| Date of Report (Date of earliest event reported) | January 22, 2024 |

||||

| Home Bancorp, Inc. | ||

| (Exact name of registrant as specified in its charter) | ||

| Louisiana | 001-34190 | 71-1051785 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

503 Kaliste Saloom Road, Lafayette, Louisiana |

70508 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

| Registrant’s telephone number, including area code | (337) 237-1960 |

||||

| N/A | ||

| (Former name or former address, if changed since last report) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock | HBCP | Nasdaq Stock Market | ||||||

| Item 2.02 | Results of Operations and Financial Condition | ||||

Item 7.01 |

Regulation FD Disclosure |

||||

| Item 8.01 | Other Events | ||||

| Item 9.01 | Financial Statements and Exhibits | ||||

| Exhibit Number | Description | |||||||

| 104 | The cover page of Home Bancorp, Inc.'s Form 8-K is formatted in Inline XBRL |

|||||||

| HOME BANCORP, INC. | |||||||||||

Date: January 22, 2024 |

By: | /s/ John W. Bordelon | |||||||||

| John W. Bordelon | |||||||||||

| Chairman of the Board, President and Chief Executive Officer | |||||||||||

| Release Date: | January 22, 2024 | ||||

| For Immediate Release | |||||

| December 31, | September 30, | Increase (Decrease) | ||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023 | Amount | Percent | ||||||||||||||||||||||

| Real estate loans: | ||||||||||||||||||||||||||

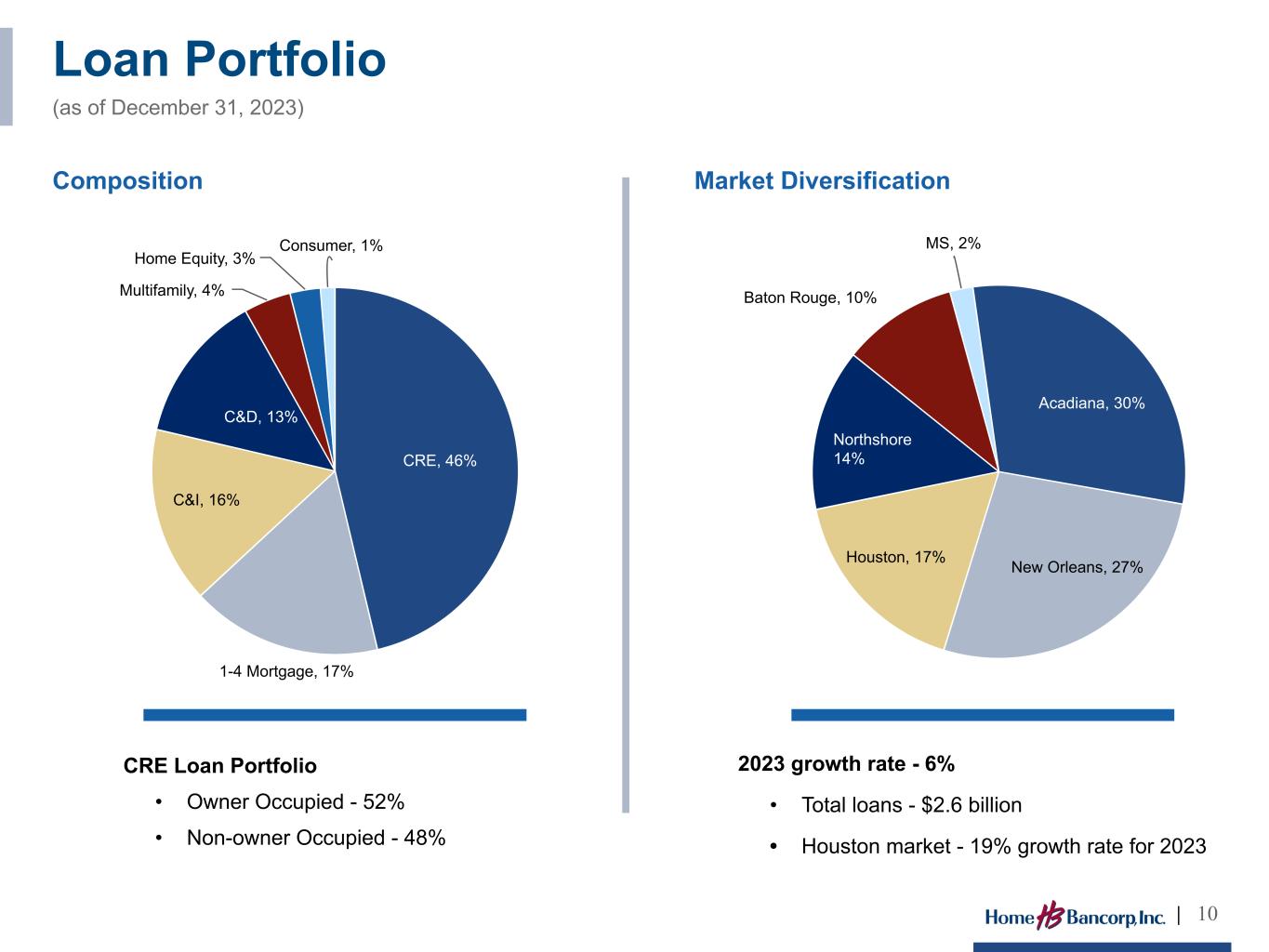

| One- to four-family first mortgage | $ | 433,401 | $ | 432,092 | $ | 1,309 | — | % | ||||||||||||||||||

| Home equity loans and lines | 68,977 | 69,350 | (373) | (1) | ||||||||||||||||||||||

