| Date of Report (Date of earliest event reported) | October 17, 2024 | ||||

| Home Bancorp, Inc. | ||

| (Exact name of registrant as specified in its charter) | ||

| Louisiana | 001-34190 | 71-1051785 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

503 Kaliste Saloom Road, Lafayette, Louisiana |

70508 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

| Registrant’s telephone number, including area code | (337) 237-1960 |

||||

| N/A | ||

| (Former name or former address, if changed since last report) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock | HBCP | Nasdaq Stock Market | ||||||

| Item 2.02 | Results of Operations and Financial Condition | ||||

Item 7.01 |

Regulation FD Disclosure |

||||

| Item 8.01 | Other Events | ||||

| Item 9.01 | Financial Statements and Exhibits | ||||

| Exhibit Number | Description | |||||||

| 104 | The cover page of Home Bancorp Inc.'s Form 8-K is formatted in Inline XBRL. | |||||||

| HOME BANCORP, INC. | |||||||||||

Date: October 17, 2024 |

By: | /s/ John W. Bordelon | |||||||||

| John W. Bordelon | |||||||||||

| Chairman of the Board, President and Chief Executive Officer | |||||||||||

| Release Date: | October 17, 2024 | ||||

| For Immediate Release | |||||

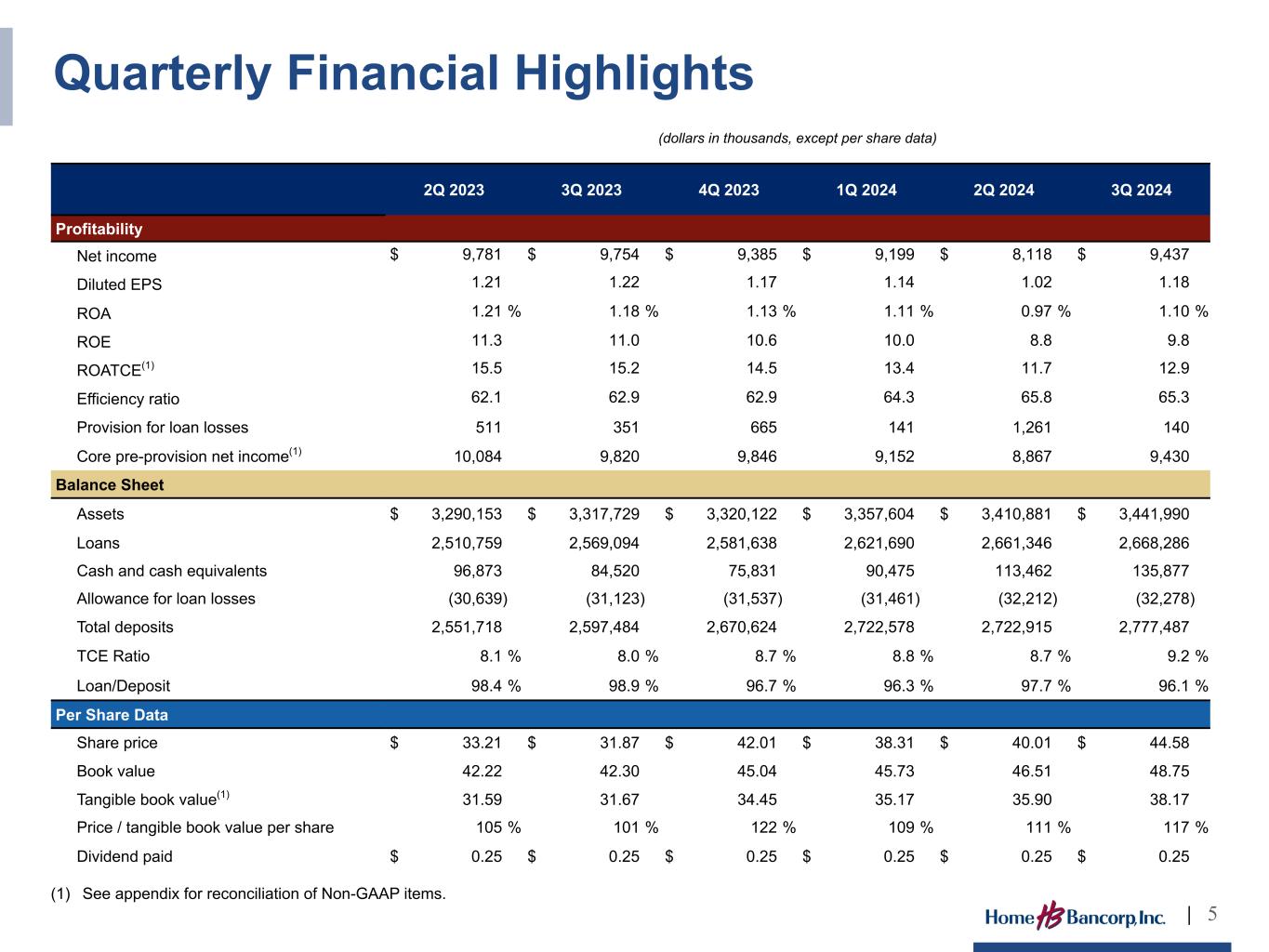

| (dollars in thousands) | 9/30/2024 | 6/30/2024 | Increase (Decrease) | |||||||||||||||||||||||

| Real estate loans: | ||||||||||||||||||||||||||

| One- to four-family first mortgage | $ | 502,784 | $ | 446,255 | $ | 56,529 | 13 | % | ||||||||||||||||||

| Home equity loans and lines | 80,935 | 70,617 | 10,318 | 15 | ||||||||||||||||||||||

| Commercial real estate | 1,143,152 | 1,228,757 | (85,605) | (7) | ||||||||||||||||||||||

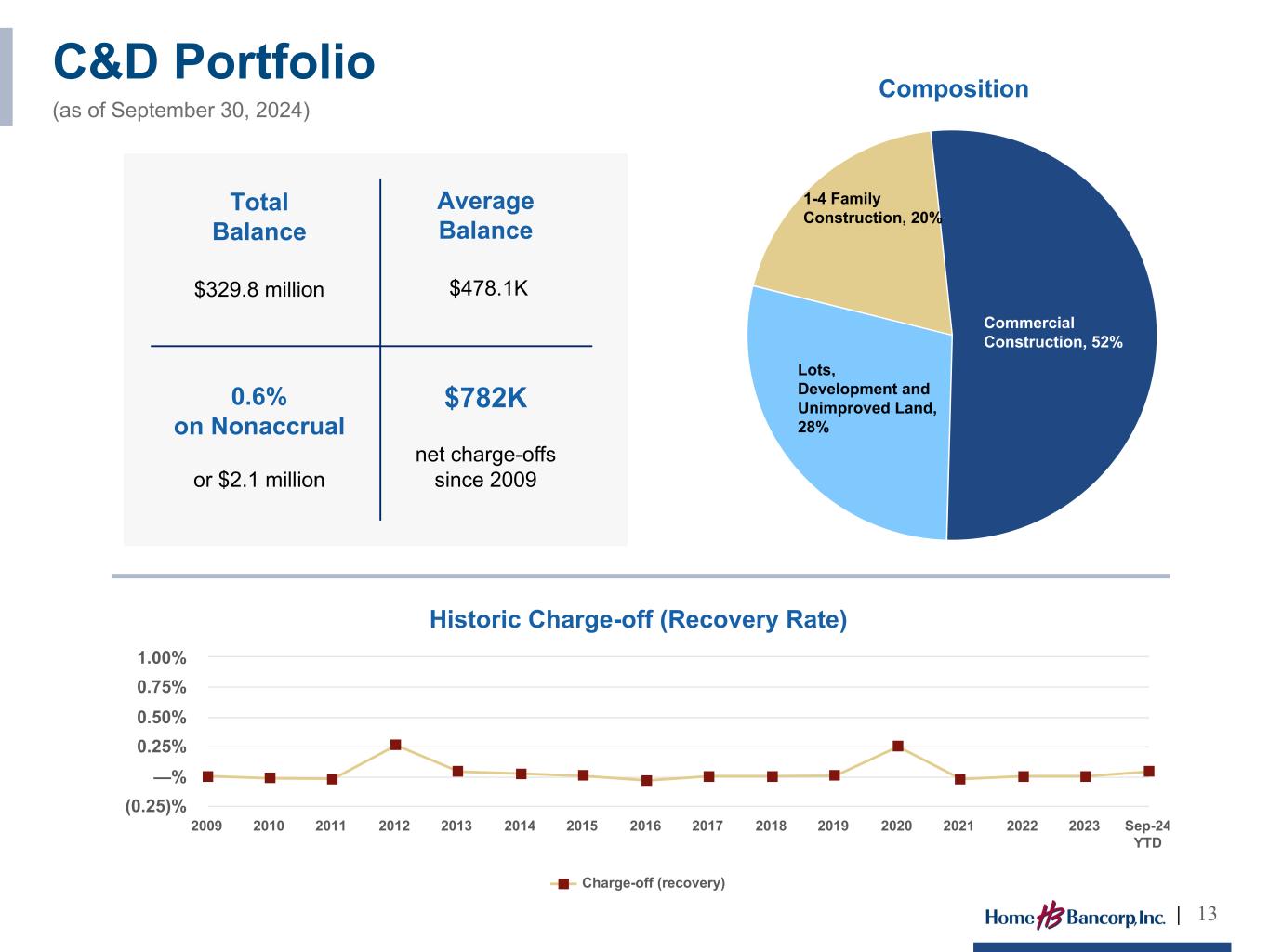

| Construction and land | 329,787 | 328,938 | 849 | — | ||||||||||||||||||||||

| Multi-family residential | 169,443 | 126,922 | 42,521 | 34 | ||||||||||||||||||||||

| Total real estate loans | 2,226,101 | 2,201,489 | 24,612 | 1 | ||||||||||||||||||||||

