UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-39032

PROFOUND MEDICAL CORP.

(Exact name of registrant as specified in its charter)

Ontario, Canada |

Not Applicable |

(State or other jurisdiction |

(I.R.S. Employer Identification No.) |

|

|

|

2400 Skymark Avenue, Unit #6, Mississauga, (Address of principal executive offices) |

L4W 5K5 (Zip Code) |

Registrant’s telephone number, including area code (647) 476-1350

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Shares, No Par Value Per Share |

PROF |

Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non-voting common shares held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common shares were last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $241,514,836.

As of March 7, 2025, the registrant had 30,039,809 common shares, no par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

Profound Medical Corp. (“ Profound” or the “Company”), a corporation organized under the laws of Ontario, Canada, qualifies as a “Foreign Private Issuer,” as defined in Rule 3b-4 under the Securities Exchange Act of 1934 (the “Exchange Act”) in the United States. The Company has voluntarily elected to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K with the United States Securities and Exchange Commission (the “SEC”) instead of filing on the reporting forms available to foreign private issuers.

Although the Company has voluntarily chosen to file periodic reports and current reports, as well as registration statements, on U.S. domestic issuer forms, the Company will maintain its status as a foreign private issuer. Accordingly, as a foreign private issuer, the Company remains exempt from the U.S. federal proxy rules pursuant to Section 14 of the Exchange Act and Regulations 14A and 14C thereunder, Regulation FD, and its officers, directors, and principal shareholders are not subject to the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act.

TABLE OF CONTENTS

i

Forward-Looking Statements

This annual report on Form 10-K for the year ended December 31, 2024, or this Annual Report on Form 10-K, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve risks and uncertainties, principally in the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including statements regarding future events, our ability to maximize capture of future milestones payments, our workforce reduction and related restructuring activities, our future financial and operating performance, anticipated timing and amounts of milestone and other payments under collaboration agreements, business strategy and plans, objectives of management for future operations, timing and outcome of legal and other proceedings and our ability to finance our operations are forward-looking statements. We have attempted to identify forward-looking statements by using terms such as including “anticipates,” “approach,” “believes,” “can,” “contemplate,” “continue,” “look forward,” “ongoing,” “could,” “estimates,” “expects,” “intends,” “may,” “appears,” “suggests,” “future,” “likely,” “goal,” “plans,” “potential,” “possibly,” “projects,” “predicts,” “seek,” “should,” “target,” “would” or “will” and other similar words or expressions or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks and uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements, to differ materially. The description of our Business set forth in Item 1, the Risk Factors set forth in Item 1A and our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 as well as other sections in this report, discuss some of the factors that could contribute to these differences. These forward-looking statements include, among other things, statements about:

| ● | the accuracy of our estimates regarding expenses, future revenues, uses of cash, capital requirements and the need for additional financing; |

| ● | our workforce reduction and related restructuring activities; |

| ● | our ability to realize the anticipated benefits of our corporate strategy; |

| ● | our cash runway and the sufficiency of our financial resources to fund our operations; |

| ● | the initiation, timing, progress, results, and decisions of our partners’ development activities, preclinical studies and clinical trials with respect to our product candidates; |

| ● | our collaborators’ election to pursue or continue research, development and commercialization activities; |

| ● | our ability to obtain future reimbursement and/or milestone payments from our collaborators; |

| ● | our ability to obtain and maintain intellectual property protection for our product candidates; |

| ● | our partners’ ability to successfully commercialize our partnered product candidates; |

| ● | the size and growth of the markets for our partnered product candidates and our partners’ ability to serve those markets; |

| ● | the rate and degree of market acceptance of any future products; |

| ● | the success of competing products that are or may become available; |

| ● | regulatory developments in the United States and other countries; |

| ● | and any restrictions on our ability to use our net operating loss carryforwards. |

PART I

Item 1. BUSINESS

We are a commercial-stage medical device company focused on the development and marketing of customizable, incision-free therapeutic systems for the ablation of diseased tissue utilizing our platform technologies. Our lead product, the TULSA-PRO system, combines real-time MRI, robotically-driven transurethral sweeping action/thermal ultrasound and closed-loop temperature feedback control to ablate whole gland or physician defined region of malignant or benign prostate tissue. The TULSA-PRO system has been shown in clinical and commercial settings to be an effective tool for physicians who are treating prostate diseases including cancer and other conditions such as benign prostatic hyperplasia (“BPH”).

In August 2019, the TULSA-PRO system received FDA clearance as a Class II device in the United States for thermal ablation of prescribed prostate tissue, using TULSA based on the Company’s TACT whole gland ablation pivotal study. It is also CE Marked in the EU for ablation of targeted prostate tissue (benign or malignant).

1

The TULSA-PRO system was approved by Health Canada in November 2019.

Our Sonalleve system is CE Marked in the EU for ablation of uterine fibroids and adenomyotic tissue, palliative relief of pain associated with bone metastases, treatment of osteoid osteoma, and management of benign desmoid tumors. The Sonalleve system is also approved in China and South Korea for non-invasive treatment of uterine fibroids. In November 2020, the Sonalleve system received HDE approval from the FDA for treatment of osteoid osteoma in the extremities.

Our systems are designed to be used with MRI scanners and are currently compatible with select MRI scanners manufactured by Philips, Siemens and GE Healthcare. We have generated revenues from the commercialization of our systems in the United States, EU and Asia. With the goal of increasing commercial adoption of products, we continue to pursue additional regulatory approvals in international jurisdictions and invest in research and development and in clinical studies designed to increase the body of evidence necessary to support customer coverage and reimbursement, both government and private payors. We may also consider synergistic strategic acquisitions to expand the applications of our platform technology and expand our commercial footprint.

Our business model in the United States is based primarily upon recurring revenues, charging a one-time fee that includes a supply of one-time-use devices, use of the TULSA-PRO and its ‘Profound Genius Services’, which provides comprehensive clinical training and case support focused on workflow efficiency. In other, international markets, and more recently in the United States, we continue to deploy a business model that consists of two components - sales of durable goods and one-time-use devices for each patient treated.

Our financial strategy to date has been to raise sufficient funds through securities offerings and bank financings to fund specific programs within a focused budget, and, following the August 2019 FDA clearance of our TULSA-PRO system, to drive commercial utilization. As our commercialization efforts increase and/or further program development costs increase, we may need to raise additional capital. See Item 4, “Risk Factors” for more information.

Our Technology Platform

Based on the clinical data from the TACT pivotal trial and additional studies conducted in the European Union (EU), we believe physicians may elect to use TULSA-PRO to ablate benign or malignant prostate tissue in patients with a variety of prostate diseases, including prostate cancer and BPH. Prostate cancer is one of the most common types of cancer affecting men. The annual incidence of newly diagnosed cases in 2024 is estimated to reach 299,010 in the United States according to the American Cancer Society, representing 29% of all new cancer diagnoses in men. The American Cancer Society further estimates that there are currently 3.3 million men living with prostate cancer in the United States, increasing to 5.8 million men when also including EU. Although 10-year survival outcomes for localized prostate cancer remain favorable, it remains the second-leading cause of cancer death in American men, behind only lung cancer. BPH is a histologic diagnosis that refers to the proliferation of smooth muscle and epithelial cells within the prostatic transition zone. According to the American Urological Association, BPH is nearly ubiquitous in the aging male population with worldwide autopsy-proven increase in histological prevalence starting at ages 40 to 45 years, reaching 60% at age 60 and 80% at age 80.

