UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ |

Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

☒ |

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

or

☐ |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to __________

or

☐ |

Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report

Commission file number 001-36206

BIT Mining Limited

(Exact Name of Registrant as Specified in Its Charter)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

428 South Seiberling Street,

Akron, Ohio 44306,

United States of America

(Address of Principal Executive Offices)

Qiang Yuan, Chief Financial Officer

+1 (346) 204-8537

428 South Seiberling Street,

Akron, Ohio 44306,

United States of America

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Securities and Exchange Act of 1934:

|

|

|||

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Class A ordinary shares, par value US$0.00005 per share* |

|

BTCM |

|

New York Stock Exchange* |

* |

Not for trading, but only in connection with the listing of the American depositary shares (“ADSs”) on the New York Stock Exchange. Each ADS represents the right to receive hundred (100) Class A ordinary shares. The ADSs are registered under the Securities Act of 1933, as amended, pursuant to a registration statement on Form F-6. Accordingly, the ADSs are exempt from registration under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12a-8 thereunder. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,595,399,890 Class A ordinary shares, 65,000 Class A preference shares and 99 Class B ordinary shares, par value US$0.00005 per share, as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Emerging Growth Company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

Table Of Contents

|

|

PAGE |

||

|

3 |

|||

|

|

3 |

||

|

|

3 |

||

|

|

3 |

||

|

|

40 |

||

|

|

51 |

||

|

|

65 |

||

|

|

72 |

||

|

|

73 |

||

|

|

73 |

||

|

|

74 |

||

|

|

80 |

||

|

|

80 |

||

|

82 |

|||

|

|

82 |

||

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

|

82 |

|

|

|

82 |

||

|

|

83 |

||

|

|

83 |

||

|

|

84 |

||

|

|

84 |

||

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

|

84 |

|

|

|

84 |

||

|

|

84 |

||

|

|

84 |

||

|

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

|

84 |

|

|

|

85 |

||

|

|

85 |

||

|

86 |

|||

|

|

86 |

||

|

|

86 |

||

|

|

87 |

||

i

CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT ON FORM 20-F

Unless otherwise indicated, references in this annual report on Form 20-F to:

| ● | “ADRs” are to the American depositary receipts, which, if issued, evidence our ADSs; |

| ● | “ADSs” are to our American depositary shares, each of which represents hundred (100) Class A ordinary shares; |

| ● | “China” and the “PRC” are to the People’s Republic of China; |

| ● | “consolidated affiliated entities” refers to the former consolidated affiliated entities of our Company, namely, |

| ● | Loto Interactive Limited, or Loto Interactive, which was disposed of by the Company on July 25, 2022, and |

| ● | other intermediate holding companies. |

| ● | “ordinary shares” are to our ordinary shares, par value US$0.00005 per share; |

| ● | “RMB” and “Renminbi” are to the legal currency of China; |

| ● | “US$” and “U.S. dollars” are to the legal currency of the United States; |

| ● | “We,” “us,” “our company,” “our,” “the Group” or “the Company” are to BIT Mining Limited, its predecessor entities and its consolidated affiliated subsidiaries. |

Our business is primarily conducted in the United States, and all of our revenues have been denominated in U.S. dollars.

Our ADSs, each representing one hundred (100) of our Class A ordinary shares, are listed on the NYSE under the Company’s English name “BIT Mining Limited,” and its ticker symbol “BTCM.” Before April 20, 2021, our ADSs were listed on the NYSE under the Company’s former English name “500.com Limited” and its former ticker symbol “WBAI.”

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that relate to future events, including our future operating results and conditions, our prospects and our future financial performance and condition, all of which are largely based on our current expectations and projections. The forward-looking statements are contained principally in the sections entitled “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “may,” “will,” “expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate,” “is/are likely to” or other and similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | our expectations regarding demand for and market acceptance of our services; |

| ● | our plans to enhance user experience, infrastructure and service offerings; |

| ● | competition in our industry; and |

| ● | relevant government policies and regulations relating to our industry. |

The forward-looking statements relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

2

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3.KEY INFORMATION

Holding Company Structure

BIT Mining Limited, our ultimate Cayman Islands holding company, does not have substantive operations other than (1) holding certain of our digital assets in connection with our cryptocurrency mining business and (2) indirectly holding the equity interest in our subsidiaries in Hong Kong, British Virgin Islands, Canada, Malta, Cyprus, Curacao, the United States, Ethiopia and China. As of the date of this annual report, (i) we do not have revenue-generating operations in China, and our remaining operations in China primarily involve the provision of administrative support to our cryptocurrency mining business as well as the provision of internal information technology services to our operating entities outside China; and (ii) we do not maintain any variable interest entity structure in China. Adverse actions by the Chinese government may potentially force us to cease our administrative support and internal information technology services from China to your international cryptocurrency mining business. We used to develop Ethereum Classic mining operation in Hong Kong, but have ceased such operation as we are focusing on growing our cryptocurrency mining operations in the United States. In 2022, 2023 and 2024, our operations in Hong Kong generated approximately 5.3%, nil and nil, of our total revenue from continuing operations and discontinued operations for such year. As used in this annual report, “we,” “us,” “our company” or “our” refers to BIT Mining Limited, a Cayman Islands exempted company and its subsidiaries. Investors in our ADSs are purchasing equity interest in a Cayman Islands holding company.

