UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to __________

Commission File Number 001-39918

PERPETUA RESOURCES CORP.

(Exact name of Registrant as specified in its Charter)

|

British Columbia, Canada (State or other jurisdiction |

|

98-1040943 (IRS Employer |

|

|

|

|

405 S. 8th Street, Ste 201 Boise, Idaho (Address of principal executive offices) |

|

83702 (Zip code) |

Registrant’s telephone number, including area code: (208) 901-3060

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Common Shares, without par value |

|

PPTA |

|

Nasdaq |

Securities registered pursuant to Section 12(g) of the Act: Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☒ |

|

|

Small reporting company |

|

☒ |

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the shares of common shares on The Nasdaq Stock Market on the last business day of the registrant’s most recently completed second fiscal quarter 2024, was $207,074,452.

The registrant had 71,254,636 common shares outstanding as of March 7, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement relating to the 2025 Annual Meeting of Shareholders, to be filed within 120 days of the Registrant’s fiscal year ended December 31, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

PART I |

|

|

5 |

||

12 |

||

31 |

||

31 |

||

32 |

||

49 |

||

50 |

||

|

|

|

PART II |

|

|

51 |

||

51 |

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 |

|

F-1 |

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

62 |

|

62 |

||

62 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

62 |

|

|

|

|

PART III |

|

|

63 |

||

63 |

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

63 |

|

Certain Relationships and Related Transactions, and Director Independence |

63 |

|

63 |

||

|

|

|

PART IV |

|

|

64 |

||

66 |

i

EXPLANATORY NOTE

Unless the context otherwise indicates, references to the “Company,” “Perpetua Resources,” “Perpetua,” “we,” “us,” or “our” in this Annual Report refer to Perpetua Resources Corp. and its subsidiaries and the “Corporation” refers only to Perpetua Resources Corp.

See the “Glossary of Technical Terms” for more information regarding some of the terms used in this Annual Report.

CURRENCY AND EXCHANGE RATE INFORMATION

Unless otherwise indicated, references herein to “US$”, “$” or “dollars” are expressed in U.S. dollars. References in this Annual Report to Canadian dollars are noted as “C$.” Our consolidated financial statements that are included in this Annual Report are presented in U.S. dollars, unless otherwise stated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report are “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and “forward-looking information” within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact included in this Annual Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Annual Report, the words “anticipate,” “believe,” “expect,” “estimate,” “intend,” “plan,” “project,” “outlook,” “may,” “will,” “should,” “would,” “could,” “can,” the negatives thereof, variations thereon and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements are based on certain estimates, beliefs, expectations and assumptions made in light of management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that may be appropriate.

Forward-looking statements necessarily involve unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed or implied in such statements. Due to the risks, uncertainties and assumptions inherent in forward-looking information, you should not place undue reliance on forward-looking statements. Factors that could have a material adverse effect on our business, financial condition, results of operations and growth prospects can be found in Item 1A, Risk Factors, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this Annual Report. These factors include, but are not limited to, the following:

| ● | planned expenditures and budgets and the execution thereof, including the ability of the Company to discharge its liabilities as they become due and to continue as a going concern; |

| ● | timely access to capital and financing sources or strategic partners to fund the exploration, permitting, development and construction of the Project (as defined below); |

| ● | the potential impact of a strategic transaction on the Company’s business, results of operations and financial condition, including substantial the costs and time associated therewith, the risk that any such transaction may not ultimately be consummated or that we may not realize the anticipated benefits of any such transaction; |

| ● | the impact of delays in obtaining or failure to obtain required permits and other governmental approvals, or the impact of legal challenges by third parties to any such permits or governmental approvals, on the Company’s business, results of operations and financial condition; |

| ● | the Company’s plans to submit a financing application to the Export-Import Bank of the United States (“U.S. EXIM”), the prospects of successfully securing financing from U.S. EXIM or other sources on acceptable terms, or at all, and the expected timing of, and benefits to the Project of, securing such financing from U.S. EXIM or other sources; |

| ● | the Company’s ability to retain funds and request reimbursement for specified costs under the Technology Investment Agreement (“TIA”) under Title III of the Defense Production Act (“DPA”); |

| ● | the intended environmental and other outcomes of the South Fork Salmon Water Quality Enhancement Fund (the “Fund”) related to the Nez Perce Tribe’s Clean Water Act (“CWA”) lawsuit, good faith discussions between the Company and the Nez Perce Tribe with respect to future permitting and activities at the Project and the anticipated source of funding of the Company’s payments required under the Settlement Agreement (as defined below); |

| ● | regulatory and legal changes, requirements for additional capital, requirements for additional water rights and the potential effect of proposed notices of environmental conditions relating to mineral claims; |

| ● | the accuracy of analyses and other information based on expectations of future performance and planned work programs; |

1

| ● | possible events, conditions or financial performance that are based on assumptions about future economic conditions and courses of action; |

| ● | assumptions and analysis underlying our mineral reserve estimates and plans for mineral resource exploration and development; |

| ● | the Company’s history of losses and expectation of future losses; |

| ● | the Company’s limited property portfolio and potential challenges related to the Company’s title to its mineral properties; |

| ● | timing, costs and potential success of future activities on the Company’s properties, including, but not limited to, development and operating costs in the event that a construction decision is made and the Company’s ability to achieve production at the Project if constructed; |

| ● | potential results of exploration, development and environmental protection and remediation activities; |

| ● | current or future litigation or environmental liability, including litigation challenging the validity of the permits and approvals issued with respect to the Project; |

| ● | global economic, political and social conditions and financial markets, including any potential regulatory or policy changes resulting from a new administration, inflationary pressures and elevated interest rates; |

| ● | changes in gold and antimony commodity prices; |

| ● | our ability to implement our strategic plan and to maintain and manage growth effectively; |

| ● | our reliance on outside consultants for critical services; |

| ● | risks related to our largest shareholder; |

| ● | loss of key executives or the inability to hire or retain key executives or employees to support construction, permitting and operational activities; |

| ● | high levels of competition within the mining industry; |

| ● | equipment, labor and services required for exploration and development of the Project; |

| ● | labor shortages and disruptions; |

| ● | cyber-attacks and other security breaches of our information and technology systems; and |

| ● | other factors and risks described under the heading “Risk Factors” in Item 1A of this Annual Report. |

Statements concerning mineral resource and mineral reserve estimates may also be deemed to constitute forward-looking information to the extent that such statements involve estimates of the mineralization that may be encountered if a property is developed.

