0001412100false00014121002024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024 (August 8, 2024)

MAIDEN HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bermuda |

|

001-34042 |

|

98-0570192 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

94 Pitts Bay Road, Pembroke HM08, Bermuda

(Address of principal executive offices and zip code)

(441) 298-4900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

| |

☒ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

|

Trading symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Shares, par value $0.01 per share |

|

MHLD |

|

NASDAQ Capital Market |

|

|

|

|

|

|

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 8, 2024, the Company issued a press release announcing its results of operations for the three and six months ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained in this Item 2.02 and in the accompanying exhibit shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

On August 8, 2024, the Company posted the Maiden Holdings, Ltd. Investor Update Presentation, August 2024 via its investor relations website at https://www.maiden.bm/investor_relations, which presentation is included as Exhibit 99.3 to this Current Report on Form 8-K.

The information under Item 7.01 and the Investor Presentation included to this Form 8-K as Exhibit 99.3 shall be deemed to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company.

On August 8, 2024, the Company issued a press release announcing its results of operations for the three and six months ended June 30, 2024 via its investor relations website at https://www.maiden.bm/investor_relations, which press release is included as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

|

|

|

|

|

|

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibit

|

|

|

|

|

|

|

|

|

| Exhibit |

|

|

| No. |

|

Description |

| |

|

|

| 99.1 |

|

|

| 99.2 |

|

|

| 99.3 |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

| Date: |

August 8, 2024 |

MAIDEN HOLDINGS, LTD. |

| |

|

|

|

| |

|

By: |

/s/ Lawrence F. Metz |

| |

|

|

Lawrence F. Metz

Executive Vice Chairman and Group President |

| |

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

| Exhibit |

|

|

| No. |

|

Description |

| |

|

|

| 99.1 |

|

|

| 99.2 |

|

|

| 99.3 |

|

|

Exhibit 99.1

PRESS RELEASE

Maiden Holdings, Ltd. Announces

Second Quarter 2024 Financial Results

PEMBROKE, Bermuda, August 8, 2024 - Maiden Holdings, Ltd. (NASDAQ: MHLD) ("Maiden" or the "Company") today reported its results for the second quarter of 2024 which included the following key developments:

•Book value per common share(1) decreased 4.0% to $2.38 and adjusted book value per common share(2) decreased 0.6% to $3.17 per common share at June 30, 2024.

•Net loss attributable to Maiden common shareholders of $10.0 million or $0.10 per diluted common share for the second quarter of 2024.

•Adjusted non-GAAP operating loss of $7.7 million or $0.08 per diluted common share for the second quarter of 2024.

•Investment results decreased to $9.9 million for the second quarter of 2024 compared to $16.5 million in second quarter of 2023 including a 1.2% net return on the alternative asset portfolio in the second quarter of 2024.

•Deferred gain on the Company's Loss Portfolio Transfer and Adverse Development Cover Agreement ("LPT/ADC Agreement") with Cavello Bay Reinsurance Limited ("Cavello") increased by $2.3 million to $78.2 million at June 30, 2024, due to adverse prior year loss development ("PPD"), which is expected to be recoverable over time as future GAAP income with $76.8 million remaining in additional limit.

•Recoveries under the LPT/ADC Agreement (and associated GAAP income recognition) expected to begin in the fourth quarter of 2024.

•Deferred tax asset of $1.19 per common share still not yet recognized in book value per share, with approximately 45% of NOL carryforwards having no expiry date.

Patrick J. Haveron, Maiden’s Chief Executive Officer commented on the second quarter of 2024 financial results: "Despite the contributions of continuing positive investment results which moderated somewhat during the second quarter, and the stabilizing effects of our LPT/ADC Agreement, adjusted book value, which we believe represents Maiden's true economic value, fell slightly during the quarter."

Mr. Haveron added, "Our active pursuit to strategically build a more consistent base of revenue and profits through fee-based income and distribution channels in the insurance and reinsurance industry remains a high priority for Maiden. Leveraging our experience in insurance and reinsurance markets, these paths should further enable us to ultimately recognize and realize the significant deferred tax asset we have. As a result, we have not made any new commitments to alternative investment opportunities."

"While our GAAP income statement continues to be impacted by adverse loss development, it’s important to reinforce the point that much of this volatility is expected to be temporary as a significant portion is expected to be covered by our LPT/ADC Agreement with Cavello. Approximately $5.6 million or 83% and $10.6 million or 80% of the total reported adverse PPD for the three and six months ended June 30, 2024, respectively, is expected to be covered by the LPT/ADC Agreement and is expected to ultimately return over time to Maiden as future GAAP income, subject to certain thresholds in the LPT/ADC Agreement and the applicable GAAP accounting rules. Our expectation that we will meet the thresholds to begin recoveries under the LPT/ADC Agreement in the fourth quarter of 2024 remains unchanged."

"As the benefits of the LPT/ADC Agreement begin to be amortized though our GAAP income statement, it reinforces why adjusted book value, which includes the $78.2 million deferred gain presently on the balance sheet, is a key metric in evaluating Maiden’s value. It's also worth noting that under the provisions of the LPT/ADC Agreement, we still have an additional $76.8 million in available limit to absorb subject loss development should it occur in the future."

"As noted, Maiden's consolidated balance sheet at June 30, 2024 does not reflect $119.2 million or $1.19 per common share in net U.S. deferred tax assets which still maintains a full valuation allowance. Of the $338.2 million in net operating loss carryforwards that we hold, approximately $152.0 million or 44.9% of these loss carryforwards have no expiry date.

Despite the recent adverse reserve development which has delayed the timing related to ultimately recognizing this asset, we believe the factors that will enable us to ultimately recognize these tax assets in the future, including our current strategic initiatives, continues to accumulate, particularly with our asset portfolio producing more current income."