3

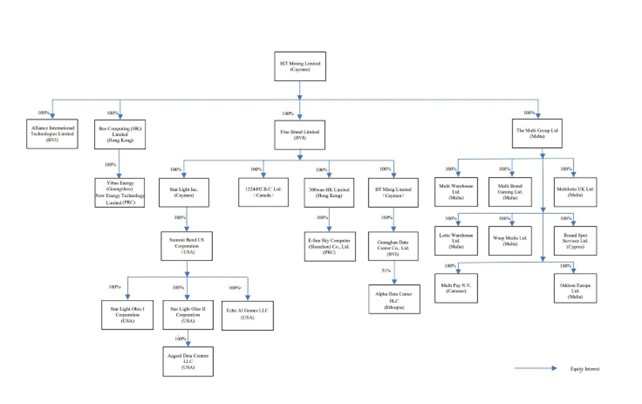

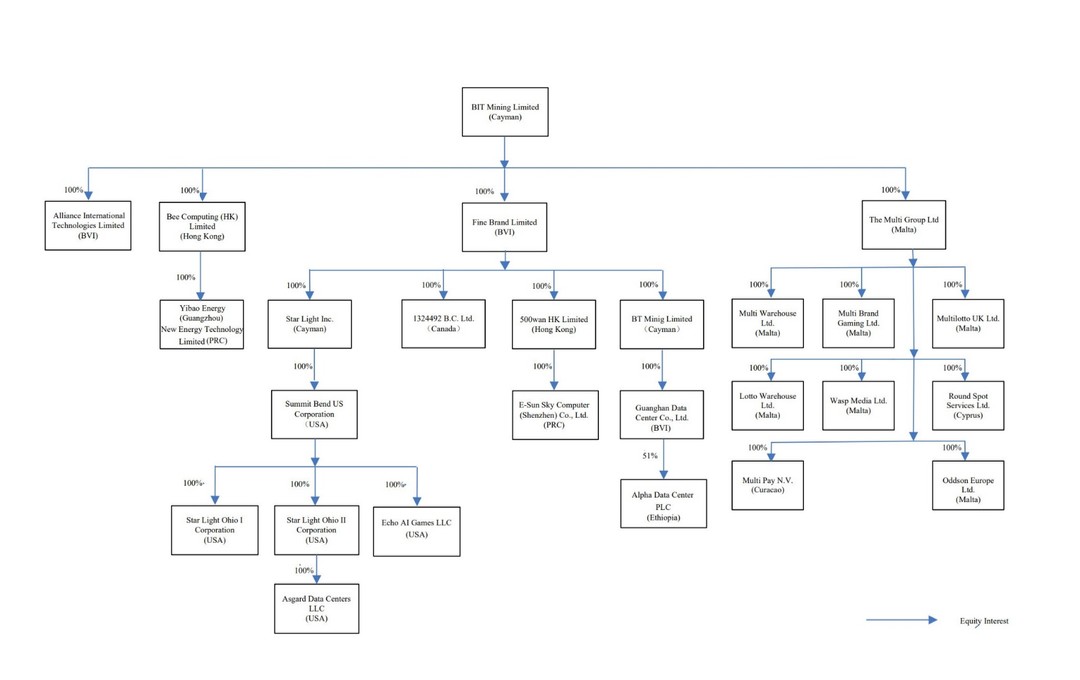

The following diagram illustrates our company’s organizational structure, and the place of formation, ownership interest and affiliation of each of our principal subsidiaries and affiliated entities as of the date of this annual report. BIT Mining Limited is the holding company.

We face various legal and operational risks and regulatory uncertainties associated with having certain non revenue-generating subsidiaries, certain administrative personnel, and certain members of the board of directors located in China. If the PRC government restricts or otherwise regulates our remaining operations in China, we may have to scale down or cease such operations. We have already ceased our mining operations in Hong Kong, and moved our mining operation to the U.S. The PRC government has significant authority to exert influence on the ability of a company located in China to conduct its business, accept foreign investments or list on U.S. or other foreign exchanges. For example, we face risks and uncertainties associated with regulatory approvals of offshore offerings and oversight on cybersecurity and data privacy. Such risks and uncertainties could result in a material change in our operations and/or the value of the ADSs or could significantly limit or completely hinder our ability to offer ADSs and/or other securities to investors and cause the value of such securities to significantly decline or be worthless. The PRC government also has significant discretion over our business operations in China, and may intervene with or influence our China-based operations as it deems appropriate to further regulatory, political and societal goals. Furthermore, the PRC government has indicated an intent to exert more oversight and control over overseas securities offerings and foreign investments in China-based companies. These regulatory risks and uncertainties could become applicable to our Hong Kong operations if regulatory authorities in Hong Kong adopt similar rules and/or regulatory actions. Any adverse action, once taken by the PRC and/or Hong Kong government, could significantly limit or completely hinder our ability to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless.

Cash Flows through our Organization

Cash and assets can be transferred between BIT Mining Limited, our holding company incorporated in the Cayman Islands, and our subsidiaries in other countries through intercompany fund advances and capital contributions.

4

As of the date of this annual report, a substantial majority of our assets and cash are located outside of China. We are not aware of any regulatory restrictions of transferring funds between BIT Mining Limited and its subsidiaries in Hong Kong, British Virgin Islands, Canada, Malta, Cyprus, Curacao, the United States and Ethiopia. We are subject to applicable PRC regulation of loans to or investment in subsidiaries in China.

As of the date of this annual report, BIT Mining Limited has not distributed any earnings to its subsidiaries. BIT Mining Limited currently does not have any plan to distribute earnings to its subsidiaries in the foreseeable future. No transfers, dividends, or distributions have been made to date to U.S. investors.

Transfers between the Holding Company and its Subsidiaries

In 2022, 2023 and 2024, BIT Mining Limited transferred cash to its subsidiaries of US$37.0 million, approximately US$2.5 million and approximately US$4.2 million, respectively, through intercompany fund advances and capital contributions.

In 2022, 2023 and 2024, BIT Mining Limited transferred assets with aggregate values of US$9.2 million, US$6.3 million and US$0.3 million, respectively, to its subsidiaries. Such assets were primarily cryptocurrency assets, through intercompany fund advances. The tax consequences of these asset transfers from BIT Mining Limited to its subsidiaries did not have a material impact on the Company’s consolidated results of operations for the years ended December 31, 2022, 2023 and 2024.

In 2022, 2023 and 2024, the Company’s subsidiaries transferred assets with aggregate values of US$9.0 million, US$9.3 million and US$14.6 million, respectively, to BIT Mining Limited. Such assets were primarily cryptocurrency assets, through intercompany fund advances. The tax consequences of these asset transfers from the Company’s subsidiaries to BIT Mining Limited did not have a material impact on the Company’s consolidated results of operations for the years ended December 31, 2022, 2023 and 2024.

The aforementioned cash and asset transfers between BIT Mining Limited and its subsidiaries were for business operation purposes.

A. |

[Reserved] |

B. |

Capitalization and Indebtedness |

Not Applicable.

C. |

Reasons for the Offer and Use of Proceeds |

Not Applicable.

D. |

Risk Factors |

Risks Related to Our Business and Industry

It may be or become illegal to acquire, own, hold, sell or use cryptocurrencies, participate in the blockchain, or transfer or utilize similar cryptocurrency assets in international markets where we operate due to adverse changes in the regulatory and policy environment in these jurisdictions.

Our blockchain and cryptocurrency mining business could be significantly affected by, among other things, the regulatory and policy developments in international markets where we operate, such as the United States. Governmental authorities are likely to continue to issue new laws, rules and regulations governing the blockchain and cryptocurrency industry we operate in and enhance enforcement of existing laws, rules and regulations.

