| Iowa | 42-1206172 | |||||||

|

(State or other jurisdiction

of incorporation)

|

(I.R.S. Employer

Identification Number)

|

|||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, $1.00 par value | MOFG | The Nasdaq Stock Market LLC | ||||||||||||

MidWestOne Financial Group, Inc. press release dated October 24, 2024 |

|||||||||||

MidWestOne Financial Group, Inc. financial supplement dated October 24, 2024 |

|||||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||||||||

MIDWESTONE FINANCIAL GROUP, INC. |

||||||||||||||||||||

| Dated: | October 24, 2024 | By: | /s/ BARRY S. RAY |

|||||||||||||||||

| Barry S. Ray | ||||||||||||||||||||

| Chief Financial Officer | ||||||||||||||||||||

| FOR IMMEDIATE RELEASE | October 24, 2024 | ||||||||||

| As of or for the quarter ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share amounts and as noted) | September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||

| Financial Results | ||||||||||||||||||||||||||||||||

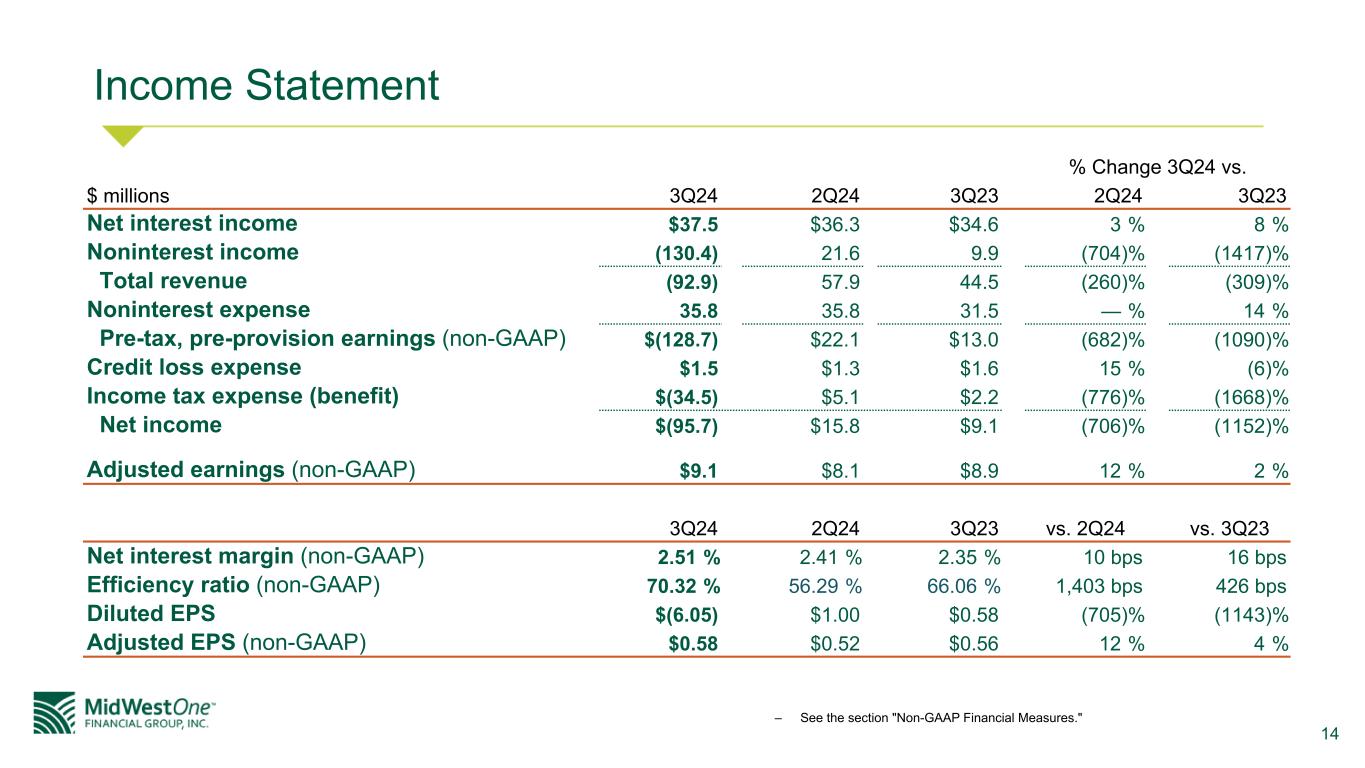

| Revenue | $ | (92,867) | $ | 57,901 | $ | 44,436 | $ | 9,515 | $ | 126,174 | ||||||||||||||||||||||

| Credit loss expense | 1,535 | 1,267 | 1,551 | 7,491 | 4,081 | |||||||||||||||||||||||||||

| Noninterest expense | 35,798 | 35,761 | 31,544 | 107,124 | 99,782 | |||||||||||||||||||||||||||

| Net (loss) income | (95,707) | 15,819 | 9,138 | (76,619) | 18,129 | |||||||||||||||||||||||||||

Adjusted earnings(1) |

9,141 | 8,132 | 8,875 | 21,762 | 28,046 | |||||||||||||||||||||||||||

| Per Common Share | ||||||||||||||||||||||||||||||||

| Diluted (loss) earnings per share | $ | (6.05) | $ | 1.00 | $ | 0.58 | $ | (4.86) | $ | 1.15 | ||||||||||||||||||||||

Adjusted earnings per share(1) |

0.58 | 0.52 | 0.56 | 1.38 | 1.79 | |||||||||||||||||||||||||||

| Book value | 27.06 | 34.44 | 32.21 | 27.06 | 32.21 | |||||||||||||||||||||||||||

Tangible book value(1) |

22.43 | 28.27 | 26.60 | 22.43 | 26.60 | |||||||||||||||||||||||||||

| Balance Sheet & Credit Quality | ||||||||||||||||||||||||||||||||

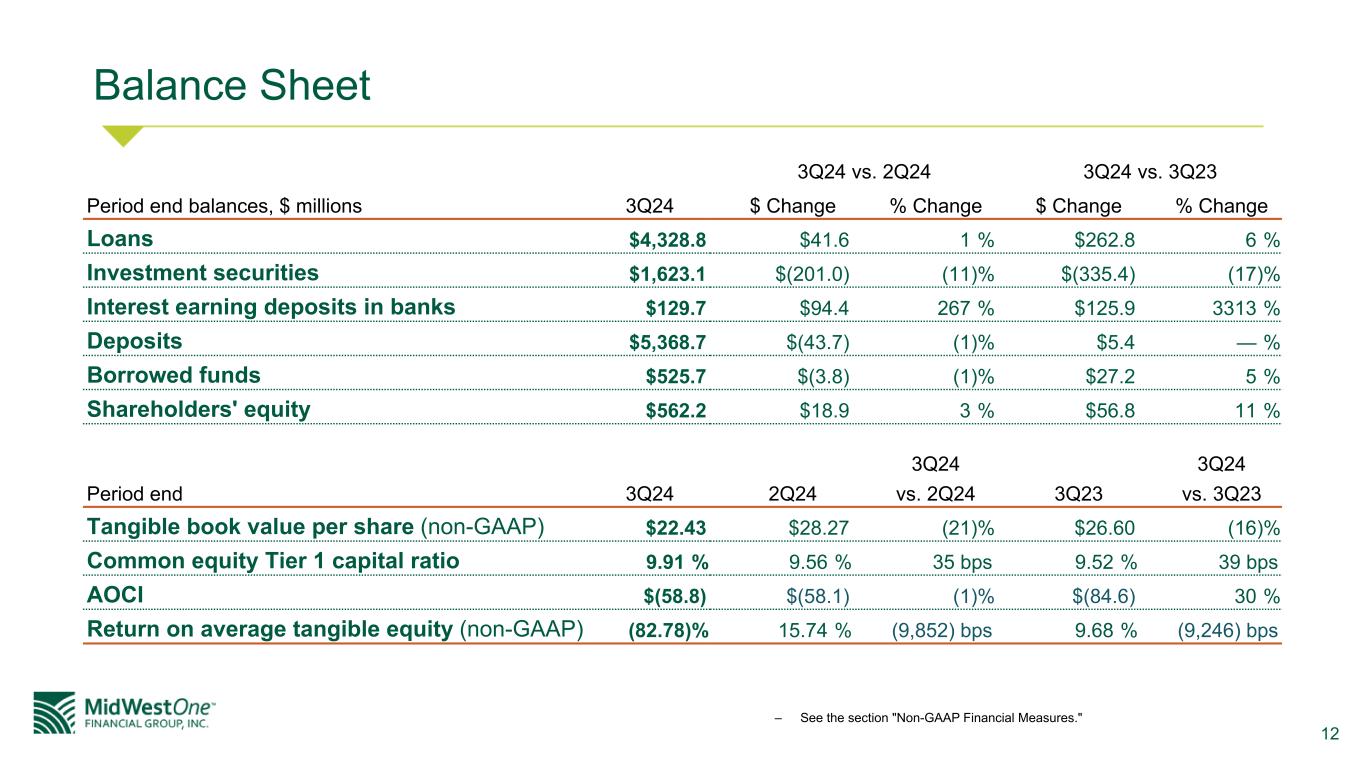

Loans In millions |

$ | 4,328.8 | $ | 4,287.2 | $ | 4,066.0 | $ | 4,328.8 | $ | 4,066.0 | ||||||||||||||||||||||

Investment securities In millions |

1,623.1 | 1,824.1 | 1,958.5 | 1,623.1 | 1,958.5 | |||||||||||||||||||||||||||

Deposits In millions |

5,368.7 | 5,412.4 | 5,363.3 | 5,368.7 | 5,363.3 | |||||||||||||||||||||||||||

Net loan charge-offs In millions |

1.7 | 0.5 | 0.5 | 2.4 | 1.7 | |||||||||||||||||||||||||||

| Allowance for credit losses ratio | 1.25 | % | 1.26 | % | 1.27 | % | 1.25 | % | 1.27 | % | ||||||||||||||||||||||

| Selected Ratios | ||||||||||||||||||||||||||||||||

| Return on average assets | (5.78) | % | 0.95 | % | 0.56 | % | (1.54) | % | 0.37 | % | ||||||||||||||||||||||

