UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

For the transition period from _________ to _____________.

Commission file number: 001-39805

BGM Group Ltd |

(Exact name of Registrant as Specified in its Charter) |

N/A |

(Translation of Registrant’s name into English)

Cayman Islands |

(Jurisdiction of Incorporation or Organization) |

|

No. 152 Hongliang East 1st Street, No. 1703, Tianfu New District, Chengdu, 610200 People’s Republic of China +86-028-64775180 |

(Address of Principal Executive Offices) |

|

|

Chen Xin, Chief Executive Officer No. 152 Hongliang East 1st Street, No. 1703, Tianfu New District, Chengdu, 610200 People’s Republic of China +86-028-64775180 Email: xinchen@qiliancorp.com |

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A Ordinary Shares |

|

BGM |

|

The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

An aggregate of 7,226,480 ordinary shares, consisting of 6,006,480 Class A ordinary shares, par value US$0.00833335 per share, and 1,220,000 Class B ordinary shares, par value US$0.00833335 per share, as of September 30, 2024.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Emerging growth company |

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ |

|

International Financial Reporting Standards as issued by the |

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

4 |

||

|

|

|

6 |

||

|

|

|

|

7 |

|

|

|

|

7 |

||

|

|

|

7 |

||

|

|

|

7 |

||

|

|

|

51 |

||

|

|

|

94 |

||

|

|

|

94 |

||

|

|

|

108 |

||

|

|

|

116 |

||

|

|

|

116 |

||

|

|

|

117 |

||

|

|

|

118 |

||

|

|

|

133 |

||

|

|

|

134 |

||

|

|

|

|

135 |

|

|

|

|

135 |

||

|

|

|

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

135 |

|

|

|

|

135 |

||

|

|

|

137 |

||

|

|

|

137 |

||

|

|

|

137 |

||

|

|

|

137 |

||

|

|

|

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

137 |

|

|

|

|

138 |

||

|

|

|

138 |

||

|

|

|

138 |

||

|

|

|

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

138 |

|

|

|

|

138 |

||

|

|

|

139 |

||

|

|

|

|

140 |

|

|

|

|

140 |

||

|

|

|

140 |

||

|

|

|

140 |

||

3

INTRODUCTION

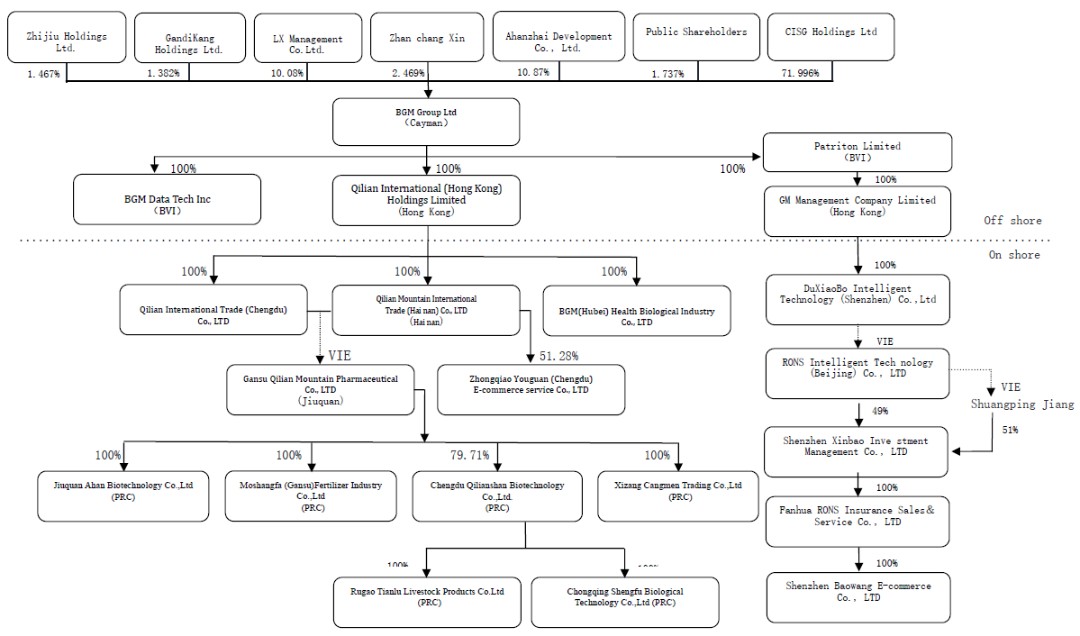

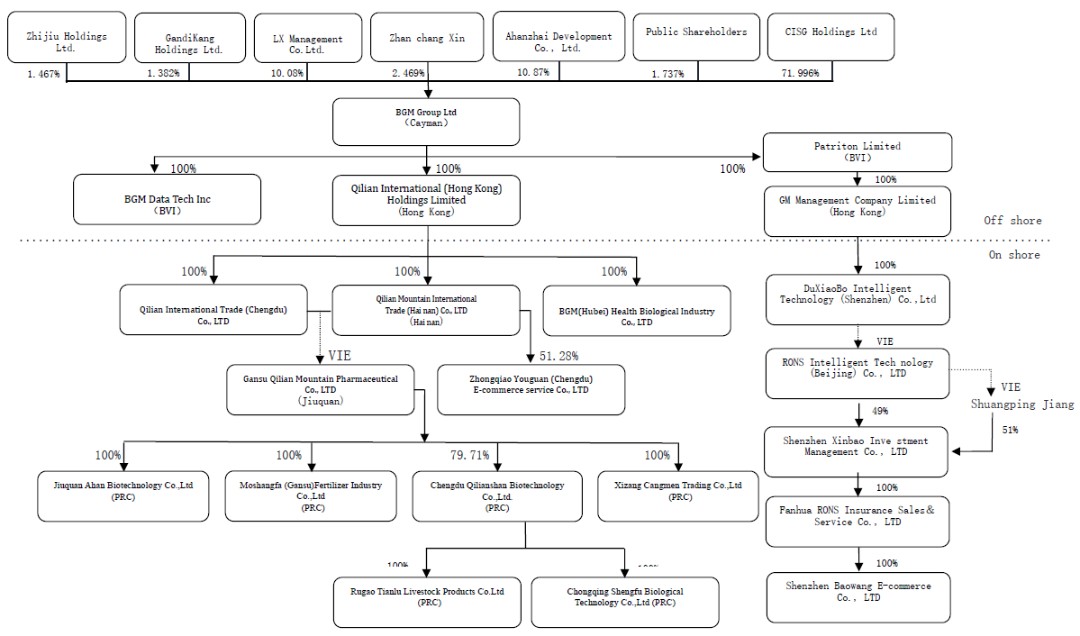

As used in this annual report on Form 20-F, (i) “we,” “us,” “Parent,” “BGM,” “our company,” the “Company,” or “our” refers specifically to BGM Group Ltd (formerly known as Qilian International Holding Group Limited); (ii) “Gansu QLS,” “variable interest entity” or “ VIE” refers to Gansu Qilianshan Pharmaceutical Co., Ltd., a company incorporated in the People’s Republic of China; (iii) “WFOE” or “PRC Subsidiary” are to Qilian International Trading (Chengdu) Co., Ltd., formerly known as Chengdu Qilian Trading Co., Ltd., and Qilian Shan International Trade (Hainan) Co., Ltd., both of which are limited liability company organized under the laws of the PRC and are wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under the laws of Hong Kong.

