Document

Exhibit 99.1

Phreesia Announces Third Quarter Fiscal 2026 Results and Introduces Fiscal 2027 Outlook

ALL-REMOTE COMPANY/WILMINGTON, Del., December 8, 2025 – Phreesia, Inc. (NYSE: PHR) (“Phreesia” or the "Company") announced financial results today for the fiscal third quarter ended October 31, 2025.

“I am very proud of our team’s strong execution in the fiscal third quarter, which is reflected throughout this letter from our revenue and profit results to product updates and client stories,” said CEO and Co-Founder Chaim Indig.

Please visit the Phreesia investor relations website at ir.phreesia.com to view the Company's Q3 Fiscal 2026 Stakeholder Letter.

Fiscal Third Quarter Ended October 31, 2025 Highlights1

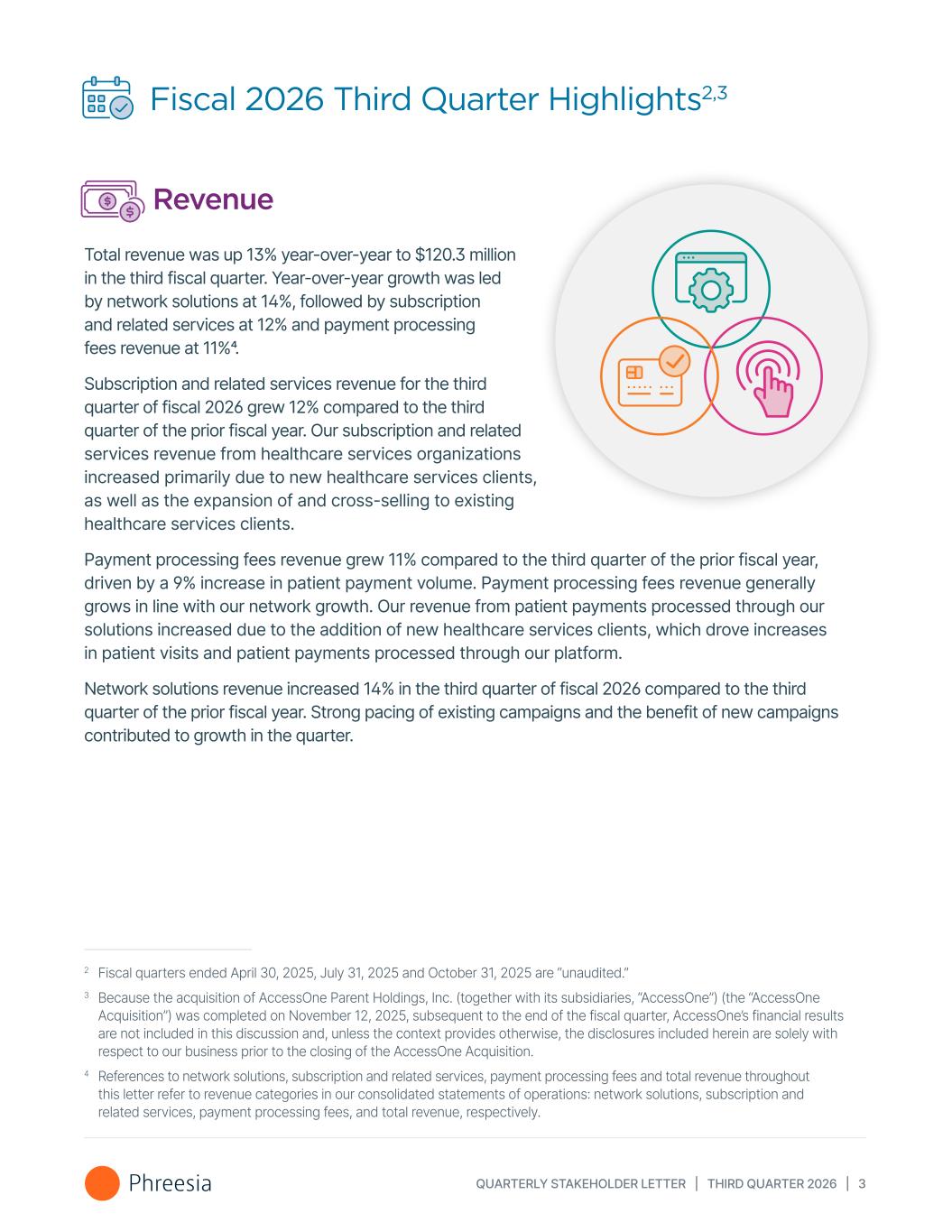

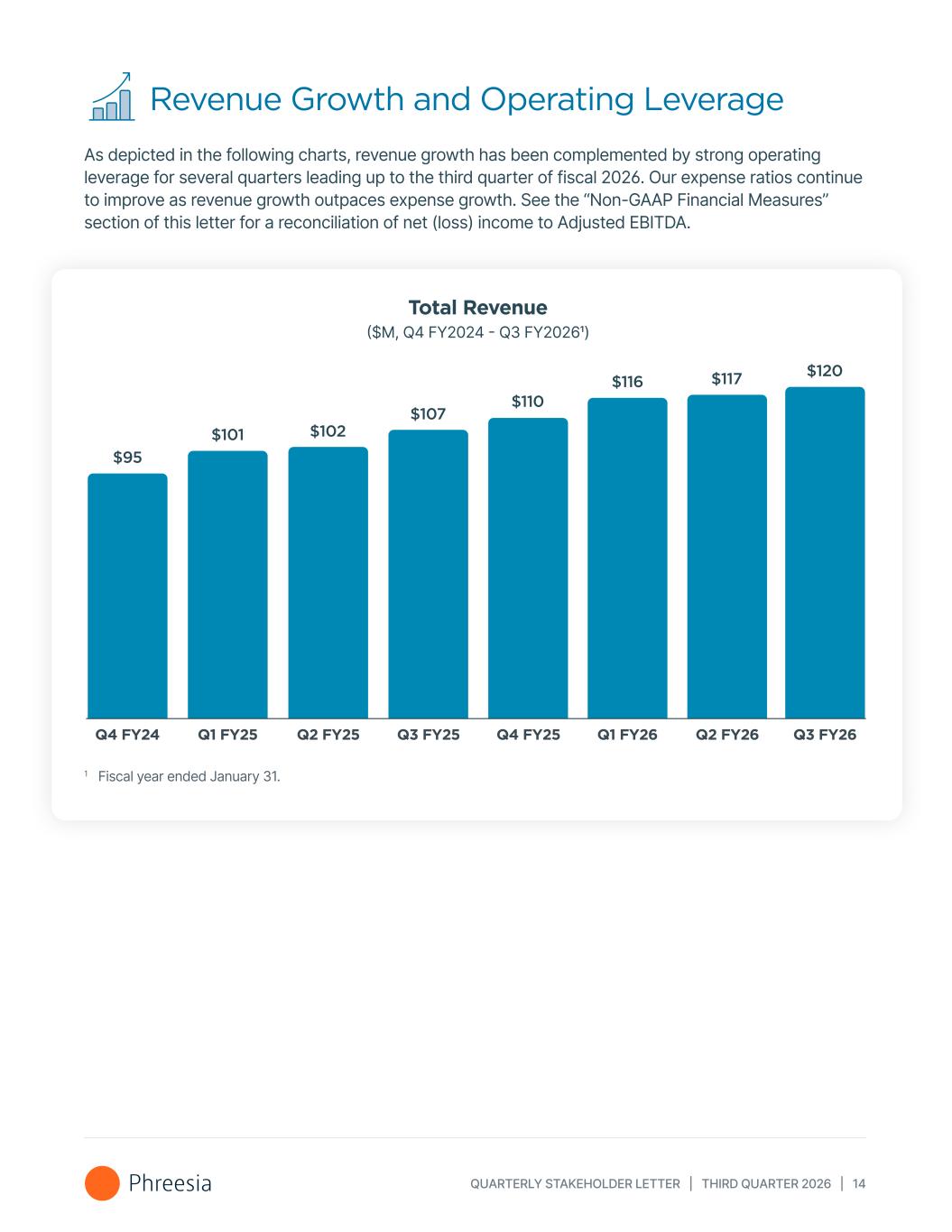

•Total revenue was $120.3 million in the quarter, up 13% year-over-year.