Net interest margin, tax equivalent(1) |

2.51 | % | 2.41 | % | 2.35 | % | 2.42 | % | 2.54 | % | ||||||||||||||||||||||

| Return on average equity | (69.05) | % | 11.91 | % | 7.14 | % | (19.03) | % | 4.81 | % | ||||||||||||||||||||||

Return on average tangible equity(1) |

(82.78) | % | 15.74 | % | 9.68 | % | (22.17) | % | 7.03 | % | ||||||||||||||||||||||

Efficiency ratio(1) |

70.32 | % | 56.29 | % | 66.06 | % | 65.20 | % | 66.40 | % | ||||||||||||||||||||||

(1) Non-GAAP measure. See the Non-GAAP Measures section for a reconciliation to the most directly comparable GAAP measure. | ||||||||||||||||||||||||||||||||

| Revenue | Change | Change | ||||||||||||||||||||||||||||||

| 3Q24 vs | 3Q24 vs | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 3Q24 | 2Q24 | 3Q23 | 2Q24 | 3Q23 | |||||||||||||||||||||||||||

| Net interest income | $ | 37,521 | $ | 36,347 | $ | 34,575 | 3 | % | 9 | % | ||||||||||||||||||||||

| Noninterest (loss) income | (130,388) | 21,554 | 9,861 | n/m | n/m | |||||||||||||||||||||||||||

| Total revenue, net of interest expense | $ | (92,867) | $ | 57,901 | $ | 44,436 | n/m | n/m | ||||||||||||||||||||||||

| (n/m) - Not meaningful | ||||||||||||||||||||||||||||||||

| Noninterest (Loss) Income | Change | Change | |||||||||||||||||||||||||||

| 3Q24 vs | 3Q24 vs | ||||||||||||||||||||||||||||

| (In thousands) | 3Q24 | 2Q24 | 3Q23 | 2Q24 | 3Q23 | ||||||||||||||||||||||||

| Investment services and trust activities | $ | 3,410 | $ | 3,504 | $ | 3,004 | (3) | % | 14 | % | |||||||||||||||||||

| Service charges and fees | 2,170 | 2,156 | 2,146 | 1 | % | 1 | % | ||||||||||||||||||||||

| Card revenue | 1,935 | 1,907 | 1,817 | 1 | % | 6 | % | ||||||||||||||||||||||

| Loan revenue | 760 | 1,525 | 1,462 | (50) | % | (48) | % | ||||||||||||||||||||||

| Bank-owned life insurance | 879 | 668 | 626 | 32 | % | 40 | % | ||||||||||||||||||||||

| Investment securities (losses) gains, net | (140,182) | 33 | 79 | n/m | n/m | ||||||||||||||||||||||||

| Other | 640 | 11,761 | 727 | (95) | % | (12) | % | ||||||||||||||||||||||

| Total noninterest (loss) income | $ | (130,388) | $ | 21,554 | $ | 9,861 | n/m | n/m | |||||||||||||||||||||

| MSR adjustment (included above in Loan revenue) | $ | (1,026) | $ | 129 | $ | 283 | n/m | n/m | |||||||||||||||||||||

| Gain on branch sale (included above in Other) | — | 11,056 | — | n/m | n/m | ||||||||||||||||||||||||

| (n/m) - Not meaningful | |||||||||||||||||||||||||||||

| Noninterest Expense | Change | Change | |||||||||||||||||||||||||||

| 3Q24 vs | 3Q24 vs | ||||||||||||||||||||||||||||

| (In thousands) | 3Q24 | 2Q24 | 3Q23 | 2Q24 | 3Q23 | ||||||||||||||||||||||||

| Compensation and employee benefits | $ | 19,943 | $ | 20,985 | $ | 18,558 | (5) | % | 7 | % | |||||||||||||||||||

| Occupancy expense of premises, net | 2,443 | 2,435 | 2,405 | — | % | 2 | % | ||||||||||||||||||||||

| Equipment | 2,486 | 2,530 | 2,123 | (2) | % | 17 | % | ||||||||||||||||||||||

| Legal and professional | 2,261 | 2,253 | 1,678 | — | % | 35 | % | ||||||||||||||||||||||

| Data processing | 1,580 | 1,645 | 1,504 | (4) | % | 5 | % | ||||||||||||||||||||||

| Marketing | 619 | 636 | 782 | (3) | % | (21) | % | ||||||||||||||||||||||

| Amortization of intangibles | 1,470 | 1,593 | 1,460 | (8) | % | 1 | % | ||||||||||||||||||||||

| FDIC insurance | 923 | 1,051 | 783 | (12) | % | 18 | % | ||||||||||||||||||||||

| Communications | 159 | 191 | 206 | (17) | % | (23) | % | ||||||||||||||||||||||

| Foreclosed assets, net | 330 | 138 | 2 | 139 | % | n/m | |||||||||||||||||||||||

| Other | 3,584 | 2,304 | 2,043 | 56 | % | 75 | % | ||||||||||||||||||||||

| Total noninterest expense | $ | 35,798 | $ | 35,761 | $ | 31,544 | — | % | 13 | % | |||||||||||||||||||

| (n/m) - Not meaningful | |||||||||||||||||||||||||||||

| Merger-related Expenses | |||||||||||||||||

| (In thousands) | 3Q24 | 2Q24 | 3Q23 | ||||||||||||||

| Compensation and employee benefits | $ | — | $ | 73 | $ | — | |||||||||||

| Occupancy expense of premises, net | — | — | — | ||||||||||||||

| Equipment | — | 28 | — | ||||||||||||||

| Legal and professional | 127 | 462 | 11 | ||||||||||||||

| Data processing | — | 251 | — | ||||||||||||||

| Marketing | — | — | — | ||||||||||||||

| Communications | — | 8 | — | ||||||||||||||

| Other | 6 | 32 | — | ||||||||||||||

| Total merger-related expenses | $ | 133 | $ | 854 | $ | 11 | |||||||||||

| Loans Held for Investment | September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||

| Balance | % of Total | Balance | % of Total | Balance | % of Total | |||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 1,149,758 | 26.6 | % | $ | 1,120,983 | 26.1 | % | $ | 1,078,773 | 26.5 | % | ||||||||||||||||||||||||||

| Agricultural | 112,696 | 2.6 | 107,983 | 2.5 | 111,950 | 2.8 | ||||||||||||||||||||||||||||||||

| Commercial real estate | ||||||||||||||||||||||||||||||||||||||

| Construction and development | 386,920 | 8.9 | 351,646 | 8.2 | 331,868 | 8.2 | ||||||||||||||||||||||||||||||||

| Farmland | 182,164 | 4.2 | 183,641 | 4.3 | 182,621 | 4.5 | ||||||||||||||||||||||||||||||||

| Multifamily | 409,544 | 9.5 | 430,054 | 10.0 | 337,509 | 8.3 | ||||||||||||||||||||||||||||||||

| Other | 1,353,513 | 31.2 | 1,348,515 | 31.5 | 1,324,019 | 32.5 | ||||||||||||||||||||||||||||||||

| Total commercial real estate | 2,332,141 | 53.8 | 2,313,856 | 54.0 | 2,176,017 | 53.5 | ||||||||||||||||||||||||||||||||

| Residential real estate | ||||||||||||||||||||||||||||||||||||||

| One-to-four family first liens | 485,210 | 11.2 | 492,541 | 11.5 | 456,771 | 11.2 | ||||||||||||||||||||||||||||||||

| One-to-four family junior liens | 176,827 | 4.1 | 176,105 | 4.1 | 173,275 | 4.3 | ||||||||||||||||||||||||||||||||

| Total residential real estate | 662,037 | 15.3 | 668,646 | 15.6 | 630,046 | 15.5 | ||||||||||||||||||||||||||||||||

| Consumer | 72,124 | 1.7 | 75,764 | 1.8 | 69,183 | 1.7 | ||||||||||||||||||||||||||||||||

| Loans held for investment, net of unearned income | $ | 4,328,756 | 100.0 | % | $ | 4,287,232 | 100.0 | % | $ | 4,065,969 | 100.0 | % | ||||||||||||||||||||||||||

| Total commitments to extend credit | $ | 1,149,815 | $ | 1,200,605 | $ | 1,251,345 | ||||||||||||||||||||||||||||||||

| Investment Securities | September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Balance | % of Total | Balance | % of Total | Balance | % of Total | ||||||||||||||||||||||||||||||||

| Available for sale | $ | 1,623,104 | 100.0 | % | $ | 771,034 | 42.3 | % | $ | 872,770 | 44.6 | % | ||||||||||||||||||||||||||

| Held to maturity | — | — | % | 1,053,080 | 57.7 | % | 1,085,751 | 55.4 | % | |||||||||||||||||||||||||||||

| Total investment securities | $ | 1,623,104 | $ | 1,824,114 | $ | 1,958,521 | ||||||||||||||||||||||||||||||||

| Deposits | September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Balance | % of Total | Balance | % of Total | Balance | % of Total | ||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | $ | 917,715 | 17.1 | % | $ | 882,472 | 16.3 | % | $ | 924,213 | 17.2 | % | ||||||||||||||||||||||||||

| Interest checking deposits | 1,230,605 | 23.0 | 1,284,243 | 23.7 | 1,334,481 | 24.9 | ||||||||||||||||||||||||||||||||

| Money market deposits | 1,038,575 | 19.3 | 1,043,376 | 19.3 | 1,127,287 | 21.0 | ||||||||||||||||||||||||||||||||

| Savings deposits | 768,298 | 14.3 | 745,639 | 13.8 | 619,805 | 11.6 | ||||||||||||||||||||||||||||||||

| Time deposits of $250 and under | 844,298 | 15.7 | 803,301 | 14.8 | 703,646 | 13.1 | ||||||||||||||||||||||||||||||||

| Total core deposits | 4,799,491 | 89.4 | 4,759,031 | 87.9 | 4,709,432 | 87.8 | ||||||||||||||||||||||||||||||||

| Brokered time deposits | 200,000 | 3.7 | 196,000 | 3.6 | 220,063 | 4.1 | ||||||||||||||||||||||||||||||||

| Time deposits over $250 | 369,236 | 6.9 | 457,388 | 8.5 | 433,829 | 8.1 | ||||||||||||||||||||||||||||||||