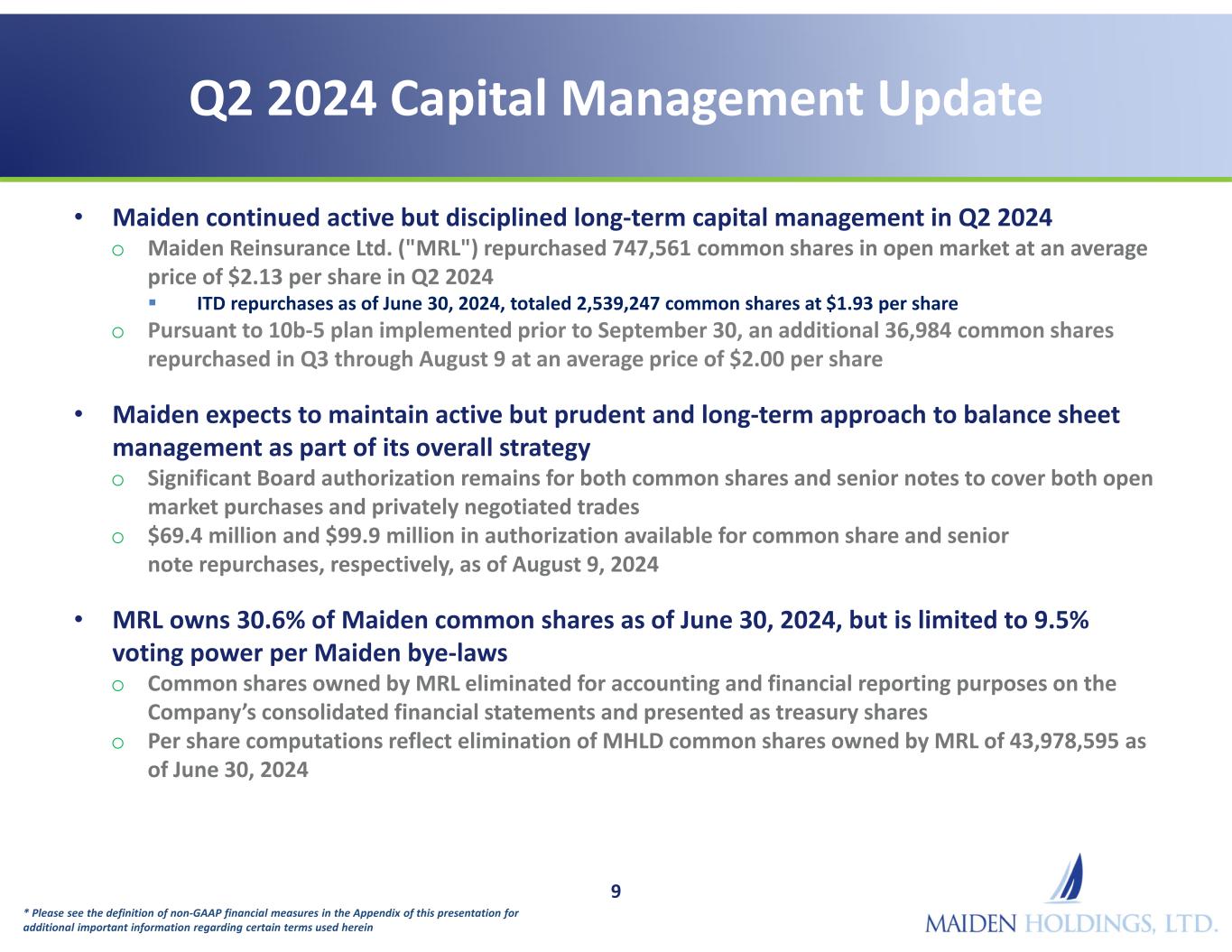

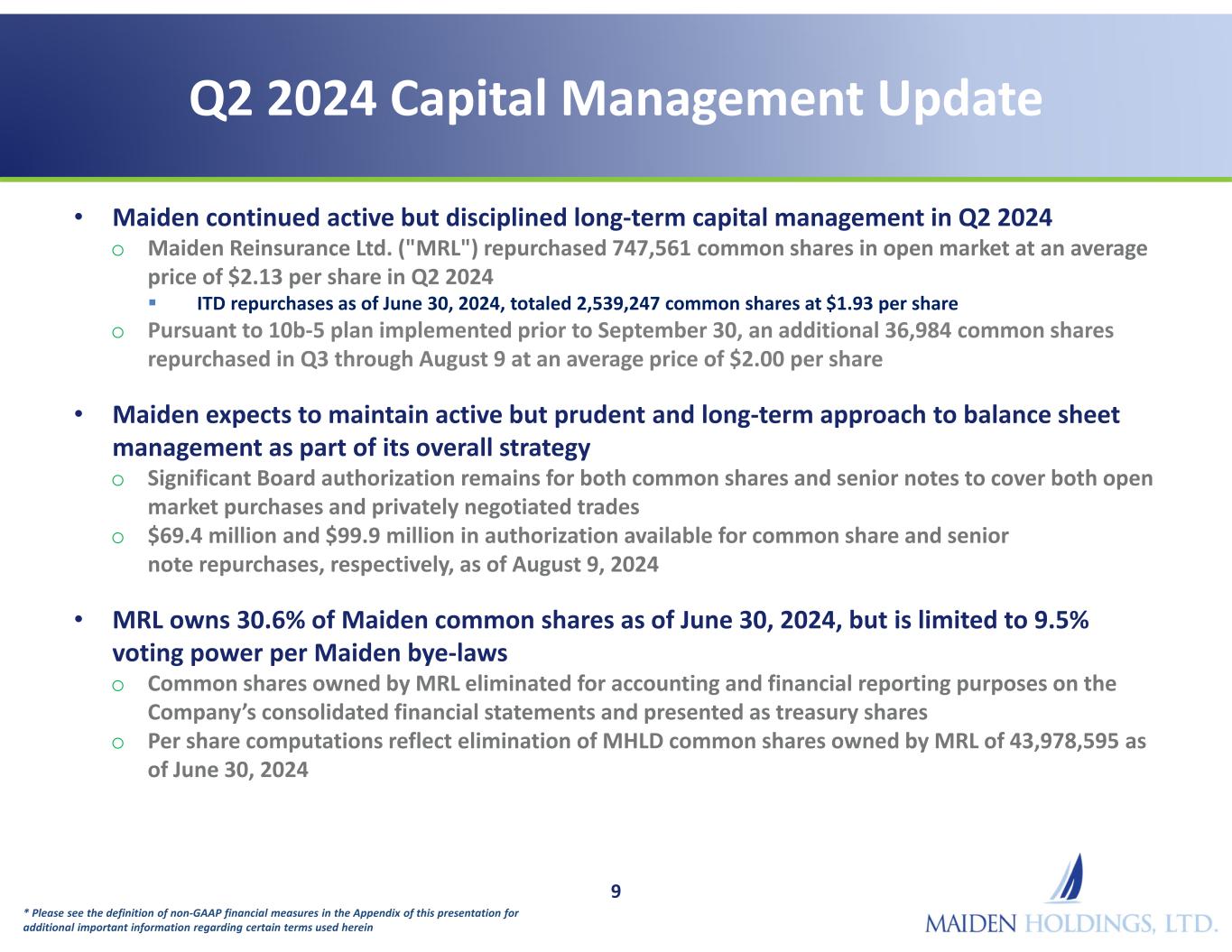

Mr. Haveron concluded, "Finally, during the second quarter via a 10b-5 trading plan implemented prior to June 30, 2024, we continued our long-term capital management strategy and repurchased 747,561 common shares at an average price per share of $2.13 under our share repurchase plan. We expect to continue a disciplined and prudent approach to share repurchases as part of this program, particularly in periods of share weakness relative to our book value."

Consolidated Results for the Quarter Ended June 30, 2024

Net loss for the three months ended June 30, 2024 was $10.0 million compared to a net loss of $2.9 million for the three months ended June 30, 2023 largely due to the following:

•higher underwriting loss(4) which was $9.8 million in the second quarter of 2024 compared to an underwriting loss of $9.3 million during the same respective period in 2023 which was influenced by:

•adverse PPD of $6.8 million in the second quarter of 2024 compared to adverse PPD of $4.5 million during the same period in 2023; and

•on a current accident year basis, underwriting loss of $3.0 million for the three months ended June 30, 2024 compared to an underwriting loss of $4.8 million for the same period in 2023.

•lower total income from investment activities of $9.9 million for the three months ended June 30, 2024 compared to $16.5 million during the same respective period in 2023 which was comprised of:

•net investment income of $7.0 million for the three months ended June 30, 2024 compared to $10.5 million for the same period in 2023;

•net realized and unrealized investment gains of $1.5 million for the three months ended June 30, 2024 compared to net realized and unrealized investment gains of $1.1 million for the same period in 2023; and

•interest in income of equity method investments of $1.5 million for the three months ended June 30, 2024 compared to income of $4.8 million for the same period in 2023.

•corporate general and administrative expenses increased to $4.8 million for the three months ended June 30, 2024 compared to $2.9 million for the same respective period in 2023; and partly offset by:

•nominal foreign exchange and other gains during the three months ended June 30, 2024, compared to foreign exchange and other losses of $2.6 million for the same respective period in 2023.

Net premiums written for the three months ended June 30, 2024 were $8.3 million compared to $6.9 million for the same period in 2023. Net premiums written in the Diversified Reinsurance segment increased by $1.7 million or 26.0% for the three months ended June 30, 2024 compared to the same period in 2023 due to growth in direct premiums for Credit Life programs written by wholly owned Swedish subsidiaries Maiden LF and Maiden GF.

On May 3, 2024 and June 20, 2024, Maiden LF and Maiden GF entered into Renewal Rights Agreements with certain subsidiaries of AmTrust ("AmTrust Renewal Rights Agreements"), which are expected to cover the majority of Maiden LF and Maiden GF's primary business written in Sweden, Norway, other Nordic countries, the United Kingdom and Ireland; and is part of a broader plan to divest of the International Insurance Services (“IIS”) business as a result of the Company's recently concluded strategic review of the IIS business platform. Maiden LF and Maiden GF are no longer writing new business and should begin to experience declines in premium written during the second half of 2024.

Net premiums earned increased by $1.0 million for the three months ended June 30, 2024 compared to the same period in 2023 due to higher earned premiums in our Diversified Reinsurance segment driven by growth in Credit Life programs written by Maiden LF and Maiden GF.

Net investment income decreased by $3.6 million or 33.9% for the three months ended June 30, 2024 compared to the same period in 2023 primarily due to lower interest income earned on our funds withheld receivable. This interest income decreased by $2.7 million in the second quarter of 2024 as loss reserves continued to be settled using the funds withheld receivable. Average aggregate fixed income assets decreased by 41.2% due to continued run-off of our reinsurance liabilities previously written on prospective risks primarily through the funds withheld receivable.

The decrease in net investment income from fixed income assets was partially offset by higher annualized average book yields from fixed income assets, which include available-for-sale ("AFS") securities, cash and restricted cash, funds withheld receivable, and loan to related party. The yield on fixed income assets increased to 4.8% for the three months ended June 30, 2024 compared to 4.2% for the same period in 2023. Our average fixed income assets are an average of the amounts disclosed in our quarterly U.S. GAAP consolidated financial statements.

Annualized yields on fixed income assets (including our related party loan) continue to rise partly due to 50.5% of our fixed income investments as of June 30, 2024 being invested in floating rate assets which enabled this component of our asset portfolio to respond to the current higher interest rate environment. The weighted average interest rate on our related party loan increased to 7.3% during the three months ended June 30, 2024, compared to 7.0% for the same period in 2023.

Net realized and unrealized investment gains for the three months ended June 30, 2024 were $1.5 million compared to net gains of $1.1 million for the same period in 2023. This included net unrealized investment gains on alternative investments of $1.5 million in the second quarter of 2024 compared to net realized and unrealized gains of $1.9 million in the second quarter of 2023.