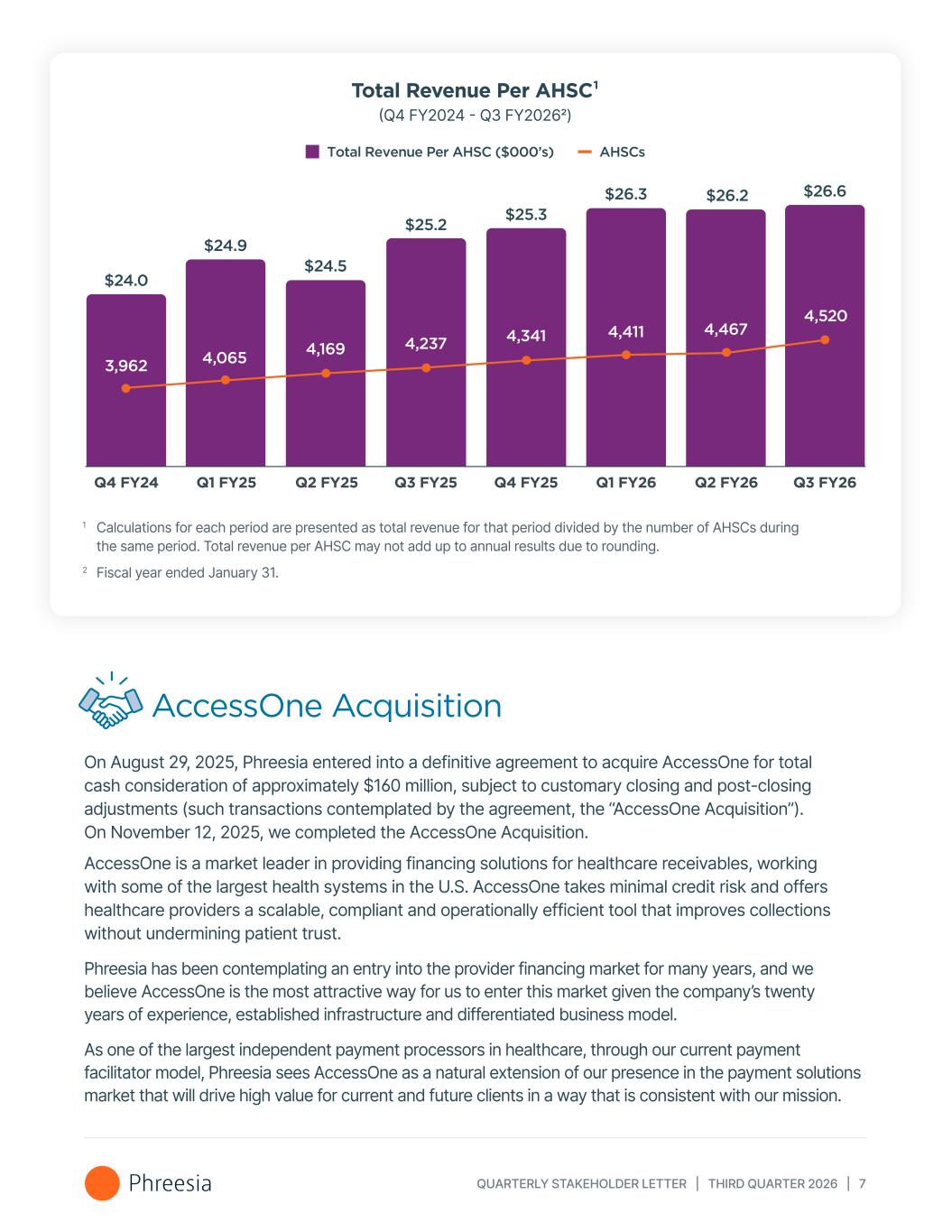

•Average number of healthcare services clients ("AHSCs") was 4,520 in the quarter, up 7% year-over-year.

•Total revenue per AHSC was $26,622 in the quarter, up 6% year-over-year. See "Key Metrics" below for additional information.

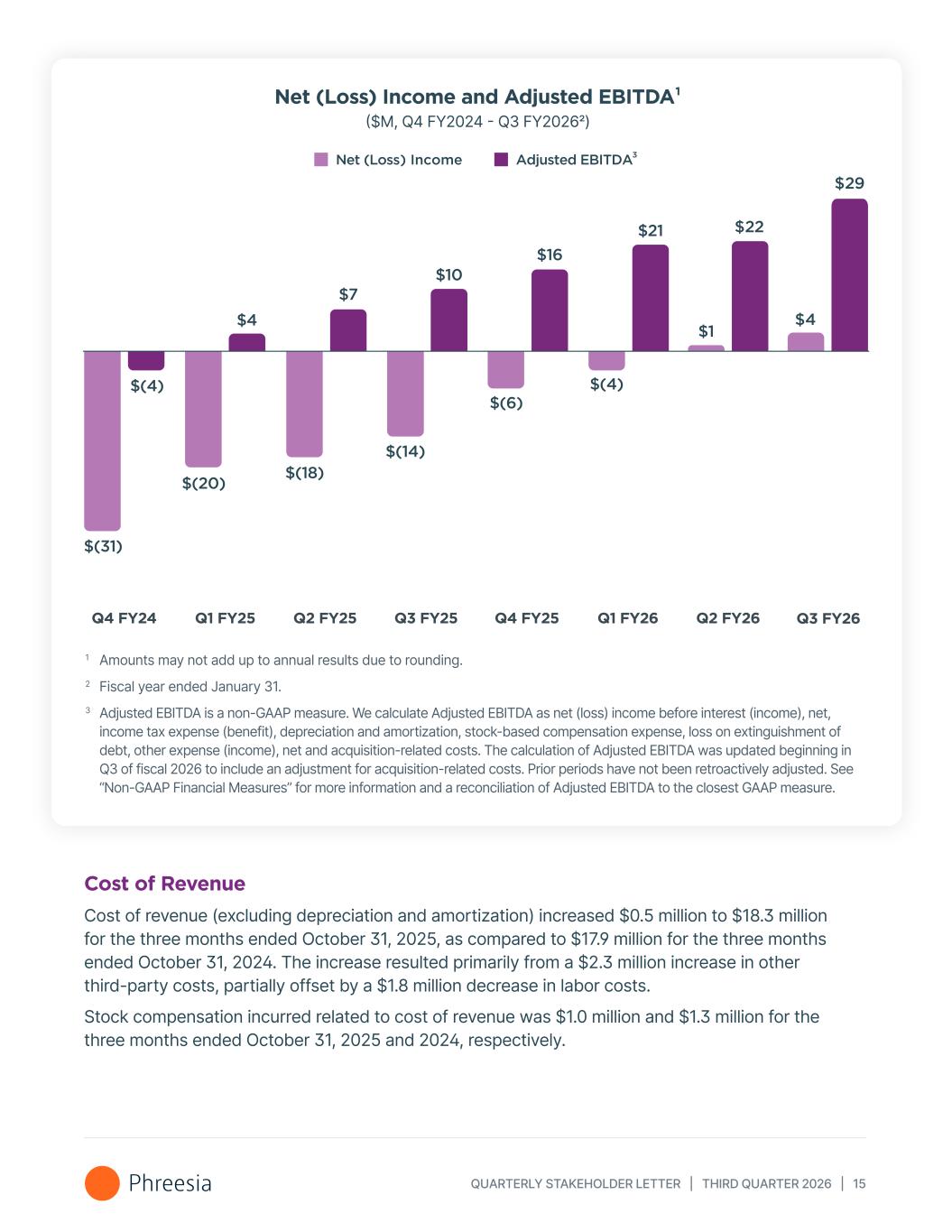

•Net income was $4.3 million in the quarter, as compared to net loss of $14.4 million in the same period in the prior year.

•Adjusted EBITDA2 was $29.1 million in the quarter, as compared to $9.8 million in the same period in the prior year.