With respect to forward-looking information contained herein, the Company has applied several material factors or assumptions including, but not limited to, certain assumptions as to production rates, operating costs, recovery and metal costs; that any additional financing needed will be available when needed on reasonable terms; that the current exploration, development, environmental and other objectives concerning the Company’s Stibnite Gold Project (the “Project” or “Stibnite Gold Project”) can be achieved and that the Company’s other corporate activities will proceed as expected; that Perpetua will be able to successfully obtain financing for the Project; that all requisite information will be available in a timely manner; that the current price and demand for gold, antimony and other metals will be sustained or will improve; that general business and economic conditions will not change in a materially adverse manner and that all necessary governmental approvals for the planned exploration, development and environmental protection activities on the Project will be obtained in a timely manner and on acceptable terms, and that the Company or such agencies will be able to successful defend against any challenges to such governmental approvals; and that the continuity of economic and political conditions and operations of the Company will be sustained.

These risks are not exhaustive. Because of these risks and other uncertainties, our actual results, performance or achievements, or industry results, may be materially different from the anticipated or estimated results discussed in the forward-looking statements in this Annual Report. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the effects of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements. Our past results of operations are not necessarily indicative of our future results. You should not rely on any forward-looking statements, which represent our beliefs, assumptions and estimates only as of the dates on which they were made, as predictions of future events. We undertake no obligation to update these forward-looking statements, even though circumstances may change in the future, except as required under applicable securities laws. We qualify all of our forward-looking statements by these cautionary statements.

2

GLOSSARY OF TECHNICAL TERMS

Conversion Factors

To Convert From |

|

To |

|

Multiply By |

Feet |

|

Metres (m) |

|

0.305 |

Metres |

|

Feet (ft) |

|

3.281 |

Miles |

|

Kilometres (km) |

|

1.609 |

Kilometres |

|

Miles |

|

0.6214 |

Hectares |

|

Acres (ac) |

|

2.471 |

Grams |

|

Ounces (Troy) (oz) |

|

0.03215 |

Grams/Tonnes |

|

Ounces (Troy)/Short Ton (oz/ton) |

|

0.02917 |

Tonnes (metric) |

|

Pounds (lbs) |

|

2,205 |

Tonnes (metric) |

|

Short Tons (st) |

|

1.1023 |

Grams |

|

Ounces (Troy) (oz) |

|

0.03215 |

The following is a glossary of certain terms used in this Annual Report:

Assay means, in economic geology, to analyze the proportions of metal in a rock or overburden sample; to test an ore or mineral for composition, purity, weight or other properties of commercial interest.

CERCLA means Comprehensive Environmental Response, Compensation, and Liability Act, referenced informally as “Superfund.”

Deposit means a mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body or as containing ore reserves, until final legal, technical, and economic factors have been resolved.

g/t Au means grams of gold per metric tonne of material.

Grade or grade means the amount of valuable metal in each tonne of ore, expressed as grams per tonne (g/t) for precious metals and as percent (%) for antimony.

km means kilometre(s).

m means metre(s) (equivalent to 3.281 feet).

M means million.

Mineralization or mineralization means the concentration of metals and their chemical compounds within a body of rock.

Mineral Reserve or mineral reserve means an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Mineral Resource or mineral resource means a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

Ore means a mineral reserve of sufficient value as to quality and quantity to enable it to be mined at a profit.

Ounce or oz means a troy ounce or twenty penny weights or 480 grains and is equivalent to 31.1035 grams.

Oz/t or oz/st means a troy ounce per short ton.

3

Sampling or sampling means a technique for collecting representative sub-volumes from a larger volume of geological material. The particular sampling method employed depends on the nature of the material being sampled and the kind of information required.

NOTICE REGARDING MINING PROPERTY DISCLOSURE RULES

The material scientific and technical information in respect of the Stibnite Gold Project in this Annual Report, unless otherwise indicated, is based upon information contained in the Technical Report Summary (the “TRS”), dated as of December 31, 2021, and amended as of June 6, 2022, developed for the Stibnite Gold Project in accordance with the mining property disclosure rules specified in Regulation S-K subpart 1300 (“S-K 1300”) promulgated by the U.S. Securities and Exchange Commission (the “SEC”). The TRS summarizes, in accordance with the mining property disclosure rules specified in S-K 1300, the technical report titled “Stibnite Gold Project, Feasibility Study Technical Report, Valley County, Idaho” dated effective December 22, 2020 and issued January 27, 2021 (the “2020 Feasibility Study”), which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosures an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the mining property disclosure rules specified in S-K 1300. Accordingly, information concerning mineral deposits from the TRS set forth herein may not be comparable with information made public by companies that report in accordance with NI 43-101.

The updated financial information in respect of the Stibnite Gold Project in this Annual Report is based upon information contained in the Financial Update – Cash Flow Forecast for the Stibnite Gold Project, February 2025 (the “Financial Update”), which is included as Exhibit 99.1 to this Annual Report on Form 10-K. The Financial Update should be read as a supplemental financial update to the 2020 Feasibility Study, which is summarized in the Company’s TRS, with respect to economic information regarding the Project. Neither the Financial Update nor the studies or data underlying such update modifies the mineral resources and mineral reserves reported in the TRS or the material assumptions and information pertaining to such disclosure. The information contained in the Financial Update is subject to the assumptions, exclusions and qualifications set forth herein, as well as those contained in the 2020 Feasibility Study and the TRS, except to the extent explicitly updated herein.

The 2020 Feasibility Study, the TRS and the Financial Update are intended to be read as a whole and sections should not be read or relied upon out of context.

All disclosures contained in this Annual Report regarding the mineral reserves and mineral resource estimates and economic analysis on the property are fully qualified by the full disclosure contained in the 2020 Feasibility Study and the TRS.

Information of a scientific or technical nature in this Annual Report and the Financial Update have been approved by Christopher Dail, AIPG CPG #10596, Exploration Manager for Perpetua Resources Idaho, Inc. and a Qualified Person (as defined in NI 43-101 and as defined in S-K 1300).

See also “Cautionary Note Regarding Forward-Looking Statements.”

4

PART I

Item 1. Business

Overview

The Corporation was incorporated under the Business Corporations Act (British Columbia) on February 22, 2011 under the name “Midas Gold Corp.” The Corporation changed its name to “Perpetua Resources Corp.” on February 15, 2021.

The Corporation’s head office is located at Suite 201 – 405 South 8th Street, Boise, Idaho, U.S.A. 83702 and its registered and records office is located at Suite 1008 – 550 Burrard Street, Vancouver, British Columbia V6C 2B5.

The Corporation is a development-stage company engaged in acquiring mining properties with the intention of exploring, evaluating and placing them into production, if warranted. Currently, its principal business is the exploration and, if warranted and subject to receipt of required permitting, redevelopment, restoration and operation of the Stibnite Gold Project in Idaho, USA. The Corporation is currently undertaking an extensive permitting process for redevelopment and restoration of the Project.

