|

California

(State or other jurisdiction of

incorporation)

|

001-38621

(Commission

File Number)

|

20-8856755

(I.R.S. Employer

Identification No.)

|

||||||||||||

|

3701 Wilshire Boulevard, Suite 900

Los Angeles, California

(Address of principal offices)

|

90010

(Zip Code)

|

|||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, no par value | PCB | Nasdaq Global Select Market | ||||||

| PCB Bancorp | |||||||||||

| Date: | October 23, 2025 | /s/ Timothy Chang | |||||||||

| Timothy Chang | |||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||

($ in thousands, except per share data) |

Three Months Ended |

Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | % Change |

9/30/2024 | % Change |

9/30/2025 | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||||||||

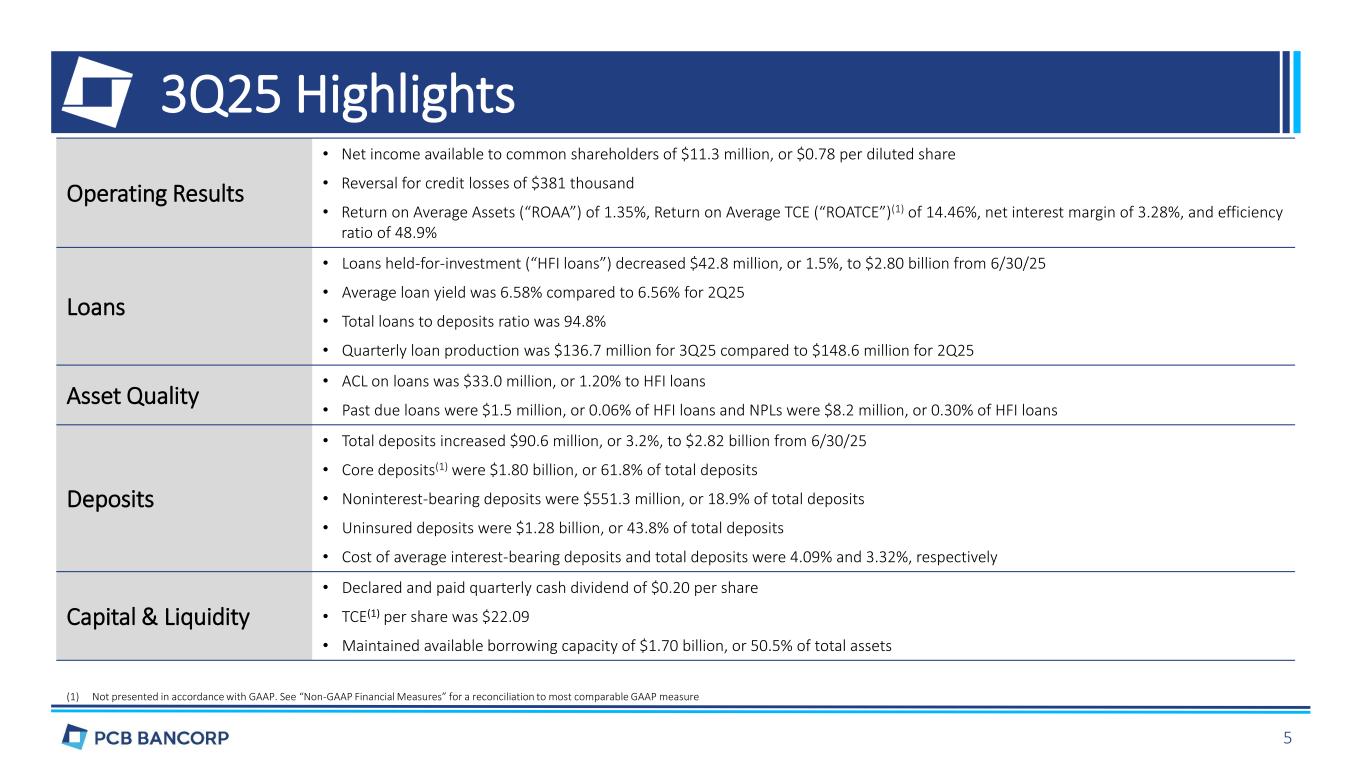

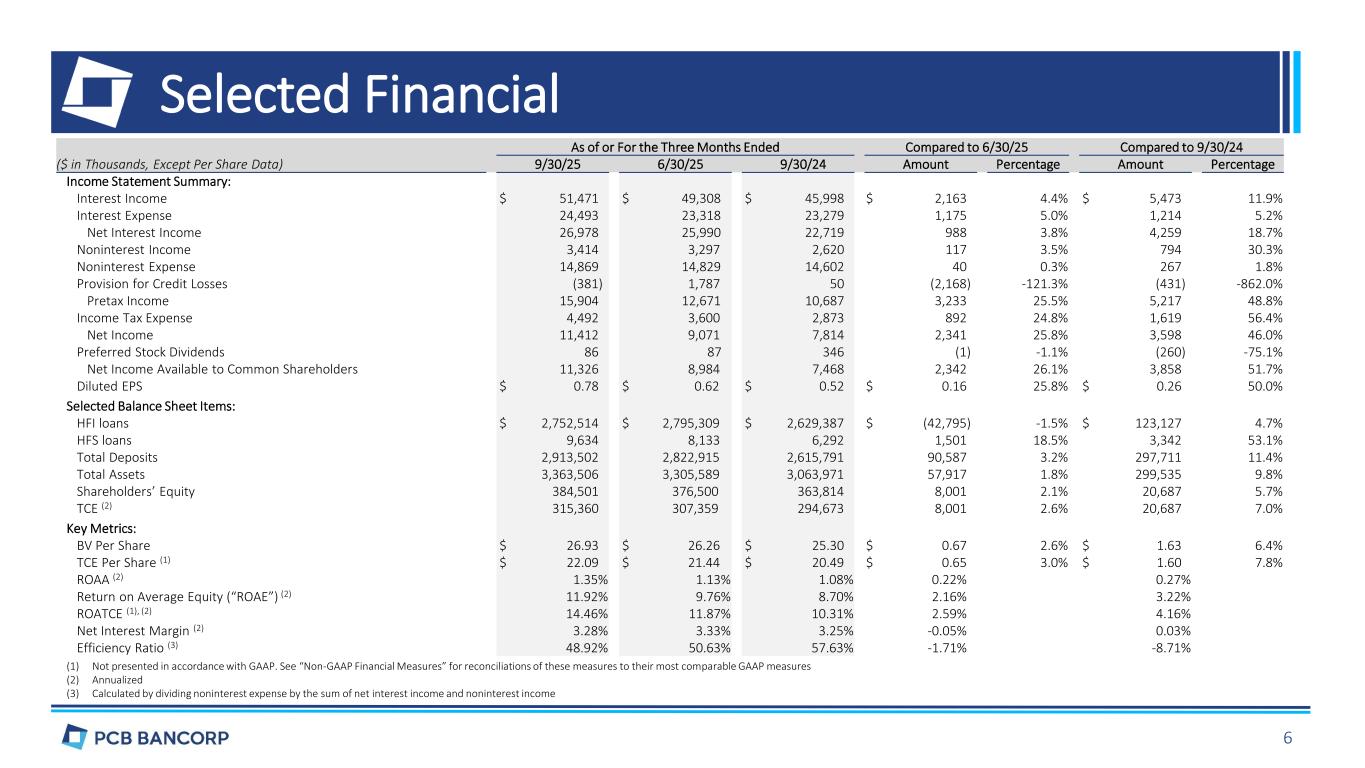

| Net income | $ | 11,412 | $ | 9,071 | 25.8 | % | $ | 7,814 | 46.0 | % | $ | 28,218 | $ | 18,780 | 50.3 | % | ||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 11,326 | $ | 8,984 | 26.1 | % | $ | 7,468 | 51.7 | % | $ | 28,005 | $ | 18,292 | 53.1 | % | ||||||||||||||||||||||||||||||||||

| Diluted earnings per common share (“EPS”) | $ | 0.78 | $ | 0.62 | 25.8 | % | $ | 0.52 | 50.0 | % | $ | 1.94 | $ | 1.27 | 52.8 | % | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 26,978 | $ | 25,990 | 3.8 | % | $ | 22,719 | 18.7 | % | $ | 77,251 | $ | 65,453 | 18.0 | % | ||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses | (381) | 1,787 | NA | 50 | NA | 3,004 | 1,399 | 114.7 | % | |||||||||||||||||||||||||||||||||||||||||

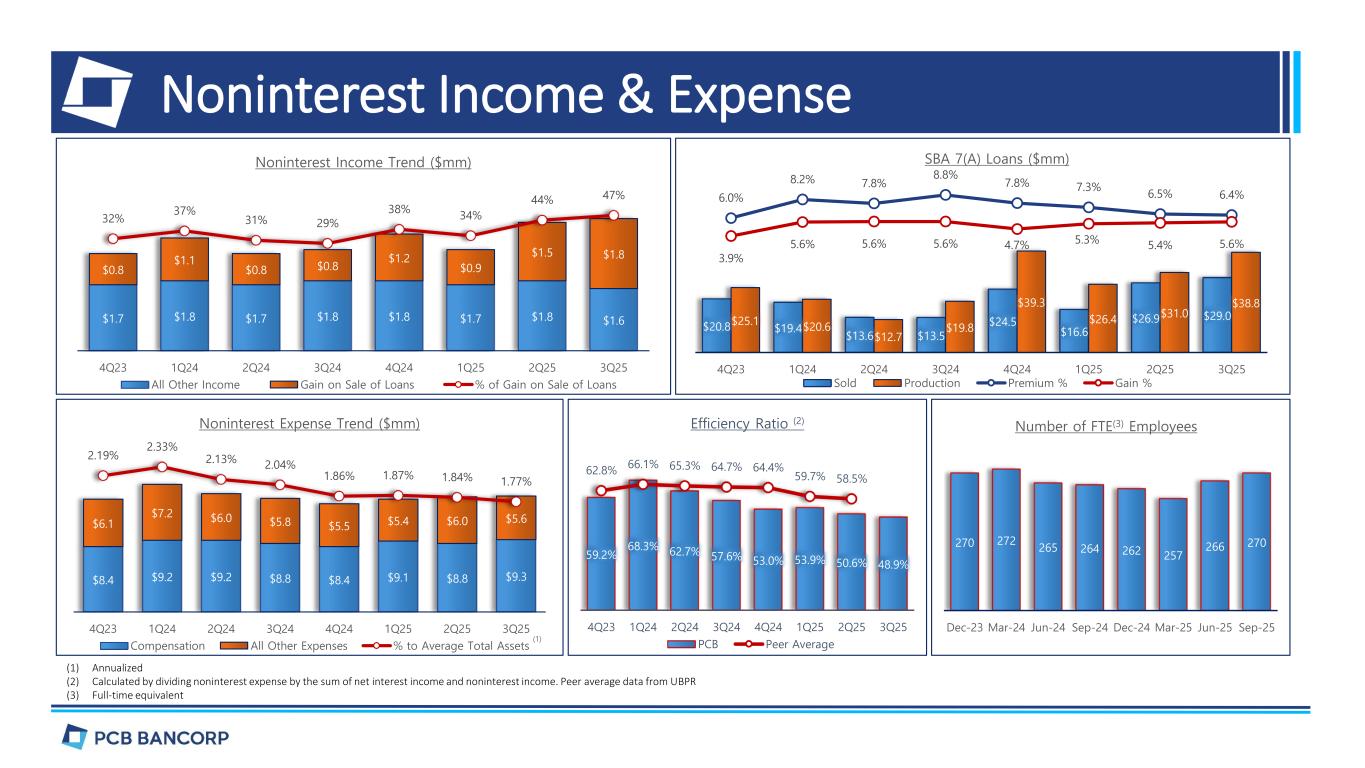

| Noninterest income | 3,414 | 3,297 | 3.5 | % | 2,620 | 30.3 | % | 9,291 | 8,050 | 15.4 | % | |||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 14,869 | 14,829 | 0.3 | % | 14,602 | 1.8 | % | 44,172 | 46,129 | (4.2) | % | |||||||||||||||||||||||||||||||||||||||

