| Maryland | 001-39529 | 26-1516177 | ||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||

|

207 High Point Drive

Suite 300

|

||||||||

Victor, New York |

14564 | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.00025 par value | BNL | The New York Stock Exchange | ||||||||||||

| (d) | Exhibits | ||||

| Exhibit No. | Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | ||||

| BROADSTONE NET LEASE, INC. | |||||||||||

| Date: | July 30, 2025 | By: | /s/ John D. Callan | ||||||||

| Name: John D. Callan Title: Senior Vice President, General Counsel and Secretary |

|||||||||||

|

Company Contact:

Brent Maedl

Director, Corporate Finance & Investor Relations

brent.maedl@broadstone.com

585.382.8507

|

|

||||

| OPERATING RESULTS |

•Generated net income of $19.8 million, or $0.10 per diluted share, representing a 44.8% decrease compared to the same period in the prior year. The decrease is primarily related to an $8.1 million increase in the provision for impairment of investment in rental properties.

•Generated adjusted funds from operations (“AFFO”) of $74.3 million, or $0.38 per diluted share, representing a 5.6% increase compared to the same period in the previous year.

•Incurred $9.6 million of general and administrative expenses, representing a 3.0% decrease compared to the previous year. Incurred core general and administrative expenses of $6.9 million, which excludes $2.5 million of stock-based compensation, $0.1 million of non-capitalized transaction costs, and $0.1 million of severance and employee transition costs, representing a 6.8% decrease compared to the previous year.

•Portfolio was 99.1% leased based on rentable square footage, with only two of our 766 properties vacant and not subject to a lease at quarter end.

•Collected 99.6% of base rents due for the quarter for all properties under lease, representing a 60 basis point increase compared to the same period in the previous year.

|

||||

| INVESTMENT & DISPOSITION ACTIVITY |

•Invested $140.8 million quarter-to-date, including $63.3 million in build-to-suit developments, $54.7 million in a new industrial property acquisition, and $22.8 million in transitional capital. The completed acquisition had an initial cash capitalization rate, straight-line yield, lease term, and annual rent increase of 7.1%, 8.2%, 10.7 years, and 3.0%, respectively. Total investments consist of $138.5 million in industrial properties and $2.3 million in retail properties.

•Through the second quarter, we invested $229.1 million, including $113.7 million in new property acquisitions, $89.8 million in build-to-suit developments, $22.8 million in transitional capital, and $2.8 million in revenue generating capital expenditures. The completed acquisitions and revenue generating capital expenditures had a weighted average initial cash capitalization rate, lease term, and annual rent increase of 7.2%, 12.4 years, and 2.8%, respectively. The completed acquisitions have a weighted average straight-line yield of 8.3%. Total investments consist of $207.6 million of industrial properties and $21.5 million in retail properties.

•Subsequent to quarter end through July 24, we invested $33.1 million, consisting of $21.3 million in new property acquisitions of retail properties and $11.8 million of build-to-suit developments.

•We have a total of $268.6 million in remaining estimated investments for build-to-suit developments to be funded through the third quarter of 2026. Additionally, we have $234.6 million of acquisitions under control and $4.5 million of commitments to fund revenue generating capital expenditures with existing tenants.

•During the quarter, we sold eight properties for gross proceeds of $13.1 million at a weighted average cash capitalization rate of 9.5% on tenanted properties. Subsequent to quarter end through July 24, we sold two properties for gross proceeds of $4.7 million.

|

||||

| CAPITAL MARKETS ACTIVITY |

•Ended the quarter with total outstanding debt of $2.1 billion, Net Debt of $2.1 billion, a Net Debt to Annualized Adjusted EBITDAre ratio of 5.3x, and a Pro Forma Net Debt to Annualized Adjusted EBITDAre ratio of 5.2x.

•As of June 30, 2025, we had $802.1 million of capacity on our unsecured revolving credit facility.

•Declared a quarterly dividend of $0.29 per share.

|

||||

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| (in thousands, except per share data) | June 30, 2025 |

March 31, 2025 |

June 30, 2024 |

June 30, 2025 |

June 30, 2024 |

|||||||||||||||||||||||||||

| Revenues | $ | 112,986 | $ | 108,690 | $ | 105,907 | $ | 221,677 | $ | 211,274 | ||||||||||||||||||||||

| Net income, including non-controlling interests | $ | 19,830 | $ | 17,493 | $ | 35,937 | $ | 37,323 | $ | 104,114 | ||||||||||||||||||||||

| Net earnings per share – diluted | $ | 0.10 | $ | 0.09 | $ | 0.19 | $ | 0.19 | $ | 0.53 | ||||||||||||||||||||||

| FFO | $ | 73,695 | $ | 72,627 | $ | 73,725 | $ | 146,322 | $ | 146,861 | ||||||||||||||||||||||

| FFO per share | $ | 0.37 | $ | 0.37 | $ | 0.37 | $ | 0.74 | $ | 0.74 | ||||||||||||||||||||||

| Core FFO | $ | 77,150 | $ | 75,280 | $ | 73,001 | $ | 152,430 | $ | 147,073 | ||||||||||||||||||||||

| Core FFO per share | $ | 0.39 | $ | 0.38 | $ | 0.37 | $ | 0.77 | $ | 0.74 | ||||||||||||||||||||||

| AFFO | $ | 74,308 | $ | 71,812 | $ | 70,401 | $ | 146,120 | $ | 141,276 | ||||||||||||||||||||||

| AFFO per share | $ | 0.38 | $ | 0.36 | $ | 0.36 | $ | 0.74 | $ | 0.72 | ||||||||||||||||||||||

| Diluted Weighted Average Shares Outstanding | 197,138 | 196,898 | 196,470 | 196,975 | 196,379 | |||||||||||||||||||||||||||

| (unaudited, in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property | Projected Rentable Square Feet | Start Date | Target Stabilization / Stabilized Date | Lease Term (Years) | Annual Rent Escalations | Estimated Total Project Investment | Cumulative Investment at 7/24/2025 |

Estimated Remaining Investment | Estimated Cash Capitalization Rate | Estimated Straight-line Yield (a) |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| In-process retail: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (Jacksonville - FL) |

1 | Jun. 2025 | Sep. 2025 | 15.0 | 1.9 | % | $ | 2,008 | $ | 1,112 | $ | 896 | 8.0 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Sprouts (Bedford - TX) |

22 | Jul. 2025 | Aug. 2026 | 15.0 | 0.9 | % | 9,533 | — | 9,533 | 7.2 | % | 7.7 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| In-process industrial: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sierra Nevada (Dayton - OH) |

122 | Oct. 2024 | Nov. 2025 | 15.0 | 3.0 | % | 58,563 | 34,515 | 24,048 | 7.6 | % | 9.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Sierra Nevada (Dayton - OH) |

122 | Oct. 2024 | Mar. 2026 | 15.0 | 3.0 | % | 55,525 | 19,485 | 36,040 | 7.7 | % | 9.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Southwire (Bremen - GA) |

1,178 | Dec. 2024 | Jul. 2026 | 10.0 | 2.8 | % | 115,411 | 16,653 | 98,758 | 7.8 | % | 8.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Fiat Chrysler Automobile (Forsyth - GA) |

422 | Apr. 2025 | Aug. 2026 | 15.0 | 2.8 | % | 78,242 | 13,067 | 65,175 | 6.9 | % | 8.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| AGCO (Visalia - CA) |

115 | Jun. 2025 | Aug. 2026 | 12.0 | 3.5 | % | 19,809 | 14,092 | 5,717 | 7.0 | % | 8.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

|

Palmer Logistics

(Midlothian - TX) (b)

|

270 | Jul. 2025 | Jul. 2026 | 12.3 | 3.5 | % | 32,063 | 3,618 | 28,445 | 7.6 | % | 9.2 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total / weighted average | 2,252 | 13.0 | 2.9 | % | 371,154 | 102,542 | 268,612 | 7.5 | % | 8.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Stabilized industrial: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UNFI (Sarasota - FL) |

1,016 | May 2023 | Stabilized - Sep. 2024 | 15.0 | 2.5 | % | 200,958 | 200,958 | — | 7.2 | % | 8.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stabilized retail: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (High Point - NC) |

1 | Dec. 2024 | Stabilized - June 2025 | 15.0 | 1.9 | % | 1,975 | 1,975 | — | 8.0 | % | 8.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (Charleston - SC) |

1 | Feb. 2025 | Stabilized - May 2025 | 15.0 | 1.9 | % | 1,729 | 1,729 | — | 7.9 | % | 8.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total / weighted average | 3,270 | 13.7 | 2.7 | % | $ | 575,816 | $ | 307,204 | $ | 268,612 | 7.4 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2025 |

December 31, 2024 |

||||||||||

| Assets | |||||||||||

| Accounted for using the operating method: | |||||||||||

| Land | $ | 784,092 | $ | 778,826 | |||||||

| Land improvements | 360,774 | 357,142 | |||||||||

| Buildings and improvements | 3,871,441 | 3,815,521 | |||||||||

| Equipment | 16,070 | 15,843 | |||||||||

| Total accounted for using the operating method | 5,032,377 | 4,967,332 | |||||||||

| Less accumulated depreciation | (721,195) | (672,478) | |||||||||

| Accounted for using the operating method, net | 4,311,182 | 4,294,854 | |||||||||

| Accounted for using the direct financing method | 25,845 | 26,154 | |||||||||

| Accounted for using the sales-type method | 569 | 571 | |||||||||

| Property under development | 116,635 | 18,784 | |||||||||

| Investment in rental property, net | 4,454,231 | 4,340,363 | |||||||||

| Cash and cash equivalents | 20,784 | 14,845 | |||||||||

| Accrued rental income | 172,310 | 162,717 | |||||||||

| Tenant and other receivables, net | 3,605 | 3,281 | |||||||||

| Prepaid expenses and other assets | 55,815 | 41,584 | |||||||||

| Interest rate swap, assets | 23,490 | 46,220 | |||||||||

| Goodwill | 339,769 | 339,769 | |||||||||

| Intangible lease assets, net | 256,675 | 267,638 | |||||||||

| Total assets | $ | 5,326,679 | $ | 5,216,417 | |||||||

| Liabilities and equity | |||||||||||

| Unsecured revolving credit facility | $ | 197,880 | $ | 93,014 | |||||||

| Mortgages, net | 75,685 | 76,846 | |||||||||

| Unsecured term loans, net | 994,028 | 897,201 | |||||||||

| Senior unsecured notes, net | 846,441 | 846,064 | |||||||||

| Interest rate swap, liabilities | 7,625 | — | |||||||||

| Accounts payable and other liabilities | 57,409 | 48,983 | |||||||||

| Dividends payable | 58,451 | 58,317 | |||||||||

| Accrued interest payable | 8,542 | 5,837 | |||||||||

| Intangible lease liabilities, net | 44,797 | 48,731 | |||||||||

| Total liabilities | 2,290,858 | 2,074,993 | |||||||||

| Commitments and contingencies | |||||||||||

| Equity | |||||||||||

| Broadstone Net Lease, Inc. equity: | |||||||||||

| Preferred stock, $0.001 par value; 20,000 shares authorized, no shares issued or outstanding | — | — | |||||||||

Common stock, $0.00025 par value; 500,000 shares authorized, 189,130 and 188,626 shares issued and outstanding at June 30, 2025 and December 31, 2024, respectively |