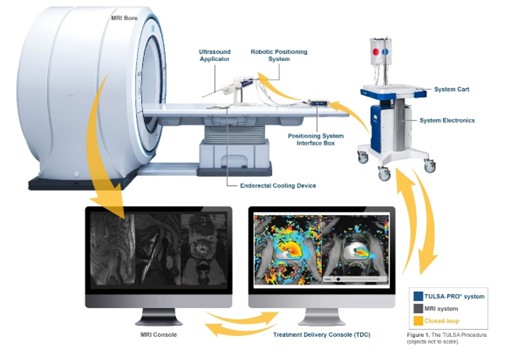

Illustration of our TULSA-PRO disposable and how it is utilized during a prostate ablation procedure.

TULSA-PRO delivers ultrasound energy through a transurethral catheter, a one-time-use device that is placed in the patient’s prostate through a natural orifice. Ultrasound energy is then delivered by the catheter in the shape of a plane or focused to a blade.

2

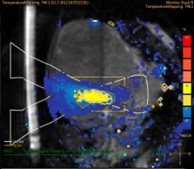

Externally, the catheter is connected to a software-controlled robot that rotates up to 360-degrees in a sweeping action to impart thermal energy and thus ablate tissue. The real-time temperature measurement of the prostate via MRI thermometry is coupled with closed-loop process control. The feedback enables delivery of the appropriate amount of ultrasound energy to gently heat the physician-prescribed region of prostate tissue to the target temperature required for cell kill without boiling or charring the tissue. To preserve the urethra within the prostate, the temperature of the transurethral catheter is maintained at an appropriate level by circulating water inside the catheter. Similarly, a water-cooled, specially designed catheter is placed in the patient’s rectum during the ablation process to keep it protected from thermal damage during the procedure. The TULSA-PRO in conjunction with its Thermal Boost module, enables surgeons to temporarily increase the ablation target temperature in treatment boundary regions which might harbor higher risk cancer features in large prostates where the treatment radius is >15 mm, further increasing user confidence that sufficient margins have been ablated. A study published in the Journal of Urology in March 2021, Magnetic Resonance Imaging-Guided Transurethral Ultrasound Ablation of Prostate Cancer, found that TULSA-PRO’s incision-free, controlled and gentle heating process may result in lower post procedural pain and complications, faster recovery, and reduced potential for side-effects that diminish quality of life, all the while delivering effective ablation of targeted diseased tissue, and significant, desirable shrinkage of the prostate via resorption of the dead tissue over time, which may provide long-term durable benefit.

TULSA-PRO system complete workflow with the MRI system.

3

Sonalleve delivers its ultrasound energy via a disc located outside the patient. Its ultrasound energy is focused to create small cylindrical hot spots a certain distance into the patient. Overlapping cylinders create ablation of the physician-prescribed desired tissue. Similar to TULSA-PRO, Sonalleve also provides for controlled temperature increases to achieve cell kill.

Sonalleve system integrated with MRI magnet.

The physician is in charge of using the Profound devices and decides which tissue needs to be ablated to impart therapeutic effect. We believe that in the hands of trained physicians, our systems have the ability to provide customizable, incision-free ablative therapies with the precision of real-time MRI visualization and thermometry, focused ultrasound and closed-loop temperature feedback control as shown below. A study published in the Journal of Urology in March 2021, Magnetic Resonance Imaging-Guided Transurethral Ultrasound Ablation of Prostate Cancer, found that our technologies offer clinicians and appropriate patients a better alternative to traditional surgical or radiation therapies, with respect to clinical outcomes, side effects and recovery time.

Customizable incision-free ablation of unrivalled variety of prostate indications.

Products

TULSA-PRO

Clinical Studies

In March 2014, we completed enrollment and treatment of 30 patients in the TULSA multi-jurisdictional safety and precision study. Based on the trial results, in April 2016, Profound received a CE Certificate of Conformity for the TULSA-PRO system from its Notified Body in the EU. In the fourth quarter of 2016, Profound initiated a pilot commercial launch of TULSA-PRO in key European markets where the CE Mark is accepted.

4

We received FDA clearance for the TULSA-PRO system in August 2019 for transurethral ultrasound ablation of prostate tissue, based on results from the Company’s TACT Pivotal Clinical Trial. The TACT Pivotal Clinical Trial is a prospective, open-label, single-arm pivotal clinical study, which initially included 115 treatment-naïve localized prostate cancer patients across 13 research sites in the United States, Canada and Europe, enrolled patients between August 2016 and February 2018. Subsequent to FDA clearance in 2019, the TACT trial re-opened enrollment of an additional 35 patients across 3 research sites in the United States (2 sites from the initial TACT recruitment period and 1 new additional site) to increase the proportion of men in the study who are American and with intermediate-risk prostate cancer.

Localized Prostate Cancer, Ablation Safety and Efficacy: TACT Pivotal Study

The TACT Pivotal Clinical Trial is a large, multi-center prospective study in which men with predominately intermediate-risk prostate cancer received whole gland ablation sparing the urethra and apical sphincter. Results demonstrate that MRI-guided TULSA is a minimally invasive procedure for effective prostate cancer ablation with a favorable side effect profile, minimal impact on quality of life and low rates of residual disease. TACT met its primary regulatory endpoint of prostate-specific antigen (“PSA”) reduction in 96% of men to a median nadir of 0.34 ng/ml and 0.5 ng/ml at 12 months. Median decrease in perfused prostate volume as assessed by a central radiology core lab using 12-month MRI was 91%, from a median 37 cc at baseline to 2.8 cc. At 12 months, extensive biopsy sampling of the markedly reduced prostate volume demonstrated histological benefit of elimination of clinically significant prostate cancer for nearly 80% of men. There was no evidence of cancer in 65% of men and 14% had low-volume clinically insignificant disease. The authors noted, however, that thermally fixed non-viable cells can retain their apparently malignant tissue morphology, confounding Gleason grading and potentially introducing false positives. By two and five years, 7% and 21.7%, of men sought additional treatment for their prostate cancer (prostatectomy, radiation, second TULSA not allowed by protocol). Two-thirds of study subjects with clinically significant cancer (ISUP Grade Group [GG] ≥ 2) had extensive disease (either bilateral or ≥5 positive cores), allowing for evaluation of oncologically relevant secondary outcomes including PSA stability, post-treatment biopsy, and salvage treatment. Notwithstanding the limitations of comparisons between ablative and extirpative therapies, the 21.7% five-year rate of salvage treatment and 21% rate of residual clinically significant prostate cancer in intermediate-risk patients are in line with accepted rates of early failure or additional intervention after standard treatments and goals for retreatment after ablative therapies. By five years, the median PSA nadir further reduced to 0.26 ng/ml. PSA reduction was durable over the extended follow-up period, from 0.53 ng/ml at one year to 0.63 ng/ml at five years.

TACT clinical trial PSA outcome to 5 years.

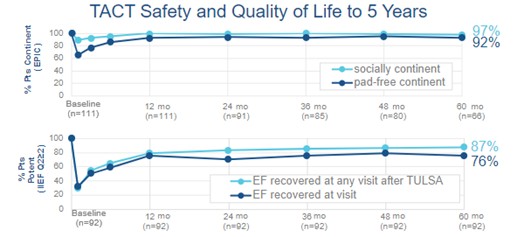

TULSA was associated with a high degree of safety and maintenance of quality-of-life, durable to five years and comparing favorably to radical prostatectomy and other whole-gland ablation techniques. At 12 months, 96% of men returned to baseline urinary continence, and 75% of potent men maintained or returned to erections sufficient for penetration. These rates continued to improve with increasing recovery time, with 97% of patients socially continent and 87% recovering erectile function at five years. A total of 12 attributable grade 3 adverse events occurred in 8% of men, including genitourinary infection (4%), urethral stricture (2%), urinary retention (1.7%), urethral calculus and pain (1%), and urinoma (1%), all of which resolved by 12 months. There were no attributable grade 4 or higher events, rectal injuries, severe incontinence requiring surgical intervention, or severe erectile dysfunction unresponsive to medication.