We have adopted the development strategy to focus on the expansion of our blockchain and cryptocurrency mining operations to international markets. We have invested in Akon, Ohio, a mining site with access to power capacity of up to 82.5 megawatts. In December 2024, we also completed the first closing of acquisition of cryptocurrency mining data centers and Bitcoin mining machines in Ethiopia. As of the date of this annual report, we have deployed our mining machines primarily to the United States and Ethiopia. However, we cannot assure you that the government authorities in these international markets will not adopt new laws and regulations in the future to restrict blockchain and cryptocurrency business.

5

Some jurisdictions restrict various uses of cryptocurrencies, including the use of cryptocurrencies as a medium of exchange, the conversion between cryptocurrencies and fiat currencies or between cryptocurrencies, the provision of trading and other services related to cryptocurrencies by financial institutions and payment institutions, and initial coin offerings and other means of capital raising based on cryptocurrencies. We cannot assure you that these jurisdictions will not enact new laws or regulations that further restrict activities relate to cryptocurrencies.

In addition, cryptocurrencies may be used by market participants for black market transactions, to conduct fraud, money laundering and terrorism-funding, tax evasion, economic sanction evasion or other illegal activities. As a result, governments may seek to regulate, restrict, control or ban the mining, use, holding and transferring of cryptocurrencies. We may not be able to eliminate all instances where other parties use cryptocurrencies mined by us to engage in money laundering or other illegal or improper activities. We cannot assure you that we will successfully detect and prevent all money laundering or other illegal or improper activities which may adversely affect our reputation, business, financial condition and results of operations.

Due to the environmental-impact concerns related to the potential high demand for electricity to support cryptocurrency mining activity, political concerns, and for other reasons, we may be required to cease mining operations without much or any prior notice by a national or local government’s formal or informal requirement or because of the anticipation of an impending requirement. For example, due to the most the power shortage and political unrest in Kazakhstan in 2021, we temporarily suspended mining activities in Kazakhstan. We are still reevaluating our prospects there, but currently do not plan to carry out any joint construction of a new data center in that country.

Any such government action or anticipated action could have a negative impact not only on the value of existing miners owned by us, but on our ability to purchase new miners and their prices. Such government action or anticipated action could also have a deleterious impact on the price of cryptocurrencies. At a minimum, such events could result in an increase in the volatility of the price of the cryptocurrencies and value of miners owned by us. Moreover, if we discontinue mining operations in one location in response to such government action or anticipated action, we likely would transfer miners to another location. However, this process would result in costs associated with the transfer to be incurred by us, as well as the transferred miners being off-line and not able to mine cryptocurrencies for some time. Our business, financial condition and results of operations may be materially and adversely affected by these adverse changes in the regulatory and policy environment in the markets where we operate our blockchain and cryptocurrency mining operations.

Any failure to obtain or renew any required approvals, licenses, permits or certifications could materially and adversely affect our business and results of operations.

In accordance with the laws and regulations in the jurisdictions in which we operate, we are required to maintain various approvals, licenses, permits and certifications in order to operate our cryptocurrency mining business. Complying with such laws and regulations may require substantial expense, and any non-compliance may expose us to liability. In the event of non-compliance, we may have to incur significant expenses and divert substantial management time to rectify the incidents. In the future, if we fail to obtain all the necessary approvals, licenses, permits and certifications, we may be subject to fines or the suspension of operations at the mining facilities or data centers that do not have all the requisite approvals, licenses, permits and certifications, which could materially and adversely affect our business and results of operations. We may also experience adverse publicity arising from non-compliance with government regulations, which would negatively impact our reputation.

We have adopted the development strategy to focus on the expansion of our blockchain and cryptocurrency mining operations in international markets, and have established, and plan to establish cryptocurrency mining data centers in the United States and Ethiopia. As such, we are subject to regulations applicable to operators of cryptocurrency mining business and data processing business in these jurisdictions. We have obtained relevant governmental approval and license required for our data center operations in these jurisdictions. However, we cannot assure your that we will be able to maintain or renew the required government approval, permit, licenses for our proposed operations on commercially reasonable terms and in a timely manner or at all. Failure to maintain or renew these government approval, permit or licenses for our international operations may cause us to suspend or terminate our data center operations in such jurisdictions, and may subject us to regulatory investigations or legal proceedings and fines in these jurisdictions, which could disrupt our international operations and materially and adversely affect our business, financial condition and results of operations.

6

More broadly, we cannot assure you that we will be able to fulfill all the conditions necessary to obtain the required government approvals in the jurisdictions where we operate, or that relevant government officials in these jurisdictions will always, if ever, exercise their discretion in our favor, or that we will be able to adapt to any new laws, regulations or policies. There may also be delays on the part of government authorities in reviewing our applications and granting approvals, whether due to the lack of administrative resources or the imposition of new rules, regulations, government policies or their implementation, interpretation and enforcement, or for no discernible reason at all. If we are unable to obtain, or experience material delays in obtaining, necessary government approvals, our operations may be substantially disrupted, which could materially and adversely affect our business, financial condition and results of operations.

A particular digital asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty, and if we are unable to properly characterize a digital asset, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, results of operations and/or financial condition.

The SEC and its staff have taken the position that certain digital assets fall within the definition of a “security” under the U.S. federal securities laws. The legal test for determining whether any given digital asset is a security is a highly complex, fact-driven analysis that evolves over time, and the outcome is difficult to predict. The SEC generally does not provide advance guidance or confirmation on the status of any particular digital asset as a security. Additionally, the SEC’s views in this area have evolved over time, and it is difficult to predict the direction or timing of any continuing evolution. Furthermore, it is also possible that a change in the governing administration or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff. Public statements by senior officials at the SEC indicate that the SEC does not intend to take the position that Bitcoin or Ethereum, in their current form, are securities. However, such statements are not official policy statements by the SEC and reflect only the speakers’ views, which are not binding on the SEC or any other agency or court, and cannot be generalized to any other digital asset. In addition, on February 27, 2025, the SEC’s Division of Corporation Finance issued a formal Staff Statement which took the position that typical meme coins do not constitute “securities” under U.S. federal securities law, and thus transactions in these meme coins need not be registered under the U.S. Securities Act of 1933, as amended, nor exempt from registration because they do not involve an “offer and sale” of securities. With respect to all other digital assets, there is currently no certainty under the applicable legal test that such assets are not securities, notwithstanding the conclusions we may draw based on our assessment regarding the likelihood that a particular digital asset could be deemed a “security” under applicable laws. Similarly, though the SEC’s Strategic Hub for Innovation and Financial Technology published a framework for analyzing whether any given digital asset is a security in April 2019, this framework is also not a rule, regulation or statement of the SEC and is not binding on the SEC.

