false2023FY0001434728http://www.gwresources.com/20231231#LeaseRightOfUseAssethttp://www.gwresources.com/20231231#LeaseRightOfUseAssethttp://www.gwresources.com/20231231#LeaseRightOfUseAssethttp://www.gwresources.com/20231231#LeaseRightOfUseAssethttp://www.gwresources.com/20231231#LeaseLiabilityCurrent http://www.gwresources.com/20231231#LeaseLiabilityNoncurrenthttp://www.gwresources.com/20231231#LeaseLiabilityCurrent http://www.gwresources.com/20231231#LeaseLiabilityNoncurrenthttp://www.gwresources.com/20231231#LeaseLiabilityCurrent http://www.gwresources.com/20231231#LeaseLiabilityNoncurrenthttp://www.gwresources.com/20231231#LeaseLiabilityCurrent http://www.gwresources.com/20231231#LeaseLiabilityNoncurrentP2Y00014347282023-01-012023-12-3100014347282023-06-30iso4217:USD00014347282024-03-06xbrli:shares00014347282023-12-3100014347282022-12-31iso4217:USDxbrli:shares0001434728gwrs:WaterServicesMember2023-01-012023-12-310001434728gwrs:WaterServicesMember2022-01-012022-12-310001434728gwrs:WastewaterAndRecycledWaterMember2023-01-012023-12-310001434728gwrs:WastewaterAndRecycledWaterMember2022-01-012022-12-310001434728gwrs:UnregulatedRevenueMember2023-01-012023-12-310001434728gwrs:UnregulatedRevenueMember2022-01-012022-12-3100014347282022-01-012022-12-310001434728us-gaap:CommonStockMember2021-12-310001434728us-gaap:TreasuryStockCommonMember2021-12-310001434728us-gaap:AdditionalPaidInCapitalMember2021-12-310001434728us-gaap:RetainedEarningsMember2021-12-3100014347282021-12-310001434728us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001434728us-gaap:RetainedEarningsMember2022-01-012022-12-310001434728us-gaap:CommonStockMember2022-01-012022-12-310001434728us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001434728us-gaap:CommonStockMember2022-12-310001434728us-gaap:TreasuryStockCommonMember2022-12-310001434728us-gaap:AdditionalPaidInCapitalMember2022-12-310001434728us-gaap:RetainedEarningsMember2022-12-310001434728us-gaap:RetainedEarningsMember2023-01-012023-12-310001434728us-gaap:CommonStockMember2023-01-012023-12-310001434728us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001434728us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001434728us-gaap:CommonStockMember2023-12-310001434728us-gaap:TreasuryStockCommonMember2023-12-310001434728us-gaap:AdditionalPaidInCapitalMember2023-12-310001434728us-gaap:RetainedEarningsMember2023-12-31gwrs:utilitygwrs:peoplegwrs:homeutr:sqmi0001434728us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembergwrs:SantaCruzMember2023-01-012023-12-31xbrli:pure0001434728us-gaap:SeniorNotesMembergwrs:SeniorSecuredNotesDueJanuary32034Member2023-10-260001434728gwrs:PrivatePlacementOfferingMember2023-06-080001434728gwrs:PrivatePlacementOfferingMember2023-06-082023-06-080001434728srt:AffiliatedEntityMembergwrs:PrivatePlacementOfferingMember2023-06-082023-06-080001434728gwrs:PublicOfferingMember2022-08-012022-08-010001434728gwrs:PublicOfferingMember2022-08-010001434728us-gaap:OverAllotmentOptionMember2022-08-012022-08-010001434728srt:AffiliatedEntityMembergwrs:PublicOfferingMember2022-08-012022-08-010001434728gwrs:ValenciaWaterCompanyMember2015-07-140001434728gwrs:ValenciaWaterCompanyMember2015-07-142015-07-140001434728gwrs:ConnectionFeesMembergwrs:OtherWaterServicesMember2022-01-012022-12-310001434728gwrs:ConnectionFeesMembergwrs:OtherWaterServicesMember2023-01-012023-12-310001434728gwrs:HookUpFeeFundsMember2023-12-310001434728gwrs:HookUpFeeFundsMember2022-12-310001434728us-gaap:CertificatesOfDepositMember2023-12-310001434728us-gaap:CertificatesOfDepositMember2022-12-310001434728us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001434728us-gaap:RestrictedStockMember2023-01-012023-12-310001434728us-gaap:RestrictedStockMember2022-01-012022-12-310001434728stpr:AZ2023-12-31gwrs:regiongwrs:segment0001434728us-gaap:WaterPlantMember2023-07-030001434728us-gaap:WaterPlantMember2023-07-310001434728us-gaap:SubsequentEventMemberus-gaap:WaterPlantMember2024-01-3100014347282023-06-270001434728us-gaap:SubsequentEventMember2024-02-292024-02-2900014347282022-07-272022-07-2700014347282022-07-270001434728gwrs:AcquisitionPremiumsMember2022-06-3000014347282022-06-300001434728gwrs:TaxCutsandJobsActMember2022-06-302022-06-300001434728gwrs:RegulatoryAssetIncomeTaxesReceivableMember2023-12-310001434728gwrs:RegulatoryAssetIncomeTaxesReceivableMember2022-12-310001434728gwrs:RegulatoryAssetRateCaseExpenseSurchargeMember2023-12-310001434728gwrs:RegulatoryAssetRateCaseExpenseSurchargeMember2022-12-310001434728gwrs:RegulatoryAssetAcquisitionPremiumsMember2023-12-310001434728gwrs:RegulatoryAssetAcquisitionPremiumsMember2022-12-310001434728us-gaap:OtherRegulatoryAssetsLiabilitiesMember2023-12-310001434728us-gaap:OtherRegulatoryAssetsLiabilitiesMember2022-12-310001434728gwrs:RegulatoryLiabilityIncomeTaxesPayableMember2023-12-310001434728gwrs:RegulatoryLiabilityIncomeTaxesPayableMember2022-12-310001434728gwrs:AcquiredInfrastructureCoordinationAndFinancingAgreementsMember2023-12-310001434728gwrs:AcquiredInfrastructureCoordinationAndFinancingAgreementsMember2022-12-310001434728gwrs:DepreciationAdjustmentMember2023-12-310001434728gwrs:DepreciationAdjustmentMember2022-12-310001434728gwrs:RegulatoryAssetRateCaseExpenseSurchargeMember2022-10-240001434728gwrs:RegulatoryAssetAcquisitionPremiumsMembergwrs:RinconWaterCompanyIncMember2021-12-030001434728gwrs:RegulatoryAssetAcquisitionPremiumsMembergwrs:RinconWaterCompanyIncMember2023-12-310001434728gwrs:RegulatoryAssetAcquisitionPremiumsMembergwrs:TurnerRanchesIrrigationIncAndRedRockUtilitiesCompanyMember2023-12-310001434728gwrs:InfrastructureCoordinationAndFinancingAgreementsMember2022-12-310001434728gwrs:InfrastructureCoordinationAndFinancingAgreementsMember2023-01-012023-12-310001434728gwrs:InfrastructureCoordinationAndFinancingAgreementsMember2023-12-310001434728gwrs:InfrastructureCoordinationAndFinancingAgreementsMember2021-12-310001434728gwrs:InfrastructureCoordinationAndFinancingAgreementsMember2022-01-012022-12-310001434728gwrs:ResidentialMemberus-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMember2023-01-012023-12-310001434728gwrs:ResidentialMemberus-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:IrrigationMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:IrrigationMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:CommercialMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:CommercialMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:ConstructionWaterServicesMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:ConstructionWaterServicesMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:OtherWaterServicesMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMembergwrs:OtherWaterServicesMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMemberus-gaap:PublicUtilitiesInventoryWaterMember2022-01-012022-12-310001434728gwrs:ResidentialMembergwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMember2023-01-012023-12-310001434728gwrs:ResidentialMembergwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMember2022-01-012022-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:CommercialMember2023-01-012023-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:CommercialMember2022-01-012022-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:RecycledwaterMember2023-01-012023-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:RecycledwaterMember2022-01-012022-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:OtherWastewaterMember2023-01-012023-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMembergwrs:OtherWastewaterMember2022-01-012022-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMember2023-01-012023-12-310001434728gwrs:WasteWaterAndRecycledWaterMemberus-gaap:RegulatedOperationMember2022-01-012022-12-310001434728us-gaap:RegulatedOperationMember2023-01-012023-12-310001434728us-gaap:RegulatedOperationMember2022-01-012022-12-310001434728us-gaap:UnregulatedOperationMembergwrs:InfrastructureCoordinationAndFinancingAgreementsMember2023-01-012023-12-310001434728us-gaap:UnregulatedOperationMembergwrs:InfrastructureCoordinationAndFinancingAgreementsMember2022-01-012022-12-310001434728us-gaap:UnregulatedOperationMember2023-01-012023-12-310001434728us-gaap:UnregulatedOperationMember2022-01-012022-12-310001434728gwrs:WaterServicesMember2023-12-310001434728gwrs:WaterServicesMember2022-12-310001434728gwrs:WastewaterAndRecycledWaterMember2023-12-310001434728gwrs:WastewaterAndRecycledWaterMember2022-12-31gwrs:lease0001434728srt:MinimumMember2022-12-310001434728srt:MaximumMember2022-12-310001434728gwrs:LeaseContractTermOneMember2021-08-310001434728gwrs:LeaseContractTermTwoMember2021-08-310001434728srt:ScenarioForecastMemberus-gaap:SubsequentEventMember2024-06-012026-02-280001434728srt:ScenarioForecastMemberus-gaap:SubsequentEventMember2022-05-012025-04-300001434728srt:ScenarioForecastMemberus-gaap:SubsequentEventMember2025-05-012027-04-300001434728us-gaap:EquipmentMember2023-12-310001434728us-gaap:EquipmentMember2022-12-310001434728gwrs:OfficeBuildingsAndOtherStructuresMember2023-12-310001434728gwrs:OfficeBuildingsAndOtherStructuresMember2022-12-310001434728gwrs:TransmissionAndDistributionPlantMember2023-12-310001434728gwrs:TransmissionAndDistributionPlantMember2022-12-310001434728srt:MinimumMemberus-gaap:EquipmentMember2023-01-012023-12-310001434728us-gaap:EquipmentMembersrt:MaximumMember2023-01-012023-12-310001434728gwrs:OfficeBuildingsAndOtherStructuresMember2023-01-012023-12-310001434728srt:MinimumMembergwrs:TransmissionAndDistributionPlantMember2023-01-012023-12-310001434728srt:MaximumMembergwrs:TransmissionAndDistributionPlantMember2023-01-012023-12-310001434728us-gaap:AllowanceForCreditLossMember2022-12-310001434728us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001434728us-gaap:AllowanceForCreditLossMember2023-12-310001434728us-gaap:AllowanceForCreditLossMember2021-12-310001434728us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001434728gwrs:FarmersWaterCompanyMember2023-02-012023-02-010001434728gwrs:CPWaterCertificateOfConvenienceAndNecessityServiceAreaMember2023-12-310001434728gwrs:CPWaterCertificateOfConvenienceAndNecessityServiceAreaMember2022-12-310001434728us-gaap:TrademarksMember2023-12-310001434728us-gaap:TrademarksMember2022-12-310001434728us-gaap:FranchiseRightsMember2023-12-310001434728us-gaap:FranchiseRightsMember2022-12-310001434728gwrs:OrganizationalCostsMember2023-12-310001434728gwrs:OrganizationalCostsMember2022-12-310001434728gwrs:AcquiredInfrastructureCoordinationAndFinancingAgreementsMember2023-12-310001434728gwrs:AcquiredInfrastructureCoordinationAndFinancingAgreementsMember2022-12-310001434728us-gaap:ContractualRightsMember2023-12-310001434728us-gaap:ContractualRightsMember2022-12-310001434728srt:AffiliatedEntityMembergwrs:MedicalBenefitsPoolPlanMember2023-01-012023-12-310001434728srt:AffiliatedEntityMembergwrs:MedicalBenefitsPoolPlanMember2022-01-012022-12-310001434728gwrs:HookUpFeeFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001434728us-gaap:FairValueInputsLevel2Membergwrs:HookUpFeeFundsMember2023-12-310001434728us-gaap:FairValueInputsLevel3Membergwrs:HookUpFeeFundsMember2023-12-310001434728gwrs:HookUpFeeFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001434728us-gaap:FairValueInputsLevel2Membergwrs:HookUpFeeFundsMember2022-12-310001434728us-gaap:FairValueInputsLevel3Membergwrs:HookUpFeeFundsMember2022-12-310001434728us-gaap:FairValueInputsLevel1Member2023-12-310001434728us-gaap:FairValueInputsLevel2Member2023-12-310001434728us-gaap:FairValueInputsLevel3Member2023-12-310001434728us-gaap:FairValueInputsLevel1Member2022-12-310001434728us-gaap:FairValueInputsLevel2Member2022-12-310001434728us-gaap:FairValueInputsLevel3Member2022-12-310001434728us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2023-12-310001434728us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2023-12-310001434728us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2023-12-310001434728us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel1Member2022-12-310001434728us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Member2022-12-310001434728us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2022-12-310001434728gwrs:RedRockUtilitiesMember2023-12-310001434728gwrs:RedRockUtilitiesMember2023-12-31gwrs:growth_premium0001434728gwrs:RedRockUtilitiesMember2023-02-012023-02-010001434728gwrs:FarmersWaterCompanyMember2023-02-010001434728gwrs:SeriesASeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310001434728gwrs:SeriesASeniorSecuredNotesMemberus-gaap:SeniorNotesMember2022-12-310001434728us-gaap:SeniorNotesMembergwrs:SeriesBSeniorSecuredNotesMember2023-12-310001434728us-gaap:SeniorNotesMembergwrs:SeriesBSeniorSecuredNotesMember2022-12-310001434728us-gaap:SeniorNotesMember2023-12-310001434728us-gaap:SeniorNotesMember2022-12-310001434728us-gaap:SeniorNotesMember2016-06-24gwrs:debt_instrument0001434728gwrs:SeriesASeniorSecuredNotesMemberus-gaap:SeniorNotesMember2016-06-240001434728gwrs:SeriesASeniorSecuredNotesMemberus-gaap:SeniorNotesMember2016-06-242016-06-240001434728us-gaap:SeniorNotesMembergwrs:SeriesBSeniorSecuredNotesMember2016-06-240001434728us-gaap:SeniorNotesMembergwrs:SeriesBSeniorSecuredNotesMember2016-06-242016-06-240001434728us-gaap:SeniorNotesMembergwrs:SeriesBSeniorSecuredNotesMember2023-01-012023-12-310001434728us-gaap:SeniorNotesMember2016-06-242016-06-240001434728us-gaap:SeniorNotesMembergwrs:SeniorSecuredNotesDueJanuary32034Member2023-10-262023-10-260001434728us-gaap:SeniorNotesMembergwrs:CovenantCompliancePeriodOneMembergwrs:SeniorSecuredNotesDueJanuary32034Member2023-10-262023-10-260001434728gwrs:CovenantCompliancePeriodTwoMemberus-gaap:SeniorNotesMembergwrs:SeniorSecuredNotesDueJanuary32034Member2023-10-262023-10-260001434728us-gaap:LineOfCreditMembergwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-04-302020-04-300001434728gwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-04-300001434728us-gaap:LineOfCreditMembergwrs:LIBORMembergwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-04-302020-04-300001434728gwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-07-260001434728gwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-06-282023-06-280001434728us-gaap:LineOfCreditMembergwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-06-282023-06-280001434728us-gaap:LineOfCreditMembergwrs:NorthernTrustMembergwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-06-282023-06-280001434728us-gaap:SubsequentEventMembersrt:ScenarioForecastMemberus-gaap:LineOfCreditMembergwrs:NorthernTrustLoanAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-07-012024-03-310001434728gwrs:TaxCutsandJobsActMember2021-12-310001434728gwrs:TaxCutsandJobsActMember2022-01-012022-06-300001434728gwrs:TwentySeventeenStockOptionGrantMember2017-08-012017-08-310001434728gwrs:TwentySeventeenStockOptionGrantMember2017-08-310001434728gwrs:TwentySeventeenStockOptionGrantMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728gwrs:TwentySeventeenStockOptionGrantMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728us-gaap:ShareBasedCompensationAwardTrancheTwoMembergwrs:TwentySeventeenStockOptionGrantMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728gwrs:TwentySeventeenStockOptionGrantMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-310001434728gwrs:TwentySeventeenStockOptionGrantMemberus-gaap:EmployeeStockOptionMembergwrs:ShareBasedPaymentArrangementTrancheFourMember2023-01-012023-12-310001434728gwrs:TwentySeventeenStockOptionGrantMember2023-01-012023-12-310001434728gwrs:TwentySeventeenStockOptionGrantMember2023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMember2019-08-012019-08-310001434728gwrs:TwentyNineteenStockOptionGrantMember2019-08-310001434728gwrs:TwentyNineteenStockOptionGrantMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMemberus-gaap:EmployeeStockOptionMembergwrs:ShareBasedPaymentArrangementTrancheFourMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMembergwrs:ShareBasedPaymentArrangementTrancheFiveMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMembergwrs:ShareBasedPaymentArrangementTrancheSixMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMember2023-01-012023-12-310001434728gwrs:TwentyNineteenStockOptionGrantMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001434728gwrs:TwentyNineteenStockOptionGrantMember2023-12-3100014347282021-01-012021-12-310001434728us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001434728gwrs:Q12019Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-01-012023-12-310001434728gwrs:Q12019Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-12-310001434728gwrs:Q12019Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2022-01-012022-12-310001434728gwrs:Q12020Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-01-012023-12-310001434728gwrs:Q12020Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-12-310001434728gwrs:Q12020Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2022-01-012022-12-310001434728gwrs:Q12021Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-01-012023-12-310001434728gwrs:Q12021Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-12-310001434728gwrs:Q12021Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2022-01-012022-12-310001434728gwrs:Q12022Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-01-012023-12-310001434728gwrs:Q12022Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-12-310001434728gwrs:Q12022Membergwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2022-01-012022-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMembergwrs:Q12023Member2023-01-012023-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMembergwrs:Q12023Member2023-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMembergwrs:Q12023Member2022-01-012022-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-01-012023-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2023-12-310001434728gwrs:PhantomStockUnitsAndOrRestrictedStockUnitsMember2022-01-012022-12-310001434728us-gaap:StockAppreciationRightsSARSMembergwrs:Q12015Member2023-01-012023-12-310001434728us-gaap:StockAppreciationRightsSARSMembergwrs:Q12015Member2023-12-310001434728us-gaap:StockAppreciationRightsSARSMembergwrs:Q12015Member2022-01-012022-12-310001434728gwrs:Q32017Memberus-gaap:StockAppreciationRightsSARSMember2023-01-012023-12-310001434728gwrs:Q32017Memberus-gaap:StockAppreciationRightsSARSMember2023-12-310001434728gwrs:Q32017Memberus-gaap:StockAppreciationRightsSARSMember2022-01-012022-12-310001434728gwrs:Q12018Memberus-gaap:StockAppreciationRightsSARSMember2023-01-012023-12-310001434728gwrs:Q12018Memberus-gaap:StockAppreciationRightsSARSMember2023-12-310001434728gwrs:Q12018Memberus-gaap:StockAppreciationRightsSARSMember2022-01-012022-12-310001434728us-gaap:StockAppreciationRightsSARSMember2023-01-012023-12-310001434728us-gaap:StockAppreciationRightsSARSMember2023-12-310001434728us-gaap:StockAppreciationRightsSARSMember2022-01-012022-12-31utr:Q0001434728gwrs:PhantomShareUnitsRestrictedStockUnitsAndStockAppreciationRightsMember2023-01-012023-12-310001434728gwrs:PhantomShareUnitsRestrictedStockUnitsAndStockAppreciationRightsMember2022-01-012022-12-310001434728us-gaap:RestrictedStockUnitsRSUMember2023-12-310001434728us-gaap:RestrictedStockMembersrt:MinimumMember2023-01-012023-12-310001434728us-gaap:RestrictedStockMembersrt:MaximumMember2023-01-012023-12-310001434728us-gaap:RestrictedStockMember2022-12-310001434728us-gaap:RestrictedStockMember2023-12-31gwrs:service_connection0001434728gwrs:FarmersWaterCompanyMember2023-12-310001434728gwrs:RedRockUtilitiesMember2018-10-16gwrs:metergwrs:account