5

TACT clinical trial urinary continence and erectile function outcomes to five years.

Other TULSA Clinical Studies

Localized Prostate Cancer, Durability of Outcomes: Safety and Precision Study

Our initial multi-jurisdictional clinical trial, which enrolled 30 subjects, demonstrated that MRI-guided TULSA is safe and precise for ablation in patients with localized prostate cancer, providing spatial ablation precision of ± 1.3 mm with a well-tolerated side-effect profile and minor or no impact on urinary, erectile and bowel function at 12 months. Notably, there was no intent to treat in this study which mandated a conservative whole-gland treatment plan less a generous, 3 mm, circumferential safety margin. There was no grade 4 or higher adverse events, one transient attributable grade 3 event (epididymitis), and notably no injury to rectal or periprostatic structures. Functional outcomes measured with the International Prostate Symptom Score (“IPSS”) and International Index of Erectile Function (IIEF-15), both showed a favorable, anticipated trend of initial deterioration with subsequent, gradual improvement toward baseline levels. Intra-operative MRI thermometry measured 90% thermal ablation of the prostate gland, consistent with the wide safety margin which was expected to spare 10% viable prostate at the gland periphery. The median PSA decreased 90% from 5.8 ng/ml pre-treatment to nadir of 0.6 ng/ml, and median prostate volume reduced by 88% on one-year MRI. Even though there was no oncologic intent, and many cancers occur in the intentionally untreated region of the prostate, residual disease was assessed. Prostate biopsy at one year identified decreased cancer burden with 61% reduction in cancer length, clinically significant cancer was found in 9 of 29 men (31%), and any cancer in 16 of 29 (55%).

Follow-up data to three and five years demonstrate durability of the outcomes, with continued treatment safety and stable quality of life, as well as predictable PSA and biopsy oncological outcomes based on treatment-day imaging and early PSA follow-up, without precluding any potential salvage therapy options. Repeat prostate biopsy at three years demonstrated durable histological outcomes, with only one subject upgrading to GG 1 from negative at 12 months, and one subject upgrading to GG 2 from GG 1 at 12 months. Between one and five years, there were no new serious adverse events. By five years, 16 men completed protocol follow-up, three withdrew with PSA <0.4 ng/ml, 10 had salvage therapy without complications (six prostatectomy, three radiation and one laser ablation), and one died of an unrelated cause. Of 16 men with complete follow-up data, five-year median PSA remained at 0.55 ng/ml. Median IPSS of 6 at baseline was stable at 5 by three months, and 6.5 at five years. At baseline, 9 of 16 had erections sufficient for penetration, 11 of 16 at one year, and 7 of 16 at five years. All 16 subjects had leak-free, pad-free continence at one and five years. Predictors of salvage therapy included lower ablation coverage and higher PSA nadir. At five years after TULSA, cancer specific survival was 100%, and overall survival 97%.

6

Clinical Studies of TULSA for Benign Prostatic Hyperplasia (BPH), Relief of Lower Urinary Tract Symptoms (LUTS)

Promising safety and feasibility of the TULSA-PRO system to relieve Lower Urinary Tract Symptoms (“LUTS”) associated with BPH has been demonstrated in two clinical studies showing improvements in IPSS comparable to modern minimally invasive surgical therapies. A retrospective 30 patient prostate cancer Safety and Precision Study analysis from the clinical study of a subgroup of nine patients who also had LUTS concurrent with prostate cancer (baseline IPSS ≥ 12) demonstrated significant IPSS improvement of 58% from 16.1 to 6.3 at 12 months (p=0.003), with at least a moderate (≥ 6 points) symptom reduction in eight of nine patients. IPSS Quality of Life (“QoL”) improved in eight of nine patients. Erectile function (IIEF-EF) remained stable from 14.6 at baseline to 15.7 at 12 months. The proportion of patients with erections sufficient for penetration was unchanged. Full urinary continence (pad-free, leak-free) was achieved at 12 months in all patients. In five men who suffered from more severe symptoms (baseline IPSS ≥ 12 and Qmax < 15 ml/s), peak urine flow rate (“Qmax”) increased from 11.6 ml/s to 22.5 ml/s at 12 months. All adverse events were mild to moderate with no serious events reported.

A prospective clinical study of TULSA-PRO® for BPH has been conducted with early outcomes published in 2022. All measures of urinary function and quality of life improved during the initial twelve-month follow up among the first 10 subjects treated, while no adverse effects were seen on sexual and bowel functions: average IPSS decreased from 17.5 to 4.0, IPSS QoL decreased from 4.0 to 0.5, and Qmax increased from 12.4 ml/s to 21.8 ml/s, among several other improved urinary measures. A single serious adverse event had occurred, abscess of the epididymis requiring drainage at two weeks post therapy. Enrollment of this study has been increased to 30 subjects, with complete study results pending publication.

Select outcomes from clinical trial of TULSA-PRO to relieve lower urinary tract symptoms in men with BPH.

7

Clinical study of TULSA for treatment of radio-recurrent localized prostate cancer, Salvage TULSA (sTULSA)

Salvage ablation of radio-recurrent localized prostate cancer has been evaluated in a prospective clinical study of TULSA-PRO published in 2024. The report includes 39 subjects who were successfully treated. All but one of the subjects were discharged on the first postoperative day; one subject was discharged on the second post-operative day. Median catheterization time was 18 days. Median PSA decreased from 3.3 ng/ml at baseline to 0.05 ng/ml at three months and was 0.17 ng/ml at 12 months. On the 12-month biopsy, 89% of subjects were free of cancer in the treated zone, and 78% were free of cancer in or out of the treated zone. MRI and PSMA PET-CT results were negative for cancer in 92% of subjects within the prostate and 79% overall. Importantly, the population was enriched in more aggressive and high-risk disease at baseline: the distribution of ISUP grade group was 9% GG2, 34% GG3, 25% GG4, and 32% GG5, and two subjects had disease outside the prostate. In contrast with the TACT and other TULSA clinical studies, which restricted to patients with no prior treatment for prostate cancer, the sTULSA population is complex and at significantly increased risk of side effects: before receiving TULSA, all had prior radiation therapy, three subjects had undergone prior salvage therapy after the radiation therapy failed, 16 were receiving hormonal therapy at enrollment, and 12 had a history of transurethral interventions. Serious adverse events were experienced by 28% of subjects, including three patients with puboprostatic fistulas and two patients requiring cystectomy. Still, this is an important study generating evidence of the safety and efficacy of TULSA in an underserved population which faces significant incremental toxicity with standard treatments.

Clinical study of TULSA for palliation of symptomatic locally advanced prostate cancer, Palliative TULSA (pTULSA)

Patients with symptomatic locally advanced prostate cancer can suffer from severe urinary retention due to bladder outlet obstruction, intractable hematuria and frequent hospitalization. While these complications are commonly treated by palliative transurethral resection of the prostate (“TURP”) intended to debulk the tumour, the improvement is often insufficient and TURP may be contraindicated in patients who cannot safely discontinue anticoagulants. The safety and feasibility of MRI-guided TULSA was evaluated as an alternative palliative treatment option for men suffering from symptomatic locally advanced prostate cancer. Ten patients with locally advanced prostate cancer were enrolled, half with clinical stage T4 disease and half with clinical T3. Prior to TULSA, all 10 subjects had continuous indwelling catheterization due to urinary retention, and 90% had history of recurrent and/or ongoing gross hematuria. Three of the subjects had palliative TURP performed six months prior to receiving palliative TULSA, all of which were unsuccessful. One week after palliative TULSA, 50% of the subjects were catheter-free. At last follow-up, 100% of the subjects were free of gross hematuria, and 80% had an improvement in catheterization, with 70% completely catheter-free. Notably, the average hospitalization time from local complications reduced from 7.3 to 1.4 days in the six-month period before and after palliative TULSA. All adverse events were related to urinary tract infections, with two subjects requiring intravenous administration of antibiotics and three subjects resolved with oral antibiotics alone. No other treatment related adverse events were recorded, with no rectal injury or fistula. Further, there was no indication for blood transfusions and there was no perioperative mortality.