Return on average assets (“ROAA”) (1) |

1.35 | % | 1.13 | % | 1.08 | % | 1.17 | % | 0.88 | % | ||||||||||||||||||||||||||||||||||||||||

Return on average shareholders’ equity (“ROAE”) (1) |

11.92 | % | 9.76 | % | 8.70 | % | 10.10 | % | 7.11 | % | ||||||||||||||||||||||||||||||||||||||||

Return on average tangible common equity (“ROATCE”) (1),(2) |

14.46 | % | 11.87 | % | 10.31 | % | 12.30 | % | 8.61 | % | ||||||||||||||||||||||||||||||||||||||||

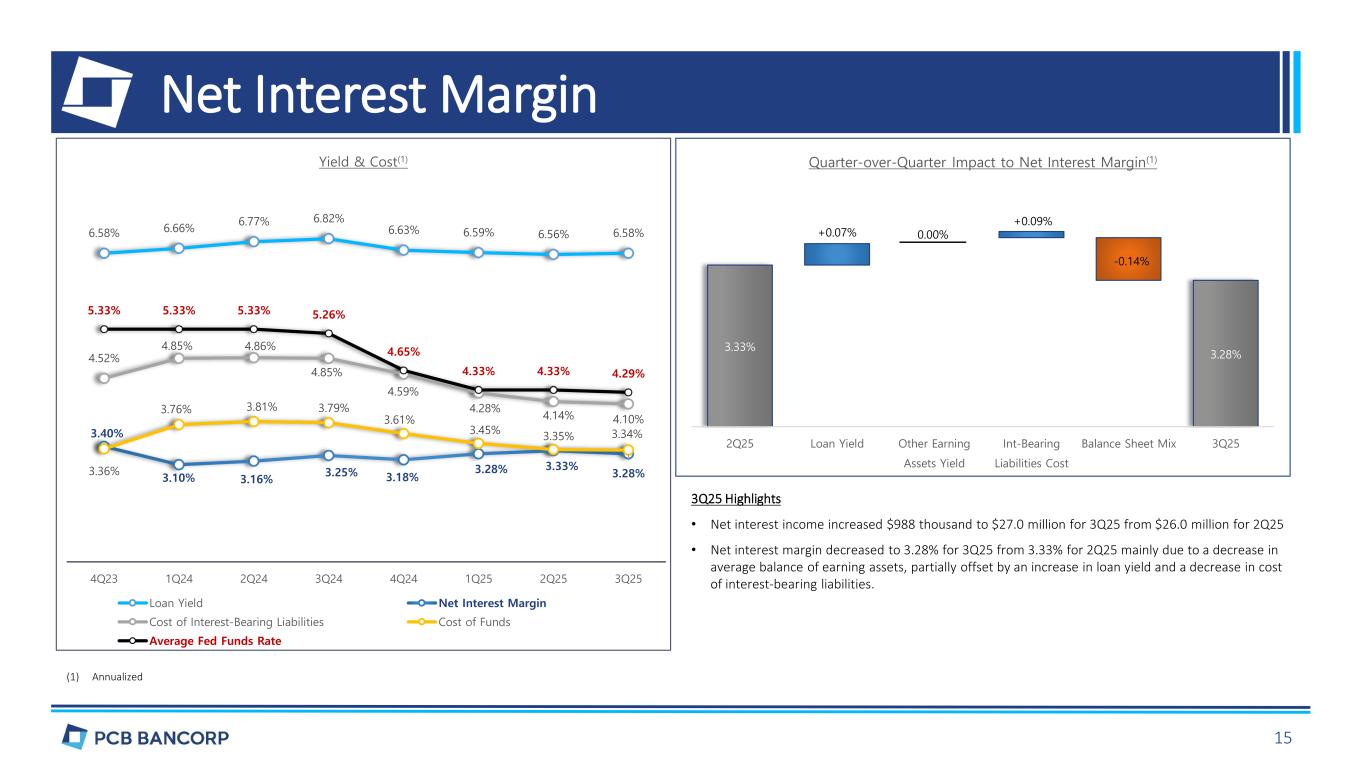

Net interest margin (1) |

3.28 | % | 3.33 | % | 3.25 | % | 3.29 | % | 3.17 | % | ||||||||||||||||||||||||||||||||||||||||

Efficiency ratio (3) |

48.92 | % | 50.63 | % | 57.63 | % | 51.04 | % | 62.76 | % | ||||||||||||||||||||||||||||||||||||||||

| ($ in thousands, except per share data) | 9/30/2025 | 6/30/2025 | % Change | 12/31/2024 | % Change | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||

Total assets |

$ | 3,363,506 | $ | 3,305,589 | 1.8 | % | $ | 3,063,971 | 9.8 | % | $ | 2,889,833 | 16.4 | % | ||||||||||||||||||||||||||||||

Net loans held-for-investment |

2,719,554 | 2,761,755 | (1.5) | % | 2,598,759 | 4.6 | % | 2,437,244 | 11.6 | % | ||||||||||||||||||||||||||||||||||

Total deposits |

2,913,502 | 2,822,915 | 3.2 | % | 2,615,791 | 11.4 | % | 2,459,682 | 18.5 | % | ||||||||||||||||||||||||||||||||||

Book value per common share (4) |

$ | 26.93 | $ | 26.26 | $ | 25.30 | $ | 25.39 | ||||||||||||||||||||||||||||||||||||

TCE per common share (2) |

$ | 22.09 | $ | 21.44 | $ | 20.49 | $ | 20.55 | ||||||||||||||||||||||||||||||||||||

Tier 1 leverage ratio (consolidated) |

11.57 | % | 11.81 | % | 12.45 | % | 12.79 | % | ||||||||||||||||||||||||||||||||||||

| Total shareholders’ equity to total assets | 11.43 | % | 11.39 | % | 11.87 | % | 12.54 | % | ||||||||||||||||||||||||||||||||||||

TCE to total assets (2), (5) |

9.38 | % | 9.30 | % | 9.62 | % | 10.14 | % | ||||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change |

9/30/2024 | % Change | 9/30/2025 | 9/30/2024 | % Change | ||||||||||||||||||||||||||||||||||||||||||

| Interest income/expense on | ||||||||||||||||||||||||||||||||||||||||||||||||||

Loans |

$ | 46,193 | $ | 45,478 | 1.6 | % | $ | 42,115 | 9.7 | % | $ | 134,697 | $ | 121,992 | 10.4 | % | ||||||||||||||||||||||||||||||||||

Investment securities |

1,474 | 1,462 | 0.8 | % | 1,384 | 6.5 | % | 4,344 | 3,940 | 10.3 | % | |||||||||||||||||||||||||||||||||||||||

Other interest-earning assets |

3,804 | 2,368 | 60.6 | % | 2,499 | 52.2 | % | 8,630 | 8,566 | 0.7 | % | |||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

51,471 | 49,308 | 4.4 | % | 45,998 | 11.9 | % | 147,671 | 134,498 | 9.8 | % | |||||||||||||||||||||||||||||||||||||||

Interest-bearing deposits |

23,995 | 22,505 | 6.6 | % | 23,057 | 4.1 | % | 69,064 | 67,560 | 2.2 | % | |||||||||||||||||||||||||||||||||||||||

Borrowings |

498 | 813 | (38.7) | % | 222 | 124.3 | % | 1,356 | 1,485 | (8.7) | % | |||||||||||||||||||||||||||||||||||||||

Total interest-bearing liabilities |

24,493 | 23,318 | 5.0 | % | 23,279 | 5.2 | % | 70,420 | 69,045 | 2.0 | % | |||||||||||||||||||||||||||||||||||||||

Net interest income |

$ | 26,978 | $ | 25,990 | 3.8 | % | $ | 22,719 | 18.7 | % | $ | 77,251 | $ | 65,453 | 18.0 | % | ||||||||||||||||||||||||||||||||||

| Average balance of | ||||||||||||||||||||||||||||||||||||||||||||||||||

Loans |

$ | 2,784,148 | $ | 2,782,200 | 0.1 | % | $ | 2,456,015 | 13.4 | % | $ | 2,738,957 | $ | 2,413,777 | 13.5 | % | ||||||||||||||||||||||||||||||||||

Investment securities |

152,084 | 151,055 | 0.7 | % | 147,528 | 3.1 | % | 149,914 | 143,283 | 4.6 | % | |||||||||||||||||||||||||||||||||||||||

Other interest-earning assets |

327,637 | 200,875 | 63.1 | % | 175,711 | 86.5 | % | 246,396 | 201,951 | 22.0 | % | |||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

$ | 3,263,869 | $ | 3,134,130 | 4.1 | % | $ | 2,779,254 | 17.4 | % | $ | 3,135,267 | $ | 2,759,011 | 13.6 | % | ||||||||||||||||||||||||||||||||||

Interest-bearing deposits |

$ | 2,326,170 | $ | 2,187,210 | 6.4 | % | $ | 1,893,006 | 22.9 | % | $ | 2,218,542 | $ | 1,861,395 | 19.2 | % | ||||||||||||||||||||||||||||||||||

Borrowings |

43,109 | 71,286 | (39.5) | % | 15,848 | 172.0 | % | 39,586 | 35,427 | 11.7 | % | |||||||||||||||||||||||||||||||||||||||

Total interest-bearing liabilities |

$ | 2,369,279 | $ | 2,258,496 | 4.9 | % | $ | 1,908,854 | 24.1 | % | $ | 2,258,128 | $ | 1,896,822 | 19.0 | % | ||||||||||||||||||||||||||||||||||

Total funding (1) |

$ | 2,910,522 | $ | 2,792,026 | 4.2 | % | $ | 2,443,615 | 19.1 | % | $ | 2,788,686 | $ | 2,434,504 | 14.5 | % | ||||||||||||||||||||||||||||||||||

| Annualized average yield/cost of | ||||||||||||||||||||||||||||||||||||||||||||||||||

Loans |

6.58 | % | 6.56 | % | 6.82 | % | 6.58 | % | 6.75 | % | ||||||||||||||||||||||||||||||||||||||||

