UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ |

Registration Statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

or

☒ |

Annual Report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

Commission File Number: 001-39966

NEW FOUND GOLD CORP.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada |

|

1040 |

|

Not Applicable |

(Province or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer Identification Number) |

2129 – 1055 West Georgia Street, Vancouver, BC

Canada V6E 3P2

Tel: (604) 977-3214

(Address and telephone number of Registrant’s principal executive offices)

C T Corporation System

28 Liberty Street

New York, New York 10005

Telephone: (212) 894-8940

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, no par value |

|

NFGC |

|

The NYSE American LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual Information Form |

☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

200,457,994 Common Shares outstanding as of December 31, 2024

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F (the “Annual Report”) of New Found Gold Corp. (the “Company”) contains “forward-looking information” and “forward-looking statements” (referred to together herein as “forward- looking information”). Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of this Annual Report, and include, but are not limited to, statements regarding discussions of results from operations (including, without limitation, statements about the Company’s opportunities, strategies, competition, expected activities and expenditures as the Company pursues its business plan, the adequacy of the Company’s available cash resources and other statements about future events or results), performance (both operational and financial) and business prospects, future business plans and opportunities and statements as to management’s expectations with respect to, among other things, the activities contemplated in this Annual Report.

Forward-looking statements included or incorporated by reference in this Annual Report include, without limitation, statements related to the Company’s Queensway Project and the Company’s planned and future exploration on the Queensway Project; the Company’s goals regarding exploration and potential development of its projects; the Company’s future business plans; expectations regarding the ability to raise further capital; the market price of gold; expectations regarding any environmental issues that may affect planned or future exploration and development programs and the potential impact of complying with existing and proposed environmental laws and regulations; the ability to retain and/or maintain any require permits, licenses or other necessary approvals for the exploration or development of its mineral properties; government regulation of mineral exploration and development operations in the Province of Newfoundland and Labrador; the Company’s compensation policy and practices; and the Company’s expected reliance on key management personnel, advisors and consultants (as such term is defined in the Company’s Annual Information Form for the year ended December 31, 2024 (the “Annual Information Form”).

These forward-looking statements involve numerous risks and uncertainties and other factors which may cause the actual results, performance or achievements of New Found to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Important factors that may cause actual results to vary include without limitation, the Company may fail to find a commercially viable deposit at any of its mineral properties; there are no mineral resources or mineral reserves on any of the properties in which the Company has an interest; the Company’s plans may be adversely affected by the Company’s reliance on historical data compiled by previous parties involved with its mineral properties; mineral exploration and development are inherently risky; the mineral exploration industry is intensely competitive; additional financing may not be available to the Company when required or, if available, the terms of such financing may not be favorable to the Company; fluctuations in the demand for gold; the Company may not be able to identify, negotiate or finance any future acquisitions successfully, or to integrate such acquisitions with its current business; the Company’s exploration activities are dependent upon the grant of appropriate licenses, concessions, leases, permits and regulatory consents, which may be withdrawn or not granted; the Company’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; there is no guarantee that title to the properties in which the Company has a material interest will not be challenged or impugned; the Company faces various risks associated with mining exploration that are not insurable or may be the subject of insurance which is not commercially feasible for the Company; the volatility of global capital markets over the past several years has generally made the raising of capital more difficult; economic and other consequences from Russia’s military action against Ukraine and the sanctions imposed in response to that action; inflationary cost pressures may escalate the Company’s operating costs; compliance with environmental regulations can be costly; social and environmental activism can negatively impact exploration, development and mining activities; the success of the Company is largely dependent on the performance of its directors and officers; the Company’s operations may be adversely affected by First Nations land claims; the Company and/or its directors and officers may be subject to a variety of legal proceedings, the results of which may have a material adverse effect on the Company’s business; the Company may be adversely affected if potential conflicts of interests involving its directors and officers are not resolved in favor of the Company; the Company’s future profitability may depend upon the world market prices of gold; dilution from future equity financing could negatively impact holders of the Company’s securities; failure to adequately meet infrastructure requirements could have a material adverse effect on the Company’s business; the Company’s projects now or in the future may be adversely affected by risks outside the control of the Company; the Company is subject to various risks associated with climate change; and other factors discussed under “Risk Factors” in the Company’s Annual Information Form.

2

In making the forward-looking statements in this Annual Report, the Company has applied several material assumptions, including without limitation, the assumptions that: the ability to raise any necessary additional capital on reasonable terms to advance exploration and development of the Company’s mineral properties; future prices of gold and other metal prices; the timing and results of exploration and drilling programs; the demand for, and price of gold; that general business and economic conditions will not change in a material adverse manner; the Company’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the geology of the Queensway Project as described in the Company’s most recent technical report; the accuracy of budgeted exploration and development costs and expenditures; future currency exchange rates and interest rates; operating conditions being favorable such that the Company is able to operate in a safe, efficient and effective manner; the Company’s ability to attract and retain skilled personnel; political and regulatory stability; the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; obtaining required renewals for existing approvals, licenses and permits on favorable terms; requirements under applicable laws; sustained labor stability; stability in financial and capital goods markets; availability of equipment.

Certain of the risks and assumptions are described in more detail under the heading “Risk Factors” in the Company’s Annual Information Form and in the Company’s audited financial statements and management discussion and analysis for the years ended December 31, 2024 and 2023.

The actual results or performance by the Company could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, the Company is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this Annual Report in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Disclosure regarding the Company’s mineral properties, including with respect to mineral reserve and mineral resource estimates included in this Annual Report, was prepared in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. Accordingly, information contained in this Annual Report is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

INCORPORATED DOCUMENTS

Annual Information Form

The Registrant’s Annual Information Form is filed as Exhibit 99.1 to this Annual Report.

Management’s Discussion and Analysis

The Registrant’s management’s discussion and analysis for the year ended December 31, 2024 (“MD&A”) is filed as Exhibit 99.2 to this Annual Report.

Audited Annual Financial Statements

The Registrant’s financial statements for the years ended December 31, 2024 and 2023 and the auditor’s report thereon are filed as Exhibit 99.3 to this Annual Report.

3

DISCLOSURE CONTROLS AND PROCEDURES

A. Evaluation of disclosure controls and procedures. Disclosure controls and procedures are designed to ensure that (i) information required to be disclosed by the Company in reports that it files or submits to the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in applicable rules and forms and (ii) material information required to be disclosed in the Company’s reports filed under the Exchange Act is accumulated and communicated to the Company’s management, including its Chief Executive Officer (“CEO”) and its Chief Financial Officer (“CFO”), as appropriate, to allow for timely decisions regarding required disclosure.

