UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934

For the transition period from to

Commission file number: 001-12584

THERIVA BIOLOGICS, INC.

(Exact name of registrant as specified in its charter)

Nevada |

|

13-3808303 |

(State or other jurisdiction of incorporation or |

|

(I.R.S. Employer |

9605 Medical Center Drive, Ste. 270 |

|

20850 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(301) 417-4364

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

||

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

TOVX |

|

NYSE American |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|||

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

|

|

|

|

|

Non-accelerated Filer |

☒ |

|

Smaller Reporting Company |

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s recently completed second fiscal quarter, was approximately $16,791,123 million based on $1.00, the closing price of the registrant’s common stock as reported by the NYSE American on that date.

As of March 21, 2024, the registrant had 17,148,049 shares of common stock outstanding.

Documents incorporated by reference: None

THERIVA BIOLOGICS, INC.

FORM 10-K

TABLE OF CONTENTS

Page |

||

3 |

||

|

||

5 |

||

|

||

31 |

||

|

||

59 |

||

|

||

59 |

||

|

|

|

60 |

||

|

||

60 |

||

|

||

60 |

||

|

||

60 |

||

|

||

60 |

||

|

||

61 |

||

|

||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

61 |

|

|

||

68 |

||

|

||

69 |

||

|

||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

108 |

|

|

||

108 |

||

|

||

109 |

||

|

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

109 |

|

|

|

|

110 |

||

|

||

110 |

||

|

||

113 |

||

|

||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

123 |

|

|

||

Certain Relationships and Related Transactions, and Director Independence |

124 |

|

|

||

125 |

||

|

||

126 |

||

|

||

126 |

||

|

||

132 |

2

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. The forward-looking statements are contained principally in Part I, Item 1. “Business,” Part I, Item 1A. “Risk Factors,” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this Annual Report. In some cases you can identify forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements.

You should refer to Item 1A. “Risk Factors” section of this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We do not undertake any obligation to update any forward-looking statements.

Unless the context requires otherwise, references to “we,” “us,” “our,” “Theriva,” and “Theriva Biologics,” refer to Theriva Biologics, Inc. and its subsidiaries.

Summary Risk Factors

The following is a summary of the key risks relating to the Company. A more detailed description of each of the risks can be found below under Item 1A. Risk Factors.

Risks Related to Our Financial Position and Capital Requirements

| ● | Our consolidated financial statements as of December 31, 2023 have been prepared under the assumption that we will continue as a going concern for the next twelve months. |

| ● | We will need to raise additional capital to operate our business. |

| ● | We expect to continue to incur significant operating and capital expenditures and we will need additional funds to support our operations. |

| ● | The actual amount of funds we will need to operate is subject to many risk factors, some of which are beyond our control. |

| ● | We currently have a limited operating history as an oncology company, no products approved for commercial sale, have no significant source of revenue and may never generate significant revenue. |

| ● | We have identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future. |

| ● | We expect to seek to raise additional capital in the future, which may be dilutive to stockholders or impose operational restrictions. |

| ● | Our operating results may fluctuate significantly, which makes our future operating results difficult to predict. |

| ● | If our acquired intangible assets become impaired, we may be required to record a significant charge to earnings. |

Risks Related to Our Business

| ● | Prior to 2022 we did not conduct any cancer research and development activities and there can be no assurance that we will successfully be able to do so. |

| ● | The development and commercialization of oncolytic viruses have experienced certain challenges. |

| ● | Our research and development efforts may not succeed in developing successful products and technologies. |

| ● | We may not realize the benefits from any strategic alliances we form or licensing arrangements we enter into. |

3

| ● | We may not be able to retain rights licensed to us by others to commercialize key products and may not be able to establish or maintain the relationships we need to develop, manufacture, and market our products. |

| ● | We may incur additional expenses in connection with our licenses and collaboration arrangements and our development of our product candidates. |

| ● | Developments by competitors may render our products or technologies obsolete or non-competitive. |

| ● | We may seek to selectively establish collaborations, and, if we are unable to establish them on commercially reasonable terms, we may have to alter our development and commercialization plans. |

| ● | If the parties we depend on for product manufacturing are unsuccessful in providing adequate drug supply, or if existing drug supply becomes unusable, it may delay or impair our ability to develop, manufacture and market our product candidates. |

| ● | Any problems obtaining the standard of care drugs that we administer with VCN-01, could result in a delay or interruption in our clinical trials. |

| ● | We may fail to retain or recruit necessary personnel, and we may be unable to secure the services of consultants. |

| ● | Global health crises may adversely affect our planned operations. |

| ● | Business disruptions could seriously harm our future revenue and financial condition and increase costs and expenses. |

| ● | Unfavorable economic conditions could adversely affect our business, financial condition or results of operations. |

| ● | We rely extensively on our information technology systems which are vulnerable to risks, including cybersecurity and data leakage risks. |

| ● | Our business and operations would suffer in the event of computer system failures. |

| ● | Any failure to maintain the security of information relating to our patients, customers, employees and suppliers, whether as a result of cybersecurity attacks or otherwise, could expose us to litigation, government enforcement actions and costly response measures, and could disrupt our operations and harm our reputation. |

| ● | We may face particular data protection, data security and privacy risks in connection with the European Union’s Global Data Protection Regulation and other privacy regulations. |

Regulatory Risks

| ● | If we do not obtain the necessary regulatory approvals we may not be able to develop or sell our product candidates. |

| ● | Clinical trials are very expensive, time consuming, and difficult to design and implement. |

| ● | The results of our clinical trials may not support our proposed product candidate claims and the results of preclinical studies and completed clinical trials are not necessarily predictive of future results. |

| ● | Difficulties in enrolling, retaining, or completing patients in our clinical trials or delays in enrollment are expected to result in our clinical development activities being delayed or otherwise adversely affected. |

| ● | Patients who are administered our product candidates may experience unexpected side effects or other safety risks that could cause a halt in clinical development, preclude approval or limit the commercial potential of the product candidate. |

| ● | It is possible that we may not be able to obtain or maintain orphan drug designation or exclusivity for our drug candidates,. |

| ● | Our product candidates, if approved for sale, may not gain acceptance among physicians, patients and the medical community. |

| ● | We depend on third parties, including researchers and sublicensees, who are not under our control. |

| ● | We currently have no marketing, sales or distribution organization and have no experience in marketing products as a company. |

| ● | Reimbursement may not be available for our product candidates, which would impede sales. |

| ● | Healthcare reform measures could hinder or prevent our product candidates’ commercial success. |

| ● | If we fail to comply with state and federal healthcare regulatory laws, we could face substantial penalties, damages, fines, disgorgement, exclusion from participation in governmental healthcare programs, and the curtailment of operations, any of which could harm our business. |

| ● | If we obtain approval to commercialize our clinical product candidates outside of the United States, a variety of risks associated with international operations could harm our business |

| ● | If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates. |

Intellectual Property Risks

| ● | We rely on patent applications and various regulatory exclusivities to protect some of our product candidates and our ability to compete may be limited or eliminated if we are not able to protect our products. |

| ● | We may incur substantial costs as a result of litigation or other proceedings relating to protecting our intellectual property rights, as well as costs associated with lawsuits. |

| ● | If we infringe the rights of others, we could be prevented from selling products or forced to pay damages. |

4

| ● | We enjoy restricted geographical protection with respect to certain patents. |

| ● | We may become subject to claims challenging inventorship or ownership of our patents and other intellectual property. |

Risks Related to Our Securities

| ● | We cannot assure you that our common stock will be liquid or that it will remain listed on the NYSE American exchange. |

| ● | We expect to seek to raise additional capital in the future, which may be dilutive to stockholders or impose operational restrictions. |

| ● | The market price of our common stock has been and may continue to be volatile and adversely affected by various factors. |

| ● | Our Articles of Incorporation and bylaws and Nevada law have anti-takeover effects that could discourage, delay or prevent a change in control, which may cause our stock price to decline. |

| ● | We do not intend to pay dividends in the foreseeable future on our common stock. |

| ● | Resales of our common stock in the public market by our stockholders may cause the market price of our common stock to fall. |

| ● | The shares of common stock offered under our current Amended and Restated At The Market Issuance Sales Agreement may be sold in “at the market” offerings, and investors who buy shares at different times will likely pay different prices. |

Item 1. Business.