| Other loans: | ||||||||||||||||||||||||||

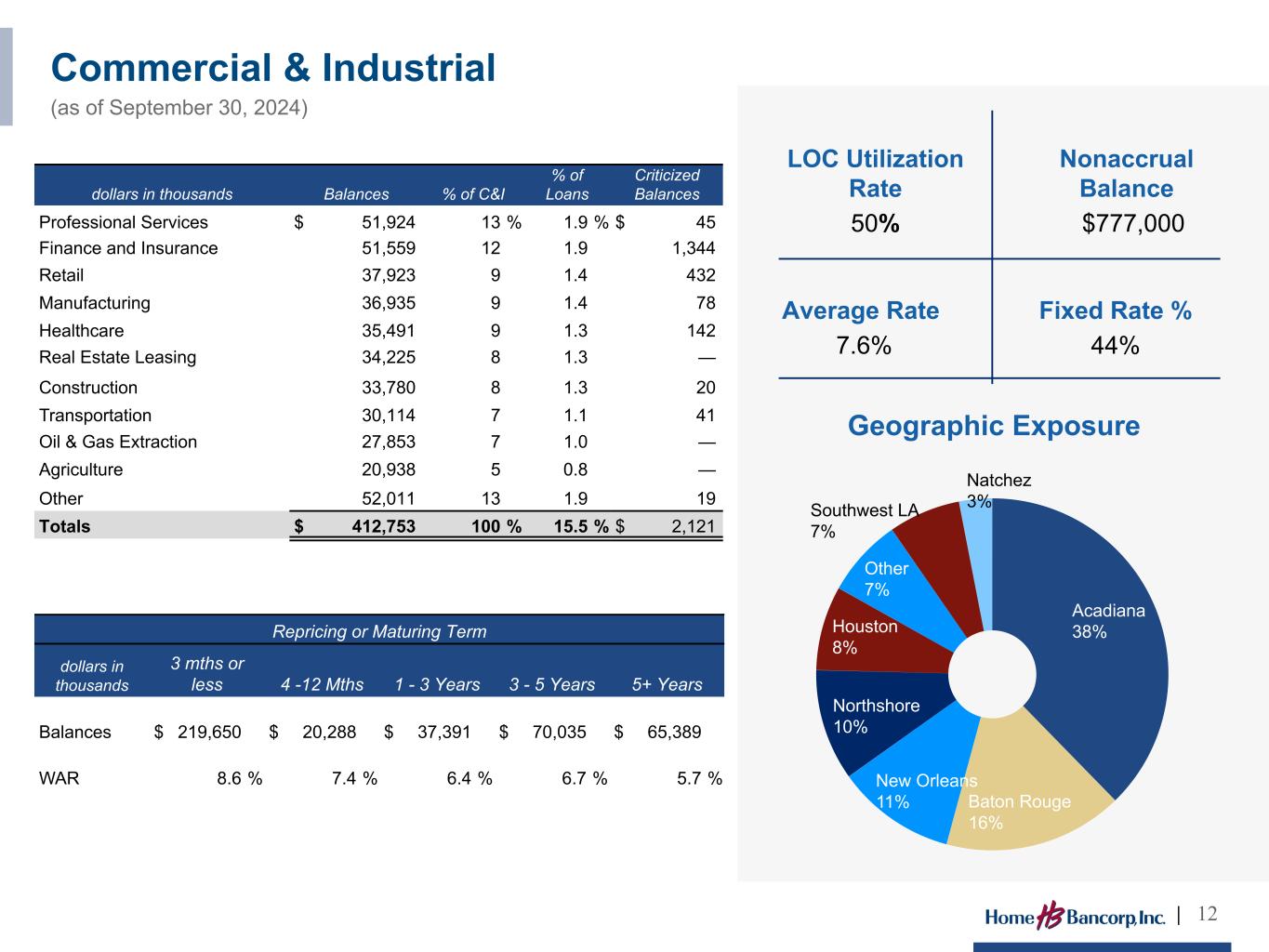

| Commercial and industrial | 412,753 | 427,339 | (14,586) | (3) | ||||||||||||||||||||||

| Consumer | 29,432 | 32,518 | (3,086) | (9) | ||||||||||||||||||||||

| Total other loans | 442,185 | 459,857 | (17,672) | (4) | ||||||||||||||||||||||

| Total loans | $ | 2,668,286 | $ | 2,661,346 | $ | 6,940 | — | % | ||||||||||||||||||

| September 30, 2024 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 494,180 | $ | 859 | $ | 7,745 | $ | 502,784 | ||||||||||||||||||

| Home equity loans and lines | 80,729 | — | 206 | 80,935 | ||||||||||||||||||||||

| Commercial real estate | 1,125,331 | — | 17,821 | 1,143,152 | ||||||||||||||||||||||

| Construction and land | 323,751 | 308 | 5,728 | 329,787 | ||||||||||||||||||||||

| Multi-family residential | 168,513 | — | 930 | 169,443 | ||||||||||||||||||||||

| Commercial and industrial | 409,388 | 1,248 | 2,117 | 412,753 | ||||||||||||||||||||||

| Consumer | 29,302 | — | 130 | 29,432 | ||||||||||||||||||||||

| Total | $ | 2,631,194 | $ | 2,415 | $ | 34,677 | $ | 2,668,286 | ||||||||||||||||||

| June 30, 2024 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 437,753 | $ | 1,417 | $ | 7,085 | $ | 446,255 | ||||||||||||||||||

| Home equity loans and lines | 70,394 | — | 223 | 70,617 | ||||||||||||||||||||||

| Commercial real estate | 1,207,421 | 3,469 | 17,867 | 1,228,757 | ||||||||||||||||||||||

| Construction and land | 324,729 | 310 | 3,899 | 328,938 | ||||||||||||||||||||||

| Multi-family residential | 125,689 | 65 | 1,168 | 126,922 | ||||||||||||||||||||||

| Commercial and industrial | 423,673 | 1,493 | 2,173 | 427,339 | ||||||||||||||||||||||

| Consumer | 32,273 | — | 245 | 32,518 | ||||||||||||||||||||||

| Total | $ | 2,621,932 | $ | 6,754 | $ | 32,660 | $ | 2,661,346 | ||||||||||||||||||