Mineral exploration and development are expected to constitute the principal business of the Corporation for the coming years. In the course of realizing its objectives, it is expected the Corporation may enter into various agreements specific to the mining industry, such as purchase or option agreements to purchase mining claims and/or joint venture agreements.

The Corporation’s principal mineral project is the Stibnite Gold Project, which contains several gold, silver and antimony mineral deposits. The Corporation’s current focus is to explore, evaluate and potentially redevelop three of the Deposits known as the Hangar Flats Deposit, West End Deposit and Yellow Pine Deposit, all of which are located within the Stibnite Gold Project, as well as reprocess certain historical tailings located on the Project. These development activities would be undertaken in conjunction with a major restoration program designed to address legacy impacts related to historical mining activities in the Project area.

The Corporation’s subsidiaries’ property holdings at the Stibnite Gold Project are comprised of a contiguous package of unpatented federal lode claims, unpatented federal mill sites, patented lode mining claims and patented mill sites. As of December 31, 2024, this land position encompassed approximately 11,548 hectares held in 1,674 unpatented lode claims and mill sites and patented land holdings. A subsidiary of the Corporation acquired these rights through a combination of purchases and transactions and staking under the 1872 Mining Law and holds a portion under an option agreement. Bureau of Land Management claim rental payments and filings are current as of the date of this filing and the claims are all held in good standing. Normal maintenance and upkeep of the Project infrastructure continued during the year.

5

Corporate Structure

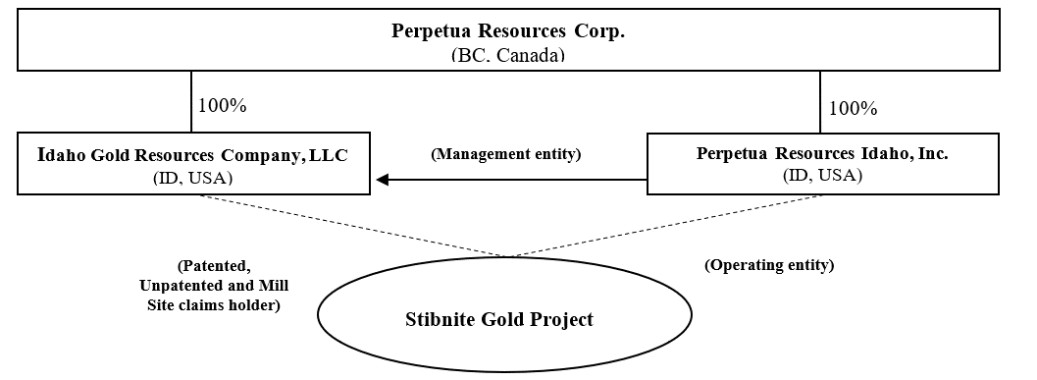

The following chart shows the intra-corporate relationships between the Corporation and its subsidiaries. Perpetua Resources Idaho, Inc. (“PRII”) has no ownership interest in the Stibnite Gold Project; rather, it is the designated operating entity of the Corporation and manages the activities on the Project site. The property holding entity, Idaho Gold Resources Company, LLC (“IGRCLLC”), is the surviving entity in a merger with Stibnite Gold Company (“SGC”), effective June 3, 2021, and is managed pursuant to an operating agreement with PRII. PRII and IGRCLLC are wholly owned by the Corporation.

IGRCLLC holds title to the Yellow Pine, Hangar Flats, and West End Deposits, all of the patented mill sites and all of the unpatented federal lode mining claims and unpatented mill sites.

Permitting and Environmental Matters

Perpetua Resources is focused on the exploration and mining of the Stibnite Gold Project (the “Project”), the reclamation of prior deposits and historical tailings, and the restoration of the area to address historical activities and legacy contamination. Our project is, therefore, subject to numerous environmental regulations, including federal, state, and local laws.

Significantly, we are subject to formal review under the National Environmental Policy Act (“NEPA”) and extensive permitting requirements. In 2016, the United States Forest Service (“USFS” or the “Forest Service”) began its formal review of the Stibnite Gold Project under NEPA. The Forest Service completed scoping in 2017 and subsequently pursuant to the NEPA process, the USFS and cooperating agencies undertook extensive review of our project and proposed actions through a Draft Environmental Impact Statement (“DEIS”), released by the USFS in August 2020. In response to public and agency feedback on the DEIS, Perpetua Resources proposed modifications to the mine plan analyzed in DEIS Alternative 2 to include reduction of the project footprint, improvements in water quality, and lower water temperatures. Perpetua Resources submitted a refined proposed action to the USFS in December 2020 (the “Modified Mine Plan”).

The USFS then prepared a Supplemental Draft Environmental Impact Statement (“SDEIS”) to further evaluate the project refinements and compare the Company’s proposed site access via Burntlog Route to an alternative option using current roads. After nearly two years of review, the SDEIS was published on October 28, 2022 for a 75-day public comment period. The USFS identified the Modified Mine Plan as the Preferred Alternative and concluded that it would reasonably accomplish the purpose and need for consideration of approval of the Stibnite Gold Project, while giving consideration to environmental, economic, and technical factors.

On September 6, 2024, the USFS published the Final Environmental Impact Statement (“FEIS”) and a Draft Record of Decision (“DROD”) for the Stibnite Gold Project. The FEIS analyzes the potential environmental effects (including benefits) of the mining and reclamation activities proposed as part of the Stibnite Gold Project. The DROD outlined the USFS’s proposed decision to authorize the Modified Mine Plan and to approve a special use authorization for transmission line upgrades and installation of a new power transmission line with supporting infrastructure.

6

On January 3, 2025, the USFS published the Final Record of Decision (the “ROD”) and FEIS Errata authorizing the Modified Mine Plan. Per the requirements of the FEIS and ROD, numerous plans comprising the suite of Environmental Monitoring and Management Plans are in process and will incorporate Project updates as well as required financial assurance, mitigation measures, environmental protection measures and design features. This will include preparation of a Final Mine Plan of Operations.

The Company’s Clean Water Act (“CWA”) Section 404 permit application, proposed Compensatory Mitigation Plan, and associated financial assurance remain under review by the U.S. Army Corps of Engineers (the “Army Corps.”) after the public comment period ended in October 2023. The Army Corps has been a part of the review process as a cooperating agency since the Company began the federal NEPA permitting process and has been formally evaluating the Section 404 permit application and proposed Compensatory Mitigation Plan since 2023. The Section 404 permit is the last remaining federal permit required to be issued prior to a construction decision. Perpetua expects the permit to be issued in the first half of 2025.

