Santa Barbara, CA November 18, 2025 2025 Investor Meeting

2 2025 © AppFolio Investor Meeting - November 18, 2025 Agenda Welcome Bill Schroeder Vice President, Finance Powering the Future of Real Estate: AppFolio Vision & Strategy Shane Trigg President & Chief Executive Officer Differentiate to Win: AppFolio Solutions Kyle Triplett Sr. Vice President, Product Deliver Performance Efficiently: Go-to-Market Strategy Lisa Horner Chief Marketing Officer Break Customer Panel Stacy Holden Vice President & Industry Principal Financial Overview Tim Eaton Chief Financial Officer Q&A All

3 2025 © AppFolio Investor Meeting - November 18, 2025 This presentation contains forward-looking statements within the meaning of federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements made in this presentation are based primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results, and prospects. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “might,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Examples of forward-looking statements include, among others, statements made regarding product development plans, future product functionality or availability, future market conditions and size, growth in the size of our business and number of customers, strategic plans and objectives, business forecasts and plans, our future or assumed financial condition, ARPU potential, results of operations and liquidity, trends affecting our business and industry, the competitive environment, responding to customer needs, and capital resource allocation plans. Further information on the above and other risks that could cause our actual results to differ materially from our current expectations and projections can be found in our Annual Report on Form 10-K filed for the year ended December 31, 2024 and in our other Securities and Exchange Commission (“SEC”) filings, including our most recent Quarterly Report on Form 10-Q, which are available on our website at https://ir.appfolioinc.com/ or the SEC’s website at www.sec.gov. We cannot guarantee that we will achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make. We undertake no obligation, and do not intend, to update these forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of the current financial quarter. The information in this presentation on new products, features, or functionality is intended solely to outline our general product direction. It is not a commitment to deliver any product, feature, or functionality; and our product direction may change at any time without notice. As such, the information may not be incorporated into any contract and purchases should not be contingent upon it. Numbers in this presentation may be rounded for presentation purposes. Safe Harbor Statement and Other Information

4 2025 © AppFolio Investor Meeting - November 18, 2025 This presentation includes information about non-GAAP operating margin (collectively the “non-GAAP financial measures”). Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because non-GAAP financial measures are not prepared in accordance with GAAP and can exclude expenses that may have a material impact on our reported financial results. As such, non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation of the historical non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the tables above. We encourage investors to review the reconciliation of these historical non-GAAP financial measures to their most directly comparable GAAP financial measures. We use non-GAAP financial measures internally to assess and compare operating results across reporting periods, for internal budgeting and forecasting purposes, and to evaluate our financial performance. We believe these adjustments also provide useful supplemental information to investors and facilitate the analysis of our operating results and comparison of operating results across reporting periods. Non-GAAP operating margin is defined as income (loss) from operations, less stock-based compensation, amortization of stock-based compensation capitalized in software development, and other non-recurring items. Statement Regarding Use of Non-GAAP Financial Measures

5 AppFolio Vision & Strategy Shane Trigg President & Chief Executive Officer Powering the Future of Real Estate:

6 2025 © AppFolio Investor Meeting - November 18, 2025 AppFolio: Two Decades of Growth & Innovation AppFolio Opens Its Doors AppFolio Property Manager Launches AppFolio Goes Public 500 Employees $100M annual revenue AppFolio Property Manager Plus 1000 Employees First AI Service Launches 9M units Leadership Team Evolves AppFolio Property Manager Max Launch of AppFolio Stack Insurance Screening Payments 2006 2018 202420152009 2021 AppFolio Acquires LiveEasy 2025 20262012

7 2025 © AppFolio Investor Meeting - November 18, 2025 Transforming Our Performance: Financial Revenue ($M) $948* $472 20252022 Non-GAAP Op Margin 24%* (1%) 20252022 Operating Cash Flow ($M) $177** $25 20252022 Operating Cash Flow Per Share $4.87** $0.72 20252022 Rev per Employee ($K) $532** $264 20252022 * 2025 represents the mid-point of 2025 annual guidance as reported on October 30, 2025. Non-GAAP operating margin is a non-GAAP financial measure. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures, where applicable. ** YTD 2025 results

8 2025 © AppFolio Investor Meeting - November 18, 2025 AppFolio Stack FolioGuard Security Deposit Alternative Report Builder Bank Feed Flexible Screening AppFolio Alpha 2022 Innovation Over the Years AppFolio Realm Leasing Signals Leasing CRM AppFolio Stack Solution Partners Progressive Maintenance Intake Auto-generated Marketing Descriptions Instant Pay for Vendors Bulk actions move-outs, renewals, & pricing Affordable Housing 2023 2024 AppFolio Realm-X Assistant AppFolio Realm-X Messages AppFolio Realm-X Flows AppFolio Max (Tier) Database API Custom Fields Modern Reporting Interface AppFolio Stack Webhooks FolioScreen ID & Document Verification Affordable Housing Waitlist Student Pre-Leasing Resident Concierge (LiveEasy) 2025 Realm-X Leasing Performer Realm-X Maintenance Performer Resident Onboarding Resident Onboarding Lift (Second Nature) Resident Messages Zillow Listing Spotlight AvidXChange Payables Centralized CRM Smart Budgeting Credit Card Accounting Bill Approval Flow & Bulk Bills Affordable Certification & HUD Move-In Student Pre-Leasing Placement Board Flexible Rental Applications Delay

9 2025 © AppFolio Investor Meeting - November 18, 2025 * YTD 2025 results ** Internal data on percentage of customers that used AppFolio Realm AI features and capabilities in 2025 Customer Count 18,441 21,759* 20252022 ARPU $103* $66 20252022 Units Under Management 20252022 7.3M 9.1M* Transforming Our Performance: Industry-Leading Innovation to Customer Value Premium Tier Adoption 25% 10% 20252022 AppFolio Realm AI Use** 40% 96% 20252022

10 2025 © AppFolio Investor Meeting - November 18, 2025 “Moving to AppFolio was a seamless experience, which speaks volumes about the partnership. AppFolio’s significant and ongoing investment in product development, along with their client-first support team, reinforces our confidence that Northpoint’s residents and owners will continue to have the best experiences and outcomes.” Adam Haleck CEO 8,000 Units Customer since 2024 AppFolio Powers Winning Businesses

2025 © AppFolio Investor Meeting - November 18, 202511 CUSTOMER IMPACT

Awards & Accolades Overall Leader, G2 Grid® for Property Management* INNOVATION

TEAM

12 2025 © AppFolio Investor Meeting - November 18, 2025 Great people make a great company. Listening to customers is in our DNA. Do the right thing; it’s good for business. Simpler is better. Innovation powers success. Build trust every day. VALUES

