Investor Presentation March 31, 2024 Iowa City, Iowa Denver, Colorado Naples, Florida Minneapolis, Minnesota Dubuque, Iowa Iowa City, Iowa Denver, Colorado Minneapolis, Minnesota

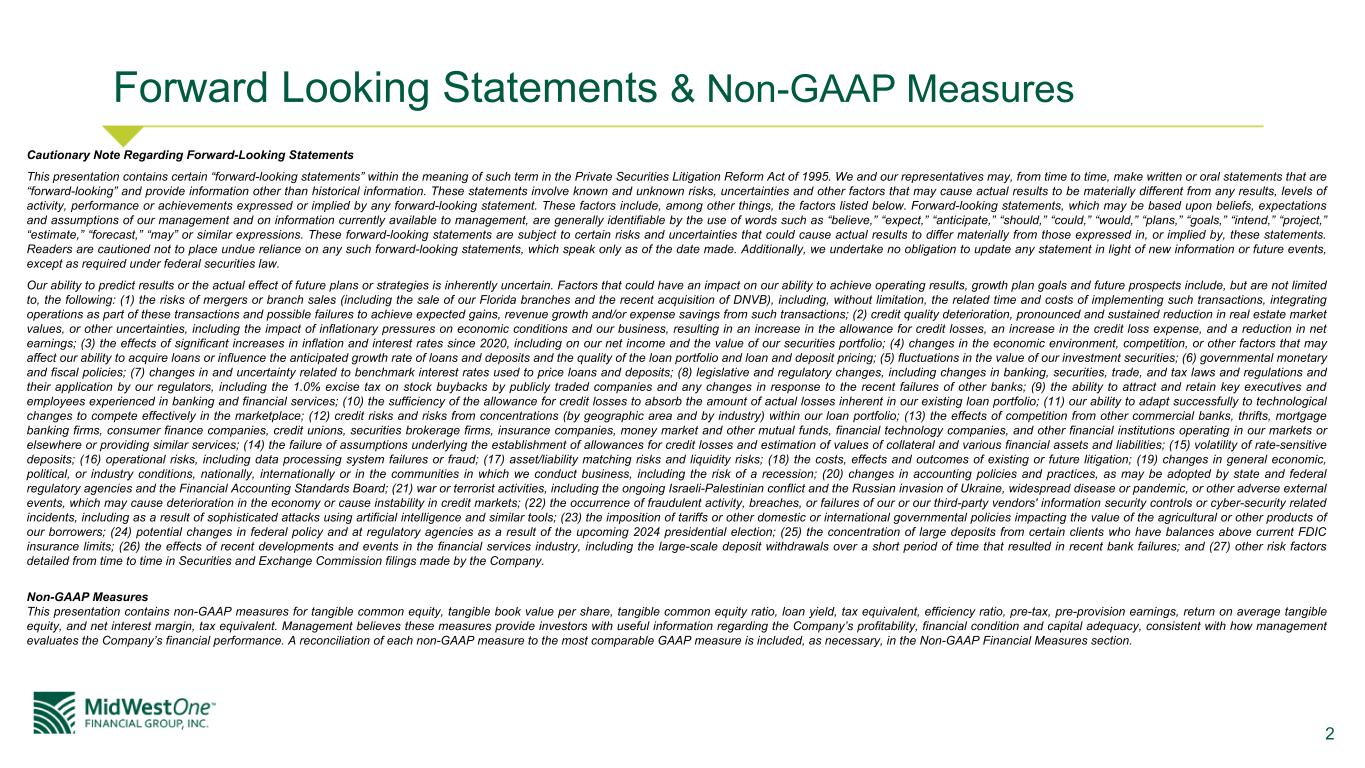

2 Forward Looking Statements & Non-GAAP Measures Cautionary Note Regarding Forward-Looking Statements This presentation contains certain “forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. We and our representatives may, from time to time, make written or oral statements that are “forward-looking” and provide information other than historical information. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement. These factors include, among other things, the factors listed below. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of our management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “should,” “could,” “would,” “plans,” “goals,” “intend,” “project,” “estimate,” “forecast,” “may” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, these statements. Readers are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Additionally, we undertake no obligation to update any statement in light of new information or future events, except as required under federal securities law. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors that could have an impact on our ability to achieve operating results, growth plan goals and future prospects include, but are not limited to, the following: (1) the risks of mergers or branch sales (including the sale of our Florida branches and the recent acquisition of DNVB), including, without limitation, the related time and costs of implementing such transactions, integrating operations as part of these transactions and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions; (2) credit quality deterioration, pronounced and sustained reduction in real estate market values, or other uncertainties, including the impact of inflationary pressures on economic conditions and our business, resulting in an increase in the allowance for credit losses, an increase in the credit loss expense, and a reduction in net earnings; (3) the effects of significant increases in inflation and interest rates since 2020, including on our net income and the value of our securities portfolio; (4) changes in the economic environment, competition, or other factors that may affect our ability to acquire loans or influence the anticipated growth rate of loans and deposits and the quality of the loan portfolio and loan and deposit pricing; (5) fluctuations in the value of our investment securities; (6) governmental monetary and fiscal policies; (7) changes in and uncertainty related to benchmark interest rates used to price loans and deposits; (8) legislative and regulatory changes, including changes in banking, securities, trade, and tax laws and regulations and their application by our regulators, including the 1.0% excise tax on stock buybacks by publicly traded companies and any changes in response to the recent failures of other banks; (9) the ability to attract and retain key executives and employees experienced in banking and financial services; (10) the sufficiency of the allowance for credit losses to absorb the amount of actual losses inherent in our existing loan portfolio; (11) our ability to adapt successfully to technological changes to compete effectively in the marketplace; (12) credit risks and risks from concentrations (by geographic area and by industry) within our loan portfolio; (13) the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, financial technology companies, and other financial institutions operating in our markets or elsewhere or providing similar services; (14) the failure of assumptions underlying the establishment of allowances for credit losses and estimation of values of collateral and various financial assets and liabilities; (15) volatility of rate-sensitive deposits; (16) operational risks, including data processing system failures or fraud; (17) asset/liability matching risks and liquidity risks; (18) the costs, effects and outcomes of existing or future litigation; (19) changes in general economic, political, or industry conditions, nationally, internationally or in the communities in which we conduct business, including the risk of a recession; (20) changes in accounting policies and practices, as may be adopted by state and federal regulatory agencies and the Financial Accounting Standards Board; (21) war or terrorist activities, including the ongoing Israeli-Palestinian conflict and the Russian invasion of Ukraine, widespread disease or pandemic, or other adverse external events, which may cause deterioration in the economy or cause instability in credit markets; (22) the occurrence of fraudulent activity, breaches, or failures of our or our third-party vendors' information security controls or cyber-security related incidents, including as a result of sophisticated attacks using artificial intelligence and similar tools; (23) the imposition of tariffs or other domestic or international governmental policies impacting the value of the agricultural or other products of our borrowers; (24) potential changes in federal policy and at regulatory agencies as a result of the upcoming 2024 presidential election; (25) the concentration of large deposits from certain clients who have balances above current FDIC insurance limits; (26) the effects of recent developments and events in the financial services industry, including the large-scale deposit withdrawals over a short period of time that resulted in recent bank failures; and (27) other risk factors detailed from time to time in Securities and Exchange Commission filings made by the Company. Non-GAAP Measures This presentation contains non-GAAP measures for tangible common equity, tangible book value per share, tangible common equity ratio, loan yield, tax equivalent, efficiency ratio, pre-tax, pre-provision earnings, return on average tangible equity, and net interest margin, tax equivalent. Management believes these measures provide investors with useful information regarding the Company’s profitability, financial condition and capital adequacy, consistent with how management evaluates the Company’s financial performance. A reconciliation of each non-GAAP measure to the most comparable GAAP measure is included, as necessary, in the Non-GAAP Financial Measures section.

3 Overview of MidWestOne Diverse & Expanding Markets: Iowa, Minnesota, Wisconsin, Colorado, and Florida Growing communities for 85+ years Headquartered in Iowa City, IA • 58 Banking Offices Commercial and Consumer Banking • $6.7B Total Assets • $4.4B Loans and $5.6B Deposits Wealth Management • $3.10B AUA Banking Offices & Financial Information as of March 31, 2024

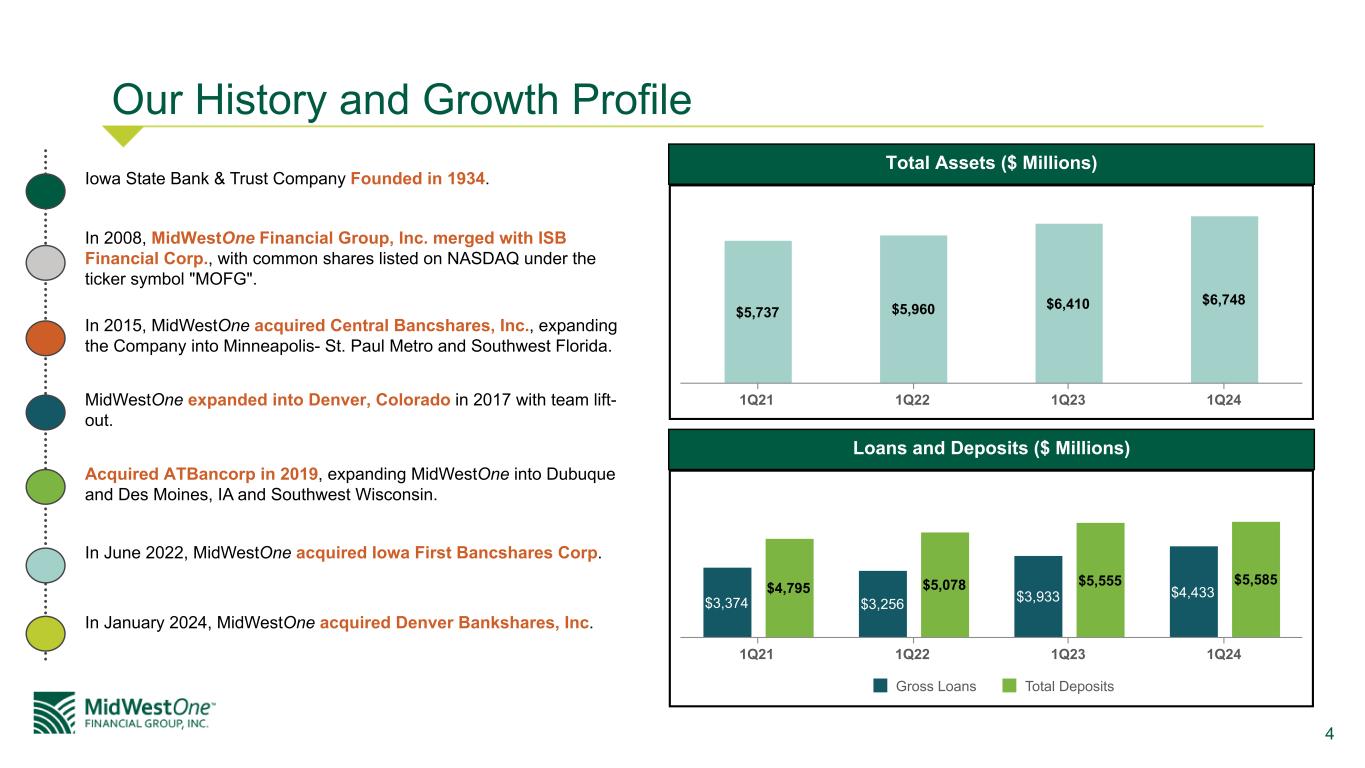

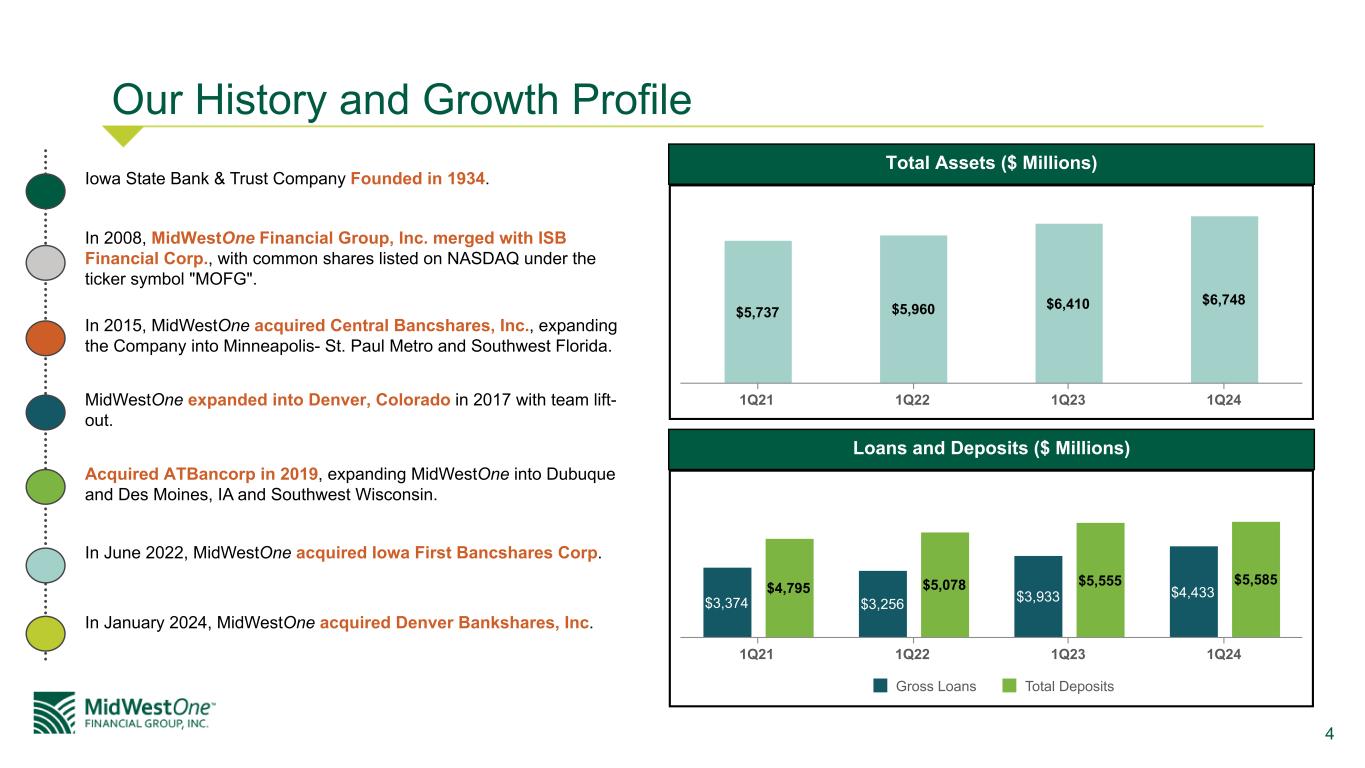

4 Our History and Growth Profile Total Assets ($ Millions) $5,737 $5,960 $6,410 $6,748 1Q21 1Q22 1Q23 1Q24 Loans and Deposits ($ Millions) $3,374 $3,256 $3,933 $4,433$4,795 $5,078 $5,555 $5,585 Gross Loans Total Deposits 1Q21 1Q22 1Q23 1Q24 Iowa State Bank & Trust Company Founded in 1934. In 2008, MidWestOne Financial Group, Inc. merged with ISB Financial Corp., with common shares listed on NASDAQ under the ticker symbol "MOFG". In 2015, MidWestOne acquired Central Bancshares, Inc., expanding the Company into Minneapolis- St. Paul Metro and Southwest Florida. MidWestOne expanded into Denver, Colorado in 2017 with team lift- out. Acquired ATBancorp in 2019, expanding MidWestOne into Dubuque and Des Moines, IA and Southwest Wisconsin. In June 2022, MidWestOne acquired Iowa First Bancshares Corp. In January 2024, MidWestOne acquired Denver Bankshares, Inc.