The U.S. Fish and Wildlife Service issued its Final Biological Opinion on September 6, 2024 and the National Marine Fisheries Service issued its Final Biological Opinion on October 7, 2024 (collectively, the “Final Biological Opinions”). These Final Biological Opinions imposed certain requirements on the Project that are incorporated into the USFS ROD.

The Company has filed applications for certain state permits and other approvals required from various agencies of the State of Idaho. These applications and approvals are at various stages of the process required under Idaho law and include applications and plans submitted to the Idaho Department of Environmental Quality (“IDEQ”) for an air Permit to Construct, Idaho Pollutant Discharge Elimination System discharge permits and a cyanidation facility permit, to the Idaho Department of Water Resources (“IDWR”) for permanent mine closure and financial assurance, and to IDWR for a stream alteration permit. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Ancillary Permitting Update, below.

With the receipt of the ROD, the Corporation is currently focused on advancing the Project towards a construction decision, including finalizing the remaining federal and state permits and securing project financing.

To address historical legacy impacts at the site of the Stibnite Gold Project, Perpetua Resources has voluntarily entered into an Administrative Settlement Agreement and Order on Consent (“ASAOC”) pursuant to CERCLA with the United States Environmental Protection Agency (the “U.S. EPA”) and the United States Department of Agriculture (“USDA”). Finalized on January 15, 2021, the ASAOC provides for a number of time-critical removal actions (early response actions referred to as “Phase 1” in the ASAOC) designed to improve water quality in several areas of the site. Upon signing of the ASAOC, the aggregate cost of the Phase 1 obligation was estimated to be approximately $7,473,805. In 2021, 2022, 2023, and 2024 the total cost estimate to voluntarily address environmental conditions increased to $19,185,438 due to scope changes, inflation and higher fuel prices. As of December 31, 2024, Perpetua Resources determined it had completed all Phase 1 response actions required by the ASAOC and filed Removal Action Completion Reports (“RACR”) with the U.S. EPA and USDA with respect to such completion. Pursuant to the terms of the ASAOC, the two federal agencies are reviewing Perpetua Resources’ RACR to ascertain whether they agree that the required Phase 1 activities are complete. The ASAOC includes a process under which the Company and the signatory federal agencies will evaluate whether the Company will proceed with additional response actions after the Phase 1 work has been certified by the federal agencies as complete. The scope of any such potential additional actions and their costs have not yet been determined. See also Notes 8 and 9 to the Consolidated Financial Statements.

Our Project is subject to ongoing litigation and could face further litigious challenges in the future. Following the USFS’ publication of the ROD authorizing the mine plan for the Project, claims were filed in the U.S. District Court for the District of Idaho against the USFS and other federal agencies on February 18, 2025 by a number of claimants, including Save the South Fork Salmon and the Idaho Conservation League, alleging violations of NEPA and other federal laws in the regulatory review process. Among other remedies, the claimants seek to vacate the ROD, FEIS, the Final Biological Opinions and Project approvals and to enjoin any further implementation of the Project. PRII has filed a motion with the court to intervene in this lawsuit. While the Company believes the federal regulatory processes resulting in the issuance of the FEIS, ROD, and other approvals and documentation were conducted thoroughly and completely by the relevant federal regulatory agencies, there can be no assurance that the ROD, FEIS, and other Project approvals will be upheld upon judicial review. See Item 1A, Risk Factors, below.

7

Government and Environmental Regulations

Mining operations and exploration activities are subject to extensive national, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances, disclosure requirements and other matters. The Corporation plans to obtain the licenses, permits or other authorizations currently required to conduct its exploration or development programs, and it believes it is currently in material compliance with governing mining, health, safety and environmental statutes and regulations in the United States and Idaho. Except as otherwise noted herein, we are not subject to any orders or directions with respect to the foregoing laws and regulations. For a more detailed discussion of the various government laws and regulations applicable to our operations and potential negative effects of these laws and regulations, see Item 1A, Risk Factors, below.

Our operations are also subject to numerous environmental, health, and safety laws and regulations in the jurisdictions in which we operate. These laws and regulations may require us to take precautions with respect to threatened, endangered, or otherwise protected species and their habitats as well as other natural, historical, and cultural resources, perform environmental assessments or impact statements, implement siting and operational programs or best practices to minimize environmental impacts from our operations, perform investigatory and remedial obligations, and obtain federal, state, and local permits, licenses, or other approvals. Failure to comply with these laws and regulations may result in the imposition of significant fines or penalties. Additionally, we could experience significant opposition from third parties to our application for such permits or during the administrative agency review and appeal process after the issuance of such permits. Delays, denials of, or challenges to permits, or the imposition of costly and difficult to comply with conditions, may impair the development of our Project or curtail our planned operations. The following provides a summary of the more significant environmental, health, and safety laws and regulations which our operations are subject to and for which compliance with may have a material adverse impact on our business.

National Environmental Policy Act

Our Project is subject to environmental review under NEPA. This law requires federal agencies to evaluate the environmental impact of their actions that may significantly affect the quality of the human environment; such review is a prerequisite for the granting of permits or similar authorization from federal agencies for the development of certain projects. As part of the review, the federal agencies are required to consider numerous environmental impacts, which may include potential impacts on air quality, water quality, cultural resources, wildlife, geology, and aesthetics, as well as alternatives to the project. The review process can lead to significant delays in approval of such projects and the issuance of the requisite permits which, in turn, can impact both the cost and development of operations. As a result of NEPA review, agencies may seek to deny permits or other support for a project, or condition approvals on certain modifications or mitigation actions. Additionally, authorizations under NEPA are subject to litigation, protest, or appeal, which has the potential to lead to further delays.

Pursuant to NEPA, the USFS and cooperating agencies undertook extensive review of our Project and proposed actions. As a result of this review, the USFS published the FEIS and DROD with respect to the Project on September 6, 2024 and published the ROD and FEIS Errata authorizing the Modified Mine Plan for the Project on January 3, 2025. Certain parties on February 18, 2025 filed a lawsuit in the U.S. District Court for the District of Idaho alleging that the USFS and other federal agencies violated applicable laws and other requirements in issuing the ROD and FEIS and taking related regulatory actions. The litigation is ongoing, and PRII has filed a motion with the court to intervene in this lawsuit. See “Permitting and Environmental Matters” above.