It is important to note that BGM is not a Chinese operating company but a Cayman Islands holding company with no material business operations. BGM conducts its operations in China through the variable interest entity-- Gansu Qilianshan Pharmaceutical Co. Ltd. (the “VIE”, “Gansu QLS”) and its subsidiaries. Investors in BGM’s ordinary shares are not purchasing equity interest in its operating entities in China but instead are purchasing equity interest in a Cayman Islands holding company.

BGM receives the economic benefits of Gansu QLS and its subsidiaries’ business operation through a series of contractual arrangements, or the VIE Agreements. As a result of the VIE Agreements, BGM is the primary beneficiary of Gansu QLS for accounting purposes and treats it as a PRC consolidated entity under U.S. GAAP. BGM consolidates the financial results of Gansu QLS and its subsidiaries in its consolidated financial statements in accordance with U.S. GAAP. BGM does not own any equity interest in Gansu QLS and its subsidiaries. For detailed descriptions of each of the VIE Agreement, please refer to disclosures under “Item 4. Information on the Company-A. History and Development of the Company- Our Holding Company Structure and Contractual Arrangements” in this annual report on Form 20-F.

Unless the context otherwise requires, in this annual report on Form 20-F, references to:

| ● | “Affiliated Entities” are to BGM’s two subsidiaries through equity ownership, along with Gansu QLS (the “VIE”) and the VIE’s subsidiaries, which BGM does not own through equity ownership; |

| ● | “Ahan” are to Jiuquan Ahan Biotechnology Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by Gansu QLS; |

| ● | “Ahan® Antibacterial Paste” are to a disinfection paste made from a mixture of 11 traditional Chinese herbal ingredients used to treat refractory chronic skin diseases; |

| ● | “APIs” are to Active Pharmaceutical Ingredients, which refer to any substance or mixture of substances intended to be used in the manufacture of a drug (medicinal) product and that, when used in the production of a drug, becomes an active ingredient of the drug product; |

| ● | “BGM” are to BGM Group Ltd (formerly known as Qilian International Holding Group Limited), an exempted company with limited liability incorporated under the laws of the Cayman Islands; |

| ● | “Cangmen” are to Tibet Cangmen trading Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by Gansu QLS; |

| ● | “Chengdu QLS” are to Chengdu Qilianshan Biotechnology Co., Ltd., a limited liability company organized under the laws of the PRC, which is 79.71% owned by Gansu QLS; |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding Taiwan but including the special administrative regions of Hong Kong and Macau for the purposes of this annual report only; |

| ● | “Class A ordinary shares” are to our Class A ordinary shares, par value of US$0.00833335 each; |

| ● | “Class B ordinary shares” are to our Class B ordinary shares, par value of US$0.00833335 each; |

| ● | “Gan Di Xin®” are to an innovative antitussive and expectorant medicine made from raw licorice materials; |

| ● | “Gansu QLS” are to Gansu Qilianshan Pharmaceutical Co. Ltd., a limited liability company organized under the laws of the PRC, which BGM controls via a series of contractual arrangements between WFOE and Gansu QLS; |

| ● | “Hainan Trade” are to Qilian Shan International Trade (Hainan) Co., Ltd., a limited liability company organized under the laws of the PRC and is wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under the laws of Hong Kong. |

| ● | “Heparin Sodium Preparation” are to a primary ingredient for pharmaceutical companies to produce medications used in treating cardiovascular diseases, cerebrovascular diseases, and hemodialysis; |

| ● | “Moshangfa” are to Moshangfa (Gansu) Fertilizer Industry Co., Ltd., formerly known as Jiuquan Qiming Biotechnology Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by Gansu QLS; |

| ● | “Ordinary Shares” are to our Class A ordinary shares and Class B ordinary shares; |

| ● | “Qilian HK” are to BGM’s wholly owned subsidiary, Qilian International (Hong Kong) Holdings Limited, a Hong Kong corporation; |

| ● | “Qilian Shan® Licorice Extract” are to a primary ingredient for pharmaceutical companies to manufacture traditional licorice tablets; |

| ● | “Qilian Shan® Licorice Liquid Extract” are to a primary ingredient for medical preparation companies to produce compound licorice oral solutions; |

| ● | “Qilian Shan® Oxytetracycline APIs” are to an active ingredient used by pharmaceutical companies in the manufacturing of medications that use oxytetracycline; |

4

| ● | “Qilian Shan® Oxytetracycline Tablets” are to tablets used to prevent and treat a wide range of diseases in chickens, turkeys, cattle, swine, and human; |

| ● | “Rugao” are to Rugao Tianlu Animal Products Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by Chengdu QLS; |

| ● | “Samen” are to Tibet Samen Trading Co., Ltd., a limited liability company organized under the laws of the PRC, which was 100% owned by Gansu QLS. Samen was dissolved in June 2023; |

| ● | “TCM” are to Traditional Chinese Medicine, a style of traditional medicine built on a foundation of more than 2,500 years of Chinese medical practice that includes various forms of herbal medicine, acupuncture, massage (tui na), exercise (qigong), and dietary therapy; |

| ● | “TCMD” are to Traditional Chinese Medicine Derivatives, a type of product derived from TCM that has been prepared through modern medicine manufacturing procedures to be ready for use; |

| ● | “VIE” are to Gansu QLS, the variable interest entity; |

| ● | “VIE Agreements” are to a series of contractual arrangements, including Exclusive Service Agreement, as amended on August 27, 2019 and later terminated and replaced by Hainan Exclusive Service Agreement on December 1, 2022, the Call Option Agreement, the Equity Pledge Agreement, the Shareholders’ Voting Rights Proxy Agreement and Powers of Attorney, and the Spousal Consents; |