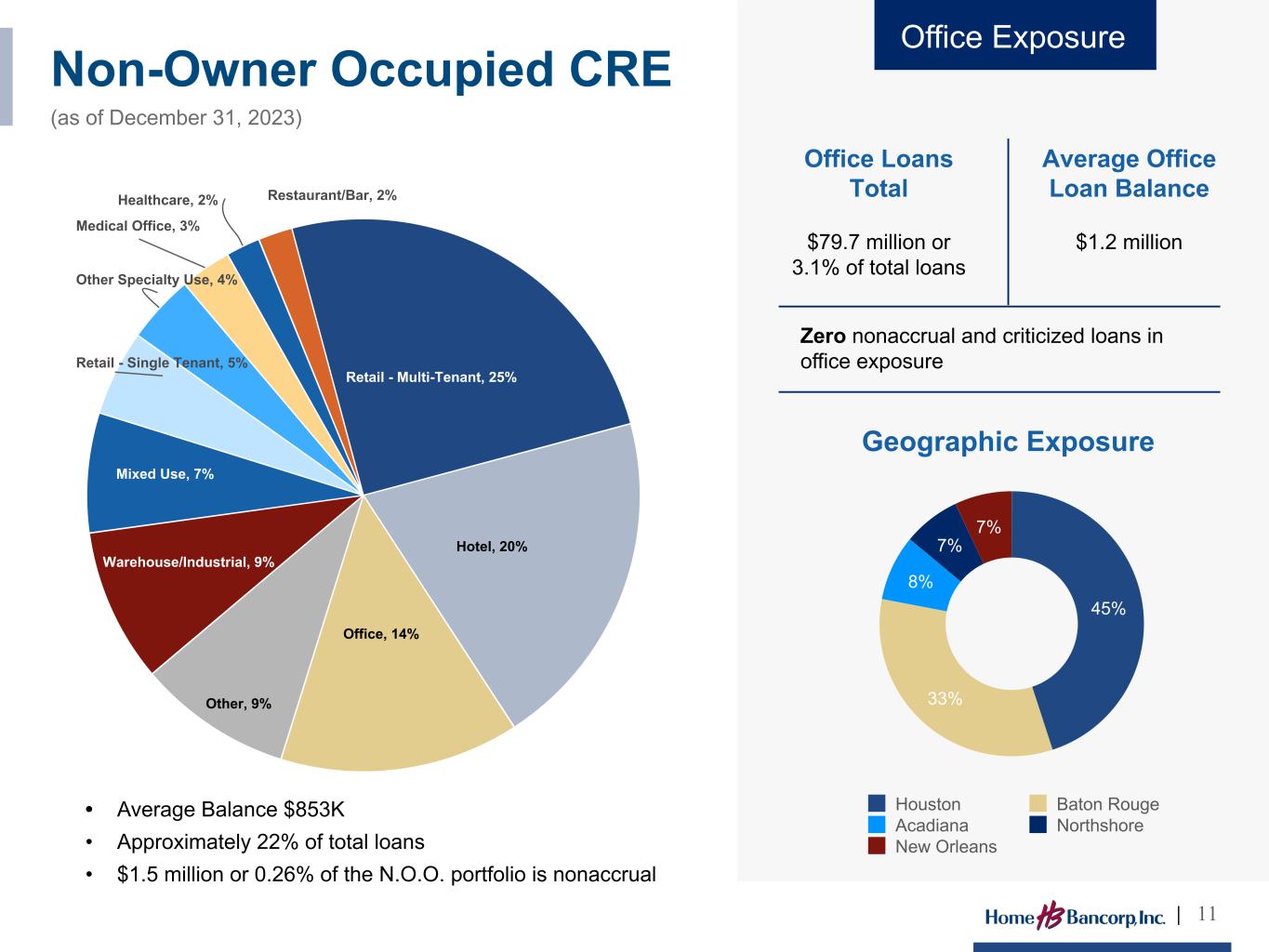

| Commercial real estate | 1,192,691 | 1,178,111 | 14,580 | 1 | ||||||||||||||||||||||

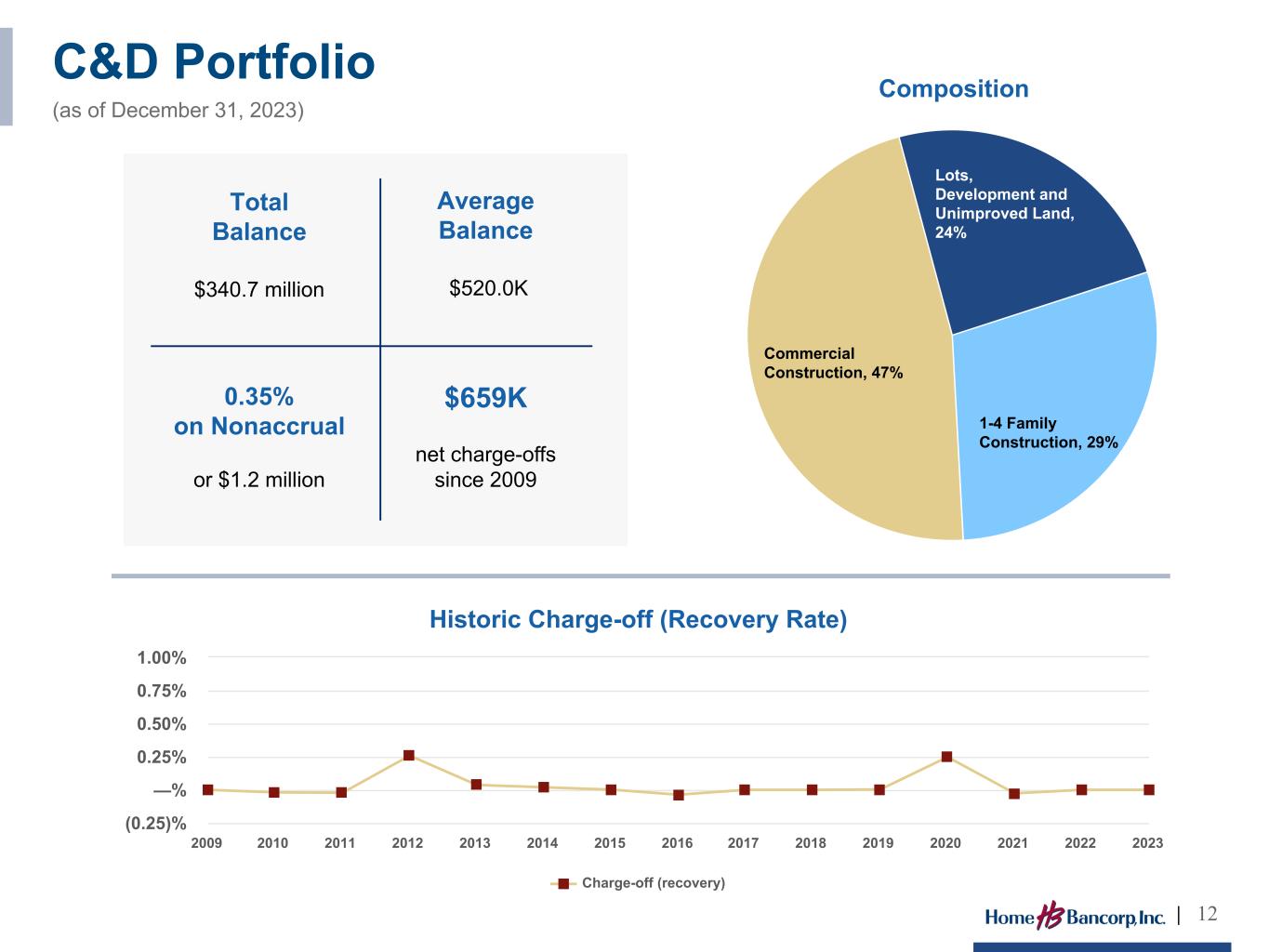

| Construction and land | 340,724 | 342,711 | (1,987) | (1) | ||||||||||||||||||||||

| Multi-family residential | 107,263 | 106,411 | 852 | 1 | ||||||||||||||||||||||

| Total real estate loans | 2,143,056 | 2,128,675 | 14,381 | 1 | ||||||||||||||||||||||

| Other loans: | ||||||||||||||||||||||||||

| Commercial and industrial | 405,659 | 407,189 | (1,530) | — | ||||||||||||||||||||||

| Consumer | 32,923 | 33,230 | (307) | (1) | ||||||||||||||||||||||

| Total other loans | 438,582 | 440,419 | (1,837) | — | ||||||||||||||||||||||

| Total loans | $ | 2,581,638 | $ | 2,569,094 | $ | 12,544 | — | % | ||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 429,964 | $ | 868 | $ | 2,569 | $ | 433,401 | ||||||||||||||||||

| Home equity loans and lines | 68,770 | — | 207 | 68,977 | ||||||||||||||||||||||

| Commercial real estate | 1,178,060 | — | 14,631 | 1,192,691 | ||||||||||||||||||||||

| Construction and land | 329,622 | 5,874 | 5,228 | 340,724 | ||||||||||||||||||||||

| Multi-family residential | 103,760 | — | 3,503 | 107,263 | ||||||||||||||||||||||

| Commercial and industrial | 402,732 | 1,186 | 1,741 | 405,659 | ||||||||||||||||||||||

| Consumer | 32,634 | — | 289 | 32,923 | ||||||||||||||||||||||

| Total | $ | 2,545,542 | $ | 7,928 | $ | 28,168 | $ | 2,581,638 | ||||||||||||||||||

| September 30, 2023 | ||||||||||||||||||||||||||

| (dollars in thousands) | Pass | Special Mention | Substandard | Total | ||||||||||||||||||||||

One- to four-family first mortgage |

$ | 429,011 | $ | 870 | $ | 2,211 | $ | 432,092 | ||||||||||||||||||

| Home equity loans and lines | 69,225 | — | 125 | 69,350 | ||||||||||||||||||||||

| Commercial real estate | 1,162,095 | 330 | 15,686 | 1,178,111 | ||||||||||||||||||||||

| Construction and land | 330,512 | 5,388 | 6,811 | 342,711 | ||||||||||||||||||||||

| Multi-family residential | 102,907 | — | 3,504 | 106,411 | ||||||||||||||||||||||

| Commercial and industrial | 402,252 | 2,458 | 2,479 | 407,189 | ||||||||||||||||||||||

| Consumer | 33,000 | — | 230 | 33,230 | ||||||||||||||||||||||

| Total | $ | 2,529,002 | $ | 9,046 | $ | 31,046 | $ | 2,569,094 | ||||||||||||||||||