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number: 001-37756

Global Water Resources, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

90-0632193 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

|

21410 N. 19th Avenue #220 |

|

|

|

Phoenix, |

Arizona |

|

85027 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (480) 360-7775

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

GWRS |

The NASDAQ Stock Market, LLC

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2023) was $142.0 million based upon the closing sale price of the registrant’s common stock as reported on the NASDAQ Global Market. As of March 6, 2024, the registrant had 24,175,241 shares of common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated herein by reference to the registrant’s definitive proxy statement relating to the 2024 annual meeting of stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the registrant’s fiscal year ended December 31, 2023.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

| PART I. |

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 1B. |

|

|

Item 1C. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| PART II. |

|

|

| Item 5. |

|

|

| Item 6. |

[Reserved] |

|

| Item 7. |

|

|

| Item 7A. |

|

|

| Item 8. |

|

|

| Item 9. |

|

|

| Item 9A. |

|

|

| Item 9B. |

|

|

| Item 9C. |

|

|

| PART III. |

|

|

| Item 10. |

|

|

| Item 11. |

|

|

| Item 12. |

|

|

| Item 13. |

|

|

| Item 14. |

|

|

| PART IV. |

|

|

| Item 15. |

|

|

|

|

|

| Item 16. |

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

Certain statements in this Annual Report on Form 10-K of Global Water Resources, Inc. (the “Company”, “GWRI”, “we”, or “us”), including all documents incorporated by reference, are forward-looking in nature and may constitute “forward-looking information” within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the words “believes”, “anticipates”, “plans”, “expects”, “intends”, “projects”, “estimates”, “objective”, “goal”, “focus”, “aim”, “should”, “could”, “may”, and similar expressions.

