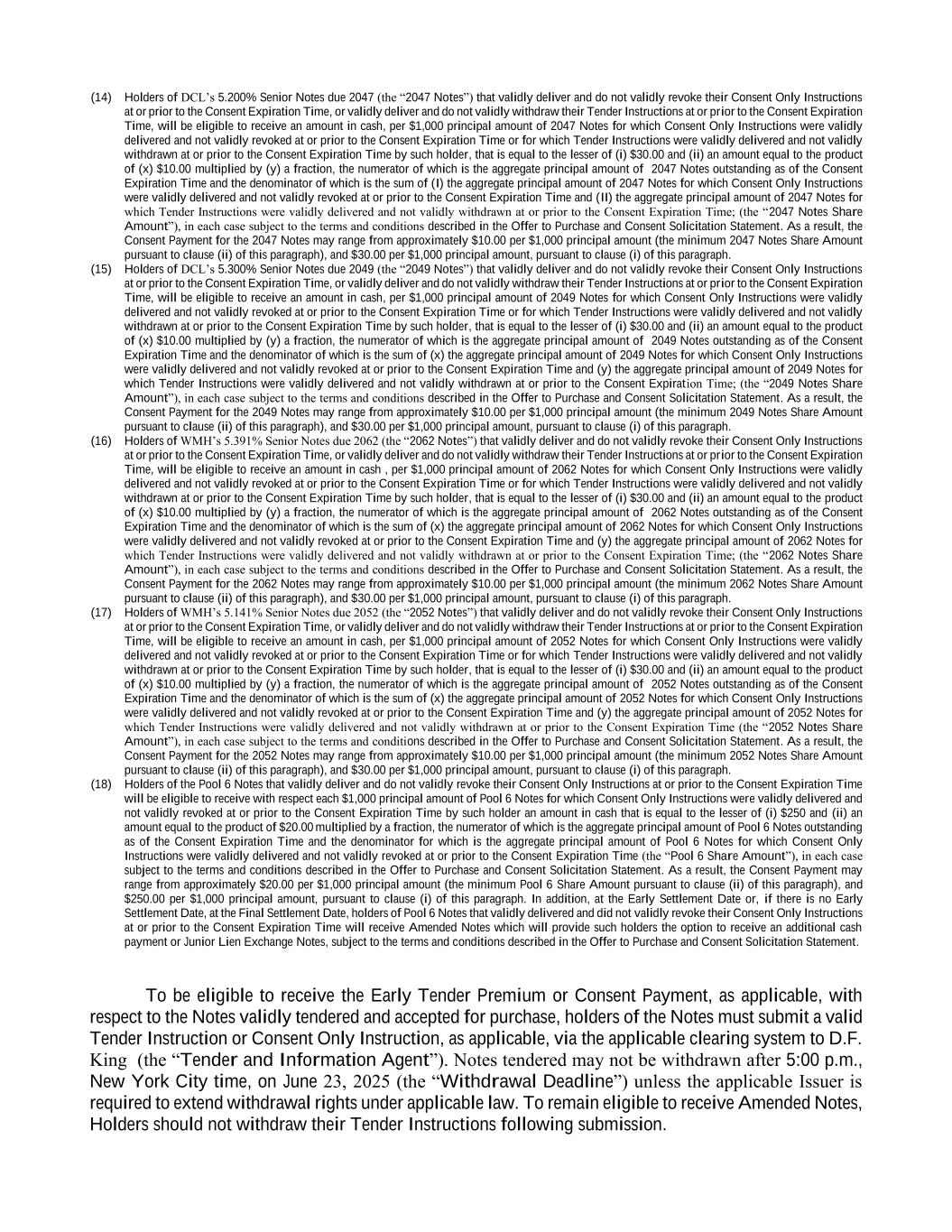

(7) Reflects the payment for Consents validly delivered and not validly revoked at or prior to the Consent Expiration Time (such payment, the “Consent Payment”) with respect to each $1,000 principal amount of the Notes denominated in U.S. Dollars in the table above or €1,000 principal amount of the Notes denominated in Euro in the table above. Holders of Tendered Consent Fee Eligible Notes are eligible to receive a Consent Payment if such Holders validly tender and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time. Holders of the Notes that validly deliver and do not validly revoke Consent Only Instructions at or prior to the Consent Expiration Time are eligible to receive a Consent Payment. (8) Holders of DCL’s 1.90% Senior Notes due 2027 (the “2027 Euro Notes”) that validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash per €1,000 principal amount of such 2027 Euro Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder that is the lesser of (i) €20.00 and (ii) an amount equal to the product of (x) €5.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of the 2027 Euro Notes outstanding as of the Consent Expiration Time and the denominator of which is the aggregate principal amount of the 2027 Euro Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “2027 Euro Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2027 Euro Notes may range from approximately €5.00 per €1,000 principal amount (the minimum 2027 Euro Notes Share Amount pursuant to clause (ii) of this paragraph), and €20.00 per €1,000 principal amount, pursuant to clause (i) of this paragraph. (9) Holders of WMH’s 3.755% Senior Notes due 2027 (the “2027 USD Notes”) that validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash per $1,000 principal amount of the 2027 USD Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder that is lesser of (i) $20.00 and (ii) an amount equal to the product of (x) $5.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2027 USD Notes outstanding as of the Consent Expiration Time and the denominator of which is the aggregate principal amount of 2027 USD Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “2027 USD Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2027 USD Notes may range from approximately $5.00 per $1,000 principal amount (the minimum 2027 USD Notes Share Amount pursuant to clause (ii) of this paragraph), and $20.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (10) Holders of the Pool 2 Notes that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash with respect to each €1,000 principal amount of Pool 2 Notes for which Consent Only Instructions or Tender Instructions, as the case may be, were delivered and not validly revoked or withdrawn prior to the Consent Expiration Time equal to the product of (i) €30.00 multiplied by (ii) a fraction, the numerator of which is the aggregate principal amount of Pool 2 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (x) the aggregate principal amount of Pool 2 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (y) the