The AppFolian Way

14 2025 © AppFolio Investor Meeting - November 18, 2025 AppFolio Leadership Team Shane Trigg President and Chief Executive Officer AppFolian Since 2020 Kyle Triplett Sr. Vice President, Product AppFolian Since 2019 Tim Eaton Chief Financial Officer AppFolian Since 2020 Matthew Baird Chief Technology Officer AppFolian Since 2022 Elizabeth Barat Chief People Officer AppFolian Since 2016 Marcy Campbell Chief Revenue Officer AppFolian Since 2024 Lisa Horner Chief Marketing Officer AppFolian Since 2014 Evan Pickering Sr. Vice President, General Counsel AppFolian Since 2018

15 2025 © AppFolio Investor Meeting - November 18, 2025 Outdated Systems AI Noise Fragmented Data Compliance Regulatory Challenges Delay

Real Performance FUTURE STATE

EXTERNAL FORCES Task-Based Management High Interest Rates Limited Rent Growth Increasing Vacancy Rates Growing Resident Expectations Inflation Data Silos Fragmented Tech Bolt-on AI Efficiency Trap Change Resistance INDUSTRY CHALLENGES CURRENT STATE

The . Performance . Gap Delay

17 2025 © AppFolio Investor Meeting - November 18, 2025 Legacy Systems Are Holding the Industry’s Performance Back VS. Siloed Data Bolt-on AI FUTURE STATE

CURRENT STATE

Point Solutions & Services Single, trusted source of truth for all critical operating information. System of Record Automates complex workflows to free up staff while delivering improved outcomes. System of Action Adds more value and revenue enhancements with services that drive growth for the entire ecosystem. System of Growth Powered by unified data, driven by performance systems, and delivered through a unified experience. Performance Platform

18 2025 © AppFolio Investor Meeting - November 18, 2025 The future of real estate has a name Real Estate Performance Management

20 2025 © AppFolio Investor Meeting - November 18, 2025 To power the future of real estate. Vision

21 2025 © AppFolio Investor Meeting - November 18, 2025 To build the platform where real estate comes to do business. Mission

22 2025 © AppFolio Investor Meeting - November 18, 2025 Investor Resident Broker Vendor AppFolio Performance Platform Property Manager Core Industry Segment

Industry Segments

Property Manager is Our Core Industry Segment Property management is the central function that integrates and activates the real estate industry. It transforms scattered assets into a thriving system of homes, businesses, and communities. Its collective actions link residents, investors, vendors, and brokers, ensuring that value is consistently created and sustained.

23 2025 © AppFolio Investor Meeting - November 18, 2025 Investing to Win Across Key Industry Control Points Investments across systems will independently grow revenue and margin while influencing customer acquisition and unit expansion DO THE WORK

System of Action AppFolio Performance Platform Real Estate Performance Management System of Record CREATE THE VALUE

System of Growth STORE THE DATA

Mission

To power the future of real estate. To build the platform where real estate comes to do business. Vision

DRIVE THE ECONOMICS

24 2025 © AppFolio Investor Meeting - November 18, 2025 To power the future of real estate. To build the platform where real estate comes to do business. Investor Annualized Total Return Cash-on-Cash Return Net Operating Income Financial Health Convenience Happiness Resident Broker Network Growth Deal Flow $$ Per Transaction Vendor Work Order Volume Estimate-to-Actual $$ Per Technician Data & Security System of Growth System of Record System of Action AppFolio Stack & APIs AppFolio Realm™ AppFolio Performance Platform Mission

Vision

Fewer, More Valuable Interactions Units Per Property Manager Profitability Per Revenue $ Core Industry Segment

Industry Segments

Performance Outcomes

Property Manager Platform | AI-Native Architecture | Performance

Where We Play & How We Win 10-Year Vision STORE

THE DATA

DO

THE WORK

UNIFY

THE EXPERIENCE

DRIVE

THE ECONOMICS

BUILD

THE PLATFORM

POWER

THE FUTURE

CREATE

THE VALUE

25 2025 © AppFolio Investor Meeting - November 18, 2025 Investor Resident Broker Vendor 10-Year Vision TAM Data & Security System of Growth System of Record System of Action AppFolio Stack™ & APIs AppFolio Realm™ AppFolio Performance Platform 52 Million Residential Units Core Industry Segment

Industry Segments

Total Addressable Market*

Property Manager Platform | AI-Native Architecture | Performance

17 Million Investors with Rentals 110 Million Residents in Rentals 5 Million Real Estate Transactions 644,000 Home Service Providers * Estimates based on AppFolio analysis of data from Census.gov, BLS.gov, McKinsey, Cotality, and other third-party sources STORE

THE DATA

DO

THE WORK

UNIFY

THE EXPERIENCE

DRIVE

THE ECONOMICS

BUILD

THE PLATFORM

POWER

THE FUTURE

CREATE

THE VALUE

Where We Play & How We Win Total Addressable Market*

26 2025 © AppFolio Investor Meeting - November 18, 2025

27 2025 © AppFolio Investor Meeting - November 18, 2025 Differentiate to Win Great People & Culture Deliver Performance Efficiently Strategic Pillars To power the future of real estate. Vision To build the platform where real estate comes to do business. Mission

28 Differentiate to Win: AppFolio Solutions Kyle Triplett Sr. Vice President, Product

30 2025 © AppFolio Investor Meeting - November 18, 2025 STORE

THE DATA

DO

THE WORK

UNIFY

THE EXPERIENCE

DRIVE

THE ECONOMICS

BUILD

THE PLATFORM

POWER

THE FUTURE

CREATE

THE VALUE

31 2025 © AppFolio Investor Meeting - November 18, 2025 Accounting Advance our accounting capabilities to support upmarket portfolios. Mixed Portfolios Broaden our coverage with expanded Affordable and Student Housing functionality. Permissions Empower large customers through more granular controls and permissions. Reporting Enhance reporting with increased flexibility and customization. Winning the System of Record