47 | 47 | |||||||||

| Additional paid-in capital | 3,459,939 | 3,450,584 | |||||||||

| Cumulative distributions in excess of retained earnings | (571,302) | (496,543) | |||||||||

| Accumulated other comprehensive income | 18,009 | 49,657 | |||||||||

| Total Broadstone Net Lease, Inc. equity | 2,906,693 | 3,003,745 | |||||||||

| Non-controlling interests | 129,128 | 137,679 | |||||||||

| Total equity | 3,035,821 | 3,141,424 | |||||||||

| Total liabilities and equity | $ | 5,326,679 | $ | 5,216,417 | |||||||

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||

| June 30, 2025 |

March 31, 2025 |

June 30, 2025 |

June 30, 2024 |

||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Lease revenues, net | $ | 112,986 | $ | 108,690 | $ | 221,677 | $ | 211,274 | |||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Depreciation and amortization | 42,575 | 39,497 | 82,072 | 75,176 | |||||||||||||||||||

| Property and operating expense | 5,003 | 5,488 | 10,491 | 10,963 | |||||||||||||||||||

| General and administrative | 9,571 | 9,672 | 19,242 | 19,336 | |||||||||||||||||||

| Provision for impairment of investment in rental properties | 11,939 | 16,128 | 28,068 | 30,252 | |||||||||||||||||||

| Total operating expenses | 69,088 | 70,785 | 139,873 | 135,727 | |||||||||||||||||||

| Other income (expenses) | |||||||||||||||||||||||

| Interest income | 122 | 99 | 221 | 882 | |||||||||||||||||||

| Interest expense | (21,112) | (20,074) | (41,186) | (36,334) | |||||||||||||||||||

| Gain on sale of real estate | 566 | 405 | 971 | 62,515 | |||||||||||||||||||

| Income taxes | (199) | (355) | (555) | (939) | |||||||||||||||||||

| Other (expenses) income | (3,445) | (487) | (3,932) | 2,443 | |||||||||||||||||||

| Net income | 19,830 | 17,493 | 37,323 | 104,114 | |||||||||||||||||||

| Net income attributable to non-controlling interests | 330 | (750) | (420) | (3,671) | |||||||||||||||||||

| Net income attributable to Broadstone Net Lease, Inc. | $ | 20,160 | $ | 16,743 | $ | 36,903 | $ | 100,443 | |||||||||||||||

| Weighted average number of common shares outstanding | |||||||||||||||||||||||

| Basic | 188,041 | 187,865 | 187,953 | 187,363 | |||||||||||||||||||

| Diluted | 197,138 | 196,898 | 196,975 | 196,379 | |||||||||||||||||||

| Net earnings per common share | |||||||||||||||||||||||

| Basic | $ | 0.11 | $ | 0.09 | $ | 0.19 | $ | 0.53 | |||||||||||||||

| Diluted | $ | 0.10 | $ | 0.09 | $ | 0.19 | $ | 0.53 | |||||||||||||||

| Comprehensive income | |||||||||||||||||||||||

| Net income | $ | 19,830 | $ | 17,493 | $ | 37,323 | $ | 104,114 | |||||||||||||||

| Other comprehensive income (loss) | |||||||||||||||||||||||

| Change in fair value of interest rate swaps | (10,463) | (19,892) | (30,355) | 10,348 | |||||||||||||||||||

| Realized (gain) loss on interest rate swaps | (6) | (6) | (12) | 221 | |||||||||||||||||||

| Comprehensive income | 9,361 | (2,405) | 6,956 | 114,683 | |||||||||||||||||||

| Comprehensive loss (income) attributable to non-controlling interests | 775 | 103 | 878 | (4,146) | |||||||||||||||||||

Comprehensive income (loss) attributable to Broadstone Net Lease, Inc. |

$ | 10,136 | $ | (2,302) | $ | 7,834 | $ | 110,537 | |||||||||||||||

| For the Three Months Ended | For the Six Months Ended | ||||||||||||||||||||||

| (in thousands, except per share data) | June 30, 2025 |

March 31, 2025 |

June 30, 2025 |

June 30, 2024 |

|||||||||||||||||||

| Net income | $ | 19,830 | $ | 17,493 | $ | 37,323 | $ | 104,114 | |||||||||||||||

| Real property depreciation and amortization | 42,492 | 39,411 | 81,902 | 75,010 | |||||||||||||||||||

| Gain on sale of real estate | (566) | (405) | (971) | (62,515) | |||||||||||||||||||

| Provision for impairment on investment in rental properties | 11,939 | 16,128 | 28,068 | 30,252 | |||||||||||||||||||

| FFO | $ | 73,695 | $ | 72,627 | $ | 146,322 | $ | 146,861 | |||||||||||||||

| Net write-offs of accrued rental income | 3 | 2,228 | 2,231 | 2,556 | |||||||||||||||||||

| Other non-core income from real estate transactions | (46) | (63) | (109) | — | |||||||||||||||||||

| Cost of debt extinguishment | — | 165 | 166 | — | |||||||||||||||||||

| Severance and employee transition costs | 53 | 1 | 54 | 99 | |||||||||||||||||||

Other (income) expenses1 |

3,445 | 322 | 3,766 | (2,443) | |||||||||||||||||||

| Core FFO | $ | 77,150 | $ | 75,280 | $ | 152,430 | $ | 147,073 | |||||||||||||||

| Straight-line rent adjustment | (5,586) | (5,907) | (11,492) | (10,031) | |||||||||||||||||||

| Adjustment to provision for credit losses | (13) | — | (13) | (17) | |||||||||||||||||||

| Amortization of debt issuance costs | 1,328 | 1,237 | 2,565 | 1,966 | |||||||||||||||||||

| Non-capitalized transaction costs | 142 | 117 | 258 | 629 | |||||||||||||||||||

| Realized gain or loss on interest rate swaps and other non-cash interest expense | 7 | 2 | 9 | 221 | |||||||||||||||||||

| Amortization of lease intangibles | (1,191) | (1,064) | (2,255) | (2,113) | |||||||||||||||||||

| Stock-based compensation | 2,471 | 2,147 | 4,618 | 3,548 | |||||||||||||||||||

| AFFO | $ | 74,308 | $ | 71,812 | $ | 146,120 | $ | 141,276 | |||||||||||||||

Diluted WASO2 |

197,138 | 196,898 | 196,975 | 196,379 | |||||||||||||||||||

Net earnings per diluted share3 |

$ | 0.10 | $ | 0.09 | $ | 0.19 | $ | 0.53 | |||||||||||||||

FFO per diluted share3 |

0.37 | 0.37 | 0.74 | 0.74 | |||||||||||||||||||

Core FFO per diluted share3 |

0.39 | 0.38 | 0.77 | 0.74 | |||||||||||||||||||

AFFO per diluted share3 |

0.38 | 0.36 | 0.74 | 0.72 | |||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| (in thousands) | June 30, 2025 |

March 31, 2025 |

June 30, 2024 |

||||||||||||||

| Net income | $ | 19,830 | $ | 17,493 | $ | 35,937 | |||||||||||

| Depreciation and amortization | 42,575 | 39,497 | 37,404 | ||||||||||||||

| Interest expense | 21,112 | 20,074 | 17,757 | ||||||||||||||

| Income taxes | 199 | 355 | 531 | ||||||||||||||

| EBITDA | $ | 83,716 | $ | 77,419 | $ | 91,629 | |||||||||||

| Provision for impairment of investment in rental properties | 11,939 | 16,128 | 3,852 | ||||||||||||||

| Gain on sale of real estate | (566) | (405) | (3,384) | ||||||||||||||

| EBITDAre | $ | 95,089 | $ | 93,142 | $ | 92,097 | |||||||||||

Adjustment for current quarter investment activity1 |

573 | 978 | 1,241 | ||||||||||||||

Adjustment for current quarter disposition activity2 |

(490) | (135) | (87) | ||||||||||||||

Adjustment to exclude non-recurring and other expenses3 |

(332) | 44 | 26 | ||||||||||||||

| Adjustment to exclude net write-offs of accrued rental income | 3 | 2,228 | — | ||||||||||||||

| Adjustment to exclude realized / unrealized foreign exchange (gain) loss | 3,445 | 322 | (748) | ||||||||||||||

| Adjustment to exclude cost of debt extinguishment | — | 166 | — | ||||||||||||||

| Adjustment to exclude other income from real estate transactions | (46) | (63) | — | ||||||||||||||

| Adjusted EBITDAre | $ | 98,242 | $ | 96,682 | $ | 92,529 | |||||||||||

Estimated revenues from developments4 |

1,629 | 631 | 3,458 | ||||||||||||||

| Pro Forma Adjusted EBITDAre | $ | 99,871 | $ | 97,313 | $ | 95,987 | |||||||||||

| Annualized EBITDAre | 380,356 | 372,568 | 368,388 | ||||||||||||||

| Annualized Adjusted EBITDAre | 392,968 | 386,728 | 370,116 | ||||||||||||||

| Pro Forma Annualized Adjusted EBITDAre | 399,484 | 389,252 | 383,948 | ||||||||||||||

| (in thousands) | June 30, 2025 |

March 31, 2025 |

June 30, 2024 |

||||||||||||||

| Debt | |||||||||||||||||

| Unsecured revolving credit facility | $ | 197,880 | $ | 174,122 | $ | 79,096 | |||||||||||

| Unsecured term loans, net | 994,028 | 893,505 | 896,574 | ||||||||||||||

| Senior unsecured notes, net | 846,441 | 846,252 | 845,687 | ||||||||||||||

| Mortgages, net | 75,685 | 76,260 | 77,970 | ||||||||||||||

| Debt issuance costs | 9,578 | 10,300 | 7,825 | ||||||||||||||

| Gross Debt | 2,123,612 | 2,000,439 | 1,907,152 | ||||||||||||||

| Cash and cash equivalents | (20,784) | (9,605) | (18,282) | ||||||||||||||

| Restricted cash | (1,192) | (1,428) | (1,614) | ||||||||||||||

| Net Debt | $ | 2,101,636 | $ | 1,989,406 | $ | 1,887,256 | |||||||||||

Estimated net proceeds from forward equity agreements1 |

(37,722) | (38,124) | — | ||||||||||||||

| Pro Forma Net Debt | $ | 2,063,914 | $ | 1,951,282 | $ | 1,887,256 | |||||||||||

| Leverage Ratios: | |||||||||||||||||

| Net Debt to Annualized EBITDAre | 5.5x | 5.3x | 5.1x | ||||||||||||||

| Net Debt to Annualized Adjusted EBITDAre | 5.3x | 5.1x | 5.1x | ||||||||||||||

| Pro Forma Net Debt to Annualized Adjusted EBITDAre | 5.2x | 5.0x | 4.9x | ||||||||||||||

| Section | Page |

|

|||||||||

32-33 |

|||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

2 |

|||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

3 |

|||||||

| Executive Team | Board of Directors | |||||||

|

John D. Moragne

Chief Executive Officer and Member, Board of Directors

Ryan M. Albano

President and Chief Operating Officer

Kevin M. Fennell

Executive Vice President, Chief Financial Officer and Treasurer

John D. Callan, Jr.

