UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12 (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2024 |

OR | |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

Date of event requiring this shell company report |

|

For the transition period from to |

Commission file number: 001-39601

MINISO Group Holding Limited |

(Exact name of Registrant as specified in its charter) |

|

N/A |

(Translation of Registrant’s name into English) |

|

Cayman Islands |

(Jurisdiction of incorporation or organization) |

|

|

8F, M Plaza, No. 109, Pazhou Avenue Haizhu District, Guangzhou 510000 Guangdong Province The People’s Republic of China |

(Address of principal executive offices) |

|

|

Jingjing Zhang, Chief Financial Officer Telephone: +86 20 3622 8788 Email: ir@miniso.com 8F, M Plaza, No. 109, Pazhou Avenue Haizhu District, Guangzhou 510000 Guangdong Province The People’s Republic of China |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

American depositary shares (each American depositary share representing four ordinary shares, par value US$0.00001 per share) |

|

MNSO |

|

The New York Stock Exchange |

|

|

|

|

|

Ordinary shares, par value US$0.00001 per share* |

|

|

|

The New York Stock Exchange |

|

|

|

|

|

Ordinary shares, par value US$0.00001 per share |

|

9896 |

|

The Stock Exchange of Hong Kong Limited |

* |

Not for trading, but only in connection with the listing on The New York Stock Exchange of American depositary shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

(Title of Class) |

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,249,871,833 ordinary shares, par value US$0.00001 per share as of December 31, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act: (Check one):

Large Accelerated Filer |

☒ |

Accelerated Filer |

☐ |

Non-Accelerated Filer |

☐ |

Emerging Growth Company |

☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ Yes ☐ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

|

IFRS Accounting Standards as issued |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

TABLE OF CONTENTS

|

|

|

1 |

||

3 |

||

4 |

||

4 |

||

4 |

||

4 |

||

79 |

||

121 |

||

121 |

||

141 |

||

150 |

||

157 |

||

159 |

||

160 |

||

175 |

||

176 |

||

181 |

||

181 |

||

Material Modifications to the Rights of Security Holders and Use of Proceeds |

181 |

|

181 |

||

182 |

||

182 |

||

182 |

||

183 |

||

183 |

||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

183 |

|

185 |

||

186 |

||

186 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

186 |

|

186 |

||

186 |

||

188 |

||

188 |

||

188 |

||

188 |

||

190 |

||

i

INTRODUCTION

In this annual report, except where the context otherwise requires, unless otherwise indicated and for purposes of this annual report only:

| ● | “ADSs” refers to our American depositary shares, each representing four ordinary shares, par value US$0.00001 per share; |

| ● | “China” or “PRC” refers to the People’s Republic of China; |

| ● | “Core SKU” refers to SKU that generates over RMB100,000 in sales for over a consecutive 12-month period; |

| ● | “GMV” refers to the total value of all merchandises sold by us and our retail partners and distributors to end customers, before deducting sales rebates and including the VAT and sales taxes collected from consumers, as applicable, regardless of whether the merchandises are returned; |

| ● | “HKEx Listing Rules” refers to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to time; |

| ● | “Hong Kong,” “HK” and “Hong Kong S.A.R.” refer to the Hong Kong Special Administrative Region of the PRC; |

| ● | “Hong Kong dollars” and “HK$” refer to the legal currency of Hong Kong; |

| ● | “Hong Kong Stock Exchange” refers to the Stock Exchange of Hong Kong Limited; |

| ● | “IFRS” refers to IFRS Accounting Standards as issued by the International Accounting Standards Board; |

| ● | “MINISO,” “we,” “us,” “our company” and “our” refer to MINISO Group Holding Limited, our Cayman Islands holding company and its subsidiaries; |

| ● | “MINISO Retail Partner” refers to franchisee under our MINISO Retail Partner model, a franchise-like store model with chain store characteristics, where the franchisee bears the store opening capital expenditure and store operating expenses to join our “MINISO” or “TOP TOY” branded retail store franchise. Other distinguishing features of the MINISO Retail Partner model include: (1) we retain ownership of inventory in the franchisee’s store before it gets sold to consumers; (2) we provide store management and consultation services to the franchisee for a fee, which include standardized guidance in certain key aspects of store operation; and (3) the franchisee keeps the remaining portion of the in-store sales proceeds after remitting a certain portion to us; |

| ● | “MINISO store” refers to any of the stores operated under the “MINISO” brand name, including those directly operated by us, those operated under the MINISO Retail Partner model, and those operated under the distributor model; |

| ● | “revenue” refers to our revenue from continuing operations, excluding the revenue from discontinued operations; |

| ● | “RMB” and “Renminbi” refer to the legal currency of China; |

| ● | “SKU” refers to stock keeping unit; |

| ● | “TOP TOY-brand products” refers to pop toy products of our own brands or brands codeveloped with IP licensors that are sold under the TOP TOY label; |

| ● | “TOP TOY store” refers to any store operated under the “TOP TOY” brand name, including those directly operated by us and those operated under the MINISO Retail Partner model; and |

1

| ● | “US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States. |

We present our financial results in RMB. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate, or at all. The PRC government promulgates legislations on its foreign currency reserves in part through regulation of the conversion of RMB into foreign exchange. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Renminbi into U.S. dollars were made at the rate at RMB7.2993 to US$1.0000, the exchange rate as set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System in effect as of December 31, 2024.

We changed our fiscal year end from June 30 to December 31 in January 2024 and filed a transition report on Form 20-F covering the six-month period from July 1, 2023 through December 31, 2023. Unless otherwise noted, all references in this annual report to years are to the calendar year from January 1 to December 31 and to our fiscal year or years are to the fiscal year or years which, prior to the transition period, ended on June 30, and from and after the transition period, ended on December 31. To enhance the comparability of our financial results of 2024, we have also included in this annual report the unaudited financial results for the twelve months ended December 31, 2023, which are derived from the arithmetic combination of our audited financial results for the six months ended December 31, 2023 and the twelve months ended June 30, 2023, after arithmetic adjustments made to exclude the financial results of the first six months of 2023.