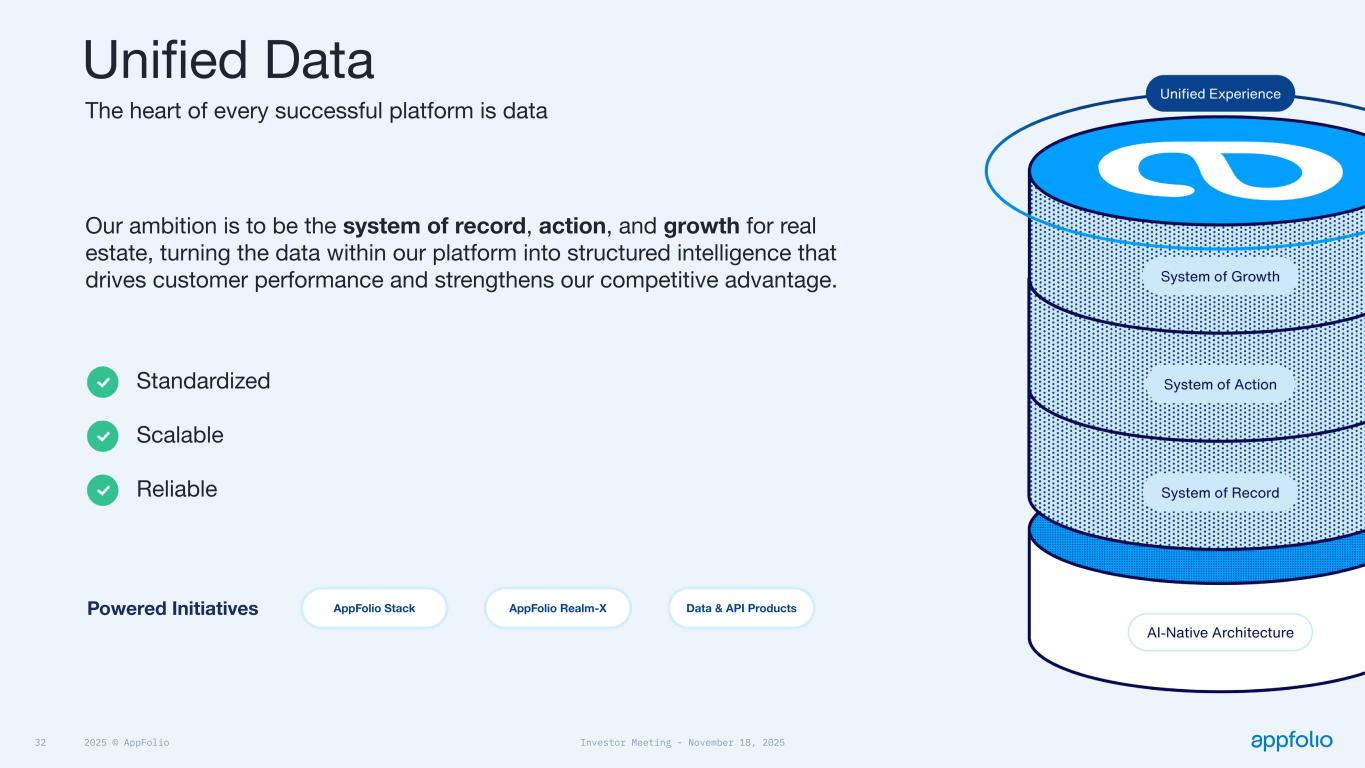

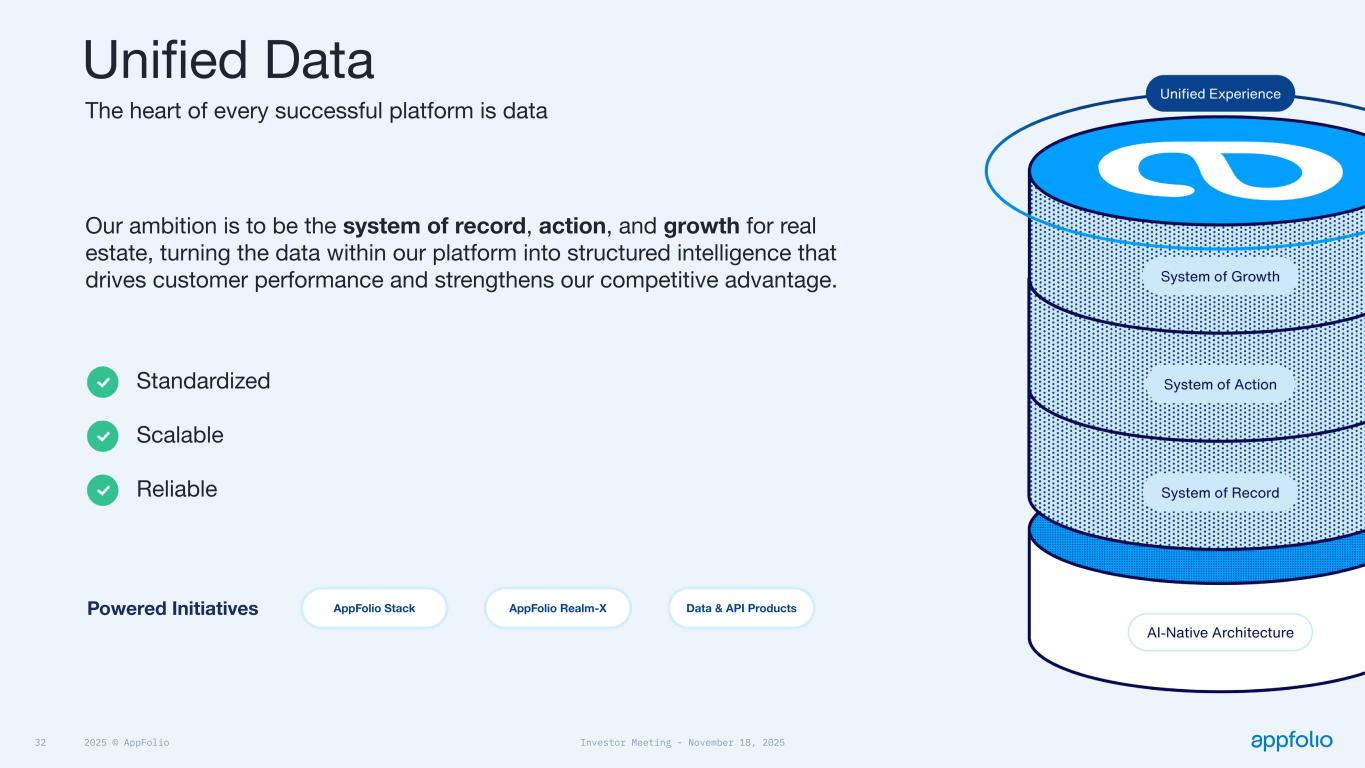

32 2025 © AppFolio Investor Meeting - November 18, 2025 Our ambition is to be the system of record, action, and growth for real estate, turning the data within our platform into structured intelligence that drives customer performance and strengthens our competitive advantage. ● Standardized ● Scalable ● Reliable Unified Data The heart of every successful platform is data Powered Initiatives AppFolio Stack AppFolio Realm-X Data & API Products

33 2025 © AppFolio Investor Meeting - November 18, 2025 4M+ Units Connected 84 Partners 8 Product Categories Investor Resident Broker Vendor Property Manager Data & Security System of Growth System of Record System of Action AppFolio Stack™ & APIs AppFolio Realm™ Platform | AI-Native Architecture | Performance