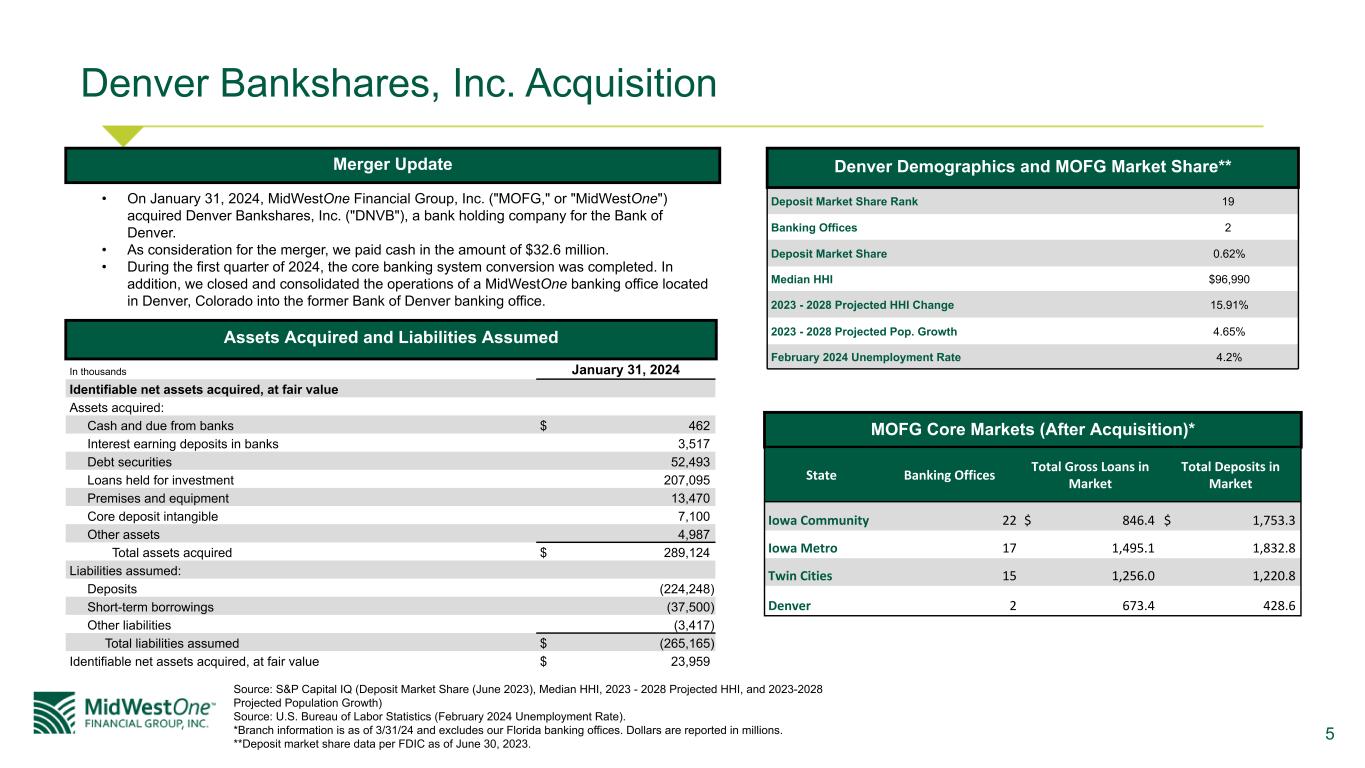

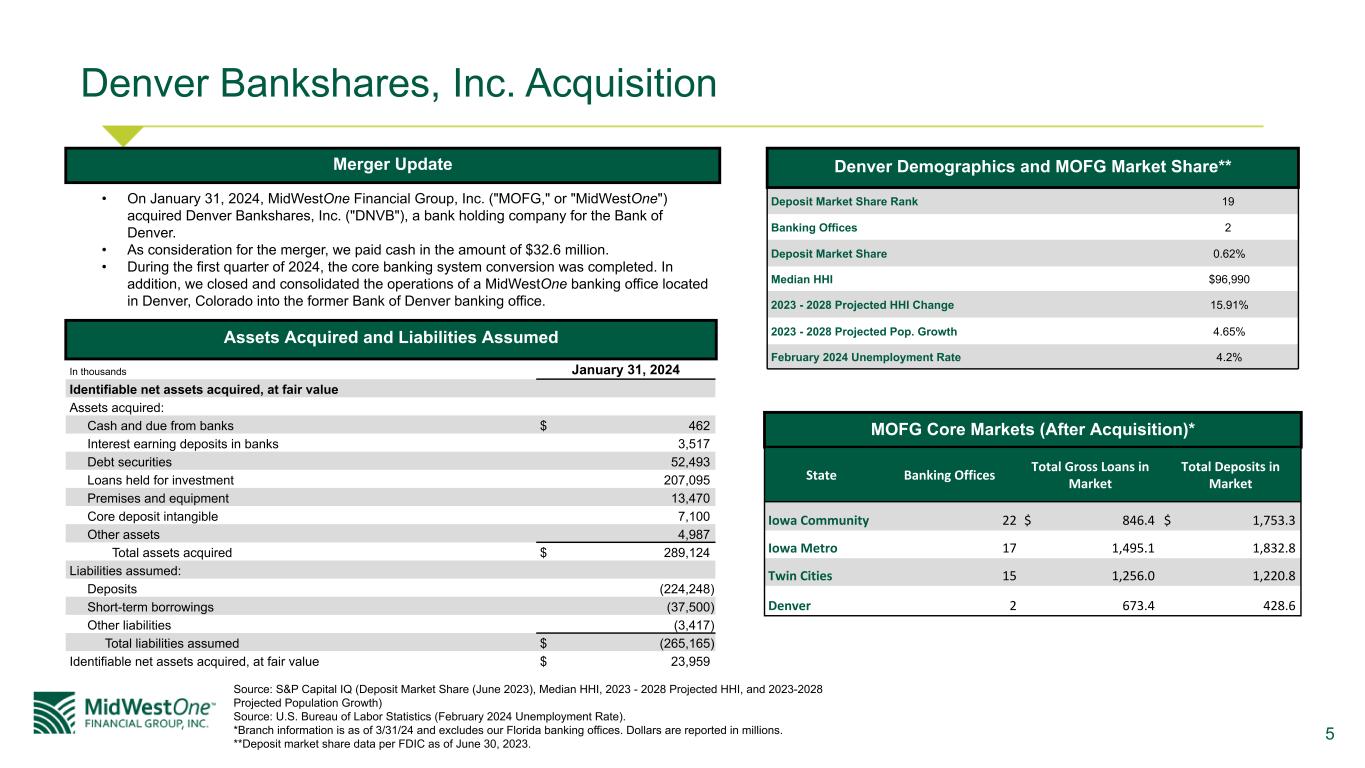

5 Denver Bankshares, Inc. Acquisition Deposit Market Share Rank 19 Banking Offices 2 Deposit Market Share 0.62% Median HHI $96,990 2023 - 2028 Projected HHI Change 15.91% 2023 - 2028 Projected Pop. Growth 4.65% February 2024 Unemployment Rate 4.2% Source: S&P Capital IQ (Deposit Market Share (June 2023), Median HHI, 2023 - 2028 Projected HHI, and 2023-2028 Projected Population Growth) Source: U.S. Bureau of Labor Statistics (February 2024 Unemployment Rate). *Branch information is as of 3/31/24 and excludes our Florida banking offices. Dollars are reported in millions. **Deposit market share data per FDIC as of June 30, 2023. Merger Update • On January 31, 2024, MidWestOne Financial Group, Inc. ("MOFG," or "MidWestOne") acquired Denver Bankshares, Inc. ("DNVB"), a bank holding company for the Bank of Denver. • As consideration for the merger, we paid cash in the amount of $32.6 million. • During the first quarter of 2024, the core banking system conversion was completed. In addition, we closed and consolidated the operations of a MidWestOne banking office located in Denver, Colorado into the former Bank of Denver banking office. Denver Demographics and MOFG Market Share** MOFG Core Markets (After Acquisition)* Assets Acquired and Liabilities Assumed In thousands January 31, 2024 Identifiable net assets acquired, at fair value Assets acquired: Cash and due from banks $ 462 Interest earning deposits in banks 3,517 Debt securities 52,493 Loans held for investment 207,095 Premises and equipment 13,470 Core deposit intangible 7,100 Other assets 4,987 Total assets acquired $ 289,124 Liabilities assumed: Deposits (224,248) Short-term borrowings (37,500) Other liabilities (3,417) Total liabilities assumed $ (265,165) Identifiable net assets acquired, at fair value $ 23,959 State Banking Offices Total Gross Loans in Market Total Deposits in Market Iowa Community 22 $ 846.4 $ 1,753.3 Iowa Metro 17 1,495.1 1,832.8 Twin Cities 15 1,256.0 1,220.8 Denver 2 673.4 428.6