Total deposits |

$ | 5,368,727 | 100.0 | % | $ | 5,412,419 | 100.0 | % | $ | 5,363,324 | 100.0 | % | ||||||||||||||||||||||||||

| Borrowed Funds | September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Balance | % of Total | Balance | % of Total | Balance | % of Total | ||||||||||||||||||||||||||||||||

| Short-term borrowings | $ | 410,630 | 78.1 | % | $ | 414,684 | 78.3 | % | $ | 373,956 | 75.0 | % | ||||||||||||||||||||||||||

| Long-term debt | 115,051 | 21.9 | % | 114,839 | 21.7 | % | 124,526 | 25.0 | % | |||||||||||||||||||||||||||||

| Total borrowed funds | $ | 525,681 | $ | 529,523 | $ | 498,482 | ||||||||||||||||||||||||||||||||

| Capital | September 30, | June 30, | September 30, | ||||||||||||||

| (Dollars in thousands) | 2024 (1) |

2024 | 2023 | ||||||||||||||

| Total shareholders' equity | $ | 562,238 | $ | 543,286 | $ | 505,411 | |||||||||||

| Accumulated other comprehensive loss | (58,842) | (58,135) | (84,606) | ||||||||||||||

MidWestOne Financial Group, Inc. Consolidated |

|||||||||||||||||

| Tier 1 leverage to average assets ratio | 8.78 | % | 8.29 | % | 8.58 | % | |||||||||||

| Common equity tier 1 capital to risk-weighted assets ratio | 9.91 | % | 9.56 | % | 9.52 | % | |||||||||||

| Tier 1 capital to risk-weighted assets ratio | 10.70 | % | 10.35 | % | 10.31 | % | |||||||||||

| Total capital to risk-weighted assets ratio | 12.96 | % | 12.62 | % | 12.45 | % | |||||||||||

MidWestOne Bank |

|||||||||||||||||

| Tier 1 leverage to average assets ratio | 9.69 | % | 9.24 | % | 9.51 | % | |||||||||||

| Common equity tier 1 capital to risk-weighted assets ratio | 11.83 | % | 11.55 | % | 11.43 | % | |||||||||||

| Tier 1 capital to risk-weighted assets ratio | 11.83 | % | 11.55 | % | 11.43 | % | |||||||||||

| Total capital to risk-weighted assets ratio | 12.88 | % | 12.61 | % | 12.36 | % | |||||||||||

(1) Regulatory capital ratios for September 30, 2024 are preliminary |

|||||||||||||||||

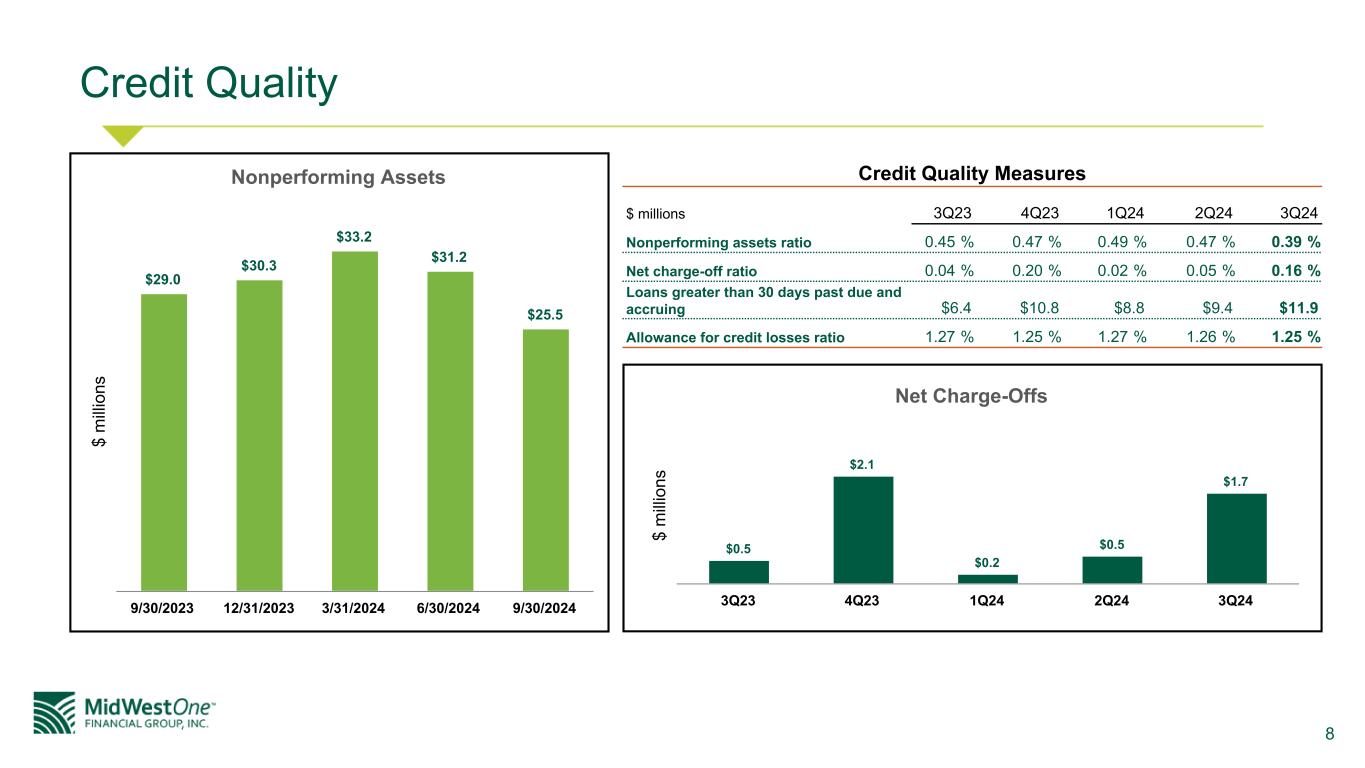

| Credit Quality | As of or For the Three Months Ended | ||||||||||||||||

| September 30, | June 30, | September 30, | |||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2023 | ||||||||||||||

| Credit loss expense related to loans | $ | 1,835 | $ | 467 | $ | 1,651 | |||||||||||

| Net charge-offs | 1,735 | 524 | 451 | ||||||||||||||

| Allowance for credit losses | 54,000 | 53,900 | 51,600 | ||||||||||||||

| Pass | $ | 4,016,683 | $ | 3,991,692 | $ | 3,785,908 | |||||||||||

| Special Mention / Watch | 177,241 | 146,253 | 163,222 | ||||||||||||||

| Classified | 134,832 | 149,287 | 116,839 | ||||||||||||||

| Loans greater than 30 days past due and accruing | $ | 11,940 | $ | 9,358 | $ | 6,449 | |||||||||||

| Nonperforming loans | $ | 21,954 | $ | 25,128 | $ | 28,987 | |||||||||||

| Nonperforming assets | 25,537 | 31,181 | 28,987 | ||||||||||||||

Net charge-off ratio(1) |

0.16 | % | 0.05 | % | 0.04 | % | |||||||||||

Classified loans ratio(2) |

3.11 | % | 3.48 | % | 2.87 | % | |||||||||||

Nonperforming loans ratio(3) |

0.51 | % | 0.59 | % | 0.71 | % | |||||||||||

Nonperforming assets ratio(4) |

0.39 | % | 0.47 | % | 0.45 | % | |||||||||||

Allowance for credit losses ratio(5) |

1.25 | % | 1.26 | % | 1.27 | % | |||||||||||

Allowance for credit losses to nonaccrual loans ratio(6) |

260.84 | % | 218.26 | % | 178.63 | % | |||||||||||

(1) Net charge-off ratio is calculated as annualized net charge-offs divided by the sum of average loans held for investment, net of unearned income and average loans held for sale, during the period. | |||||||||||||||||

(2) Classified loans ratio is calculated as classified loans divided by loans held for investment, net of unearned income, at the end of the period. | |||||||||||||||||

(3) Nonperforming loans ratio is calculated as nonperforming loans divided by loans held for investment, net of unearned income, at the end of the period. | |||||||||||||||||

(4) Nonperforming assets ratio is calculated as nonperforming assets divided by total assets at the end of the period. | |||||||||||||||||

(5) Allowance for credit losses ratio is calculated as allowance for credit losses divided by loans held for investment, net of unearned income, at the end of the period. | |||||||||||||||||