AppFolio Stack AppFolio Performance Platform AppFolio Stack Our customers’ space to connect their data to the outside world

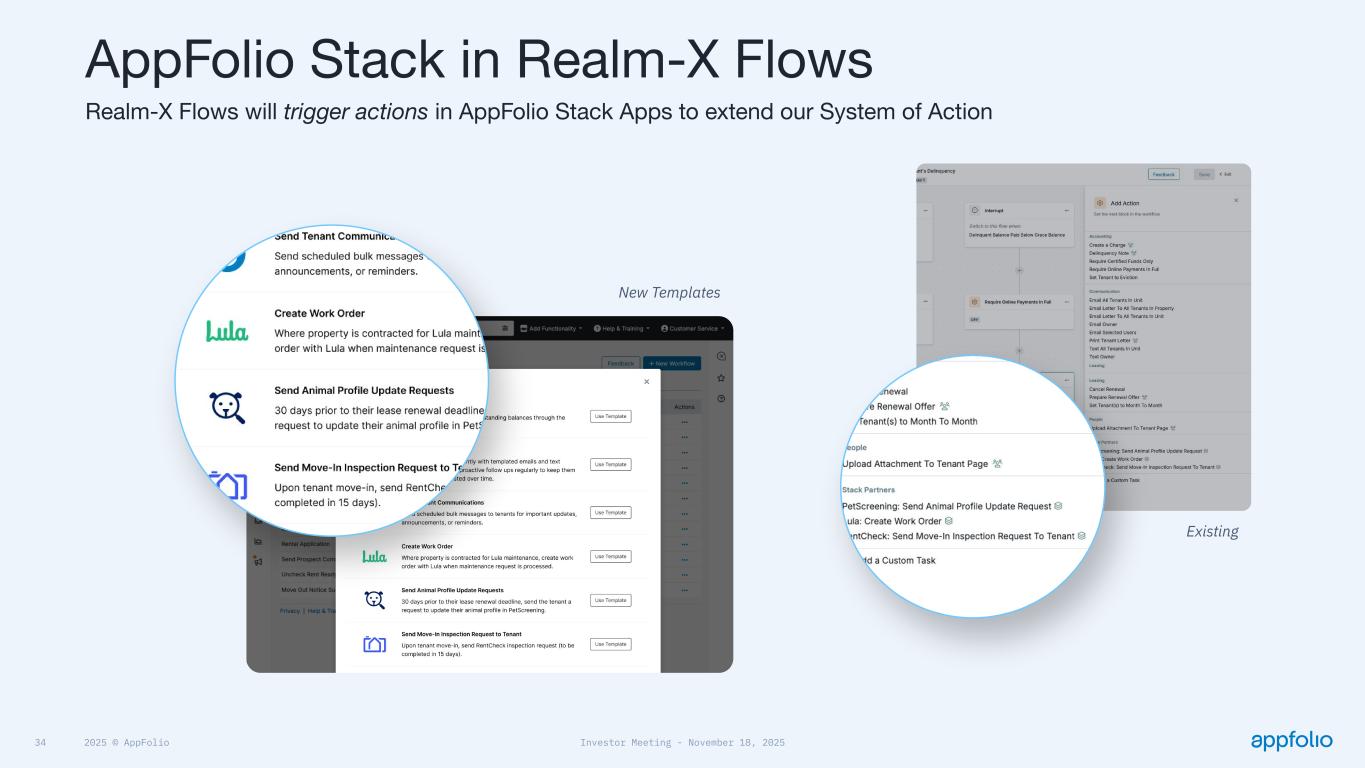

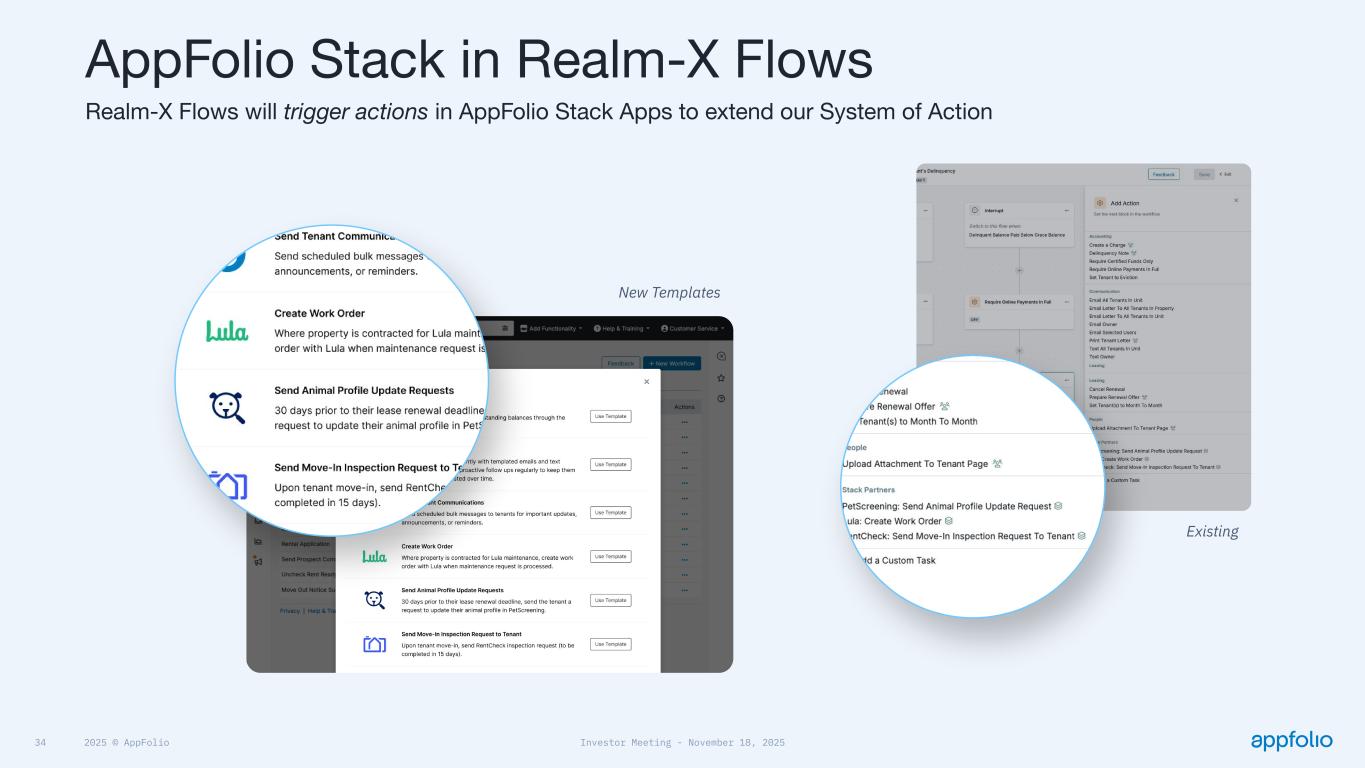

34 2025 © AppFolio Investor Meeting - November 18, 2025 New Templates

Existing

AppFolio Stack in Realm-X Flows Realm-X Flows will trigger actions in AppFolio Stack Apps to extend our System of Action