Comprehensive Environmental Response, Compensation, and Liability Act

The site upon which our Project is located has significant legacy contamination from previous mining operations by companies not related to Perpetua. CERCLA can impose joint and several liability, without regard to fault or legality of conduct, on classes of persons who are statutorily responsible for the release of hazardous substances into the environment. These persons include current owners or operators of a site where a release has occurred. Under CERCLA, such current owners or operators may be subject to strict, joint and several liability for the entire cost of cleaning up hazardous substances and for other expenditures, such as response costs and damage to natural resources. Idaho also has environmental cleanup laws analogous to CERCLA.

Voluntary cleanup actions can be undertaken pursuant to settlement agreements under CERCLA. We entered into an ASAOC with the U.S. EPA and the USDA in 2021 to conduct a number of time critical removal actions focused on improving water quality in several areas of the site. The Company filed RACR with the U.S. EPA and USDA advising the agencies that the Company believes it has completed all work required under Phase 1 of the ASAOC. The federal agencies are currently reviewing the RACR. See “Permitting and Environmental Matters” above and Notes 8 and 9 to the Consolidated Financial Statements.

8

Protection of Species and Habitat

Our operations are subject to several environmental regulations and guidelines regarding various protected species and their habitats and include the federal Endangered Species Act, the Migratory Bird Treaty Act, and the Bald and Golden Eagle Protection Act, alongside similar state laws. These laws impose significant civil and criminal penalties for violations, including injunctions limiting or otherwise prohibiting operations in certain areas where protected species or their habitats are located. The imposition of such restrictions, such as seasonal limitations, may result in additional costs and delays and could impact the feasibility of our Project.

Clean Water Act

The CWA and other similar federal and state laws and regulations may require us to obtain permits for water discharges or take mitigation actions with respect to the loss of wetlands. Additionally, such regulations require us to implement a variety of best management practices to ensure that water quality is protected and the impacts of our operations on water quality are minimized. The CWA and analogous laws and regulations provide for administrative, civil and criminal penalties for unauthorized discharges of pollutants in reportable quantities and may impose substantial potential liability for the costs of addressing such discharges. The Nez Perce Tribe in 2019 filed a lawsuit against the Company in the U.S. District Court for the District of Idaho alleging violations of the CWA due to, among other things, exceedances of applicable water quality standards in certain water bodies in the vicinity of the Project site. The Company entered into a settlement of this litigation with the Nez Perce Tribe in 2023. See Item 3. Legal Proceedings, below.

Clean Air Act

The Clean Air Act and other similar laws and regulations may require us to obtain permits before construction can commence on a new source of potentially significant air emissions. Additionally, the U.S. EPA establishes and periodically reviews emissions standards that require the maximum degree of reduction in emissions of hazardous air pollutants, and we are required to comply with such emissions standards. The U.S. EPA and state agencies such as the Idaho Department of Environmental Quality have the ability to issue citations and orders and assess penalties for violations of permits or other applicable regulatory requirements.

Mine and Safety Health Administration

Mining operations are regulated by the U.S. Department of Labor’s Mine and Safety Health Administration (“MSHA”) which carries out the provisions of the Federal Mine Safety and Health Act of 1977, as amended by the Mine Improvement and New Emergency Response Act of 2006. MSHA enforces the health and safety rules for all U.S mines and conducts mine inspections regarding compliance with applicable laws and regulations. MSHA has the ability to issue citations and orders and assess penalties for health and safety violations.

District Exploration

No exploration drilling was conducted by the Company during the reporting period. Some laboratory test work was completed to support requirements under the Defense Ordnance Technology Consortium agreement. Other site activities during the reporting period focused on maintaining claim location monuments and surveying, studies to support permitting and design, engineering and environmental studies to support the ongoing activities related to the ASAOC.

Employees

At December 31, 2024, the Corporation had 36 full time employees and 1 part time employee. 34 employees were directly related to the mineral development activities of the Stibnite Gold Project and the remaining 3 employees were focused on executive management, investor relations and administrative support of the Corporation. A total of 27 employees were employed in Idaho, with many of the Perpetua Resources team working remotely. The Corporation also contracts out certain activities to contractors with specific skills to assist with various aspects of the Project.

9

Competition

The gold and critical mineral exploration and mining business is a competitive business. The Corporation competes with numerous other companies possessing greater financial and technical research resources. Competition is particularly intense with respect to the acquisition of desirable, undeveloped gold or critical mineral properties. The Corporation’s competitive strength is due, in part, to having the only antimony reserves in the United States. If additional accessible sources of antimony become available or demand is reduced, the Corporation’s ability to access funding or government support may be affected. We also encounter competition for the hiring of key personnel. This competition could adversely impact our ability to advance the Project, acquire suitable prospects for exploration in the future on terms we consider acceptable, attract necessary capital funding or acquire an interest in additional properties. See Item 1A., Risk Factors, below.

Environmental, Social and Governance (“ESG”)

Our commitment to ESG practices is explained in our ESG Policy. Our ESG Policy, Sustainability Roadmap and our 2023 Sustainability Report can be found on the Company’s website. Information on our website is neither part of, nor incorporated into, this Annual Report on Form 10-K.

Availability of Raw Materials

The raw materials we require to carry on our business are readily available through normal supply or business contracting channels in the United States and Canada. Historically, we have been able to secure the appropriate equipment and supplies required to conduct our contemplated programs. As a result, we do not believe that we will experience any shortages of required equipment or supplies in the foreseeable future. See also section Item 1A, Risk Factors – “A shortage of supplies and equipment, or the inability to obtain such supplies and equipment when needed and at expected prices, could adversely affect Perpetua Resources’ ability to operate its business.” and “Changes in U.S. administrative policy, including the imposition of or increases in tariffs on steel and/or other raw materials, changes to existing trade agreements and any resulting changes in international trade relations, may have an adverse effect on us.”