Net loss and LAE increased by $2.4 million during the three months ended June 30, 2024 compared to the same period in 2023. Net loss and LAE for the second quarter of 2024 was impacted by net adverse PPD of $6.8 million compared to net adverse PPD of $4.5 million for the second quarter of 2023. The AmTrust Reinsurance segment had adverse PPD of $5.2 million in the second quarter of 2024 compared to adverse PPD of $3.2 million for the second quarter of 2023. The Diversified Reinsurance segment had adverse PPD of $1.6 million in the second quarter of 2024 compared to adverse PPD of $1.3 million for the second quarter of 2023.

Of the total adverse PPD experienced in the AmTrust Reinsurance segment for the three months ended June 30, 2024 and 2023, approximately $5.6 million and $10.7 million, respectively, is recoverable under the LPT/ADC Agreement and is expected to be recognized as future GAAP income over time as recoveries are received subject to provisions of the LPT/ADC Agreement and applicable GAAP accounting rules. This represents 83.1% and 238.7% of the Company's total adverse PPD for the three months ended June 30, 2024 and 2023, respectively.

Commission and other acquisition expenses were $4.8 million for the three months ended June 30, 2024 compared to $4.9 million for the same period in 2023.

Total general and administrative expenses increased by $1.0 million, or 15.2% for the three months ended June 30, 2024, compared to the same period in 2023 due to higher professional, audit and legal fees. Excluding expenses related to the Company’s IIS business, which is no longer writing new business and has entered into the AmTrust Renewal Rights Agreements, total general and administrative expenses increased 22.4% to $6.5 million for the three months ended June 30, 2024, compared to $5.3 million for the same period in 2023 due to higher professional, audit and legal fees.

Consolidated Results for the six months ended June 30, 2024

Net loss for the six months ended June 30, 2024 was $8.5 million compared to a net loss of $14.3 million for the six months ended June 30, 2023 largely due to the following:

•underwriting loss of $17.3 million in the six months ended June 30, 2024 compared to an underwriting loss of $17.5 million for the same period in 2023 driven by:

•adverse PPD of $13.4 million for six months ended June 30, 2024 compared to adverse PPD of $8.2 million for the same period in 2023 mostly incurred within our AmTrust Reinsurance segment for both periods; and

•on a current accident year basis, an underwriting loss of $3.9 million for the six months ended June 30, 2024 compared to an underwriting loss of $9.4 million for the same period in 2023.

•total income from investment activities was $26.9 million for the six months ended June 30, 2024 compared to $27.0 million for the same period in 2023 which was comprised of:

•net investment income decreased to $14.7 million for the six months ended June 30, 2024 compared to $20.1 million that was earned for the same period in 2023;

•net realized and unrealized investment gains of $10.2 million for the six months ended June 30, 2024 compared to net realized and unrealized investment gains of $2.2 million for the same period in 2023; and

•interest in income of equity method investments of $2.1 million for the six months ended June 30, 2024 compared to an interest in income of equity method investments of $4.8 million for the same period in 2023.

•corporate general and administrative expenses increased to $10.1 million for the six months ended June 30, 2024 compared to $9.9 million for the same period in 2023; and partly offset by:

•foreign exchange and other gains of $2.1 million for the six months ended June 30, 2024 compared to foreign exchange and other losses of $5.4 million earned for the same period in 2023.

Net premiums written for the six months ended June 30, 2024 were $16.7 million compared to $7.6 million for the same period in 2023. Net premiums written in our AmTrust Reinsurance segment were $(0.5) million for the six months ended June 30, 2024, compared to net premiums of $(5.8) million for the same period in 2023 which included negative gross and net premiums written of $6.1 million due to the cancellation of cases in a certain program in Specialty Risk and Extended Warranty. Net premiums written in our Diversified Reinsurance segment increased by $3.8 million or 28.1% for the six months ended June 30, 2024 compared to the same period in 2023 due to growth in direct premiums for Credit Life programs written by wholly owned Swedish subsidiaries Maiden LF and Maiden GF.

Net premiums earned increased by $4.4 million for the six months ended June 30, 2024 compared to the same period in 2023 largely due to higher earned premiums of $2.5 million or 17.3% in our Diversified Reinsurance segment driven by growth in Credit Life programs written by Maiden LF and Maiden GF. There were also higher earned premiums of $1.9 million or 35.4% in our AmTrust Reinsurance segment due to negative earned premium adjustments made in the first quarter of 2023.

Net investment income decreased by $5.4 million or 27.0% for the six months ended June 30, 2024 compared to the same period in 2023 largely due to lower interest income earned on our funds withheld balance which decreased by $5.2 million as claim payments continued to be settled through the funds held receivable. Average aggregate fixed income assets at June 30, 2024 decreased by 39.8% due to run-off of our reinsurance liabilities previously written on prospective risks primarily through the funds withheld receivable. Annualized average book yields increased to 4.7% for the six months ended June 30, 2024 compared to 4.0% for the same period in 2023 driven by floating rate investments which comprise 50.5% of our fixed income asset portfolio at June 30, 2024. This was largely due to the weighted average interest rate on our related party loan which increased to 7.3% during the six months ended June 30, 2024 compared to 6.7% for the same period in 2023.

Total net realized and unrealized investment gains increased by $8.1 million for the six months ended June 30, 2024 compared to the same period in 2023 primarily due to unrealized gains in the private equity asset class of $8.1 million. Net unrealized investment gains on alternative investments were $10.5 million for the six months ended June 30, 2024 compared to net realized and unrealized gains of $2.9 million for the same period in 2023.

Net loss and LAE increased by $4.2 million or 19.9% during the six months ended June 30, 2024 compared to the same period in 2023. Net loss and LAE was impacted by net adverse PPD of $13.4 million in 2024 compared to net adverse PPD of $8.2 million during 2023. Net adverse PPD of $12.5 million and $6.1 million was incurred in our AmTrust Reinsurance segment in the six months ended June 30, 2024 and 2023, respectively.

Of the total adverse development experienced in the AmTrust Reinsurance segment during the six months ended June 30, 2024 and 2023, approximately $10.6 million and $12.3 million, respectively, is recoverable under the LPT/ADC Agreement and is expected to be recognized as future GAAP income over time as recoveries are received under the provisions of the LPT/ADC Agreement and applicable GAAP accounting rules. This represents 79.7% and 150.9% of the Company's total net adverse PPD for the six months ended June 30, 2024 and 2023, respectively.

Commission and other acquisition expenses increased by $1.2 million or 13.4% for the six months ended June 30, 2024 compared to the same period in 2023 primarily due to lower earned premium adjustments in the AmTrust Reinsurance segment. The negative premium adjustments in the first quarter of 2023 resulted in lower commission costs and brokerage fees.

Total general and administrative expenses decreased by $1.0 million or 5.9% for the six months ended June 30, 2024 compared to the same period in 2023 primarily due to lower incentive compensation costs. Excluding expenses related to the Company’s IIS business, which is no longer writing new business and has entered into the AmTrust Renewal Rights Agreements, total general and administrative expenses decreased 4.7% to $13.3 million for the six months ended June 30, 2024, compared to $13.9 million for the same period in 2023 due to lower incentive compensation costs.

Operating Results for the three and six months ended June 30, 2024

In addition to other adjustments, management adjusts reported GAAP net loss and underwriting results by excluding incurred losses and LAE covered by the LPT/ADC Agreement with Cavello. Such losses are fully recoverable from Cavello, and are expected to be reported as future GAAP income over time as recoveries are received subject to both the provisions of the LPT/ADC Agreement and the applicable GAAP accounting rules, therefore adjusting for these losses shows the ultimate economic benefit of the LPT/ADC Agreement to Maiden. Management presently expects recoveries under the LPT/ADC Agreement to begin before the end of 2024.

Non-GAAP operating loss(5) was $10.6 million or $0.11 per diluted common share for the second quarter of 2024 compared to non-GAAP operating earnings of $4.5 million or $0.04 per diluted common share for the second quarter of 2023. Adjusted to include net realized and unrealized investment gains and an interest in income of equity method investments which are recurring parts of investment results with the Company’s underwriting activities in run-off, the non-GAAP operating loss was $7.7 million or $0.08 per diluted common share for the second quarter of 2024, compared to non-GAAP operating earnings of $10.4 million or $0.10 per diluted common share for the second quarter of 2023.

Non-GAAP operating loss was $15.6 million or $0.16 per diluted common share for the six months ended June 30, 2024, compared to a non-GAAP operating loss of $3.4 million or $0.03 per diluted common share for the same period in 2023. Adjusted to include net realized and unrealized investment gains and an interest in income of equity method investments which are recurring parts of investment results with the Company’s underwriting activities in run-off, the non-GAAP operating loss was $3.3 million or $0.03 per diluted common share for the six months ended June 30, 2024, compared to non-GAAP operating earnings of $3.5 million or $0.03 per diluted common share for the same period in 2023.