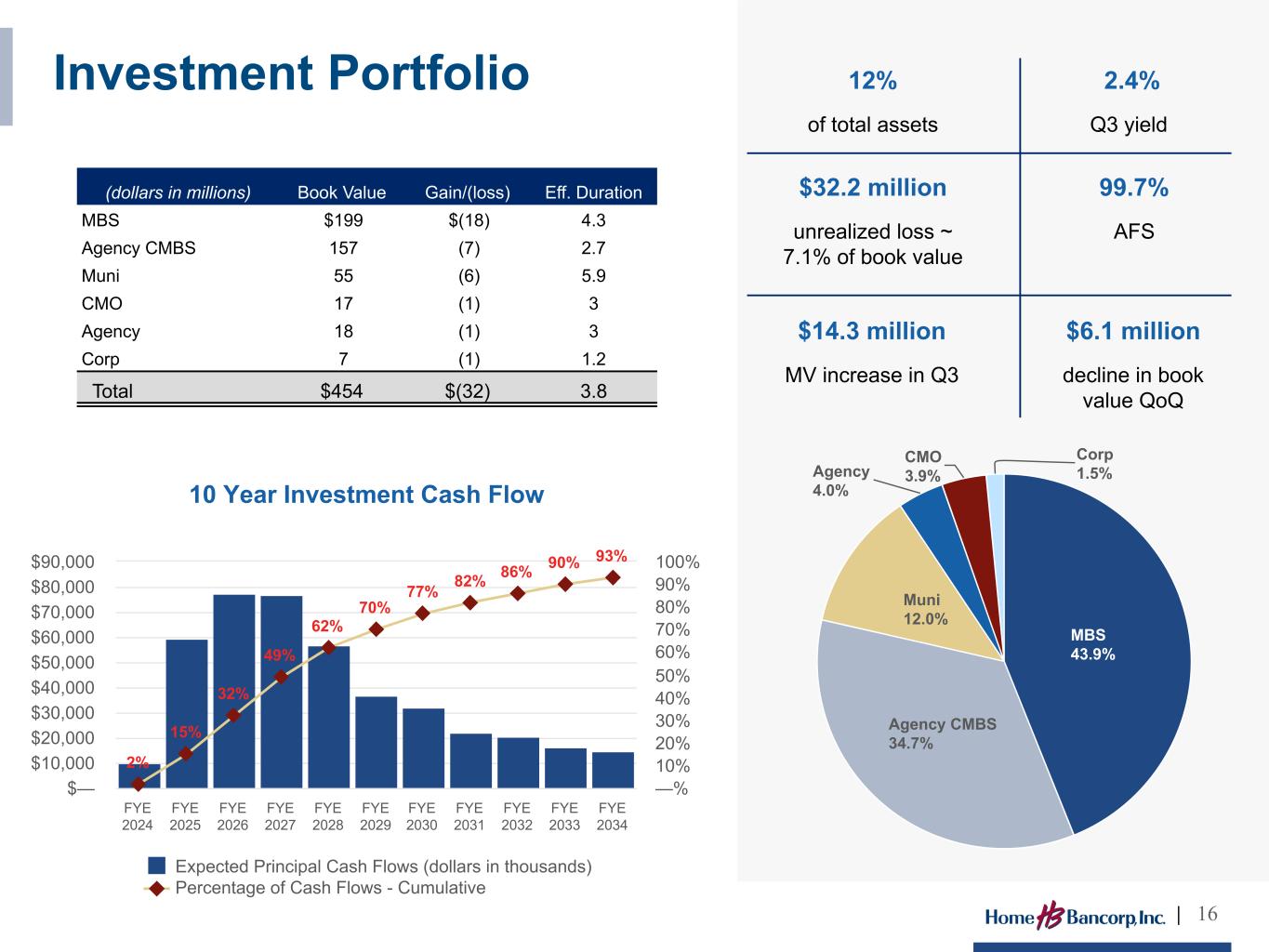

| (dollars in thousands) | Amortized Cost | Fair Value | ||||||||||||

| Available for sale: | ||||||||||||||

| U.S. agency mortgage-backed | $ | 296,894 | $ | 273,581 | ||||||||||

| Collateralized mortgage obligations | 77,351 | 75,438 | ||||||||||||

| Municipal bonds | 53,568 | 47,770 | ||||||||||||

| U.S. government agency | 18,139 | 17,490 | ||||||||||||

| Corporate bonds | 6,984 | 6,444 | ||||||||||||

| Total available for sale | $ | 452,936 | $ | 420,723 | ||||||||||

| Held to maturity: | ||||||||||||||

| Municipal bonds | $ | 1,065 | $ | 1,066 | ||||||||||

| Total held to maturity | $ | 1,065 | $ | 1,066 | ||||||||||

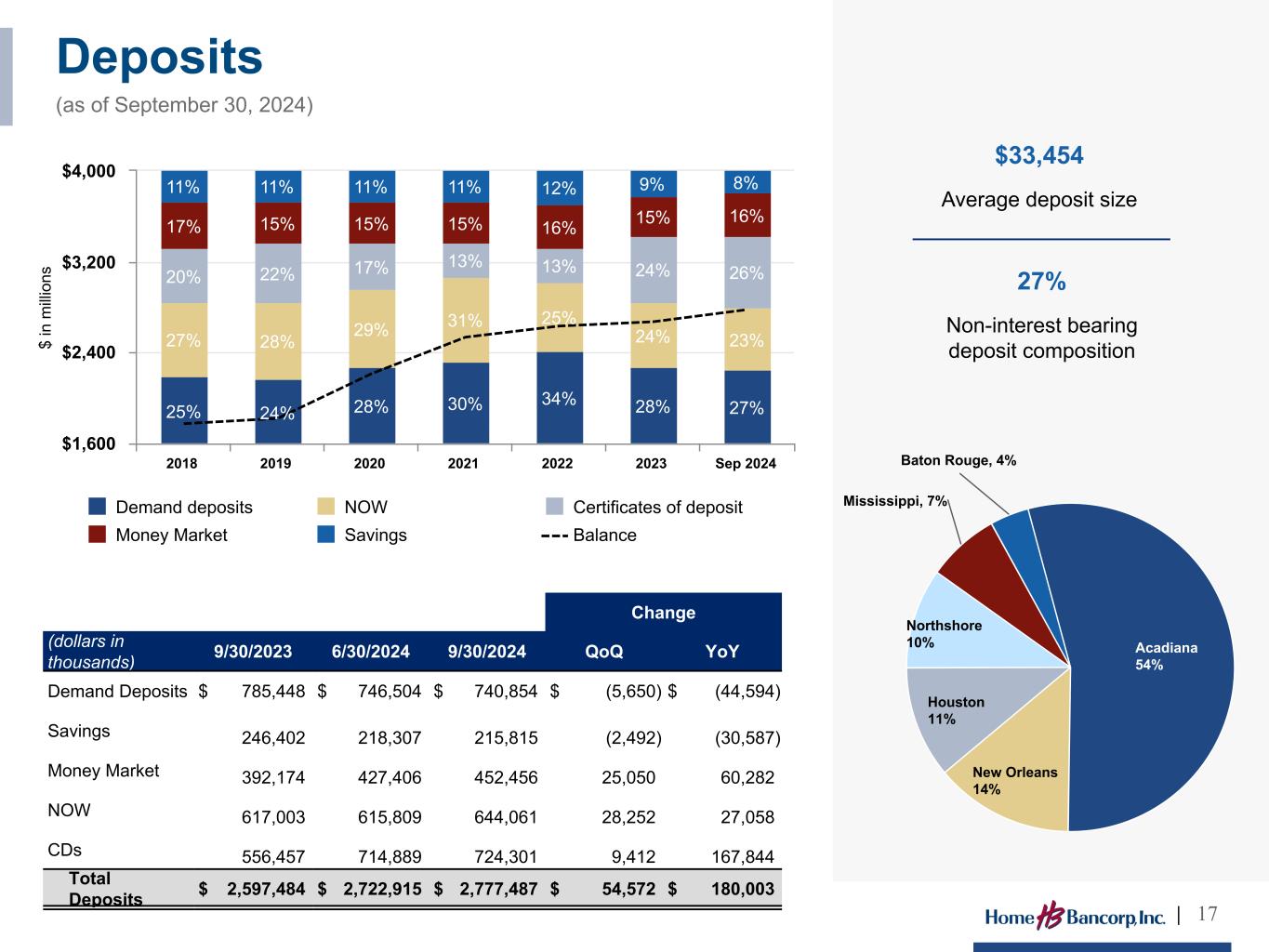

| (dollars in thousands) | 9/30/2024 | 6/30/2024 | Increase (Decrease) | |||||||||||||||||||||||

| Demand deposits | $ | 740,854 | $ | 746,504 | $ | (5,650) | (1) | % | ||||||||||||||||||

| Savings | 215,815 | 218,307 | (2,492) | (1) | ||||||||||||||||||||||

| Money market | 452,456 | 427,406 | 25,050 | 6 | ||||||||||||||||||||||

| NOW | 644,061 | 615,809 | 28,252 | 5 | ||||||||||||||||||||||

| Certificates of deposit | 724,301 | 714,889 | 9,412 | 1 | ||||||||||||||||||||||

| Total deposits | $ | 2,777,487 | $ | 2,722,915 | $ | 54,572 | 2 | % | ||||||||||||||||||

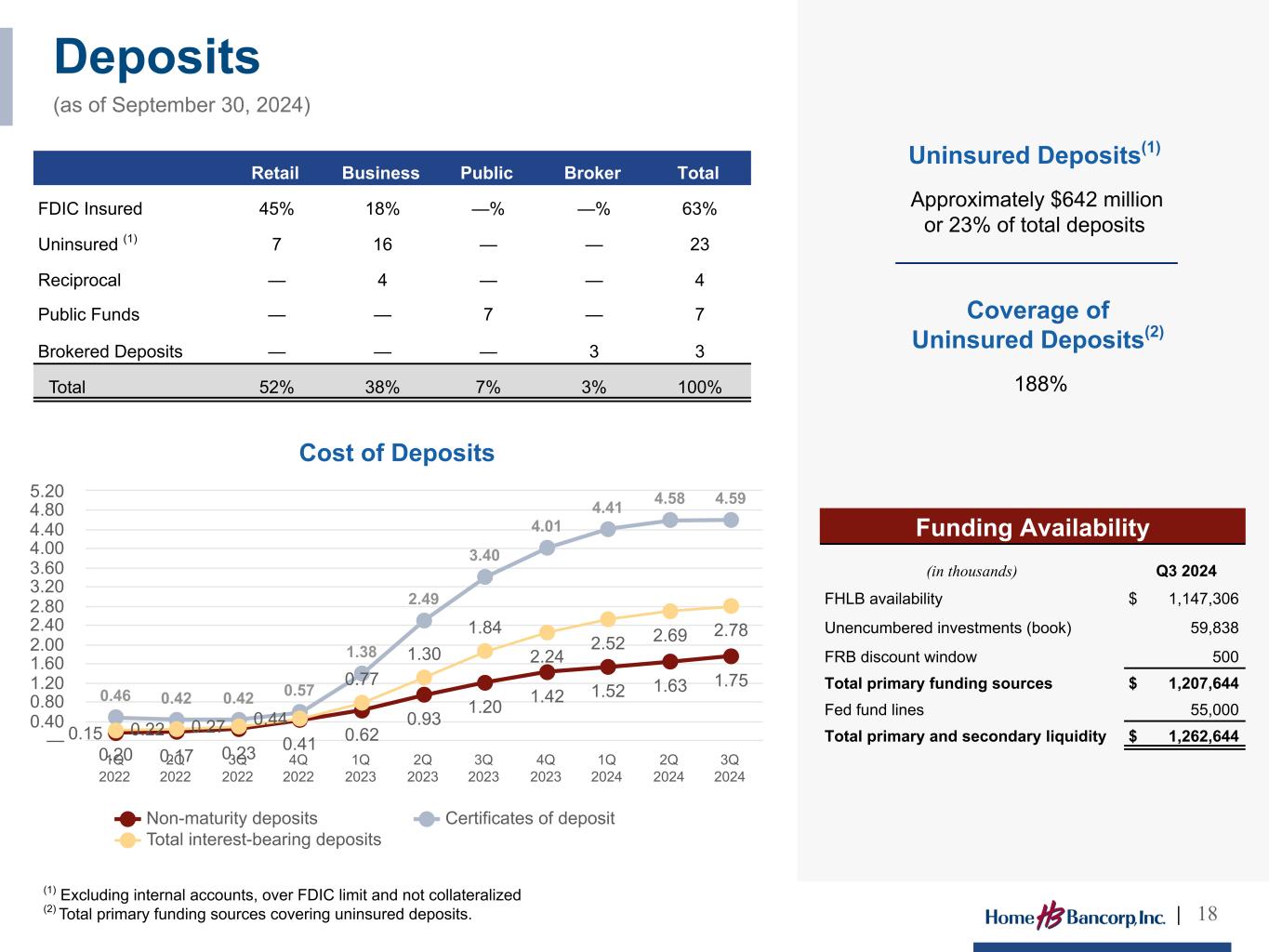

| September 30, 2024 | June 30, 2024 | |||||||||||||

| Individuals | 52% | 53% | ||||||||||||

| Small businesses | 38 | 37 | ||||||||||||

| Public funds | 7 | 8 | ||||||||||||

| Broker | 3 | 2 | ||||||||||||

| Total | 100% | 100% | ||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||||||||

| 9/30/2024 | 6/30/2024 | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance | Interest | Average Yield/ Rate | Average Balance | Interest | Average Yield/ Rate | ||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