35 2025 © AppFolio Investor Meeting - November 18, 2025 STORE

THE DATA

DO

THE WORK

UNIFY

THE EXPERIENCE

DRIVE

THE ECONOMICS

BUILD

THE PLATFORM

POWER

THE FUTURE

CREATE

THE VALUE

36 2025 © AppFolio Investor Meeting - November 18, 2025 The AppFolio Difference: AI-Powered Innovation Realm-X Assistant

Smart Bill Entry

FolioGuard Smart Ensure

Leasing Descriptions

Bank Feed

Leasing Signals

Realm-X Flows

Realm-X Messages

Smart Budgeting

37 2025 © AppFolio Investor Meeting - November 18, 2025 26 Seconds Saved for Every Message Created** 10.3 Hours Saved Completing Tasks per User Each Week* 15+ Million Actions Automated in 2025 Real Performance with Realm-X * Average from 2024 survey of 343 AppFolio Realm-X users ** Estimated average from customer-usage data

38 2025 © AppFolio Investor Meeting - November 18, 2025

39 2025 © AppFolio Investor Meeting - November 18, 2025 STORE

THE DATA

DO

THE WORK

UNIFY

THE EXPERIENCE

DRIVE

THE ECONOMICS

BUILD

THE PLATFORM

POWER

THE FUTURE

CREATE

THE VALUE

40 2025 © AppFolio Investor Meeting - November 18, 2025 APPLY

QUALIFY

We’re closing the lease and securing a commitment I’m signing my lease and paying deposits I’m moving in and setting my space up the way I like it We’re welcoming new residents & ensuring a seamless move-in experience ONBOARD

SIGN & MOVE-IN

Unifying the Resident Experience I'm looking for a place to call “home” DISCOVER

ATTRACT

We’re marketing & generating quality/trusted leads I’m deciding whether to stay or move out RENEW

RETAIN

We’re driving renewals and managing turnover I’m living in a hassle-free and comfortable space & I feel supported LIVE

MANAGE

We’re providing services, collecting rent, & maintaining retention R E S ID E N T JO U R N E Y P M JO U R N E Y

41 2025 © AppFolio Investor Meeting - November 18, 2025 We’re closing the lease and securing a commitment I’m signing my lease and paying deposits I’m moving in and setting my space up the way I like it We’re welcoming new residents & ensuring a seamless move-in experience ONBOARD

SIGN & MOVE-IN

I'm looking for a place to call “home” ATTRACT

We’re marketing & generating quality/trusted leads I’m applying for this rental QUALIFY

We’re processing and screening applicants I’m deciding whether to stay or move out RETAIN

We’re driving renewals and managing turnover I’m living in a hassle-free and comfortable space & I feel supported MANAGE

We’re providing services, collecting rent, & maintaining retention DISCOVER

APPLY

LIVE

RENEW

of residents move in every year Millions Delivering Value During Resident Onboarding R E S ID E N T JO U R N E Y P M JO U R N E Y

42 2025 © AppFolio Investor Meeting - November 18, 2025 VIDEO 5 PLACEHOLDER Resident Onboarding https://drive.google. com/file/d/1B0O6iY khRM7nTJQe2aehr FL6zrP6KfI8/view? usp=sharing 4K WIP

43 2025 © AppFolio Investor Meeting - November 18, 2025 Helping customers improve the resident experience and create new revenue streams with Resident Onboarding Lift, powered by Second Nature. Receive convenient benefits, cost savings, and an improved quality of life. Generate ancillary revenue & deliver value to residents without adding more work. Reduce maintenance costs, increase retention, & stand out from their competition. + RESIDENT PROPERTY MANAGER INVESTOR

44 2025 © AppFolio Investor Meeting - November 18, 2025 Resident Messenger Performer Hi Jordan, we’re happy to grant you a one-time waiver. The charge has been removed. RESIDENT TO PM

Can my late fee be waived? PERFORMER ESCALATIONS

AUTOMATED DECISIONS

AI Concierge Just now Good news, you’re eligible for a one-time late fee removal, and it’s all taken care of. PROACTIVE

AI Concierge 3 mins ago Hi Jordan, just a quick reminder that your June rent of $1320 is past due. No problem, I can split that into two payments: 📆 Payment Plan • Today: $660 • Aug 15: $660 Want me to set that up? Just now AI Concierge 12 mins ago Hey there 👋 how can I help you? I can check with your Property Manager on that. Are there any other details you’d like to include before I send the request? Hi Jordan, we’re happy to grant you a one-time waiver. The charge has been removed. Carol Just now Carol has entered the chat PM PM Can my late fee be waived? Can my late fee be waived? Hey there 👋 how can I help you? Pay Now Can I setup a payment plan? AppFolio Realm-X Resident Messenger Performer is currently being piloted with select customers

45 2025 © AppFolio Investor Meeting - November 18, 2025 Value Added Services Resident Onboarding Lift FolioGuard Leasing Signals Zillow Listing Spotlight FolioScreen Receivables Payables AvidPay GROW VALUE FOR RESIDENTS AND PROPERTY MANAGERS

GROW OCCUPANCY

GROW PAYMENTS IMPACT

Premium Listings Sites Realm-X Performers Leasing CRM ACTION THE WORK

46 2025 © AppFolio Investor Meeting - November 18, 2025 * Averages from 2025 survey of 120 AppFolio Realm-X Flows users

5 days Vacancy Time Reduced* 20% Increased Renewal Rates* 2.8% Increased Net Operating Income*

47 Deliver Performance Efficiently: Go-to-Market Strategy Lisa Horner Chief Marketing Officer

Our Brand Is a Differentiator for AppFolio Delay

49 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

Differentiated Brand & Customer Experiences Delivers Efficient Growth for AppFolio

50 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

GTM Alignment & Insights Create Efficient Customer Acquisition *YTD 2025 non-GAAP expense Ideal Customer Profile Alignment GTM Investments Prioritized By Highest Fit + Propensity to Buy Prospect Accounts S&M Expense 13% of Revenue* Tier 7 Tier 6 Tier 5 Tier 4 Tier 3 Tier 2 Tier 1 Buyer Group Engagement Personalized Value Plays by Buyer Group Stakeholder 80% Buyer Group Engagement With Top 500 Prospect Accounts CEO/Owner

CFO

Accountant

Property

Manager Lead

Leasing

Lead

Maintenance

Lead

GTM Acquisition Playbooks by Segment + Common Goals Across GTM Functions Acquisition Market Segmentation +40% Upmarket Acquisition Sales Capacity Since 2023 UP MARKET SMB Delay * 2025 represents YTD Q3-2025 as reported on October 30, 2025. Non-GAAP operating margin is a non-GAAP financial measure. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures, where applicable.

