Document

Exhibit 99.1

Major Shareholder Announcement

Company Announcement

•Major shareholder announcement for Genmab A/S

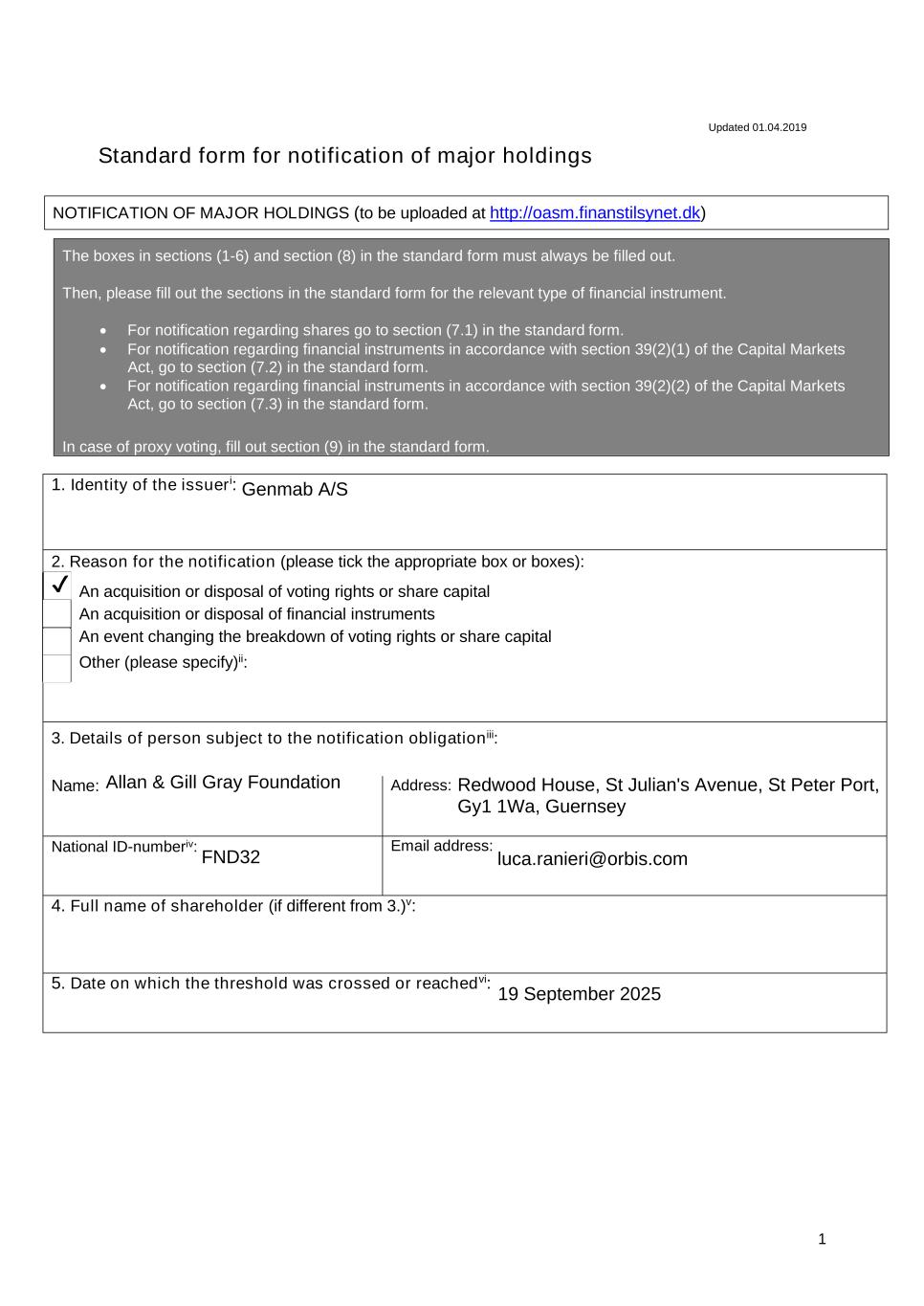

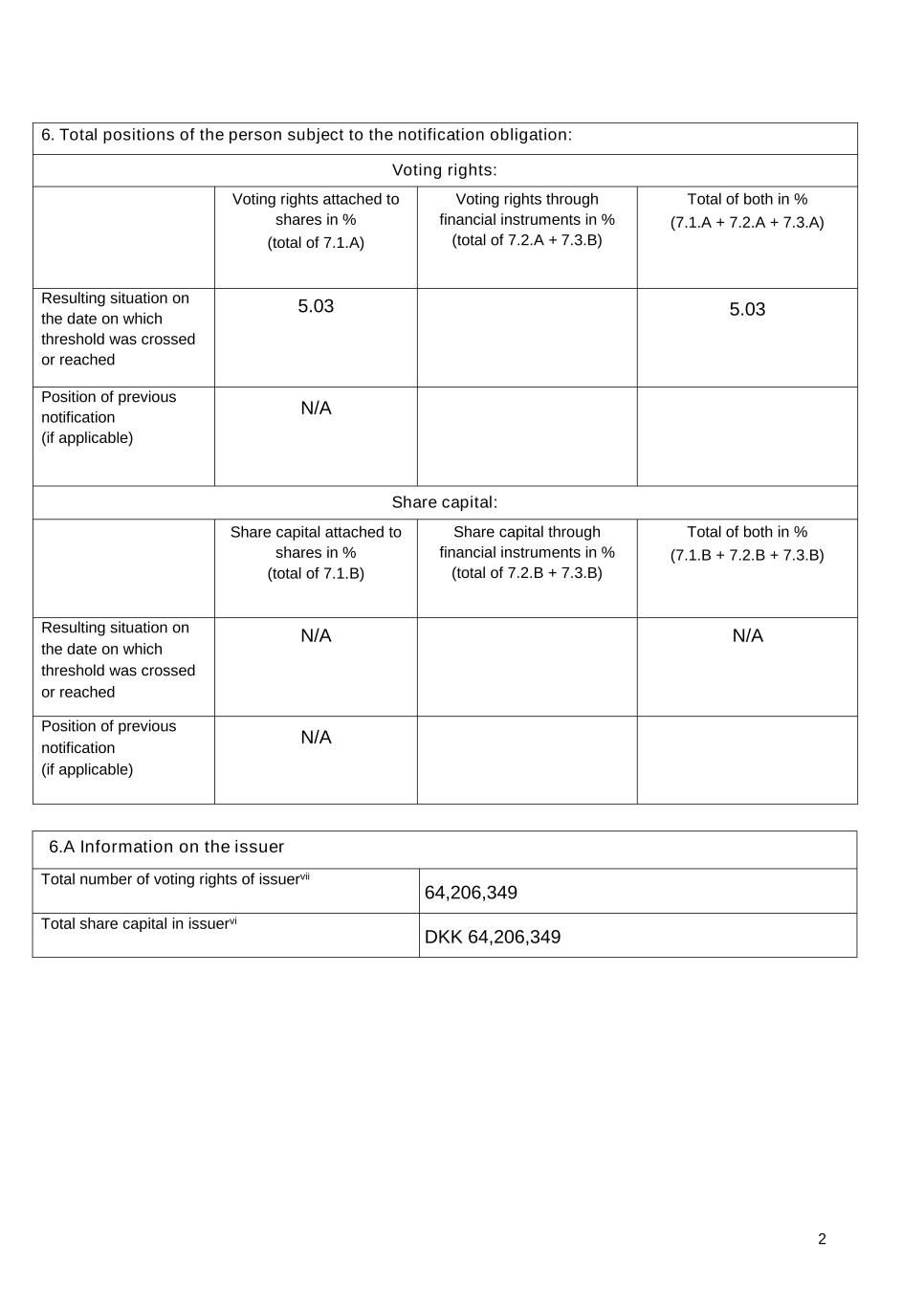

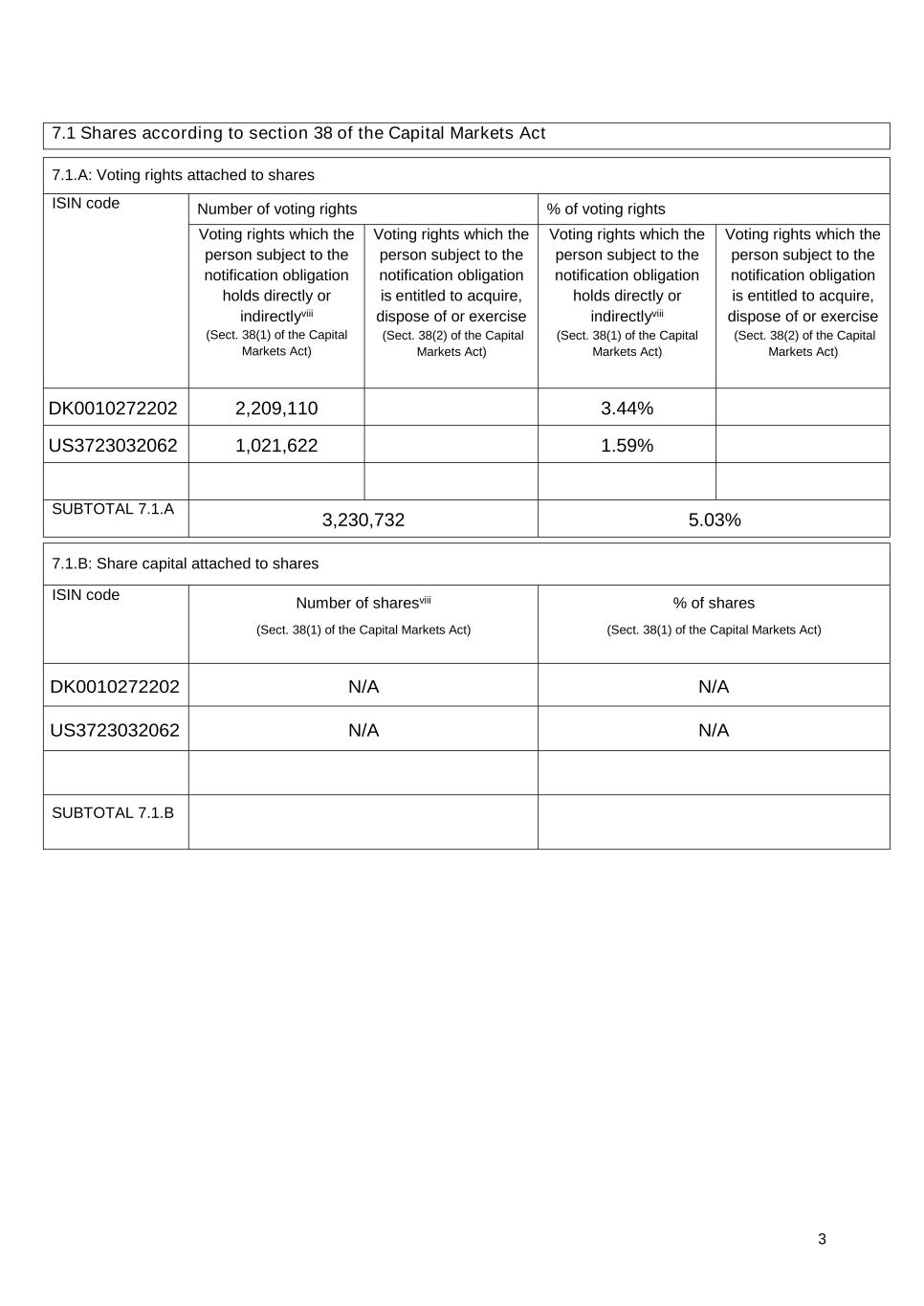

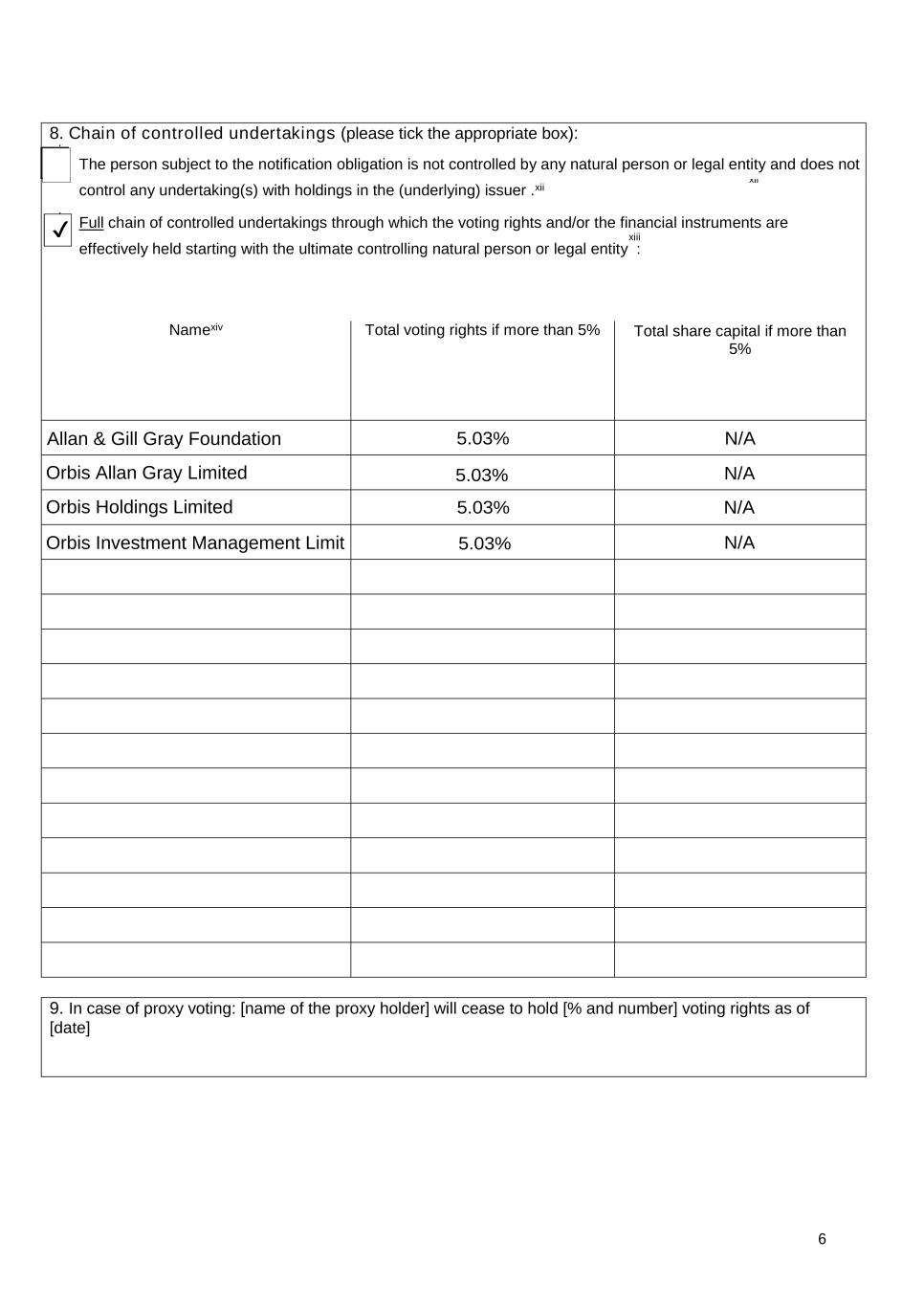

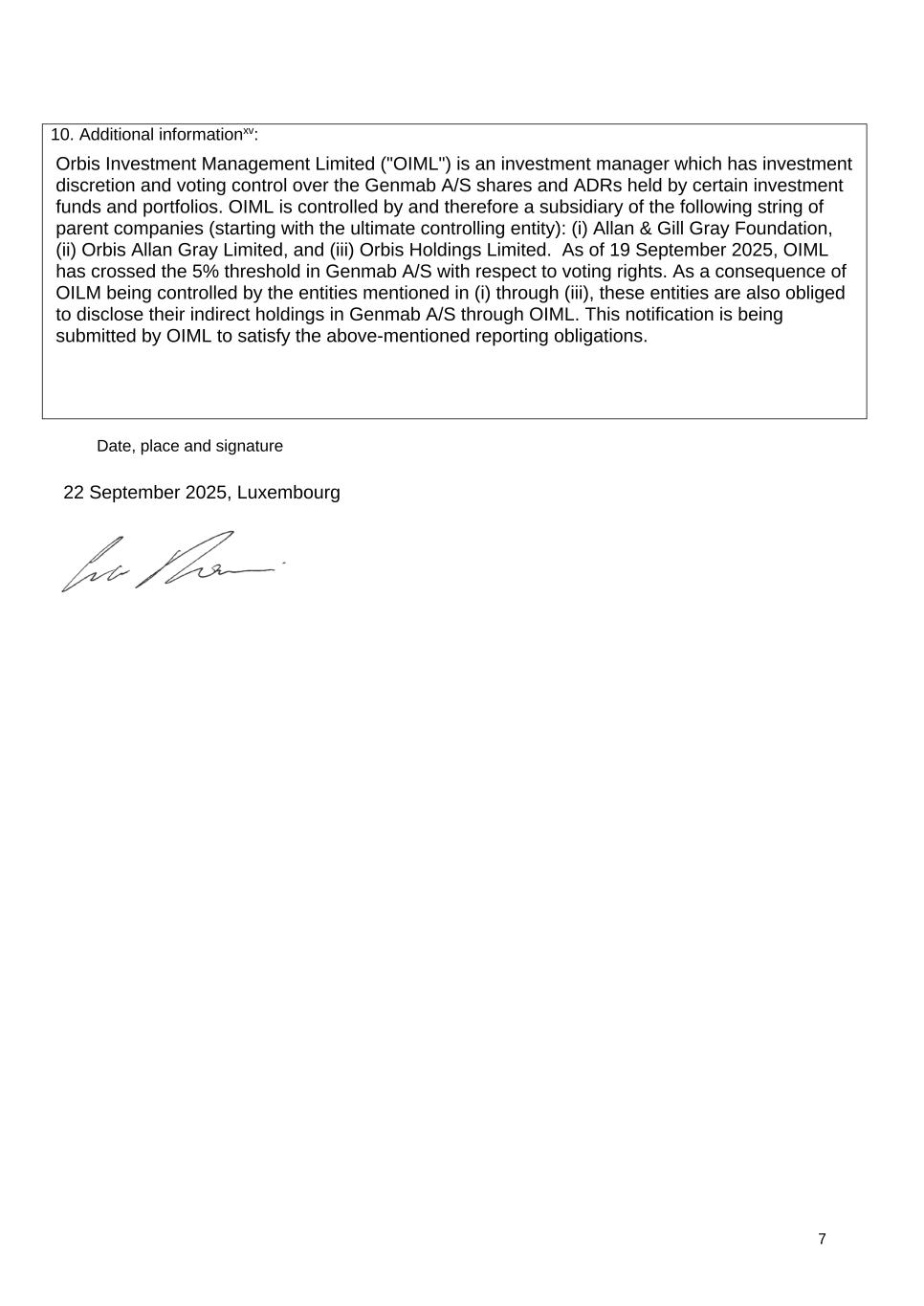

COPENHAGEN, Denmark; September 23, 2025 – Genmab A/S (Nasdaq: GMAB) announces under reference to Section 30 of the Danish Capital Markets Act that Orbis Investment Management Limited has informed us that, as of September 19, 2025, Orbis Investment Management Limited through shares and ADRs, representing shares, controlled the voting rights to 3,230,732 shares in Genmab A/S, which amounts to 5.03% of the share capital and voting rights in Genmab A/S.

The major shareholder announcement of Orbis Investment Management Limited is attached to this announcement.