Senior Vice President, General Counsel, and Secretary

Michael B. Caruso

Senior Vice President, Underwriting & Strategy

Will D. Garner

Senior Vice President, Acquisitions

Jennie L. O’Brien

Senior Vice President and Chief Accounting Officer

Molly Kelly Wiegel

Senior Vice President, Human Resources & Administration

|

Laurie A. Hawkes

Chairman of the Board

John D. Moragne

Chief Executive Officer

Michael A. Coke

Jessica Duran

Laura Felice

Richard Imperiale

David M. Jacobstein

Joseph Saffire

James H. Watters

|

|||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

4 |

|||||||

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

||||||||||||||||||||||||||||

| Financial Summary | ||||||||||||||||||||||||||||||||

| Investment in rental property | $ | 5,058,791 | $ | 5,032,276 | $ | 4,994,057 | $ | 5,018,626 | $ | 4,840,961 | ||||||||||||||||||||||

| Less accumulated depreciation | (721,195) | (694,990) | (672,478) | (644,214) | (627,871) | |||||||||||||||||||||||||||

| Property under development | 116,635 | 35,492 | 18,784 | — | 165,014 | |||||||||||||||||||||||||||

| Investment in rental property, net | 4,454,231 | 4,372,778 | 4,340,363 | 4,374,412 | 4,378,104 | |||||||||||||||||||||||||||

| Cash and cash equivalents | 20,784 | 9,605 | 14,845 | 8,999 | 18,282 | |||||||||||||||||||||||||||

| Restricted cash | 1,192 | 1,428 | 1,148 | 2,219 | 1,614 | |||||||||||||||||||||||||||

| Total assets | 5,326,679 | 5,237,186 | 5,216,417 | 5,263,286 | 5,264,557 | |||||||||||||||||||||||||||

| Unsecured revolving credit facility | 197,880 | 174,122 | 93,014 | 125,482 | 79,096 | |||||||||||||||||||||||||||

| Mortgages, net | 75,685 | 76,260 | 76,846 | 77,416 | 77,970 | |||||||||||||||||||||||||||

| Unsecured term loans, net | 994,028 | 893,505 | 897,201 | 896,887 | 896,574 | |||||||||||||||||||||||||||

| Senior unsecured notes, net | 846,441 | 846,252 | 846,064 | 845,875 | 845,687 | |||||||||||||||||||||||||||

| Total liabilities | 2,290,858 | 2,156,372 | 2,074,993 | 2,124,927 | 2,067,147 | |||||||||||||||||||||||||||

| Total Broadstone Net Lease, Inc. equity | 2,906,693 | 2,949,734 | 3,003,745 | 2,999,074 | 3,054,802 | |||||||||||||||||||||||||||

| Total equity (book value) | 3,035,821 | 3,080,814 | 3,141,424 | 3,138,359 | 3,197,410 | |||||||||||||||||||||||||||

| Revenues | 112,986 | 108,690 | 112,130 | 108,397 | 105,907 | |||||||||||||||||||||||||||

| General and administrative - other | 7,100 | 7,525 | 7,951 | 6,893 | 7,831 | |||||||||||||||||||||||||||

| Stock based compensation | 2,471 | 2,147 | 1,977 | 1,829 | 2,073 | |||||||||||||||||||||||||||

| General and administrative | 9,571 | 9,672 | 9,928 | 8,722 | 9,904 | |||||||||||||||||||||||||||

| Total operating expenses | 69,088 | 70,785 | 77,369 | 54,811 | 56,463 | |||||||||||||||||||||||||||

| Interest expense | 21,112 | 20,074 | 19,564 | 18,178 | 17,757 | |||||||||||||||||||||||||||

| Net income | 19,830 | 17,493 | 27,607 | 37,268 | 35,937 | |||||||||||||||||||||||||||

| Net earnings per common share, diluted | $ | 0.10 | $ | 0.09 | $ | 0.14 | $ | 0.19 | $ | 0.19 | ||||||||||||||||||||||

| FFO | 73,695 | 72,627 | 80,003 | 73,818 | 73,725 | |||||||||||||||||||||||||||

| FFO per share, diluted | $ | 0.37 | $ | 0.37 | $ | 0.41 | $ | 0.37 | $ | 0.37 | ||||||||||||||||||||||

| Core FFO | 77,150 | 75,280 | 74,427 | 73,971 | 73,001 | |||||||||||||||||||||||||||

| Core FFO per share, diluted | $ | 0.39 | $ | 0.38 | $ | 0.38 | $ | 0.37 | $ | 0.37 | ||||||||||||||||||||||

| AFFO | 74,308 | 71,812 | 70,532 | 70,185 | 70,401 | |||||||||||||||||||||||||||

| AFFO per share, diluted | $ | 0.38 | $ | 0.36 | $ | 0.36 | $ | 0.35 | $ | 0.36 | ||||||||||||||||||||||

| Net cash provided by operating activities | 79,280 | 71,459 | 63,911 | 67,303 | 74,172 | |||||||||||||||||||||||||||

| Capital expenditures and improvements | 614 | 1,106 | 2,205 | 1,180 | 134 | |||||||||||||||||||||||||||

| Capital expenditures and improvements - revenue generating | 1,994 | 13,242 | 3,755 | 6,351 | 38 | |||||||||||||||||||||||||||

| Net cash (used in) provided by investing activities | (131,258) | (85,335) | 27,338 | (65,618) | (225,708) | |||||||||||||||||||||||||||

| Net cash provided by (used in) financing activities | 62,921 | 8,916 | (86,474) | (10,363) | (51,346) | |||||||||||||||||||||||||||

| Distributions declared | 57,284 | 58,874 | 57,209 | 56,354 | 57,710 | |||||||||||||||||||||||||||

| Distributions declared per diluted share | $ | 0.290 | $ | 0.290 | $ | 0.290 | $ | 0.290 | $ | 0.290 | ||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

5 |

|||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Accounted for using the operating method: | |||||||||||||||||||||||||||||

| Land | $ | 784,092 | $ | 780,817 | $ | 778,826 | $ | 784,545 | $ | 773,224 | |||||||||||||||||||

| Land improvements | 360,774 | 360,197 | 357,142 | 357,090 | 324,138 | ||||||||||||||||||||||||

| Buildings and improvements | 3,871,441 | 3,848,623 | 3,815,521 | 3,834,310 | 3,708,366 | ||||||||||||||||||||||||

| Equipment | 16,070 | 16,070 | 15,843 | 15,824 | 8,248 | ||||||||||||||||||||||||

| Total accounted for using the operating method | 5,032,377 | 5,005,707 | 4,967,332 | 4,991,769 | 4,813,976 | ||||||||||||||||||||||||

| Less accumulated depreciation | (721,195) | (694,990) | (672,478) | (644,214) | (627,871) | ||||||||||||||||||||||||

| Accounted for using the operating method, net | 4,311,182 | 4,310,717 | 4,294,854 | 4,347,555 | 4,186,105 | ||||||||||||||||||||||||

| Accounted for using the direct financing method | 25,845 | 25,999 | 26,154 | 26,285 | 26,413 | ||||||||||||||||||||||||

| Accounted for using the sales-type method | 569 | 570 | 571 | 572 | 572 | ||||||||||||||||||||||||

| Property under development | 116,635 | 35,492 | 18,784 | — | 165,014 | ||||||||||||||||||||||||

| Investment in rental property, net | 4,454,231 | 4,372,778 | 4,340,363 | 4,374,412 | 4,378,104 | ||||||||||||||||||||||||

| Investment in rental property and intangible lease assets held for sale, net | — | — | — | 38,779 | — | ||||||||||||||||||||||||

| Cash and cash equivalents | 20,784 | 9,605 | 14,845 | 8,999 | 18,282 | ||||||||||||||||||||||||

| Accrued rental income | 172,310 | 166,436 | 162,717 | 158,350 | 153,551 | ||||||||||||||||||||||||

| Tenant and other receivables, net | 3,605 | 2,581 | 3,281 | 2,124 | 2,604 | ||||||||||||||||||||||||

| Prepaid expenses and other assets | 55,815 | 52,260 | 41,584 | 36,230 | 33,255 | ||||||||||||||||||||||||

| Interest rate swap, assets | 23,490 | 29,681 | 46,220 | 27,812 | 56,444 | ||||||||||||||||||||||||

| Goodwill | 339,769 | 339,769 | 339,769 | 339,769 | 339,769 | ||||||||||||||||||||||||

| Intangible lease assets, net | 256,675 | 264,076 | 267,638 | 276,811 | 282,548 | ||||||||||||||||||||||||

| Total assets | $ | 5,326,679 | $ | 5,237,186 | $ | 5,216,417 | $ | 5,263,286 | $ | 5,264,557 | |||||||||||||||||||

| Liabilities and equity | |||||||||||||||||||||||||||||

| Unsecured revolving credit facility | $ | 197,880 | $ | 174,122 | $ | 93,014 | $ | 125,482 | $ | 79,096 | |||||||||||||||||||

| Mortgages, net | 75,685 | 76,260 | 76,846 | 77,416 | 77,970 | ||||||||||||||||||||||||

| Unsecured term loans, net | 994,028 | 893,505 | 897,201 | 896,887 | 896,574 | ||||||||||||||||||||||||

| Senior unsecured notes, net | 846,441 | 846,252 | 846,064 | 845,875 | 845,687 | ||||||||||||||||||||||||

| Interest rate swap, liabilities | 7,625 | 3,353 | — | 13,050 | — | ||||||||||||||||||||||||

| Accounts payable and other liabilities | 57,409 | 48,424 | 48,983 | 47,651 | 42,635 | ||||||||||||||||||||||||

| Dividends payable | 58,451 | 58,220 | 58,317 | 58,163 | 58,028 | ||||||||||||||||||||||||

| Accrued interest payable | 8,542 | 9,399 | 5,837 | 9,642 | 14,033 | ||||||||||||||||||||||||

| Intangible lease liabilities, net | 44,797 | 46,837 | 48,731 | 50,761 | 53,124 | ||||||||||||||||||||||||

| Total liabilities | 2,290,858 | 2,156,372 | 2,074,993 | 2,124,927 | 2,067,147 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Broadstone Net Lease, Inc. equity: | |||||||||||||||||||||||||||||

| Preferred stock, $0.001 par value | — | — | — | — | — | ||||||||||||||||||||||||

| Common stock, $0.00025 par value | 47 | 47 | 47 | 47 | 47 | ||||||||||||||||||||||||

| Additional paid-in capital | 3,459,939 | 3,456,041 | 3,450,584 | 3,450,116 | 3,444,265 | ||||||||||||||||||||||||

| Cumulative distributions in excess of retained earnings | (571,302) | (536,074) | (496,543) | (467,922) | (449,893) | ||||||||||||||||||||||||

| Accumulated other comprehensive income | 18,009 | 29,720 | 49,657 | 16,833 | 60,383 | ||||||||||||||||||||||||

| Total Broadstone Net Lease, Inc. equity | 2,906,693 | 2,949,734 | 3,003,745 | 2,999,074 | 3,054,802 | ||||||||||||||||||||||||

| Non-controlling interests | 129,128 | 131,080 | 137,679 | 139,285 | 142,608 | ||||||||||||||||||||||||

| Total equity | 3,035,821 | 3,080,814 | 3,141,424 | 3,138,359 | 3,197,410 | ||||||||||||||||||||||||

| Total liabilities and equity | $ | 5,326,679 | $ | 5,237,186 | $ | 5,216,417 | $ | 5,263,286 | $ | 5,264,557 | |||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

6 |

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Lease revenues, net | $ | 112,986 | $ | 108,690 | $ | 112,130 | $ | 108,397 | $ | 105,907 | |||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||

| Depreciation and amortization | 42,575 | 39,497 | 42,987 | 38,016 | 37,404 | ||||||||||||||||||||||||

| Property and operating expense | 5,003 | 5,488 | 6,764 | 7,014 | 5,303 | ||||||||||||||||||||||||

| General and administrative | 9,571 | 9,672 | 9,928 | 8,722 | 9,904 | ||||||||||||||||||||||||

| Provision for impairment of investment in rental properties | 11,939 | 16,128 | 17,690 | 1,059 | 3,852 | ||||||||||||||||||||||||

| Total operating expenses | 69,088 | 70,785 | 77,369 | 54,811 | 56,463 | ||||||||||||||||||||||||

| Other income (expenses) | |||||||||||||||||||||||||||||

| Interest income | 122 | 99 | 42 | 70 | 649 | ||||||||||||||||||||||||

| Interest expense | (21,112) | (20,074) | (19,564) | (18,178) | (17,757) | ||||||||||||||||||||||||

| Gain on sale of real estate | 566 | 405 | 8,196 | 2,441 | 3,384 | ||||||||||||||||||||||||

| Income taxes | (199) | (355) | (527) | 291 | (531) | ||||||||||||||||||||||||

| Other (expenses) income | (3,445) | (487) | 4,699 | (942) | 748 | ||||||||||||||||||||||||

| Net income | 19,830 | 17,493 | 27,607 | 37,268 | 35,937 | ||||||||||||||||||||||||

| Net loss (income) attributable to non-controlling interests | 330 | (750) | (1,217) | (1,660) | (608) | ||||||||||||||||||||||||

| Net income attributable to Broadstone Net Lease, Inc. | $ | 20,160 | $ | 16,743 | $ | 26,390 | $ | 35,608 | $ | 35,329 | |||||||||||||||||||

| Weighted average number of common shares outstanding | |||||||||||||||||||||||||||||