The unamortized deferred gain on retroactive reinsurance under the LPT/ADC Agreement with Cavello was $78.2 million as of June 30, 2024, an increase of $7.3 million compared to $70.9 million at December 31, 2023, driven by adverse prior year loss development of $10.1 million reported for policies under the AmTrust Quota Share for the six months ended June 30, 2024. These losses are recoverable under the LPT/ADC Agreement and are expected to be recognized as future GAAP income over time as recoveries are received under the provisions of the LPT/ADC Agreement and the applicable GAAP accounting rules.

Adjusted for prior year reserve development under the AmTrust Quota Share which is fully recoverable from Cavello under the LPT/ADC Agreement, the non-GAAP net loss and LAE(9) decreased by $2.3 million and $7.3 million for the three and six months ended June 30, 2024, respectively, compared to non-GAAP net loss and LAE that decreased by $10.7 million and $12.3 million for the three and six months ended June 30, 2023, respectively. The non-GAAP underwriting loss(9) was $7.5 million and $10.0 million for the three and six months ended June 30, 2024, respectively, compared to non-GAAP underwriting income of $1.5 million and loss of $5.2 million for the three and six months ended June 30, 2023, respectively.

The non-GAAP underwriting loss for the three and six months ended June 30, 2024 primarily included underwriting results in the AmTrust Reinsurance segment not covered by the LPT/ADC Agreement, specifically:

•run-off of the AmTrust Quota Share with losses occurring after December 31, 2018;

•adverse loss development of $0.1 million and $2.6 million for the European Hospital Liability Quota Share for the three and six months ended June 30, 2024, respectively;

•underwriting losses in the Diversified Reinsurance segment of $2.8 million and $3.0 million for the three and six months ended June 30, 2024, respectively; and

•please refer to the Non-GAAP Financial Measures tables in this earnings release for additional information on these non-GAAP financial measures and reconciliation of these measures to the appropriate GAAP measures.

Quarterly Report on Form 10-Q for the Period Ended June 30, 2024 and Other Financial Matters

The Company’s Quarterly Report on Form 10-Q for the six months ended June 30, 2024 was filed with the U.S. Securities and Exchange Commission on August 8, 2024. Additional information on the matters reported in this news release along with other required disclosures can be found in that filing.

Total assets were $1.4 billion at June 30, 2024 which decreased by $119.0 million compared to December 31, 2023 largely due to the continuing run-off of the Company's prior reinsurance liabilities. Shareholders' equity was $238.0 million at June 30, 2024 compared to $249.2 million at December 31, 2023.

Adjusted shareholders' equity(2) was $316.2 million at June 30, 2024 compared to $320.1 million at December 31, 2023, which includes an unamortized deferred gain under the LPT/ADC Agreement of $78.2 million at June 30, 2024 and $70.9 million at December 31, 2023.

The Company's wholly owned subsidiary, Maiden Holdings North America, Ltd., holds net operating loss carryforwards ("NOLs") which were $338.2 million as of June 30, 2024. Approximately $152.0 million or 44.9% of the Company's NOL carryforwards have no expiry date under the relevant U.S. tax law. These NOLs, in combination with additional net deferred tax assets primarily related to our insurance liabilities, result in a net U.S. deferred tax asset (before valuation allowance) of $119.2 million or $1.19 per common share as of June 30, 2024. The net deferred tax assets are not presently recognized on the Company’s balance sheet as a full valuation allowance is carried against them.

During the three and six months ended June 30, 2024, Maiden Reinsurance continued its long-term capital management strategy via its previously implemented Rule 10b-5 trading plan and repurchased 747,561 and 1,099,672 common shares, respectively, at an average price per share of $2.13 and $2.06, respectively. Subsequent to the three months ended June 30, 2024 and through the period ended August 7, 2024, the Company repurchased 36,984 additional common shares at an average price per share of $2.00 under the Company's authorized common share repurchase plan. The Company's remaining share repurchase authorization was $69.3 million at August 7, 2024 under the Company's $100.0 million share repurchase plan, which was approved by the Company's Board of Directors on February 21, 2017.

On May 3, 2023, the Company's Board of Directors approved the repurchase, including the repurchase by Maiden Reinsurance in accordance with its investment guidelines, of up to $100.0 million of the Company's Senior Notes from time to time at market prices in open market purchases or as may be privately negotiated. The Company's current remaining authorization is $99.9 million for Senior Notes repurchases.

As of June 30, 2024, the Company's indirect wholly owned subsidiary Genesis Legacy Solutions ("GLS") and its subsidiaries have insurance related liabilities of $23.9 million which consisted of total reserves of $17.6 million, an underwriting-related derivative liability of $4.0 million, and net deferred gains on retroactive reinsurance of $2.3 million. The Company presently does not anticipate any further contracts in the GLS legacy management segment, and no longer considers it part of its strategy to produce acceptable shareholder returns therefore no additional capital will be committed to new accounts in this unit. The Company is currently running off the small number of accounts GLS underwrote since its formation as previously reported in our Annual Report on Form 10-K for the year ended December 31, 2023.

The Company no longer presents certain non-GAAP measures such as combined ratio and its related components in its news release or quarterly reports, as it believes that as the run-off of its reinsurance portfolios progresses, such ratios are increasingly not meaningful and of less value to readers as they evaluate our financial results.

Quarterly Dividends

The Company's Board of Directors did not authorize any quarterly dividends on its common shares during the three and six months ended June 30, 2024 and 2023.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets.

(1)(2)(4)(5)(9) Please refer to the Non-GAAP Financial Measures tables for additional information on these non-GAAP financial measures and reconciliation of these measures to GAAP measures.

CONTACT:

FGS Global

Maiden@fgsglobal.com

Special Note about Forward Looking Statements

Certain statements in this press release, other than purely historical information, including estimates, projections, statements relating to the Company’s business plans, objectives and expected operating results and the assumptions upon which those statements are based are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include general statements both with respect to the Company and the insurance industry and generally are identified with the words "anticipate", "believe", "expect", "predict", "estimate", "intend", "plan", "project", "seek", "potential", "possible", "could", "might", "may", "should", "will", "would", "will be", "will continue", "will likely result" and similar expressions. In light of the risks and uncertainties inherent in all forward-looking statements, the inclusion of such statements in this press release should not be considered as a representation by the Company or any other person that the Company’s objectives or plans or other matters described in any forward-looking statement will be achieved. These statements are based on current plans, estimates, assumptions and expectations. Actual results may differ materially from those projected in such forward-looking statements and therefore, you should not place undue reliance on them. Important factors that could cause actual results to differ materially from those in such forward-looking statements are set forth in Item 1A "Risk Factors" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. COVID-19 triggered a period of increased volatility with respect to global economic conditions. During the year ended December 31, 2023, inflation became unusually high in many parts of the world, and central banks in the U.S. and other countries aggressively raised interest rates to counter inflation by slowing economic activity. Monetary policy tightening actions are ongoing at June 30, 2024, and their long-term impact on financial markets and the real economy is currently uncertain. Please also see additional risks described in "Part I, Item 1A, Risk Factors" of our Annual Report on Form 10-K for the year ended December 31, 2023.

The Company cautions that the list of important risk factors in its Annual Report on Form 10-K for the year ended December 31, 2023 is not intended to be and is not exhaustive. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law, and all subsequent written and oral forward-looking statements attributable to the Company or individuals acting on the Company’s behalf are expressly qualified in their entirety by this paragraph. If one or more risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from what was projected. Any forward-looking statements in this press release reflect the Company’s current view with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the Company’s operations, results of operations, growth, strategy and liquidity. Readers are cautioned not to place undue reliance on the forward-looking statements which speak only as of the dates of the documents in which such statements were made.

Any discrepancies between the amounts included in the results of operations discussion and the consolidated financial statement tables are due to rounding.

MAIDEN HOLDINGS, LTD.

CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

December 31, 2023 |

|

|

(Unaudited) |

|

(Audited) |

| ASSETS |

| Investments: |

|

|

|

|

Fixed maturities, available-for-sale, at fair value (amortized cost 2024 - $225,971; 2023 - $258,536) |

|

$ |

219,541 |

|

|

$ |

250,601 |

|

| Equity securities, at fair value |

|

44,388 |

|

|

45,299 |

|

| Equity method investments |

|

83,794 |

|

|

80,929 |

|

| Other investments |

|

208,595 |

|

|

182,811 |

|

| Total investments |

|

556,318 |

|

|

559,640 |

|

| Cash and cash equivalents |

|

24,807 |

|

|

35,412 |

|

| Restricted cash and cash equivalents |

|

12,515 |

|

|

7,266 |

|

| Accrued investment income |

|

3,741 |

|

|

4,532 |

|

| Reinsurance balances receivable, net |

|

10,014 |

|

|

12,450 |

|

| Reinsurance recoverable on unpaid losses |

|

570,036 |

|

|

564,331 |

|

| Loan to related party |

|

167,975 |

|

|

167,975 |

|

| Deferred commission and other acquisition expenses, net |

|

14,435 |

|

|

17,566 |

|

| Funds withheld receivable |

|

32,592 |

|

|

143,985 |

|

| Other assets |

|

7,517 |

|

|

5,777 |

|

|

|

|

|

|

| Total assets |

|

$ |

1,399,950 |

|

|

$ |

1,518,934 |

|

| LIABILITIES |

| Reserve for loss and loss adjustment expenses |

|

$ |

762,264 |

|

|

$ |

867,433 |

|

| Unearned premiums |

|

38,377 |

|

|

46,260 |

|

| Deferred gain on retroactive reinsurance |

|

80,506 |

|

|

73,240 |

|

|

|

|

|

|

| Accrued expenses and other liabilities |

|

26,082 |

|

|

28,244 |

|

| Senior notes - principal amount |

|

262,361 |

|

|

262,361 |

|

| Less: unamortized debt issuance costs |

|

7,686 |

|

|

7,764 |

|

| Senior notes, net |

|

254,675 |

|

|

254,597 |

|

|

|

|

|

|

| Total liabilities |

|

1,161,904 |

|

|

1,269,774 |

|

| Commitments and Contingencies |

|

|

|

|

| EQUITY |

|

|

|

|

|

| Common shares |

|

1,503 |

|

|

1,497 |

|

| Additional paid-in capital |

|

886,972 |

|

|

886,072 |

|

| Accumulated other comprehensive loss |

|

(32,485) |

|

|

(31,469) |

|

| Accumulated deficit |

|

(495,457) |

|

|

(486,945) |

|

| Treasury shares, at cost |

|

(122,487) |

|

|

(119,995) |

|

|

|

|

|

|

|

|

|

|

|

| Total Equity |

|

238,046 |

|

|

249,160 |

|

| Total Liabilities and Equity |

|

$ |

1,399,950 |

|

|

$ |

1,518,934 |

|

|

|

|

|

|

Book value per common share(1) |

|

$ |

2.38 |

|

|

$ |

2.48 |

|

|

|

|

|

|

| Common shares outstanding |

|

99,811,336 |

|

|

100,472,120 |

|

MAIDEN HOLDINGS, LTD.

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

|

| Gross premiums written |

|

$ |

8,449 |

|

|

$ |

6,875 |

|

|

$ |

16,772 |

|

|

$ |

7,711 |

|

| Net premiums written |

|

$ |

8,339 |

|

|

$ |

6,875 |

|

|

$ |

16,653 |

|

|

$ |

7,635 |

|

| Change in unearned premiums |

|

3,738 |

|

|

4,164 |

|

|

7,832 |

|

|

12,406 |

|

| Net premiums earned |

|

12,077 |

|

|

11,039 |

|

|

24,485 |

|

|

20,041 |

|

| Other insurance revenue, net |

|

— |

|

|

78 |

|

|

46 |

|

|

19 |

|

| Net investment income |

|

6,953 |

|

|

10,518 |

|

|

14,653 |

|

|

20,063 |

|

| Net realized and unrealized investment gains |

|

1,457 |

|

|

1,145 |

|

|

10,207 |

|

|

2,150 |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

20,487 |

|

|

22,780 |

|

|

49,391 |

|

|

42,273 |

|

| Expenses: |

|

|

|

|

|

|

|

|

| Net loss and loss adjustment expenses |

|

13,971 |

|

|

11,532 |

|

|

25,596 |

|

|

21,347 |

|

| Commission and other acquisition expenses |

|

4,813 |

|

|

4,945 |

|

|

10,406 |

|

|

9,180 |

|

| General and administrative expenses |

|

7,879 |

|

|

6,839 |

|

|

15,939 |

|

|

16,947 |

|

| Total expenses |

|

26,663 |

|

|

23,316 |

|

|

51,941 |

|

|

47,474 |

|

| Other expenses |

|

|

|

|

|

|

|

|

| Interest and amortization expenses |

|

4,816 |

|

|

4,773 |

|

|

9,631 |

|

|

8,597 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange and other (gains) losses |

|

— |

|

|

2,621 |

|

|

(2,053) |

|

|

5,437 |

|

| Total other expenses |

|

4,816 |

|

|

7,394 |

|

|

7,578 |

|

|

14,034 |

|

| Loss before income taxes |

|

(10,992) |

|

|

(7,930) |

|

|

(10,128) |

|

|

(19,235) |

|

| Less: income tax expense (benefit) |

|

442 |

|

|

(194) |

|

|

453 |

|

|

(222) |

|

| Interest in income of equity method investments |

|

1,463 |

|

|

4,803 |

|

|

2,069 |

|

|

4,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(9,971) |

|

|

$ |

(2,933) |

|

|

$ |

(8,512) |

|

|

$ |

(14,261) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per share attributable to common shareholders |

|

$ |

(0.10) |

|

|

$ |

(0.03) |

|

|

$ |

(0.08) |

|

|

$ |

(0.14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annualized return on average common equity |

|

(16.5) |

% |

|

(4.4) |

% |

|

(7.0) |

% |

|

(10.4) |

% |

| Weighted average number of common shares - basic and diluted |

|

100,159,973 |

|

101,754,218 |

|

100,308,549 |

|

101,653,848 |

|

|

|

|

|

|

|

|

|

MAIDEN HOLDINGS, LTD.

SUPPLEMENTAL FINANCIAL DATA - SEGMENT INFORMATION (Unaudited)

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Three Months Ended June 30, 2024 |

|

Diversified Reinsurance |

|

AmTrust Reinsurance |

|

|

|

Total |

Gross premiums written |

|

$ |

8,493 |

|

|

$ |

(44) |

|

|

|

|

$ |

8,449 |

|

Net premiums written |

|

$ |

8,383 |

|

|

$ |

(44) |

|

|

|

|

$ |

8,339 |

|

Net premiums earned |

|

$ |

8,229 |

|

|

$ |

3,848 |

|

|

|

|

$ |

12,077 |

|

|

|

|

|

|

|

|

|

|

Net loss and loss adjustment expenses ("loss and LAE") |

|

(5,354) |

|

|

(8,617) |

|

|

|

|

(13,971) |

|

Commission and other acquisition expenses |

|

(3,294) |

|

|

(1,519) |

|

|

|

|

(4,813) |

|

General and administrative expenses(3) |

|

(2,358) |

|

|

(700) |

|

|

|

|

(3,058) |

|

Underwriting loss (4) |

|

$ |

(2,777) |

|

|

$ |

(6,988) |

|

|

|

|

(9,765) |

|

Reconciliation to net loss |

|

|

|

|

|

|

|

|

Net investment income and net realized and unrealized investment gains |

|

|

|

|

|

|

|

8,410 |

|

|

|

|

|

|

|

|

|

|

Interest and amortization expenses |

|

|

|

|

|

|

|

(4,816) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other general and administrative expenses(3) |