aggregate principal amount of Pool 2 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “Pool 2 Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Pool 2 Share Amount will range from €30.00 per €1,000 principal amount (if all holders of all outstanding Pool 2 Notes consent) to approximately €60.00 per €1,000 principal amount (if holders of a simple majority of the aggregate principal amount of the Pool 2 Notes consent). In addition, at the Early Settlement Date or, if there is no Early Settlement Date, at the Final Settlement Date, holders of Pool 2 Notes that validly delivered and did not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time will receive Amended Notes which will provide such holders the option to receive an additional cash payment or Junior Lien Exchange Notes, subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. (11) Holders of the 2028 Notes that validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time will be eligible to receive an amount in cash, per $1,000 principal amount of 2028 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder, that is equal to the lesser of (i) $250 and (ii) an amount equal to the product of $20.00 multiplied by a fraction, the numerator of which is the aggregate principal amount of 2028 Notes outstanding as of the Consent Expiration Time and the denominator of which is the aggregate principal amount of 2028 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “2028 Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment may range from approximately $20.00 per $1,000 principal amount (the minimum 2028 Share Amount pursuant to clause (ii) of this paragraph), and $250.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (12) Holders of DCL’s 4.000% Senior Notes due 2055 (the “2055 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash, per $1,000 principal amount of 2055 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2055 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (I) the aggregate principal amount of 2055 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (II) the aggregate principal amount of 2055 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time; (the “2055 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2055 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2055 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (13) Holders of DCL’s 4.650% Senior Notes due 2050 (the “2050 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash, per $1,000 principal amount of 2050 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time or for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2050 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (I) the aggregate principal amount of 2050 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (II) the aggregate principal amount of 2050 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “2050 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2050 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2050 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph.