Basic (a) |

188,041 | 187,865 | 187,592 | 187,496 | 187,436 | ||||||||||||||||||||||||

Diluted (a) |

197,138 | 196,898 | 196,697 | 196,932 | 196,470 | ||||||||||||||||||||||||

Net earnings per common share (b) |

|||||||||||||||||||||||||||||

| Basic | $ | 0.11 | $ | 0.09 | $ | 0.14 | $ | 0.19 | $ | 0.19 | |||||||||||||||||||

| Diluted | $ | 0.10 | $ | 0.09 | $ | 0.14 | $ | 0.19 | $ | 0.19 | |||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

7 |

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Net income | $ | 19,830 | $ | 17,493 | $ | 27,607 | $ | 37,268 | $ | 35,937 | |||||||||||||||||||

| Real property depreciation and amortization | 42,492 | 39,411 | 42,902 | 37,932 | 37,320 | ||||||||||||||||||||||||

| Gain on sale of real estate | (566) | (405) | (8,196) | (2,441) | (3,384) | ||||||||||||||||||||||||

| Provision for impairment of investment in rental properties | 11,939 | 16,128 | 17,690 | 1,059 | 3,852 | ||||||||||||||||||||||||

| FFO | $ | 73,695 | $ | 72,627 | $ | 80,003 | $ | 73,818 | $ | 73,725 | |||||||||||||||||||

| Net write-offs of accrued rental income | 3 | 2,228 | 120 | — | — | ||||||||||||||||||||||||

| Other non-core income from real estate transactions | (46) | (63) | (1,183) | (887) | — | ||||||||||||||||||||||||

| Cost of debt extinguishment | — | 165 | — | — | — | ||||||||||||||||||||||||

| Severance and employee transition costs | 53 | 1 | 187 | 98 | 24 | ||||||||||||||||||||||||

Other (income) expenses (a) |

3,445 | 322 | (4,700) | 942 | (748) | ||||||||||||||||||||||||

| Core FFO | $ | 77,150 | $ | 75,280 | $ | 74,427 | $ | 73,971 | $ | 73,001 | |||||||||||||||||||

| Straight-line rent adjustment | (5,586) | (5,907) | (6,312) | (5,309) | (5,051) | ||||||||||||||||||||||||

| Adjustment to provision for credit losses | (13) | — | — | — | (17) | ||||||||||||||||||||||||

| Amortization of debt issuance costs | 1,328 | 1,237 | 983 | 983 | 983 | ||||||||||||||||||||||||

| Non-capitalized transaction costs | 142 | 117 | 299 | 25 | 445 | ||||||||||||||||||||||||

| Realized gain or loss on interest rate swaps and other non-cash interest expense | 7 | 2 | (6) | (5) | 62 | ||||||||||||||||||||||||

| Amortization of lease intangibles | (1,191) | (1,064) | (991) | (1,309) | (1,095) | ||||||||||||||||||||||||

| Stock-based compensation | 2,471 | 2,147 | 1,977 | 1,829 | 2,073 | ||||||||||||||||||||||||

| Deferred taxes | — | — | 155 | — | — | ||||||||||||||||||||||||

| AFFO | $ | 74,308 | $ | 71,812 | $ | 70,532 | $ | 70,185 | $ | 70,401 | |||||||||||||||||||

Diluted weighted average shares outstanding (b) |

197,138 | 196,898 | 196,697 | 196,932 | 196,470 | ||||||||||||||||||||||||

Net earnings per diluted share (c) |

$ | 0.10 | $ | 0.09 | $ | 0.14 | $ | 0.19 | $ | 0.19 | |||||||||||||||||||

FFO per diluted share (c) |

0.37 | 0.37 | 0.41 | 0.37 | 0.37 | ||||||||||||||||||||||||

Core FFO per diluted share (c) |

0.39 | 0.38 | 0.38 | 0.37 | 0.37 | ||||||||||||||||||||||||

AFFO per diluted share (c) |

0.38 | 0.36 | 0.36 | 0.35 | 0.36 | ||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

8 |

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Contractual rental amounts billed for operating leases | $ | 101,014 | $ | 99,314 | $ | 98,193 | $ | 96,596 | $ | 95,736 | |||||||||||||||||||

Adjustment to recognize contractual operating lease billings on a straight-line basis |

5,753 | 6,064 | 6,444 | 5,438 | 5,177 | ||||||||||||||||||||||||

| Net write-offs of accrued rental income | — | (2,228) | — | — | — | ||||||||||||||||||||||||

| Variable rental amounts earned | 718 | 680 | 1,098 | 644 | 659 | ||||||||||||||||||||||||

| Earned income from direct financing leases | 679 | 682 | 686 | 691 | 689 | ||||||||||||||||||||||||

| Interest income from sales-type leases | 14 | 14 | 15 | 14 | 15 | ||||||||||||||||||||||||

| Operating expenses billed to tenants | 4,795 | 4,944 | 5,400 | 5,537 | 4,651 | ||||||||||||||||||||||||

| Other income from real estate transactions | 63 | 77 | 1,054 | 907 | 12 | ||||||||||||||||||||||||

Adjustment to revenue recognized for uncollectible rental amounts billed, net |

(50) | (857) | (760) | (1,430) | (1,032) | ||||||||||||||||||||||||

| Total lease revenues, net | $ | 112,986 | $ | 108,690 | $ | 112,130 | $ | 108,397 | $ | 105,907 | |||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

9 |

|||||||

| EQUITY | |||||

| Shares of Common Stock | 189,130 | ||||

| OP Units | 8,402 | ||||

| Common Stock & OP Units | 197,532 | ||||

Price Per Share / Unit at June 30, 2025 |

$ | 16.05 | |||

| IMPLIED EQUITY MARKET CAPITALIZATION | $ | 3,170,389 | |||

| % of Total Capitalization | 59.9 | % | |||

| DEBT | |||||

| Unsecured Revolving Credit Facility - 2026 | $ | 197,880 | |||

| Unsecured Term Loans | 1,000,000 | ||||

| Unsecured Term Loan - 2027 | 200,000 | ||||

| Unsecured Term Loan - 2028 | 500,000 | ||||

| Unsecured Term Loan - 2029 | 300,000 | ||||

| Senior Unsecured Notes | 850,000 | ||||

| Senior Unsecured Notes - 2027 | 150,000 | ||||

| Senior Unsecured Notes - 2028 | 225,000 | ||||

| Senior Unsecured Notes - 2030 | 100,000 | ||||

| Senior Unsecured Public Notes - 2031 | 375,000 | ||||

| Mortgage Debt - Various | 75,732 | ||||

| TOTAL DEBT | $ | 2,123,612 | |||

| % of Total Capitalization | 40.1 | % | |||

| Floating Rate Debt % | 2.3 | % | |||

| Fixed Rate Debt % | 97.7 | % | |||

| Secured Debt % | 3.6 | % | |||

| Unsecured Debt % | 96.4 | % | |||

| Total Capitalization | $ | 5,294,001 | |||

| Less: Cash and Cash Equivalents | (20,784) | ||||

| Enterprise Value | $ | 5,273,217 | |||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

10 |

|||||||

| Shares of Common Stock | OP Units | Total Diluted Shares | |||||||||||||||

Balance, January 1, 2025 |

188,626 | 8,646 | 197,272 | ||||||||||||||

| Grants of restricted stock awards - employees | 292 | — | 292 | ||||||||||||||

| Retirement of common shares under equity incentive plan | (86) | — | (86) | ||||||||||||||

| Forfeiture of restricted stock awards | (3) | — | (3) | ||||||||||||||

| OP unit conversion | 244 | (244) | — | ||||||||||||||

Balance, March 31, 2025 |

189,073 | 8,402 | 197,475 | ||||||||||||||

| Grants of restricted stock awards - employees | 61 | — | 61 | ||||||||||||||

| Forfeiture of restricted stock awards | (4) | — | (4) | ||||||||||||||

Balance, June 30, 2025 |

189,130 | 8,402 | 197,532 | ||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

11 |

|||||||

| June 30, 2025 |

December 31, 2024 |

Interest Rate | Maturity Date | ||||||||||||||||||||

| Unsecured revolving credit facility | $ | 197,880 | $ | 93,014 | applicable reference rate + 0.85% (a) |

Mar. 2029 (d) |

|||||||||||||||||

| Unsecured term loans: | |||||||||||||||||||||||

| 2026 Unsecured Term Loan | — | 400,000 | one-month adjusted SOFR + 1.00% (b) |

Feb. 2026 (e) |

|||||||||||||||||||

| 2027 Unsecured Term Loan | 200,000 | 200,000 | daily simple adjusted SOFR + 0.95% (c) |

Aug. 2027 | |||||||||||||||||||

| 2028 Unsecured Term Loan | 500,000 | — | one-month adjusted SOFR + 0.95% (b) |

Mar. 2028 (f) |

|||||||||||||||||||

| 2029 Unsecured Term Loan | 300,000 | 300,000 | daily simple adjusted SOFR + 1.25% (c) |

Aug. 2029 | |||||||||||||||||||

| Total unsecured term loans | 1,000,000 | 900,000 | |||||||||||||||||||||

| Unamortized debt issuance costs, net | (5,972) | (2,799) | |||||||||||||||||||||

| Total unsecured term loans, net | 994,028 | 897,201 | |||||||||||||||||||||

| Senior unsecured notes: | |||||||||||||||||||||||

| 2027 Senior Unsecured Notes - Series A | 150,000 | 150,000 | 4.84% | Apr. 2027 | |||||||||||||||||||

| 2028 Senior Unsecured Notes - Series B | 225,000 | 225,000 | 5.09% | Jul. 2028 | |||||||||||||||||||

| 2030 Senior Unsecured Notes - Series C | 100,000 | 100,000 | 5.19% | Jul. 2030 | |||||||||||||||||||

| 2031 Senior Unsecured Public Notes | 375,000 | 375,000 | 2.60% | Sep. 2031 | |||||||||||||||||||

| Total senior unsecured notes | 850,000 | 850,000 | |||||||||||||||||||||

| Unamortized debt issuance costs and original issuance discount, net | (3,559) | (3,936) | |||||||||||||||||||||

| Total senior unsecured notes, net | 846,441 | 846,064 | |||||||||||||||||||||

| Total unsecured debt, net | $ | 2,038,349 | $ | 1,836,279 | |||||||||||||||||||

| Lender | Origination Date |

Maturity Date |

Interest Rate |

June 30, 2025 |

December 31, 2024 |

|||||||||||||||||||||||||||

| Wilmington Trust National Association | Apr. 2019 | Feb. 2028 | 4.92% | $ | 42,121 | $ | 42,838 | |||||||||||||||||||||||||

| Wilmington Trust National Association | Jun. 2018 | Aug. 2025 | 4.36% | 18,052 | 18,283 | |||||||||||||||||||||||||||

| PNC Bank | Oct. 2016 | Nov. 2026 | 3.62% | 15,559 | 15,792 | |||||||||||||||||||||||||||

| Total mortgages | 75,732 | 76,912 | ||||||||||||||||||||||||||||||

| Debt issuance costs, net | (47) | (66) | ||||||||||||||||||||||||||||||

| Mortgages, net | $ | 75,685 | $ | 76,846 | ||||||||||||||||||||||||||||

| Year of Maturity | Revolving Credit Facility |

Mortgages | Term Loans | Senior Notes | Total | ||||||||||||||||||||||||

| 2025 | $ | — | $ | 19,015 | $ | — | $ | — | $ | 19,015 | |||||||||||||||||||

| 2026 | — | 16,843 | — | — | 16,843 | ||||||||||||||||||||||||

| 2027 | — | 1,596 | 200,000 | 150,000 | 351,596 | ||||||||||||||||||||||||

| 2028 | — | 38,278 | 500,000 | 225,000 | 763,278 | ||||||||||||||||||||||||

| 2029 | 197,880 | — | 300,000 | — | 497,880 | ||||||||||||||||||||||||

| Thereafter | — | — | — | 475,000 | 475,000 | ||||||||||||||||||||||||

| Total | $ | 197,880 | $ | 75,732 | $ | 1,000,000 | $ | 850,000 | $ | 2,123,612 | |||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