These forward-looking statements include, but are not limited to, statements about our strategies; expectations about future business plans, prospective performance, growth, and opportunities; future financial performance; regulatory and Arizona Corporation Commission (“ACC”) proceedings, decisions and approvals, such as the anticipated benefits resulting from Rate Decision No. 78644, including our expected collective revenue increase due to new water and wastewater rates and benefits from consolidation of rates, as well as our beliefs and expectations pertaining to ACC actions relating to our Southwest Plant; acquisition plans and our ability to complete additional acquisitions; population and growth projections; technologies, including expected benefits from implementing such technologies; revenues; metrics; operating expenses; trends relating to our industry, market, population growth, and housing permits; the adequacy of our water supply to service our current demand and growth for the foreseeable future; liquidity; plans and expectations for capital expenditures; cash flows and uses of cash; dividends; depreciation and amortization; tax payments; our ability to repay indebtedness and invest in initiatives; the anticipated impact and resolutions of legal matters; the anticipated impact of new or proposed laws, including regulatory requirements, tax changes, and judicial decisions; and the anticipated impact of accounting changes and other pronouncements.

Forward-looking statements should not be read as a guarantee of future performance or results. They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks. Consequently, actual results may vary materially from what is contained in a forward looking statement. Investors are cautioned not to place undue reliance on forward-looking information. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including risks related to legal, regulatory, and legislative matters; risks related to our business and operations; risks related to market and financial matters; risks related to technology; risks related to the ownership of our common stock; and certain general risks, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. These risks include, but are not limited to, the following principal risks:

•we are subject to regulation by the ACC and our financial condition depends upon our ability to recover costs in a timely manner from customers through regulated rates;

•new or stricter regulatory standards or other governmental actions could increase our regulatory compliance and operating costs, require us to alter our existing treatment facilities, and/or cause us to build additional facilities;

•our ability to expand into new service areas and to expand current water and wastewater service depends on approval from regulatory agencies;

•changes to environmental and other regulation may require us to alter our existing treatment facilities or build additional facilities;

•our water and wastewater systems are subject to condemnation by governmental authorities;

•inadequate water and wastewater supplies could have a material adverse effect upon our ability to achieve the customer growth necessary to increase our revenues;

•there is no guaranteed source of water;

•future acquisitions may not achieve sufficient profitability relative to expenses and investment;

•pandemics, epidemics or disease outbreaks, such as the COVID-19 pandemic, could adversely affect our business operations, cash flows, and financial position to an extent that is difficult to predict;

•we may have difficulty accomplishing our growth strategy within and outside of our current service areas;

•service interruptions, including due to any disruption or problem at our facilities could increase our expenses;

•any failure of our network of treatment facilities, water and wastewater pipes and water reservoirs could result in losses and damages;

•contamination of the water supplied by us may result in disruption in our services, loss of credibility, lower demand for our services, and potential liability;

•our operations of regulated utilities are currently located exclusively in the state of Arizona and concentrated heavily within a single municipality;

•our utilities business is subject to seasonal fluctuations and other weather-related conditions;

•our growth depends significantly on increased residential and commercial development in our service areas;

•our information technology systems may be subject to cyberattacks and may be vulnerable to unauthorized external or internal access due to hacking, ransomware, viruses, or other breaches; and

•the concentration of our stock ownership with our officers, directors, certain stockholders and their affiliates will limit our stockholders’ ability to influence corporate matters.

These and other factors are discussed in the risk factors described in Part I, Item 1A “Risk Factors” of this report, which readers should review carefully before placing any reliance on our financial statements or disclosures. Additionally, there may be other risks described from time to time in the reports that we file with the Securities and Exchange Commission (the “SEC”). Any forward-looking statement speaks only as of the date of this report. Except as required by law, we undertake no obligation to publicly release the results of any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

PART I

ITEM 1.BUSINESS

Overview

GWRI is a water resource management company that owns, operates, and manages twenty-nine water, wastewater, and recycled water systems in strategically located communities, principally in metropolitan Phoenix and Tucson, Arizona. The Company seeks to deploy an integrated approach, referred to as “Total Water Management.” Total Water Management is a comprehensive approach to water utility management that reduces demand on scarce non-renewable water sources and costly renewable water supplies, in a manner that ensures sustainability and greatly benefits communities both environmentally and economically. This approach employs a series of principles and practices that can be tailored to each community:

•Reuse of recycled water, either directly or to non-potable uses, through aquifer recharge, or possibly direct potable reuse in the future;

•Regional planning;

•Use of advanced technology and data;

•Employing respected subject matter experts and retaining thought and application leaders;

•Leading outreach and educational initiatives to ensure all stakeholders including customers, development partners, regulators, and utility staff are knowledgeable on the principles and practices of the Total Water Management approach; and

•Establishing partnerships with communities, developers, and industry stakeholders to gain support of the Total Water Management principles and practices.

Serving more than 82,000 people in approximately 32,000 homes within the Company’s 408 square miles of certificated service areas as of December 31, 2023, the Company provides water and wastewater utility services under the regulatory authority of the ACC. Approximately 89.3% of the active service connections are customers of the Company’s the Company’s Global Water - Santa Cruz Water Company, Inc. (“Santa Cruz”) and Global Water - Palo Verde Utilities Company, Inc. (“Palo Verde”) utilities, which are located within a single service area.

U.S. Water Industry Overview

U.S. Water Industry Areas of Business

The U.S. water industry has two main areas of business:

•Utility Services to Customers. This business includes water and wastewater utilities, which are owned and operated by governmental subdivisions or investors in the private sector. Investor-owned water and wastewater utilities are generally economically regulated, including rate regulation, by public utility commissions in the states in which they operate. The utility segment is characterized by high barriers to entry, including high capital spending requirements.

•General Water Products and Services. This business includes manufacturing, engineering and consulting companies, and numerous other fee-for-service businesses. The activities of these businesses include the building, financing, and operating of water and wastewater utilities, utility repair services, contract operations, laboratory services, manufacturing and distribution of infrastructure and technology components, and other specialized services.

Key Characteristics of the U.S. Water Industry

In the U.S., the water industry is characterized by:

•Significant Constraints on the Availability of Fresh Water. In Arizona, the Arizona Department of Water Resources (“ADWR”) estimates that annual water usage is 7 million acre-feet per year, as of 2017. Arizona has the right to use 2.8 million acre-feet from the Colorado River and approximately half of that can be delivered through the Central Arizona Project, a 336-mile long system of aqueducts, tunnels, pumping plants, and pipelines from the Colorado River to central Arizona. The Colorado River is shared by seven U.S. States and Mexico and is presently over-allocated, which means that more surface water right allocations have been issued than the actual average annual flow, with allocations being determined based on data from a period during which flows were significantly higher than in recent years. The Central Arizona Project is the only means of transporting Colorado River water into central Arizona. Approximately 41% of the water used in Arizona comes from groundwater. Water in the western U.S. is being pumped from groundwater sources faster than it is replenished naturally, a condition known as overdraft. In areas of water scarcity, such as the arid western U.S., water recycling represents a relatively simple, inexpensive, and energy-efficient means of augmenting water supply as compared to transporting surface water, groundwater, or desalinated water from other locations. Approximately 70% of the water provided for municipal use is currently utilized for non-potable applications where recycled water could potentially be utilized.

•Lack of Technology Utilization to Increase Operating Efficiencies and Decrease Operating Costs. The U.S. water industry has traditionally not taken advantage of advances in technology available to enhance revenue, increase operating efficiencies, and decrease operating costs (including labor and energy costs). Areas of opportunity include automated meter reading, systems management, and administrative functions, such as customer billing and remittance systems. Key drivers for the lack of investment in technology in water and wastewater utilities have been the historical lack of incentives offered or standards imposed by regulators to achieve efficiencies and lower costs and the ownership of the U.S. water utility sector, which largely consists of small, undercapitalized, municipally-owned utilities that lack the financial and technical resources to pursue technology opportunities.

•Highly Fragmented Ownership. The utility segment of the U.S. water industry is highly fragmented, with approximately 50,000 water utilities and approximately 16,000 community wastewater utilities, according to the U.S. Environmental Protection Agency (“EPA”). The majority of the approximately 50,000 water utilities are serving a population of 5,000 or less, and 85% of the water utilities serve only 10% of the population.

•Large Public Sector Ownership. Municipally-owned utilities provide water and wastewater services for the vast majority of the U.S. population. For homes connected to a community water system, approximately 80% are provided service by municipally-owned utilities.

•Aging Infrastructure in Need of Significant Capital Expenditures. Water infrastructure in the U.S. is aging and requires significant investment and stringent focus on cost control to upgrade or replace aging facilities and to provide service to growing populations. Throughout the U.S., utilities are required to make expenditures on the rehabilitation of existing utilities and on the installation of new infrastructure to accommodate growth and make improvements to water quality and wastewater discharges mandated by stricter water quality standards. Water quality standards, first introduced with the Clean Water Act in 1972 and the Safe Drinking Water Act in 1974, are becoming increasingly stringent and numerous. For water, the American Water Works Association estimates investment needs for buried drinking water infrastructure will total more than $1 trillion over the next 25 years. The American Society of Civil Engineers estimates capital investment needs to update and grow the nation’s drinking water and wastewater systems is expected to increase to $434 billion by 2029.

Private Sector Opportunities

Municipal water utilities typically fund their capital expenditure needs through user-based water and wastewater rates, municipal taxes, or the issuance of bonds. However, raising large amounts of funds required for capital investment is often challenging for municipal water utilities, which affects their ability to fund capital spending. Many smaller utilities also do not have the in-house technical and engineering resources to manage significant infrastructure or technology-related investments. In order to meet their capital spending challenges and take advantage of technology-related operating efficiencies, many municipalities are examining a combination of outsourcing and partnerships with the private sector or outright privatizations.

•Outsourcing involves municipally-owned utilities contracting with private sector service providers to provide services, such as meter reading, billing, maintenance, or asset management services.

•Public-private partnerships among government, operating companies, and private investors include arrangements, such as design, build, and operate contracts; build, own, operate, and transfer contracts; and own, leaseback, and operate contracts.

