0001421461false2023FYP1YP4YP1YP5Yhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#OperatingLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#FinanceLeaseLiabilityNoncurrenthttp://fasb.org/us-gaap/2023#FinanceLeaseLiabilityNoncurrent00014214612023-01-012023-12-3100014214612023-06-30iso4217:USD00014214612024-02-29xbrli:shares0001421461ipi:TrioMember2023-10-012023-12-3100014214612023-12-3100014214612022-12-31iso4217:USDxbrli:shares0001421461us-gaap:MineralMember2023-01-012023-12-310001421461us-gaap:MineralMember2022-01-012022-12-310001421461us-gaap:MineralMember2021-01-012021-12-310001421461us-gaap:CargoAndFreightMember2023-01-012023-12-310001421461us-gaap:CargoAndFreightMember2022-01-012022-12-310001421461us-gaap:CargoAndFreightMember2021-01-012021-12-310001421461ipi:WarehouseandHandlingMember2023-01-012023-12-310001421461ipi:WarehouseandHandlingMember2022-01-012022-12-310001421461ipi:WarehouseandHandlingMember2021-01-012021-12-3100014214612022-01-012022-12-3100014214612021-01-012021-12-310001421461us-gaap:CommonStockMember2020-12-310001421461us-gaap:AdditionalPaidInCapitalMember2020-12-310001421461us-gaap:RetainedEarningsMember2020-12-3100014214612020-12-310001421461us-gaap:RetainedEarningsMember2021-01-012021-12-310001421461us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001421461us-gaap:CommonStockMember2021-01-012021-12-310001421461us-gaap:CommonStockMember2021-12-310001421461us-gaap:AdditionalPaidInCapitalMember2021-12-310001421461us-gaap:RetainedEarningsMember2021-12-3100014214612021-12-310001421461us-gaap:RetainedEarningsMember2022-01-012022-12-310001421461us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001421461us-gaap:CommonStockMember2022-01-012022-12-310001421461us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001421461us-gaap:CommonStockMember2022-12-310001421461us-gaap:TreasuryStockCommonMember2022-12-310001421461us-gaap:AdditionalPaidInCapitalMember2022-12-310001421461us-gaap:RetainedEarningsMember2022-12-310001421461us-gaap:RetainedEarningsMember2023-01-012023-12-310001421461us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001421461us-gaap:CommonStockMember2023-01-012023-12-310001421461us-gaap:CommonStockMember2023-12-310001421461us-gaap:TreasuryStockCommonMember2023-12-310001421461us-gaap:AdditionalPaidInCapitalMember2023-12-310001421461us-gaap:RetainedEarningsMember2023-12-31ipi:Facilityipi:Reporting_Segments0001421461us-gaap:RestrictedStockMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMember2022-01-012022-12-310001421461us-gaap:RestrictedStockMember2021-01-012021-12-310001421461us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001421461us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001421461us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001421461us-gaap:LandMember2023-12-310001421461us-gaap:LandMember2022-12-310001421461us-gaap:LandImprovementsMember2023-12-310001421461us-gaap:LandImprovementsMember2022-12-310001421461us-gaap:MiningPropertiesAndMineralRightsMember2023-12-310001421461us-gaap:MiningPropertiesAndMineralRightsMember2022-12-310001421461us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001421461us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001421461us-gaap:MachineryAndEquipmentMember2023-12-310001421461us-gaap:MachineryAndEquipmentMember2022-12-310001421461us-gaap:VehiclesMember2023-12-310001421461us-gaap:VehiclesMember2022-12-310001421461us-gaap:OfficeEquipmentMember2023-12-310001421461us-gaap:OfficeEquipmentMember2022-12-310001421461ipi:RightOfUseAssetsMember2023-12-310001421461ipi:RightOfUseAssetsMember2022-12-310001421461us-gaap:BreedingAndProductionAnimalsMember2023-12-310001421461us-gaap:BreedingAndProductionAnimalsMember2022-12-310001421461us-gaap:ConstructionInProgressMember2023-12-310001421461us-gaap:ConstructionInProgressMember2022-12-310001421461ipi:WestFacilityMember2023-10-012023-12-310001421461ipi:OilFieldServicesMember2023-01-012023-12-310001421461srt:MinimumMember2023-12-310001421461srt:MaximumMember2023-12-31xbrli:pure00014214612019-05-012019-05-310001421461us-gaap:RoyaltyAgreementsMember2023-12-310001421461us-gaap:RoyaltyAgreementsMember2022-12-310001421461us-gaap:UseRightsMember2023-12-310001421461us-gaap:UseRightsMember2022-12-310001421461us-gaap:RevolvingCreditFacilityMember2022-07-310001421461us-gaap:RevolvingCreditFacilityMember2022-08-020001421461srt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001421461us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001421461us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001421461us-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001421461us-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001421461us-gaap:RevolvingCreditFacilityMember2023-12-310001421461us-gaap:RevolvingCreditFacilityMember2021-12-310001421461us-gaap:RevolvingCreditFacilityMember2022-12-310001421461ipi:PaycheckProtectionProgramLoanMember2020-04-012020-04-300001421461ipi:PaycheckProtectionProgramLoanMember2021-06-012021-06-300001421461ipi:SeriesBSeniorNotesMember2021-06-012021-06-300001421461srt:MinimumMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001421461us-gaap:MeasurementInputRiskFreeInterestRateMembersrt:MaximumMember2023-12-3100014214612022-09-012022-09-300001421461ipi:PotashMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberipi:PotashMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:PotashMember2023-01-012023-12-310001421461ipi:PotashMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461ipi:PotashMember2023-01-012023-12-310001421461ipi:PotashMemberipi:TrioMember2023-01-012023-12-310001421461ipi:TrioMemberipi:TrioMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:TrioMember2023-01-012023-12-310001421461us-gaap:IntersegmentEliminationMemberipi:TrioMember2023-01-012023-12-310001421461ipi:TrioMember2023-01-012023-12-310001421461ipi:WaterProductMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberipi:WaterProductMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:WaterProductMember2023-01-012023-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WaterProductMember2023-01-012023-12-310001421461ipi:WaterProductMember2023-01-012023-12-310001421461ipi:SaltMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberipi:SaltMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:SaltMember2023-01-012023-12-310001421461us-gaap:IntersegmentEliminationMemberipi:SaltMember2023-01-012023-12-310001421461ipi:SaltMember2023-01-012023-12-310001421461ipi:MagnesiumChlorideMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberipi:MagnesiumChlorideMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:MagnesiumChlorideMember2023-01-012023-12-310001421461ipi:MagnesiumChlorideMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461ipi:MagnesiumChlorideMember2023-01-012023-12-310001421461ipi:BrinesMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberipi:BrinesMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberipi:BrinesMember2023-01-012023-12-310001421461ipi:BrinesMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461ipi:BrinesMember2023-01-012023-12-310001421461us-gaap:ProductAndServiceOtherMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001421461us-gaap:ProductAndServiceOtherMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001421461us-gaap:MineralMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:MineralMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMember2023-01-012023-12-310001421461us-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461ipi:PotashMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberipi:PotashMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:PotashMember2022-01-012022-12-310001421461ipi:PotashMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461ipi:PotashMember2022-01-012022-12-310001421461ipi:PotashMemberipi:TrioMember2022-01-012022-12-310001421461ipi:TrioMemberipi:TrioMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:TrioMember2022-01-012022-12-310001421461us-gaap:IntersegmentEliminationMemberipi:TrioMember2022-01-012022-12-310001421461ipi:TrioMember2022-01-012022-12-310001421461ipi:WaterProductMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberipi:WaterProductMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:WaterProductMember2022-01-012022-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WaterProductMember2022-01-012022-12-310001421461ipi:WaterProductMember2022-01-012022-12-310001421461ipi:SaltMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberipi:SaltMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:SaltMember2022-01-012022-12-310001421461us-gaap:IntersegmentEliminationMemberipi:SaltMember2022-01-012022-12-310001421461ipi:SaltMember2022-01-012022-12-310001421461ipi:MagnesiumChlorideMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberipi:MagnesiumChlorideMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:MagnesiumChlorideMember2022-01-012022-12-310001421461ipi:MagnesiumChlorideMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461ipi:MagnesiumChlorideMember2022-01-012022-12-310001421461ipi:BrinesMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberipi:BrinesMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberipi:BrinesMember2022-01-012022-12-310001421461ipi:BrinesMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461ipi:BrinesMember2022-01-012022-12-310001421461us-gaap:ProductAndServiceOtherMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001421461us-gaap:ProductAndServiceOtherMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001421461us-gaap:MineralMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:MineralMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMember2022-01-012022-12-310001421461us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461ipi:PotashMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberipi:PotashMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:PotashMember2021-01-012021-12-310001421461ipi:PotashMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461ipi:PotashMember2021-01-012021-12-310001421461ipi:PotashMemberipi:TrioMember2021-01-012021-12-310001421461ipi:TrioMemberipi:TrioMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:TrioMember2021-01-012021-12-310001421461us-gaap:IntersegmentEliminationMemberipi:TrioMember2021-01-012021-12-310001421461ipi:TrioMember2021-01-012021-12-310001421461ipi:WaterProductMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberipi:WaterProductMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:WaterProductMember2021-01-012021-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WaterProductMember2021-01-012021-12-310001421461ipi:WaterProductMember2021-01-012021-12-310001421461ipi:SaltMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberipi:SaltMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:SaltMember2021-01-012021-12-310001421461us-gaap:IntersegmentEliminationMemberipi:SaltMember2021-01-012021-12-310001421461ipi:SaltMember2021-01-012021-12-310001421461ipi:MagnesiumChlorideMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberipi:MagnesiumChlorideMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:MagnesiumChlorideMember2021-01-012021-12-310001421461ipi:MagnesiumChlorideMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461ipi:MagnesiumChlorideMember2021-01-012021-12-310001421461ipi:BrinesMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberipi:BrinesMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberipi:BrinesMember2021-01-012021-12-310001421461ipi:BrinesMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461ipi:BrinesMember2021-01-012021-12-310001421461us-gaap:ProductAndServiceOtherMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001421461us-gaap:ProductAndServiceOtherMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001421461us-gaap:MineralMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:MineralMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMember2021-01-012021-12-310001421461us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461us-gaap:RestrictedStockMember2023-12-310001421461us-gaap:EmployeeStockOptionMember2023-12-310001421461us-gaap:RestrictedStockMemberipi:KeyEmployeesMemberipi:ServiceBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMembersrt:DirectorMemberipi:ServiceBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceBasedVestingMember2022-01-012022-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceBasedVestingMember2021-01-012021-12-310001421461ipi:A2023Memberus-gaap:RestrictedStockMemberipi:ExecutiveMemberOneMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461ipi:A2023Memberipi:ExecutiveMemberTwoMemberus-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:A2022Memberipi:ExecutiveMemberOneMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461ipi:ExecutiveMemberTwoMemberus-gaap:RestrictedStockMemberipi:A2022Memberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:A2021Memberipi:ExecutiveMemberOneMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461ipi:ExecutiveMemberTwoMemberus-gaap:RestrictedStockMemberipi:A2021Memberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461ipi:A2020Memberus-gaap:RestrictedStockMembersrt:ExecutiveOfficerMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2023-01-012023-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2022-01-012022-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2021-01-012021-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2023-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2022-12-310001421461us-gaap:RestrictedStockMemberipi:ServiceAndMarketConditionBasedVestingMember2021-12-310001421461us-gaap:RestrictedStockMember2022-12-310001421461us-gaap:EmployeeStockOptionMember2022-12-310001421461us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001421461ipi:WaterRightsMember2022-03-012022-03-31utr:aft0001421461ipi:ProtestantsExpeditedInterSeProceedingMember2017-01-012017-12-310001421461ipi:WaterRightsMember2018-01-012018-12-310001421461ipi:WaterRightsMember2021-03-012021-03-310001421461ipi:WaterRightsMember2022-09-012022-09-300001421461ipi:WaterRightsMember2023-12-310001421461ipi:WaterRightsMember2022-12-310001421461us-gaap:CorporateDebtSecuritiesMember2023-12-310001421461us-gaap:USTreasuryAndGovernmentMember2023-12-310001421461us-gaap:CorporateDebtSecuritiesMember2022-12-310001421461us-gaap:USTreasuryAndGovernmentMember2022-12-310001421461ipi:EquityInvestmentWDVGLMember2021-12-310001421461ipi:EquityInvestmentWDVGLMember2022-12-310001421461ipi:EquityInvestmentWDVGLMember2023-12-310001421461ipi:EquityInvestmentWDVGLMember2022-07-310001421461ipi:EquityInvestmentOvationMember2023-12-310001421461ipi:EquityInvestmentOvationMember2022-12-310001421461ipi:EquityInvestmentOvationMember2021-12-310001421461ipi:EquityInvestmentOvationMember2023-01-012023-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461us-gaap:MineralMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001421461us-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2023-01-012023-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WarehouseandHandlingMember2023-01-012023-12-310001421461us-gaap:OperatingSegmentsMemberipi:PotashMember2023-01-012023-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461us-gaap:MineralMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001421461us-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2022-01-012022-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WarehouseandHandlingMember2022-01-012022-12-310001421461us-gaap:OperatingSegmentsMemberipi:PotashMember2022-01-012022-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:MineralMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461us-gaap:MineralMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:CargoAndFreightMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461us-gaap:CargoAndFreightMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001421461us-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMemberipi:WarehouseandHandlingMember2021-01-012021-12-310001421461us-gaap:IntersegmentEliminationMemberipi:WarehouseandHandlingMember2021-01-012021-12-310001421461us-gaap:OperatingSegmentsMemberipi:PotashMember2021-01-012021-12-310001421461ipi:TrioMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461ipi:OilFieldServicesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001421461us-gaap:MineralMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-31ipi:marketsipi:customer0001421461us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2023-01-012023-12-310001421461us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2022-01-012022-12-310001421461us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMembercountry:US2021-01-012021-12-3100014214612022-02-2800014214612023-12-122023-12-120001421461us-gaap:SubsequentEventMember2024-01-022024-01-020001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001421461us-gaap:InventoryValuationReserveMember2020-12-310001421461us-gaap:InventoryValuationReserveMember2021-01-012021-12-310001421461us-gaap:InventoryValuationReserveMember2021-12-310001421461us-gaap:AllowanceForCreditLossMember2020-12-310001421461us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001421461us-gaap:AllowanceForCreditLossMember2021-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001421461us-gaap:InventoryValuationReserveMember2022-01-012022-12-310001421461us-gaap:InventoryValuationReserveMember2022-12-310001421461us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001421461us-gaap:AllowanceForCreditLossMember2022-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001421461us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001421461us-gaap:InventoryValuationReserveMember2023-01-012023-12-310001421461us-gaap:InventoryValuationReserveMember2023-12-310001421461us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001421461us-gaap:AllowanceForCreditLossMember2023-12-3100014214612023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

|

|

|

|

|

|

|

|

| ☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2023

|

|

|

|

|

|

| or |

| ☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 001-34025

INTREPID POTASH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

Delaware |

26-1501877 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

| 707 17th Street, Suite 4200 |

|

| Denver, |

|

| Colorado |

80202 |

(Address of principal executive offices) |

(Zip Code) |

(303) 296-3006

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

IPI |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

¨ |

Accelerated filer |

x |

Non-accelerated filer |

¨ |

|

|

| Smaller reporting company |

¨ |

Emerging growth company |

¨ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act).

Yes ☐ No x The aggregate market value of the registrant's common stock held by non-affiliates of the registrant, based upon the closing sale price of the common stock on June 30, 2023, the last trading day of the registrant's most recently completed second fiscal quarter, of $22.69 per share as reported on the New York Stock Exchange was $247 million. Shares of common stock held by each director and executive officer and by each person who owns 10% or more of the registrant's outstanding common stock and is believed by the registrant to be in a control position were excluded. The determination of affiliate status for this purpose is not a conclusive determination of affiliate status for any other purposes.

As of February 29, 2024, the registrant had 13,141,035 shares of common stock, par value $0.001, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this report is incorporated by reference from portions of the registrant's definitive proxy statement relating to its 2024 annual meeting of stockholders to be filed within 120 days after December 31, 2023.

INTREPID POTASH, INC.

TABLE OF CONTENTS

PART I

Unless the context otherwise requires, the following definitions apply throughout this Annual Report on Form 10-K (the "Annual Report"):

•"Intrepid," "our," "we," or "us" means Intrepid Potash, Inc. and its consolidated subsidiaries.