2

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by words or phrases such as “may,” “could,” “should,” “would,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to,” “project,” “continue,” “potential” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

| ● | our mission, goals and strategies; |

| ● | our future business development, financial conditions and results of operations; |

| ● | the expected growth of the retail market and the market of branded variety retail of lifestyle products in China and globally; |

| ● | our expectations regarding demand for and market acceptance of our products; |

| ● | our expectations regarding our relationships with consumers, suppliers, MINISO Retail Partners, local distributors, and our other business partners; |

| ● | competition in our industry; |

| ● | relevant government policies and regulations relating to our business and our industry; and |

| ● | general economic and business conditions globally and in China. |

You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

3

PART I

Item 1. |

Identity of Directors, Senior Management and Advisers |

Not applicable.

Item 2.Offer Statistics and Expected Timetable

Not applicable.

Item 3.Key Information

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023 in December 2022, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor.

In November 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of the annual report on Form 20-F for the fiscal year ended June 30, 2022. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. As of the date of this annual report, the PCAOB has not issued any new determination that it is unable to inspect or investigate completely registered public accounting firms headquartered in any jurisdiction. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F.

Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors of the benefits of such inspections” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

4

Doing Business in China

A substantial portion of our business operations are conducted in China and we face various risks and uncertainties related to doing business in China. We are subject to complex and evolving laws and regulations in mainland China. For example, we face risks associated with regulatory approvals on offshore offerings and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or be worthless. For a detailed description of risks related to doing business in China, please refer to risks disclosed under “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China.”

PRC government’s significant authority in regulating our operations and its oversight over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. For example, the PRC Data Security Law and the PRC Personal Information Protection Law in 2021 posed additional challenges to our cybersecurity and data privacy compliance, including without limitation, challenges in discharging our extra responsibilities in relation to establishing data security management systems for our entire operational process, organizing education and training sessions on data security, employing corresponding technical and other necessary measures to safeguard data security, formulating internal management systems and operating procedures, adopting corresponding security technical measures, and preventing unauthorized access as well as breach, tampering, or loss of personal information. The Cybersecurity Review Measures issued by the Cyberspace Administration of China, or the CAC and several other governmental authorities in mainland China in December 2021 and the Regulations on Cyber Data Security Management or the Cyber Data Regulations published by the State Council on September 24, 2024, which became effective on January 1, 2025, also resulted in uncertainties and potential additional restrictions on China-based overseas-listed companies like us. For example, uncertainty exists as to how the Cybersecurity Review Measures and the Cyber Data Regulations may be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new regulations or detailed implementation rules and interpretation thereof. If the detailed rules, implementations, or the final promulgated version of the draft regulations mandate clearance of cybersecurity review and other specific actions to be completed by us, we will face uncertainties as to whether such clearance can be timely obtained, the failure of which may subject us to penalties, which could materially and adversely affect our business and results of operations and the price of the ADSs. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Failure to protect personal or confidential information against security breaches could subject us to significant reputational, financial and legal consequences and substantially harm our business and results of operations” for additional details.

Furthermore, anti-monopoly regulators in mainland China have promulgated new anti-monopoly and competition laws and regulations and strengthened the enforcement under these laws and regulations. There remain uncertainties as to how the laws, regulations and guidelines recently promulgated will be implemented and whether these laws, regulations and guidelines will have a material impact on our business, financial condition, results of operations and prospects. If any non-compliance is identified by relevant authorities, we may be subject to fines and other penalties. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Mainland China’s M&A Rules and certain other regulations establish complex procedures for certain acquisitions of mainland China companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in mainland China.” In addition, implementation of industry-wide regulations may cause the value of such securities to significantly decline. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—The PRC government’s oversight and regulation over our business operations could result in a material change in our operations and the value of our ordinary shares or the ADSs.”

Risks and uncertainties arising from the legal system in mainland China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in mainland China, could result in a material adverse change in our operations and the value of our ADSs. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—Uncertainties in the interpretation and enforcement of laws and regulations in mainland China could limit the legal protections available to you and us.”

5

In addition to our operations in mainland China, we have operations in Hong Kong. The operational risks associated with being based in and having operations in mainland China also apply to operations in Hong Kong. While entities and businesses in Hong Kong operate under different sets of laws from mainland China, the legal risks associated with being based in and having operations in mainland China could apply to our operations in Hong Kong, if the laws applicable to mainland China become applicable to entities and businesses in Hong Kong in the future.

We believe that there is uncertainty as to whether the courts of Hong Kong would (i) recognize or enforce judgments of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States, or (ii) entertain original actions brought in Hong Kong against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. A judgment of a court in the United States predicated upon U.S. federal or state securities laws may be forced in Hong Kong at common law by bringing an action in a Hong Kong court on that judgment for the amount due thereunder, and then seeking summary judgment on the strength of the foreign judgment, provided that the foreign judgment, among other things, is (i) for a debt or a definite sum of money (not being taxes or similar charges to a foreign government taxing authority or a fine or other penalty), and (ii) final and conclusive on the merits of the claim, but not otherwise. Such a judgment may not, in any event, be so enforced in Hong Kong if (a) it was obtained by fraud, (b) the proceedings in which the judgment was obtained were opposed to natural justice, (c) its enforcement or recognition would be contrary to the public policy of Hong Kong, (d) the court of the United States was not jurisdictionally competent, or (e) the judgment was in conflict with a prior Hong Kong judgment. Hong Kong has no arrangement for the reciprocal enforcement of judgments with the United States. As a result, there is uncertainty as to the enforceability in Hong Kong, in original actions or in actions for enforcement, of judgments of United States courts of civil liabilities predicated solely upon the federal securities laws of the United States or the securities laws of any State or territory within the United States.

There are relevant laws and regulations in Hong Kong regarding data security, such as the Personal Data (Privacy) Ordinance and the Unsolicited Electronic Messages Ordinance, which impose obligations regarding the collection and handling of personal data in Hong Kong. In addition, new laws or regulations related to data security in Hong Kong may be enacted or promulgated in the future, and such new laws and regulations may also have a material impact on our business in Hong Kong. As of the date of this annual report, we have not received any notice or allegation from the governmental authority in Hong Kong alleging any breach or non-compliance of applicable data security laws.

Our business operations in Hong Kong are also subject to the Competition Ordinance in Hong Kong, which prohibits anti-competitive agreements, abuse of market power and anti-competitive mergers and acquisitions. As of the date of this annual report, no issues relating to the Competition Ordinance or our compliance with the Competition Ordinance have resulted in any material impact on our ability to conduct business. We are not now nor have ever been a party to any inquiries or investigations relating to the Competition Ordinance.

