UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from N/A to N/A

Commission File Number 0-16540

|

UNITED BANCORP, INC. |

|

|

(Exact name of registrant as specified in its Charter.) |

|

Ohio |

|

34-1405357 |

(State or other jurisdiction of incorporation or organization) |

|

(IRS) Employer Identification No.) |

201 South Fourth Street, Martins Ferry, Ohio |

|

43935 |

(Address of principal executive offices) |

|

(ZIP Code) |

Registrant’s telephone number, including area code: (740) 633-0445

Securities registered pursuant to Section 12(b) of the Act:

|

|

|||

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which |

Common Stock, Par Value $1.00 |

|

UBCP |

|

NASDQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒.

Indicated by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐s

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒. No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of June 30, 2023 the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $57,635,454 based on the closing sale price as reported on the National Association of Securities Dealers Automated Quotation System.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

Registrant had 5,702,685 common shares outstanding as of March 11, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the Annual Shareholders meeting to be held April 17, 2024 are incorporated by reference into Part III.

Portions of the Annual Report to Shareholders for the year ended December 31, 2023 are incorporated by reference into Parts I and II.

PART I

Item 1Business

Business

United Bancorp, Inc. (Company) is a bank holding company headquartered in Martins Ferry, Ohio. The Company is an Ohio corporation which filed its initial articles of incorporation on July 8, 1983. At December 31, 2023 the Company has one wholly-owned subsidiary bank, Unified Bank, Martins Ferry, Ohio (Unified, or the Bank).

The Company serves customers in northeastern, eastern, southeastern and south central Ohio and the Northern panhandle of West Virginia and is engaged in the business of commercial and retail banking in Belmont, Harrison, Jefferson, Tuscarawas, Carroll, Athens, Hocking, and Fairfield counties and the surrounding localities. The bank also operates in Marshall County West Virginia. The Bank provides a broad range of banking and financial services, which includes accepting demand, savings and time deposits and granting commercial, real estate and consumer loans. Unified conducts its business through its main office and stand alone operations center in Martins Ferry, Ohio and eighteen branches located in the counties mentioned above.

Unified has no single customer or related group of customers whose banking activities, whether through deposits or lending, would have a material impact on the continued earnings capabilities if those activities were removed.

For a discussion of the development of the Company’s business over the course of the prior fiscal year, refer to “Management’s Discussion and Analysis” from the 2023 Annual Report To Shareholders filed herewith as Exhibit 13.

Competition

The markets in which Unified operates continue to be highly competitive. Unified competes for loans and deposits with other retail commercial banks, savings and loan associations, finance companies, credit unions and other types of financial institutions within the Mid-Ohio valley geographic area along the eastern border of Ohio including Belmont, Harrison and Jefferson counties and extending into the northern panhandle of West Virginia and the Tuscarawas and Carroll County geographic areas of northeastern Ohio. Unified also encounters similar competition for loans and deposits throughout the Athens, and Fairfield County geographic areas of central and southeastern Ohio.

Pursuant to deposit market share information provided by the FDIC as of June 30, 2023, Unified competes with approximately 39 other commercial banking institutions in its Ohio and West Virginia markets. Based on this information, the Bank ranked fifth in total deposit market share. The top four institutions in Unified’s primary banking markets included: Huntington National Bank; JP Morgan Chase Bank; PNC Bank; and Wesbanco Bank.

Supervision and Regulation

Regulatory Environment

The banking industry is highly regulated. We are subject to supervision, regulation, and examination by various federal and state regulators, including the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and the Ohio Division of Financial Institutions (ODFI). The statutory and regulatory framework that governs us is generally intended to protect depositors and customers, the Deposit Insurance Fund (DIF) maintained by the FDIC, the U.S. banking and financial system, and financial markets as a whole.

Banking statutes, regulations, and policies are continually under review by Congress, state legislatures, and federal and state regulatory agencies. In addition to laws and regulations, state and federal bank regulatory agencies may issue policy statements, interpretive letters, and similar written guidance applicable to the Company and the Bank. Any change in the statutes, regulations, or regulatory policies applicable to us, including changes in their interpretation or implementation, could have a material effect on our business or organization.

Several of the more significant regulatory provisions applicable to banks and bank holding companies to which the Company and Unified are subject are discussed below. To the extent that the following information describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory provisions. Any change in applicable law or regulation may have a material effect on the business and prospects of the Company and Unified.

Supervision, Examination and Enforcement

A principal objective of the U.S. bank regulatory regime is to protect depositors and customers, the DIF, the U.S. banking and financial system, and financial markets as a whole by ensuring the financial safety and soundness of BHCs and banks, including the Company and the Bank. Bank regulators regularly examine the operations of BHCs and banks. In addition, BHCs and banks are subject to periodic reporting and filing requirements.

The Federal Reserve, ODFI and FDIC have broad supervisory and enforcement authority with regard to BHCs and banks, including the power to conduct examinations and investigations, impose nonpublic supervisory agreements, issue cease and desist orders, impose fines and other civil and criminal penalties, terminate deposit insurance, and appoint a conservator or receiver. Supervision and examinations are confidential, and the outcomes of these actions may not be made public.

Bank regulators have various remedies available if they determine that the financial condition, capital resources, asset quality, earnings prospects, management, liquidity, or other aspects of a banking organization’s operations are unsatisfactory. The regulators may also take action if they determine that the banking organization or its management is violating or has violated any law or regulation. The regulators have the power to, among other things, prohibit unsafe or unsound practices, require affirmative actions to correct any violation or practice, issue administrative orders that can be judicially enforced, direct increases in capital, direct the sale of subsidiaries or other assets, limit dividends and distributions, restrict growth, assess civil monetary penalties, remove officers and directors, and terminate deposit insurance.

Engaging in unsafe or unsound practices or failing to comply with applicable laws, regulations, and supervisory agreements could subject the Company, the Bank, and their respective officers, directors, and institution-affiliated parties to the remedies described above, and other sanctions. In addition, the FDIC may terminate a bank’s deposit insurance upon a finding that the bank’s financial condition is unsafe or unsound or that the bank has engaged in unsafe or unsound practices or has violated an applicable rule, regulation, order, or condition enacted or imposed by the bank’s regulatory agency.

Regulatory Agencies

The Company is a registered bank holding company and is subject to inspection, examination and supervision by the Board of Governors of the Federal Reserve System (Federal Reserve) pursuant to the Bank Holding Company Act of 1956, as amended.

Unified is an Ohio chartered commercial bank. It is subject to regulation and examination by both the ODFI and the FDIC.