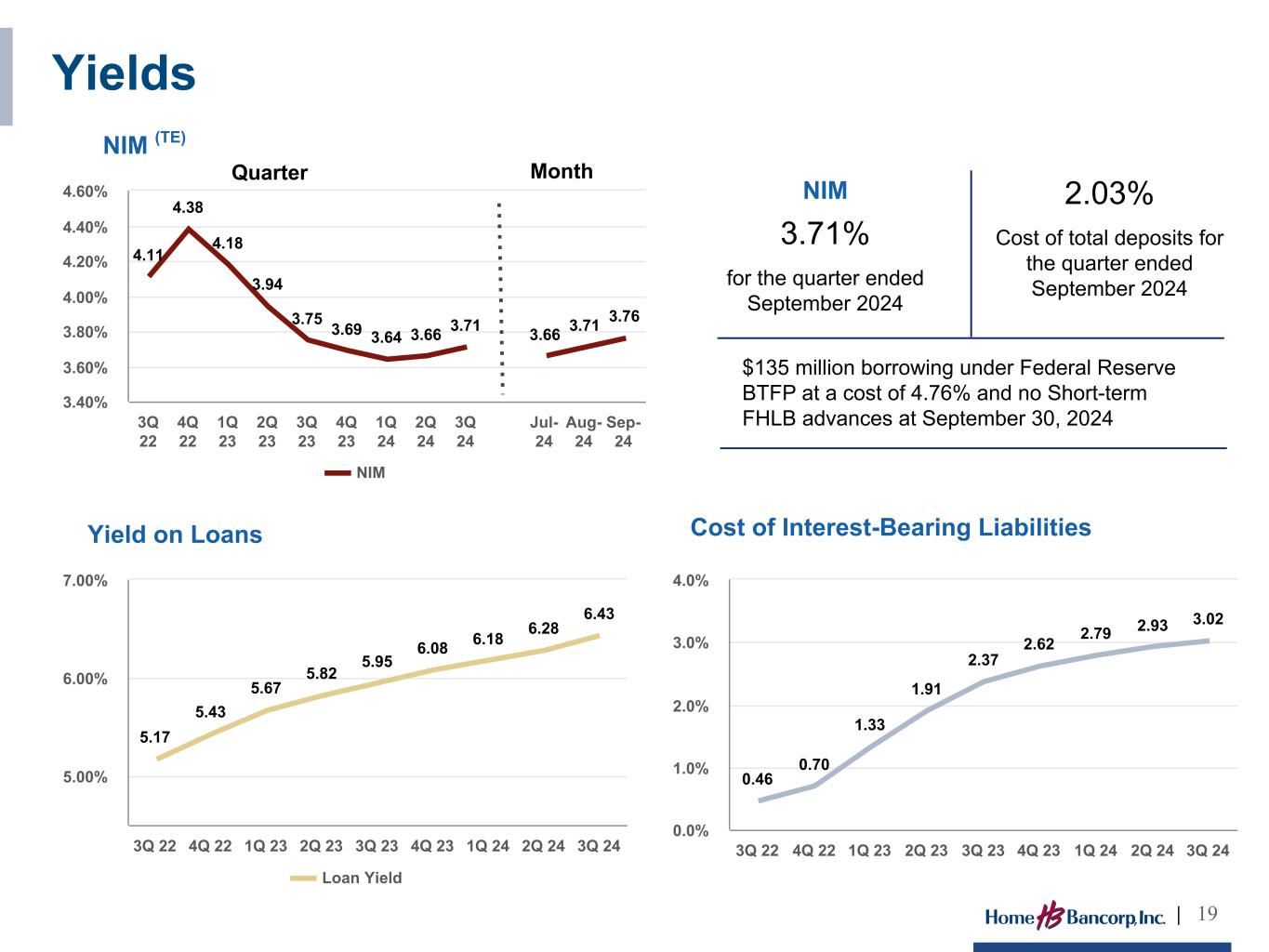

| Loans receivable | $ | 2,668,672 | $ | 43,711 | 6.43 | % | $ | 2,652,331 | $ | 41,999 | 6.28 | % | ||||||||||||||||||||||||||

Investment securities (TE) |

454,024 | 2,677 | 2.38 | 463,500 | 2,740 | 2.38 | ||||||||||||||||||||||||||||||||

| Other interest-earning assets | 79,668 | 991 | 4.95 | 51,355 | 719 | 5.64 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 3,202,364 | $ | 47,379 | 5.82 | % | $ | 3,167,186 | $ | 45,458 | 5.70 | % | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Savings, checking, and money market | $ | 1,266,465 | $ | 5,571 | 1.75 | % | $ | 1,260,491 | $ | 5,108 | 1.63 | % | ||||||||||||||||||||||||||

| Certificates of deposit | 722,717 | 8,337 | 4.59 | 704,690 | 8,026 | 4.58 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,989,182 | 13,908 | 2.78 | 1,965,181 | 13,134 | 2.69 | ||||||||||||||||||||||||||||||||

| Other borrowings | 140,539 | 1,673 | 4.74 | 140,610 | 1,656 | 4.74 | ||||||||||||||||||||||||||||||||

| Subordinated debt | 54,374 | 844 | 6.21 | 54,322 | 844 | 6.22 | ||||||||||||||||||||||||||||||||

| FHLB advances | 56,743 | 572 | 3.99 | 46,499 | 431 | 3.69 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 2,240,838 | $ | 16,997 | 3.02 | % | $ | 2,206,612 | $ | 16,065 | 2.93 | % | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 741,387 | $ | 751,776 | ||||||||||||||||||||||||||||||||||

Net interest spread (TE) |

2.80 | % | 2.77 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (TE) |

3.71 | % | 3.66 | % | ||||||||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2024 | |||||||

| Cash and cash equivalents | $ | 135,877 | ||||||

| Unencumbered investment securities, amortized cost | 59,838 | |||||||

| FHLB advance availability | 1,147,306 | |||||||

| Amounts available from unsecured lines of credit | 55,000 | |||||||

| Federal Reserve discount window availability | 500 | |||||||

| Total primary and secondary sources of available liquidity | $ | 1,398,521 | ||||||

| Quarter Ended | ||||||||||||||||||||

| (dollars in thousands, except per share data) | 9/30/2024 | 6/30/2024 | 9/30/2023 | |||||||||||||||||

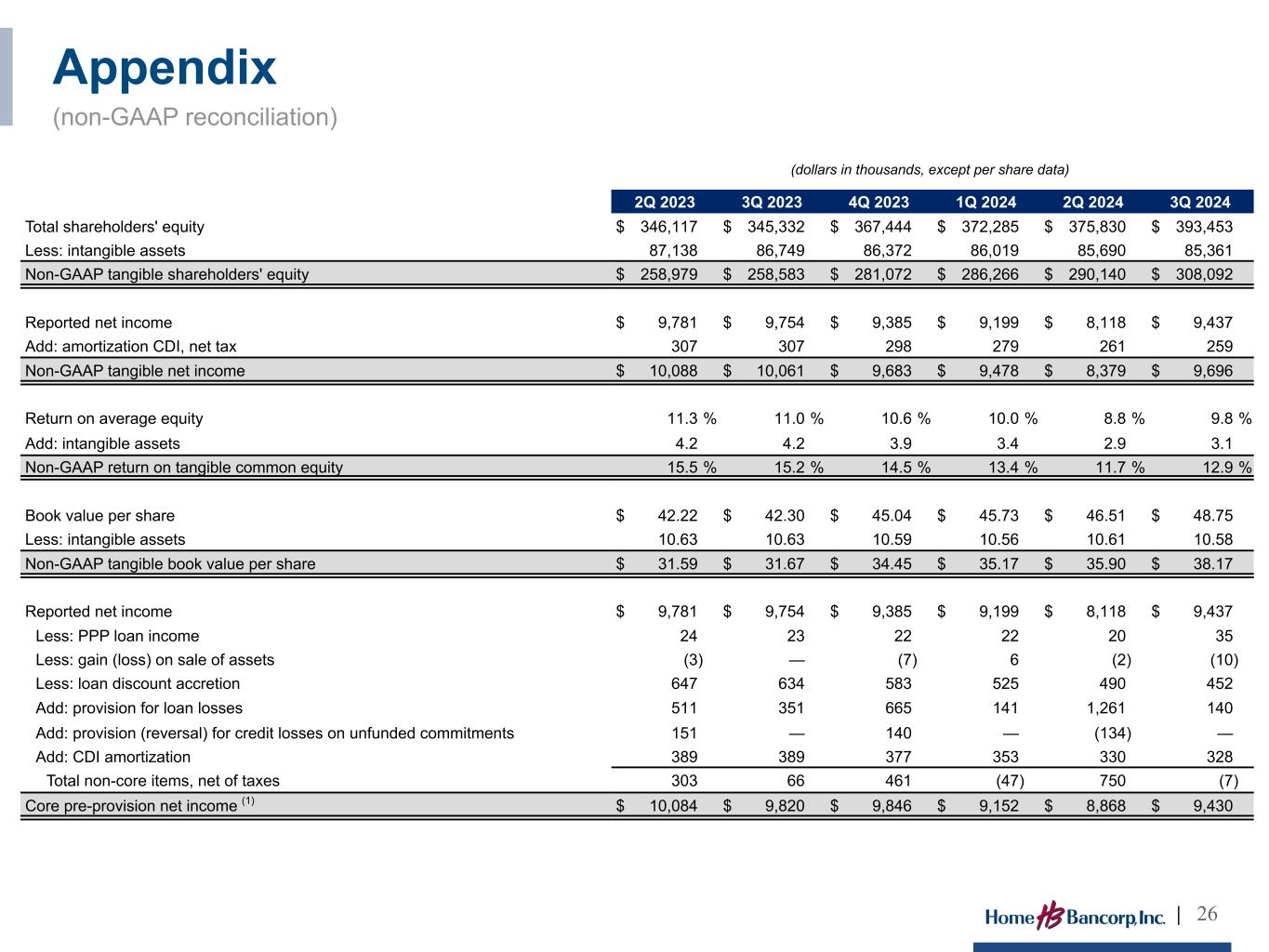

| Reported net income | $ | 9,437 | $ | 8,118 | $ | 9,754 | ||||||||||||||

| Add: Core deposit intangible amortization, net tax | 259 | 261 | 307 | |||||||||||||||||

| Non-GAAP tangible income | $ | 9,696 | $ | 8,379 | $ | 10,061 | ||||||||||||||

| Total assets | $ | 3,441,990 | $ | 3,410,881 | $ | 3,317,729 | ||||||||||||||

| Less: Intangible assets | 85,361 | 85,690 | 86,749 | |||||||||||||||||

| Non-GAAP tangible assets | $ | 3,356,629 | $ | 3,325,191 | $ | 3,230,980 | ||||||||||||||

| Total shareholders’ equity | $ | 393,453 | $ | 375,830 | $ | 345,332 | ||||||||||||||

| Less: Intangible assets | 85,361 | 85,690 | 86,749 | |||||||||||||||||

| Non-GAAP tangible shareholders’ equity | $ | 308,092 | $ | 290,140 | $ | 258,583 | ||||||||||||||