8

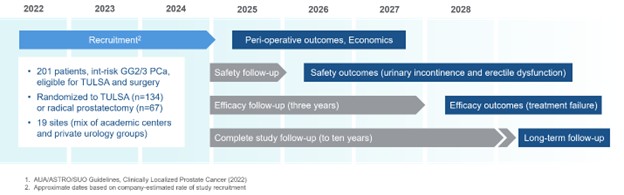

CAPTAIN trial

CAPTAIN (A Comparison of TULSA Procedure vs. Radical Prostatectomy in Participants with Localized Prostate Cancer) is a prospective, multi-centre randomized controlled trial of 201 subjects aimed at comparing the safety and efficacy of the TULSA procedure (performed with the TULSA-PRO system) with radical prostatectomy (“RP”) in men with organ-confined, intermediate-risk, Gleason Score 7 (Grade Group 2 and 3) prostate cancer. In the CAPTAIN trial, 134 subjects will be randomized to receive one or two TULSA procedures, and 67 subjects will be randomized to receive RP. The trial sites are primarily located in the United States, with the exception of two sites in Canada and one in Europe. Site activation has been completed for 19 sites to date, and those sites are currently recruiting patients.

RP is currently the gold-standard surgical treatment for intermediate-risk prostate cancer. RP effectively controls disease but carries risk of significant side effects such as long-term erectile dysfunction and urinary incontinence. The TULSA procedure may reduce the risk of side effects relative to RP, with high spatial, thermal, and anatomic resolution of the target volume enabling precise ablation of prostate tissue while sparing functionally important structures. To achieve precise ablation, the procedure combines transurethral, robotically driven therapeutic ultrasound with real-time visualization of temperature and automated control of heating from magnetic resonance thermometry., potentially.

The goal of the CAPTAIN trial is to demonstrate that the efficacy of the TULSA procedure is not inferior to RP, while demonstrating superior quality of life outcomes in patients receiving the TULSA procedure as compared to those patients receiving RP. The primary safety endpoint is the proportion of subjects who preserve both erectile potency and urinary continence at one year after treatment. The primary efficacy endpoint is the proportion of subjects who are free from any additional treatment for prostate cancer by three years after treatment. Secondary endpoints include comparison of rates of complications, cost effectiveness, and timing of the return to baseline activity. Long-term follow-up will be gathered for up to 10 years after treatment.

Sonalleve

Our Sonalleve system combines real-time MRI and thermometry with focused ultrasound delivered from the outside of the patient to enable precise and incision-free ablation of diseased tissue. We acquired the Sonalleve technology from Philips in 2017.

The Sonalleve system is CE marked in the EU for ablation of uterine fibroids and adenomyotic tissue, palliative pain relief associated with bone metastases, treatment of osteoid osteoma, and management of benign desmoid tumors. The uterine fibroids application is also available for sale in Canada. In 2018, the Sonalleve system was also approved in China and South Korea by the National Medical Products Administration for the non-invasive treatment of uterine fibroids. Philips Oy registered Sonalleve in several Middle East, and Southeast Asian countries. In 2020 Sonalleve also received HDE from the U.S. FDA for treatment of osteoid osteoma in the extremities.

9

Sonalleve Clinical Applications

Uterine Fibroids and Adenomyosis

Uterine fibroids (“UFs”) are the most common non-cancerous tumors in women of childbearing age. Both surgical and medical treatments are available, and the choice depends on number, size, and location of UFs, patient’s age and preferences, and pregnancy expectations. To date, symptomatic UFs have been mostly treated with radical surgery (hysterectomy) in women who have completed childbearing, or conservative surgery (myomectomy and endometrial ablation) in women who wish to preserve fertility. Today, the radiologist also has interventional options available. Minimally or non-invasive interventional radiology procedures include uterine artery embolization.

Uterine fibroid ablation using Sonalleve MR-HIFU

There is currently no ideal treatment for adenomyosis, and new options are needed. Drawing on experience of treatment of uterine fibroids, MR-HIFU has been explored as a potential new conservative treatment and MR-HIFU is an early-stage, non-invasive, therapeutic technology with the potential to improve the quality of life and decrease the cost of care for patients with adenomyosis.

To achieve its current regulatory clearances, the Sonalleve MR-HIFU System has undergone several studies and clinical trials for uterine applications at Sunnybrook Health Sciences Centre (Toronto, Ontario), University Medical Center Utrecht (Utrecht, the Netherlands), University Hospital St. André (Bordeaux, France), Samsung Medical Center (Seoul, Korea), Peking University First Hospital Beijing (Beijing, China), First Affiliated Hospital of Medical College of Xi’an Jiaotong University (Xi’an, China), Turku University Hospital (Turku, Finland), National Institutes of Health (Bethesda, MD, USA), St. Luke’s Episcopal Hospital (Houston, TX, USA), and others.

In addition, a comprehensive literature review provides supportive evidence showcasing the beneficial action of MR-HIFU in uterine fibroid and adenomyosis therapy. These studies include the Verpalen et al. 2020, Nguyen 2020, Yeo et al. 2017, Kim et al. 2017, and Hocquelet et al. 2017 that utilized the Sonalleve MR-HIFU system. Specifically, the studies show impressive performance in terms of ablation efficiency, therapeutic efficacy, symptom reduction, and/or QoL improvement. There were no treatment-related serious adverse events in any of these studies, although Browne et al. 2020 describes a procedure-related major complication in the form of deep vein thrombosis that was noted in one study subject (0.8%) and subsequently and successfully treated with anticoagulation therapy. Minor adverse events, when present, typically include 1st and 2nd degree skin burns, local swelling, cramps, leg pain, abdominal pain, buttock pain, and back pain, which are all known and anticipated adverse events of MR-HIFU therapy.

Palliative Bone Pain Treatment

Pain caused by bone metastases are common in the event of malignancy and are inevitably associated with serious complications that may deteriorate the QoL of patients and become life threatening.

10

For patients with bone metastases, clinical evaluation reports (GCP-10277 Rev. B) were completed in October, 2020 showing significant decrease in pain score, dosage of medication, or quality of life are to be expected with MR-HIFU bone therapy. The randomized controlled Phase III study by Hurwitz et al. published in the Journal of the National Cancer Institute in April 2014 represents some of the most important clinical data that has been reported. In 112 subjects receiving MR-HIFU compared against 35 subjects receiving sham treatment, significant pain reduction at three months (decrease in worst NRS pain ≥ 2 without increase in pain medication) was 64.3% vs. 20.0% (p<0.001), with mean NRS reduction of 3.6 ± 3.1 vs. 0.7 ± 2.4 from an initial median NRS score of 7.0 in both groups. Improvement in average BPI-QoL at three months was 2.4 points superior in the MR-HIFU group (p<0.001), representing a clinically important reduction in impairment caused by bone metastasis pain.