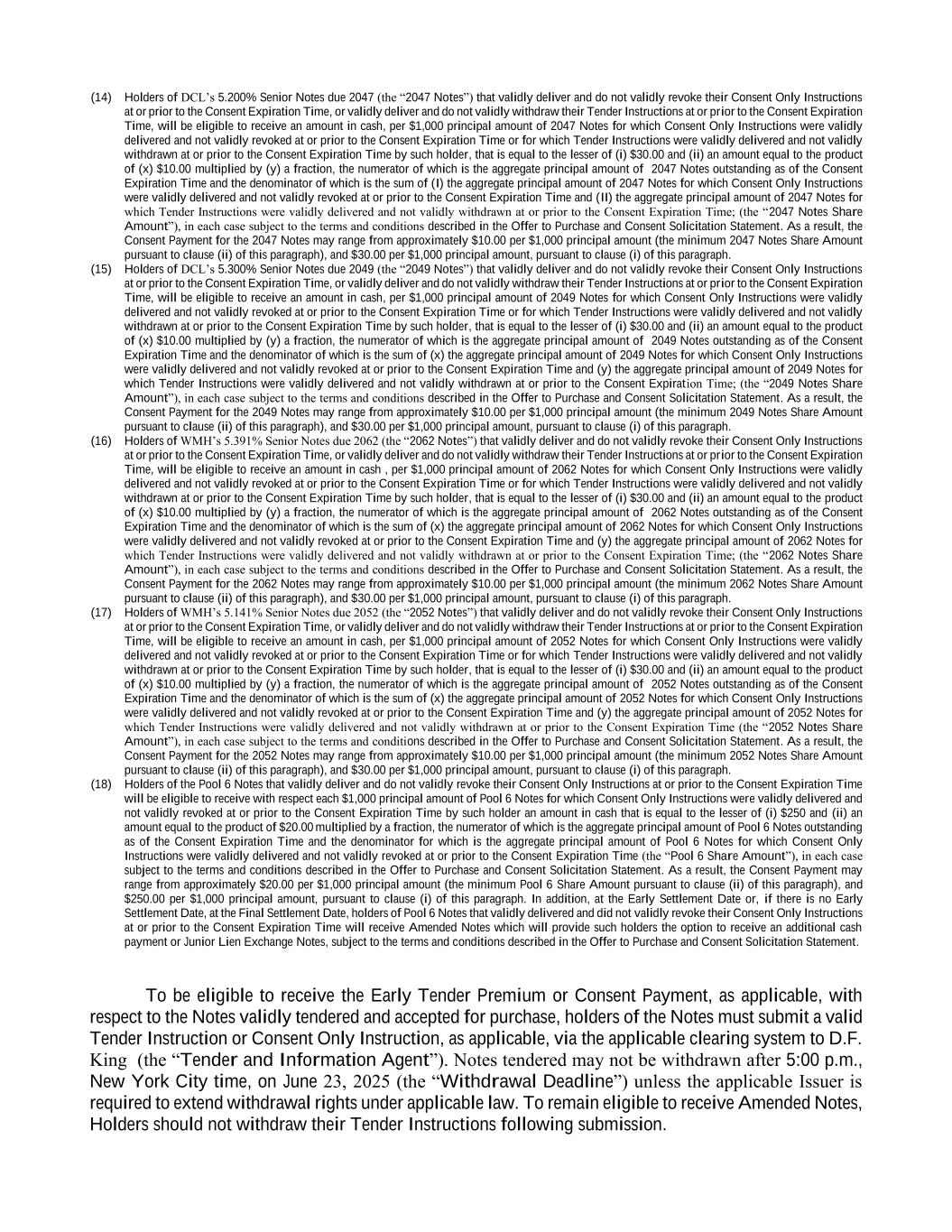

(14) Holders of DCL’s 5.200% Senior Notes due 2047 (the “2047 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash, per $1,000 principal amount of 2047 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time or for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder, that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2047 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (I) the aggregate principal amount of 2047 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (II) the aggregate principal amount of 2047 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time; (the “2047 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2047 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2047 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (15) Holders of DCL’s 5.300% Senior Notes due 2049 (the “2049 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash, per $1,000 principal amount of 2049 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time or for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder, that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2049 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (x) the aggregate principal amount of 2049 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (y) the aggregate principal amount of 2049 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time; (the “2049 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2049 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2049 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (16) Holders of WMH’s 5.391% Senior Notes due 2062 (the “2062 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash , per $1,000 principal amount of 2062 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time or for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder, that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2062 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (x) the aggregate principal amount of 2062 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (y) the aggregate principal amount of 2062 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time; (the “2062 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2062 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2062 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (17) Holders of WMH’s 5.141% Senior Notes due 2052 (the “2052 Notes”) that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time, or validly deliver and do not validly withdraw their Tender Instructions at or prior to the Consent Expiration Time, will be eligible to receive an amount in cash, per $1,000 principal amount of 2052 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time or for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time by such holder, that is equal to the lesser