•Privatization involves a transfer of responsibility for, and ownership of, the utility from the municipality to private investors.

We believe investor-owned utilities that have greater access to capital are generally more capable of making mandated and other necessary infrastructure upgrades to both water and wastewater utilities, addressing increasingly stringent environmental and human health standards, and navigating a wide variety of regulatory processes. In addition, investor-owned utilities that achieve larger scales are able to spread overhead expenses over a larger customer base, thereby reducing the costs to serve each customer. Since many administrative and support activities can be efficiently centralized to gain economies of scale and sharing of best practices, companies that participate in industry consolidation have the potential to improve operating efficiencies, lower costs, and improve service at the same time.

Our Strategy

We are a water resource management company that provides water, wastewater, and recycled water utility services. We believe we are a leader in Total Water Management practices, such as water scarcity management and advanced water recycling applications. Our long-term goal is to become one of the largest investor-owned operators of integrated water and wastewater utilities in areas of the arid western U.S. where water scarcity management is necessary for long-term economic sustainability and growth.

Our growth strategy involves the elements listed below:

•acquiring or forming utilities in the path of prospective population growth;

•expanding our service areas geographically and organically growing our customer base within those areas; and

•deploying our Total Water Management approach into these utilities and service areas.

We believe this plan can be executed in our current service areas and in other geographic areas where water scarcity management is necessary to support long-term growth and in which regulatory authorities recognize the need for water conservation through water recycling.

Total Water Management is a demand-side-management framework (in that it is a solution intended to drive down demand for water supplies versus developing new water supplies) that alleviates the pressures of water scarcity in communities where growth is reasonably expected to outpace potable water supply. Built on an all-encompassing view of the water cycle, Total Water Management promotes sustainable community development through reduced potable water consumption while monetizing the value of water through each stage of delivery, collection, and reuse.

Our business model applies Total Water Management in high growth communities. Components of our Total Water Management approach include:

•Regional planning to reduce overall design and implementation costs, leveraging the benefits of replicable designs, gaining the benefits of economies of scale, and enhancing the Company’s position as a premier water and wastewater service provider in the region.

◦For example, the Company has secured four separate area-wide Clean Water Act Section 208 Regional Water Quality Management Plans in its major planning areas, covering more than 500 square miles of land. To obtain these plans, a provider must develop, amongst other things, a regional wastewater solution, including plans for engineering, infrastructure location and size, and goals for the management of treated reclaimed water, which the Company successfully demonstrated in obtaining its plans.

•Stretching a limited resource by maximizing the use of recycled water, using renewable surface water where available and recharging aquifers with any available excess water.

◦For example, the Company’s water recycling model has been fully implemented in the City of Maricopa. The Company is the water, wastewater, and recycled water provider for the City of Maricopa, which currently has a population of approximately 74,000. A community of this size produces an approximate annual average of 3.7 million gallons of wastewater per day.

Because the Company requires developers to take back and utilize recycled water within their communities and invest in “purple pipe” recycled water infrastructure during the initial development of subdivisions, the Company is now able to distribute the majority of its recycled water back to the community for beneficial purposes. Approximately 66% of the recycled water goes towards common area non-potable irrigation and for use at a local farm, which allows for the recycled water to naturally recharge into the aquifer. This reduces the total amount of limited ground or surface water that would otherwise be required within the community by almost 30%. To date, the Company has reused approximately 11.7 billion gallons of recycled water in the City of Maricopa.

•Integrating and standardizing water, wastewater, and recycled water infrastructure delivery systems using a separate distribution system of purple pipes to conserve water resources, reduce energy, treatment, and consumable costs (e.g., chemicals, filter media, other general materials, and supplies), provide operational efficiencies, and align the otherwise disparate objectives of water sales and conservation.

◦In addition to the previous example, which related to the requirements for recycled water usage, the separate distribution system of purple pipes, and water conservation achievements, the Company believes that its model results in additional benefits from an economic perspective due to lower use of power and consumables. For every gallon of recycled water that is directly reused while already on land surface, the need to pump additional scarce groundwater and surface water is eliminated. Such additional groundwater and surface water would otherwise need to be treated and distributed in accordance with the Safe Drinking Water Act, which is costly and requires significant energy.

•Gaining market and regulatory acceptance of broad utilization of recycled water through agreements with developers, strategic relationships with governments, academic research, and publication as industry experts, coupled with public education and community outreach campaigns.

◦For example, the Company has public-private partnerships formally adopted through memorandums of understanding with the City of Maricopa, City of Casa Grande, City of Coolidge and Town of Sahuarita. Each memorandum of understanding reflects the Company’s intent to deploy Total Water Management. The Company also has 154 infrastructure coordination and financing agreements with landowners or developer entities that include requirements for usage of recycled water and other attributes that support the Company’s Total Water Management model. As discussed above, the Company’s integrated provider model, which is focused on the maximum use of recycled water, underpins its Clean Water Act Section 208 Regional Water Quality Management Plans and Designations of Assured Water Supply. In addition, the Company has won numerous awards for education, outreach, and conservation in the water industry.

•Incorporating automated processes, such as supervisory control and data acquisition, automated meter reading, and back-office technologies and “green” billing, which reduce operating costs, improve system availability and reliability, and improve customer satisfaction.

◦Supervisory Control and Data Acquisition. The Company employs supervisory control and data acquisition in most of its utility systems, which provides continuous monitoring, instantaneous alarming, and historical trending on all key operating assets, including instrumentation and dynamic components (e.g., pumps, motor-controlled valves, treatment systems, etc.). This data is reported back to the appropriate operations personnel through a standard industry software. The benefits of this system include the significantly enhanced ability to: achieve compliance and safety mandates; reduce service outages; troubleshoot systems; provide for remote operations; and allow for proactive maintenance and lower costs related to efficient real-time operations.

◦Automated Meter Infrastructure. The Company has implemented automated meter reading for 99% of its active customers with a substantial proportion of its remaining customers in the process of or being, or planned to be, upgraded with such functionality. Currently, all meters in our Maricopa service areas allow for automated meter infrastructure. This technology reads each meter numerous times per day (often hourly) and continuously transmits the meter readings back to a centralized data base through a communications tower and cellular transmission units. The data is then presented to the utility, and is made available to customers, through a simple user interface. Reading meters at this frequency provides many benefits to both the utility and the customer. With this data, we can better model demand usage, identify system water loss, identify leaks on the customer side of the meter, monitor for abnormal usage, and present interval, hourly, daily, weekly, or monthly usage back to the customers.

◦Back-Office Technologies and Paperless Billing. The Company employs a series of technologies that allow for the automation of the billing and remittance process. The Company also provides its customers with over seven ways to pay, with the majority of options being integrated with the Company’s back-office technologies. In combination with automated meter reading, this suite of technology has minimized the use of human labor and reduced the potential for human error for the entire billing and remittance process, while providing better customer service.

We believe our Total Water Management-based business model provides us with a significant competitive advantage in high growth, water scarce regions. Based on our experience and discussions with developers, we believe developers prefer our approach because it provides a bundled solution to infrastructure provision and improves housing density in areas of scarce water resources. Developers are also focusing on increased consumer and regulatory demands for environmentally friendly or “green” housing alternatives. Communities prefer the approach because it provides a partnering platform which promotes economic development, reduces their traditional dependence on bond financing and ensures long term water sustainability.

Our competitive advantage facilitates the execution of our growth strategy. We believe our proven conservation methods lead to successful permitting for more connections in expanded and new service areas.

A key component of our water utility business is the use of recycled water. Recycled water is highly treated and purified wastewater that is distributed through a separate distribution system of purple pipes for a variety of beneficial, non-potable uses. Recycled water can be delivered for all common area irrigation needs, as well as delivered direct to homes where it can be used for outdoor residential irrigation. Our Total Water Management model, an integrated approach to the use of potable and non-potable water to manage the entire water cycle, both conserves water and maximizes its total economic value. The application of the Total Water Management model has proven to be effective as a means of water scarcity management that promotes sustainable communities and helps achieve greater dwelling unit density in areas where the availability of sustainable water can be a key constraint on development. Our implementation of the Total Water Management philosophy in Arizona has led to the development of relationships with key regulatory bodies.