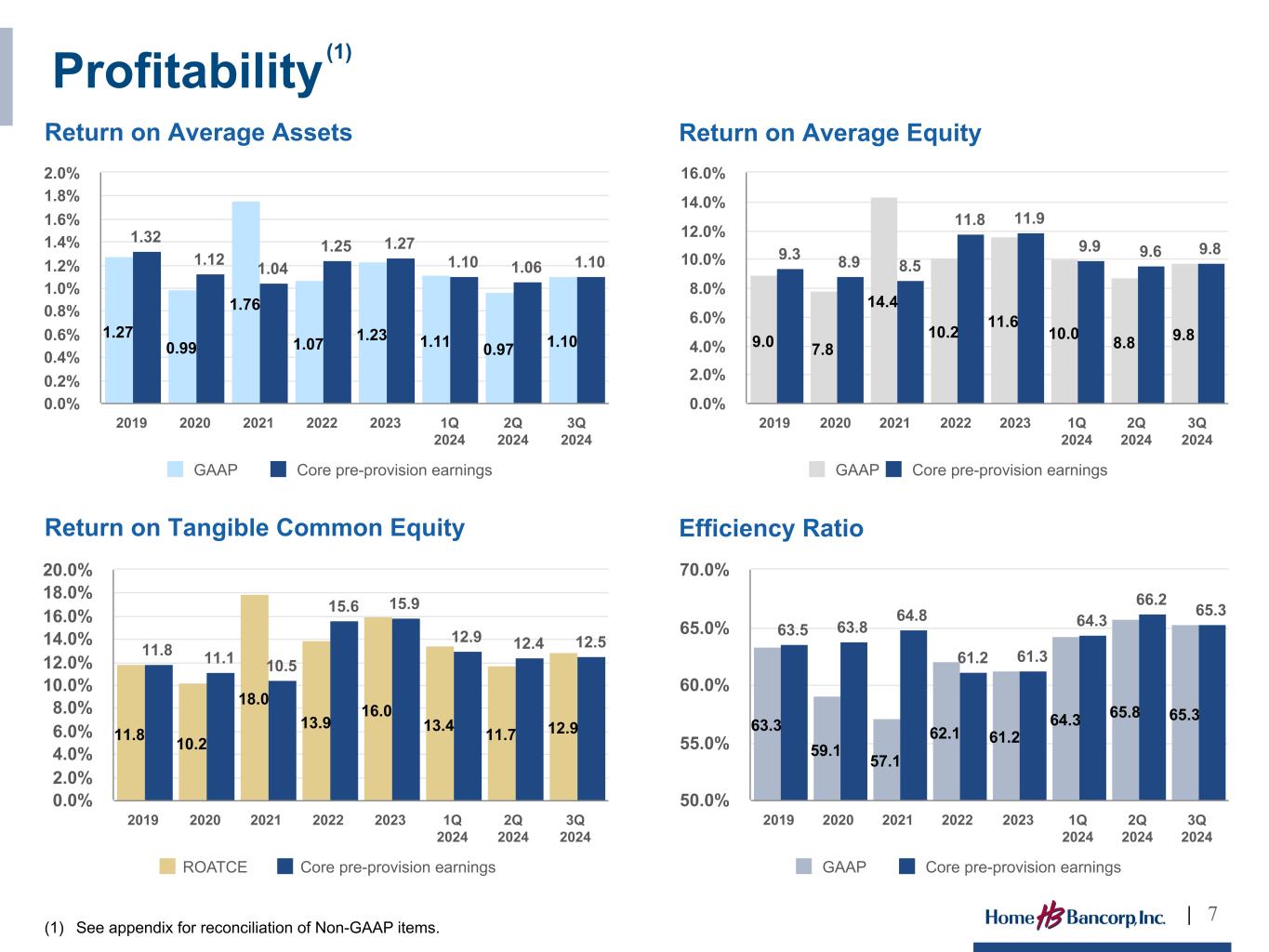

| Return on average equity | 9.76 | % | 8.75 | % | 11.04 | % | ||||||||||||||

| Add: Average intangible assets | 3.14 | 2.98 | 4.11 | |||||||||||||||||

| Non-GAAP return on average tangible common equity | 12.90 | % | 11.73 | % | 15.15 | % | ||||||||||||||

| Common equity ratio | 11.43 | % | 11.02 | % | 10.41 | % | ||||||||||||||

| Less: Intangible assets | 2.25 | 2.29 | 2.41 | |||||||||||||||||

| Non-GAAP tangible common equity ratio | 9.18 | % | 8.73 | % | 8.00 | % | ||||||||||||||

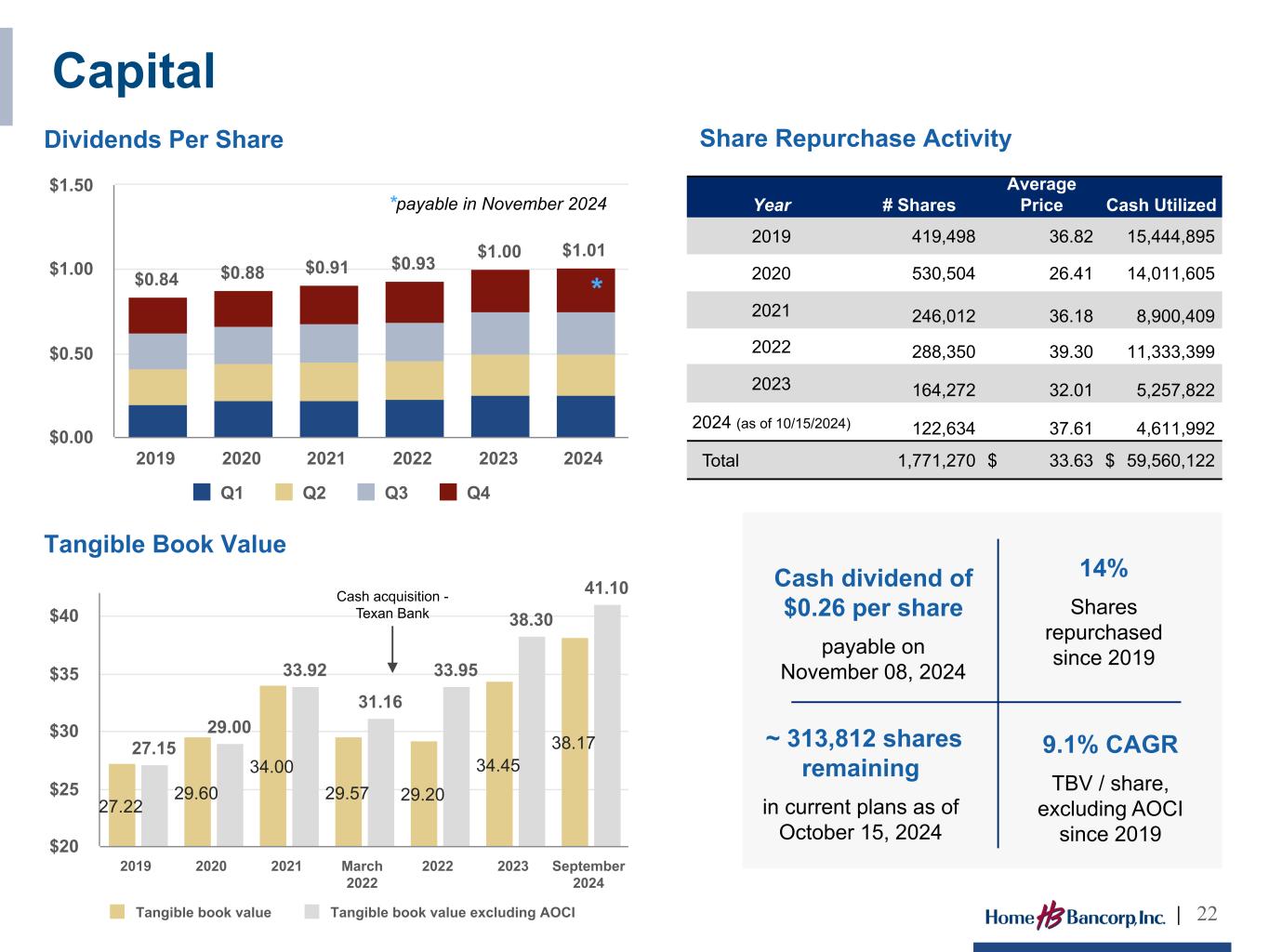

| Book value per share | $ | 48.75 | $ | 46.51 | $ | 42.30 | ||||||||||||||

| Less: Intangible assets | 10.58 | 10.61 | 10.63 | |||||||||||||||||

| Non-GAAP tangible book value per share | $ | 38.17 | $ | 35.90 | $ | 31.67 | ||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF FINANCIAL CONDITION | ||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||

| (dollars in thousands) | 9/30/2024 | 6/30/2024 | % Change | 9/30/2023 | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 135,877 | $ | 113,462 | 20 | % | $ | 84,520 | ||||||||||||||||||

| Interest-bearing deposits in banks | — | — | — | 99 | ||||||||||||||||||||||

| Investment securities available for sale, at fair value | 420,723 | 412,472 | 2 | 427,019 | ||||||||||||||||||||||

| Investment securities held to maturity | 1,065 | 1,065 | — | 1,065 | ||||||||||||||||||||||

| Mortgage loans held for sale | 242 | — | — | 467 | ||||||||||||||||||||||

| Loans, net of unearned income | 2,668,286 | 2,661,346 | — | 2,569,094 | ||||||||||||||||||||||

| Allowance for loan losses | (32,278) | (32,212) | — | (31,123) | ||||||||||||||||||||||

| Total loans, net of allowance for loan losses | 2,636,008 | 2,629,134 | — | 2,537,971 | ||||||||||||||||||||||

| Office properties and equipment, net | 42,659 | 43,089 | (1) | 42,402 | ||||||||||||||||||||||

| Cash surrender value of bank-owned life insurance | 48,139 | 47,858 | 1 | 47,054 | ||||||||||||||||||||||

| Goodwill and core deposit intangibles | 85,361 | 85,690 | — | 86,749 | ||||||||||||||||||||||

| Accrued interest receivable and other assets | 71,916 | 78,111 | (8) | 90,383 | ||||||||||||||||||||||