of (i) $30.00 and (ii) an amount equal to the product of (x) $10.00 multiplied by (y) a fraction, the numerator of which is the aggregate principal amount of 2052 Notes outstanding as of the Consent Expiration Time and the denominator of which is the sum of (x) the aggregate principal amount of 2052 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time and (y) the aggregate principal amount of 2052 Notes for which Tender Instructions were validly delivered and not validly withdrawn at or prior to the Consent Expiration Time (the “2052 Notes Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment for the 2052 Notes may range from approximately $10.00 per $1,000 principal amount (the minimum 2052 Notes Share Amount pursuant to clause (ii) of this paragraph), and $30.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. (18) Holders of the Pool 6 Notes that validly deliver and do not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time will be eligible to receive with respect each $1,000 principal amount of Pool 6 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time by such holder an amount in cash that is equal to the lesser of (i) $250 and (ii) an amount equal to the product of $20.00 multiplied by a fraction, the numerator of which is the aggregate principal amount of Pool 6 Notes outstanding as of the Consent Expiration Time and the denominator for which is the aggregate principal amount of Pool 6 Notes for which Consent Only Instructions were validly delivered and not validly revoked at or prior to the Consent Expiration Time (the “Pool 6 Share Amount”), in each case subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. As a result, the Consent Payment may range from approximately $20.00 per $1,000 principal amount (the minimum Pool 6 Share Amount pursuant to clause (ii) of this paragraph), and $250.00 per $1,000 principal amount, pursuant to clause (i) of this paragraph. In addition, at the Early Settlement Date or, if there is no Early Settlement Date, at the Final Settlement Date, holders of Pool 6 Notes that validly delivered and did not validly revoke their Consent Only Instructions at or prior to the Consent Expiration Time will receive Amended Notes which will provide such holders the option to receive an additional cash payment or Junior Lien Exchange Notes, subject to the terms and conditions described in the Offer to Purchase and Consent Solicitation Statement. To be eligible to receive the Early Tender Premium or Consent Payment, as applicable, with respect to the Notes validly tendered and accepted for purchase, holders of the Notes must submit a valid Tender Instruction or Consent Only Instruction, as applicable, via the applicable clearing system to D.F. King (the “Tender and Information Agent”). Notes tendered may not be withdrawn after 5:00 p.m., New York City time, on June 23, 2025 (the “Withdrawal Deadline”) unless the applicable Issuer is required to extend withdrawal rights under applicable law. To remain eligible to receive Amended Notes, Holders should not withdraw their Tender Instructions following submission.