(6)Allowance for credit losses to nonaccrual loans ratio is calculated as allowance for credit losses divided by nonaccrual loans at the end of the period. | |||||||||||||||||

| Nonperforming Loans Roll Forward | Nonaccrual | 90+ Days Past Due & Still Accruing | Total | ||||||||||||||

| (Dollars in thousands) | |||||||||||||||||

Balance at June 30, 2024 |

$ | 24,695 | $ | 433 | $ | 25,128 | |||||||||||

| Loans placed on nonaccrual or 90+ days past due & still accruing | 6,426 | 1,326 | 7,752 | ||||||||||||||

| Proceeds related to repayment or sale | (7,761) | (1) | (7,762) | ||||||||||||||

| Loans returned to accrual status or no longer past due | (500) | (339) | (839) | ||||||||||||||

| Charge-offs | (1,609) | (167) | (1,776) | ||||||||||||||

| Transfers to foreclosed assets | (549) | — | (549) | ||||||||||||||

Balance at September 30, 2024 |

$ | 20,702 | $ | 1,252 | $ | 21,954 | |||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| (In thousands) | 2024 | 2024 | 2024 | 2023 | 2023 | ||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 72,173 | $ | 66,228 | $ | 68,430 | $ | 76,237 | $ | 71,015 | |||||||||||||||||||

| Interest earning deposits in banks | 129,695 | 35,340 | 29,328 | 5,479 | 3,773 | ||||||||||||||||||||||||

| Federal funds sold | — | — | 4 | 11 | — | ||||||||||||||||||||||||

| Total cash and cash equivalents | 201,868 | 101,568 | 97,762 | 81,727 | 74,788 | ||||||||||||||||||||||||

| Debt securities available for sale at fair value | 1,623,104 | 771,034 | 797,230 | 795,134 | 872,770 | ||||||||||||||||||||||||

| Held to maturity securities at amortized cost | — | 1,053,080 | 1,064,939 | 1,075,190 | 1,085,751 | ||||||||||||||||||||||||

| Total securities | 1,623,104 | 1,824,114 | 1,862,169 | 1,870,324 | 1,958,521 | ||||||||||||||||||||||||

| Loans held for sale | 3,283 | 2,850 | 2,329 | 1,045 | 2,528 | ||||||||||||||||||||||||

| Gross loans held for investment | 4,344,559 | 4,304,619 | 4,433,258 | 4,138,352 | 4,078,060 | ||||||||||||||||||||||||

| Unearned income, net | (15,803) | (17,387) | (18,612) | (11,405) | (12,091) | ||||||||||||||||||||||||

| Loans held for investment, net of unearned income | 4,328,756 | 4,287,232 | 4,414,646 | 4,126,947 | 4,065,969 | ||||||||||||||||||||||||

| Allowance for credit losses | (54,000) | (53,900) | (55,900) | (51,500) | (51,600) | ||||||||||||||||||||||||

| Total loans held for investment, net | 4,274,756 | 4,233,332 | 4,358,746 | 4,075,447 | 4,014,369 | ||||||||||||||||||||||||

| Premises and equipment, net | 90,750 | 91,793 | 95,986 | 85,742 | 85,589 | ||||||||||||||||||||||||

| Goodwill | 69,788 | 69,388 | 71,118 | 62,477 | 62,477 | ||||||||||||||||||||||||

| Other intangible assets, net | 26,469 | 27,939 | 29,531 | 24,069 | 25,510 | ||||||||||||||||||||||||

| Foreclosed assets, net | 3,583 | 6,053 | 3,897 | 3,929 | — | ||||||||||||||||||||||||

| Other assets | 258,881 | 224,621 | 226,477 | 222,780 | 244,036 | ||||||||||||||||||||||||

| Total assets | $ | 6,552,482 | $ | 6,581,658 | $ | 6,748,015 | $ | 6,427,540 | $ | 6,467,818 | |||||||||||||||||||

| LIABILITIES | |||||||||||||||||||||||||||||

| Noninterest bearing deposits | $ | 917,715 | $ | 882,472 | $ | 920,764 | $ | 897,053 | $ | 924,213 | |||||||||||||||||||

| Interest bearing deposits | 4,451,012 | 4,529,947 | 4,664,472 | 4,498,620 | 4,439,111 | ||||||||||||||||||||||||

| Total deposits | 5,368,727 | 5,412,419 | 5,585,236 | 5,395,673 | 5,363,324 | ||||||||||||||||||||||||

| Short-term borrowings | 410,630 | 414,684 | 422,988 | 300,264 | 373,956 | ||||||||||||||||||||||||

| Long-term debt | 115,051 | 114,839 | 122,066 | 123,296 | 124,526 | ||||||||||||||||||||||||

| Other liabilities | 95,836 | 96,430 | 89,685 | 83,929 | 100,601 | ||||||||||||||||||||||||

| Total liabilities | 5,990,244 | 6,038,372 | 6,219,975 | 5,903,162 | 5,962,407 | ||||||||||||||||||||||||

| SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||

| Common stock | 21,580 | 16,581 | 16,581 | 16,581 | 16,581 | ||||||||||||||||||||||||

| Additional paid-in capital | 414,965 | 300,831 | 300,845 | 302,157 | 301,889 | ||||||||||||||||||||||||

| Retained earnings | 206,490 | 306,030 | 294,066 | 294,784 | 295,862 | ||||||||||||||||||||||||

| Treasury stock | (21,955) | (22,021) | (22,648) | (24,245) | (24,315) | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (58,842) | (58,135) | (60,804) | (64,899) | (84,606) | ||||||||||||||||||||||||

| Total shareholders' equity | 562,238 | 543,286 | 528,040 | 524,378 | 505,411 | ||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 6,552,482 | $ | 6,581,658 | $ | 6,748,015 | $ | 6,427,540 | $ | 6,467,818 | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||||||||||

| (In thousands, except per share data) | 2024 | 2024 | 2024 | 2023 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 62,521 | $ | 61,643 | $ | 57,947 | $ | 54,093 | $ | 51,870 | $ | 182,111 | $ | 148,086 | |||||||||||||||||||||||||||

| Taxable investment securities | 8,779 | 9,228 | 9,460 | 9,274 | 9,526 | 27,467 | 29,704 | ||||||||||||||||||||||||||||||||||

| Tax-exempt investment securities | 1,611 | 1,663 | 1,710 | 1,789 | 1,802 | 4,984 | 5,751 | ||||||||||||||||||||||||||||||||||

| Other | 785 | 242 | 418 | 230 | 374 | 1,445 | 686 | ||||||||||||||||||||||||||||||||||

| Total interest income | 73,696 | 72,776 | 69,535 | 65,386 | 63,572 | 216,007 | 184,227 | ||||||||||||||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||||||||||||||

| Deposits | 29,117 | 28,942 | 27,726 | 27,200 | 23,128 | 85,785 | 58,564 | ||||||||||||||||||||||||||||||||||

| Short-term borrowings | 5,043 | 5,409 | 4,975 | 3,496 | 3,719 | 15,427 | 7,623 | ||||||||||||||||||||||||||||||||||

| Long-term debt | 2,015 | 2,078 | 2,103 | 2,131 | 2,150 | 6,196 | 6,427 | ||||||||||||||||||||||||||||||||||

| Total interest expense | 36,175 | 36,429 | 34,804 | 32,827 | 28,997 | 107,408 | 72,614 | ||||||||||||||||||||||||||||||||||

| Net interest income | 37,521 | 36,347 | 34,731 | 32,559 | 34,575 | 108,599 | 111,613 | ||||||||||||||||||||||||||||||||||

| Credit loss expense | 1,535 | 1,267 | 4,689 | 1,768 | 1,551 | 7,491 | 4,081 | ||||||||||||||||||||||||||||||||||

| Net interest income after credit loss expense | 35,986 | 35,080 | 30,042 | 30,791 | 33,024 | 101,108 | 107,532 | ||||||||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||

| Investment services and trust activities | 3,410 | 3,504 | 3,503 | 3,193 | 3,004 | 10,417 | 9,056 | ||||||||||||||||||||||||||||||||||

| Service charges and fees | 2,170 | 2,156 | 2,144 | 2,148 | 2,146 | 6,470 | 6,201 | ||||||||||||||||||||||||||||||||||

| Card revenue | 1,935 | 1,907 | 1,943 | 1,802 | 1,817 | 5,785 | 5,412 | ||||||||||||||||||||||||||||||||||

| Loan revenue | 760 | 1,525 | 856 | 909 | 1,462 | 3,141 | 3,791 | ||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 879 | 668 | 660 | 656 | 626 | 2,207 | 1,844 | ||||||||||||||||||||||||||||||||||

| Investment securities (losses) gains, net | (140,182) | 33 | 36 | (5,696) | 79 | (140,113) | (13,093) | ||||||||||||||||||||||||||||||||||

| Other | 640 | 11,761 | 608 | 850 | 727 | 13,009 | 1,350 | ||||||||||||||||||||||||||||||||||

| Total noninterest (loss) income | (130,388) | 21,554 | 9,750 | 3,862 | 9,861 | (99,084) | 14,561 | ||||||||||||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 19,943 | 20,985 | 20,930 | 17,859 | 18,558 | 61,858 | 58,551 | ||||||||||||||||||||||||||||||||||

| Occupancy expense of premises, net | 2,443 | 2,435 | 2,813 | 2,309 | 2,405 | 7,691 | 7,725 | ||||||||||||||||||||||||||||||||||

| Equipment | 2,486 | 2,530 | 2,600 | 2,466 | 2,123 | 7,616 | 6,729 | ||||||||||||||||||||||||||||||||||

| Legal and professional | 2,261 | 2,253 | 2,059 | 2,269 | 1,678 | 6,573 | 5,096 | ||||||||||||||||||||||||||||||||||

| Data processing | 1,580 | 1,645 | 1,360 | 1,411 | 1,504 | 4,585 | 4,388 | ||||||||||||||||||||||||||||||||||

| Marketing | 619 | 636 | 598 | 700 | 782 | 1,853 | 2,910 | ||||||||||||||||||||||||||||||||||

| Amortization of intangibles | 1,470 | 1,593 | 1,637 | 1,441 | 1,460 | 4,700 | 4,806 | ||||||||||||||||||||||||||||||||||

| FDIC insurance | 923 | 1,051 | 942 | 900 | 783 | 2,916 | 2,394 | ||||||||||||||||||||||||||||||||||

| Communications | 159 | 191 | 196 | 183 | 206 | 546 | 727 | ||||||||||||||||||||||||||||||||||

| Foreclosed assets, net | 330 | 138 | 358 | 45 | 2 | 826 | (32) | ||||||||||||||||||||||||||||||||||

| Other | 3,584 | 2,304 | 2,072 | 2,548 | 2,043 | 7,960 | 6,488 | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | 35,798 | 35,761 | 35,565 | 32,131 | 31,544 | 107,124 | 99,782 | ||||||||||||||||||||||||||||||||||

| (Loss) income before income tax expense | (130,200) | 20,873 | 4,227 | 2,522 | 11,341 | (105,100) | 22,311 | ||||||||||||||||||||||||||||||||||

| Income tax (benefit) expense | (34,493) | 5,054 | 958 | (208) | 2,203 | (28,481) | 4,182 | ||||||||||||||||||||||||||||||||||

| Net (loss) income | $ | (95,707) | $ | 15,819 | $ | 3,269 | $ | 2,730 | $ | 9,138 | $ | (76,619) | $ | 18,129 | |||||||||||||||||||||||||||