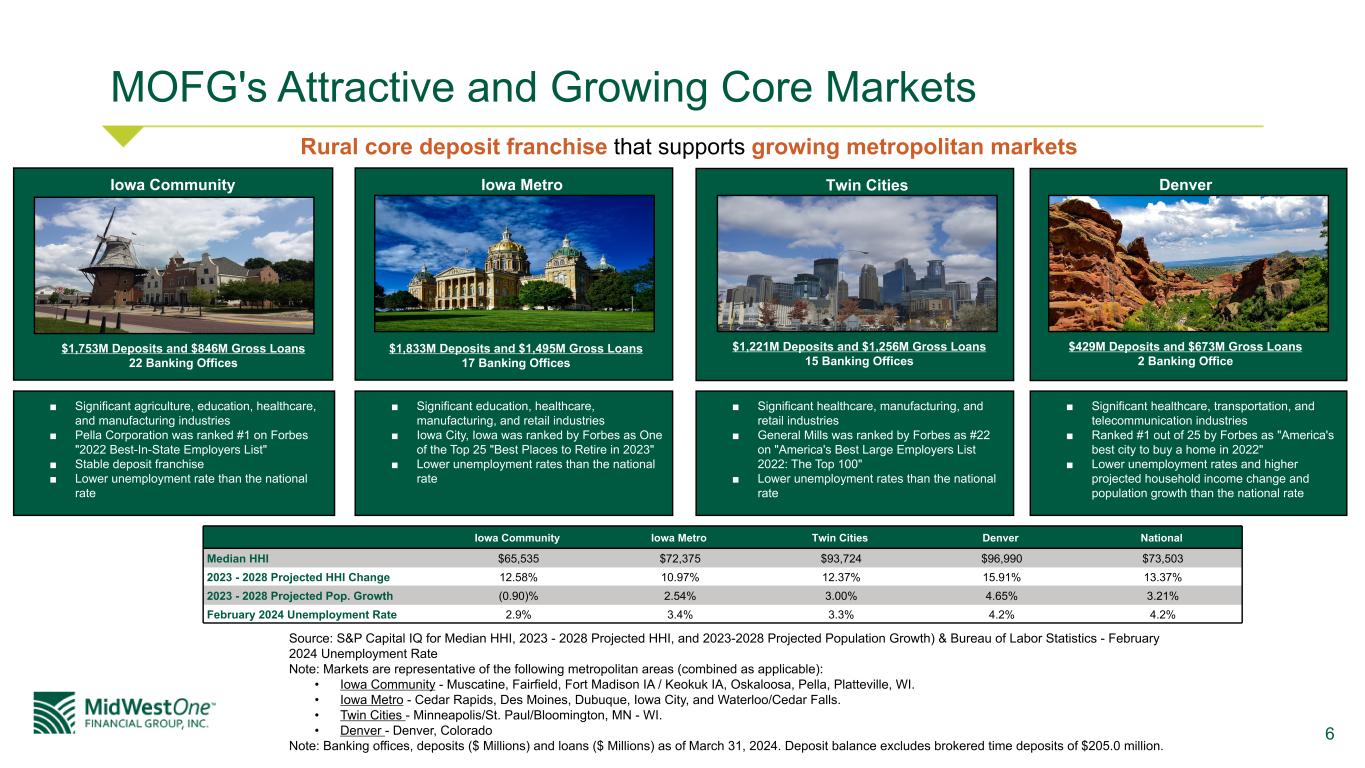

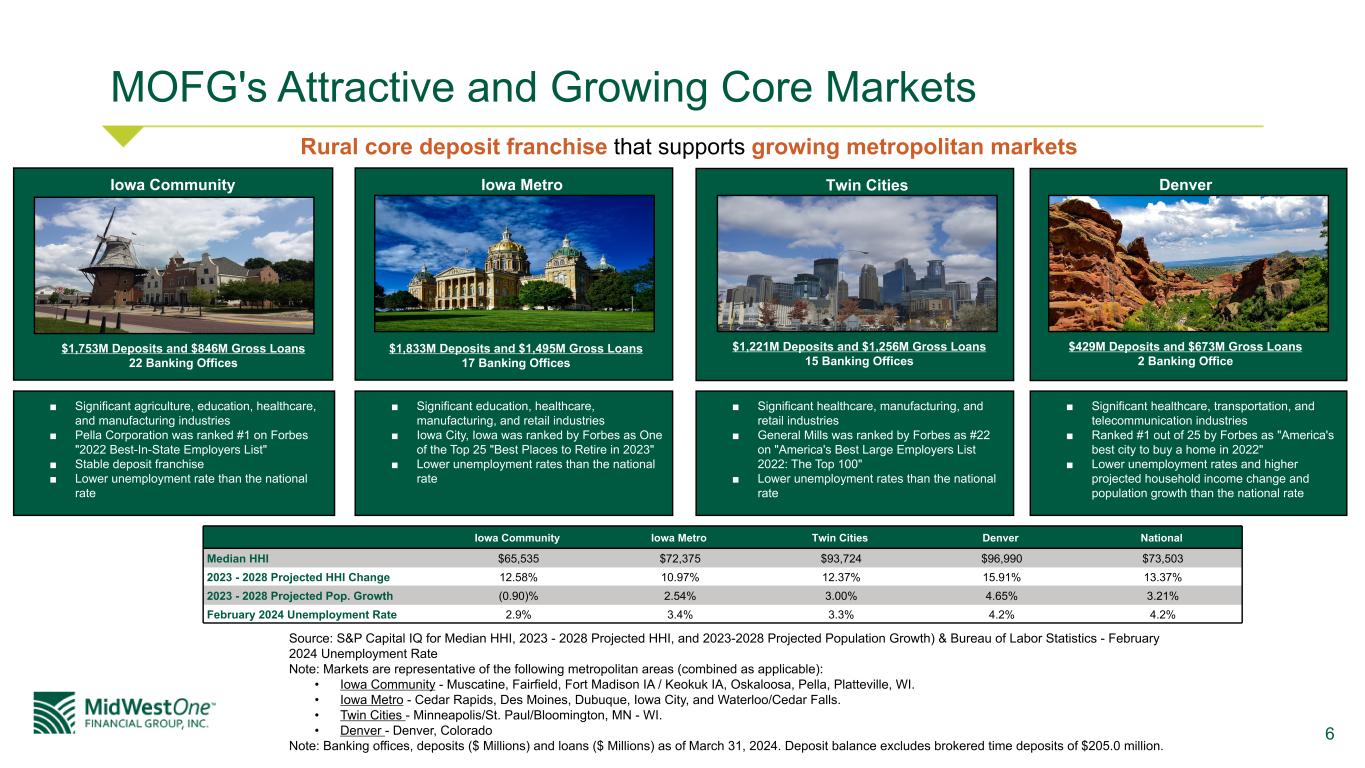

6 MOFG's Attractive and Growing Core Markets Iowa Community Iowa Metro Twin Cities Denver National Median HHI $65,535 $72,375 $93,724 $96,990 $73,503 2023 - 2028 Projected HHI Change 12.58% 10.97% 12.37% 15.91% 13.37% 2023 - 2028 Projected Pop. Growth (0.90)% 2.54% 3.00% 4.65% 3.21% February 2024 Unemployment Rate 2.9% 3.4% 3.3% 4.2% 4.2% ■ Significant education, healthcare, manufacturing, and retail industries ■ Iowa City, Iowa was ranked by Forbes as One of the Top 25 "Best Places to Retire in 2023" ■ Lower unemployment rates than the national rate ■ Significant healthcare, manufacturing, and retail industries ■ General Mills was ranked by Forbes as #22 on "America's Best Large Employers List 2022: The Top 100" ■ Lower unemployment rates than the national rate ■ Significant healthcare, transportation, and telecommunication industries ■ Ranked #1 out of 25 by Forbes as "America's best city to buy a home in 2022" ■ Lower unemployment rates and higher projected household income change and population growth than the national rate ■ Significant agriculture, education, healthcare, and manufacturing industries ■ Pella Corporation was ranked #1 on Forbes "2022 Best-In-State Employers List" ■ Stable deposit franchise ■ Lower unemployment rate than the national rate Iowa Community Iowa Metro Twin Cities Denver $1,753M Deposits and $846M Gross Loans 22 Banking Offices $1,833M Deposits and $1,495M Gross Loans 17 Banking Offices Source: S&P Capital IQ for Median HHI, 2023 - 2028 Projected HHI, and 2023-2028 Projected Population Growth) & Bureau of Labor Statistics - February 2024 Unemployment Rate Note: Markets are representative of the following metropolitan areas (combined as applicable): • Iowa Community - Muscatine, Fairfield, Fort Madison IA / Keokuk IA, Oskaloosa, Pella, Platteville, WI. • Iowa Metro - Cedar Rapids, Des Moines, Dubuque, Iowa City, and Waterloo/Cedar Falls. • Twin Cities - Minneapolis/St. Paul/Bloomington, MN - WI. • Denver - Denver, Colorado Note: Banking offices, deposits ($ Millions) and loans ($ Millions) as of March 31, 2024. Deposit balance excludes brokered time deposits of $205.0 million. $1,221M Deposits and $1,256M Gross Loans 15 Banking Offices $429M Deposits and $673M Gross Loans 2 Banking Office Rural core deposit franchise that supports growing metropolitan markets

7 OUR VISION To be the preeminent relationship-driven community bank where our expertise and proactive approach generate meaningful impact for our stakeholders

8 Shareholder Value Strategy

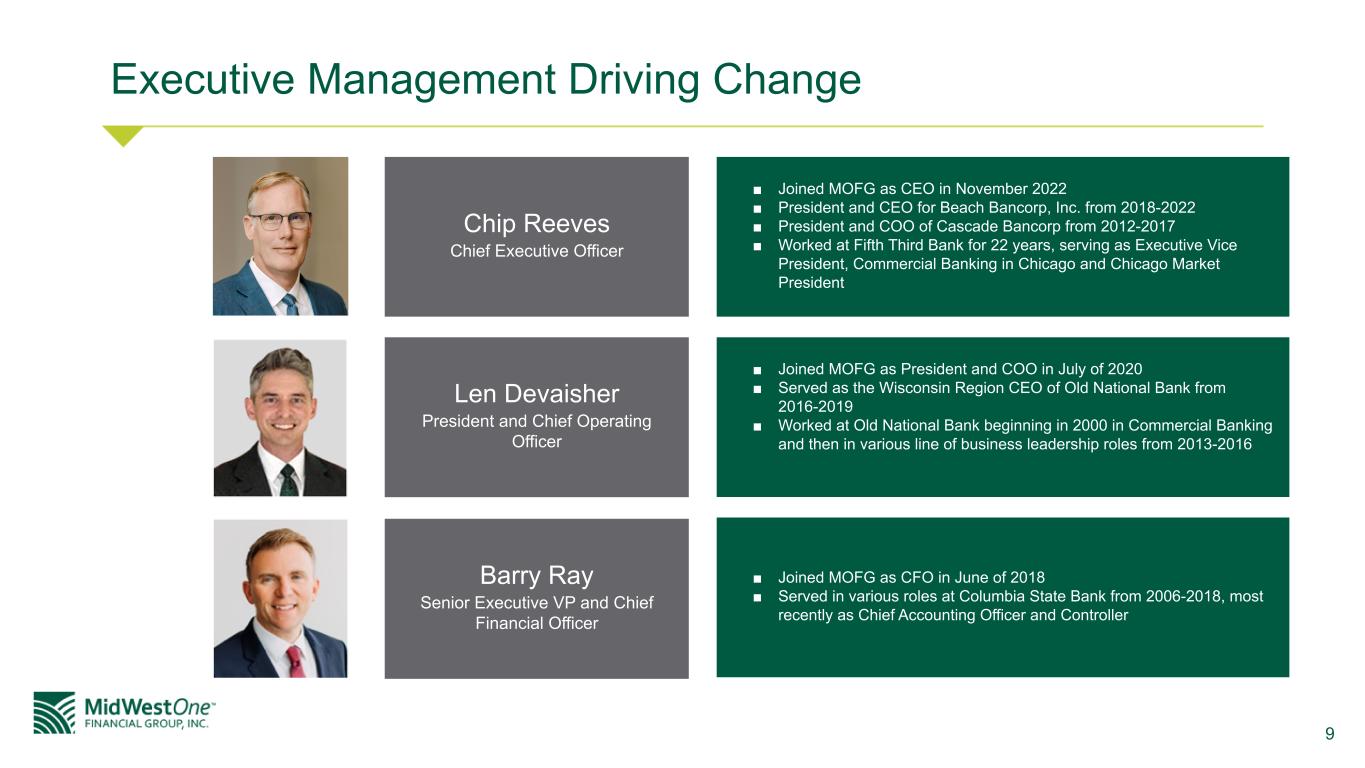

9 Executive Management Driving Change Chip Reeves Chief Executive Officer Len Devaisher President and Chief Operating Officer Barry Ray Senior Executive VP and Chief Financial Officer ■ Joined MOFG as CEO in November 2022 ■ President and CEO for Beach Bancorp, Inc. from 2018-2022 ■ President and COO of Cascade Bancorp from 2012-2017 ■ Worked at Fifth Third Bank for 22 years, serving as Executive Vice President, Commercial Banking in Chicago and Chicago Market President ■ Joined MOFG as President and COO in July of 2020 ■ Served as the Wisconsin Region CEO of Old National Bank from 2016-2019 ■ Worked at Old National Bank beginning in 2000 in Commercial Banking and then in various line of business leadership roles from 2013-2016 ■ Joined MOFG as CFO in June of 2018 ■ Served in various roles at Columbia State Bank from 2006-2018, most recently as Chief Accounting Officer and Controller

10 MOFG's Five Strategic Pillars to Deliver Improved Results Exceptional Customer and Employee Engagement 1 Enhance MOFG's award winning culture with a continued focus on performance and financial results 2 Protect and enhance MOFG's dominant community bank franchise through product expansion 3 Continue to hire exceptional relationship bankers and wealth management professionals 4 Develop specialty commercial banking verticals by continuing to attract experienced professionals 5 Continue to identify and execute on opportunities for efficiency gains and cost reduction Strong Core Local Banking Model Sophisticated Commercial Banking and Wealth Management Specialty Business Lines Improving our Efficiency and Operations

11 Strategic Pillar #1: Exceptional Customer and Employee Engagement Build Upon MOFG's Award-Winning Culture 1 Measurable goals aligned to MidWestOne's financial results 2 Invest in capabilities to achieve a successful transformation 3 Incentivize financial results focused performance metrics 4 Leverage employee feedback to drive improvements Results Driven Performance Results Driven Talent Development Reward Driven Performance Metrics Integrate Employee Insights to Improve

12 Strategic Pillar #2: Strong Core Local Banking Model Stable and Granular, Core Deposit Base Supports MOFG's Strategic Plan MOFG’s relationship driven community bank platform offers diverse products and services that attracts deposits from consumer and commercial customers while driving cross sell opportunities Average Account Size $33k Average Services Used 3.46 Average Branch Deposit Size $92mm Relationship Driven Community Bank

13 Strategic Pillar #3:Commercial Banking and Wealth Management Leaning Into Our Major Markets of the Twin Cities, Denver and Metro Iowa • Continue to hire experienced bankers with proven track records • Target companies from $20 - $150 million in revenues • Focus on major markets • Maintain a prudent approach to risk and growth • Exiting 2025 - targeting high single digit loan growth, annually Commercial Banking • Treasury Management is a key enabler to our commercial success • Will invest to expand our platform, product offerings, and talent • Goals - drive deposit growth, improve non-interest bearing deposit mix as a % of total deposits, & increase fee income Treasury Management • Team lift outs in the Twin Cities and Cedar Rapids driving AUM growth • Will continue to look for team lift outs to further drive asset growth and fee income • Continue to add to MOFG's investment strategy platforms Wealth Management