At the end of the period covered by this report, an evaluation was carried out under the supervision of and with the participation of the Company’s management, including the CEO and CFO, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d- 15(e) under the Exchange Act). The evaluation included documentation review, enquiries and other procedures considered by management to be appropriate in the circumstances. Based on that evaluation, the Company’s CEO and CFO have concluded that, as of the end of the period covered by this report, the Company’s disclosure controls and procedures were effective.

B. Management’s report on internal control over financial reporting. The Company’s management is responsible for establishing and maintaining effective internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. The Company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2024, based on the criteria set forth in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. This evaluation included review of the documentation of controls, evaluation of the design effectiveness of controls, testing of the operating effectiveness of controls and a conclusion on this evaluation. Based on this evaluation, management has concluded that the Company’s internal control over financial reporting was effective as of December 31, 2024.

C. Attestation report of the registered public accounting firm. As an “emerging growth company” under the Jumpstart our Business Startups Act, the Company is exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, which requires that a public company’s registered public accounting firm provide an attestation report relating to management’s assessment of internal control over financial reporting.

D. Changes in internal control over financial reporting. During the period covered by this Annual Report, no change occurred in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

The Company’s management, including the CEO and CFO, does not expect that its disclosure controls and procedures or internal controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

4

NOTICES PURSUANT TO REGULATION BTR

The Company was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended December 31, 2024.

AUDIT COMMITTEE FINANCIAL EXPERT

The Company’s Board of Directors (the “Board”) has determined that it has at least one audit committee financial expert serving on its Audit Committee. The Board has determined that Vijay Mehta is an audit committee financial expert and is independent, as that term is defined by the Exchange Act and the NYSE American LLC’s (the “NYSE American”) corporate governance standards applicable to the Company.

The Commission has indicated that the designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose on such person any duties, obligations or liability that are greater than those imposed on such person as a member of the Audit Committee and the Board in the absence of such designation and does not affect the duties, obligations or liability of any other member of the Audit Committee or Board.

CODE OF ETHICS

The Board has adopted a written code of business conduct and ethics (the “Code”), by which it and all officers and employees of the Company, including the Company’s principal executive officer, principal financial officer and principal accounting officer or controller, abide. There were no waivers granted in respect of the Code during the fiscal year ended December 31, 2024. The Code is posted on the Company’s website at www.newfoundgold.ca. If there is an amendment to the Code, or if a waiver of the Code is granted to any of Company’s principal executive officer, principal financial officer, principal accounting officer or controller, the Company intends to disclose any such amendment or waiver by posting such information on the Company’s website. Unless and to the extent specifically referred to herein, the information on the Company’s website shall not be deemed to be incorporated by reference in this Annual Report.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

KPMG LLP, Vancouver, British Columbia, Canada, Auditor Firm ID: 85, acted as the Company’s independent registered public accounting firm for the fiscal years ended December 31, 2024 and 2023. See page 60 of the Company’s Annual Information Form, which is attached hereto as Exhibit 99.1, for the total amount billed to the Company by KPMG LLP for services performed in the fiscal years ended December 31, 2024 and 2023 by category of service (for audit fees, audit-related fees, tax fees and all other fees).

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

See page 60 of the Company’s Annual Information Form, which is attached hereto as Exhibit 99.1. No audit-related fees, tax fees or other non-audit fees were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

During the year ended December 31, 2024, the Company was not a party to any off-balance-sheet arrangements that have, or are reasonably likely to have, a current or future effect on the financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, cash requirements or capital resources of the Company.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Board has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and satisfies the requirements of Exchange Act Rule 10A-3 (“Rule 10A-3”). As at December 31, 2024, the Company’s Audit Committee was comprised of William Hayden, Paul Huet, and Vijay Mehta, all of whom at such time, in the opinion of the Board, were independent (as determined under Rule 10A-3 of the Exchange Act and the NYSE American Company Guide) and financially literate. As at the date hereof, the Company’s Audit Committee is comprised of William Hayden, Chad Williams, and Vijay Mehta, all of whom, in the opinion of the Board, are independent (as determined under Rule 10A-3 of the Exchange Act and the NYSE American Company Guide) and all of whom are financially literate.

5

CORPORATE GOVERNANCE PRACTICES

The Company’s common shares are listed on the NYSE American. Section 110 of the NYSE American Company Guide permits the NYSE American to consider the laws, customs and practices of foreign issuers and to grant exemptions from NYSE American listing criteria based on these considerations. Below is a description of the significant ways in which the Company’s governance practices differ from those followed by U.S. domestic companies pursuant to NYSE American standards:

Quorum

Section 123 of the NYSE American Company Guide recommends a quorum of not less than one-third of a listed company’s shares issued and outstanding entitled to vote at a meeting of shareholders. The Company’s quorum requirement under its Articles is one person present or represented by proxy who, in the aggregate, holds at least 5% of the issued shares entitled to be voted at the meeting.

Independent Directors

Section 803 of the NYSE American Company Guide requires each issuer to have a sufficient number of independent directors on its Board of Directors such that at least a majority of such directors are independent directors, subject to certain exceptions set forth in Section 801 of the NYSE American Company Guide. As at December 31, 2024, the Board of Directors was comprised of five directors, three of whom were considered independent (as determined under Rule 10A-3 of the Exchange Act and the NYSE American Company Guide), which satisfied the requirements of Section 803 of the NYSE American Company Guide. As at the date hereof, the Board of Directors is comprised of six directors, three of whom remain independent. The Company exists under the provincial laws of British Columbia, Canada, and is governed by the Business Corporations Act (British Columbia), the rules and policies of the TSX Venture Exchange (“TSXV”), and securities legislation in each of the provinces and territories (together, the “Applicable Legislation”). The composition of the Board of Directors is compliant with Applicable Legislation.

Shareholder Approval

Section 711 of the NYSE American Listed Company Guide requires shareholder approval of all equity compensation plans and material revisions to such plans. The definition of “equity compensation plans” includes plans that provide for the delivery of both newly issued and treasury securities, as well as plans that include securities re-acquired in the open market by the issuing company for the purpose of redistribution to employees and directors. The Company will follow the shareholder approval requirements listed in Policy 4.4 of the TSXV Corporate Finance Manual in connection with equity compensation arrangements.