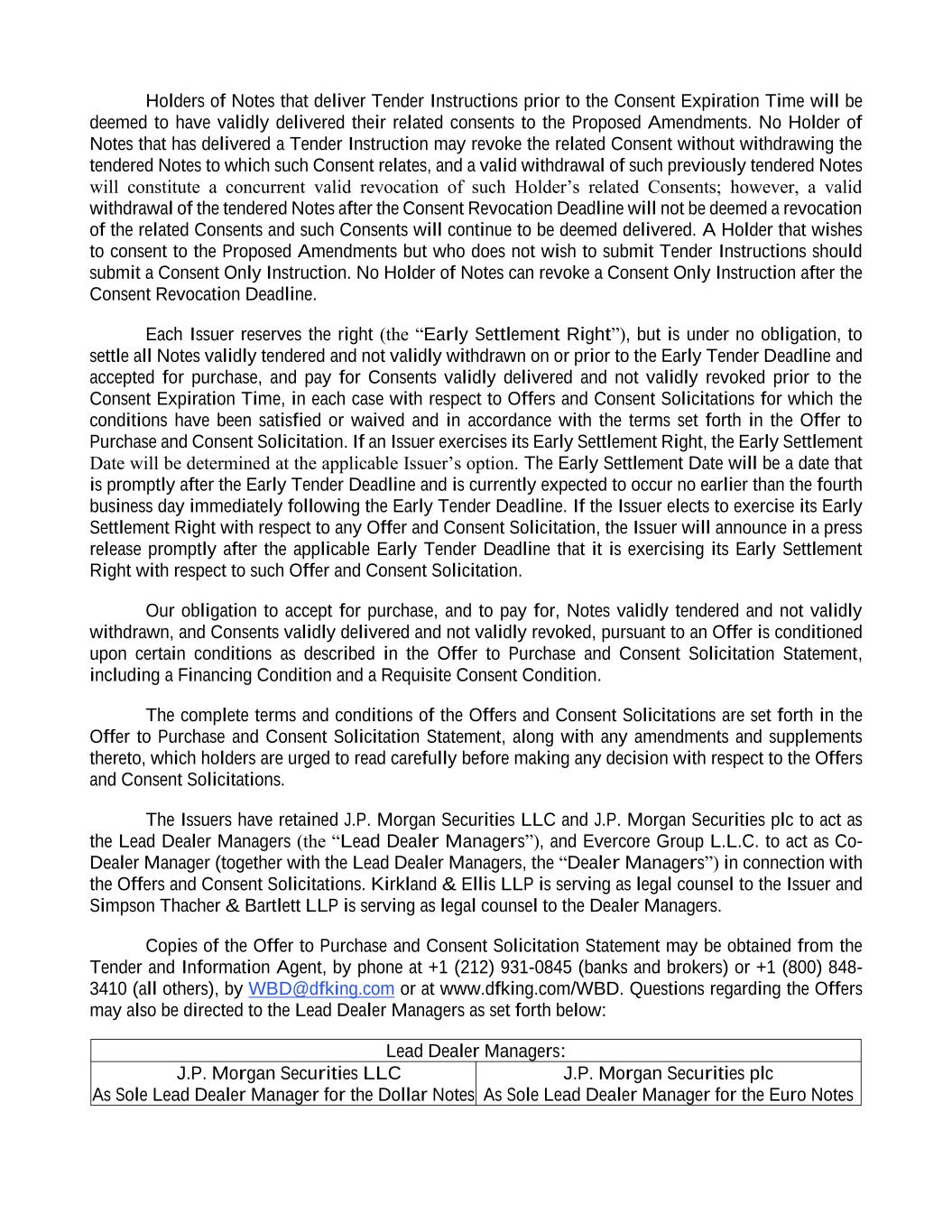

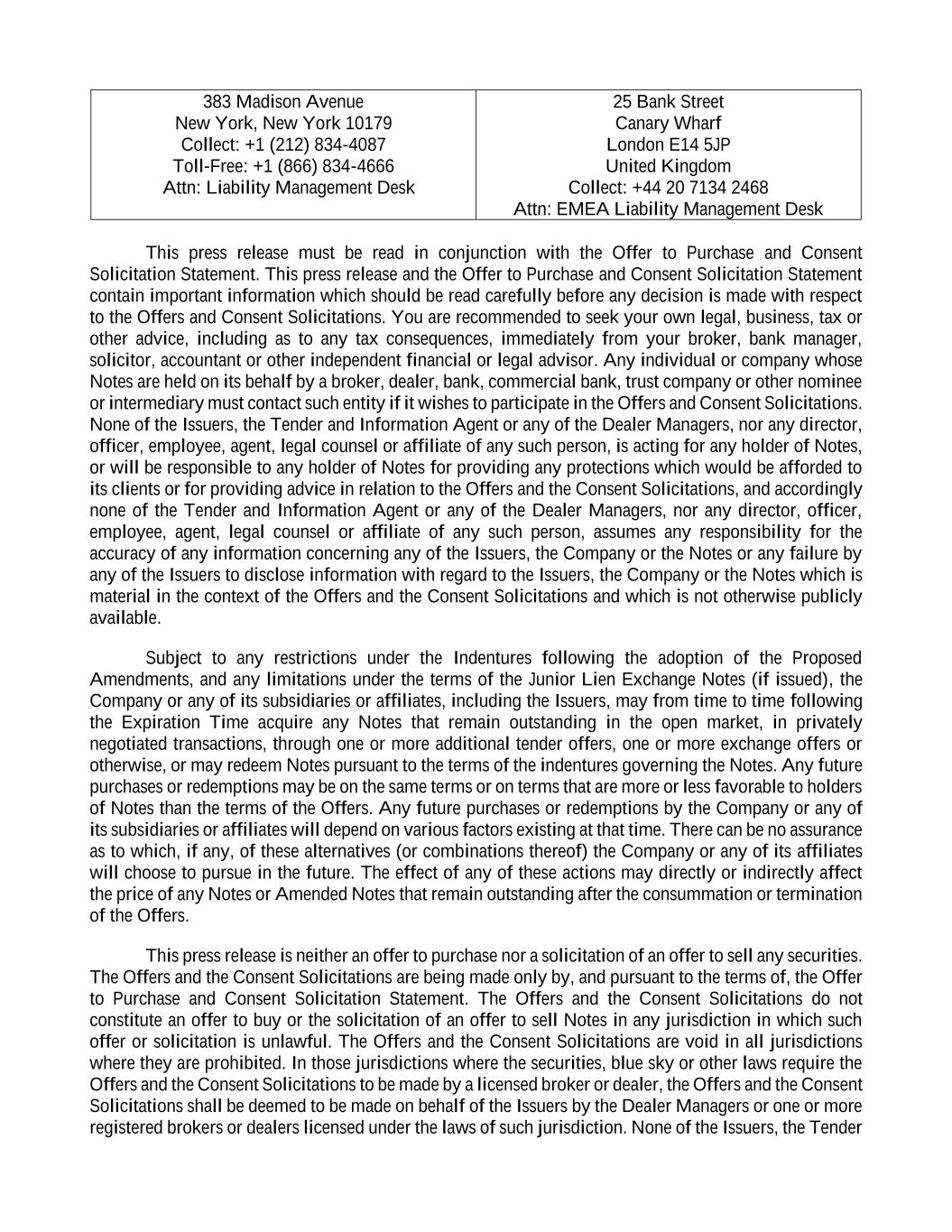

Holders of Notes that deliver Tender Instructions prior to the Consent Expiration Time will be deemed to have validly delivered their related consents to the Proposed Amendments. No Holder of Notes that has delivered a Tender Instruction may revoke the related Consent without withdrawing the tendered Notes to which such Consent relates, and a valid withdrawal of such previously tendered Notes will constitute a concurrent valid revocation of such Holder’s related Consents; however, a valid withdrawal of the tendered Notes after the Consent Revocation Deadline will not be deemed a revocation of the related Consents and such Consents will continue to be deemed delivered. A Holder that wishes to consent to the Proposed Amendments but who does not wish to submit Tender Instructions should submit a Consent Only Instruction. No Holder of Notes can revoke a Consent Only Instruction after the Consent Revocation Deadline. Each Issuer reserves the right (the “Early Settlement Right”), but is under no obligation, to settle all Notes validly tendered and not validly withdrawn on or prior to the Early Tender Deadline and accepted for purchase, and pay for Consents validly delivered and not validly revoked prior to the Consent Expiration Time, in each case with respect to Offers and Consent Solicitations for which the conditions have been satisfied or waived and in accordance with the terms set forth in the Offer to Purchase and Consent Solicitation. If an Issuer exercises its Early Settlement Right, the Early Settlement Date will be determined at the applicable Issuer’s option. The Early Settlement Date will be a date that is promptly after the Early Tender Deadline and is currently expected to occur no earlier than the fourth business day immediately following the Early Tender Deadline. If the Issuer elects to exercise its Early Settlement Right with respect to any Offer and Consent Solicitation, the Issuer will announce in a press release promptly after the applicable Early Tender Deadline that it is exercising its Early Settlement Right with respect to such Offer and Consent Solicitation. Our obligation to accept for purchase, and to pay for, Notes validly tendered and not validly withdrawn, and Consents validly delivered and not validly revoked, pursuant to an Offer is conditioned upon certain conditions as described in the Offer to Purchase and Consent Solicitation Statement, including a Financing Condition and a Requisite Consent Condition. The complete terms and conditions of the