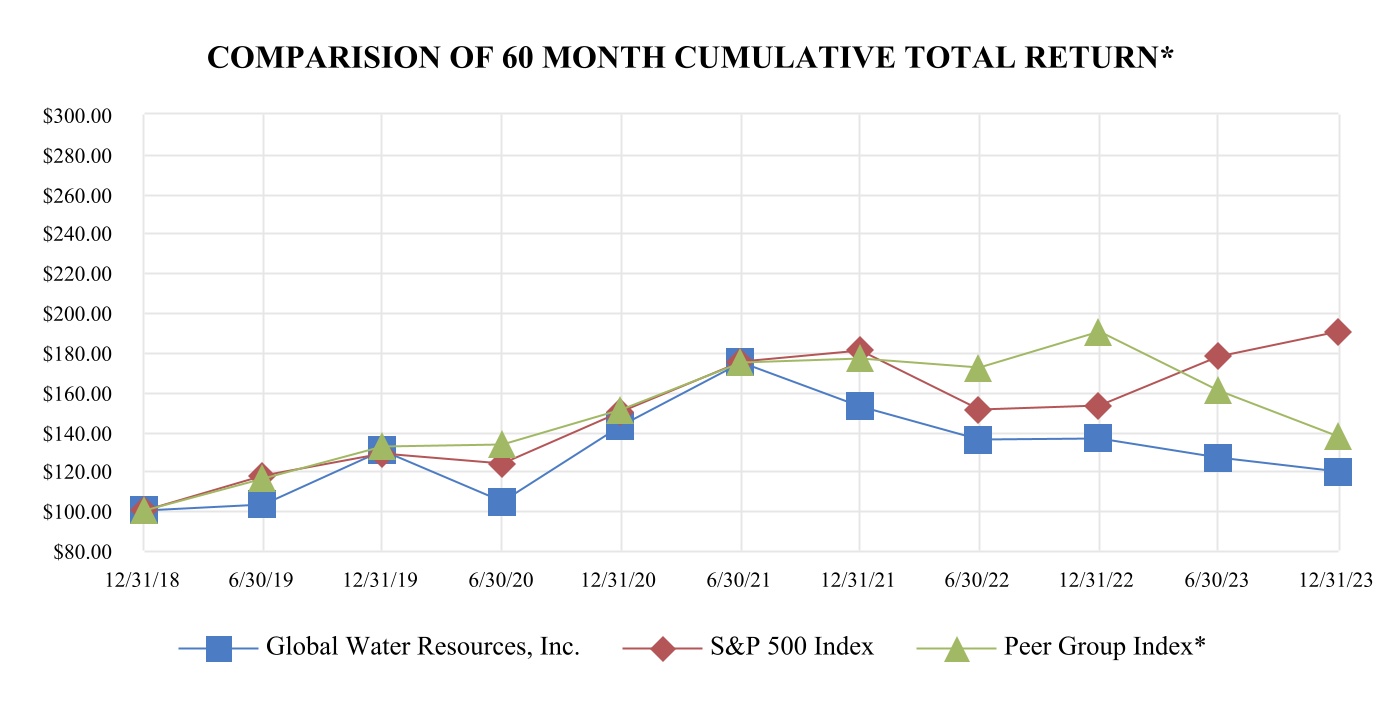

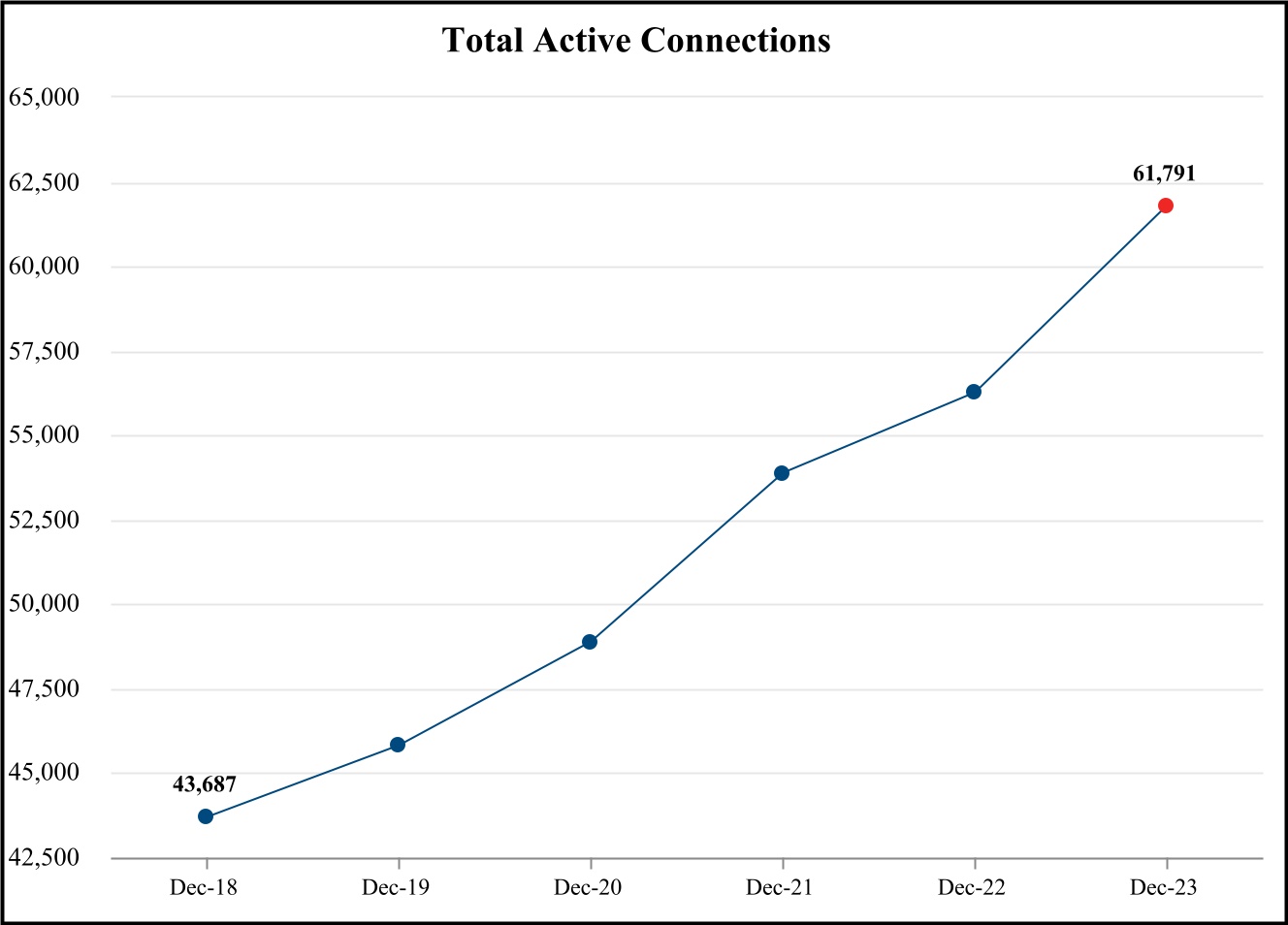

Our Regulated Utilities

We own and operate regulated water, wastewater, and recycled water utilities in communities principally located in metropolitan Phoenix and Tucson. Our utilities are regulated by the ACC, as described further under “—Regulation—Arizona Regulatory Agencies” below. As of December 31, 2023, our utilities collectively had 61,791 active service connections offering predictable rate-regulated cash flows. Revenues from our regulated utilities accounted for approximately 94.7% of total revenues in 2023. Our utilities currently possess the high-level regional permits that allow us to implement our business model; thus, we believe we are well-positioned for organic growth in our current service areas that are generally located in Arizona’s population growth corridors: Maricopa County, Pinal County and Pima County.

