| Date of Report (Date of earliest event reported) | July 21, 2025 | ||||

| Home Bancorp, Inc. | ||

| (Exact name of registrant as specified in its charter) | ||

| Louisiana | 001-34190 | 71-1051785 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

503 Kaliste Saloom Road, Lafayette, Louisiana |

70508 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

| Registrant’s telephone number, including area code | (337) 237-1960 |

||||

| N/A | ||

| (Former name or former address, if changed since last report) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock | HBCP | Nasdaq Stock Market | ||||||

| Item 2.02 | Results of Operations and Financial Condition | ||||

Item 7.01 |

Regulation FD Disclosure |

||||

| Item 8.01 | Other Events | ||||

| Item 9.01 | Financial Statements and Exhibits | ||||

| Exhibit Number | Description | |||||||

| 104 | The cover page of Home Bancorp Inc.'s Form 8-K is formatted in Inline XBRL. | |||||||

| HOME BANCORP, INC. | |||||||||||

Date: July 21, 2025 |

By: | /s/ John W. Bordelon | |||||||||

| John W. Bordelon | |||||||||||

| Chairman of the Board, President and Chief Executive Officer | |||||||||||

| Release Date: | July 21, 2025 | ||||

| For Immediate Release | |||||

| (dollars in thousands) | 6/30/2025 | 3/31/2025 | Increase (Decrease) | |||||||||||||||||||||||

| Real estate loans: | ||||||||||||||||||||||||||

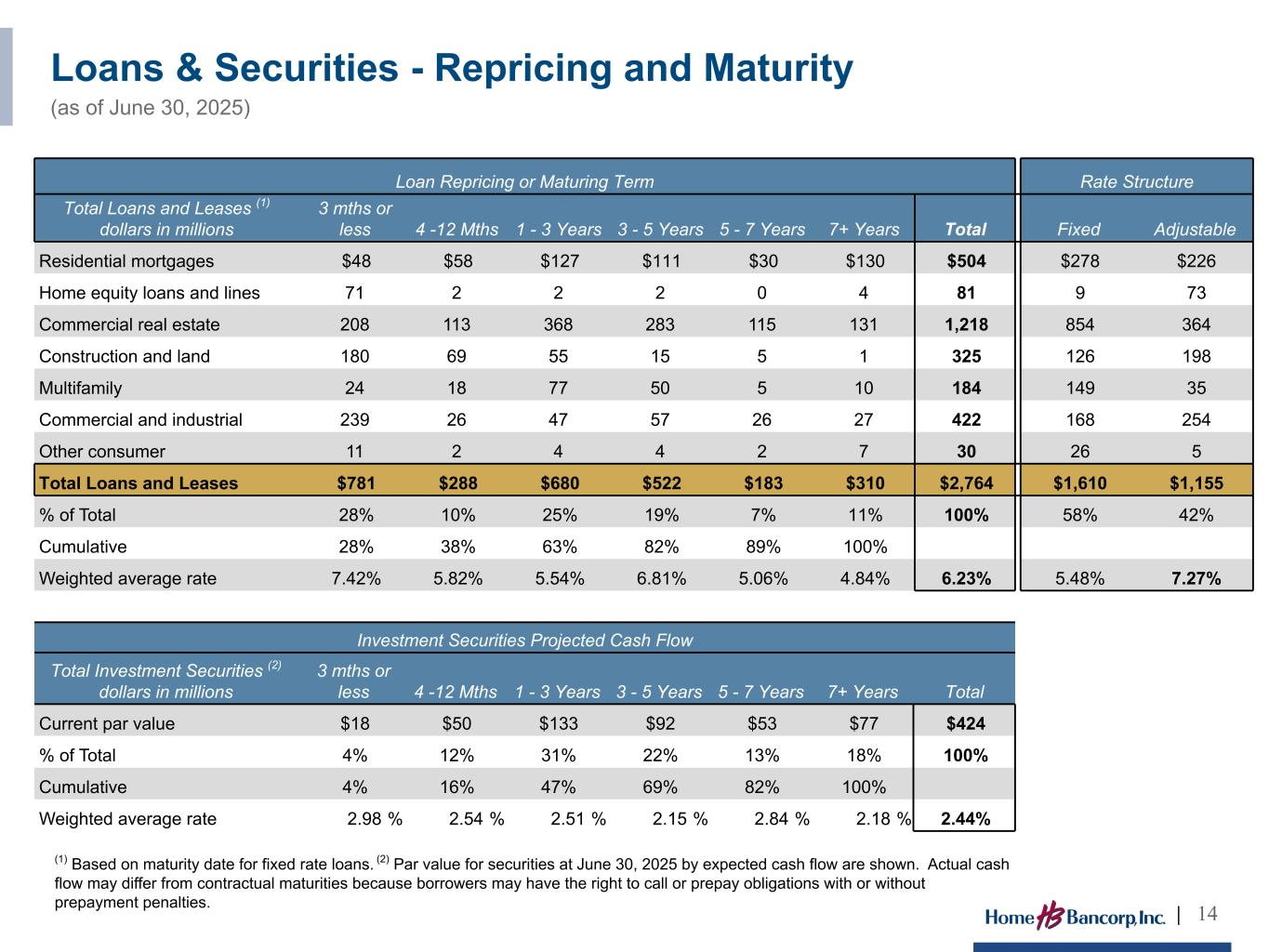

| One- to four-family first mortgage | $ | 504,145 | $ | 504,356 | $ | (211) | — | % | ||||||||||||||||||

| Home equity loans and lines | 81,178 | 77,417 | 3,761 | 5 | ||||||||||||||||||||||

| Commercial real estate | 1,218,168 | 1,193,364 | 24,804 | 2 | ||||||||||||||||||||||

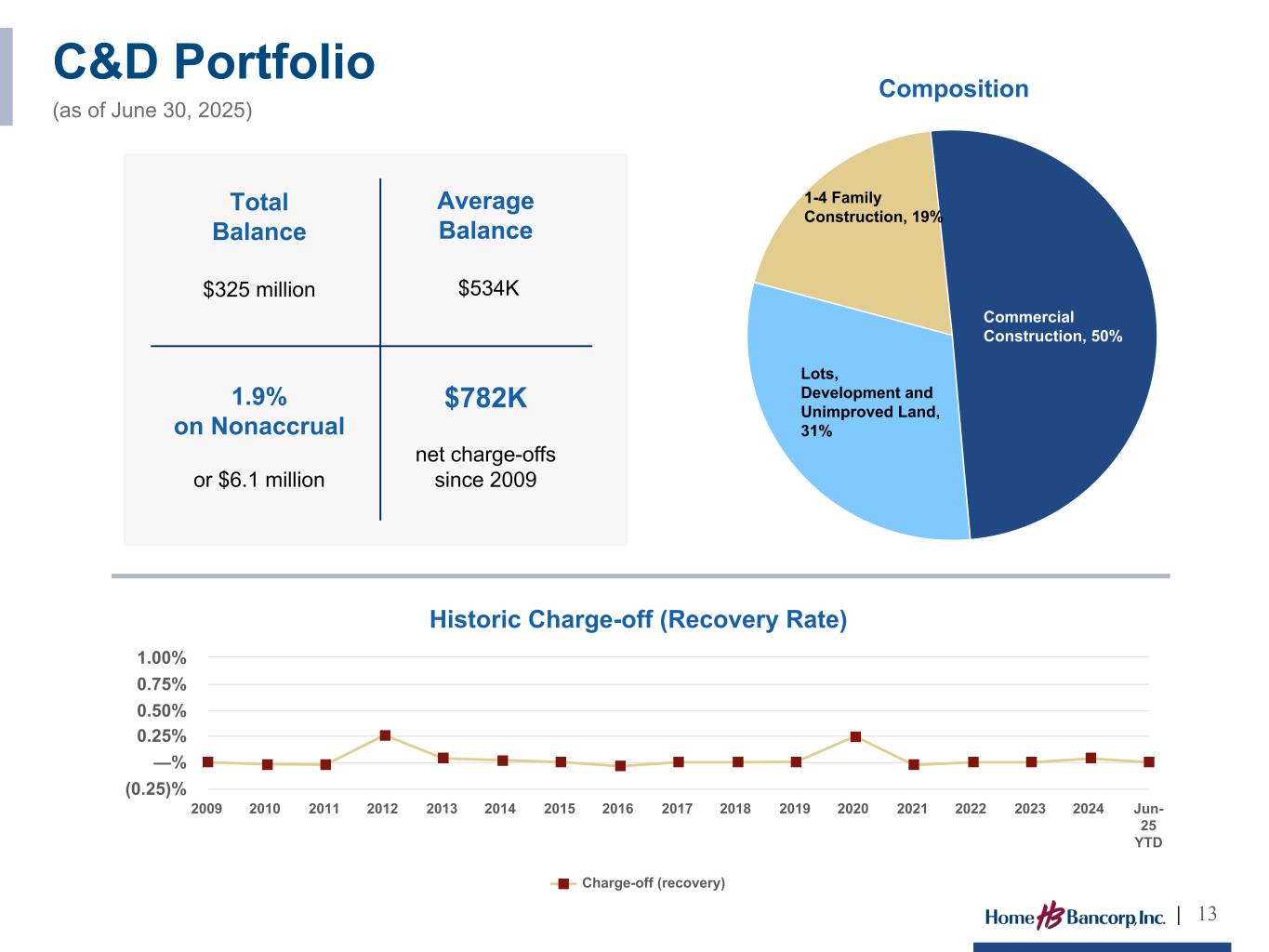

| Construction and land | 324,574 | 346,987 | (22,413) | (6) | ||||||||||||||||||||||

| Multi-family residential | 183,809 | 183,792 | 17 | — | ||||||||||||||||||||||

| Total real estate loans | 2,311,874 | 2,305,916 | 5,958 | — | ||||||||||||||||||||||