As of the date of this annual report, regulatory actions related to data security or anti-monopoly concerns in Hong Kong do not have a material impact on our ability to conduct business, accept foreign investment in the future, continue to list on a United States stock exchange or maintain our listing status on the Hong Kong Stock Exchange. However, new regulatory actions related to data security or anti-monopoly concerns in Hong Kong may be taken in the future, and such regulatory actions may have a material impact on our ability to conduct business, accept foreign investment, continue to list on a United States stock exchange or maintain our listing status on the Hong Kong Stock Exchange. For a detailed description of risks related to doing business in China, please refer to risks disclosed under “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China.”

Under the PRC Enterprise Income Tax Law, dividends paid by a foreign invested entity to any of its foreign non-resident enterprise investors are subject to a 10% withholding tax. Thus, the dividends, if and when payable by our subsidiaries in mainland China to their respective shareholders established in Hong Kong, would be subject to a 10% withholding tax. A lower tax rate will be applied if such foreign non-resident enterprise investor’s jurisdiction of incorporation has entered into a tax treaty or arrangement with mainland China for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

6

Permissions Required from the PRC Authorities

Permissions required from the PRC authorities for our operations

Our operations in mainland China are governed by mainland China laws and regulations. As advised by JunHe LLP, our PRC legal adviser, except that (i) we are in the process of completing the commercial franchise filing for the “TOP TOY” brand, (ii) we have not obtained the certificate for fire control inspection for four of our directly operated TOP TOY stores and three of our directly operated MINISO stores, and (iii) the lease agreements for some of our leased properties in mainland China have not been registered with the relevant PRC government authorities in mainland China as required by mainland China laws, as of the date of this annual report, our mainland China subsidiaries have obtained all requisite licenses and permits from the relevant mainland China government authorities for the business operations in mainland China. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Any lack of requisite approvals, licenses or permits applicable to our business may have a material and adverse impact on our business, financial condition and results of operations” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our leased property interest may be defective and such defects may negatively affect our right to such leases” for more details. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future.

Our operations in Hong Kong are governed by Hong Kong laws and regulations. As of the date of this annual report, our Hong Kong subsidiaries have obtained business registrations and other permits and certificates required for the rented premises, such as fire control certificates. These are the requisite licenses and permits from the government authorities in Hong Kong for our business operations in Hong Kong. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, and that the scope of our business operations in Hong Kong may change in the future, we may be required to obtain additional licenses, permits, filings or approvals for our business operations in Hong Kong in the future.

Permissions required from the PRC authorities for overseas financing activities

The PRC government has recently sought to exert more oversight and control over capital raising activities of listed companies that are conducted overseas and/or foreign investment in China-based issuers. In December 2021, the Cyberspace Administration of China, or the CAC, together with other authorities, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022 and replaced its predecessor regulation. Pursuant to the Cybersecurity Review Measures, critical information infrastructure operators, or the CIIOs, that procure internet products and services and network platform operators that conduct data process activities must be subject to the cybersecurity review if their activities affect or may affect national security. The Cybersecurity Review Measures further stipulates that network platform operators that hold personal information of over one million users shall apply with the Cybersecurity Review Office for a cybersecurity review before any public offering at a foreign stock exchange, and relevant governmental authorities may initiate cybersecurity review if such governmental authorities consider that relevant network products or services and data processing affect or may affect national security. As advised by JunHe LLP, our PRC legal adviser, we were not subject to the cybersecurity review requirement under the Cybersecurity Review Measures with regard to our initial public offering in the United States and our public offering and listing in Hong Kong because (i) our initial public offering in the United States was completed prior to the Cybersecurity Review Measures took effect, and (ii) our public offering and listing in Hong Kong was not regarded as a listing abroad within the meaning of the Cybersecurity Review Measures as confirmed by the China Cybersecurity Review Technology and Certification Center, an organization delegated by the CAC to receive consultations and applications for cybersecurity reviews, or the CCRC, during a phone consultation conducted on March 25, 2022 by our PRC legal advisor, JunHe LLP.

7

On September 24, 2024, the State Council published the Cyber Data Regulations, which became effective on January 1, 2025. The Cyber Data Regulations restates and further specifies the legal requirements for personal information, important data, cross-border data transfer, network platform services, and data security. If the network data processing activities have or may have impact on national security, such activities shall be subject to national security review in accordance with relevant laws and regulations. Any failure to comply with such requirements may subject us to, among others, suspension of services, fines, revoking relevant business permits or business licenses and penalties. As of the date of this annual report, we have not been informed by any PRC governmental authorities that our products or services are deemed to be provided to any CIIO, nor have we been identified as a CIIO by any PRC governmental authorities, nor have we received any notice from any PRC governmental authorities requiring us to undergo a cybersecurity review or network data security review by the CAC.

Since the measures are relatively new, uncertainties exist with respect to the interpretation and implementation of these regulations. In anticipation of the strengthened implementation of cybersecurity laws and regulations and the continued expansion of our business, we cannot rule out the possibility that we may be deemed to be a “critical information infrastructure operator” or a “network platform operator” that affects or may affect national security under the Cybersecurity Review Measures. If that were to happen, we would be required to follow cybersecurity review procedures even if we do not engage in public offerings in a foreign exchange. In addition to laws, regulations and other applicable rules regarding data privacy and cybersecurity, industry associations may propose new and different privacy standards. See “Item 4. Information on the Company—B. Business Overview—Regulations.” Any failure or perceived failure to comply with these laws, regulations or policy may result in inquiries and other proceedings or actions against us by governmental authorities, users, consumers or others, such as warnings, fines, penalties, required rectifications, service suspension or removal of mobile apps from the relevant app stores and/or other sanctions, as well as negative publicity and damage to our reputation, which could cause us to lose customers and business partners and have an adverse effect on our business and results of operations.