Gold Price History

The price of gold is volatile and is affected by numerous factors, all of which are beyond our control, such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the U.S. dollar and foreign currencies, changes in global and regional gold demand, and international and national political and economic conditions. The following table presents the annual high, low and average daily afternoon London Bullion Market Association gold price over the past five calendar years on the London Bullion Market ($/ounce):

Year |

|

High |

|

Low |

|

Average |

|||

2020 |

|

$ |

2,067 |

|

$ |

1,474 |

|

$ |

1,770 |

2021 |

|

$ |

1,943 |

|

$ |

1,684 |

|

$ |

1,799 |

2022 |

|

$ |

2,039 |

|

$ |

1,629 |

|

$ |

1,801 |

2023 |

|

$ |

2,078 |

|

$ |

1,811 |

|

$ |

1,943 |

2024 |

|

$ |

2,778 |

|

$ |

1,985 |

|

$ |

2,387 |

2025 (through March 7) |

|

$ |

2,934 |

|

$ |

2,609 |

|

$ |

2,806 |

Data Source: www.kitco.com

10

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”) enacted in April 2012. Certain specified reduced reporting and other regulatory requirements are available to public companies that are emerging growth companies. These provisions include:

| ● | an exemption from the auditor attestation requirement in the assessment of the effectiveness of our internal controls over financial reporting required by Section 404 of the Sarbanes-Oxley Act of 2002; |

| ● | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| ● | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about our audit and our financial statements; and |

| ● | reduced disclosure about our executive compensation arrangements. |

We will continue to be an emerging growth company until the earliest of:

| ● | the last day of our fiscal year in which we have total annual gross revenues of $1.235 billion (as such amount is indexed for inflation every five years by the SEC to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest $1.0 million) or more; |

| ● | the last day of our fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (“Securities Act”); |

| ● | the date on which we have, during the prior three-year period, issued more than $1.0 billion in non-convertible debt; or |

| ● | the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC, which means the market value of our common shares that is held by non-affiliates (or public float) exceeds $700.0 million as of the last day of our second fiscal quarter in our prior fiscal year. |

We have elected to take advantage of certain of the reduced disclosure obligations in this Annual Report and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

Available Information

We file or furnish annual, quarterly and current reports, proxy statements and other documents with the SEC under the Exchange Act. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers, including Perpetua, that file electronically with the SEC. We are also subject to requirements of the applicable securities laws of Canada, and documents that we file with the Canadian Securities Administrators may be found at www.sedarplus.ca.

We make available free of charge through our website (www.perpetuaresources.com) our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC or the securities commissions or similar regulatory authorities in Canada. In addition to the reports filed or furnished with the SEC and the securities commissions or similar regulatory authorities in Canada, we publicly disclose information from time to time in our press releases, investor presentations posted on our website and at publicly accessible conferences. Such information, including information posted on or connected to our website, is not a part of, or incorporated by reference in, this Annual Report or any other document we file with or furnish to the SEC or the securities commissions or similar regulatory authorities in Canada.

We have adopted a Code of Conduct and Ethics Policy (the “Code of Conduct”) that applies to our management and to our other employees. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K relating to amendments to or waivers from any provision of our Code of Conduct applicable to our principal executive officer, principal financial officer, principal accounting officer and other persons performing similar functions by posting such information on our website (www.perpetuaresources.com). Our other policies and the charters of our Audit, Compensation and Corporate Governance and Nominating Committees are available on our website. Information on our website is neither part of, nor incorporated into, this Annual Report on Form 10-K.

11

Item 1A. Risk Factors.

Investing in our common shares involves a high degree of risk. An investment in our securities is speculative and involves a high degree of risk due to the nature of our business and the present stage of exploration and development of our mineral properties. You should carefully consider the risks described below, as well as the other information in this Annual Report, including our consolidated financial statements and the related notes and Part II, Item 7. entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in any documents incorporated in this Annual Report by reference, before deciding whether to invest in our common shares. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations, and growth prospects and could cause them to differ materially from the estimates described in forward-looking statements in this Annual Report. In such an event, the market price of our common shares could decline, and you may lose all or part of your investment. Although we have discussed risks we have identified as material risks, the risks described below are not the only ones that we may face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair our business operations. Certain statements below are forward-looking statements. See also “Cautionary Note Regarding Forward-Looking Statements” in this Annual Report.

Risk Factor Summary

The following is a summary of important risk factors that are specific to our business, industry and our incorporation under the laws of British Columbia:

| ● | Our ability to continue the exploration, permitting, development, and construction of the Project, and to continue as a going concern, will depend in part on our ability to obtain suitable financing. |

| ● | We do not currently have sufficient funds or committed financing necessary to commence construction of the Project, and we may be unable to raise the necessary funds. |

| ● | Funding under the U.S. EXIM letter of interest is subject to an application and diligence process, and the amount and timing of such funding, if any, is uncertain and subject to conditions outside the Company’s control. |

| ● | A strategic transaction, whether or not consummated, could have an adverse effect on our business, results of operations and financial conditions. |

| ● | Our funding under the TIA is subject to certain conditions, limitations and ongoing obligations. If we fail to satisfy these conditions, we may be unable to obtain all of the funding allocated to Perpetua Resources or may be required to disgorge such funds. |

| ● | We require various permits to commence construction and operation of the Project and any future operations, and delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, could have a material adverse impact on us. |

| ● | We have no history of commercially producing precious metals from our mineral properties and there can be no assurance that we will successfully establish mining operations or profitably produce precious metals. |

| ● | Perpetua Resources’ future exploration and development efforts may be unsuccessful. |

| ● | Perpetua Resources’ mineral resource and mineral reserve estimates may not be indicative of the actual gold or other minerals that can be mined. |

| ● | Perpetua Resources faces numerous uncertainties in estimating economically recoverable mineral reserves and mineral resources, and inaccuracies in estimates could result in lower than expected revenues, higher than expected costs and decreased profitability. |

| ● | Perpetua Resources’ title to its mineral properties and its validity may be disputed in the future by others claiming title to all or part of such properties. |

| ● | Perpetua Resources has a history of net losses and expects losses to continue for the foreseeable future. |

| ● | We have a limited property portfolio. |

| ● | Perpetua Resources faces substantial competition within the mining industry from other mineral companies with much greater financial and technical resources and Perpetua Resources may not be able to effectively compete. |

| ● | We are subject to extensive environmental laws and regulations, where compliance failure may impact our operations. |

| ● | Our operations, including permitting, currently are and in the future may be subject to legal challenges, which could result in adverse impacts to our business and financial condition. |

| ● | Our operations are subject to climate change risks. |

| ● | Increasing attention to ESG matters and conservation measures may adversely impact our business. |

| ● | Perpetua Resources depends on key personnel for critical management decisions and industry contacts but does not maintain key person insurance. |