| ● | “we,” “us,” “Parent,” or “the Company” are to BGM Group Ltd; |

| ● | “WFOE” or “PRC Subsidiary” are to Qilian International Trading (Chengdu) Co., Ltd., formerly known as Chengdu Qilian Trading Co., Ltd., and Qilian Shan International Trade (Hainan) Co., Ltd., both of which are limited liability company organized under the laws of the PRC and are wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under the laws of Hong Kong; |

| ● | “Xiongguan® Organic Fertilizer” are to a fertilizer product designed to improve crop yield, increase soil’s chemical properties, and reduce soil compaction; |

| ● | “Xiongguan® Organic-Inorganic Compound Fertilizer” are to a fertilizer product made from both organic materials and traditional chemical fertilizer and is designed to increased plant growth; |

| ● | “Zhongqiao” are to Zhongqiao Youguan (Chengdu) E-Commerce Service Co., Ltd., a limited liability company organized under the laws of the PRC, which is a 51% subsidiary of Hainan Trade; and |

| ● | “Zhu Xiaochang® Sausage Casings” are to an all-natural food product used for culinary purposes. |

This annual report on Form 20-F includes our audited consolidated financial statements for the fiscal years ended September 30, 2024, 2023, and 2022. In this annual report, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in United States dollars. These dollar references are based on the exchange rate of RMB to United States dollars, determined as of a specific date or for a specific period. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of United States dollars which may result in an increase or decrease in the amount of our obligations and the value of our assets.

This annual report contains translations of certain RMB amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

|

|

September 30, |

||||

US$Exchange Rate |

|

2024 |

|

2023 |

|

2022 |

At the end of the year - RMB |

|

RMB 7.0176 to $1.00 |

|

RMB7.2960 to $1.00 |

|

RMB7.1135 to $1.00 |

Average rate for the year - RMB |

|

RMB 7.2043 to $1.00 |

|

RMB7.0533 to $1.00 |

|

RMB6.5532 to $1.00 |

5

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. Known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” may cause our and the VIE and its subsidiaries’ actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our and the VIE and its subsidiaries’ actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our, the VIE and its subsidiaries’ financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our and the VIE and its subsidiaries’ mission, goals and strategies; |

| ● | our and the VIE and its subsidiaries’ future business development, financial conditions and results of operations; |

| ● | the expected growth of the PRC pharmaceutical and chemical industries in China; |

| ● | our and the VIE and its subsidiaries’ expectations regarding demand for and market acceptance of their products; |

| ● | our and the VIE and its subsidiaries’ expectations regarding their relationships with their suppliers and customers; |

| ● | competition in our and the VIE and its subsidiaries’ industries; and |

| ● | relevant government policies and regulations relating to our and the VIE and its subsidiaries’ industry. |

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our, the VIE and its subsidiaries’ actual results could be materially different from our expectations. Other sections of this annual report include additional factors that could adversely impact BGM and its affiliated entities’ business and financial performance. Moreover, our and the VIE and its subsidiaries’ operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our, the VIE and its subsidiaries’ business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should read thoroughly this annual report and the documents that we refer to with the understanding that our actual future results may be materially different from, or worse than, what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This annual report contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The pharmaceutical industry may not grow at the rate projected by market data, or at all. Failure of this market to grow at the projected rate may have a material and adverse effect on our and the VIE and its subsidiaries’ business and the market price of the Ordinary Shares. In addition, the rapidly evolving nature of this industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our and the VIE and its subsidiaries’ market. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we refer to in this annual report and exhibits to this annual report completely and with the understanding that our and the VIE and its subsidiaries’ actual future results may be materially different from what we expect.

6

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

Our Holding Company Structure and Contractual Arrangements with the Consolidated Affiliated Entities

BGM Group Ltd is not a Chinese operating company but a Cayman Islands holding company with no business operations. The business operations are conducted by Gansu Qilianshan Pharmaceutical Co., Ltd. (the “VIE”, “Gansu QLS”) and its subsidiaries established in the PRC. See “Item 4.C. INFORMATION ON THE COMPANY - Our Corporate Structure” for further information regarding our affiliated entities’ names, places of incorporation, and equity ownership. BGM and its affiliated entities are subject to legal and operational risks associated with being mostly based in the PRC and Hong Kong and having all of their operations in the PRC, discussed in greater detail below. BGM is incorporated in the Cayman Islands-- a holding company with no material operations, the Company conducts its operations in China through the variable interest entities-- Gansu QLS and its subsidiaries. Investors in BGM’s ordinary shares are not purchasing equity interest in its operating entities in China but instead are purchasing equity interest in a Cayman Islands holding company.

BGM receives the economic benefits of Gansu QLS and its subsidiaries’ business operation through a series of contractual arrangements, or the VIE Agreements. As a result of the VIE Agreements, BGM is the primary beneficiary of Gansu QLS for accounting purposes and treat it as a PRC consolidated entity under U.S. GAAP. BGM consolidates the financial results of Gansu QLS and its subsidiaries in its consolidated financial statements in accordance with U.S. GAAP. Neither BGM nor its investors own any equity ownership in, direct foreign investment in, or control through such ownership/investment of Gansu QLS. These VIE Agreements have not been tested in a court of law in the PRC. As a result, investors in BGM’s ordinary shares thus are not purchasing equity interest in its operating entities in China but instead are purchasing equity interest in a Cayman Islands holding company. As used in this annual report, (i) “Gansu QLS,” “variable interest entity” or “ VIE” refers to Gansu Qilianshan Pharmaceutical Co., Ltd., a company incorporated in the People’s Republic of China; (ii) “WFOE” or “PRC Subsidiary” refers to Qilian International Trading (Chengdu) Co., Ltd., formerly known as Chengdu Qilian Trading Co., Ltd., and Qilian Shan International Trade (Hainan) Co., Ltd., both of which are limited liability company organized under the laws of the PRC and are wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under the laws of Hong Kong; and (iii) “BGM”, “the Company” refers to BGM Group Ltd, an exempted company with limited liability incorporated under the laws of the Cayman Islands.

Our corporate structure is subject to risks associated with BGM’s contractual arrangements with the VIE. The Company that investors will own may never have a direct ownership interest in the businesses that are conducted by the VIE. If the PRC government finds that the agreements that establish the structure for operating the VIE and its subsidiaries’ business in China do not comply with PRC laws and regulations, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in the operations of the VIE and its subsidiaries. This would result in the VIE being deconsolidated. The majority of our assets, including the necessary licenses to conduct business in China, are held by the VIE and its subsidiaries. A significant part of our revenue is generated by the VIE. An event that results in the deconsolidation of the VIE would have a material effect on the VIE and its subsidiaries’ operations and result in the Ordinary Shares diminishing substantially in value or even becoming worthless. The Company, our Hong Kong entity, the VIE and its subsidiaries, and our investors face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIE and, consequently, significantly affect the financial performance of the VIE and the Company as a whole. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3. Key Information-D. Risk Factors-Risks Related to Our Corporate Structure” in this annual report on Form 20-F.