Overview

We are a diversified clinical-stage company developing therapeutics designed ot treat cancer and related diseases in areas of high unmet need. As a result of the acquisition in March 2022 of Theriva Biologics, S.L. (“VCN”, formerly named VCN Biosciences, S.L.), described in more detail below (the “Acquisition”), we began transitioning our strategic focus to oncology, which is now our primary focus, through the development of VCN’s new oncolytic adenovirus platform designed for intravenous and intravitreal delivery to trigger tumor cell death, to improve access of co-administered cancer therapies to the tumor, and to promote a robust and sustained anti-tumor response by the patient’s immune system. Our lead product candidate, VCN-01, a clinical stage oncolytic human adenovirus that is modified to express an enzyme, PH20 hyaluronidase, is currently being administered in a Phase 2 clinical study for the treatment of pancreatic cancer, a Phase 1 clinical study for the treatment of retinalblastoma, a Phase 1 clinical study for the treatment of head and neck squamous cell carcinoma and a Phase 1 clinical study for the treatment of solid tumors.

Prior to the Acquisition, our focus was on developing therapeutics designed to treat gastrointestinal (GI) diseases which included our clinical development candidates: (1) SYN-004 (ribaxamase) which is designed to degrade certain commonly used intravenous (IV) beta-lactam antibiotics within the GI tract to prevent microbiome damage, thereby preventing overgrowth and infection by pathogenic organisms such Clostridioides difficile infection (CDI) and vancomycin resistant Enterococci (VRE), and reducing the incidence and severity of acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients, and (2) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under cGMP conditions and intended to treat both local GI and systemic diseases. As part of our strategic transformation into an oncology focused company, we are exploring value creation options for our SYN-004 and SYN-020 assets, including out-licensing or partnering.

5

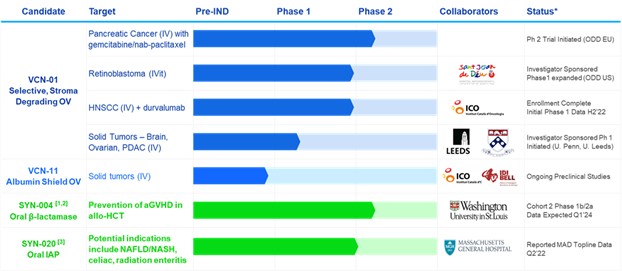

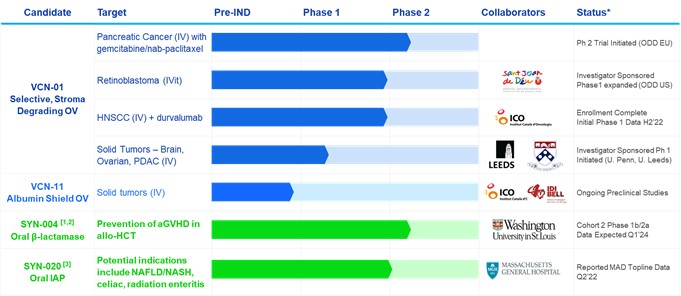

Our Current Product Pipeline

*Based on management’s current beliefs and expectations

allo-HCT allogeneic hematopoietic cell transplant. CPI immune checkpoint inhibitor. HNSCC head and neck squamous cell carcinoma. IV intravenous. IVit intravitreal. ODD Orphan Drug Designation. For other abbreviations see the text.

¹Additional products with preclinical proof-of-concept include SYN-006 (carbapenemase) to prevent aGVHD and infection by carbapenem resistant enterobacteriaceae and SYN-007 (ribaxamase) DR to prevent antibiotic associated diarrhea with oral β-lactam antibiotics.

²Depending on funding/partnership. SYN-004 may enter an FDA-agreed Phase 3 clinical trial for the treatment of CDI.

³We have an option-license agreement with Massachusetts General Hospital to develop SYN-020 in several potential indications related to inflammation and gut barrier dysfunction.

4We have an option agreement with Sant Joan de Déu-Barcelona Children’s Hospital to license their intellectual property rights related to the use of VCN-01 in combination with topoisomerase I inhibitor chemotherapies for the treatment of cancer.

Our Current Oncology-Focused Pipeline

Oncolytic Viruses

Our oncology platform is based on oncolytic virotherapy (“OV therapy”), which exploits the ability of certain viruses to kill tumor cells and trigger an anti-tumor immune response. This novel class of anticancer agents has unique mechanisms of action compared to other cancer drugs. Oncolytic viruses exploit the fact that cancer cells contain mutations that cause them to lose growth control and form tumors. Once inside a tumor cell, oncolytic viruses exploit the tumor cell machinery to generate thousands of additional copies of the virus, which then kill the tumor cell and spread to neighboring cells, causing a chain reaction of cell killing. This infection and tumor cell killing by OVs also alerts the immune system, which can then attack the virus infected tumor cells to help destroy the tumor in some instances.

Our OV product candidates are engineered to efficiently infect and selectively replicate to a high extent in tumor cells versus normal host cells, which enables intravenous delivery. By contrast, many other oncolytic viruses in clinical development today are administered by direct injection into the tumor. Intravenous delivery has the potential to expand the therapeutic effect of OVs because the virus can infect both the primary tumor and tumor metastases throughout the body.

6

Our first product candidate, VCN-01, is a clinical stage oncolytic human adenovirus that is modified to express an enzyme,PH20 hyaluronidase, that degrades hyaluronan in the tumor stroma, which helps the virus and other molecules to penetrate and spread throughout the tumor. VCN-01 can be used alone or in combination with other cancer therapies, such as chemotherapy and immunotherapy, for difficult to treat cancers. An expanding intellectual property portfolio supports our oncology programs, and because our products are characterized as biologics with Orphan Drug designation in our target indications, they will be further protected by data and/or market exclusivity in major markets.

VCN-01 — An oncolytic human type-5 adenovirus engineered for intravenous administration and to express a tumor matrix degrading enzyme (PH20 hyaluronidase) that facilitates the entry of therapeutics and immune cells into tumors

VCN-01 is a genetically modified oncolytic adenovirus that has been engineered to contain four independent genetic modifications on the backbone of the wild-type human adenovirus serotype 5 (HAd5) genome. These modifications have been shown in preclinical and clinical studies to confer tumor selective replication and antitumor activity. VCN-01 was engineered to replicate in and kill virtually all types of solid tumor cells, to expose tumor neoantigens of lysed tumors, to reduce liver tropism, and to express PH20 hyaluronidase to enhance the penetration of virus, chemotherapy, immuno-oncology therapy, and immune cells into the tumor.

Malignant tumors are made up of tumor cells as well as significant supporting tissue known as tumor stroma. The tumor stroma supports the formation and growth of tumors and contains cells and other components that are required for robust tumor growth and metastasis. The stroma also forms an effective barrier to the entry of therapeutic agents such as chemotherapy and immuno-oncology products . A key structural component of the tumor stroma is hyaluronic acid, and tumor levels of hyaluronic acid have been clinically associated with reduced survival in metastatic pancreatic cancer patients. VCN-01 is designed to overcome the stroma barrier problem by expressing the hyaluronan degrading enzyme PH20 hyaluronidase after it infects tumor cells. Expression of PH20 by VCN-01 is designed to degrade the hyaluronic acid within the tumor stroma and improves virus spread throughout the tumor. Based upon the foregoing, we believe our oncolytic virus platform, exemplified by VCN-01, represents a new and potentially powerful form of therapy that combines tumor cell killing, anti-tumor immunity and stroma destruction after intravenous delivery.