On February 17, 2023, China Securities Regulatory Commission, or the CSRC, released several regulations regarding the filing requirements for overseas offerings and listings by domestic companies, including the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines (collectively, the “Overseas Listing Trial Measures”), which took effect on March 31, 2023. According to the Overseas Listing Trial Measures, PRC domestic enterprises that have completed overseas listings are not required to make any immediate filing with the CSRC. However, such companies will be required to comply with the filing requirements under the Overseas Listing Trial Measures if and when they pursue any future securities offerings and listings outside of mainland China, including but not limited to follow-on offerings and secondary listings, unless otherwise provided thereunder. The filing requirements for overseas financing activities discussed above are applicable to indirect offshore issuance of securities and listings in the name of offshore enterprises of which the principal business activities are conducted in mainland China with the underlying equity, assets, income, or other similar interests in enterprises in mainland China. If we conduct such indirect issuance of securities and listings, we would be subject to such filing requirements. Any failure to obtain or delay in obtaining such approval or completing such review or filing procedures under the Overseas Listing Trial Measures or otherwise, for any future securities offerings and listings outside of mainland China, including but not limited to follow-on offerings and secondary listings, could subject us to restrictions and penalties imposed by the CSRC, which could include fines and penalties on our operations in mainland China, or other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects, as well as the trading price of the ADSs. Since we completed our initial public offering in the United States and our dual primary listing in Hong Kong, both prior to the Overseas Listing Trial Measures coming into effect, as advised by our PRC legal advisor, JunHe LLP, we therefore are not required to submit filings to the CSRC under the Overseas Listing Trial Measures for our initial public offering and listing. However, we are required to complete the filing procedures with the CSRC pursuant to the requirements of the Overseas Listing Trial Measures for our subsequent issuance of equity securities.

8

The filing requirements for overseas financing activities discussed above are applicable to indirect offshore issuance of securities and listings in the name of offshore enterprises of which the principal business activities are conducted in mainland China with the underlying equity, assets, income, or other similar interests in enterprises in mainland China. Were we conduct such indirect issuance of securities and listings, we would be subject to such filing requirements. In connection with the offering of 2032 Securities, we have (i) completed the pre-issuance registration with the NDRC and obtained a certificate evidencing such registration, (ii) filed the requisite information on our equity linked securities with the NDRC within the time period as required by the NDRC after the issuance of our equity linked securities, and (iii) submitted the filing with the CSRC within the time period as required under the Trial Administrative Measures of Overseas Securities Offerings and Listings by Domestic Companies after the completion of the offering of our equity linked securities. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The approval of the CSRC or other PRC government authorities may be required in connection with future offerings or future issuance of securities abroad under mainland China law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval,” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—If we cannot obtain sufficient cash when we need it, we may not be able to meet our payment obligations under our outstanding and future obligations in relation to our equity linked securities.”

If the CSRC, CAC or other relevant regulatory agencies subsequently determine that approval or filing is required for any of our offshore offerings, future offerings of securities overseas or to maintain the listing status of the ADSs, we cannot guarantee that we will be able to obtain such approval or complete the filing in a timely manner, or at all. The CSRC, CAC or other regulatory agencies also may take actions requiring us, or making it advisable for us, not to proceed with such offering or maintain the listing status of our listed securities. If we proceed with any of such offering or maintain the listing status of our listed securities without obtaining the CSRC’s or other relevant regulatory agencies’ approval or filing to the extent it is required, or if we are unable to comply with any new approval requirements which might be adopted for offerings that we have completed prior to the publication of the above-referenced opinions, we may face regulatory actions or other sanctions from the CSRC, CAC or other regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in mainland China, limit our ability to pay dividends outside of mainland China, limit our operating privileges in mainland China, delay or restrict the repatriation of the proceeds from offering of securities overseas into mainland China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of the listed securities.

Furthermore, if there are any other approvals, filings and/or other administration procedures to be obtained from or completed with the CSRC, CAC or other regulatory agencies as required by any new laws and regulations for any of our future proposed offering of securities overseas or the listing of the listed securities, we cannot assure you that we can obtain the required approval or complete the required filings or other regulatory procedures in a timely manner, or at all. Any failure to obtain the relevant approvals or complete the filings and other relevant regulatory procedures may subject us to regulatory actions or other sanctions from the CSRC or other regulatory agencies, which may have a material adverse effect on our business, financial condition or results of operations. Uncertainties and/or negative publicity regarding these regulations could also have a material adverse effect on the trading price of our listed securities.