Regulatory Reform

Overview. Congress, the U.S. Department of the Treasury (“Treasury”), and the federal banking regulators, including the FDIC, have taken broad action since early September 2008 to address volatility in the U.S. banking system and financial markets. Beginning in late 2008, the U.S. and global financial markets experienced deterioration of the worldwide credit markets, which created significant challenges for financial institutions both in the United States and around the world. These actions included the adoption by Congress of both the Emergency Economic Stabilization Act of 2008 (“EESA”), and the American Recovery and Reinvestment Act of 2009 (“ARRA”). The most recent significant piece of legislation adopted in response to this crisis was the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”), which was signed into law on July 21, 2010, and which is discussed more thoroughly below.

Dodd-Frank Wall Street Reform and Consumer Protection Act. The Dodd-Frank Act created many new restrictions and an expanded framework of regulatory oversight for financial institutions, including insured depository institutions. Currently, federal regulators are still in the process of drafting the implementing regulations for many portions of the Dodd-Frank Act. Federal regulators continue to implement many provisions of the Dodd-Frank Act. The Dodd-Frank Act created an independent regulatory body, the Bureau of Consumer Financial Protection (“Bureau”), with authority and responsibility to set rules and regulations for most consumer protection laws applicable to all banks - both large and small. Oversight of Federal consumer financial protection functions have been transferred to the Bureau. The Bureau has responsibility for mortgage reform and enforcement, as well as broad new powers over consumer financial activities which could impact what consumer financial services would be available and how they are provided. The following consumer protection laws are the designated laws that fall under the Bureau’s rulemaking authority: the Alternative Mortgage Transactions Parity Act of 1928, the Consumer Leasing Act of 1976, the Electronic Fund Transfer Act, the Equal Credit Opportunity Act, the Fair Credit Billing Act, the Fair Credit Reporting Act subject to certain exclusions, the Fair Debt Collection Practices Act, the Home Owners Protection Act, certain privacy provisions of the Gramm-Leach-Bliley Act, the Home Mortgage Disclosure Act (HMDA), the Home Ownership and Equity Protection Act of 1994, the Real Estate Settlement Procedures Act (RESPA), the S.A.F.E. Mortgage Licensing Act of 2008 (SAFE Act), and the Truth in Lending Act. Review and revision of current financial regulations in conjunction with added new financial service regulations will heighten the regulatory compliance burden and increase litigation risk for the banking industry.

The Holding Company Regulation

As a holding company incorporated and doing business within the State of Ohio, the Company is subject to regulation and supervision under the Bank Holding Act of 1956, as amended (the “Act”). The Company is required to file with the Federal Reserve on quarterly basis information pursuant to the Act. The Federal Reserve may conduct examinations or inspections of the Company and Unified.

The Company is required to obtain prior approval from the Federal Reserve for the acquisition of more than five percent of the voting shares or substantially all of the assets of any bank or bank holding company. In addition, the Company is generally prohibited by the Act from acquiring direct or indirect ownership or control of more than five percent of the voting shares of any company which is not a bank or bank holding company and from engaging directly or indirectly in activities other than those of banking, managing or controlling banks or furnishing services to its subsidiaries. The Company may, however, subject to certain prior approval requirements of the Federal Reserve, engage in, or acquire shares of companies engaged in activities which are deemed by the Federal Reserve by order or by regulation to be financial in nature or closely related to banking.

On November 12, 1999, the Gramm-Leach-Bliley Act (the “GLB Act”) was enacted into law. The GLB Act made sweeping changes with respect to the permissible financial services which various types of financial institutions may now provide. The Glass-Steagall Act, which had generally prevented banks from affiliation with securities and insurance firms, was repealed. Pursuant to the GLB Act, bank holding companies may elect to become a “financial holding company,” provided that all of the depository institution subsidiaries of the bank holding company are “well capitalized” and “well managed” under applicable regulatory standards.

Under the GLB Act, a bank holding company that has elected to become a financial holding company may affiliate with securities firms and insurance companies and engage in other activities that are financial in nature. Activities that are “financial in nature” include securities underwriting, dealing and market-making, sponsoring mutual funds and investment companies, insurance underwriting and agency, merchant banking, and activities that the Federal Reserve has determined to be closely related to banking. No Federal Reserve approval is required for a financial holding company to acquire a company, other than a bank holding company, bank or savings association, engaged in activities that are financial in nature or incidental to activities that are financial in nature, as determined by the Federal Reserve. As with bank holding companies, prior Federal Reserve approval is required before a financial holding company may acquire the beneficial ownership or control of more than five percent of the voting shares, or substantially all of the assets, of a bank holding company, bank or savings association. If any subsidiary bank of a financial holding company ceases to be “well capitalized” or “well managed” under applicable regulatory standards, the Federal Reserve may, among other actions, order the Company to divest the subsidiary bank. Alternatively, the company may elect to conform its activities to those permissible for a bank holding company that is not also a financial holding company. If any subsidiary bank of a financial holding company receives a rating under the Community Reinvestment Act of 1977 of less than satisfactory, the company will be prohibited from engaging in new activities or acquiring companies other than bank holding companies, banks or savings associations. The Company is not a financial holding company and has no current intention of making such an election.

Dividends and Capital Reductions. The Board of Governors of the Federal Reserve has issued Supervisory Guidance and Regulations on the Payment of Dividends, Stock Redemptions, and Stock Repurchases by Bank Holding Companies (the “Policy Statement”). In the Policy Statement, the Federal Reserve stated that it is important for a banking organization’s board of directors to ensure that the dividend level is prudent relative to the organization’s financial position and is not based on overly optimistic earnings scenarios. As a general matter, the Policy Statement provides that the board of directors of a bank holding company should inform the Federal Reserve and should eliminate, defer, or significantly reduce its dividends if:

(1) net income available to shareholders for the past four quarters, net of dividends previously paid during that period, is not sufficient to fully fund the dividends;

(2) the prospective rate of earnings retention is not consistent with the company’s capital needs and overall current and prospective financial condition; or

(3) the company will not meet, or is in danger of not meeting, its minimum regulatory capital adequacy ratios.

Failure to do so could result in a supervisory finding that the organization is operating in an unsafe and unsound manner. Moreover, the Policy Statement requires a bank holding company to inform the Federal Reserve reasonably in advance of declaring or paying a dividend that exceeds earnings for the period (e.g., quarter) for which the dividend is being paid or that could result in a material adverse change to the organization’s capital structure. Declaring or paying a dividend in either circumstance could raise supervisory concerns. Unified exceeded its minimum capital requirements under applicable guidelines as of December 31, 2023.

Control Acquisitions. The Federal Change in Bank Control Act prohibits a person or group of persons from acquiring “control” of the Company unless the Federal Reserve has been notified and has not objected to the transaction. The acquisition of 10% or more of a class of voting stock of a bank holding company with a class of securities registered under Section 12 of the Exchange Act, such as the Company, is rebuttably presumed to constitute the acquisition of control of the bank holding company. In addition, a company is required to obtain the approval of the Federal Reserve under the Federal Bank Holding Company Act before acquiring 25% (5% in the case of an acquirer that is a bank holding company) or more of any class of outstanding voting stock of a bank holding company, or otherwise obtaining control or a “controlling influence” over that bank holding company.