51 2025 © AppFolio Investor Meeting - November 18, 2025 Ease of Use Drives High Adoption & Customer Outcomes Adoption & Customer Performance By Integrating Technology Customers Need 4M+ Units Connected | 84 Partners Extended Value with Stack ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

Easy to Use Native Agentic Collaboration So Customers Build Thriving Communities 96% Use of AppFolio Realm AI Suite** AI & Agentic Product Experiences Automating Onboarding Reduces Barrier to Switch + Decreases Time To Value 93% Onboarding Customer Satisfaction* Product-Led Onboarding Delay * Represents the percentage of Upmarket new customers who rated their AppFolio migration experience a 9 or 10 via automated post-migration surveys since 1/1/25 ** Internal data on percentage of customers that used AppFolio Realm AI features and capabilities in 2025

52 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

We Win When Our Customers Win GTM Growth Playbooks by Segment + Common Goals Across GTM Functions +12% ARPU Growth from Prior Year* Revenue Potential Segmentation TIER 1 TIER 2 TIER 3 TIER 4 TI ER 5 T 6 T 7 Transforming Unstructured Customer Data Into Proactive Growth Outcomes 47% Customers Engaged Via Automation AI-Led Growth Driving Customer Outcomes Underpins Monetization Strategy +50% Growth Sales Capacity Since 2023 Value Added Services & Upsell *YTD 2025 ARPU is an approximate based YTD annualized actual results through September 30, 2025 Delay

53 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

Service Excellence at Every Touchpoint Customer Differentiation When Customers Create Performance for Their Customers, We Are True Partners Realm-X Flows Users See +20% Renewal Rates** Real Customer Performance As we Do The Work in Real Estate AppFolio Customers Perform Realm-X Users Save 10.3 Hours Per Week* Our Customers Get Agentic Assistance within our Platform AI In-App Assistance 59% Support Interactions Handled by AI Delay * Average from 2024 survey of 343 AppFolio Realm-X users ** Average from 2025 survey of 120 AppFolio Realm-X Flows users

54 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

Our Reputation Is Built on Customer Success Buyers Trust Authentic Customer Reviews & Ratings Overall Leader, G2 Grid® for Property Management* Stories of Customer Performance Fuel Our Efficient Growth We Break Through The AI Hype with Stories of Real Performance Real Stories of Success 56% of Managed Accounts Are Active Prospect References Community Multipliers Users Connect to Share Best Practices Driving Community Led Growth +28% YoY Community Engagements * G2 Grid for Property Management Software, AppFolio overall leader ranking as of 11/17/2025. Rankings are dynamic. Delay

55 2025 © AppFolio Investor Meeting - November 18, 2025 ACQUIRE

ADOPT

GROW

RETAIN

ADVOCATE

We Deliver AppFolio & Real Estate Performance Efficiently Delay

56 AppFolio Customer Panel Stacy Holden Vice President & Industry Principal

57 2025 © AppFolio Investor Meeting - November 18, 2025 Hello to our Customers! Rob Gayle President Dream. Live. Prosper Communities Josh Winch President Focus Property Management Stacy Winship Executive Vice President Fairgrove Property Management Tony Julianelle CEO, Partner Atlas Real Estate

58 2025 © AppFolio Investor Meeting - November 18, 2025 Rob Gayle President St. Augustine, FL 9,900 Units Multifamily, Single Family, Commercial +

Customer Since 2017 Payments Sites Realm-X Flows, Assistant, Messages Realm-X Maintenance Performer Beta Investment Manager Collections Premium Leads Leasing Signals, Leasing CRM Max

59 2025 © AppFolio Investor Meeting - November 18, 2025 Tony Julianelle CEO, Partner IM Denver, CO 5,475 Units Single-Family, Multifamily, Build-to-Rent, Commercial Customer Since 2015 Payments Sites Realm-X Flows, Assistant, Messages Collections Premium Leads Automated AP +

IMMax

60 2025 © AppFolio Investor Meeting - November 18, 2025 Josh Winch President Kaukauna, WI 6,161 Units Multifamily, Single Family, Commercial Customer Since 2019 Payments Sites Realm-X Flows, Assistant, Messages Procurement Collections Premium Leads +

Plus

61 2025 © AppFolio Investor Meeting - November 18, 2025 Realm-X Maintenance Performer Beta Stacy Winship Executive Vice President Irvine, CA 9,080 Units Multifamily, Single Family Customer Since 2018 Payments Sites Realm-X Flows, Assistant, Messages Collections Premium Leads Leasing Signals, Leasing CRM +

Max

Thank You, AppFolio Customers! AppFolio Customer Panel

63 Financial Overview Tim Eaton Chief Financial Officer

64 2025 © AppFolio Investor Meeting - November 18, 2025 REVENUE GROWTH

● Drive unit growth through new business and customer expansion ● Accelerate premium tier and value added services adoption ● Scale resident industry segment Delivering Shareholder Value Financial Priorities MARGIN EXPANSION

● Prioritize profitable revenue growth ● Continued operational discipline across S&M, R&D, and G&A ● Invest in highest-ROI opportunities CAPITAL ALLOCATION

● Prioritize organic growth while thoughtfully considering inorganic opportunities ● Maintain financial flexibility with appropriate liquidity ● Execute opportunistic share repurchases to drive long-term shareholder value Growing Operating Cash Flow Per Share * Operating Cash Flow is a GAAP metric. Operating cash flow per share defined as operating cash flow divided by diluted weighted average common shares outstanding.