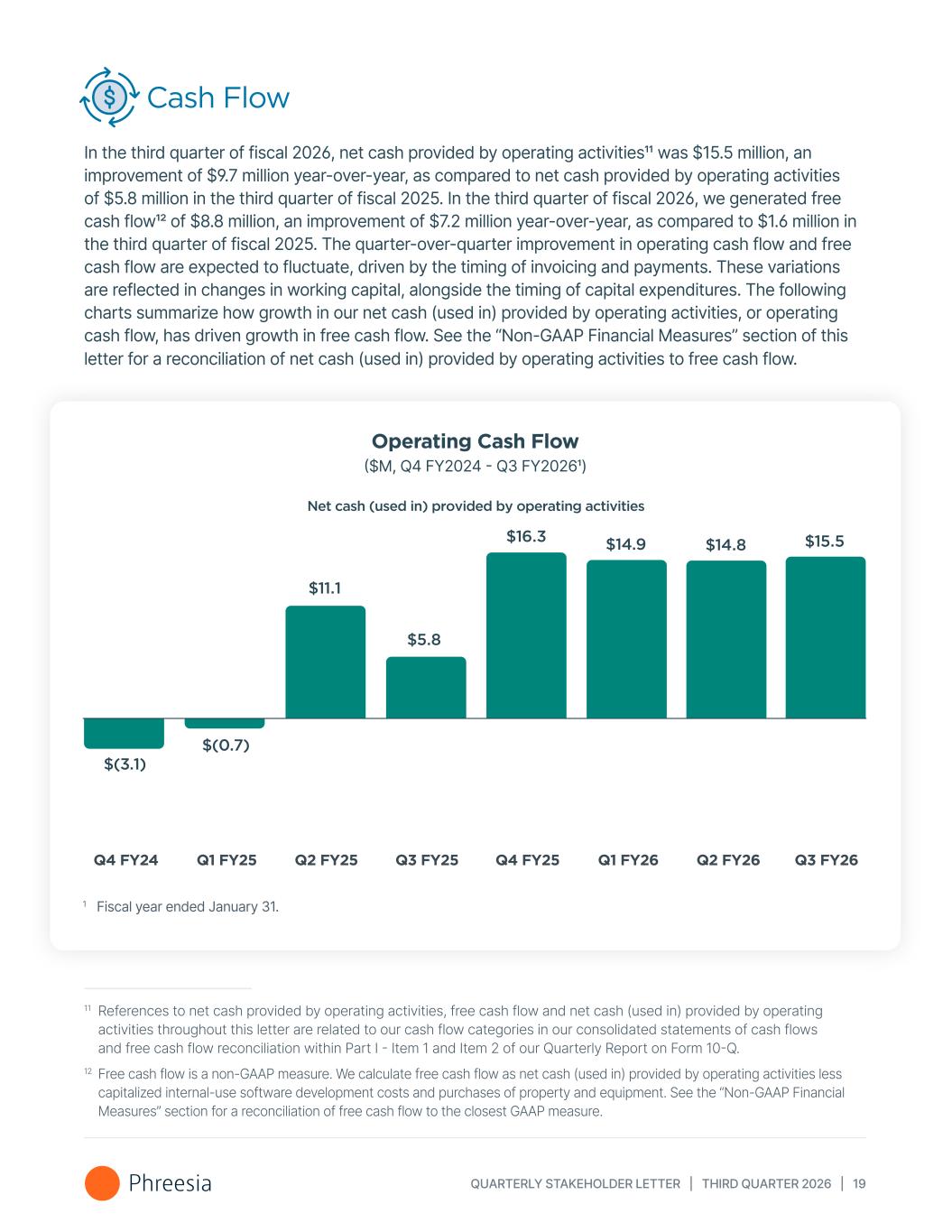

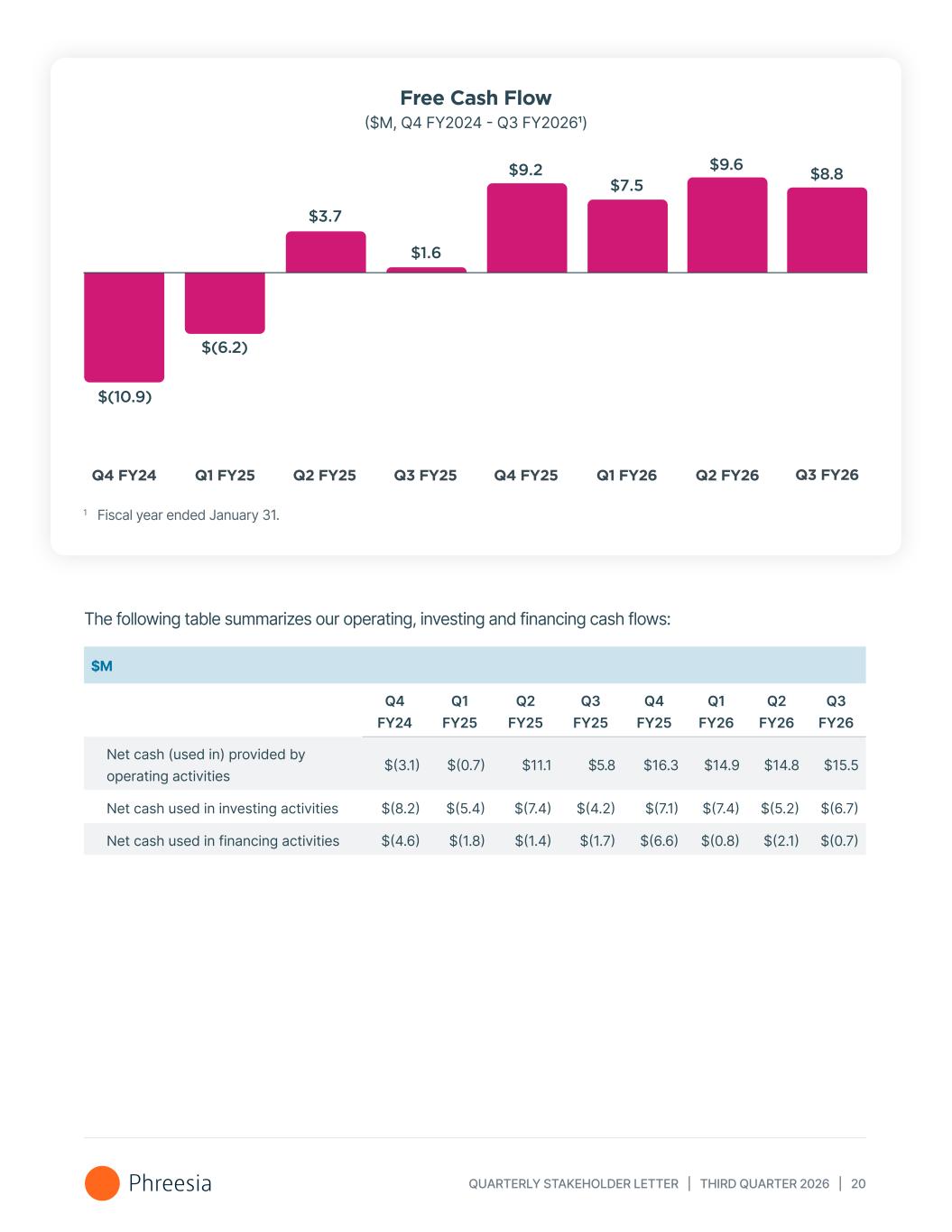

•Net cash provided by operating activities was $15.5 million in the quarter, as compared to $5.8 million in the same period in the prior year.

•Free cash flow3 was $8.8 million in the quarter, as compared to $1.6 million in the same period in the prior year.

•Cash and cash equivalents as of October 31, 2025 was $106.4 million, an increase of $22.2 million from January 31, 2025 and up $8.1 million from July 31, 2025.