Liability for Banking Subsidiaries. Under the current Federal Reserve policy, the Company is expected to act as a source of financial and managerial strength to its subsidiary bank and to maintain resources adequate to support the Bank. This support may be required at times when the Company may not have the resources to provide it. In the event of the Company’s bankruptcy, any commitment to a U.S. federal bank regulatory agency to maintain the capital of the Bank would be assumed by the bankruptcy trustee and entitled to priority of payment.

Regulation of the Bank

General. Unified is an Ohio-chartered bank that is not a member of the Federal Reserve System. Unified is therefore regulated by the ODFI as well as the FDIC. The regulatory agencies have the authority to regularly examine Unified, which is subject to all applicable rules and regulations promulgated by its supervisory agencies. In addition, the deposits of Unified are insured by the FDIC to the fullest extent permitted by law.

Deposit Insurance. As an FDIC-insured institution, Unified is required to pay deposit insurance premium assessments to the FDIC. The FDIC has adopted a risk-based assessment system under which all insured depository institutions are placed into one of nine categories and assessed insurance premiums based upon their respective levels of capital and results of supervisory evaluations. Institutions classified as well-capitalized (as defined by the FDIC) and considered healthy pay the lowest premium while institutions that are less than adequately capitalized (as defined by the FDIC) and considered of substantial supervisory concern pay the highest premium. Risk classification of all insured institutions is made by the FDIC for each semi-annual assessment period.

The FDIC may terminate the deposit insurance of any insured depository institution if the FDIC determines, after a hearing, that the institution has engaged or is engaging in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, order, or any condition imposed in writing by, or written agreement with, the FDIC. The FDIC may also suspend deposit insurance temporarily during the hearing process for a permanent termination of insurance if the institution has no tangible capital. Management of the Company is not aware of any activity or condition that could result in termination of the deposit insurance of Unified.

The Dodd-Frank Act revised the statutory authorities governing the FDIC’s management of the DIF. Key requirements from the Dodd-Frank Act resulted in the FDIC’s adoption of new rules in February 2011 regarding Assessments, Dividends, Assessment Base, and Large Bank Pricing. The new rules implemented the following changes: (1) redefined the definition of an institution’s deposit insurance assessment base from one based on domestic deposits to one based on assets now defined as “average consolidated total assets minus average tangible equity”; (2) changed the assessment rate adjustments to better account for risk based on an institution’s funding sources; (3) revised the deposit insurance assessment rate schedule in light of the new assessment base and assessment rate adjustments; (4) implemented Dodd-Frank Act dividend provisions; (5) revised the large insured depository institution assessment system to better differentiate for risk and to take into account losses the FDIC may incur from large institution failures; and (6) provided technical and other changes to the FDIC’s assessment rules. Though deposit insurance assessments maintain a risk-based approach, the FDIC imposed a more extensive risk-based assessment system on large insured depository institutions with at least $10 billion in total assets since they are more complex in nature and could pose greater risk.

Regulatory Capital Requirements Unified is required to maintain minimum levels of capital in accordance with FDIC capital adequacy guidelines. If capital falls below minimum guideline levels, a bank, among other things, may be denied approval to acquire or establish additional branches or organize or acquire other non-bank businesses. The required capital levels and the Bank’s capital position at December 31, 2023 and 2022 are summarized in the table included in Note 11 to the consolidated financial statements.

Beginning in 2015, bank holding companies and banks were required to measure capital adequacy using Basel III accounting. Basel III is a comprehensive set of reform measures, developed by the Basel Committee on Banking Supervision, to strengthen the regulation, supervision and risk management of the banking sector. Implementation of the rules will be overseen by the Federal Reserve, the FDIC and the OCC. Reporting under the new rules began with the March 2015 quarterly regulatory filings.

FDICIA

The Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”), and the regulations promulgated under FDICIA, among other things, established five capital categories for insured depository institutions-well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized-and requires U.S. federal bank regulatory agencies to implement systems for “prompt corrective action” for insured depository institutions that do not meet minimum capital requirements based on these categories. Unless a bank is well capitalized, it is subject to restrictions on its ability to offer brokered deposits and on certain other aspects of its operations. An undercapitalized bank must develop a capital restoration plan and its parent bank holding company must guarantee the bank’s compliance with the plan up to the lesser of 5% of the bank’s assets at the time it became undercapitalized and the amount needed to comply with the plan. As of December 31, 2023, the Bank was well capitalized pursuant to these prompt corrective action guidelines.

Dividends. Ohio law prohibits Unified, without the prior approval of the ODFI, from paying dividends in an amount greater than the lesser of its undivided profits or the total of its net income for that year, combined with its retained net income from the preceding two years. The payment of dividends by any financial institution is also affected by the requirement to maintain adequate capital pursuant to applicable capital adequacy guidelines and regulations.

Safety and Soundness Standards. The Federal banking agencies have adopted guidelines that establish operational and managerial standards to promote the safety and soundness of federally insured depository institutions. The guidelines set forth standards for internal controls, information systems, internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth, compensation, fees and benefits, asset quality and earnings.

In general, the safety and soundness guidelines prescribe the goals to be achieved in each area, and each institution is responsible for establishing its own procedures to achieve those goals. If an institution fails to comply with any of the standards set forth in the guidelines, the institution’s primary federal regulator may require the institution to submit a plan for achieving and maintaining compliance. If an institution fails to submit an acceptable compliance plan, or fails in any material respect to implement a compliance plan that has been accepted by its primary federal regulator, the regulator is required to issue an order directing the institution to cure the deficiency. Until the deficiency cited in the regulator’s order is cured, the regulator may restrict the institution’s rate of growth, require the institution to increase its capital, restrict the rates the institution pays on deposits or require the institution to take any action the regulator deems appropriate under the circumstances. Noncompliance with the standards established by the safety and soundness guidelines may also constitute grounds for other enforcement action by the federal banking regulators, including cease and desist orders and civil money penalty assessments.

With respect to lending, the federal bank regulatory agencies have adopted uniform regulations prescribing standards for extensions of credit that are secured by liens or interests in real estate or made for the purpose of financing permanent improvements to real estate. Under these regulations, all insured depository institutions, such as the Bank, must adopt and maintain written policies establishing appropriate limits and standards for extensions of credit that are secured by liens or interests in real estate or are made for the purpose of financing permanent improvements to real estate. These policies must establish loan portfolio diversification standards, prudent underwriting standards (including loan-to-value limits) that are clear and measurable, loan administration procedures, and documentation, approval and reporting requirements. The real estate lending policies must reflect consideration of the federal bank regulatory agencies’ Interagency Guidelines for Real Estate Lending Policies.