Section 713 of the NYSE American Listed Company Guide requires a listed company to obtain the approval of its shareholders for certain kinds of securities issuances, including private placements that result in the issuance of common shares (or securities convertible into common shares) equal to 20% or more of presently outstanding shares for less than the greater of book or market value of such shares. The Company will follow the shareholder approval requirements listed in Policy 4.1 of the TSXV Corporate Finance Manual in connection with certain securities issuances, including private placements.

In addition, the Company may from time-to-time seek exemption from NYSE American corporate governance requirements under Section 110 of the NYSE American Company Guide, in which case the Company will make any required disclosures of such exemptions. The foregoing is consistent with the laws, customs and practices in Canada.

MINE SAFETY

Not applicable.

6

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. |

Undertaking |

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

B. |

Consent to Service of Process |

The Company has filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this Annual Report arises.

7

EXHIBIT INDEX

Exhibit No. |

|

Description |

|---|---|---|

97 |

|

|

|

|

|

99.1 |

|

Annual Information Form for the year ended December 31, 2024 |

|

|

|

99.2 |

|

Management’s Discussion and Analysis for the year ended December 31, 2024 |

|

|

|

99.3 |

|

Financial Statements for the years ended December 31, 2024 and 2023 |

|

|

|

99.4 |

|

|

|

|

|

99.5 |

|

|

|

|

|

99.6 |

|

|

|

|

|

99.7 |

|

|

|

|

|

99.8 |

|

Consent of KPMG LLP, Independent Registered Public Accounting Firm |

|

|

|

99.9 |

|

|

|

|

|

99.10 |

|

|

|

|

|

99.11 |

|

|

|

|

|

99.12 |

|

|

|

|

|

101 |

|

Interactive Data File (formatted as Inline XBRL) |

|

|

|

104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

8

SIGNATURE

Pursuant to the requirements of the Exchange Act, New Found Gold Corp. certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

Dated: March 20, 2025

|

NEW FOUND GOLD CORP. |

||

|

|

|

|

|

|

By: |

/s/ Michael Kanevsky |

|

|

|

|

|

|

Name: Michael Kanevsky |

|

|

|

Title: Chief Financial Officer |

|

9

EXHIBIT 97

CLAWBACK POLICY

New Found Gold Corp. (the “Company”) has adopted this Policy in accordance with New York Stock Exchange (“NYSE”) listing requirements.

A. |

Application of Policy |

This Policy applies in the event of any accounting restatement (“Restatement”) due to the Company’s material non-compliance with financial reporting requirements under applicable federal securities laws, in accordance with Rule 10D-1 of the Securities Exchange Act of 1934 (“Rule 10D-1”). This Policy shall apply to Incentive-Based Compensation (as defined below) received on or after October 2, 2023 (the “Effective Date”).

B. |

Executive Officers Subject to the Policy |

The executives of the Company who serve or served as an “executive officer” (as defined under Rule 10D-1) of the Company (the “Executive Officers”) are covered by this Policy. This includes the Company’s current or former principal executive officer, president, principal financial officer, chief accounting officer or controller, any vice-president of the Company in charge of a principal business unit, division or function, and any other current or former officer or person who performs or performed a significant policy-making function for the Company, including executive officers of Company subsidiaries or the Company’s parent, if they perform such policy-making functions. All of these Executive Officers are subject to this Policy, even if an Executive Officer had no responsibility for the financial statement errors which required restatement. The Company’s Board of Directors (the “Board”) determines who shall be an Executive Officer for purposes of this Policy on annual basis.

C. |

Compensation Subject to and Clawback Period of the Policy |

This Policy covers all incentive-based compensation (including any cash or equity compensation) that is granted, earned or vested based wholly or in part upon the attainment of any “financial reporting measure” (“Incentive-Based Compensation”). This Policy applies to any Incentive-Based Compensation “received” by an Executive Officer during the period (the “Clawback Period”) consisting of any of the three completed fiscal years immediately preceding:

| ● | the date that the Company’s Board (or Audit Committee) concludes, or reasonably should have concluded, that the Company is required to prepare a Restatement, or |

| ● | the date that a court, regulator, or other legally authorized body directs the Company to prepare a Restatement. |

In addition, the Clawback Period includes any transition period (that results from a change in the Company’s fiscal year) within or immediately following those three completed fiscal years. However, a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to twelve months would be deemed a completed fiscal year.

Financial reporting measures are those that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements and any measures derived wholly or in part from such financial information (including non-GAAP measures, stock price and total shareholder return).

1

For purposes of this Policy, Incentive-Based Compensation is deemed “received” in the fiscal period during which the applicable financial reporting measure (as specified in the terms of the award) is attained (the “Performance Period”), even if the payment or grant occurs after the end of that fiscal period. For the avoidance of doubt, the Clawback Period with respect to an Executive Officer applies to Incentive-Based Compensation received by the Executive Officer (a) after beginning services as an Executive Officer (including compensation derived from an award authorized before the individual is newly hired as an Executive Officer, e.g. inducement grants) and (b) if that person served as an Executive Officer at any time during the Performance Period for such Incentive-Based Compensation.

For the avoidance of doubt, Incentive-Based Compensation does not include (i) base annual salary, (ii) compensation which is awarded based solely on service to the Company (e.g. a time-vested award, including time-vesting stock options or restricted share units), or (iii) compensation which is awarded based solely on subjective standards, strategic measures (e.g. completion of a merger) or operational measures (e.g. attainment of a certain market share).

D. |

Amount Required to be Repaid Pursuant to this Policy |

The amount of Incentive-Based Compensation that must be repaid by the Executive Officer (subject to the few limitations discussed below) is the amount of Incentive-Based Compensation received by the Executive Officer that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the Restatement (the “Recoverable Amount”). Applying this definition, after a Restatement, the Company will recalculate the applicable financial reporting measure and the Recoverable Amount in accordance with SEC and the NYSE rules. The Company will determine whether, based on that financial reporting measure as calculated relying on the original financial statements, the Executive Officer received a greater amount of Incentive-Based Compensation than would have been received applying the recalculated financial measure. Where Incentive- Based Compensation is based only in part on the achievement of a financial reporting measure performance goal, the Company will determine the portion of the original Incentive-Based Compensation based on or derived from the financial reporting measure which was restated and will recalculate the affected portion based on the financial reporting measure as restated to determine the difference between the greater amount based on the original financial statements and the lesser amount that would have been received based on the Restatement. For Incentive- Based Compensation based on stock price or total shareholder return, where the Recoverable Amount is not subject to mathematical recalculation directly from the information in an accounting restatement: (a) the amount shall be based on a reasonable estimate of the effect of the accounting restatement on the stock price or total shareholder return upon which the incentive- based compensation was received; and (b) the Company shall maintain and provide documentation of the determination of that reasonable estimate to the NYSE. The Recoverable Amounts will be calculated on a pre-tax basis to ensure that the Company recovers the full amount of Incentive-Based Compensation that was erroneously awarded. Documentation of the Company’s calculation of the Recoverable Amount shall be maintained, and may be provided to NYSE as required by the NYSE rules.