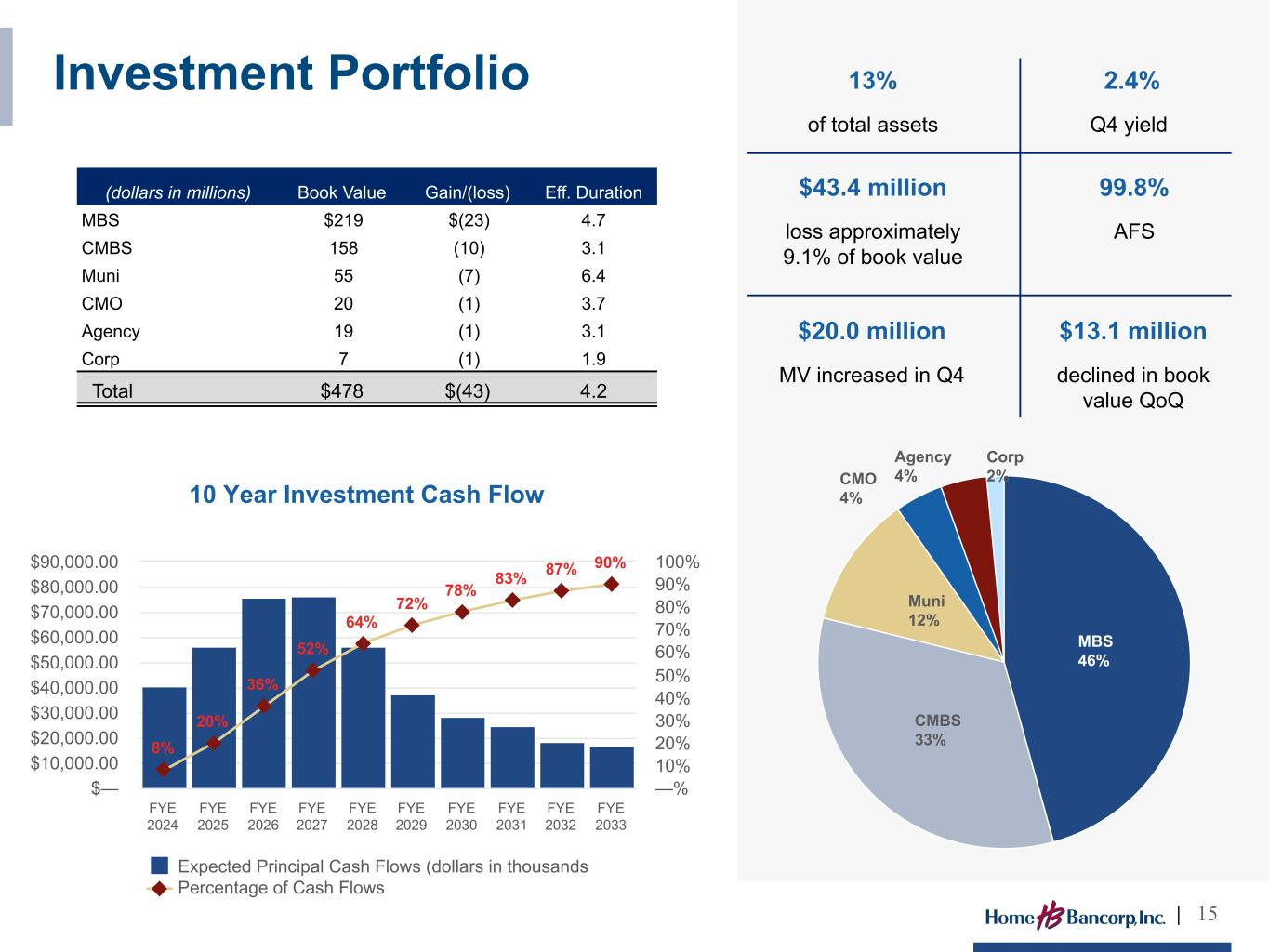

| (dollars in thousands) | Amortized Cost | Fair Value | ||||||||||||

| Available for sale: | ||||||||||||||

| U.S. agency mortgage-backed | $ | 314,569 | $ | 283,853 | ||||||||||

| Collateralized mortgage obligations | 82,764 | 79,262 | ||||||||||||

| Municipal bonds | 53,891 | 46,674 | ||||||||||||

| U.S. government agency | 19,151 | 18,049 | ||||||||||||

| Corporate bonds | 6,982 | 6,088 | ||||||||||||

| Total available for sale | $ | 477,357 | $ | 433,926 | ||||||||||

| Held to maturity: | ||||||||||||||

| Municipal bonds | $ | 1,065 | $ | 1,066 | ||||||||||

| Total held to maturity | $ | 1,065 | $ | 1,066 | ||||||||||

| December 31, | September 30, | Increase/(Decrease) | ||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023 | Amount | Percent | ||||||||||||||||||||||

| Demand deposits | $ | 744,424 | $ | 785,448 | $ | (41,024) | (5) | % | ||||||||||||||||||

| Savings | 231,624 | 246,402 | (14,778) | (6) | ||||||||||||||||||||||

| Money market | 408,024 | 392,174 | 15,850 | 4 | ||||||||||||||||||||||

| NOW | 641,818 | 617,003 | 24,815 | 4 | ||||||||||||||||||||||

| Certificates of deposit | 644,734 | 556,457 | 88,277 | 16 | ||||||||||||||||||||||

| Total deposits | $ | 2,670,624 | $ | 2,597,484 | $ | 73,140 | 3 | % | ||||||||||||||||||

| December 31, 2023 | September 30, 2023 | |||||||||||||

| Individuals | 53% | 52% | ||||||||||||

| Small businesses | 38 | 39 | ||||||||||||

| Public funds | 7 | 7 | ||||||||||||

| Broker | 2 | 2 | ||||||||||||

| Total | 100% | 100% | ||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance | Interest | Average Yield/ Rate | Average Balance | Interest | Average Yield/ Rate | ||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||