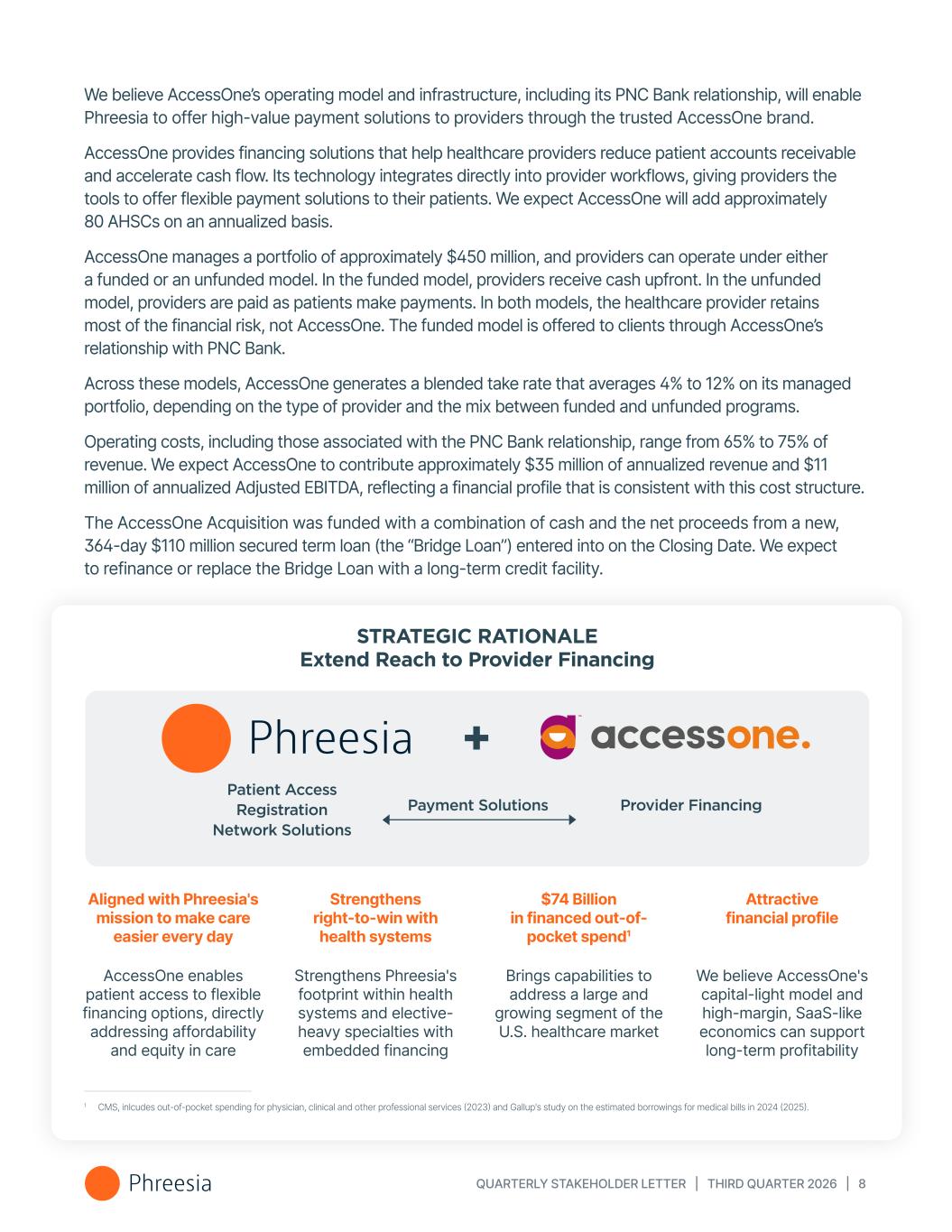

AccessOne Acquisition

On August 29, 2025, Phreesia entered into a definitive agreement to acquire AccessOne Parent Holdings, Inc. (together with its subsidiaries, “AccessOne”) for total cash consideration of approximately $160 million, subject to customary closing and post-closing adjustments (such transactions contemplated by the agreement, the “AccessOne Acquisition”). AccessOne is a market leader in providing financing solutions for healthcare receivables, working with some of the largest health systems in the U.S. AccessOne takes minimal credit risk and offers healthcare providers a scalable, compliant and operationally efficient tool that improves collections without undermining patient trust. On November 12, 2025 (the “Closing Date”), subsequent to the end of the quarter, we completed the AccessOne Acquisition, and AccessOne became a wholly owned subsidiary of Phreesia.

The purchase price was funded with a combination of cash and the net proceeds from a new, 364-day $110 million secured term loan (the “Bridge Loan”) entered into on the Closing Date. We expect to refinance or replace the Bridge Loan with a long-term credit facility.

Also on the Closing Date, we entered into an amendment (the “Credit Facility Amendment”) to our senior ABL facility with Capital One, National Association (as amended, the “Capital One Credit Facility”). The Credit Facility Amendment amended the covenant limiting acquisitions to permit the acquisition of AccessOne, amended the

1 Because the AccessOne Acquisition (as defined herein) was completed on November 12, 2025, subsequent to the end of the fiscal quarter, AccessOne’s (as defined herein) financial results are not included in this discussion and, unless the context provides otherwise, the disclosures included herein are solely with respect to our business prior to the closing of the AccessOne Acquisition.

2 Adjusted EBITDA is a non-GAAP measure. We calculate Adjusted EBITDA as net income (loss) before interest income, net, income tax (benefit) expense, depreciation and amortization, stock-based compensation expense, other (income) expense, net and acquisition-related costs. The calculation of Adjusted EBITDA was updated beginning in Q3 of Fiscal 2026 to include an adjustment for acquisition-related costs. Prior periods have not been retroactively adjusted. See “Non-GAAP Financial Measures” for more information and a reconciliation of Adjusted EBITDA to the closest GAAP measure.

3 Free cash flow is a non-GAAP measure. We calculate free cash flow as net cash provided by operating activities less capitalized internal-use software development costs and purchases of property and equipment. See “Non-GAAP Financial Measures” for a reconciliation of free cash flow to the closest GAAP measure.

covenant limiting additional indebtedness to accommodate the Bridge Loan, and amended the security interest supporting the Capital One Credit Facility to permit the security interests granted in connection with the Bridge Loan. The amendment included further changes to sections governing mandatory and voluntary prepayments, negative covenants and events of default to accommodate the existence of the Bridge Loan.

For more information regarding the AccessOne Acquisition, the Bridge Loan and the Credit Facility Amendment, please see our Current Reports on Form 8-K filed with the SEC on September 4, 2025 and November 12, 2025.

Fiscal 2026 Outlook

We are updating our revenue outlook for fiscal 2026 to a range of $479 million to $481 million from a previous range of $472 million to $482 million. The updated revenue outlook includes approximately $7.5 million of expected revenue from AccessOne between the November 12th closing date and January 31, 2026 but does not assume revenue from other potential future acquisitions completed between now and January 31, 2026.

We are updating our Adjusted EBITDA outlook for fiscal 2026 to a range of $99 million to $101 million from a previous range of $87 million to $92 million. The updated Adjusted EBITDA outlook includes expected Adjusted EBITDA contributions from the AccessOne Acquisition between the November 12th closing Date and January 31, 2026 and assumes continued improvements in operating leverage across the Company through a focus on efficiency. Beginning in the third quarter of fiscal 2026, Adjusted EBITDA now includes an adjustment for acquisition-related costs—primarily legal, advisory, professional fees and integration expenses. Management believes this change improves period-to-period comparability of core operating performance and trends. Refer to the “Non-GAAP Financial Measures” section for further information.

We are updating our expectation for AHSCs for fiscal 2026 to approximately 4,515 from a previous expectation of approximately 4,500. The updated expectation for AHSCs includes 15 AHSCs added as a result of the AccessOne Acquisition between the November 12th closing date through January 31, 2026. Additionally, we continue to expect total revenue per AHSC in fiscal 2026 to increase from fiscal 2025.

Fiscal 2027 Outlook

We are introducing our revenue outlook for fiscal 2027. We expect revenue to be in the range of $545 million to $559 million, a 14-16% increase over our fiscal 2026 outlook. The revenue range provided for fiscal 2027 assumes no additional revenue from potential future acquisitions completed between now and January 31, 2027. We expect revenue from AccessOne to represent approximately 6.5% of our fiscal 2027 total revenue outlook.

We are introducing our Adjusted EBITDA outlook for fiscal 2027. We expect Adjusted EBITDA to be in the range of $125 million to $135 million. The Adjusted EBITDA range provided for fiscal 2027 assumes continued improvement in operating leverage across the Company through a focus on efficiency.

We expect AHSCs and Total revenue per AHSC to grow in the mid-single-digit percent range and low-double-digit percent range, respectively, in fiscal 2027.

We believe our cash and cash equivalents, cash generated in our normal operations, and our available borrowing capacity under the Capital One Credit Facility will be sufficient to reach our fiscal 2026 and fiscal 2027 outlook and meet our obligations. As of October 31, 2025 we had no borrowings outstanding under the Capital One Credit Facility.

Non-GAAP4 Financial Measures

We have not reconciled our Adjusted EBITDA outlook to GAAP net income (loss) because we do not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other (income) expense, net and income tax (benefit) expense, which are reconciling items between Adjusted EBITDA and GAAP net income (loss). Because we cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP net income (loss). For further information regarding the non-GAAP financial measures included in this press release, including a reconciliation of GAAP to non-GAAP financial measures and an explanation of these measures, please see “Non-GAAP Financial Measures” below.

Available Information

4 GAAP is defined as generally accepted accounting principles in the United States.

We intend to use our Company website (including our Investor Relations website) as well as our Facebook, X, LinkedIn and Instagram accounts as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD.

Forward Looking Statements

This press release includes express or implied statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or our future financial or operating performance and may contain projections of our future results of operations or of our financial information or state other forward-looking information. These statements include, but are not limited to, statements regarding: our future financial and operating performance, including our revenue, operating leverage, margins, Adjusted EBITDA, cash flows and profitability; the expected results of the AccessOne Acquisition discussed herein, including anticipated additional revenue, Adjusted EBITDA and AHSCs; the Capital One Credit Agreement, the Bridge Loan and expectations regarding a long-term credit facility; our ability to finance our plans to achieve our fiscal 2026 and fiscal 2027 outlook with our current cash balance, cash generated in the normal course of business and our available borrowing capacity under the Capital One Credit Facility; and our outlook for fiscal 2026 and fiscal 2027, including our expectations regarding revenue, Adjusted EBITDA, AHSCs and total revenue per AHSC. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control, including, without limitation, risks associated with: our ability to effectively manage our growth and meet our growth objectives; our focus on the long-term and our investments in growth; the ability to integrate operations or realize any operational or corporate synergies and other benefits from the AccessOne Acquisition; the competitive environment in which we operate; our ability to comply with the covenants in our Capital One Credit Facility and the Bridge Loan; changes in market conditions and receptivity to our products and services; our ability to develop and release new products and services and successful enhancements, features and modifications to our existing products and services; our ability to maintain the security and availability of our platform; the impact of cyberattacks, security incidents or breaches impacting our business; changes in laws and regulations applicable to our business model; our ability to make accurate predictions about our industry and addressable market; our ability to attract, retain and cross-sell to healthcare services clients; our ability to continue to operate effectively with a primarily remote workforce and attract and retain key talent; our ability to realize the intended benefits of our acquisitions and partnerships; and difficulties in integrating our acquisitions and investments; artificial intelligence that can impact our business, including by posing security risks to our confidential information, proprietary information and personal data, increasing our regulatory and compliance burden and increasing competition; and other general, market, political, economic and business conditions (including from the U.S. federal government, tariff and trade issues, and the warfare and/or political and economic instability in Ukraine, the Middle East or elsewhere). The forward-looking statements contained in this press release are also subject to other risks and uncertainties, including those listed or described in our filings with the Securities and Exchange Commission (“SEC”), including in our Quarterly Report on Form 10-Q for the fiscal quarter ended October 31, 2025 that will be filed with the SEC following this press release. The forward-looking statements in this press release speak only as of the date on which the statements are made. We undertake no obligation to update, and expressly disclaim the obligation to update, any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law.