About Genmab

Genmab is an international biotechnology company with a core purpose of guiding its unstoppable team to strive toward improving the lives of patients with innovative and differentiated antibody therapeutics. For more than 25 years, its passionate, innovative and collaborative team has invented next-generation antibody technology platforms and leveraged translational, quantitative and data sciences, resulting in a proprietary pipeline including bispecific T-cell engagers, antibody-drug conjugates, next-generation immune checkpoint modulators and effector function-enhanced antibodies. By 2030, Genmab’s vision is to transform the lives of people with cancer and other serious diseases with knock-your-socks-off (KYSO) antibody medicines®.

Established in 1999, Genmab is headquartered in Copenhagen, Denmark, with international presence across North America, Europe and Asia Pacific. For more information, please visit Genmab.com and follow us on LinkedIn and X.

Contact:

Marisol Peron, Senior Vice President, Global Communications & Corporate Affairs

T: +1 609 524 0065; E: mmp@genmab.com

Andrew Carlsen, Vice President, Head of Investor Relations

T: +45 3377 9558; E: acn@genmab.com

The Company Announcement contains forward looking statements. The words “believe,” “expect,” “anticipate,” “intend” and “plan” and similar expressions identify forward looking statements. Actual results or performance may differ materially from any future results or performance expressed or implied by such statements. The important factors that could cause our actual results or performance to differ materially include, among others, risks