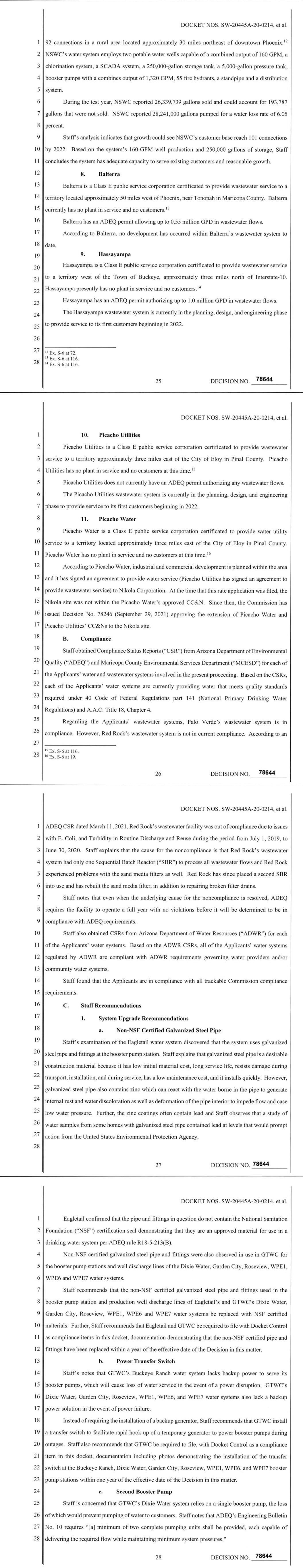

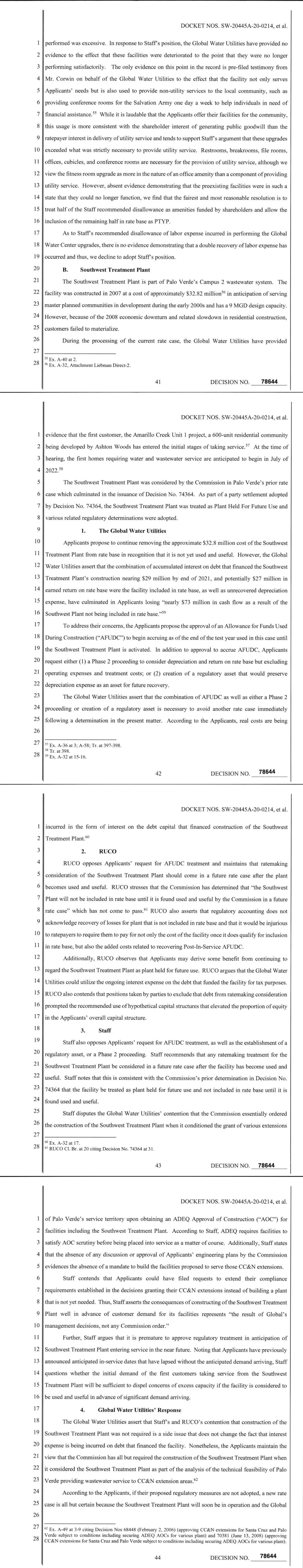

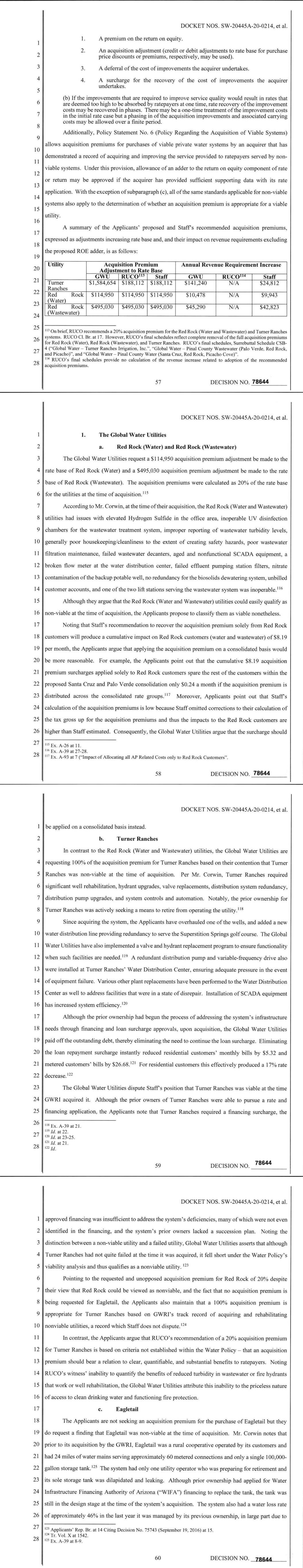

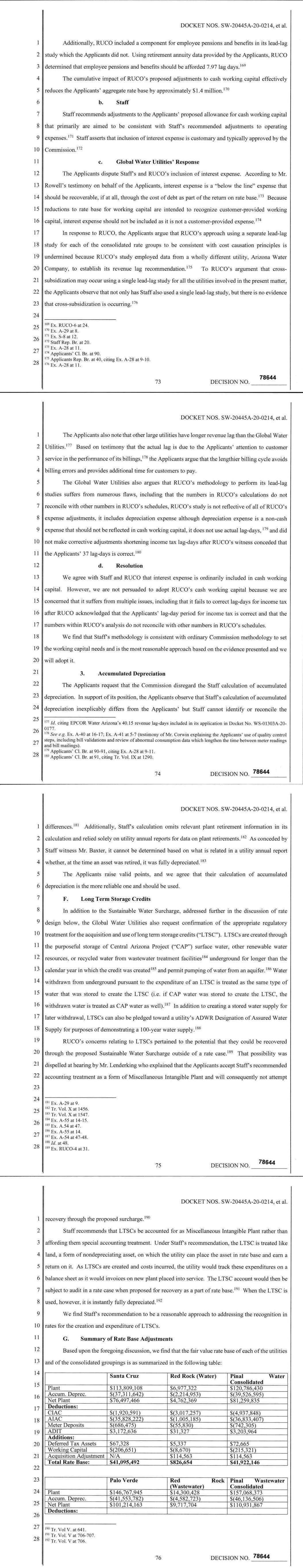

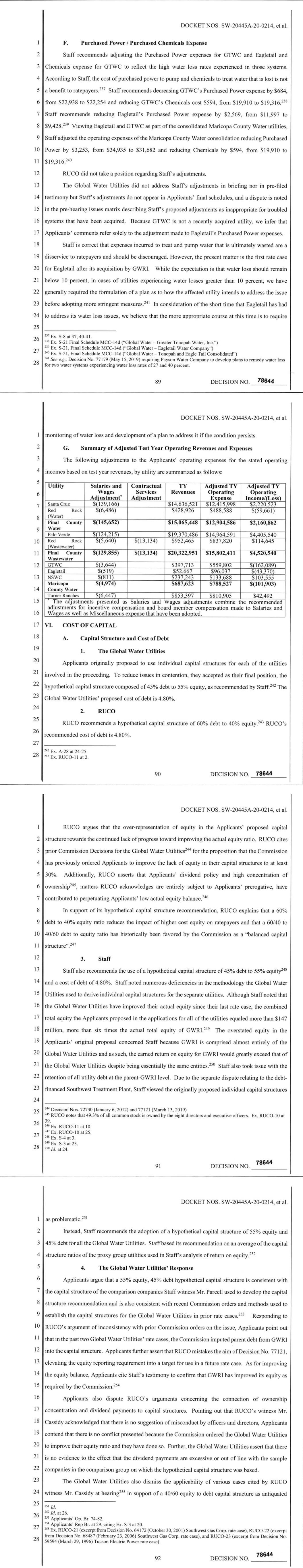

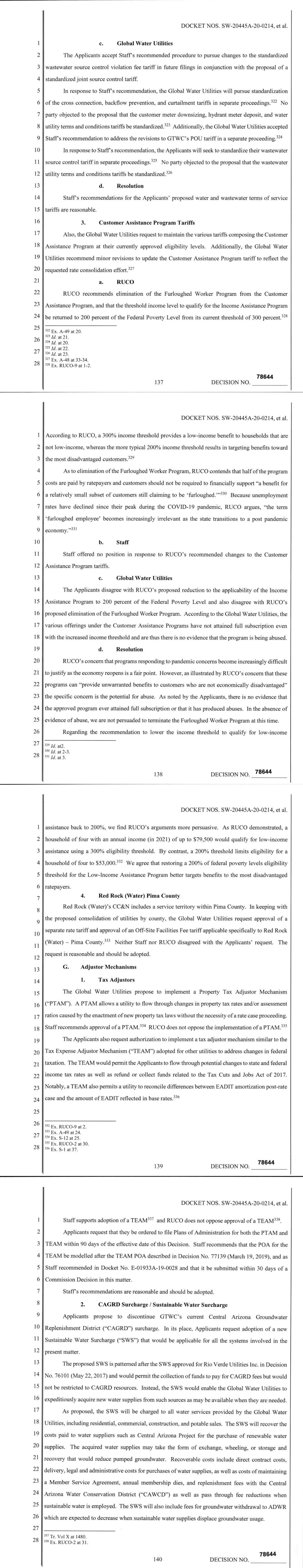

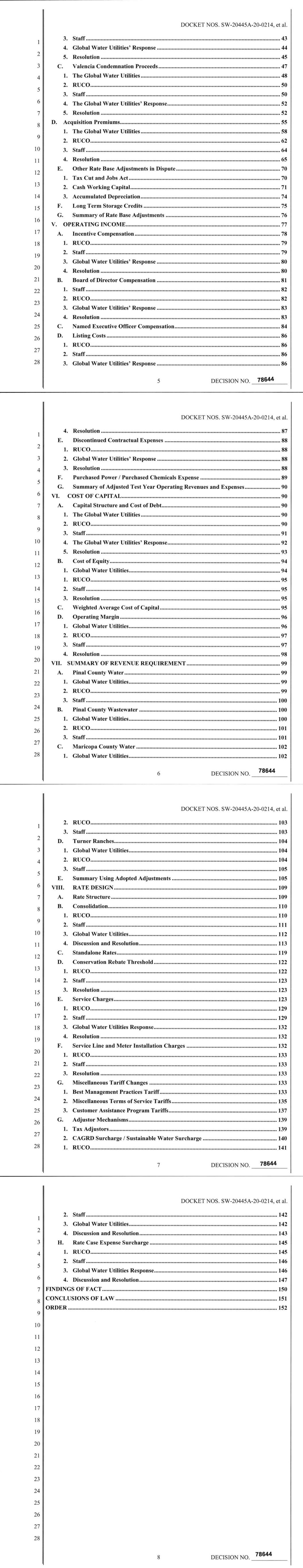

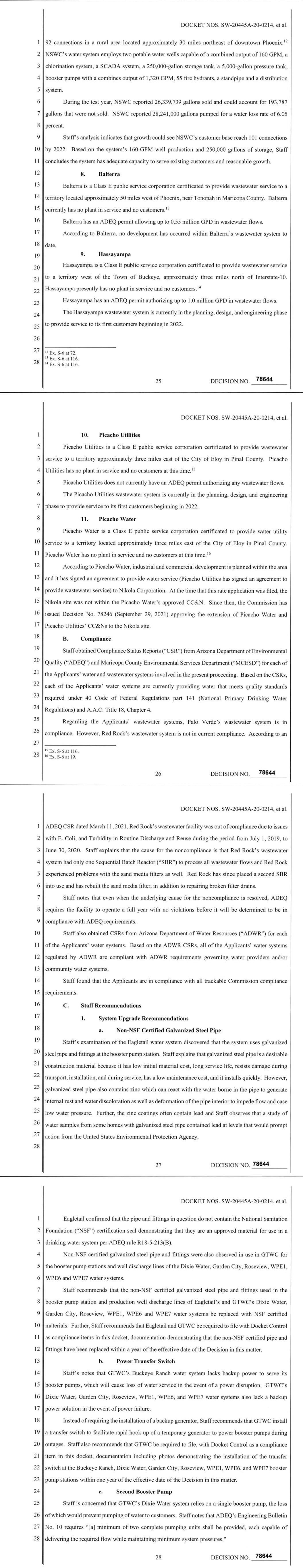

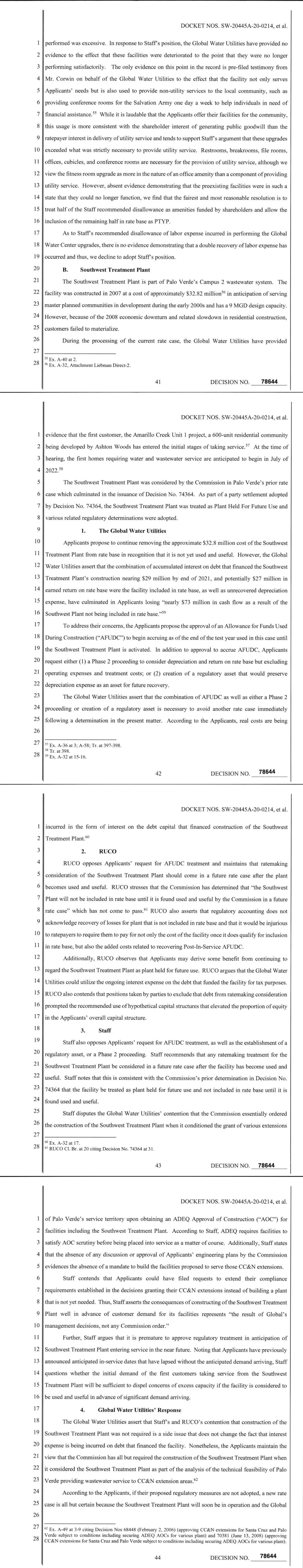

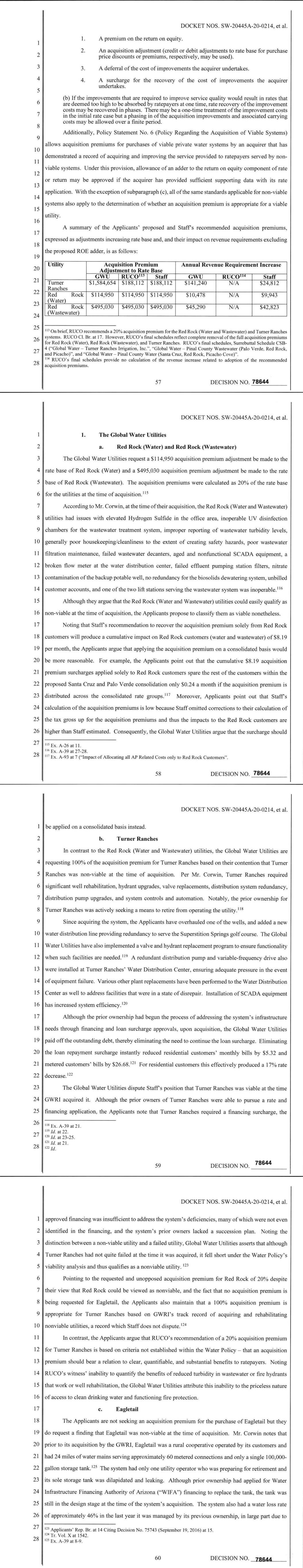

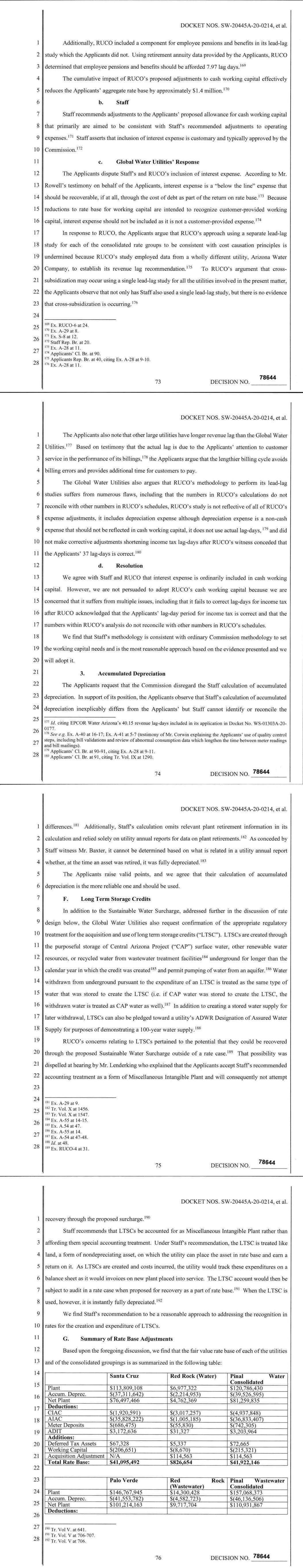

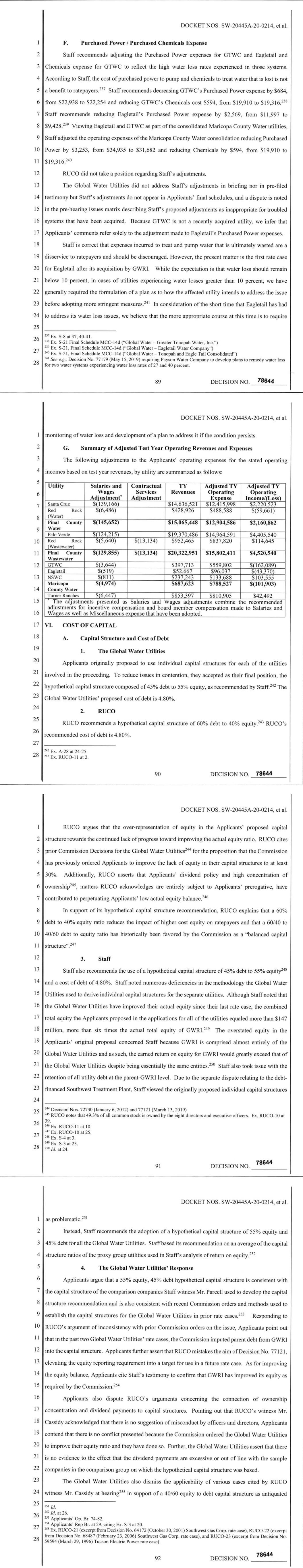

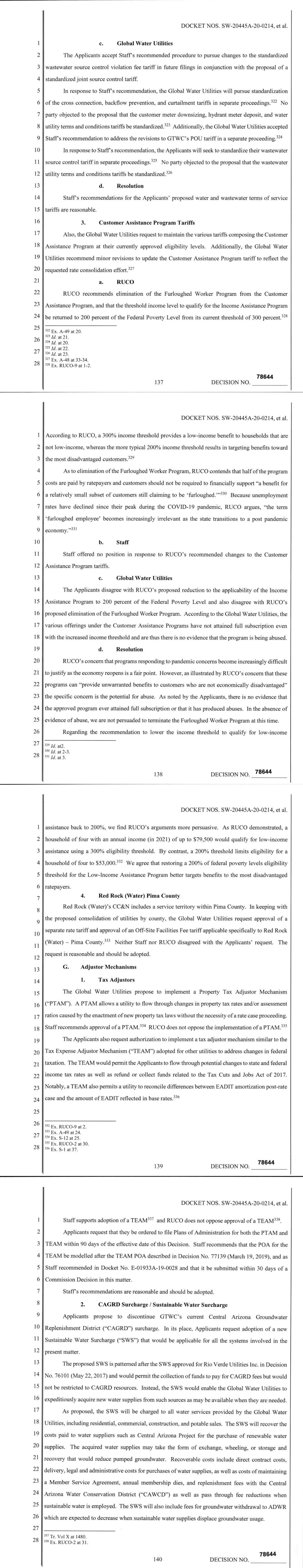

A summary description of our utilities at December 31, 2023 is set forth in the following table and described in more detail below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Utility |

|

Date of Acquisition (A) or Formation (F) |

|

Service Provided |

|

Square Miles of Service Area (1) |

|

Active Service Connections |

|

Average Monthly Rate Per Service Connection |

| PINAL COUNTY |

|

|

|

|

|

|

|

|

|

|

| Global Water - Santa Cruz Water Company, Inc. |

|

2004 (A) |

|

Water |

|

90 |

|

|

27,766 |

|

|

$ |

63 |

|

| Global Water - Palo Verde Utilities Company, Inc. |

|

2004 (A) |

|

Wastewater and Recycled Water |

|

115 |

|

|

27,421 |

|

|

77 |

|

|

|

|

|

|

|

|

|

|

|

|

| MARICOPA COUNTY |

|

|

|

|

|

|

|

|

|

|

| Global Water - Hassayampa Utilities Company, Inc. |

|

2005 (F) |

|

Wastewater and Recycled Water |

|

43 |

|

|

0 |

|

0 |

| Global Water - Belmont Water Company, Inc. |

|

2006 (A) |

|

Water |

|

111 |

|

|

622 |

|

|

142 |

|

| Global Water - Turner Ranches Irrigation, Inc. |

|

2018 (A) |

|

Water |

|

7 |

|

|

962 |

|

|

82 |

|

|

|

|

|

|

|

|

|

|

|

|

| PIMA COUNTY |

|

|

|

|

|

|

|

|

|

|

| Global Water - Red Rock Water Company, Inc. |

|

2018 (A) |

|

Water |

|

7.0 |

|

|

0 |

|

0 |

| Global Water - Francesca Water Company, Inc. |

|

2020 (A) |

|

Water |

|

0.4 |

|

|

119 |

|

|

61 |

|

| Global Water - Mirabell Water Company, Inc. |

|

2020 (A) |

|

Water |

|

0.4 |

|

|

61 |

|

|

82 |

|

| Global Water - Lyn Lee Water Company, Inc. |

|

2020 (A) |

|

Water |

|

1 |

|

|

38 |

|

|

44 |

|

| Global Water - Tortolita Water Company, Inc. |

|

2020 (A) |

|

Water |

|

0.1 |

|

|

23 |

|

|

59 |

|

| Global Water - Las Quintas Serenas Water Company, Inc. |

|

2021 (A) |

|

Water |

|

3.0 |

|

|

1,238 |

|

|

51 |

|

| Global Water - Rincon Water Company, Inc. |

|

2022 (A) |

|

Water |

|

9 |

|

|

79 |

|

|

77 |

|

| Global Water - Farmers Water Company, Inc. |

|

2023 (A) |

|

Water |

|

21 |

|

|

3,462 |

|

|

27 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

408 |

|

|

61,791 |

|

|

|

(1) Certified areas may overlap in whole or in part for separate utilities.

Pinal County

The City of Maricopa is located in Pinal County approximately 12 miles south of Phoenix. The relative proximity to a significant urban center, coupled with relatively abundant and inexpensive land, were the key drivers of the real estate boom experienced by this community. The City of Maricopa continues to grow, as demonstrated by our addition of 12,959 active service connections, which represents 6.1% annualized growth from December 2018 to December 2023. Development in the area is still considered to be affordable with the median home value being $341,000 compared to $429,000 in the Phoenix Metro area.

We operate in this region through Global Water - Santa Cruz Water Company, Inc. (“Santa Cruz”) and Global Water - Palo Verde Utilities Company, Inc. (“Palo Verde”).

We acquired Santa Cruz and Palo Verde in 2004. Santa Cruz served 27,766 active service connections as of December 31, 2023 and revenues from Santa Cruz represented approximately 39.3% and 40.0% of our total revenue for the years ended December 31, 2023 and 2022, respectively. In January 2022, Santa Cruz acquired Twin Hawks Utility, Inc., which added 18 new connections to Santa Cruz, at the time of acquisition. Palo Verde served 27,421 active service connections as of December 31, 2023 and revenues from Palo Verde represented approximately 47.9% and 51.8% of our total revenue for the years ended December 31, 2023 and 2022, respectively.