This press release includes certain non-GAAP financial measures as defined by SEC rules. We have provided a reconciliation of those measures to the most directly comparable GAAP measures, with the exception of our Adjusted EBITDA outlook for the reasons described above.

Conference Call Information

We will hold a conference call on Monday, December 8, 2025 at 5:00 p.m. Eastern Time to review our fiscal 2026 third quarter financial results. To participate in our live conference call and webcast, please dial (800) 715-9871 (or (646) 307-1963 for international participants) using conference code number 7404611 or visit the “Events & Presentations” section of our Investor Relations website at ir.phreesia.com.

A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call, at the same web link, and will remain available for approximately 90 days.

About Phreesia

Phreesia is a trusted leader in patient activation, giving healthcare providers, life sciences companies and other organizations tools to help patients take a more active role in their care. Founded in 2005, Phreesia enabled approximately 170 million patient visits in 2024—1 in 7 visits across the U.S.—scale that we believe allows us to make meaningful impact. Offering patient-driven digital solutions for intake, outreach, education and more, Phreesia enhances the patient experience, drives efficiency and improves healthcare outcomes.

Investor Relations Contact:

Balaji Gandhi

Phreesia, Inc.

investors@phreesia.com

(929) 506-4950

Media Contact:

Nicole Gist

Phreesia, Inc.

nicole.gist@phreesia.com

(407) 760-6274

Phreesia, Inc.

Consolidated Balance Sheets

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

October 31, 2025 |

|

January 31, 2025 |

|

(Unaudited) |

|

|

| Assets |

|

|

|

| Current: |

|

|

|

| Cash and cash equivalents |

$ |

106,371 |

|

|

$ |

84,220 |

|

| Settlement assets |

25,391 |

|

|

29,176 |

|

| Accounts receivable, net of allowance for doubtful accounts of $2,175 and $1,468 as of October 31, 2025 and January 31, 2025, respectively |

88,257 |

|

|

73,617 |

|

| Deferred contract acquisition costs |

427 |

|

|

401 |

|

| Prepaid expenses and other current assets |

20,460 |

|

|

15,871 |

|

| Total current assets |

240,906 |

|

|

203,285 |

|

| Property and equipment, net of accumulated depreciation and amortization of $93,842 and $84,505 as of October 31, 2025 and January 31, 2025, respectively |

21,111 |

|

|

23,651 |

|

| Capitalized internal-use software, net of accumulated amortization of $65,681 and $55,991 as of October 31, 2025 and January 31, 2025, respectively |

54,093 |

|

|

52,763 |

|

| Operating lease right-of-use assets |

820 |

|

|

1,477 |

|

| Deferred contract acquisition costs |

444 |

|

|

583 |

|

| Intangible assets, net of accumulated amortization of $11,018 and $8,407 as of October 31, 2025 and January 31, 2025, respectively |

25,532 |

|

|

28,143 |

|

| Goodwill |

75,845 |

|

|

75,845 |

|

Deferred tax asset |

1,640 |

|

|

— |

|

| Other assets |

3,081 |

|

|

2,668 |

|

| Total Assets |

$ |

423,472 |

|

|

$ |

388,415 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current: |

|

|

|

| Settlement obligations |

$ |

25,391 |

|

|

$ |

29,176 |

|

| Current portion of finance lease liabilities and other debt |

6,199 |

|

|

8,043 |

|

| Current portion of operating lease liabilities |

746 |

|

|

964 |

|

| Accounts payable |

6,218 |

|

|

5,622 |

|

| Accrued expenses |

30,517 |

|

|

37,460 |

|

| Deferred revenue |

29,712 |

|

|

32,758 |

|

|

|

|

|

| Total current liabilities |

98,783 |

|

|

114,023 |

|

| Long-term finance lease liabilities and other debt |

3,353 |

|

|

8,150 |

|

| Operating lease liabilities, non-current |

132 |

|

|

646 |

|

| Long-term deferred revenue |

151 |

|

|

119 |

|

| Long-term deferred tax liabilities |

683 |

|

|

484 |

|

| Other long-term liabilities |

41 |

|

|

185 |

|

| Total Liabilities |

103,143 |

|

|

123,607 |

|

| Commitments and contingencies |

|

|

|

| Stockholders’ Equity: |

|

|

|

Preferred stock, undesignated, $0.01 par value—20,000,000 shares authorized as of both October 31, 2025 and January 31, 2025; no shares issued or outstanding as of both October 31, 2025 and January 31, 2025 |

— |

|

|

— |

|

| Common stock, $0.01 par value—500,000,000 shares authorized as of both October 31, 2025 and January 31, 2025; 61,589,913 and 60,083,444 shares issued as of October 31, 2025 and January 31, 2025, respectively |

616 |

|

|

601 |

|

| Additional paid-in capital |

1,166,078 |

|

|

1,111,274 |

|

| Accumulated deficit |

(800,485) |

|

|

(801,496) |

|

| Accumulated other comprehensive income (loss) |

(360) |

|

|

(51) |

|

| Treasury stock, at cost, 1,355,169 shares as of both October 31, 2025 and January 31, 2025 |

(45,520) |

|

|

(45,520) |

|

| Total Stockholders’ Equity |

320,329 |

|

|

264,808 |

|

| Total Liabilities and Stockholders’ Equity |

$ |

423,472 |

|

|

$ |

388,415 |

|

Phreesia, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

October 31, |

|

Nine months ended

October 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenue: |

|

|

|

|

|

|

|

| Subscription and related services |

$ |

55,480 |

|

|

$ |

49,363 |

|

|

$ |

163,537 |

|

|

$ |

144,717 |

|

| Payment processing fees |

27,422 |

|

|

24,704 |

|

|

85,739 |

|

|

77,064 |

|

| Network solutions |

37,431 |

|

|

32,733 |

|

|

104,248 |

|

|

88,351 |

|

| Total revenues |

120,333 |

|

|

106,800 |

|

|

353,524 |

|

|

310,132 |

|

| Expenses: |

|

|

|

|

|

|

|

| Cost of revenue (excluding depreciation and amortization) |

18,338 |

|

|

17,854 |

|

|

52,373 |

|

|

49,720 |

|

| Payment processing expense |

19,689 |

|

|

16,683 |

|

|

61,360 |

|

|

51,648 |

|

| Sales and marketing |

24,148 |

|

|

30,071 |

|

|

75,587 |

|

|

92,266 |

|

| Research and development |

29,453 |

|

|

29,315 |

|

|

90,556 |

|

|

87,738 |

|

| General and administrative |

17,488 |

|

|

19,633 |

|

|

52,938 |

|

|

58,182 |

|

| Depreciation |

3,199 |

|

|

3,566 |

|

|

9,464 |

|

|

11,011 |

|

| Amortization |

4,279 |

|

|

3,521 |

|

|

12,301 |

|

|

10,052 |

|

| Total expenses |

116,594 |

|

|

120,643 |

|

|

354,579 |

|

|

360,617 |

|

| Operating income (loss) |

3,739 |

|

|

(13,843) |

|

|

(1,055) |

|

|

(50,485) |

|

| Other income (expense), net |

1,006 |

|

|

(144) |

|

|

1,680 |

|

|

(261) |

|

| Interest income, net |

380 |

|

|

26 |

|

|

758 |

|

|

311 |

|

| Total other income (expense), net |

1,386 |

|

|

(118) |

|

|

2,438 |

|

|

50 |

|

| Income (loss) before income tax expense |

5,125 |

|

|

(13,961) |

|

|

1,383 |

|

|

(50,435) |

|

| Income tax expense |

(854) |

|

|

(442) |

|

|

(372) |

|

|

(1,702) |

|

| Net income (loss) |

$ |

4,271 |

|

|

$ |

(14,403) |

|

|

$ |

1,011 |

|

|

$ |

(52,137) |

|

Net income (loss) per share attributable to common stockholders: |

|

|

|

|

|

|

|

Basic |

$ |

0.07 |

|

|

$ |

(0.25) |

|

|

$ |

0.02 |

|

|

$ |

(0.91) |

|

Diluted |

$ |

0.07 |

|

|

$ |

(0.25) |

|

|

$ |

0.02 |

|

|

$ |

(0.91) |

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

Basic |

60,008,780 |

|

|

57,891,591 |

|

|

59,513,478 |

|

|

57,358,637 |

|

Diluted |

61,559,849 |

|

|

57,891,591 |

|

|

61,491,761 |

|

|

57,358,637 |

|

Phreesia, Inc.