Several foreign jurisdictions have taken a broad-based approach to classifying digital assets as “securities,” while other foreign jurisdictions have adopted a narrower approach. As a result, certain digital assets may be deemed to be a “security” under the laws of some jurisdictions but not others. Various foreign jurisdictions may, in the future, adopt additional laws, regulations, or directives that affect the characterization of digital assets as “securities.”

The classification of a digital asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer, sale, trading, and clearing of such assets. For example, a digital asset that is a security in the United States may generally only be offered or sold in the United States pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption from registration. Persons that effect transactions in digital assets that are securities in the United States may be subject to registration with the SEC as a “broker” or “dealer.” Platforms that bring together purchasers and sellers to trade digital assets that are securities in the United States are generally subject to registration as national securities exchanges, or must qualify for an exemption, such as by being operated by a registered broker-dealer as an alternative trading system (“ATS”), in compliance with rules for ATSs. Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency. Foreign jurisdictions may have similar licensing, registration, and qualification requirements. We have mined cryptocurrencies other than Bitcoin and Ethereum, and we received other types of cryptocurrencies, as commissions of our mining pool operation. The likely status of these cryptocurrencies as securities could limit distributions, transfers, or other actions involving such cryptocurrencies, including mining, in the United States.

7

We have adopted risk-based policies and procedures to analyze whether the digital assets that we mine, hold and sell for our own account could be deemed to be a “security” under applicable laws. Our policies and procedures do not constitute a legal standard, but rather represent our management’s assessment, based on advice of our securities counsel, regarding the likelihood that a particular digital asset could be deemed a “security” under applicable laws. Regardless of our conclusions, we could be subject to legal or regulatory action in the event the SEC, a foreign regulatory authority, or a court were to determine that a digital asset currently held by us is a “security” under applicable laws. If the digital assets mined and held by us are deemed as securities, it could limit distributions, transfers, or other actions involving such digital assets, including mining, in the United States. For example, the distribution of cryptocurrencies to miners could be deemed to involve an illegal offering or distribution of securities subject to U.S. federal or state law. In addition, miners on cryptocurrency networks could, under certain circumstances, be viewed as statutory underwriters or as “brokers” subject to regulation under the Exchange Act. This could require us or our customers to change, limit, or cease mining operations, register as broker-dealers and comply with applicable law, or be subject to penalties, including fines. In addition, we could be subject to judicial or administrative sanctions for failing to sell the digital asset or distribute block rewards in compliance with the registration requirements, or for acting as a broker, dealer, or national securities exchange without appropriate registration. Such an action could result in injunctions, cease and desist orders, as well as civil monetary penalties, fines, and disgorgement, criminal liability, and reputational harm.

Distributing digital assets involves risks, which could result in loss of customer assets, customer disputes and other liabilities, adversely impact our business, results of operations and/or financial condition.

In order to own, transfer and use a digital asset on its underlying blockchain network, a person must have a private and public key pair associated with a network address, commonly referred to as a “wallet.” Each wallet is associated with a unique “public key” and “private key” pair, each of which is a string of alphanumerical characters. In order for us to allocate digital assets to customers, customers must provide us with the public key of the wallet that the digital assets are to be transferred to, and we would be required to authorize the transfer. We rely on the information provided by customers to distribute cryptocurrencies to them, and we do not have access to customers’ private key. A number of errors can occur in the process of distributing digital assets to customers’ wallets, such as typos, mistakes, or the failure to include the information required by the blockchain network. For instance, a customer may incorrectly enter the desired recipient’s public key when retrieving digital assets, which may result in the permanent and irretrievable loss of the customer’s digital assets. Such incidents could result in disputes, damage to our brand and reputation, legal claims against us, and financial liabilities, any of which could adversely affect our business, results of operations and/or financial condition.

The loss or destruction of private keys required to access any digital assets held by us may be irreversible. If we are unable to access our private keys or if we experience a hack or other data loss relating to our ability to access any digital assets, it could cause regulatory scrutiny, reputational harm, and other losses.

Cryptocurrencies are generally controllable only by the possessor of the unique private key relating to the digital wallet in which the digital assets are held. While blockchain protocols typically require public addresses to be published when used in a transaction, private keys must be safeguarded and kept private in order to prevent a third party from accessing the digital assets held in such a wallet. We will publish the public key relating to digital wallets in use when we verify the receipt of transfers and disseminate such information into the network, but we will need to safeguard the private keys relating to such digital wallets. We safeguard and keep private the private keys relating to our digital assets by primarily utilizing enterprise multi-signature storage solution provided by an established third-party digital asset financial services platform.

To the extent that any of the private keys relating to our wallets containing digital assets held by us is lost, destroyed, or otherwise compromised or unavailable, and no backup of the private key is accessible, we will be unable to access digital assets held in the related wallet. Furthermore, as currently our digital wallet is maintained by a third-party digital asset financial services platform, we cannot provide assurance that our wallet will not be hacked or compromised, or that any information leakage and data security breach of such platform will not compromise the security of our digital wallet. Digital assets and blockchain technologies have been, and may in the future be, subject to security breaches, hacking, or other malicious activities. Any loss of private keys relating to, or hack or other compromise of, digital wallets used to store our digital assets could subject us to significant financial losses, and we may be unable to distribute mining rewards to customers of our mining pool services, or adequately compensate our customers for damages caused by such security breach. As such, any loss of private keys due to a hack, employee or service provider misconduct or error, or other compromise by third parties could hurt our brand and reputation, result in significant losses, and adversely impact our business, results of operations and/or financial condition.

8

We may incur significant compliance costs if we are required to register as a money services business under the regulations promulgated by the Financial Crimes Enforcement Network under the authority of the U.S. Bank Secrecy Act, or otherwise under U.S. state laws.

We are in the process of expanding our cryptocurrency operation into the United States. To the extent that our operations in United States cause us to be deemed a money services business under the regulations promulgated by the Financial Crimes Enforcement Network (“FinCEN”) under the authority of the U.S. Bank Secrecy Act, we may be required to comply with FinCEN regulations, including those that would mandate us to implement anti-money laundering programs, make certain reports to FinCEN and maintain certain records. To the extent that our operations cause us to be deemed a “money transmitter” or equivalent designation, under state law in any U.S. state in which we plan to operate, we may be required to seek a license or otherwise register with a state regulator and comply with state regulations that may include the implementation of anti-money laundering programs, maintenance of certain records and other operational requirements. Such additional federal or state regulatory obligations may cause us to incur extraordinary expenses, and may affect an investment in our securities in a materially adverse manner. Furthermore, we and our service providers may not be capable of complying with certain federal or state regulatory obligations applicable to money services businesses and money transmitters. If we are deemed to be subject to and determine not to comply with such additional regulatory and registration requirements, we may have to leave a particular U.S. state or the United States completely. Any such action would be expected to materially adversely affect our operations.