The clinical data show that a statistically significant decrease in pain scores and/or in medication dosage and increase in quality of life are possible with MR-HIFU bone metastasis therapy.

Osteoid Osteoma Treatment

Osteoid osteoma is a relative rare, painful bone tumor that typically occurs in the cortex of long bones, especially in children and adolescents, and accounts for approximately 10% of all benign bone tumors.

Current osteoid osteoma treatment options include surgery and radiofrequency ablation, which is a less invasive option than surgical resection. Although RFA can have a high success rate, the treatment is invasive and can potentially cause minor and major complications. It also exposes patients and operators to ionizing radiation associated with the CT imaging guidance. Sonalleve MR-HIFU provides an alternative therapy choice for osteoid osteoma that is precise, completely non-invasive, and free from ionizing radiation.

Osteoid osteoma treatment using Sonalleve MR - HIFU

Desmoid Tumor Treatment

The recent studies have assessed the use of Sonalleve MR-HIFU in treatment of osteoid osteoma, showing a high clinical success rate and complete symptom resolution without any serious adverse effects and only few minor adverse effects that promptly resolve. The Sonalleve MR-HIFU device offers a novel, minimally invasive, MRI-guided method to treat osteoid osteoma safely and effectively. A desmoid tumor, also called desmoid fibromatosis or aggressive fibromatosis, is a non-metastasizing but locally aggressive proliferation of myofibroblasts that affects children and adults, with a peak incidence in early adulthood. Traditional management of desmoid tumors includes observation, surgical resection, radiation, and/or chemotherapy. Observation allows assessment of the rate of tumor growth and may be acceptable in small, slow-growing, or asymptomatic lesions. Surgical resection is often a highly morbid procedure and has a high rate of recurrence even with negative margins. Radiotherapy provides somewhat improved local control rates but the morbidity from radiation, including burns, fibrosis, chronic edema, and pathologic fractures, is problematic. In addition, the small but finite risk of a radiation-induced malignancy is particularly troublesome in this young patient population, considering the tumor being treated is benign.

11

Recently, MR-HIFU has been assessed as a non-invasive therapy of desmoid tumors, showing good clinical success and even complete tumor eradication in some cases with low number and relative mild adverse events, which typically promptly resolve. The Sonalleve MR-HIFU device offers a novel, non-invasive, MRI-guided method to treat desmoid tumors.

This technology is ideally suited for the treatment of desmoid tumors in a patient population that is generally young, otherwise healthy, and would like to avoid the morbidity of traditional surgical, radiation, and medical therapies for a benign disease. Magnetic resonance imaging provides visualization of critical neurovascular structures and allows sparing of these structures during therapy. While complete ablation of a desmoid tumor may not be possible in all cases because of involvement of these structures, significant reduction in tumor volume is often obtained with a corresponding improvement in pain and functional impairment. As the natural history of the disease often involves recurrence, the ability to re-treat with MR-HIFU without an upper dose limit is also an advantage.

Business Strategy

We initiated our launch of the TULSA-PRO system in the United States in the fourth quarter of 2019 and the first patient was treated in the United States in a clinical service setting in January 2020. Since then, our business model has evolved to a recurring revenue model that includes durable hardware usage, one-time-use devices and our Genius service, which includes necessary support for a productive start-up of the practice. In 2024, we introduced in the United States a capital sales model in addition to the purely recurring revenue model that we have been using since 2019.

We generate revenues from capital sales, one-time-use devices and related services, in the EU (principally in Germany), United States and Asia. For the year ended December 31, 2024, approximately 78%, 8% and 14% of revenues were generated in the United States, EU and Asia, respectively, compared to approximately 71%, 26% and 3%, respectively for the year ended December 31, 2023. Revenue on a quarter over quarter basis is expected to fluctuate given that we are maintaining a limited European commercial effort and remain primarily focused on the U.S. market.

On January 10, 2020, we announced the signing of our first-ever US multi-site imaging center agreement for TULSA-PRO with RadNet, Inc., the largest owner and operator of outpatient imaging centers in the United States, pursuant to which we will install TULSA-PRO systems at three RadNet imaging centers in the greater Los Angeles.

Our TULSA-PRO system is primarily marketed to early adopter physicians who specialize in treatment of prostate disease including urologists and radiologists at opinion leading hospitals. TULSA-PRO services are available at either independent imaging centers or at hospital-based imaging centers.

Historically treatment of conditions such as localized prostate disease and uterine fibroids have included surgical intervention. Over time, surgery has evolved from an ‘open’ technique, to laparoscopic, to robotic surgery. The motivation of surgeons behind this evolution has been to perform procedures that reduce invasiveness, improve clinical outcomes and reduce recovery times. Profound is now taking this concept to the next level by enabling customizable, incision-free therapies for the MRI-guided ablation of diseased tissue with the TULSA-PRO and Sonalleve systems. These incision-free and radiation-free procedures offer surgeons the option of providing predictable and customizable procedures that eliminate invasiveness, offer the potential to improve clinical outcomes and further reduce hospital stays and patient recovery times.

We are establishing our own direct sales and marketing teams for sales of TULSA-PRO systems and the one-time-use devices related thereto, as well as for Sonalleve systems in the jurisdictions where it is approved. The primary focus of our direct sales team is to cultivate adoption of the TULSA-PRO technology, support clinical customers with the TULSA-PRO procedures and increase the utilization of the systems and one-time-use devices. We expect to generate recurring revenues from the use of the system, one-time-use devices, clinical support and service maintenance.

We also collaborate with our strategic partners Philips and Siemens for lead generation and distribution of durable equipment.

On December 2, 2024, Profound Medical and Siemens Healthineers announced a definitive co-sales and co-marketing agreement of its TULSA-PRO and Free.Max MRI, to offer a complete solution for MRI-guided prostate therapy.

12

On December 21, 2020, we entered into a co-development agreement with GE Healthcare (the “GE Agreement”) whereby we and GE Healthcare agreed to a non-exclusive, worldwide license that will enable us to interface our TULSA-PRO system with certain GE Healthcare MRI scanners. The collaboration with GE Healthcare expands our potential to interface with a significant portion of GE’s new and currently installed MRI scanners globally. In March 2022, we confirmed the TULSA-PRO system’s new compatibility with GE Healthcare’s 3T MRI scanners and signed the first site agreement for a TULSA-PRO system interfaced with a GE scanner.

Competition

TULSA-PRO

The TULSA-PRO system is intended to ablate benign and malignant prostate tissue, however there are other treatment options for prostate disease. There are currently no marketed devices indicated for the treatment of prostate diseases or prostate cancer and our FDA indication and CE Mark in the EU also do not include treatment of any particular disease or condition. However, there are a number of devices indicated for the destruction or removal of prostate tissue and devices indicated for use in performing surgical procedures that physicians and surgeons currently utilize when treating patients with prostate disease, including prostate cancer. Approaches that physicians and surgeons currently use to address prostate disease include: (1) watchful waiting/active surveillance; (2) simple prostatectomy; (3) radical prostatectomy (includes open, laparoscopic and robotic procedures); (4) radiation therapies including, external beam radiation therapy, brachytherapy and high dose radiation; (5) cryoablation; and (6) trans-rectal high intensity focused ultrasound (“HIFU”). In addition, certain adjunct or less common procedures are used or are under development to address prostate disease, such as androgen deprivation therapy and proton beam therapy.

Each of the foregoing competing options have their own limitations and benefits and may only be appropriate for limited patient populations. For example, active surveillance is generally recommended for patients who have been diagnosed with earlier stage, lower risk, disease where the possibility of side effects from intervention may outweigh the expected benefit of the chosen procedure. For clinicians and patients, the gap between active surveillance and the most commonly utilized options of surgery or radiation therapy imposes the possibility of substantial side effects, creating a need for a less invasive methodology to remove diseased prostate tissue that is both radiation- and incision-free and provides a more favorable side-effect profile.