| Earnings (loss) per common share | |||||||||||||||||||||||||||||||||||||||||

| Basic | $ | (6.05) | $ | 1.00 | $ | 0.21 | $ | 0.17 | $ | 0.58 | $ | (4.86) | $ | 1.16 | |||||||||||||||||||||||||||

| Diluted | $ | (6.05) | $ | 1.00 | $ | 0.21 | $ | 0.17 | $ | 0.58 | $ | (4.86) | $ | 1.15 | |||||||||||||||||||||||||||

| Weighted average basic common shares outstanding | 15,829 | 15,763 | 15,723 | 15,693 | 15,689 | 15,772 | 15,673 | ||||||||||||||||||||||||||||||||||

| Weighted average diluted common shares outstanding | 15,829 | 15,781 | 15,774 | 15,756 | 15,711 | 15,772 | 15,696 | ||||||||||||||||||||||||||||||||||

| Dividends paid per common share | $ | 0.2425 | $ | 0.2425 | $ | 0.2425 | $ | 0.2425 | $ | 0.2425 | $ | 0.7275 | $ | 0.7275 | |||||||||||||||||||||||||||

| As of or for the Three Months Ended | As of or for the Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||

| (Dollars in thousands, except per share amounts) | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||

| Earnings: | |||||||||||||||||||||||||||||

| Net interest income | $ | 37,521 | $ | 36,347 | $ | 34,575 | $ | 108,599 | $ | 111,613 | |||||||||||||||||||

| Noninterest (loss) income | (130,388) | 21,554 | 9,861 | (99,084) | 14,561 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | (92,867) | 57,901 | 44,436 | 9,515 | 126,174 | ||||||||||||||||||||||||

| Credit loss expense | 1,535 | 1,267 | 1,551 | 7,491 | 4,081 | ||||||||||||||||||||||||

| Noninterest expense | 35,798 | 35,761 | 31,544 | 107,124 | 99,782 | ||||||||||||||||||||||||

| (Loss) income before income tax expense | (130,200) | 20,873 | 11,341 | (105,100) | 22,311 | ||||||||||||||||||||||||

| Income tax (benefit) expense | (34,493) | 5,054 | 2,203 | (28,481) | 4,182 | ||||||||||||||||||||||||

| Net (loss) income | $ | (95,707) | $ | 15,819 | $ | 9,138 | $ | (76,619) | $ | 18,129 | |||||||||||||||||||

Adjusted earnings(1) |

$ | 9,141 | $ | 8,132 | $ | 8,875 | $ | 21,762 | $ | 28,046 | |||||||||||||||||||

| Per Share Data: | |||||||||||||||||||||||||||||

| Diluted (loss) earnings | $ | (6.05) | $ | 1.00 | $ | 0.58 | $ | (4.86) | $ | 1.15 | |||||||||||||||||||

Adjusted earnings(1) |

0.58 | 0.52 | 0.56 | 1.38 | 1.79 | ||||||||||||||||||||||||

| Book value | 27.06 | 34.44 | 32.21 | 27.06 | 32.21 | ||||||||||||||||||||||||

Tangible book value(1) |

22.43 | 28.27 | 26.60 | 22.43 | 26.60 | ||||||||||||||||||||||||

| Ending Balance Sheet: | |||||||||||||||||||||||||||||

| Total assets | $ | 6,552,482 | $ | 6,581,658 | $ | 6,467,818 | $ | 6,552,482 | $ | 6,467,818 | |||||||||||||||||||

| Loans held for investment, net of unearned income | 4,328,756 | 4,287,232 | 4,065,969 | 4,328,756 | 4,065,969 | ||||||||||||||||||||||||

| Total securities | 1,623,104 | 1,824,114 | 1,958,521 | 1,623,104 | 1,958,521 | ||||||||||||||||||||||||

| Total deposits | 5,368,727 | 5,412,419 | 5,363,324 | 5,368,727 | 5,363,324 | ||||||||||||||||||||||||

| Short-term borrowings | 410,630 | 414,684 | 373,956 | 410,630 | 373,956 | ||||||||||||||||||||||||

| Long-term debt | 115,051 | 114,839 | 124,526 | 115,051 | 124,526 | ||||||||||||||||||||||||

| Total shareholders' equity | 562,238 | 543,286 | 505,411 | 562,238 | 505,411 | ||||||||||||||||||||||||

| Average Balance Sheet: | |||||||||||||||||||||||||||||

| Average total assets | $ | 6,583,404 | $ | 6,713,573 | $ | 6,452,815 | $ | 6,643,897 | $ | 6,480,636 | |||||||||||||||||||

| Average total loans | 4,311,693 | 4,419,697 | 4,019,852 | 4,343,087 | 3,964,119 | ||||||||||||||||||||||||

| Average total deposits | 5,402,634 | 5,514,924 | 5,379,871 | 5,465,993 | 5,459,749 | ||||||||||||||||||||||||

| Financial Ratios: | |||||||||||||||||||||||||||||

| Return on average assets | (5.78) | % | 0.95 | % | 0.56 | % | (1.54) | % | 0.37 | % | |||||||||||||||||||

| Return on average equity | (69.05) | % | 11.91 | % | 7.14 | % | (19.03) | % | 4.81 | % | |||||||||||||||||||

Return on average tangible equity(1) |

(82.78) | % | 15.74 | % | 9.68 | % | (22.17) | % | 7.03 | % | |||||||||||||||||||

Efficiency ratio(1) |

70.32 | % | 56.29 | % | 66.06 | % | 65.20 | % | 66.40 | % | |||||||||||||||||||

Net interest margin, tax equivalent(1) |

2.51 | % | 2.41 | % | 2.35 | % | 2.42 | % | 2.54 | % | |||||||||||||||||||

| Loans to deposits ratio | 80.63 | % | 79.21 | % | 75.81 | % | 80.63 | % | 75.81 | % | |||||||||||||||||||

| Common equity ratio | 8.58 | % | 8.25 | % | 7.81 | % | 8.58 | % | 7.81 | % | |||||||||||||||||||

Tangible common equity ratio(1) |

7.22 | % | 6.88 | % | 6.54 | % | 7.22 | % | 6.54 | % | |||||||||||||||||||

| Credit Risk Profile: | |||||||||||||||||||||||||||||

| Total nonperforming loans | $ | 21,954 | $ | 25,128 | $ | 28,987 | $ | 21,954 | $ | 28,987 | |||||||||||||||||||

| Nonperforming loans ratio | 0.51 | % | 0.59 | % | 0.71 | % | 0.51 | % | 0.71 | % | |||||||||||||||||||

| Total nonperforming assets | $ | 25,537 | $ | 31,181 | $ | 28,987 | $ | 25,537 | $ | 28,987 | |||||||||||||||||||

| Nonperforming assets ratio | 0.39 | % | 0.47 | % | 0.45 | % | 0.39 | % | 0.45 | % | |||||||||||||||||||

| Net charge-offs | $ | 1,735 | $ | 524 | $ | 451 | $ | 2,448 | $ | 1,681 | |||||||||||||||||||

| Net charge-off ratio | 0.16 | % | 0.05 | % | 0.04 | % | 0.08 | % | 0.06 | % | |||||||||||||||||||

| Allowance for credit losses | $ | 54,000 | $ | 53,900 | $ | 51,600 | $ | 54,000 | $ | 51,600 | |||||||||||||||||||

| Allowance for credit losses ratio | 1.25 | % | 1.26 | % | 1.27 | % | 1.25 | % | 1.27 | % | |||||||||||||||||||

| Allowance for credit losses to nonaccrual ratio | 260.84 | % | 218.26 | % | 178.63 | % | 260.84 | % | 178.63 | % | |||||||||||||||||||

(1) Non-GAAP measure. See the Non-GAAP Measures section for a reconciliation to the most directly comparable GAAP measure. | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Average Balance |

Interest Income/ Expense |

Average Yield/ Cost |

Average

Balance

|

Interest

Income/

Expense

|

Average Yield/ Cost |

Average Balance | Interest Income/ Expense |

Average Yield/ Cost |

||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans, including fees (1)(2)(3) |

$ | 4,311,693 | $ | 63,472 | 5.86 | % | $ | 4,419,697 | $ | 62,581 | 5.69 | % | $ | 4,019,852 | $ | 52,605 | 5.19 | % | |||||||||||||||||||||||||||||||||||

| Taxable investment securities | 1,489,843 | 8,779 | 2.34 | % | 1,520,253 | 9,228 | 2.44 | % | 1,637,259 | 9,526 | 2.31 | % | |||||||||||||||||||||||||||||||||||||||||

Tax-exempt investment securities (2)(4) |

313,935 | 1,976 | 2.50 | % | 322,092 | 2,040 | 2.55 | % | 341,330 | 2,234 | 2.60 | % | |||||||||||||||||||||||||||||||||||||||||

Total securities held for investment(2) |

1,803,778 | 10,755 | 2.37 | % | 1,842,345 | 11,268 | 2.46 | % | 1,978,589 | 11,760 | 2.36 | % | |||||||||||||||||||||||||||||||||||||||||

| Other | 52,054 | 785 | 6.00 | % | 20,452 | 242 | 4.76 | % | 34,195 | 374 | 4.34 | % | |||||||||||||||||||||||||||||||||||||||||