| Total Assets | $ | 3,441,990 | $ | 3,410,881 | 1 | % | $ | 3,317,729 | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Deposits | $ | 2,777,487 | $ | 2,722,915 | 2 | % | $ | 2,597,484 | ||||||||||||||||||

| Other Borrowings | 140,539 | 140,539 | — | 5,539 | ||||||||||||||||||||||

| Subordinated debt, net of issuance cost | 54,402 | 54,348 | — | 54,187 | ||||||||||||||||||||||

| Federal Home Loan Bank advances | 38,410 | 83,506 | (54) | 283,826 | ||||||||||||||||||||||

| Accrued interest payable and other liabilities | 37,699 | 33,743 | 12 | 31,361 | ||||||||||||||||||||||

| Total Liabilities | 3,048,537 | 3,035,051 | — | 2,972,397 | ||||||||||||||||||||||

| Shareholders' Equity | ||||||||||||||||||||||||||

| Common stock | 81 | 81 | — | 81 | ||||||||||||||||||||||

| Additional paid-in capital | 166,743 | 165,918 | — | 165,149 | ||||||||||||||||||||||

| Common stock acquired by benefit plans | (1,428) | (1,518) | 6 | (1,787) | ||||||||||||||||||||||

| Retained earnings | 251,692 | 245,046 | 3 | 227,649 | ||||||||||||||||||||||

| Accumulated other comprehensive loss | (23,635) | (33,697) | 30 | (45,760) | ||||||||||||||||||||||

| Total Shareholders' Equity | 393,453 | 375,830 | 5 | 345,332 | ||||||||||||||||||||||

| Total Liabilities and Shareholders' Equity | $ | 3,441,990 | $ | 3,410,881 | 1 | % | $ | 3,317,729 | ||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF INCOME | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 9/30/2024 | 6/30/2024 | % Change | 9/30/2023 | % Change | |||||||||||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 43,711 | $ | 41,999 | 4 | % | $ | 38,490 | 14 | % | ||||||||||||||||||||||

| Investment securities | 2,677 | 2,740 | (2) | 2,939 | (9) | |||||||||||||||||||||||||||

Other investments and deposits |

991 | 719 | 38 | 649 | 53 | |||||||||||||||||||||||||||

| Total interest income | 47,379 | 45,458 | 4 | 42,078 | 13 | |||||||||||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||||||||

| Deposits | 13,908 | 13,134 | 6 | % | 8,181 | 70 | % | |||||||||||||||||||||||||

| Other borrowings | 1,673 | 1,656 | 1 | 53 | 3057 | |||||||||||||||||||||||||||

| Subordinated debt expense | 844 | 844 | — | 845 | — | |||||||||||||||||||||||||||

Federal Home Loan Bank advances |

572 | 431 | 33 | 3,490 | (84) | |||||||||||||||||||||||||||

| Total interest expense | 16,997 | 16,065 | 6 | 12,569 | 35 | |||||||||||||||||||||||||||

| Net interest income | 30,382 | 29,393 | 3 | 29,509 | 3 | |||||||||||||||||||||||||||

| Provision for loan losses | 140 | 1,261 | (89) | 351 | (60) | |||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 30,242 | 28,132 | 8 | 29,158 | 4 | |||||||||||||||||||||||||||

| Noninterest Income | ||||||||||||||||||||||||||||||||

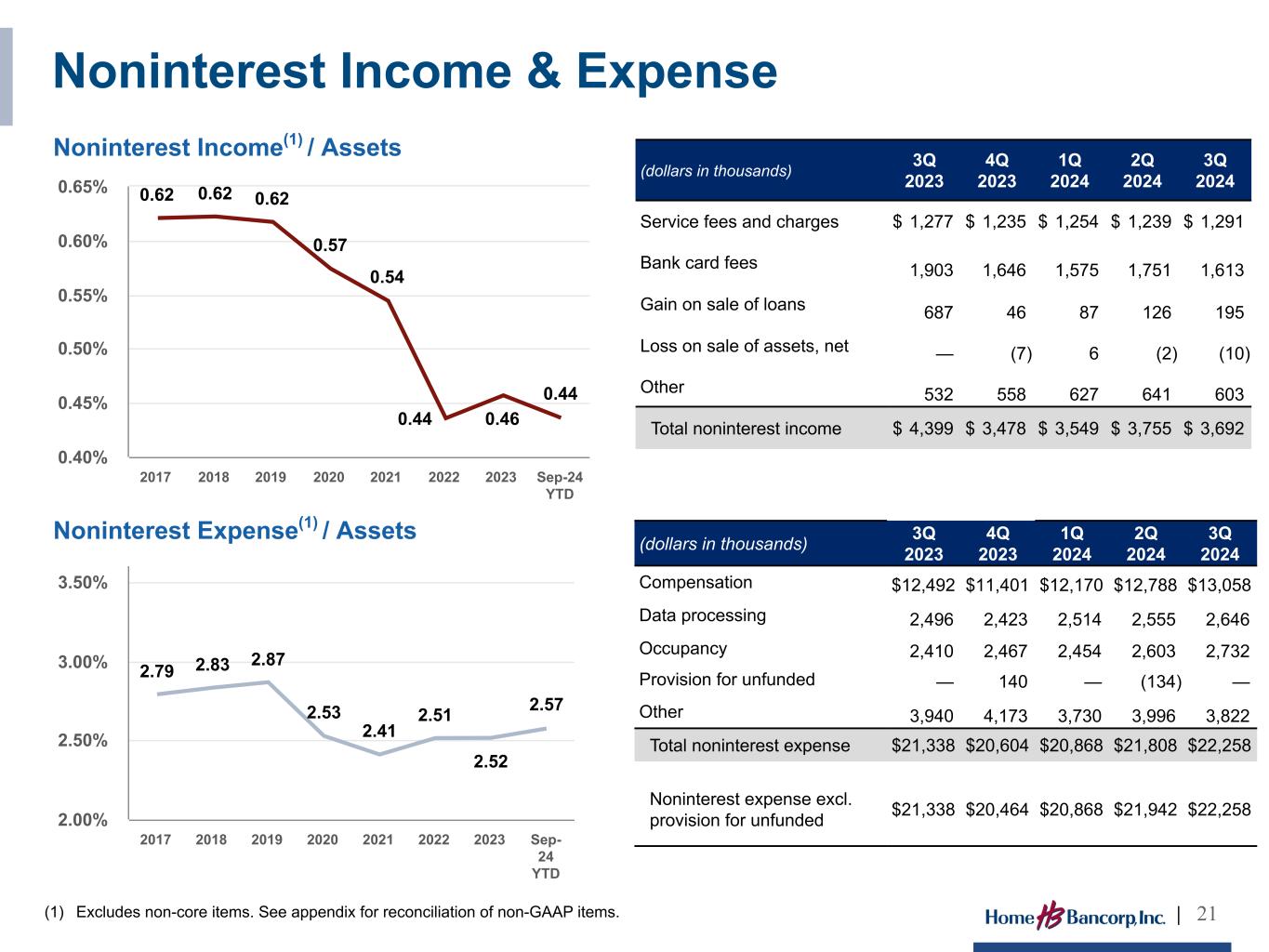

| Service fees and charges | 1,291 | 1,239 | 4 | % | 1,277 | 1 | % | |||||||||||||||||||||||||

| Bank card fees | 1,613 | 1,751 | (8) | 1,903 | (15) | |||||||||||||||||||||||||||

| Gain on sale of loans, net | 195 | 126 | 55 | 687 | (72) | |||||||||||||||||||||||||||

Income from bank-owned life insurance |

281 | 271 | 4 | 265 | 6 | |||||||||||||||||||||||||||

| Loss on sale of assets, net | (10) | (2) | (400) | — | — | |||||||||||||||||||||||||||

| Other income | 322 | 370 | (13) | 267 | 21 | |||||||||||||||||||||||||||

| Total noninterest income | 3,692 | 3,755 | (2) | 4,399 | (16) | |||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||

| Compensation and benefits | 13,058 | 12,788 | 2 | % | 12,492 | 5 | % | |||||||||||||||||||||||||

| Occupancy | 2,732 | 2,603 | 5 | 2,410 | 13 | |||||||||||||||||||||||||||

| Marketing and advertising | 382 | 485 | (21) | 638 | (40) | |||||||||||||||||||||||||||

Data processing and communication |

2,646 | 2,555 | 4 | 2,496 | 6 | |||||||||||||||||||||||||||

| Professional fees | 450 | 581 | (23) | 402 | 12 | |||||||||||||||||||||||||||

| Forms, printing and supplies | 188 | 187 | 1 | 195 | (4) | |||||||||||||||||||||||||||

| Franchise and shares tax | 488 | 487 | — | 542 | (10) | |||||||||||||||||||||||||||

| Regulatory fees | 493 | 509 | (3) | 511 | (4) | |||||||||||||||||||||||||||

| Foreclosed assets, net | 62 | 89 | (30) | 99 | (37) | |||||||||||||||||||||||||||

Amortization of acquisition intangible |

328 | 329 | — | 389 | (16) | |||||||||||||||||||||||||||

(Reversal) provision for credit losses on unfunded commitments |

— | (134) | 100 | — | — | |||||||||||||||||||||||||||

| Other expenses | 1,431 | 1,329 | 8 | 1,164 | 23 | |||||||||||||||||||||||||||

| Total noninterest expense | 22,258 | 21,808 | 2 | 21,338 | 4 | |||||||||||||||||||||||||||

Income before income tax expense |

11,676 | 10,079 | 16 | 12,219 | (4) | |||||||||||||||||||||||||||

| Income tax expense | 2,239 | 1,961 | 14 | 2,465 | (9) | |||||||||||||||||||||||||||

| Net income | $ | 9,437 | $ | 8,118 | 16 | % | $ | 9,754 | (3) | % | ||||||||||||||||||||||

| Earnings per share - basic | $ | 1.19 | $ | 1.02 | 17 | % | $ | 1.22 | (2) | % | ||||||||||||||||||||||

| Earnings per share - diluted | $ | 1.18 | $ | 1.02 | 16 | % | $ | 1.22 | (3) | % | ||||||||||||||||||||||