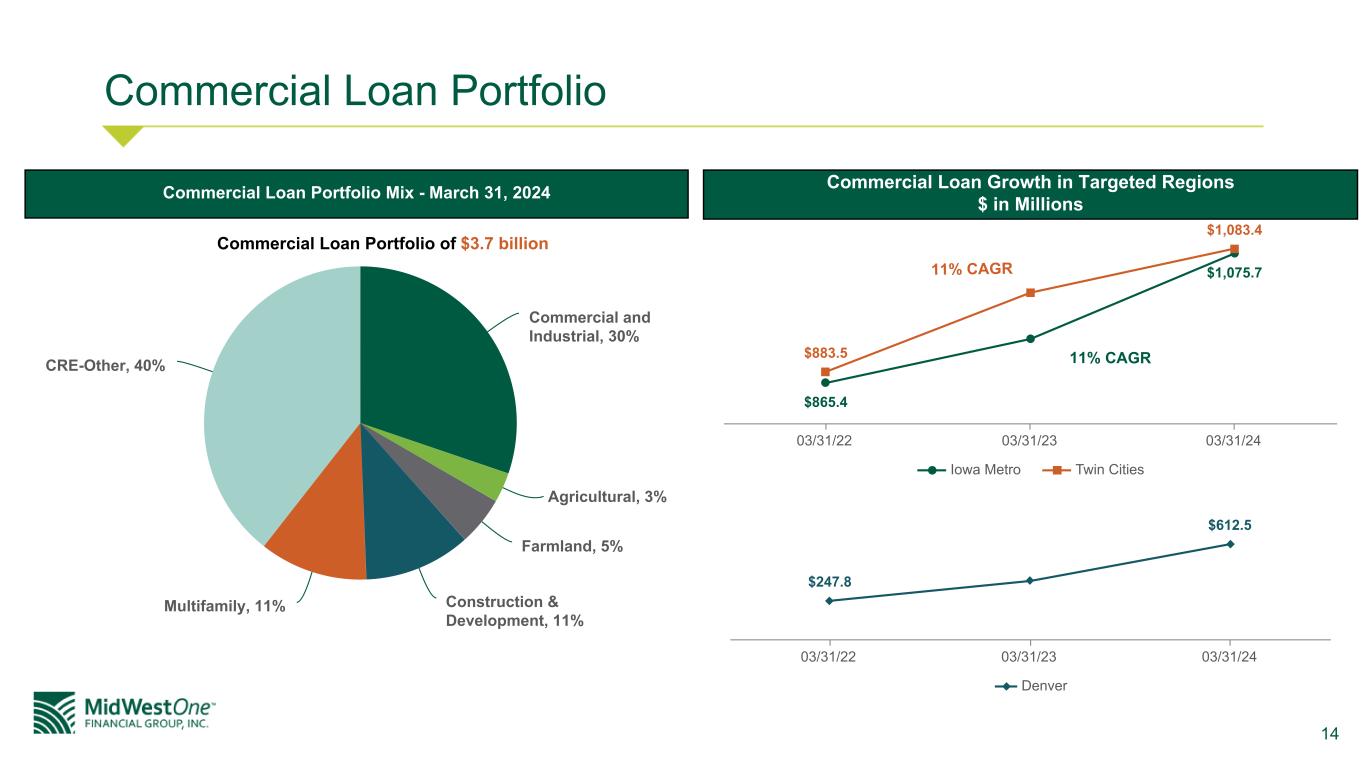

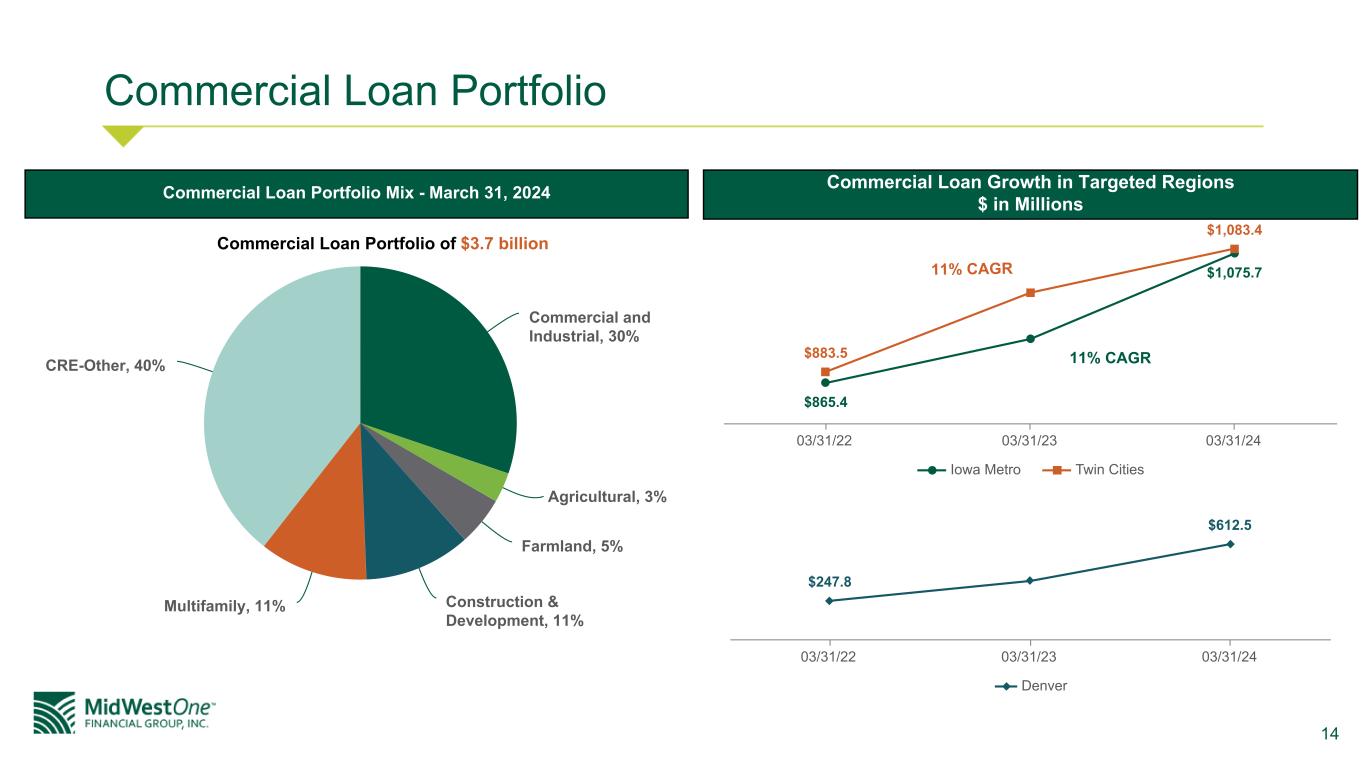

14 Commercial Loan Portfolio Commercial and Industrial, 30% Agricultural, 3% Farmland, 5% Construction & Development, 11% Multifamily, 11% CRE-Other, 40% Commercial Loan Portfolio Mix - March 31, 2024 Commercial Loan Portfolio of $3.7 billion Commercial Loan Growth in Targeted Regions $ in Millions $865.4 $1,075.7 $883.5 $1,083.4 Iowa Metro Twin Cities 03/31/22 03/31/23 03/31/24 $247.8 $612.5 Denver 03/31/22 03/31/23 03/31/24 11% CAGR 11% CAGR

15 Focusing on Growth in Wealth Management $2.44 $2.74 $2.73 $3.01 $3.10 2020 2021 2022 2023 1Q24 $— $1.00 $2.00 $3.00 $4.00 Investment Services and Trust Activity Revenue • Asset amounts presented are in billions of dollars • Revenue amounts presented are in millions of dollars $9.6 $11.7 $11.2 $12.2 $3.5 $3.2 $4.2 $3.9 $3.8 $1.2 $6.4 $7.5 $7.3 $8.4 $2.3 Investment Services Trust 2020 2021 2022 2023 1Q24 $5.0 $10.0 $15.0 Wealth Management Assets Under Administration • Hired a new Head of Wealth Management, with deep expertise in investment strategies and relationship management • Built momentum in the Twin Cities with a talented Wealth Management team focused on leveraging strong relationships with our Retail and Commercial colleagues • Strengthened Wealth Management capabilities with the addition of an experienced team in Eastern Iowa that collectively has more than 120 years of experience • Expanded our presence to a new office in Cedar Rapids, Iowa, a targeted metropolitan market • Invested in financial technology that will improve the customer experience and streamline internal processes

16 Strategic Pillar #4: Specialty Business Lines Growth Opportunities in Specialty Commercial Business Lines Leverage Recent Talent Acquisition Expertise In: • Middle Market C&I • Government / Non-Profit • Commercial Real Estate • Government Guaranteed Lending • Agri Business Over the Medium Term: • Develop Deposit Vertical • Sponsor Finance • Recruit Product Specialists • Innovative Commercial Loan Platform • Specialization Policy Development • Evolved Decisioning Process • Enhanced Compliance Controls Focus on Full Customer Relationship Acquisition Drive Deposit Growth While Maintaining Risk Management

17 Strategic Pillar #5: Improving Our Efficiency and Operations • Engaged a third-party strategic consulting firm to identify areas for efficiency gains and cost reduction • Focusing on operational efficiency and expense discipline in 2024 • Investing in digital capabilities and infrastructure: creating a three-year technology / digital road map focused on improving customer experience and enabling the company to achieve its strategic plan priorities Drive Operational Efficiency Improve efficiency and ability to scale operations to reduce costs and improve customer experiences Modernize Our Infrastructure Reduce core dependency to increase speed-to-market, control costs, and drive scalability

18 Strategic Enabler: Expanding and Enhancing our Digital Capabilities The constant evolution of customer expectations and technology advancements require continuous investment in digital experiences, technology, and automation. We intend to meet these demands through continued investment in new technology platforms, architecture improvement, and talent acquisition to improve the customer experience and streamline internal processes. *Projected roll-out timing. 2020 PPP Loan Origination Platform + DocuSign Launched Open Architecture Digital Banking Platform Enhanced Electronic & Paper Account Statements 2021 Mobile App Performance Enhancements Improved Online Banking Platform and Commercial Lending Process Contactless Chip Cards 2022 Enhancements to Positive Pay Service Cloud-Based Construction Lending Platform New Trust Core System Launched an Enhanced Digital Consumer Loan Experience 2023 New Retail Deposit Account Opening Platform Digital Banking Experience and Performance Enhancements New Fraud Detection / Anti-Money Laundering System Instant Payments Receive 2024-2025* In-Branch Retail Digital Account Opening Platform Digital Banking: New Commercial Loan Origination System New Commercial Digital Banking Platform Instant Payments Send

19 Digital and Branch Banking Trends (1) Total digital includes mobile and online/desktop. Customer Interactions 43% 47% 9% 1% Mobile Logins Online/Desktop Logins Branch/Teller Transactions Service Center Calls 90% Digital(1) B ill P ay P ay m en ts Zelle P aym ents 91,011 90,508 14,094 18,680 Bill Pay Payments Zelle Payments 1Q23 2Q23 3Q23 4Q23 1Q24 80,000 85,000 90,000 95,000 10,000 12,500 15,000 17,500 20,000 Retail Payments

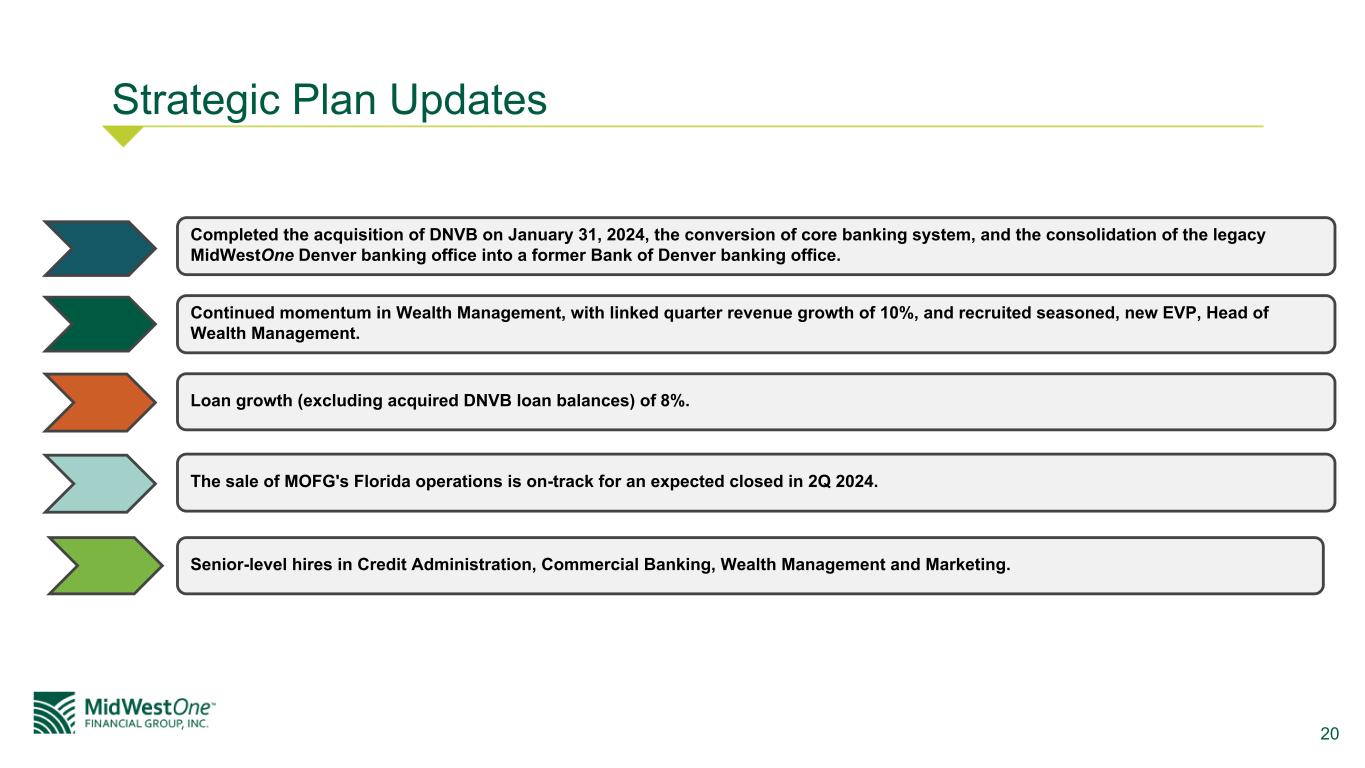

20 Strategic Plan Updates Loan growth (excluding acquired DNVB loan balances) of 8%. The sale of MOFG's Florida operations is on-track for an expected closed in 2Q 2024. Continued momentum in Wealth Management, with linked quarter revenue growth of 10%, and recruited seasoned, new EVP, Head of Wealth Management. Completed the acquisition of DNVB on January 31, 2024, the conversion of core banking system, and the consolidation of the legacy MidWestOne Denver banking office into a former Bank of Denver banking office. Senior-level hires in Credit Administration, Commercial Banking, Wealth Management and Marketing.