| Other loans: | ||||||||||||||||||||||||||

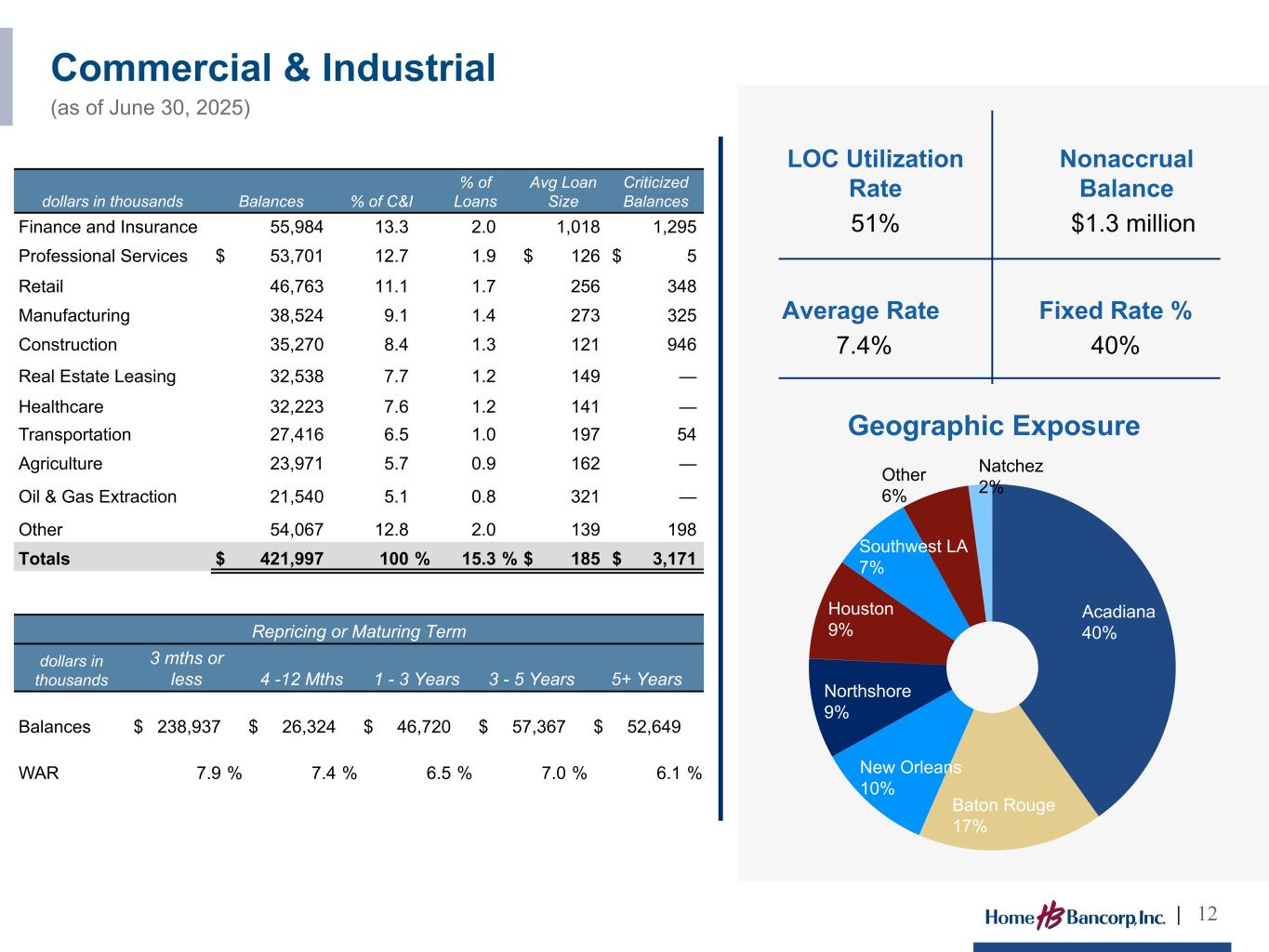

| Commercial and industrial | 421,997 | 411,363 | 10,634 | 3 | ||||||||||||||||||||||

| Consumer | 30,667 | 29,998 | 669 | 2 | ||||||||||||||||||||||

| Total other loans | 452,664 | 441,361 | 11,303 | 3 | ||||||||||||||||||||||

| Total loans | $ | 2,764,538 | $ | 2,747,277 | $ | 17,261 | 1 | % | ||||||||||||||||||

| June 30, 2025 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 497,404 | $ | — | $ | 6,741 | $ | 504,145 | ||||||||||||||||||

| Home equity loans and lines | 80,145 | — | 1,033 | 81,178 | ||||||||||||||||||||||

| Commercial real estate | 1,185,738 | 1,063 | 31,367 | 1,218,168 | ||||||||||||||||||||||

| Construction and land | 317,593 | 749 | 6,232 | 324,574 | ||||||||||||||||||||||

| Multi-family residential | 182,572 | — | 1,237 | 183,809 | ||||||||||||||||||||||

| Commercial and industrial | 418,831 | — | 3,166 | 421,997 | ||||||||||||||||||||||

| Consumer | 30,632 | — | 35 | 30,667 | ||||||||||||||||||||||

| Total | $ | 2,712,915 | $ | 1,812 | $ | 49,811 | $ | 2,764,538 | ||||||||||||||||||

| March 31, 2025 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 496,694 | $ | 820 | $ | 6,842 | $ | 504,356 | ||||||||||||||||||

| Home equity loans and lines | 77,045 | — | 372 | 77,417 | ||||||||||||||||||||||

| Commercial real estate | 1,174,920 | — | 18,444 | 1,193,364 | ||||||||||||||||||||||

| Construction and land | 341,273 | — | 5,714 | 346,987 | ||||||||||||||||||||||

| Multi-family residential | 182,536 | — | 1,256 | 183,792 | ||||||||||||||||||||||

| Commercial and industrial | 407,742 | — | 3,621 | 411,363 | ||||||||||||||||||||||

| Consumer | 29,838 | — | 160 | 29,998 | ||||||||||||||||||||||

| Total | $ | 2,710,048 | $ | 820 | $ | 36,409 | $ | 2,747,277 | ||||||||||||||||||