Investment securities |

3.85 | % | 3.88 | % | 3.73 | % | 3.87 | % | 3.67 | % | ||||||||||||||||||||||||||||||||||||||||

Other interest-earning assets |

4.61 | % | 4.73 | % | 5.66 | % | 4.68 | % | 5.67 | % | ||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 6.26 | % | 6.31 | % | 6.58 | % | 6.30 | % | 6.51 | % | ||||||||||||||||||||||||||||||||||||||||

Interest-bearing deposits |

4.09 | % | 4.13 | % | 4.85 | % | 4.16 | % | 4.85 | % | ||||||||||||||||||||||||||||||||||||||||

Borrowings |

4.58 | % | 4.57 | % | 5.57 | % | 4.58 | % | 5.60 | % | ||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 4.10 | % | 4.14 | % | 4.85 | % | 4.17 | % | 4.86 | % | ||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.28 | % | 3.33 | % | 3.25 | % | 3.29 | % | 3.17 | % | ||||||||||||||||||||||||||||||||||||||||

Cost of total funding (1) |

3.34 | % | 3.35 | % | 3.79 | % | 3.38 | % | 3.79 | % | ||||||||||||||||||||||||||||||||||||||||

Supplementary information |

||||||||||||||||||||||||||||||||||||||||||||||||||

| Net accretion of discount on loans | $ | 563 | $ | 610 | (7.7) | % | $ | 773 | (27.2) | % | $ | 2,045 | $ | 2,137 | (4.3) | % | ||||||||||||||||||||||||||||||||||

| Net amortization of deferred loan fees | $ | 433 | $ | 414 | 4.6 | % | $ | 246 | 76.0 | % | $ | 1,113 | $ | 919 | 21.1 | % | ||||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | 12/31/2024 | 9/30/2024 | |||||||||||||||||||||||||||||||||||||||||||||||

| % to Total Loans | Weighted-Average Contractual Rate | % to Total Loans | Weighted-Average Contractual Rate | % to Total Loans | Weighted-Average Contractual Rate | % to Total Loans | Weighted-Average Contractual Rate | |||||||||||||||||||||||||||||||||||||||||||

Fixed rate loans |

18.2 | % | 5.60 | % | 18.0 | % | 5.51 | % | 17.4 | % | 5.23 | % | 18.3 | % | 5.06 | % | ||||||||||||||||||||||||||||||||||

Hybrid rate loans |

39.5 | % | 5.51 | % | 38.5 | % | 5.43 | % | 37.3 | % | 5.27 | % | 37.6 | % | 5.14 | % | ||||||||||||||||||||||||||||||||||

Variable rate loans |

42.3 | % | 7.38 | % | 43.5 | % | 7.53 | % | 45.3 | % | 7.63 | % | 44.1 | % | 8.10 | % | ||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change |

9/30/2024 | % Change |

9/30/2025 | 9/30/2024 | % Change |

||||||||||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses on loans | $ | (428) | $ | 1,721 | NA | $ | 193 | NA | $ | 2,884 | $ | 1,444 | 99.7 | % | ||||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses on off-balance sheet credit exposure | 47 | 66 | (28.8) | % | (143) | NA | 120 | (45) | NA | |||||||||||||||||||||||||||||||||||||||||

| Total provision (reversal) for credit losses | $ | (381) | $ | 1,787 | NA | $ | 50 | NA | $ | 3,004 | $ | 1,399 | 114.7 | % | ||||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change |

9/30/2024 | % Change |

9/30/2025 | 9/30/2024 | % Change |

||||||||||||||||||||||||||||||||||||||||||

Gain on sale of loans |

$ | 1,617 | $ | 1,465 | 10.4 | % | $ | 750 | 115.6 | % | $ | 3,969 | $ | 2,591 | 53.2 | % | ||||||||||||||||||||||||||||||||||

Service charges and fees on deposits |

377 | 375 | 0.5 | % | 399 | (5.5) | % | 1,124 | 1,141 | (1.5) | % | |||||||||||||||||||||||||||||||||||||||

Loan servicing income |

719 | 760 | (5.4) | % | 786 | (8.5) | % | 2,204 | 2,504 | (12.0) | % | |||||||||||||||||||||||||||||||||||||||

| Bank-owned life insurance (“BOLI”) income | 259 | 253 | 2.4 | % | 239 | 8.4 | % | 759 | 703 | 8.0 | % | |||||||||||||||||||||||||||||||||||||||

Other income |

442 | 444 | (0.5) | % | 446 | (0.9) | % | 1,235 | 1,111 | 11.2 | % | |||||||||||||||||||||||||||||||||||||||

Total noninterest income |

$ | 3,414 | $ | 3,297 | 3.5 | % | $ | 2,620 | 30.3 | % | $ | 9,291 | $ | 8,050 | 15.4 | % | ||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 9/30/2024 | % Change | 9/30/2025 | 9/30/2024 | % Change | ||||||||||||||||||||||||||||||||||||||||||

Gain on sale of SBA loans |

||||||||||||||||||||||||||||||||||||||||||||||||||

Sold loan balance |

$ | 29,017 | $ | 26,947 | 7.7 | % | $ | 13,506 | 114.8 | % | $ | 72,569 | $ | 46,539 | 55.9 | % | ||||||||||||||||||||||||||||||||||

Premium received |

1,852 | 1,750 | 5.8 | % | 1,185 | 56.3 | % | 4,810 | 3,837 | 25.4 | % | |||||||||||||||||||||||||||||||||||||||

Gain recognized |

1,617 | 1,465 | 10.4 | % | 750 | 115.6 | % | 3,969 | 2,591 | 53.2 | % | |||||||||||||||||||||||||||||||||||||||

Gain on sale of residential mortgage loans |

||||||||||||||||||||||||||||||||||||||||||||||||||

Sold loan balance |

$ | — | $ | — | — | % | $ | 676 | (100.0) | % | $ | — | $ | 676 | (100.0) | % | ||||||||||||||||||||||||||||||||||

Gain recognized |

— | — | — | % | — | — | % | — | — | — | % | |||||||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change |

9/30/2024 | % Change |

9/30/2025 | 9/30/2024 | % Change |

||||||||||||||||||||||||||||||||||||||||||

| Loan servicing income | ||||||||||||||||||||||||||||||||||||||||||||||||||

Servicing income received |

$ | 1,247 | $ | 1,251 | (0.3) | % | $ | 1,264 | (1.3) | % | $ | 3,771 | $ | 3,875 | (2.7) | % | ||||||||||||||||||||||||||||||||||

Servicing assets amortization |

(528) | (491) | 7.5 | % | (478) | 10.5 | % | (1,567) | (1,371) | 14.3 | % | |||||||||||||||||||||||||||||||||||||||

| Loan servicing income | $ | 719 | $ | 760 | (5.4) | % | $ | 786 | (8.5) | % | $ | 2,204 | $ | 2,504 | (12.0) | % | ||||||||||||||||||||||||||||||||||

Underlying loans at end of period |

$ | 518,309 | $ | 514,974 | 0.6 | % | $ | 527,062 | (1.7) | % | $ | 518,309 | $ | 527,062 | (1.7) | % | ||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 9/30/2024 | % Change | 9/30/2025 | 9/30/2024 | % Change | ||||||||||||||||||||||||||||||||||||||||||

Salaries and employee benefits |

$ | 9,293 | $ | 8,844 | 5.1 | % | $ | 8,801 | 5.6 | % | $ | 27,212 | $ | 27,244 | (0.1) | % | ||||||||||||||||||||||||||||||||||

Occupancy and equipment |

2,372 | 2,379 | (0.3) | % | 2,261 | 4.9 | % | 7,040 | 6,919 | 1.7 | % | |||||||||||||||||||||||||||||||||||||||

Professional fees |

541 | 805 | (32.8) | % | 599 | (9.7) | % | 1,974 | 2,656 | (25.7) | % | |||||||||||||||||||||||||||||||||||||||

Marketing and business promotion |

669 | 597 | 12.1 | % | 667 | 0.3 | % | 1,509 | 1,304 | 15.7 | % | |||||||||||||||||||||||||||||||||||||||

Data processing |

333 | 317 | 5.0 | % | 397 | (16.1) | % | 983 | 1,294 | (24.0) | % | |||||||||||||||||||||||||||||||||||||||

Director fees and expenses |

223 | 225 | (0.9) | % | 226 | (1.3) | % | 674 | 679 | (0.7) | % | |||||||||||||||||||||||||||||||||||||||

Regulatory assessments |

373 | 358 | 4.2 | % | 309 | 20.7 | % | 1,075 | 934 | 15.1 | % | |||||||||||||||||||||||||||||||||||||||

| Other expense | 1,065 | 1,304 | (18.3) | % | 1,342 | (20.6) | % | 3,705 | 5,099 | (27.3) | % | |||||||||||||||||||||||||||||||||||||||

Total noninterest expense |

$ | 14,869 | $ | 14,829 | 0.3 | % | $ | 14,602 | 1.8 | % | $ | 44,172 | $ | 46,129 | (4.2) | % | ||||||||||||||||||||||||||||||||||