With respect to compensation practices, ours are subject to oversight by the Federal regulatory agencies, which have issued joint guidance on executive compensation designed to ensure that the incentive compensation policies of banking organizations, such as the Company and the Bank, do not encourage imprudent risk taking and are consistent with the safety and soundness of the organization. In addition, in October 2022 the SEC adopted final Executive Compensation Clawback Rules directing national stock exchanges to require listed public companies to implement policies intended to recoup bonuses paid to executives if the company is found to have misstated its financial results. The SEC rules, mandated by Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, are intended to discourage executives from taking questionable actions that temporarily boost share prices but ultimately result in a correction of financial statements. On June 9, 2023 the U.S. Securities and Exchange Commission (the “SEC”) approved the clawback listing standards proposed by the New York Stock Exchange and The Nasdaq Stock Market. As a result, all listed companies had until Friday, December 1, 2023 to adopt and implement a compliant clawback policy.

Branching Authority. Ohio chartered banks have the authority under Ohio law to establish branches anywhere in the State of Ohio, subject to receipt of all required regulatory approvals. Additionally, in May 1997 Ohio adopted legislation “opting in” to the provisions of Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (the “Interstate Act”) which allows banks to establish interstate branch networks through acquisitions of other banks, subject to certain conditions, including certain limitations on the aggregate amount of deposits that may be held by the surviving bank and all of its insured depository institution affiliates. Effective with the enactment of The Dodd-Frank Act, the FDI Act and the National Bank Act have been amended to remove the expressly required “opt-in” concept applicable to de novo interstate branching and now permits national and insured state banks to engage in de novo in interstate branching if, under the laws of the state where the new branch is to be established, a state bank chartered in that state would be permitted to establish a branch.

Affiliate Transactions. Various governmental requirements, including Sections 23A and 23B of the Federal Reserve Act, limit borrowings by holding companies and non-bank subsidiaries from affiliated insured depository institutions, and also limit various other transactions between holding companies and their non-bank subsidiaries, on the one hand, and their affiliated insured depository institutions on the other. Section 23A of the Federal Reserve Act also generally requires that an insured depository institution’s loan to its non-bank affiliates be secured, and Section 23B of the Federal Reserve Act generally requires that an insured depository institution’s transactions with its non-bank affiliates be on arms-length terms.

Depositor Preference. The Federal Deposit Insurance Act provides that, in the event of the “liquidation or other resolution” of an insured depository institution, the claims of depositors of the institution, including the claims of the FDIC as subrogee of insured depositors, and certain claims for administrative expenses of the FDIC as a receiver, will have priority over other general unsecured claims against the institution. If an insured depository institution fails, insured and uninsured depositors, along with the FDIC, will have priority in payment ahead of unsecured, non deposit creditors and shareholders of the institution.

Privacy Provisions of Gramm-Leach-Bliley Act. Under GLB, federal banking regulators adopted rules that limit the ability of banks and other financial institutions to disclose non-public information about consumers to non-affiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to non-affiliated third parties. The privacy provisions of GLB affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors.

Cybersecurity. GLB also requires financial institutions to implement a comprehensive information security program that includes administrative, technical, and physical safeguards to ensure the security and confidentiality of customer records and information.

Anti-Money Laundering Provisions of the USA Patriot Act of 2001. On October 26, 2001, the USA Patriot Act of 2001 (the “Patriot Act”) was signed into law. The Patriot Act is intended to strengthen U.S. law enforcement’s and the intelligence community’s ability to work cohesively to combat terrorism on a variety of fronts. The potential impact of the Patriot Act on financial institutions of all kinds is significant and wide-ranging. The Patriot Act contains sweeping anti-money laundering and financial transparency laws and requires various regulations, including: (a) due diligence requirements for financial institutions that administer, maintain, or manage private bank accounts or correspondent accounts for non-U.S. persons; (b) standards for verifying customer identification at account opening; and (c) rules to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering.

Fiscal and Monetary Policies. Unified’s business and earnings are affected significantly by the fiscal and monetary policies of the federal government and its agencies. Unified is particularly affected by the policies of the Federal Reserve, which regulates the supply of money and credit in the United States. Among the instruments of monetary policy available to the Federal Reserve are (a) conducting open market operations in United States government securities, (b) changing the discount rates of borrowings of depository institutions, (c) imposing or changing reserve requirements against depository institutions’ deposits, and (d) imposing or changing reserve requirements against certain borrowing by banks and their affiliates. These methods are used in varying degrees and combinations to affect directly the availability of bank loans and deposits, as well as the interest rates charged on loans and paid on deposits. For that reason alone, the policies of the Federal Reserve have a material effect on the earnings of Unified.

Environmental Laws. Banks that hold mortgages on property as secured lenders are exempt from liability under Federal environmental protection laws if certain criteria are met. The Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) contains a secured creditor exemption that eliminates owner or operator liability for lenders who take an ownership interest in a property primarily to protect their interest in the facility as security on a loan, provided that the bank does not participate in the management of the facility. Generally, participation in management applies if a bank exercises decision-making control over a property’s environmental compliance, or exercises control at a level similar to a manager of the facility or property.

Additional and Pending Regulation. Unified is also subject to federal regulation as to such matters as the maintenance of required reserves against deposits, limitations in connection with affiliate transactions, limitations as to the nature and amount of its loans and investments, regulatory approval of any merger or consolidation, issuance or retirement by Unified of its own securities and other aspects of banking operations. In addition, the activities and operations of Unified are subject to a number of additional detailed, complex and sometimes overlapping laws and regulations. These include state usury and consumer credit laws, state laws relating to fiduciaries, the Federal Truth-in-Lending Act and Regulation Z, the Federal Equal Credit Opportunity Act and Regulation B, the Fair Credit Reporting Act, the Truth in Savings Act, the Community Reinvestment Act, anti-redlining legislation and antitrust laws.

Congress regularly considers legislation that may have an impact upon the operation of the Company and Unified. At this time, the Company is unable to predict whether any proposed legislation will be enacted and, therefore, is unable to predict the impact such legislation may have on the operations of the Company.

Employees

The Company itself, as a holding company, has no compensated employees. Unified has 115 full time employees, with 31 of these serving in a management capacity, and 11 part time employees.

|

|

|

|

Executive Officers Positions held with Company; |

|

Name |

|

Age |

|

Business Experience |

|

Scott Everson |

|

56 |

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

Matthew F. Branstetter |

|

56 |

|

Senior Vice President – Chief Operating Officer |

|

|

|

|

|

|

|

Randall M. Greenwood |

|

60 |

|

Senior Vice President, Chief Financial Officer, Treasurer & Corporate Secretary |

|

Each individual has held the position noted during the past five years.