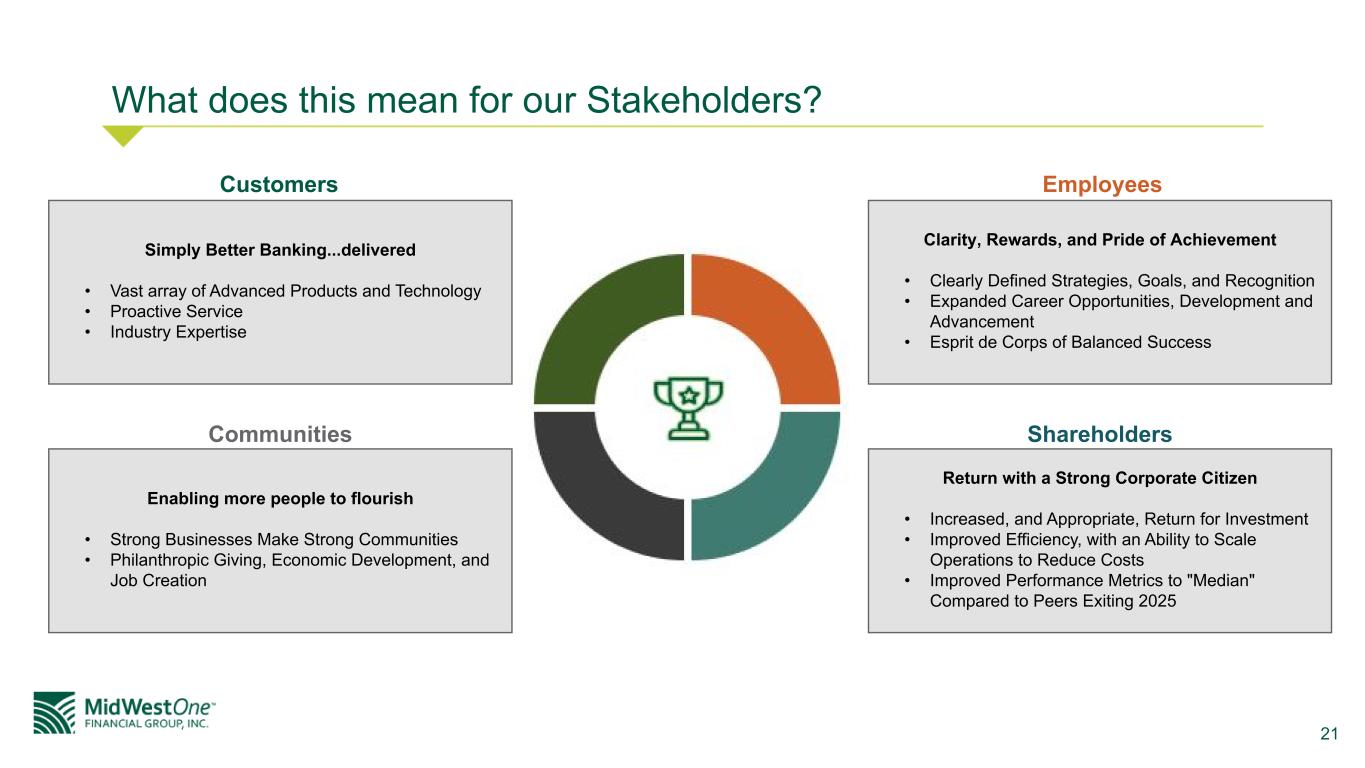

21 What does this mean for our Stakeholders? Simply Better Banking...delivered • Vast array of Advanced Products and Technology • Proactive Service • Industry Expertise Enabling more people to flourish • Strong Businesses Make Strong Communities • Philanthropic Giving, Economic Development, and Job Creation Clarity, Rewards, and Pride of Achievement • Clearly Defined Strategies, Goals, and Recognition • Expanded Career Opportunities, Development and Advancement • Esprit de Corps of Balanced Success Return with a Strong Corporate Citizen • Increased, and Appropriate, Return for Investment • Improved Efficiency, with an Ability to Scale Operations to Reduce Costs • Improved Performance Metrics to "Median" Compared to Peers Exiting 2025 Customers Employees ShareholdersCommunities

22 Financial Performance

23 Financial Highlights Total assets $ 6,748.0 4.99 % 5.27 % Total loans held for investment, net 4,414.6 6.97 12.64 Total deposits 5,585.2 3.51 0.54 Balance Sheet Equity to assets ratio 7.83 % (33) bps 2 bps Tangible common equity ratio (non-GAAP) 6.43 (47) (5) CET1 risk-based capital ratio 8.98 (61) (41) Total risk-based capital ratio 11.97 (56) (34) Loans to deposits ratio 79.04 % 255 849 Capital and Liquidity Net interest margin, tax equivalent (non-GAAP) 2.33 % 11 bps (42) bps Cost of total deposits 2.03 5 91 Return on average assets 0.20 3 11 Return on average tangible equity (non-GAAP) 4.18 61 148 Efficiency ratio (non-GAAP) 71.28 112 896 Profitability Nonperforming loans ratio 0.66 % 2 bps 29 bps Nonperforming assets ratio 0.49 2 26 Net charge-off ratio 0.02 (18) (1) Allowance for credit losses ratio 1.27 2 0 Credit Risk Profile 1Q24 Financial Highlights3 (1) First Quarter 2024 Summary compares to the fourth quarter of 2023 unless noted. (2) See the section "Non-GAAP Financial measures." (3) Financial metrics as of or for the quarter ended March 31, 2024. Change vs. Dollars in millions 1Q24 4Q23 1Q23 First Quarter 2024 Summary1 • Completed acquisition of Denver Bankshares, Inc. ("DNVB"), the related core banking system conversion, and closure of the legacy MidWestOne Denver banking office. • Net income of $3.3 million, or $0.21 per diluted common share. ◦ Revenue was $44.5 million, comprised of net interest income of $34.7 million and noninterest income of $9.8 million, which included a negative MSR valuation adjustment of $368 thousand. ◦ Credit loss expense of $4.7 million, which included day 1 credit loss expense of $3.2 million related to the DNVB acquisition. ◦ Noninterest Expense of $35.6 million, which included merger-related costs of $1.3 million, OREO write-down expense of $311 thousand, and non-acquisition related severance expense of $261 thousand. • Net interest margin (tax equivalent) expanded 11 bps to 2.33%2. • Annualized adjusted loan growth (excluding acquired DNVB loan balances) of 8%. • Continued momentum in Wealth Management with revenue growth of 10%. • Nonperforming assets ratio remained stable at 0.49%; net charge-off ratio was 0.02%.

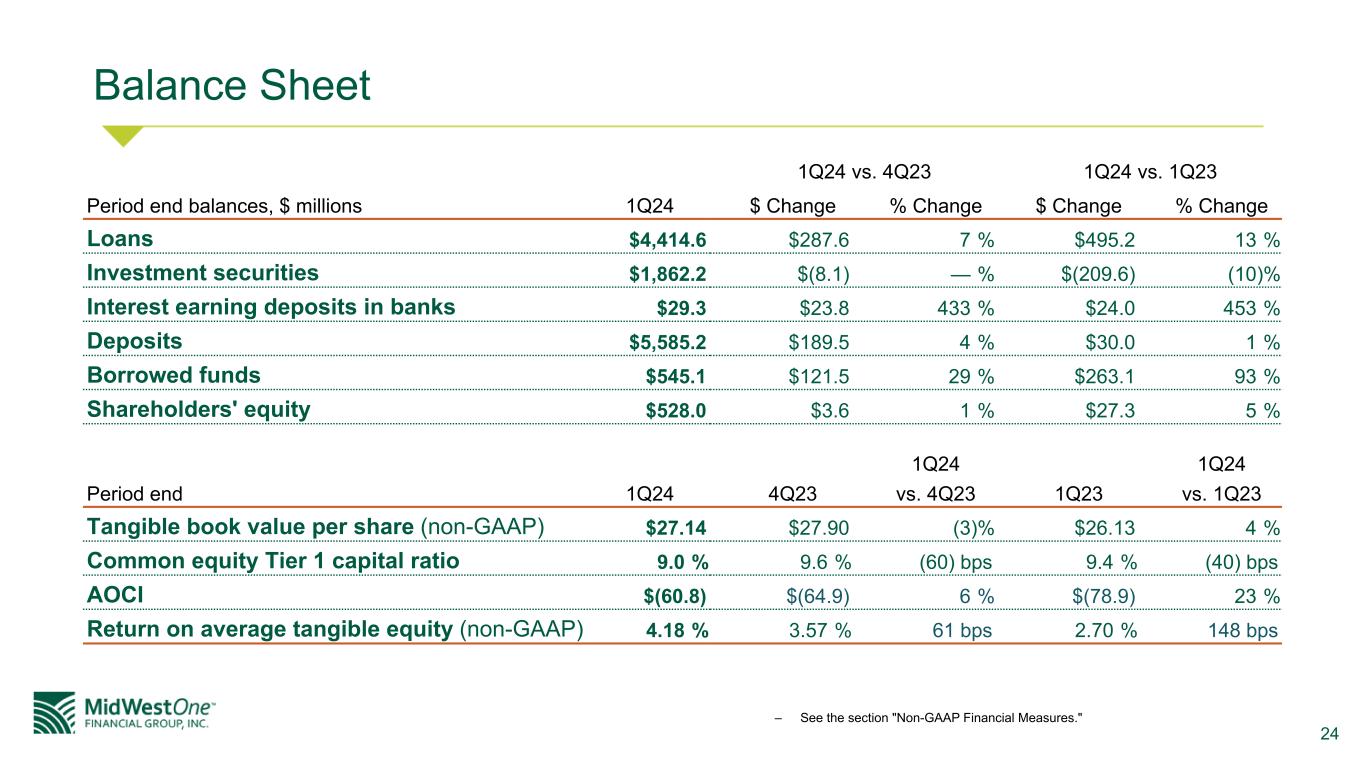

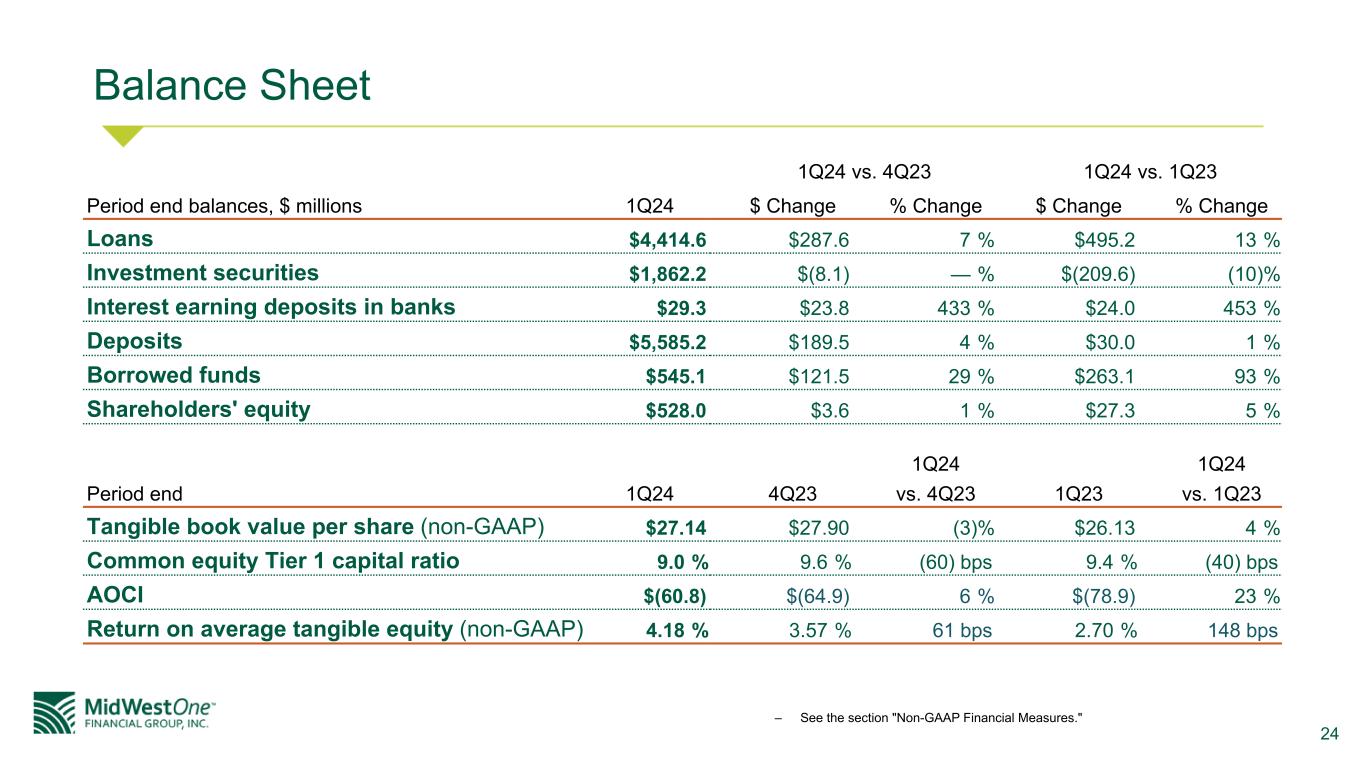

24 Balance Sheet 1Q24 vs. 4Q23 1Q24 vs. 1Q23 Period end balances, $ millions 1Q24 $ Change % Change $ Change % Change Loans $4,414.6 $287.6 7 % $495.2 13 % Investment securities $1,862.2 $(8.1) — % $(209.6) (10) % Interest earning deposits in banks $29.3 $23.8 433 % $24.0 453 % Deposits $5,585.2 $189.5 4 % $30.0 1 % Borrowed funds $545.1 $121.5 29 % $263.1 93 % Shareholders' equity $528.0 $3.6 1 % $27.3 5 % 1Q24 1Q24 Period end 1Q24 4Q23 vs. 4Q23 1Q23 vs. 1Q23 Tangible book value per share (non-GAAP) $27.14 $27.90 (3) % $26.13 4 % Common equity Tier 1 capital ratio 9.0 % 9.6 % (60) bps 9.4 % (40) bps AOCI $(60.8) $(64.9) 6 % $(78.9) 23 % Return on average tangible equity (non-GAAP) 4.18 % 3.57 % 61 bps 2.70 % 148 bps – See the section "Non-GAAP Financial Measures."

25 Balance Sheet - Debt Securities Portfolio Municipals, 15% MBS, 1% CLO, 8% CMO, 22% Corporate, 54% 2.40% 2.35% 2.36% 2.36% 2.46% Total Securities Held for Investment (FTE) 1Q23 2Q23 3Q23 4Q23 1Q24 Investment Securities Yield Available for Sale Debt Securities Portfolio Mix March 31, 2024(1) Municipals, 50% MBS, 7% CMO, 43% Held to Maturity Debt Securities Portfolio Mix March 31, 2024(1) • Investment Portfolio Mix: ◦ AFS Securities - $0.8 billion ◦ HTM Securities - $1.1 billion • Investment Portfolio Duration (Years): ◦ AFS Securities - 2.8 ◦ HTM Securities - 6.2 ◦ Total Securities - 4.8 • Allowance for credit losses for investments is $0 Portfolio Composition (1)Percentages may not total 100% due to rounding.