12

| ● | Perpetua Resources does not have a full staff of technical experts and relies upon outside consultants to provide critical services. |

| ● | Certain Perpetua Resources directors and officers also serve as officers and/or directors of other mining companies, which may give rise to conflicts. |

| ● | Perpetua Resources’ business involves risks for which Perpetua Resources may not be adequately insured, if it is insured at all. |

| ● | A shortage of supplies and equipment, or the inability to obtain such supplies and equipment when needed and at expected prices, could adversely affect Perpetua Resources’ ability to operate its business. |

| ● | Resource exploration and development is a high risk, speculative business. |

| ● | Mineral exploration and development is subject to numerous industry operating hazards and risks, many of which are beyond Perpetua Resources’ control and any one of which may have an adverse effect on its financial condition and operations. |

| ● | Metal prices have fluctuated widely in the past and are expected to continue to do so in the future, which may adversely affect the amount of revenues derived from the future commercial production. |

| ● | Rising metal prices encourage mining exploration, development, and construction activity, which in the past has increased demand for and cost of contract mining services and equipment. |

| ● | Global financial markets can have a profound impact on the global economy in general and on the mining industry in particular. |

| ● | Our business could be negatively impacted by inflationary pressures, which may increase our operating costs and decrease our access to capital required to operate our business. |

| ● | Changes in U.S. administrative policy, including the imposition of or increases in tariffs on steel and/or other raw materials, changes to existing trade agreements and any resulting changes in international trade relations, may have an adverse effect on us. |

| ● | The requirements of being a public company in the United States and Canada and maintaining a dual listing on both Nasdaq and the TSX, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and applicable securities laws of Canada, may strain our resources, increase our costs, and require significant management time and resources. |

| ● | For as long as we are an “emerging growth company,” or a “smaller reporting company” we will not be required to comply with certain reporting requirements that apply to some other public companies, and such reduced disclosures requirement may make our Common Shares less attractive. |

| ● | Provisions in the Company’s corporate charter documents and Canadian law could make an acquisition of the Company, which may be beneficial to its shareholders, more difficult and may prevent attempts by the shareholders to replace or remove the Company’s current management and/or limit the market price of the Common Shares. |

| ● | Because we are a corporation incorporated in British Columbia and some of our directors and officers may reside, now or in the future, in Canada, it may be difficult for investors in the United States to enforce civil liabilities against us based solely upon the federal securities laws of the United States. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors and officers that reside outside of Canada. |

| ● | Perpetua Resources has no history of paying dividends, does not expect to pay dividends in the immediate future and may never pay dividends. |

| ● | Perpetua Resources will need to raise additional capital through the sale of its securities or other interests, resulting in potential for significant dilution to the existing shareholders and, if such funding is not available, Perpetua Resources’ operations would be adversely affected. |

| ● | Future sales of Perpetua Resources’ common shares into the public market by holders of Perpetua Resources options and warrants may lower the market price, which may result in losses to Perpetua Resources’ shareholders. |

| ● | Our largest shareholder has significant influence on us and may also affect the market price and liquidity of our securities. |

| ● | In the future, we may be subject to legal proceedings. |

| ● | We are subject to taxation both in Canada and the United States, and shareholders may be subject to Canadian and U.S. withholding and certain other taxes. |

| ● | We are required to develop and maintain proper and effective internal controls over financial reporting. We may not complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may not be determined to be effective, which may adversely affect investor confidence in us and, as a result, the value of our common stock. |

| ● | If securities or industry analysts do not continue to publish research or reports about our business, or if they issue an adverse or misleading opinion regarding our stock, our stock price and trading volume could decline. |

| ● | System security vulnerabilities, data breaches, and cyber-attacks could compromise proprietary or otherwise sensitive information or disrupt operations, which could adversely affect Perpetua Resources’ business, reputation, operations, and stock price. |

13

Risk Factor Discussion

Risks Related to Our Business

Our ability to continue the exploration, permitting, development, and construction of the Project, and to continue as a going concern, will depend in part on our ability to obtain suitable financing.

We have limited financial resources. We will need external financing to develop and construct the Project and to complete the permitting process. The Company’s latest liquidity forecast indicates that available cash resources for expenses not eligible for reimbursement under the TIA (as defined below) are expected to be exhausted in the third quarter of 2025. We expect to incur other costs in the foreseeable future that are not eligible for reimbursement under the TIA and may incur unanticipated increases to costs as a result of inflation, fuel or labor costs or other factors. Furthermore, only approximately $10 million remained available for reimbursement under the TIA as of December 31, 2024, and costs must be incurred on or before June 16, 2025 to be eligible for reimbursement. Once such funding is exhausted or has expired, the Company will need to seek new funding sources for expenses currently reimbursed through the TIA. The Company continues to explore various funding opportunities, which may include the issuance of additional equity, new debt, or project specific debt; government funding; and/or other financing or strategic opportunities. In particular, the Company has engaged RBC Capital Markets and Endeavour Financial to assist with the evaluation of potential strategic and financing opportunities and to support the Company’s application process in connection with the U.S. EXIM $1.8 billion Letter of Interest received in April 2024. Any such financing or strategic transaction, or any funding commitment from U.S. EXIM, will be subject to due diligence, the negotiation of funding terms and other conditions, and there can be no assurance of the amount, timing or nature of any such financing or strategic transaction, if any, and any such financing or strategic transaction may not be consummated at all. Additionally, the potential costs of obtaining such financing or any strategic transaction can be significant and may put additional strains on our cash flows. Furthermore, in May 2023 the Company entered into the Sales Agreement (as defined herein) with respect to an ATM Offering (as defined herein); however, only $6.2 million remained available under the program as of December 31, 2024. Sales under the program are also subject to certain conditions, including market conditions, and there is no assurance that the Company will be able to raise additional funds under the program, at acceptable stock prices or at all. If additional financing is not secured before the third quarter of 2025, the Company would no longer be able to meet its ongoing obligations or advance construction readiness activities.

We do not currently have sufficient funds or committed financing necessary to commence construction of the Project, and we may be unable to raise the necessary funds.

We have commenced pre-construction engineering and other preparations with the goal of commencing construction of the Project in 2025. According to the Financial Update, as of December 31, 2024, the total initial capital cost estimate for the Project was approximately $2,215 million.

We do not currently have sufficient funds or committed financing to commence construction of the Project. Our ability to obtain sufficient funds or committed financing on acceptable terms, or at all, may be impacted by various factors, including, but not limited to, unfavorable market conditions or commodity pricing; unfavorable interest rates; regulatory uncertainty; the incurrence of additional debt, which may be subject to certain restrictive covenants; restrictions on our use of government funding and permitting delays or challenges to our existing permits. The cost and terms of such financing, if obtained, may significantly reduce the expected benefits from development of the Project and/or render such development uneconomic, including by imposing restrictive covenants; limiting our ability to control certain property or development decisions as a result of our entry into joint ventures or other similar arrangements; the loss of certain economic benefits of our property as a result of our entry into royalty or similar agreements; or dilution to existing shareholders resulting from additional equity financing.

Our failure to obtain sufficient financing could result in the delay or indefinite postponement of exploration, permitting, development, construction, or production at the Project. There can be no assurance that additional capital or other types of financing will be available when needed or that, if available, the terms of such financing will be favorable. Our failure to obtain financing could have a material adverse effect on our growth strategy and results of operations and financial condition.