12 |

|||||||

| June 30, 2025 | ||||||||||||||||||||||||||||||||

| Counterparty | Maturity Date (a) |

Fixed

Rate (b)

|

Variable Rate Index | Notional Amount |

Fair Value |

|||||||||||||||||||||||||||

Effective Swaps: (c) |

||||||||||||||||||||||||||||||||

| Bank of Montreal | July 2025 | 2.32 | % | daily compounded SOFR | $ | 25,000 | $ | — | ||||||||||||||||||||||||

| Truist Financial Corporation | July 2025 | 1.99 | % | daily compounded SOFR | 25,000 | — | ||||||||||||||||||||||||||

| Truist Financial Corporation | December 2025 | 2.30 | % | daily compounded SOFR | 25,000 | 242 | ||||||||||||||||||||||||||

| Bank of Montreal | January 2026 | 1.92 | % | daily compounded SOFR | 25,000 | 293 | ||||||||||||||||||||||||||

| Bank of Montreal | January 2026 | 2.05 | % | daily compounded SOFR | 40,000 | 443 | ||||||||||||||||||||||||||

| Capital One, National Association | January 2026 | 2.08 | % | daily compounded SOFR | 35,000 | 383 | ||||||||||||||||||||||||||

| Truist Financial Corporation | January 2026 | 1.93 | % | daily compounded SOFR | 25,000 | 292 | ||||||||||||||||||||||||||

| Capital One, National Association | April 2026 | 2.68 | % | daily compounded SOFR | 15,000 | 159 | ||||||||||||||||||||||||||

| Capital One, National Association | July 2026 | 1.32 | % | daily compounded SOFR | 35,000 | 905 | ||||||||||||||||||||||||||

| Bank of Montreal | December 2026 | 2.33 | % | daily compounded SOFR | 10,000 | 200 | ||||||||||||||||||||||||||

| Bank of Montreal | December 2026 | 1.99 | % | daily compounded SOFR | 25,000 | 625 | ||||||||||||||||||||||||||

| Toronto-Dominion Bank | March 2027 | 2.46 | % | daily compounded CORRA | 14,616 | (d) |

71 | |||||||||||||||||||||||||

| Wells Fargo Bank, N.A. | April 2027 | 2.72 | % | daily compounded SOFR | 25,000 | 382 | ||||||||||||||||||||||||||

| Bank of Montreal | December 2027 | 2.37 | % | daily compounded SOFR | 25,000 | 679 | ||||||||||||||||||||||||||

| Capital One, National Association | December 2027 | 2.37 | % | daily compounded SOFR | 25,000 | 677 | ||||||||||||||||||||||||||

| Wells Fargo Bank, N.A. | January 2028 | 2.37 | % | daily compounded SOFR | 75,000 | 2,035 | ||||||||||||||||||||||||||

| Bank of Montreal | May 2029 | 2.09 | % | daily compounded SOFR | 25,000 | 1,262 | ||||||||||||||||||||||||||

| Regions Bank | May 2029 | 2.11 | % | daily compounded SOFR | 25,000 | 1,241 | ||||||||||||||||||||||||||

| Regions Bank | June 2029 | 2.03 | % | daily compounded SOFR | 25,000 | 1,318 | ||||||||||||||||||||||||||

| U.S. Bank National Association | June 2029 | 2.03 | % | daily compounded SOFR | 25,000 | 1,318 | ||||||||||||||||||||||||||

| Regions Bank | August 2029 | 2.58 | % | one-month SOFR | 100,000 | 2,908 | ||||||||||||||||||||||||||

| Toronto-Dominion Bank | August 2029 | 2.58 | % | one-month SOFR | 45,000 | 1,332 | ||||||||||||||||||||||||||

| U.S. Bank National Association | August 2029 | 2.65 | % | one-month SOFR | 15,000 | 403 | ||||||||||||||||||||||||||

| U.S. Bank National Association | August 2029 | 2.58 | % | one-month SOFR | 100,000 | 2,920 | ||||||||||||||||||||||||||

| U.S. Bank National Association | August 2029 | 1.35 | % | daily compounded SOFR | 25,000 | 2,044 | ||||||||||||||||||||||||||

| Bank of Montreal | March 2030 | 3.80 | % | daily simple SOFR | 80,000 | (1,507) | ||||||||||||||||||||||||||

| JPMorgan Chase Bank, N.A. | March 2030 | 3.79 | % | daily simple SOFR | 50,000 | (907) | ||||||||||||||||||||||||||

| U.S. Bank National Association | June 2030 | 3.73 | % | daily simple SOFR | 70,000 | (1,118) | ||||||||||||||||||||||||||

| Truist Financial Corporation | June 2030 | 3.73 | % | daily simple SOFR | 55,000 | (889) | ||||||||||||||||||||||||||

| Regions Bank | March 2032 | 2.69 | % | daily compounded CORRA | 14,616 | (d) |

288 | |||||||||||||||||||||||||

| U.S. Bank National Association | March 2032 | 2.70 | % | daily compounded CORRA | 14,616 | (d) |

285 | |||||||||||||||||||||||||

| Bank of Montreal | March 2034 | 2.81 | % | daily compounded CORRA | 29,232 | (e) |

785 | |||||||||||||||||||||||||

| 1,148,080 | 19,069 | |||||||||||||||||||||||||||||||

Forward Starting Swaps: (c) (f) |

||||||||||||||||||||||||||||||||

| Manufacturers & Traders Trust Company | September 2030 | 3.71 | % | daily simple SOFR | 50,000 | (806) | ||||||||||||||||||||||||||

| Regions Bank | September 2030 | 3.69 | % | daily simple SOFR | 15,000 | (236) | ||||||||||||||||||||||||||

| Truist Financial Corporation | September 2030 | 3.70 | % | daily simple SOFR | 15,000 | (236) | ||||||||||||||||||||||||||

| Toronto-Dominion Bank | December 2030 | 3.66 | % | daily simple SOFR | 70,000 | (1,071) | ||||||||||||||||||||||||||

| Regions Bank | December 2030 | 3.66 | % | daily simple SOFR | 55,000 | (855) | ||||||||||||||||||||||||||

| 205,000 | (3,204) | |||||||||||||||||||||||||||||||

| Total Swaps | $ | 1,353,080 | $ | 15,865 | ||||||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

13 |

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Net income | $ | 19,830 | $ | 17,493 | $ | 27,607 | $ | 37,268 | $ | 35,937 | |||||||||||||||||||

| Depreciation and amortization | 42,575 | 39,497 | 42,987 | 38,016 | 37,404 | ||||||||||||||||||||||||

| Interest expense | 21,112 | 20,074 | 19,565 | 18,178 | 17,757 | ||||||||||||||||||||||||

| Income taxes | 199 | 355 | 527 | 291 | 531 | ||||||||||||||||||||||||

| EBITDA | $ | 83,716 | $ | 77,419 | $ | 90,686 | $ | 93,753 | $ | 91,629 | |||||||||||||||||||

| Provision for impairment of investment in rental properties | 11,939 | 16,128 | 17,690 | 1,059 | 3,852 | ||||||||||||||||||||||||

| Gain on sale of real estate | (566) | (405) | (8,197) | (2,441) | (3,384) | ||||||||||||||||||||||||

| EBITDAre | $ | 95,089 | $ | 93,142 | $ | 100,179 | $ | 92,371 | $ | 92,097 | |||||||||||||||||||

Adjustment for current quarter investment activity (a) |

573 | 978 | 28 | 4,080 | 1,241 | ||||||||||||||||||||||||

Adjustment for current quarter disposition activity (b) |

(490) | (135) | (11) | (66) | (87) | ||||||||||||||||||||||||

Adjustment to exclude non-recurring and other expenses (c) |

(332) | 44 | 348 | (201) | 26 | ||||||||||||||||||||||||

| Adjustment to exclude net write-offs of accrued rental income | 3 | 2,228 | 120 | — | — | ||||||||||||||||||||||||

| Adjustment to exclude realized / unrealized foreign exchange (gain) loss | 3,445 | 322 | (4,699) | 942 | (748) | ||||||||||||||||||||||||

| Adjustment to exclude cost of debt extinguishment | — | 166 | — | — | — | ||||||||||||||||||||||||

| Adjustment to exclude other income from real estate transactions | (46) | (63) | (1,183) | (887) | — | ||||||||||||||||||||||||

| Adjusted EBITDAre | $ | 98,242 | $ | 96,682 | $ | 94,782 | $ | 96,239 | $ | 92,529 | |||||||||||||||||||

Estimated revenues from developments (d) |

1,629 | 631 | 334 | — | 3,458 | ||||||||||||||||||||||||

| Pro Forma Adjusted EBITDAre | $ | 99,871 | $ | 97,313 | $ | 95,116 | $ | 96,239 | $ | 95,987 | |||||||||||||||||||

| Annualized EBITDAre | $ | 380,356 | $ | 372,568 | $ | 400,716 | $ | 369,484 | $ | 368,388 | |||||||||||||||||||

| Annualized Adjusted EBITDAre | 392,968 | 386,728 | 379,128 | 384,956 | 370,116 | ||||||||||||||||||||||||

| Pro Forma Annualized Adjusted EBITDAre | 399,484 | 389,252 | 380,464 | 384,956 | 383,948 | ||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Adjusted EBITDAre | $ | 98,242 | $ | 96,682 | $ | 94,782 | $ | 96,239 | $ | 92,529 | |||||||||||||||||||

| General and administrative (excluding certain expenses reflected above) | 9,524 | 9,628 | 9,581 | 8,924 | 9,878 | ||||||||||||||||||||||||

| Adjusted Net Operating Income ("NOI") | $ | 107,766 | $ | 106,310 | $ | 104,363 | $ | 105,163 | $ | 102,407 | |||||||||||||||||||

| Straight-line rental revenue, net | (5,693) | (6,084) | (6,317) | (6,128) | (5,191) | ||||||||||||||||||||||||

| Other amortization and non-cash charges | (1,569) | (1,007) | (796) | (1,309) | (1,095) | ||||||||||||||||||||||||

| Adjusted Cash NOI | $ | 100,504 | $ | 99,219 | $ | 97,250 | $ | 97,726 | $ | 96,121 | |||||||||||||||||||

| Annualized Adjusted NOI | $ | 431,064 | $ | 425,240 | $ | 417,452 | $ | 420,652 | $ | 409,628 | |||||||||||||||||||

| Annualized Adjusted Cash NOI | 402,016 | 396,876 | 389,000 | 390,904 | 384,484 | ||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

14 |

|||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||||||||||||||

| Debt | |||||||||||||||||||||||||||||

| Unsecured revolving credit facility | $ | 197,880 | $ | 174,122 | $ | 93,014 | $ | 125,482 | $ | 79,096 | |||||||||||||||||||

| Unsecured term loans, net | 994,028 | 893,505 | 897,201 | 896,887 | 896,574 | ||||||||||||||||||||||||

| Senior unsecured notes, net | 846,441 | 846,252 | 846,064 | 845,875 | 845,687 | ||||||||||||||||||||||||

| Mortgages, net | 75,685 | 76,260 | 76,846 | 77,416 | 77,970 | ||||||||||||||||||||||||

| Debt issuance costs | 9,578 | 10,300 | 6,802 | 7,314 | 7,825 | ||||||||||||||||||||||||

| Gross Debt | 2,123,612 | 2,000,439 | 1,919,927 | 1,952,974 | 1,907,152 | ||||||||||||||||||||||||

| Cash and cash equivalents | (20,784) | (9,605) | (14,845) | (8,999) | (18,282) | ||||||||||||||||||||||||

| Restricted cash | (1,192) | (1,428) | (1,148) | (2,219) | (1,614) | ||||||||||||||||||||||||

| Net Debt | $ | 2,101,636 | $ | 1,989,406 | $ | 1,903,934 | $ | 1,941,756 | $ | 1,887,256 | |||||||||||||||||||