7

In addition, while BGM will take every precaution available to enforce the contractual and corporate relationship of the VIE agreements, these contractual arrangements are less effective than direct ownership and BGM may incur substantial costs to enforce the terms of the arrangements. For example, the VIE, its subsidiaries, and their shareholders could breach their contractual arrangements with BGM by, among other things, failing to conduct their operations in an acceptable manner or taking other actions that are detrimental to BGM’s interests. If BGM had direct ownership of the VIE and its subsidiaries, it would be able to exercise its rights as a shareholder to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under VIE Agreements, BGM relies on the performance by the VIE and its shareholders of their obligations under the contracts to direct the operation of the VIE and its subsidiaries. As such, the shareholders of VIE and its subsidiaries may not act in the best interests of BGM or may not perform their obligations under these contracts. In addition, failure of the VIE shareholders to perform certain obligations could compel BGM to rely on legal remedies available under PRC laws, including seeking specific performance or injunctive relief, and claiming damages, which may not be effective. Further, it is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. PRC regulatory authorities could disallow this structure, which would materially adversely affect the value of BGM’s ordinary shares, and could cause the value of such securities to significantly decline or become worthless. BGM faces numerous challenges in enforcing these contractual agreements due to uncertainties under Chinese law as well as jurisdictional limits. For a description of the risks related to these contractual arrangements and our corporate structure, see “Risk Factors - Risks Related to Our Corporate Structure.” For detailed descriptions of each of the VIE Agreement, please refer to disclosures under “Item 4. Information on the Company-A. History and Development of the Company- Our Holding Company Structure and Contractual Arrangements” in this annual report on Form 20-F.

BGM faces legal and operational risks associated with having the majority of its operations in China. The Chinese government has significant authority to exert influence on the ability of a China-based company, such as BGM, to conduct its business. Therefore, investors of BGM and its business conducted by the VIE and its subsidiaries face potential uncertainty from the PRC government. Changes in China’s economic, political or social conditions or government policies could materially adversely affect BGM and its affiliated entities’ business and results of operations. For example, BGM faces risks associated with PRC governmental authorities’ significant oversight and discretion over the businesses and financing activities of the VIE, the requirement of regulatory approvals for offerings conducted overseas by and foreign investment in China-based issuers, the use of variable interest entities, the enforcement of anti-monopoly regime, the regulatory oversight on cybersecurity and data privacy as well as the risk of delisting due to if the PCAOB is unable to conduct inspection on our auditors, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. These risks could result in a material adverse change in the VIE and its subsidiaries’ operations conducted by the VIE and its subsidiaries and the value of BGM’s ordinary shares, significantly limit or completely hinder BGM’s ability and the ability of any holder of its Ordinary Shares or other securities of BGM to offer or continue to offer such securities to investors, or cause the value of such securities to significantly decline. In particular, recent statements and regulatory actions by China’s government, such as those related to data security or anti-monopoly concerns, as well as the PCAOB’s ability to inspect our auditors, may impact BGM’s ability to conduct its business through the VIE and its subsidiaries, accept foreign investments, or be listed on a U.S. or other foreign stock exchange. See “Item 3. Key Information - D. Risk Factors - Risks Related to Doing Business in China - The PRC government has significant authority to intervene or influence the China operations of an offshore holding company, such as ours, at any time. The PRC government may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers. If the PRC government exerts more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers and we, the VIE or its subsidiaries were to be subject to such oversight and control, it may result in a material adverse change to the VIE and its subsidiaries’ business operations, significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors, and cause its ordinary shares to significantly decline in value or become worthless” and “Item 3. Key Information - D. Risk Factors - Risks Related to Doing Business in China - Uncertainties with respect to the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder BGM’s ability and the ability of any holder of BGM’s securities to offer or continue to offer such securities, result in a material adverse change to the WFOE and the VIE and its subsidiaries’ business operations, and damage BGM and its subsidiaries’ reputation, which would materially and adversely affect BGM and its affiliates’ financial condition and results of operations and cause the Ordinary Shares to significantly decline in value or become worthless.”

8

BGM has been advised by Gansu Quanyi Law Firm, our PRC counsel, that as of the date of this Annual Report, our listing in the U.S. is not subject to the review, permission or prior approval of PRC authorities including the Cyberspace Administration of China (“CAC”) or the China Securities Regulatory Commission (“CSRC”) because (i) the CSRC currently has not issued any definitive rule or interpretation concerning whether our listing is subject to this regulation; and (ii) our operating entities (the WFOE, the VIE and its subsidiaries) were established and operate in PRC are not included in the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC. Uncertainties still exist, however, due to the possibility that laws, regulations, or policies in the PRC could change rapidly in the future. In the event that the PRC government expanded the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC, and BGM inadvertently concluded that relevant permissions or approvals were not required or that BGM did not receive or failed to maintain relevant permissions or approvals required and such permissions were subsequently rescinded, any action by the PRC government could significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

On December 16, 2021, the PCAOB issued a report on its determination that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in China and in Hong Kong because of positions taken by PRC and Hong Kong authorities in those jurisdictions. The PCAOB has made such determination as mandated under the Holding Foreign Companies Accountable Act. Pursuant to each annual determination by the PCAOB, the SEC will, on an annual basis, identify issuers that have used non-inspected audit firms and thus are at risk of such suspensions in the future. Our auditors, ZH CPA, LLC and Enrome LLP, the independent registered public accounting firms that issue the audit reports included elsewhere in this annual reports, as auditors of companies that are traded publicly in the U.S. and firms registered with the PCAOB, are subject to laws in the U.S., pursuant to which the PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. ZH CPA, LLC and Enrome LLP are located in Denver, Colorado and Singapore, and have been inspected by the PCAOB on a regular basis. Our auditors are not subject to the determination issued by the PCAOB on December 16, 2021.

On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. See “—D. Risk Factors—Risks Related to Doing Business in China — Our Ordinary Shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect auditors who are located in China. The delisting and the cessation of trading of our Ordinary Shares, or the threat of their being delisted and prohibited from being traded, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors with the benefits of such inspections.”