65 2025 © AppFolio Investor Meeting - November 18, 2025 ● Drive unit growth through new business and customer expansion ● Accelerate premium tier and value added services adoption ● Scale resident industry segment ● Prioritize profitable revenue growth ● Continued operational discipline across S&M, R&D, and G&A ● Invest in highest-ROI opportunities ● Prioritize organic growth while thoughtfully considering inorganic opportunities ● Maintain financial flexibility with appropriate liquidity ● Execute opportunistic share repurchases to drive long-term shareholder value Delivering Shareholder Value Financial Priorities REVENUE GROWTH

MARGIN EXPANSION

Growing Operating Cash Flow Per Share * Operating Cash Flow is a GAAP metric. Operating cash flow per share defined as operating cash flow divided by diluted weighted average common shares outstanding. CAPITAL ALLOCATION

66 2025 © AppFolio Investor Meeting - November 18, 2025 CAGR 26% * 2025 revenue of $948M is the full-year midpoint guidance provided on October 30, 2025. Consistent Revenue Growth

67 2025 © AppFolio Investor Meeting - November 18, 2025 Growing Units CAGR 8% Community Association Units Upmarket Residential (1,500+ Units) SMB Residential (50-1,499 Units) Prioritizing Residential Unit Acquisition * 2025 represents units under management as of September 30, 2025.

68 2025 © AppFolio Investor Meeting - November 18, 2025 Growing ARPU Value Added CAGR 21% Value Added Services ARPU Core ARPU Through value added services adoption * YTD 2025 ARPU is an approximate based YTD annualized actual results through September 30. 2025.

69 2025 © AppFolio Investor Meeting - November 18, 2025 Premium Tier CAGR 40% Plus Tier Units Core Tier Units Max Tier Units Through premium tier adoption ~1 in 4 units on premium tier Growing ARPU

70 2025 © AppFolio Investor Meeting - November 18, 2025 WH OL E NU MB ER S ~$40 ~$160~$103 Increased Premium Tier adoption & Value Added Services usage Long Runway for Future ARPU Growth +11% Growth from Prior Year ALL CUSTOMERS LOWEST 20% CUSTOMERS HIGHEST 20% CUSTOMERS +11% Growth from Prior Year +17% Growth from Prior Year * ARPU is based on 2025 YTD annualized actual results through September 30. 2025.

71 2025 © AppFolio Investor Meeting - November 18, 2025 Innovating for Future ARPU Growth Resident Investor Realm-X Realm-X Performers Residential Mixed Portfolio Premium Tiers AppFolio Stack Other Value Added Services … Significant Long-term ARPU Potential

72 2025 © AppFolio Investor Meeting - November 18, 2025 ● Drive unit growth through new business and customer expansion ● Accelerate premium tier and value added services adoption ● Scale resident industry segment ● Prioritize profitable revenue growth ● Invest in highest-ROI opportunities ● Continued operational discipline across S&M, R&D, and G&A Growing Operating Cash Flow Per Share * Operating Cash Flow is a GAAP metric. Operating cash flow per share defined as operating cash flow divided by diluted weighted average common shares outstanding. ● Prioritize organic growth while thoughtfully considering inorganic opportunities ● Maintain financial flexibility with appropriate liquidity ● Execute opportunistic share repurchases to drive long-term shareholder value REVENUE GROWTH

MARGIN EXPANSION

CAPITAL ALLOCATION

Delivering Shareholder Value Financial Priorities

73 2025 © AppFolio Investor Meeting - November 18, 2025 * 2025 represents the mid-point of 2025 annual guidance as reported on October 30, 2025. Non-GAAP operating margin is a non-GAAP financial measure. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures, where applicable. Non-GAAP Operating Margin Non-GAAP Operating Margin % Prioritizing Profitability Investing in profitable revenue growth while delivering operational efficiencies

74 2025 © AppFolio Investor Meeting - November 18, 2025 Non-GAAP COR Non-GAAP COR % Optimizing Cost of Revenue Balancing product mix, COR operational efficiencies, and early scaling of profitable revenue growth * 2025 represents YTD Q3-2025 as reported on October 30, 2025. Non-GAAP operating margin is a non-GAAP financial measure. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures, where applicable.

75 2025 © AppFolio Investor Meeting - November 18, 2025 Non-GAAP D&A % Non-GAAP G&A % Non-GAAP R&D % Non-GAAP S&M % Continued Operational Discipline Across G&A, R&D, and S&M * 2025 represents YTD Q3-2025 as reported on October 30, 2025. Non-GAAP operating margin is a non-GAAP financial measure. Refer to the Appendix for an explanation of non-GAAP financial measures, and why we believe these measures can be useful, as well as a reconciliation of non-GAAP financial measures to the most comparable GAAP measures, where applicable.

76 2025 © AppFolio Investor Meeting - November 18, 2025 * 2025 represents ending employee count as of September 30, 2025 and trailing 12 months of revenue. Ending Employee # Revenue Per Employee ($K) Improving Revenue Per Employee Through operational leverage

77 2025 © AppFolio Investor Meeting - November 18, 2025 Growing Operating Cash Flow Per Share * Operating Cash Flow is a GAAP metric. Operating cash flow per share defined as operating cash flow divided by diluted weighted average common shares outstanding. REVENUE GROWTH

MARGIN EXPANSION

CAPITAL ALLOCATION

● Drive unit growth through new business and customer expansion ● Accelerate premium tier and value added services adoption ● Scale resident industry segment ● Prioritize profitable revenue growth ● Invest in highest-ROI opportunities ● Continued operational discipline across S&M, R&D, and G&A ● Prioritize organic growth while thoughtfully considering inorganic opportunities ● Maintain financial flexibility with appropriate liquidity ● Execute opportunistic share repurchases to drive long-term shareholder value Delivering Shareholder Value Financial Priorities

78 2025 © AppFolio Investor Meeting - November 18, 2025 CAPITAL RETURN & SHAREHOLDER VALUE

INORGANIC GROWTH

Research & Development M&A and Minority Investments Sales and Marketing investment to drive new customer acquisition and customer growth R&D investment in capabilities to deliver value to customers, win new units, and expand ARPU Accelerating our vision to own moments that matter and be the platform where real estate comes to do business General & Administrative Functional investment to deliver performance efficiently, enhance security, and ensure compliance Share Repurchases Sales & Marketing Opportunistically repurchase shares to drive long-term shareholder value and manage dilution ORGANIC REVENUE GROWTH

Accounting Reporting & Permissions Mixed Portfolios Sales Capacity Ad & Promo Information Security Internal Systems & Processes Compliance & Governance 689K Shares repurchased 2025 YTD Capital Allocation Priorities System of Growth System of Action System of Record AI-Native Architecture ADOPT

GROW

RETAIN

ADVOCATE

ACQUIRE

79 2025 © AppFolio Investor Meeting - November 18, 2025 REVENUE GROWTH

● Drive unit growth through new business and customer expansion ● Accelerate premium tier and value added services adoption ● Scale resident industry segment Delivering Shareholder Value Financial Priorities MARGIN EXPANSION

● Prioritize profitable revenue growth ● Continued operational discipline across S&M, R&D, and G&A ● Invest in highest-ROI opportunities CAPITAL ALLOCATION

● Prioritize organic growth while thoughtfully considering inorganic opportunities ● Maintain financial flexibility with appropriate liquidity ● Execute opportunistic share repurchases to drive long-term shareholder value Growing Operating Cash Flow Per Share * Operating Cash Flow is a GAAP metric. Operating cash flow per share defined as operating cash flow divided by diluted weighted average common shares outstanding.