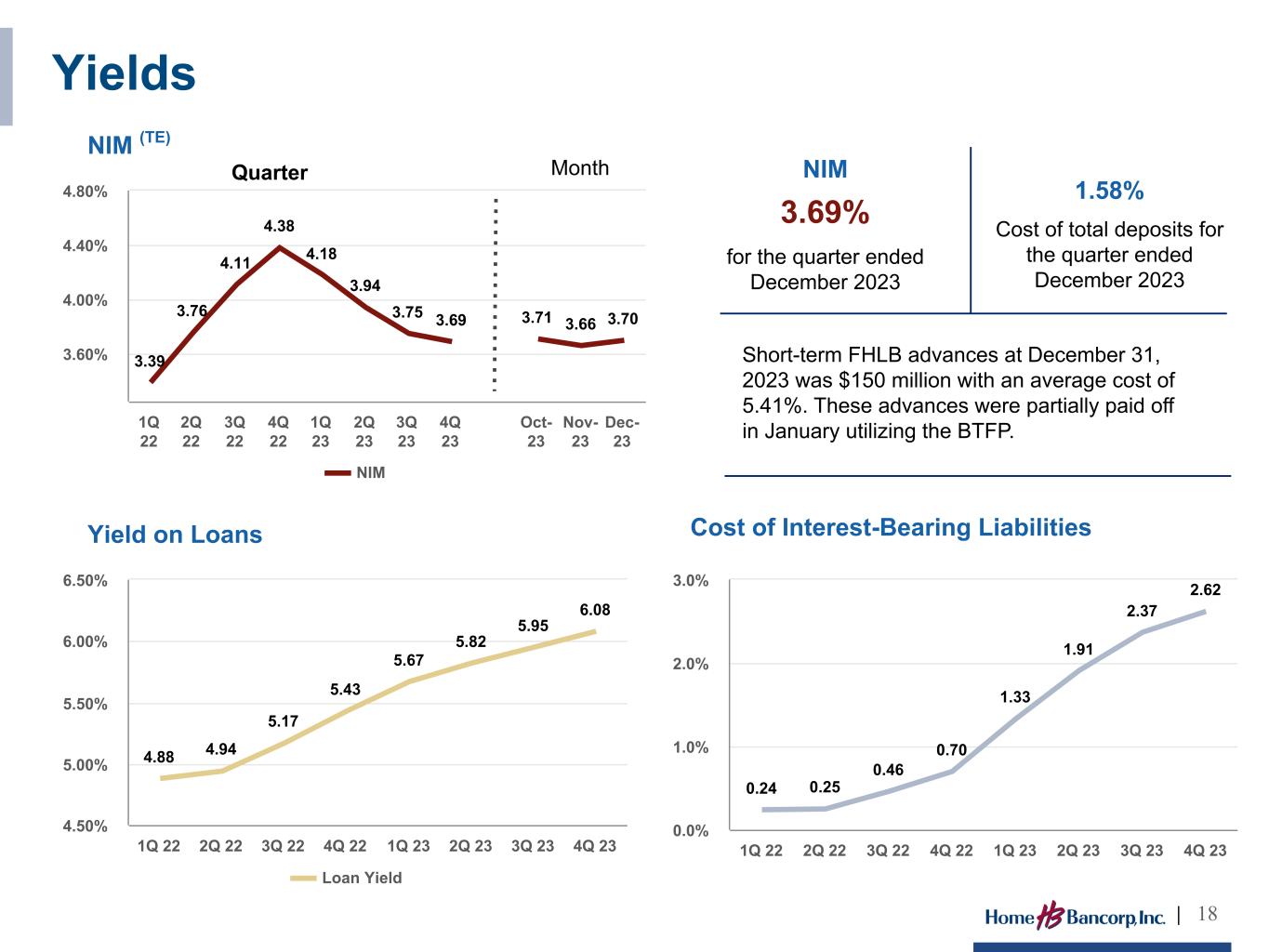

| Loans receivable | $ | 2,572,400 | $ | 39,820 | 6.08 | % | $ | 2,538,218 | $ | 38,490 | 5.95 | % | ||||||||||||||||||||||||||

Investment securities (TE) |

481,322 | 2,837 | 2.37 | 495,219 | 2,939 | 2.39 | ||||||||||||||||||||||||||||||||

| Other interest-earning assets | 57,523 | 742 | 5.12 | 54,015 | 649 | 4.77 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 3,111,245 | $ | 43,399 | 5.49 | % | $ | 3,087,452 | $ | 42,078 | 5.36 | % | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Savings, checking, and money market | $ | 1,273,550 | $ | 4,561 | 1.42 | % | $ | 1,256,885 | $ | 3,791 | 1.20 | % | ||||||||||||||||||||||||||

| Certificates of deposit | 591,205 | 5,975 | 4.01 | 511,754 | 4,390 | 3.40 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,864,755 | 10,536 | 2.24 | 1,768,639 | 8,181 | 1.84 | ||||||||||||||||||||||||||||||||

| Other borrowings | 5,539 | 53 | 3.80 | 5,539 | 53 | 3.80 | ||||||||||||||||||||||||||||||||

| Subordinated debt | 54,214 | 844 | 6.23 | 54,159 | 845 | 6.24 | ||||||||||||||||||||||||||||||||

| FHLB advances | 212,412 | 2,684 | 4.96 | 273,087 | 3,490 | 5.01 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 2,136,920 | $ | 14,117 | 2.62 | % | $ | 2,101,424 | $ | 12,569 | 2.37 | % | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 777,184 | $ | 799,534 | ||||||||||||||||||||||||||||||||||

Net interest spread (TE) |

2.87 | % | 2.99 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (TE) |

3.69 | % | 3.75 | % | ||||||||||||||||||||||||||||||||||

| (dollars in thousands) | December 31, 2023 | |||||||

| Cash and cash equivalents | $ | 75,831 | ||||||

| Unencumbered investment securities, amortized cost | 70,467 | |||||||

| FHLB advance availability | 1,020,494 | |||||||

| Amounts available from unsecured lines of credit | 55,000 | |||||||

Federal Reserve bank term funding program ** |

103,368 | |||||||

| Federal Reserve discount window availability | 500 | |||||||

| Total primary and secondary sources of available liquidity | $ | 1,325,660 | ||||||

| For the Three Months Ended | ||||||||||||||||||||

| (dollars in thousands, except per share data) | December 31, 2023 | September 30, 2023 | December 31, 2022 | |||||||||||||||||

| Reported net income | $ | 9,385 | $ | 9,754 | $ | 10,776 | ||||||||||||||

| Add: Core deposit intangible amortization, net tax | 298 | 307 | 350 | |||||||||||||||||

| Non-GAAP tangible income | $ | 9,683 | $ | 10,061 | $ | 11,126 | ||||||||||||||

| Total assets | $ | 3,320,122 | $ | 3,317,729 | $ | 3,228,280 | ||||||||||||||

| Less: Intangible assets | 86,372 | 86,749 | 87,973 | |||||||||||||||||

| Non-GAAP tangible assets | $ | 3,233,750 | $ | 3,230,980 | $ | 3,140,307 | ||||||||||||||

| Total shareholders’ equity | $ | 367,444 | $ | 345,332 | $ | 329,954 | ||||||||||||||

| Less: Intangible assets | 86,372 | 86,749 | 87,973 | |||||||||||||||||

| Non-GAAP tangible shareholders’ equity | $ | 281,072 | $ | 258,583 | $ | 241,981 | ||||||||||||||

| Return on average equity | 10.61 | % | 11.04 | % | 13.23 | % | ||||||||||||||

| Add: Average intangible assets | 3.92 | 4.11 | 5.52 | |||||||||||||||||

| Non-GAAP return on average tangible common equity | 14.53 | % | 15.15 | % | 18.75 | % | ||||||||||||||

| Common equity ratio | 11.07 | % | 10.41 | % | 10.22 | % | ||||||||||||||

| Less: Intangible assets | 2.38 | 2.41 | 2.51 | |||||||||||||||||

| Non-GAAP tangible common equity ratio | 8.69 | % | 8.00 | % | 7.71 | % | ||||||||||||||