Estimated net proceeds from forward equity agreements (a) |

(37,722) | (38,124) | (38,514) | (38,983) | — | ||||||||||||||||||||||||

| Pro Forma Net Debt | $ | 2,063,914 | $ | 1,951,282 | $ | 1,865,420 | $ | 1,902,773 | $ | 1,887,256 | |||||||||||||||||||

| Leverage Ratios: | |||||||||||||||||||||||||||||

| Net Debt to Annualized EBITDAre | 5.5x | 5.3x | 4.8x | 5.3x | 5.1x | ||||||||||||||||||||||||

| Net Debt to Annualized Adjusted EBITDAre | 5.3x | 5.1x | 5.0x | 5.0x | 5.1x | ||||||||||||||||||||||||

| Pro Forma Net Debt to Annualized Adjusted EBITDAre | 5.2x | 5.0x | 4.9x | 4.9x | 4.9x | ||||||||||||||||||||||||

| Covenants | Required | Revolving Credit Facility and Unsecured Term Loans | Senior Unsecured Notes Series A, B, & C |

2031 Senior Unsecured Public Notes | ||||||||||||||||||||||

| Leverage ratio | ≤ 0.60 to 1.00 | 0.34 | 0.35 | Not Applicable | ||||||||||||||||||||||

| Secured indebtedness ratio | ≤ 0.40 to 1.00 | 0.01 | 0.01 | Not Applicable | ||||||||||||||||||||||

| Unencumbered coverage ratio | ≥ 1.75 to 1.00 | 3.43 | Not Applicable | Not Applicable | ||||||||||||||||||||||

| Fixed charge coverage ratio | ≥ 1.50 to 1.00 | 4.23 | 4.23 | Not Applicable | ||||||||||||||||||||||

| Total unsecured indebtedness to total unencumbered eligible property value | ≤ 0.60 to 1.00 | 0.36 | 0.38 | Not Applicable | ||||||||||||||||||||||

| Dividends and other restricted payments | Only applicable in case of default | Not Applicable | Not Applicable | Not Applicable | ||||||||||||||||||||||

| Aggregate debt ratio | ≤ 0.60 to 1.00 | Not Applicable | Not Applicable | 0.38 | ||||||||||||||||||||||

| Consolidated income available for debt to annual debt service charge | ≥ 1.50 to 1.00 | Not Applicable | Not Applicable | 5.14 | ||||||||||||||||||||||

| Total unencumbered assets to total unsecured debt | ≥ 1.50 to 1.00 | Not Applicable | Not Applicable | 2.66 | ||||||||||||||||||||||

| Secured debt ratio | ≤ 0.40 to 1.00 | Not Applicable | Not Applicable | 0.01 | ||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

15 |

|||||||

Weighted Average Debt Maturity: 4.2 years (a) | ||

|

Weighted Average Effective Swap Maturity: 3.3 years

Weighted Average Effective & Forward Starting Swap Maturity: 3.6 years

| ||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

16 |

|||||||

Q2 2025 |

Q1 2025 |

YTD 2025 |

|||||||||

| Acquisitions: | |||||||||||

| Number of transactions | 1 | 3 | 4 | ||||||||

| Number of properties | 1 | 6 | 7 | ||||||||

| Square feet | 348 | 438 | 786 | ||||||||

| Acquisition price | $ | 54,722 | $ | 59,004 | $ | 113,726 | |||||

| Industrial | 54,722 | 41,088 | 95,810 | ||||||||

| Retail | — | 17,916 | 17,916 | ||||||||

| Initial cash capitalization rate | 7.1 | % | 7.2 | % | 7.1 | % | |||||

| Straight-line yield | 8.2 | % | 8.3 | % | 8.3 | % | |||||

| Weighted average lease term (years) | 10.7 | 13.6 | 12.2 | ||||||||

| Weighted average annual rent increase | 3.0 | % | 2.6 | % | 2.8 | % | |||||

| Build-to-suit developments: | |||||||||||

| Investments | $ | 63,295 | $ | 26,494 | $ | 89,789 | |||||

| Revenue generating capital expenditures: | |||||||||||

| Number of existing properties | — | 3 | 3 | ||||||||

| Investments | $ | — | $ | 2,835 | $ | 2,835 | |||||

| Initial cash capitalization rate | — | % | 8.0 | % | 8.0 | % | |||||

| Weighted average lease term (years) | — | 17.7 | 17.7 | ||||||||

| Weighted average annual rent increase | — | % | 1.7 | % | 1.7 | % | |||||

| Transitional capital: | |||||||||||

| Number of transactions | 2 | — | 2 | ||||||||

Investments (a) |

$ | 22,781 | $ | — | $ | 22,781 | |||||

| Cash capitalization rate | 7.8 | % | — | % | 7.8 | % | |||||

| Total investments | $ | 140,798 | $ | 88,333 | $ | 229,131 | |||||

Total initial cash capitalization rate (b) |

7.1 | % | 7.2 | % | 7.2 | % | |||||

Total weighted average lease term (years) (b) |

10.7 | 13.8 | 12.4 | ||||||||

Total weighted average annual rent increase (b) |

3.0 | % | 2.5 | % | 2.8 | % | |||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

17 |

|||||||

| Property | Projected Rentable Square Feet | Start Date (a) |

Target Stabilization Date/Stabilized Date (a) |

Lease Term (Years) | Annual Rent Escalations |

Estimated Total Project Investment (a) |

Cumulative Investment | QTD Q2 2025 Investment |

Estimated Remaining Investment | Estimated Cash Capitalization Rate (a) |

Estimated Straight-line Yield (a) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| In-process retail: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (Jacksonville - FL) |

1 | Jun. 2025 | Oct. 2025 | 15.0 | 1.9 | % | $ | 2,008 | $ | 1,112 | $ | 1,112 | $ | 896 | 8.0 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| In-process industrial: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sierra Nevada (Dayton - OH) |

122 | Oct. 2024 | Nov. 2025 | 15.0 | 3.0 | % | 58,563 | 27,955 | 15,439 | 30,609 | 7.6 | % | 9.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sierra Nevada (Dayton - OH) |

122 | Oct. 2024 | Mar. 2026 | 15.0 | 3.0 | % | 55,525 | 17,841 | 9,806 | 37,684 | 7.7 | % | 9.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southwire (Bremen - GA) |

1,178 | Dec. 2024 | Jul. 2026 | 15.0 | 2.8 | % | 115,411 | 16,653 | 5,250 | 98,757 | 7.8 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fiat Chrysler Automobile (Forsyth - GA) | 422 | Apr. 2025 | Aug. 2026 | 15.0 | 3.0 | % | 78,242 | 13,067 | 13,067 | 65,175 | 6.9 | % | 8.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AGCO (Vasaila - CA) |

115 | Jun. 2025 | Aug. 2026 | 12.0 | 3.5 | % | 19,809 | 14,092 | 14,092 | 5,717 | 7.0 | % | 8.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total / weighted average | 1,959 | 14.8 | 2.9 | % | 329,558 | 90,719 | 58,766 | 238,838 | 7.5 | % | 8.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stabilized industrial: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UNFI (Sarasota - FL) |

1,016 | May 2023 | Stabilized - Sep. 2024 | 15.0 | 2.5 | % | 200,958 | 200,958 | — | — | 7.2 | % | 8.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stabilized retail: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (High Point - NC) |

1 | Dec. 2024 | Stabilized - Jun. 2025 | 15.0 | 1.9 | % | 1,975 | 1,975 | 498 | — | 8.0 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 Brew (Charleston - SC) |

1 | Feb. 2025 | Stabilized - May 2025 | 15.0 | 1.9 | % | 1,729 | 1,729 | 693 | — | 7.9 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total / weighted average | 2,976 | 13.8 | 2.8 | % | $ | 534,220 | $ | 295,381 | $ | 59,957 | $ | 238,838 | 7.4 | % | 8.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

18 |

|||||||

Q2 2025 |

|||||

| Transitional Capital: | |||||

| Retail Center - St. Louis, MO | |||||

| Type | Preferred Equity | ||||

Investment (’000s) (a) |

$ | 52,694 | |||

Stabilized cash capitalization rate (b) |

8.0 | % | |||

| Annualized initial cash NOI yield | 7.6 | % | |||

Remaining term (years) (c) |

2.0 | ||||

| Underlying property metrics | |||||

| Number of retail spaces | 28 | ||||

| Rentable square footage (“SF”) (’000s) | 332 | ||||

| Weighted average remaining lease term (years) | 5.9 | ||||

Occupancy rate (based on SF) (d) |

95.2 | % | |||

| Quarterly rent collection | 100.0 | % | |||

| Industrial Park - Olyphant, PA | |||||

| Type | Preferred Equity | ||||

Investment (’000s) (e) |

$ | 22,287 | |||

Stabilized cash capitalization rate (b) |

7.8 | % | |||

| Annualized initial cash NOI yield | — | % | |||

Remaining term (years) (f) |

3.0 | ||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

19 |

|||||||

| Q1 2025 | ||||||||||||||||||||||||||||||||

| Property Type | Number of Properties | Square Feet | Acquisition Price | Disposition Price | Net Book Value |

|||||||||||||||||||||||||||

| Other | 3 | 30 | $ | 9,621 | $ | 7,385 | $ | 9,802 | ||||||||||||||||||||||||

| Total Properties | 3 | 30 | 9,621 | 7,385 | 9,802 | |||||||||||||||||||||||||||

| Weighted average cash cap rate | 9.2 | % | ||||||||||||||||||||||||||||||

| Q2 2025 | ||||||||||||||||||||||||||||||||

| Property Type | Number of Properties | Square Feet | Acquisition Price | Disposition Price | Net Book Value |

|||||||||||||||||||||||||||

| Retail | 6 | 31 | $ | 13,720 | $ | 7,548 | $ | 9,154 | ||||||||||||||||||||||||

| Other | 2 | 67 | 26,700 | 5,550 | 7,473 | |||||||||||||||||||||||||||

| Total Properties | 8 | 98 | 40,420 | 13,098 | 16,628 | |||||||||||||||||||||||||||

| Weighted average cash cap rate | 9.5 | % | ||||||||||||||||||||||||||||||

| YTD 2025 | ||||||||||||||||||||||||||||||||

| Property Type | Number of Properties | Square Feet | Acquisition Price | Disposition Price | Net Book Value |

|||||||||||||||||||||||||||

| Retail | 6 | 31 | $ | 13,720 | $ | 7,548 | $ | 9,154 | ||||||||||||||||||||||||

| Other | 5 | 97 | 36,321 | 12,935 | 17,275 | |||||||||||||||||||||||||||

| Total Properties | 11 | 128 | $ | 50,041 | $ | 20,483 | $ | 26,430 | ||||||||||||||||||||||||