associated with pre-clinical and clinical development of products, uncertainties related to the outcome and conduct of clinical trials including unforeseen safety issues, uncertainties related to product manufacturing, the lack of market acceptance of our products, our inability to manage growth, the competitive environment in relation to our business area and markets, our inability to attract and retain suitably qualified personnel, the unenforceability or lack of protection of our patents and proprietary rights, our relationships with affiliated entities, changes and developments in technology which may render our products or technologies obsolete, and other factors. For a further discussion of these risks, please refer to the risk management sections in Genmab’s most recent financial reports, which are available on www.genmab.com and the risk factors included in Genmab’s most recent Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission (SEC), which are available at www.sec.gov. Genmab does not undertake any obligation to update or revise forward looking statements in the Company Announcement nor to confirm such statements to reflect subsequent events or circumstances after the date made or in relation to actual results, unless required by law.

Genmab A/S and/or its subsidiaries own the following trademarks: Genmab®; the Y-shaped Genmab logo®; Genmab in combination with the Y-shaped Genmab logo®; HuMax®; DuoBody®; HexaBody®; DuoHexaBody®, HexElect® and KYSO®.

|

|

|

|

|

|

|

|

|

Genmab A/S

Carl Jacobsens Vej 30

2500 Valby, Denmark |

Tel: +45 7020 2728

www.genmab.com

|

Company Announcement no. 44

Page 1/1

CVR no. 2102 3884

LEI Code 529900MTJPDPE4MHJ122

|