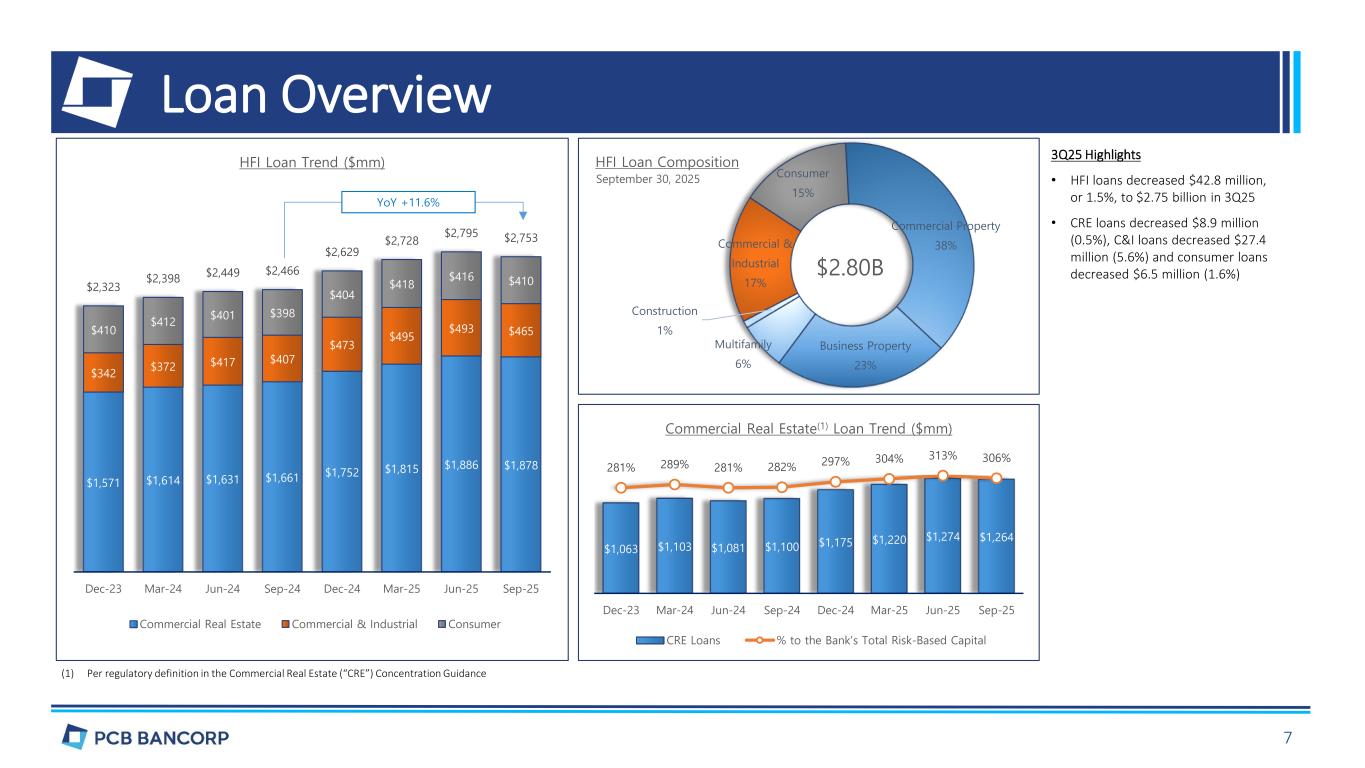

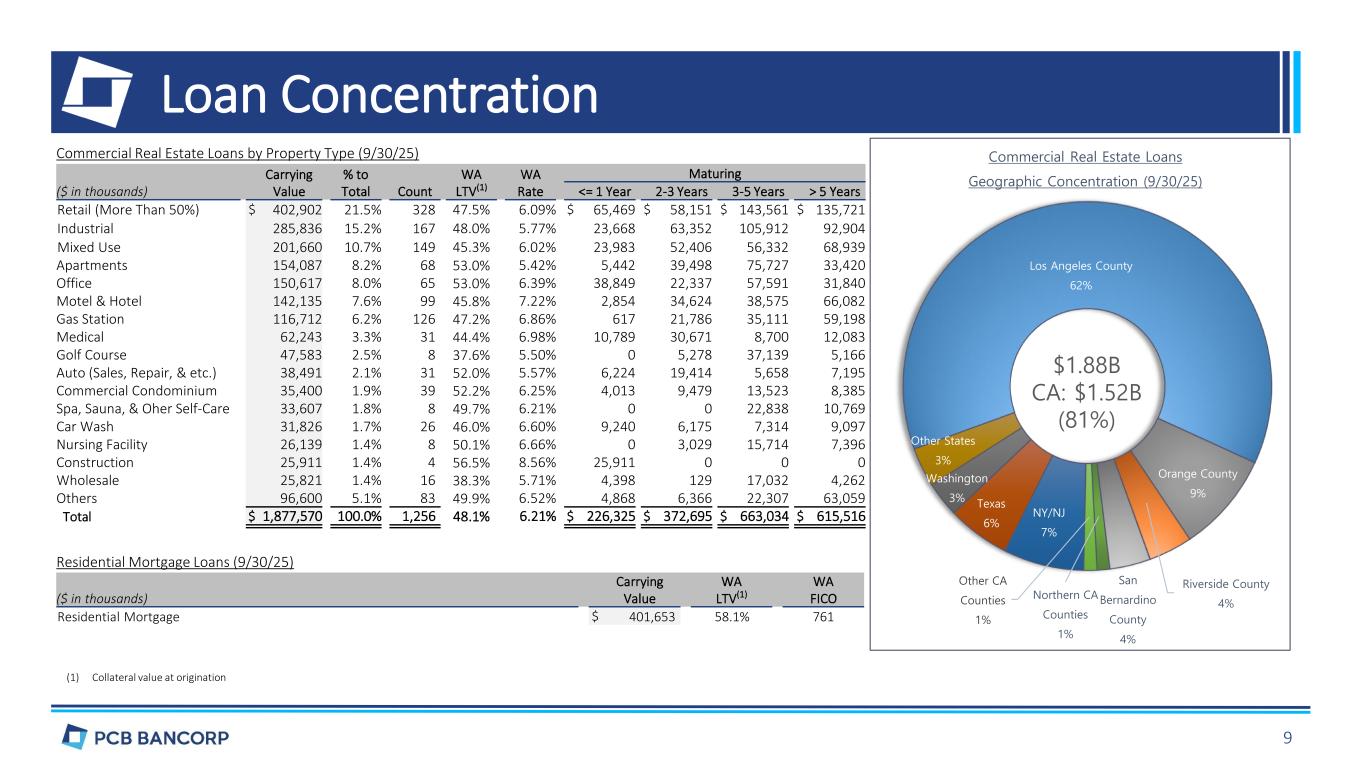

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 12/31/2024 | % Change | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||

| Commercial real estate: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial property | $ | 1,039,965 | $ | 1,010,780 | 2.9 | % | $ | 940,931 | 10.5 | % | $ | 874,824 | 18.9 | % | ||||||||||||||||||||||||||||||

| Business property | 639,596 | 635,648 | 0.6 | % | 595,547 | 7.4 | % | 579,461 | 10.4 | % | ||||||||||||||||||||||||||||||||||

| Multifamily | 172,098 | 212,738 | (19.1) | % | 194,220 | (11.4) | % | 185,485 | (7.2) | % | ||||||||||||||||||||||||||||||||||

| Construction | 25,911 | 27,294 | (5.1) | % | 21,854 | 18.6 | % | 21,150 | 22.5 | % | ||||||||||||||||||||||||||||||||||

| Total commercial real estate | 1,877,570 | 1,886,460 | (0.5) | % | 1,752,552 | 7.1 | % | 1,660,920 | 13.0 | % | ||||||||||||||||||||||||||||||||||

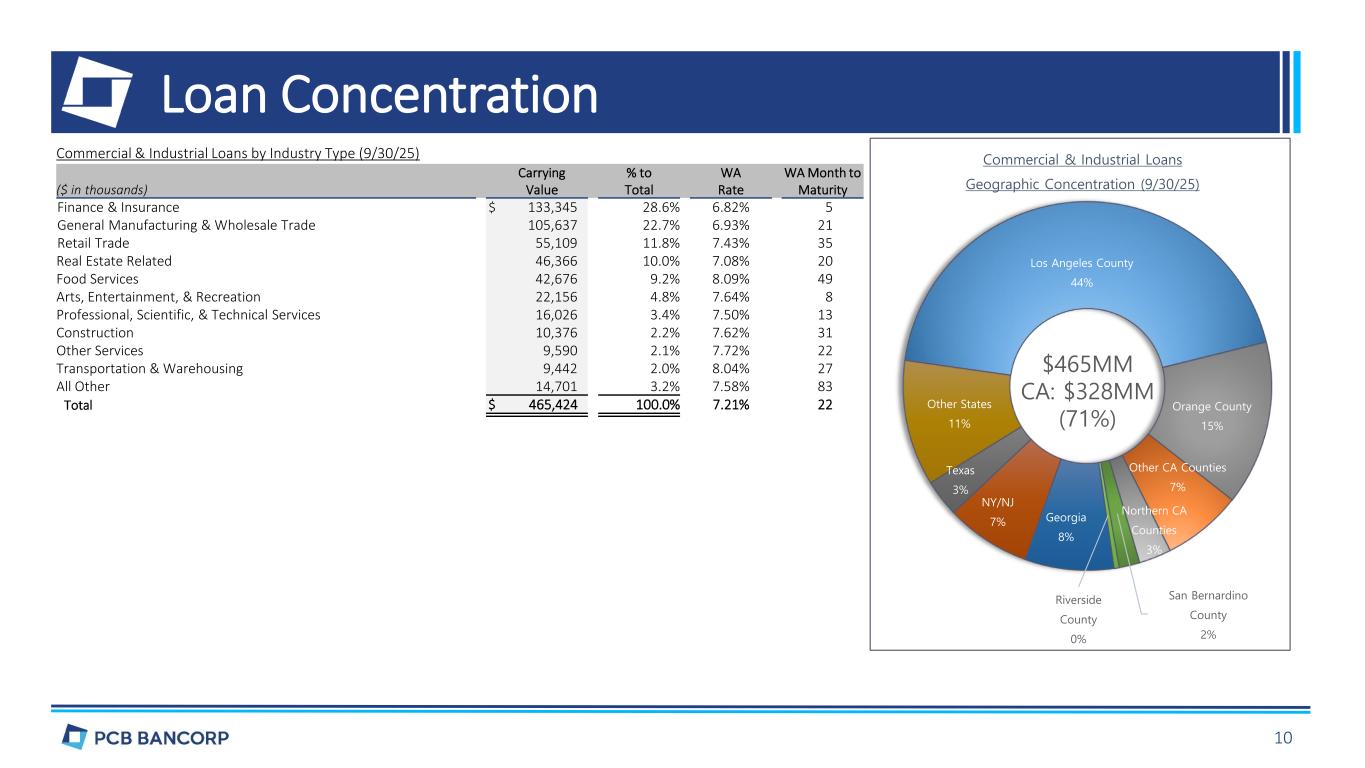

| Commercial and industrial | 465,424 | 492,857 | (5.6) | % | 472,763 | (1.6) | % | 407,024 | 14.3 | % | ||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 401,653 | 406,682 | (1.2) | % | 392,456 | 2.3 | % | 383,377 | 4.8 | % | ||||||||||||||||||||||||||||||||||

| Other consumer | 7,867 | 9,310 | (15.5) | % | 11,616 | (32.3) | % | 14,853 | (47.0) | % | ||||||||||||||||||||||||||||||||||

| Total consumer | 409,520 | 415,992 | (1.6) | % | 404,072 | 1.3 | % | 398,230 | 2.8 | % | ||||||||||||||||||||||||||||||||||

| Loans held-for-investment | 2,752,514 | 2,795,309 | (1.5) | % | 2,629,387 | 4.7 | % | 2,466,174 | 11.6 | % | ||||||||||||||||||||||||||||||||||

| Loans held-for-sale | 9,634 | 8,133 | 18.5 | % | 6,292 | 53.1 | % | 5,170 | 86.3 | % | ||||||||||||||||||||||||||||||||||