An investment in our ordinary shares involves a high degree of risk and should be considered speculative. You should carefully consider the following risks set out below and other information before investing in our ordinary shares. If any event arising from these risks occurs, the VIE and its subsidiaries’ business, prospects, financial condition, results of operations or cash flows could be adversely affected, the trading price of our ordinary shares could decline and all or part of your investment may be lost.

9

Transfers of Cash Amongst Our Subsidiaries, the VIE, and the VIE’s Subsidiaries

BGM is permitted under the laws of Cayman Islands to provide funding to its subsidiary in Hong Kong (Qilian HK) through loans or capital contributions without restrictions on the amount of the funds. Qilian HK is permitted under the laws of Hong Kong to provide funding to BGM through dividend distribution without restrictions on the amount of the funds. Any determination related to our dividend policy will be made at the discretion of BGM’s board of directors after considering its financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any financing instruments. Subject to the Companies Act (Revised) of the Cayman Islands and its memorandum and articles of association (as amended and restated from time to time), BGM’s board of directors may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately following the dividend the value of its assets will exceed its liabilities and BGM will be able to pay its debts as they become due. There is no further restriction under the Companies Act (Revised) of the Cayman Islands on the amount of funds which may be distributed by BGM by dividend.

If BGM determines to pay dividends on any of its Ordinary Shares, as a holding company, it will be dependent on receipt of funds from its Hong Kong subsidiary by way of dividend payments. Under the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid by us. The laws and regulations of the PRC do not currently have any material impact on transfer of cash from BGM to Qilian HK or from Qilian HK to BGM. There are no restrictions or limitation under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong Kong, nor there is any restriction on foreign exchange to transfer cash between BGM and its affiliated entities, across borders and to U.S investors, nor there is any restrictions and limitations to distribute earnings from BGM’s operating business conducted by its PRC based VIE and its subsidiaries, to BGM and U.S. investors and amounts owed.

Current PRC regulations permit WFOE to pay dividends to our Hong Kong subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, WFOE is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. WFOE could further set aside a portion of its after-tax profits to fund a discretionary reserve, although the amount to be set aside, if any, is determined at the discretion of its shareholders. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

While the PRC government imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC, none of the entities affiliated to the Company are on the negative list of domestic and foreign investments explicitly prohibited by the Chinese government. Thus, the Company will not experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from its VIE’s profits. If WFOE incurs debt on its own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If BGM or its subsidiaries are unable to receive all of the revenues from their operations through the current VIE agreements, it may be unable to pay dividends on its ordinary shares.

Cash dividends, if any, on BGM’s ordinary shares will be paid in U.S. dollars. If BGM is considered a PRC tax resident enterprise for tax purposes, any dividends it pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%. In order for BGM to pay dividends to its shareholders, it will rely on payments made from the VIE and its subsidiaries to WFOE, pursuant to VIE agreements between them, and the distribution of such payments to Qilian HK as dividends from WFOE. Certain payments from the VIE and its subsidiaries to WFOE are subject to PRC taxes, including enterprise income taxes, VAT and certain other taxes, as the case maybe.

For the year ended September 30, 2024, cash flow from WFOE to VIE included proceeds from repayment of loan of $702,469 and net proceeds from product sales and purchase of $898,863. For the year ended September 30, 2023, cash flow from VIE to WFOE included payment of $39,508 for net payments for products sales and purchase. For the year ended September 30, 2022, cash flow from WFOE to VIE included proceeds from repayment of loan of $762,986, interest payment of $166,458 and net payment for product sales and purchase of $209,064.

10

See “Dividend Policy”, “Risk Factors — BGM is a holding company and it relies for funding on dividend payments from its affiliated entities by contracts, which are subject to restrictions under PRC laws. Any limitation on the ability of BGM’s affiliated entities to make payments to it could have a material adverse effect on BGM’s ability to maintain its business.”, Summary Consolidated Financial Data and Consolidated Statements of Change in Shareholders’ Equity in the Report of Independent Registered Public Accounting Firm for more information.

PRC Limitation on Overseas Listing and Share Issuances

Currently, BGM and its affiliated entities, are not required to obtain approval from Chinese authorities, including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to operate and list on U.S. exchanges or issue securities to foreign investors. If approval is required in the future and BGM is denied permission from Chinese authorities to list on U.S. exchanges, BGM will not be able to operate or to continue listing on U.S. exchange, which would materially affect the interest of the investors. It is uncertain when and whether the Company will be required to obtain permission from the PRC government to continue to operate or to list on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although BGM and its affiliated entities are currently not required to obtain permission from any of the PRC federal or local government and have not received any denial to list on the U.S. exchange, BGM’s operations and ability to continue to list and issue securities to foreign investors may be adversely affected in the future, directly or indirectly, by existing or future laws and regulations relating to BGM’s PRC business operations. For more detailed information, see “Risks Related to Doing Business in China — The PRC government may intervene and influence the WFOE and the VIE and its subsidiaries’ business operations at any time or may exert more control over offerings conducted overseas and foreign investment in China based issuers, which could result in a material change in the WFOE and the VIE and its subsidiaries’ business operations or the value of BGM’s securities. Additionally, the governmental and regulatory interference could significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. BGM and its affiliated entities are also currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if they are required to obtain approval in the future and are denied permission from Chinese authorities to list on U.S. exchanges, BGM will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.”

Financial Information Related to the VIE

The following tables provide condensed consolidating schedules depicting the financial position, cash flows, and results of operations for the parent, subsidiaries, WFOE, the consolidated VIE, and any eliminating adjustments and consolidated totals as of and for the years ended September 30, 2024, 2023 and 2022.