| Book value per share | $ | 45.04 | $ | 42.30 | $ | 39.82 | ||||||||||||||

| Less: Intangible assets | 10.59 | 10.63 | 10.62 | |||||||||||||||||

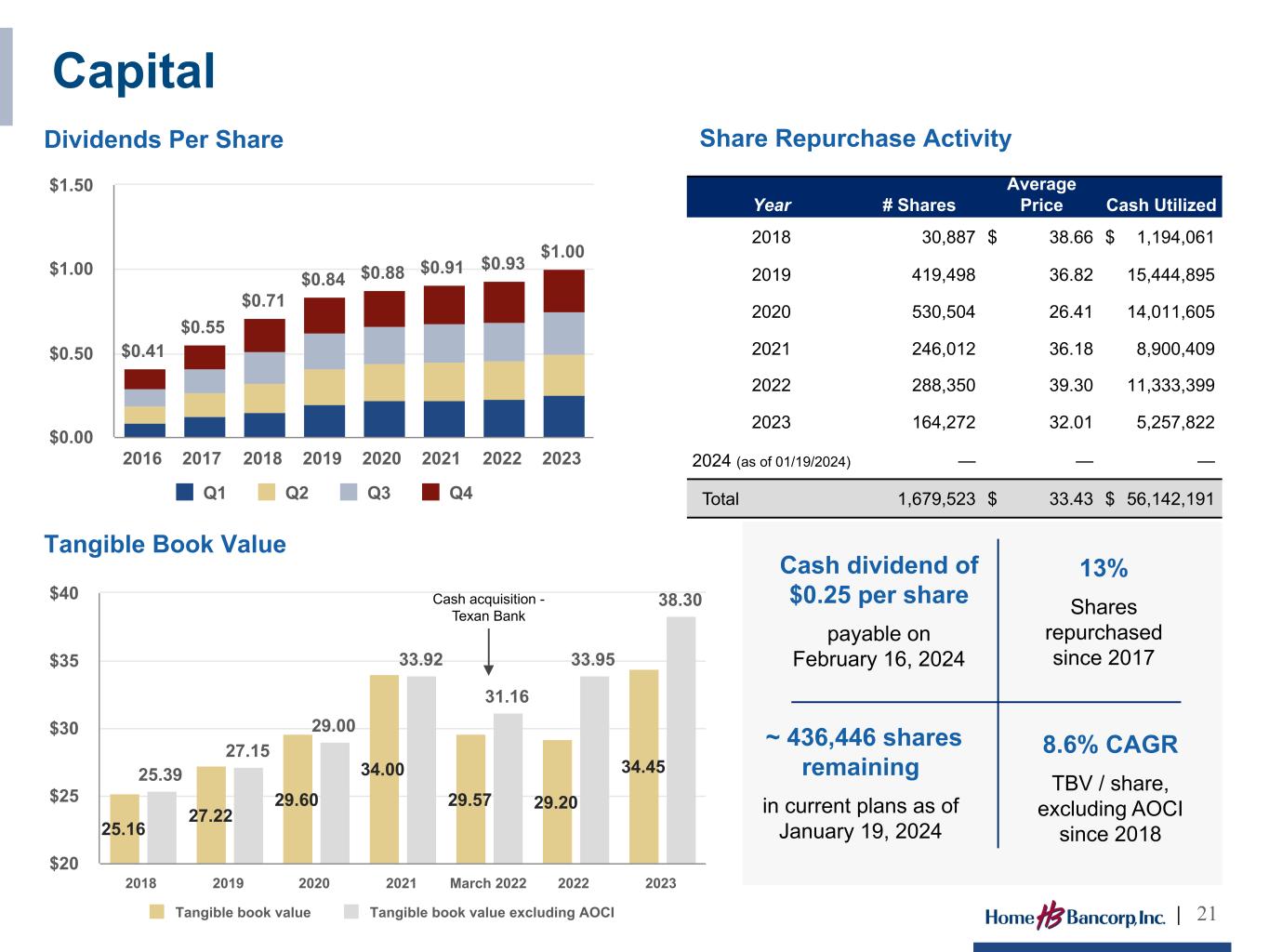

| Non-GAAP tangible book value per share | $ | 34.45 | $ | 31.67 | $ | 29.20 | ||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF FINANCIAL CONDITION | ||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||

| (dollars in thousands) | December 31, 2023 | September 30, 2023 | % Change | December 31, 2022 | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 75,831 | $ | 84,520 | (10) | % | $ | 87,401 | ||||||||||||||||||

| Interest-bearing deposits in banks | 99 | 99 | — | 349 | ||||||||||||||||||||||

| Investment securities available for sale, at fair value | 433,926 | 427,019 | 2 | 486,518 | ||||||||||||||||||||||

| Investment securities held to maturity | 1,065 | 1,065 | — | 1,075 | ||||||||||||||||||||||

| Mortgage loans held for sale | 361 | 467 | (23) | 98 | ||||||||||||||||||||||

| Loans, net of unearned income | 2,581,638 | 2,569,094 | — | 2,430,750 | ||||||||||||||||||||||

| Allowance for loan losses | (31,537) | (31,123) | (1) | (29,299) | ||||||||||||||||||||||

| Total loans, net of allowance for loan losses | 2,550,101 | 2,537,971 | — | 2,401,451 | ||||||||||||||||||||||

| Office properties and equipment, net | 41,980 | 42,402 | (1) | 43,560 | ||||||||||||||||||||||

| Cash surrender value of bank-owned life insurance | 47,321 | 47,054 | 1 | 46,276 | ||||||||||||||||||||||

| Goodwill and core deposit intangibles | 86,372 | 86,749 | — | 87,973 | ||||||||||||||||||||||

| Accrued interest receivable and other assets | 83,066 | 90,383 | (8) | 73,579 | ||||||||||||||||||||||

| Total Assets | $ | 3,320,122 | $ | 3,317,729 | — | $ | 3,228,280 | |||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Deposits | $ | 2,670,624 | $ | 2,597,484 | 3 | % | $ | 2,633,181 | ||||||||||||||||||

| Other Borrowings | 5,539 | 5,539 | — | 5,539 | ||||||||||||||||||||||

| Subordinated debt, net of issuance cost | 54,241 | 54,187 | — | 54,013 | ||||||||||||||||||||||

| Federal Home Loan Bank advances | 192,713 | 283,826 | (32) | 176,213 | ||||||||||||||||||||||

| Accrued interest payable and other liabilities | 29,561 | 31,361 | (6) | 29,380 | ||||||||||||||||||||||

| Total Liabilities | 2,952,678 | 2,972,397 | (1) | 2,898,326 | ||||||||||||||||||||||

| Shareholders' Equity | ||||||||||||||||||||||||||

| Common stock | 81 | 81 | — | % | 83 | |||||||||||||||||||||

| Additional paid-in capital | 165,823 | 165,149 | — | 164,942 | ||||||||||||||||||||||

| Common stock acquired by benefit plans | (1,697) | (1,787) | 5 | (2,060) | ||||||||||||||||||||||

| Retained earnings | 234,619 | 227,649 | 3 | 206,296 | ||||||||||||||||||||||

| Accumulated other comprehensive loss | (31,382) | (45,760) | 31 | (39,307) | ||||||||||||||||||||||

| Total Shareholders' Equity | 367,444 | 345,332 | 6 | 329,954 | ||||||||||||||||||||||

| Total Liabilities and Shareholders' Equity | $ | 3,320,122 | $ | 3,317,729 | — | $ | 3,228,280 | |||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| CONDENSED STATEMENTS OF INCOME | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | December 31, 2023 | September 30, 2023 | % Change | December 31, 2022 | % Change | |||||||||||||||||||||||||||

| Interest Income | ||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 39,820 | $ | 38,490 | 3 | % | $ | 32,826 | 21 | % | ||||||||||||||||||||||

| Investment securities | 2,837 | 2,939 | (3) | 3,214 | (12) | |||||||||||||||||||||||||||

Other investments and deposits |

742 | 649 | 14 | 555 | 34 | |||||||||||||||||||||||||||

| Total interest income | 43,399 | 42,078 | 3 | 36,595 | 19 | |||||||||||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||||||||

| Deposits | 10,536 | 8,181 | 29 | % | 1,949 | 441 | % | |||||||||||||||||||||||||

| Other borrowings | 53 | 53 | — | 53 | — | |||||||||||||||||||||||||||

| Subordinated debt expense | 844 | 845 | — | 851 | (1) | |||||||||||||||||||||||||||

Federal Home Loan Bank advances |

2,684 | 3,490 | (23) | 456 | 489 | |||||||||||||||||||||||||||

| Total interest expense | 14,117 | 12,569 | 12 | 3,309 | 327 | |||||||||||||||||||||||||||

| Net interest income | 29,282 | 29,509 | (1) | 33,286 | (12) | |||||||||||||||||||||||||||