Cash dividends declared per common share |

$ | 0.25 | $ | 0.25 | — | % | $ | 0.25 | — | % | ||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| SUMMARY FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| Quarter Ended | ||||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 9/30/2024 | 6/30/2024 | % Change | 9/30/2023 | % Change | |||||||||||||||||||||||||||

| EARNINGS DATA | ||||||||||||||||||||||||||||||||

| Total interest income | $ | 47,379 | $ | 45,458 | 4 | % | $ | 42,078 | 13 | % | ||||||||||||||||||||||

| Total interest expense | 16,997 | 16,065 | 6 | 12,569 | 35 | |||||||||||||||||||||||||||

| Net interest income | 30,382 | 29,393 | 3 | 29,509 | 3 | |||||||||||||||||||||||||||

| Provision for loan losses | 140 | 1,261 | (89) | 351 | (60) | |||||||||||||||||||||||||||

| Total noninterest income | 3,692 | 3,755 | (2) | 4,399 | (16) | |||||||||||||||||||||||||||

| Total noninterest expense | 22,258 | 21,808 | 2 | 21,338 | 4 | |||||||||||||||||||||||||||

| Income tax expense | 2,239 | 1,961 | 14 | 2,465 | (9) | |||||||||||||||||||||||||||

| Net income | $ | 9,437 | $ | 8,118 | 16 | $ | 9,754 | (3) | ||||||||||||||||||||||||

| AVERAGE BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||

| Total assets | $ | 3,405,083 | $ | 3,367,207 | 1 | % | $ | 3,281,093 | 4 | % | ||||||||||||||||||||||

| Total interest-earning assets | 3,202,364 | 3,167,186 | 1 | 3,087,452 | 4 | |||||||||||||||||||||||||||

| Total loans | 2,668,672 | 2,652,331 | 1 | 2,538,218 | 5 | |||||||||||||||||||||||||||

| PPP loans | 4,470 | 5,156 | (13) | 5,869 | (24) | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,989,182 | 1,965,181 | 1 | 1,768,639 | 12 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 2,240,838 | 2,206,612 | 2 | 2,101,424 | 7 | |||||||||||||||||||||||||||

| Total deposits | 2,730,568 | 2,716,957 | 1 | 2,568,173 | 6 | |||||||||||||||||||||||||||

| Total shareholders' equity | 384,518 | 373,139 | 3 | 350,436 | 10 | |||||||||||||||||||||||||||

| PER SHARE DATA | ||||||||||||||||||||||||||||||||

| Earnings per share - basic | $ | 1.19 | $ | 1.02 | 17 | % | $ | 1.22 | (2) | % | ||||||||||||||||||||||

| Earnings per share - diluted | 1.18 | 1.02 | 16 | 1.22 | (3) | |||||||||||||||||||||||||||

| Book value at period end | 48.75 | 46.51 | 5 | 42.30 | 15 | |||||||||||||||||||||||||||

| Tangible book value at period end | 38.17 | 35.90 | 6 | 31.67 | 21 | |||||||||||||||||||||||||||

| Shares outstanding at period end | 8,070,539 | 8,081,344 | — | 8,163,655 | (1) | |||||||||||||||||||||||||||

| Weighted average shares outstanding | ||||||||||||||||||||||||||||||||

| Basic | 7,921,582 | 7,972,445 | (1) | % | 8,006,226 | (1) | % | |||||||||||||||||||||||||

| Diluted | 7,966,957 | 8,018,908 | (1) | 8,038,606 | (1) | |||||||||||||||||||||||||||

SELECTED RATIOS (1) |

||||||||||||||||||||||||||||||||

| Return on average assets | 1.10 | % | 0.97 | % | 13 | % | 1.18 | % | (7) | % | ||||||||||||||||||||||

| Return on average equity | 9.76 | 8.75 | 12 | 11.04 | (12) | |||||||||||||||||||||||||||

| Common equity ratio | 11.43 | 11.02 | 4 | 10.41 | 10 | |||||||||||||||||||||||||||

Efficiency ratio (2) |

65.32 | 65.79 | (1) | 62.93 | 4 | |||||||||||||||||||||||||||

| Average equity to average assets | 11.29 | 11.08 | 2 | 10.68 | 6 | |||||||||||||||||||||||||||

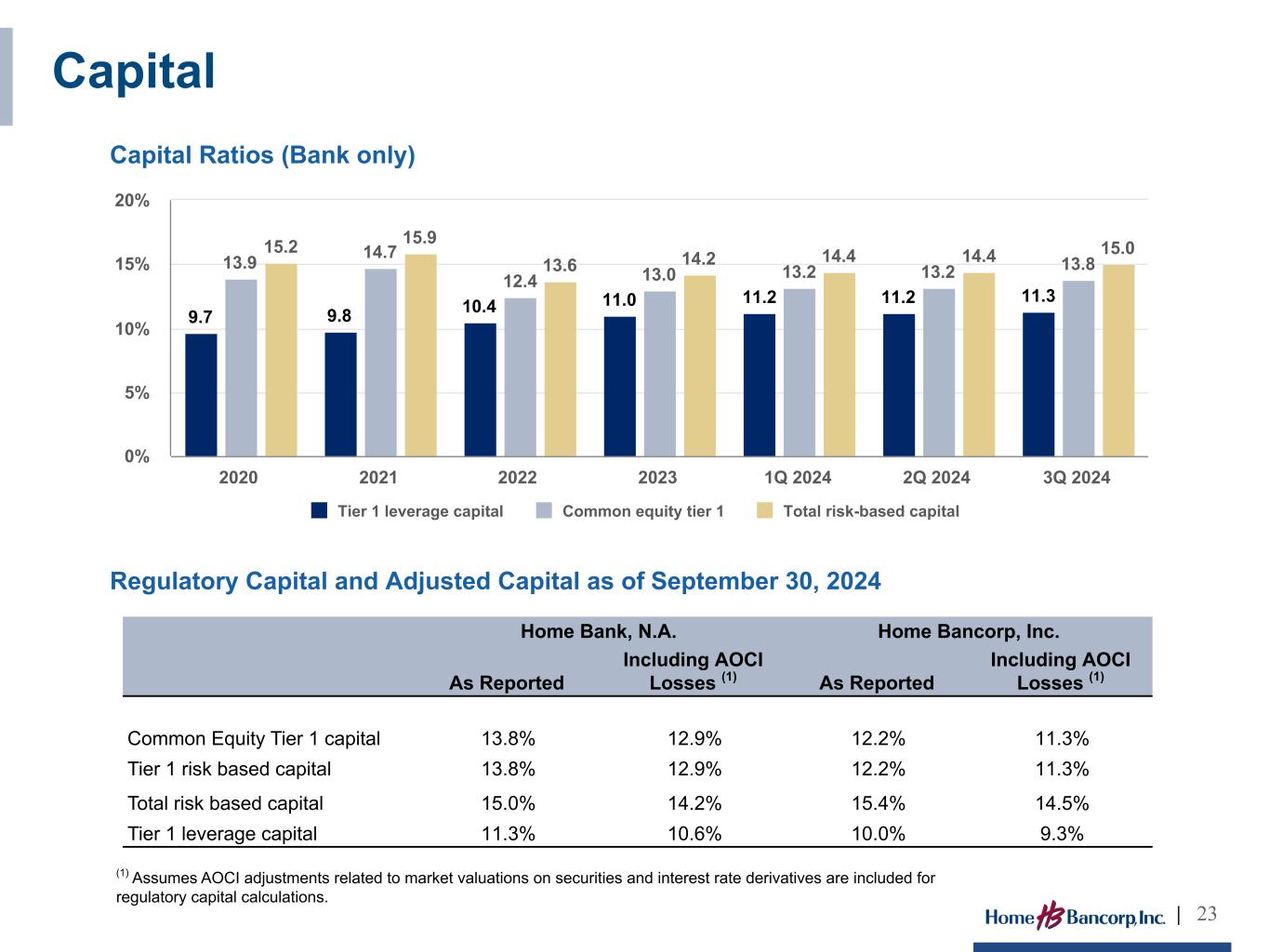

Tier 1 leverage capital ratio (3) |

11.32 | 11.22 | 1 | 10.71 | 6 | |||||||||||||||||||||||||||

Total risk-based capital ratio (3) |

15.03 | 14.39 | 4 | 13.73 | 9 | |||||||||||||||||||||||||||

Net interest margin (4) |

3.71 | 3.66 | 1 | 3.75 | (1) | |||||||||||||||||||||||||||

SELECTED NON-GAAP RATIOS (1) |

||||||||||||||||||||||||||||||||

Tangible common equity ratio (5) |

9.18 | % | 8.73 | % | 5 | % | 8.00 | % | 15 | % | ||||||||||||||||||||||

Return on average tangible common equity (6) |

12.90 | 11.73 | 10 | 15.15 | (15) | |||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY CREDIT QUALITY INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9/30/2024 | 6/30/2024 | 9/30/2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Originated | Acquired | Total | Originated | Acquired | Total | Originated | Acquired | Total | |||||||||||||||||||||||||||||||||||||||||||||||