Selected Condensed Consolidating Statements of Operations Information

|

|

For the Year ended September 30, 2024 |

||||||||||

|

|

|

|

|

|

|

|

The VIE |

|

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination(4) |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Total revenues |

|

— |

|

— |

|

698,583 |

|

25,097,953 |

|

(698,585) |

|

25,097,951 |

Including: Service fee revenue (loss absorbed) from the VIE |

|

— |

|

— |

|

698,585 |

|

— |

|

(698,585) |

|

— |

Cost of revenues |

|

— |

|

— |

|

7,807 |

|

20,975,389 |

|

— |

|

20,983,196 |

Total operating expenses |

|

820,606 |

|

(3,694) |

|

358,251 |

|

4,198,253 |

|

(694,890) |

|

4,678,526 |

Including: Service fee expense charged by the WFOE |

|

— |

|

— |

|

— |

|

698,585 |

|

(698,585) |

|

— |

Share of (loss) income of subsidiary (1) |

|

80,506 |

|

76,813 |

|

— |

|

— |

|

(157,319) |

|

— |

Net income (loss) |

|

(1,522,700) |

|

80,506 |

|

76,813 |

|

5,534 |

|

(157,315) |

|

(1,517,161) |

11

|

|

For the Year ended September 30, 2023 |

||||||||||

|

|

|

|

|

|

|

|

The VIE |

|

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination(4) |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Total revenues |

|

— |

|

— |

|

(1,260,840) |

|

46,471,478 |

|

1,260,840 |

|

46,471,478 |

Including: Service fee revenue (loss absorbed) from the VIE |

|

— |

|

— |

|

(1,333,066) |

|

— |

|

1,333,066 |

|

— |

Cost of revenues |

|

— |

|

— |

|

3,255 |

|

44,716,729 |

|

— |

|

44,719,984 |

Total operating expenses |

|

649,697 |

|

— |

|

307,155 |

|

2,143,901 |

|

1,260,840 |

|

4,361,593 |

Including: Service fee expense charged by the WFOE |

|

— |

|

— |

|

— |

|

(1,333,066) |

|

1,333,066 |

|

— |

Share of (loss) income of subsidiary (1) |

|

(1,602,772) |

|

(1,602,772) |

|

— |

|

— |

|

3,205,544 |

|

— |

Net income (loss) |

|

(7,780,620) |

|

(1,602,772) |

|

(1,602,772) |

|

(341,450) |

|

3,205,544 |

|

(8,122,070) |

|

|

For the Year ended September 30, 2022 |

||||||||||

|

|

|

|

|

|

|

|

The VIE |

|

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination(4) |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Total revenues |

|

— |

|

— |

|

7,440,476 |

|

64,468,807 |

|

(7,054,258) |

|

64,855,025 |

Including: Service fee revenue from the VIE |

|

— |

|

— |

|

2,730,580 |

|

— |

|

(2,730,580) |

|

— |

Cost of revenues |

|

— |

|

— |

|

4,268,747 |

|

58,682,658 |

|

(4,323,677) |

|

58,627,728 |

Total operating expenses |

|

522,923 |

|

— |

|

318,236 |

|

6,014,715 |

|

(2,730,580) |

|

4,125,294 |

Including: Service fee expense charged by the WFOE |

|

— |

|

— |

|

— |

|

2,730,580 |

|

(2,730,580) |

|

— |

Share of income of subsidiary(1) |

|

2,720,596 |

|

2,720,596 |

|

— |

|

— |

|

(5,441,192) |

|

— |

Net income |

|

3,050,625 |

|

2,720,596 |

|

2,720,596 |

|

21,632 |

|

(7,147,192) |

|

1,366,257 |

Selected Condensed Consolidating Balance Sheets Information

|

|

As of September 30, 2024 |

||||||||||

|

|

|

|

|

|

|

|

The VIE |

|

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination(4) |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Cash and cash equivalents |

|

1,856,344 |

|

1,058,635 |

|

2,427,472 |

|

4,474,803 |

|

— |

|

9,817,254 |

Amount due from the Parent/WFOE(2) |

|

— |

|

— |

|

— |

|

5,128,511 |

|

(5,128,511) |

|

— |

Total current assets |

|

10,191,931 |

|

1,113,335 |

|

2,464,159 |

|

15,999,790 |

|

(5) |

|

29,769,210 |

Service fee receivable from the VIE |

|

— |

|

— |

|

11,789,750 |

|

— |

|

(11,789,750) |

|

— |

Investment in subsidiary(3) |

|

11,141,678 |

|

11,141,678 |

|

— |

|

— |

|

(22,283,356) |

|

— |

Other non-current assets |

|

— |

|

3,328,215 |

|

6,139,822 |

|

16,016,484 |

|

(2,250,003) |

|

23,234,518 |

Total assets |

|

21,333,609 |

|

15,583,228 |

|

20,393,731 |

|

37,144,785 |

|

(41,451,624) |

|

53,003,728 |

Amounts due to the VIE and its subsidiaries(2) |

|

(3,435,100) |

|

4,436,707 |

|

4,126,905 |

|

— |

|

(5,128,512) |

|

— |

Total current liabilities |

|

— |

|

1,149 |

|

2,853,836 |

|

5,921,003 |

|

(3) |

|

8,775,985 |

Service fee payable to the WFOE |

|

— |

|

— |

|

— |

|

11,789,750 |

|

(11,789,750) |

|

— |

Other non-current liabilities |

|

— |

|

— |

|

— |

|

134,394 |

|

— |

|

134,394 |

Total liabilities |

|

(3,435,100) |

|

4,437,856 |

|

6,980,741 |

|

17,845,147 |

|

(16,918,264) |

|

8,910,379 |

Total shareholders’ equity |

|

24,768,709 |

|

11,145,373 |

|

13,412,990 |

|

19,299,638 |

|

(24,533,361) |

|

44,093,349 |

Total liabilities and shareholders’ equity |

|

21,333,609 |

|

15,583,228 |

|

20,393,731 |

|

37,144,785 |

|

(41,451,625) |

|

53,003,728 |

12

|

|

As of September 30, 2023 |

||||||||||

|

|

|

|

|

|

|

|

The VIE |

|

|

|

|

|

|

|

|

|

|

|

|

and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination(4) |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Cash and cash equivalents |