Provision for loan losses |

665 | 351 | 89 | 1,987 | (67) | |||||||||||||||||||||||||||

Net interest income after provision for loan losses |

28,617 | 29,158 | (2) | 31,299 | (9) | |||||||||||||||||||||||||||

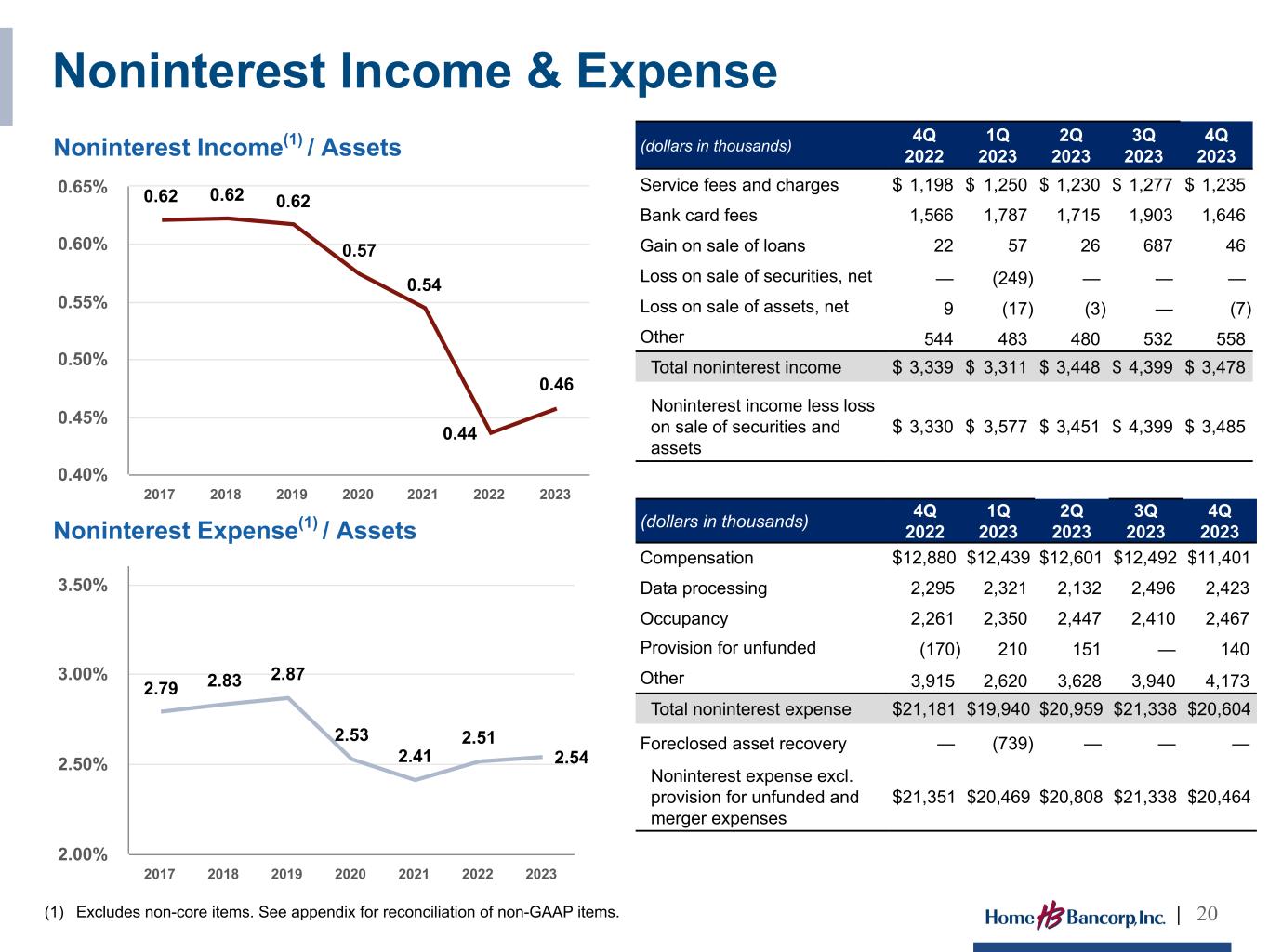

| Noninterest Income | ||||||||||||||||||||||||||||||||

| Service fees and charges | 1,235 | 1,277 | (3) | % | 1,198 | 3 | % | |||||||||||||||||||||||||

| Bank card fees | 1,646 | 1,903 | (14) | 1,566 | 5 | |||||||||||||||||||||||||||

| Gain on sale of loans, net | 46 | 687 | (93) | 22 | 109 | |||||||||||||||||||||||||||

Income from bank-owned life insurance |

267 | 265 | 1 | 257 | 4 | |||||||||||||||||||||||||||

| Loss on sale of assets, net | (7) | — | — | 9 | (178) | |||||||||||||||||||||||||||

| Other income | 291 | 267 | 9 | 287 | 1 | |||||||||||||||||||||||||||

| Total noninterest income | 3,478 | 4,399 | (21) | 3,339 | 4 | |||||||||||||||||||||||||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||

| Compensation and benefits | 11,401 | 12,492 | (9) | % | 12,880 | (11) | % | |||||||||||||||||||||||||

| Occupancy | 2,467 | 2,410 | 2 | 2,261 | 9 | |||||||||||||||||||||||||||

| Marketing and advertising | 759 | 638 | 19 | 550 | 38 | |||||||||||||||||||||||||||

Data processing and communication |

2,423 | 2,496 | (3) | 2,295 | 6 | |||||||||||||||||||||||||||

| Professional fees | 465 | 402 | 16 | 392 | 19 | |||||||||||||||||||||||||||

| Forms, printing and supplies | 195 | 195 | — | 182 | 7 | |||||||||||||||||||||||||||

| Franchise and shares tax | 131 | 542 | (76) | 693 | (81) | |||||||||||||||||||||||||||

| Regulatory fees | 589 | 511 | 15 | 511 | 15 | |||||||||||||||||||||||||||

| Foreclosed assets, net | 43 | 99 | (57) | 30 | 43 | |||||||||||||||||||||||||||

Amortization of acquisition intangible |

377 | 389 | (3) | 443 | (15) | |||||||||||||||||||||||||||

| Provision for credit losses on unfunded lending commitments | 140 | — | — | (170) | 182 | |||||||||||||||||||||||||||

| Other expenses | 1,614 | 1,164 | 39 | 1,114 | 45 | |||||||||||||||||||||||||||

| Total noninterest expense | 20,604 | 21,338 | (3) | 21,181 | (3) | |||||||||||||||||||||||||||

Income before income tax expense |

11,491 | 12,219 | (6) | 13,457 | (15) | |||||||||||||||||||||||||||

| Income tax expense | 2,106 | 2,465 | (15) | 2,681 | (21) | |||||||||||||||||||||||||||

| Net income | $ | 9,385 | $ | 9,754 | (4) | $ | 10,776 | (13) | ||||||||||||||||||||||||

| Earnings per share - basic | $ | 1.18 | $ | 1.22 | (3) | % | $ | 1.33 | (11) | % | ||||||||||||||||||||||

| Earnings per share - diluted | $ | 1.17 | $ | 1.22 | (4) | $ | 1.32 | (11) | ||||||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.25 | $ | 0.25 | — | % | $ | 0.24 | 4 | % | ||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||

| SUMMARY FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | December 31, 2023 | September 30, 2023 | % Change | December 31, 2022 | % Change | |||||||||||||||||||||||||||

| EARNINGS DATA | ||||||||||||||||||||||||||||||||

| Total interest income | $ | 43,399 | $ | 42,078 | 3 | % | $ | 36,595 | 19 | % | ||||||||||||||||||||||

| Total interest expense | 14,117 | 12,569 | 12 | 3,309 | 327 | |||||||||||||||||||||||||||

| Net interest income | 29,282 | 29,509 | (1) | 33,286 | (12) | |||||||||||||||||||||||||||

Provision for loan losses |

665 | 351 | 89 | 1,987 | (67) | |||||||||||||||||||||||||||

| Total noninterest income | 3,478 | 4,399 | (21) | 3,339 | 4 | |||||||||||||||||||||||||||

| Total noninterest expense | 20,604 | 21,338 | (3) | 21,181 | (3) | |||||||||||||||||||||||||||

| Income tax expense | 2,106 | 2,465 | (15) | 2,681 | (21) | |||||||||||||||||||||||||||

| Net income | $ | 9,385 | $ | 9,754 | (4) | $ | 10,776 | (13) | ||||||||||||||||||||||||

| AVERAGE BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||

| Total assets | $ | 3,299,069 | $ | 3,281,093 | 1 | % | $ | 3,173,676 | 4 | % | ||||||||||||||||||||||

| Total interest-earning assets | 3,111,245 | 3,087,452 | 1 | 2,986,266 | 4 | |||||||||||||||||||||||||||

| Total loans | 2,572,400 | 2,538,218 | 1 | 2,374,065 | 8 | |||||||||||||||||||||||||||

| PPP loans | 5,643 | 5,869 | (4) | 6,883 | (18) | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,864,755 | 1,768,639 | 5 | 1,769,966 | 5 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 2,136,920 | 2,101,424 | 2 | 1,884,109 | 13 | |||||||||||||||||||||||||||

| Total deposits | 2,641,939 | 2,568,173 | 3 | 2,707,823 | (2) | |||||||||||||||||||||||||||

| Total shareholders' equity | 350,898 | 350,436 | — | 323,102 | 9 | |||||||||||||||||||||||||||

| PER SHARE DATA | ||||||||||||||||||||||||||||||||

| Earnings per share - basic | $ | 1.18 | $ | 1.22 | (3) | % | $ | 1.33 | (11) | % | ||||||||||||||||||||||

| Earnings per share - diluted | 1.17 | 1.22 | (4) | 1.32 | (11) | |||||||||||||||||||||||||||

| Book value at period end | 45.04 | 42.30 | 6 | 39.82 | 13 | |||||||||||||||||||||||||||

| Tangible book value at period end | 34.45 | 31.67 | 9 | 29.20 | 18 | |||||||||||||||||||||||||||

| Shares outstanding at period end | 8,158,281 | 8,163,655 | — | 8,286,084 | (2) | |||||||||||||||||||||||||||

| Weighted average shares outstanding | ||||||||||||||||||||||||||||||||

| Basic | 7,978,160 | 8,006,226 | — | % | 8,070,734 | (1) | % | |||||||||||||||||||||||||

| Diluted | 8,008,362 | 8,038,606 | — | 8,119,481 | (1) | |||||||||||||||||||||||||||