The Board (or its applicable committee) will take such action as it deems appropriate, in its sole and absolute discretion, reasonably promptly to recover the Recoverable Amount, unless the Company’s committee of independent directors responsible for executive compensation decisions, or in the absence of such a committee, a majority of the independent directors serving on the Board, determines that it would be impracticable to recover such amount because (1) the Company has made a reasonable and documented attempt to recover the Recoverable Amount and has determined that the direct costs of enforcing recovery would exceed the Recoverable Amount, or (2) recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder, or (3) if the recovery of the incentive-based compensation would, based on an opinion of counsel, violate the home-country laws of the Company.

E. |

Additional Clawback Required by Section 304 of the Sarbanes-Oxley Act of 2002 |

In addition to the provisions described above, if the Company is required to prepare an accounting restatement due to the material noncompliance of the Company, as a result of misconduct, with any financial reporting requirement under the securities laws, then, in accordance with Section 304 of the Sarbanes-Oxley Act of 2002, the Chief Executive Officer and Chief Financial Officer (at the time the financial document embodying such financial reporting requirement was originally issued) shall reimburse the Company for:

2

| ● | any bonus or other incentive-based or equity-based compensation received from the Company during the 12-month period following the first public issuance or filing with the Commission (whichever first occurs) of such financial document; and |

| ● | any profits realized from the sale of securities of the Company during that 12- month period. |

F. |

Crediting of Recovery Amounts |

To the extent that subsections A, B, C and D of this Policy (the “Rule 10D-1 Clawback Requirements”) would provide for recovery of Incentive-Based Compensation recoverable by the Company pursuant to Section 304 of the Sarbanes-Oxley Act, in accordance with subsection E of this Policy (the “Sarbanes-Oxley Clawback Requirements”), and/or any other recovery obligations (including pursuant to employment agreements, or plan awards), the amount such Executive Officer has already reimbursed the Company shall be credited to the required recovery under the Rule 10D-1 Clawback Requirements. Recovery pursuant to the Rule 10D-1 Clawback Requirements does not preclude recovery under the Sarbanes-Oxley Clawback Requirements, to the extent any applicable amounts have not been reimbursed to the Company.

G. |

General Provisions |

This Policy may be amended by the Board or its applicable committee from time to time. Changes to this Policy will be communicated to all persons to whom this Policy applies.

The provisions of this Policy apply to the fullest extent of the law; provided however, to the extent that any provisions of this Policy are found to be unenforceable or invalid under any applicable law, such provision will be applied to the maximum extent permitted, and shall automatically be deemed amended in a manner consistent with its objectives to the extent necessary to conform to any limitations required under applicable law.

This Policy is in addition to (and not in lieu of) any right of repayment, forfeiture or right of offset against any Executive Officer that is required pursuant to any other statutory repayment requirement (regardless of whether implemented at any time prior to or following the adoption of this Policy).

All determinations and decisions made by the Board (or any committee thereof) pursuant to the provisions of this Policy shall be final, conclusive and binding on the Company, its subsidiaries and the persons to whom this Policy applies. If you have questions about the interpretation of this Policy, please contact the Chief Financial Officer of the Company.

3

Exhibit 99.1

NEW FOUND GOLD CORP.

ANNUAL INFORMATION FORM

For the year ended December 31, 2024

Dated: March 20, 2025

TABLE OF CONTENTS

2 |

|||

2 |

|||

2 |

|||

2 |

|||

4 |

|||

4 |

|||

4 |

|||

4 |

|||

4 |

|||

5 |

|||

8 |

|||

9 |

|||

16 |

|||

19 |

|||

19 |

|||

20 |

|||

26 |

|||

30 |

|||

33 |

|||

38 |

|||

43 |

|||

47 |

|||

48 |

|||

48 |

|||

50 |

|||

50 |

|||

50 |

|||

50 |

|||

51 |

|||

51 |

|||

52 |

|||

52 |

|||

53 |

|||

53 |

|||

56 |

|||

56 |

|||

58 |

|||

58 |

|||

58 |

|||

59 |

|||

60 |

|||

60 |

|||

61 |

|||

61 |

|||

61 |

|||

61 |

|||

62 |

|||

SCHEDULE “A” CHARTER OF THE AUDIT COMMITTEE OF NEW FOUND GOLD CORP. |

A-1 |

||

1 |

In this Annual Information Form (“AIF”), “New Found”, “NFG” or the “Company” refers to New Found Gold Corp.

All information contained herein is as at December 31, 2024, unless otherwise stated.

1.1 |

New Found’s financial statements for the fiscal year ended December 31, 2024, were prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

This AIF should be read in conjunction with New Found’s audited financial statements and notes thereto, as well as the management’s discussion and analysis for the years ended December 31, 2024 and 2023. The financial statements and management’s discussion and analysis are available under New Found’s profile on SEDAR+ at www.sedarplus.ca and on the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) website at www.sec.gov of the United States Securities and Exchange Commission (the “SEC”).

1.2 |

All sums of money which are referred to in this AIF are expressed in lawful money of Canada, unless otherwise specified. References to “US$” are to United States Dollars.

1.3 |

This AIF contains “forward-looking information” and “forward-looking statements” (referred to together herein as “forward-looking information”). Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward-looking statements and information are not historical facts, are made as of the date of AIF, and include, but are not limited to, statements regarding discussions of results from operations (including, without limitation, statements about the Company’s opportunities, strategies, competition, expected activities and expenditures as the Company pursues its business plan, the adequacy of the Company’s available cash resources and other statements about future events or results), performance (both operational and financial) and business prospects, future business plans and opportunities and statements as to management’s expectations with respect to, among other things, the activities contemplated in this AIF.