9

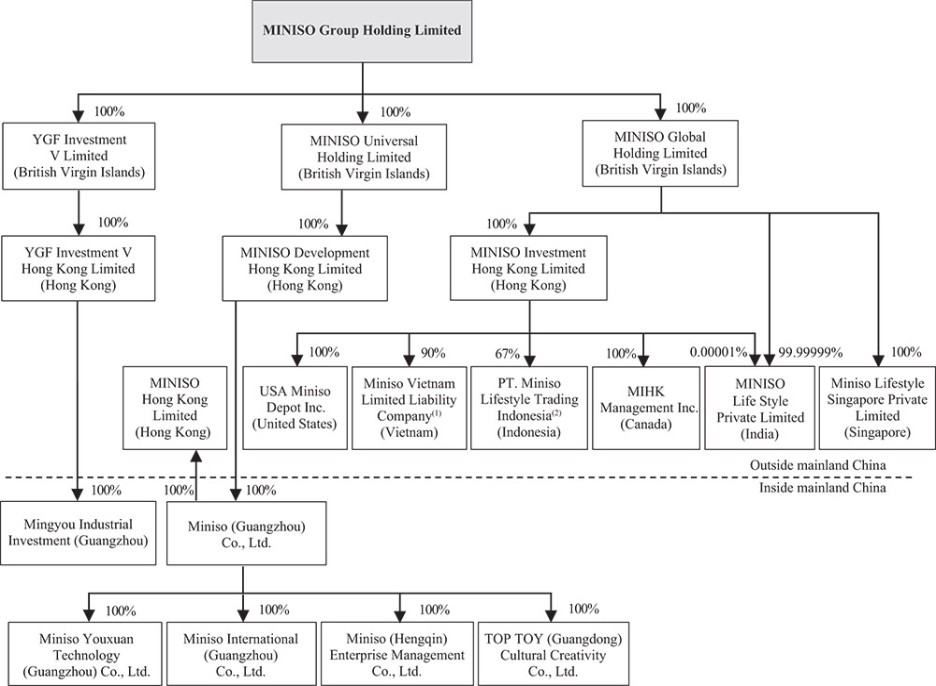

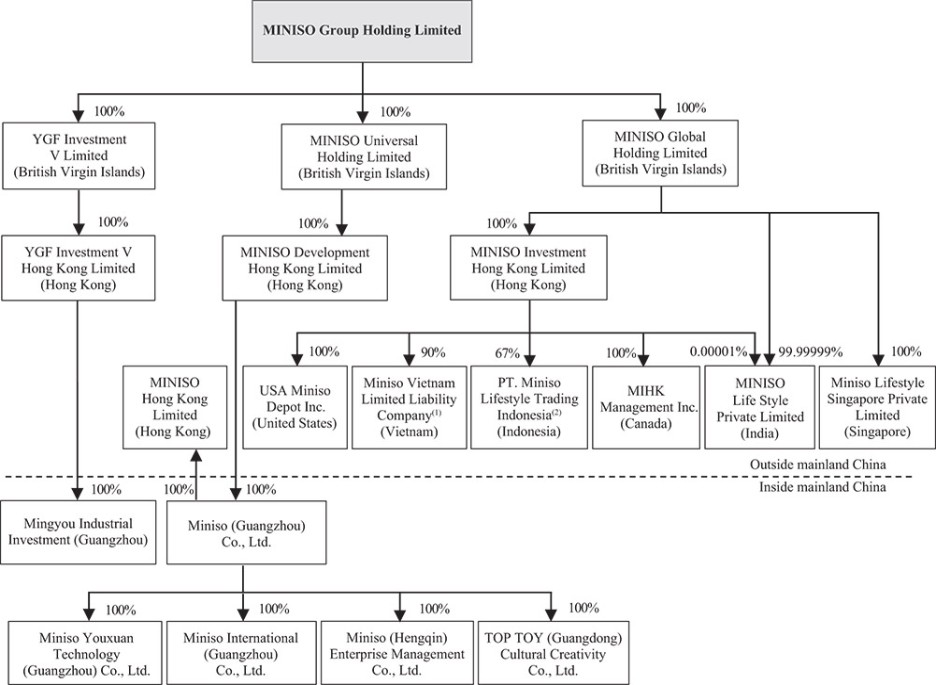

Our Holding Company Structure

We are not an operating company but a Cayman Islands holding company with operations primarily conducted by our subsidiaries in China, and to a lesser extent by our subsidiaries outside China. We do not use a variable interest entity structure. The following diagram illustrates our corporate structure consisting of our principal subsidiaries as of the date of this annual report:

| (1) | The remaining 10% shares of Miniso Vietnam Limited Liability Company is held by an individual distributor in Vietnam. |

| (2) | The remaining shares of PT. Miniso Lifestyle Trading Indonesia is held by PT. Mitra Retail Indonesia and PT. Yar Noor International as to 20% and 13%, respectively. |

10

MINISO Group Holding Limited is a Cayman holding company and our operations are conducted primarily through subsidiaries in China. By purchasing the ADSs, you are purchasing interests in our Cayman holding company, as opposed to interests in our subsidiaries in China. Except for certain specific industries, current laws and regulations in mainland China do not prohibit direct foreign investment in mainland China companies. However, foreign investment laws in mainland China are constantly evolving and there is uncertainty with respect to future laws and regulations as well as regulatory actions to be taken by the PRC government in this regard. Were this holding company structure to be challenged or disallowed by PRC regulatory authorities, our business operations would be materially and adversely affected and the value of the ADSs could significantly decline or become worthless. Our holding company structure also involves certain risks in terms of dividend distribution, direct investment in entities in mainland China and obtaining benefits under relevant tax treaty. See “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—MINISO Group Holding Limited is a Cayman holding company and we may rely on dividends and other distributions on equity paid by our mainland China subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our mainland China subsidiaries or Hong Kong subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business,” “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Mainland China regulation of loans to and direct investment in mainland China entities by offshore holding companies and governmental administration of currency conversion may delay or prevent us from using the proceeds of our offshore offerings to make loans to or make additional capital contributions to our mainland China subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business,” “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—Mainland China regulations relating to offshore investment activities by mainland China residents may limit our mainland China subsidiaries’ ability to increase their registered capital or distribute profits to us or otherwise expose us or our mainland China resident beneficial owners to liability and penalties under laws of mainland China” and “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—We may not be able to obtain certain benefits under relevant tax treaty on dividends paid by our mainland China subsidiaries to us through our Hong Kong subsidiary.” See also “Item 4. Information on the Company—B. Business Overview—Regulations—Mainland China—Regulation related to foreign exchange” and “Item 4. Information on the Company—B. Business Overview—Regulations—Mainland China—Regulation related to dividend distribution.”

Transfer of Funds and Other Assets Within Our Organization

We are not an operating company but a Cayman Islands holding company with operations primarily conducted by our subsidiaries in China, and to a lesser extent by our subsidiaries outside China. Our ability to pay dividends to the shareholders and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to us. In addition, under PRC laws and regulations, our PRC subsidiaries are permitted to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Furthermore, our PRC subsidiaries are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies.

11

Furthermore, if certain procedural requirements are satisfied, the payment of current account items, including profit distributions and trade and service related foreign exchange transactions, can be made in foreign currencies without prior approval from State Administration of Foreign Exchange (the “SAFE”) or its local branches. However, where RMB is to be converted into foreign currency and remitted out of mainland China to pay capital expenses, such as the repayment of loans denominated in foreign currencies, or where foreign currency is converted into RMB and remitted into mainland China to purchase goods or services from our mainland China subsidiaries, prior approval from or registration with competent government authorities or its authorized banks is required. The PRC government may take measures at its discretion from time to time to restrict access to foreign currencies for current account or capital account transactions. If the foreign exchange administration system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our offshore intermediary holding companies or ultimate parent company, and therefore, our shareholders or investors in our ADSs. Further, we cannot assure you that new regulations or policies will not be promulgated in the future, which may further restrict the remittance of RMB out of the mainland China. We cannot assure you, in light of the restrictions in place, or any amendment to be made from time to time, that our current or future mainland China subsidiaries will be able to satisfy their respective payment obligations that are denominated in foreign currencies, including the remittance of dividends outside of the mainland China. As a result of the restrictions discussed above, to the extent cash in the business is in a mainland China entity, the funds may not be available to fund operations or for other use outside of mainland China due to interventions in or the imposition of restrictions and limitations on the ability of us or our mainland China subsidiaries by the PRC government to transfer cash. These restrictions and limitations imposed by the PRC government in mainland China are not applicable to cash transfers in and out of Hong Kong or our Hong Kong subsidiaries. If the laws applicable to mainland China become applicable to entities and businesses in Hong Kong in the future, funds in Hong Kong or in our Hong Kong subsidiaries may not be available to fund operations or for other use outside of Hong Kong. See “Item 4. Information on the Company—B. Business Overview—Regulations—Mainland China—Regulation related to foreign exchange” and “Item 4. Information on the Company—B. Business Overview—Regulations—Mainland China—Regulation related to dividend distribution.” See also “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China—MINISO Group Holding Limited is a Cayman holding company and we may rely on dividends and other distributions on equity paid by our mainland China subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our mainland China subsidiaries or Hong Kong subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” for more information.