Unaudited Consolidated Statements of Comprehensive Income (Loss)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

October 31, |

|

Nine months ended

October 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

4,271 |

|

|

$ |

(14,403) |

|

|

$ |

1,011 |

|

|

$ |

(52,137) |

|

| Other comprehensive loss: |

|

|

|

|

|

|

|

| Net change in unrealized gains (losses) on cash flow hedges |

(433) |

|

|

— |

|

|

(225) |

|

|

— |

|

| Change in foreign currency translation adjustments |

(39) |

|

|

(3) |

|

|

(84) |

|

|

(5) |

|

| Other comprehensive loss |

(472) |

|

|

(3) |

|

|

(309) |

|

|

(5) |

|

| Comprehensive income (loss) |

$ |

3,799 |

|

|

$ |

(14,406) |

|

|

$ |

702 |

|

|

$ |

(52,142) |

|

Phreesia, Inc.

Unaudited Consolidated Statements of Cash Flows

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended

October 31, |

|

Nine months ended

October 31, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Operating activities: |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

4,271 |

|

|

$ |

(14,403) |

|

|

$ |

1,011 |

|

|

$ |

(52,137) |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization |

7,478 |

|

|

7,087 |

|

|

21,765 |

|

|

21,063 |

|

| Stock-based compensation expense |

15,959 |

|

|

16,525 |

|

|

49,414 |

|

|

49,813 |

|

| Amortization of deferred financing costs and debt discount |

61 |

|

|

62 |

|

|

185 |

|

|

174 |

|

| Cost of Phreesia hardware purchased by customers |

235 |

|

|

571 |

|

|

828 |

|

|

1,248 |

|

| Deferred contract acquisition costs amortization |

111 |

|

|

1,322 |

|

|

463 |

|

|

1,706 |

|

| Non-cash operating lease expense |

224 |

|

|

207 |

|

|

657 |

|

|

568 |

|

| Deferred taxes |

57 |

|

|

57 |

|

|

(1,441) |

|

|

176 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

| Accounts receivable |

(11,455) |

|

|

(10,141) |

|

|

(14,765) |

|

|

(6,558) |

|

| Prepaid expenses and other assets |

(1,952) |

|

|

1,005 |

|

|

(4,868) |

|

|

4,286 |

|

Deferred contract acquisition costs |

— |

|

|

(552) |

|

|

(351) |

|

|

(765) |

|

| Accounts payable |

1,303 |

|

|

6,948 |

|

|

1,632 |

|

|

5,198 |

|

| Accrued expenses and other liabilities |

(3,452) |

|

|

(3,655) |

|

|

(5,632) |

|

|

(6,202) |

|

| Lease liabilities |

(242) |

|

|

(202) |

|

|

(732) |

|

|

(622) |

|

| Deferred revenue |

2,869 |

|

|

954 |

|

|

(3,014) |

|

|

(1,823) |

|

| Net cash provided by operating activities |

15,467 |

|

|

5,785 |

|

|

45,152 |

|

|

16,125 |

|

| Investing activities: |

|

|

|

|

|

|

|

| Capitalized internal-use software |

(3,395) |

|

|

(3,566) |

|

|

(10,718) |

|

|

(11,112) |

|

| Purchases of property and equipment |

(3,271) |

|

|

(616) |

|

|

(8,542) |

|

|

(5,919) |

|

| Net cash used in investing activities |

(6,666) |

|

|

(4,182) |

|

|

(19,260) |

|

|

(17,031) |

|

| Financing activities: |

|

|

|

|

|

|

|

| Proceeds from issuance of common stock upon exercise of stock options |

838 |

|

|

17 |

|

|

1,080 |

|

|

583 |

|

| Proceeds from employee stock purchase plan |

632 |

|

|

840 |

|

|

1,975 |

|

|

2,443 |

|

| Finance lease payments |

(1,783) |

|

|

(1,895) |

|

|

(5,669) |

|

|

(5,170) |

|

| Principal payments on financing agreements |

(336) |

|

|

(304) |

|

|

(984) |

|

|

(888) |

|

| Debt issuance costs and loan facility fee payments |

(18) |

|

|

— |

|

|

(56) |

|

|

(152) |

|

| Financing payments of acquisition-related liabilities |

— |

|

|

(309) |

|

|

— |

|

|

(1,673) |

|

| Net cash used in financing activities |

(667) |

|

|

(1,651) |

|

|

(3,654) |

|

|

(4,857) |

|

| Effect of exchange rate changes on cash and cash equivalents |

(29) |

|

|

(10) |

|

|

(87) |

|

|

(17) |

|

| Net increase (decrease) in cash and cash equivalents |

8,105 |

|

|

(58) |

|

|

22,151 |

|

|

(5,780) |

|

| Cash and cash equivalents – beginning of period |

98,266 |

|

|

81,798 |

|

|

84,220 |

|

|

87,520 |

|

| Cash and cash equivalents – end of period |

$ |

106,371 |

|

|

$ |

81,740 |

|

|

$ |

106,371 |

|

|

$ |

81,740 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental information of non-cash investing and financing information: |

|

|

|

|

|

|

|

| Right of use assets acquired in exchange for operating lease liabilities |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,958 |

|

| Property and equipment acquisitions through finance leases |

$ |

— |

|

|

$ |

6,847 |

|

|

$ |

— |

|

|

$ |

13,709 |

|

| Purchase of property and equipment and capitalized software included in current liabilities |

$ |

879 |

|

|

$ |

3,508 |

|

|

$ |

879 |

|

|

$ |

3,508 |

|

| Capitalized stock-based compensation |

$ |

312 |

|

|

$ |

343 |

|

|

$ |

964 |

|

|

$ |

1,006 |

|

| Issuance of stock to settle liabilities for stock-based compensation |

$ |

3,880 |

|

|

$ |

2,853 |

|

|

$ |

11,734 |

|

|

$ |

10,679 |

|

| Cash paid for: |

|

|

|

|

|

|

|

| Interest |

$ |

239 |

|

|

$ |

595 |

|

|

$ |

893 |

|

|

$ |

1,459 |

|

| Income taxes |

$ |

334 |

|

|

$ |

549 |

|

|

$ |

1,648 |

|

|

$ |

2,559 |

|

Non-GAAP Financial Measures

This press release and statements made during the above-referenced webcast may include certain non-GAAP financial measures as defined by SEC rules.