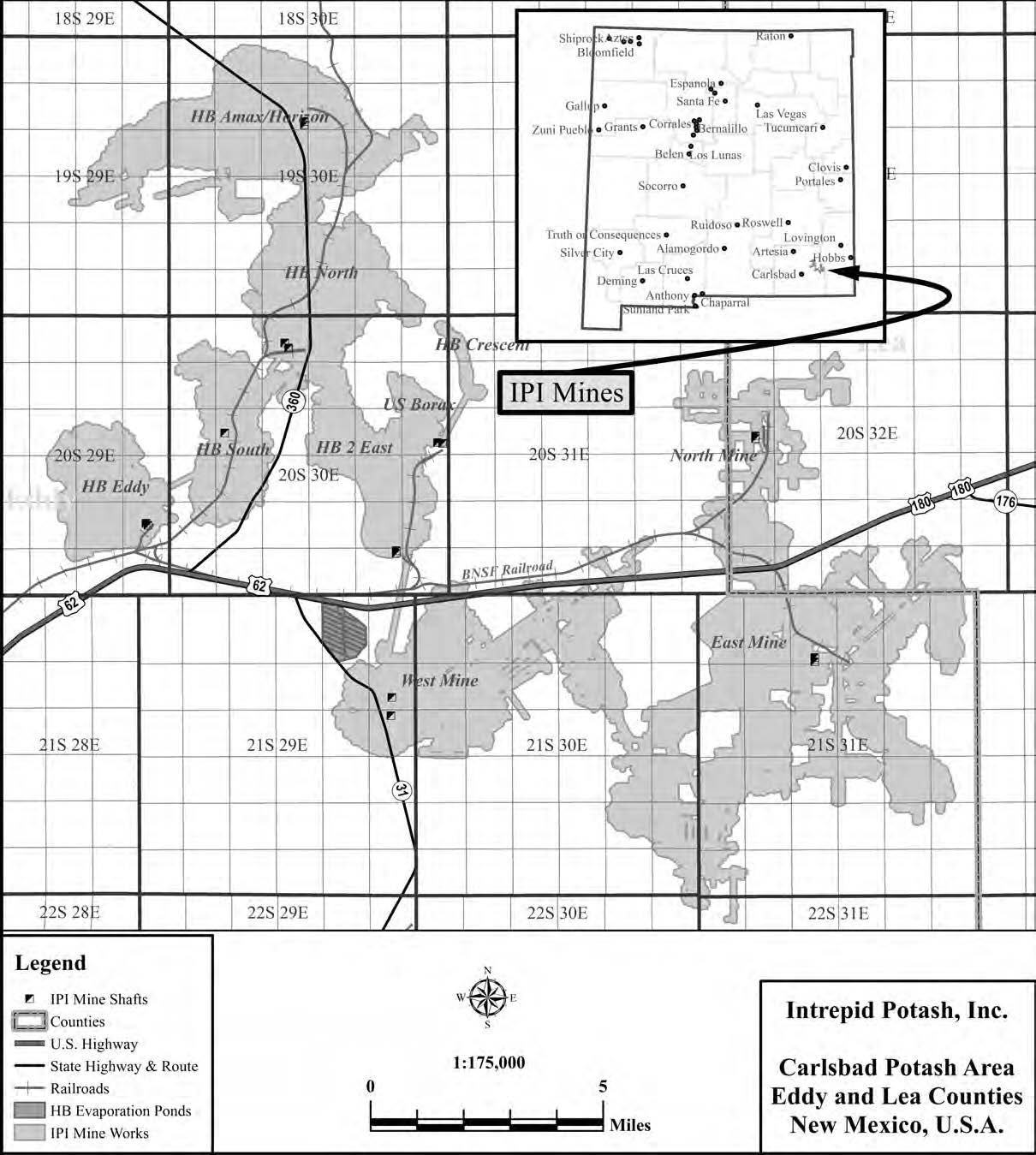

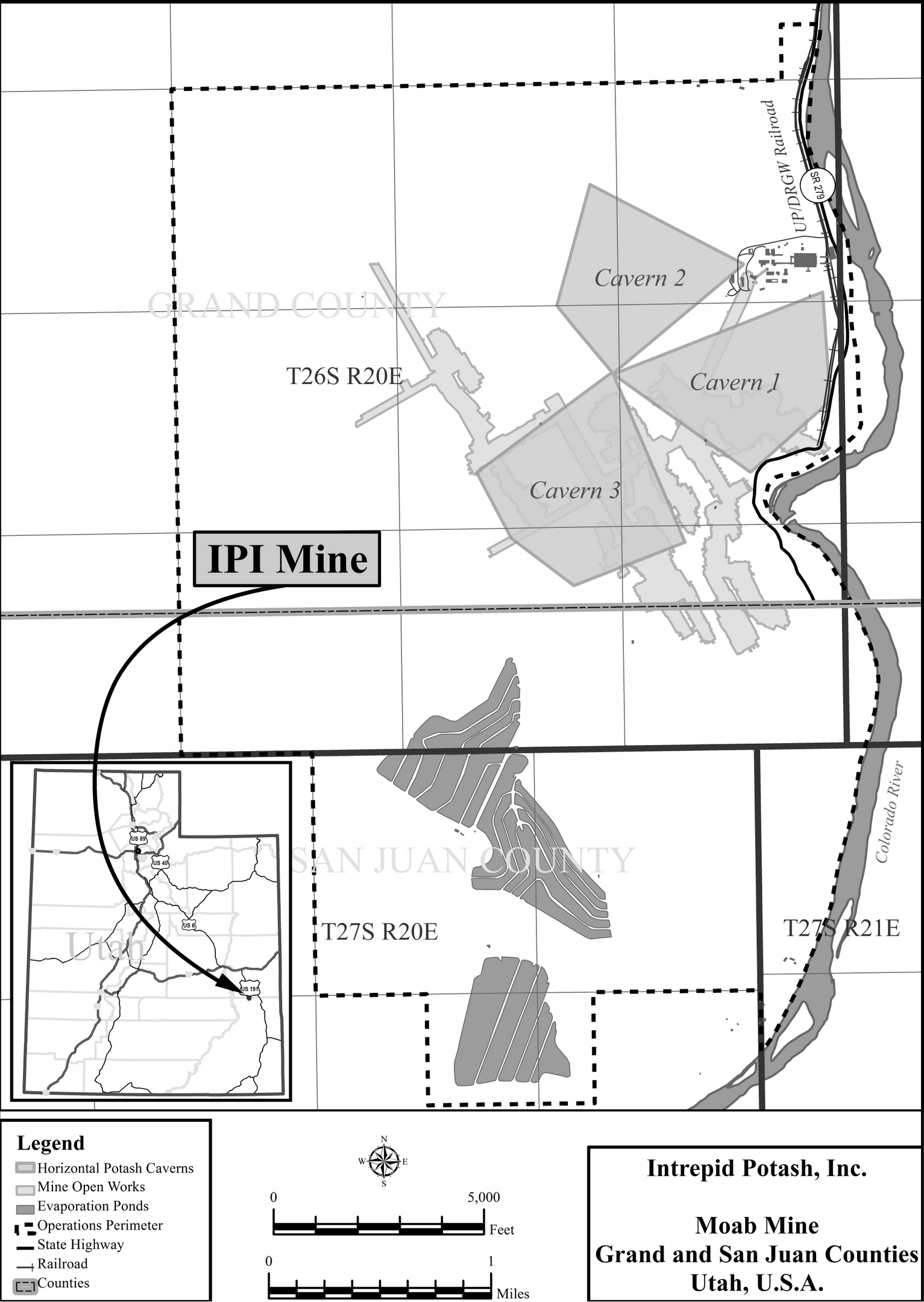

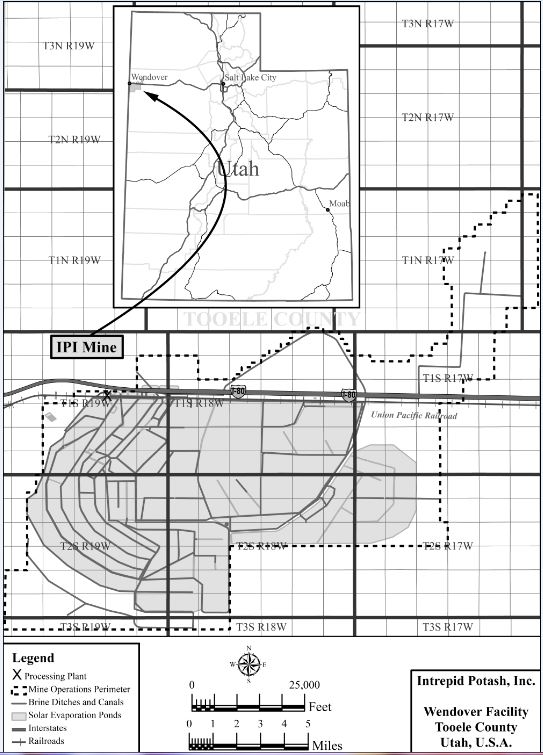

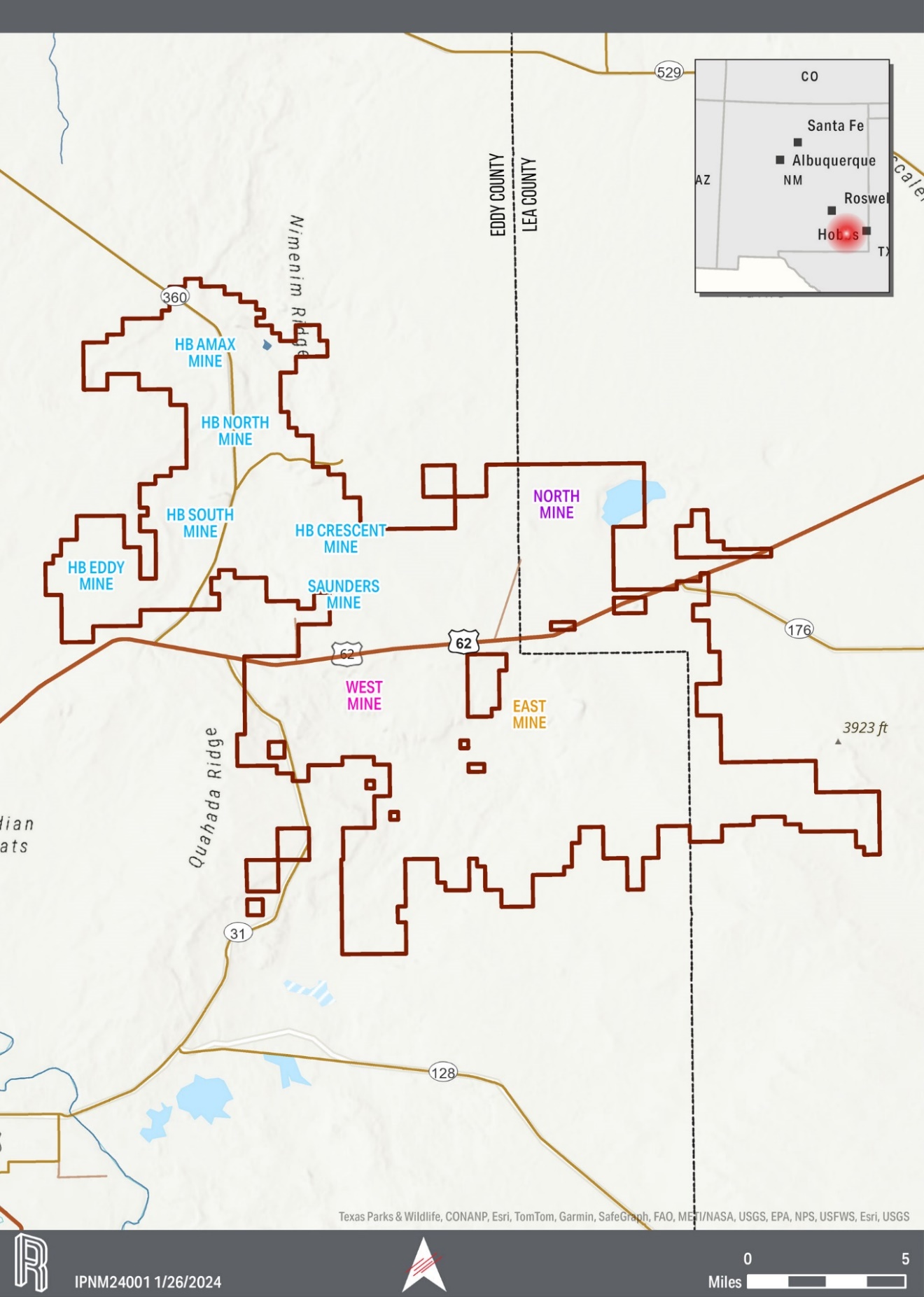

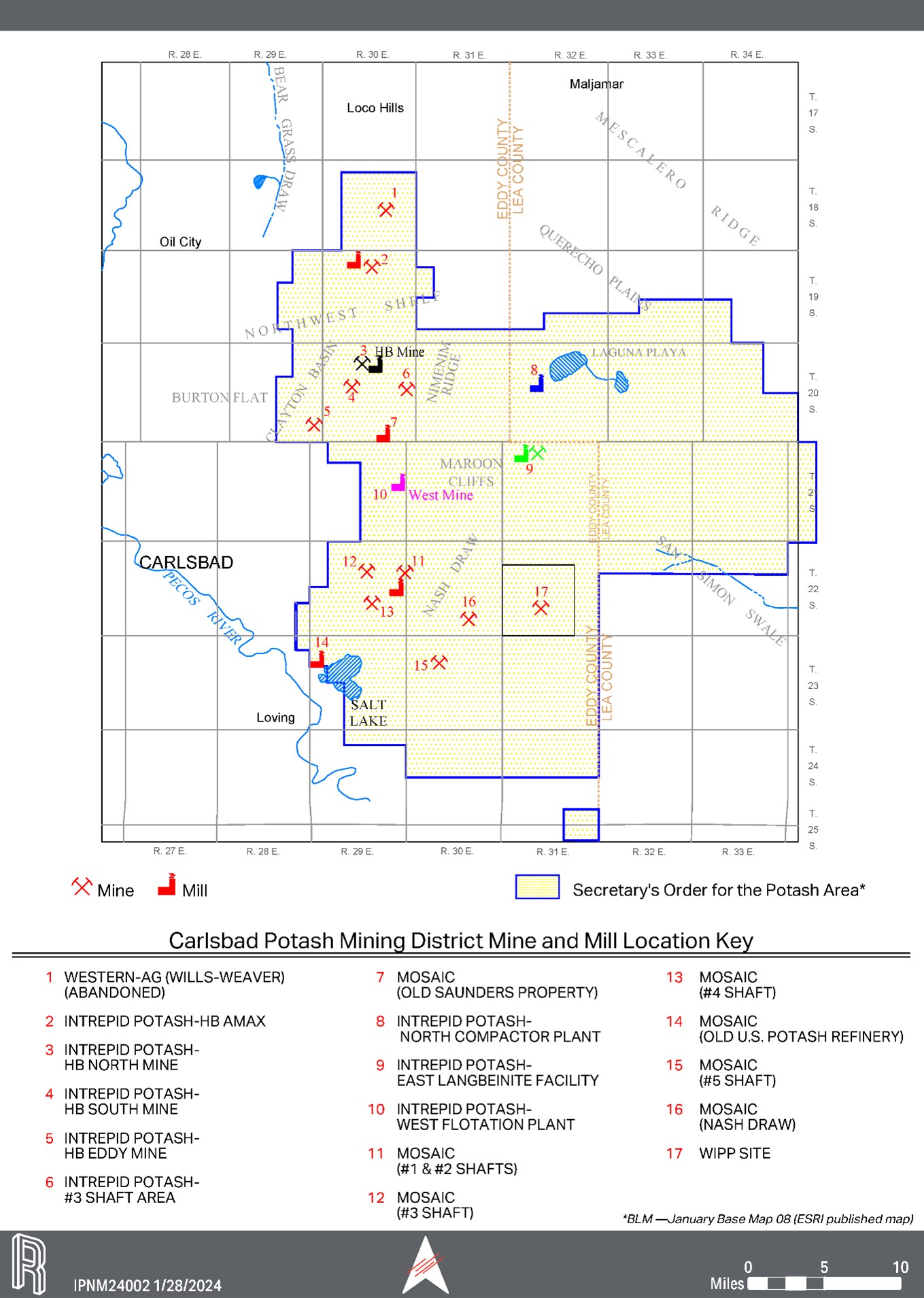

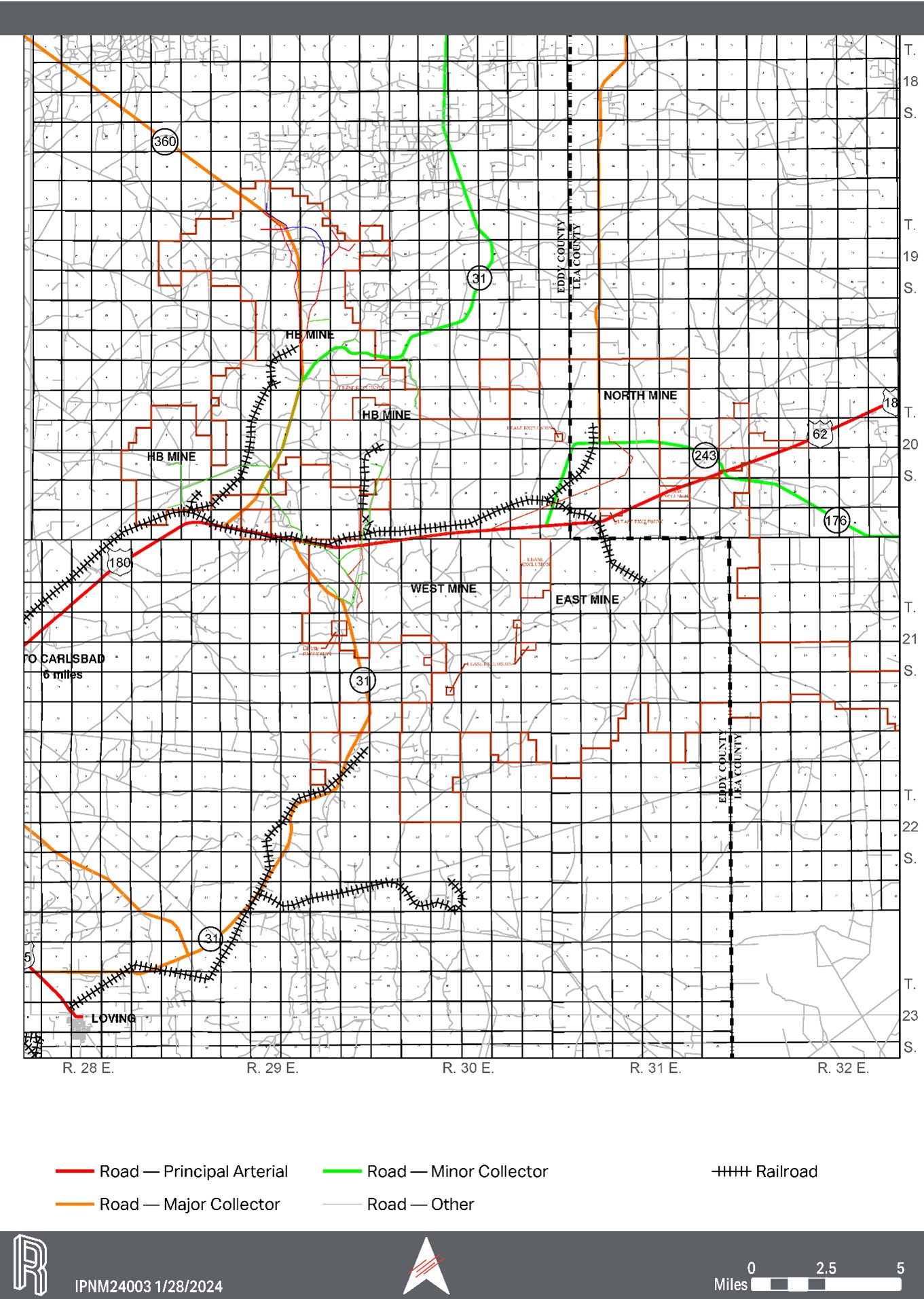

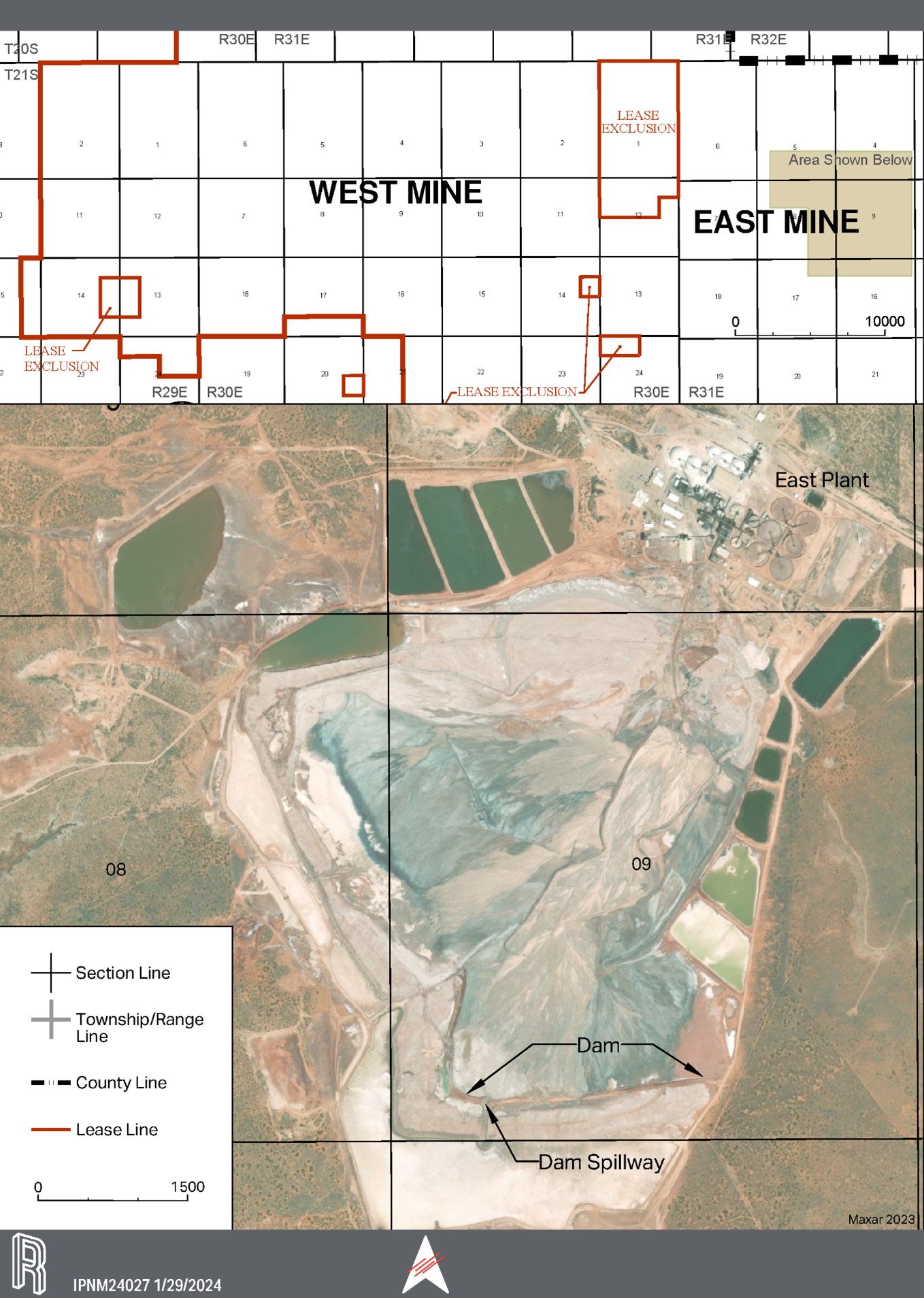

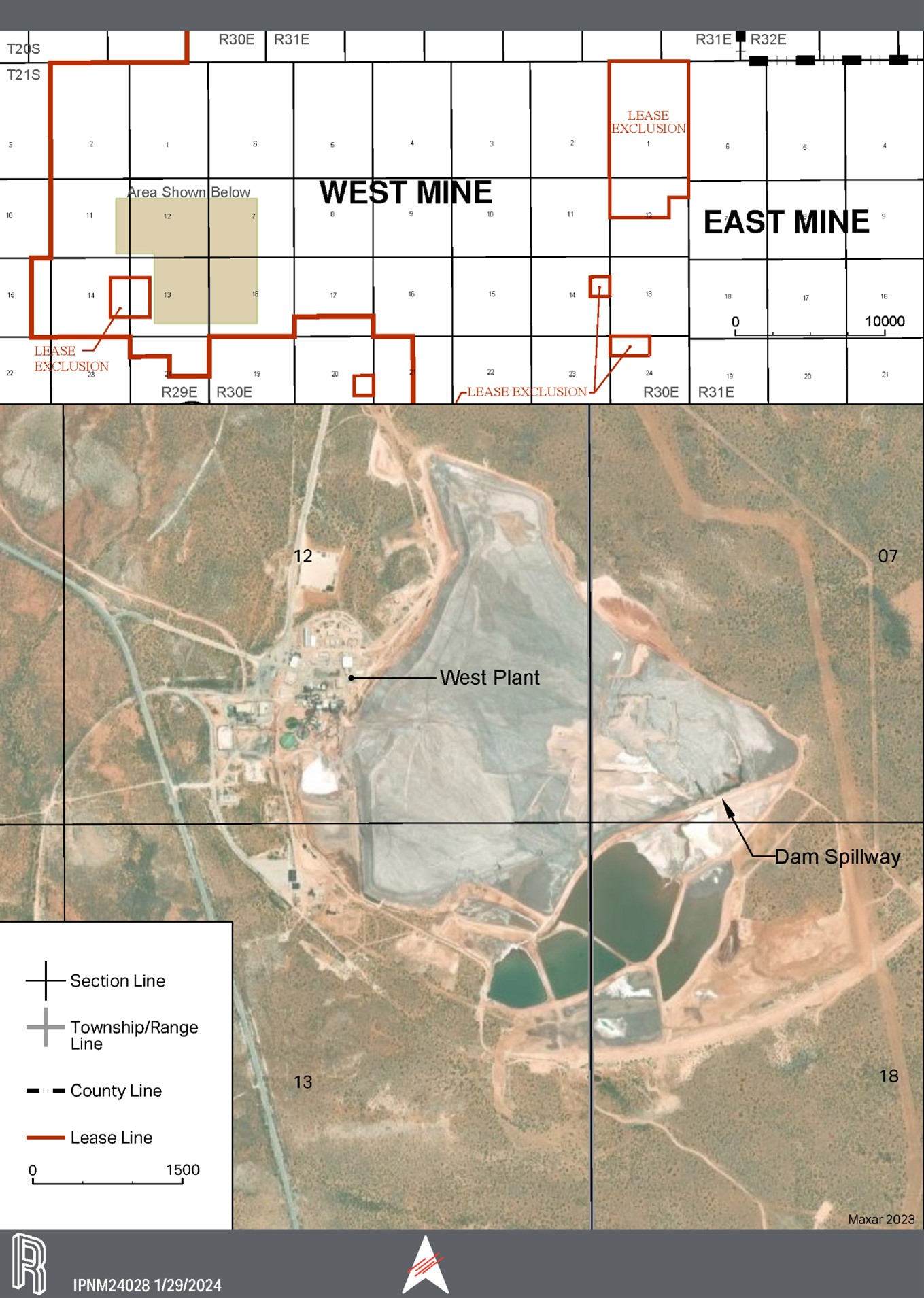

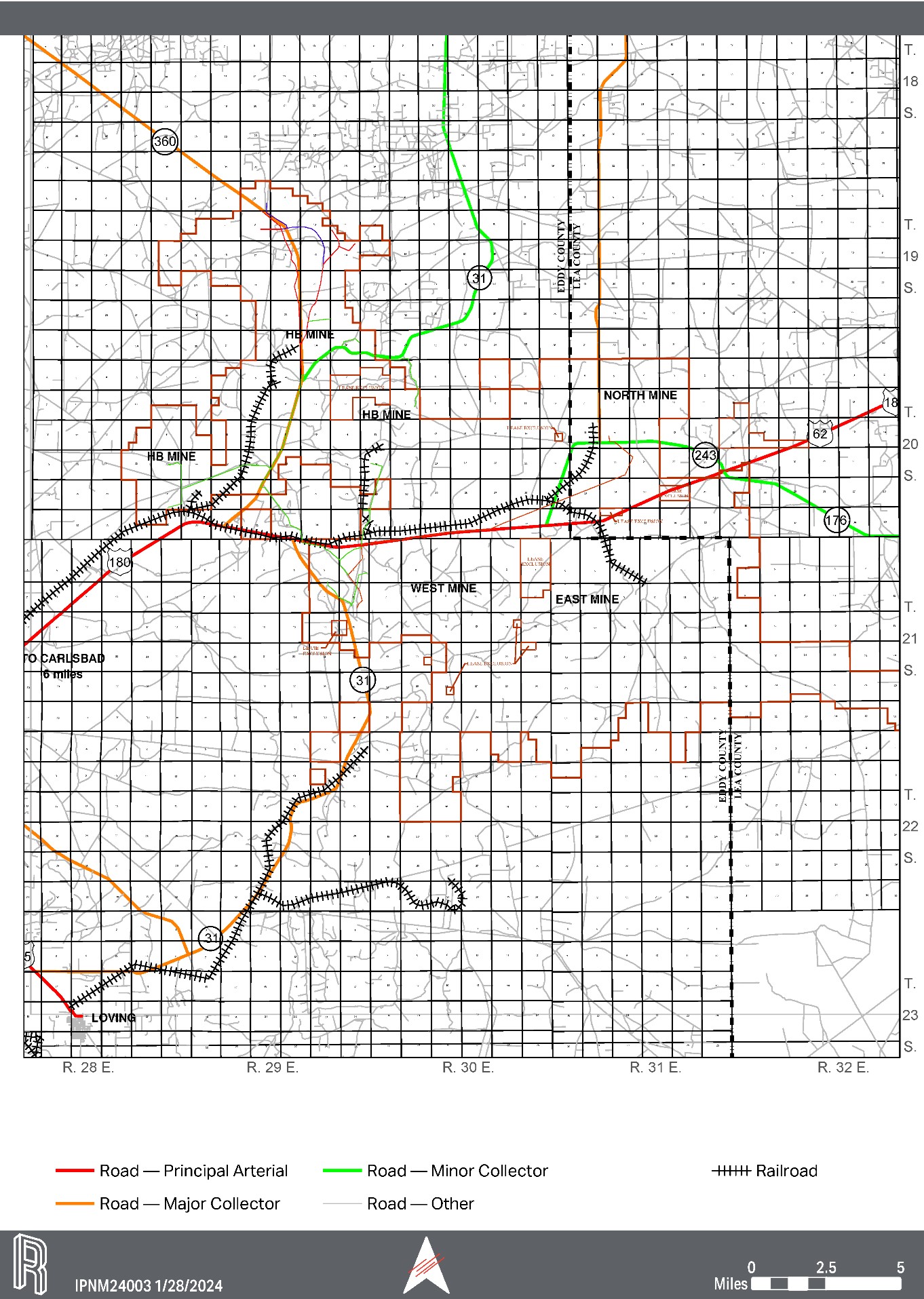

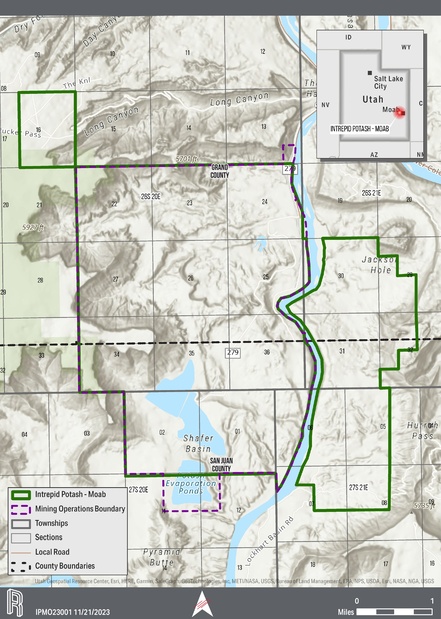

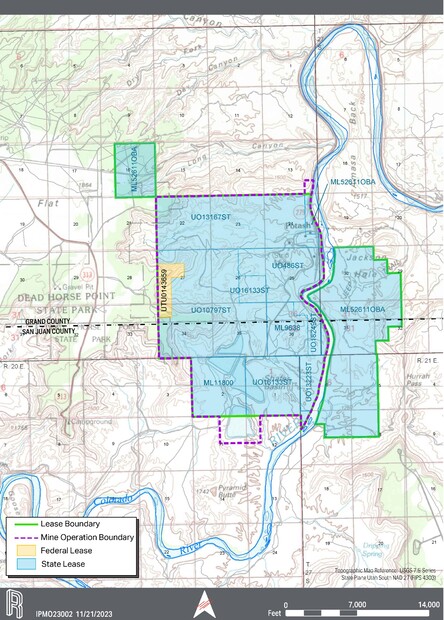

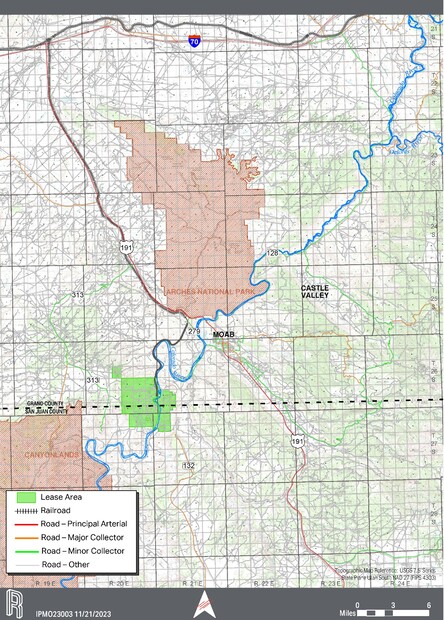

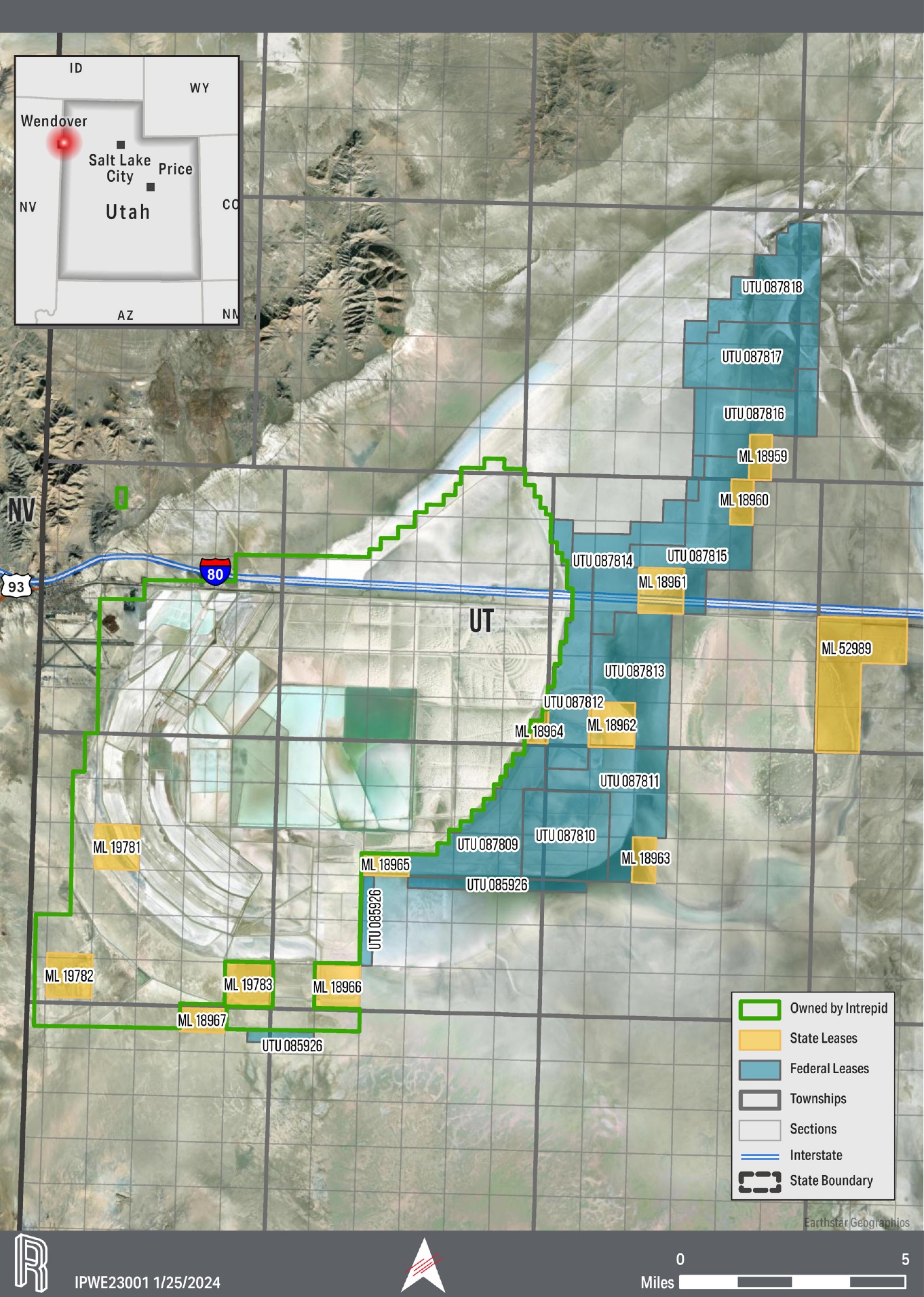

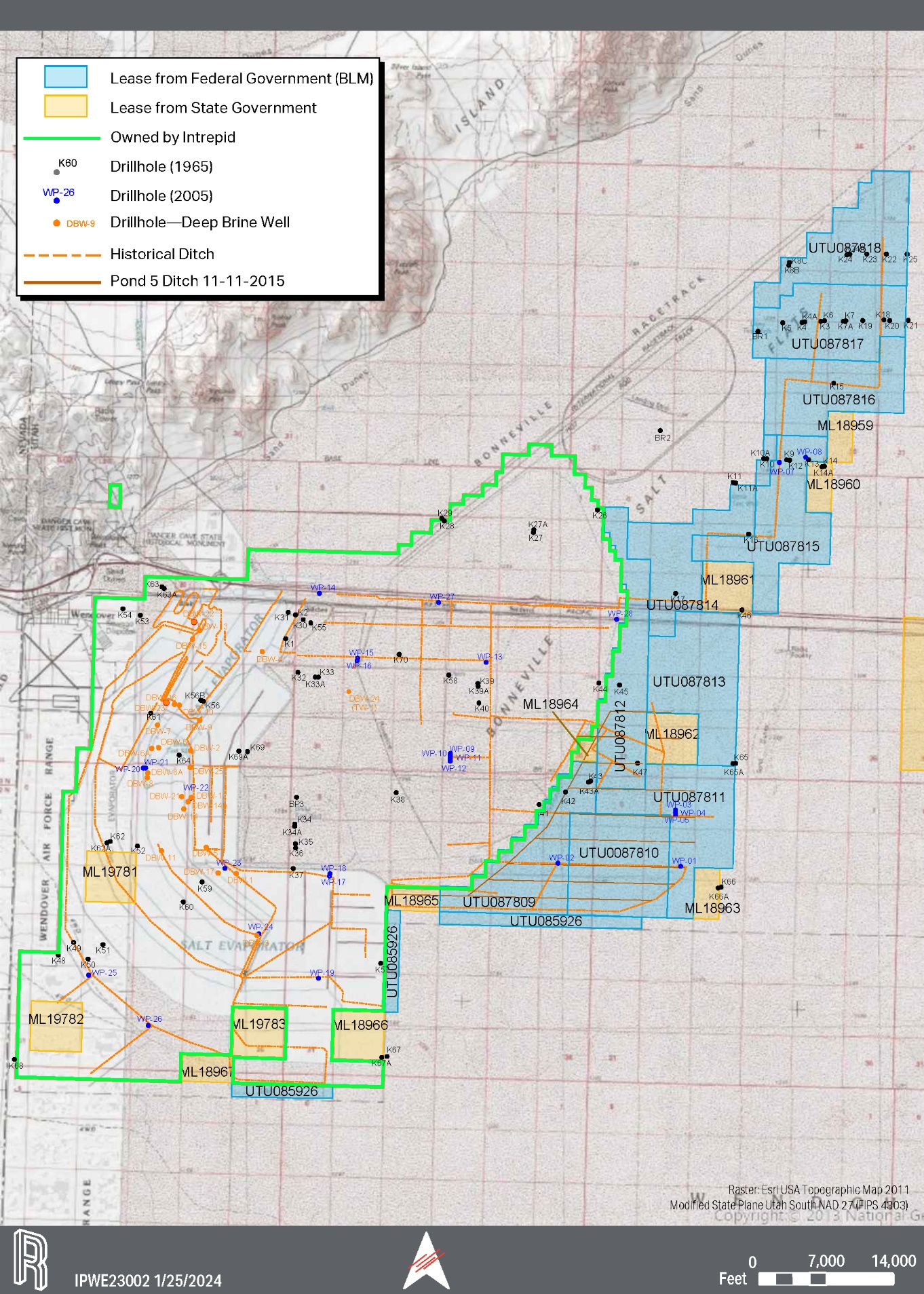

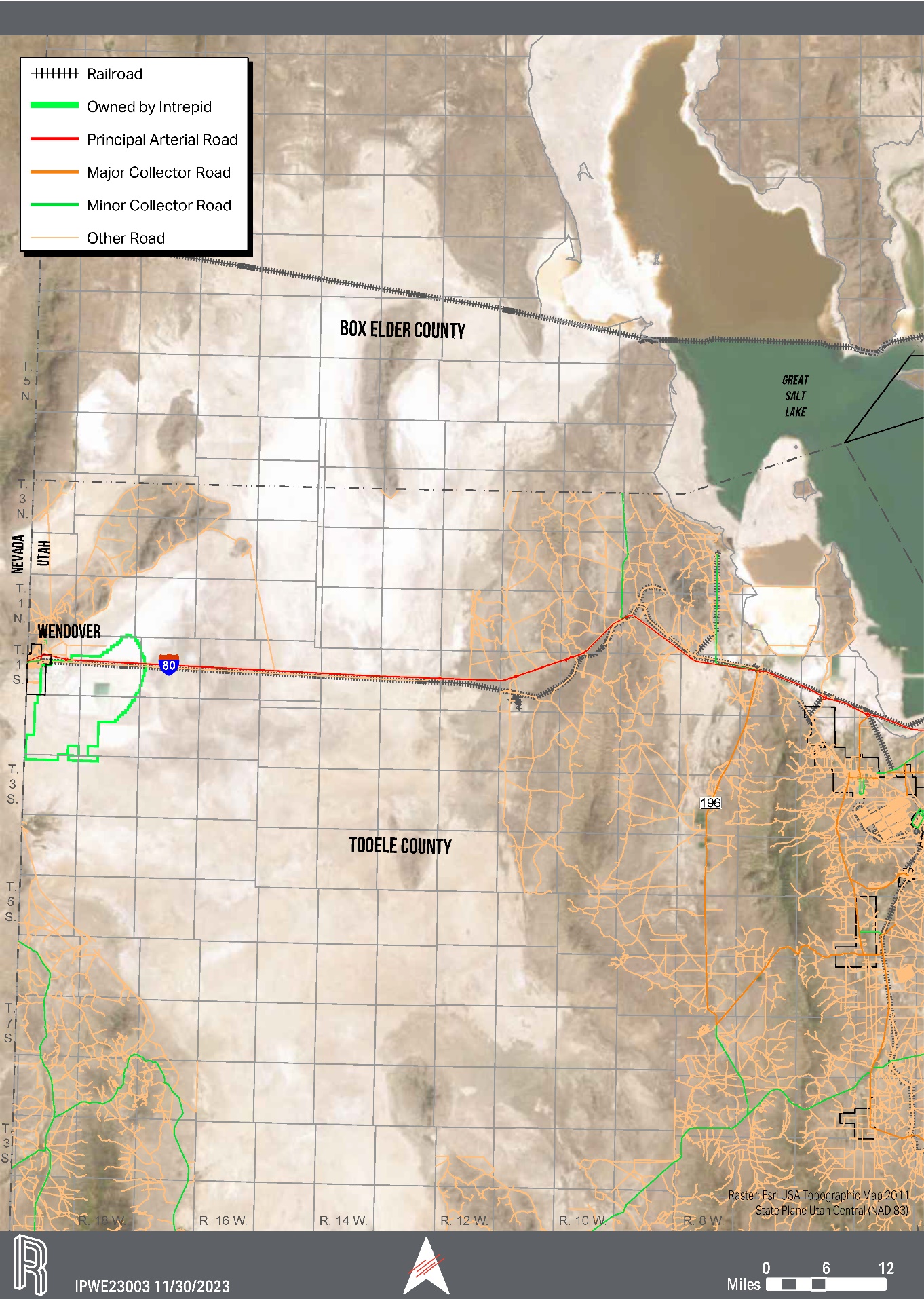

•"East," "North," and "HB" mean our three operating facilities in Carlsbad, New Mexico. "Moab" means our operating facility in Moab, Utah. "Wendover" means our operating facility in Wendover, Utah. "West" means our previous operating facility in Carlsbad, New Mexico, which has been in care-and-maintenance since mid‑2016. "Intrepid South" refers to certain land, water rights, and other related assets in southeast New Mexico which we acquired from Dinwiddie Cattle Company in May 2019. You can find more information about our facilities in Item 2 of this Annual Report.

•"Ton" means a short ton, or a measurement of mass equal to 2,000 pounds.

To supplement our consolidated financial statements, which are presented in this Annual Report and which are prepared and presented in accordance with generally accepted accounting principles ("GAAP"), we use "average net realized sales price per ton," which is a non‑GAAP financial measure to monitor and evaluate our performance. You can find more information about average net realized sales price per ton, including a reconciliation of this measure to the most comparable GAAP measure, in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations under the heading "Non-GAAP Financial Measure."

CAUTIONARY NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Annual Report contains forward‑looking statements within the meaning of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Securities Act of 1933, as amended. These forward‑looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements in this Annual Report other than statements of historical fact are forward‑looking statements. Forward-looking statements include, but are not limited to, statements about, among other things, our future results of operations and financial position, our business strategy and plans, our environmental, safety and governance ("ESG") initiatives and our objectives for future operations. In some cases, you can identify these statements by forward‑looking words, such as "estimate," "expect," "anticipate," "project," "plan," "intend," "believe," "forecast," "foresee," "likely," "may," "should," "goal," "target," "might," "will," "could," "predict," and "continue." Forward‑looking statements are only predictions based on our current knowledge, expectations, and projections about future events.

These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including the following:

•changes in the price, demand, or supply of our products and services;

•challenges and legal proceedings related to our water rights;