Total loans |

$ | 2,762,148 | $ | 2,803,442 | (1.5) | % | $ | 2,635,679 | 4.8 | % | $ | 2,471,344 | 11.8 | % | ||||||||||||||||||||||||||||||

| SBA loans included in: | ||||||||||||||||||||||||||||||||||||||||||||

| Loans held-for-investment | $ | 151,766 | $ | 150,688 | 0.7 | % | $ | 146,940 | 3.3 | % | $ | 142,819 | 6.3 | % | ||||||||||||||||||||||||||||||

| Loans held-for-sale | $ | 9,634 | $ | 8,133 | 18.5 | % | $ | 6,292 | 53.1 | % | $ | 5,170 | 86.3 | % | ||||||||||||||||||||||||||||||

| ACL on loans | $ | 32,960 | $ | 33,554 | (1.8) | % | $ | 30,628 | 7.6 | % | $ | 28,930 | 13.9 | % | ||||||||||||||||||||||||||||||

| ACL on loans to loans held-for-investment | 1.20 | % | 1.20 | % | 1.16 | % | 1.17 | % | ||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 12/31/2024 | % Change | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||

| Commercial property | $ | 13,772 | $ | 10,851 | 26.9 | % | $ | 8,888 | 55.0 | % | $ | 3,291 | 318.5 | % | ||||||||||||||||||||||||||||||

| Business property | 10,740 | 10,364 | 3.6 | % | 11,058 | (2.9) | % | 12,441 | (13.7) | % | ||||||||||||||||||||||||||||||||||

| Construction | 7,688 | 8,985 | (14.4) | % | 14,423 | (46.7) | % | 17,810 | (56.8) | % | ||||||||||||||||||||||||||||||||||

| Commercial and industrial | 373,560 | 342,467 | 9.1 | % | 364,731 | 2.4 | % | 394,428 | (5.3) | % | ||||||||||||||||||||||||||||||||||

| Other consumer | 1,357 | 2,274 | (40.3) | % | 1,475 | (8.0) | % | 5,590 | (75.7) | % | ||||||||||||||||||||||||||||||||||

| Total commitments to extend credit | 407,117 | 374,941 | 8.6 | % | 400,575 | 1.6 | % | 433,560 | (6.1) | % | ||||||||||||||||||||||||||||||||||

| Letters of credit | 7,074 | 7,418 | (4.6) | % | 6,795 | 4.1 | % | 6,673 | 6.0 | % | ||||||||||||||||||||||||||||||||||

| Total off-balance sheet credit exposure | $ | 414,191 | $ | 382,359 | 8.3 | % | $ | 407,370 | 1.7 | % | $ | 440,233 | (5.9) | % | ||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 12/31/2024 | % Change | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||

| Nonaccrual loans | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate: | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial property | $ | 1,448 | $ | 1,497 | (3.3) | % | $ | 1,851 | (21.8) | % | $ | 1,633 | (11.3) | % | ||||||||||||||||||||||||||||||

| Business property | 962 | 1,654 | (41.8) | % | 2,336 | (58.8) | % | 2,367 | (59.4) | % | ||||||||||||||||||||||||||||||||||

| Multifamily | — | — | — | % | — | — | % | 2,038 | (100.0) | % | ||||||||||||||||||||||||||||||||||

| Total commercial real estate | 2,410 | 3,151 | (23.5) | % | 4,187 | (42.4) | % | 6,038 | (60.1) | % | ||||||||||||||||||||||||||||||||||

| Commercial and industrial | 378 | 255 | 48.2 | % | 79 | 378.5 | % | 124 | 204.8 | % | ||||||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 5,370 | 5,526 | (2.8) | % | 403 | 1,232.5 | % | 414 | 1,197.1 | % | ||||||||||||||||||||||||||||||||||

| Other consumer | — | — | — | % | 24 | (100.0) | % | 38 | (100.0) | % | ||||||||||||||||||||||||||||||||||

| Total consumer | 5,370 | 5,526 | (2.8) | % | 427 | 1,157.6 | % | 452 | 1,088.1 | % | ||||||||||||||||||||||||||||||||||

Total nonaccrual loans held-for-investment |

8,158 | 8,932 | (8.7) | % | 4,693 | 73.8 | % | 6,614 | 23.3 | % | ||||||||||||||||||||||||||||||||||

Loans past due 90 days or more and still accruing |

— | — | — | % | — | — | % | — | — | % | ||||||||||||||||||||||||||||||||||

| Non-performing loans (“NPLs”) | 8,158 | 8,932 | (8.7) | % | 4,693 | 73.8 | % | 6,614 | 23.3 | % | ||||||||||||||||||||||||||||||||||

| NPLs held-for-sale | — | — | — | % | — | — | % | — | — | % | ||||||||||||||||||||||||||||||||||

| Total NPLs | 8,158 | 8,932 | (8.7) | % | 4,693 | 73.8 | % | 6,614 | 23.3 | % | ||||||||||||||||||||||||||||||||||

Other real estate owned (“OREO”) |

— | — | — | % | — | — | % | 466 | (100.0) | % | ||||||||||||||||||||||||||||||||||

Non-performing assets (“NPAs”) |

$ | 8,158 | $ | 8,932 | (8.7) | % | $ | 4,693 | 73.8 | % | $ | 7,080 | 15.2 | % | ||||||||||||||||||||||||||||||

| Loans past due and still accruing | ||||||||||||||||||||||||||||||||||||||||||||

Past due 30 to 59 days |

$ | 1,548 | $ | 2,327 | (33.5) | % | $ | 4,599 | (66.3) | % | $ | 2,973 | (47.9) | % | ||||||||||||||||||||||||||||||

Past due 60 to 89 days |

— | 226 | (100.0) | % | 303 | (100.0) | % | 21 | (100.0) | % | ||||||||||||||||||||||||||||||||||

Past due 90 days or more |

— | — | — | % | — | — | % | — | — | % | ||||||||||||||||||||||||||||||||||

Total loans past due and still accruing |

$ | 1,548 | $ | 2,553 | (39.4) | % | 4,902 | (68.4) | % | $ | 2,994 | (48.3) | % | |||||||||||||||||||||||||||||||

| Special mention loans | $ | 6,477 | $ | 6,838 | (5.3) | % | $ | 5,034 | 28.7 | % | $ | 5,057 | 28.1 | % | ||||||||||||||||||||||||||||||

Classified assets |

||||||||||||||||||||||||||||||||||||||||||||

| Classified loans held-for-investment | $ | 10,172 | $ | 16,433 | (38.1) | % | $ | 6,930 | 46.8 | % | $ | 8,860 | 14.8 | % | ||||||||||||||||||||||||||||||

| Classified loans held-for-sale | — | — | — | % | — | — | % | — | — | % | ||||||||||||||||||||||||||||||||||

OREO |

— | — | — | % | — | — | % | 466 | (100.0) | % | ||||||||||||||||||||||||||||||||||

Classified assets |

$ | 10,172 | $ | 16,433 | (38.1) | % | $ | 6,930 | 46.8 | % | $ | 9,326 | 9.1 | % | ||||||||||||||||||||||||||||||

| NPLs to loans held-for-investment | 0.30 | % | 0.32 | % | 0.18 | % | 0.27 | % | ||||||||||||||||||||||||||||||||||||

NPAs to total assets |

0.24 | % | 0.27 | % | 0.15 | % | 0.24 | % | ||||||||||||||||||||||||||||||||||||

Classified assets to total assets |

0.30 | % | 0.50 | % | 0.23 | % | 0.32 | % | ||||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 6/30/2025 | % Change | 9/30/2024 | % Change | 9/30/2025 | 9/30/2024 | % Change | ||||||||||||||||||||||||||||||||||||||||||

| ACL on loans | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 33,554 | $ | 31,942 | 5.0 | % | $ | 28,747 | 16.7 | % | $ | 30,628 | $ | 27,533 | 11.2 | % | ||||||||||||||||||||||||||||||||||

| Charge-offs | (454) | (120) | 278.3 | % | (111) | 309.0 | % | (927) | (296) | 213.2 | % | |||||||||||||||||||||||||||||||||||||||

| Recoveries | 288 | 11 | 2,518.2 | % | 101 | 185.1 | % | 375 | 249 | 50.6 | % | |||||||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses on loans | (428) | 1,721 | NA | 193 | NA | 2,884 | 1,444 | 99.7 | % | |||||||||||||||||||||||||||||||||||||||||

| Balance at end of period | $ | 32,960 | $ | 33,554 | (1.8) | % | $ | 28,930 | 13.9 | % | $ | 32,960 | $ | 28,930 | 13.9 | % | ||||||||||||||||||||||||||||||||||

| ACL on off-balance sheet credit exposure | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at beginning of period | $ | 1,263 | $ | 1,197 | 5.5 | % | $ | 1,375 | (8.1) | % | $ | 1,190 | $ | 1,277 | (6.8) | % | ||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses on off-balance sheet credit exposure | 47 | 66 | (28.8) | % | (143) | NA | 120 | (45) | NA | |||||||||||||||||||||||||||||||||||||||||

| Balance at end of period | $ | 1,310 | $ | 1,263 | 3.7 | % | $ | 1,232 | 6.3 | % | $ | 1,310 | $ | 1,232 | 6.3 | % | ||||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | 12/31/2024 | 9/30/2024 | |||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Amount | % to Total | Amount | % to Total | Amount | % to Total | Amount | % to Total | ||||||||||||||||||||||||||||||||||||||||||

Noninterest-bearing demand deposits |

$ | 551,312 | 18.9 | % | $ | 575,905 | 20.4 | % | $ | 547,853 | 20.9 | % | $ | 540,068 | 22.0 | % | ||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||

Savings |

5,287 | 0.2 | % | 5,695 | 0.2 | % | 5,765 | 0.2 | % | 5,718 | 0.2 | % | ||||||||||||||||||||||||||||||||||||||

NOW |

13,411 | 0.5 | % | 12,765 | 0.5 | % | 13,761 | 0.5 | % | 15,873 | 0.6 | % | ||||||||||||||||||||||||||||||||||||||

Retail money market accounts |

650,675 | 22.2 | % | 533,032 | 18.7 | % | 447,360 | 17.1 | % | 470,347 | 19.1 | % | ||||||||||||||||||||||||||||||||||||||

Brokered money market accounts |

1 | 0.1 | % | 1 | 0.1 | % | 1 | 0.1 | % | 1 | 0.1 | % | ||||||||||||||||||||||||||||||||||||||

| Retail time deposits of | ||||||||||||||||||||||||||||||||||||||||||||||||||

$250,000 or less |

580,300 | 19.9 | % | 555,357 | 19.7 | % | 493,644 | 18.9 | % | 492,430 | 20.0 | % | ||||||||||||||||||||||||||||||||||||||

More than $250,000 |

671,516 | 23.1 | % | 649,160 | 23.0 | % | 605,124 | 23.1 | % | 580,166 | 23.6 | % | ||||||||||||||||||||||||||||||||||||||

State and brokered time deposits |

441,000 | 15.1 | % | 491,000 | 17.4 | % | 502,283 | 19.2 | % | 355,079 | 14.4 | % | ||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits |

2,362,190 | 81.1 | % | 2,247,010 | 79.6 | % | 2,067,938 | 79.1 | % | 1,919,614 | 78.0 | % | ||||||||||||||||||||||||||||||||||||||