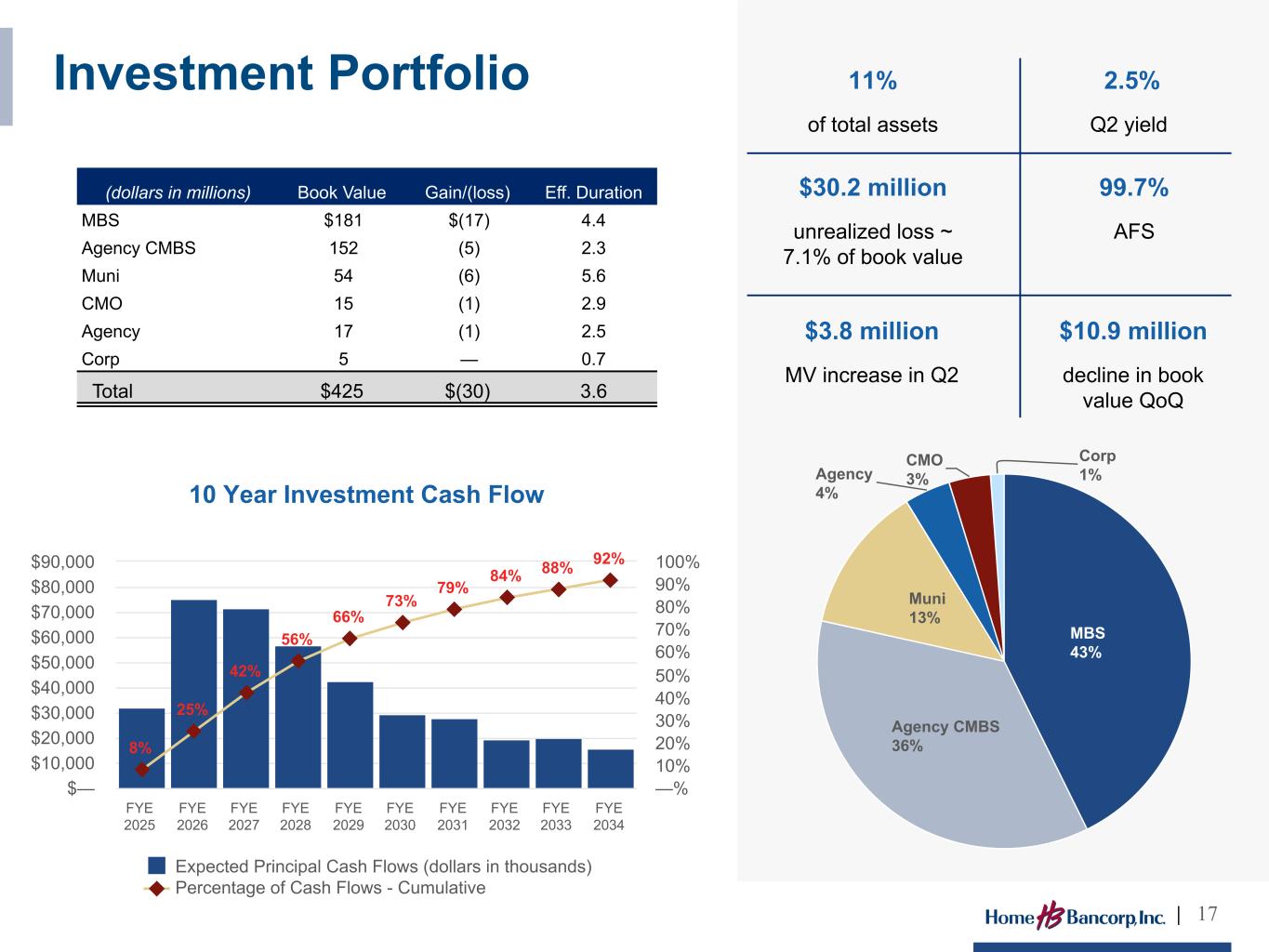

| (dollars in thousands) | Amortized Cost | Fair Value | ||||||||||||

| Available for sale: | ||||||||||||||

| U.S. agency mortgage-backed | $ | 280,484 | $ | 258,925 | ||||||||||

| Collateralized mortgage obligations | 68,080 | 66,615 | ||||||||||||

| Municipal bonds | 53,240 | 46,942 | ||||||||||||

| U.S. government agency | 16,863 | 16,338 | ||||||||||||

| Corporate bonds | 4,985 | 4,642 | ||||||||||||

| Total available for sale | $ | 423,652 | $ | 393,462 | ||||||||||

| Held to maturity: | ||||||||||||||

| Municipal bonds | $ | 1,065 | $ | 1,066 | ||||||||||

| Total held to maturity | $ | 1,065 | $ | 1,066 | ||||||||||

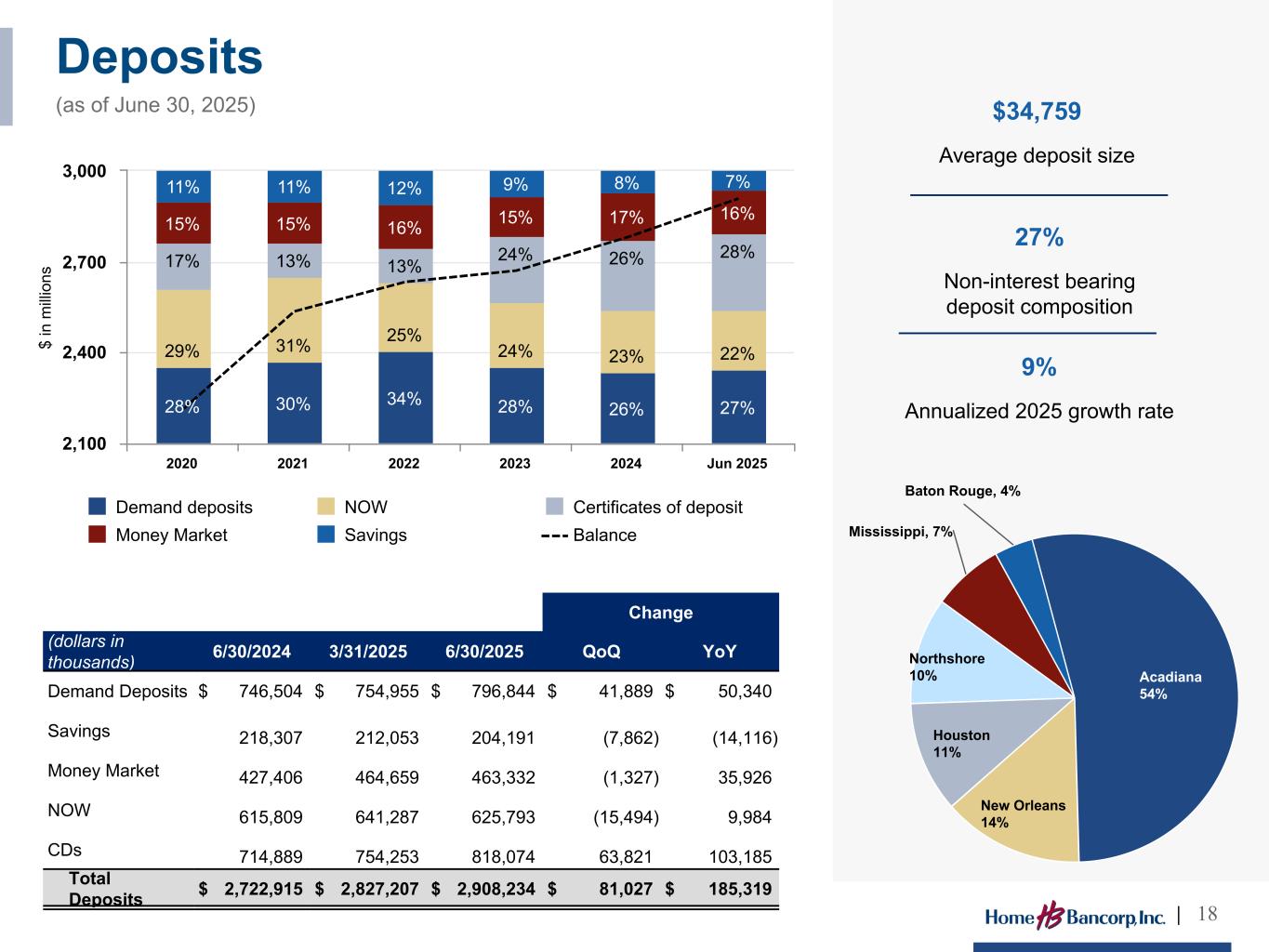

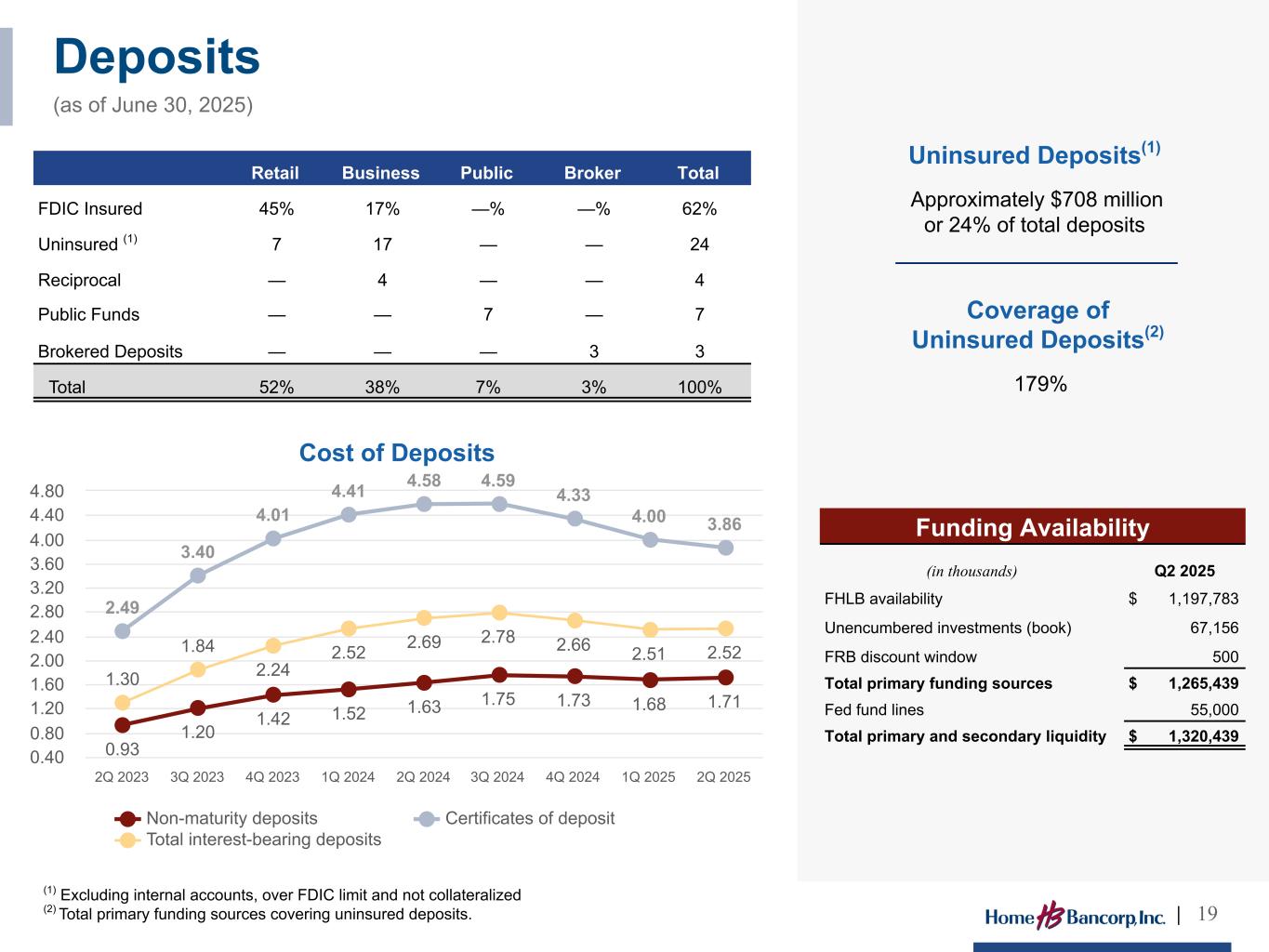

| (dollars in thousands) | 6/30/2025 | 3/31/2025 | Increase (Decrease) | |||||||||||||||||||||||

| Demand deposits | $ | 796,844 | $ | 754,955 | $ | 41,889 | 6 | % | ||||||||||||||||||

| Savings | 204,191 | 212,053 | (7,862) | (4) | ||||||||||||||||||||||

| Money market | 463,332 | 464,659 | (1,327) | — | ||||||||||||||||||||||

| NOW | 625,793 | 641,287 | (15,494) | (2) | ||||||||||||||||||||||

| Certificates of deposit | 818,074 | 754,253 | 63,821 | 8 | ||||||||||||||||||||||

| Total deposits | $ | 2,908,234 | $ | 2,827,207 | $ | 81,027 | 3 | % | ||||||||||||||||||

| June 30, 2025 | March 31, 2025 | |||||||||||||

| Individuals | 52% | 53% | ||||||||||||

| Small businesses | 38 | 36 | ||||||||||||

| Public funds | 7 | 8 | ||||||||||||

| Broker | 3 | 3 | ||||||||||||

| Total | 100% | 100% | ||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | |||||||||||||||||||||||||||