We believe that the flexibility of the TULSA-PRO system may allow the Company to demonstrate its use as a tool for ablating benign and malignant diseased prostate tissue with greater speed and precision than current options while minimizing potential side effects. We believe that the TULSA-PRO system may overcome certain limitations of other devices and methodologies for removing or addressing diseased prostate tissue including HIFU, such as complications associated with trans-rectal delivery and limitations relating to prostate size. We believe that a transurethral (inside out) ablation approach with millimeter accuracy has advantages over HIFU in ablating the whole gland safely.

Watchful Waiting; Active Surveillance

Watchful waiting means no treatment until there is an indication that the cancer has spread. Active surveillance is monitoring of the prostate cancer closely with PSA tests and digital rectal exams. Prostate biopsies may also be done to see if the cancer is becoming more aggressive. Test results will indicate whether a more aggressive treatment option should be considered.

Simple Prostatectomy

Simple prostatectomy is recommended for men with severe urinary symptoms caused by an obstructive prostate gland and whose symptoms are not responsive to other medical or minimally-invasive therapies. Simple prostatectomy involves removing only the obstructive portion of the prostate gland rather than the entire gland and surrounding tissue. A simple prostatectomy can be open or robotic. Open simple prostatectomy can be conducted through retropubic, suprapubic, or perineal routes. Simple prostatectomy has higher morbidity and longer hospitalization in comparison to less invasive therapies such as transurethral resection of the prostate. Simple prostatectomy is contraindicated in the presence of cancer.

13

Radical Prostatectomy

Radical prostatectomy, an open surgical removal of the entire prostate gland and some surrounding tissues, represents a current standard of care, practiced by urologists in North America and Europe, which procedure involves the removal of the localized cancerous tissue. However, the conventional open surgical technique has high post-surgery incidences of impotence and incontinence and long recovery time. Recently, robotic surgery systems have become more common in the market. Cited benefits of robotic technique include improved precision and range of motion. Risks specific to robotic technique include longer operation time, the possible need to convert the procedure to a non-robotic approach, and the need for additional or larger incision sites. Converting the procedure could mean a longer operation time, resulting in a longer time under anesthesia.

External Beam Radiation Therapy (“EBRT”)

EBRT requires multiple weekly clinic visits over a period of six to eight weeks. The procedure directs a beam of radiation from outside the body to cancerous tissue inside the body. Although such procedures are relatively costly with studies showing significant risk of collateral damage and lengthy recovery times, it is non-invasive. It can also be used to irradiate cancer that has spread to other areas.

Brachytherapy and High Dose Radiation

With brachytherapy, radioactive seeds are implanted in the prostate to irradiate the cancerous tissue. The seeds irradiate the prostate over time and decay in place to background levels; they remain implanted and inert afterwards. Side effects of brachytherapy are similar to those of EBRT in terms of urinary, bowel and erectile function. An alternative is HDR, in which highly radioactive seeds are temporarily inserted, then removed during the same procedure, leaving nothing implanted afterward. HDR has the ability to target tissue, but requires hospital stays and usually is accompanied by adjunct EBRT over several weeks.

Cryoablation

Cryoablation freezes cells to death by introducing cooled liquids and gases to an area of cancerous tissue. Studies show cryoablation offers poor precision and has delivered impotence rates that are almost as high as those for conventional radical prostatectomy. The procedure also carries a risk of potential damage to the tissue between the urethra and rectum, potentially resulting in a urinary rectal fistulas.

Trans-rectal High Intensity Focused Ultrasound (“HIFU”)

Trans-rectal HIFU is used increasingly in the European Union, United States and Canada. This technique utilizes focused ultrasound that is delivered through the rectal wall to treat the prostate. Image guidance is generally provided by ultrasound. At an FDA urology panel meeting in 2014, the panel indicated that HIFU can lead to complications such as rectal fistulae and rectal incontinence. Due to the focused treatment zone, this treatment requires approximately three hours to complete. One limitation of HIFU is prostate size; the procedure is limited to patients with prostate volume smaller than 40 cubic centimeters. Patients with larger prostates need a separate surgical procedure, such as TURP or ADT, both described below, to de-bulk or reduce the size of the prostate prior to HIFU. This additional procedure increases costs and the risk of complications. Recent studies have indicated positive survival outcomes and thermal ultrasound appears to be gaining traction in certain settings.

Adjunct and Emerging Therapies

Androgen deprivation therapy (“ADT”) uses hormones to suppress testosterone production and alleviate symptoms, but with the primary side-effect of reduced sexual interest and activity. Although historically used as a last line of defense for the disease (and typically in a palliative setting), it is increasingly used as a first line treatment or in combination with other treatments.

TURP is a surgical procedure that removes portions of the prostate gland through the penis. This procedure is used to relieve moderate to severe urinary symptoms caused by an enlarged prostate, a condition known as BPH. This procedure is also used in adjunct to a HIFU procedure when a prostate gland is larger than 40 cubic centimeters.

14

Proton beam therapy is a way to deliver radiation to tumors using tiny, sub-atomic particles (protons) instead of the photons used in conventional radiation treatment. Proton beam therapy uses new technology to accelerate atoms to approximately 93,000 miles per second, separating the protons from the atom. While moving at this high speed, the particles are “fired” at the patient’s tumor. These charged particles deliver a very high dose of radiation to the cancer but release very little radiation to the normal tissue in their path. In theory, this approach minimizes damage to healthy organs and structures surrounding the cancer. The radiation beams must pass through the skin, the bladder and the rectum on the way to the prostate gland, and once they reach the gland, they encounter normal prostate cells and the nerves that control penile erections. Damage to these tissues can lead to complications, including bladder problems, rectal leakage or bleeding, and erectile dysfunction.

We believe that use of the TULSA-PRO system as a tool to ablate prostate tissue can provide a clinician and his or her patients with the following clinical advantages:

| ● | Clinically shown to have millimeter accuracy designed to ablate prostate tissue while sparing nearby critical structures, and that real time MR thermometry also ensures precision in ablation temperature, minimizing side effects that can occur from overheating; |

| ● | Enables clinician to define the boundaries of the tissue to be ablated, whether the whole prostate or any of its subsections, to ensure customization of the needs of each patient; |

| ● | Transurethral approach allows for ablation of even the largest prostates that may be 120 cubic centimeters or larger in size; |

| ● | Potential to be a single outpatient procedure with a rapid recovery time; and |

| ● | Designed to be compatible with leading MRI platforms and could become part of a continuum of care from MR imaging diagnosis, MR guided biopsy to MR guided treatment. |

We believe that the flexibility of the TULSA-PRO system may allow us to demonstrate its use as a tool for ablating benign and malignant diseased prostate tissue with greater speed and precisions than current options while minimizing potential side effects. We believe that the TULSA-PRO system may overcome certain limitations of other devices and methodologies for removing or addressing disease prostate tissue including HIFU, such as complications associated with trans-rectal delivery and limitations relating to prostate size. We believe that a transurethral (inside out) ablation approach with millimeter accuracy has advantages over HIFU in ablating the whole gland safely.

Sonalleve

The treatment choices for uterine fibroids usually depend on the symptoms of the patient, size of the fibroid, desire for future pregnancy, and preference of the treating gynecologist. Most common treatment options for uterine fibroids include: (1) hormonal medications including gonadotrophin releasing hormone agonists (“Gn-RH”); (2) progesterone releasing intra-uterine devices; (3) surgical procedures such as hysterectomy and myomectomy; and (4) uterine artery embolization.