Each of these Executive Officers is appointed annually by the Company’s board of directors and is serving at-will in their current positions.

Industry Segments

United Bancorp and its subsidiary are engaged in one line of business, banking. Item 8 of this 10-K provides financial information for United Bancorp’s business.

Statistical Disclosures by Bank Holding Companies

I Distribution of Assets, Liabilities and Stockholders’ Equity; Interest Rates and Interest Differential

Refer to Management’s Discussion and Analysis “Average Balances, Net Interest Income and Yields Earned and Rates Paid” and “Rate/Volume Analysis on pages 19 and 20 of our 2023 Annual Report filed herewith as Exhibit 13, which is incorporated by reference.

Average Balances, Net Interest Income and Yields Earned and Rates Paid

The following table provides average balance sheet information and reflects the taxable equivalent average yield on interest-earning assets and the average cost of interest-bearing liabilities for the years ended December 31, 2022 and 2021. The yields and costs are calculated by dividing income or expense by the average balance of interest-earning assets or interest-bearing liabilities.

The average balance of available-for-sale securities is computed using the carrying value of securities while the yield for available for sale securities has been computed using the average amortized cost. Average balances are derived from average month-end balances, which include nonaccruing loans in the loan portfolio, net of the allowance for loan losses. Interest income has been adjusted to tax-equivalent basis.

|

|

2021 |

|

|

2022 |

|

||||||||||||

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

Interest |

|

|

|

||

|

|

Average |

|

Income/ |

|

Yield/ |

|

|

Average |

|

Income/ |

|

Yield/ |

|

||||

|

|

Balance |

|

Expense |

|

Rate |

|

|

Balance |

|

Expense |

|

Rate |

|

||||

Loans (1) |

|

$ |

451,762 |

|

$ |

20,220 |

|

4.48 |

% |

|

$ |

462,692 |

|

$ |

20,748 |

|

4.48 |

% |

Taxable Securitied AFS |

|

|

13,297 |

|

|

467 |

|

3.51 |

|

|

|

54,852 |

|

|

1,899 |

|

3.46 |

|

Tax Exempt securities available for sale (1) |

|

|

118,062 |

|

|

4,908 |

|

4.16 |

|

|

|

120,073 |

|

|

5,565 |

|

4.63 |

|

Federal funds sold |

|

|

79,698 |

|

|

101 |

|

0.13 |

|

|

|

44,668 |

|

|

493 |

|

1.10 |

|

FHLB stock and other |

|

|

3,925 |

|

|

81 |

|

2.06 |

|

|

|

3,191 |

|

|

139 |

|

4.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest-bearing assets |

|

|

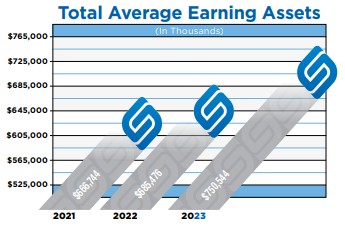

666,744 |

|

|

25,777 |

|

3.87 |

|

|

|

685,476 |

|

|

28,844 |

|

4.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

|

8,593 |

|

|

|

|

|

|

|

|

8,301 |

|

|

|

|

|

|

Premises and equipment (net) |

|

|

13,469 |

|

|

|

|

|

|

|

|

12,547 |

|

|

|

|

|

|

Other nonearning assets |

|

|

38,170 |

|

|

|

|

|

|

|

|

32,471 |

|

|

|

|

|

|

Less: allowance for loan losses |

|

|

(4,576) |

|

|

|

|

|

|

|

|

(3,020) |

|

|

|

|

|

|

Total noninterest-earning assets |

|

|

55,656 |

|

|

|

|

|

|

|

|

50,299 |

|

|

|

|

|

|

Total assets |

|

$ |

722,400 |

|

|

|

|

|

|

|

$ |

735,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

$ |

256,638 |

|

|

313 |

|

0.12 |

% |

|

$ |

262,763 |

|

|

845 |

|

0.32 |

% |

Savings deposits |

|

|

133,826 |

|

|

17 |

|

0.01 |

|

|

|

144,283 |

|

|

77 |

|

0.05 |

|

Time deposits |

|

|

69,591 |

|

|

920 |

|

1.32 |

|

|

|

67,848 |

|

|

722 |

|

1.06 |

|

Subordinated debentures |

|

|

23,665 |

|

|

1,323 |

|

5.59 |

|

|

|

23,726 |

|

|

1,387 |

|

5.85 |

|

Repurchase agreements |

|

|

19,452 |

|

|

23 |

|

0.12 |

|

|

|

22,581 |

|

|

242 |

|

1.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest-bearing liabilities |

|

$ |

503,172 |

|

|

2,596 |

|

0.52 |

|

|

$ |

521,201 |

|

|

3,273 |

|

0.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

|

140,555 |

|

|

|

|

|

|

|

|

151,342 |

|

|

|

|

|

|

Other liabilities |

|

|

7,512 |

|

|

|

|

|

|

|

|

4,016 |

|

|

|

|

|

|

Total noninterest-bearing liabilities |

|

|

148,067 |

|

|

|

|

|

|

|

|

155,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

651,239 |

|

|

|

|

|

|

|

|

677,059 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

71,161 |

|

|

|

|

|

|

|

|

58,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities & stockholders’ equity |

|

$ |

722,400 |

|

|

|

|

|

|

|

$ |

735,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

|

|

$ |

23,181 |

|

|

|

|

|

|

|

$ |

25,571 |

|

|

|

Net interest spread |

|

|

|

|

|

|

|

3.35 |

% |

|

|

|

|

|

|

|

3.58 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net yield on interest earning assets |

|

|

|

|

|

|

|

3.48 |

% |

|

|

|

|

|

|

|

3.73 |

% |

| ● | For purposes of this schedule, nonaccrual loans are included in loans. |

| ● | Fees collected on loans are included in interest on loans. However, such fees are not material for comparative purposes. |

| ● | Earnings on tax-exempt earnings is shown on a tax equivalent basis using a marginal tax rate of 21% |

Rate/Volume Analysis

The table below describes the extent to which changes in interest rates and changes in volume of interest-earning assets and interest-bearing liabilities have affected interest income and expense during 2022. For purposes of this table, changes in interest due to volume and rate were determined using the following methods:

| ● | Volume variance results when the change in volume is multiplied by the previous year’s rate. |

| ● | Rate variance results when the change in rate is multiplied by the previous year’s volume. |

| ● | Rate/volume variance results when the change in volume is multiplied by the change in rate. |

NOTE: The rate/volume variance was allocated to volume variance and rate variance in proportion to the relationship of the absolute dollar amount of the change in each. Non accrual loans are ignored for purposes of the calculations due to the nominal amount of the loans.