The Santa Cruz and Palo Verde service areas include approximately 205 square miles, which we believe provide further opportunities for growth. Most of the Santa Cruz and Palo Verde infrastructure is less than twenty years old. Santa Cruz and Palo Verde provide water, wastewater, and recycled water services, respectively, under an innovative public-private partnership memorandum of understanding with the City of Maricopa in Pinal County for approximately 278 square miles of its planning area. We signed a similar memorandum of understanding with the City of Casa Grande to partner in providing water, wastewater, and recycled water services to an approximate 100 square miles of its western region for anticipated growth.

Rate proceedings were completed in 2022 for both Santa Cruz and Palo Verde , which resulted, among other things, in consolidation of the following utilities into Santa Cruz:

•Global Water - Red Rock Utilities Company, Inc. (water services only)

•Global Water - Picacho Cove Water Company, Inc. (water services only)

In addition, the following utilities were consolidated into Palo Verde:

•Global Water - Red Rock Utilities Company, Inc. (wastewater and recycled water services only)

•Global Water - Picacho Cove Utilities Company, Inc. (wastewater services only)

Prior to the consolidation in 2022, Global Water - Red Rock Utilities Company, Inc. provided water and wastewater utility services in Pinal County and had a service area for water utility service in Pima County. Only service areas located in Pinal County were consolidated into Santa Cruz and Palo Verde. Refer to the Pima County section for information on Global Water - Red Rock Water Company, Inc. which holds the Pima County water utility service area.

For additional information related to the rate case, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Rate Case Activity”, included in Part II, Item 7 of this report and Note 2 – “Regulatory Decision and Related Accounting and Policy Changes” of the Notes to the Consolidated Financial Statements included in Part II, Item 8 of this report.

Maricopa County

We operate in this region through Global Water - Belmont Water Company, Inc., Global Water - Hassayampa Utilities Company, Inc. (“Hassayampa”), and Global Water - Turner Ranches Irrigation, Inc. (“Turner”).

As a result of the rate proceedings completed in 2022, which resulted, among other things, in consolidation of the following utilities into Global Water - Greater Tonopah Water Company, Inc.:

•Global Water - Northern Scottsdale Water Company, Inc. (“Northern Scottsdale”)

•Global Water - Eagletail Water Company, Inc. (“Eagletail”)

Global Water - Greater Tonopah Water Company, Inc. was then renamed Global Water - Belmont Water Company, Inc. (“Belmont”).

The rate proceedings also resulted in the consolidation of Global Water - Balterra Utilities Company, Inc. into Hassayampa.

Belmont served 622 active service connections as of December 31, 2023. The service areas include approximately 111 square miles and provides water services to Maricopa County west of the Hassayampa River and to two small subdivisions in northern Scottsdale. Within the Belmont service area, we have entered into agreements with developers to serve approximately 100,000 home sites plus commercial, schools, parks, and industrial developments at full build-out. The Belmont development is a mixed use, master planned community.

We formed Hassayampa in 2005. Hassayampa is a wastewater utility and has a Certificate of Convenience & Necessity (“CC&N”) for approximately 43 square miles in an area in western Maricopa County known as Tonopah. Hassayampa currently has no active service connections; however, its service area lies directly in the expected path of future growth in the far west valley of metropolitan Phoenix, which we believe should provide opportunities for growth once development commences in this area.