Because cryptocurrencies may be determined to be investment securities, we may inadvertently violate the Investment Company Act of 1940, as amended, and we may incur substantial losses and become subject to such act as a result.

We believe that we are not engaged in the business of investing, reinvesting, or trading in securities, and we do not hold ourselves out as being engaged in those activities. However, under the Investment Company Act of 1940, as amended (the “Investment Company Act”), a company may be deemed an investment company under section 3(a)(1)(C) thereof if the value of its investment securities is more than 40% of its total assets (exclusive of government securities and cash items) on an unconsolidated basis.

As a result of our investments and our cryptocurrency mining activities, including investments in which we do not have a controlling interest, and the sale of Shares of Loto Interactive Limited, the investment securities we hold could exceed 40% of our total assets, exclusive of cash items and, accordingly, we could determine that we have become an inadvertent investment company. The cryptocurrency we own, acquire or mine may be deemed an investment security by the SEC, although we do not believe any of the cryptocurrencies we own, acquire or mine are securities.

An inadvertent investment company can avoid being classified as an investment company if it can rely on one of the exclusions under the Investment Company Act. One such exclusion, Rule 3a-2 under the Investment Company Act, allows an inadvertent investment company a grace period of one year from the earlier of (a) the date on which an issuer owns securities and/or cash having a value exceeding 50% of the issuer’s total assets on either a consolidated or unconsolidated basis and (b) the date on which an issuer owns or proposes to acquire investment securities having a value exceeding 40% of the value of such issuer’s total assets (exclusive of government securities and cash items) on an unconsolidated basis. As of December 31, 2024, we do not believe we are an inadvertent investment company, however this issue has not been resolved by SEC rules or regulations. For us, any grace period would be unknown until further clarifications from or regulations by the SEC concerning cryptocurrency treatment. We may take actions to cause the investment securities held by us to be less than 40% of our total assets, which may include acquiring assets with our cash and cryptocurrency on hand or liquidating our investment securities or cryptocurrency or seeking a no-action letter from the SEC if we are unable to acquire sufficient assets or liquidate sufficient investment securities in a timely manner.

As the Rule 3a-2 exception is available to a company no more than once every three years, and assuming no other exclusion were available to us, we would have to keep within the 40% limit for at least three years after we cease being an inadvertent investment company. This may limit our ability to make certain investments or enter into joint ventures that could otherwise have a positive impact on our earnings. In any event, we do not intend to become an investment company engaged in the business of investing and trading securities.

9

Current and future legislation and the SEC rulemaking and other regulatory developments, including interpretations released by a regulatory authority, may impact the manner in which cryptocurrencies are treated for classification and clearing purposes. The SEC’s July 25, 2017 Report expressed its view that digital assets may be securities depending on the facts and circumstances. As of the date of this annual report, we are not aware of any rules that have been proposed to regulate cryptocurrencies as securities. We cannot be certain as to how future regulatory developments will impact the treatment of cryptocurrency under the applicable U.S. federal or state laws. Such additional registrations may result in extraordinary, non-recurring expenses, thereby materially and adversely impacting an investment in us. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease certain of our operations. Any such action may adversely affect an investment in us.

Classification as an investment company under the Investment Company Act requires registration with the SEC. If an investment company fails to register, it would have to stop doing almost all business, and its contracts would become voidable. Registration is time consuming and restrictive and would require a restructuring of our operations, and we would be very constrained in the kind of business we could do as a registered investment company. Furthermore, we would become subject to substantial regulation concerning management, operations, transactions with affiliated persons and portfolio composition, and would need to file reports under the Investment Company Act regime. The cost of such compliance would result in substantial additional expenses, and the failure to complete the required registration would have a materially adverse impact to conduct our operations.

We do not maintain insurance for our digital assets, which may expose us and our shareholders to the risk of loss of our digital assets, and there will be limited rights of legal recourse available to us to recover our losses.

We do not maintain insurance for the digital assets held by us. Banking institutions will not accept our digital assets, and they are therefore not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Therefore, we may suffer loss with respect to our digital assets which is not covered by insurance, and we may not be able to recover any of our carried value in these digital assets if they are lost or stolen or suffer significant and sustained reduction in conversion spot price. If we are not otherwise able to recover damages from a malicious actor in connection with these losses, our business, results of operations and share price may be adversely affected.

If we fail to maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results in accordance with U.S. GAAP may be materially and adversely affected. In addition, investor confidence in us and the market price of our ADSs may decline significantly.

We are required to assess the effectiveness of our disclosure controls and procedures and internal control over financial reporting. As defined in standards established by the United States Public Company Accounting Oversight Board, or the PCAOB, a “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

While our management concluded that our internal control over financial reporting was effective as of December 31, 2024, we may not be able to always maintain an effective internal control over financial reporting for a variety of reasons. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud will be detected. If we fail to maintain effective internal control over financial reporting in the future, our management and our independent registered public accounting firm may not be able to conclude that we have effective internal control over financial reporting at a reasonable assurance level. This could in turn result in the loss of investor confidence in the reliability of our financial statements and negatively impact the trading price of our ADSs. Furthermore, we have incurred and anticipate that we will continue to incur considerable costs, management time and other resources in an effort to maintain compliance with Section 404 and other requirements of the Sarbanes-Oxley Act.

Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the NYSE, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

10

Risks Related to Doing Business in China

Recent regulatory developments in China may subject us to additional regulatory review and disclosure requirements, expose us to government interference, or otherwise restrict or completely hinder our ability to offer securities and raise capitals outside China, all of which could materially and adversely affect our business, and cause the value of our securities to significantly decline or become worthless.

As our remaining operations in China primarily involve the provision of administrative supports to our cryptocurrency mining business outside China, as well as internal information technology services to our operating entities outside China, we may still be subject to PRC laws relating to, among others, data security and restrictions over foreign investments in value-added telecommunications services and other industry sectors set out in the Special Administrative Measures (Negative List) for the Access of Foreign Investment (2024 Edition). Specifically, we may be subject to PRC laws relating to the collection, use, sharing, retention, security, and transfer of confidential and private information, such as personal information and other data. These PRC laws apply not only to third-party transactions, but also to transfers of information between us and our wholly foreign-owned enterprises in China, and other parties with which we have commercial relations. These PRC laws and their interpretations and enforcement continue to develop and are subject to change, and the PRC government may adopt other rules and restrictions in the future.