|

277,218 |

|

— |

|

322,834 |

|

6,876,195 |

|

— |

|

7,476,247 |

Amount due from the Parent/WFOE(2) |

|

— |

|

— |

|

— |

|

4,125,329 |

|

(4,125,329) |

|

— |

Total current assets |

|

15,230,237 |

|

— |

|

369,857 |

|

23,037,856 |

|

(4,125,329) |

|

34,512,621 |

Service fee receivable from the VIE |

|

— |

|

— |

|

11,091,165 |

|

— |

|

(11,091,165) |

|

— |

Investment in subsidiary(3) |

|

10,693,672 |

|

10,693,672 |

|

— |

|

— |

|

(21,387,344) |

|

— |

Other non-current assets |

|

— |

|

— |

|

2,772,206 |

|

13,973,167 |

|

— |

|

16,745,373 |

Total assets |

|

25,923,910 |

|

10,693,672 |

|

14,233,228 |

|

37,011,023 |

|

(36,603,839) |

|

51,257,994 |

Amounts due to the VIE and its subsidiaries(2) |

|

575,793 |

|

— |

|

3,549,536 |

|

— |

|

(4,125,329) |

|

— |

Total current liabilities |

|

575,793 |

|

— |

|

3,539,555 |

|

6,670,120 |

|

(4,125,329) |

|

6,660,139 |

Service fee payable to the WFOE |

|

— |

|

— |

|

— |

|

11,091,165 |

|

(11,091,165) |

|

— |

Other non-current liabilities |

|

— |

|

— |

|

— |

|

246,454 |

|

— |

|

246,454 |

Total liabilities |

|

575,793 |

|

— |

|

3,539,555 |

|

18,007,739 |

|

(15,216,494) |

|

6,906,593 |

Total shareholders’equity |

|

25,348,117 |

|

10,693,672 |

|

10,693,673 |

|

19,003,284 |

|

(21,387,345) |

|

44,351,401 |

Total shareholders’liabilities and equity |

|

25,923,910 |

|

10,693,672 |

|

14,233,228 |

|

37,011,023 |

|

(36,603,839) |

|

51,257,994 |

Selected Condensed Consolidating Cash Flows Information

|

|

For the Year ended September 30, 2024 |

||||||||||

|

|

|

|

|

|

|

|

The VIE and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Net cash (used in) provided by operating activities |

|

(4,220,872) |

|

3,379,370 |

|

1,203,550 |

|

182,190 |

|

— |

|

544,238 |

Net cash (used in) provided by investing activities |

|

5,800,000 |

|

(1,078,215) |

|

(1,404,938) |

|

(2,333,429) |

|

— |

|

983,418 |

Net cash used in financing activities |

|

— |

|

— |

|

— |

|

(491,728) |

|

— |

|

(491,728) |

|

|

For the Year ended September 30, 2023 |

||||||||||

|

|

|

|

|

|

|

|

The VIE and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Net cash (used in) provided by operating activities |

|

(635,467) |

|

— |

|

(268,752) |

|

1,203,435 |

|

12,993 |

|

312,209 |

Net cash used in by investing activities |

|

(1,000,000) |

|

— |

|

(29,347) |

|

(3,700,105) |

|

(12,993) |

|

(4,742,445) |

Net cash provided by (used in) financing activities |

|

(1,787,517) |

|

— |

|

56,711 |

|

(1,190,278) |

|

— |

|

(2,921,084) |

|

|

For the Year ended September 30, 2022 |

||||||||||

|

|

|

|

|

|

|

|

The VIE and |

|

|

|

Consolidated |

|

|

Parent |

|

Qilian HK |

|

WFOE |

|

subsidiaries |

|

Elimination |

|

Total |

|

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

|

US$ |

Net cash (used in) provided operating activities |

|

(527,971) |

|

— |

|

280,889 |

|

12,901,270 |

|

— |

|

12,654,188 |

Net cash used in investing activities |

|

— |

|

— |

|

(1,341,994) |

|

(1,153,972) |

|

(762,986) |

|

(3,258,952) |

Net cash used in financing activities |

|

— |

|

— |

|

(762,986) |

|

(5,937,529) |

|

762,986 |

|

(5,937,529) |

13

The following table represents the roll-forward of the investments in our subsidiaries, the VIE and the VIE’s subsidiaries:

|

|

USD |

As of September 30, 2020 |

|

6,966,081 |

Share of income of subsidiaries, the VIE and the VIE’s subsidiaries |

|

2,974,990 |

Effect of exchange rate |

|

6,858 |

As of September 30, 2021 |

|

9,947,929 |

Share of income of subsidiaries, the VIE and the VIE’s subsidiaries |

|

2,720,596 |

Effect of exchange rate |

|

(22,641) |

As of September 30, 2022 |

|

12,645,883 |

Share of income of subsidiaries, the VIE and the VIE’s subsidiaries |

|

(1,602,772) |

Effect of exchange rate |

|

(349,439) |

As of September 30, 2023 |

|

10,693,672 |

Share of income of subsidiaries, the VIE and the VIE’s subsidiaries |

|

80,506 |

Effect of exchange rate |

|

367,500 |

As of September 30, 2024 |

|

11,141,678 |

Notes

| (1) | It represents the elimination of share of income by BGM from Qilian HK with the net income recognized at Qilian HK level, and share of income by Qilian HK from the WFOE with the net income recognized at the WFOE level, respectively. |

| (2) | It represents the elimination of intercompany balances among BGM, Qilian HK, the Primary WFOE, and the VIEs and their subsidiaries that we consolidate. |

| (3) | As of September 30, 2024, the $4,012,005 intercompany balances included $702,469 loan of WFOE due to the VIE and its subsidiaries, $3,001,210 of receivable of the VIE and its subsidiaries from WFOE originated from purchase made by WFOE from the VIE and its subsidiaries and $232,338 of other payable to the VIE and its subsidiaries from WFOE. |

As of September 30, 2023, the $4,125,329 intercompany balances included $575,793 loan due to the VIE and its subsidiaries from the Parent, $3,316,379 of receivable of the VIE and its subsidiaries from WFOE originated from purchase made by WFOE from the VIE and its subsidiaries and $233,157 of other payable to the VIE and its subsidiaries from WFOE.

| (4) | It represents the elimination of the investments in Qilian HK by BGM, and investments in the WFOE by Qilian HK, respectively. |

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

14

D. Risk Factors

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks we, our subsidiaries, the VIE and its subsidiaries face, organized under relevant headings. The legal and operational risks associated with having operations in the PRC also apply to our presence in Hong Kong. As Hong Kong currently operates under a different set of laws from the PRC, the laws, regulations and the discretion of the governmental authorities in the PRC discussed in this annual report are expected to apply to our entities and businesses in the PRC, rather than entities or businesses in Hong Kong. However, there can be no assurance as to whether the government of Hong Kong will enact laws and regulations similar to the PRC, or whether any laws or regulations of the PRC will become applicable to our operations in Hong Kong in the future. These risks are discussed more fully in the section titled “Item 3. Key Information—D. Risk Factors” in this annual report.