Total deposits |

$ | 2,913,502 | 100.0 | % | $ | 2,822,915 | 100.0 | % | $ | 2,615,791 | 100.0 | % | $ | 2,459,682 | 100.0 | % | ||||||||||||||||||||||||||||||||||

| Estimated total deposits not covered by deposit insurance | $ | 1,275,127 | 43.8 | % | $ | 1,164,592 | 41.3 | % | $ | 1,036,451 | 39.6 | % | $ | 1,042,366 | 42.4 | % | ||||||||||||||||||||||||||||||||||

| ($ in thousands) | 9/30/2025 | 12/31/2024 | % Change | |||||||||||||||||

Cash and cash equivalents |

$ | 369,498 | $ | 198,792 | 85.9 | % | ||||||||||||||

Cash and cash equivalents to total assets |

11.0 | % | 6.5 | % | ||||||||||||||||

| Available borrowing capacity | ||||||||||||||||||||

FHLB advances |

$ | 826,136 | $ | 722,439 | 14.4 | % | ||||||||||||||

Federal Reserve Discount Window |

808,651 | 586,525 | 37.9 | % | ||||||||||||||||

Overnight federal funds lines |

65,000 | 50,000 | 30.0 | % | ||||||||||||||||

Total |

$ | 1,699,787 | $ | 1,358,964 | 25.1 | % | ||||||||||||||

Total available borrowing capacity to total assets |

50.5 | % | 44.4 | % | ||||||||||||||||

| 9/30/2025 | 6/30/2025 | 12/31/2024 | 9/30/2024 | Well Capitalized Minimum Requirements | ||||||||||||||||||||||||||||

PCB Bancorp |

||||||||||||||||||||||||||||||||

Common tier 1 capital (to risk-weighted assets) |

11.52 | % | 11.14 | % | 11.44 | % | 11.92 | % | 6.50 | % | ||||||||||||||||||||||

Total capital (to risk-weighted assets) |

15.24 | % | 14.84 | % | 15.24 | % | 15.88 | % | 10.00 | % | ||||||||||||||||||||||

Tier 1 capital (to risk-weighted assets) |

14.00 | % | 13.60 | % | 14.04 | % | 14.68 | % | 8.00 | % | ||||||||||||||||||||||

Tier 1 capital (to average assets) |

11.57 | % | 11.81 | % | 12.45 | % | 12.79 | % | 5.00 | % | ||||||||||||||||||||||

| PCB Bank | ||||||||||||||||||||||||||||||||

Common tier 1 capital (to risk-weighted assets) |

13.61 | % | 13.23 | % | 13.72 | % | 14.33 | % | 6.5 | % | ||||||||||||||||||||||

Total capital (to risk-weighted assets) |

14.85 | % | 14.47 | % | 14.92 | % | 15.54 | % | 10.0 | % | ||||||||||||||||||||||

Tier 1 capital (to risk-weighted assets) |

13.61 | % | 13.23 | % | 13.72 | % | 14.33 | % | 8.0 | % | ||||||||||||||||||||||

Tier 1 capital (to average assets) |

11.25 | % | 11.50 | % | 12.16 | % | 12.49 | % | 5.0 | % | ||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | % Change | 12/31/2024 | % Change | 9/30/2024 | % Change | ||||||||||||||||||||||||||||||||||||||

Assets |

||||||||||||||||||||||||||||||||||||||||||||

Cash and due from banks |

$ | 24,366 | $ | 41,614 | (41.4) | % | $ | 27,100 | (10.1) | % | $ | 29,981 | (18.7) | % | ||||||||||||||||||||||||||||||

| Interest-bearing deposits in other financial institutions | 345,132 | 221,953 | 55.5 | % | 171,692 | 101.0 | % | 163,083 | 111.6 | % | ||||||||||||||||||||||||||||||||||

Total cash and cash equivalents |

369,498 | 263,567 | 40.2 | % | 198,792 | 85.9 | % | 193,064 | 91.4 | % | ||||||||||||||||||||||||||||||||||

Securities available-for-sale, at fair value |

150,279 | 154,620 | (2.8) | % | 146,349 | 2.7 | % | 147,635 | 1.8 | % | ||||||||||||||||||||||||||||||||||

Loans held-for-sale |

9,634 | 8,133 | 18.5 | % | 6,292 | 53.1 | % | 5,170 | 86.3 | % | ||||||||||||||||||||||||||||||||||

| Loans held-for-investment | 2,752,514 | 2,795,309 | (1.5) | % | 2,629,387 | 4.7 | % | 2,466,174 | 11.6 | % | ||||||||||||||||||||||||||||||||||

| Allowance for credit losses on loans | (32,960) | (33,554) | (1.8) | % | (30,628) | 7.6 | % | (28,930) | 13.9 | % | ||||||||||||||||||||||||||||||||||

Net loans held-for-investment |

2,719,554 | 2,761,755 | (1.5) | % | 2,598,759 | 4.6 | % | 2,437,244 | 11.6 | % | ||||||||||||||||||||||||||||||||||

Premises and equipment, net |

8,604 | 8,942 | (3.8) | % | 8,280 | 3.9 | % | 8,414 | 2.3 | % | ||||||||||||||||||||||||||||||||||

Federal Home Loan Bank and other bank stock |

14,978 | 14,978 | — | % | 14,042 | 6.7 | % | 14,042 | 6.7 | % | ||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 32,525 | 32,266 | 0.8 | % | 31,766 | 2.4 | % | 31,520 | 3.2 | % | ||||||||||||||||||||||||||||||||||

Deferred tax assets, net |

7,164 | 7,032 | 1.9 | % | 7,249 | (1.2) | % | — | NA | |||||||||||||||||||||||||||||||||||

Servicing assets |

5,883 | 5,756 | 2.2 | % | 5,837 | 0.8 | % | 5,902 | (0.3) | % | ||||||||||||||||||||||||||||||||||

Operating lease assets |

17,136 | 17,861 | (4.1) | % | 17,254 | (0.7) | % | 17,932 | (4.4) | % | ||||||||||||||||||||||||||||||||||

Accrued interest receivable |

10,829 | 10,879 | (0.5) | % | 10,466 | 3.5 | % | 9,896 | 9.4 | % | ||||||||||||||||||||||||||||||||||

Other assets |

17,422 | 19,800 | (12.0) | % | 18,885 | (7.7) | % | 18,548 | (6.1) | % | ||||||||||||||||||||||||||||||||||

Total assets |

$ | 3,363,506 | $ | 3,305,589 | 1.8 | % | $ | 3,063,971 | 9.8 | % | $ | 2,889,833 | 16.4 | % | ||||||||||||||||||||||||||||||

Liabilities |

||||||||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||||||||

Noninterest-bearing demand |

$ | 551,312 | $ | 575,905 | (4.3) | % | $ | 547,853 | 0.6 | % | $ | 540,068 | 2.1 | % | ||||||||||||||||||||||||||||||

Savings, NOW and money market accounts |

669,374 | 551,493 | 21.4 | % | 466,887 | 43.4 | % | 491,939 | 36.1 | % | ||||||||||||||||||||||||||||||||||

Time deposits of $250,000 or less |

961,299 | 986,357 | (2.5) | % | 935,927 | 2.7 | % | 787,509 | 22.1 | % | ||||||||||||||||||||||||||||||||||

Time deposits of more than $250,000 |

731,517 | 709,160 | 3.2 | % | 665,124 | 10.0 | % | 640,166 | 14.3 | % | ||||||||||||||||||||||||||||||||||

Total deposits |

2,913,502 | 2,822,915 | 3.2 | % | 2,615,791 | 11.4 | % | 2,459,682 | 18.5 | % | ||||||||||||||||||||||||||||||||||

| Other short-term borrowings | — | — | — | % | 15,000 | (100.0) | % | — | — | % | ||||||||||||||||||||||||||||||||||

Federal Home Loan Bank advances |

— | 45,000 | (100.0) | % | — | — | % | — | — | % | ||||||||||||||||||||||||||||||||||

| Deferred tax liabilities, net | — | — | — | % | — | — | % | 1,168 | (100.0) | % | ||||||||||||||||||||||||||||||||||

Operating lease liabilities |

18,961 | 19,652 | (3.5) | % | 18,671 | 1.6 | % | 19,301 | (1.8) | % | ||||||||||||||||||||||||||||||||||

Accrued interest payable and other liabilities |

46,542 | 41,522 | 12.1 | % | 50,695 | (8.2) | % | 47,382 | (1.8) | % | ||||||||||||||||||||||||||||||||||

Total liabilities |

2,979,005 | 2,929,089 | 1.7 | % | 2,700,157 | 10.3 | % | 2,527,533 | 17.9 | % | ||||||||||||||||||||||||||||||||||

Commitments and contingent liabilities |

||||||||||||||||||||||||||||||||||||||||||||

Shareholders’ equity |

||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock | 69,141 | 69,141 | — | % | 69,141 | — | % | 69,141 | — | % | ||||||||||||||||||||||||||||||||||

| Common stock | 140,580 | 142,152 | (1.1) | % | 143,195 | (1.8) | % | 142,926 | (1.6) | % | ||||||||||||||||||||||||||||||||||

Retained earnings |

180,189 | 171,735 | 4.9 | % | 160,797 | 12.1 | % | 156,680 | 15.0 | % | ||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (5,409) | (6,528) | (17.1) | % | (9,319) | (42.0) | % | (6,447) | (16.1) | % | ||||||||||||||||||||||||||||||||||

Total shareholders’ equity |

384,501 | 376,500 | 2.1 | % | 363,814 | 5.7 | % | 362,300 | 6.1 | % | ||||||||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity |

$ | 3,363,506 | $ | 3,305,589 | 1.8 | % | $ | 3,063,971 | 9.8 | % | $ | 2,889,833 | 16.4 | % | ||||||||||||||||||||||||||||||

Outstanding common shares |

14,277,164 | 14,336,602 | 14,380,651 | 14,266,725 | ||||||||||||||||||||||||||||||||||||||||

Book value per common share (1) |

$ | 26.93 | $ | 26.26 | $ | 25.30 | $ | 25.39 | ||||||||||||||||||||||||||||||||||||

TCE per common share (2) |

$ | 22.09 | $ | 21.44 | $ | 20.49 | $ | 20.55 | ||||||||||||||||||||||||||||||||||||

Total loan to total deposit ratio |

94.81 | % | 99.31 | % | 100.76 | % | 100.47 | % | ||||||||||||||||||||||||||||||||||||

Noninterest-bearing deposits to total deposits |

18.92 | % | 20.40 | % | 20.94 | % | 21.96 | % | ||||||||||||||||||||||||||||||||||||

Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | % Change | 9/30/2024 | % Change | 9/30/2025 | 9/30/2024 | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Interest and dividend income | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 46,193 | $ | 45,478 | 1.6 | % | $ | 42,115 | 9.7 | % | $ | 134,697 | $ | 121,992 | 10.4 | % | ||||||||||||||||||||||||||||||||||

| Investment securities | 1,474 | 1,462 | 0.8 | % | 1,384 | 6.5 | % | 4,344 | 3,940 | 10.3 | % | |||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 3,804 | 2,368 | 60.6 | % | 2,499 | 52.2 | % | 8,630 | 8,566 | 0.7 | % | |||||||||||||||||||||||||||||||||||||||

| Total interest income | 51,471 | 49,308 | 4.4 | % | 45,998 | 11.9 | % | 147,671 | 134,498 | 9.8 | % | |||||||||||||||||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | 23,995 | 22,505 | 6.6 | % | 23,057 | 4.1 | % | 69,064 | 67,560 | 2.2 | % | |||||||||||||||||||||||||||||||||||||||

| Other borrowings | 498 | 813 | (38.7) | % | 222 | 124.3 | % | 1,356 | 1,485 | (8.7) | % | |||||||||||||||||||||||||||||||||||||||