The VCN-01 product candidate is provided as a sterile liquid concentrate that is diluted for infusion or injection. The proposed therapeutic indication for VCN-01 is the treatment of solid tumors, as its selectivity mechanism relies on cellular properties shared by virtually all human tumor cells. Our initial indication for clinical development is unresectable metastatic pancreatic cancer, a disease for which there is currently no cure and only limited therapeutic options.

VCN-01 has been administered to 116 patients across multiple Phase 1 clinical trials and Phase 2 VIRAGE trial, including patients with pancreatic cancer, head and neck squamous cell carcinoma, ovarian carcinoma, colorectal cancer, and retinoblastoma.

Pancreatic Ductal Adenocarcinoma

Cancer of the pancreas consists of two main histological types: cancer that arises from the ductal (exocrine) cells of the pancreas or, much less often, cancers may arise from the endocrine compartment of the pancreas. Pancreatic ductal adenocarcinoma (“PDAC”) accounts for more than 90% of all pancreatic tumors. It can be located either in the head of the pancreas or in the body-tail. Pancreatic cancer usually metastasizess to the liver and peritoneum. Other less common metastatic sites are the lungs, brain, kidney and bone. In its early stages, pancreatic cancer does not typically result in any characteristic symptoms. In many instances, progressive abdominal pain is the first symptom. Therefore, in most cases, pancreatic cancer is diagnosed in its late stages (locally advanced non-metastatic or metastatic stage of the disease) when surgical resection and possibly curative treatment is not possible. It is generally assumed that only 10% of cases are resectable at presentation, whereas 30-40% of patients are diagnosed at local advanced/unresectable stage and 50-60% present with distant metastases.

7

PDAC Clinical Unmet Need and Market Opportunity

PDAC is one of the most fatal cancers, accounting for the 4th highest cause of cancer-associated deaths in the US and the European Union. Despite significant research efforts, minimal progress has been achieved to date. The five-year overall survival rate is < 10% and has not substantially improved over the last 30 years. Surgery is the only treatment that offers the prospect of long term-survival; however, the 5-year survival for the limited number of patients in whom resection is possible remains low (20 – 30 %). Patients with advanced disease are managed with chemotherapy. In recent years, the combination of gemcitabine with albumin-bound paclitaxel (GA), and the combination of folic acid, 5-fluorouracil, irinotecan and oxaliplatin (FOLFIRINOX) have emerged as the standard of care. More recently, liposomal irinotecan, approved for second line PDAC in combination with fluorouracil and leucovorin, has shown potential as first line therapy when administered along with 5-FU and other chemotherapies. However, the results are still very poor and new therapeutic interventions are needed. The increase is particularly evident in younger people and several studies anticipate that pancreatic cancer is expected to become the second leading cause of cancer-related death in the United States by 2030. The rising incidence of pancreatic cancer and its current economic burden place increased pressure to improve outcomes for patients.

In May 2011, the Committee for Orphan Medicinal Products (“COMP”) from the European Medicines Agency (“EMA”) recommended granting Orphan Medicinal Product Designation to VCN-01 for the treatment of pancreatic cancer and in June 2011, the European Commission confirmed the designation under Regulation (“EC”) No 141/2000 of the European Parliament and of the Council.

In June 2023, the FDA granted Orphan Drug designation to VCN-01 for the treatment of pancreatic cancer.

Phase 1a/Proof of Concept Trial of VCN-01 by intratumoral administration in PDAC

In September 2019, VCN presented a poster at the European Society for Molecular Oncology (“ESMO”) annual meeting describing initial mechanism of action data from a multicenter, Phase 1 dose escalation study of intratumoral (“IT”) VCN-01 administered to pancreatic cancer patients in combination with standard doses/schedules of either gemcitabine or nab-paclitaxel plus gemcitabine (NCT02045589). The study was conducted at three hospitals in Spain and 8 patients with confirmed histologic diagnosis of unresectable PDAC amenable to endoscopic ultrasound guided (“EUS”) injection were treated with 3 injections (coincident with 1st day of the chemotherapy cycles) at two different dose levels of VCN-01 (six patients had metastatic disease and two had locally advanced disease). The treatment regimen was generally well-tolerated; however, one patient died from severe intraabdominal fluid collection that was considered to be related to VCN-01 treatment. Evaluation of virus pharmacokinetics and PH20 levels in serum were consistent with strong virus replication in the tumors. This was supported by the presence of viral particles in tumor cells as assessed in paired tumor biopsies collected before and after treatment. Tumor stiffness was reduced in all VCN-01-injected lesions as measured by elastography. Disease stabilization of injected lesions was observed in 5 out of 6 patients although subsequent tumor progression was observed in most of the patients due to the appearance of new lesions or growth of distant, non-injected, metastatic lesions. This study provided encouraging mechanism of action data for VCN-01; however, intratumoral injection did not appear to deliver sufficiently high VCN-01 levels for effective delivery to non-injected tumors. We believe these results supported the evaluation of the safety/tolerability and potential efficacy of VCN-01 via intravenous administration in combination with chemotherapy and/or immunotherapies for the treatment of advanced PDAC. The results of this study were published in the Journal for Immunotherapy of Cancer. 2021 Nov;9(11):e003254. doi: 10.1136/jitc-2021-003254.

Phase 1 Trial of intravenous VCN-01 with or without nab-paclitaxel plus gemcitabine in patients with solid tumors and PDAC

In March 2022, we announced the peer-reviewed publication of a Phase 1, multicenter, open-label, dose-escalation study investigating the safety, tolerability and biodistribution of intravenous VCN-01 oncolytic adenovirus with or without standard-of-care (SoC) chemotherapy (gemcitabine/nab-paclitaxel) in patients with advanced solid tumors (NCT02045602). The data, published in the Journal for ImmunoTherapy of Cancer, suggests that intravenous treatment with VCN-01 is feasible and has an acceptable safety profile, with encouraging biological and clinical activity. (Journal for Immunotherapy of Cancer 2022;10:e003255. doi:10.1136/jitc-2021-003255).

Data from the publication had previously been presented, in part, in a poster at the ESMO 2019 annual meeting. The published study was a multicenter, open-label, dose-escalation phase I clinical trial of a single dose of intravenous VCN-01 alone (Part I, 16 patients with advanced refractory solid tumors) or in combination with nab-paclitaxel plus gemcitabine (Part II and III; patients with pancreatic adenocarcinoma). In Part II, 12 patients received VCN-01 dose concurrent with chemotherapy on day 1, whereas in Part III 14 additional patients received the dose of VCN-01 seven days before chemotherapy. The recommended Phase 2 doses (RP2D) were determined to be 1x1013 viral particles (vp)/patient in Part I, 3.3x1012 vp/patient in Part II and 1x1013 vp/patient in Part III. Based on its apparent safety profile and the absence of dose-limiting toxicities, 1x1013 vp/patient using sequential dosing schedule was selected for further clinical development.

8

Pharmacokinetic data showed dose linearity, as well as relevant VCN-01 exposure. Analysis of VCN-01 clearance in patients enrolled in Part II did not show significant differences with respect to patients receiving VCN-01 as a single agent. VCN-01 viral genomes were detected in tumor tissue in 5 out of 6 biopsies. A second viral peak in plasma and increased hyaluronidase serum levels suggested replication after intravenous injection in all patients. Increased levels of immune biomarkers (IFNγ, sLAG3, IL-6, IL-10) were found after VCN-01 administration. In patients with pancreatic adenocarcinoma, the overall response rate (ORR) was 50% for Part II and 50% for Part III, as assessed by the investigators. Median progression free survival (PFS) for patients in Part III was 6.7 months, and median overall survival (OS) was 13.5 months. Eight patients (66.7%) survived more than 12 months. In addition, in April 2021, a subgroup analysis of patients at the RP2D (1.x1013 vp/patient followed by nab-paclitaxel plus gemcitabine one week later, n=6) was conducted and showed an ORR of 83%, with a median PFS of 6.3 months and median OS of 20.8 months. Some VCN-01 treated patients appeared to benefit from late-onset responses. This form of delayed anti-tumor activity is not common with chemotherapy but is frequently observed with immunotherapies. We believe an immune mechanism of action associated with the oncolytic activity of VCN-01 may be the underlying explanation. VCN-01 appeared to convert the typically immunosuppressive tumor microenvironment of pancreatic adenocarcinomas into an enhanced inflammatory microenvironment (IDO, CD28, PD-1, CTL signature up-regulation, and collagen formation) after treatment.