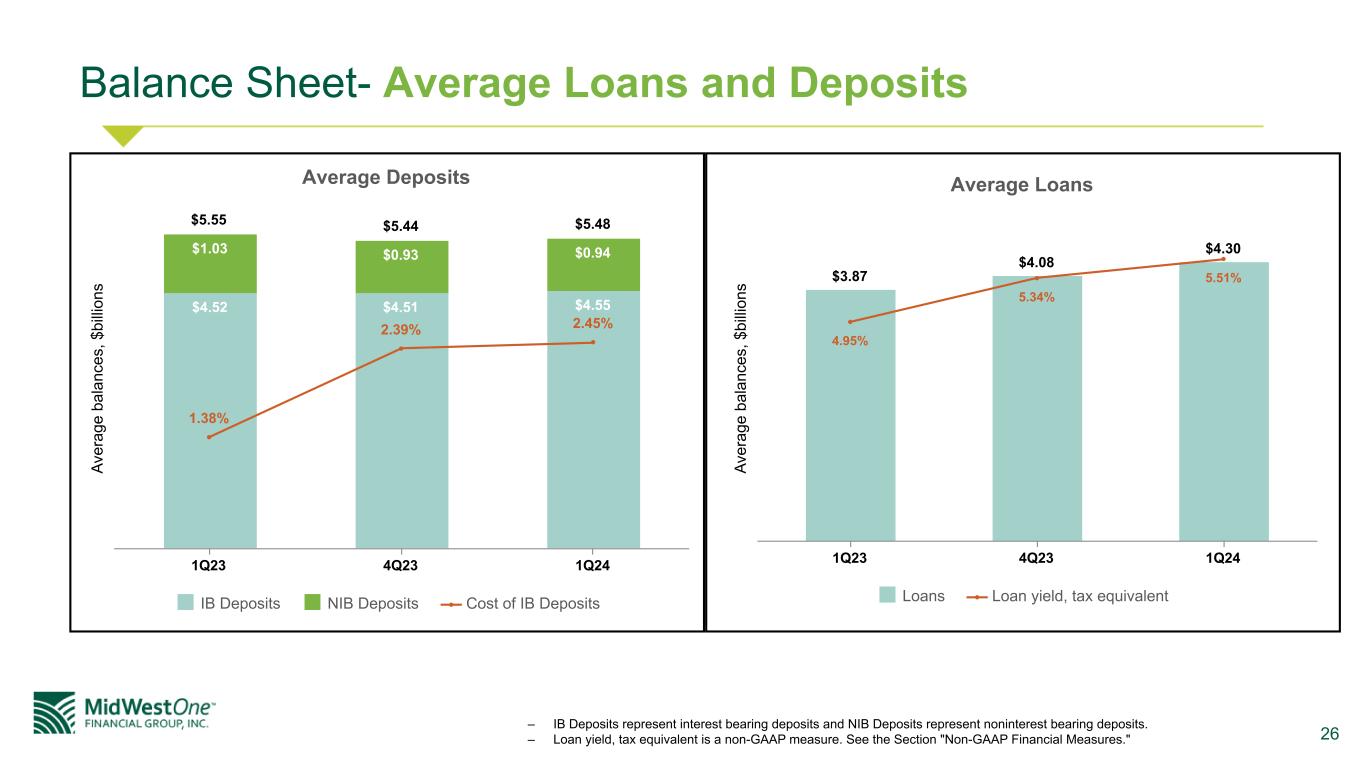

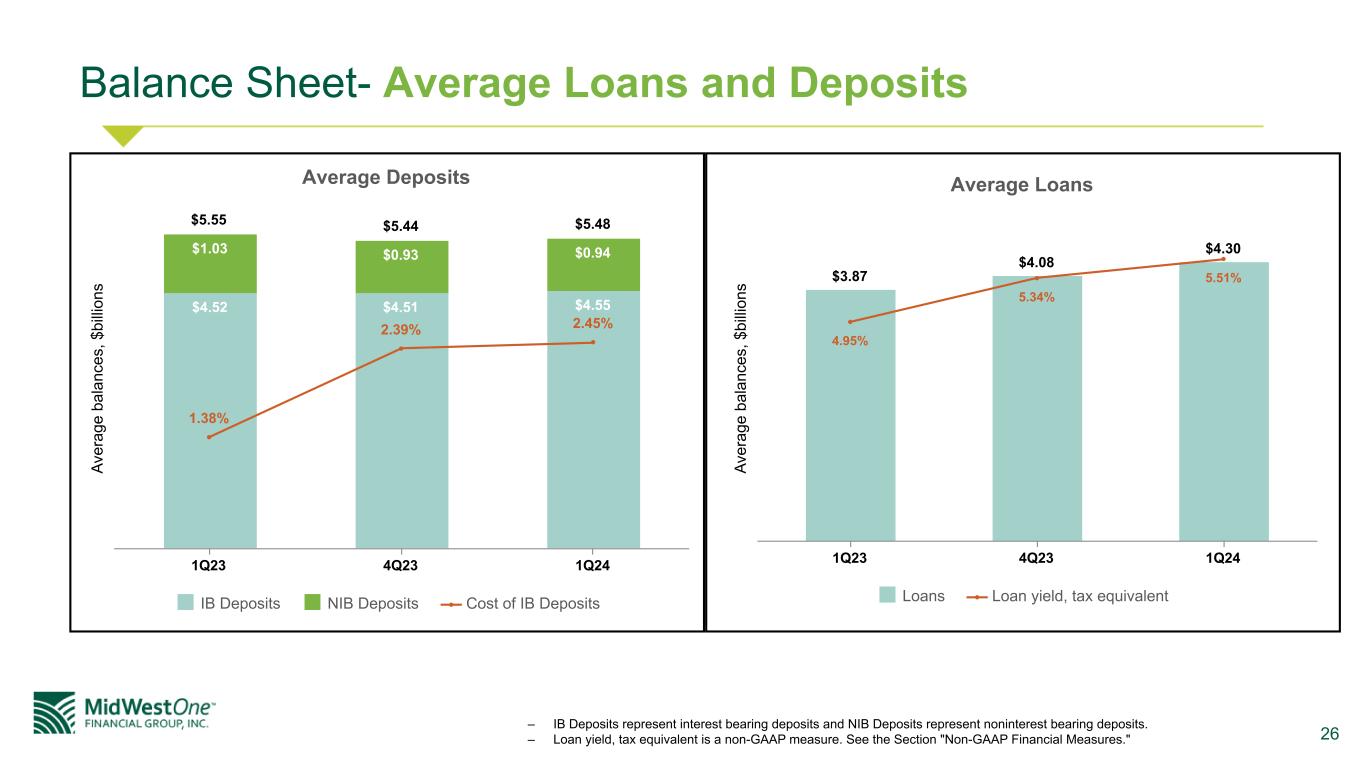

26 Balance Sheet- Average Loans and Deposits – IB Deposits represent interest bearing deposits and NIB Deposits represent noninterest bearing deposits. – Loan yield, tax equivalent is a non-GAAP measure. See the Section "Non-GAAP Financial Measures." Av er ag e ba la nc es , $ bi lli on s Average Deposits $5.55 $5.44 $5.48 $4.52 $4.51 $4.55 $1.03 $0.93 $0.94 1.38% 2.39% 2.45% IB Deposits NIB Deposits Cost of IB Deposits 1Q23 4Q23 1Q24 Av er ag e ba la nc es , $ bi lli on s Average Loans $3.87 $4.08 $4.30 4.95% 5.34% 5.51% Loans Loan yield, tax equivalent 1Q23 4Q23 1Q24

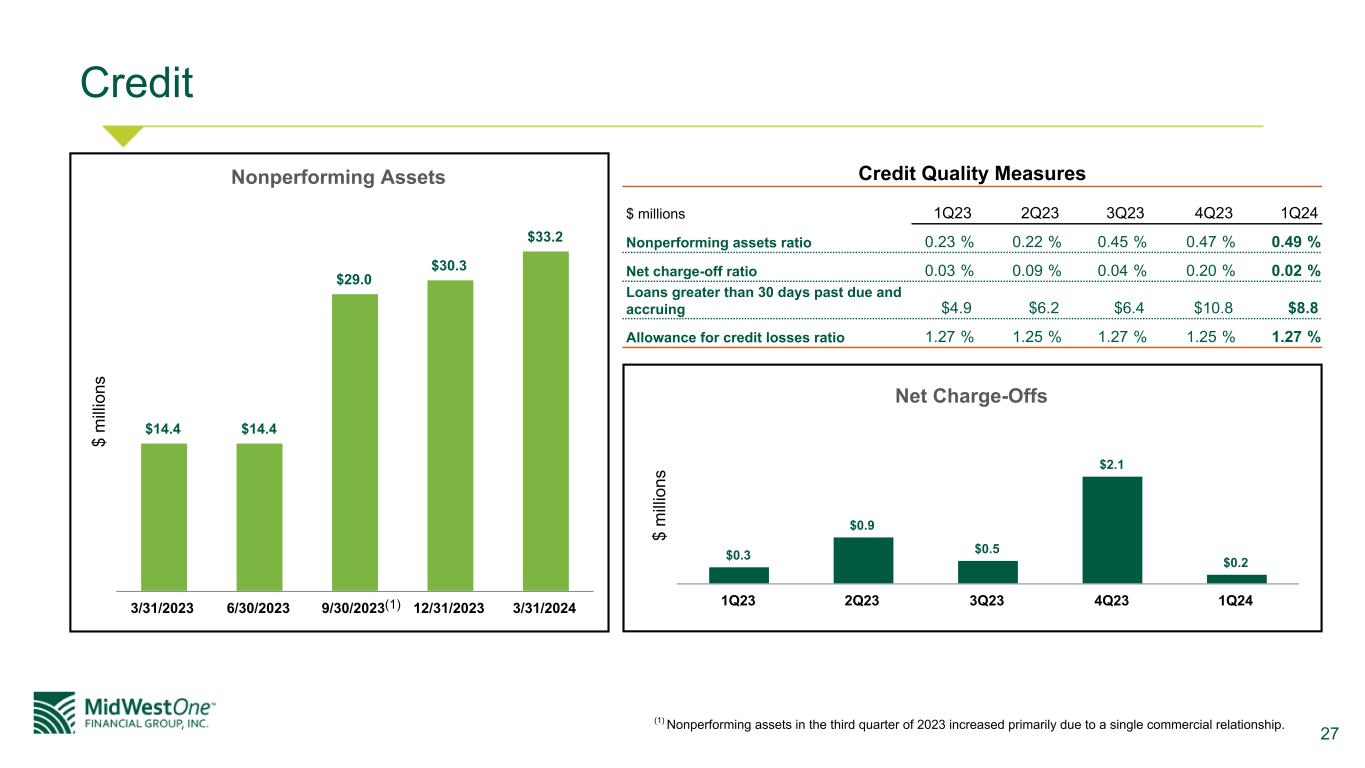

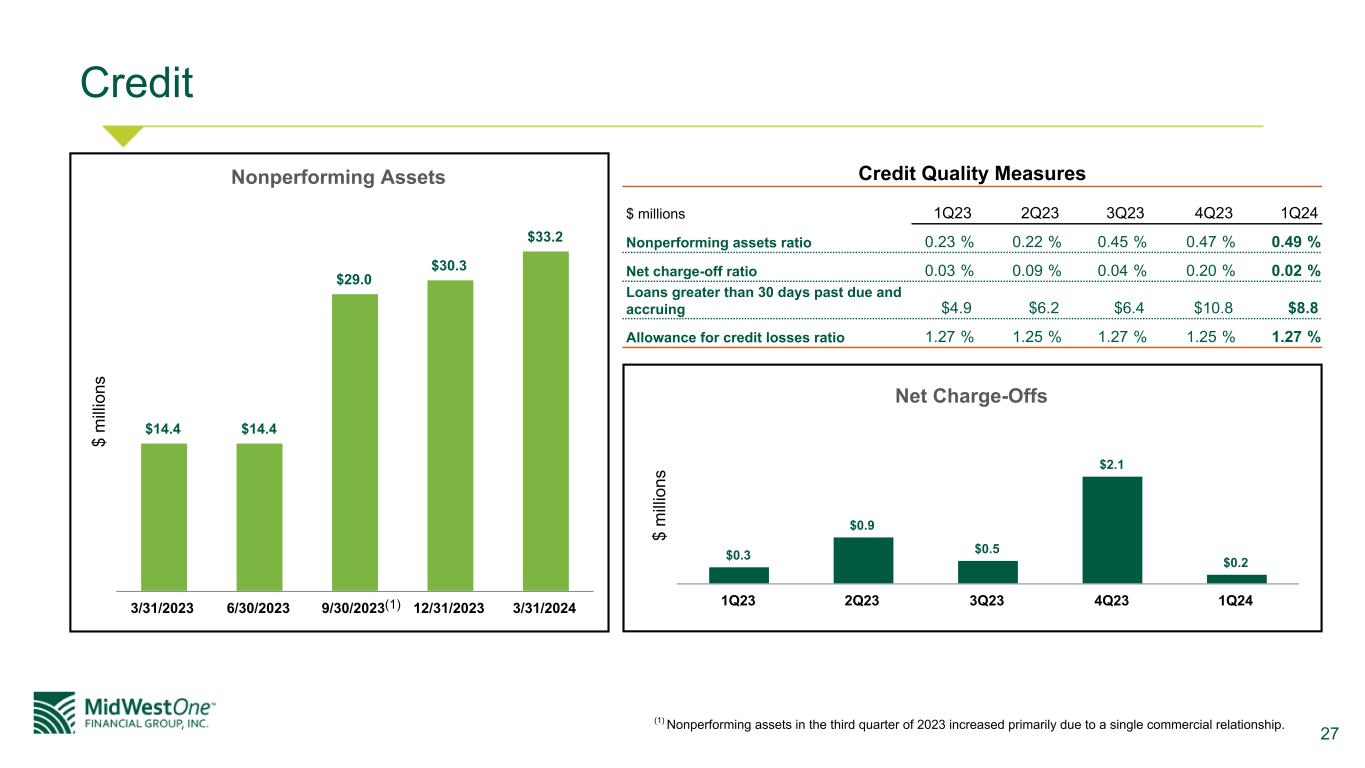

27 Credit $ m illi on s Nonperforming Assets $14.4 $14.4 $29.0 $30.3 $33.2 3/31/2023 6/30/2023 9/30/2023 12/31/2023 3/31/2024 $ m illi on s Net Charge-Offs $0.3 $0.9 $0.5 $2.1 $0.2 1Q23 2Q23 3Q23 4Q23 1Q24 Credit Quality Measures $ millions 1Q23 2Q23 3Q23 4Q23 1Q24 Nonperforming assets ratio 0.23 % 0.22 % 0.45 % 0.47 % 0.49 % Net charge-off ratio 0.03 % 0.09 % 0.04 % 0.20 % 0.02 % Loans greater than 30 days past due and accruing $4.9 $6.2 $6.4 $10.8 $8.8 Allowance for credit losses ratio 1.27 % 1.25 % 1.27 % 1.25 % 1.27 % (1) Nonperforming assets in the third quarter of 2023 increased primarily due to a single commercial relationship. (1)