| Weighted average cash cap rate | 9.4 | % | ||||||||||||||||||||||||||||||

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

||||||||||||||||||||||||||||

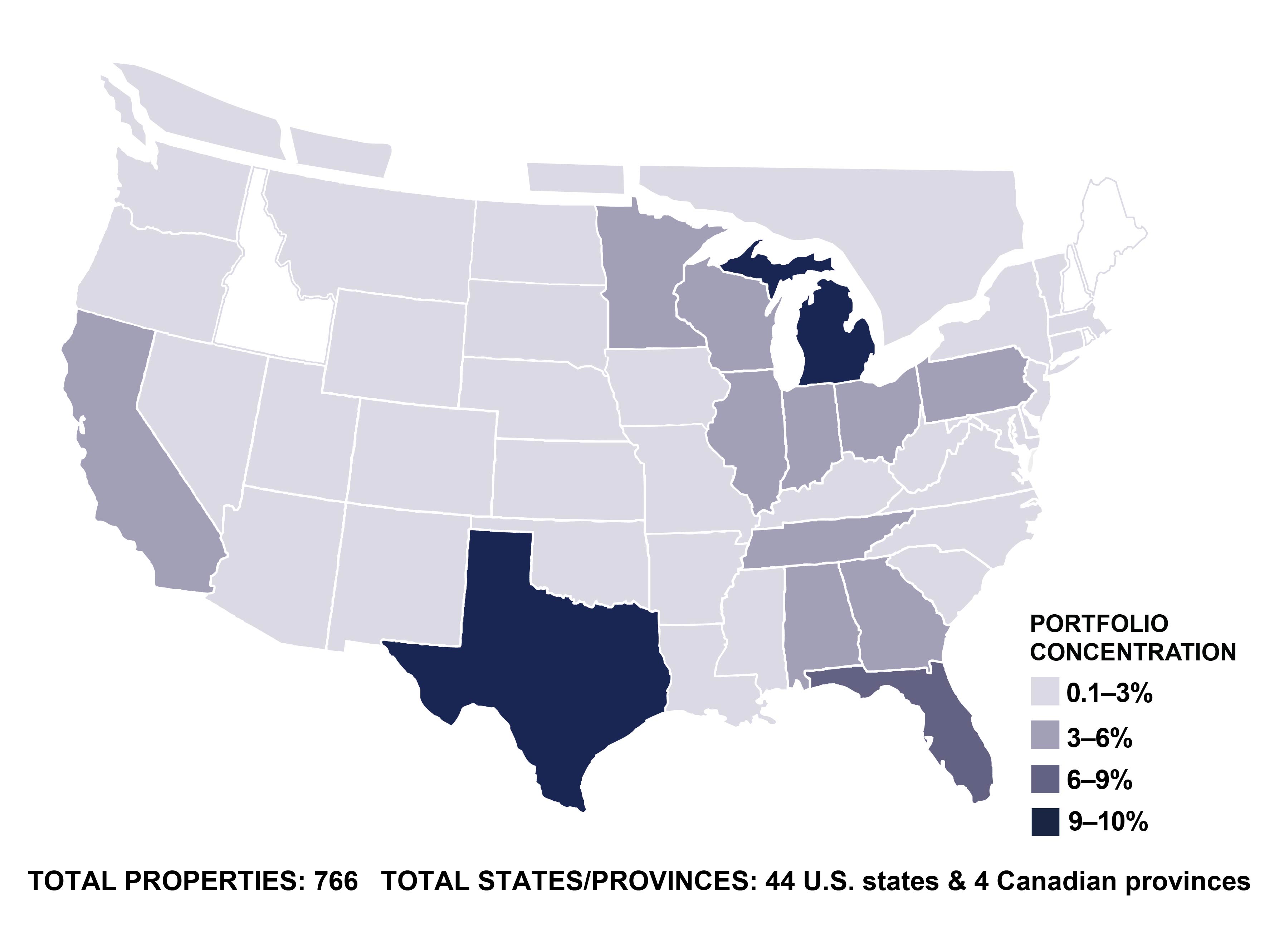

| Properties | 766 | 769 | 765 | 773 | 777 | |||||||||||||||||||||||||||

| U.S. States | 44 | 44 | 44 | 44 | 44 | |||||||||||||||||||||||||||

| Canadian Provinces | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||

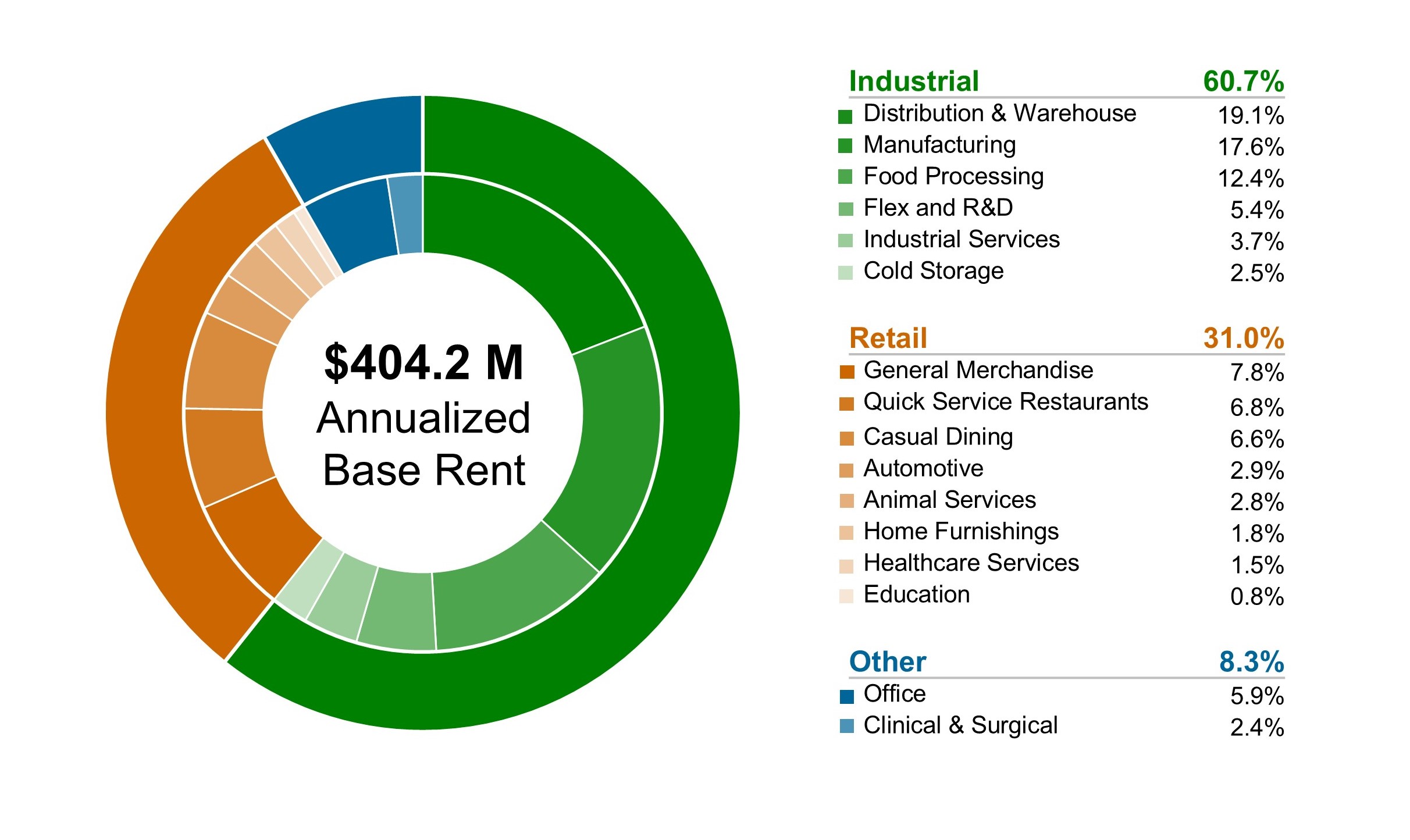

| Total annualized base rent | $404.2 | M | $401.3 | M | $395.5 | M | $398.2 | M | $385.5 | M | ||||||||||||||||||||||

| Total rentable square footage (“SF”) | 40.1 | M | 39.8 | M | 39.4 | M | 39.7 | M | 38.5 | M | ||||||||||||||||||||||

| Tenants | 205 | 204 | 202 | 203 | 207 | |||||||||||||||||||||||||||

| Brands | 195 | 192 | 190 | 191 | 196 | |||||||||||||||||||||||||||

| Industries | 56 | 55 | 55 | 55 | 53 | |||||||||||||||||||||||||||

| Occupancy (based on SF) | 99.1 | % | 99.1 | % | 99.1 | % | 99.0 | % | 99.3 | % | ||||||||||||||||||||||

| Rent Collection | 99.6 | % | 99.1 | % | 99.2 | % | 99.1 | % | 99.0 | % | ||||||||||||||||||||||

| Top 10 tenant concentration | 21.8 | % | 21.9 | % | 21.9 | % | 21.4 | % | 20.2 | % | ||||||||||||||||||||||

| Top 20 tenant concentration | 35.2 | % | 35.3 | % | 35.5 | % | 34.9 | % | 33.4 | % | ||||||||||||||||||||||

Investment grade (tenant/guarantor) (b) |

20.7 | % | 20.1 | % | 20.2 | % | 19.8 | % | 18.1 | % | ||||||||||||||||||||||

Financial reporting coverage (c) |

92.4 | % | 94.1 | % | 94.2 | % | 94.0 | % | 94.8 | % | ||||||||||||||||||||||

| Rent coverage ratio (restaurants only) | 3.3x | 3.2x | 3.3x | 3.3x | 3.3x | |||||||||||||||||||||||||||

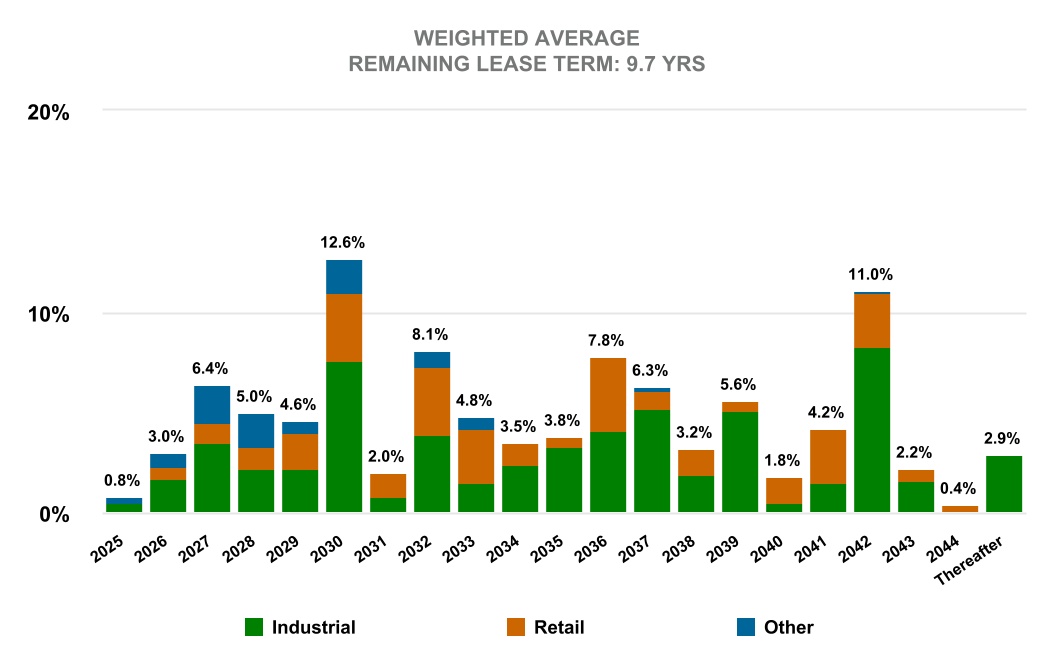

| Weighted average annual rent increases | 2.0 | % | 2.0 | % | 2.0 | % | 2.0 | % | 2.0 | % | ||||||||||||||||||||||

| Weighted average remaining lease term | 9.7 years | 10.0 years | 10.2 years | 10.3 years | 10.4 years | |||||||||||||||||||||||||||

| Master leases (based on ABR) | ||||||||||||||||||||||||||||||||

| Total portfolio | 40.1 | % | 40.9 | % | 41.4 | % | 40.2 | % | 41.7 | % | ||||||||||||||||||||||

| Multi-site tenants | 68.3 | % | 68.7 | % | 69.1 | % | 69.0 | % | 71.0 | % | ||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