Funding under the U.S. EXIM letter of interest is subject to an application and diligence process, and the amount and timing of such funding, if any, is uncertain and subject to conditions outside the Company’s control.

On April 8, 2024, the Company announced that it received a non-binding and conditional Letter of Interest from the Export-Import Bank of the United States (“U.S. EXIM”) for potential debt financing of up to $1.8 billion through U.S. EXIM’s “Make More in America” and “China and Transformational Exports Program” initiatives. The Company expects to submit a formal application to U.S. EXIM in the second quarter of 2025. Upon receipt of an application for financing, U.S. EXIM will conduct the due diligence necessary to determine if a final commitment may be issued.

14

Any final commitment will be dependent on meeting U.S. EXIM’s underwriting criteria, authorization process, finalization and satisfaction of terms and conditions. All final commitments must comply with U.S. EXIM policies as well as program, legal and eligibility requirements.

There can be no assurance that the Company will be able to successfully satisfy any or all of such conditions. In particular, one condition of funding is that the Company raise a certain amount of equity financing. The Company may be unable to raise such additional financing on acceptable terms, or at all. If such condition is satisfied through an issuance of common shares, shareholders may experience significant dilution (see Item 1A. Risk Factors – Perpetua Resources will need to raise additional capital through the sale of its securities or other interests, resulting in potential for significant dilution to the existing shareholders and, if such funding is not available, Perpetua Resources’ operations would be adversely affected.).

The application process is controlled by U.S. EXIM and is subject to the procedures, priorities and staffing of the agency. As a result, the Company’s application may not be reviewed or processed on the Company’s preferred or expected timeline, and funds may not be available when needed to commence construction. Furthermore, U.S. EXIM funding is subject to the priorities of the federal government, which may result in changes to the amount, timing or conditions of funding. Even if approved, the terms of any U.S. EXIM funding may not be on acceptable terms or may be subject to conditions that the Company is unable to satisfy. If the Company is unable to secure U.S. EXIM financing, it may be unsuccessful in obtaining other project financing when needed or enter into strategic transactions on acceptable terms, or at all.

A strategic transaction, whether or not consummated, could have an adverse effect on our business, results of operations and financial conditions.

In 2024, the Company engaged RBC Capital Markets and Endeavour Financial to assist with the evaluation of potential strategic and financing opportunities and to support the Company’s application process in connection with the U.S. EXIM $1.8 billion Letter of Interest received in April 2024. The pursuit of such strategic transactions involve significant risks to the Company’s operations and financial results, whether or not such transaction is ultimately consummated. Such risks could include:

| ● | Diversion of management’s attention away from our business; |

| ● | Significant transaction costs, which may or may not be recovered in the future and which may be incurred even if such strategic transaction fails to close or is otherwise unsuccessful; |

| ● | Dilution of our equity interests or a decrease in the value of our common shares; |

| ● | Failure to complete such strategic transaction on expected timeframes, or at all; |

| ● | A change in control or a shareholder’s acquisition of a controlling stake in our business, which could trigger certain rights and remedies available to our contractual counterparties; |

| ● | Restrictions on our ability to raise additional capital, incur indebtedness or control decisions regarding our operations and management; |

| ● | Loss of key management personnel or employees, or the deterioration of our relationships with our employees; |

| ● | Disruption to our relationships with contract counterparties, community members, regulators and other stakeholders; |

| ● | Negative publicity or harm to our reputation; |

| ● | Legal proceedings and substantial costs associated with litigation; and |

| ● | Failure to realize expected benefits of any such transaction. |

The negotiation and consummation of any such financing or strategic transaction will require significant expenditures of time, attention and funds. Additionally, we may not control decisions made pursuant to agreements relating to strategic transactions, including joint ventures, to the extent we do not have a controlling interest in the venture or are not an operator under such agreements. The other parties to these arrangements may have economic, business, or legal interests or goals that are inconsistent with the Company’s and, therefore, decisions may be made that the Company does not believe are in its best interest. Moreover, parties to such agreements or ventures may be unable to meet their economic or other obligations, and the Company may be required to fulfill those obligations alone. In either case, the value of the investment and the Company’s business and financial condition may be adversely affected.

Achievement of the benefits expected from financing or strategic transactions may require us to incur significant costs and could have a material adverse effect on our business, operating results, financial condition and the price of our common shares. In addition, the negotiation and consummation of any such transaction may require significant attention from our management team, which may detract attention from our day-to-day operations. Any one or more of these factors or other risks could cause us not to realize the anticipated benefits of a financing or strategic transaction and could have a material adverse effect on our financial condition.

15

Our funding under the TIA is subject to certain conditions, limitations and ongoing obligations. If we fail to satisfy these conditions, we may be unable to obtain all of the funding allocated to Perpetua Resources or may be required to disgorge such funds.

In December 2022, Perpetua Resources was awarded an undefinitized Technology Investment Agreement (“TIA”) of up to $24.8 million under Title III of the DPA. On July 25, 2023, the TIA was definitized with the United States Department of Defense (the “DOD”), establishing the full, not-to-exceed amount of $24.8 million. The TIA contains customary terms and conditions for technology investment agreements, including ongoing reporting obligations. If we fail to satisfy these conditions, we will be unable to obtain remaining funds available under the TIA and, under certain circumstances, could be required to disgorge funds already paid. On May 2, 2024, the TIA was modified with an additional $34.4 million in funding, bringing the total amount of the TIA to $59.2 million.

Under the TIA, Perpetua Resources may request reimbursement for certain costs incurred through June 16, 2025 related to environmental baseline data monitoring, environmental and technical studies and other activities related to advancing Perpetua’s construction readiness and permitting process for the Stibnite Gold Project, which includes reimbursement of employee wages for activities included in the scope of the TIA. The funds may be used only for the purposes specified in the TIA and are not available to the Corporation for general corporate purposes other than those specified. Furthermore, the TIA contains limitations on the Corporation’s ability to share or sell certain assets, interests or technology to foreign counterparties, which may limit the Corporation’s ability to raise funding from foreign sources or capitalize on business opportunities with foreign companies.

We require various permits to commence construction and operation of the Project and any future operations, and delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, could have a material adverse impact on us.

Our current and anticipated future operations, including further exploration and development activities and commencement of construction and operations on the Project, require permits from various United States federal, state, and local governmental authorities. There can be no assurance that all permits that we require for the construction of mining facilities and to conduct mining operations will be obtainable on reasonable terms, or at all. Furthermore, permitting requirements can be costly to comply with and involve extended timelines. Permitting delays, failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained or successful legal challenges to the issuance of permits we have obtained, could have a material adverse impact on us.