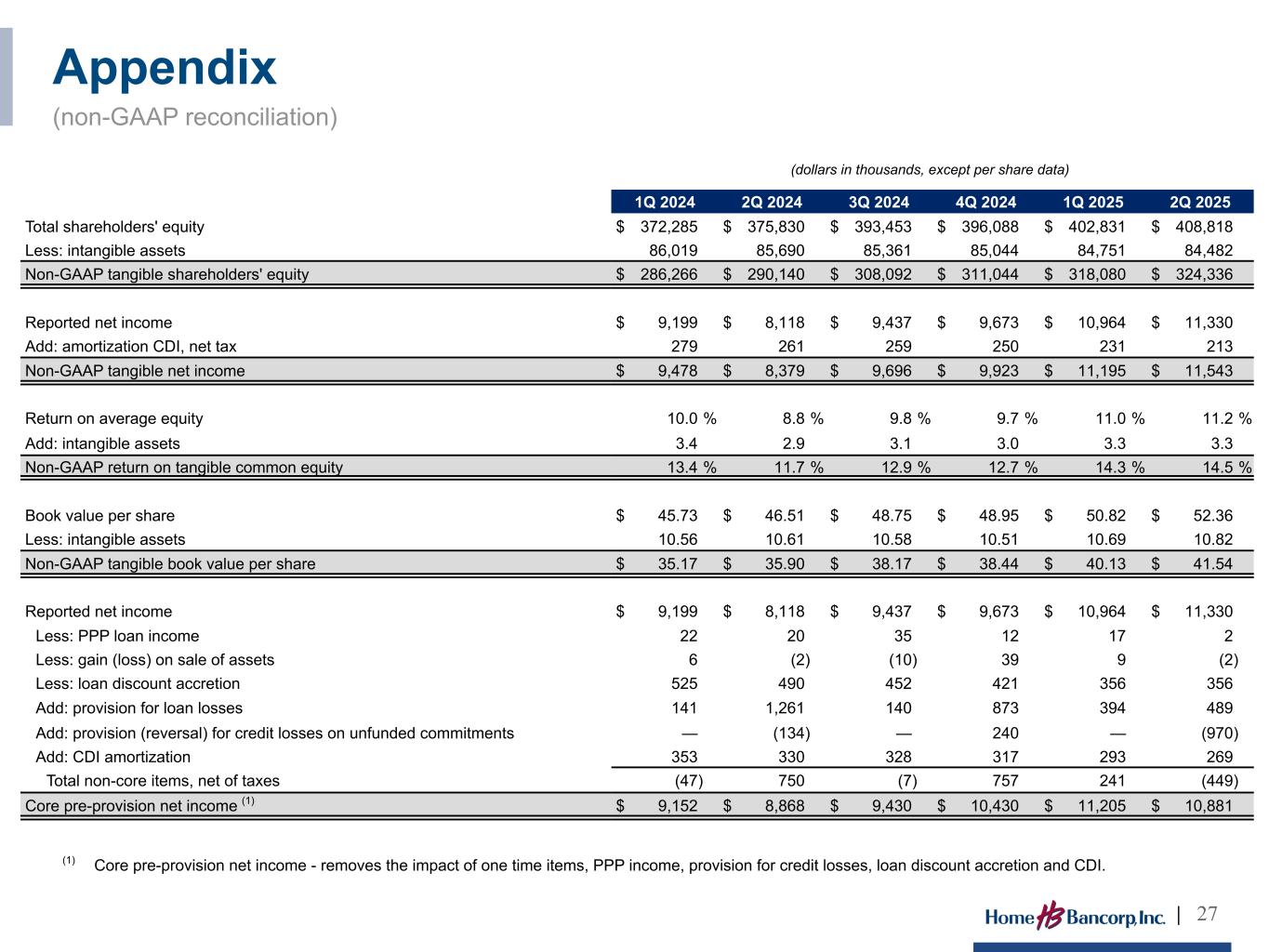

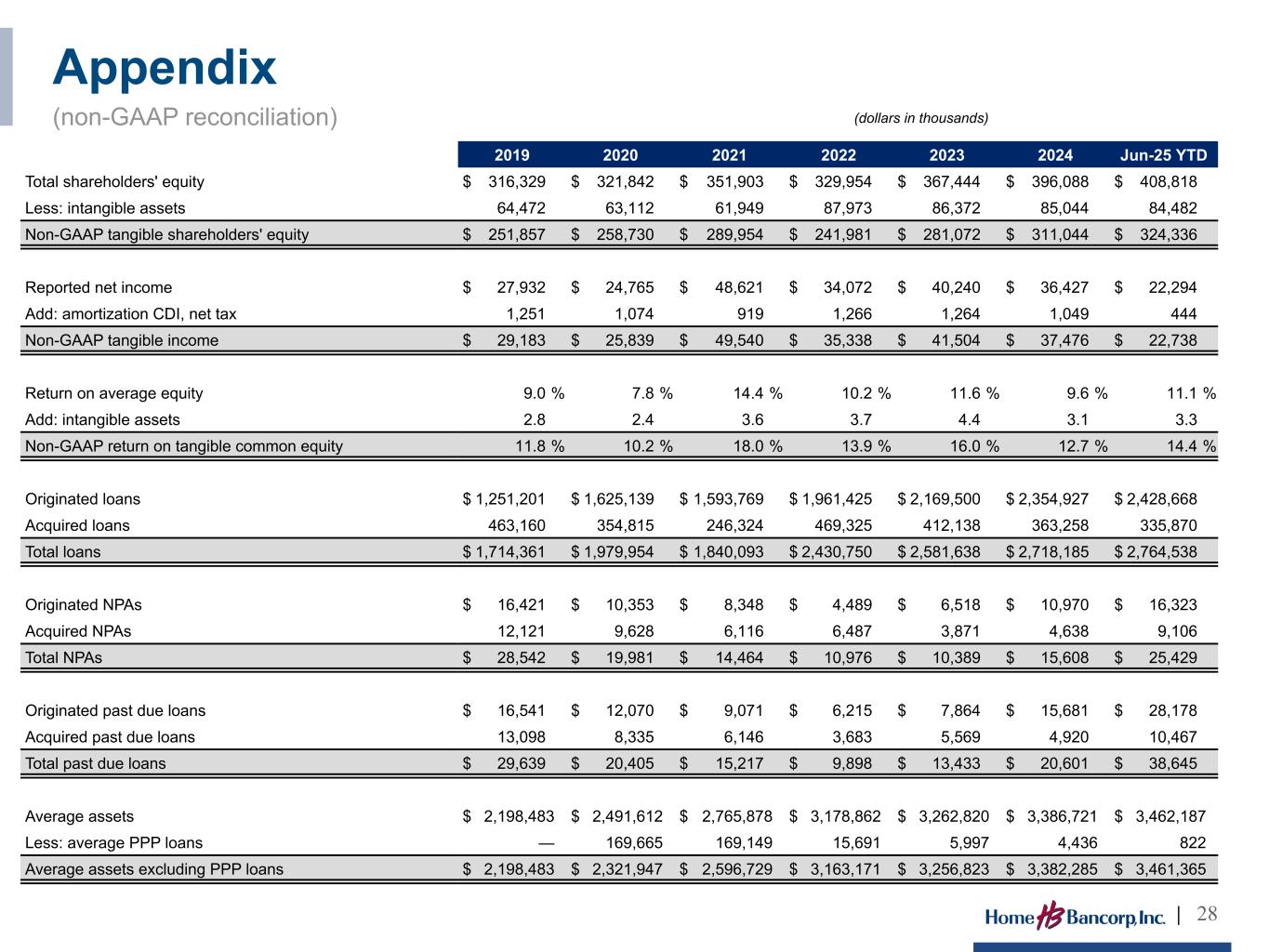

| Reported net income | $ | 11,330 | $ | 10,964 | $ | 9,673 | $ | 9,437 | $ | 8,118 | ||||||||||||||||||||||

| Add: Core deposit intangible amortization, net tax | 213 | 231 | 250 | 259 | 261 | |||||||||||||||||||||||||||

| Non-GAAP tangible income | $ | 11,543 | $ | 11,195 | $ | 9,923 | $ | 9,696 | $ | 8,379 | ||||||||||||||||||||||

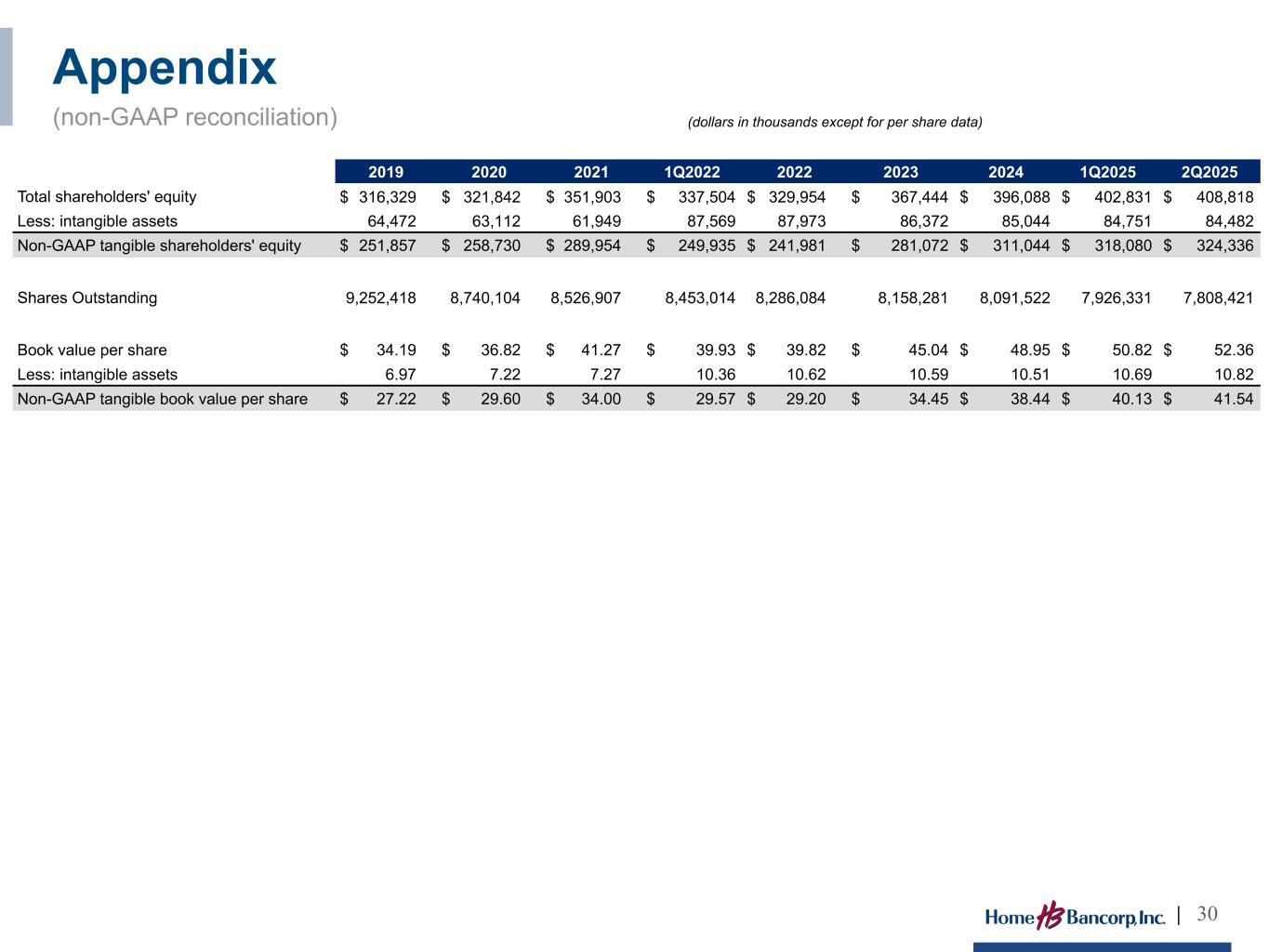

| Total assets | $ | 3,491,455 | $ | 3,485,453 | $ | 3,443,668 | $ | 3,441,990 | $ | 3,410,881 | ||||||||||||||||||||||

| Less: Intangible assets | 84,482 | 84,751 | 85,044 | 85,361 | 85,690 | |||||||||||||||||||||||||||

| Non-GAAP tangible assets | $ | 3,406,973 | $ | 3,400,702 | $ | 3,358,624 | $ | 3,356,629 | $ | 3,325,191 | ||||||||||||||||||||||

| Total shareholders’ equity | $ | 408,818 | $ | 402,831 | $ | 396,088 | $ | 393,453 | $ | 375,830 | ||||||||||||||||||||||

| Less: Intangible assets | 84,482 | 84,751 | 85,044 | 85,361 | 85,690 | |||||||||||||||||||||||||||

| Non-GAAP tangible shareholders’ equity | $ | 324,336 | $ | 318,080 | $ | 311,044 | $ | 308,092 | $ | 290,140 | ||||||||||||||||||||||

| Return on average equity | 11.24 | % | 11.02 | % | 9.71 | % | 9.76 | % | 8.75 | % | ||||||||||||||||||||||

| Add: Average intangible assets | 3.24 | 3.23 | 2.99 | 3.14 | 2.98 | |||||||||||||||||||||||||||

| Non-GAAP return on average tangible common equity | 14.48 | % | 14.25 | % | 12.70 | % | 12.90 | % | 11.73 | % | ||||||||||||||||||||||

| Common equity ratio | 11.71 | % | 11.56 | % | 11.50 | % | 11.43 | % | 11.02 | % | ||||||||||||||||||||||

| Less: Intangible assets | 2.19 | 2.21 | 2.24 | 2.25 | 2.29 | |||||||||||||||||||||||||||

| Non-GAAP tangible common equity ratio | 9.52 | % | 9.35 | % | 9.26 | % | 9.18 | % | 8.73 | % | ||||||||||||||||||||||