|

|

|

|

|

|

|

(4,821) |

|

Income tax expense |

|

|

|

|

|

|

|

(442) |

|

Interest in income of equity method investments |

|

|

|

|

|

|

|

1,463 |

|

Net loss |

|

|

|

|

|

|

|

$ |

(9,971) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

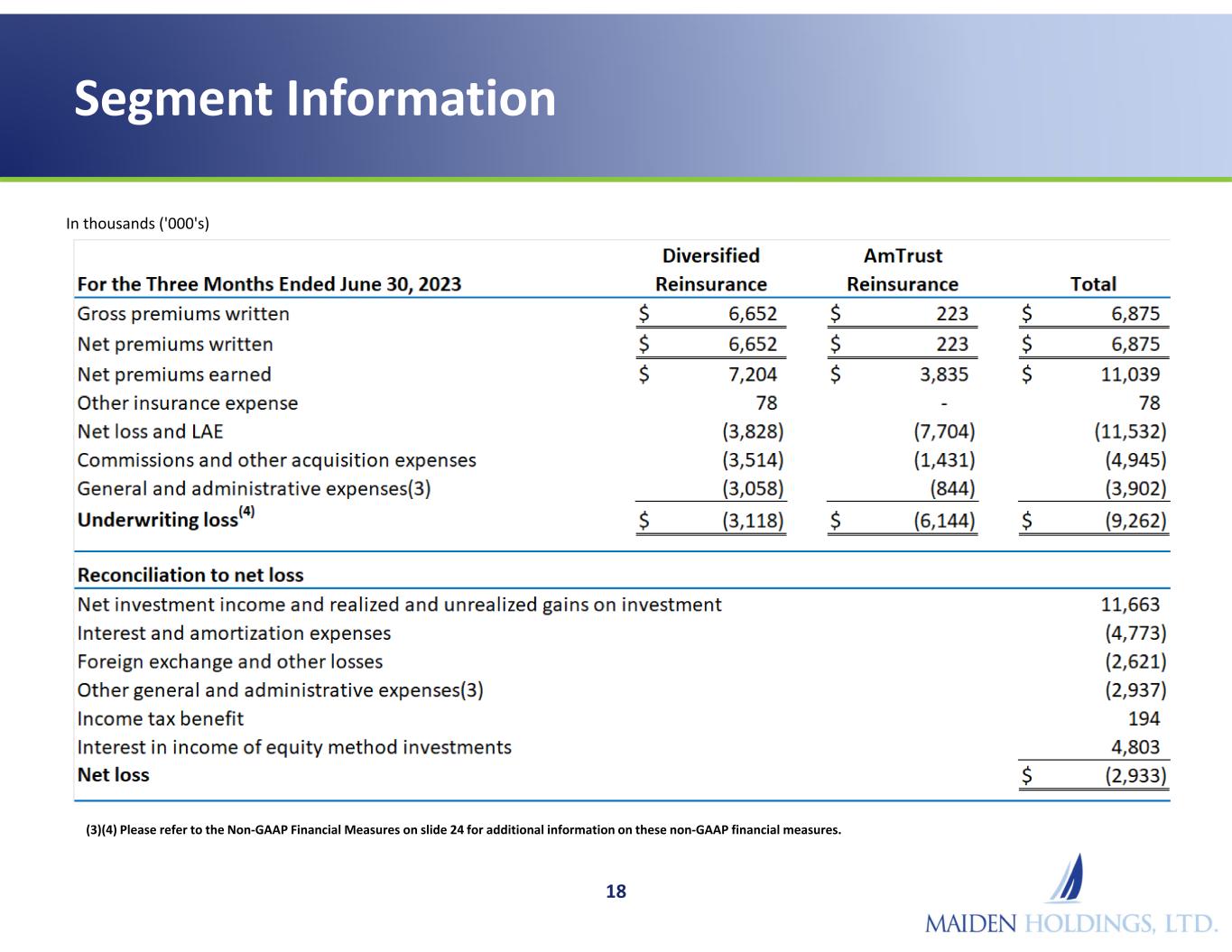

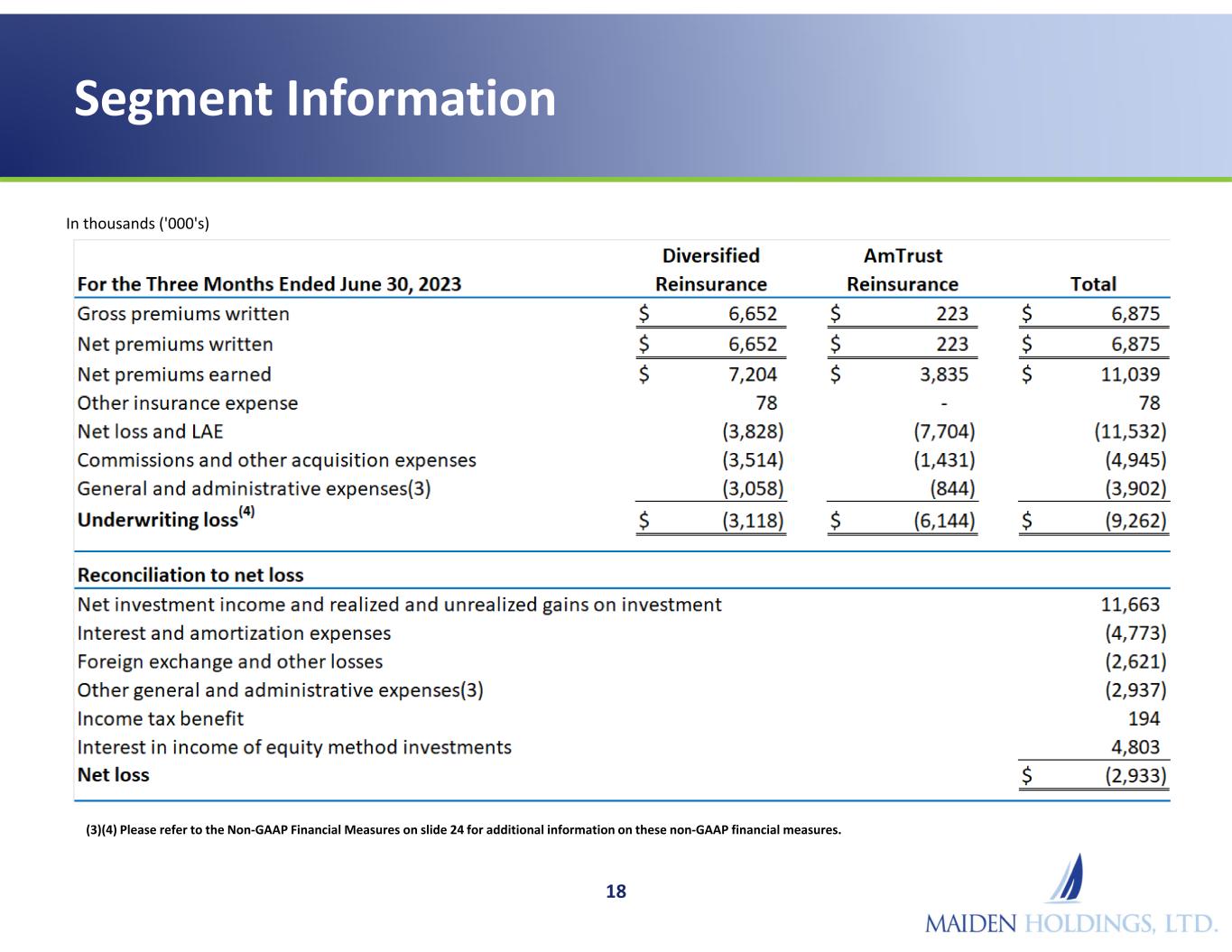

| For the Three Months Ended June 30, 2023 |

|

Diversified Reinsurance |

|

AmTrust Reinsurance |

|

|

|

Total |

Gross premiums written |

|

$ |

6,652 |

|

|

$ |

223 |

|

|

|

|

$ |

6,875 |

|

Net premiums written |

|

$ |

6,652 |

|

|

$ |

223 |

|

|

|

|

$ |

6,875 |

|

Net premiums earned |

|

$ |

7,204 |

|

|

$ |

3,835 |

|

|

|

|

$ |

11,039 |

|

| Other insurance revenue |

|

78 |

|

|

— |

|

|

|

|

78 |

|

Net loss and LAE |

|

(3,828) |

|

|

(7,704) |

|

|

|

|

(11,532) |

|

Commission and other acquisition expenses |

|

(3,514) |

|

|

(1,431) |

|

|

|

|

(4,945) |

|

General and administrative expenses(3) |

|

(3,058) |

|

|

(844) |

|

|

|

|

(3,902) |

|

Underwriting loss(4) |

|

$ |

(3,118) |

|

|

$ |

(6,144) |

|

|

|

|

(9,262) |

|

Reconciliation to net loss |

|

|

|

|

|

|

|

|

Net investment income and net realized and unrealized investment gains |

|

|

|

|

|

|

|

11,663 |

|

|

|

|

|

|

|

|

|

|

Interest and amortization expenses |

|

|

|

|

|

|

|

(4,773) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange and other losses, net |

|

|

|

|

|

|

|

(2,621) |

|

Other general and administrative expenses(3) |

|

|

|

|

|

|

|

(2,937) |

|

Income tax benefit |

|

|

|

|

|

|

|

194 |

|

Interest in income of equity method investments |

|

|

|

|

|

|

|

4,803 |

|

Net loss |

|

|

|

|

|

|

|

$ |

(2,933) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIDEN HOLDINGS, LTD.