The recent regulatory developments in China, in particular with respect to restrictions on China-based companies raising capital offshore, may lead to additional regulatory review in China over our financing and capital raising activities in the United States.

11

Pursuant to the PRC Cybersecurity Law (“Cybersecurity Law”), which was promulgated by the Standing Committee of the National People’s Congress on November 7, 2016 and took effect on June 1, 2017, personal information and important data collected and generated by a critical information infrastructure operator (“CIIO”) in the course of its operations in China must be stored in China, and if a critical information infrastructure operator, as defined by “The Security Protection Regulations for Critical Information Infrastructure,” effective on September 1, 2021, purchases internet products and services that affect or may affect national security, it should be subject to cybersecurity review by the Cyberspace Administration of China (“CAC”). The Cybersecurity Law also establishes more stringent requirements applicable to operators of computer networks, especially to operators of networks which involve critical information infrastructure. The Cybersecurity Law contains an overarching framework for regulating Internet security, protection of private and sensitive information, and safeguards for national cyberspace security and provisions for the continued government regulation of the Internet and content available in China. The Cybersecurity Law emphasizes requirements for network products, services, operations and information security, as well as monitoring, early detection, emergency response and reporting. On January 4, 2022, the CAC announced the adoption of the Cybersecurity Review Measures, and effective on February 15, 2022, online platforms operators possessing personal information of more than one million user must undergo a cybersecurity review by the CAC when they seek listing in foreign markets. In addition, pursuant to the PRC Data Security Law (“Data Security Law”), which was promulgated by the Standing Committee of the National People’s Congress on June 10, 2021 and took effect on September 1, 2021, all data activities that take place in China, as well as abroad if the data activities are deemed to impair China’s national security, China’s public interest or the legitimate rights and interests of Chinese citizens or organizations, shall be subject to the Data Security Law. The Data Security Law classifies data collected and stored in China based on its potential impact on Chinese national security and regulates its storage and transfer depending on the data’s classification level. Data processors are prohibited from providing any data stored in China, regardless of the data’s sensitivity level and whether or not the data was initially collected in China, to any foreign judicial or law enforcement agency without the prior approval of the relevant PRC authorities. China’s central government is required by the Data Security Law to formulate a catalogue of important data based on the data classified and graded system, while relevant authorities in different regions and industries are then required to identify important data and formulate detailed implementing catalogues for their respective regions and industries. According to Regulation on Network Data Security Management, promulgated by the State Council on September 24, 2024, effective on January 1, 2025, Companies handling data classified as “important data” are required to (i) designate a person in charge of network data security; (ii) set up a network data security management department, performing the following responsibilities: a) formulating and implementing network data security management systems and operation procedures as well as emergency response plans for network data security incidents; b) organizing activities such as network data security risk monitoring, risk assessment, emergency drills, publicity, education and training on a regular basis, and promptly disposing of network data security risks and incidents; c) accepting and handling complaints and reports about network data security; (iii) conduct annual risk assessment for its processing activities, and (iv) report the assessment’s result to the relevant authority. On July 7, 2022, the CAC announced the adoption of the Security Assessment Measures for Outbound Data Transfer (“Security Assessment Measures”), and effective on September 1, 2022, The Security Assessment Measures requires not only CIIOs, but also other data processors to file for CAC’s security assessment before transferring important data out of China. The Administrative Measures on Data Security in the Industry and Information Technology Sectors (for Trial Implementation) (“Security Administrative Measures”) effective on January 1, 2023, divides industrial and telecom data into three categories, namely (i) ordinary data, (ii) important data, and (iii) core data, and requires the data processors to make filings with their Local Regulators regarding their Important Data and Core Data. Furthermore, the Standing Committee of the National People’s Congress passed the Personal Information Protection Law of the PRC (“PIPL”), which became effective on November 1, 2021, and requires a personal information handler to meet any of the following conditions when transferring personal information outside the territory of PRC: (i) it shall pass the security assessment organized by the CAC; (ii) it shall have been certified by a specialized agency for protection of personal information; and (iii) it shall enter into a standard contract for the outbound transfer of personal information with the overseas recipient. Furthermore, it is mandatory for the following two types of personal information handlers to declare security assessment for their provision of data abroad to the CAC: (i) personal information handlers processing the personal information of more than one million people that provide personal information abroad; and (ii) personal information handlers that have provided personal information of 100,000 people or sensitive personal information of 10,000 people in total abroad since January 1 of the previous year. In addition, Regulation on Network Data Security Management requires that personal information handlers handling the personal information of more than 10 million individuals shall also designate a person in charge of network data security and set up a network data security management department conducting the same responsibilities as the important data handlers mentioned above.

On July 30, 2021, in response to the recent regulatory developments in China and actions adopted by the PRC government, the Chairman of the SEC issued a statement requesting additional disclosures from offshore issuers with China-based operating companies before their registration statements will be declared effective, including detailed disclosure related to VIE structures and whether the VIE and the issuer, when applicable, received or were denied permission from the PRC authorities to list on U.S. exchanges and the risks that such approval could be denied or rescinded. On August 1, 2021, the CSRC stated in a statement that it had taken note of the new disclosure requirements announced by the SEC regarding the listings of PRC companies and the recent regulatory development in the PRC, and that the securities regulators in both countries should strengthen communications on regulating China-related issuers.

12

On February 17, 2023, the CSRC releases the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, which came into effect on March 31, 2023. The Trial Administrative Measures require that a domestic company seeking direct and indirect overseas offering and listing shall fulfill the filing procedure with the CSRC, submit relevant materials that contain a filing report and a legal opinion, and provide truthful, accurate and complete information on the shareholders and other information required. Where the filing documents are complete and in compliance with stipulated requirements, the CSRC will, within 20 working days after receiving the filing documents, conclude the filing procedure and publish the filing results on the CSRC website. As is stipulated in the Trial Administrative Measures, direct overseas offering and listing by domestic companies refers to such overseas offering and listing by a joint-stock company incorporated domestically, while indirect overseas offering and listing by domestic companies refers to such overseas offering and listing by a company in the name of an overseas incorporated entity, whereas the company’s major business operations are located domestically and such offering and listing is based on the underlying equity, assets, earnings or other similar rights of a domestic company. Any overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the senior managers in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland. The determination as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance over form basis.