Under PRC laws, MINISO Group Holding Limited may fund our PRC subsidiaries only through capital contributions or loans, subject to satisfaction of applicable government registration and approval requirements. In the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023 and the fiscal year ended December 31, 2024, the amount of capital contribution made by MINISO Group Holding Limited and/or intermediate holding companies to our PRC subsidiaries was RMB1,332.0 million, RMB26.0 million, nil and RMB59.8 million (US$8.2 million), respectively. No loans were extended by MINISO Group Holding Limited to our PRC subsidiaries during these periods. In addition, our PRC subsidiaries may receive cash payments from our certain offshore subsidiaries for product sales to such offshore subsidiaries. In the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023 and the fiscal year ended December 31, 2024, our PRC subsidiaries received RMB1,824.4 million, RMB2,661.0 million, RMB1,671.5 million and RMB4,728.4 million (US$647.8 million), respectively, from such payments. In the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023 and the fiscal year ended December 31, 2024, no assets other than cash were transferred through our organization.

12

On August 17, 2022, our board of directors declared a cash dividend in the amount of US$0.172 per ADS, or US$0.043 per ordinary share, payable as of the close of business on September 9, 2022 to shareholders of record as of the close of business on August 31, 2022. The aggregate amount of cash dividends paid was US$53.6 million. On August 22, 2023, our board of directors declared another cash dividend in the amount of US$0.412 per ADS, or US$0.103 per ordinary share, payable as of the close of business on September 19, 2023 to shareholders of record as of the close of business on September 7, 2023. The aggregate amount of cash dividend paid was US$128.8 million (RMB 923.7 million). On March 12, 2024, our board of directors declared a special cash dividend in the amount of US$0.2900 per ADS, or US$0.0725 per ordinary share, to shareholders of record as of the close of business on March 28, 2024. The aggregate amount of cash dividends paid was US$90.6 million (RMB644.8 million). On August 30, 2024, our board of directors declared an interim cash dividend in the amount of US$0.2744 per ADS, or US$0.0686 per ordinary share, to shareholders of record as of the close of business on September 13, 2024. The aggregate amount of cash dividends paid was US$85.2 million (RMB601.1 million). On March 21, 2025, our board of directors declared a final cash dividend in the amount of US$ 0.3268 per ADS, or US$0.0817 per ordinary share, to shareholders of record as of the close of business on April 8, 2025. The aggregate amount of cash dividends paid was US$101.4 million (RMB740.4 million). All of the above-mentioned dividend distributions were funded by surplus cash on our balance sheet. Other than these dividends, MINISO Group Holding Limited has not declared or paid any cash dividends. We intend to distribute dividends annually in the future representing no less than 50% of our annual adjusted net profit, a non-IFRS measure, which is defined as profit for the period excluding equity-settled share-based payment expenses. However, whether or not we actually distribute dividends and, if yes, when we are going to distribute dividends are at the discretion of our board of directors. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy” for details. For mainland China and United States federal income tax considerations of an investment in the ADSs, see “Item 10. Additional Information—E. Taxation.”

In addition to the dividend policy discussed above, we have adopted cash management policies, including specific policies governing approvals with respect to fund transfers throughout our organization. Our management and the audit committee of the board of directors oversee our major financial risk exposures. We maintain an authorization policy on cash management, setting forth the scope of authority for certain treasury matters that are delegated by our board of directors to be approved by our management. Under this policy, certain treasury matters, such as intercompany loans, capital contribution made by our company and/or its intermediate holding companies to its subsidiaries and dividends distributed from our company’s subsidiaries to the holding company, are clearly defined, with the level of approval required for each matter specifically identified. When funding is required, we will obtain all necessary approvals from our management and relevant governmental authorities, including the SAFE.

Other than the transfers of funds within our organization discussed above, there were no other transfer of assets, dividends or distributions made between our company and our subsidiaries, and no transfer of cash or other assets, dividends or distributions made to U.S. investors for the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023, and the year ended December 31, 2024. There are no additional tax consequences upon cash payments for capital contribution or product sales within our organization discussed above. Under the current laws of the Cayman Islands, we are not subject to tax on income or capital gains. In addition, upon payments of dividends to our shareholders, no Cayman Islands withholding tax will be imposed.

A.Selected Financial Data

We changed our fiscal year end from June 30 to December 31 in January 2024. The following tables present the selected consolidated financial information of our company. The selected consolidated statement of profit or loss and other comprehensive income data for the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023 and the fiscal year ended December 31, 2024, the selected consolidated statement of financial position data as of June 30, 2023 and December 31, 2023 and 2024, and selected consolidated statement of cash flows data for the fiscal years ended June 30, 2022 and 2023, the six months ended December 31, 2023 and the fiscal year ended December 31, 2024 have been derived from our audited consolidated financial statements included in this annual report beginning on page F-1. The unaudited financial data for the six months ended June 30, 2022 and the year ended December 31, 2023 is presented solely for the purpose of providing meaningful comparisons with that for the six months ended June 30, 2023 and the year ended December 31, 2024, respectively. The selected consolidated statement of financial position data as of June 30, 2020, 2021 and 2022 and the selected consolidated statement of profit or loss and other comprehensive income data for the fiscal years ended June 30, 2020 and 2021 have been derived from our audited consolidated financial statements not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with IFRS Accounting Standards, or IFRS, issued by the International Accounting Standard Board, or IASB. Our historical results are not necessarily indicative of results expected for future periods. You should read the following selected financial data in conjunction with the consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report.