Total interest expense |

24,493 | 23,318 | 5.0 | % | 23,279 | 5.2 | % | 70,420 | 69,045 | 2.0 | % | |||||||||||||||||||||||||||||||||||||||

Net interest income |

26,978 | 25,990 | 3.8 | % | 22,719 | 18.7 | % | 77,251 | 65,453 | 18.0 | % | |||||||||||||||||||||||||||||||||||||||

| Provision (reversal) for credit losses | (381) | 1,787 | NA | 50 | NA | 3,004 | 1,399 | 114.7 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest income after provision (reversal) for credit losses | 27,359 | 24,203 | 13.0 | % | 22,669 | 20.7 | % | 74,247 | 64,054 | 15.9 | % | |||||||||||||||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||||||||||||||||||||

Gain on sale of loans |

1,617 | 1,465 | 10.4 | % | 750 | 115.6 | % | 3,969 | 2,591 | 53.2 | % | |||||||||||||||||||||||||||||||||||||||

Service charges and fees on deposits |

377 | 375 | 0.5 | % | 399 | (5.5) | % | 1,124 | 1,141 | (1.5) | % | |||||||||||||||||||||||||||||||||||||||

Loan servicing income |

719 | 760 | (5.4) | % | 786 | (8.5) | % | 2,204 | 2,504 | (12.0) | % | |||||||||||||||||||||||||||||||||||||||

| BOLI income | 259 | 253 | 2.4 | % | 239 | 8.4 | % | 759 | 703 | 8.0 | % | |||||||||||||||||||||||||||||||||||||||

Other income |

442 | 444 | (0.5) | % | 446 | (0.9) | % | 1,235 | 1,111 | 11.2 | % | |||||||||||||||||||||||||||||||||||||||

Total noninterest income |

3,414 | 3,297 | 3.5 | % | 2,620 | 30.3 | % | 9,291 | 8,050 | 15.4 | % | |||||||||||||||||||||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||||||||||||||||||||||||||

Salaries and employee benefits |

9,293 | 8,844 | 5.1 | % | 8,801 | 5.6 | % | 27,212 | 27,244 | (0.1) | % | |||||||||||||||||||||||||||||||||||||||

Occupancy and equipment |

2,372 | 2,379 | (0.3) | % | 2,261 | 4.9 | % | 7,040 | 6,919 | 1.7 | % | |||||||||||||||||||||||||||||||||||||||

Professional fees |

541 | 805 | (32.8) | % | 599 | (9.7) | % | 1,974 | 2,656 | (25.7) | % | |||||||||||||||||||||||||||||||||||||||

| Marketing and business promotion | 669 | 597 | 12.1 | % | 667 | 0.3 | % | 1,509 | 1,304 | 15.7 | % | |||||||||||||||||||||||||||||||||||||||

Data processing |

333 | 317 | 5.0 | % | 397 | (16.1) | % | 983 | 1,294 | (24.0) | % | |||||||||||||||||||||||||||||||||||||||

Director fees and expenses |

223 | 225 | (0.9) | % | 226 | (1.3) | % | 674 | 679 | (0.7) | % | |||||||||||||||||||||||||||||||||||||||

Regulatory assessments |

373 | 358 | 4.2 | % | 309 | 20.7 | % | 1,075 | 934 | 15.1 | % | |||||||||||||||||||||||||||||||||||||||

| Other expense | 1,065 | 1,304 | (18.3) | % | 1,342 | (20.6) | % | 3,705 | 5,099 | (27.3) | % | |||||||||||||||||||||||||||||||||||||||

Total noninterest expense |

14,869 | 14,829 | 0.3 | % | 14,602 | 1.8 | % | 44,172 | 46,129 | (4.2) | % | |||||||||||||||||||||||||||||||||||||||

Income before income taxes |

15,904 | 12,671 | 25.5 | % | 10,687 | 48.8 | % | 39,366 | 25,975 | 51.6 | % | |||||||||||||||||||||||||||||||||||||||

Income tax expense |

4,492 | 3,600 | 24.8 | % | 2,873 | 56.4 | % | 11,148 | 7,195 | 54.9 | % | |||||||||||||||||||||||||||||||||||||||

Net income |

11,412 | 9,071 | 25.8 | % | 7,814 | 46.0 | % | 28,218 | 18,780 | 50.3 | % | |||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 86 | 87 | (1.1) | % | 346 | (75.1) | % | 213 | 488 | (56.4) | % | |||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 11,326 | $ | 8,984 | 26.1 | % | $ | 7,468 | 51.7 | % | $ | 28,005 | $ | 18,292 | 53.1 | % | ||||||||||||||||||||||||||||||||||

Earnings per common share |

||||||||||||||||||||||||||||||||||||||||||||||||||

Basic |

$ | 0.79 | $ | 0.63 | $ | 0.52 | $ | 1.95 | $ | 1.28 | ||||||||||||||||||||||||||||||||||||||||

Diluted |

$ | 0.78 | $ | 0.62 | $ | 0.52 | $ | 1.94 | $ | 1.27 | ||||||||||||||||||||||||||||||||||||||||

Average common shares |

||||||||||||||||||||||||||||||||||||||||||||||||||

Basic |

14,201,054 | 14,213,032 | 14,241,014 | 14,228,524 | 14,237,851 | |||||||||||||||||||||||||||||||||||||||||||||

Diluted |

14,325,956 | 14,326,011 | 14,356,384 | 14,354,284 | 14,328,510 | |||||||||||||||||||||||||||||||||||||||||||||

Dividend paid per common share |

$ | 0.20 | $ | 0.20 | $ | 0.18 | $ | 0.60 | $ | 0.54 | ||||||||||||||||||||||||||||||||||||||||

ROAA (1) |

1.35 | % | 1.13 | % | 1.08 | % | 1.17 | % | 0.88 | % | ||||||||||||||||||||||||||||||||||||||||

ROAE (1) |

11.92 | % | 9.76 | % | 8.70 | % | 10.10 | % | 7.11 | % | ||||||||||||||||||||||||||||||||||||||||

ROATCE (1), (2) |

14.46 | % | 11.87 | % | 10.31 | % | 12.30 | % | 8.61 | % | ||||||||||||||||||||||||||||||||||||||||

Efficiency ratio (3) |

48.92 | % | 50.63 | % | 57.63 | % | 51.04 | % | 62.76 | % | ||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | 9/30/2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest Income/ Expense | Avg. Yield/Rate(6) |

Average Balance | Interest Income/ Expense | Avg. Yield/Rate(6) |

Average Balance | Interest Income/ Expense | Avg. Yield/Rate(6) |

||||||||||||||||||||||||||||||||||||||||||||||||

Assets |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total loans (1) |

$ | 2,784,148 | $ | 46,193 | 6.58 | % | $ | 2,782,200 | $ | 45,478 | 6.56 | % | $ | 2,456,015 | $ | 42,115 | 6.82 | % | ||||||||||||||||||||||||||||||||||||||

Mortgage-backed securities |

120,226 | 1,167 | 3.85 | % | 117,987 | 1,145 | 3.89 | % | 111,350 | 1,000 | 3.57 | % | ||||||||||||||||||||||||||||||||||||||||||||

Collateralized mortgage obligation |

19,957 | 197 | 3.92 | % | 20,616 | 203 | 3.95 | % | 22,661 | 244 | 4.28 | % | ||||||||||||||||||||||||||||||||||||||||||||

SBA loan pool securities |

4,686 | 41 | 3.47 | % | 5,368 | 46 | 3.44 | % | 6,571 | 69 | 4.18 | % | ||||||||||||||||||||||||||||||||||||||||||||

Municipal bonds (2) |

2,411 | 22 | 3.62 | % | 2,379 | 21 | 3.54 | % | 2,698 | 24 | 3.54 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Corporate bonds | 4,804 | 47 | 3.88 | % | 4,705 | 47 | 4.01 | % | 4,248 | 47 | 4.40 | % | ||||||||||||||||||||||||||||||||||||||||||||

Other interest-earning assets |

327,637 | 3,804 | 4.61 | % | 200,875 | 2,368 | 4.73 | % | 175,711 | 2,499 | 5.66 | % | ||||||||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

3,263,869 | 51,471 | 6.26 | % | 3,134,130 | 49,308 | 6.31 | % | 2,779,254 | 45,998 | 6.58 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 23,539 | 23,267 | 24,098 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ACL on loans | (33,548) | (31,932) | (28,797) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Other assets |

100,728 | 100,930 | 92,152 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total noninterest-earning assets |

90,719 | 92,265 | 87,453 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total assets |

$ | 3,354,588 | $ | 3,226,395 | $ | 2,866,707 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NOW and money market accounts |

$ | 612,527 | 5,698 | 3.69 | % | $ | 532,842 | 4,772 | 3.59 | % | $ | 496,158 | 5,129 | 4.11 | % | |||||||||||||||||||||||||||||||||||||||||

Savings |

5,519 | 3 | 0.22 | % | 5,334 | 4 | 0.30 | % | 6,204 | 4 | 0.26 | % | ||||||||||||||||||||||||||||||||||||||||||||

Time deposits |

1,708,124 | 18,294 | 4.25 | % | 1,649,034 | 17,729 | 4.31 | % | 1,390,644 | 17,924 | 5.13 | % | ||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits |

2,326,170 | 23,995 | 4.09 | % | 2,187,210 | 22,505 | 4.13 | % | 1,893,006 | 23,057 | 4.85 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 43,109 | 498 | 4.58 | % | 71,286 | 813 | 4.57 | % | 15,848 | 222 | 5.57 | % | ||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing liabilities |

2,369,279 | 24,493 | 4.10 | % | 2,258,496 | 23,318 | 4.14 | % | 1,908,854 | 23,279 | 4.85 | % | ||||||||||||||||||||||||||||||||||||||||||||

Noninterest-bearing liabilities |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Noninterest-bearing demand |

541,243 | 533,530 | 534,761 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Other liabilities |

64,232 | 61,740 | 65,716 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total noninterest-bearing liabilities |

605,475 | 595,270 | 600,477 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities |

2,974,754 | 2,853,766 | 2,509,331 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total shareholders’ equity |

379,834 | 372,629 | 357,376 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity |

$ | 3,354,588 | $ | 3,226,395 | $ | 2,866,707 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income |

$ | 26,978 | $ | 25,990 | $ | 22,719 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread (3) |

2.16 | % | 2.17 | % | 1.73 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (4) |

3.28 | % | 3.33 | % | 3.25 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total deposits |

$ | 2,867,413 | $ | 23,995 | 3.32 | % | $ | 2,720,740 | $ | 22,505 | 3.32 | % | $ | 2,427,767 | $ | 23,057 | 3.78 | % | ||||||||||||||||||||||||||||||||||||||