SELECTED RATIOS (1) |

||||||||||||||||||||||||||||||||

| Return on average assets | 1.13 | % | 1.18 | % | (4) | % | 1.35 | % | (16) | % | ||||||||||||||||||||||

| Return on average equity | 10.61 | 11.04 | (4) | 13.23 | (20) | |||||||||||||||||||||||||||

| Common equity ratio | 11.07 | 10.41 | 6 | 10.22 | 8 | |||||||||||||||||||||||||||

Efficiency ratio (2) |

62.89 | 62.93 | — | 57.83 | 9 | |||||||||||||||||||||||||||

| Average equity to average assets | 10.64 | 10.68 | — | 10.18 | 5 | |||||||||||||||||||||||||||

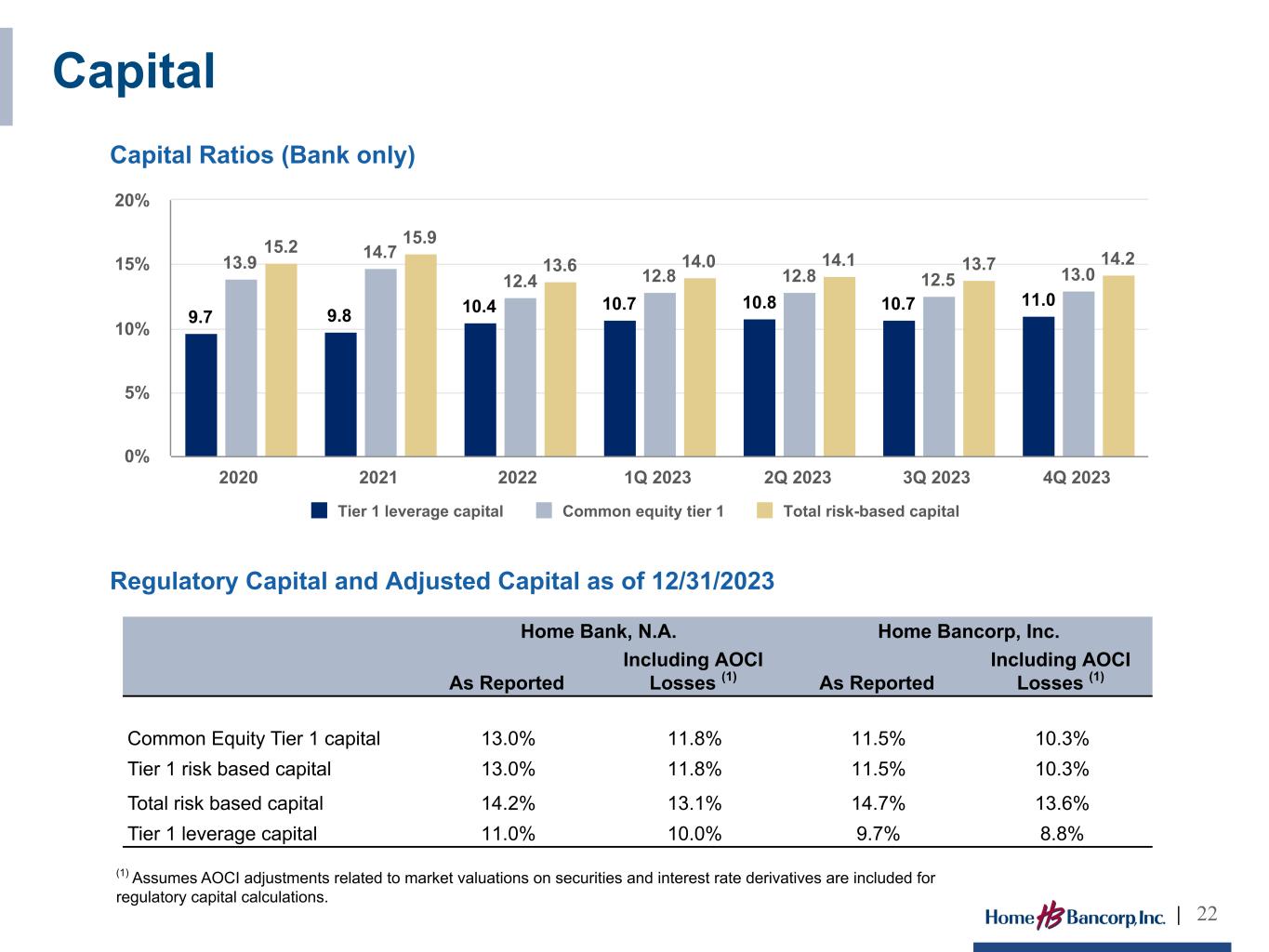

Tier 1 leverage capital ratio (3) |

10.98 | 10.71 | 3 | 10.43 | 5 | |||||||||||||||||||||||||||

Total risk-based capital ratio (3) |

14.23 | 13.73 | 4 | 13.63 | 4 | |||||||||||||||||||||||||||

Net interest margin (4) |

3.69 | 3.75 | (2) | 4.38 | (16) | |||||||||||||||||||||||||||

SELECTED NON-GAAP RATIOS (1) |

||||||||||||||||||||||||||||||||

Tangible common equity ratio (5) |

8.69 | % | 8.00 | % | 9 | % | 7.71 | % | 13 | % | ||||||||||||||||||||||

Return on average tangible common equity (6) |

14.53 | 15.15 | (4) | 18.75 | (23) | |||||||||||||||||||||||||||

|

(1)With the exception of end-of-period ratios, all ratios are based on average daily balances during the respective periods.

(2)The efficiency ratio represents noninterest expense as a percentage of total revenues. Total revenues is the sum of net interest income and noninterest income.

(3)Capital ratios are preliminary end-of-period ratios for the Bank only and are subject to change.

(4)Net interest margin represents net interest income as a percentage of average interest-earning assets. Taxable equivalent yields are calculated using a marginal tax rate of 21%.

(5)Tangible common equity ratio is common shareholders' equity less intangible assets divided by total assets less intangible assets. See "Non-GAAP Reconciliation" for additional information.