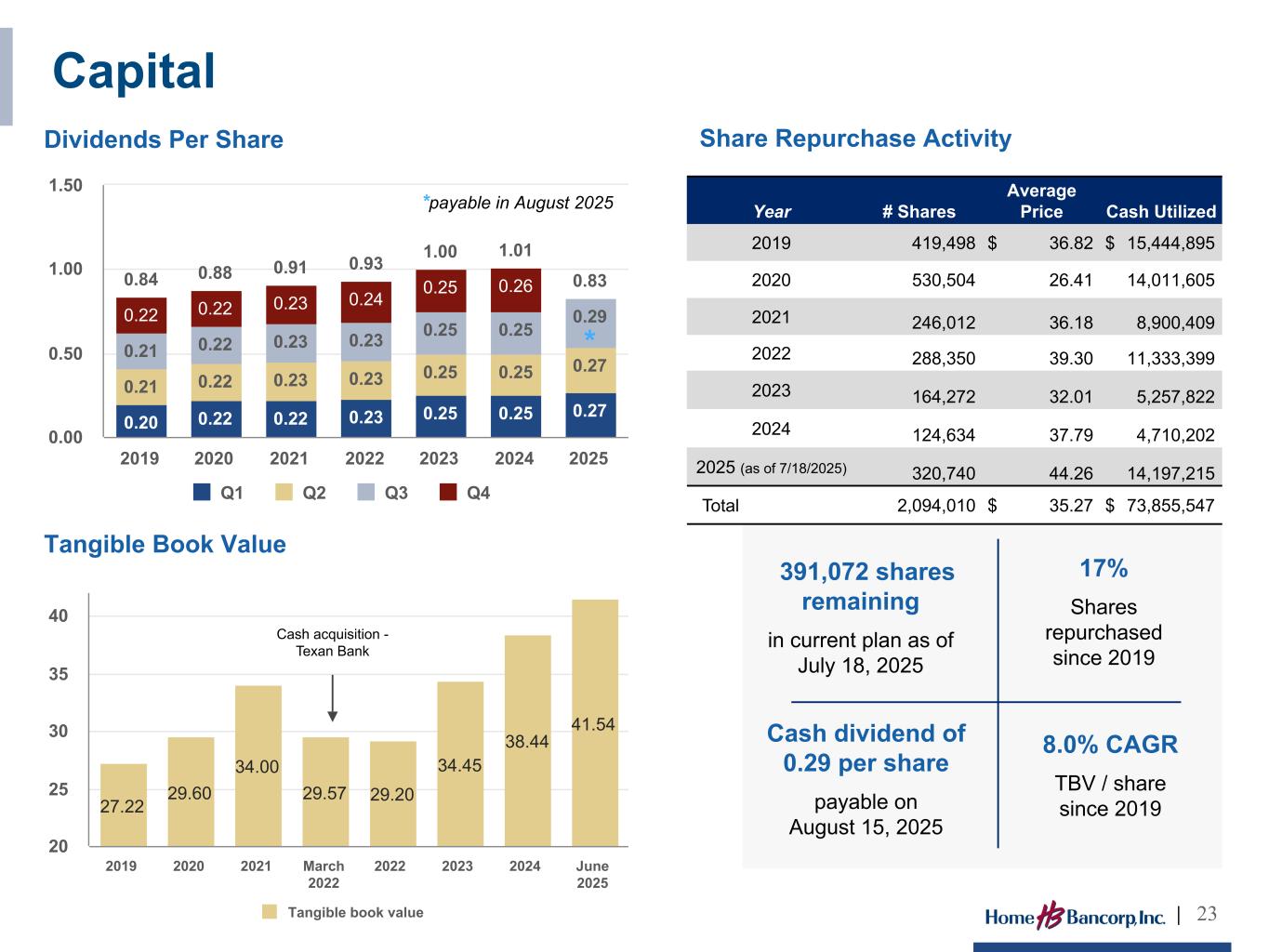

| Book value per share | $ | 52.36 | $ | 50.82 | $ | 48.95 | $ | 48.75 | $ | 46.51 | ||||||||||||||||||||||

| Less: Intangible assets | 10.82 | 10.69 | 10.51 | 10.58 | 10.61 | |||||||||||||||||||||||||||

| Non-GAAP tangible book value per share | $ | 41.54 | $ | 40.13 | $ | 38.44 | $ | 38.17 | $ | 35.90 | ||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF FINANCIAL CONDITION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| (dollars in thousands) | 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | |||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 112,595 | $ | 110,662 | $ | 98,548 | $ | 135,877 | $ | 113,462 | ||||||||||||||||||||||

| Investment securities available for sale, at fair value | 393,462 | 400,553 | 402,792 | 420,723 | 412,472 | |||||||||||||||||||||||||||

| Investment securities held to maturity | 1,065 | 1,065 | 1,065 | 1,065 | 1,065 | |||||||||||||||||||||||||||

| Mortgage loans held for sale | 1,305 | 1,855 | 832 | 242 | — | |||||||||||||||||||||||||||

| Loans, net of unearned income | 2,764,538 | 2,747,277 | 2,718,185 | 2,668,286 | 2,661,346 | |||||||||||||||||||||||||||

| Allowance for loan losses | (33,432) | (33,278) | (32,916) | (32,278) | (32,212) | |||||||||||||||||||||||||||

| Total loans, net of allowance for loan losses | 2,731,106 | 2,713,999 | 2,685,269 | 2,636,008 | 2,629,134 | |||||||||||||||||||||||||||

| Office properties and equipment, net | 45,216 | 45,327 | 42,324 | 42,659 | 43,089 | |||||||||||||||||||||||||||

| Cash surrender value of bank-owned life insurance | 48,981 | 48,699 | 48,421 | 48,139 | 47,858 | |||||||||||||||||||||||||||

| Goodwill and core deposit intangibles | 84,482 | 84,751 | 85,044 | 85,361 | 85,690 | |||||||||||||||||||||||||||

| Accrued interest receivable and other assets | 73,243 | 78,542 | 79,373 | 71,916 | 78,111 | |||||||||||||||||||||||||||

| Total Assets | $ | 3,491,455 | $ | 3,485,453 | $ | 3,443,668 | $ | 3,441,990 | $ | 3,410,881 | ||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||

| Deposits | $ | 2,908,234 | $ | 2,827,207 | $ | 2,780,696 | $ | 2,777,487 | $ | 2,722,915 | ||||||||||||||||||||||

| Other Borrowings | 5,539 | 5,539 | 5,539 | 140,539 | 140,539 | |||||||||||||||||||||||||||

| Subordinated debt, net of issuance cost | 54,567 | 54,513 | 54,459 | 54,402 | 54,348 | |||||||||||||||||||||||||||

| Federal Home Loan Bank advances | 88,196 | 163,259 | 175,546 | 38,410 | 83,506 | |||||||||||||||||||||||||||

| Accrued interest payable and other liabilities | 26,101 | 32,104 | 31,340 | 37,699 | 33,743 | |||||||||||||||||||||||||||

| Total Liabilities | 3,082,637 | 3,082,622 | 3,047,580 | 3,048,537 | 3,035,051 | |||||||||||||||||||||||||||

| Shareholders' Equity | ||||||||||||||||||||||||||||||||

| Common stock | 78 | 79 | 81 | 81 | 81 | |||||||||||||||||||||||||||

| Additional paid-in capital | 166,576 | 167,231 | 168,138 | 166,743 | 165,918 | |||||||||||||||||||||||||||

| Common stock acquired by benefit plans | (1,160) | (1,250) | (1,339) | (1,428) | (1,518) | |||||||||||||||||||||||||||

| Retained earnings | 265,817 | 261,856 | 259,190 | 251,692 | 245,046 | |||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (22,493) | (25,085) | (29,982) | (23,635) | (33,697) | |||||||||||||||||||||||||||

| Total Shareholders' Equity | 408,818 | 402,831 | 396,088 | 393,453 | 375,830 | |||||||||||||||||||||||||||

| Total Liabilities and Shareholders' Equity | $ | 3,491,455 | $ | 3,485,453 | $ | 3,443,668 | $ | 3,441,990 | $ | 3,410,881 | ||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF INCOME | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

Three Months Ended |

Six Months Ended | |||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 6/30/2025 | 3/31/2025 | 6/30/2024 | 6/30/2025 | 6/30/2024 | |||||||||||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 45,287 | $ | 44,032 | $ | 41,999 | $ | 89,319 | $ | 82,566 | ||||||||||||||||||||||

| Investment securities | 2,596 | 2,664 | 2,740 | 5,260 | 5,528 | |||||||||||||||||||||||||||

Other investments and deposits |

746 | 505 | 719 | 1,251 | 1,490 | |||||||||||||||||||||||||||

| Total interest income | 48,629 | 47,201 | 45,458 | 95,830 | 89,584 | |||||||||||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||||||||

| Deposits | 13,142 | 12,622 | 13,134 | 25,764 | 25,266 | |||||||||||||||||||||||||||

| Other borrowings | 53 | 53 | 1,656 | 106 | 3,142 | |||||||||||||||||||||||||||

| Subordinated debt expense | 844 | 845 | 844 | 1,689 | 1,689 | |||||||||||||||||||||||||||

Federal Home Loan Bank advances |

1,239 | 1,932 | 431 | 3,171 | 1,193 | |||||||||||||||||||||||||||

| Total interest expense | 15,278 | 15,452 | 16,065 | 30,730 | 31,290 | |||||||||||||||||||||||||||

| Net interest income | 33,351 | 31,749 | 29,393 | 65,100 | 58,294 | |||||||||||||||||||||||||||

| Provision for loan losses | 489 | 394 | 1,261 | 883 | 1,402 | |||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 32,862 | 31,355 | 28,132 | 64,217 | 56,892 | |||||||||||||||||||||||||||

| Noninterest Income | ||||||||||||||||||||||||||||||||

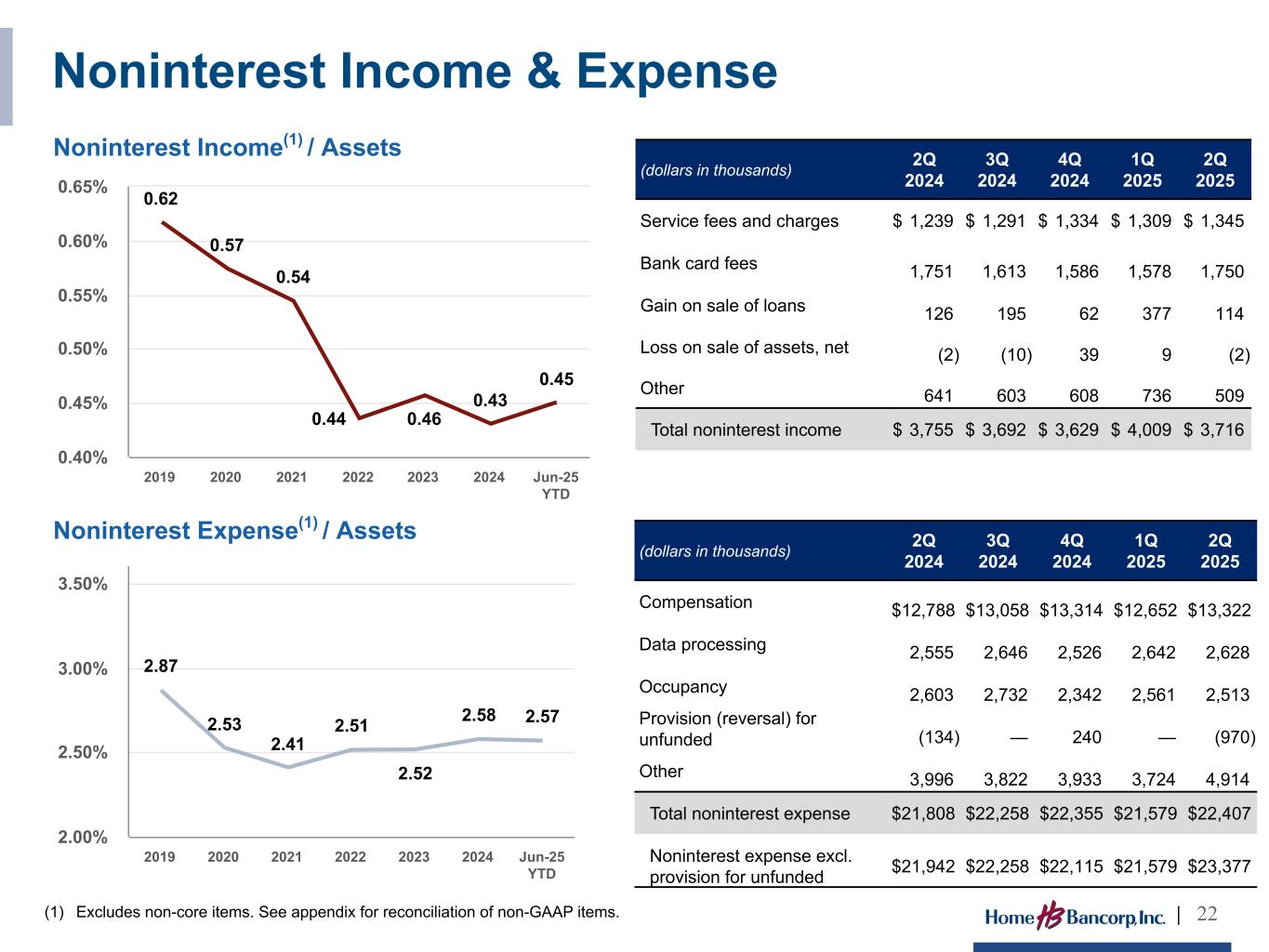

| Service fees and charges | 1,345 | 1,309 | 1,239 | 2,654 | 2,493 | |||||||||||||||||||||||||||

| Bank card fees | 1,750 | 1,578 | 1,751 | 3,328 | 3,326 | |||||||||||||||||||||||||||

| Gain on sale of loans, net | 114 | 377 | 126 | 491 | 213 | |||||||||||||||||||||||||||