Total interest earning assets(2) |

$ | 6,167,525 | $ | 75,012 | 4.84 | % | $ | 6,282,494 | $ | 74,091 | 4.74 | % | $ | 6,032,636 | $ | 64,739 | 4.26 | % | |||||||||||||||||||||||||||||||||||

| Other assets | 415,879 | 431,079 | 420,179 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 6,583,404 | $ | 6,713,573 | $ | 6,452,815 | |||||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest checking deposits | $ | 1,243,327 | $ | 3,041 | 0.97 | % | $ | 1,297,356 | $ | 3,145 | 0.97 | % | $ | 1,354,597 | $ | 2,179 | 0.64 | % | |||||||||||||||||||||||||||||||||||

| Money market deposits | 1,047,081 | 7,758 | 2.95 | % | 1,072,688 | 7,821 | 2.93 | % | 1,112,149 | 7,402 | 2.64 | % | |||||||||||||||||||||||||||||||||||||||||

| Savings deposits | 761,922 | 3,128 | 1.63 | % | 738,773 | 2,673 | 1.46 | % | 603,628 | 749 | 0.49 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 1,430,723 | 15,190 | 4.22 | % | 1,470,956 | 15,303 | 4.18 | % | 1,403,504 | 12,798 | 3.62 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 4,483,053 | 29,117 | 2.58 | % | 4,579,773 | 28,942 | 2.54 | % | 4,473,878 | 23,128 | 2.05 | % | |||||||||||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 5,812 | 12 | 0.82 | % | 5,300 | 10 | 0.76 | % | 66,020 | 85 | 0.51 | % | |||||||||||||||||||||||||||||||||||||||||

| Other short-term borrowings | 415,961 | 5,031 | 4.81 | % | 442,546 | 5,399 | 4.91 | % | 277,713 | 3,634 | 5.19 | % | |||||||||||||||||||||||||||||||||||||||||

| Total short-term borrowings | 421,773 | 5,043 | 4.76 | % | 447,846 | 5,409 | 4.86 | % | 343,733 | 3,719 | 4.29 | % | |||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 116,032 | 2,015 | 6.91 | % | 120,256 | 2,078 | 6.95 | % | 125,737 | 2,150 | 6.78 | % | |||||||||||||||||||||||||||||||||||||||||

| Total borrowed funds | 537,805 | 7,058 | 5.22 | % | 568,102 | 7,487 | 5.30 | % | 469,470 | 5,869 | 4.96 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 5,020,858 | $ | 36,175 | 2.87 | % | $ | 5,147,875 | $ | 36,429 | 2.85 | % | $ | 4,943,348 | $ | 28,997 | 2.33 | % | |||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 919,581 | 935,151 | 905,993 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 91,551 | 96,553 | 95,408 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 551,414 | 533,994 | 508,066 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 6,583,404 | $ | 6,713,573 | $ | 6,452,815 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income(2) |

$ | 38,837 | $ | 37,662 | $ | 35,742 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(2) |

1.97 | % | 1.89 | % | 1.93 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin(2) |

2.51 | % | 2.41 | % | 2.35 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Total deposits(5) |

$ | 5,402,634 | $ | 29,117 | 2.14 | % | $ | 5,514,924 | $ | 28,942 | 2.11 | % | $ | 5,379,871 | $ | 23,128 | 1.71 | % | |||||||||||||||||||||||||||||||||||

Cost of funds(6) |

2.42 | % | 2.41 | % | 1.97 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended | |||||||||||||||||||||||||||||||||||

| September 30, 2024 | September 30, 2023 | ||||||||||||||||||||||||||||||||||

| (Dollars in thousands) |

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Cost

|

Average

Balance

|

Interest

Income/

Expense

|

Average

Yield/

Cost

|

|||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

Loans, including fees (1)(2)(3) |

$ | 4,343,087 | $ | 184,920 | 5.69 | % | $ | 3,964,119 | $ | 150,250 | 5.07 | % | |||||||||||||||||||||||

| Taxable investment securities | 1,522,447 | 27,467 | 2.41 | % | 1,714,912 | 29,704 | 2.32 | % | |||||||||||||||||||||||||||

Tax-exempt investment securities (2)(4) |

321,560 | 6,113 | 2.54 | % | 361,254 | 7,136 | 2.64 | % | |||||||||||||||||||||||||||

Total securities held for investment(2) |

1,844,007 | 33,580 | 2.43 | % | 2,076,166 | 36,840 | 2.37 | % | |||||||||||||||||||||||||||

| Other | 34,435 | 1,445 | 5.61 | % | 22,741 | 686 | 4.03 | % | |||||||||||||||||||||||||||

Total interest earning assets(2) |

$ | 6,221,529 | $ | 219,945 | 4.72 | % | $ | 6,063,026 | $ | 187,776 | 4.14 | % | |||||||||||||||||||||||

| Other assets | 422,368 | 417,610 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 6,643,897 | $ | 6,480,636 | |||||||||||||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|||||||||||||||||||||||||||||||||||

| Interest checking deposits | $ | 1,280,581 | $ | 9,076 | 0.95 | % | $ | 1,429,804 | $ | 5,999 | 0.56 | % | |||||||||||||||||||||||

| Money market deposits | 1,074,006 | 23,644 | 2.94 | % | 1,014,708 | 15,970 | 2.10 | % | |||||||||||||||||||||||||||

| Savings deposits | 731,724 | 7,848 | 1.43 | % | 620,011 | 1,309 | 0.28 | % | |||||||||||||||||||||||||||

| Time deposits | 1,449,485 | 45,217 | 4.17 | % | 1,437,122 | 35,286 | 3.28 | % | |||||||||||||||||||||||||||

| Total interest bearing deposits | 4,535,796 | 85,785 | 2.53 | % | 4,501,645 | 58,564 | 1.74 | % | |||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 5,482 | 33 | 0.80 | % | 123,512 | 958 | 1.04 | % | |||||||||||||||||||||||||||

| Other short-term borrowings | 422,653 | 15,394 | 4.87 | % | 174,448 | 6,665 | 5.11 | % | |||||||||||||||||||||||||||

| Total short-term borrowings | 428,135 | 15,427 | 4.81 | % | 297,960 | 7,623 | 3.42 | % | |||||||||||||||||||||||||||

| Long-term debt | 119,837 | 6,196 | 6.91 | % | 133,375 | 6,427 | 6.44 | % | |||||||||||||||||||||||||||

| Total borrowed funds | 547,972 | 21,623 | 5.27 | % | 431,335 | 14,050 | 4.36 | % | |||||||||||||||||||||||||||

| Total interest bearing liabilities | $ | 5,083,768 | $ | 107,408 | 2.82 | % | $ | 4,932,980 | $ | 72,614 | 1.97 | % | |||||||||||||||||||||||

| Noninterest bearing deposits | 930,197 | 958,104 | |||||||||||||||||||||||||||||||||

| Other liabilities | 92,235 | 85,650 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 537,697 | 503,902 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 6,643,897 | $ | 6,480,636 | |||||||||||||||||||||||||||||||

Net interest income(2) |

$ | 112,537 | $ | 115,162 | |||||||||||||||||||||||||||||||

Net interest spread(2) |

1.90 | % | 2.17 | % | |||||||||||||||||||||||||||||||

Net interest margin(2) |

2.42 | % | 2.54 | % | |||||||||||||||||||||||||||||||

Total deposits(5) |

$ | 5,465,993 | $ | 85,785 | 2.10 | % | $ | 5,459,749 | $ | 58,564 | 1.43 | % | |||||||||||||||||||||||

Cost of funds(6) |

2.39 | % | 1.65 | % | |||||||||||||||||||||||||||||||

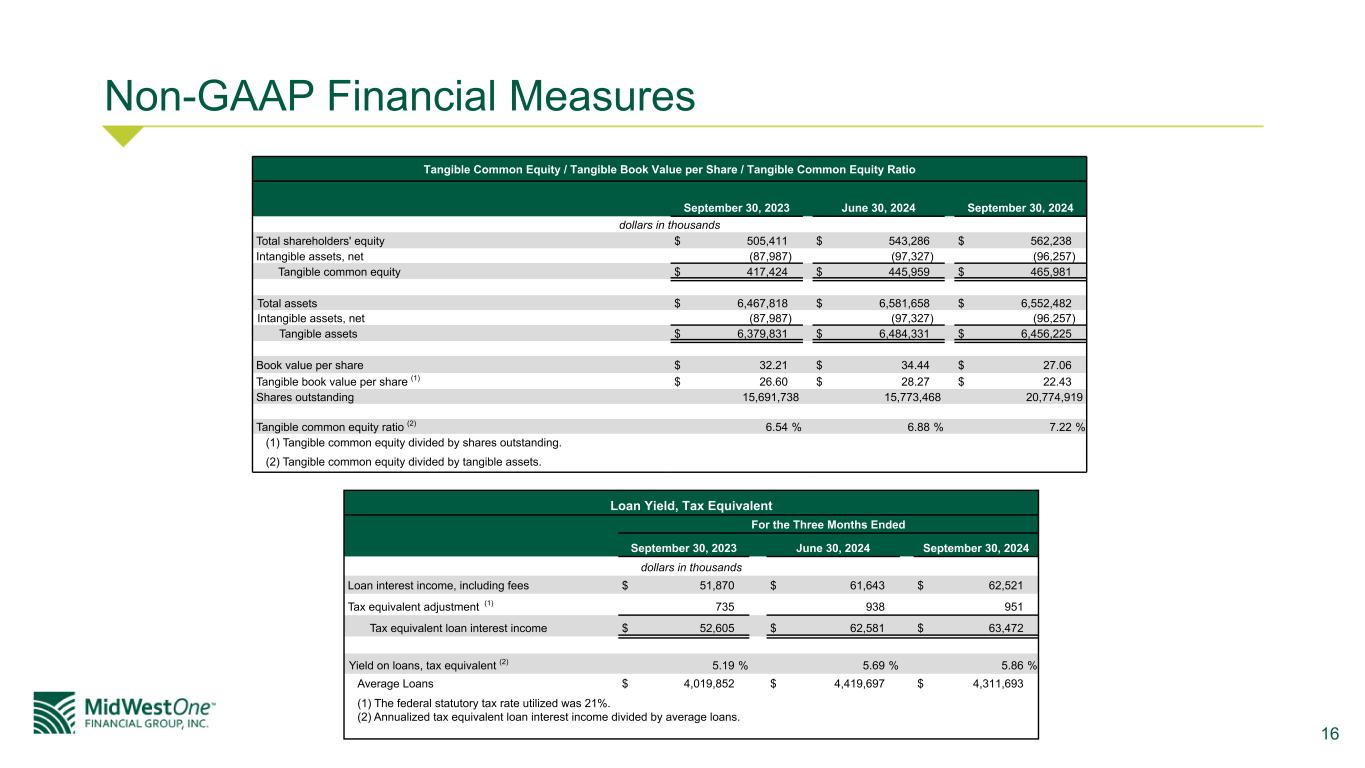

| Tangible Common Equity/Tangible Book Value | |||||||||||||||||||||||||||||||||||

| per Share/Tangible Common Equity Ratio | September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2024 | 2024 | 2023 | 2023 | ||||||||||||||||||||||||||||||

| Total shareholders’ equity | $ | 562,238 | $ | 543,286 | $ | 528,040 | $ | 524,378 | $ | 505,411 | |||||||||||||||||||||||||