Forward-looking statements included or incorporated by reference in this AIF include, without limitation, statements related to the Queensway Project (as such term is defined herein) and the Company’s planned and future exploration on the Queensway Project; the completion and timing of the Company’s initial resource estimate and preliminary economic assessment; the Company’s goals regarding exploration and potential development of its projects; the Company’s future business plans; expectations regarding the ability to raise further capital; the market price of gold; expectations regarding any environmental issues that may affect planned or future exploration and development programs and the potential impact of complying with existing and proposed environmental laws and regulations; the ability to retain and/or maintain any require permits, licenses or other necessary approvals for the exploration or development of its mineral properties; government regulation of mineral exploration and development operations in the Province of Newfoundland and Labrador; the Company’s compensation policy and practices; and the Company’s expected reliance on key management personnel, advisors and consultants.

These forward-looking statements involve numerous risks and uncertainties and other factors which may cause the actual results, performance or achievements of New Found to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

2

Important factors that may cause actual results to vary include without limitation, the Company may fail to find a commercially viable deposit at any of its mineral properties; there are no mineral resources or mineral reserves on any of the properties in which the Company has an interest; the Company’s plans may be adversely affected by the Company’s reliance on historical data compiled by previous parties involved with its mineral properties; mineral exploration and development are inherently risky; the mineral exploration industry is intensely competitive; additional financing may not be available to the Company when required or, if available, the terms of such financing may not be favourable to the Company; fluctuations in the demand for gold; the Company may not be able to identify, negotiate, finance or receive regulatory approval for any future acquisitions successfully, or to integrate such acquisitions with its current business; the Company’s exploration activities are dependent upon the grant of appropriate licenses, concessions, leases, permits and regulatory consents, which may be withdrawn or not granted; the Company’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; there is no guarantee that title to the properties in which the Company has a material interest will not be challenged or impugned; the Company faces various risks associated with mining exploration that are not insurable or may be the subject of insurance which is not commercially feasible for the Company; the volatility of global capital markets over the past several years has generally made the raising of capital more difficult; the potential impact of any tariffs, countervailing duties or other trade restrictions; economic and other consequences from Russia’s military action against Ukraine and the sanctions imposed in response to that action; economic and other consequences from the Israel-Hamas war; inflationary cost pressures may escalate the Company’s operating costs; compliance with environmental regulations can be costly; social and environmental activism can negatively impact exploration, development and mining activities; the success of the Company is largely dependent on the performance of its directors and officers; the Company’s operations may be adversely affected by First Nations land claims; the Company and/or its directors and officers may be subject to a variety of legal proceedings, the results of which may have a material adverse effect on the Company’s business; the Company may be adversely affected if potential conflicts of interests involving its directors and officers are not resolved in favour of the Company; the Company’s future profitability may depend upon the world market prices of gold; dilution from future equity financing could negatively impact holders of the Company’s securities; risks related to uninsured or partially insured losses; risks related to compliance with securities laws and listing requirements; failure to adequately meet infrastructure requirements could have a material adverse effect on the Company’s business; the Company’s projects now or in the future may be adversely affected by risks outside the control of the Company; the Company is subject to various risks associated with climate change; and other factors discussed under “Risk Factors”.

In making the forward-looking statements in this AIF, New Found has applied several material assumptions, including without limitation, the assumptions that: the ability to raise any necessary additional capital on reasonable terms to advance exploration and development of the Company’s mineral properties; future prices of gold and other metal prices; the timing and results of exploration and drilling programs; the demand for, and price of gold; that general business and economic conditions will not change in a material adverse manner; the Company’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the geology of the Queensway Project as described in the Technical Report (as such term is defined herein); the accuracy of budgeted exploration and development costs and expenditures; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; the Company’s ability to attract and retain skilled personnel; political and regulatory stability; the receipt of governmental, regulatory, exchange and third-party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; and availability of equipment.

Certain of the risks and assumptions are described in more detail under the heading “Risk Factors” herein and in New Found’s audited financial statements and management discussion and analysis for the years ended December 31, 2024 and 2023, available under New Found’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

The actual results or performance by New Found could differ materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of the Company. Except as required by law, New Found is under no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

3

2 |

2.1 |

New Found was incorporated under the Business Corporations Act (Ontario) as Palisade Resources Corp. on January 6, 2016. By articles of amendment effective June 20, 2017, the Company’s name was changed to New Found Gold Corp.

On June 23, 2020, the Company continued into British Columbia under the provisions of the Business Corporations Act (British Columbia) (the “BCBCA”). The Company’s head office is located at 1055 West Georgia Street, Suite 2129, Vancouver, British Columbia V6E 3P2, Canada. The Company’s registered office is located at 1133 Melville Street, Suite 3500, The Stack, Vancouver, British Columbia, V6E 4E5, Canada.

New Found does not have any subsidiaries.

3 |

3.1 |

3.1.1 |

General |

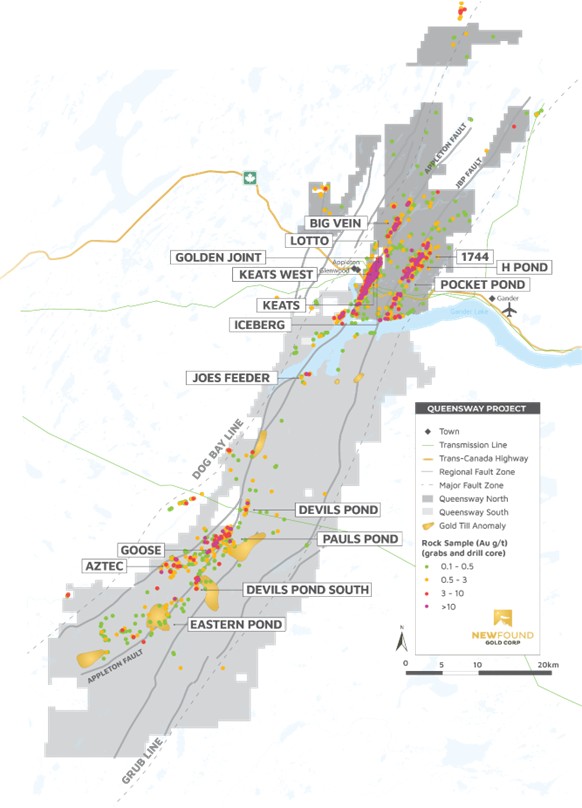

New Found is a mineral exploration company involved in the identification, acquisition and exploration of mineral properties primarily in the Province of Newfoundland and Labrador. The Company’s exploration is focused on discovering and delineating gold resources. The Company has one material property: the Queensway Project located in Newfoundland, Canada (the “Queensway Project”, the “Queensway Property”, or the “Property”). At present, the Queensway Project does not have any known mineral resources or reserves.