Offers and Consent Solicitations are set forth in the Offer to Purchase and Consent Solicitation Statement, along with any amendments and supplements thereto, which holders are urged to read carefully before making any decision with respect to the Offers and Consent Solicitations. The Issuers have retained J.P. Morgan Securities LLC and J.P. Morgan Securities plc to act as the Lead Dealer Managers (the “Lead Dealer Managers”), and Evercore Group L.L.C. to act as Co- Dealer Manager (together with the Lead Dealer Managers, the “Dealer Managers”) in connection with the Offers and Consent Solicitations. Kirkland & Ellis LLP is serving as legal counsel to the Issuer and Simpson Thacher & Bartlett LLP is serving as legal counsel to the Dealer Managers. Copies of the Offer to Purchase and Consent Solicitation Statement may be obtained from the Tender and Information Agent, by phone at +1 (212) 931-0845 (banks and brokers) or +1 (800) 848- 3410 (all others), by WBD@dfking.com or at www.dfking.com/WBD. Questions regarding the Offers may also be directed to the Lead Dealer Managers as set forth below: Lead Dealer Managers: J.P. Morgan Securities LLC As Sole Lead Dealer Manager for the Dollar Notes J.P. Morgan Securities plc As Sole Lead Dealer Manager for the Euro Notes

383 Madison Avenue New York, New York 10179 Collect: +1 (212) 834-4087 Toll-Free: +1 (866) 834-4666 Attn: Liability Management Desk 25 Bank Street Canary Wharf London E14 5JP United Kingdom Collect: +44 20 7134 2468 Attn: EMEA Liability Management Desk This press release must be read in conjunction with the Offer to Purchase and Consent Solicitation Statement. This press release and the Offer to Purchase and Consent Solicitation Statement contain important information which should be read carefully before any decision is made with respect to the Offers and Consent Solicitations. You are recommended to seek your own legal, business, tax or other advice, including as to any tax consequences, immediately from your broker, bank manager, solicitor, accountant or other independent financial or legal advisor. Any individual or company whose Notes are held on its behalf by a broker, dealer, bank, commercial bank, trust company or other nominee or intermediary must contact such entity if it wishes to participate in the Offers and Consent Solicitations. None of the Issuers, the Tender and Information Agent or any of the Dealer Managers, nor any director, officer, employee, agent, legal counsel or affiliate of any such person, is acting for any holder of Notes, or will be responsible to any holder of Notes for providing any protections which would be afforded to its clients or for providing advice in relation to the Offers and the Consent Solicitations, and accordingly none of the Tender and Information Agent or any of the Dealer Managers, nor any