•our ability to successfully identify and implement any opportunities to grow our business whether through expanded sales of water, Trio®, byproducts, and other non-potassium related products or other revenue diversification activities;

•the costs of, and our ability to successfully execute, any strategic projects;

•declines or changes in agricultural production or fertilizer application rates;

•declines in the use of potassium-related products or water by oil and gas companies in their drilling operations;

•our ability to prevail in outstanding legal proceedings against us;

•our ability to comply with the terms of our revolving credit facility, including the underlying covenants;

•further write-downs of the carrying value of assets, including inventories;

•circumstances that disrupt or limit production, including operational difficulties or variances, geological or geotechnical variances, equipment failures, environmental hazards, and other unexpected events or problems;

•changes in reserve estimates;

•currency fluctuations;

•adverse changes in economic conditions or credit markets;

•the impact of governmental regulations, including environmental and mining regulations, the enforcement of those regulations, and governmental policy changes;

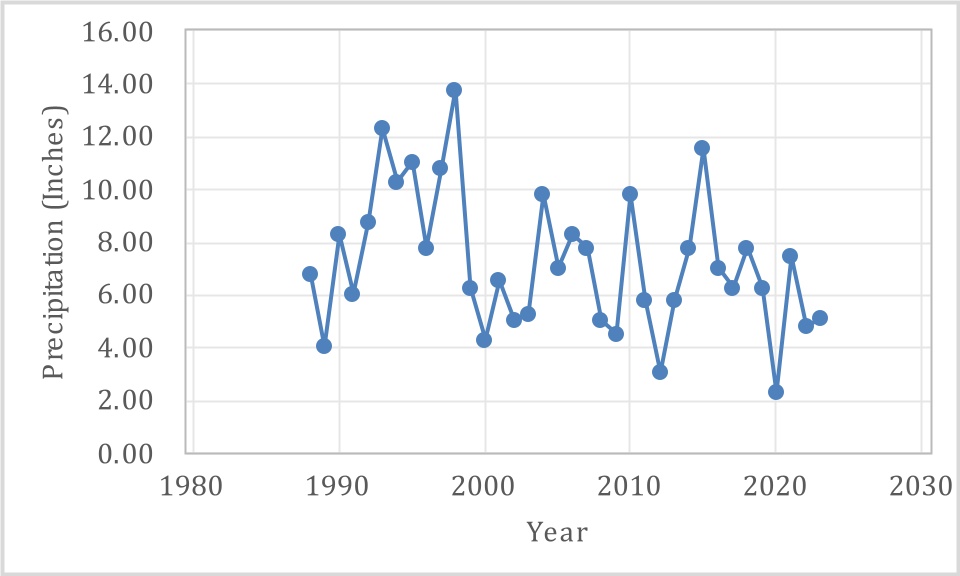

•adverse weather events, including events affecting precipitation and evaporation rates at our solar solution mines;

•increased labor costs or difficulties in hiring and retaining qualified employees and contractors, including workers with mining, mineral processing, or construction expertise;

•changes in the prices of raw materials, including chemicals, natural gas, and power;

•our ability to obtain and maintain any necessary governmental permits or leases relating to current or future operations;

•interruptions in rail or truck transportation services, or fluctuations in the costs of these services;

•our inability to fund necessary capital investments;

•the impact of global health issues and other global disruptions on our business, operations, liquidity, financial condition and results of operations; and

•the other risks, uncertainties, and assumptions described in Item 1A. Risk Factors in this Annual Report.

In addition, new risks emerge from time to time. It is not possible for our management to predict all risks that may cause actual results to differ materially from those contained in any forward-looking statements we may make.

In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in these forward-looking statements. As a result, you should not place undue reliance on these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, except as required by law.

ITEM 1.BUSINESS

General

We are a diversified mineral company that delivers potassium, magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed and the oil and gas industry. We are the only U.S. producer of muriate of potash (sometimes referred to as potassium chloride or potash), which is applied as an essential nutrient for healthy crop development, utilized in several industrial applications, and used as an ingredient in animal feed. In addition, we produce a specialty fertilizer, Trio®, which delivers three key nutrients, potassium, magnesium, and sulfur, in a single particle. We also provide water, magnesium chloride, brine and various oilfield products and services.