Intangible assets, net |

(96,257) | (97,327) | (100,649) | (86,546) | (87,987) | ||||||||||||||||||||||||||||||

| Tangible common equity | $ | 465,981 | $ | 445,959 | $ | 427,391 | $ | 437,832 | $ | 417,424 | |||||||||||||||||||||||||

| Total assets | $ | 6,552,482 | $ | 6,581,658 | $ | 6,748,015 | $ | 6,427,540 | $ | 6,467,818 | |||||||||||||||||||||||||

Intangible assets, net |

(96,257) | (97,327) | (100,649) | (86,546) | (87,987) | ||||||||||||||||||||||||||||||

| Tangible assets | $ | 6,456,225 | $ | 6,484,331 | $ | 6,647,366 | $ | 6,340,994 | $ | 6,379,831 | |||||||||||||||||||||||||

| Book value per share | $ | 27.06 | $ | 34.44 | $ | 33.53 | $ | 33.41 | $ | 32.21 | |||||||||||||||||||||||||

Tangible book value per share(1) |

$ | 22.43 | $ | 28.27 | $ | 27.14 | $ | 27.90 | $ | 26.60 | |||||||||||||||||||||||||

| Shares outstanding | 20,774,919 | 15,773,468 | 15,750,471 | 15,694,306 | 15,691,738 | ||||||||||||||||||||||||||||||

| Common equity ratio | 8.58 | % | 8.25 | % | 7.83 | % | 8.16 | % | 7.81 | % | |||||||||||||||||||||||||

Tangible common equity ratio(2) |

7.22 | % | 6.88 | % | 6.43 | % | 6.90 | % | 6.54 | % | |||||||||||||||||||||||||

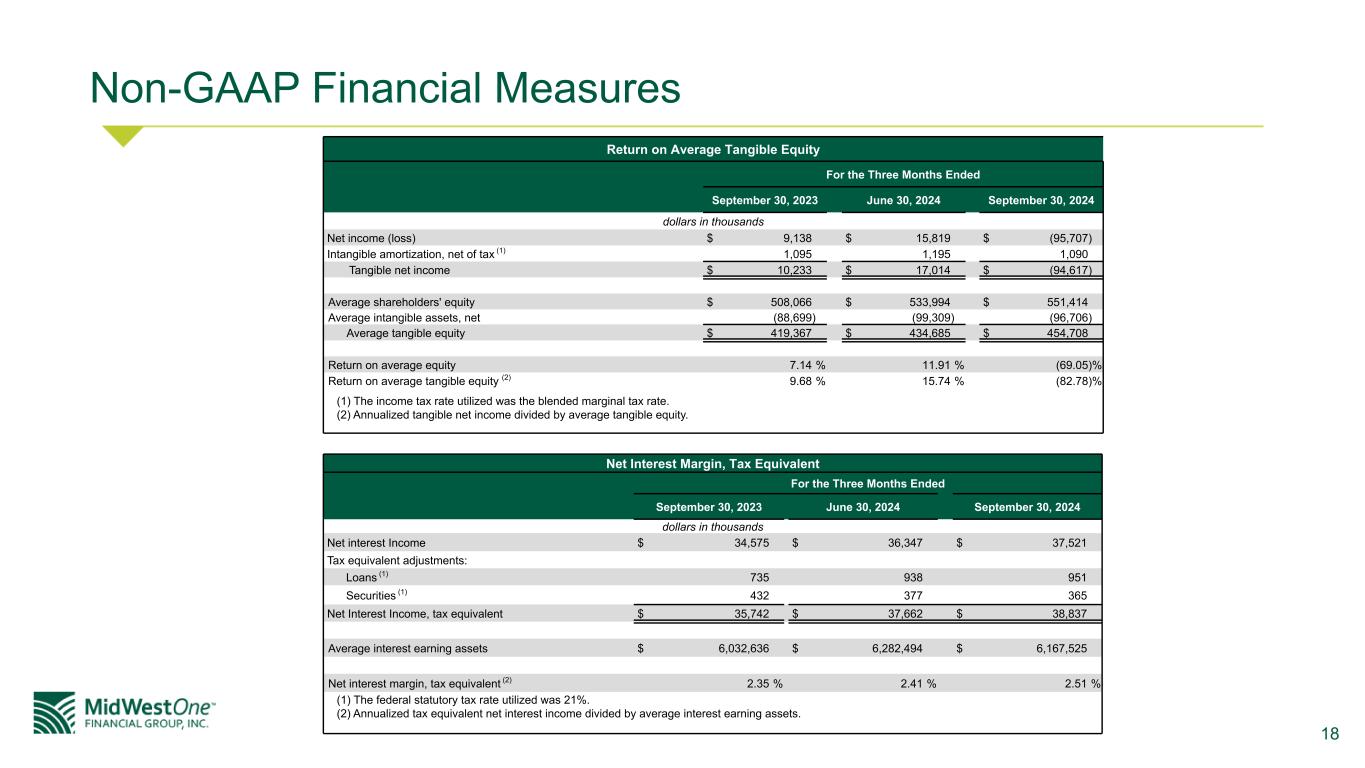

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||

| Return on Average Tangible Equity | September 30, | June 30, | September 30, | September 30, | September 30, | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||

| Net (loss) income | $ | (95,707) | $ | 15,819 | $ | 9,138 | $ | (76,619) | $ | 18,129 | |||||||||||||||||||||||||

Intangible amortization, net of tax(1) |

1,090 | 1,195 | 1,095 | 3,487 | 3,605 | ||||||||||||||||||||||||||||||

| Tangible net (loss) income | $ | (94,617) | $ | 17,014 | $ | 10,233 | $ | (73,132) | $ | 21,734 | |||||||||||||||||||||||||

| Average shareholders’ equity | $ | 551,414 | $ | 533,994 | $ | 508,066 | $ | 537,697 | $ | 503,902 | |||||||||||||||||||||||||

Average intangible assets, net |

(96,706) | (99,309) | (88,699) | (97,102) | (90,308) | ||||||||||||||||||||||||||||||

| Average tangible equity | $ | 454,708 | $ | 434,685 | $ | 419,367 | $ | 440,595 | $ | 413,594 | |||||||||||||||||||||||||

Return on average equity |

(69.05) | % | 11.91 | % | 7.14 | % | (19.03) | % | 4.81 | % | |||||||||||||||||||||||||

Return on average tangible equity(2) |

(82.78) | % | 15.74 | % | 9.68 | % | (22.17) | % | 7.03 | % | |||||||||||||||||||||||||

| Net Interest Margin, Tax Equivalent/ Core Net Interest Margin |

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||

| Net interest income | $ | 37,521 | $ | 36,347 | $ | 34,575 | $ | 108,599 | $ | 111,613 | |||||||||||||||||||||||||

| Tax equivalent adjustments: | |||||||||||||||||||||||||||||||||||

Loans(1) |

951 | 938 | 735 | 2,809 | 2,164 | ||||||||||||||||||||||||||||||

Securities(1) |

365 | 377 | 432 | 1,129 | 1,385 | ||||||||||||||||||||||||||||||

| Net interest income, tax equivalent | $ | 38,837 | $ | 37,662 | $ | 35,742 | $ | 112,537 | $ | 115,162 | |||||||||||||||||||||||||

| Loan purchase discount accretion | (1,426) | (1,261) | (791) | (3,839) | (2,964) | ||||||||||||||||||||||||||||||

| Core net interest income | $ | 37,411 | $ | 36,401 | $ | 34,951 | $ | 108,698 | $ | 112,198 | |||||||||||||||||||||||||

| Net interest margin | 2.42 | % | 2.33 | % | 2.27 | % | 2.33 | % | 2.46 | % | |||||||||||||||||||||||||

Net interest margin, tax equivalent(2) |

2.51 | % | 2.41 | % | 2.35 | % | 2.42 | % | 2.54 | % | |||||||||||||||||||||||||

Core net interest margin(3) |

2.41 | % | 2.33 | % | 2.30 | % | 2.33 | % | 2.47 | % | |||||||||||||||||||||||||

| Average interest earning assets | $ | 6,167,525 | $ | 6,282,494 | $ | 6,032,636 | $ | 6,221,529 | $ | 6,063,026 | |||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| Loan Yield, Tax Equivalent / Core Yield on Loans | September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||

| Loan interest income, including fees | $ | 62,521 | $ | 61,643 | $ | 51,870 | $ | 182,111 | $ | 148,086 | ||||||||||||||||||||||

Tax equivalent adjustment(1) |

951 | 938 | 735 | 2,809 | 2,164 | |||||||||||||||||||||||||||

| Tax equivalent loan interest income | $ | 63,472 | $ | 62,581 | $ | 52,605 | $ | 184,920 | $ | 150,250 | ||||||||||||||||||||||

| Loan purchase discount accretion | (1,426) | (1,261) | (791) | (3,839) | (2,964) | |||||||||||||||||||||||||||

| Core loan interest income | $ | 62,046 | $ | 61,320 | $ | 51,814 | $ | 181,081 | $ | 147,286 | ||||||||||||||||||||||

| Yield on loans | 5.77 | % | 5.61 | % | 5.12 | % | 5.60 | % | 4.99 | % | ||||||||||||||||||||||

Yield on loans, tax equivalent(2) |

5.86 | % | 5.69 | % | 5.19 | % | 5.69 | % | 5.07 | % | ||||||||||||||||||||||

Core yield on loans(3) |

5.72 | % | 5.58 | % | 5.11 | % | 5.57 | % | 4.97 | % | ||||||||||||||||||||||

| Average loans | $ | 4,311,693 | $ | 4,419,697 | $ | 4,019,852 | $ | 4,343,087 | $ | 3,964,119 | ||||||||||||||||||||||