Since incorporation, the Company has taken the following steps in developing its business: (i) identified and acquired mineral properties with sufficient merit to warrant exploration; (ii) raised funds to progress the Company’s exploration activities on its mineral properties, as described herein; (iii) completed technical reports on the Queensway Project, including the technical report titled “New Found Gold Corp’s Queensway Gold Project in Newfoundland and Labrador, Canada: 2024 Property Expansion And Exploration Update”, with an effective date of 1 November 2024, prepared by D. Roy Eccles, M.Sc., P. Geol. P. Geo. of APEX Geoscience Ltd., Mark K. Jorgensen, B.Sc., QP Metallurgy of Jorgensen Engineering and Technical Services, LLC, and Gary Simmons, B.Sc. QP Metallurgy of GL Simmons Consulting, LLC in compliance with National Instrument 43-101 (“NI 43-101”) (the “Technical Report”); (iv) undertaken exploration programs, including a 650,000 metre drill program, on the Queensway Project; and (v) retained directors, officers and employees with the skills required to successfully operate a public mineral exploration company.

The Company is a reporting issuer in all provinces and territories in Canada and is subject to the reporting requirements of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Common Shares (as defined herein) of the Company trade on the TSX Venture Exchange (the “TSXV”) under the symbol “NFG” and on the NYSE American stock exchange (the “NYSE American”) under the symbol “NFGC”.

3.2 |

3.2.1 |

Principal Operations |

The Company is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties located in the Province of Newfoundland and Labrador, Canada.

3.2.2 |

Competitive Conditions |

The mineral exploration and mining industry is competitive in all phases of exploration, development and production. The Company competes with a number of other entities and individuals in the search for and the acquisition of attractive mineral properties. As a result of this competition, the Company may not be able to acquire attractive properties in the future on terms it considers acceptable. The Company may also encounter competition from other mining companies in efforts to hire experienced mining professionals. Increased competition could adversely affect the Company’s ability to attract necessary funding or acquire suitable properties or prospects for mineral exploration in the future. See “Risk Factors – Competition and Mineral Exploration”.

4

3.2.3 |

Specialized Skills and Knowledge |

Various aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include, but are not limited to, expertise related to mineral exploration, geology, drilling, permitting, metallurgy, logistical planning, and implementation of exploration programs, as well as legal compliance, finance, and accounting. The Company expects to rely upon various legal and financial advisors, consultants, and others in the operation and management of its business. See “Risk Factors – Dependence on Management and Key Personnel”.

3.2.4 |

Cycles |

The Company’s mineral exploration activities may be subject to seasonality due to adverse weather conditions including, without limitation, inclement weather, frozen ground and restricted access due to snow, ice, or other weather-related factors. In addition, the mining and mineral exploration business is subject to global economic cycles effecting, among other things, the marketability and price of gold products in the global marketplace.

3.2.5 |

Employees |

As at December 31, 2024, the Company had 62 employees, and at the date of this AIF, the Company has 53 employees. The Company also relies on consultants and contractors to carry on its business activities and, in particular, to supervise and carry-out mineral exploration on its Queensway Project.

3.2.6 |

Environmental Protection |

The Company is currently engaged in exploration activities on its Queensway Project and such activities are subject to various laws, rules, and regulations governing the protection of the environment. Corporate obligations to protect the environment under the various regulatory regimes in which the Company operates may affect the financial position, operational performance, and earnings of the Company. A breach of such legislation may result in imposition of fines and penalties. Management believes all of the Company’s activities are in material compliance with all applicable environmental legislation. See “Risk Factors – Environmental Risks”.

3.2.7 |

Social or Environmental Policies |

The Company is committed to conducting its operations in accordance with sound social and environmental practices. At present, the scale of operations has not required the adoption of formal policies. The Company will re-evaluate this position if and when necessary.

The Company is subject to the laws and regulations relating to environmental matters in all jurisdictions in which it operates, including provisions relating to property reclamation, discharge of hazardous materials and other matters. The Company may also be held liable should environmental problems be discovered that were caused by former owners and operators of its properties. The Company conducts its mineral exploration activities in compliance with applicable environmental protection legislation.

3.3 |

3.3.1 |

Director and Officer Appointments and Resignations |

On April 14, 2022, the Company announced that Craig Roberts resigned as Chief Executive Officer and as a director of the Company, Collin Kettell was appointed as Chief Executive Officer of the Company and Vijay Mehta was appointed as a director of the Company. As part of a planned transition, Craig Roberts continued with the Company as a full-time consultant in the role of Lead Advisor until November 2022.

On June 7, 2022, the Company announced the appointment of Ron Hampton as Chief Development Officer of the Company and the resignation of Dr. Quinton Hennigh as a director of the Company.

On October 11, 2022, the Company announced the appointment of Raymond Threlkeld as an independent member of the Company’s board of directors (the “Board”).

On December 18, 2024, the Company announced that following the annual general meeting of the shareholders, the Board comprised of Paul Huet, Collin Kettell, Vijay Mehta, William Hayden, and Melissa Render.

5

3.3.2 |

Initiation of Maiden Resource and Preliminary Economic Assessment |

On November 6, 2024, the Company announced initiation of work towards a maiden resource estimate, as well as a preliminary economic assessment for the Queensway Project. The Company is currently preparing initial mineral resource estimate with a projected release date in early Q2 2025. The Company intends to use the initial mineral resources to prepare a preliminary economic assessment in late Q2 2025.

3.3.3 |

Royalty Purchase Agreements |

On July 30, 2024 the Company announced that it entered into three royalty purchase agreements (the “Royalty Purchase Agreements”) with arm’s length royalty holders (each a “Vendor” and collectively the “Vendors”) whereby the Company purchased part of each Vendor’s royalty interest. Pursuant to the Royalty Purchase Agreements, the Company purchased, in aggregate, 0.6% of the Vendors’ 1.6% net smelter returns royalty on the Company’s Golden Bullet property (the “Royalty Interests”). Under the terms of the Royalty Purchase Agreements, as consideration for the Royalty Interests, the Company paid $650,000 cash consideration and issued 100,000 Common Shares to each Vendor, for an aggregate cash consideration of $1,950,000 and aggregate share consideration of 300,000 Common Shares. The Company had the right to purchase the remaining 1% net smelter returns royalty from the Vendors for an aggregate price equal to $1,000,000 (the “Repurchase Price”) by November 12, 2024, payable by (i) an aggregate of $100,000 and (ii) an additional $4,950, in the aggregate, per year until the Repurchase Price is satisfied.