We believe that the Sonalleve system may provide a treatment option that is more convenient and comfortable with less side effects than surgical procedures, such as hysterectomy or myomectomy.

Hormonal Medications

Fibroids can be treated with hormonal drugs, such as Gn-RH agonists. Gn-RH agonists can treat fibroids by blocking the production of estrogen and progesterone, putting women into a temporary postmenopausal state. As a result, menstruation stops, fibroids shrink, and anemia is often alleviated. Other hormonal medications can also be utilized in patients with uterine fibroids. In many cases, however, medication may provide only temporary relief from the symptoms caused by fibroids. The symptoms often return when the patient stops taking the medication. Moreover, the side effects of some drugs may cause them to be unsuitable for some patients. Gn-RH agonists typically are used for no more than three to six months because long-term use can cause loss of bone.

Progesterone Releasing Intra-Uterine Devices

Progesterone releasing intra-uterine devices can relieve heavy bleeding caused by fibroids. However, these devices can only provide symptom relief and do not impact the fibroid itself.

15

Uterine Artery Embolization

Uterine artery embolization involves injection of embolic agents into the arteries that supply the uterus, thereby cutting off the blood supply to the fibroids. Many women require at least one day of hospitalization and heavy pain medication. The prolonged pain may slow down the recovery period. Complications may occur if the blood supply to the ovaries or other organs is compromised.

Surgery

Surgical options for the treatment of uterine fibroids include hysterectomy and myomectomy. Hysterectomy is a surgical procedure which involves the complete removal of uterus with or without removal of the cervix, ovaries and fallopian tubes. Hysterectomy can be performed abdominally in an open, laparoscopic, robotic-assisted or vaginal method. Surgical options are associated with blood loss, hospital stays, long recovery times, pain and scarring. Post-operative complications can include infections, urinary incontinence, vaginal prolapse, fistula formation and chronic pain. After a hysterectomy, a woman will enter menopause and is infertile. Myomectomy is a surgical procedure to remove uterine fibroids from the wall of the uterus. The procedure can be performed with an abdominal incision, laparoscopic, or hysteroscopic.

Current osteoid osteoma treatment options include surgery and radiofrequency ablation, which is a less invasive option than surgical resection. Although RFA can have a high success rate, the treatment is invasive and can potentially cause minor and major complications. It also exposes patients and operators to ionizing radiation associated with the CT imaging guidance.

We believe that use of the Sonalleve system as a tool to ablate uterine fibroids or osteoid osteoma can provide a clinician and his or her patients with the following clinical advantages:

| ● | Millimeter accuracy designed to ablate uterine fibroid while sparing nearby critical structures; |

| ● | Outpatient procedure with rapid recovery time, not requiring general anesthesia; and |

| ● | Non-invasive approach using thermal ablation designed to heat the uterine fibroid; and guided by real-time MRI with temperature (thermometry) feedback. |

Intellectual Property

Our intellectual property is comprised of a broad and world-wide portfolio of patents, patent applications, trademarks, copyrights, trade secrets and other proprietary assets. Our intellectual property portfolio is both growing and dynamic and includes approximately 40 patent families representing approximately 165 granted or allowed patents and 25 patent applications in various stages of review and prosecution around the world.

Many of our patents and patent applications claim electronic and mechanical aspects of hardware, software and methods related to ultrasonic ablation of tissue. The intellectual property assets are largely directed to (i) using real time MRI imaging as a tool to plan, monitor or control said ultrasonic ablation; (ii) MRI thermometry methods, especially in respect of our ultrasound therapy processes and devices; (iii) the phasing, beam-forming, and control of acoustic arrays and similar energy sources; (iv) computational method to improve filtering, imaging and analyzing the results of MRI-guided thermal therapy processes; and (v) secondary and support systems such as active cooling of near-target tissues. The portfolio covers both the “TULSA” and the “Sonalleve” families of products, as well as generic technologies and applications and extensions of our products.

We believe that the protection of our intellectual property is an essential element of our business and we intend to continue our investment in the development of our intellectual property portfolio. We have worked over the past year to pursue, maintain and expand on the intellectual property portfolio acquired from Philips in 2017. This intellectual property has been strengthened and extended to many jurisdictions around the globe in support of our sales, development and marketing efforts.

We pursue a global intellectual property strategy, registering for patent protection in all jurisdictions where we intend to carry on business, including the United States, Canada, Japan, major European markets (e.g., Germany, France, U.K., Italy, Spain and Turkey) and the emerging markets (e.g., Brazil, Russia, India, and China).

16

We also rely upon trade secrets, know-how and other proprietary, confidential information for the protection of our technology. We require all employees, consultants, scientific advisors and other contractors to enter into confidentiality agreements to protect against the disclosure of such proprietary information. Each inventor is required to execute a formal assignment specific to each invention that he or she has listed, and which is officially recorded in the proper patent office.

In addition to developing our own intellectual property portfolio, we have licensed and acquired intellectual property rights from third parties through exclusive licenses, collaborative research and asset purchase agreements. Material license agreements include an exclusive license with Sunnybrook entered into on May 11, 2010 (the “Sunnybrook License”). Under the Sunnybrook License, Sunnybrook granted us an exclusive worldwide and royalty-free right to use certain defined Sunnybrook technology in connection with, among other things, manufacturing, marketing and selling products such as the TULSA-PRO system, in the field of MRI-guided transurethral ultrasound therapy. Under the license, we are subject to various obligations, including a milestone payment of C$250,000 that was paid in connection with our FDA clearance of TULSA-PRO in August 2019. In addition, we are required to pay legal costs associated with patent application preparation, filing and maintenance. If either party to the Sunnybrook License breaches or fails to perform a material obligation and fails to cure such breach or perform such obligations within a 30-day cure period, the non-breaching party may terminate the agreement. Material obligations include our agreement not to use the technology or intellectual property outside of the license scope, not to use the technology or intellectual property outside the field of MRI-guided transurethral ultrasound therapy (or permitting our customers to do so) and not to breach confidentiality obligations.

Regulatory

On August 15, 2019, we obtained 510(k) clearance for commercial sale of the TULSA-PRO as a class II device in the United States and have previously received a CE Certificate of Conformity for our products in European Union, and we have obtained regulatory approval for Sonalleve in China. On November 20, 2019, the TULSA-PRO was approved as a class III device by Health Canada, which is key to our global expansion strategy that requires a country-of-origin approval for medical devices. Additionally, the TULSA-PRO system has received regulatory clearances or approvals for commercial sale in Saudi Arabia, Singapore, South Korea and Malaysia, while the Sonalleve system has received regulatory clearance or approval for commercial sale in Canada, Saudi Arabia, South Korea and Malaysia. Our long-term goal is to expand our regulatory indications in Asia and other parts of the world where potential profitable business development opportunities warrant such investments.

United States

Regulation of Medical Devices

The FDA strictly regulates medical devices under the authority of the federal Food, Drug, and Cosmetic Act (“FFDCA”) and the regulations promulgated by the FDA under the FFDCA. The FFDCA and the implementing regulations govern, among other things, the following related to our products: preclinical and clinical testing, design, manufacture, safety, efficacy, labeling, packaging, storage, installation, servicing, record keeping, sales and distribution, importation, post-market adverse event reporting, recalls, and advertising and promotion.

The TULSA-PRO system, Sonalleve, and any future medical devices that we may develop, will be classified by the FDA under the statutory framework described in the FFDCA. Medical devices are classified into three classes from lowest risk (class I) to highest risk (class III). Unless an exemption applies, medical devices require FDA clearance or approval prior to commercial sale in the United States depending on the assigned risk class. Most class I devices and some class II devices are exempt from premarket review requirements. Class I devices are subject to “general controls,” which include establishment registration and device listing, requirements of the Quality System Regulation (“QSR”), labeling requirements, medical device reporting, and reporting of corrections and removals.