CREDIT QUALITY (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

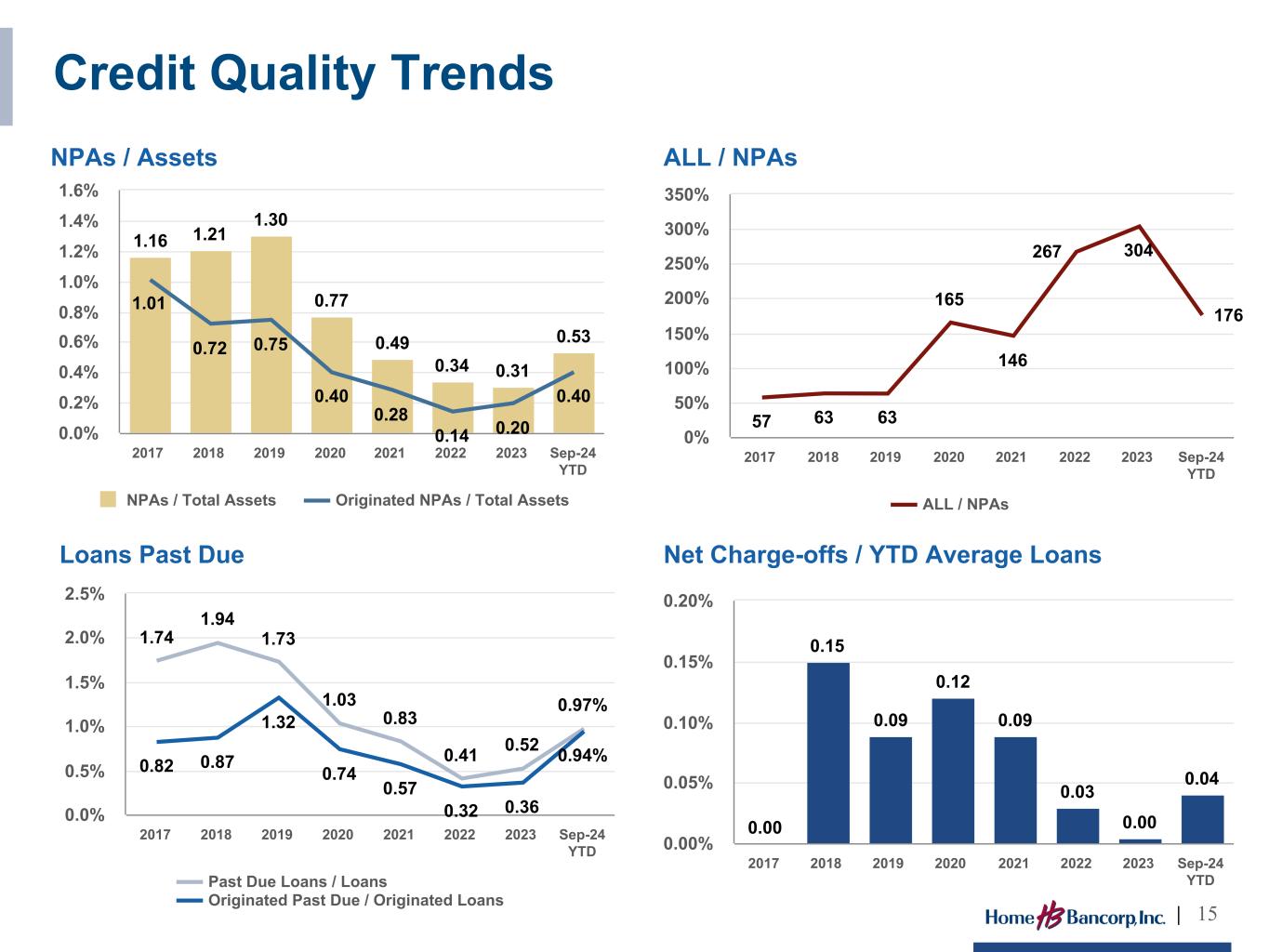

Nonaccrual loans |

$ | 13,741 | $ | 4,314 | $ | 18,055 | $ | 12,594 | $ | 4,223 | $ | 16,817 | $ | 8,001 | $ | 3,905 | $ | 11,906 | ||||||||||||||||||||||||||||||||||||||

| Accruing loans 90 days or more past due | 34 | — | 34 | 1 | — | 1 | 43 | — | 43 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total nonperforming loans | 13,775 | 4,314 | 18,089 | 12,595 | 4,223 | 16,818 | 8,044 | 3,905 | 11,949 | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreclosed assets and ORE | — | 267 | 267 | 16 | 215 | 231 | 221 | 141 | 362 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total nonperforming assets | $ | 13,775 | $ | 4,581 | $ | 18,356 | $ | 12,611 | $ | 4,438 | $ | 17,049 | $ | 8,265 | $ | 4,046 | $ | 12,311 | ||||||||||||||||||||||||||||||||||||||

| Nonperforming assets to total assets | 0.53 | % | 0.50 | % | 0.37 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans to total assets | 0.53 | 0.49 | 0.36 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans to total loans | 0.68 | 0.63 | 0.47 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY CREDIT QUALITY INFORMATION - CONTINUED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9/30/2024 | 6/30/2024 | 9/30/2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collectively Evaluated | Individually Evaluated | Total | Collectively Evaluated | Individually Evaluated | Total | Collectively Evaluated | Individually Evaluated | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One- to four-family first mortgage | $ | 4,402 | $ | — | $ | 4,402 | $ | 3,349 | $ | — | $ | 3,349 | $ | 3,320 | $ | — | $ | 3,320 | ||||||||||||||||||||||||||||||||||||||

| Home equity loans and lines | 785 | — | 785 | 705 | — | 705 | 742 | — | 742 | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 13,271 | 200 | 13,471 | 14,957 | 200 | 15,157 | 14,185 | 230 | 14,415 | |||||||||||||||||||||||||||||||||||||||||||||||

| Construction and land | 5,167 | — | 5,167 | 5,304 | — | 5,304 | 5,123 | — | 5,123 | |||||||||||||||||||||||||||||||||||||||||||||||

| Multi-family residential | 1,079 | — | 1,079 | 582 | — | 582 | 523 | — | 523 | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 6,635 | 42 | 6,677 | 6,320 | 58 | 6,378 | 6,161 | 105 | 6,266 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 697 | — | 697 | 737 | — | 737 | 734 | — | 734 | |||||||||||||||||||||||||||||||||||||||||||||||

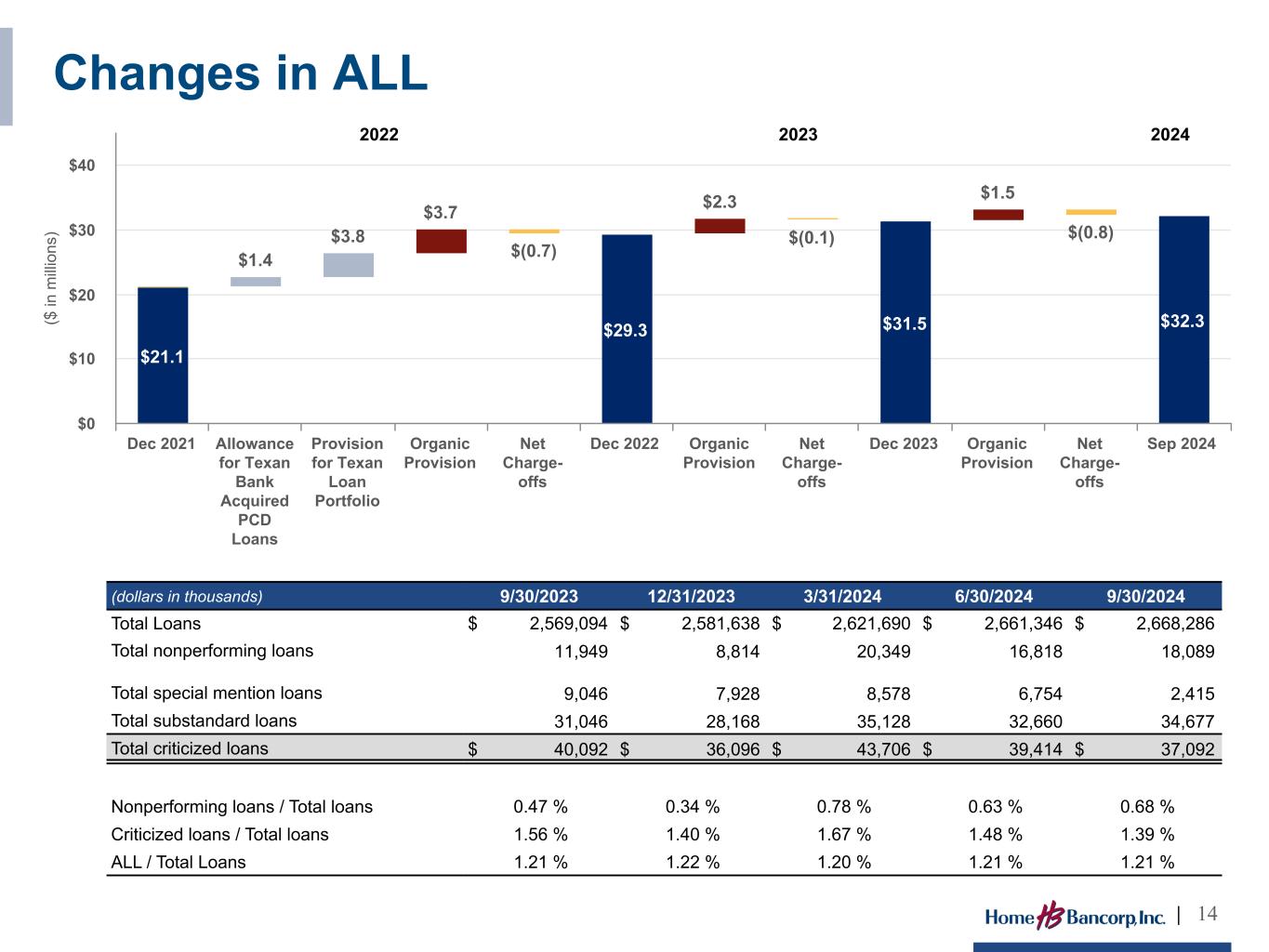

Total allowance for loan losses |

$ | 32,036 | $ | 242 | $ | 32,278 | $ | 31,954 | $ | 258 | $ | 32,212 | $ | 30,788 | $ | 335 | $ | 31,123 | ||||||||||||||||||||||||||||||||||||||

Unfunded lending commitments(2) |

2,460 | — | 2,460 | 2,460 | — | 2,460 | 2,454 | — | 2,454 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total allowance for credit losses | $ | 34,496 | $ | 242 | $ | 34,738 | $ | 34,414 | $ | 258 | $ | 34,672 | $ | 33,242 | $ | 335 | $ | 33,577 | ||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to nonperforming assets | 175.84 | % | 188.94 | % | 252.81 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to nonperforming loans | 178.44 | % | 191.53 | % | 260.47 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to total loans | 1.21 | % | 1.21 | % | 1.21 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.30 | % | 1.30 | % | 1.31 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date loan charge-offs | $ | 1,030 | $ | 815 | $ | 148 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date loan recoveries | 229 | 88 | 296 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date net loan (charge-offs) recoveries | $ | (801) | $ | (727) | $ | 148 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Annualized YTD net loan (charge-offs) recoveries to average loans | (0.04) | % | (0.06) | % | 0.01 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||