13

The following table presents our selected consolidated statement of profit or loss and other comprehensive income data for the fiscal years ended June 30, 2020, 2021, 2022 and 2023, the six months ended December 31, 2022 and 2023 and the years ended December 31, 2023 and 2024:

|

|

|

|

|

|

|

|

|

|

For the six months ended |

|

For the year ended |

||||||

|

|

For the fiscal year ended June 30, |

|

December 31, |

|

December 31, |

||||||||||||

|

|

2020 |

|

2021 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2024 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

(Unaudited) |

|

|

|

|

|

|

(in thousands, except for share and per share data) |

||||||||||||||||

Selected consolidated statement of profit or loss and other comprehensive income data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

8,978,986 |

|

9,071,659 |

|

10,085,649 |

|

11,473,208 |

|

5,266,878 |

|

7,632,467 |

|

13,838,797 |

|

16,994,025 |

|

2,328,172 |

Cost of sales |

|

(6,246,488) |

|

(6,640,973) |

|

(7,015,888) |

|

(7,030,156) |

|

(3,281,218) |

|

(4,391,428) |

|

(8,140,366) |

|

(9,356,965) |

|

(1,281,899) |

Gross profit |

|

2,732,498 |

|

2,430,686 |

|

3,069,761 |

|

4,443,052 |

|

1,985,660 |

|

3,241,039 |

|

5,698,431 |

|

7,637,060 |

|

1,046,273 |

Other income |

|

37,208 |

|

52,140 |

|

25,931 |

|

17,935 |

|

14,311 |

|

18,993 |

|

22,617 |

|

21,595 |

|

2,959 |

Selling and distribution expenses(1) |

|

(1,190,477) |

|

(1,206,782) |

|

(1,442,339) |

|

(1,716,093) |

|

(798,127) |

|

(1,363,114) |

|

(2,281,080) |

|

(3,519,534) |

|

(482,174) |

General and administrative expenses(1) |

|

(796,435) |

|

(810,829) |

|

(816,225) |

|

(633,613) |

|

(313,908) |

|

(357,689) |

|

(677,394) |

|

(931,651) |

|

(127,636) |

Other net income/(loss) |

|

45,997 |

|

(40,407) |

|

87,308 |

|

114,106 |

|

72,850 |

|

21,105 |

|

62,361 |

|

114,696 |

|

15,713 |

(Credit loss)/ reversal of credit loss on trade and other receivables |

|

(25,366) |

|

(20,832) |

|

(28,924) |

|

1,072 |

|

(3,716) |

|

(2,080) |

|

2,708 |

|

2,469 |

|

338 |

Impairment loss on non-current assets |

|

(36,844) |

|

(2,941) |

|

(13,485) |

|

(3,448) |

|

— |

|

(4,547) |

|

(7,995) |

|

(8,846) |

|

(1,212) |

Operating profit |

|

766,581 |

|

401,035 |

|

882,027 |

|

2,223,011 |

|

957,070 |

|

1,553,707 |

|

2,819,648 |

|

3,315,789 |

|

454,261 |

Finance income |

|

25,608 |

|

40,433 |

|

66,344 |

|

145,225 |

|

64,684 |

|

123,969 |

|

204,510 |

|

118,672 |

|

16,258 |

Finance costs |

|

(31,338) |

|

(28,362) |

|

(33,396) |

|

(34,622) |

|

(16,345) |

|

(25,202) |

|

(43,479) |

|

(92,915) |

|

(12,729) |

Net finance (costs)/income |

|

(5,730) |

|

12,071 |

|

32,948 |

|

110,603 |

|

48,339 |

|

98,767 |

|

161,031 |

|

25,757 |

|

3,529 |

Fair value changes of paid-in capital subject to redemption and other preferential rights/ redeemable shares with other preferential rights |

|

(680,033) |

|

(1,625,287) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Share of loss of equity-accounted investee, net of tax |

|

— |

|

(4,011) |

|

(8,162) |

|

— |

|

— |

|

268 |

|

268 |

|

5,986 |

|

820 |

Profit/(loss) before taxation |

|

80,818 |

|

(1,216,192) |

|

906,813 |

|

2,333,614 |

|

1,005,409 |

|

1,652,742 |

|

2,980,947 |

|

3,347,532 |

|

458,610 |

Income tax expense |

|

(210,949) |

|

(213,255) |

|

(267,070) |

|

(551,785) |

|

(241,498) |

|

(396,665) |

|

(706,952) |

|

(712,104) |

|

(97,558) |

(Loss)/profit for the year/period from continuing operations |

|

(130,131) |

|

(1,429,447) |

|

639,743 |

|

1,781,829 |

|

763,911 |

|

1,256,077 |

|

2,273,995 |

|

2,635,428 |

|

361,052 |

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the year from discontinued operations, net of tax |

|

(130,045) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

(Loss)/profit for the year/period |

|

(260,176) |

|

(1,429,447) |

|

639,743 |

|

1,781,829 |

|

763,911 |

|

1,256,077 |

|

2,273,995 |

|

2,635,428 |

|

361,052 |

Attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity shareholders of the Company |

|

(262,267) |

|

(1,415,010) |

|

638,170 |

|

1,768,926 |

|

764,090 |

|

1,248,405 |

|

2,253,241 |

|

2,617,560 |

|

358,604 |

Non-controlling interests |

|

2,091 |

|

(14,437) |

|

1,573 |

|

12,903 |

|

(179) |

|

7,672 |

|

20,754 |

|

17,868 |

|

2,448 |

(Loss)/profit for the year/period |

|

(260,176) |

|

(1,429,447) |

|

639,743 |

|

1,781,829 |

|

763,911 |

|

1,256,077 |

|

2,273,995 |

|

2,635,428 |

|

361,052 |

(Loss)/earnings per share(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

(0.26) |

|

(1.18) |

|

0.53 |

|

1.42 |

|

0.61 |

|

1.00 |

|

1.81 |

|

2.11 |

|

0.29 |

—Diluted |

|

(0.26) |

|

(1.18) |

|

0.52 |

|

1.41 |

|

0.61 |

|

1.00 |

|

1.80 |

|

2.10 |

|

0.29 |

(Loss)/earnings per share(2) – Continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—Basic |