Phase 2 Trial of intravenous VCN-01 with or without nab-paclitaxel plus gemcitabine in patients with solid tumors and PDAC

In January 2023, we dosed the first patients in VIRAGE, the Phase 2b randomized, open-label, placebo-controlled, multicenter clinical trial of systemically administered VCN-01 in combination with standard-of-care (SoC) chemotherapy (gemcitabine/nab-paclitaxel) as a first line therapy for patients with newly-diagnosed metastatic pancreatic ductal adenocarcinoma. The study is expected to enroll 92 patients and be conducted at approximately 25 sites in the US and EU. Two doses of VCN-01 are included in the treatment arm: the 1st dose is administered on day 1, then one week later 3 cycles of gemcitabine and nab-paclitaxel as standard of care is administered. The second VCN-01 dose is administered 7 days before the 4th cycle of chemotherapy (approximately 90 days after the first VCN-01 dose), followed by additional cycles of gemcitabine/nab-paclitaxel chemotherapy.

Patient dosing was initiated in the U.S. in July 2023 and the fourteen patients have received their second doses of intravenous VCN-01, which were well tolerated and demonstrated the expected VCN-01 safety profile.

On February 7, 2024, we announced that the Independent Data Monitoring Committee (IDMC) recommended the continuation of enrollment as planned into VIRAGE, a multinational, Phase 2b, randomized, open-label, controlled clinical trial evaluating VCN-01 in combination with standard-of-care chemotherapy (gemcitabine/nab-paclitaxel) as a first-line therapy for patients with metastatic pancreatic ductal adenocarcinoma (PDAC).

According to the IDMC's comprehensive assessment of clinical data from patients enrolled across 6 sites open in the U.S. and 9 sites open in Spain, the ongoing Phase 2b trial will continue without any changes to the protocol. No safety concerns were raised based on the evaluation of data presented at the IDMC meeting. Intravenous VCN-01 has been well tolerated and demonstrated a safety profile consistent with prior clinical trials. Importantly, no additional toxicities were observed in patients receiving a second dose of VCN-01, providing the first clinical evidence of the feasibility of repeated systemic dosing. VIRAGE remains on track to complete enrollment in the first half of 2024.

Retinoblastoma

Retinoblastoma is a tumor that originates in the retina and it is the most common type of eye cancer in children. It occurs in approximately 1/14,000 - 1/18,000 live newborns and accounts for 15% of the tumors in the pediatric population < 1 year old. The average age of pediatric patients at diagnosis is 2, and it rarely occurs in children older than 6. In the US, retinoblastoma shows an incidence rate of 3.3 per 1,000,000 with only about 200 to 300 children diagnosed per year according to the American Cancer Society. Bilateral retinoblastoma (Rb1 germinal mutation) represents 25-35% of the cases while unilateral retinoblastoma (sporadic mutation) accounts for 65-75%. While retinoblastoma is a highly curable disease in the US, with a current disease-free survival rate of >95%, the clinical challenge for those who treat retinoblastoma is to preserve life and to prevent the loss of an eye, blindness and other serious effects of treatment that reduce the patient’s life span or the quality of life. In addition, children with retinoblastoma have been more likely to lose their eye and die of metastatic disease in low-resource countries.

9

Current treatments are not without significant morbidity, which may include visual impairment and severe cosmetic deformity secondary to enucleation and/or irradiation of the orbital region. The use of intravenous chemotherapy and more recently intra-arterial and intravitreal chemotherapy have resulted in a significantly greater number of eyes preserved with fewer long-term effects compared to past treatments such as external radiation therapy. However, allowing patients with advanced intraocular disease to be treated conservatively, led to the appearance of a subgroup of patients with advanced intraocular disease who relapsed after an initial response. Most of these cases include those patients who present gross vitreous or subretinal seeding. Once the aforementioned treatments are exhausted, these patients rarely manage to preserve the eyes and vision and must be enucleated. The ocular preservation rate of these eyes with advanced disease is still less than 50%.

In February 2022, the FDA granted Orphan Drug designation to VCN-01 for the treatment of retinoblastoma.

Phase 1 Trial of intravitreal VCN-01 in patients with retinoblastoma

During the third quarter of 2017, VCN entered into a Clinical Trial Agreement with Hospital Sant Joan de Déu (Barcelona, Spain) to conduct an investigator sponsored Phase 1 clinical study evaluating the safety and tolerability of two intravitreal injections of VCN-01 in patients with intraocular retinoblastoma refractory to systemic, intra-arterial or intravitreal chemotherapy, or radiotherapy, in whom enucleation was the only recommended treatment (NCT03284268). Patients received two doses of VCN-01 injected 14 days apart using a dose escalation regimen. At this time, the dose-escalation phase of the study has already been completed in 6 patients distributed in two cohorts (2 x 109 vp/eye and 2 x 1010 vp/eye). VCN-01 was well tolerated to date after intravitreal administration, although some degree of intravitreal inflammation and associated turbidity were observed. Inflammation has been managed and potential turbidity minimized with local and systemic administration of anti-inflammatory drugs. VCN-01 does not appear to change the retinal function, and selective VCN-01 replication in retinoblastoma cells has been observed by immunohistochemical analysis. Replication within retinoblastoma tumors over time was detected and VCN-01 reduced the number of vitreous seeds in 4 out of 5 patients treated at 2 x 1010 vp/eye (n=5). The investigator has reported that one patient treated with VCN-01 has had a complete regression lasting more than 30 months.

This Phase 1 trial with VCN-01 has now completed enrollment and a total of nine (9) patients been treated. This study is expected to complete patient follow-up in Q1 2024. A pre-IND meeting with the FDA was held on December 19, 2023 to discuss the path forward for VCN-01 as an adjunct to chemotherapy in pediatric patients with advanced retinoblastoma. The FDA provided some guidance on the potential endpoints and patient population for an advanced clinical trial and encouraged submission of a formal protocol under a US IND in order to provide more detailed commentary.

Dr. Angel Montero-Carcaboso presented new data from the study for which he is the lead investigator atan oral presentation entitled “Topotecan enhances oncolytic adenovirus infection, replication and antitumor activity in retinoblastoma,” at Fundació Sant Joan de Déu at the SIOP 2022 Congress of the International Society of Pediatric Oncology, that was held in Barcelona, Spain from September 28-October 1, 2022. The new data from the study for which Dr. Angel Montero-Carcaboso is the lead investigator further support evaluation of VCN-01, an oncolytic adenovirus expressing hyaluronidase, and topotecan for the treatment of refractory retinoblastoma. Key data and conclusions showcased in the SIOP presentation include:

| ● | VCN-01 treatment in combination with topotecan, but not with carboplatin or melphalan, significantly increased VCN-01 infection and replication in retinoblastoma cells (p=0.0007) in vitro. |

| ● | In athymic mice engrafted with human retinoblastomas, topotecan administered systemically after intratumoral VCN-01 increased viral genome replication and the number of VCN-01 infected cells when compared to administration of VCN-01 alone (p = 0.0002). |

| ● | Sequential administration of intratumoral VCN-01 followed by systemic topotecan significantly increased median ocular survival, compared to VCN-01 alone (p =0.0364). |

10

VCN-01 in combination with Immunomodulatory therapeutics

Based on the clinical and pre-clinical data described below, we believe that the administration of VCN-01, can elicit an anti-tumor immune response that could potentiate the effects of VCN-01 and co-administered therapeutics. Biopsies from the Phase 1 trial of PDAC patients administered intravenous VCN-01 demonstrated lymphocyte (CD8+) infiltration and modulated levels of immune markers in tumors, including an induction of the PD1/PD-L1 expression in tumor tissue from some of the patients. Preclinical experiments demonstrated that VCN-01 significantly increased extravasation of an anti-PD-L1 antibody into subcutaneous xenograft tumors compared to non-treated (PBS) tumors and also that PH20 hyaluronidase improves the ingress of T-cells in animal models. Thus, we hypothesize that the administration of VCN-01 into the tumor will help to overcome the observed resistance to PD-L1 checkpoint inhibitors and to mesothelin-directed CAR-T cells.