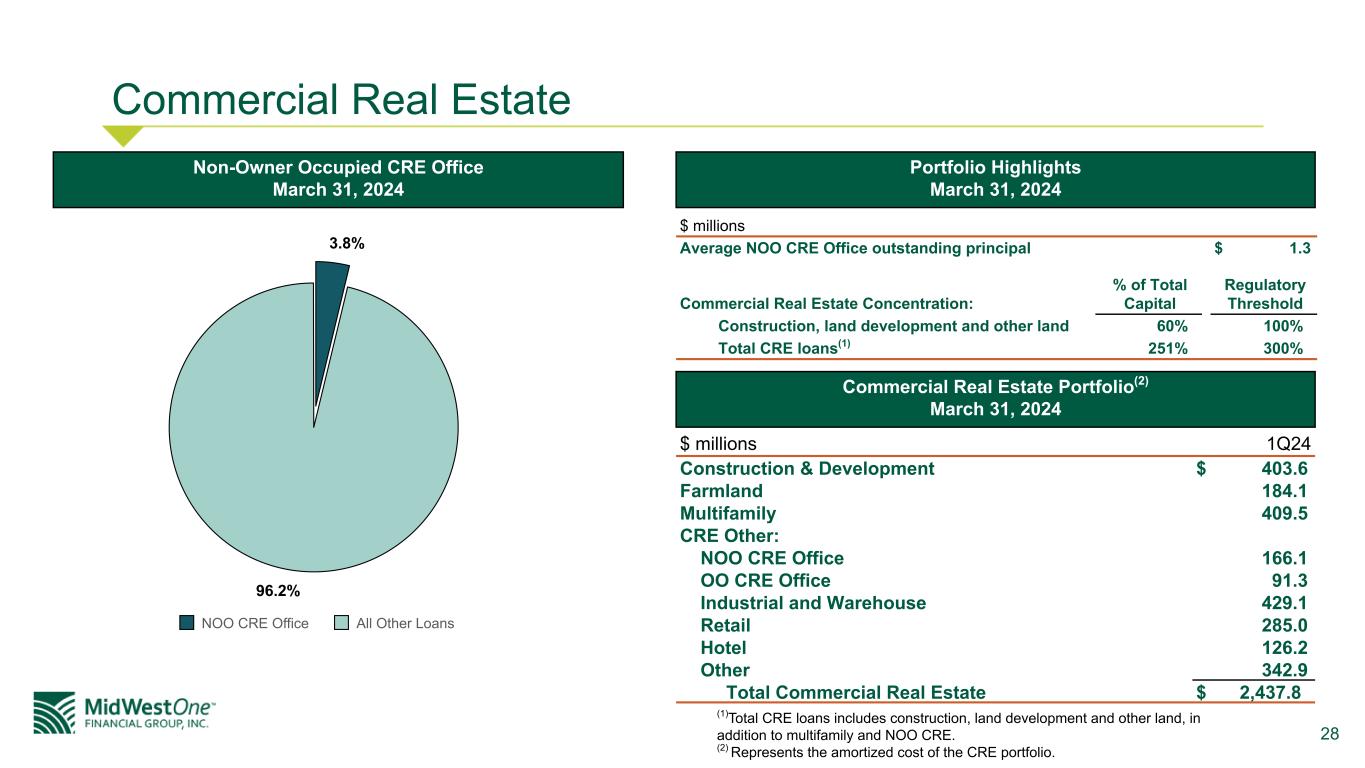

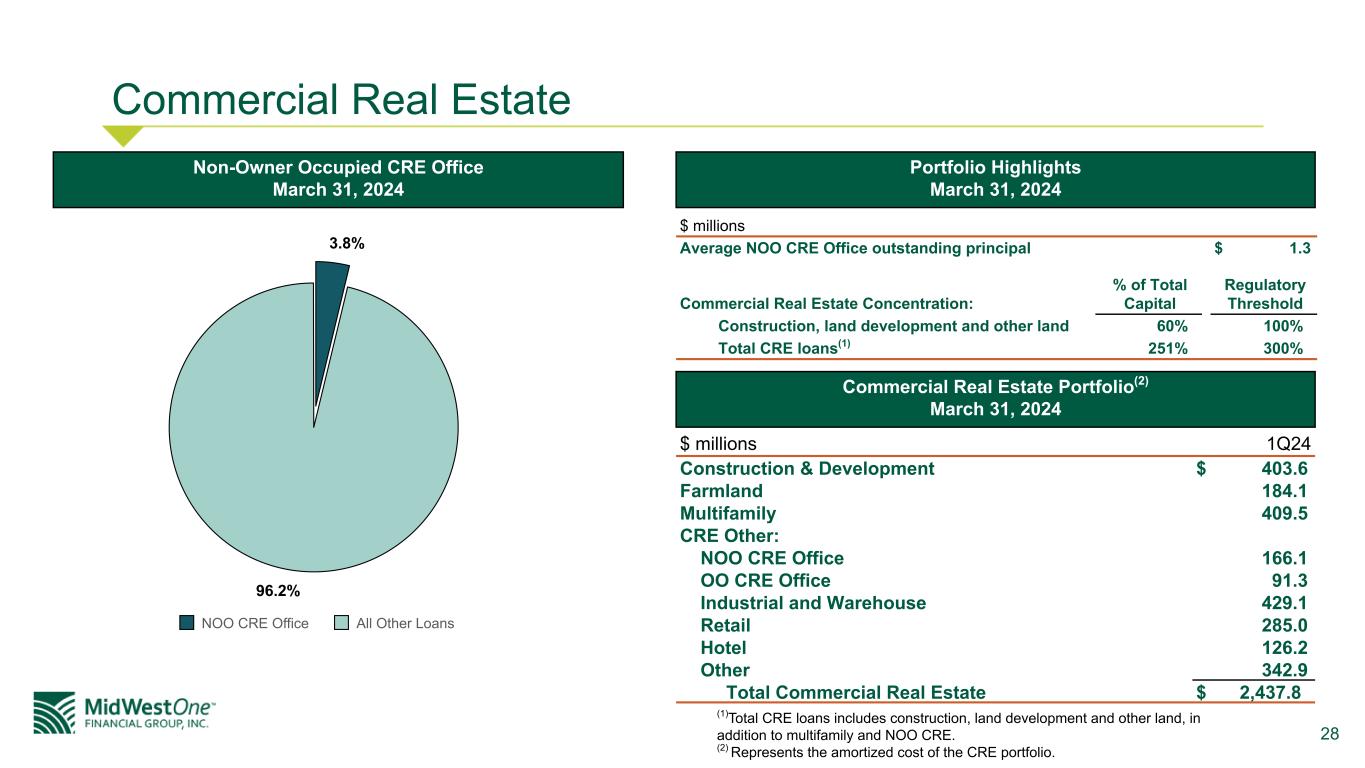

28 Commercial Real Estate 3.8% 96.2% NOO CRE Office All Other Loans Non-Owner Occupied CRE Office March 31, 2024 $ millions 1Q24 Construction & Development $ 403.6 Farmland 184.1 Multifamily 409.5 CRE Other: NOO CRE Office 166.1 OO CRE Office 91.3 Industrial and Warehouse 429.1 Retail 285.0 Hotel 126.2 Other 342.9 Total Commercial Real Estate $ 2,437.8 Commercial Real Estate Portfolio(2) March 31, 2024 Portfolio Highlights March 31, 2024 $ millions Average NOO CRE Office outstanding principal $ 1.3 Commercial Real Estate Concentration: % of Total Capital Regulatory Threshold Construction, land development and other land 60 % 100 % Total CRE loans(1) 251 % 300 % (1)Total CRE loans includes construction, land development and other land, in addition to multifamily and NOO CRE. (2) Represents the amortized cost of the CRE portfolio.

29 Income Statement % Change 1Q24 vs. $ millions 1Q24 4Q23 1Q23 4Q23 1Q23 Net interest income $34.7 $32.6 $40.1 6 % (13) % Noninterest income 9.8 3.9 (4.0) 151 % n/m Total revenue 44.5 36.5 36.1 22 % 23 % Noninterest expense 35.6 32.1 33.3 11 % 7 % Pre-tax, pre-provision earnings (non-GAAP) $8.9 $4.4 $2.8 102 % 218 % Credit loss expense $4.7 $1.8 $0.9 161 % 422 % Income tax expense $1.0 $(0.2) $0.4 n/m 150 % Net income $3.3 $2.7 $1.4 22 % 136 % 1Q24 1Q24 1Q24 4Q23 1Q23 vs. 4Q23 vs. 1Q23 Net interest margin (non-GAAP) 2.33 % 2.22 % 2.75 % 11 bps (42) bps Efficiency ratio (non-GAAP) 71.28 % 70.16 % 62.32 % (112) bps (896) bps Diluted EPS $0.21 $0.17 $0.09 24 % 133 % Results are not meaningful (n/m) – See the section "Non-GAAP Financial Measures."

30 Appendix

31 Our Mission and Our Operating Principles Take care of our customers … and those who should be. Since our company was founded during the Great Depression, it has been our belief that the communities we serve are the purpose behind our existence. We passionately pursue success for our neighbors and we support organizations that create opportunities in our communities. Because we believe the positive actions of each one of us contributes to the success of us all. Our brand is built by the actions of our employees, supporting our mission statement, one relationship at a time. It's about caring. Our Operating Principles ◦ Expertise: Learn constantly so we can continually improve ◦ Integrity: Always conduct yourself with the utmost integrity ◦ Teamwork: Work as one team ◦ Talent: Hire and retain excellent employees ◦ Results: Generate impact for our stakeholders

32 Leadership within the Community $26 $284 Employee Company Company and Employee Giving $ thousands Note: Company & Employee Giving and Volunteer Hours are for YTD Q1.24 Volunteer Hours 1,043 Hours $309 Shelter House Book Drive - Iowa City, Iowa Love Your Community Event - Osceola, Wisconsin

33 Long-term Shareholder Return Source: S&P Capital IQ Total Return Performance 223.1 207.1 MidWestOne Financial Group, Inc. S&P U.S. BMI Banks - Midwest Region Index 04/01/08 03/31/09 03/31/10 03/31/11 03/31/12 03/31/13 03/31/14 03/31/15 03/31/16 03/31/17 03/31/18 03/31/19 03/31/20 03/31/21 03/31/22 03/31/23 03/31/24 0.0 50.0 100.0 150.0 200.0 250.0 300.0 350.0