|

(0.12) |

|

(1.18) |

|

0.53 |

|

1.42 |

|

0.61 |

|

1.00 |

|

1.81 |

|

2.11 |

|

0.29 |

—Diluted |

|

(0.12) |

|

(1.18) |

|

0.52 |

|

1.41 |

|

0.61 |

|

1.00 |

|

1.80 |

|

2.10 |

|

0.29 |

Other comprehensive income /(loss)for the year |

|

6,361 |

|

(16,548) |

|

40,494 |

|

41,198 |

|

(13,634) |

|

(32,504) |

|

22,328 |

|

19,128 |

|

2,621 |

Total comprehensive income/(loss) for the year |

|

(253,815) |

|

(1,445,995) |

|

680,237 |

|

1,823,027 |

|

750,277 |

|

1,223,573 |

|

2,296,323 |

|

2,654,556 |

|

363,673 |

Equity shareholders of the Company |

|

(256,583) |

|

(1,429,621) |

|

677,667 |

|

1,803,797 |

|

746,698 |

|

1,217,804 |

|

2,274,903 |

|

2,635,833 |

|

361,108 |

Non-controlling interests |

|

2,768 |

|

(16,374) |

|

2,570 |

|

19,230 |

|

3,579 |

|

5,769 |

|

21,420 |

|

18,723 |

|

2,565 |

Notes:

| (1) | Equity-settled share-based payment expenses were allocated as follows: |

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended |

|

For the year ended |

||||||||

|

|

For the fiscal year ended June 30, |

|

December 31, |

|

December 31, |

||||||||||||

|

|

2020 |

|

2021 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2024 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

(in thousands) |

||||||||||||||||

Equity-settled share-based payment expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and distribution expenses |

|

127,743 |

|

131,215 |

|

52,000 |

|

44,824 |

|

16,622 |

|

41,506 |

|

69,709 |

|

13,454 |

|

1,843 |

General and administrative expenses |

|

236,637 |

|

150,104 |

|

30,835 |

|

18,058 |

|

9,958 |

|

4,926 |

|

13,025 |

|

71,730 |

|

9,827 |

Total |

|

364,380 |

|

281,319 |

|

82,835 |

|

62,882 |

|

26,580 |

|

46,432 |

|

82,734 |

|

85,184 |

|

11,670 |

| (2) | Our company was incorporated on January 7, 2020 during the reorganization to establish our current offshore structure and we issued 976,634,771 ordinary shares in January 2020. For purposes of calculating basic and diluted loss per share for the fiscal years ended June 30, 2020, the number of outstanding ordinary shares used in the calculation was 865,591,398, which excluded 111,043,373 ordinary shares held by certain share incentive awards holding vehicles as of June 30, 2020 as these shares were regarded as treasury shares for purposes of calculating per share data. The number of ordinary shares used in the calculation has been retroactively adjusted to reflect the issuance of ordinary shares by our company in connection with the incorporation of our company and the reorganization as if these events had occurred at the beginning of the earliest period presented. For purposes of calculating basic and diluted earnings per share for the fiscal year ended June 30, 2022, the weighted average number of ordinary shares in issue used in the calculation was 1,205,527,348 and 1,216,637,439, respectively. For purposes of calculating basic and diluted earnings per share for the fiscal year ended June 30, 2023, the weighted average number of ordinary shares in issue used in the calculation was 1,243,320,377 and 1,250,545,116, respectively. For purposes of calculating basic and diluted earnings per share for the six months ended December 31, 2023, the weighted average number of ordinary shares in issue used in the calculation was 1,244,926,865 and 1,251,635,862, respectively. For purposes of calculating basic and diluted earnings per share for the year ended December 31, 2023, the weighted average number of ordinary shares in issue used in the calculation was 1,244,720,534 and 1,252,361,115, respectively. For purposes of calculating basic and diluted earnings per share for the fiscal year ended December 31, 2024, the weighted average number of ordinary shares in issue used in the calculation was 1,239,394,263 and 1,246,817,617, respectively. |

The following table presents our selected consolidated statement of financial position data as of June 30, 2020, 2021, 2022 and 2023 and December 31, 2023 and 2024:

|

|

As of June 30, |

|

As of December 31, |

||||||||||||

|

|

2020 |

|

2021 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2024 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

(in thousands) |

||||||||||||||

Selected consolidated statement of financial position data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

2,853,980 |

|

6,771,653 |

|

5,348,492 |

|

6,489,213 |

|

5,186,601 |

|

6,415,441 |

|

6,328,121 |

|

866,949 |

Inventories |

|

1,395,674 |

|

1,496,061 |

|

1,188,095 |

|

1,450,519 |

|

1,474,792 |

|

1,922,241 |

|

2,750,389 |

|

376,802 |

Trade and other receivables |

|

729,889 |

|

824,725 |

|

1,056,198 |

|

1,150,156 |

|

1,108,501 |

|

1,518,357 |

|

2,207,013 |

|

302,360 |

Total current assets |

|

4,986,599 |

|

9,199,087 |

|

8,072,562 |

|

9,904,005 |

|

8,743,692 |

|

10,327,634 |

|

11,655,501 |

|

1,596,798 |

Total assets |

|

5,836,251 |

|

10,705,030 |

|

11,281,788 |

|

13,447,713 |

|

11,997,380 |

|

14,485,309 |

|

18,120,128 |

|

2,482,449 |

Trade and other payables |

|

2,419,795 |

|

2,809,182 |

|

3,072,991 |

|

3,019,302 |

|

2,939,852 |

|

3,389,826 |

|

3,943,988 |

|

540,324 |

Total current liabilities |

|

3,309,643 |

|

3,482,855 |

|

3,788,671 |

|

3,885,595 |

|

3,711,558 |

|

4,406,979 |

|

5,727,189 |

|

784,623 |

Total liabilities |

|

6,159,297 |

|

4,052,876 |

|

4,254,388 |

|

4,529,445 |

|

4,188,353 |

|

5,294,092 |

|

7,764,606 |

|

1,063,748 |

Total equity/(deficit) |

|

(323,046) |

|

6,652,154 |

|

7,027,400 |

|

8,918,268 |

|

7,809,027 |

|

9,191,217 |

|

10,355,522 |

|

1,418,701 |

Total equity and liabilities |

|

5,836,251 |

|

10,705,030 |

|

11,281,788 |

|

13,447,713 |

|

11,997,380 |

|

14,485,309 |

|

18,120,128 |

|

2,482,449 |

15

The following table presents our selected consolidated statement of cash flows data for the fiscal years ended June 30, 2020, 2021, 2022 and 2023, the six months ended December 31, 2023 and the years ended December 31, 2023 and 2024:

|

|

|

|

For the six months ended |

|

For the year ended |

||||||||||||

|

|

For the fiscal year ended June 30, |

|

December 31, |

|

December 31, |

||||||||||||

|

|

2020 |

|

2021 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2024 |

||

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|