Phase 1 Trial of intravenous VCN-01 in Combination with Durvalumab in Subjects with Recurrent/ Metastatic SCCHN

In February 2019, VCN entered into a Clinical Trial Agreement with Catalan Institute of Oncology (ICO) (Spain) to conduct an investigator sponsored Phase 1 clinical study to evaluate the safety, tolerability and RP2D of a single intravenous injection of VCN-01 combined with durvalumab in two administration regimens: VCN-01 concomitantly with durvalumab, or sequentially with durvalumab starting two weeks after VCN-01 administration (NCT03799744). The study is also designed to evaluate whether VCN-01 treatment can re-sensitize PD-(l)-1 refractory tumors to subsequent anti-PD-L1 therapy. Durvalumab is a human monoclonal antibody (mAb) of the immunoglobulin G (IgG) 1 kappa subclass that inhibits binding of PD-L1. It is marketed as IMFINZI® by AstraZeneca/MedImmune, who supplied the product for its use in the clinical study. This Phase I trial is a multicenter, open label, dose escalation study in patients with histologically confirmed head and neck squamous cell carcinoma from specific sites: oral cavity, oropharynx, larynx or hypopharynx that is recurrent/metastatic (R/M) and not amenable to curative therapy by surgery or radiation. In addition, all patients should have undergone prior exposure to anti-PD-(L) 1 and progressed. Patients are entered at each dose level, according to a planned dose escalation schedule. The treatment is a single intravenous VCN-01 dose combined with concomitant intravenous durvalumab (MEDI4736) 1500 mg Q4W (Arm I) or durvalumab starting two weeks after VCN-01 administration (“sequential schedule”; Arm II). Patient recruitment into Arm I and Arm II was performed concurrently. Intravenous VCN-01 was administered to each patient only once during the trial at the VCN-01 dose level to which they were randomized. Durvalumab was administered Q4W until disease progression, unacceptable toxicity, withdrawal of consent, or another discontinuation criterion. Patient recruitment into the study was completed in February 2022 with a total of 18 patients enrolled. On September 05, 2022 we announced a presentation of initial data from this study in a poster at the European Society for Medical Oncology (ESMO) Congress. The poster reported that treatment with VCN-01 had an acceptable safety profile when administered with durvalumab in the sequential schedule and the most common treatment-related adverse events were dose-dependent and reversible pyrexia, flu-like symptoms and increases in liver transaminases. Sustained blood levels of VCN-01 viral genomes and increased serum hyaluronidase levels were maintained for over six weeks and analysis of tumor samples showed an increase in CD8 T cells (a marker of tumor inflammation); upregulation of PD-L1; and downregulation of matrix-related pathways after VCN-01 administration. The last patients in this study are currently being followed for overall survival and patent samples are being analyzed to evaluate potential VCN-01 pharmacodynamic effects.

On October 16, 2023, we presented additional data from this study in a poster at the European Society for Medical Oncology (ESMO) 2023 Congress held virtually and in Madrid, Spian from October 20-24, 2023. Key data and conclusions featured in the ESMO presentation include:

| ● | 20 patients were enrolled with a median of 4 prior lines of therapy, from which six in the concomitant (CS) (single dose of VCN-01 in combination with durvalumab on day 1) and 12 in the sequential (SS) (single dose of VCN-01 on day -14 and durvalumab on day 1) were evaluable for response. |

| ● | In the CS cohort at the 3.3×1012 viral particles (vp) dose, overall survival (OS) was 10.4 months. |

| ● | In the SS cohort at the 3.3×1012vp dose OS was 15.5 months, whereas in the SS cohort at the 1×1013 vp dose OS was 17.3 months. |

| ● | 11 patients (61.1%) were alive >12 months (2 in CS; 5 in SS at 3.3×1012vp, 4 in SS at 1×1013 vp). |

| ● | In spite of the advanced stage of the disease, and a global objective response rate for the trial of 5.5%, most of the patients appeared to benefit from subsequent treatment, with 2 patients showing complete responses to palliative chemotherapy and at least one patient still alive 4 years after entering the study. |

| ● | Biological activity: Patients showed VCN-01 replication and increased serum hyaluronidase levels were maintained for over six weeks. |

11

| ● | Observed an increase in CD8 T cells, a marker of tumor inflammation and an upregulation of PD-L1 in tumors. |

| ● | Increase of PDL1-CPS (16/21; p=0.013) and CD8 T-cells (12/21; p=0.007) from baseline were found in tumor biopsies. |

| ● | There was a statistical significant correlation between OS observed in patients and CPS on day 8 (p=0.005). |

Phase 1 Trial evaluating the safety and feasibility of huCART-meso cells when given in combination with VCN-01

In July 2021, VCN entered into a Clinical Trial Agreement with the University of Pennsylvania (Philadelphia) to conduct an investigator sponsored Phase 1 clinical study to evaluate the safety, tolerability and feasibility of intravenous administration of VCN-01 in combination with lentiviral transduced huCART-meso cells (developed by the laboratory of Dr. Carl June) in patients with histologically confirmed unresectable or metastatic pancreatic adenocarcinoma and serous epithelial ovarian cancer (NCT05057715). This is a Phase I study evaluating the combination of VCN-01 when given in combination with huCART-meso cells in a dose-escalation design in two cohorts (N = 3-6), where patients receive VCN-01 as a single IV infusion (at 3.3x1012 or 1x1013 vp) on Day 0, followed by a single dose of 5x107 huCART-meso cells on Day 14 via IV infusion. huCART-meso cells are modified T-cells targeting the mesothelin antigen, which is frequently expressed in multiple tumor types, particularly in pancreatic and ovarian cancers. Dr. June’s previous clinical studies have shown that huCART-meso cells encounter significant challenges in the tumor microenvironment, including immunosuppressive cells and soluble factors as well as metabolic restrictions. Initial VCN-01 clinical data from the studies described above suggest that administration of VCN-01 may increase tumor immunogenicity and improve access of the huCART-meso cells to tumor cells. This Phase I study will evaluate the safety and tolerability of the VCN-01 huCART-meso cell combination and test the hypothesis that administration of VCN-01 may enhance the potential antitumor effects of the co-administered huCART-meso cells.

On July 8, 2022, we were notified that the first patient to be dosed with VCN-01 had passed the safety evaluation period in this study. The study is on-going.

On June 22, 2023, at their Cellicon Valley conference, and again at the Society for Immunotherapy of Cancer (SITC) meeting in San Diego, CA on November 03, 2023, and the International Oncolytic Virotherapy Conference (IOVC2023) in Calgary on November 13 2023, University of Pennsylvania investigators presented preliminary clinical safety and pharmacokinetic data from this study highlighting the feasibility of administering VCN-01 in sequence with huCART-meso cells in pancreatic and ovarian cancer patients. VCN-01 persistence was suggestive of tumor infection and active replication. The peak and duration of huCART-meso T cells in the peripheral blood as well as duration of stable disease in evaluable patients showed encouraging trends.

The study will test higher doses of VCN-01 and will interrogate tumor biopsies to gain further insights. The results will inform and guide optimization of the combination of CAR T cells with oncolytic virus.