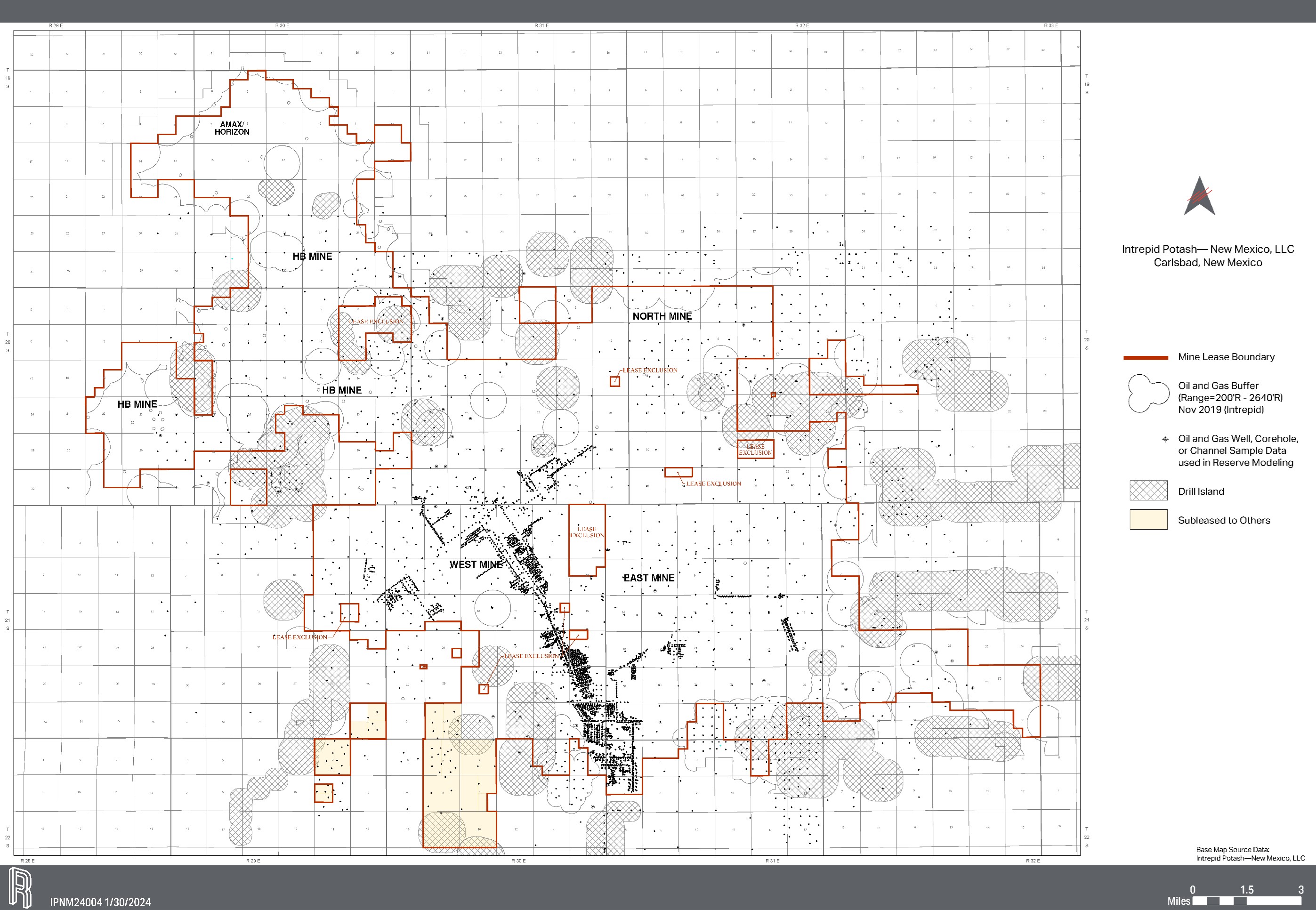

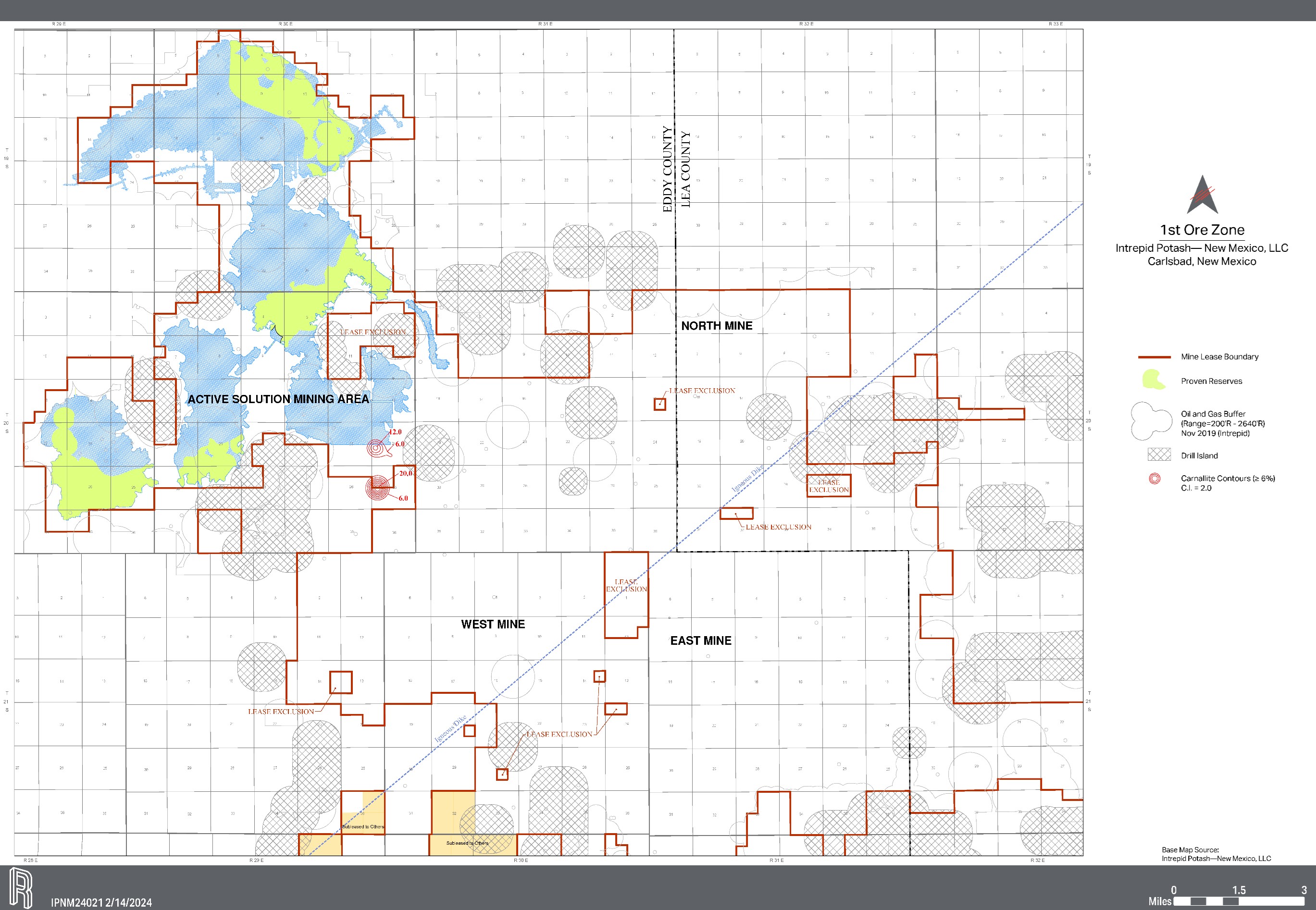

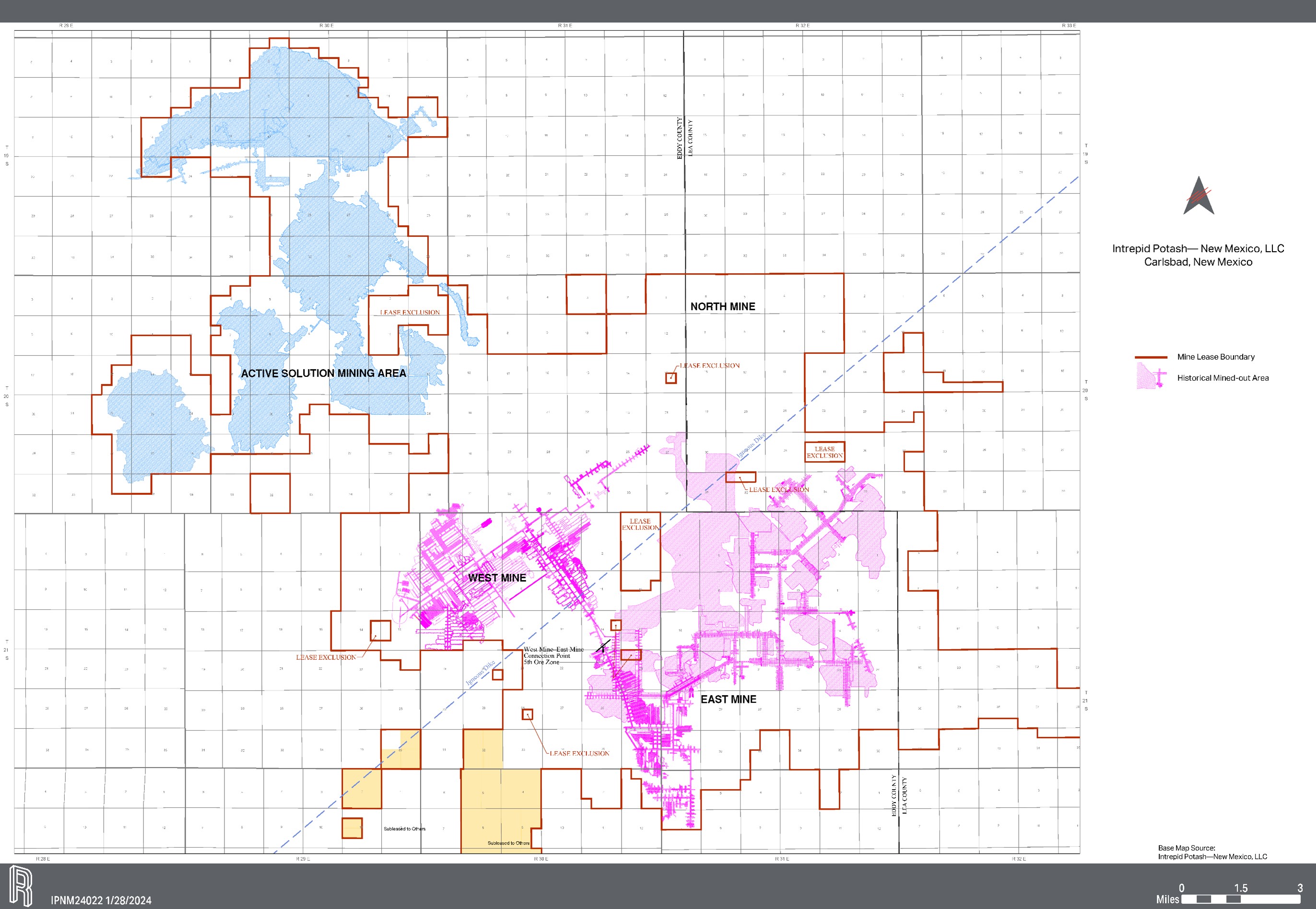

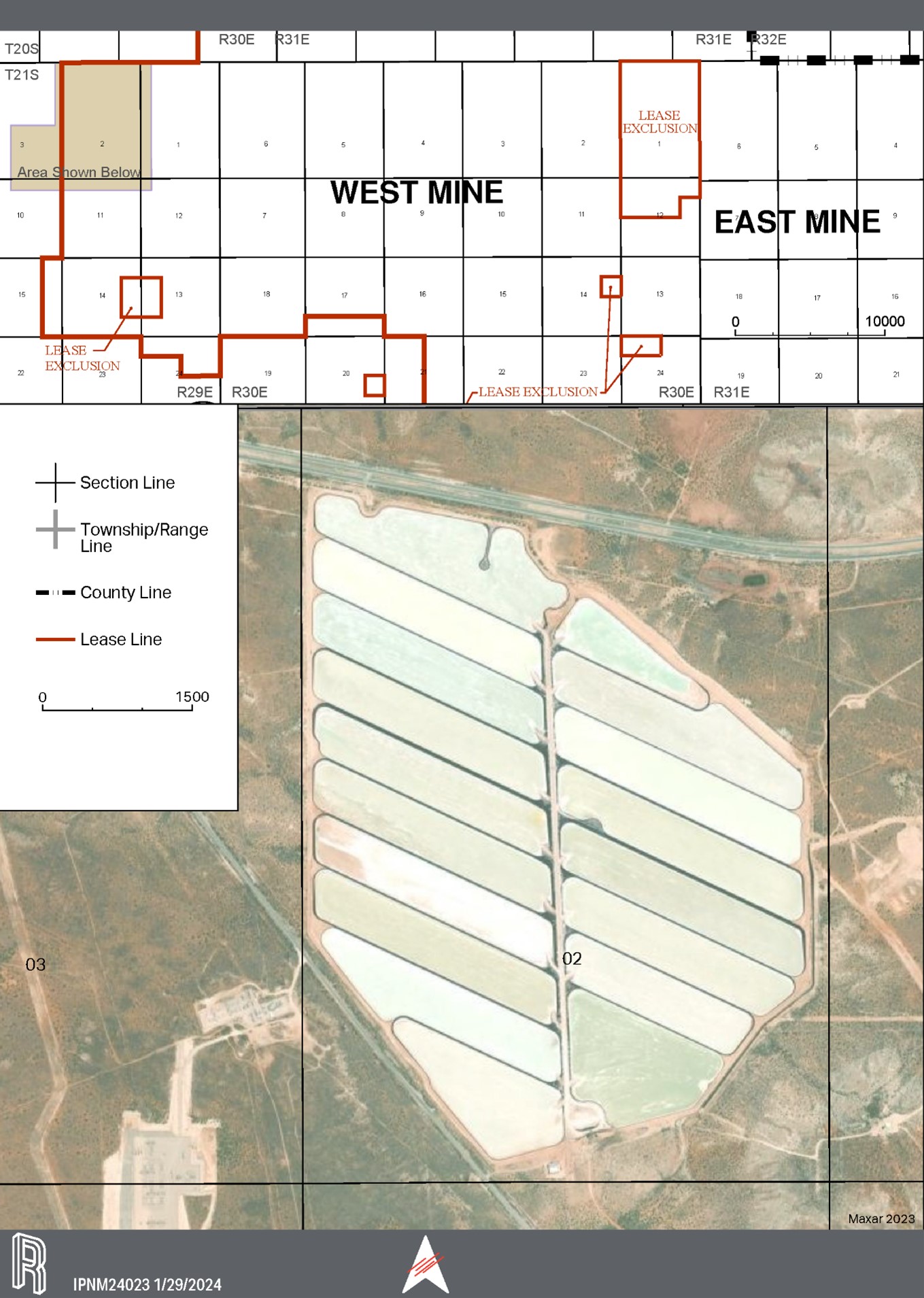

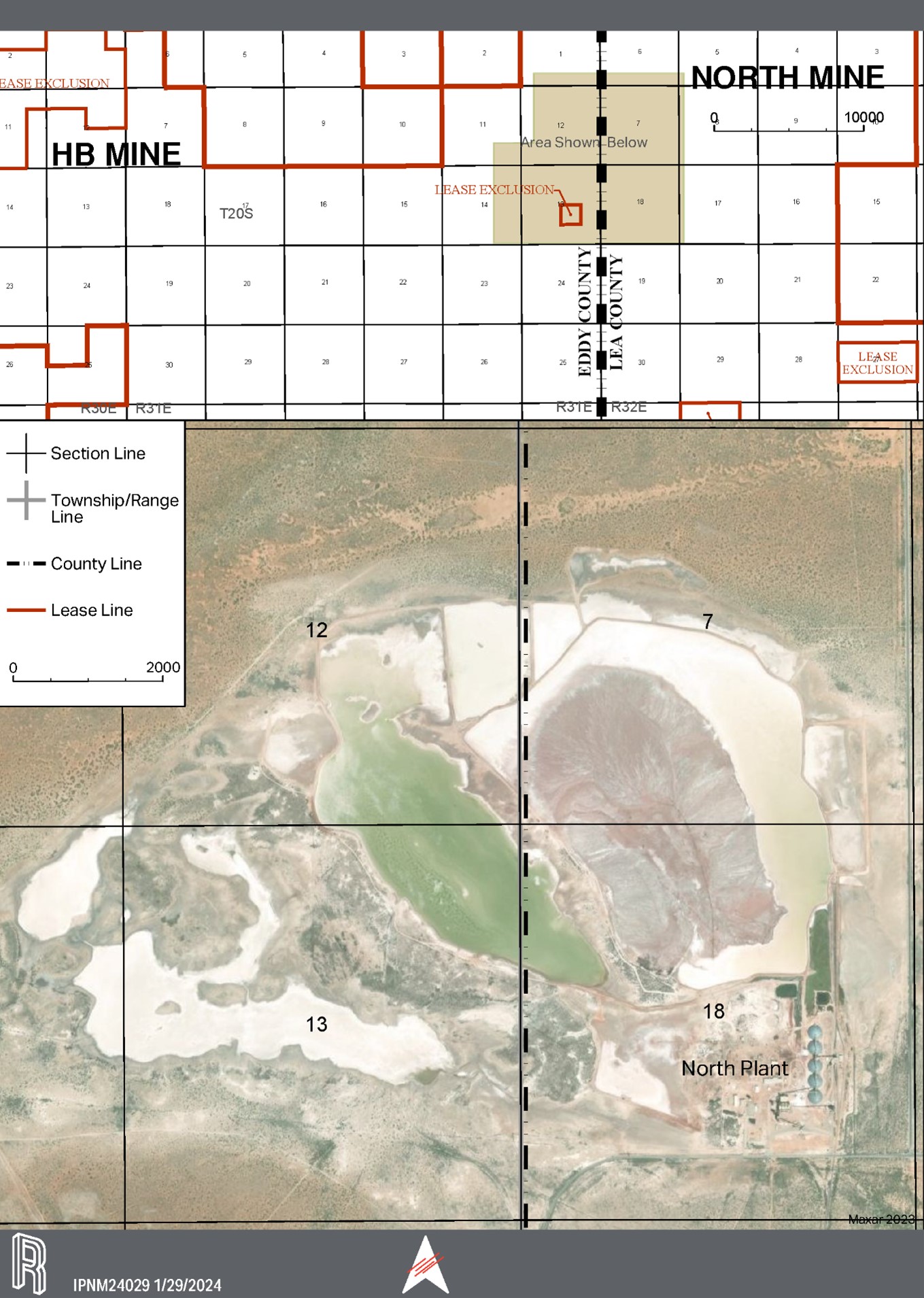

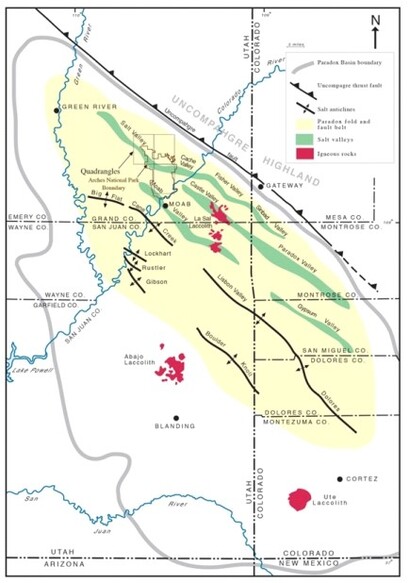

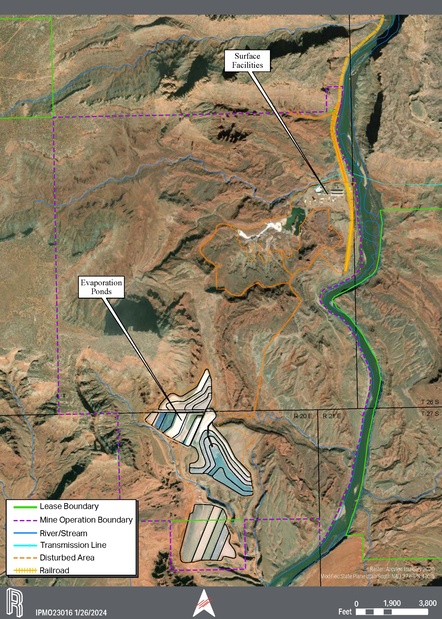

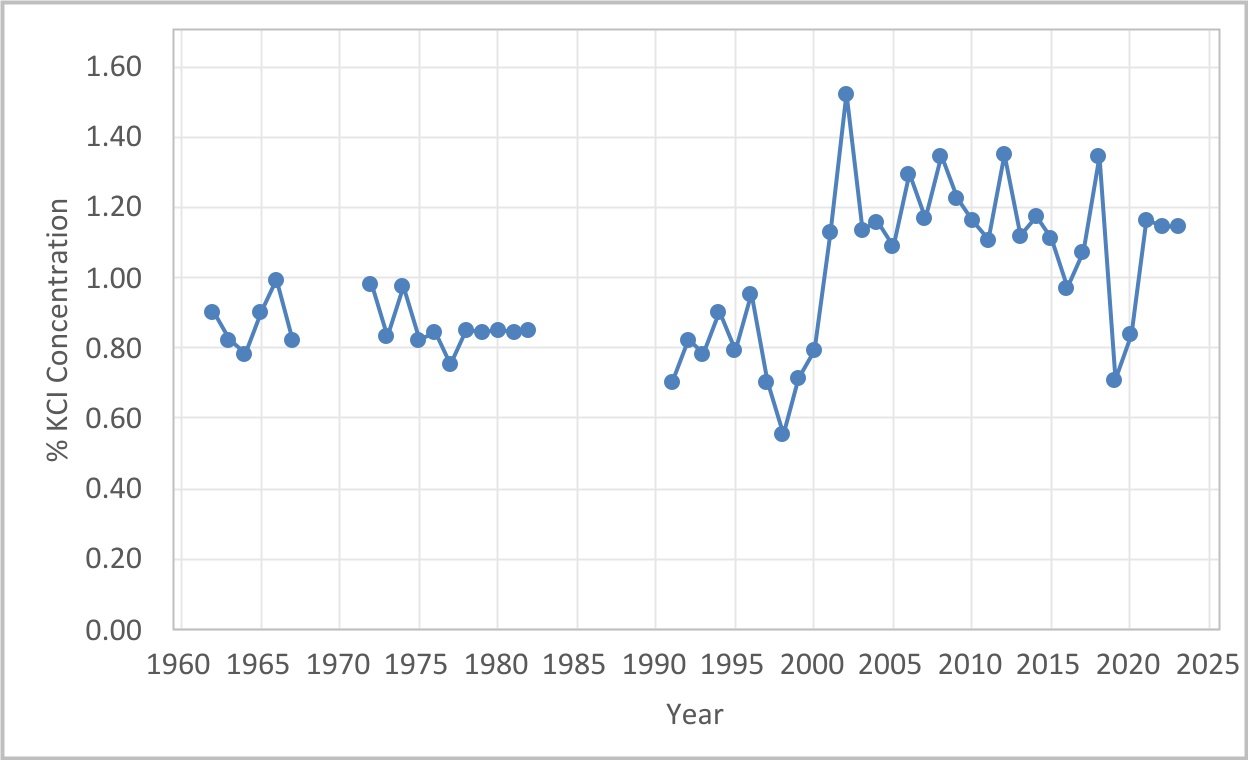

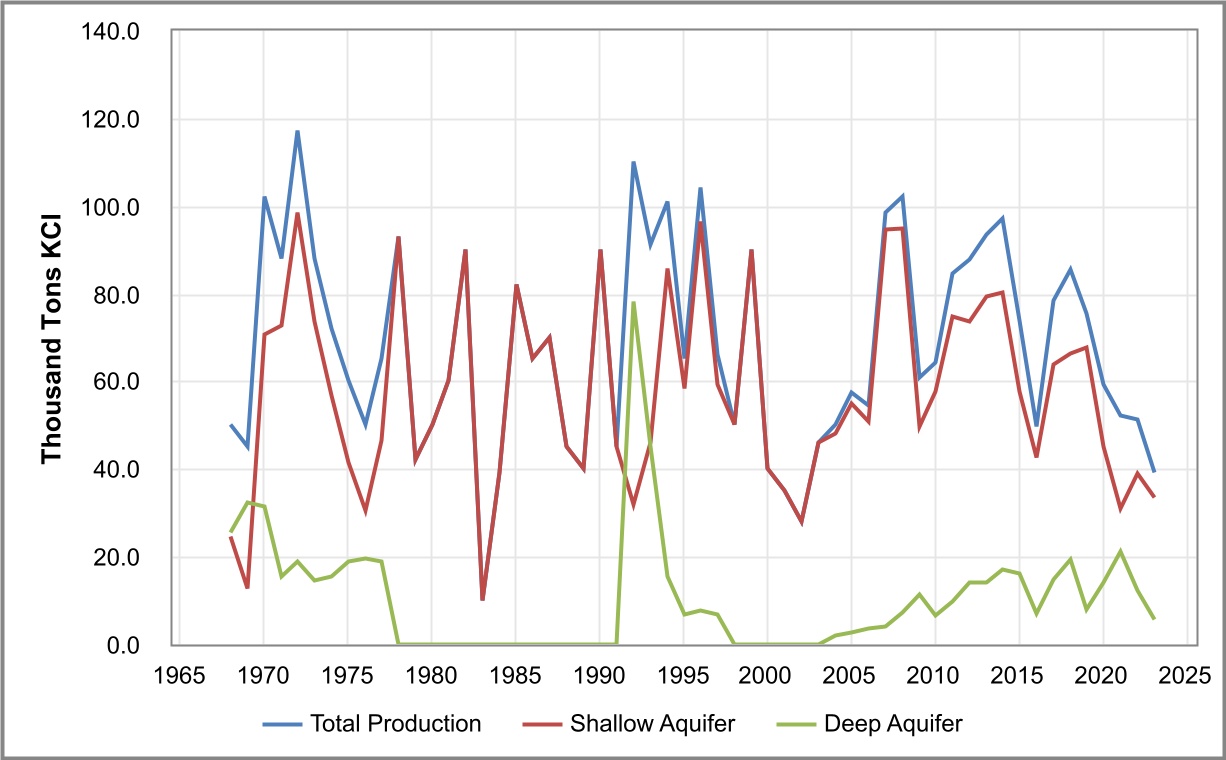

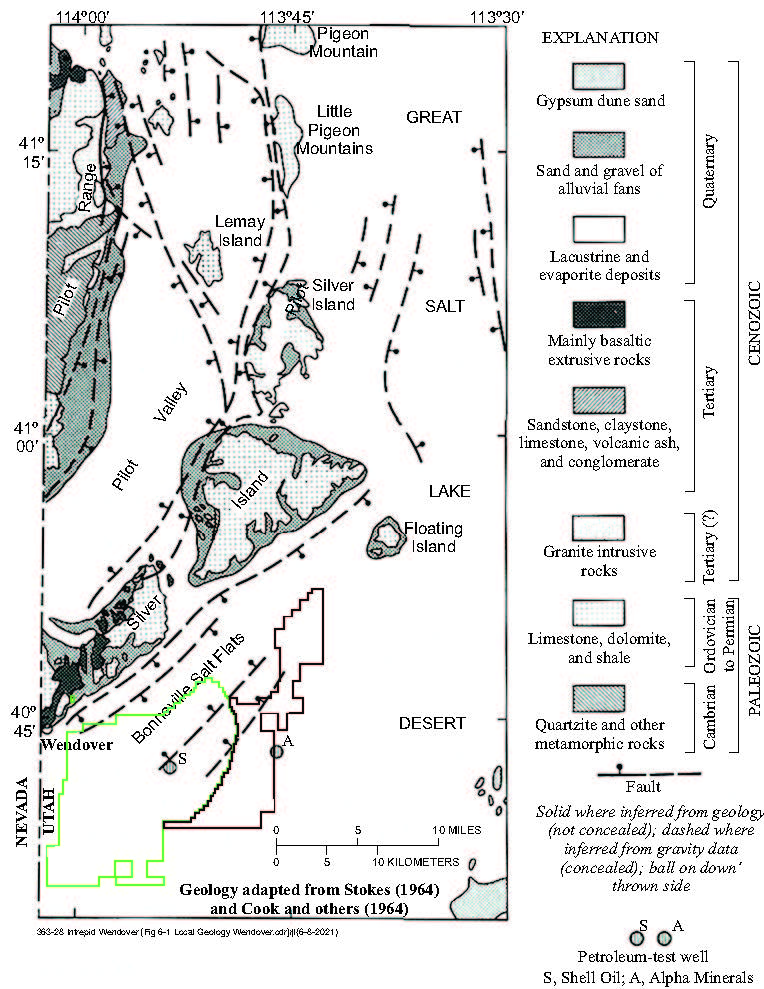

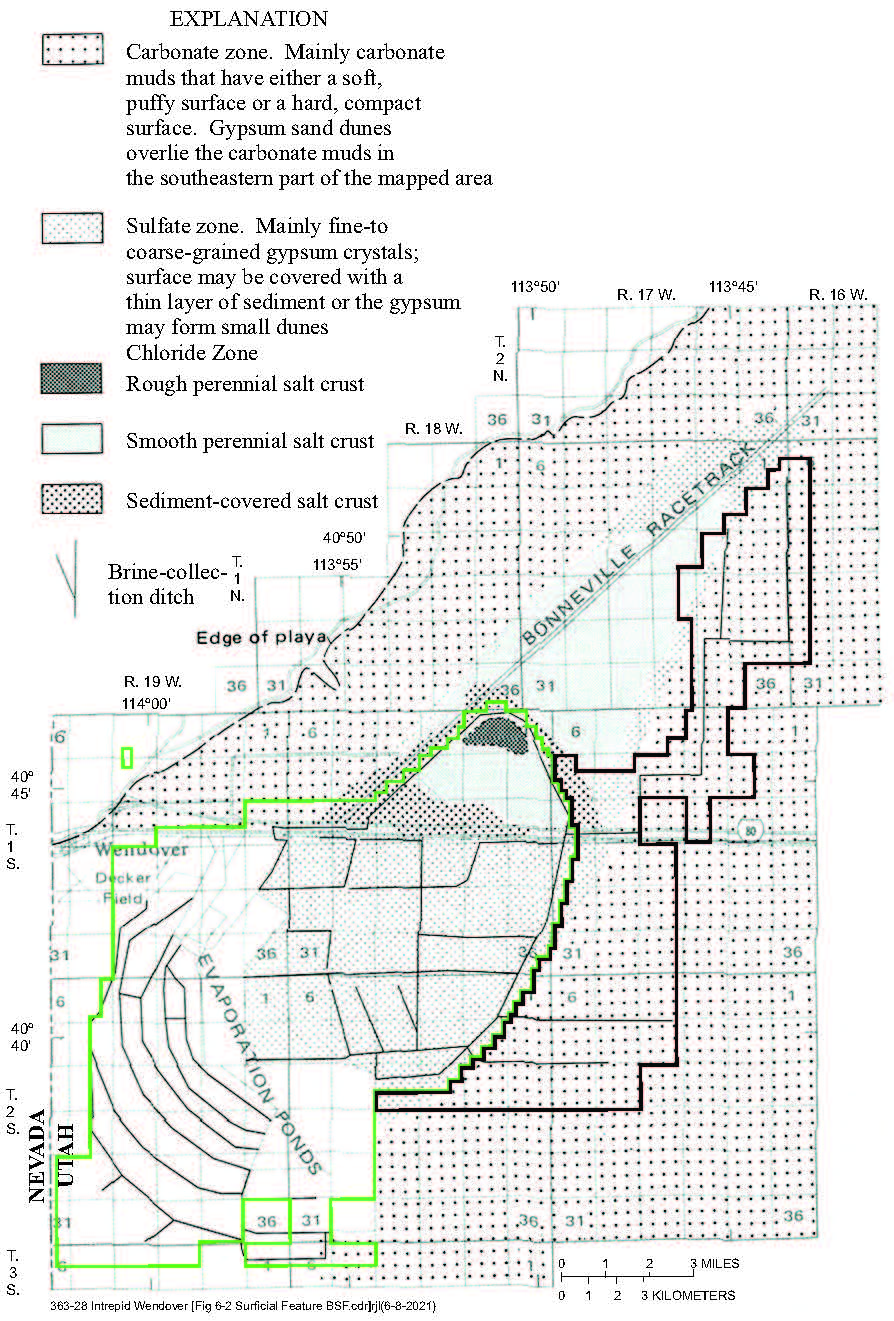

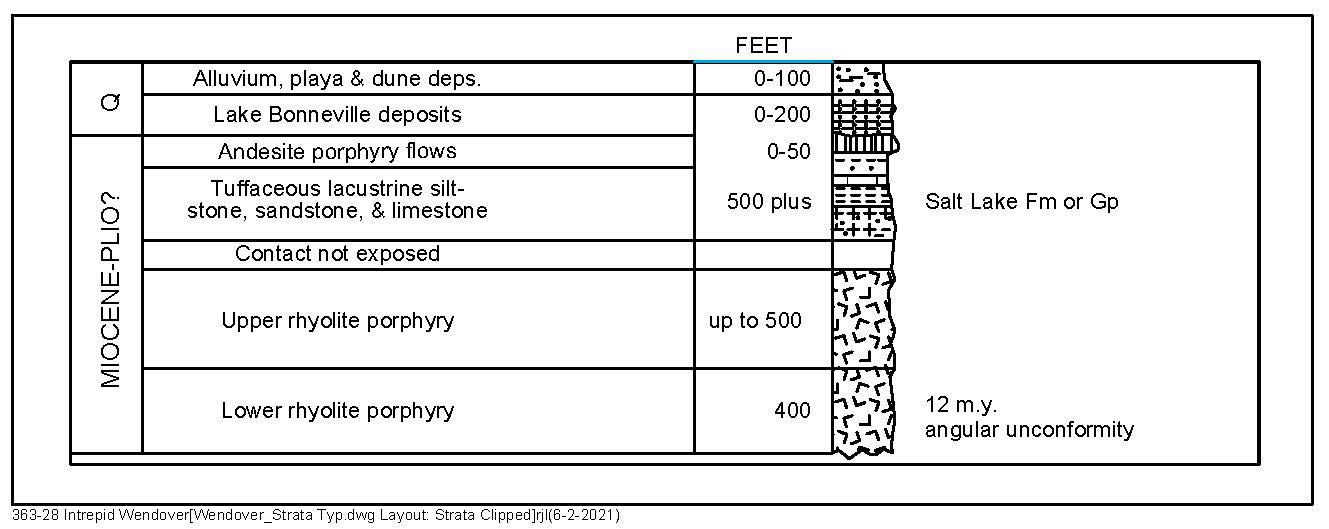

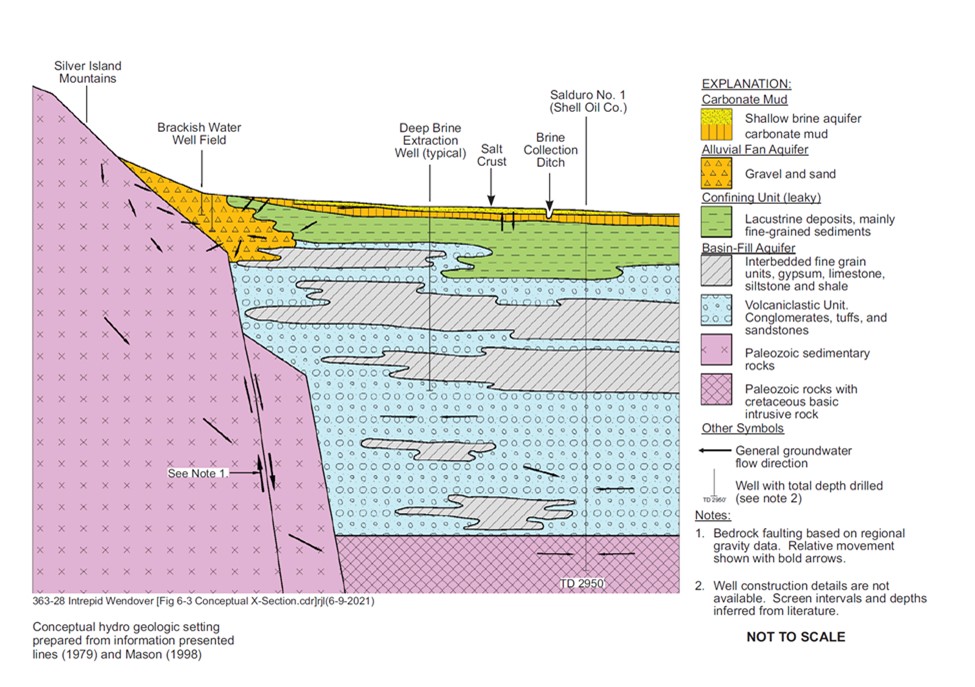

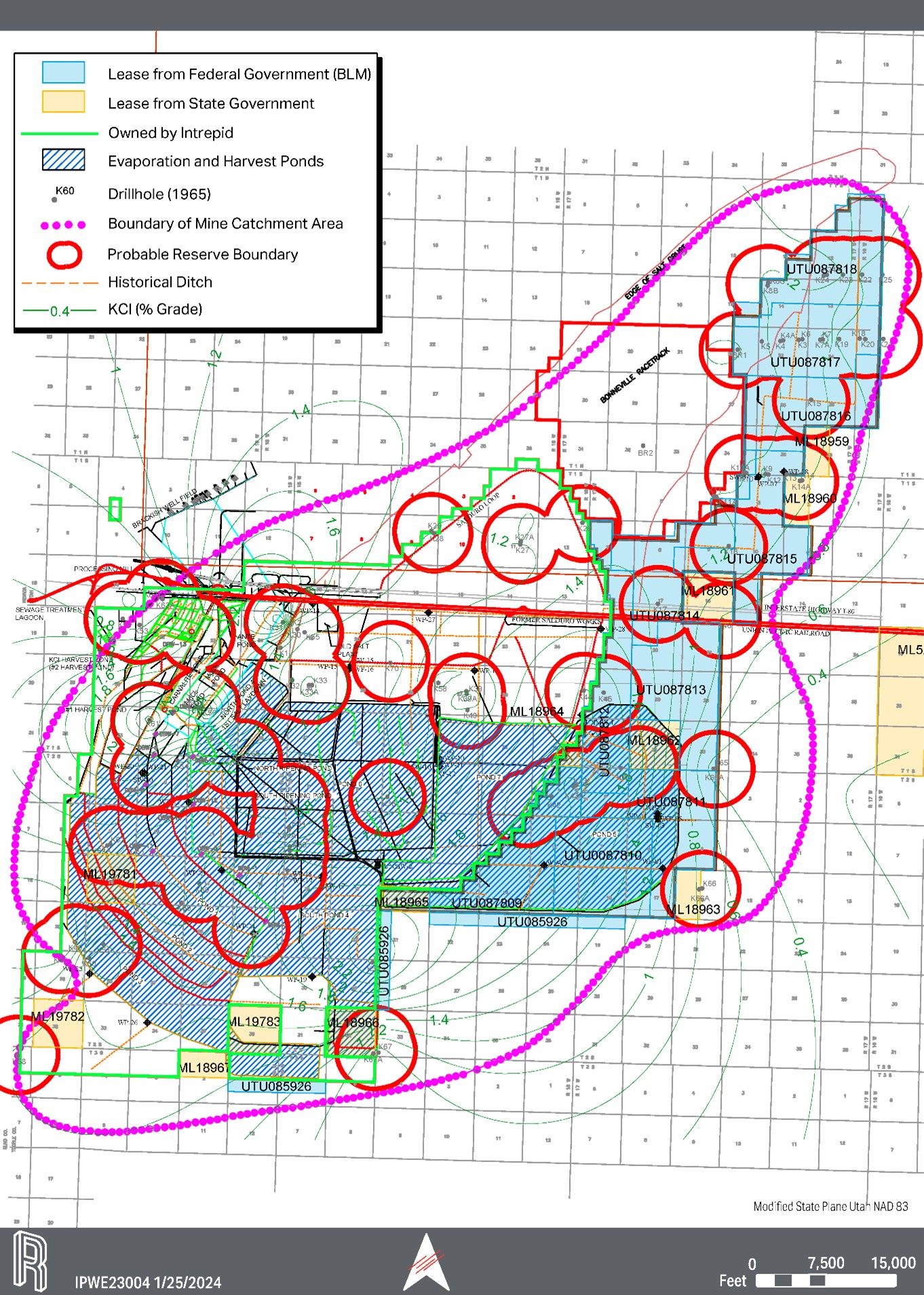

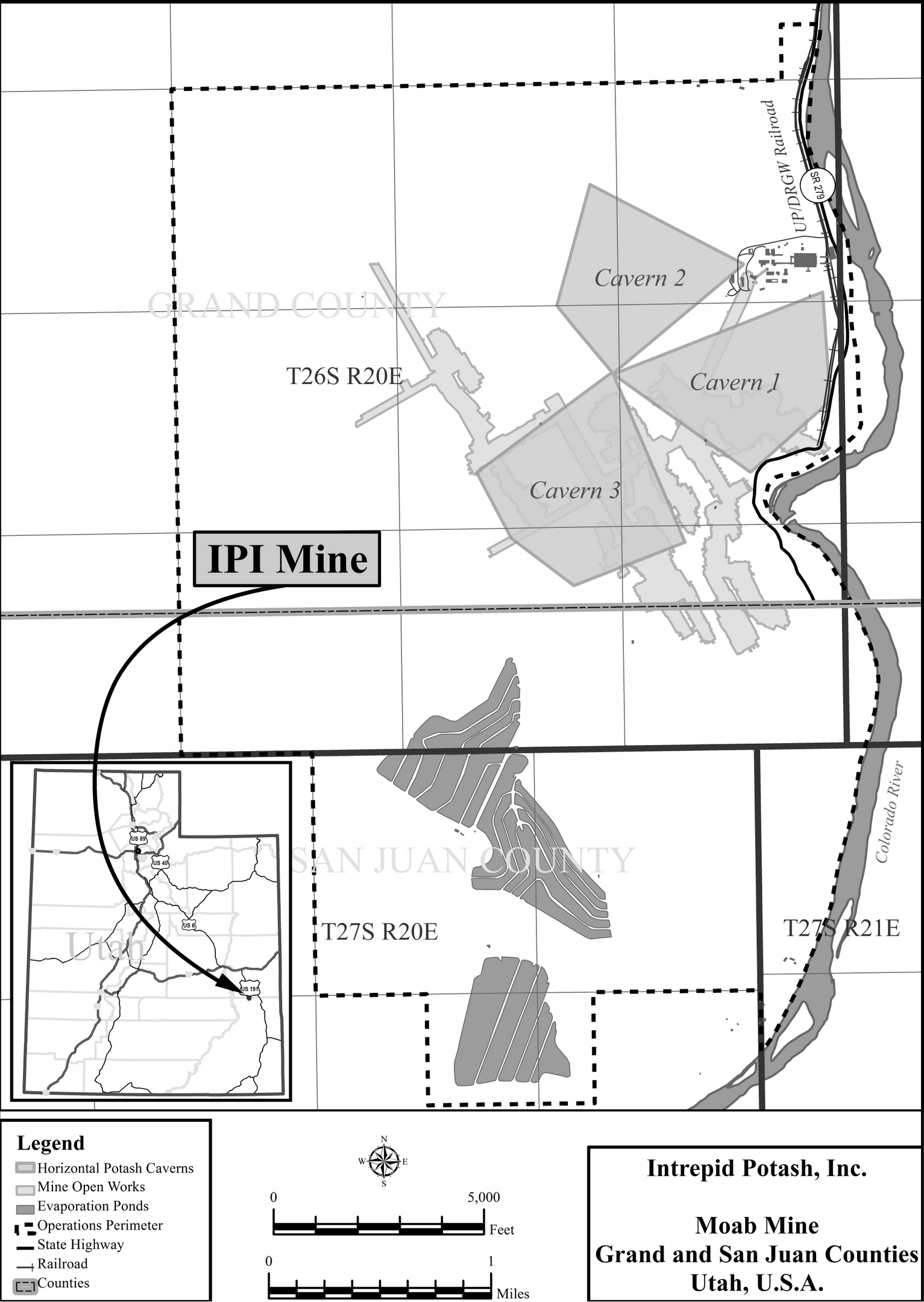

Our extraction and production operations are conducted entirely in the continental U.S. We produce potash from three solution mining facilities: our HB solution mine in Carlsbad, New Mexico, our solution mine in Moab, Utah and our brine recovery mine in Wendover, Utah. We also operate our North compaction facility in Carlsbad, New Mexico, which compacts and granulates product from the HB mine. We produce Trio® from our conventional underground East mine in Carlsbad, New Mexico.

We have permitted, licensed, declared and partially adjudicated water rights in New Mexico. We sell a portion of water from these water rights to support oil and gas development in the Permian Basin near our Carlsbad facilities. We continually work to expand water sales.

In May 2019, we acquired certain land, water rights, state grazing leases for cattle, and other related assets from Dinwiddie Cattle Company. We refer to these assets and operations as "Intrepid South." Due to the strategic location of Intrepid South, part of our long-term operating strategy is selling small parcels of land, including restricted use agreements of surface or subsurface rights to customers, where such sales provide a solution to a customer's operations in the oil and gas industry.

Our principal offices are located at 707 17th Street, Suite 4200, Denver, Colorado 80202, and our telephone number is (303) 296-3006. Intrepid was incorporated in Delaware in 2007.

Our Products and Services

Our three primary products are potash, Trio®, and water. We also sell salt, magnesium chloride, brines, and water that are derived as part of our mining processes. Product sales as a percentage of total sales for the last three years were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

2023 |

|

2022 |

|

2021 |

| Potash |

|

47 |

% |

|

50 |

% |

|

48 |

% |

Trio® |

|

35 |

% |

|

34 |

% |

|

34 |

% |

| Water |

|

5 |

% |

|

7 |

% |

|

8 |

% |

| Salt |

|

4 |

% |

|

3 |

% |

|

4 |

% |

| Magnesium Chloride |

|

3 |

% |

|

2 |

% |

|

3 |

% |

| Brines |

|

3 |

% |

|

2 |

% |

|

1 |

% |

| Other |

|

3 |

% |

|

2 |

% |

|

2 |

% |

| Total |

|

100 |

% |

|

100 |

% |

|

100 |

% |

Potash

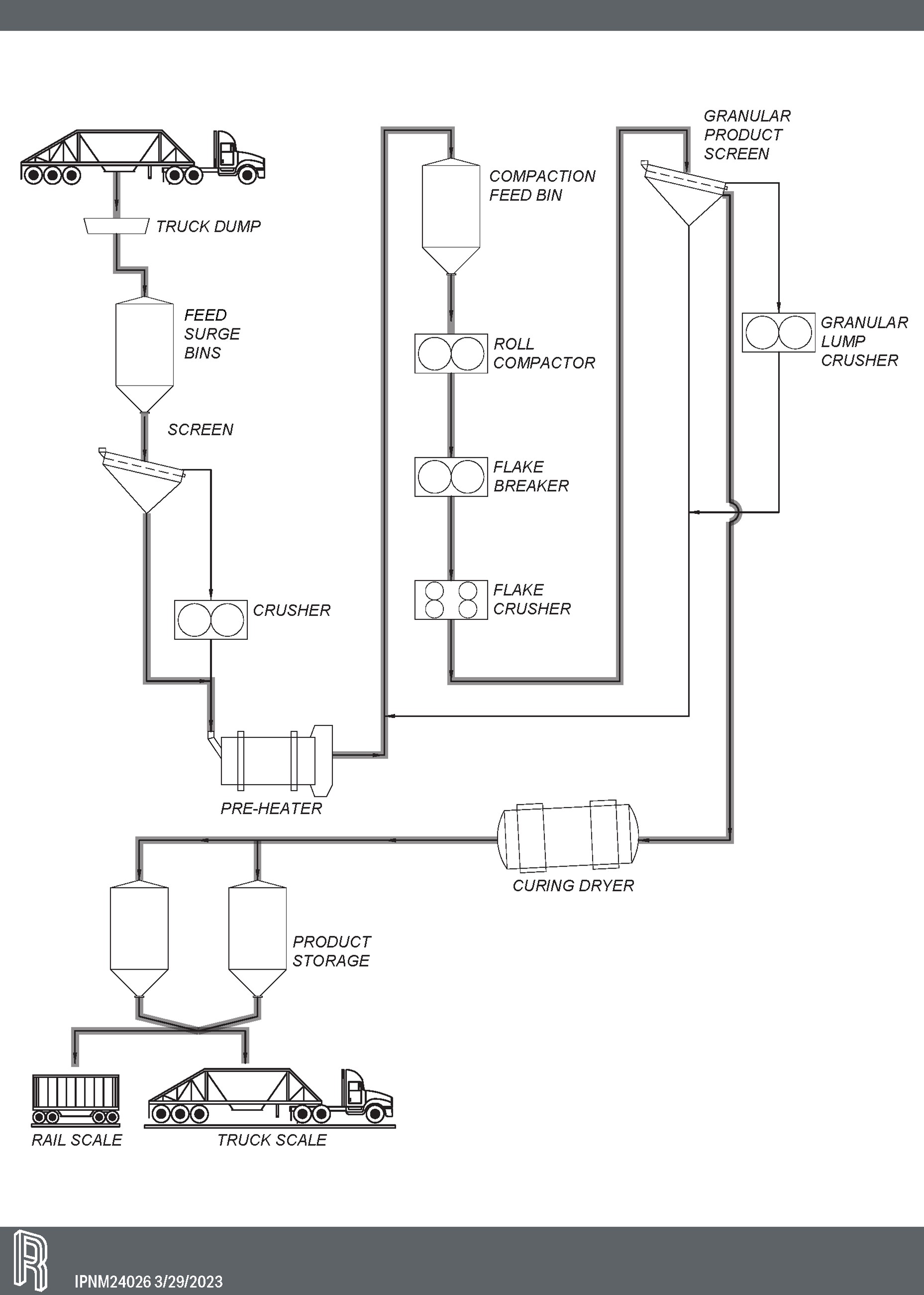

We sell potash into three primary markets: the agricultural market as a fertilizer input, the animal feed market as a nutrient supplement, and the industrial market as a component in drilling and fracturing fluids for oil and gas wells and an input to other industrial processes. Potash is sold in different product sizes, such as granular, standard, and fine standard. The agricultural market predominately uses granular-sized potash, while the industrial and animal feed markets mostly use standard- and fine standard-sized product. We have the flexibility to produce all of our product in a granular form, which decreases our dependence on sales of any one particular size of potash and any particular market.