Risks Related to our Corporate Structure

We, our subsidiaries, the VIE and its subsidiaries are also subject to risks and uncertainties related to our corporate structure, including, but not limited to, the following:

| ● | PRC laws and regulations governing our subsidiaries, the VIE, and its subsidiaries’ businesses and the validity of certain of our contractual arrangements are uncertain. If we, our subsidiaries, the VIE or its subsidiaries are found to be in violation, we, our subsidiaries, the VIE or its subsidiaries could be subject to sanctions. In addition, changes in PRC laws and regulations or changes in interpretations thereof may materially and adversely affect the WFOE and the VIE and its subsidiaries’ business. |

| ● | We rely on contractual arrangements with the VIE and its subsidiaries in China for the VIE and its subsidiaries’ business operations, which may not be as effective in providing operational control or enabling us to derive economic benefits as through ownership of controlling equity interests, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements. |

| ● | Gansu QLS’s shareholders may have potential conflicts of interest with us, which may materially and adversely affect BGM and its affiliated entities’ business and financial condition and the value of your investment in our shares. |

Risks Related to Doing Business in China

| ● | The approval and/or other requirements of the China Securities Regulatory Commission, or the CSRC, or other PRC governmental authorities may be required in connection with an offering under PRC rules, regulations or policies, and, if required, we and our affiliated entities cannot predict whether or how soon we, the VIE or its subsidiaries will be able to obtain such approval. |

| ● | Our Ordinary Shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect auditors who are located in China. The delisting and the cessation of trading of our Ordinary Shares, or the threat of their being delisted and prohibited from being traded, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors with the benefits of such inspections. |

| ● | On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus, would reduce the time before our Ordinary Shares may be prohibited from trading or delisted. |

15

| ● | On December 16, 2021, the PCAOB issued a report on its determination that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in China and in Hong Kong because of positions taken by PRC and Hong Kong authorities in those jurisdictions. The PCAOB has made such determination as mandated under the Holding Foreign Companies Accountable Act. Pursuant to each annual determination by the PCAOB, the SEC will, on an annual basis, identify issuers that have used non-inspected audit firms and thus are at risk of such suspensions in the future. Our auditors, ZH CPA, LLC and Enrome LLP, the independent registered public accounting firms that issue the audit reports included elsewhere in this annual report, as auditors of companies that are traded publicly in the U.S. and firms registered with the PCAOB, are subject to laws in the U.S., pursuant to which the PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. ZH CPA, LLC and Enrome LLP are located in Denver, Colorado and Singapore, respectively, and have been inspected by the PCAOB on a regular basis. Our auditors are not subject to the determination issued by the PCAOB on December 16, 2021. |

| ● | The PRC government has significant authority to intervene or influence the China operations of an offshore holding company, such as ours, at any time. The PRC government may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers. If the PRC government exerts more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers and we or our affiliated entities were to be subject to such oversight and control, it may result in a material adverse change to the WFOE and the VIE and its subsidiaries’ business operations, significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors, and cause Ordinary Shares to significantly decline in value or become worthless. See “-Risks Relating to Doing Business in China -The PRC government has significant authority to intervene or influence the China operations of an offshore holding company, such as ours, at any time. The PRC government may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers. If the PRC government exerts more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers and we and our affiliated entities were to be subject to such oversight and control, it may result in a material adverse change to our, the VIE or its subsidiaries business operations, significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors, and cause our Ordinary Shares to significantly decline in value or become worthless”; |

| ● | On December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other administrations jointly issued the revised Measures for Cybersecurity Review, or the “Revised Review Measures”, which became effective and replaced the existing Measures for Cybersecurity Review on February 15, 2022. According to the Revised Review Measures, if an “online platform operator” that is in possession of personal data of more than one million users intends to list in a foreign country, it must apply for a cybersecurity review. Based on a set of Q&A published on the official website of the State Cipher Code Administration in connection with the issuance of the Revised Review Measures, an official of the said administration indicated that an online platform operator should apply for a cybersecurity review prior to the submission of its listing application with non-PRC securities regulators. Moreover, the CAC released the draft of the Regulations on Network Data Security Management in November 2021 for public consultation, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. Given the recency of the issuance of the Revised Review Measures and their pending effectiveness, there is a general lack of guidance and substantial uncertainties exist with respect to their interpretation and implementation. For more information, see page 29 under “The PRC government may intervene or influence the WFOE or the VIE and its subsidiaries’ business operations at any time or may exert more control over offerings conducted overseas and foreign investment in China based issuers, which could result in a material change in the WFOE and the VIE and its subsidiaries’ business operations or the value of BGM’s securities.” Additionally, the governmental and regulatory interference could significantly limit or completely hinder BGM’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. We and our affiliated entities are also currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our affiliated entities are required to obtain approval in the future and are denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. |

16

| ● | Failure to comply with cybersecurity, data privacy, data protection, or any other laws and regulations related to data may materially and adversely affect BGM and its affiliated entities’ business, financial condition, and results of operations. See “Risks Relating to Doing Business in the PRC-Failure to comply with cybersecurity, data privacy, data protection, or any other laws and regulations related to data may materially and adversely affect BGM and its affiliated entities’ business, financial condition, and results of operations”. |

| ● | Changes in laws, regulations and policies in the PRC and uncertainties with respect to the interpretation and enforcement of the laws, regulations and policies in the PRC and the fact that rules and regulations in the PRC can change quickly with little advance notice. Rules and regulations in the PRC are subject to changes by the relevant authorities. Sometimes such authorities will publish draft of the revisions to existing rules and regulations for public comments and consultation before enacting such revisions. But such consultations are done on case-by-case basis and we otherwise lack public channels to learn the extents of the revisions beforehand, in which case we might have limited time to ensure timely compliance upon the enactment of such revisions. Uncertainties with respect to the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder BGM’s ability and the ability of any holder of BGM’s securities to offer or continue to offer such securities, result in a material adverse change to the WFOE and the VIE and its subsidiaries’ business operations, and damage our reputation, which would materially and adversely affect BGM and its affiliated entities’ financial condition and results of operations and cause the Ordinary Shares to significantly decline in value or become worthless. |

| ● | A severe or prolonged downturn in the Chinese or global economy could materially and adversely affect BGM and its affiliated entities’ business and financial condition. |

| ● | Substantial uncertainties exist with respect to the interpretation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. |

Risks Related to the WFOE, the VIE and its Subsidiaries’ Business

Risks and uncertainties related to the WFOE, the VIE and its subsidiaries’ business include, but are not limited to, the following:

| ● | The VIE and its subsidiaries face significant competition in industries experiencing rapid technological change, and there is a possibility that their competitors may achieve regulatory approval and develop new product candidates before the VIE and its subsidiaries, which may harm our and the VIE and its subsidiaries’ financial condition and the ability of the VIE and its subsidiaries to successfully market or commercialize any of their product candidates. |

| ● | The pharmaceutical business of the WFOE, the VIE and its subsidiaries is subject to inherent risks relating to product liability and personal injury claims. |

| ● | The business operations of the WFOE, the VIE and its subsidiaries require a number of permits and licenses. We cannot assure you that the VIE and its subsidiaries can maintain all required licenses, permits and certifications to carry on their business at all times. |