(6)Return on average tangible common equity is net income plus amortization of core deposit intangible, net of taxes, divided by average common shareholders' equity less average intangible assets. See "Non-GAAP Reconciliation" for additional information.

| ||||||||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY CREDIT QUALITY INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Acquired | Originated | Total | Acquired | Originated | Total | Acquired | Originated | Total | |||||||||||||||||||||||||||||||||||||||||||||||

CREDIT QUALITY (1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Nonaccrual loans (2) |

$ | 3,791 | $ | 5,023 | $ | 8,814 | $ | 3,905 | $ | 8,001 | $ | 11,906 | $ | 6,177 | $ | 4,336 | $ | 10,513 | ||||||||||||||||||||||||||||||||||||||

| Accruing loans past due 90 days and over | — | — | — | — | 43 | 43 | — | 2 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total nonperforming loans | 3,791 | 5,023 | 8,814 | 3,905 | 8,044 | 11,949 | 6,177 | 4,338 | 10,515 | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreclosed assets and ORE | 80 | 1,495 | 1,575 | 141 | 221 | 362 | 310 | 151 | 461 | |||||||||||||||||||||||||||||||||||||||||||||||

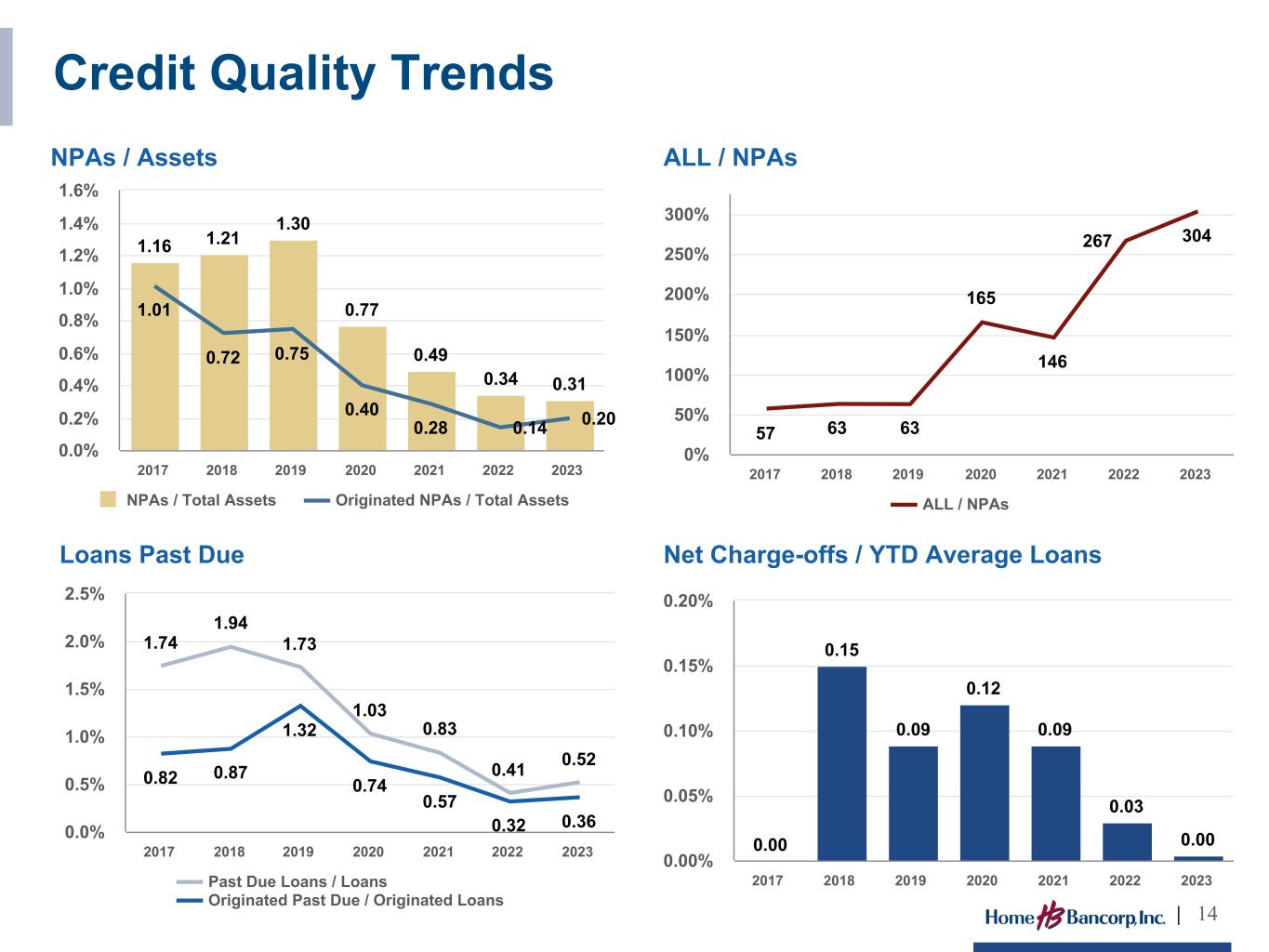

| Total nonperforming assets | 3,871 | 6,518 | 10,389 | 4,046 | 8,265 | 12,311 | 6,487 | 4,489 | 10,976 | |||||||||||||||||||||||||||||||||||||||||||||||

| Performing troubled debt restructurings | — | — | — | — | — | — | 1,605 | 4,600 | 6,205 | |||||||||||||||||||||||||||||||||||||||||||||||

Total nonperforming assets and troubled debt restructurings |

$ | 3,871 | $ | 6,518 | $ | 10,389 | $ | 4,046 | $ | 8,265 | $ | 12,311 | $ | 8,092 | $ | 9,089 | $ | 17,181 | ||||||||||||||||||||||||||||||||||||||

| Nonperforming assets to total assets | 0.31 | % | 0.37 | % | 0.34 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans to total assets | 0.27 | 0.36 | 0.33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nonperforming loans to total loans | 0.34 | 0.47 | 0.43 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(1)It is our policy to cease accruing interest on loans 90 days or more past due. Nonperforming assets consist of nonperforming loans, foreclosed assets and other real estate (ORE). Foreclosed assets consist of assets acquired through foreclosure or acceptance of title in-lieu of foreclosure. ORE consists of closed or unused bank buildings.

(2)Nonaccrual loans include originated restructured loans placed on nonaccrual totaling $3.1 million at December 31, 2022. Acquired restructured loans placed on nonaccrual totaled $3.7 million at December 31, 2022. With the adoption of ASU 2022-02, effective January 1, 2023, TDR accounting has been eliminated.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| HOME BANCORP, INC. AND SUBSIDIARY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY CREDIT QUALITY INFORMATION - CONTINUED | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2023 | September 30, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collectively Evaluated | Individually Evaluated | Total | Collectively Evaluated | Individually Evaluated | Total | Collectively Evaluated | Individually Evaluated | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One- to four-family first mortgage | $ | 3,255 | $ | — | $ | 3,255 | $ | 3,320 | $ | — | $ | 3,320 | $ | 2,883 | $ | — | $ | 2,883 | ||||||||||||||||||||||||||||||||||||||

| Home equity loans and lines | 688 | — | 688 | 742 | — | 742 | 624 | — | 624 | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 14,604 | 201 | 14,805 | 14,185 | 230 | 14,415 | 13,264 | 550 | 13,814 | |||||||||||||||||||||||||||||||||||||||||||||||

| Construction and land | 5,292 | 123 | 5,415 | 5,123 | — | 5,123 | 4,680 | — | 4,680 | |||||||||||||||||||||||||||||||||||||||||||||||

| Multi-family residential | 474 | — | 474 | 523 | — | 523 | 572 | — | 572 | |||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 6,071 | 95 | 6,166 | 6,161 | 105 | 6,266 | 5,853 | 171 | 6,024 | |||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 734 | — | 734 | 734 | — | 734 | 702 | — | 702 | |||||||||||||||||||||||||||||||||||||||||||||||

Total allowance for loan losses |

$ | 31,118 | $ | 419 | $ | 31,537 | $ | 30,788 | $ | 335 | $ | 31,123 | $ | 28,578 | $ | 721 | $ | 29,299 | ||||||||||||||||||||||||||||||||||||||

Unfunded lending commitments(3) |

2,594 | — | 2,594 | 2,454 | — | 2,454 | 2,093 | — | 2,263 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total allowance for credit losses | $ | 33,712 | $ | 419 | $ | 34,131 | $ | 33,242 | $ | 335 | $ | 33,577 | $ | 30,671 | $ | 721 | $ | 2,093 | ||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to nonperforming assets | 303.56 | % | 252.81 | % | 266.94 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to nonperforming loans | 357.81 | % | 260.47 | % | 278.64 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for loan losses to total loans | 1.22 | % | 1.21 | % | 1.21 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.32 | % | 1.31 | % | 1.29 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date loan charge-offs | $ | 471 | $ | 148 | $ | 1,398 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date loan recoveries | 368 | 296 | 704 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-date net loan (charge-offs) recoveries | $ | (103) | $ | 148 | $ | (694) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Annualized YTD net loan (charge-offs) recoveries to average loans | — | % | 0.01 | % | 0.03 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

(3)The allowance for unfunded lending commitments is recorded within accrued interest payable and other liabilities on the Consolidated Statements of Financial Condition. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||