director, officer, employee, agent, legal counsel or affiliate of any such person, assumes any responsibility for the accuracy of any information concerning any of the Issuers, the Company or the Notes or any failure by any of the Issuers to disclose information with regard to the Issuers, the Company or the Notes which is material in the context of the Offers and the Consent Solicitations and which is not otherwise publicly available. Subject to any restrictions under the Indentures following the adoption of the Proposed Amendments, and any limitations under the terms of the Junior Lien Exchange Notes (if issued), the Company or any of its subsidiaries or affiliates, including the Issuers, may from time to time following the Expiration Time acquire any Notes that remain outstanding in the open market, in privately negotiated transactions, through one or more additional tender offers, one or more exchange offers or otherwise, or may redeem Notes pursuant to the terms of the indentures governing the Notes. Any future purchases or redemptions may be on the same terms or on terms that are more or less favorable to holders of Notes than the terms of the Offers. Any future purchases or redemptions by the Company or any of its subsidiaries or affiliates will depend on various factors existing at that time. There can be no assurance as to which, if any, of these alternatives (or combinations thereof) the Company or any of its affiliates will choose to pursue in the future. The effect of any of these actions may directly or indirectly affect the price of any Notes or Amended Notes that remain outstanding after the consummation or termination of the Offers. This press release is neither an offer to purchase nor a solicitation of an offer to sell any securities. The Offers and the Consent Solicitations are being made only by, and pursuant to the terms of, the Offer to Purchase and Consent Solicitation Statement. The Offers and the Consent Solicitations do not constitute an offer to buy or the solicitation of an offer to sell Notes in any jurisdiction in which such offer or solicitation is unlawful. The Offers and the Consent Solicitations are void in all jurisdictions where they are prohibited. In those jurisdictions where the securities, blue sky or other laws require the Offers and the Consent Solicitations to be made by a licensed broker or dealer, the Offers and the Consent Solicitations shall be deemed to be made on behalf of the Issuers by the Dealer Managers or one or more registered brokers or dealers licensed under the laws of such jurisdiction. None of the Issuers, the Tender

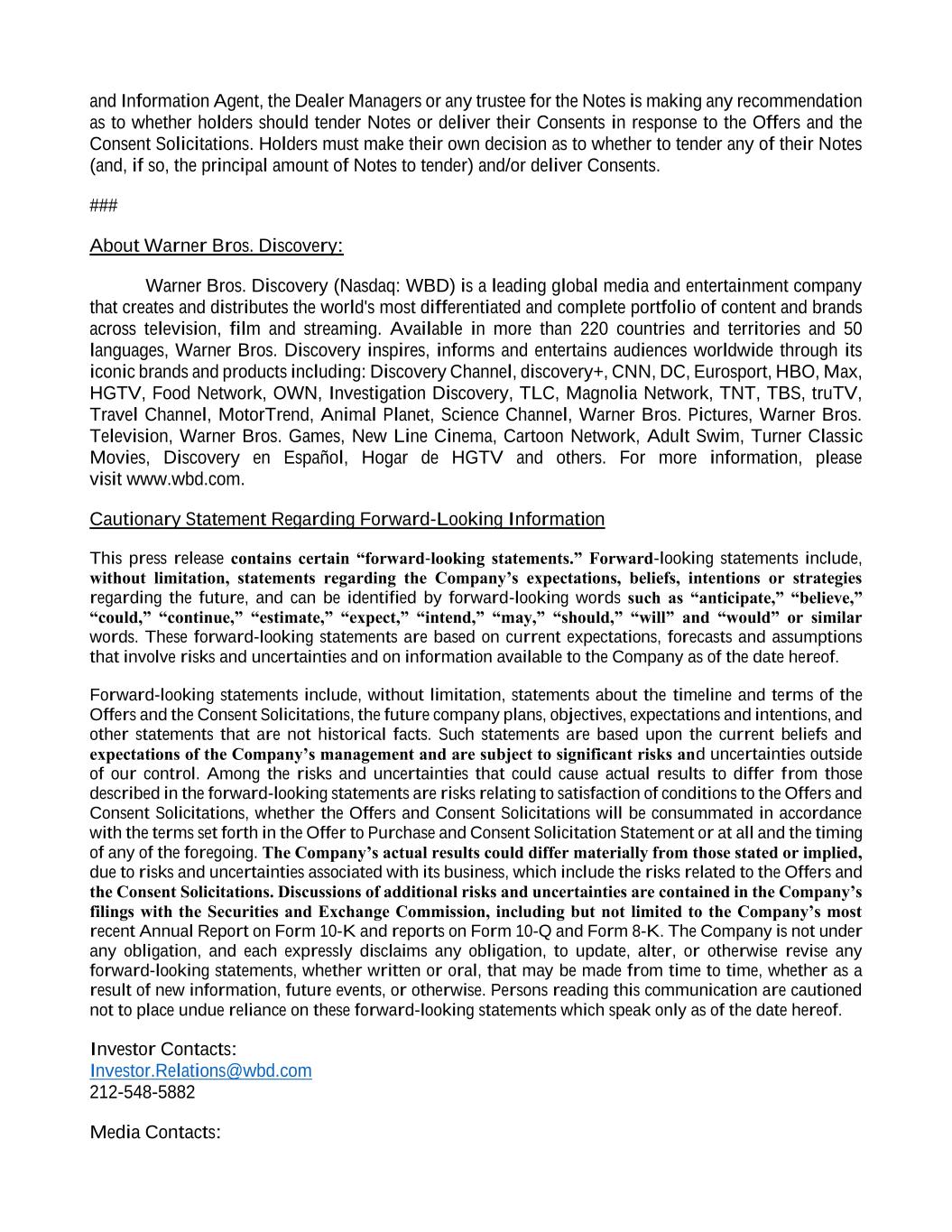