SUPPLEMENTAL FINANCIAL DATA - SEGMENT INFORMATION (Unaudited)

(in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Six Months Ended June 30, 2024 |

|

Diversified Reinsurance |

|

AmTrust Reinsurance |

|

|

|

Total |

Gross premiums written |

|

$ |

17,321 |

|

|

$ |

(549) |

|

|

|

|

$ |

16,772 |

|

Net premiums written |

|

$ |

17,202 |

|

|

$ |

(549) |

|

|

|

|

$ |

16,653 |

|

Net premiums earned |

|

$ |

17,220 |

|

|

$ |

7,265 |

|

|

|

|

$ |

24,485 |

|

| Other insurance revenue |

|

46 |

|

|

— |

|

|

|

|

46 |

|

Net loss and LAE |

|

(8,278) |

|

|

(17,318) |

|

|

|

|

(25,596) |

|

Commission and other acquisition expenses |

|

(7,589) |

|

|

(2,817) |

|

|

|

|

(10,406) |

|

General and administrative expenses |

|

(4,448) |

|

|

(1,370) |

|

|

|

|

(5,818) |

|

Underwriting loss |

|

$ |

(3,049) |

|

|

$ |

(14,240) |

|

|

|

|

(17,289) |

|

Reconciliation to net loss |

|

|

|

|

|

|

|

|

Net investment income and net realized and unrealized investment gains |

|

|

|

|

|

|

|

24,860 |

|

|

|

|

|

|

|

|

|

|

Interest and amortization expenses |

|

|

|

|

|

|

|

(9,631) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange and other gains, net |

|

|

|

|

|

|

|

2,053 |

|

Other general and administrative expenses |

|

|

|

|

|

|

|

(10,121) |

|

Income tax expense |

|

|

|

|

|

|

|

(453) |

|

Interest in income from equity method investments |

|

|

|

|

|

|

|

2,069 |

|

Net loss |

|

|

|

|

|

|

|

$ |

(8,512) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Six Months Ended June 30, 2023 |

|

Diversified Reinsurance |

|

AmTrust Reinsurance |

|

|

|

Total |

Gross premiums written |

|

$ |

13,501 |

|

|

$ |

(5,790) |

|

|

|

|

$ |

7,711 |

|

Net premiums written |

|

$ |

13,425 |

|

|

$ |

(5,790) |

|

|

|

|

$ |

7,635 |

|

Net premiums earned |

|

$ |

14,675 |

|

|

$ |

5,366 |

|

|

|

|

$ |

20,041 |

|

Other insurance revenue |

|

19 |

|

|

— |

|

|

|

|

19 |

|

Net loss and LAE |

|

(6,984) |

|

|

(14,363) |

|

|

|

|

(21,347) |

|

Commission and other acquisition expenses |

|

(7,170) |

|

|

(2,010) |

|

|

|

|

(9,180) |

|

General and administrative expenses |

|

(5,647) |

|

|

(1,401) |

|

|

|

|

(7,048) |

|

Underwriting loss |

|

$ |

(5,107) |

|

|

$ |

(12,408) |

|

|

|

|

(17,515) |

|

Reconciliation to net loss |

|

|

|

|

|

|

|

|

Net investment income and net realized and unrealized investment gains |

|

|

|

|

|

|

|

22,213 |

|

|

|

|

|

|

|

|

|

|

Interest and amortization expenses |

|

|

|

|

|

|

|

(8,597) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange and other losses, net |

|

|

|

|

|

|

|

(5,437) |

|

Other general and administrative expenses |

|

|

|

|

|

|

|

(9,899) |

|

Income tax benefit |

|

|

|

|

|

|

|

222 |

|

Interest in income from equity method investments |

|

|

|

|

|

|

|

4,752 |

|

Net loss |

|

|

|

|

|

|

|

$ |

(14,261) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Non-GAAP operating (loss) earnings (5) |

|

$ |

(10,604) |

|

|

$ |

4,467 |

|

|

$ |

(15,554) |

|

|

$ |

(3,426) |

|

Non-GAAP basic and diluted operating (loss) earnings per common share (attributable) available to Maiden common shareholders(5) |

|

$ |

(0.11) |

|

|

$ |

0.04 |

|

|

$ |

(0.16) |

|

|

$ |

(0.03) |

|

|

|

|

|

|

|

|

|

|

Annualized non-GAAP operating return on average adjusted common equity(6) |

|

(13.3) |

% |

|

5.6 |

% |

|

(9.8) |

% |

|

(2.1) |

% |

Reconciliation of net loss to non-GAAP operating (loss) earnings: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(9,971) |

|

|

$ |

(2,933) |

|

|

$ |

(8,512) |

|

|

$ |

(14,261) |

|

| Add (subtract): |

|

|

|

|

|

|

|

|

| Net realized and unrealized investment gains |

|

(1,457) |

|

|

(1,145) |

|

|

(10,207) |

|

|

(2,150) |

|

|

|

|

|

|

|

|

|

|

| Foreign exchange and other (gains) losses |

|

— |

|

|

2,621 |

|

|

(2,053) |

|

|

5,437 |

|

| Interest in income of equity method investments |

|

(1,463) |

|

|

(4,803) |

|

|

(2,069) |

|

|

(4,752) |

|

|

|

|

|

|

|

|

|

|

| Change in deferred gain on retroactive reinsurance under the LPT/ADC Agreement |

|

2,287 |

|

|

10,727 |

|

|

7,287 |

|

|

12,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP operating (loss) earnings (5) |

|

$ |

(10,604) |

|

|

$ |

4,467 |

|

|

$ |

(15,554) |

|

|

$ |

(3,426) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares - basic and diluted |

|

100,159,973 |

|

|

101,754,218 |

|

|

100,308,549 |

|

|

101,653,848 |

|

|

|

|

|

|

|

|

|

|

Reconciliation of diluted loss per share attributable to Maiden common shareholders to non-GAAP diluted operating (loss) earnings per share (attributable) available to Maiden common shareholders: |

|

|

|

|

| Diluted loss per share attributable to common shareholders |

|

$ |

(0.10) |

|

|

$ |

(0.03) |

|

|

$ |

(0.08) |

|

|

$ |

(0.14) |

|

| Add (subtract): |

|

|

|

|

|

|

|

|

| Net realized and unrealized investment gains |

|

(0.01) |

|

|

(0.01) |

|

|

(0.11) |

|

|

(0.02) |

|

|

|

|

|

|

|

|

|

|

| Foreign exchange and other (gains) losses |

|

— |

|

|

0.02 |

|

|

(0.02) |

|

|

0.05 |

|

| Interest in income of equity method investments |

|

(0.02) |

|

|

(0.05) |

|

|

(0.02) |

|

|

(0.04) |

|

|

|

|

|

|

|

|

|

|

| Change in deferred gain on retroactive reinsurance under the LPT/ADC Agreement |

|

0.02 |

|

|

0.11 |

|

|

0.07 |

|

|

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted operating (loss) earnings per share (attributable) available to common shareholders |

|

$ |

(0.11) |

|

|

$ |

0.04 |

|

|

$ |

(0.16) |

|

|

$ |

(0.03) |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Underwriting Results and Non-GAAP Net Loss and LAE |

|

|

|

|

|

|

| Gross premiums written |

|

$ |

8,449 |

|

|

$ |

6,875 |

|

|

$ |

16,772 |

|

|

$ |

7,711 |

|

| Net premiums written |

|

$ |

8,339 |

|

|

$ |

6,875 |

|

|

$ |

16,653 |

|

|

$ |

7,635 |

|

| Net premiums earned |

|

$ |

12,077 |

|

|

$ |

11,039 |

|

|

$ |

24,485 |

|

|

$ |

20,041 |

|

| Other insurance revenue, net |

|

— |

|

|

78 |

|

|

46 |

|

|

19 |

|

Non-GAAP net loss and LAE(9) |

|

(11,684) |

|

|

(805) |

|

|

(18,309) |

|

|

(9,047) |

|

| Commission and other acquisition expenses |

|

(4,813) |

|

|

(4,945) |

|

|

(10,406) |

|

|

(9,180) |

|

General and administrative expenses(3) |

|

(3,058) |

|

|

(3,902) |

|

|

(5,818) |

|

|

(7,048) |

|

Non-GAAP underwriting loss(9) |

|

$ |

(7,478) |

|

|

$ |

1,465 |

|

|

$ |

(10,002) |

|

|

$ |

(5,215) |

|

|

|

|

|

|

|

|

|

|

| Net loss and LAE |

|

$ |

13,971 |

|

|

$ |

11,532 |

|

|

$ |

25,596 |

|

|

$ |

21,347 |

|

Less: adverse prior year loss development covered under the LPT/ADC Agreement |

|

2,287 |

|

|

10,727 |

|

|

7,287 |

|

|

12,300 |

|

Non-GAAP net loss and LAE(9) |

|

$ |

11,684 |

|

|

$ |

805 |

|

|

$ |

18,309 |

|

|

$ |

9,047 |

|

MAIDEN HOLDINGS, LTD.

NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

| Investable assets: |

|

|

|

| Total investments |

$ |

556,318 |

|

|

$ |

559,640 |

|

| Cash and cash equivalents |

24,807 |

|

|

35,412 |

|

| Restricted cash and cash equivalents |

12,515 |

|

|

7,266 |

|

| Loan to related party |

167,975 |

|

|

167,975 |

|

| Funds withheld receivable |

32,592 |

|

|

143,985 |

|

Total investable assets(7) |

$ |

794,207 |

|

|

$ |

914,278 |

|

|

|

|

|

| Capital: |

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

$ |

238,046 |

|

|

$ |

249,160 |

|

2016 Senior Notes |

110,000 |

|

|

110,000 |

|

2013 Senior Notes |

152,361 |

|

|

152,361 |

|

Total capital resources(8) |

$ |

500,407 |

|

|

$ |

511,521 |

|

|

|

|

|

Reconciliation of total shareholders' equity to adjusted shareholders' equity: |

|

|

|

Total Shareholders’ Equity |

$ |

238,046 |

|

|

$ |

249,160 |

|

|

|

|

|

| Unamortized deferred gain on LPT/ADC Agreement |

78,203 |

|

|

70,916 |

|

Adjusted shareholders' equity(2) |

$ |

316,249 |

|

|

$ |

320,076 |

|

|

|

|

|

Reconciliation of book value per common share to adjusted book value per common share: |

|

|

|

Book value per common share |

$ |

2.38 |

|

|

$ |

2.48 |

|

|

|

|

|

| Unamortized deferred gain on LPT/ADC Agreement |

0.79 |

|

|

0.71 |

|

Adjusted book value per common share(2) |

$ |

3.17 |

|

|

$ |

3.19 |

|

|

|

|

|

|

|

|

|

|

| (1) Book value per common share is calculated using shareholders’ equity divided by the number of common shares outstanding. Management uses growth in this metric as a prime measure of the value we are generating for our common shareholders, because management believes that growth in this metric ultimately results in growth in the Company’s common share price. This metric is impacted by the Company’s net income and external factors, such as interest rates, which can drive changes in unrealized gains or losses on our investment portfolio, as well as share repurchases. |

| |

|

|

| (2) Adjusted Total Shareholders' Equity and Adjusted Book Value per Common Share: Management has adjusted GAAP shareholders' equity by adding the unamortized deferred gain on retroactive reinsurance arising from the LPT/ADC Agreement. As a result, by virtue of this adjustment, management has also computed the Adjusted Book Value per Common Share. The deferred gain on retroactive reinsurance represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement. We believe reflecting this economic benefit is helpful to understand future trends in our operations, which will improve the Company's shareholders' equity over the settlement period. |

|

|

|

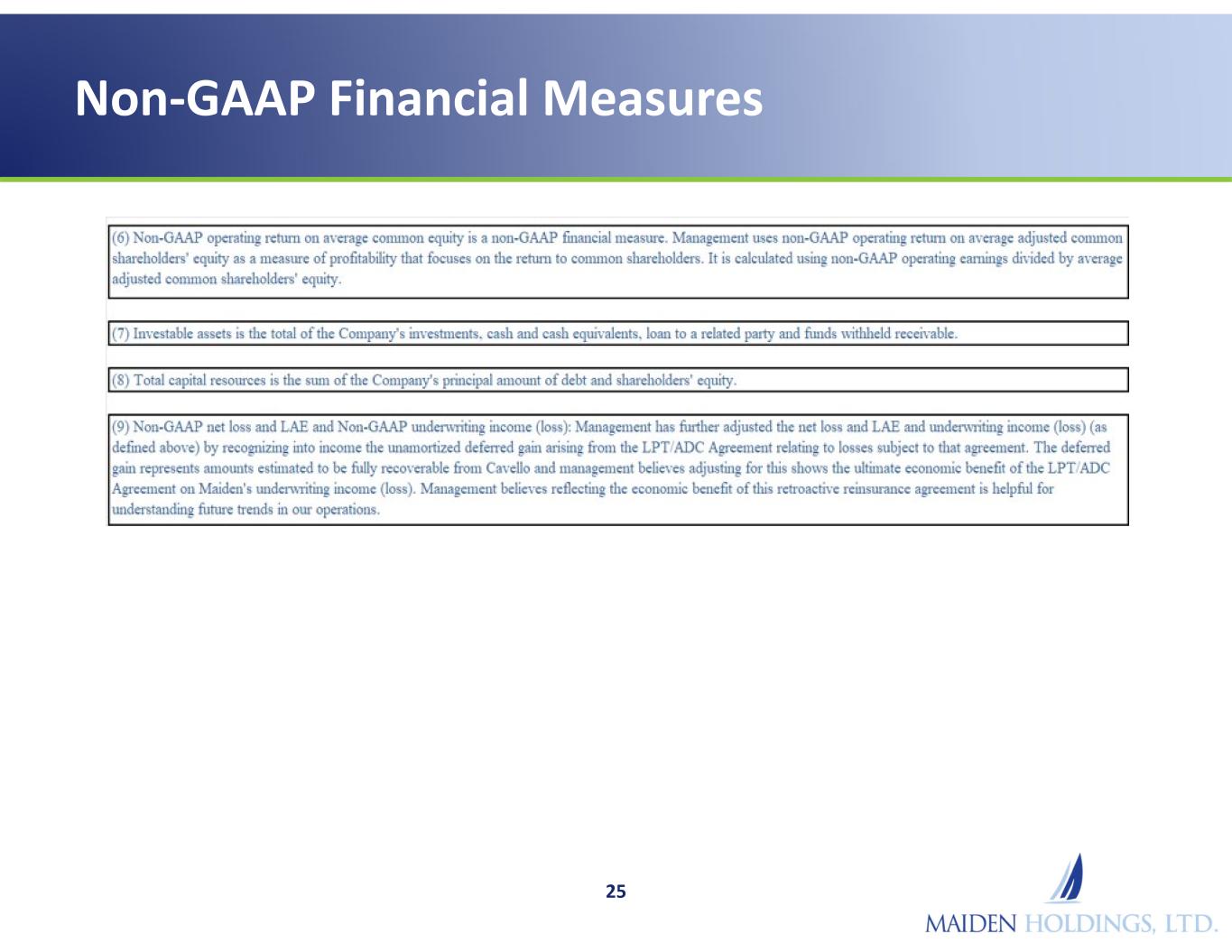

| (3) Underwriting related general and administrative expenses is a non-GAAP measure and includes expenses which are segregated for analytical purposes as a component of underwriting income (loss). |

|

|

|

| (4) Underwriting income or loss is a non-GAAP measure and is calculated as net premiums earned plus other insurance revenue less net loss and LAE, commission and other acquisition expenses and general and administrative expenses directly related to underwriting activities. For purposes of these non-GAAP operating measures, the fee-generating business, which is included in our Diversified Reinsurance segment, is considered part of the underwriting operations of the Company. Management believes that this measure is important in evaluating the underwriting performance of the Company and its segments. This measure is also a useful tool to measure the profitability of the Company separately from the investment results and is also a widely used performance indicator in the insurance industry. |

|

|

|

| (5) Non-GAAP operating earnings (loss) and non-GAAP basic and diluted operating earnings (loss) per common share are non-GAAP financial measure defined by the Company as net income (loss) excluding realized investment gains and losses, foreign exchange and other gains and losses, interest in income (loss) of equity method investment, and (favorable) adverse prior year loss development subject to LPT/ADC Agreement and should not be considered as an alternative to net income (loss). The Company's management believes that the use of non-GAAP operating earnings (loss) and non-GAAP diluted operating earnings (loss) per common share enables investors and other users of the Company’s financial information to analyze its performance in a manner similar to how management analyzes performance. Management also believes that these measures generally follow industry practice therefore allowing the users of financial information to compare the Company’s performance with its industry peer group, and that the equity analysts and certain rating agencies which follow the Company, and the insurance industry as a whole, generally exclude these items from their analyses for the same reasons. Non-GAAP operating earnings should not be viewed as a substitute for U.S. GAAP net income. |

|

|

|

| (6) Non-GAAP operating return on average adjusted shareholders' equity is a non-GAAP financial measure. Management uses non-GAAP operating return on average adjusted shareholders' equity as a measure of profitability that focuses on the return to common shareholders. It is calculated using non-GAAP operating earnings divided by average adjusted shareholders' equity adjusted for the deferred gain on LPT/ADC Agreement. |

|

|

|

| (7) Investable assets are the total of the Company's investments, cash and cash equivalents, loan to a related party and funds withheld receivable. |

|

|

|

| (8) Total capital resources are the sum of the Company's principal amount of debt and shareholders' equity. |

|

|

|

| (9) Non-GAAP net loss and LAE and Non-GAAP underwriting income (loss): Management has further adjusted the net loss and LAE and underwriting income (loss) (as defined above) by recognizing into income the (favorable) adverse prior year loss development subject to LPT/ADC Agreement relating to losses subject to that agreement. The deferred gain represents amounts estimated to be fully recoverable from Cavello and management believes adjusting for this shows the ultimate economic benefit of the LPT/ADC Agreement on Maiden's underwriting income (loss). Management believes reflecting the economic benefit of this retroactive reinsurance agreement is helpful for understanding future trends in our operations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.2

PRESS RELEASE

Maiden Holdings, Ltd. Releases

Second Quarter 2024 Financial Results

PEMBROKE, Bermuda, August 8, 2024 (BUSINESS WIRE) -- Maiden Holdings, Ltd. (NASDAQ:MHLD) ("Maiden") has released its second quarter 2024 financial results via its investor relations website. Concurrent with releasing its results, Maiden also published an investor update presentation. Both documents are posted at https://www.maiden.bm/investor_relations.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed in 2007. Maiden creates shareholder value by actively managing and allocating our assets and capital, including through ownership and management of businesses and assets mostly in the insurance and related financial services industries where we can leverage our deep knowledge of those markets.

CONTACT:

FGS Global

Maiden@fgsglobal.com

EX-99.3