|

|

2022 Compared to 2021 |

|||||

|

|

Increase/(Decrease) |

|||||

(In thousands) |

|

|

|

|

Change |

|

Change |

|

|

Total |

|

Due To |

|

Due To |

|

|

|

Change |

|

Volume |

|

Rate |

|

Interest and dividend income |

|

|

|

|

|

|

|

Loans |

|

$ |

528 |

|

490 |

|

38 |

Taxable securities available for sale |

|

|

1,432 |

|

1,367 |

|

65 |

Tax-exempt securities available for sale |

|

|

657 |

|

550 |

|

107 |

Federal funds sold |

|

|

392 |

|

(63) |

|

455 |

FHLB stock and other |

|

|

58 |

|

(18) |

|

76 |

Total interest and dividend income |

|

|

3,067 |

|

2,326 |

|

741 |

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

|

|

Demand deposits |

|

|

532 |

|

8 |

|

524 |

Savings deposits |

|

|

60 |

|

1 |

|

59 |

Time deposits |

|

|

(198) |

|

(23) |

|

(175) |

Trust Preferred debentures |

|

|

64 |

|

— |

|

64 |

Repurchase agreements |

|

|

219 |

|

4 |

|

215 |

Total interest expense |

|

|

677 |

|

(10) |

|

687 |

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

2,390 |

|

2,336 |

|

54 |

II Investment Portfolio

A Contractual maturities of securities at year-end 2023 were as follows:

|

|

Amortized |

|

Estimated |

|

Average Tax |

|

||

|

|

Cost |

|

Fair Value |

|

Equivalent Yield |

|

||

|

|

(dollars in thousands) |

|

||||||

US Agency obligations |

|

|

|

|

|

|

|

|

|

Under 1 Year |

|

$ |

15,000 |

|

$ |

14,870 |

|

3.71 |

% |

1 – 5 Years |

|

|

27,500 |

|

|

27,043 |

|

3.82 |

% |

5-10 Years |

|

|

2,500 |

|

|

2,355 |

|

4.00 |

% |

Over 10 Years |

|

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

State and municipal obligations |

|

|

|

|

|

|

|

|

|

Under 1 Year |

|

$ |

— |

|

$ |

— |

|

— |

|

1 – 5 Years |

|

|

— |

|

|

— |

|

— |

|

5-10 Years |

|

|

4,514 |

|

|

4,468 |

|

3.68 |

% |

Over 10 Years |

|

|

173,156 |

|

|

169,724 |

|

4.49 |

% |

|

|

|

|

|

|

|

|

|

|

Subordinated Debt |

|

|

|

|

|

|

|

|

|

Under 1 Year |

|

|

— |

|

|

— |

|

— |

|

1 – 5 Years |

|

$ |

3,097 |

|

$ |

2,890 |

|

2.96 |

% |

5-10 Years |

|

|

25,916 |

|

|

21,410 |

|

3.53 |

% |

Over 10 Years |

|

|

— |

|

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

Total securities available for sale |

|

$ |

251,683 |

|

$ |

242,760 |

|

4.24 |

% |

III Loan Portfolio

A Maturities and Sensitivities of Loans to Changes in Interest Rates

The following is a schedule of commercial and commercial real estate loans at December 31, 2023 maturing within the various time frames indicated:

|

|

|

|

|

|

|

|

Five |

|

|

|

|

|

|

|

|

|

One |

|

One |

|

Through |

|

|

|

|

|

|

|||

|

|

Year or |

|

Through |

|

Fifteen |

|

After |

|

|

|

||||

|

|

Less |

|

Five Years |

|

Years |

|

Fifteen Years |

|

Total |

|||||

|

|

(In thousands) |

|||||||||||||

Commercial and industrial loans |

|

$ |

5,599 |

|

$ |

62,043 |

|

$ |

20,562 |

|

$ |

3,090 |

|

$ |

91,294 |

Commercial real estate loans |

|

|

8,406 |

|

|

47,159 |

|

|

135,466 |

|

|

100,828 |

|

|

291,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

14,005 |

|

$ |

109,202 |

|

$ |

156,028 |

|

$ |

103,918 |

|

$ |

383,153 |

The following is a schedule of fixed-rate and variable-rate commercial and commercial real estate loans at December 31, 2023 due to mature after one year:

|

|

|

|

|

|

|

|

Total > |

|

|

|

Fixed |

|

Variable |

|

One |

|||

|

|

Rate |

|

Rate |

|

Year |

|||

|

|

(In thousands) |

|||||||

Commercial and industrial loans |

|

$ |

49,288 |

|

$ |

36,407 |

|

$ |

85,695 |

Commercial real estate loans |

|

|

54,517 |

|

|

228,936 |

|

|

283,453 |

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

103,805 |

|

$ |

265,343 |

|

$ |

369,148 |

Variable rate loans are those loans with floating or adjustable interest rates.

IV Summary of Credit Loss Experience

The allowance for credit losses (“ACL”) is a valuation reserve established and maintained by charges against income and is deducted from the amortized cost basis of loans to present the net amount expected to be collected on the loans. Loans, or portions thereof, are charged off against the ACL when they are deemed uncollectible. Expected recoveries do not exceed the aggregate of amounts previously charged-off and expected to be charged-off.

The ACL is an estimate of expected credit losses, measured over the contractual life of a loan, that considers our historical loss experience, current conditions and forecasts of future economic conditions. Determination of an appropriate ACL is inherently subjective and may have significant changes from period to period.

The methodology for determining the ACL has two main components: evaluation of expected credit losses for certain groups of homogeneous loans that share similar risk characteristics and evaluation of loans that do not share risk characteristics with other loans.

The allowance for credit losses is measured on a collective (pool) basis when similar risk characteristics exist. The Company uses the call report classification as its segment breakout and measures the allowance for credit losses using the Weighted Average Remaining Maturity method for all loan segments.

Historical credit loss experience is the basis for the estimation of expected credit losses. We apply historical loss rates to pools of loans with similar risk characteristics. After consideration of the historic loss calculation, management applies qualitative adjustments to reflect the current conditions and reasonable and supportable forecasts not already reflected in the historical loss information at the balance sheet date. Our reasonable and supportable forecast adjustment is based on a 2 year unemployment forecast provided by Bloomberg and management judgment. For periods beyond our reasonable and supportable forecast, we revert back to historical annual loss rates for the remainder of the life of each pool after the forecast period. The qualitative adjustments for current conditions are based upon current level of inflation and the rapid increase in interest rates, changes in lending policies and practices, experience and ability of lending staff, quality of the Company’s loan review system, value of underlying collateral, the existence of and changes in concentrations and other external factors. These modified historical loss rates are multiplied by the outstanding principal balance of each loan to calculate a required reserve.