Income from bank-owned life insurance |

282 | 278 | 271 | 560 | 537 | |||||||||||||||||||||||||||

| (Loss) gain on sale of assets, net | (2) | 9 | (2) | 7 | 4 | |||||||||||||||||||||||||||

| Other income | 227 | 458 | 370 | 685 | 731 | |||||||||||||||||||||||||||

| Total noninterest income | 3,716 | 4,009 | 3,755 | 7,725 | 7,304 | |||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||

| Compensation and benefits | 13,322 | 12,652 | 12,788 | 25,974 | 24,958 | |||||||||||||||||||||||||||

| Occupancy | 2,513 | 2,561 | 2,603 | 5,074 | 5,057 | |||||||||||||||||||||||||||

| Marketing and advertising | 461 | 429 | 485 | 890 | 951 | |||||||||||||||||||||||||||

Data processing and communication |

2,628 | 2,642 | 2,555 | 5,270 | 5,069 | |||||||||||||||||||||||||||

| Professional fees | 396 | 405 | 581 | 801 | 1,056 | |||||||||||||||||||||||||||

| Forms, printing and supplies | 203 | 200 | 187 | 403 | 392 | |||||||||||||||||||||||||||

| Franchise and shares tax | 483 | 476 | 487 | 959 | 975 | |||||||||||||||||||||||||||

| Regulatory fees | 502 | 516 | 509 | 1,018 | 978 | |||||||||||||||||||||||||||

| Foreclosed assets, net | 419 | 227 | 89 | 646 | 154 | |||||||||||||||||||||||||||

Amortization of acquisition intangible |

269 | 293 | 329 | 562 | 682 | |||||||||||||||||||||||||||

Reversal for credit losses on unfunded commitments |

(970) | — | (134) | (970) | (134) | |||||||||||||||||||||||||||

| Other expenses | 2,181 | 1,178 | 1,329 | 3,359 | 2,538 | |||||||||||||||||||||||||||

| Total noninterest expense | 22,407 | 21,579 | 21,808 | 43,986 | 42,676 | |||||||||||||||||||||||||||

Income before income tax expense |

14,171 | 13,785 | 10,079 | 27,956 | 21,520 | |||||||||||||||||||||||||||

| Income tax expense | 2,841 | 2,821 | 1,961 | 5,662 | 4,203 | |||||||||||||||||||||||||||

| Net income | $ | 11,330 | $ | 10,964 | $ | 8,118 | $ | 22,294 | $ | 17,317 | ||||||||||||||||||||||

| Earnings per share - basic | $ | 1.47 | $ | 1.38 | $ | 1.02 | $ | 2.85 | $ | 2.17 | ||||||||||||||||||||||

| Earnings per share - diluted | $ | 1.45 | $ | 1.37 | $ | 1.02 | $ | 2.82 | $ | 2.16 | ||||||||||||||||||||||

Cash dividends declared per common share |

$ | 0.27 | $ | 0.27 | $ | 0.25 | $ | 0.54 | $ | 0.50 | ||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| SUMMARY FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

Three Months Ended |

Six Months Ended | |||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 6/30/2025 | 3/31/2025 | 6/30/2024 | 6/30/2025 | 6/30/2024 | |||||||||||||||||||||||||||

| EARNINGS DATA | ||||||||||||||||||||||||||||||||

| Total interest income | $ | 48,629 | $ | 47,201 | $ | 45,458 | $ | 95,830 | $ | 89,584 | ||||||||||||||||||||||

| Total interest expense | 15,278 | 15,452 | 16,065 | 30,730 | 31,290 | |||||||||||||||||||||||||||

| Net interest income | 33,351 | 31,749 | 29,393 | 65,100 | 58,294 | |||||||||||||||||||||||||||

| Provision for loan losses | 489 | 394 | 1,261 | 883 | 1,402 | |||||||||||||||||||||||||||

| Total noninterest income | 3,716 | 4,009 | 3,755 | 7,725 | 7,304 | |||||||||||||||||||||||||||

| Total noninterest expense | 22,407 | 21,579 | 21,808 | 43,986 | 42,676 | |||||||||||||||||||||||||||

| Income tax expense | 2,841 | 2,821 | 1,961 | 5,662 | 4,203 | |||||||||||||||||||||||||||

| Net income | $ | 11,330 | $ | 10,964 | $ | 8,118 | $ | 22,294 | $ | 17,317 | ||||||||||||||||||||||

| AVERAGE BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||

| Total assets | $ | 3,474,762 | $ | 3,449,472 | $ | 3,367,207 | $ | 3,462,187 | $ | 3,350,545 | ||||||||||||||||||||||

| Total interest-earning assets | 3,261,733 | 3,240,619 | 3,167,186 | 3,251,235 | 3,149,904 | |||||||||||||||||||||||||||

| Total loans | 2,764,065 | 2,745,212 | 2,652,331 | 2,754,691 | 2,627,636 | |||||||||||||||||||||||||||

| PPP loans | 330 | 1,320 | 5,156 | 822 | 5,274 | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 2,087,781 | 2,038,681 | 1,965,181 | 2,063,367 | 1,951,414 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 2,261,916 | 2,279,363 | 2,206,612 | 2,270,592 | 2,198,104 | |||||||||||||||||||||||||||

| Total deposits | 2,863,683 | 2,772,295 | 2,716,957 | 2,818,241 | 2,698,933 | |||||||||||||||||||||||||||

| Total shareholders' equity | 404,367 | 403,504 | 373,139 | 403,938 | 371,950 | |||||||||||||||||||||||||||

| PER SHARE DATA | ||||||||||||||||||||||||||||||||

| Earnings per share - basic | $ | 1.47 | $ | 1.38 | $ | 1.02 | $ | 2.85 | $ | 2.17 | ||||||||||||||||||||||

| Earnings per share - diluted | 1.45 | 1.37 | 1.02 | 2.82 | 2.16 | |||||||||||||||||||||||||||

| Book value at period end | 52.36 | 50.82 | 46.51 | 52.36 | 46.51 | |||||||||||||||||||||||||||

| Tangible book value at period end | 41.54 | 40.13 | 35.90 | 41.54 | 35.90 | |||||||||||||||||||||||||||

| Shares outstanding at period end | 7,808,421 | 7,926,331 | 8,081,344 | 7,808,421 | 8,081,344 | |||||||||||||||||||||||||||

| Weighted average shares outstanding | ||||||||||||||||||||||||||||||||

| Basic | 7,707,423 | 7,949,477 | 7,972,445 | 7,827,781 | 7,978,381 | |||||||||||||||||||||||||||

| Diluted | 7,781,021 | 8,026,815 | 8,018,908 | 7,903,239 | 8,029,206 | |||||||||||||||||||||||||||

SELECTED RATIOS (1) |

||||||||||||||||||||||||||||||||

| Return on average assets | 1.31 | % | 1.29 | % | 0.97 | % | 1.30 | % | 1.04 | % | ||||||||||||||||||||||

| Return on average equity | 11.24 | 11.02 | 8.75 | 11.13 | 9.36 | |||||||||||||||||||||||||||

| Common equity ratio | 11.71 | 11.56 | 11.02 | 11.71 | 11.02 | |||||||||||||||||||||||||||

Efficiency ratio (2) |

60.45 | 60.35 | 65.79 | 60.40 | 65.06 | |||||||||||||||||||||||||||

| Average equity to average assets | 11.64 | 11.70 | 11.08 | 11.67 | 11.10 | |||||||||||||||||||||||||||