20 |

|||||||

| Tenant | Property Type | # of Properties |

ABR (’000s) |

ABR as a % of Total Portfolio |

Square Feet (’000s) |

SF as a % of Total Portfolio |

||||||||||||||||||||||||||||||||

| Roskam Baking Company, LLC* | Food Processing | 7 | $ | 16,236 | 4.0 | % | 2,250 | 5.6 | % | |||||||||||||||||||||||||||||

| United Natural Foods, Inc. | Distribution & Warehouse | 1 | 14,386 | 3.6 | % | 1,016 | 2.5 | % | ||||||||||||||||||||||||||||||

| AHF, LLC* | Distribution & Warehouse/Manufacturing | 8 | 9,852 | 2.4 | % | 2,284 | 5.7 | % | ||||||||||||||||||||||||||||||

| Joseph T. Ryerson & Son, Inc | Distribution & Warehouse | 11 | 8,025 | 2.0 | % | 1,599 | 4.0 | % | ||||||||||||||||||||||||||||||

| Jack’s Family Restaurants LP* | Quick Service Restaurants | 43 | 7,605 | 1.9 | % | 147 | 0.4 | % | ||||||||||||||||||||||||||||||

| Dollar General Corporation | General Merchandise | 64 | 6,603 | 1.6 | % | 609 | 1.5 | % | ||||||||||||||||||||||||||||||

| Tractor Supply Company | General Merchandise | 23 | 6,496 | 1.6 | % | 462 | 1.1 | % | ||||||||||||||||||||||||||||||

| J. Alexander’s, LLC* | Casual Dining | 16 | 6,301 | 1.6 | % | 132 | 0.3 | % | ||||||||||||||||||||||||||||||

| Salm Partners, LLC* | Food Processing | 2 | 6,276 | 1.6 | % | 426 | 1.1 | % | ||||||||||||||||||||||||||||||

| Nestle’ Dreyer's Ice Cream Company | Cold Storage | 2 | 6,259 | 1.5 | % | 503 | 1.3 | % | ||||||||||||||||||||||||||||||

| Total Top 10 Tenants | 177 | $ | 88,039 | 21.8 | % | 9,428 | 23.5 | % | ||||||||||||||||||||||||||||||

| Hensley & Company* | Distribution & Warehouse | 3 | $ | 6,231 | 1.5 | % | 577 | 1.4 | % | |||||||||||||||||||||||||||||

| BluePearl Holdings, LLC** | Animal Services | 13 | 5,905 | 1.5 | % | 159 | 0.4 | % | ||||||||||||||||||||||||||||||

| Axcelis Technologies, Inc. | Flex and R&D | 1 | 5,900 | 1.5 | % | 417 | 1.0 | % | ||||||||||||||||||||||||||||||

| Red Lobster Hospitality & Red Lobster Restaurants LLC* | Casual Dining | 18 | 5,563 | 1.4 | % | 147 | 0.4 | % | ||||||||||||||||||||||||||||||

Outback Steakhouse of Florida LLC*(a) |

Casual Dining | 22 | 5,544 | 1.4 | % | 140 | 0.3 | % | ||||||||||||||||||||||||||||||

| Krispy Kreme Doughnut Corporation | Quick Service Restaurants/ Food Processing |

27 | 5,538 | 1.3 | % | 156 | 0.4 | % | ||||||||||||||||||||||||||||||

| Big Tex Trailer Manufacturing Inc.* | Automotive/Distribution & Warehouse/Manufacturing/Office | 17 | 5,260 | 1.3 | % | 1,302 | 3.2 | % | ||||||||||||||||||||||||||||||

| Jelly Belly Candy Company | Distribution & Warehouse/Food Processing/General Merchandise | 5 | 4,789 | 1.2 | % | 576 | 1.4 | % | ||||||||||||||||||||||||||||||

| Arkansas Surgical Hospital, LLC | Clinical & Surgical | 1 | 4,702 | 1.2 | % | 129 | 0.3 | % | ||||||||||||||||||||||||||||||

| Chiquita Holdings Limited | Food Processing | 1 | 4,692 | 1.1 | % | 335 | 1.0 | % | ||||||||||||||||||||||||||||||

| Total Top 20 Tenants | 285 | $ | 142,163 | 35.2 | % | 13,366 | 33.3 | % | ||||||||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

21 |

|||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

22 |

|||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

23 |

|||||||

| Brand | Property Type | # of Properties |

ABR (’000s) |

ABR as a % of Total Portfolio |

Square Feet (’000s) |

SF as a % of Total Portfolio |

||||||||||||||||||||||||||||||||

| Roskam Baking Company, LLC* | Food Processing | 7 | $ | 16,236 | 4.0 | % | 2,250 | 5.6 | % | |||||||||||||||||||||||||||||

| United Natural Foods, Inc. | Distribution & Warehouse | 1 | 14,386 | 3.6 | % | 1,016 | 2.5 | % | ||||||||||||||||||||||||||||||

| AHF Products* | Distribution & Warehouse/ Manufacturing |

8 | 9,852 | 2.4 | % | 2,284 | 5.7 | % | ||||||||||||||||||||||||||||||

| Ryerson | Distribution & Warehouse | 11 | 8,025 | 2.0 | % | 1,599 | 4.0 | % | ||||||||||||||||||||||||||||||

| Jack's Family Restaurants* | Quick Service Restaurants | 43 | 7,605 | 1.9 | % | 147 | 0.4 | % | ||||||||||||||||||||||||||||||

| Dollar General | General Merchandise | 64 | 6,603 | 1.6 | % | 609 | 1.5 | % | ||||||||||||||||||||||||||||||

| Tractor Supply Company | General Merchandise | 23 | 6,496 | 1.6 | % | 462 | 1.1 | % | ||||||||||||||||||||||||||||||

| Salm Partners, LLC* | Food Processing | 2 | 6,276 | 1.6 | % | 426 | 1.1 | % | ||||||||||||||||||||||||||||||

| Nestle’ | Cold Storage | 2 | 6,259 | 1.5 | % | 503 | 1.3 | % | ||||||||||||||||||||||||||||||

| Hensley* | Distribution & Warehouse | 3 | 6,231 | 1.5 | % | 577 | 1.4 | % | ||||||||||||||||||||||||||||||

| Total Top 10 Brands | 164 | $ | 87,969 | 21.7 | % | 9,873 | 24.6 | % | ||||||||||||||||||||||||||||||

| BluePearl Veterinary Partners** | Animal Services | 13 | 5,905 | 1.5 | % | 159 | 0.4 | % | ||||||||||||||||||||||||||||||

| Axcelis | Flex and R&D | 1 | 5,900 | 1.5 | % | 417 | 1.0 | % | ||||||||||||||||||||||||||||||

| Bob Evans Farms* | Casual Dining/Food Processing | 21 | 5,680 | 1.4 | % | 282 | 0.6 | % | ||||||||||||||||||||||||||||||

| Red Lobster* | Casual Dining | 18 | 5,563 | 1.4 | % | 147 | 0.4 | % | ||||||||||||||||||||||||||||||

| Krispy Kreme | Quick Service Restaurants/ Food Processing |

27 | 5,538 | 1.3 | % | 156 | 0.4 | % | ||||||||||||||||||||||||||||||

| Big Tex Trailers* | Automotive/Distribution & Warehouse/Manufacturing/Office | 17 | 5,260 | 1.3 | % | 1,302 | 3.2 | % | ||||||||||||||||||||||||||||||

| Outback Steakhouse* | Casual Dining | 20 | 4,796 | 1.2 | % | 126 | 0.3 | % | ||||||||||||||||||||||||||||||

| Jelly Belly | Distribution & Warehouse/Food Processing/General Merchandise | 5 | 4,789 | 1.2 | % | 576 | 1.4 | % | ||||||||||||||||||||||||||||||

| Arkansas Surgical Hospital, LLC | Clinical & Surgical | 1 | 4,702 | 1.2 | % | 129 | 0.3 | % | ||||||||||||||||||||||||||||||

| Chiquita | Food Processing | 1 | 4,692 | 1.1 | % | 335 | 1.0 | % | ||||||||||||||||||||||||||||||

| Total Top 20 Brands | 288 | $ | 140,794 | 34.8 | % | 13,502 | 33.6 | % | ||||||||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

24 |

|||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

25 |

|||||||

| Property Type | # of Properties | ABR (’000s) |

ABR as a % of Total Portfolio |

Square Feet (’000s) | SF as a % of Total Portfolio |

|||||||||||||||||||||||||||

| Industrial | ||||||||||||||||||||||||||||||||

| Distribution & Warehouse | 51 | $ | 77,277 | 19.1 | % | 11,127 | 27.7 | % | ||||||||||||||||||||||||

| Manufacturing | 80 | 70,956 | 17.6 | % | 12,319 | 30.7 | % | |||||||||||||||||||||||||

| Food Processing | 34 | 50,098 | 12.4 | % | 5,736 | 14.3 | % | |||||||||||||||||||||||||

| Flex and R&D | 10 | 21,902 | 5.4 | % | 1,606 | 4.0 | % | |||||||||||||||||||||||||

| Industrial Services | 29 | 14,983 | 3.7 | % | 725 | 1.8 | % | |||||||||||||||||||||||||

| Cold Storage | 3 | 10,047 | 2.5 | % | 723 | 1.8 | % | |||||||||||||||||||||||||

| In-process Developments | 6 | — | — | % | 115 | 0.3 | % | |||||||||||||||||||||||||

| Untenanted | 2 | — | — | % | 343 | 0.9 | % | |||||||||||||||||||||||||

| Industrial Total | 215 | 245,263 | 60.7 | % | 32,694 | 81.5 | % | |||||||||||||||||||||||||

| Retail | ||||||||||||||||||||||||||||||||

| General Merchandise | 143 | 31,114 | 7.8 | % | 2,302 | 5.8 | % | |||||||||||||||||||||||||

| Quick Service Restaurants | 153 | 27,458 | 6.8 | % | 515 | 1.3 | % | |||||||||||||||||||||||||

| Casual Dining | 96 | 26,754 | 6.6 | % | 643 | 1.6 | % | |||||||||||||||||||||||||

| Automotive | 65 | 11,691 | 2.9 | % | 764 | 1.9 | % | |||||||||||||||||||||||||

| Animal Services | 27 | 11,484 | 2.8 | % | 421 | 1.0 | % | |||||||||||||||||||||||||

| Home Furnishings | 13 | 7,386 | 1.8 | % | 797 | 2.0 | % | |||||||||||||||||||||||||

| Healthcare Services | 18 | 6,068 | 1.5 | % | 220 | 0.5 | % | |||||||||||||||||||||||||

| Education | 5 | 3,296 | 0.8 | % | 128 | 0.3 | % | |||||||||||||||||||||||||

| In-process Developments | 1 | — | — | % | — | — | % | |||||||||||||||||||||||||

| Retail Total | 521 | 125,251 | 31.0 | % | 5,790 | 14.4 | % | |||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||||||||

| Office | 14 | 23,828 | 5.9 | % | 1,311 | 3.3 | % | |||||||||||||||||||||||||

| Clinical & Surgical | 16 | 9,840 | 2.4 | % | 336 | 0.8 | % | |||||||||||||||||||||||||

| Other Total | 30 | 33,668 | 8.3 | % | 1,647 | 4.1 | % | |||||||||||||||||||||||||

| Total | 766 | $ | 404,182 | 100.0 | % | 40,131 | 100.0 | % | ||||||||||||||||||||||||

BROADSTONE NET LEASE, INC. | www.broadstone.com | © 2025 Broadstone Net Lease, LLC. All rights reserved. |

26 |

|||||||

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

|||||||||||||||||||||||||

| Industrial | |||||||||||||||||||||||||||||

| Number of properties | 215 | 211 | 210 | 207 | 206 | ||||||||||||||||||||||||

| Square feet (000s) | 32,694 | 32,231 | 31,898 | 31,898 | 30,602 | ||||||||||||||||||||||||

| Weighted average lease term (years) | 10.5 | 10.7 | 11.0 | 11.1 | 11.0 | ||||||||||||||||||||||||

| Weighted average annual rent escalation | 2.1 | % | 2.2 | % | 2.1 | % | 2.1 | % | 2.0 | % | |||||||||||||||||||

| Percentage of total ABR | 60.7 | % | 59.8 | % | 59.6 | % | 59.1 | % | 56.0 | % | |||||||||||||||||||

| Retail | |||||||||||||||||||||||||||||

| Number of properties | 521 | 526 | 520 | 519 | 518 | ||||||||||||||||||||||||