The Company has elected to exclude accrued interest receivable from the measurement of its ACL. When a loan is placed on non-accrual status, any outstanding accrued interest is reversed against interest income.

The ACL for individual loans begins with the use of normal credit review procedures to identify whether a loan no longer shares similar risk characteristics with other pooled loans and therefore, should be individually assessed. We evaluate all commercial and industrial and commercial real estate loans, as well as residential and installment loans greater than $100,000 that meet the following criteria: 1) when it is determined that foreclosure is probable, 2) substandard, doubtful and nonperforming loans when repayment is expected to be provided substantially through the operation or sale of the collateral, 3) when it is determined by management that a loan does not share similar risk characteristics with other loans. Specific reserves are established based on the following three acceptable methods for measuring the ACL: 1) the present value of expected future cash flows discounted at the loan’s original effective interest rate; 2) the loan’s observable market price; or 3) the fair value of the collateral when the loan is collateral dependent. Our individual loan evaluations consist primarily of the fair value of collateral method because most of our loans are collateral dependent. Collateral values are discounted to consider disposition costs when appropriate. A specific reserve is established or a charge-off is taken if the fair value of the loan is less than the loan balance.

For additional explanation of factors which influence management’s judgment in determining amounts charged to expense, refer to pages 13-15 of the “Management’s Discussion and Analysis” and Notes to Consolidated Financial Statements set forth in our 2023 Annual Report, which is incorporated herein by reference.

A |

Analysis of the Allowance for Credit Losses |

The following table provides key credit ratios for each applicable period.

|

|

2023 |

|

2022 |

|

2021 |

|

|||

Ratio of net charge-offs to average loans outstanding for the year |

|

|

0.02 |

% |

|

0.14 |

% |

|

0.04 |

% |

Ratio of commercial loans and industrial net charge-offs to average commercial loans |

|

|

(0.03) |

% |

|

(0.01) |

% |

|

0.08 |

% |

Ratio of commercial real estate loans net charge-offs to average commercial real estate loans |

|

|

0.00 |

% |

|

0.21 |

% |

|

0.00 |

% |

Ratio of real estate loans net charge-offs to average real estate loans |

|

|

0.00 |

% |

|

0.00 |

% |

|

0.02 |

% |

Ratio of installment loans net charge-off to average consumer loans |

|

|

1.93 |

% |

|

1.90 |

% |

|

1.39 |

% |

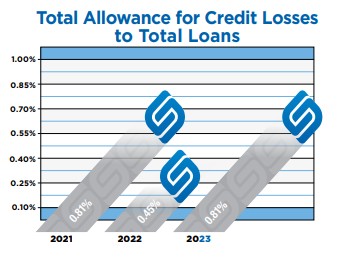

Total allowance for credit losses to total loans |

|

|

0.81 |

% |

|

0.45 |

% |

|

0.81 |

% |

Nonaccrual loans to total loans |

|

|

0.10 |

% |

|

0.04 |

% |

|

0.64 |

% |

Total allowance for credit losses to nonperforming loans |

|

|

611.23 |

% |

|

1127.47 |

% |

|

87.27 |

% |

B |

Allocation of the Allowance for Credit Losses |

The following table allocates the allowance for credit losses at December 31, 2023, 2022, and 2021. Management adjusts the allowance periodically to account for changes in national trends and economic conditions in the Bank’s service areas. The allowance has been allocated according to the amount deemed to be reasonably necessary to provide for the probability of losses being incurred within the following categories of loans at the dates indicated:

|

|

2023 |

|

2022 |

|

2021 |

|

||||||||||

|

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

% of |

|

|

|

|

|

|

|

Loans |

|

|

|

|

Loans |

|

|

|

|

Loans |

|

|

|

|

Allowance |

|

to Total |

|

Allowance |

|

to Total |

|

Allowance |

|

to Total |

|

||||

|

|

Amount |

|

Loans |

|

Amount |

|

Loans |

|

Amount |

|

Loans |

|

||||

Loan type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and Industrial |

|

$ |

573 |

|

|

18.89 |

% |

$ |

215 |

|

19.65 |

% |

$ |

1,046 |

|

20.00 |

% |

Commercial real estate |

|

|

1,408 |

|

|

60.40 |

% |

|

815 |

|

58.65 |

% |

|

1,235 |

|

58.71 |

% |

Residential real estate |

|

|

1,843 |

|

|

19.32 |

% |

|

816 |

|

20.40 |

% |

|

1,121 |

|

19.84 |

% |

Consumer |

|

|

94 |

|

|

1.39 |

% |

|

206 |

|

1.30 |

% |

|

271 |

|

1.45 |

% |

General |

|

|

N/A |

|

|

|

|

|

— |

|

N/A |

|

|

— |

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

3,918 |

|

|

100.00 |

% |

$ |

2,052 |

|

100.00 |

% |

$ |

3,673 |

|

100.00 |

% |

V Deposits

A |

Schedule of Average Deposit Amounts and Rates |

Refer to Section I of this “Statistical Disclosures by Bank Holding Companies” section and to Management’s Discussion and Analysis “Average Balances, Net Interest Income and Yields Earned and Rates Paid” on page 19 of our 2023 Annual Report filed herewith as Exhibit 13, which is incorporated by reference. At December 31, 2023, 2022 and 2021 the aggregate amount of uninsured deposits was approximately $102.9 million, $89.8 million and $77.9 million.

B |

Maturity analysis of time deposits greater than $250,000. |

At December 31, 2023, the time to remaining maturity for time deposits in excess of $250,000 was:

|

|

2023 |

|

|

|

(In thousands) |

|

Three months or less |

|

$ |

4,234 |

Over three through six months |

|

|

12,069 |

Over six through twelve months |

|

|

5,878 |

Over twelve months |

|

|

15,426 |

|

|

|

|

Total |

|

$ |

37,607 |

Item 1A. Risk Factors

Smaller Reporting Companies are not required to provide this disclosure.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cybersecurity

General

All companies utilizing technology are subject to threats of breaches of their cybersecurity programs. To mitigate the threat to our business and address regulatory requirements, we take a comprehensive approach to cybersecurity risk management and have developed and implemented a cybersecurity risk management program intended to protect the confidentiality, integrity, and availability of our critical systems and information. As described in more detail below, we have established policies, standards, processes, and practices for assessing, identifying, and managing material risks from cybersecurity threats. We devote significant financial and personnel resources to implement and maintain security measures to meet regulatory requirements and customer expectations, and we intend to continue to make significant investments to maintain the security of our data and cybersecurity infrastructure.