Phase 1 Trial evaluating the intravenous administration of VCN-01 in patients prior to surgical resection of high-grade brain tumors

In the second quarter of 2021, VCN entered into a Clinical Trial Agreement with the University of Leeds (UK) to sponsor a proof-of-concept Phase 1 clinical study to evaluate whether intravenously administered VCN-01 can cross the blood-brain barrier and infect the target brain tumor. This is an open-label, non-randomized, single center study of VCN-01 given intravenously at a dose of 1x1013 virus particles to patients prior to planned surgery for recurrent high-grade primary or metastatic brain tumors. We believe that the intravenous delivery of anti-cancer therapy to brain tumors, if effective, may enable the treatment of systemically disseminated brain metastases and may allow for reduction in the need to use neurosurgery to administer the drugs. This study aims to assess the presence of VCN-01 within the resected surgical specimen after systemic VCN-01 delivery and determine the safety of intravenous VCN-01 in patients with recurrent high-grade glioma or brain metastases. By confirming the presence of VCN-01 in high grade brain tumors following intravenous delivery, this study may pave the way for larger trials to study VCN-01 efficacy, both as a monotherapy and in combination with PD-1/PD-L1 blockade. This trial has already received approval from Medicines & Healthcare Products Regulatory Agency (MHRA) from UK Government.

On January 9, 2023, we issued a press release announcing that the first patient was dosed in this study and recruitment is on-going.

12

Our Current Gastrointestinal (GI) and Microbiome-Focused Pipeline

Our SYN-004 (ribaxamase) and SYN-020 clinical programs are focused on the gastrointestinal tract (GI) and the gut microbiome, which is home to billions of microbial species and composed of a natural balance of both “good” beneficial species and potentially “bad” pathogenic species. When the natural balance or normal function of these microbial species is disrupted, a person’s health can be compromised. All of our programs are supported by our growing intellectual property portfolio. We are maintaining and building our patent portfolio through: filing new patent applications; prosecuting existing applications; and licensing and acquiring new patents and patent applications.

SYN-004 (ribaxamase) — Prevention of antibiotic-mediated microbiome damage, thereby preventing overgrowth and infection by pathogenic organisms such as Clostridioides difficile infection (CDI) and vancomycin resistant Enterococci (VRE), and reducing the incidence and severity of acute graft-versus-host disease (aGVHD) in allogeneic HCT recipients

SYN-004 (ribaxamase) is a proprietary oral capsule prophylactic therapy designed to degrade certain IV beta-lactam antibiotics excreted into the GI tract and thereby maintain the natural balance of the gut microbiome. Preventing beta-lactam damage to the gut microbiome has a range of potential therapeutic outcomes, including prevention of CDI, suppression of the overgrowth of pathogenic species (particularly antimicrobial-resistant organisms) and potentially reducing the incidence and/or severity of aGVHD in allogeneic hematopoietic cell transplant (HCT) patients. SYN-004 (ribaxamase) 75 mg capsules are intended to be administered orally while patients are administered certain IV beta-lactam antibiotics. The capsule dosage form is designed to release the SYN-004 (ribaxamase) enzyme into proximal small intestine, where it has been shown to degrade beta-lactam antibiotics in the GI tract without altering systemic antibiotic levels. Beta-lactam antibiotics are a mainstay in hospital infection management and include the commonly used penicillin and cephalosporin classes of antibiotics.

Clostridioides difficile Infection

Clostridioides difficile (formerly known as Clostridium difficile and often called C. difficile or CDI) is a leading type of hospital acquired infection and is frequently associated with IV beta-lactam antibiotic treatment. The Centers for Disease Control and Prevention (CDC) identified C. difficile as an “urgent public health threat,” particularly given its resistance to many drugs used to treat other infections. CDI is a major unintended risk associated with the prophylactic or therapeutic use of IV antibiotics, which may adversely alter the natural balance of microflora that normally protect the GI tract, leading to C. difficile overgrowth and infection. Other risk factors for CDI include hospitalization, prolonged length of stay (estimated at 7 days), underlying illness, and immune-compromising conditions including the administration of chemotherapy and advanced age. According to a paper published in BMC Infectious Diseases (Desai K et al. BMC Infect Dis. 2016; 16: 303) the economic cost of CDI was approximately $5.4 billion in 2016 ($4.7 billion in healthcare settings; $725 million in the community) in the U.S., mostly due to hospitalizations.

Limitations of Current Treatments and Market Opportunity

CDI is a widespread and often drug resistant infectious disease. Approximately 20% of patients who have been diagnosed with CDI experience a recurrence of CDI within one to three months. Furthermore, controlling the spread of CDI has proven challenging, as the C. difficile spores are easily transferred to patients via normal contact with healthcare personnel and with inanimate objects. There is currently no vaccine or approved product for the prevention of primary (incident) CDI. The current standard of care for primary CDI, as outlined by the Infectious Disease Society of America (IDSA), is to treat with powerful antibiotics such as fidaxomicin or vancomycin. Prolonged use of fidaxomicin and vancomycin has been shown to further exacerbate damage to the gut microbiome, leading to increased risk of CDI recurrence as well as the emergence of pathogenic and antimicrobial-resistant (AMR) organisms, such as vancomycin-resistant enterococci (VRE). AMR is a serious global threat and one which world leaders have begun to take action against. According to the European Society of Clinical Microbiology and Infections Disease (ECCMID), failure to address AMR could lead to a potential “antibiotic Armageddon”, resulting in 10 million deaths worldwide by 2050 and may cost as much as $100 trillion in worldwide economic output.

13

According to a paper published in BMC Infectious Diseases,”Epidemiological and economic burden of Clostridium difficile in the United States: estimates from a modeling approach”. (Desai et.al., BMC Infect Dis 16: 303), it is estimated that approximately 606,000 patients are infected with C. difficile annually in the U.S., and it has been reported that approximately 44,500 deaths are attributable to CDI-associated complications each year. According to IMS Health Incorporated*, in 2016, the potential addressable market for SYN-004 (ribaxamase) included approximately 227 million doses of intravenous Penicillin and Cephalosporin antibiotics which were administered in the United States and which may contribute to the onset of CDI. Additional data derived from IMS Health Incorporated states that in 2016, the worldwide market for SYN-004 (ribaxamase)-addressable intravenous beta-lactam antibiotics was approximately 7.5 billion doses, which may represent a multi-billion-dollar market opportunity for us. If approved, SYN-004 (ribaxamase) would be the first therapeutic intervention indicated to prevent the onset of antibiotic-mediated primary CDI.

Phase 1a and 1b Clinical Trial Pharmacokinetic Data

In March 2015, we reported supportive pharmacokinetic data from a Phase 1a clinical trial, which suggested that SYN-004 (ribaxamase) should have no effect on the IV antibiotic in the bloodstream, allowing the antibiotic to fight the primary infection. In February 2015, we reported supportive topline results from a subsequent Phase 1b clinical trial of escalating doses of oral SYN-004 (ribaxamase), with no safety or tolerability issues reported at dose levels and dosing regimens that were equivalent to or exceeded those expected to be studied in subsequent clinical trials. The Phase 1a (40 participants) and 1b (24 participants) clinical trials of SYN-004 (ribaxamase) were initiated in December 2014.

Two Phase 2a Clinical Trials: Topline Results

In December 2015, we reported supportive topline results from our first Phase 2a clinical trial of SYN-004 (ribaxamase, NCT02419001). The study demonstrated that SYN-004 (ribaxamase) successfully degraded IV ceftriaxone in the chyme of ten participants with ileostomies without affecting the levels of ceftriaxone in the bloodstream. In May 2016, we reported supportive topline results from a second Phase 2a clinical trial of SYN-004 (ribaxamase) in 14 healthy participants with functioning ileostomies administered IV ceftriaxone with and without oral SYN-004 (ribaxamase) (NCT02473640). This second study demonstrated that the 150 mg dose of SYN-004 (ribaxamase), both alone and in the presence of the proton pump inhibitor (PPI), esomeprazole, degraded ceftriaxone excreted into the chyme resulting in ceftriaxone levels that were low or not-detectable. Ceftriaxone plasma concentrations in participants of the second study were not altered by SYN-004 (ribaxamase) in the presence or absence of an oral PPI, suggesting limited drug-drug interactions. The 150 mg dose of SYN-004 (ribaxamase) was well tolerated by all participants in this clinical trial.

Phase 2b Proof of Concept Clinical Trial Design & Results

In September 2015, we initiated a multicenter, randomized, placebo-controlled Phase 2b proof-of-concept clinical study in 412 patients (206 per group; NCT02563106).