Prior to the disposal of our lottery-related business in China in July 2021, we collected and processed personal, transactional and behavioral data. By the end of 2021, we have disposed of our lottery-related business and suspended the operations of our data centers in China, and have migrated our cryptocurrency mining business to international markets. Our remaining operations in China do not involve the processing of any significant amount of personal information. However, we cannot assure you that the PRC regulatory authorities will not take a contrary view or will not subsequently require us to undergo the approval procedures and subject us to penalties for non-compliance, or that if we are required to obtain such clearance, such clearance can be timely obtained, or at all. If we become subject to cybersecurity inspection and/or review by the CAC or other PRC authorities or are required by them to take any specific actions, it could cause suspension or termination of the future offering of our securities, disruptions to our operations, result in negative publicity regarding our company, and divert our managerial and financial resources. We may also be subject to significant fines or other penalties, which could materially and adversely affect our business, financial condition and results of operations. Any actions by the PRC government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in companies having operations in China, such as us, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors, and cause the value of our securities to significantly decline or become worthless.

Our efforts to adjust our corporate structure and business operations, including the termination of our previous VIE structures and the exit of our mining pool business from China, may not be completed in a liability-free manner, and we may still be subject to cybersecurity review by the CAC, or deemed to be in violation of PRC laws regulating our industry and operations.

In light of the recent statements by the Chinese government indicating its intention exert more oversight and control over overseas offerings of China-based companies, the CAC review for certain data processing operators in China, and restrictions imposed by the PRC government relating to cryptocurrency mining business, we have adjusted, and may continue to adjust our business operations in the future, to comply with PRC laws regulating our industry and our business operations. However, such efforts may not be completed in a liability-free manner or at all.

Due to restrictions over foreign investment in lottery and IDC services, we previously maintained VIE structure with respect to our lottery-related business in China and certain of our data processing services in connection with our cryptocurrency mining business previously conducted in China. By the end of 2021, we did not maintain any VIE structures in China. Since June 2021, we have also suspended the operations of data centers in China. In October 2021, in light of change in the regulatory environment in China, we began to cause our mining pool subsidiary, BTC.com to exit the China market, cease registering new mining pool customers from China and retire the accounts of existing mining pool customers in China in an orderly manner.

13

We cannot assure you that the disposal of the lottery-related affiliated entities and unwinding of the related VIE structures in China, or the discontinuation of our mining pool operation in China, will not give rise to dispute or liability, or that such disposal, unwinding and discontinuation of operations will not adversely affect our overall results of operations and financial condition. In February 2022, the then subsidiaries of Zhejiang Keying deregistered their respective IDC licenses, and Zhejiang Keying completed the transfer of equity interests of its then subsidiaries to Loto Shenzhen. In the same month, we completed the formal SAIC registration of the disposal of the subsidiaries under the former variable interest entity structure. During the process of disposing of the lottery-related affiliated entities and the unwinding of the related VIE structures in China, including the VIE structure of Zhejiang Keying, and after such process is completed, we cannot guarantee that we will not continue to be subject to PRC regulatory inspection and/or review relating to cybersecurity, especially when there remains significant uncertainty as to the scope and manner of the regulatory enforcement. If we become subject to regulatory inspection and/or review by the CAC or other PRC authorities, or are required by them to take any specific actions, it could cause suspension or termination of the future offering of our securities, disruptions to our operations, result in negative publicity regarding our company, and divert our managerial and financial resources. The discontinuation of operations of BTC.com in China and in particular, the retirement of accounts of existing mining pool customers in China, may give rise to user complaints or dispute claims against us, which could divert a significant amount of managerial attention and other resources from our business and operations, and require us to incur significant expenses. We may also be subject to fines or other penalties, which could materially and adversely affect our business, financial condition, and results of operations.

We could still face the risk of delisting and cease of trading of our securities from a stock exchange or an over-the-counter market in the United States under the HFCA Act and the securities regulations promulgated thereunder if the PCAOB determines in the future that it is unable to completely inspect or investigate our auditor which has a presence in China, and it may materially and adversely affect the value of your investment.

The Holding Foreign Companies Accountable Act (“HFCA Act”) was enacted on December 18, 2020. The HFCA Act states if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years, the SEC shall prohibit our shares or ADSs from being traded on a national securities exchange or in the over the counter trading market in the United States.

Our financial statements contained in the annual report on Form 20-F for the year ended December 31, 2024 have been audited by Our U.S.-based auditor, MaloneBailey, LLP, an independent registered public accounting firm that is headquartered in the United States with offices in Beijing and Shenzhen, China. MaloneBailey, LLP is not among the PCAOB-registered public accounting firms headquartered in the PRC or Hong Kong that are subject to PCAOB’s determination on December 16, 2021 of having been unable to inspect or investigate completely. As of the date of this annual report, we have not been identified by the SEC as a commission-identified issuer under the HFCA Act.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCA Act, which provides a framework for the PCAOB to determine, as contemplated under the HFCA Act, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 2, 2021, the SEC adopted amendments to finalize the implementation of disclosure and documentation measures, which require us to identify, in our annual report on Form 20-F, (1) the auditors that provided opinions to the financial statements presented in the annual report, (2) the location where the auditors’ report was issued, and (3) the PCAOB ID number of the audit firm or branch that performed the audit work. If the SEC determines that we have three consecutive non-inspection years, the SEC will issue a stop order to prohibit the trading of our ADSs on any U.S. stock exchange or over-the-counter market. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act (the “AHFCA Act”), was signed into law, which reduced the number of consecutive non-inspection years required for triggering the prohibitions under the AHFCA Act from three years to two. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Protocol”) with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, governing inspections and investigations of audit firms based in mainland China and Hong Kong. Pursuant to the Protocol, the PCAOB conducted inspections on select registered public accounting firms subject to the previous December 16, 2021 determinations in Hong Kong between September and November 2022. On December 15, 2022, the PCAOB board announced that it had completed the inspections, determined that it had complete access to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, and voted to vacate the previous December 16, 2021 determinations.

14

Nevertheless, we could still face the risk of delisting and cease of trading of our securities from a stock exchange or an over-the-counter market in the United States under the HFCA Act and the securities regulations promulgated thereunder if the PCAOB determines in the future that it is unable to completely inspect or investigate our auditor which has a presence in China, and it may materially and adversely affect the value of your investment.

The PRC government has significant and arbitrary influence over companies with operations in China by enforcing existing rules and regulation, adopting new ones, or changing relevant industrial policies in a manner that may materially increase our compliance cost, abruptly change relevant industry landscape, or cause significant changes to, or otherwise intervene or influence, our remaining operations in China at any time, which could result in material and adverse changes in our operations and cause the value of our securities to significantly decline or become worthless.