Most class II devices and some class I devices require FDA clearance of a 510(k) premarket notification prior to marketing; however, the FDA has the authority to exempt a class II device from the premarket notification requirement under certain circumstances. As a result, manufacturers of most class II devices must submit premarket notifications to the FDA under Section 510(k) of the FFDCA (21 U.S.C. § 360(k)) in order to obtain the necessary authorization to market or commercially distribute such devices. To obtain 510(k) clearance, manufacturers must submit to the FDA adequate information demonstrating that the proposed device is “substantially equivalent” to a “predicate device” that is already on the market. A predicate device is a legally marketed device that is not subject to PMA, meaning, (i) a device that was legally marketed prior to May 28, 1976 (a “preamendments device”) and for which a PMA is not required, (ii) a device that has been reclassified from class III to class II or I, or (iii) a device that was found substantially equivalent through the 510(k) process.

17

Following receipt of a premarket notification for a device, the FDA determines whether the submission is sufficiently complete to permit a substantive review. The agency typically issues a decision on a 510(k) application that is accepted for review within 90 days of receipt. However, the FDA may stop the review clock for up to 180 days to request that the applicant respond to the agency’s requests for additional information about the proposed device. If the FDA agrees that the device is substantially equivalent to the predicate device identified by the applicant in a premarket notification submission, the agency will grant 510(k) clearance for the new device, permitting the applicant to commercialize the device. Premarket notifications are subject to user fees, unless a specific exemption applies. In addition to the general controls, Class II devices are subject to “special controls,” such as performance standards, post-market surveillance requirements, patient registries and guidance documents, as identified in the classification regulation for the device type.

If there is no adequate predicate to which a manufacturer can compare its proposed device, the proposed device is automatically classified as a class III device. In such cases, a device manufacturer must then fulfill the more rigorous PMA requirements or can request a risk-based classification determination for its device in accordance with the De Novo classification process.

Devices that are intended to be life sustaining or life supporting, devices that are implantable, devices that present a potential unreasonable risk of harm or are of substantial importance in preventing impairment of health, and devices that are not substantially equivalent to a predicate device and for which safety and effectiveness cannot be assured solely by the general controls and special controls are placed in class III. Such devices require FDA approval of a premarket approval application, or PMA, demonstrating reasonable assurance of safety and effectiveness of the device, prior to commercial distribution, unless the device is a preamendments device not yet subject to a regulation requiring premarket approval. Class III devices are subject to the general controls and any conditions of approval in the PMA approval order, which can include postmarket study requirements. The PMA process requires the manufacturer to demonstrate through extensive data, including data from preclinical studies and one or more clinical studies, that the device is safe and effective for its proposed indication. The PMA must also contain a full description of the device and its components, a full description of the methods, facilities and controls used for manufacturing, and proposed labeling. Following receipt of a PMA submission, the FDA determines whether the application is sufficiently complete to permit a substantive review. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review and determine whether the proposed device can be approved for commercialization, although in practice, PMA reviews often take significantly longer, and it can take up to several years for the FDA to issue a final decision. Before approving a PMA, the FDA generally also performs an on-site inspection of manufacturing facilities for the product to ensure compliance with the QSR.

If the FDA’s evaluation of the PMA application and inspection of the manufacturing facility is favorable, the FDA may issue an approval order authorizing commercial marketing of the device, or an “approvable letter,” which usually contains a number of conditions that must be met in order to secure final approval of the PMA. When and if those conditions have been met to the satisfaction of the FDA, the agency will issue a PMA approval order, subject to the conditions of approval and the limitations established in the approval order. If the FDA’s evaluation of a PMA application or manufacturing facility is not favorable, the FDA will deny approval of the PMA or issue a “not approvable letter.” The FDA may also determine that additional studies are necessary, in which case the PMA approval may be delayed for several months or years while such additional studies are conducted and data is submitted in an amendment to the PMA. The PMA process can be expensive, uncertain and lengthy, and each PMA submission is subject to a substantial user fee unless a specific exemption applies. PMA approval may also be granted with post-approval requirements such as the need for additional patient follow-up or requirements to conduct additional clinical trials.

Novel devices that have not been classified and devices deemed not substantially equivalent to a predicate device are automatically classified into class III. The manufacturer can submit a De Novo classification request to classify such a device into class I or class II based on evidence that the device in fact presents low or moderate risk, instead of following the typical class III device pathway requiring the submission and approval of a PMA application. The FDA typically issues a decision on a De Novo classification request within 150 days of receipt. If the manufacturer seeks reclassification into class II, the classification request must include a draft proposal for special controls that are necessary to provide a reasonable assurance of the safety and effectiveness of the medical device. If the FDA grants the De Novo request, the device may be legally marketed in the United States. However, the FDA may reject the classification request if the agency identifies a suitable legally marketed predicate device that provides a reasonable basis for review of substantial equivalence or determines that the device is not low to moderate risk or that general controls would be inadequate to control the risks and adequate special controls cannot be developed. De Novo classification requests are subject to user fees, unless a specific exemption applies.

18

There is also a separate pathway for Humanitarian Use Devices, which are medical devices intended to benefit patients in the treatment or diagnosis of a disease or condition that affects or is manifested in not more than 8,000 individuals in the United States per year. Once a device has received designation as a Humanitarian Use Device, the sponsor may seek marketing authorization for the device under a Humanitarian Device Exemption (“HDE”) application. An HDE application must demonstrate the device will not expose patients to an unreasonable or significant risk of illness or injury and the probable benefit to health outweighs the risk of injury or illness (but is not required to demonstrate reasonable assurance of effectiveness). Devices with an approved HDE may only be used pursuant to the review and authorization of an institutional review board (“IRB”) and are subject to certain profit and use restrictions, in addition to all applicable general controls.

After a device is placed on the market, numerous regulatory requirements apply. Device manufacturers must register their establishments annually, list the devices they manufacture and pay an annual registration fee. Device manufacturers are also subject to the QSR, which includes both design control requirements and good manufacturing practice requirements (such as requirements for purchasing controls, document controls, production and process controls, labeling and packaging controls, control of nonconforming product, complaint handling, corrective and preventative actions, storage, handling, distribution, and servicing). Devices must be labeled in accordance with the FDA’s device labeling regulations, including Unique Device Identification requirements. The FDA also regulates the promotion of medical devices, including a requirement that all device promotion be truthful and non-misleading and a prohibition against the promotion of devices for “off-label” uses, i.e., uncleared or unapproved uses.

Under the medical device reporting regulations, manufacturers must submit a report to the FDA if they become aware of information that reasonably suggests that one of their marketed devices may have caused or contributed to a death or serious injury or malfunctioned and the malfunction would be likely to cause or contribute to a death or serious injury if it were to recur. The medical device reporting requirements also extend to healthcare facilities that use medical devices in providing care to patients, or “device user facilities,” which include hospitals, ambulatory surgical facilities, nursing homes, outpatient diagnostic facilities, or outpatient treatment facilities, but not physician offices. A device user facility must report any device-related death to both the FDA and the device manufacturer, or any device-related serious injury to the manufacturer (or, if the manufacturer is unknown, to the FDA) within 10 days of the event. Device user facilities are not required to report device malfunctions that would likely cause or contribute to death or serious injury if the malfunction were to recur but may voluntarily report such malfunctions through MedWatch, the FDA’s Safety Information and Adverse Event Reporting Program.