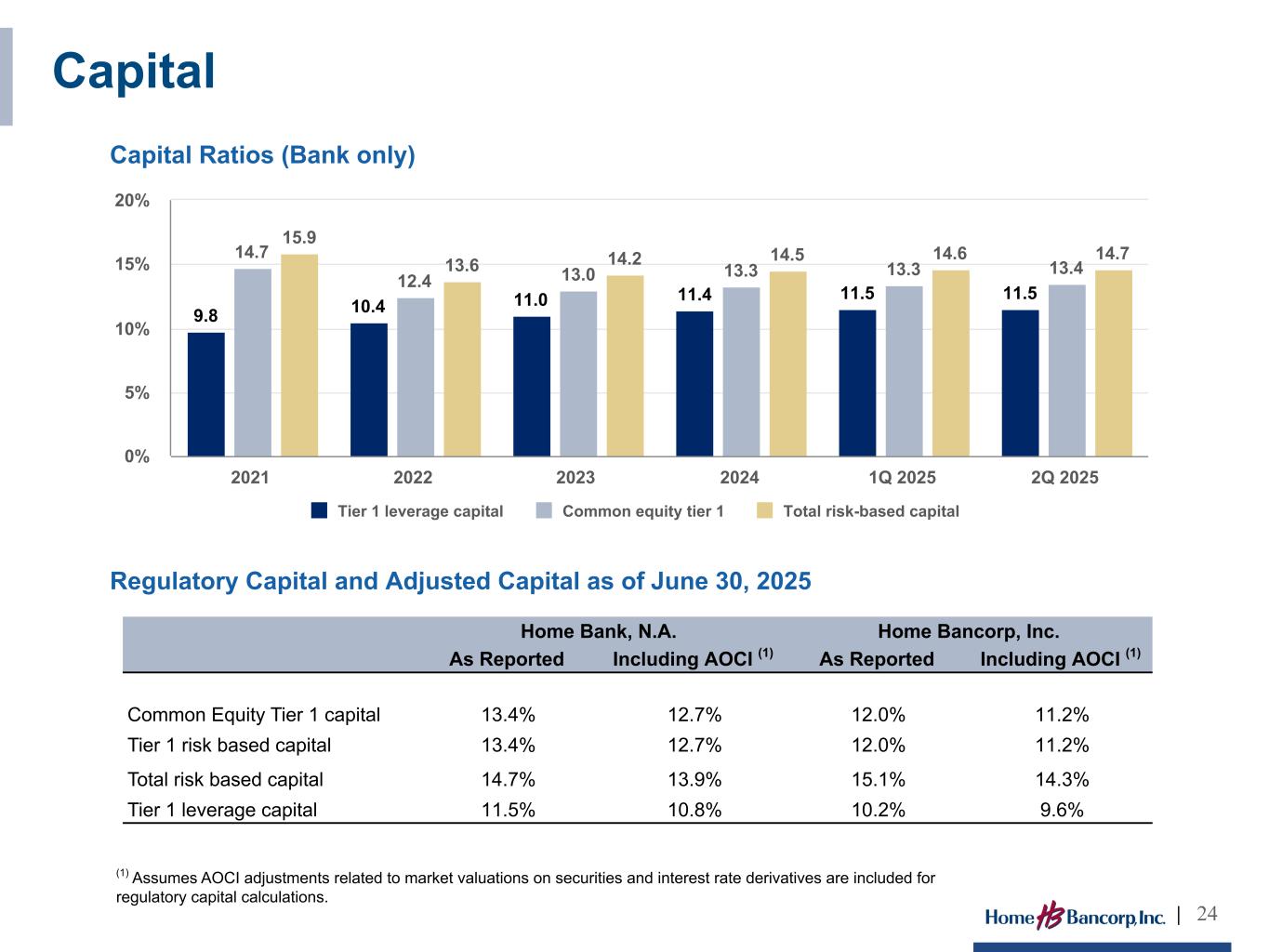

Tier 1 leverage capital ratio (3) |

11.47 | 11.48 | 11.22 | 11.47 | 11.22 | |||||||||||||||||||||||||||

Total risk-based capital ratio (3) |

14.66 | 14.58 | 14.39 | 14.66 | 14.39 | |||||||||||||||||||||||||||

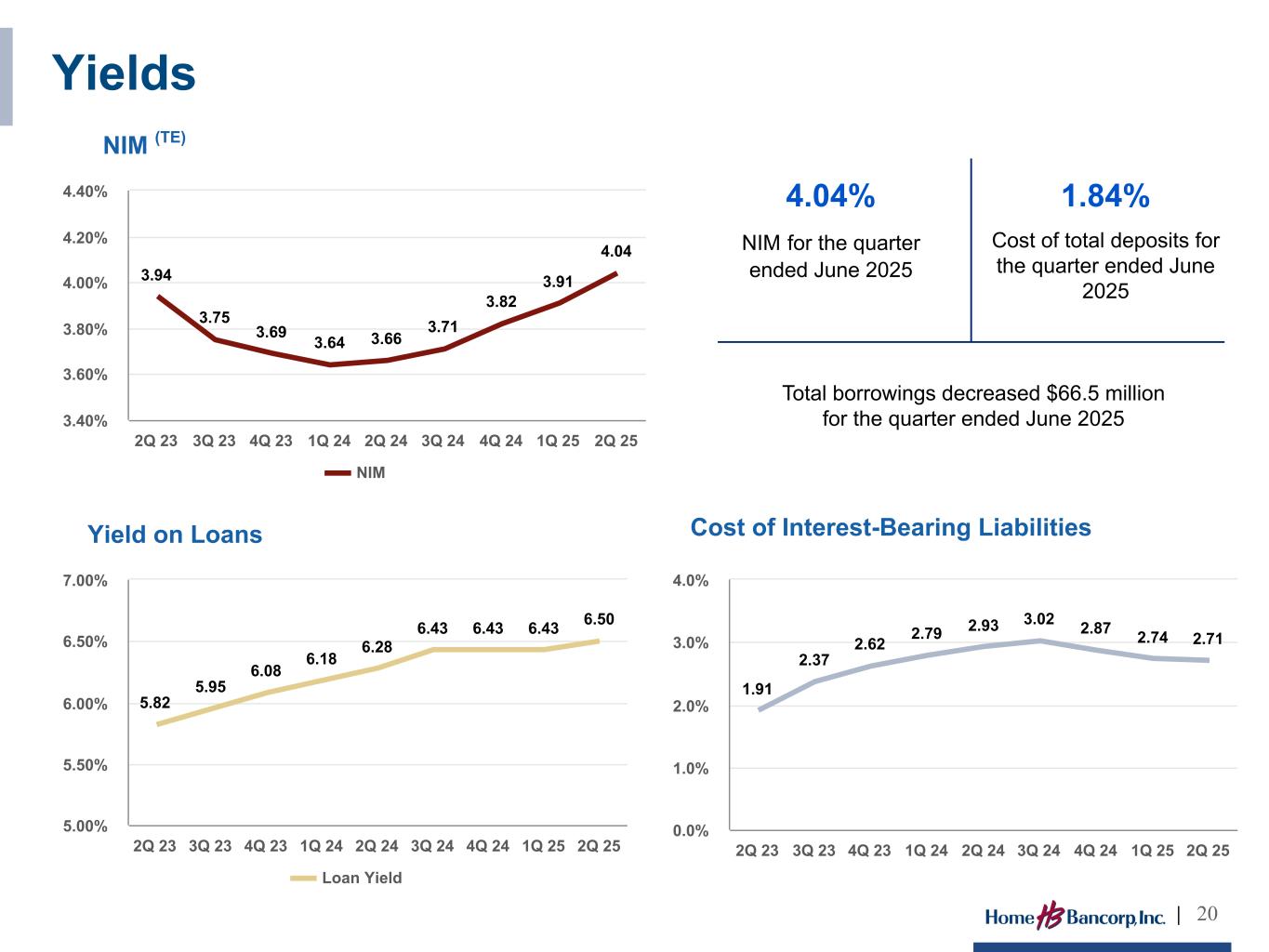

Net interest margin (4) |

4.04 | 3.91 | 3.66 | 3.98 | 3.65 | |||||||||||||||||||||||||||

SELECTED NON-GAAP RATIOS (1) |

||||||||||||||||||||||||||||||||

Tangible common equity ratio (5) |

9.52 | % | 9.35 | % | 8.73 | % | 9.52 | % | 8.73 | % | ||||||||||||||||||||||

Return on average tangible common equity (6) |

14.48 | 14.25 | 11.73 | 14.37 | 12.56 | |||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Consolidated Net Interest Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6/30/2025 | 3/31/2025 | 6/30/2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance | Interest | Average Yield/ Rate | Average Balance | Interest | Average Yield/ Rate | Average Balance | Interest | Average Yield/ Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans receivable | $ | 2,764,065 | $ | 45,287 | 6.50 | % | $ | 2,745,212 | $ | 44,032 | 6.43 | % | $ | 2,652,331 | $ | 41,999 | 6.28 | % | ||||||||||||||||||||||||||||||||||||||

Investment securities (TE)(1) |

426,601 | 2,596 | 2.45 | 439,556 | 2,664 | 2.44 | 463,500 | 2,740 | 2.38 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 71,067 | 746 | 4.21 | 55,851 | 505 | 3.67 | 51,355 | 719 | 5.64 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 3,261,733 | $ | 48,629 | 5.92 | % | $ | 3,240,619 | $ | 47,201 | 5.84 | % | $ | 3,167,186 | $ | 45,458 | 5.70 | % | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings, checking, and money market | $ | 1,296,541 | $ | 5,531 | 1.71 | % | $ | 1,306,602 | $ | 5,401 | 1.68 | % | $ | 1,260,491 | $ | 5,108 | 1.63 | % | ||||||||||||||||||||||||||||||||||||||

| Certificates of deposit | 791,240 | 7,611 | 3.86 | 732,079 | 7,221 | 4.00 | 704,690 | 8,026 | 4.58 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 2,087,781 | 13,142 | 2.52 | 2,038,681 | 12,622 | 2.51 | 1,965,181 | 13,134 | 2.69 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 5,572 | 53 | 3.84 | 5,539 | 53 | 3.89 | 140,610 | 1,656 | 4.74 | |||||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debt | 54,540 | 844 | 6.20 | 54,485 | 845 | 6.20 | 54,322 | 844 | 6.22 | |||||||||||||||||||||||||||||||||||||||||||||||

| FHLB advances | 114,023 | 1,239 | 4.30 | 180,658 | 1,932 | 4.28 | 46,499 | 431 | 3.69 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 2,261,916 | $ | 15,278 | 2.71 | % | $ | 2,279,363 | $ | 15,452 | 2.74 | % | $ | 2,206,612 | $ | 16,065 | 2.93 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 775,902 | $ | 733,613 | $ | 751,776 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread (TE)(1) |

3.21 | % | 3.10 | % | 2.77 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (TE)(1) |

4.04 | % | 3.91 | % | 3.66 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||

Consolidated Net Interest Margin | ||||||||||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||||||||||||||||

| 6/30/2025 | 6/30/2024 | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance | Interest | Average Yield/ Rate | Average Balance | Interest | Average Yield/ Rate | ||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

| Loans receivable | $ | 2,754,691 | $ | 89,319 | 6.46 | % | $ | 2,627,636 | $ | 82,566 | 6.23 | % | ||||||||||||||||||||||||||

Investment securities (TE)(1) |

433,043 | 5,260 | 2.45 | 468,039 | 5,528 | 2.38 | ||||||||||||||||||||||||||||||||

| Other interest-earning assets | 63,501 | 1,251 | 3.97 | 54,229 | 1,490 | 5.53 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 3,251,235 | $ | 95,830 | 5.88 | % | $ | 3,149,904 | $ | 89,584 | 5.65 | % | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Savings, checking, and money market | $ | 1,301,544 | $ | 10,932 | 1.69 | % | $ | 1,264,892 | $ | 9,908 | 1.58 | % | ||||||||||||||||||||||||||

| Certificates of deposit | 761,823 | 14,832 | 3.93 | 686,522 | 15,358 | 4.50 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 2,063,367 | 25,764 | 2.52 | 1,951,414 | 25,266 | 2.60 | ||||||||||||||||||||||||||||||||

| Other borrowings | 5,556 | 106 | 3.86 | 133,294 | 3,142 | 4.74 | ||||||||||||||||||||||||||||||||

| Subordinated debt | 54,512 | 1,689 | 6.20 | 54,295 | 1,689 | 6.22 | ||||||||||||||||||||||||||||||||

| FHLB advances | 147,157 | 3,171 | 4.29 | 59,101 | 1,193 | 4.02 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 2,270,592 | $ | 30,730 | 2.72 | % | $ | 2,198,104 | $ | 31,290 | 2.86 | % | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 754,874 | $ | 747,519 | ||||||||||||||||||||||||||||||||||

Net interest spread (TE)(1) |

3.16 | % | 2.79 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (TE)(1) |

3.98 | % | 3.65 | % | ||||||||||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