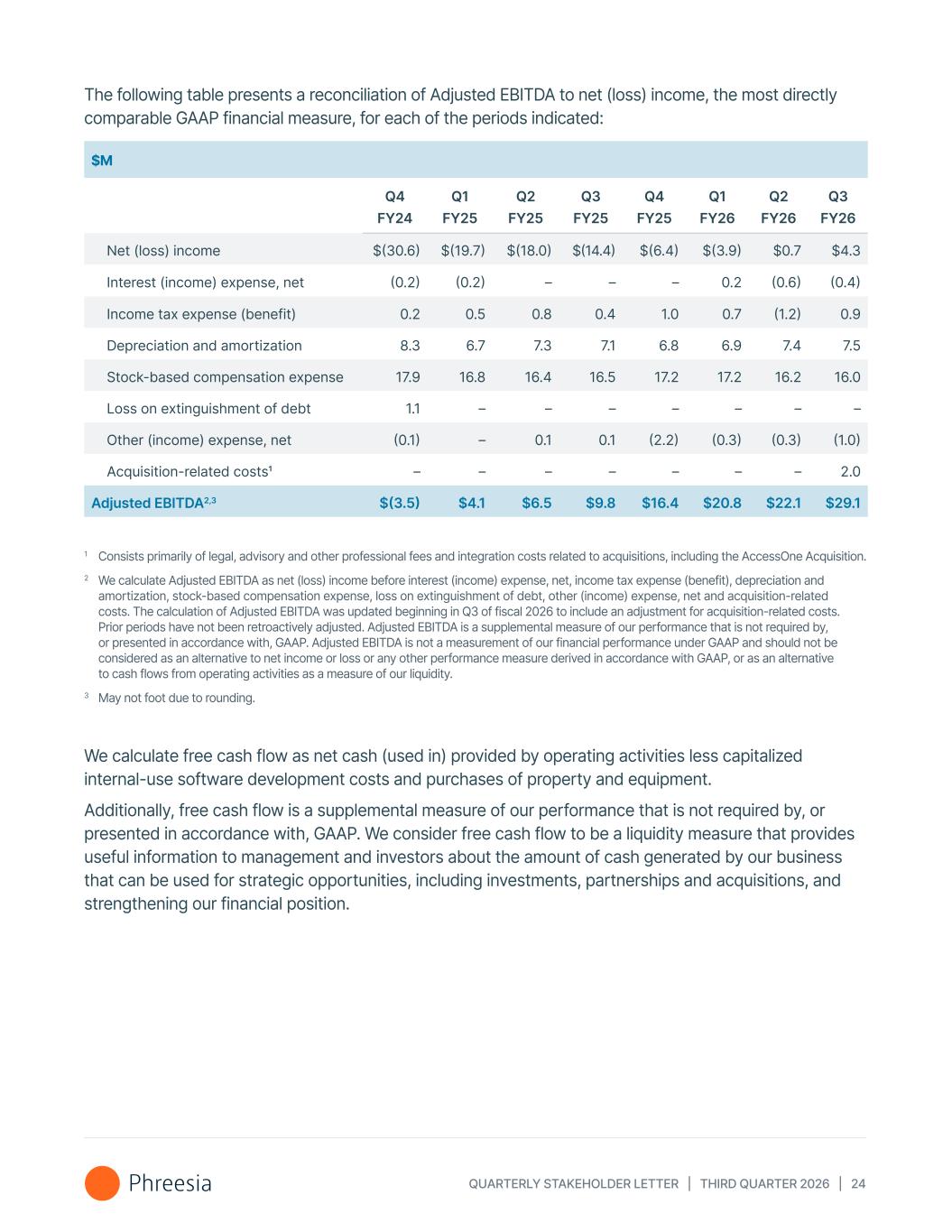

Adjusted EBITDA is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income or loss or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of our liquidity. We calculate Adjusted EBITDA as net income (loss) before interest income, net, income tax expense, depreciation and amortization, stock-based compensation expense, other (income) expense, net and acquisition-related costs. The calculation of Adjusted EBITDA was updated beginning in the three months ended October 31, 2025 to include an adjustment for acquisition-related costs, which consist primarily of legal, advisory and other professional fees and integration costs related to acquisitions. Management believes adjusting for these acquisition-related costs provides investors with a more consistent period-to-period comparison of our core operating performance and trends. For periods prior to the three and nine months ended October 31, 2025, the calculation of Adjusted EBITDA did not adjust for acquisition-related costs, and prior periods have not been retroactively adjusted.

We have provided below a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure. We have presented Adjusted EBITDA in this press release and our Quarterly Report on Form 10-Q to be filed after this press release because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short and long-term operational plans. In particular, we believe that the exclusion of the amounts eliminated in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

We have not reconciled our Adjusted EBITDA outlook to GAAP net income (loss) because we do not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other (income) expense, net and income tax (benefit) expense which are reconciling items between Adjusted EBITDA and GAAP net income (loss). Because we cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP net income (loss).

Our use of Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are as follows:

•Although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•Adjusted EBITDA does not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) the potentially dilutive impact of non-cash stock-based compensation; (3) tax payments that may represent a reduction in cash available to us; (4) interest income, net; or (5) acquisition-related costs; and

•Other companies, including companies in our industry, may calculate Adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure.

Because of these and other limitations, you should consider Adjusted EBITDA along with other GAAP-based financial performance measures, including various cash flow metrics, net income (loss), and our GAAP financial results.

The following table presents a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, for each of the periods indicated:

Phreesia, Inc.

Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

October 31, |

|

Nine months ended

October 31, |

(in thousands, unaudited) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

4,271 |

|

|

$ |

(14,403) |

|

|

$ |

1,011 |

|

|

$ |

(52,137) |

|

| Interest income, net |

(380) |

|

|

(26) |

|

|

(758) |

|

|

(311) |

|

| Income tax expense |

854 |

|

|

442 |

|

|

372 |

|

|

1,702 |

|

| Depreciation and amortization |

7,478 |

|

|

7,087 |

|

|

21,765 |

|

|

21,063 |

|

| Stock-based compensation expense |

15,959 |

|

|

16,525 |

|

|

49,414 |

|

|

49,813 |

|

| Other (income) expense, net |

(1,006) |

|

|

144 |

|

|

(1,680) |

|

|

261 |

|

Acquisition-related costs (1) |

1,973 |

|

|

— |

|

|

1,973 |

|

|

— |

|

| Adjusted EBITDA |

$ |

29,149 |

|

|

$ |

9,769 |

|

|

$ |

72,097 |

|

|

$ |

20,391 |

|

(1) Consists primarily of legal, advisory and other professional fees and integration costs related to acquisitions, including the AccessOne Acquisition. |

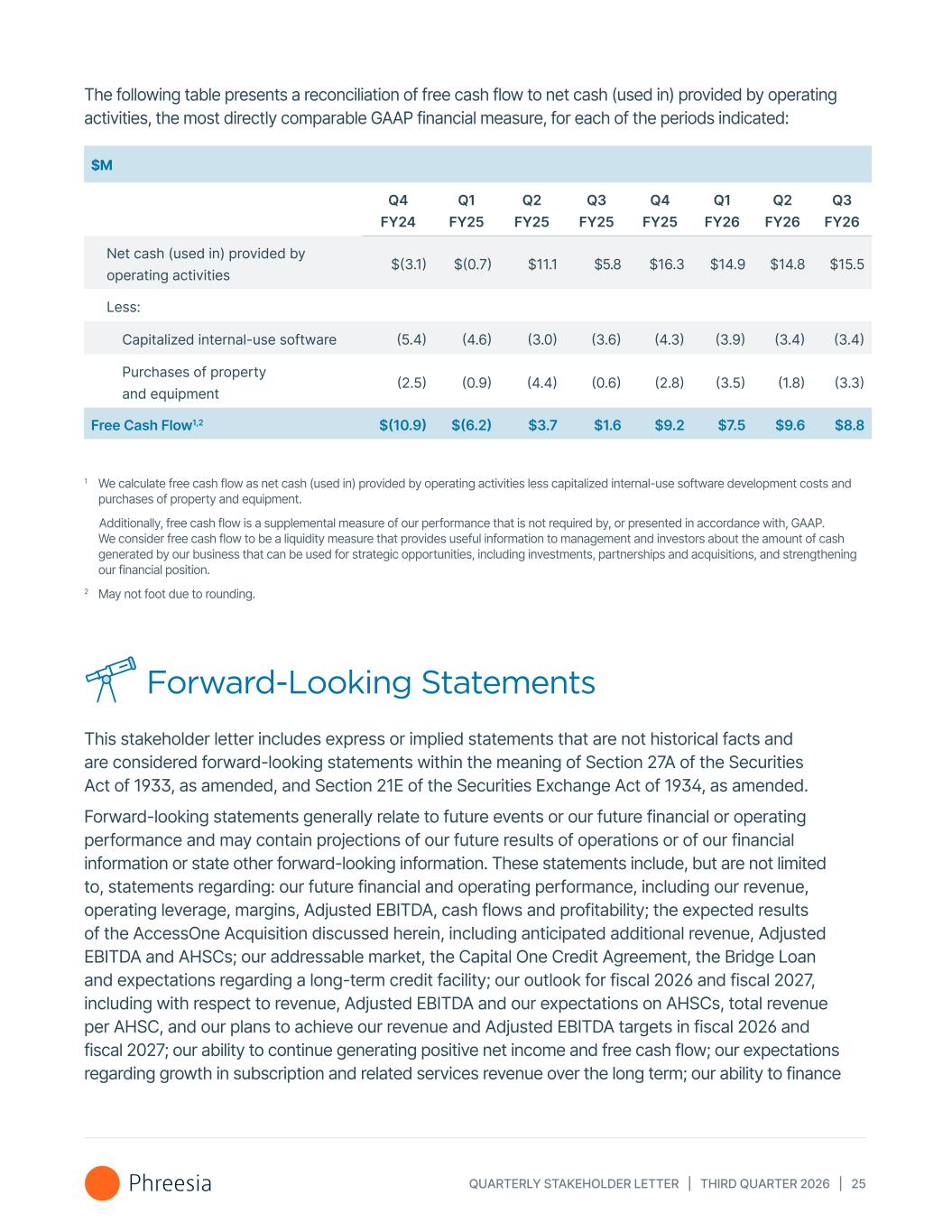

We calculate free cash flow as net cash provided by operating activities less capitalized internal-use software development costs and purchases of property and equipment.

Additionally, free cash flow is a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by our business that can be used for strategic opportunities, including investments, partnerships and acquisitions, and strengthening our financial position.

The following table presents a reconciliation of free cash flow from net cash provided by operating activities, the most directly comparable GAAP financial measure, for each of the periods indicated:

Phreesia, Inc.

Free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended

October 31, |

|

Nine months ended

October 31, |

(in thousands, unaudited) |

2025 |

|

2024 |

|

2025 |

|

2024 |

Net cash provided by operating activities |

$ |

15,467 |

|

|

$ |

5,785 |

|

|

$ |

45,152 |

|

|

$ |

16,125 |

|

| Less: |

|

|

|

|

|

|

|

| Capitalized internal-use software |

(3,395) |

|

|

(3,566) |

|

|

(10,718) |

|

|

(11,112) |

|

| Purchases of property and equipment |

(3,271) |

|

|

(616) |

|

|

(8,542) |

|

|

(5,919) |

|

| Free cash flow |

$ |

8,801 |

|

|

$ |

1,603 |

|

|

$ |

25,892 |

|

|

$ |

(906) |

|

Phreesia, Inc.