Total funding (5) |

$ | 2,910,522 | $ | 24,493 | 3.34 | % | $ | 2,792,026 | $ | 23,318 | 3.35 | % | $ | 2,443,615 | $ | 23,279 | 3.79 | % | ||||||||||||||||||||||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||||||||||||||||

| 9/30/2025 | 9/30/2024 | |||||||||||||||||||||||||||||||||||||

| Average Balance | Interest Income/ Expense | Avg. Yield/Rate(6) |

Average Balance | Interest Income/ Expense | Avg. Yield/Rate(6) |

|||||||||||||||||||||||||||||||||

Assets |

||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||

Total loans (1) |

$ | 2,738,957 | $ | 134,697 | 6.58 | % | $ | 2,413,777 | $ | 121,992 | 6.75 | % | ||||||||||||||||||||||||||

Mortgage-backed securities |

117,040 | 3,387 | 3.87 | % | 105,933 | 2,750 | 3.47 | % | ||||||||||||||||||||||||||||||

Collateralized mortgage obligation |

20,530 | 610 | 3.97 | % | 23,137 | 747 | 4.31 | % | ||||||||||||||||||||||||||||||

SBA loan pool securities |

5,322 | 141 | 3.54 | % | 6,925 | 221 | 4.26 | % | ||||||||||||||||||||||||||||||

Municipal bonds (2) |

2,405 | 65 | 3.61 | % | 3,077 | 81 | 3.52 | % | ||||||||||||||||||||||||||||||

| Corporate bonds | 4,617 | 141 | 4.08 | % | 4,211 | 141 | 4.47 | % | ||||||||||||||||||||||||||||||

Other interest-earning assets |

246,396 | 8,630 | 4.68 | % | 201,951 | 8,566 | 5.67 | % | ||||||||||||||||||||||||||||||

Total interest-earning assets |

3,135,267 | 147,671 | 6.30 | % | 2,759,011 | 134,498 | 6.51 | % | ||||||||||||||||||||||||||||||

| Noninterest-earning assets | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 23,817 | 22,845 | ||||||||||||||||||||||||||||||||||||

| ACL on loans | (32,063) | (28,251) | ||||||||||||||||||||||||||||||||||||

Other assets |

100,101 | 89,784 | ||||||||||||||||||||||||||||||||||||

Total noninterest-earning assets |

91,855 | 84,378 | ||||||||||||||||||||||||||||||||||||

Total assets |

$ | 3,227,122 | $ | 2,843,389 | ||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||

NOW and money market accounts |

$ | 543,570 | 14,767 | 3.63 | % | $ | 474,584 | 14,670 | 4.13 | % | ||||||||||||||||||||||||||||

Savings |

5,488 | 10 | 0.24 | % | 6,432 | 12 | 0.25 | % | ||||||||||||||||||||||||||||||

Time deposits |

1,669,484 | 54,287 | 4.35 | % | 1,380,379 | 52,878 | 5.12 | % | ||||||||||||||||||||||||||||||

Total interest-bearing deposits |

2,218,542 | 69,064 | 4.16 | % | 1,861,395 | 67,560 | 4.85 | % | ||||||||||||||||||||||||||||||

| Other borrowings | 39,586 | 1,356 | 4.58 | % | 35,427 | 1,485 | 5.60 | % | ||||||||||||||||||||||||||||||

Total interest-bearing liabilities |

2,258,128 | 70,420 | 4.17 | % | 1,896,822 | 69,045 | 4.86 | % | ||||||||||||||||||||||||||||||

Noninterest-bearing liabilities |

||||||||||||||||||||||||||||||||||||||

Noninterest-bearing demand |

530,558 | 537,682 | ||||||||||||||||||||||||||||||||||||

Other liabilities |

64,997 | 56,019 | ||||||||||||||||||||||||||||||||||||

Total noninterest-bearing liabilities |

595,555 | 593,701 | ||||||||||||||||||||||||||||||||||||

Total liabilities |

2,853,683 | 2,490,523 | ||||||||||||||||||||||||||||||||||||

Total shareholders’ equity |

373,439 | 352,866 | ||||||||||||||||||||||||||||||||||||

Total liabilities and shareholders’ equity |

$ | 3,227,122 | $ | 2,843,389 | ||||||||||||||||||||||||||||||||||

Net interest income |

$ | 77,251 | $ | 65,453 | ||||||||||||||||||||||||||||||||||

Net interest spread (3) |

2.13 | % | 1.65 | % | ||||||||||||||||||||||||||||||||||

Net interest margin (4) |

3.29 | % | 3.17 | % | ||||||||||||||||||||||||||||||||||

Total deposits |

$ | 2,749,100 | $ | 69,064 | 3.36 | % | $ | 2,399,077 | $ | 67,560 | 3.76 | % | ||||||||||||||||||||||||||

Total funding (5) |

$ | 2,788,686 | $ | 70,420 | 3.38 | % | $ | 2,434,504 | $ | 69,045 | 3.79 | % | ||||||||||||||||||||||||||

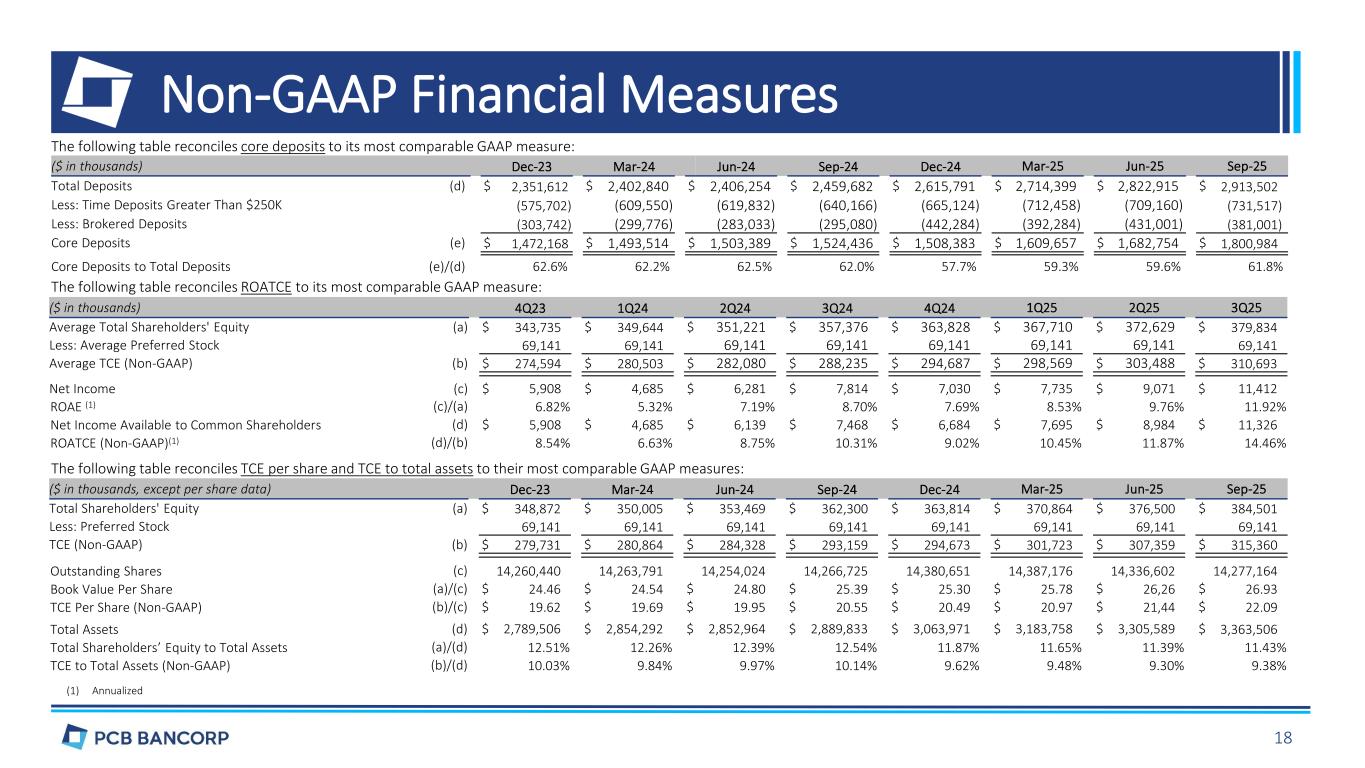

| ($ in thousands) | Three Months Ended |

Nine Months Ended | |||||||||||||||||||||||||||||||||

| 9/30/2025 | 6/30/2025 | 9/30/2024 | 9/30/2025 | 9/30/2024 | |||||||||||||||||||||||||||||||

| Average total shareholders' equity | (a) | $ | 379,834 | $ | 372,629 | $ | 357,376 | $ | 373,439 | $ | 352,866 | ||||||||||||||||||||||||

| Less: average preferred stock | (b) | 69,141 | 69,141 | 69,141 | 69,141 | 69,141 | |||||||||||||||||||||||||||||

| Average TCE | (c)=(a)-(b) | 310,693 | 303,488 | 288,235 | 304,298 | 283,725 | |||||||||||||||||||||||||||||

| Net income | (d) | $ | 11,412 | $ | 9,071 | $ | 7,814 | $ | 28,218 | $ | 18,780 | ||||||||||||||||||||||||

ROAE (1) |

(d)/(a) | 11.92 | % | 9.76 | % | 8.70 | % | 10.10 | % | 7.11 | % | ||||||||||||||||||||||||

| Net income available to common shareholders | (e) | 11,326 | 8,984 | 7,468 | 28,005 | 18,292 | |||||||||||||||||||||||||||||

ROATCE (1) |

(e)/(c) | 14.46 | % | 11.87 | % | 10.31 | % | 12.30 | % | 8.61 | % | ||||||||||||||||||||||||

| ($ in thousands, except per share data) | 9/30/2025 | 6/30/2025 | 12/31/2024 | 9/30/2024 | |||||||||||||||||||||||||

| Total shareholders' equity | (a) | $ | 384,501 | $ | 376,500 | $ | 363,814 | $ | 362,300 | ||||||||||||||||||||

| Less: preferred stock | (b) | 69,141 | 69,141 | 69,141 | 69,141 | ||||||||||||||||||||||||

| TCE | (c)=(a)-(b) | 315,360 | 307,359 | 294,673 | 293,159 | ||||||||||||||||||||||||

Outstanding common shares |

(d) | 14,277,164 | 14,336,602 | 14,380,651 | 14,266,725 | ||||||||||||||||||||||||

| Book value per common share | (a)/(d) | $ | 26.93 | $ | 26.26 | $ | 25.30 | $ | 25.39 | ||||||||||||||||||||

| TCE per common share | (c)/(d) | 22.09 | 21.44 | 20.49 | 20.55 | ||||||||||||||||||||||||

| Total assets | (e) | $ | 3,363,506 | $ | 3,305,589 | $ | 3,063,971 | $ | 2,889,833 | ||||||||||||||||||||

| Total shareholders' equity to total assets | (a)/(e) | 11.43 | % | 11.39 | % | 11.87 | % | 12.54 | % | ||||||||||||||||||||

| TCE to total assets | (c)/(e) | 9.38 | % | 9.30 | % | 9.62 | % | 10.14 | % | ||||||||||||||||||||