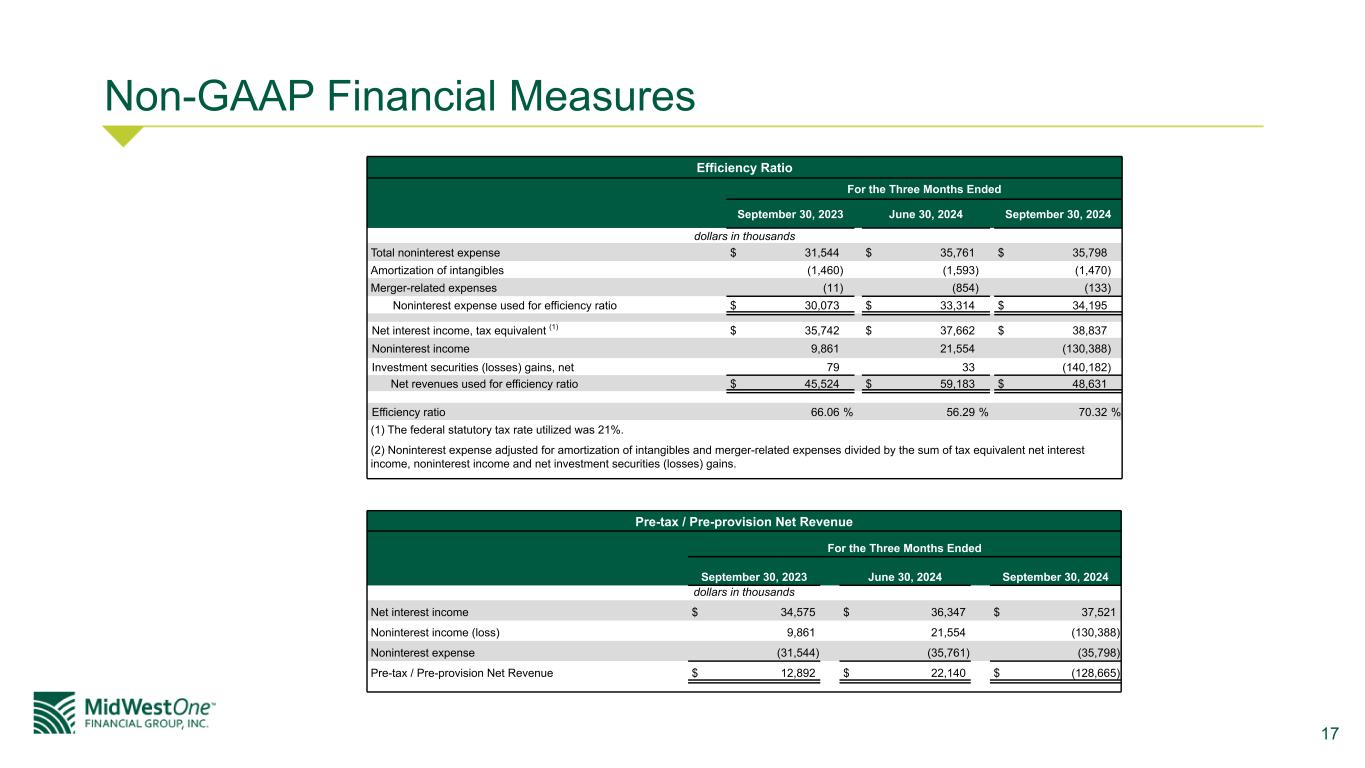

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| Efficiency Ratio | September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||

| Total noninterest expense | $ | 35,798 | $ | 35,761 | $ | 31,544 | $ | 107,124 | $ | 99,782 | ||||||||||||||||||||||

| Amortization of intangibles | (1,470) | (1,593) | (1,460) | (4,700) | (4,806) | |||||||||||||||||||||||||||

| Merger-related expenses | (133) | (854) | (11) | (2,301) | (147) | |||||||||||||||||||||||||||

| Noninterest expense used for efficiency ratio | $ | 34,195 | $ | 33,314 | $ | 30,073 | $ | 100,123 | $ | 94,829 | ||||||||||||||||||||||

Net interest income, tax equivalent(1) |

$ | 38,837 | $ | 37,662 | $ | 35,742 | $ | 112,537 | $ | 115,162 | ||||||||||||||||||||||

| Plus: Noninterest (loss) income | (130,388) | 21,554 | 9,861 | (99,084) | 14,561 | |||||||||||||||||||||||||||

| Less: Investment securities (losses) gains, net | (140,182) | 33 | 79 | (140,113) | (13,093) | |||||||||||||||||||||||||||

| Net revenues used for efficiency ratio | $ | 48,631 | $ | 59,183 | $ | 45,524 | $ | 153,566 | $ | 142,816 | ||||||||||||||||||||||

Efficiency ratio (2) |

70.32 | % | 56.29 | % | 66.06 | % | 65.20 | % | 66.40 | % | ||||||||||||||||||||||

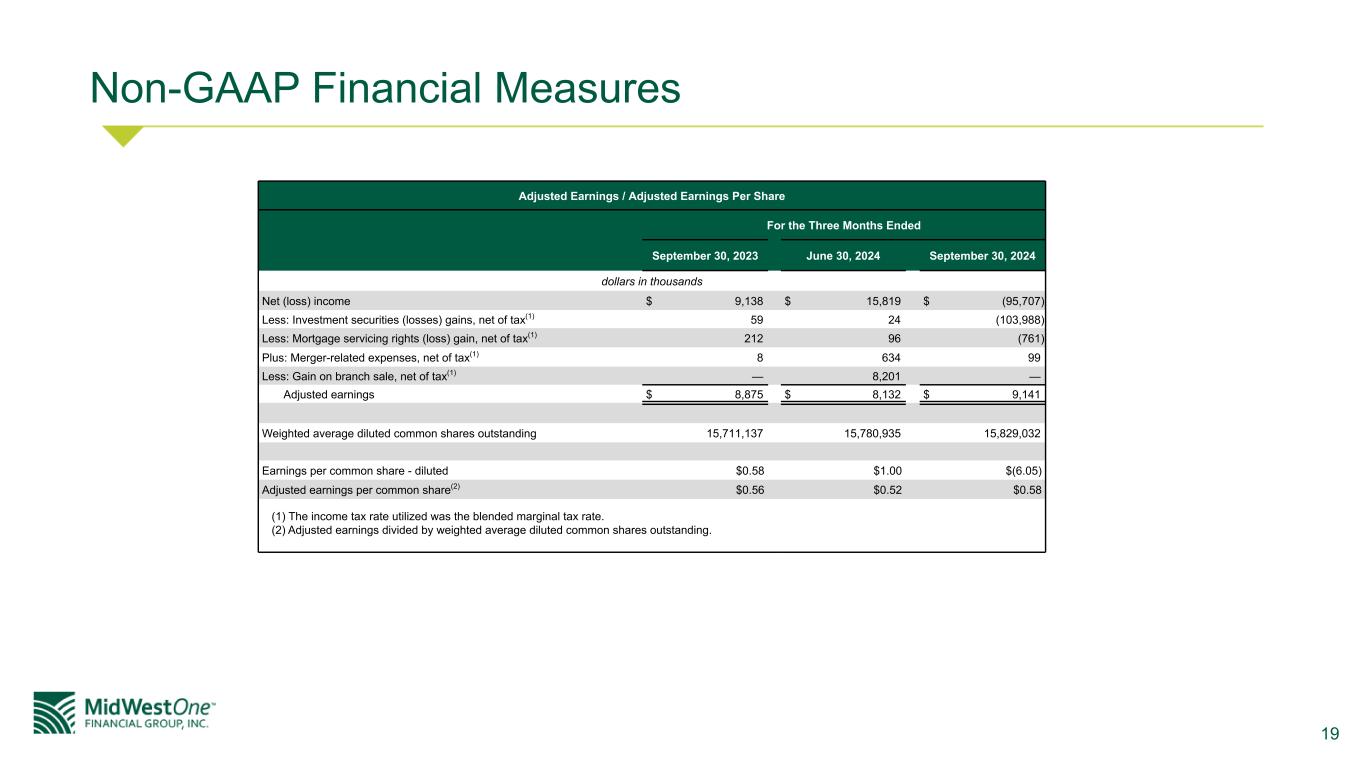

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| Adjusted Earnings | September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||

| Net (loss) income | $ | (95,707) | $ | 15,819 | $ | 9,138 | $ | (76,619) | $ | 18,129 | ||||||||||||||||||||||

Less: Investment securities (losses) gains, net of tax(1) |

(103,988) | 24 | 59 | (103,937) | (9,820) | |||||||||||||||||||||||||||

Less: Mortgage servicing rights (loss) gain, net of tax(1) |

(761) | 96 | 212 | (938) | 13 | |||||||||||||||||||||||||||

Plus: Merger-related expenses, net of tax(1) |

99 | 634 | 8 | 1,707 | 110 | |||||||||||||||||||||||||||

Less: Gain on branch sale, net of tax(1) |

— | 8,201 | — | 8,201 | — | |||||||||||||||||||||||||||

| Adjusted earnings | $ | 9,141 | $ | 8,132 | $ | 8,875 | $ | 21,762 | $ | 28,046 | ||||||||||||||||||||||

| Weighted average diluted common shares outstanding | 15,829 | 15,781 | 15,711 | 15,772 | 15,696 | |||||||||||||||||||||||||||

| Earnings per common share - diluted | $ | (6.05) | $ | 1.00 | $ | 0.58 | $ | (4.86) | $ | 1.15 | ||||||||||||||||||||||

Adjusted earnings per common share(2) |

$ | 0.58 | $ | 0.52 | $ | 0.56 | $ | 1.38 | $ | 1.79 | ||||||||||||||||||||||

| Contact: | |||||||||||

| Charles N. Reeves | Barry S. Ray | ||||||||||

| Chief Executive Officer | Chief Financial Officer | ||||||||||

| 319.356.5800 | 319.356.5800 | ||||||||||