34 Non-GAAP Financial Measures

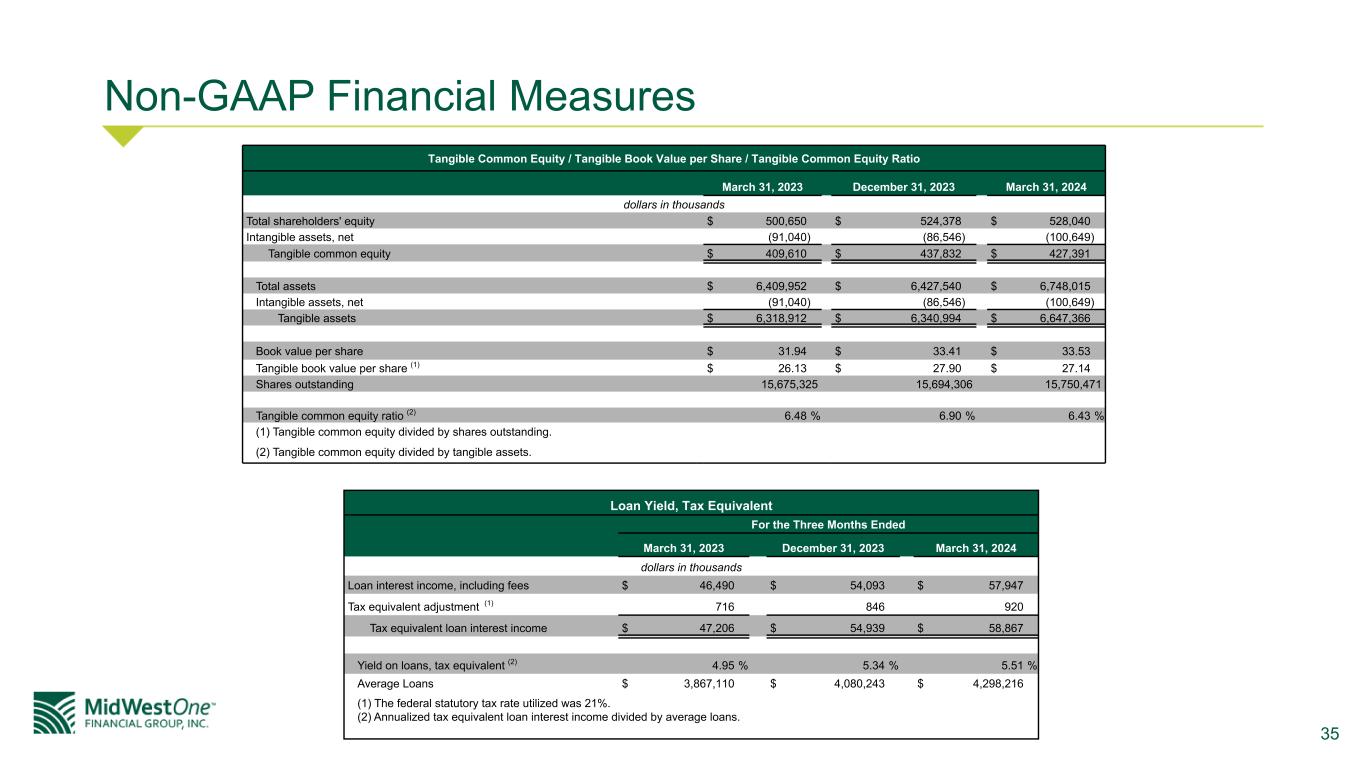

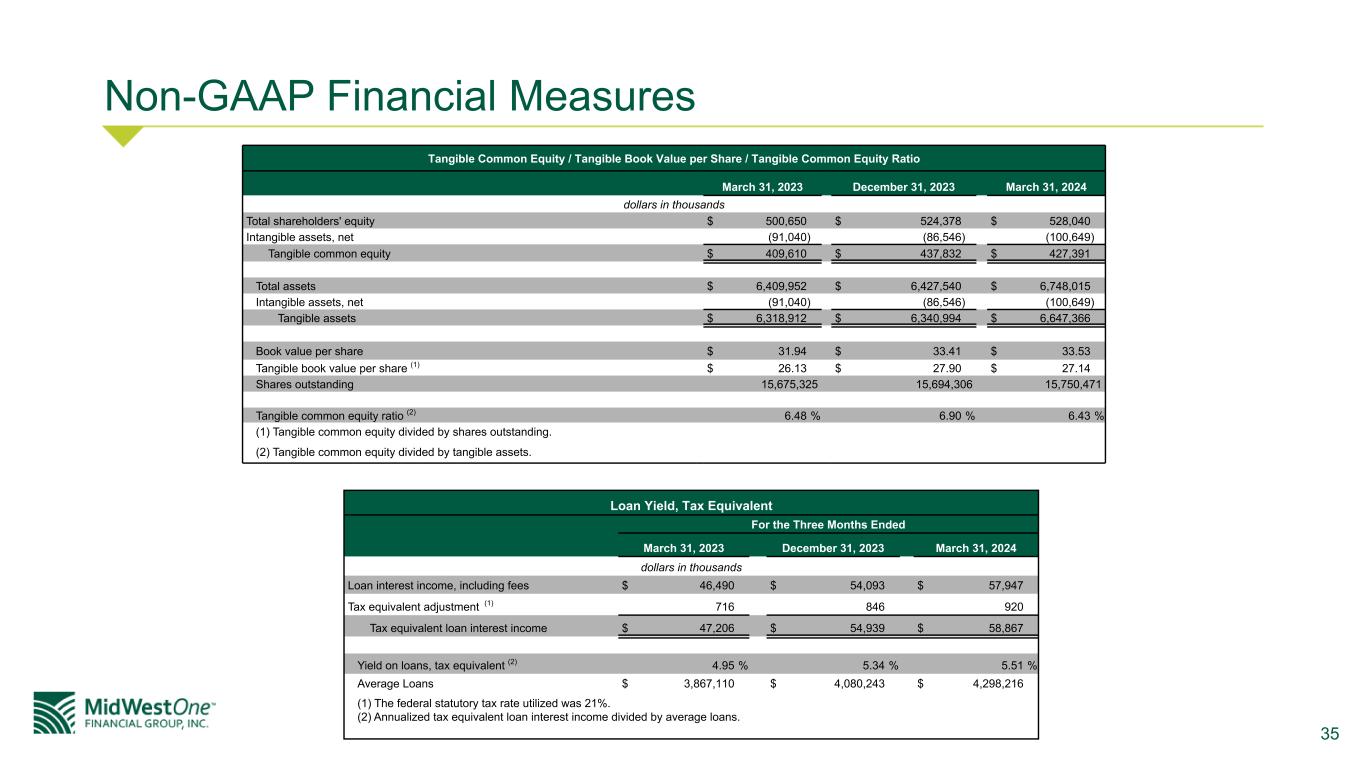

35 Non-GAAP Financial Measures Tangible Common Equity / Tangible Book Value per Share / Tangible Common Equity Ratio March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Total shareholders' equity $ 500,650 $ 524,378 $ 528,040 Intangible assets, net (91,040) (86,546) (100,649) Tangible common equity $ 409,610 $ 437,832 $ 427,391 Total assets $ 6,409,952 $ 6,427,540 $ 6,748,015 Intangible assets, net (91,040) (86,546) (100,649) Tangible assets $ 6,318,912 $ 6,340,994 $ 6,647,366 Book value per share $ 31.94 $ 33.41 $ 33.53 Tangible book value per share (1) $ 26.13 $ 27.90 $ 27.14 Shares outstanding 15,675,325 15,694,306 15,750,471 Tangible common equity ratio (2) 6.48 % 6.90 % 6.43 % (1) Tangible common equity divided by shares outstanding. (2) Tangible common equity divided by tangible assets. Loan Yield, Tax Equivalent For the Three Months Ended March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Loan interest income, including fees $ 46,490 $ 54,093 $ 57,947 Tax equivalent adjustment (1) 716 846 920 Tax equivalent loan interest income $ 47,206 $ 54,939 $ 58,867 Yield on loans, tax equivalent (2) 4.95 % 5.34 % 5.51 % Average Loans $ 3,867,110 $ 4,080,243 $ 4,298,216 (1) The federal statutory tax rate utilized was 21%. (2) Annualized tax equivalent loan interest income divided by average loans.

36 Non-GAAP Financial Measures Efficiency Ratio For the Three Months Ended March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Total noninterest expense $ 33,319 $ 32,131 $ 35,565 Amortization of intangibles (1,752) (1,441) (1,637) Merger-related expenses (136) (245) (1,314) Noninterest expense used for efficiency ratio $ 31,431 $ 30,445 $ 32,614 Net interest income, tax equivalent (1) $ 41,314 $ 33,833 $ 36,038 Noninterest income (4,046) 3,862 9,750 Investment securities (losses) gains, net (13,170) (5,696) 36 Net revenues used for efficiency ratio $ 50,438 $ 43,391 $ 45,752 Efficiency ratio 62.32 % 70.16 % 71.28 % (1) The federal statutory tax rate utilized was 21%. (2) Noninterest expense adjusted for amortization of intangibles and merger-related expenses divided by the sum of tax equivalent net interest income, noninterest income and net investment securities (losses) gains. Pre-tax / Pre-provision Net Revenue For the Three Months Ended March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Net interest income $ 40,076 $ 32,559 $ 34,731 Noninterest income (4,046) 3,862 9,750 Noninterest expense (33,319) (32,131) (35,565) Pre-tax / Pre-provision Net Revenue $ 2,711 $ 4,290 $ 8,916

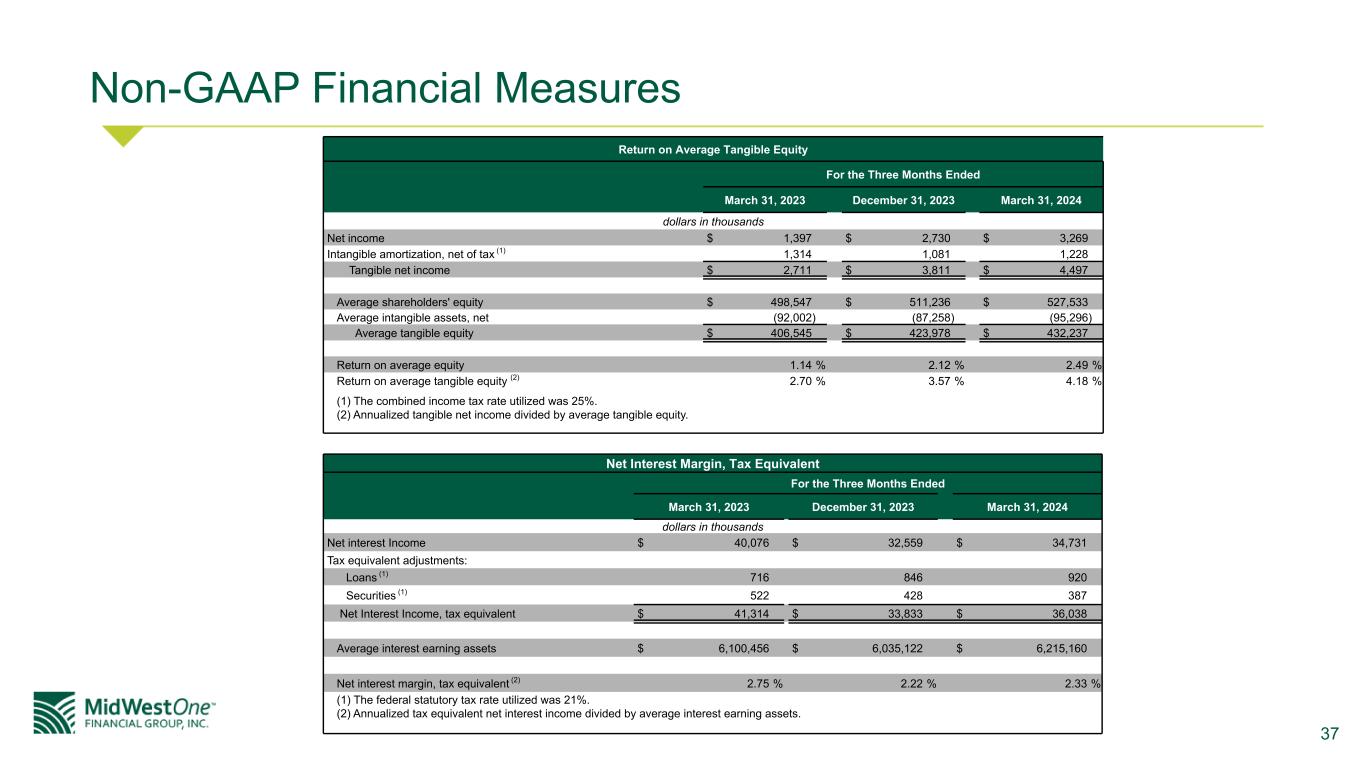

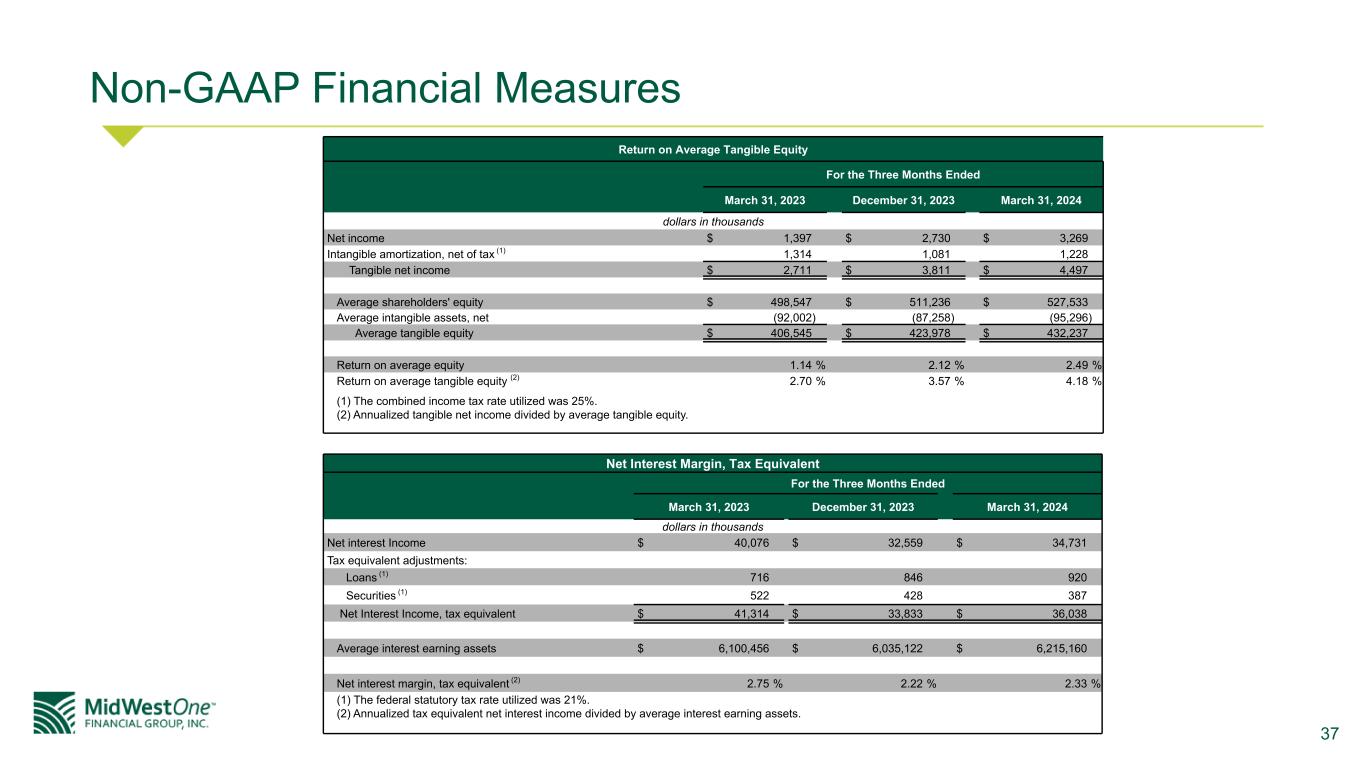

37 Non-GAAP Financial Measures Return on Average Tangible Equity For the Three Months Ended March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Net income $ 1,397 $ 2,730 $ 3,269 Intangible amortization, net of tax (1) 1,314 1,081 1,228 Tangible net income $ 2,711 $ 3,811 $ 4,497 Average shareholders' equity $ 498,547 $ 511,236 $ 527,533 Average intangible assets, net (92,002) (87,258) (95,296) Average tangible equity $ 406,545 $ 423,978 $ 432,237 Return on average equity 1.14 % 2.12 % 2.49 % Return on average tangible equity (2) 2.70 % 3.57 % 4.18 % (1) The combined income tax rate utilized was 25%. (2) Annualized tangible net income divided by average tangible equity. Net Interest Margin, Tax Equivalent For the Three Months Ended March 31, 2023 December 31, 2023 March 31, 2024 dollars in thousands Net interest Income $ 40,076 $ 32,559 $ 34,731 Tax equivalent adjustments: Loans (1) 716 846 920 Securities (1) 522 428 387 Net Interest Income, tax equivalent $ 41,314 $ 33,833 $ 36,038 Average interest earning assets $ 6,100,456 $ 6,035,122 $ 6,215,160 Net interest margin, tax equivalent (2) 2.75 % 2.22 % 2.33 % (1) The federal statutory tax rate utilized was 21%. (2) Annualized tax equivalent net interest income divided by average interest earning assets.