Legal Overview

Pursuant to the requirements of section 39 of the Federal Deposit Insurance Act (12 U.S.C. 1831p–1) and sections 501 and 505(b) of the Gramm-Leach-Bliley Act (15 U.S.C. 6801, 6805(b)), the federal bank regulatory agencies adopted the Interagency Guidelines Establishing Information Security Standards (the “Guidelines”). The requirements of the Guidelines apply to all FDIC-insured depository institutions, most subsidiaries of such entities, and to state savings associations. Federal law also mandates that information security procedures and controls be routinely evaluated by the Bank’s state and federal regulators as part of the standard safety and soundness examination process.

Bank Security Policy

To comply with all applicable federal requirements, the Bank’s Board of Directors has adopted the Unified Bank Information Security Policy (the “ISP”), which establishes a program that the Bank’s management and board can use to:

| ● | Ensure the security and confidentiality of customer information; |

| ● | Protect against any anticipated threats or hazards to the security or integrity of such information; and |

| ● | Protect against unauthorized access to or use of customer information that could result in substantial harm or inconvenience to any customer. |

Under the ISP, the Board of Directors or an appropriate committee thereof is required to oversee all efforts with respect to the development, implementation and maintenance of an effective information security program. In addition, the ISP charges management with responsibility for identifying all reasonably foreseeable internal and external threats that could result in unauthorized disclosure, misuse, alteration or destruction of Bank information, and directs management to develop and implement procedures and other controls designed to reduce or eliminate identified risks.

The Bank has also implemented controls designed to identify and mitigate cybersecurity threats associated with our use of the Bank’s critical third-party service providers. Such providers are subject to security risk assessments at the time of onboarding, contract renewal, and based on risk profile. A variety of inputs are used in such assessments, including information supplied by providers and third parties. In addition, we require our providers to meet appropriate security requirements, controls and responsibilities and investigate security incidents that have impacted our third-party providers, as appropriate.

In addition to being subject to routine examination by the Bank’s state and federal regulators, the efficacy of the Bank’s information security program is also audited annually by an independent third-party auditing firm.

Managerial and Board Oversight

To facilitate oversight, the Bank has established a front line committee, the Compliance Risk Assessment Committee, which is comprised of all members of senior management, the head of information security and certain other operationally significant employees. This Committee, which meets quarterly, is responsible for monitoring all key operational risks applicable to the Bank. Cyber risk assessments are routinely conducted and reported to the Audit Committee of the Board of Directors In addition, key members of senior management also meet annually with a cyber risk consultant who apprises management on emerging cyber threats and evaluates the Company’s adequacy of cyber risk insurance coverage. The findings of this meeting are also reported to the Executive Committee. All significant matters are reported by the Executive Committee to the full Board of Directors.

Item 2Properties

The Company owns and operates its Main Office and stand alone operations center in Martins Ferry, Ohio and the following offices:

Branch Office Location |

|

Owned or Leased |

|

Location |

|

Owned or Leased |

Bridgeport, Ohio |

|

Owned |

|

Sherrodsville, Ohio |

|

Owned |

Colerain, Ohio |

|

Owned |

|

Glouster, Ohio |

|

Owned |

Jewett, Ohio |

|

Owned |

|

Nelsonville, Ohio |

|

Owned |

St. Clairsville, Ohio |

|

Owned |

|

Lancaster, Ohio |

|

Owned |

Dover, Ohio |

|

Owned |

|

Lancaster, Ohio |

|

Owned |

Dellroy, Ohio |

|

Owned |

|

Powhatan, Ohio |

|

Owned |

New Philadelphia, Ohio |

|

Owned |

|

Moundsville, WV |

|

Owned |

Strasburg, Ohio |

|

Owned |

|

St. Clairsville, Ohio |

|

Owned |

Tiltonsville, Ohio |

|

Owned |

|

Wheeling, WV |

|

Leased |

Management believes the properties described above to be in good operating condition for the purpose for which they are used. The properties are unencumbered by any mortgage or security interest and are, in management’s opinion, adequately insured.

Item 3Legal Proceedings

There are no material legal proceedings, other than ordinary routine litigation incidental to its business, to which the Company or its subsidiary is a party or to which any of its property is subject.

Item 4Mine Safety Disclosures

Not applicable.

PART II

Item 5Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

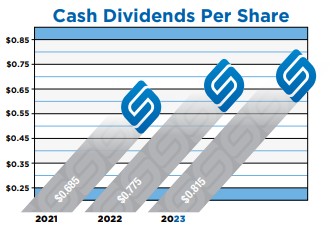

Refer to Page 9, “Shareholder Information” of the 2023 Annual Report To Shareholders filed herewith as Exhibit 13 and refer to Page 31, Note 1 of the Notes to the Consolidated Financial Statements of the Company in the 2023 Annual Report To Shareholders for common stock trading ranges, cash dividends declared and information relating to dividend restrictions, which information is incorporated herein by reference. Additional disclosure regarding dividend restrictions is also included under Part I, Item 1 of this 10-K in the section captioned “Supervision and Regulation.”

ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

|

|

|

|

(c) |

|

(d) |

|

|

|

|

|

|

|

Total Number of |

|

Maximum Number |

|

|

|

|

|

|

|

Shares (or Units) |

|

(or Approximate Dollar Value) of |

|

|

(a) |

|

(b) |

|

Purchased as Part |

|

Shares (or Units) |

|

|

|

Total Number of |

|

Average Price |

|

of Publicly |

|

that May Yet Be |

|

|

|

Shares (or Units) |

|

Paid per Share |

|

Announced Plans |

|

Purchased Under the |

|

Period |

|

Purchased |

|

(or Unit) |

|

or Programs |

|

Plans or Programs |

|

Month #l 10/1/2023 to 10/31/2023 |

|

— |

|

$ |

— |

|

— |

|

— |

Month #2 11/1/2023 to 11/30/2023 |

|

— |

|

|

— |

|

— |

|

— |

Month #3 12/1/2023 to 12/31/2023 |

|

10,507 |

(1) |

|

11.57 |

|

— |

|

— |

Total |

|

10,507 |

(1) |

$ |

11.57 |

|

— |

|

— |

(1) |

All of these shares were purchased by the Company on the open market to fund acquisitions under the Company’s Directors and Officers Deferred Compensation Plan. |

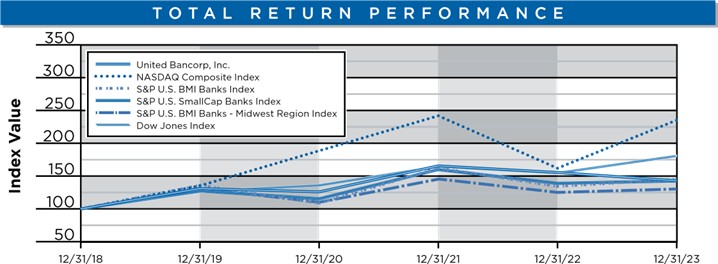

Unregistered Sales of Equity Securities and Use of Proceeds