We manage sales and marketing operations centrally. This allows us to evaluate the product needs of our customers and then centrally determine which of our production facilities is best suited, typically based on geographic location, to use to fill customer orders in a manner designed to realize the highest average net realized sales price per ton. Average net realized sales price per ton is a non-GAAP measure that we calculate as sales less byproduct sales and freight costs and then divided by product sales tons. We also monitor product inventory levels and overall production costs centrally.

During 2023, we supplied approximately 0.4% of global annual potassium consumption and approximately 2.6% of the U.S.'s annual potassium consumption. Substantially all of our potash is sold in the U.S. Our domestic potash sales are geographically concentrated in the central and western U.S. Weather, planting conditions and farmer economics all affect fertilizer sales. For more information, please see "Seasonality."

Trio®

Trio® is our specialty fertilizer that is low in chloride and delivers potassium, sulfur, and magnesium in a single particle. This unique combination of nutrients makes Trio® an attractive fertilizer across diverse crops and geographies. We produce Trio® in premium, granular, standard, and fine standard sizes for sale both domestically and internationally.

Oilfield Solutions

Oil and gas activity and development in southeast New Mexico drives demand for our water and other oilfield related products and services.

We have permitted, licensed, declared and partially adjudicated water rights in New Mexico under which we sell water primarily for industrial uses in the oil and gas services industry.

In May 2019, we acquired Intrepid South, from which we sell products and services to support oil and gas development in the Permian Basin in southeast New Mexico. Our other oilfield related products and service offerings include, but are not limited to, caliche, right-of-way agreements, surface damages and easements, and a produced water royalty. Due to the strategic location of Intrepid South, part of our long-term operating strategy is selling small parcels of land, including restricted use agreements of surface or subsurface rights, to customers, where such sales provide a solution to a customer's operations in the oil and gas industry.

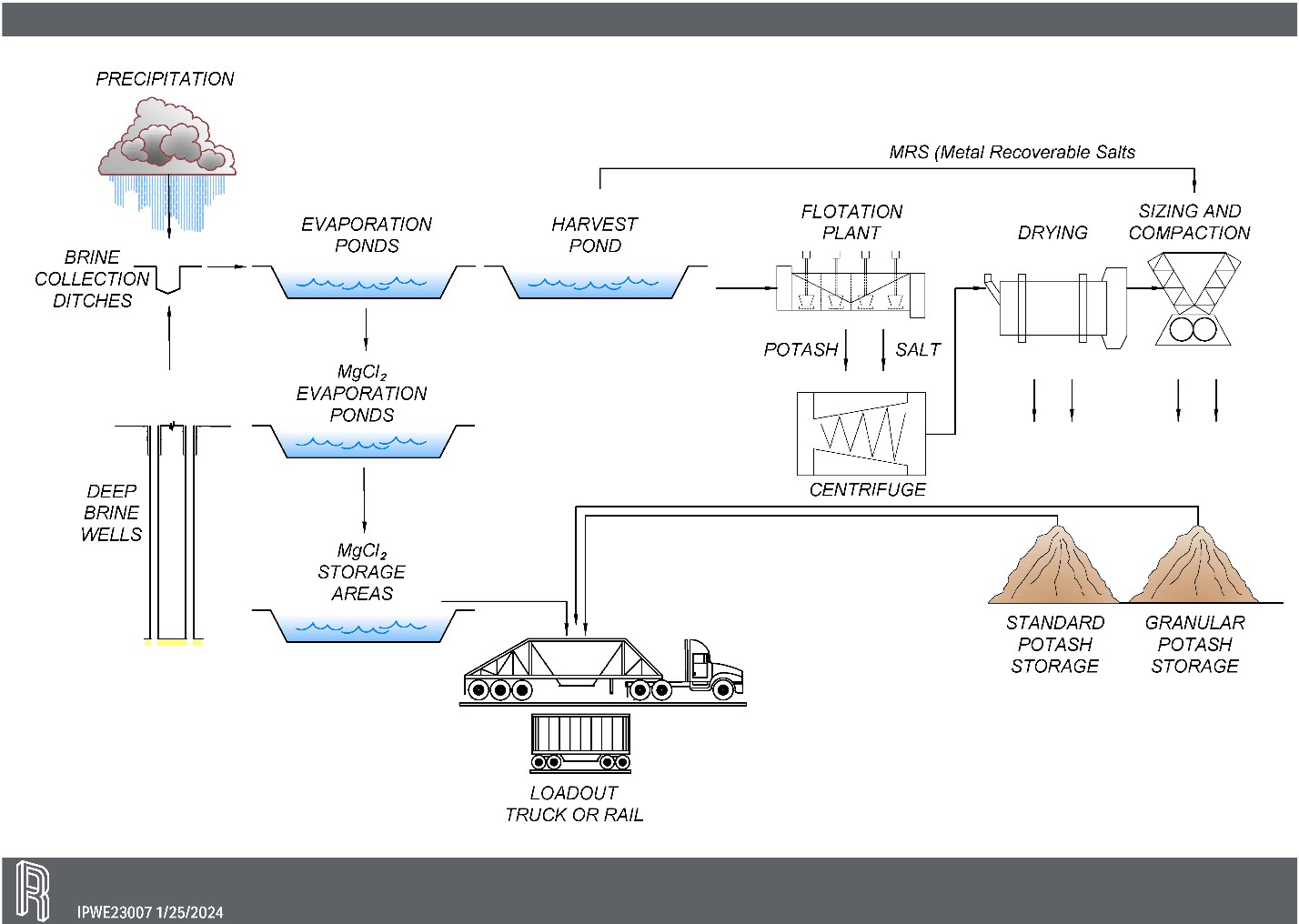

Byproducts

We also sell salt, magnesium chloride, brines, and water that are derived as part of our mining processes. Our salt is used in a variety of markets including animal feed, industrial applications, pool salt, and the treatment of roads and walkways for ice melting or to manage road conditions. Magnesium chloride is typically used as a road treatment agent for both deicing and dedusting. Our brines contain salt and potassium and are used primarily by the oil and gas industry to support well workover and completion activities. When the water that we sell was previously used in the production process for potash or Trio®, it is considered a byproduct of the underlying product. We continue to work to expand sales of byproducts, particularly to serve the oil and gas markets near our operating facilities. Sales of byproducts are accounted for within the segment that produced the byproduct. In each of the last three years, the potash segment accounted for the majority of our byproduct sales.