On October 15, 2024, the Company announced that the Company purchased the remaining royalty from the Vendors for an aggregate cash consideration of $1,000,000.

3.3.4 |

LabGold Acquisitions |

On July 9, 2024, the Company announced that it completed an acquisition of a 100% interest in Labrador Gold Corp.’s (“LabGold”) Kingsway Project (the “Kingsway Project”), located in Gander, Newfoundland and Labrador, as well as certain related assets of LabGold. Pursuant to the acquisition, the Company issued to LabGold 5,263,157 Common Shares as consideration.

3.3.5 |

ThreeD Settlement Agreement |

On June 6, 2024, the Company announced that it had entered into a settlement agreement (the “Settlement Agreement”) with respect to the lawsuit filed by ThreeD Capital Inc. (“ThreeD”) and 13313366 Ontario Inc. (“131”) and, together with ThreeD, the “Plaintiffs”) against the Company, Palisades Goldcorp Ltd. and Collin Kettell (together, the “Defendants”) in the Ontario Superior Court of Justice. Pursuant to the Settlement Agreement, New Found issued 285,429 Common Shares to ThreeD and 84,571 Common Shares to 131. The Settlement Agreement does not include any admission of liability and provides for fulsome releases by the Plaintiffs to the Defendants.

3.3.6 |

Sky Gold Corp Acquisitions |

In May 2024, New Found completed a purchase agreement with Sky Gold Corp. (“Sky Gold”), whereby New Found completed an acquisition of a 100% interest in certain licenses and mining claims of Sky Gold subject to certain existing royalties, which were assumed by New Found. Pursuant to the agreement, New Found paid $35,000 as consideration.

3.3.7 |

November 2023 $56 Million Bought Deal Financing |

On October 30, 2023, the Company announced it entered into an agreement with BMO Nesbitt Burns Inc. on behalf of a syndicate of underwriters, pursuant to which the underwriters agreed to purchase, on a “bought deal” basis, 7,725,000 Common Shares that qualify as “flow-through shares” (within the meaning of the Income Tax Act (Canada) (the “Tax Act”)) at a price of $7.25 per flow-through Common Share (the “2023 Offering Price”) for aggregate gross proceeds of $56,006,250. The Company granted the underwriters an option to purchase up to an additional 1,158,750 flow-through Common Shares at the 2023 Offering Price for the purpose of covering the underwriters’ over-allocation position.

On November 6, 2023, the Company announced it closed the offering of 7,725,000 flow through Common Shares for aggregate gross proceeds of $56,006,250. These flow-through Common Shares were offered by way of a prospectus supplement dated November 1, 2023, to the 2022 Base Shelf (as defined herein) in each of the provinces and territories of Canada (other than Québec) and were also offered by way of U.S. prospectus supplement contained in the effective Registration Statement (as defined below).

6

3.3.8 |

Participation in Brokered Note Offering by Maritime Resources Corp. |

On August 14, 2023, the Company participated in a brokered note offering completed by Maritime Resources Corp. consisting of the issuance of non‐convertible senior secured notes and common share purchase warrants. The Company subscribed for 2,000 non‐convertible senior secured notes, which mature on August 14, 2025, with a face value of US$1,000 each. These non‐convertible senior secured notes were issued at a 2.0% original issue discount on the principal amount for a gross investment of US$1,960,000 (CAD$2,638,500).

3.3.9 |

Disposal of Lucky Strike Property and Investment in Kirkland Lake Discoveries Corp. |

On May 25, 2023, the Company disposed of its 100% interest in its Lucky Strike project to Kirkland Lake Discoveries Corp. (formerly Warrior Gold Inc.) (“KLD”) for total non-cash consideration comprised of 28,612,500 common shares of KLD (“KLD Shares”) and a 1.0% net smelter return royalty on future production from the mineral claims. The investment represented 32.29% of the issued and outstanding KLD Shares at the time of closing, and as at December 31, 2023. The Company exercised its right to nominate two additional directors to the board of directors of KLD.

Based on assessments of the relevant facts and circumstances, primarily, the Company’s ownership interests, board representation and ability to influence operating, strategic and financing decisions, the Company concluded that it has had significant influence over KLD for the period from May 25, 2023 and has accounted for its investment in KLD as an investment in an associate.

The KLD Shares are listed on the TSXV.

3.3.10 |

December 2022 Flow-Through Public Offering |

On December 7, 2022, the Company announced it entered into an agreement with BMO Nesbitt Burns Inc. on behalf of a syndicate of underwriters, pursuant to which the underwriters agreed to purchase, on a “bought deal” basis, 6,250,000 Common Shares that qualify as “flow-through shares” within the meaning of the Tax Act at a price of $8.00 per flow-through Common Share (the “2022 Offering Price”) for aggregate gross proceeds of $50,000,000. The Company granted the underwriters an option to purchase up to an additional 937,500 flow-through Common Shares at the 2022 Offering Price for the purpose of covering the underwriters’ over-allocation position.

On December 14, 2022, the Company announced it closed the offering of 6,250,000 flow through Common Shares for aggregate gross proceeds of $50,000,000. Eric Sprott participated to maintain his 19.9% interest in the Company. These flow-through Common Shares were offered by way of a prospectus supplement dated December 9, 2022, to the 2022 Base Shelf in each of the provinces and territories of Canada (other than Québec) and were also offered by way of U.S. prospectus supplement contained in the effective Registration Statement.

3.3.11 |

At-The-Market Offering |

On August 26, 2022, the Company announced that it had entered into an equity distribution agreement dated August 26, 2022, providing for an at-the-market equity offering program (“ATM”), with BMO Nesbitt Burns Inc. and Paradigm Capital Inc., as the Canadian agents, and BMO Capital Markets Corp., as the U.S. agent. The intention of the ATM was to allow New Found, through the agents and from time to time, to offer and sell, in Canada and the United States through the facilities of the TSXV and NYSE American, such number of Common Shares as would have an aggregate offering price of up to US$100 million. The sales of Common Shares through the ATM were made pursuant to, and qualified in Canada by, a prospectus supplement dated August, 26, 2022, to the 2022 Base Shelf prospectus and in the U.S. pursuant to a prospectus supplement contained in the effective Registration Statement.