On January 5, 2017, we announced positive topline data from our Phase 2b proof-of-concept clinical trial intended to evaluate the ability of SYN-004 (ribaxamase) to prevent CDI, CDAD (C. difficile-associated diarrhea) and AAD (antibiotic-associated diarrhea) in patients hospitalized for a lower respiratory tract infection and receiving IV ceftriaxone. Results from this study demonstrated that SYN-004 (ribaxamase) achieved its primary endpoint of significantly reducing CDI. Preliminary analysis of the data indicated seven confirmed cases of CDI in the placebo group compared to two cases in the SYN-004 (ribaxamase) treatment group. Patients receiving SYN-004 (ribaxamase) achieved a 71.4% relative risk reduction (p-value=0.045) in CDI rates compared to patients receiving placebo. SYN-004 (ribaxamase) treated patients also demonstrated a significant reduction in new colonization by vancomycin-resistant enterococci (VRE) compared to placebo (p-value=0.002). Results from this trial also demonstrated that patients administered ribaxamase in conjunction with IV-ceftriaxone demonstrated comparable cure rates (approximately 94%) for the treatment of primary infection compared to the placebo group. Results from this trial also demonstrated that the percentage of subjects reporting at least one treatment emergent adverse event (TEAE) was similar between SYN-004 (ribaxamase) and placebo treatment groups (40.8% vs 44.2%). Adverse events reported during this trial were comparable between treatment and placebo arms. Serious adverse events (SAEs) in the treatment arm, including fatal AEs, which exceeded those in the placebo arm, were not considered drug-related by investigators at the clinical sites, or by an independent third-party, each of whom determined SAEs were attributable to disparities in the underlying health and comorbidities between the groups.

* |

This information is an estimate derived from the use of information under license from the following IMS Health Incorporated information service: IMS Health Analytics for the full year 2016. IMS expressly reserves all rights, including rights of copying, distribution, and republication. |

14

On October 6, 2016 we were awarded a government contract in the amount of $521,014 by the CDC’s Broad Agency Announcement (BAA) 2016-N-17812 to examine changes in the gut resistome of patients in our Phase 2b clinical study. Data generated under this contract are consistent with SYN-004’s (ribaxamase) mode of action of preserving the normal gut flora by degrading ceftriaxone in the upper GI tract of study participants treated with SYN-004 (ribaxamase). The data further demonstrated that SYN-004 (ribaxamase) significantly reduced the loss of microbial diversity, reduced overgrowth of opportunistically pathogenic species(such as VRE), and reduced the emergence of antimicrobial resistance (AMR) genes caused by ceftriaxone treatment in SYN-004 (ribaxamase) treated patients compared to placebo.

Future Potential Regulatory Strategy for Prevention of Primary CDI

On November 21, 2018, we announced results from our End-of-Phase 2 meeting with the FDA during which key elements of a Phase 3 clinical program were confirmed. Pursuant to the meeting, the FDA proposed criteria for Phase 3 clinical efficacy and safety which, if achieved, may support submission for marketing approval of SYN-004 (ribaxamase) on the basis of a single Phase 3 clinical trial. The proposed SYN-004 (ribaxamase) Phase 3 clinical program entails a single, global, event-driven clinical trial with a fixed maximum number of approximately 4,000 patients for total enrollment and evaluates the potential efficacy and safety of ribaxamase in a broad patient population by enrolling patients with a variety of underlying infections treated with a range of IV beta-lactam antibiotics.

The proposed Phase 3 clinical trial incorporates co-primary safety and efficacy endpoints (mortality and the reduction in the incidence of CDI at one month after the last drug dose in the SYN-004 (ribaxamase) treatment group versus placebo,respectively). We expect the clinical development costs to complete this trial to be in excess of $80 million and anticipate initiating the Phase 3 clinical program only after securing additional potential financing via a strategic partnership.

Acute Graft-Versus-Host-Disease in Allogeneic Hematopoietic Cell Transplant (allogeneic HCT) Recipients & SYN-004 (ribaxamase)

In parallel with our clinical and regulatory efforts, we completed a Health Economics Outcomes Research (HEOR) study, which was conducted to generate key insights on how we can expect Health Care Practitioners, or HCPs, to evaluate patient access for SYN-004 (ribaxamase) while also providing a framework for potential reimbursement strategies. After evaluating findings from the study, we believe that there is significant potential value in exploring the development of SYN-004 (ribaxamase) in a narrower patient population where the incidence of the disease endpoint is high and the clinical development may be less costly.

We believe allogeneic hematopoietic cell transplant (HCT) recipients, who have a very high risk of CDI, VRE colonization and potentially fatal bacteremia, and acute-graft-vs-host disease (aGVHD), represent such a patient population. Published literature has demonstrated a strong association between these adverse outcomes and microbiome damage caused by IV beta-lactam antibiotics in these patients. Approximately 80-90% of HCT recipients receive IV beta-lactam antibiotics to treat febrile neutropenia. Penicillins and cephalosporins are first-line therapies in the USA and EU, whereas carbapenems are first-line in China. Antibiotic-mediated damage to the gut microbiome is strongly associated with GVHD, bloodstream infections, VRE bacteremia, transplant relapse, and increased mortality in HCT recipients, raising concern over the spectrum of antibiotics used during HCT.

CDI occurs in up to 31% of HCT patients and is associated with GVHD and increased mortality. aGVHD occurs in 30-60% of allogeneic HCT recipients and is recognized as a primary contributor to morbidity and mortality in this patient population. The most recent available data indicate approximately 8,000 reported allogeneic HCT procedures each year in the USA, 19,800 procedures in Europe, 12,700 in China, and 3,500 in Japan. First-line treatments for aGVHD fail in more than 50% of patients and 2-year survival in patients with steroid refractory aGVHD is only 20%. At least one U.S. study found allogeneic HCT recipients who developed aGVHD had 3-times higher in-hospital mortality and almost 2-fold higher median hospital costs than patients who did not develop aGVHD. It has been reported that in-patient costs for allogeneic HCT in the USA range from $180,000-$300,000 depending on the disease severity. In 2014, all-cause costs for allogeneic HCT in the USA were greater than $600,000 per patient (up to 12 months post-transplant). VRE infection is a persistent problem in HCT patients and VRE colonization after HCT has been associated with decreased patient survival.

Phase 1b/2a Clinical Study in Allogeneic HCT Recipients

In August 2019, we entered into a Clinical Trial Agreement (CTA) with the Washington University School of Medicine (Washington University) to conduct a Phase 1b/2a clinical trial of SYN-004 (ribaxamase). Under the terms of this agreement, we serve as the sponsor of the study and supply SYN-004 (ribaxamase). Dr. Erik R. Dubberke, Professor of Medicine and Clinical Director, Transplant Infectious Diseases at Washington University and a member of the SYN-004 (ribaxamase) steering committee serves as the principal investigator of the clinical trial in collaboration with his Washington University colleague Dr. Mark A. Schroeder, Associate Professor of Medicine, Division of Oncology, Bone Marrow Transplantation and Leukemia.

15

The Phase 1b/2a clinical trial will comprise a single center, randomized, double-blinded, placebo-controlled clinical trial of oral SYN-004 (ribaxamase) in up to 36 evaluable adult allogeneic HCT recipients. The goal of this study is to evaluate the safety, tolerability and potential absorption into the systemic circulation (if any) of oral SYN-004 (ribaxamase; 150 mg four times daily) administered to allogeneic HCT recipients who receive an IV carbapenem or beta-lactam antibiotic to treat fever. Study participants will be enrolled into three sequential cohorts administered a different study-assigned IV antibiotic. Each cohort seeks to complete eight evaluable participants treated with SYN-004 (ribaxamase) and four evaluable participants treated with placebo. Safety and pharmacokinetic data for each cohort will be reviewed by an independent Data and Safety Monitoring Committee, which will make a recommendation on whether to proceed to the next IV antibiotic cohort. The study will also evaluate potential protective effects of SYN-004 on the gut microbiome as well as generate preliminary information on potential therapeutic benefits and patient outcomes of SYN-004 in allogeneic HCT recipients.