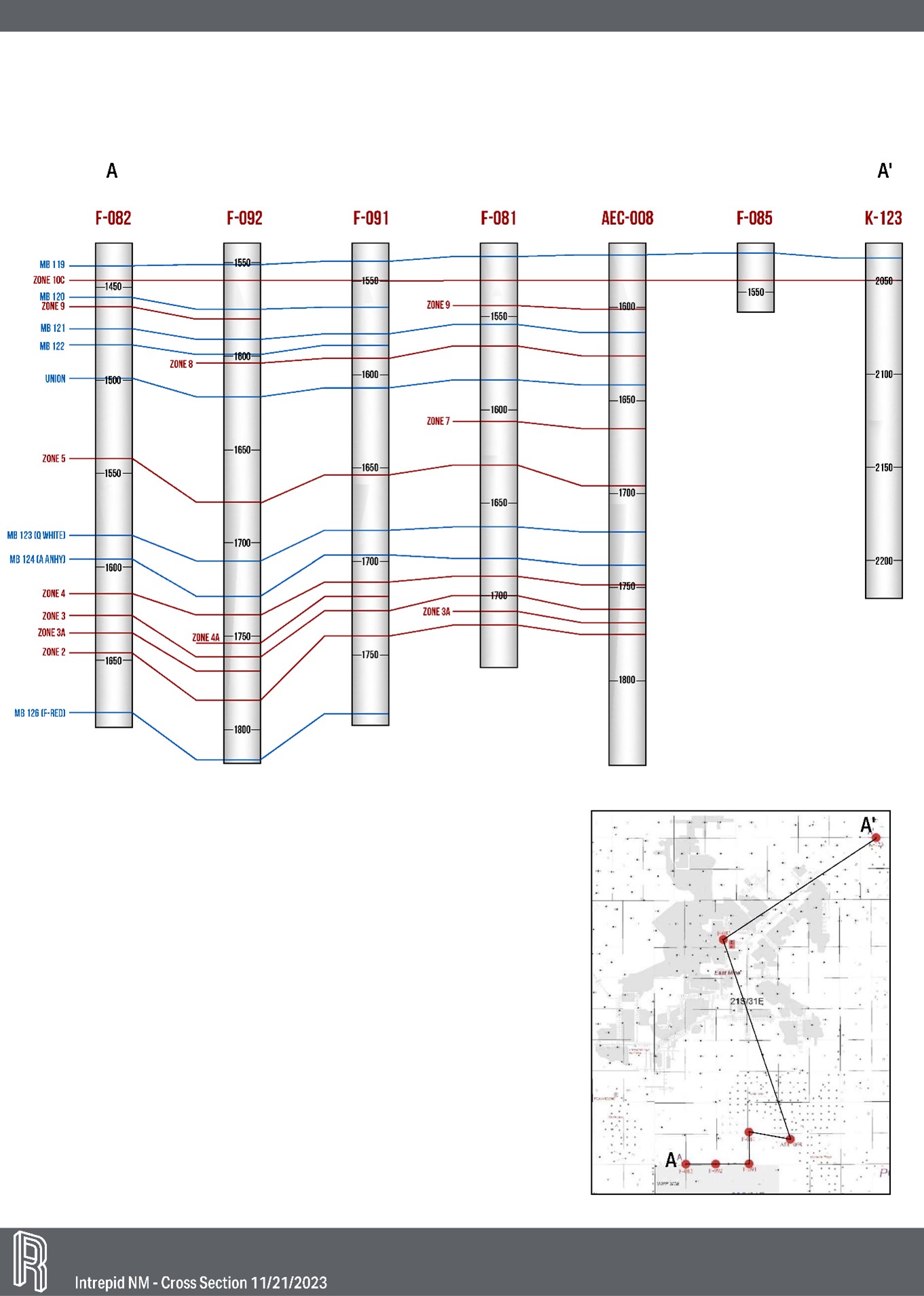

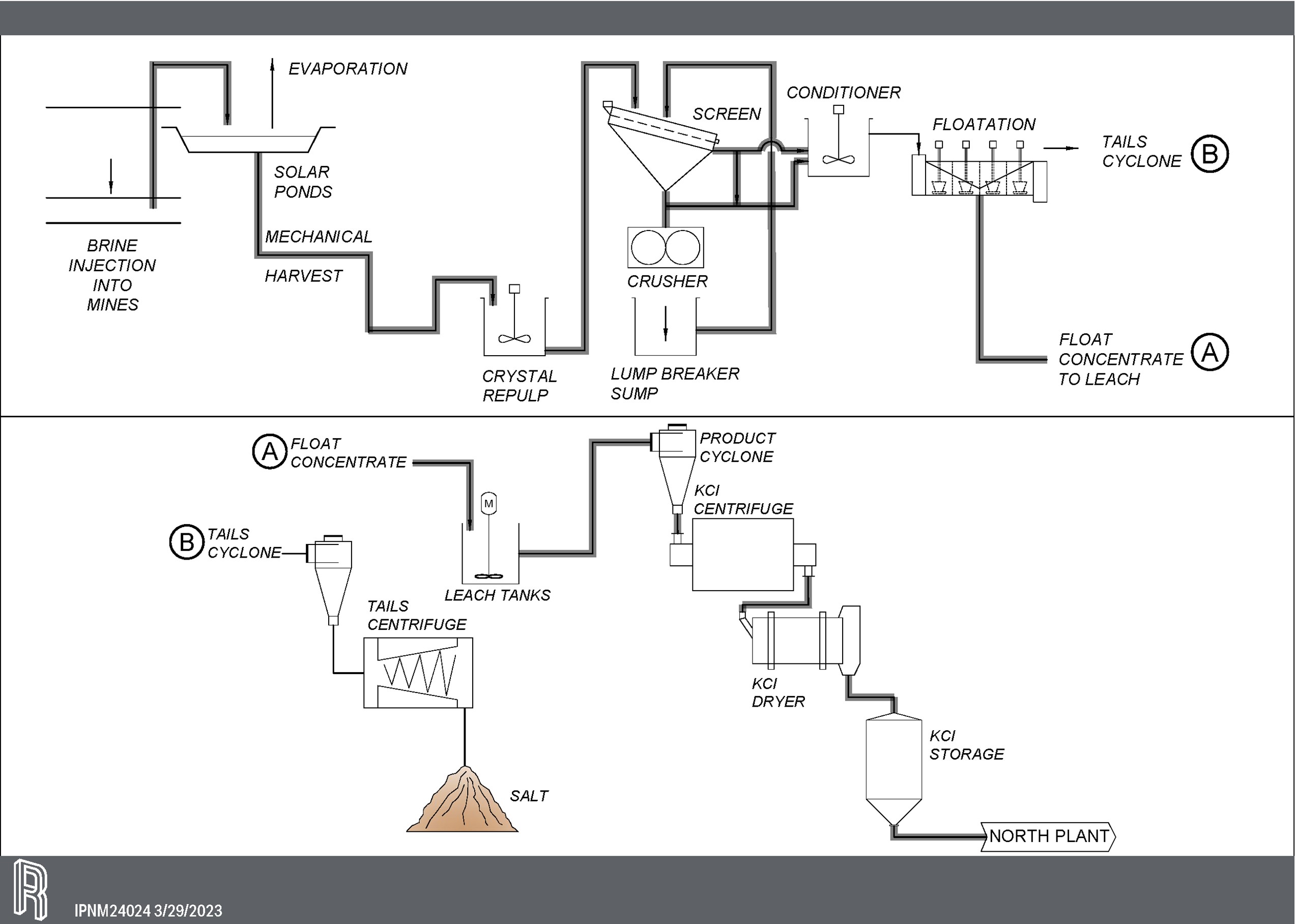

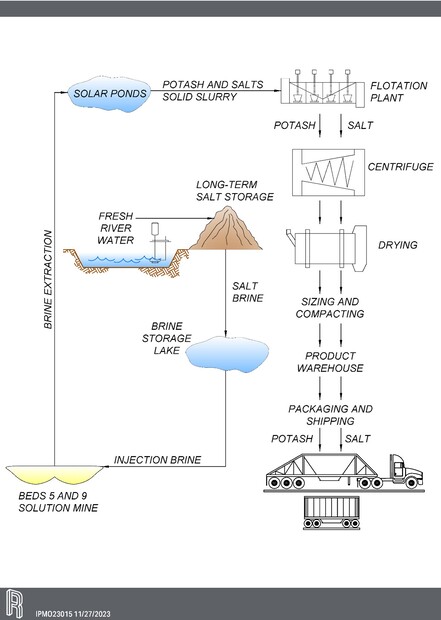

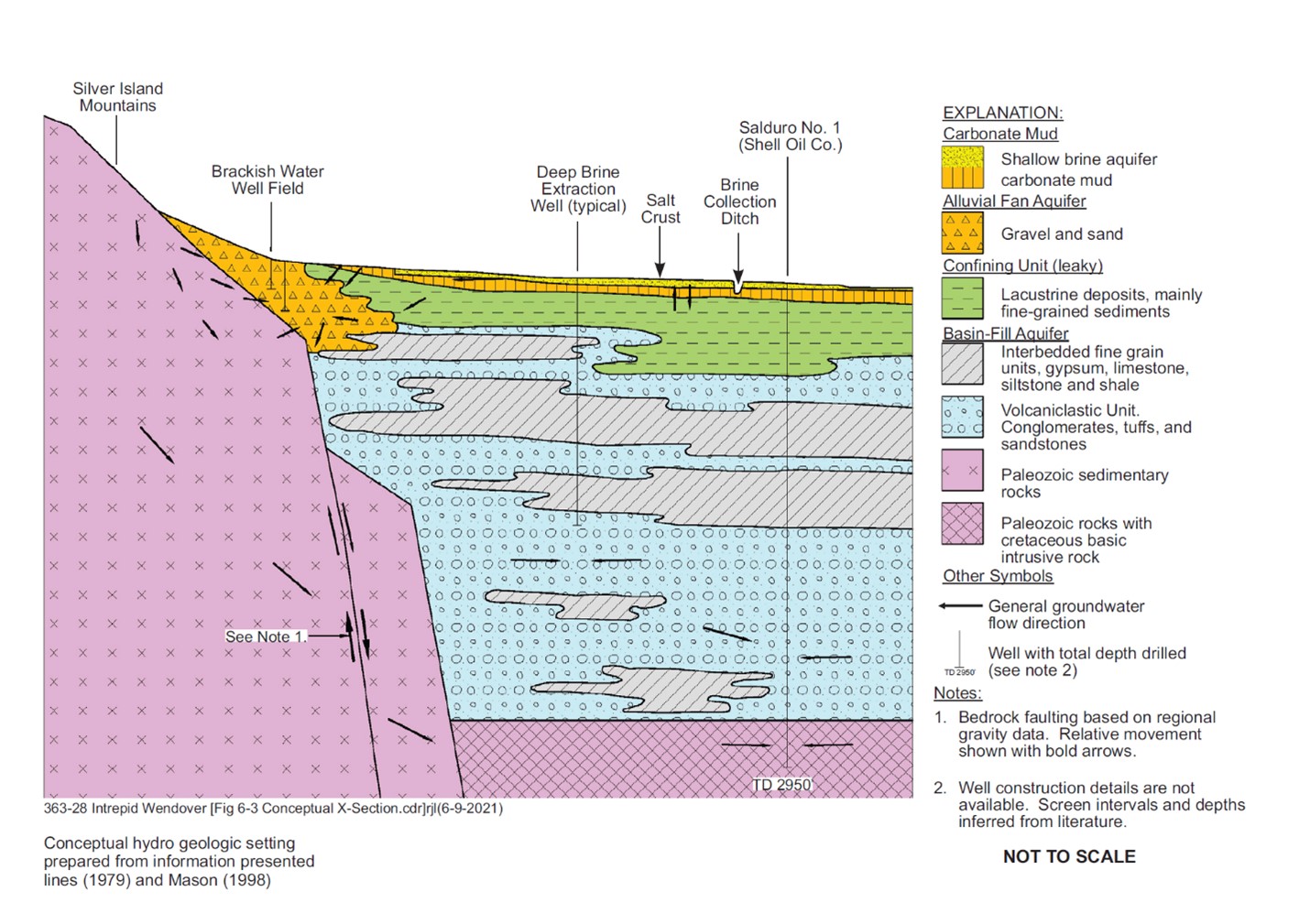

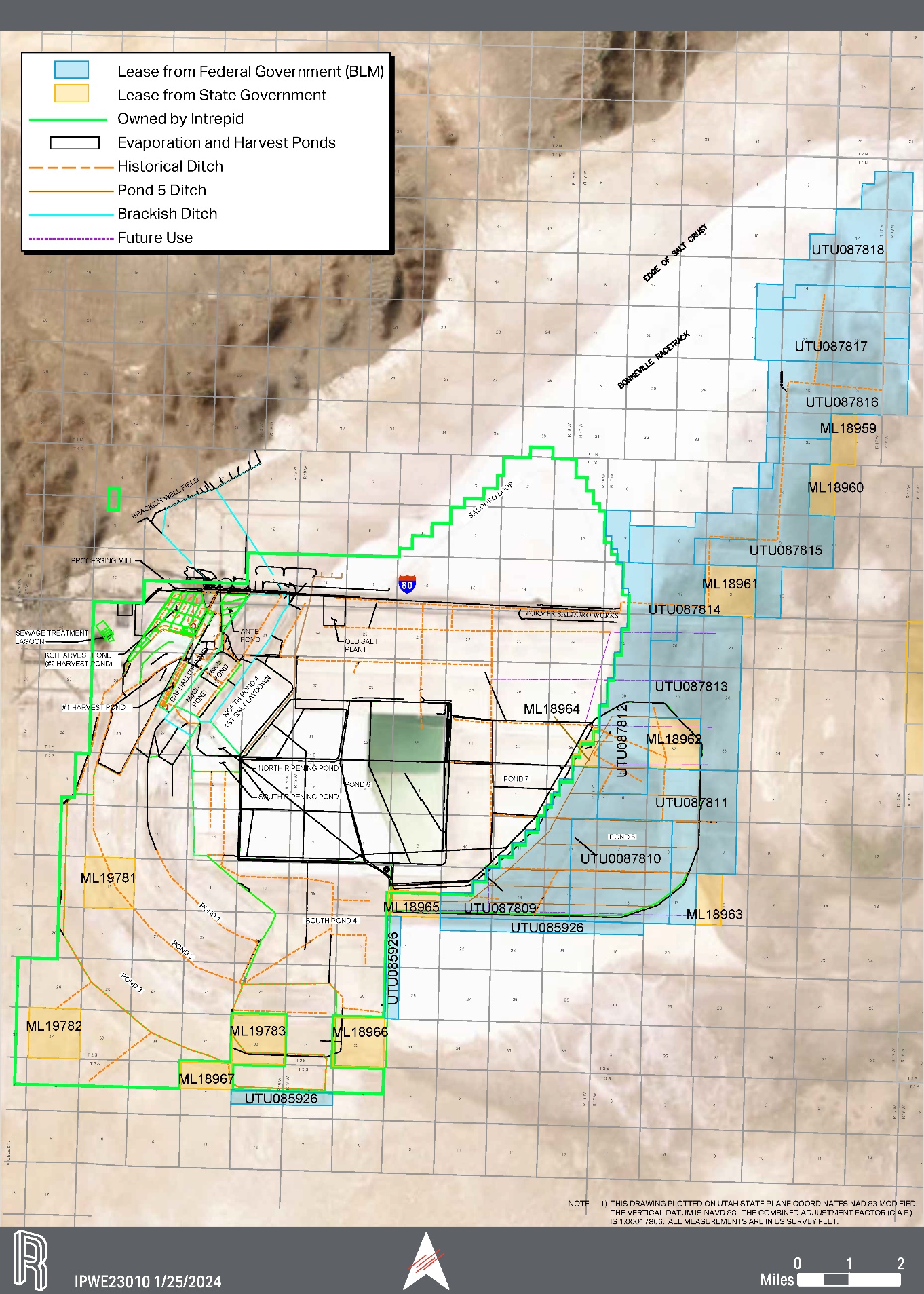

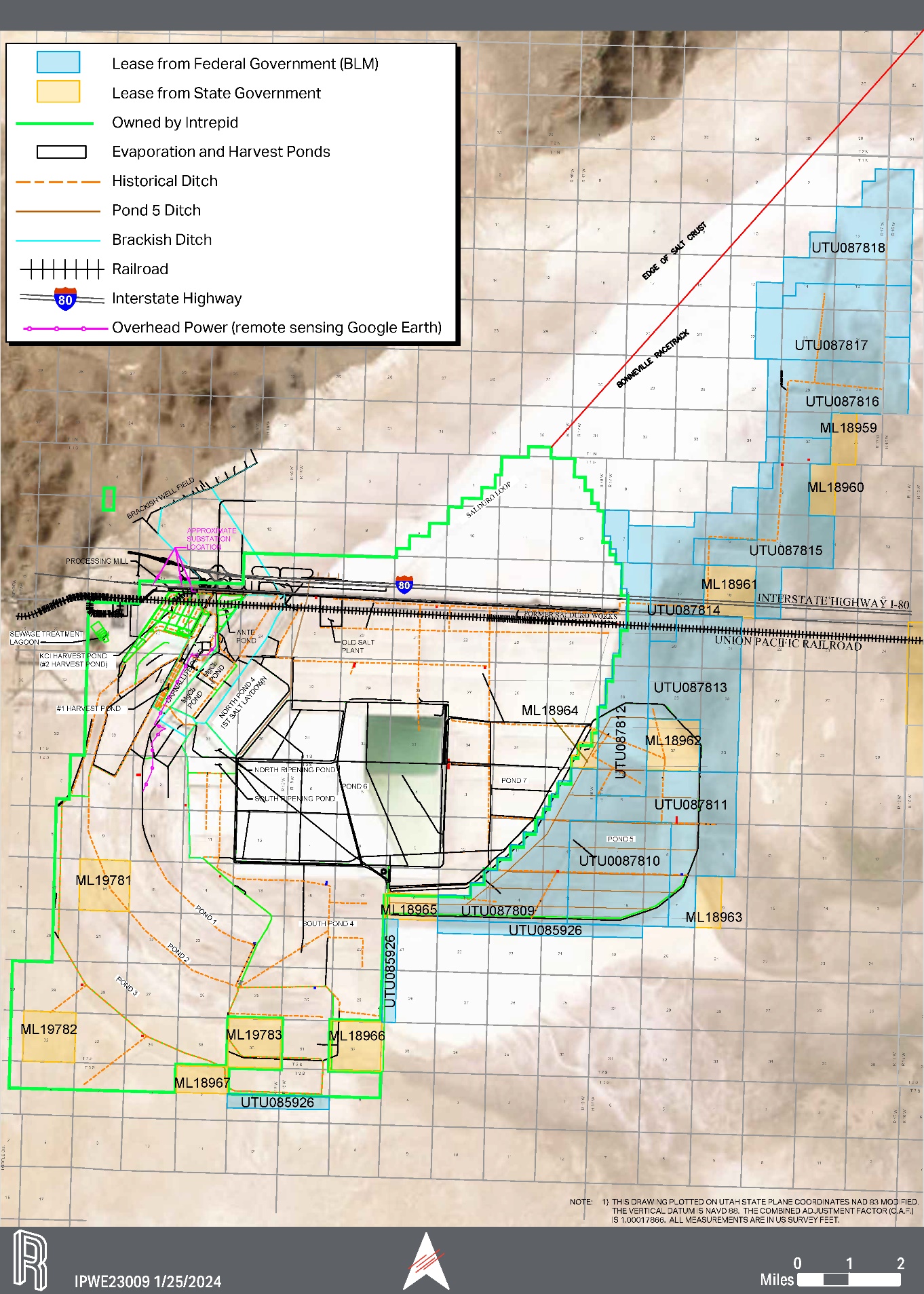

Production Facilities

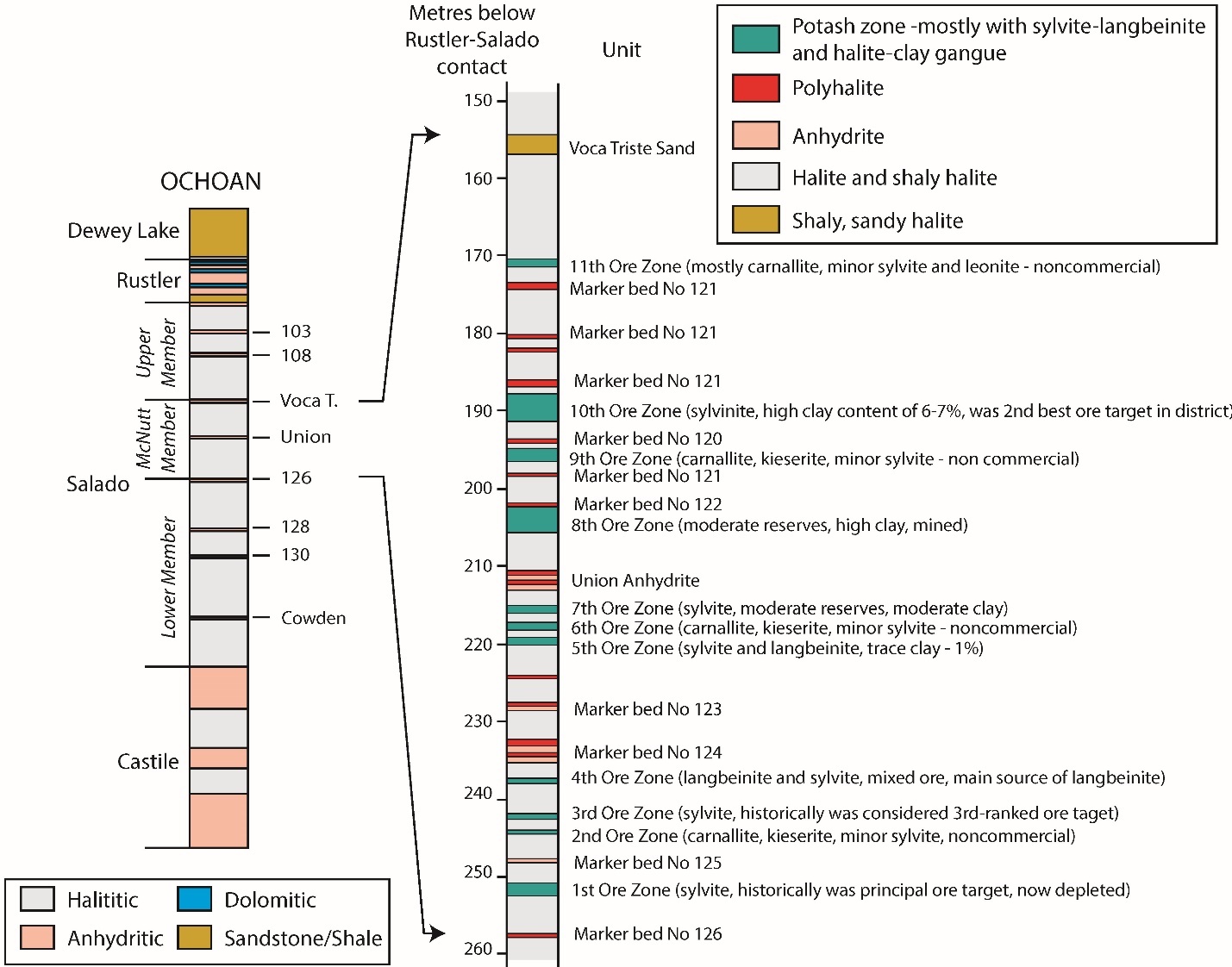

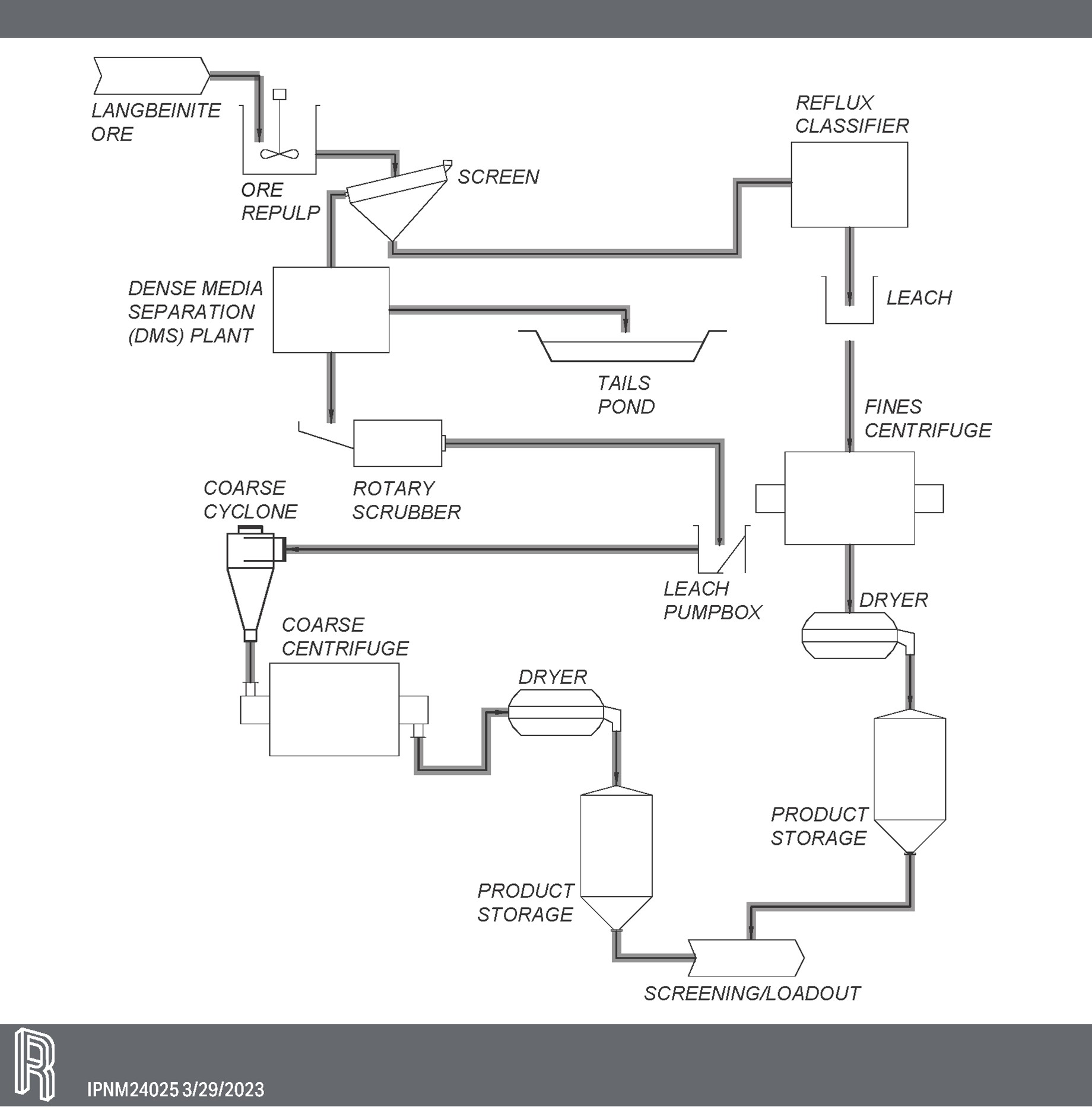

We produce potash from three solar evaporation solution mining facilities: our HB solution mine in Carlsbad, New Mexico, a solution mine in Moab, Utah, and a brine recovery mine in Wendover, Utah. We also operate our North compaction facility in Carlsbad, New Mexico, which compacts and granulates product from the HB mine. Solution mining is a process by which potash is extracted from mineralized beds by injecting a salt-saturated brine into a potash ore body and recovering a brine that contains potash and other minerals. The brine is brought to the surface for mineral recovery through solar evaporation. For solar evaporation, the brine is placed in ponds and solar energy is used to evaporate water thus crystallizing out the potash and minerals contained in the brine. The resulting mineral evaporates are then processed to separate the minerals for sale. Solution mining does not require employees or machines to be underground.