Reconciliation of GAAP and Adjusted Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended

October 31, |

|

Nine months ended

October 31, |

(in thousands, unaudited) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP operating expenses |

|

|

|

|

|

|

|

| General and administrative |

$ |

17,488 |

|

|

$ |

19,633 |

|

|

$ |

52,938 |

|

|

$ |

58,182 |

|

| Sales and marketing |

24,148 |

|

|

30,071 |

|

|

75,587 |

|

|

92,266 |

|

| Research and development |

29,453 |

|

|

29,315 |

|

|

90,556 |

|

|

87,738 |

|

| Cost of revenue (excluding depreciation and amortization) |

18,338 |

|

|

17,854 |

|

|

52,373 |

|

|

49,720 |

|

|

$ |

89,427 |

|

|

$ |

96,873 |

|

|

$ |

271,454 |

|

|

$ |

287,906 |

|

| Stock compensation included in GAAP operating expenses |

|

|

|

|

|

|

|

| General and administrative |

$ |

6,258 |

|

|

$ |

6,049 |

|

|

$ |

19,193 |

|

|

$ |

18,534 |

|

| Sales and marketing |

4,804 |

|

|

5,431 |

|

|

14,723 |

|

|

16,500 |

|

| Research and development |

3,934 |

|

|

3,793 |

|

|

12,531 |

|

|

11,049 |

|

| Cost of revenue (excluding depreciation and amortization) |

963 |

|

|

1,252 |

|

|

2,967 |

|

|

3,730 |

|

|

$ |

15,959 |

|

|

$ |

16,525 |

|

|

$ |

49,414 |

|

|

$ |

49,813 |

|

| Adjusted operating expenses |

|

|

|

|

|

|

|

| General and administrative |

$ |

11,230 |

|

|

$ |

13,584 |

|

|

$ |

33,745 |

|

|

$ |

39,648 |

|

| Sales and marketing |

19,344 |

|

|

24,640 |

|

|

60,864 |

|

|

75,766 |

|

| Research and development |

25,519 |

|

|

25,522 |

|

|

78,025 |

|

|

76,689 |

|

| Cost of revenue (excluding depreciation and amortization) |

17,375 |

|

|

16,602 |

|

|

49,406 |

|

|

45,990 |

|

|

$ |

73,468 |

|

|

$ |

80,348 |

|

|

$ |

222,040 |

|

|

$ |

238,093 |

|

Phreesia, Inc.

Key Metrics

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

October 31, |

|

Nine months ended

October 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Average number of healthcare services clients ("AHSCs") |

4,520 |

|

|

4,237 |

|

|

4,466 |

|

|

4,157 |

|

| Total revenue per AHSC |

$ |

26,622 |

|

|

$ |

25,207 |

|

|

$ |

79,159 |

|

|

$ |

74,605 |

|

The definitions of our key metrics are presented below.

•AHSCs. We define AHSCs as the average number of clients that generate subscription and related services or payment processing fees revenue each month during the applicable period. In cases where we act as a subcontractor providing white-label services to our partner's clients, we treat the contractual relationship as a single healthcare services client. We believe growth in AHSCs is a key indicator of the performance of our business and depends, in part, on our ability to successfully develop and market our solutions to healthcare services organizations that are not yet clients. We believe growth in AHSCs provides useful information to investors as an important indicator of expected revenue growth. In addition, growth in AHSCs informs our management of the areas of our business that will require further investment to support expected future AHSC growth. For example, as AHSCs increase, we may need to add to our customer support team and invest to maintain effectiveness and performance of our solutions for our healthcare services clients and their patients.

•Total revenue per AHSC. We define total revenue per AHSC as total revenue in a given period divided by the number of AHSCs during that same period. Our healthcare services clients directly generate subscription and related services and payment processing fees revenue. Additionally, our relationships with healthcare services clients who subscribe to our solutions give us the opportunity to engage with life sciences companies, government entities, patient advocacy, public interest and not-for-profit and other organizations who deliver direct communication to patients through our solutions. As a result, we believe that our ability to

increase total revenue per AHSC provides useful information to investors as an indicator of the long-term value of our solutions.

Phreesia, Inc.

Additional Information

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

October 31, |

|

Nine months ended

October 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Patient payment volume (in millions) |

$ |

1,181 |

|

|

$ |

1,081 |

|

|

$ |

3,745 |

|

|

$ |

3,340 |

|

| Payment facilitator volume percentage |

85 |

% |

|

81 |

% |

|

83 |

% |

|

81 |

% |

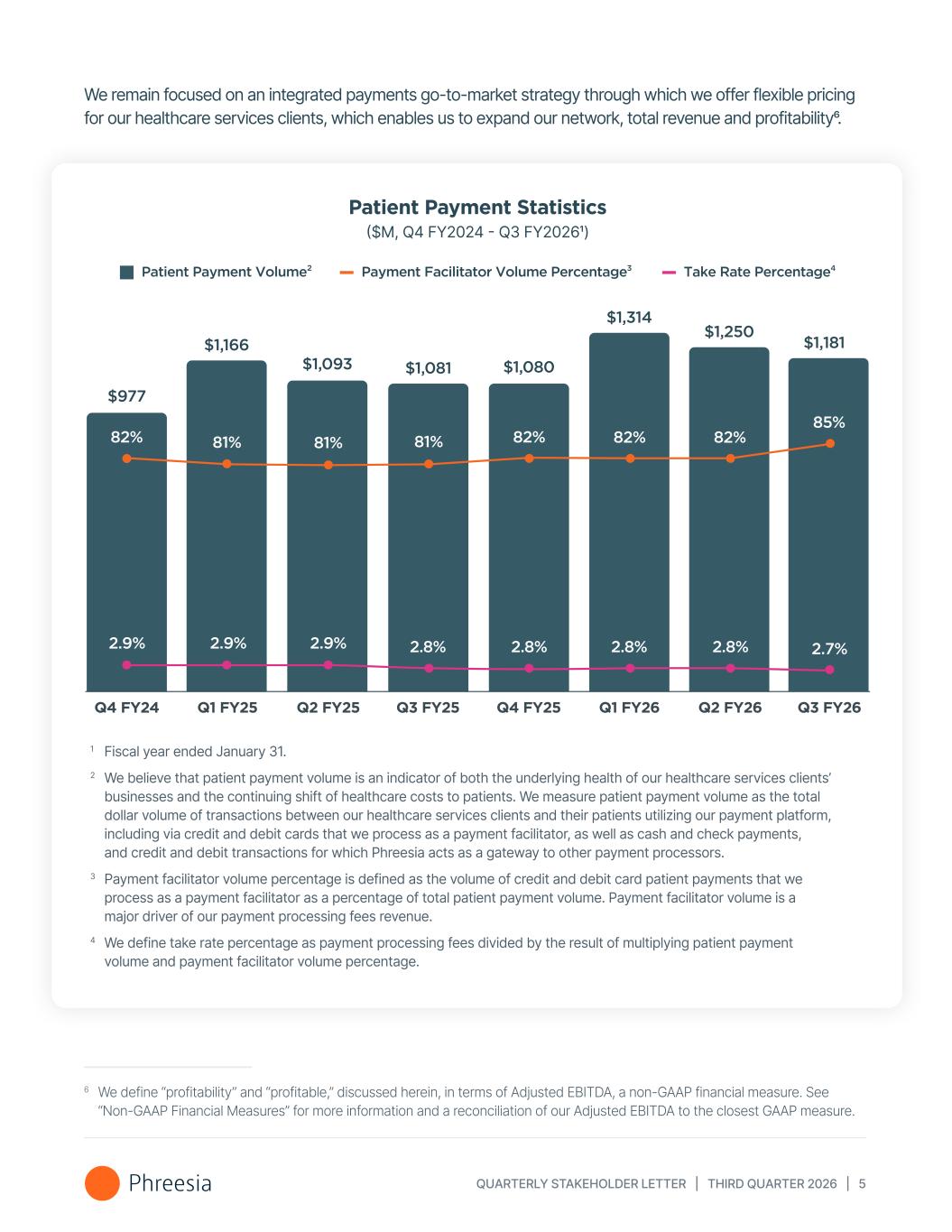

•Patient payment volume. We believe that patient payment volume is an indicator of both the underlying health of our healthcare services clients’ businesses and the continuing shift of healthcare costs to patients. We measure patient payment volume as the total dollar volume of transactions between our healthcare services clients and their patients utilizing our payment platform, including via credit and debit cards that we process as a payment facilitator as well as cash and check payments and credit and debit transactions for which we act as a gateway to other payment processors.

•Payment facilitator volume percentage. We define payment facilitator volume percentage as the volume of credit and debit card patient payments that we process as a payment facilitator as a percentage of total patient payment volume. Payment facilitator volume is a major driver of our payment processing fees revenue. Our payment facilitator volume percentage could decline slightly over time should we increase our penetration of enterprise customers that are less likely to use Phreesia as a payment facilitator.