During the twelve months ended December 31, 2022, the Company sold 500,229 Common Shares under the ATM at an average price of $5.097 for gross proceeds of $2,549,677, or net proceeds of $2,489,754, and paid an aggregate commission of $59,923.

During the twelve months ended December 31, 2023, the Company sold 3,552,224 Common Shares under the ATM at an average price of $6.47 for gross proceeds of $22,980,338, or net proceeds of $22,440,215, and paid an aggregate commission of $540,123.

During the twelve months ended December 31, 2024, the Company sold 5,857,242 Common Shares under the ATM at an average price of $4.70 for gross proceeds of $27,522,494, or net proceeds of $26,604,884, and paid an aggregate commission of $917,610. As at September 30, 2024, the ATM was terminated.

7

3.3.12 |

2022 Base Shelf Prospectus |

On July 22, 2022, the Company filed a final short form base shelf prospectus (the “2022 Base Shelf”) and a United States registration statement on Form F-10 (File No. 333-266285) with the SEC (the “Registration Statement”) with respect to offerings of securities of the Company to raise aggregate gross proceeds of up to US$300 million over 25 months.

3.3.13 |

Novo Transaction |

On March 6, 2020, the Company issued 15,000,000 Common Shares to Novo Resources Corp., a TSXV-listed mineral exploration and development corporation (“Novo”), at a subscription price of $1.12 per Common Share, which was paid to the Company by the issuance of 6,944,444 common shares in the capital of Novo. Upon closing of the transaction, Novo owned approximately 15.97% of the Company’s issued and outstanding Common Shares and New Found owned approximately 3.73% of the issued and outstanding common shares of Novo. Pursuant to the terms of the transaction, Novo had the right to appoint a director to the Board (as defined herein) at any time until March 6, 2023, provided that Novo holds no less than 10% of the issued and outstanding Common Shares. In connection with Novo’s right to appoint a director to the Board, Novo appointed Dr. Quinton Hennigh as its director nominee. Dr. Hennigh was elected to the Board on June 17, 2020. On April 27, 2022, Eric Sprott announced that 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 8,250,000 Common Shares from Novo at $8.35 per Common Share for consideration of $68,887,500 in connection with the first tranche closing of the private agreement transaction announced by him on April 12, 2022. A second tranche closed on August 8, 2022, for an additional 6,750,000 Common Shares at $8.45 per Common Share for a total consideration of $125,925,000 for all of Novo’s Common Shares.

3.3.14 |

Recent Events |

On January 20, 2025, the Company announced the appointment of Keith Boyle as Chief Executive Officer of the Company, following the resignation of Collin Kettell from such position.

On February 18, 2025, the Company announced the appointment of Dr. Fiona Childe (Ph.D., P.Geo.) as Vice President, Communications and Corporate Development, Dr. Jared Saunders (Ph.D., CRSP, EP) as Vice President, Sustainability, and Robert Assabgui (P.Eng.) as Study Manager. The Company also announced the resignation of Greg Matheson as Chief Operating Officer, and Ron Hampton as Chief Development Officer.

On March 3, 2025, the Company announced the appointment of Chad Williams to its Board, replacing Collin Kettell, who resigned from the Board.

Since the filling of the last Technical Report (effectively dated November 1, 2024), the Company has completed an additional 23,226 m of diamond drilling as part of a regional exploration program along the most northern segment of the AFZ at Pistachio, Dropkick and early targets in addition to follow up drilling at the recent discovery, Golden Dome, located north of Golden Joint. These drilling activities expand the gold mineralization at Golden Dome (announced February 24, 2025) and Dropkick (announced February 11, 2025).

On December 2, 2024, the Company announced the results of its Phase II Keats Trench channel sampling program, which increased sample density along gold-bearing veins providing information about the variability of the gold mineralization and the assessment of the vein domains that are oblique to the Phase I (announced September 23, 2024) systematic channel sampling grid.

The Company is currently preparing initial mineral resource estimate with a projected release date in early Q2 2025. The Company intends to use the initial mineral resources to prepare a preliminary economic assessment in late Q2 2025.

4 |

The business and operations of New Found are speculative due to the high-risk nature of its business, which is the exploration of mineral properties. The risks listed below are not the only risks and uncertainties that New Found faces. Additional risks and uncertainties not presently known to New Found or that New Found currently considers immaterial may also materially impair its business. These risk factors could materially affect New Found’s business, financial condition and future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company.

If any of the following risks occur, New Found’s business, financial condition and operating results could be materially adversely affected.

8

4.1 |

4.1.1 |

Exploration Stage Company |

The Company is an exploration stage company and cannot give any assurance that a commercially viable deposit, or “reserve,” exists on any properties for which the Company currently has or may have (through potential future joint venture agreements or acquisitions) an interest. Determination of the existence of a reserve depends on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If the Company fails to find a commercially viable deposit on any of its properties, its financial condition and results of operations will be materially adversely affected.

4.1.2 |

No Mineral Resources |

Currently, there are no mineral resources (within the meaning of NI 43-101) on any of the properties in which the Company has an interest and the Company cannot give any assurance that any mineral resources will be identified. If the Company fails to identify any mineral resources on any of its properties, its financial condition and results of operations will be materially adversely affected.

4.1.3 |

No Mineral Reserves |

Currently, there are no mineral reserves (within the meaning of NI 43-101) on any of the properties in which the Company has an interest and the Company cannot give any assurance that any mineral reserves will be identified. If the Company fails to identify any mineral reserves on any of its properties, its financial condition and results of operations will be materially adversely affected.

4.1.4 |

Reliability of Historical Information |

The Company has relied on, and the disclosure in the Technical Report is based, in part, upon, historical data compiled by previous parties involved with the mineral claims that form the Queensway Project. To the extent that any of such historical data is inaccurate or incomplete, the Company’s exploration plans may be adversely affected.

4.1.5 |

Mineral Exploration and Development |

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

There is no assurance that the Company’s mineral exploration and any development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of the Company’s operations will in part be directly related to the costs and success of its exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish mineral resources through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. Substantial expenditures are required to establish reserves through exploration and drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities and grades to justify commercial operations or that funds required for development can be obtained on a timely basis.