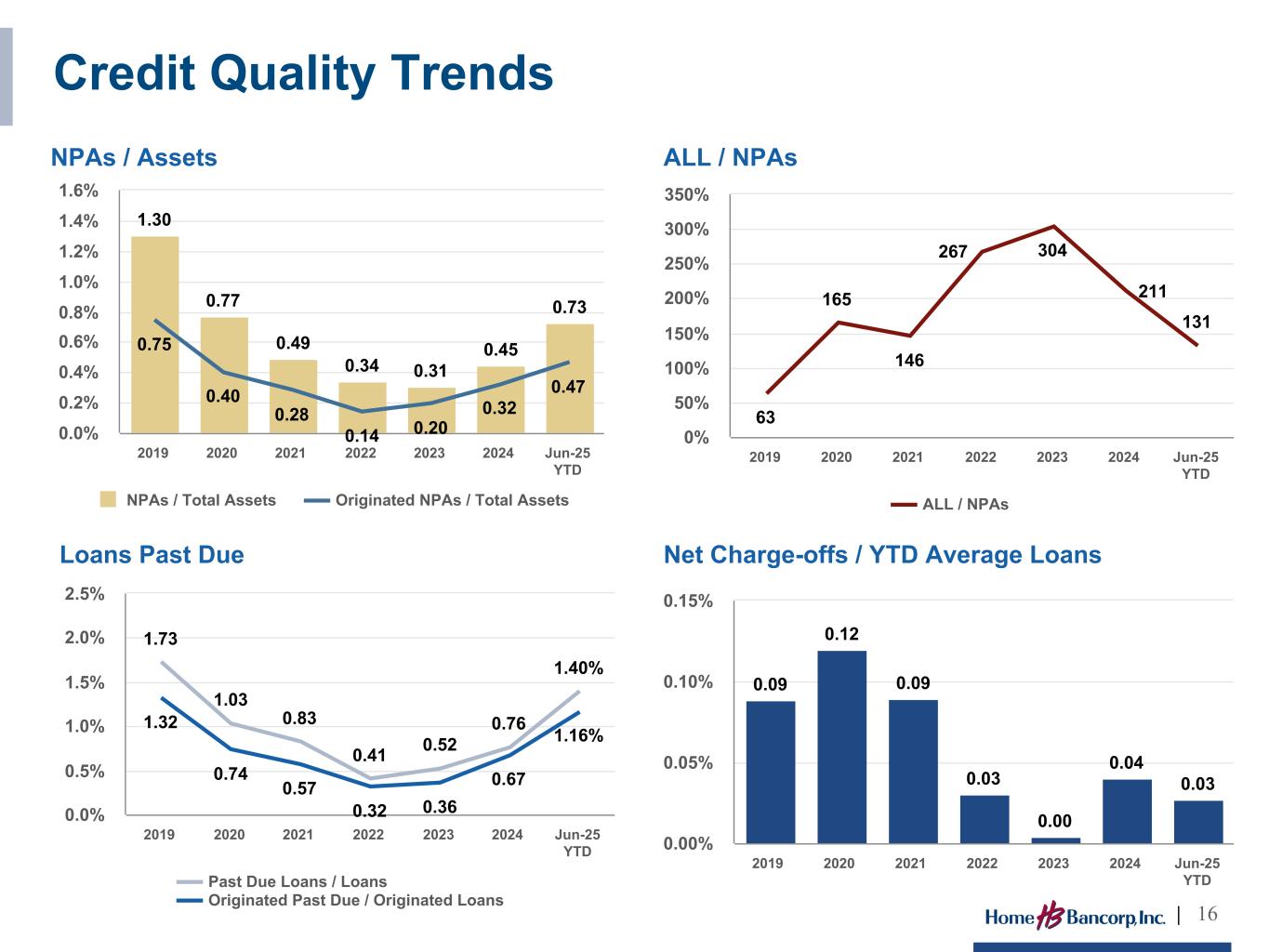

SUMMARY CREDIT QUALITY INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

Three Months Ended |

||||||||||||||||||||||||||||||||

| 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | ||||||||||||||||||||||||||||

CREDIT QUALITY (1) |

||||||||||||||||||||||||||||||||

Nonaccrual loans: |

||||||||||||||||||||||||||||||||

One- to four-family first mortgage |

$ | 6,272 | $ | 6,368 | $ | 7,039 | $ | 7,750 | $ | 6,892 | ||||||||||||||||||||||

| Home equity loans and lines | 1,033 | 372 | 279 | 208 | 224 | |||||||||||||||||||||||||||

| Commercial real estate | 7,669 | 4,349 | 3,304 | 7,064 | 8,110 | |||||||||||||||||||||||||||

| Construction and land | 6,103 | 5,584 | 1,622 | 2,127 | 297 | |||||||||||||||||||||||||||

| Multi-family residential | 916 | 930 | — | — | 238 | |||||||||||||||||||||||||||

| Commercial and industrial | 1,312 | 1,206 | 1,311 | 777 | 810 | |||||||||||||||||||||||||||

| Consumer | 35 | 161 | 27 | 129 | 246 | |||||||||||||||||||||||||||

Total nonaccrual loans |

$ | 23,340 | $ | 18,970 | $ | 13,582 | $ | 18,055 | $ | 16,817 | ||||||||||||||||||||||

| Accruing loans 90 days or more past due | 12 | 77 | 16 | 34 | 1 | |||||||||||||||||||||||||||

| Total nonperforming loans | 23,352 | 19,047 | 13,598 | 18,089 | 16,818 | |||||||||||||||||||||||||||

| Foreclosed assets and ORE | 2,077 | 2,424 | 2,010 | 267 | 231 | |||||||||||||||||||||||||||

| Total nonperforming assets | $ | 25,429 | $ | 21,471 | $ | 15,608 | $ | 18,356 | $ | 17,049 | ||||||||||||||||||||||

| Nonperforming assets to total assets | 0.73 | % | 0.62 | % | 0.45 | % | 0.53 | % | 0.50 | % | ||||||||||||||||||||||

| Nonperforming loans to total assets | 0.67 | 0.55 | 0.39 | 0.53 | 0.49 | |||||||||||||||||||||||||||

| Nonperforming loans to total loans | 0.84 | 0.69 | 0.50 | 0.68 | 0.63 | |||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||

Allowance for loan losses: |

||||||||||||||||||||||||||||||||

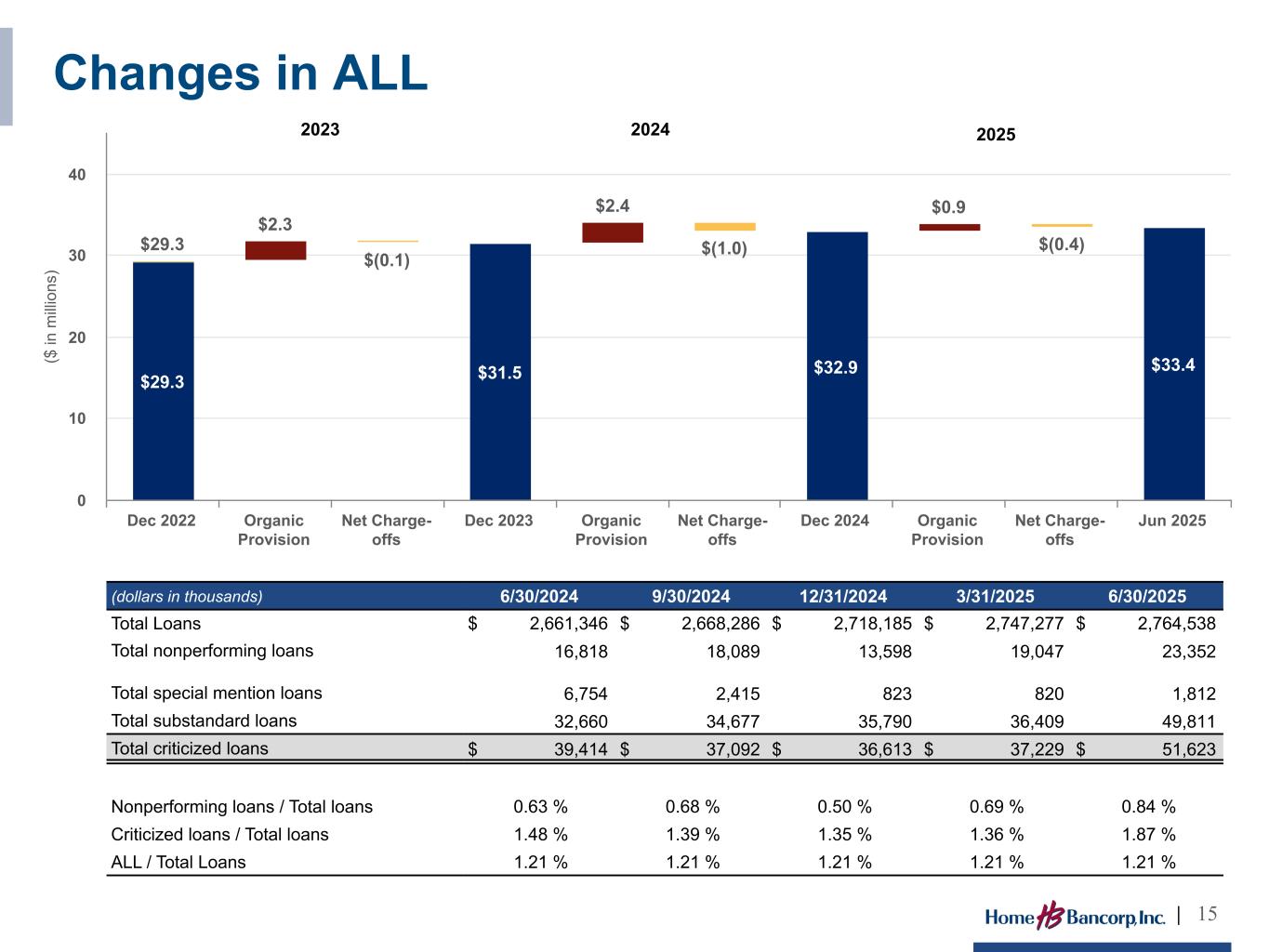

Beginning balance |

$ | 33,278 | $ | 32,916 | $ | 32,278 | $ | 32,212 | $ | 31,461 | ||||||||||||||||||||||

Provision for loan losses |

489 | 394 | 873 | 140 | 1,261 | |||||||||||||||||||||||||||

Charge-offs |

(460) | (226) | (255) | (215) | (574) | |||||||||||||||||||||||||||

Recoveries |

125 | 194 | 20 | 141 | 64 | |||||||||||||||||||||||||||

Net charge-offs |

(335) | (32) | (235) | (74) | (510) | |||||||||||||||||||||||||||

Ending balance |

$ | 33,432 | $ | 33,278 | $ | 32,916 | $ | 32,278 | $ | 32,212 | ||||||||||||||||||||||

Reserve for unfunded lending commitments(2) |

||||||||||||||||||||||||||||||||

Beginning balance |

$ | 2,700 | $ | 2,700 | $ | 2,460 | $ | 2,460 | $ | 2,594 | ||||||||||||||||||||||

(Reversal) provision for losses on unfunded lending commitments |

(970) | — | 240 | — | (134) | |||||||||||||||||||||||||||

Ending balance |

$ | 1,730 | $ | 2,700 | $ | 2,700 | $ | 2,460 | $ | 2,460 | ||||||||||||||||||||||

| Total allowance for credit losses | 35,162 | 35,978 | 35,616 | 34,738 | 34,672 | |||||||||||||||||||||||||||

Total loans |

$ | 2,764,538 | $ | 2,747,277 | $ | 2,718,185 | $ | 2,668,286 | $ | 2,661,346 | ||||||||||||||||||||||

Total unfunded commitments |

492,306 | 508,864 | 516,785 | 527,333 | 509,835 | |||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

SUMMARY CREDIT QUALITY INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

Three Months Ended |

||||||||||||||||||||||||||||||||

| 6/30/2025 | 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | ||||||||||||||||||||||||||||

| Allowance for loan losses to nonperforming assets | 131.47 | % | 154.99 | % | 210.89 | % | 175.84 | % | 188.94 | % | ||||||||||||||||||||||

| Allowance for loan losses to nonperforming loans | 143.17 | 174.72 | 242.07 | 178.44 | 191.53 | |||||||||||||||||||||||||||

| Allowance for loan losses to total loans | 1.21 | 1.21 | 1.21 | 1.21 | 1.21 | |||||||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.27 | 1.31 | 1.31 | 1.30 | 1.30 | |||||||||||||||||||||||||||

| Year-to-date loan charge-offs | $ | (686) | $ | (226) | $ | (1,285) | $ | (1,030) | $ | (815) | ||||||||||||||||||||||

| Year-to-date loan recoveries | 319 | 194 | 249 | 229 | 88 | |||||||||||||||||||||||||||

| Year-to-date net loan charge-offs | $ | (367) | $ | (32) | $ | (1,036) | $ | (801) | $ | (727) | ||||||||||||||||||||||

| Annualized YTD net loan charge-offs to average loans | (0.03) | % | — | % | (0.04) | % | (0.04) | % | (0.06) | % | ||||||||||||||||||||||