To date, we have completed the first of 3 cohorts (Cohort 1) in this study, which enrolled 19 patients who received at least 1 dose of study drug (SYN-004 or Placebo randomized 2:1). Sixteen patients received at least one dose of intravenous (IV) meropenem and 12 of these patients completed sufficient doses of IV meropenem to be evaluable towards the study endpoints. On September 27, 2022, we issued a press release announcing positive outcomes from the Data and Safety Monitoring Committee (“DSMC”) review of results from the first Cohort and their recommendation that the study may proceed to enroll Cohort 2 in which study drug (SYN-004 or Placebo) is administered in combination with the IV beta-lactam antibiotic piperacillin/tazobactam. On November 3, 2022 we announced the first patient had been dosed in Cohort 2. Patient dosing is on-going and if enrollment proceeds on the current schedule, we may be positioned to announce data readouts for the second cohort during the first half of 2024 and the third cohort during the first half of 2025.

On February 16, 2023 and April 13, 2023 we announced the presentation of safety and pharmacokinetic data from Cohort 1 of the Phase 1b/2a Clinical Trial of SYN-004 (ribaxamase) in allogeneic hematopoietic cell transplant recipients at the 2023 Tandem Meetings: Transplantation & Cellular Therapy Meetings of ASTCT and CIBMTR and at the European Congress of Clinical Microbiology & Infectious Diseases (ECCMID) respectively.

SYN-020 — Oral Intestinal Alkaline Phosphatase (IAP)

SYN 020 is a quality-controlled, recombinant version of bovine Intestinal Alkaline Phosphatase (IAP) produced under cGMP conditions and formulated for oral delivery. The published literature indicates that IAP functions to diminish GI and systemic inflammation, tighten the gut barrier to diminish “leaky gut,” diminish fat absorption, and promote a healthy microbiome. Despite its broad therapeutic potential, a key hurdle to commercialization has been the high cost of IAP manufacture which is commercially available for as much as $10,000 per gram. We believe we have developed technologies to traverse this hurdle and now have the ability to produce more than 3 grams per liter of SYN-020 and anticipate a cost of roughly a few hundred dollars per gram at commercial scale. Based on the known mechanisms as well as our own supporting animal model data, we intended to initially develop SYN-020 to mitigate the intestinal damage caused by radiation therapy that is routinely used to treat pelvic cancers. While we believe SYN-020 may play a pivotal role in addressing acute and long-term complications associated with radiation exposure to the GI tract, we have also begun planning for potential development of SYN-020 in large market indications with significant unmet medical needs. Such indications include celiac disease, non-alcoholic fatty liver disease (“NAFLD”), and indications to treat and prevent metabolic and inflammatory disorders associated with aging, which are supported by our collaboration with Massachusetts General Hospital (“MGH”).

On June 30, 2020, we submitted an IND application to the FDA in support of an initial indication for the treatment of radiation enteropathy secondary to pelvic cancer therapy. On July 30, 2020, we announced that we received a study-may-proceed letter from the FDA to conduct a Phase 1a single-ascending-dose (“SAD”) study in healthy volunteers designed to evaluate SYN-020 for safety, tolerability and pharmacokinetic parameters (NCT04815993). On April 1, 2021, we announced that enrollment had commenced in the Phase 1 SAD clinical trial of SYN-020. On June 29, 2021, we announced that enrollment, patient dosing and observation had been completed in the Phase 1, open-label, SAD study of SYN-020. The SAD study enrolled 6 healthy adult volunteers into each of four cohorts with SYN-020 given orally as single doses ranging from 5 mg to 150 mg. The data demonstrated that SYN-020 maintained a favorable safety profile, was well tolerated at all dose levels, and no adverse events were attributed to the study drug. No serious adverse events were reported.

16

During the third quarter of 2021 we initiated a Phase 1 clinical study evaluating multiple ascending doses (“MAD”) of SYN-020 (NCT05045833). On October 21, 2021 we announced that patient enrollment, dosing, and observation commenced in the Phase 1 MAD study of SYN-020. The placebo-controlled, blinded study enrolled 32 healthy adult volunteers into four cohorts with SYN-020 administered orally in doses ranging from 5 mg to 75 mg twice daily for 14 days with a follow-up evaluation at day 35. Each cohort included six subjects who received SYN-020 and two who received placebo. On May 10, 2022, we announced positive safety data from the Phase 1 MAD study demonstrating that SYN-020 maintained a favorable safety profile and was well-tolerated across all dose levels. There were a few treatment-related adverse events, and all were mild (grade 1) and resolved without medical intervention. The most common adverse event, constipation, occurred in three out of 24 subjects in the treatment arm and in one out of eight subjects in the placebo arm. No adverse event led to discontinuation of the study drug and there were no serious adverse events. Additionally, fecal SYN-020 analyses verified intestinal bioavailability while plasma levels of SYN-020 were below the limit of quantitation in all samples at all timepoints verifying that SYN-020 was not absorbed into the systemic circulation.

During the second quarter of 2020, we announced that we entered into an agreement with Massachusetts General Hospital (“MGH”) granting us an option for an exclusive license to intellectual property and technology related to the use of IAP to maintain GI and microbiome health, diminish systemic inflammation, and treat age-related diseases. During the second quarter of 2021, we announced an amendment to our option for an exclusive license agreement with MGH to include intellectual property and technology related to the use of SYN-020 to inhibit liver fibrosis in select diseases, including NAFLD. Research published by a team of investigators led by Richard Hodin, MD, Chief of the Massachusetts General Hospital Division of General and Gastrointestinal Surgery and Professor of Surgery, Harvard Medical School, evaluated long-term oral supplementation of IAP, including SYN-020, in mice. Dr. Hodin’s research demonstrated that IAP administration, starting at 10 months of age, slowed the microbiome changes, gut-barrier dysfunction, and gastrointestinal and systemic inflammation that normally accompany aging. Additionally, the IAP administration resulted in improved metabolic profiles in the aged mice, diminished frailty, and extended lifespan. Under the terms of the agreement, we are granted exclusive rights to negotiate a worldwide license with MGH to commercially develop SYN-020 to treat and prevent metabolic and inflammatory diseases associated with aging. If executed, we plan to use this license in the advancement of an expanded clinical development program for SYN-020.

The Phase 1 data from our SAD and MAD studies are intended to support the development of SYN-020 in multiple clinical indications including radiation enteritis, NAFLD, celiac disease, and indications supported by our collaboration with Massachusetts General Hospital. With our transition to an oncology focused Company, we are exploring strategic opportunities to enable advancement of this potentially valuable asset.

Future Potential Regulatory Strategy for Prevention of Primary CDI

As part of our strategic transformation into an oncology focused company, we are exploring value creation options for our SYN-004 and SYN-020 assets, including out-licensing or partnering.

Research Programs

VCN-11 Albumin Shield™ Technology

VCN-11 is a novel virus that we believe has the potential to extend our OV platform. VCN-11 has been engineered to contain all of the features of VCN-01 as well as an additional modification to include an albumin binding domain (ABD) in the virus capsid. The virus capsid is the target for neutralizing antibodies (NAbs) that are generated by the host immune system to destroy circulating viruses. The presence of an albumin binding domain, however, blocks the binding of most neutralizing antibodies, which allows the virus to reach the tumor following intravenous administration. This “Albumin Shield” works because human blood contains a large amount of albumin to coat the VCN-11 virus. Importantly, this coating of albumin appears to be displaced after the virus reaches tumor cells to infect them. In pre-clinical mouse studies to test the functionality of the “albumin shield”, mice pre-immunized with virus are able to completely neutralize an unmodified OV because they have a large concentration of neutralizing antibodies in their blood. By contrast, viruses containing the albumin binding domain such as VCN-11 are not neutralized and retain their ability to infect and destroy tumor cells. We believe these results support the further development of VCN-11 for tumors in which rapid multi-dosing may be beneficial.