and Information Agent, the Dealer Managers or any trustee for the Notes is making any recommendation as to whether holders should tender Notes or deliver their Consents in response to the Offers and the Consent Solicitations. Holders must make their own decision as to whether to tender any of their Notes (and, if so, the principal amount of Notes to tender) and/or deliver Consents. ### About Warner Bros. Discovery: Warner Bros. Discovery (Nasdaq: WBD) is a leading global media and entertainment company that creates and distributes the world's most differentiated and complete portfolio of content and brands across television, film and streaming. Available in more than 220 countries and territories and 50 languages, Warner Bros. Discovery inspires, informs and entertains audiences worldwide through its iconic brands and products including: Discovery Channel, discovery+, CNN, DC, Eurosport, HBO, Max, HGTV, Food Network, OWN, Investigation Discovery, TLC, Magnolia Network, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, Warner Bros. Pictures, Warner Bros. Television, Warner Bros. Games, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies, Discovery en Español, Hogar de HGTV and others. For more information, please visit www.wbd.com. Cautionary Statement Regarding Forward-Looking Information This press release contains certain “forward-looking statements.” Forward-looking statements include, without limitation, statements regarding the Company’s expectations, beliefs, intentions or strategies regarding the future, and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. These forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties and on information available to the Company as of the date hereof. Forward-looking statements include, without limitation, statements about the timeline and terms of the Offers and the Consent Solicitations, the future company plans, objectives, expectations and intentions, and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties outside of our control. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are risks relating to satisfaction of conditions to the Offers and Consent Solicitations, whether the Offers and Consent Solicitations will be consummated in accordance with the terms set forth in the Offer to Purchase and Consent Solicitation Statement or at all and the timing of any of the foregoing. The Company’s actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include the risks related to the Offers and the Consent Solicitations. Discussions of additional risks and uncertainties are contained in the Company’s filings with the Securities and Exchange Commission, including but not limited to the Company’s most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. The Company is not under any obligation, and each expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. Investor Contacts: Investor.Relations@wbd.com 212-548-5882 Media Contacts:

Robert Gibbs Robert.Gibbs@wbd.com 347-268-3017 Megan Klein Megan.Klein@wbd.com\ Source: Warner Bros. Discovery, Inc.