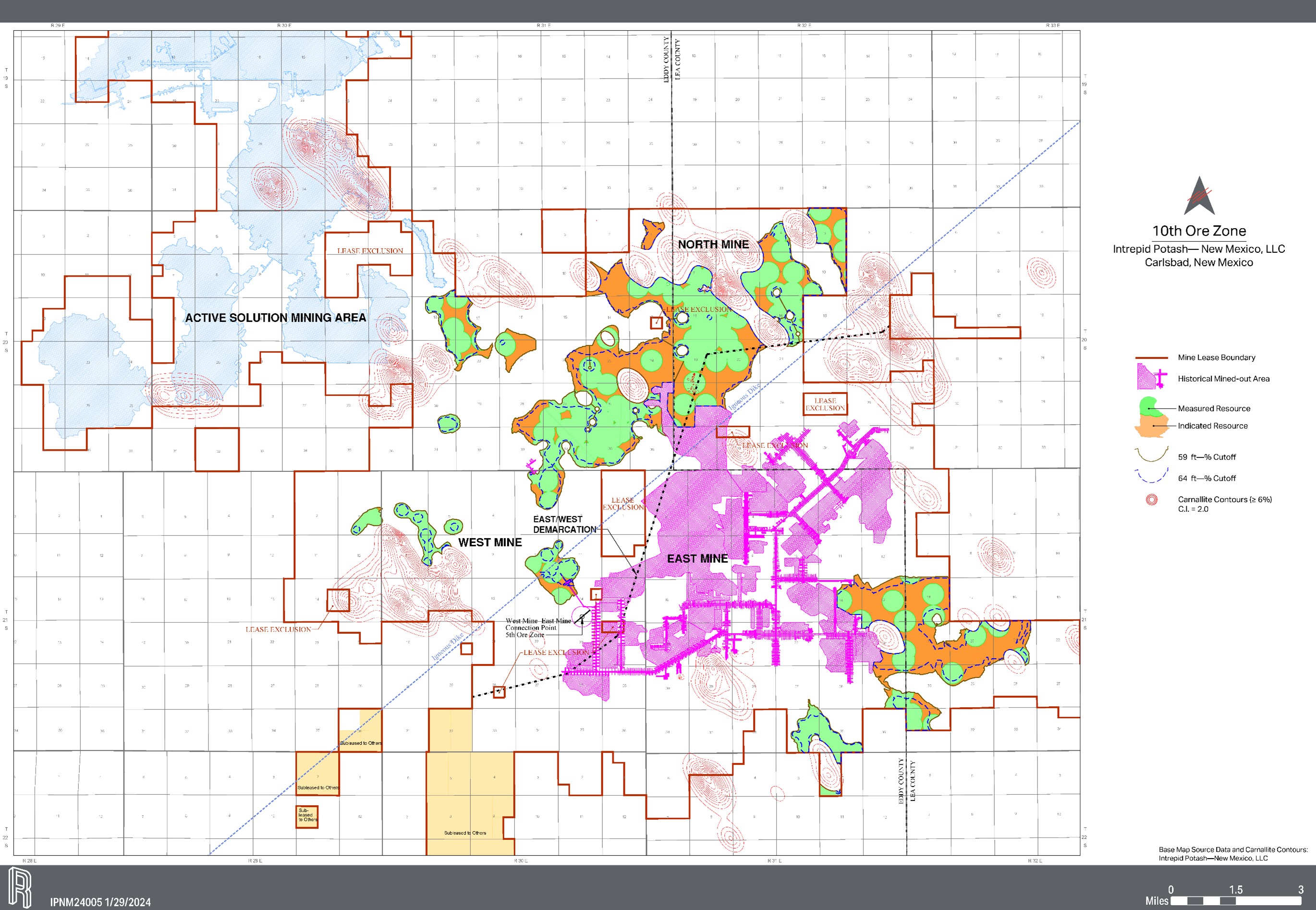

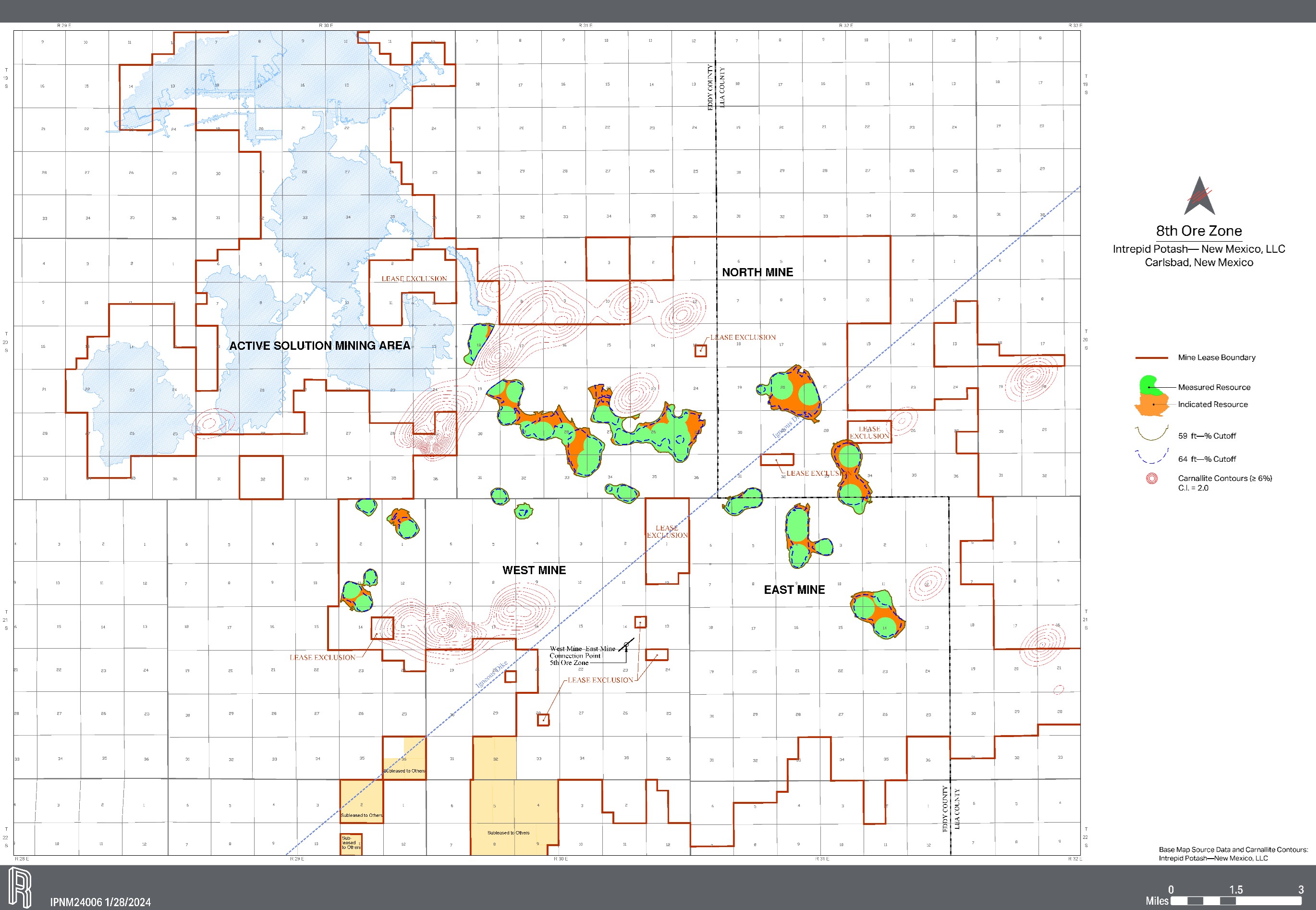

We produce Trio® from our conventional underground East mine in Carlsbad, New Mexico. A conventional underground mine uses a mechanical method of extracting minerals from underground. Underground mining consists of multiple shafts or entry points and a network of tunnels to provide access to minerals and conveyance systems to transport materials to the surface. Underground mining machines are used to remove the ore and a series of pillars are left behind to provide the appropriate level of ground support to ensure safe access and mining.

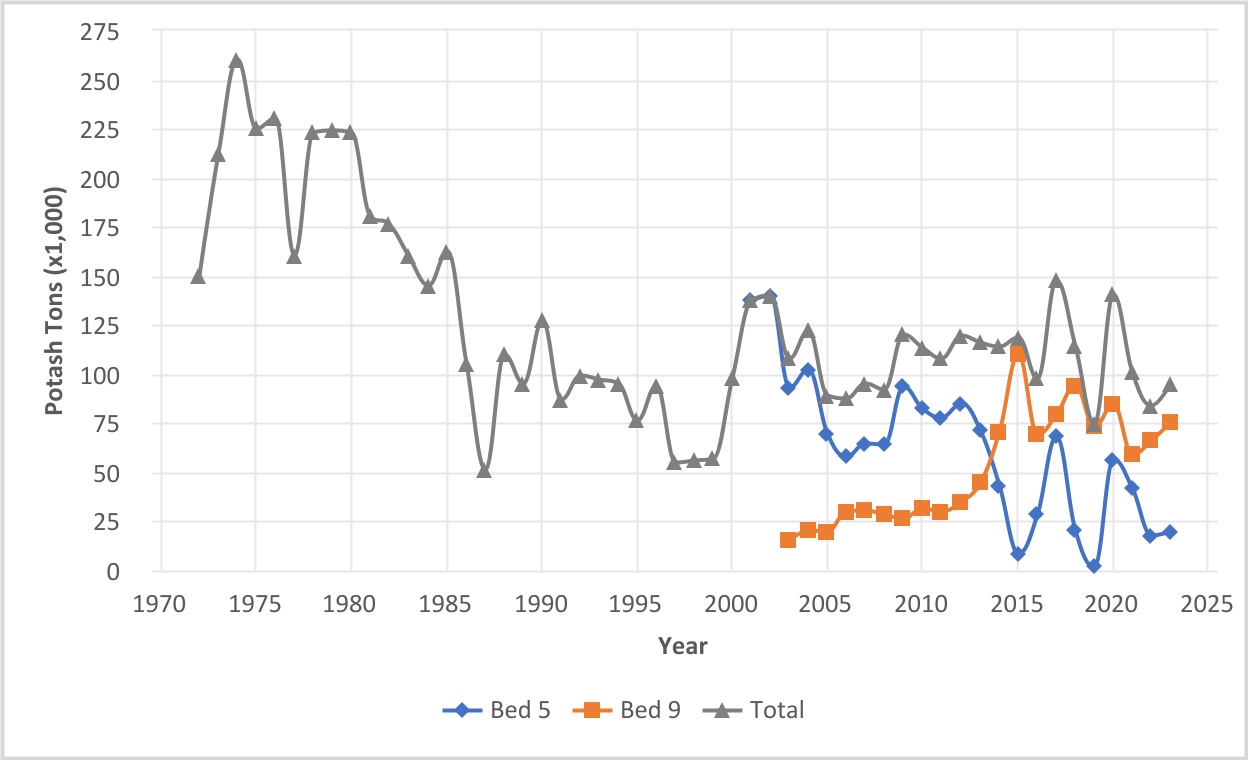

We have a current estimated annual designed productive capacity of approximately 365,000 tons of potash from our solar evaporation solution mines. We also have an estimated annual designed productive capacity of 400,000 tons of Trio®.

Our annual production rates for potash and Trio® are less than our estimated productive capacity. Actual production is affected by operating rates, the grade of ore mined, recoveries, mining rates, evaporation rates, product pricing, product demand, and the amount of development work that we perform. Therefore, as with other producers in our industry, our production results tend to be lower than reported productive capacity.

We also have water pipelines and reservoir ponds that we use to deliver water to our New Mexico facilities and to customers. When we acquired Intrepid South in May 2019, we increased our water rights and water delivery infrastructure.

Industry Overview

Potash and Trio®

Fertilizer serves a fundamental role in global agriculture by providing essential crop nutrients that help sustain both crop yield and quality. The three primary nutrients required for plant growth are nitrogen, phosphate, and potassium. There are no known substitutes for these nutrients. A proper balance of each of the three nutrients is necessary to maximize their effectiveness in crop growth. Potassium helps regulate plants' physiological functions and improves plant durability, providing crops with protection from drought, disease, parasites, and cold weather. Unlike nitrogen and phosphate, the potassium contained in naturally occurring potash does not require additional chemical conversion to be used as a plant nutrient.

In addition to the primary nutrients, which are required in the greatest quantities in crop nutrition, important secondary nutrients such as sulfur and magnesium are also essential in crop nutrition. Intrepid's Trio® product contains the primary nutrient potassium and two secondary nutrients, sulfur and magnesium.

Historically, population growth and global economic conditions drive long-term global fertilizer demand. Sustained per capita income growth and agricultural policies in the developing world and other geopolitical factors, such as temporary disruptions in fertilizer trade related to government intervention and changes in the buying patterns of key fertilizer consuming countries, also affect global fertilizer demand. Annual demand variations are affected by planted acreage, agricultural commodity yields and prices, inventories of grains and oilseeds, application rates of fertilizer, weather patterns, and farm sector income. Volatility in agricultural commodity prices may impact farmer fertilizer buying decisions. We expect these key variables to continue to have an impact on global fertilizer demand for the foreseeable future.

Nameplate production capacities that exceed demand historically shape the world potash market. A few potash companies have controlled a significant portion of this capacity, which was magnified in early 2018 with the merger of two Canadian producers. Generally, these larger producers have managed production levels to approximate world demand. The world potash market experienced a significant decrease in production rates in 2022, due to sanctions on Belarusian potash and Russia's invasion of Ukraine. In 2022, global production decreased approximately 10 million metric tonnes, compared to record production of approximately 71 million metric tonnes in 2021. Global production increased in 2023 to an estimated 67 million metric tonnes and is expected to be approximately 70 million metric tonnes in 2024, due to improving production in Belarus and increased production in Canada and other countries. With planned production expansions anticipated in future years, potash pricing will likely depend on the larger producers' ability to continue to manage the supply and demand balance through decreased utilization rates. Increases in world fertilizer demand, due mainly to population growth and limitations on arable land, are expected to eventually lessen the burden on producers, although recent increases in productive capacities and the continued progress of key expansion projects, specifically BHP's approval of the Jansen Stage 1 project, which expects first production in late 2026, add additional uncertainty to the long-term supply and demand balance for the potash market.

The volume of potash imports to the U.S. further impacts the potash market. A change in the volume of imports could result in a material change to potash prices in the U.S. The U.S. imposed sanctions on Belarusian potash imports, which took effect in April 2022. Belarusian potash historically accounted for approximately 7% of annual demand in the U.S. In response to these sanctions, other foreign suppliers increased the volume of potash imports to the U.S. The overall effect of these sanctions on the potash market remains uncertain.

The world's potash production is heavily focused on a few producers within a handful of countries. Twenty commercial potash deposits produce almost all of the world's potash. According to S&P Global Commodity Insights and data published by potash mining companies, six countries accounted for approximately 87% of the world's aggregate potash production during 2023. During the same period, the top nine potash producing countries supplied approximately 95% of the world's potash production. Two major Canadian producers participate in the Canpotex marketing group that supplied approximately 34% of global potash production in 2023. Russia accounted for 17% and Belarus accounted for 11% of global potash production in 2023.

Oilfield Solutions

The most productive region in the U.S. for oil production is the Permian Basin, which spans from west Texas to southeastern New Mexico. As of January 2024, the Permian Basin produced approximately 6.0 million barrels of oil per day. For comparison, the next most productive region in the U.S. produced approximately 1.3 million barrels of oil per day. In addition to producing wells, the Permian Basin also had approximately 800 drilled but uncompleted wells as of December 2023.

The majority of oil and gas wells drilled in the U.S., including the Permian Basin, are hydraulically fractured horizontal wells, which account for the record amount of fossil fuels produced in the U.S. in recent years. The use of horizontal drilling in oil and gas production allows a well to remain in contact with the targeted formation thereby increasing production compared to vertically drilled wells. Horizontal drilling has resulted in longer wells, with some horizontal drilling sections reaching several miles long.

The increase in horizontal drilling has resulted in an increase in the use of fresh water. A single hydraulically fracked well has the potential to use millions of gallons of fresh water. In the frac process, water and sand are used to move proppant and other frac additives into the targeted rock formation. Fresh water is important in the fracking process, as impurities in the water can impact the overall effectiveness of the frac. Pipelines transport most water used in fracking to the frac site, where it is stored in ponds or storage tanks.

While fresh water remains a key input for many fracs, operators have switched to using more recycled/produced water when completing wells. We believe this change is due to water conservation efforts, a move towards more environmentally friendly operations, and an increase in the amount of produced water available for fracking. By recycling and using produced water, operators are able to reduce fresh water purchases and decrease the cost of transporting and disposing of produced water into disposal wells.

In evaluating the hydraulic fluid to use for frac operations, oil and gas operators consider whether to use produced or fresh water and consider the weight of the fluid used. Operators are using more heavy brines as heavier fluids can drill through salt formations more effectively than lighter weight alternatives.

Competition and Competitive Strategy

We sell our potash and Trio® into commodity markets in which delivered price and the ability to timely deliver high quality products are essential. We are a competitive producer in the industry because of our ability to timely deliver high quality potash and Trio® products with specific particle sizes and with specific potassium oxide contents. In the potash market, we compete with larger Canadian potash producers and, to a lesser extent, producers located in Russia, Chile, Germany, and Israel. For Trio®, we compete with one other producer of langbeinite as well as producers of other specialty nutrients and blended products. The competitive market for our water resources includes other water right holders, which include companies, farmers, and ranchers operating in or near the Permian Basin in New Mexico.

Some of our direct and potential competitors may have significant advantages over us, including greater name recognition, longer operating histories, pre-existing relationships with current or potential customers, significantly greater financial, marketing and other resources, ownership of more diverse assets and products, and/or access to less expensive mining assets, any of which could allow them to respond more quickly to new or changing opportunities.

Our competitive strategy is focused on the following:

•Maximizing potash gross margin and optimizing potash production. All of our potash production comes from solar solution mines, which carry fewer fixed costs than our conventional potash mines. Our per-ton costs are lower for solution mining than conventional mining as solar solution mining requires less labor, energy, and equipment. Additionally, we are advantageously located close to the markets we serve, with the North American market demand being significantly larger than our production capacity; therefore, we are able to selectively participate in the markets that we believe will provide the highest average net realized sales price per ton. We also maximize our gross margin by leveraging our freight advantage to key geographies, improving our diverse customer and market base, and developing our flexible marketing approach. We have optimization and expansion opportunities at our solution mining facilities, that, over time, could reduce our per-ton costs and increase our potash production.

•Maximizing Trio® gross margin and optimizing Trio® production. We are working to optimize our production process to produce more granular-sized product, which is preferred by most markets. Our sales and marketing approach is focused on domestic and select international markets and includes crop nutrition education and increased marketing efforts targeting organic agriculture and high-value specialty crop markets. We currently operate our Trio® facility at a reduced production level and expect to continue to do so for the foreseeable future.

•Expanding offerings of oilfield solutions. We intend to continue our expansion of water and brine sales, particularly to serve the oil and gas markets near our operating plants in New Mexico. We have water rights from which we sell water for commercial uses in the oil and gas services industry. We also use a portion of our water rights to produce heavy brines for use in the oil and gas industry. Additionally, as described above, in May 2019, we acquired certain land, water rights, federal and state grazing leases for cattle, and other related assets from Dinwiddie Cattle Company in the Permian Basin which we operate as Intrepid South. We expect to increase the amount of water available for sale from Intrepid South over the next few years through permitting additional water rights and infrastructure investments. Our other oilfield related products and services include, but are not limited to, surface use and right-of-way agreements, a produced water royalty agreement, and caliche sales. Given the location of Intrepid South, part of our long-term operating strategy is selling small parcels of land, including through the use of restricted use agreements for surface or subsurface rights, to customers.

•Continuing diversification of byproducts and services. We recover magnesium chloride, salt, brines, and water byproducts during the production of potash and Trio®. These byproducts diversify our portfolio of product and service offerings. As we continue to explore and evaluate opportunities to diversify our revenue sources, we may enter into new or complementary businesses that expand our current product and service offerings, including an expansion into oil and natural gas exploration and production, or into new products or services in our current industry or other industries.

Competitive Strengths

•U.S.-based producer. We are the only producer of potash in the U.S. We are located in a market that consumes significantly more potash than we can currently produce on an annual basis. Our geographic location provides us with a transportation advantage over our competitors for shipping our product to customers. In general, this allows us to obtain a higher average net realized sales price per ton than our competitors, who ship their products across longer distances to consuming markets, which increases their costs and reduces their gross margin. Our location allows us to target sales to the markets in which we have the greatest transportation advantage, maximizing our average net realized sales price per ton. Our access to strategic rail destination points and our location along major agricultural trucking routes also supports this advantage.

As a U.S. producer, we enjoy a significantly lower total production tax and royalty burden than our principal competitors, which operate primarily in Saskatchewan, Canada. The Saskatchewan tax system for potash producers includes a capital tax and several potash mineral taxes, none of which are imposed on us as a U.S. producer. We currently pay an average royalty rate of approximately 4.9% for our potash and Trio® sales less their related freight costs, which compares favorably to that of our competitors in Canada. The relative tax and royalty advantage for U.S. producers becomes more pronounced when profits per ton increase due primarily to the profit tax component of the Saskatchewan potash mineral tax.

•Solar evaporation operations. All our potash production comes from solar solution mines. Solar evaporation is a cost-efficient production method because it significantly reduces our labor force and energy consumption, which are two of the largest costs of production. Our understanding and application of low-cost solution mining, combined with our reserves being located where a favorable climate for evaporation exists, make solar solution mining difficult for other producers to replicate. We also have significant reserves for future expansion of our solution mining operations.