We currently maintain operations in China primarily for the provision of administrative support to our cryptocurrency mining business outside China, as well as the provision of internal information technology services to our operating entities outside China. The PRC government has significant and arbitrary influence over the operations in China of any company by allocating resources, providing preferential treatment to particular industries or companies, or imposing industry-wide policies on certain industries. The PRC government may also amend or enforce existing rules and regulation, or adopt ones, which could materially increase our compliance cost, abruptly change the relevant industry landscape, or cause significant changes to, or otherwise intervene or influence, our remaining operations in China at any times. In addition, the PRC regulatory system is based in part on government policies and internal guidance, some of which are not published on a timely basis or at all, and some of which may even have a retroactive effect. We may not be aware of all non-compliance incidents at all time, and may face regulatory investigation, fines and other penalties as a result. As a result of the changes in the industrial policies of the PRC government, including the amendment to and/or enforcement of the related laws and regulations, companies with operations in China, including us, and the industries in which we operate, face significant compliance and operational risks and uncertainties. For example, on July 24, 2021, Chinese state media, including Xinhua News Agency and China Central Television, announced a broad set of reforms targeting private education companies providing after-school tutoring services and prohibiting foreign investments in institutions providing such after-school tutoring services. As a result, the market value of certain U.S. listed companies with operations in China in the affected sectors declined substantially. On August 30, 2021, the PRC government imposed restrictions over the provision of online gaming services to minors, aiming at curbing excessive indulgence in online gaming and protecting minors’ mental and physical health, which could adversely affect the development of the online gaming industry in China. The PRC government has also imposed severe restrictions over the operations of cryptocurrency business, which changed the entire industry landscape in China. See “—It may be or become illegal to acquire, own, hold, sell or use cryptocurrencies, participate in the blockchain, or transfer or utilize similar cryptocurrency assets in international markets where we operate due to adverse changes in the regulatory and policy environment in these jurisdictions.” In addition, the National Development and Reform Commission of China has classified cryptocurrency mining operations as an industry to be eliminated. We have adopted a development strategy to focus on expansion of our blockchain and cryptocurrency mining operations in international markets, and have adjusted our business operations in China, including the termination of the operations of our data centers in China. As of the date of this annual report, we are not aware of any similar regulations that may be adopted to significantly curtail our remaining non-revenue generating operations in China. However, if other adverse regulations or policies are adopted in China, our remaining operations in China will be materially and adversely affected, and we may have to cease our administrative supports and internal information technology services in China and move them abroad to support our international cryptocurrency mining business, and relocate our offices and certain assets to international markets outside China, which may significantly disrupt our international operations and adversely affect our business, financial condition and results of operations.

15

PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of any offering of our securities to make loans or additional capital contributions to our PRC subsidiaries.

We are an offshore holding company incorporated in the Cayman Islands, with limited operations in China. To the extent necessary, we may make loans to our PRC subsidiaries subject to the approval, registration, and filing with governmental authorities and limitation of amount, or we may make additional capital contributions to our wholly foreign-owned subsidiaries in China. Any loans to our wholly foreign-owned subsidiaries in China, which are treated as foreign-invested enterprises under PRC law, are subject to foreign exchange loan registrations with the National Development and Reform Commission, or the NDRC, and SAFE or its local branches. In addition, a foreign invested enterprise shall use its capital pursuant to the principle of authenticity and self-use within its business scope. The capital of a foreign invested enterprise shall not be used for the following purposes: (i) directly or indirectly used for expenditures prohibited by laws and regulations of the State; (ii) unless otherwise specified, directly or indirectly used for securities investment or other investment and wealth management (except for wealth management products and structured deposits with risk rating results of not higher than Grade II); (iii) used for granting loans to non-affiliated enterprises (except for circumstances where it is specified in the scope of business, or in four areas, namely, Lin-gang Special Area of the China (Shanghai) Pilot Free Trade Zone, Guangzhou Nansha New Area of the China (Guangdong) Pilot Free Trade Zone, Yangpu Economic Development Zone of the China (Hainan) Pilot Free Trade Zone, and Beilun District of Ningbo City, Zhejiang Province); or (iv) used for purchasing residential real estate not for self-use (except for enterprises engaging in real estate development and leasing operation).

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will be able to complete the necessary government registrations or obtain the necessary government approvals or filings on a timely basis, if at all, with respect to future loans by us to our PRC subsidiaries or with respect to future capital contributions by us to our PRC subsidiaries. If we fail to complete such registrations or obtain such approvals, our ability to use the proceeds from any offering of our securities and capitalize or otherwise fund our PRC operations may be negatively affected.

We have changed our business model a few times during the last few years, which makes it difficult to evaluate our business.

In recent years, we have begun new lines of businesses and suspended or disposed of existing lines of businesses. Since announcing our entry into the cryptocurrency industry in December 2020, we have (i) purchased cryptocurrency mining machines, (ii) acquired a 7-nanometer mining machine manufacturer to unfurl a comprehensive approach to cryptocurrency mining, (iii) developed a cryptocurrency mining data center in Ohio with power capacity of 82.5 megawatts, and (iv) completed the first closing of acquisition of cryptocurrency mining data centers and Bitcoin mining machines in Ethiopia.

Many of our business lines are relatively new business models in an emerging and rapidly evolving market. This makes it difficult for you to evaluate our business, financial performance and prospects, and our historical growth rate may not be indicative of our future performance. We may not be able to realize our profit expectations when we began to offer any of these new lines of businesses. You should consider our prospects in light of the risks and uncertainties that fast-growing companies in a rapidly evolving market may encounter.

Implementation of new lines of business may not yield desirable profits or improve our results of operations.

From time to time, we may implement new lines of business or offer new products and product enhancements as well as new services within our existing lines of business. There are substantial risks and uncertainties associated with these efforts, particularly when considering the market is not fully developed. In developing these new lines of business or services, we may invest significant time and resources. Initial timetables for the introduction and development of these lines of business and services may not be achieved and profitability targets may not prove feasible. External factors, such as compliance with regulations, competition and shifting market preferences, may also impact the successful implementation of these new lines business or services. Our personnel and technology systems may fail to adapt to the changes in these new lines of business or we may fail to effectively integrate new services into our existing operations. In addition, we may be unable to compete effectively due to the different competitive landscape in the new areas of business. Furthermore, these lines of business could have a significant impact on the effectiveness of our internal control system. Failure to successfully manage these risks in the development and implementation of these lines of business and services could have a material adverse effect on our business, results of operations and financial condition.

16

The success of our business depends on our ability to maintain and enhance our reputation and brand.