We acquired Turner in May 2018. Turner is a non-potable irrigation water utility located in Maricopa County, Arizona, with approximately seven square miles of service area. Turner served 962 residential irrigation customers as of December 31, 2023.

We formerly operated additional utilities in Maricopa County through Valencia Water Company, Inc. (“Valencia”) and Water Utility of Greater Buckeye (“Greater Buckeye”). Valencia was consolidated with Greater Buckeye in 2008, and on July 14, 2015, we closed the stipulated condemnation to transfer the operations and assets of Valencia to the City of Buckeye.

See Note 1 — “Basis of Presentation, Corporate Transactions, Significant Accounting Policies, and Recent Accounting Pronouncements — Corporate Transactions — Stipulated Condemnation of the Operations and Assets of Valencia Water Company, Inc.” of the Notes to the Consolidated Financial Statements included in Part II, Item 8 of this report for additional information.

For additional information related to the rate case, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Rate Case Activity”, included in Part II, Item 7 of this report and Note 2 — “Regulatory Decision and Related Accounting and Policy Changes” of the Notes to the Consolidated Financial Statements included in Part II, Item 8 of this report.

Pima County

We operate in this region through Global Water - Mirabell Water Company, Inc. (“Mirabell”), Global Water - Francesca Water Company, Inc. (“Francesca”), Global Water - Tortolita Water Company, Inc. (“Tortolita”), Global Water - Lyn Lee Water Company, Inc. (“Lyn Lee”), Global Water - Las Quintas Serenas Water Company, Inc. (“Las Quintas Serenas”), Global Water - Rincon Water Company, Inc. (“Rincon”), Red Rock-Pima, and Global Water - Farmers Company, Inc. (“Farmers”).

We acquired Mirabell in October 2020. Mirabell served 61 active water connections as of December 31, 2023. Mirabell has a CC&N for 0.4 square miles located in the southwest area of Tucson, Arizona.

We acquired Francesca, Tortolita and Lyn Lee in November 2020. Francesca is located in the southwest area of Tucson, Arizona whereas Tortolita and Lyn Lee are located in Marana, Arizona. As of December 31, 2023, Francesca, Tortolita, and Lyn Lee served 119, 23, and 38 active water connections, respectively.

We acquired Las Quintas Serenas in November 2021. Las Quintas Serenas served 1,238 active water connections with approximately 3.0 square miles of service area located in Sahuarita, Arizona.

In January 2022, the Company acquired the assets of Rincon Water Company, Inc., a water utility serving the vicinity of Vail, Arizona. As of December 31, 2023, Rincon served 79 active water connections with approximately 9.0 square miles of service area.

Global Water - Red Rock Water Company, Inc. (“Red Rock”) was acquired by the Company in 2018 and holds service areas located in Pima County . At this time, Red Rock has no active service connections.

In February 2023, the Company completed the acquisition of Farmers Water Co., an operator of a water utility with service area in Sahuarita, Arizona and in unincorporated Pima County, Arizona. As of December 31, 2023, Farmers served 3,462 active water connections with approximately 21.0 square miles of service area.

Regulation

Our water and wastewater utility operations are subject to extensive regulation by U.S. federal, state, and local regulatory agencies that enforce environmental, health, and safety requirements, which affect all of our regulated subsidiaries. These requirements include the Safe Drinking Water Act, the Clean Water Act, and the regulations issued under these laws by the EPA. We are also subject to state environmental laws and regulations, such as Arizona’s Aquifer Protection Program and other environmental laws and regulations enforced by the Arizona Department of Environmental Quality (“ADEQ”), and extensive regulation by the ACC, which regulates public utilities. The ACC also has broad administrative power and authority to set rates and charges, determine service areas and conditions of service, and authorize the issuance of securities as well as authority to establish uniform systems of accounts and approve the terms of contracts with both affiliates and customers.

We are also subject to various federal, state, and local laws and regulations governing the storage of hazardous materials, the management and disposal of hazardous and solid wastes, discharges to air and water, the cleanup of contaminated sites, dam safety, fire protection services in the areas we serve, and other matters relating to the protection of the environment, health, and safety.

In addition to regulation by governmental entities, our operations may also be affected by civic or consumer advocacy groups. These organizations provide a voice for customers at local and national levels to communicate their service priorities and concerns. Although these organizations may lack regulatory or enforcement authority, they may be influential in achieving service quality and rate improvements for customers.

We maintain a comprehensive environmental program which addresses, among other things, responsible business practices and compliance with environmental laws and regulations, including the use and conservation of natural resources. Water samples across our water system are analyzed on a regular basis in material compliance with regulatory requirements. Water quality tests are conducted at subcontracted laboratory facilities in addition to providing continuous online instrumentation for monitoring parameters, such as turbidity and disinfectant residuals, and allowing for adjustments to chemical treatment based on changes in incoming water quality. For 2023, we achieved a compliance rate of 99.9% for meeting state and federal drinking water standards and 99.9% for compliance with wastewater requirements, for an overall compliance rating of 99.9%. Compliance with governmental regulations is of utmost importance to us, and considerable time and resources are spent ensuring compliance with all applicable federal, state, and local laws and regulations.

Safe Drinking Water Act

The federal Safe Drinking Water Act and regulations promulgated thereunder establish minimum national quality standards for drinking water. The EPA has issued rules governing the levels of numerous naturally occurring and man-made chemical and microbial contaminants and radionuclides allowable in drinking water and continues to propose new rules. These rules also prescribe testing requirements for detecting contaminants, the treatment systems that may be used for removing contaminants, and other requirements. Federal and state water quality requirements have become increasingly more stringent, including increased water testing requirements, to reflect public health concerns. In Arizona, the requirements of the Safe Drinking Water Act are incorporated by reference into the Arizona Administrative Code.

In order to remove or inactivate microbial organisms, the EPA has promulgated various rules to improve the disinfection and filtration of drinking water and to reduce consumers’ exposure to disinfectants and by-products of the disinfection process.

Contaminants of emerging concern (“CECs”) are chemicals and other substances that have no regulatory standard, but have been discovered in water or in the environment where they had not previously been detected, or were only present at insignificant levels. We believe CECs may form the basis for additional regulatory initiatives and requirements in the future. We rely on governmental agencies to establish regulatory standards regarding CECs and we meet or exceed these standards, when established.

Although it is difficult to project the ultimate costs of complying with the above or other pending or future requirements, we do not expect current requirements under the Safe Drinking Water Act to have a material impact on our operations or financial condition, although it is possible new methods of treating drinking water may be required if additional regulations become effective in the future. In addition, capital expenditures and operating costs to comply with environmental mandates traditionally have been recognized by state public utility commissions as appropriate for inclusion in establishing rates, although rate recovery may be delayed by “regulatory lag”, that is, the delay between the utility’s test year and the issuance of a rate order approving new rates.

Clean Water Act

The federal Clean Water Act regulates discharges of liquid effluents from drinking water and wastewater treatment facilities into waters of the U.S., including lakes, rivers, streams and subsurface, or sanitary sewers. In Arizona, with the exception of Clean Water Act Section 208 Regional Water Quality Management Plans, capacity management and operations and maintenance requirements, and source control requirements, wastewater operations are primarily regulated under the Aquifer Protection Permit program and the Arizona Pollutant Discharge Elimination System program.

The EPA certifies Clean Water Act Section 208 Regional Water Quality Management Plans and Amendments which govern the location of water reclamation facilities and wastewater treatment plants. The EPA’s 40 C.F.R. Pt. 503 bio-solids requirements are reported to the EPA through the ADEQ. While we are not presently regulated to meet source control requirements, we maintain source control through various Codes of Practice that have been accepted by the ACC as enforceable limits on consumer discharges to sanitary sewer systems. We believe we maintain the necessary permits and approvals for the discharges from our water and wastewater facilities.

Arizona Regulatory Agencies

The ACC is the regulatory authority in Arizona with jurisdiction over privately-held water and wastewater utilities. The ACC has exclusive constitutional authority related to ratemaking and extensive constitutional authority to mandate accounting treatments, authorize long-term financing programs, evaluate significant capital expenditures and plant additions, examine and regulate transactions between a regulated subsidiary and its affiliated entities, and approve or disapprove some reorganizations, mergers, and acquisitions prior to their completion. Additionally, the ACC has statutory authority to oversee service quality and consumer complaints, and approve or disapprove expansion of service areas. The ACC is comprised of five elected members, each serving a four year term.

Companies that wish to provide water or wastewater service apply for a CC&N with the ACC, which, if granted, allows them to serve customers within a geographic area specified by a legal description of the property. In considering an application for a CC&N, the ACC will determine if the applicant is fit and proper to provide service within a specified area, whether the applicant has sufficient technical, managerial, and financial capabilities to provide the service, and if that service is necessary and in the public interest. Once a CC&N is granted, the utility falls under the ACC’s jurisdiction and must abide by the rules and laws under which a public service corporation operates. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Rate Case Activity,” included in Part II, Item 7 of this report, for additional information regarding rate case activity involving the ACC.

Arizona water and wastewater utilities must also comply with state environmental regulation regarding drinking water and wastewater, including environmental regulations set by Councils of Government (such as the Central Arizona Governments and the Maricopa Association of Governments), the ADEQ, and the ADWR.

The Central Arizona Governments is the designated management authority for Section 208 of the Clean Water Act for Pinal and Gila Counties and administers the requirements of the Regional Water Quality Management Plans and Amendments at the local level. The Maricopa Association of Governments is the designated management authority for Section 208 of the Clean Water Act for Maricopa County and administers the requirements of the Regional Water Quality Management Plans and Amendments at the local level.

The ADEQ regulates water quality and permits water reclamation facilities, discharges of recycled water, re-use of recycled water, and recharge of recycled water. The ADEQ also regulates the clean closure requirements of facilities. The Maricopa County Environmental Services Department has delegated authority for overseeing ADEQ requirements in Maricopa County. The Pima County Department of Environmental Quality has delegated authority for overseeing ADEQ requirements in Pima County.

The ADWR regulates surface water extraction, groundwater withdrawal, designations and certificates of assured water supply, extinguishment of irrigation grandfathered water rights, groundwater savings facilities, recharge facilities, recharge permits, recovery well permits, storage accounts, and well construction, abandonment, or replacement.

Within each regulatory organization, we have invested in developing cooperative relationships at all levels, from staff to executives to elected and appointed officials, and have adopted a proactive attitude toward regulatory compliance.

Assured and Adequate Water Supply Regulations

We intend to seek access to renewable water supplies as we grow our water resource portfolio. However, we currently rely almost exclusively (and are likely to continue to rely) on the pumping of groundwater and the generation and delivery of recycled water for non-potable uses to meet future demands in our service areas. Aside from some rights to water through the Central Arizona Project, groundwater (and recycled water derived from groundwater) is the only water supply available to us.