80 2025 © AppFolio Investor Meeting - November 18, 2025 Growing Operating Cash Flow Per Share Operating Cash Flow per Share Operating Cash Flow * 2025 represents three quarters of results through September 30, 2025. Prior years represent full year results. (Q1-Q3)

81 2025 © AppFolio Investor Meeting - November 18, 2025 Strategic Pillars Differentiate to Win Great People & Culture Deliver Performance Efficiently

82 2025 © AppFolio Investor Meeting - November 18, 2025 To power the future of real estate. Vision

83 Appendix

84 2025 © AppFolio Investor Meeting - November 18, 2025 METRIC NAME DEFINITION WHY IT MATTERS ARPU Annualized average revenue per unit. Recurring revenue (Core revenue + Value added services revenue) divided by average ending units under management for the specified period. Provides insight into how much revenue recognized, on average, from each unit in a given period. Customers Customers which have an entitlement to an APM Core, Plus, or Max subscription at the end of the specified period. Indicates our market penetration, the growth of our business, and our potential future business opportunities. Non-GAAP Operating Margin Operating margin is defined as income (loss) from operations, less stock-based compensation, amortization of stock-based compensation capitalized in software development, amortization of intangibles and other non-recurring items. Serves as a non-GAAP financial measure of profitability. Operating Cash Flow per Share Operating cash flow per share is defined as operating cash flow divided by diluted weighted average common shares outstanding Reflects the underlying economic engine of our business, encompassing our efforts to drive revenue growth and deliver non-GAAP operating margin improvement, while managing dilution. Residential Units Includes single-family, multi-family, student, and affordable rental units. Demonstrates our market for AppFolio Property Management Solution products. Community Associations Units Includes condominium owners’ associations who manage common structures with multiple units, such as apartments and townhomes and homeowner associations who oversee single-family homes in planned developments, usually made up of individual lots and homes. Demonstrates our market for AppFolio Property Management Solution products. Units Number of ending units under management which have an entitlement to an APM Core, Plus or Max subscription at the end of the specified period. Indicates our our market penetration, the growth of our business, and our potential future business opportunities. Revenue Per Employee Annualized average revenue per employee. Total revenue divided by ending full time equivalents for the specified period. Expressed in thousands. Measures workforce efficiency and demonstrates our ability to convert our people and their capital into revenue. Definitions of Measures and Metrics and Why They Matter

85 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation OPERATING MARGIN

2022

2023

2024

YTD 2025

GAAP income (loss) from operations as a percentage of revenue (15.3%) 0.2% 17.1% 15.6% Stock-based compensation expense as a percentage of revenue 8.7% 8.4% 7.6% 7.9% Amortization of stock-based compensation capitalized in software development costs as a percentage of revenue 0.5% 0.4% 0.2% 0.1% Impairment, net as a percentage of revenue 4.7% — % — % — % Amortization of purchased intangibles as a percentage of revenue 0.9% 0.4% 0.3% 1.1% CEO separation costs payment as a percentage of revenue — % 1.9% — % — % Gain on lease modification as a percentage of revenue — % (0.7%) — % — % Severance payments for workforce reduction as a percentage of revenue — % 1.8% — % — % Non-GAAP operating margin as a percentage of revenue (0.6%) 12.2% 25.2% 24.7%

86 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation COR EXPENSES

2022

2023

2024

YTD 2025

GAAP COR expense as a percentage of revenue 40.7% 38.4% 35.5% 36.3% Stock-based compensation expense as a percentage of revenue (0.6%) (0.6%) (0.6%) (0.6%) Severance payments for workforce reduction as a percentage of revenue — % (0.3%) — % — % Non-GAAP COR expense as a percentage of revenue 40.1% 37.4% 34.9% 35.7%

87 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation S&M OPERATING EXPENSES

2022

2023

2024

YTD 2025

GAAP S&M expense as a percentage of revenue 22.8% 17.3% 13.9% 14.8% Stock-based compensation expense as a percentage of revenue (1.8%) (1.0%) (1.0%) (1.3%) Severance payments for workforce reduction as a percentage of revenue — % (0.5%) — % — % Non-GAAP S&M expense as a percentage of revenue 20.9% 15.8% 12.9% 13.4%

88 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation R&D OPERATING EXPENSES

2022

2023

2024

YTD 2025

GAAP R&D expense as a percentage of revenue 23.5% 24.4% 20.2% 20.6% Stock-based compensation expense as a percentage of revenue (3.4%) (3.4%) (3.2%) (3.4%) Severance payments for workforce reduction as a percentage of revenue — % (0.4%) — % — % Non-GAAP R&D expense as a percentage of revenue 20.2% 20.6% 17.0% 17.1%

89 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation G&A OPERATING EXPENSES

2022

2023

2024

YTD 2025

GAAP G&A expense as a percentage of revenue 21.4% 15.1% 10.8% 10.4% Stock-based compensation expense as a percentage of revenue (2.9%) (3.5%) (2.8%) (2.6%) CEO separation costs payment as a percentage of revenue — % (1.9%) — % — % Gain on lease modification as a percentage of revenue — % 0.7% — % — % Severance payments for workforce reduction as a percentage of revenue — % (0.3%) — % — % Impairment, net as a percentage of revenue (4.7%) — % — % — % Non-GAAP G&A expense as a percentage of revenue 13.8% 10.1% 8.0% 7.8%

90 2025 © AppFolio Investor Meeting - November 18, 2025 GAAP to Non-GAAP Reconciliation D&A OPERATING EXPENSES

2022

2023

2024

YTD 2025

GAAP D&A expense as a percentage of revenue 7.0% 4.7% 2.5% 2.5% Amortization of stock-based compensation capitalized in software development costs as a percentage of revenue (0.5%) (0.4%) (0.2%) (0.1%) Amortization of purchased intangibles as a percentage of revenue (0.9%) (0.4%) (0.3%) (1.1%) Non-GAAP D&A expense as a percentage of revenue 5.6% 3.9% 2.0% 1.3%

91 2025 © AppFolio Investor Meeting - November 18, 2025 Operating Cash Flow Per Share Reconciliation OPERATING CASH FLOW PER SHARE

2022

2023

2024

YTD 2025

GAAP net cash provided by operating activities $25.4M $60.3M $188.2M $177.1M Diluted Weighted Average Shares Outstanding 35.0M 36.4M 36.8M 36.4M Operating cash flow per share $0.72 $1.66 $5.12 $4.87