•Diversity in Secondary Nutrient Markets. Given the greater scarcity of langbeinite relative to potash, its agronomic suitability for certain chloride-sensitive soils and crops, and the addition of key secondary nutrients in sulfur and magnesium, we believe there is a market for Trio® outside of our core potash markets. We also believe that there is a market for Trio® beyond the U.S., although freight expense and competition from substitute products have made this a difficult market to penetrate. We also offer Organic Materials Review Institute ("OMRI") listed potash and Trio® products that provide essential minerals for growing certified organic crops.

•Water rights. Water rights in New Mexico are real property rights, which authorize a water right owner to use a specific amount of water, diverted from a specific location, for a specific purpose of use, in a specific place. Water rights are limited to the amount of water put to beneficial use. In New Mexico, the New Mexico Office of the State Engineer (“OSE”) administers water rights. The validity of water rights is ultimately confirmed or denied by a court in an adjudication proceeding. Prior to an adjudication, a water right may be acquired through the OSE’s permitting or licensing process. If a water right existed before the OSE had authority to issue permits, a water rights owner may file a declaration with the OSE. The OSE issues permits for both surface and groundwater appropriations. These permits are inchoate rights, which allow a permittee to put the water to beneficial use as prescribed by the agency. Once the OSE confirms that water diversion works have been completed and water has been put to beneficial use, the water right is licensed. A declaration is made when water was put to beneficial use either before New Mexico adopted its current water code in 1907 for surface water declarations, or before the OSE declared an underground water basin for groundwater declarations. A water right claimant must apply to the OSE for a permit to make changes to a water right, including changes in the place or purpose of use. The validity of water rights is ultimately confirmed or denied by courts in an adjudication process. We have permitted, licensed, declared and partially adjudicated water rights in New Mexico under which we sell water primarily for commercial uses in the oil and gas services industry. We continue to work to expand sales of water, especially to support oil and gas development in the Permian Basin near our Carlsbad facilities. The Intrepid South property increased the total water rights available for sale in and around the Delaware Basin, a sub-basin of the Permian Basin. This has expanded our relationships with oil and gas producers, which we may be able to use to expand sales of our industrial potash products, byproducts, and services.

•Diversity of potash markets. We sell potash into three different markets—the agricultural, feed and industrial markets. In 2023, these markets represented approximately 74%, 23%, and 3%, of potash sales, respectively, and during 2022, these markets represented approximately 69%, 23%, and 8%, of our potash sales, respectively. The agricultural market supplies crop nutrients to farmers producing a wide range of crops in different geographies and the animal feed market supplies feed manufacturers with key nutrients for a wide range of feed blends into various markets such as pet food and cattle feed. Sales into industrial markets have historically supported drilling activities in oil and gas, although the use of lower-cost potash substitutes in recent years has reduced our sales into those markets.

•Marketing flexibility. We have the ability to convert all of our standard-sized potash product into granular-sized product as market conditions warrant. We produce Trio® in premium, granular, standard and fine standard sizes. This provides us with increased marketing flexibility as well as decreased dependence on any one particular market.

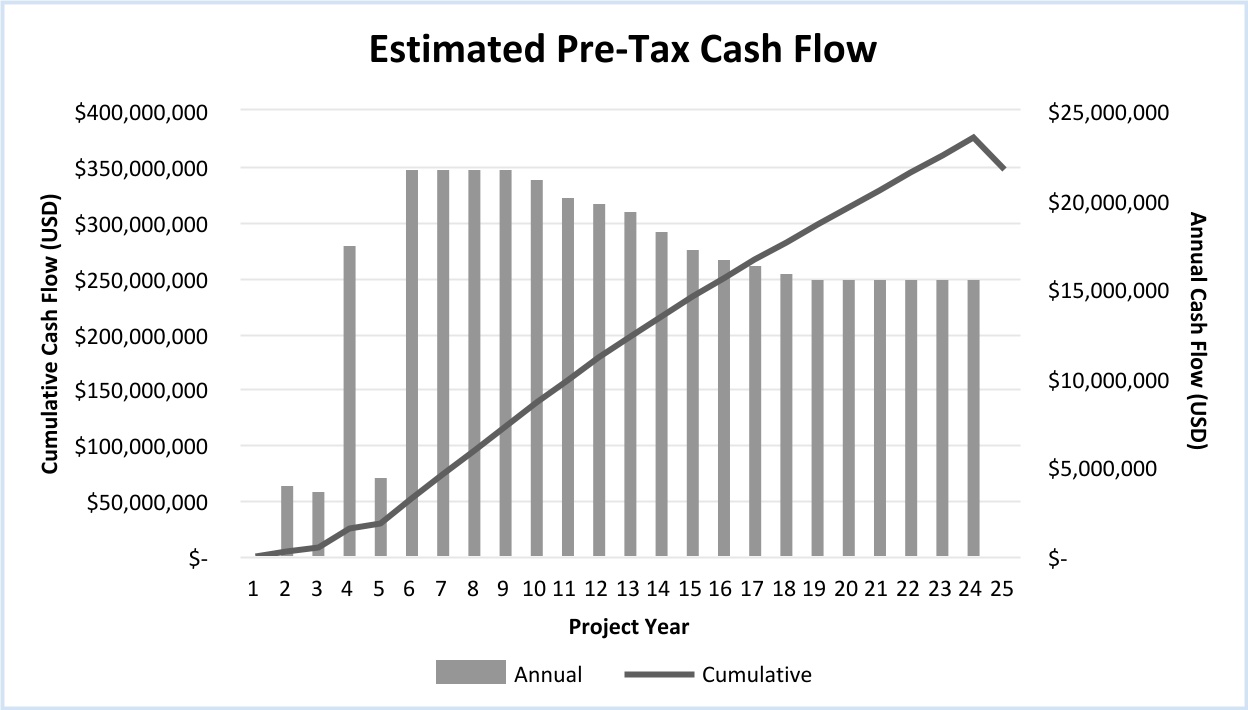

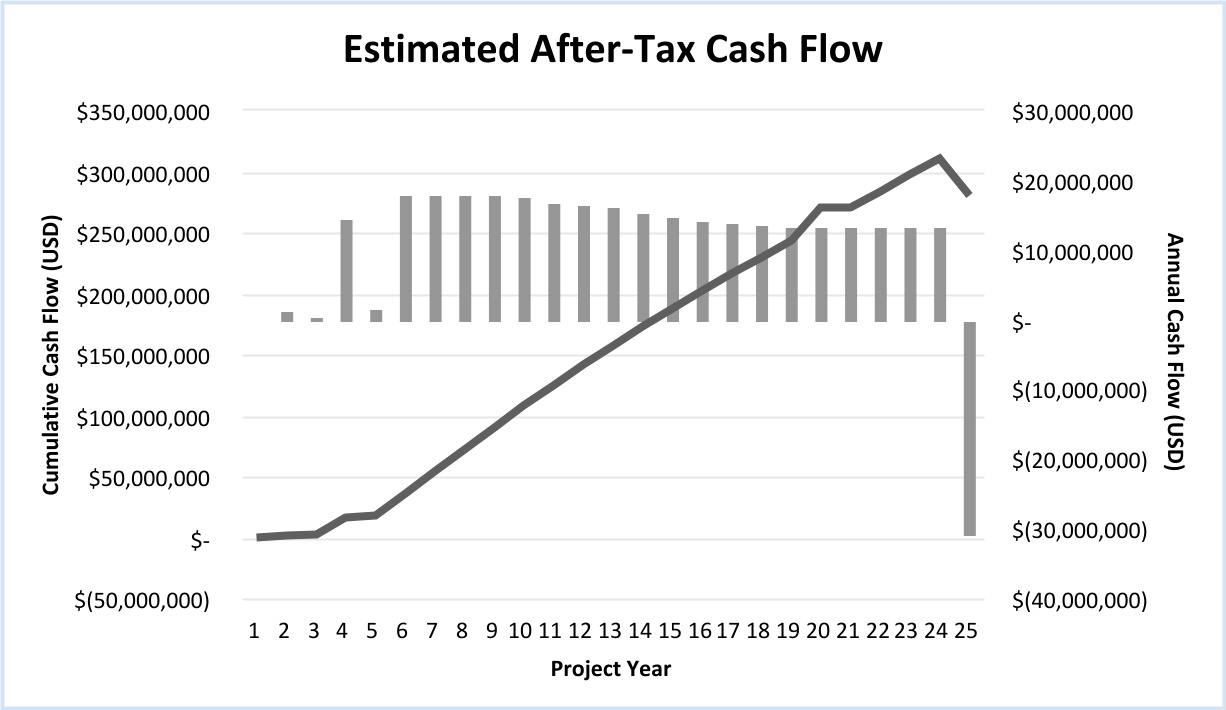

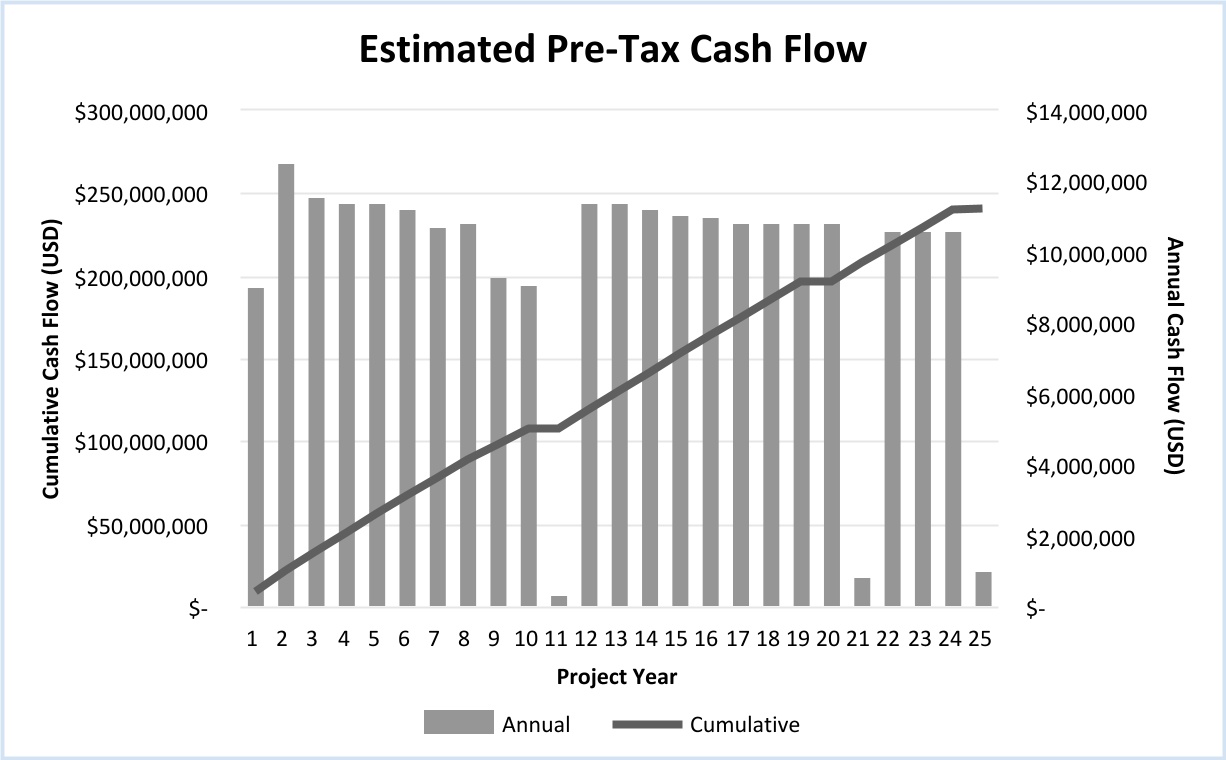

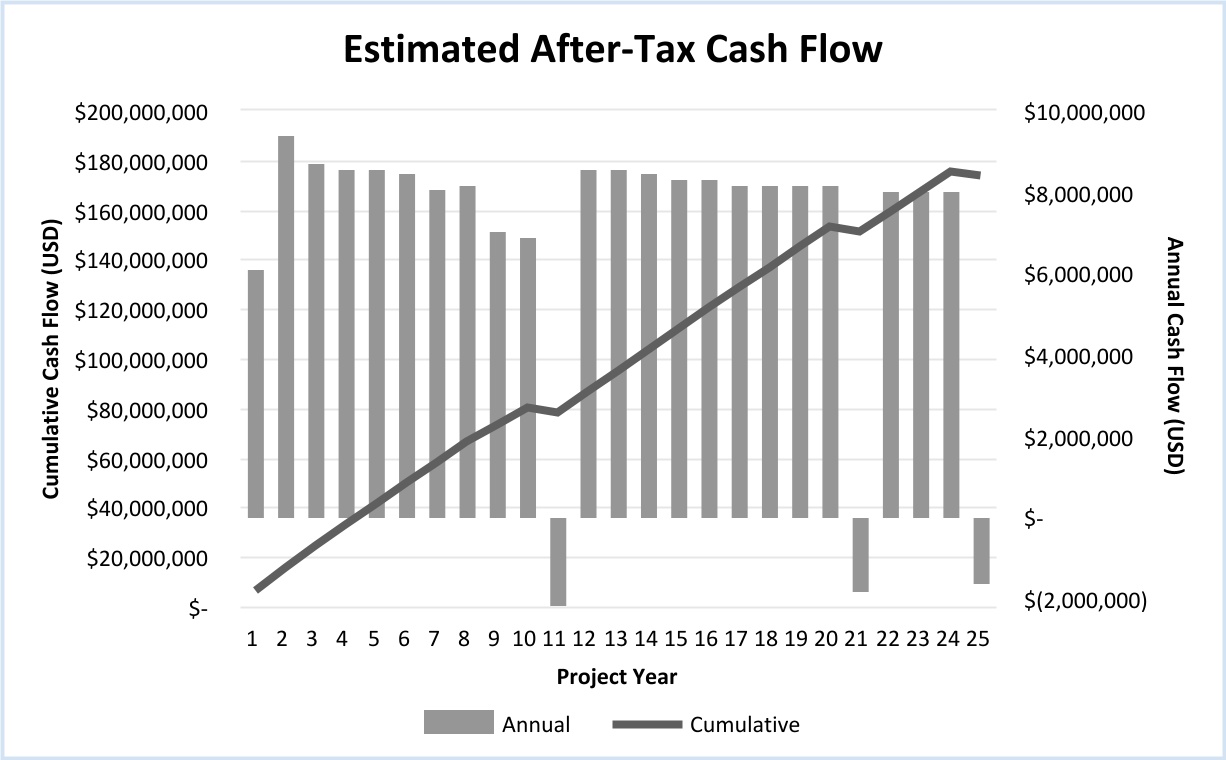

•Significant mineral reserve and resource life. Our potash reserves and resources have substantial years of reserve life and resource life. Reserve life is based on the current mine plan and estimated at 25 years for all our potash facilities. Resource life at our potash facilities ranges from 33 years to over 100 years. In addition to our reserves, we have water rights and access to additional mineralized areas of potash for potential future exploitation. In December 2023, we recorded an impairment of our long-lived assets at our East facility of $31.9 million, which included a $2.3 million impairment of our mineral rights at our East mine. As such, we no longer show mineral reserves at our East mine, and only include a mineral resource estimate. Additional information regarding our mineral reserves and resource estimates can be found in Item 2. Properties and in the updated Technical Report Summaries included with this filing.

•Existing facilities and infrastructure. Constructing a new potash production facility requires substantial time and extensive capital investment in mining, milling, and infrastructure to extract, process, store, and ship product. Our operations already have significant facilities and infrastructure in place. We also have the ability to expand our business using existing installed infrastructure, in less time and with lower expenditures than would be required to construct entirely new mines.

Seasonality

The month-to-month seasonality of our agricultural sales is somewhat moderated due to the variety of crops, industries, distribution strategies, and geographies that we serve. There is a seasonal sales pattern for potash sold into the agricultural market. Over the last three years, approximately 80% of our total annual potash sales volumes occurred in January through May, in anticipation for the spring application season, and September through November, in anticipation of the fall application season. The specific timing of when farmers apply potash remains highly weather dependent and varies across the numerous growing regions within the U.S. Marketing programs of potash producers and storage volumes closer to the farm gate significantly influence the timing of potash sales.

The sales pattern for Trio® sold into the domestic agricultural market is also seasonal. Over the last three years, our domestic Trio® sales volume has been highest in February through May, as Trio® products are typically applied to crops in the U.S. during the spring planting season. Demand for the spring planting season generally runs from December to May, when we have sold approximately 60% of our annual domestic Trio® volumes over the past three years.

We observed fertilizer dealers in North America instituting practices that are designed to reduce the risk of changes in the price of fertilizer products through consignment-type programs. These programs tend to make the timing of the spring and fall seasonal demand profile less predictable within the season. Further, through technological advances, farmers in the U.S. are more efficient in planting and harvesting their crops, which has compressed the application seasons.

Our quarterly and yearly financial results can also vary from one year to the next due to weather‑related shifts in planting schedules and purchasing patterns.

Because all of our potash production comes from our solar solution mines, our potash production is also seasonal. Our solar solution mines suspend potash production activities from early spring through late summer, the peak solar evaporation period. Accordingly, we manage our inventories during the low demand periods of the year in order to ensure timely product availability during the peak sales seasons, as well as during the summer evaporation period when we are not producing potash. Our sales volumes are highest during the spring and our working capital requirements are highest just before the start of the spring season, as a result of the seasonality of fertilizer demand.

Demand of our oilfield products and services is highly correlated to oil and gas exploration activities and can vary from quarter to quarter and year to year.

Major Customers

Within the agricultural market, we supply a diversified customer base of distributors, cooperatives, retailers, and dealers, which in turn supply farmers producing a wide range of crops in different geographies. We sell into the industrial and feed markets through sales to distributors and directly to end users. For water, we sell to a diverse set of customers through a combination of spot sales and a multi-year contract. For brine, we sell to a diverse set of customers in the spot market.

In 2023 and 2022, we had one customer, Bill Barr & Company, Inc., which accounted for more than 10% of our total consolidated revenues. In 2021, no customer accounted for more than 10% of our total consolidated revenues.

Environmental, Safety, and Health Matters

We are subject to federal, state, and local environmental, safety, and health laws that regulate, among other things; (1) soil, air, and water quality standards for our facilities; (2) disposal, storage, and management of hazardous and solid wastes; (3) post-mining land reclamation and closure; (4) conditions of mining and production operations; (5) employee and contractor safety and occupational health; and (6) product content and labeling. We employ and consult with professionals who assist in monitoring our compliance with these laws and who work with management to ensure that appropriate strategies and processes are in place to promote a culture that prioritizes safety and environmental responsibility.

In 2023, we had approximately $2.6 million of capital investments and reclamation projects, and $1.2 million in other expenses, relating to environmental compliance, environmental studies, and remediation efforts. We expect to spend $2.0 million to $3.0 million for environmental related capital and reclamation projects in both 2024 and 2025. Future capital expenditures are subject to uncertainties, including changes to environmental laws. Material expenditures could be required in the future to fulfill environmental compliance requirements, either new or existing. We anticipate a focus on environmental issues will result in increased future investments for environmental controls at our operations. See Item 1A. Risk Factors “Risks Related to Our Business - Environmental laws and regulations could subject us to significant liability and require us to incur additional costs.”

Product Registration Requirements

We are required to register fertilizer products with each U.S. state and foreign country where products are sold. Each brand and grade of commercial fertilizer must be registered appropriately before being offered for sale, sold, or distributed. In most cases, these product registrations impose specific requirements relating to guaranteed analysis, product labeling, and regular reporting of sales.

Some U.S. states require similar registration and reporting for feed grade products. Industrial-grade products typically do not require registration or reporting.

Operating Requirements and Government Regulations

Permits

We are subject to numerous environmental laws and regulations, including laws and regulations regarding land use and reclamation; release of emissions to the atmosphere; release of contaminants to water; preservation of plant and animal life; and the generation, treatment, storage, disposal, and handling of hazardous substances and wastes. These laws include the Clean Air Act ("CAA"); the Clean Water Act ("CWA"); the Resource Conservation and Recovery Act ("RCRA"); the Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA"); the Toxic Substances Control Act ("TSCA"); and various other federal, state, and local laws and regulations. Violations can result in substantial penalties, court orders to install pollution‑control equipment, civil and criminal sanctions, permit revocations, and facility shutdowns. Environmental laws and regulations may impose joint and several liability, without regard to fault, for cleanup costs on potentially responsible parties who have released, disposed of, or arranged for release or disposal of hazardous substances in the environment.

We hold numerous environmental, mining, and other permits or approvals authorizing operations at each of our facilities. Our operations are subject to permits for, among other things, extraction of salt and brine, discharges of process materials and waste to air and water, injection of brine, and appropriation of water. Some of our proposed activities may require waste storage permits. A decision by a government agency to deny or delay issuing a new, modified, or renewed permit or approval, or to revoke or substantially modify an existing permit or approval, could limit or prevent us from mining at these properties. In addition, changes to environmental and mining regulations or permit requirements could limit our ability to continue operations at the affected facility. In many cases, environmental permits and approvals are also required for an expansion of, or changes to, our operations. As a condition to procuring the necessary permits and approvals, we may be required to comply with financial assurance regulatory requirements. The purpose of these requirements is to assure the government that sufficient company funds will be available for the ultimate reclamation, closure, and post-closure care at our facilities. We obtain bonds as financial assurance for these obligations. These bonds require annual payment and renewal.

We believe we are in compliance with existing regulatory programs, permits, and approvals where non-compliance could have a material adverse effect on our operating results or financial condition. In 2016, the OSE determined that our East tailing impoundment embankments are considered jurisdictional dams. We continue to work with the OSE's Dam Safety Bureau to determine the hazard level of our dams and the OSE to determine required dam modifications associated with this determination. We may be required to spend a significant amount of capital to bring the impoundments into compliance with requirements for jurisdictional dams or modify our operations to no longer use impoundments that may qualify as jurisdictional dams.

Occasionally governmental agencies notify us of noncompliance with certain environmental laws, regulations, permits, or approvals. For example, although designated as zero discharge facilities under the applicable water quality laws and regulations, our East, North, and Moab facilities at times may experience some water and brine discharges during periods of significant rainfall or due to other circumstances. We have implemented several initiatives to address discharge issues, including the reconstruction or modification of certain impoundments, increasing evaporation, and reducing process water usage and discharges and improved management systems. State and federal officials are aware of these issues and have visited the sites to review our corrective efforts and action plans.

Air and Drinking Water

In the ordinary course of our business, we receive notices from the New Mexico Environment Department of alleged air or drinking water quality control violations. Upon receipt of these notices, we evaluate the matter and take any required corrective actions. In some cases, we may be required to pay civil penalties for these notices of violation. The Utah Division of Air Quality conducts periodic compliance inspections at our Moab and Wendover facilities and affirms our compliance with applicable approval orders.

Safety and Health Regulation and Programs

Some of our facilities are subject to the Federal Mine Safety and Health Act of 1977 ("MSHA"), the Occupational Safety and Health Act ("OSHA"), related state statutes and regulations, or a combination of these laws.

Our conventional underground mines and related surface facilities in New Mexico are subject to MSHA jurisdiction. In accordance with MSHA, these facilities are regularly inspected by MSHA personnel. Item 4 and Exhibit 95.1 to this Annual Report provide information concerning certain mine safety violations.

As part of our ongoing safety programs, we collaborate with MSHA and the New Mexico Bureau of Mine Safety to identify and implement accident prevention techniques and practices. A trained mine rescue team services our New Mexico facilities. This team is ready to respond to on-site incidents or assist in local incidents, if needed. In addition, our New Mexico facilities participate in a basin agreement with other natural resource and hazardous waste facilities to provide mine rescue support.

Our Utah facilities and our HB mine and plant are subject to OSHA jurisdiction. We provide all OSHA required training and other certifications to our employees at these facilities.

Remediation at Intrepid Facilities

Many of our current facilities have been in operation for a number of years. Our and our predecessors' operations involved the historical use and handling of potash, salt, related potash and salt byproducts, process tailings, hydrocarbons and other regulated substances. Some of these operations resulted, or may have resulted, in soil, surface water, or groundwater contamination. At some locations, there are areas where process waste, building materials (including asbestos‑containing transite), and ordinary trash may have been disposed or buried, and have since been properly closed and maintained.

At some of our facilities, spills or other releases of regulated substances may have occurred or could potentially occur, possibly requiring us to undertake or fund cleanup efforts under CERCLA or state laws governing cleanup or disposal of hazardous and solid waste.

We work closely with government authorities to obtain the appropriate permits to address identified site conditions. For example, buildings located at our facilities in Utah and New Mexico have a type of siding that contains asbestos. We have adopted programs to encapsulate and stabilize portions of the siding through use of an adhesive spray and to remove the siding, replacing it with an asbestos-free material. We have trained asbestos abatement crews that handle and dispose of the asbestos‑containing siding and related materials. We have a permitted asbestos landfill in Utah and have worked closely with Utah officials to address asbestos‑related issues at our Moab mine.

Reclamation Obligations