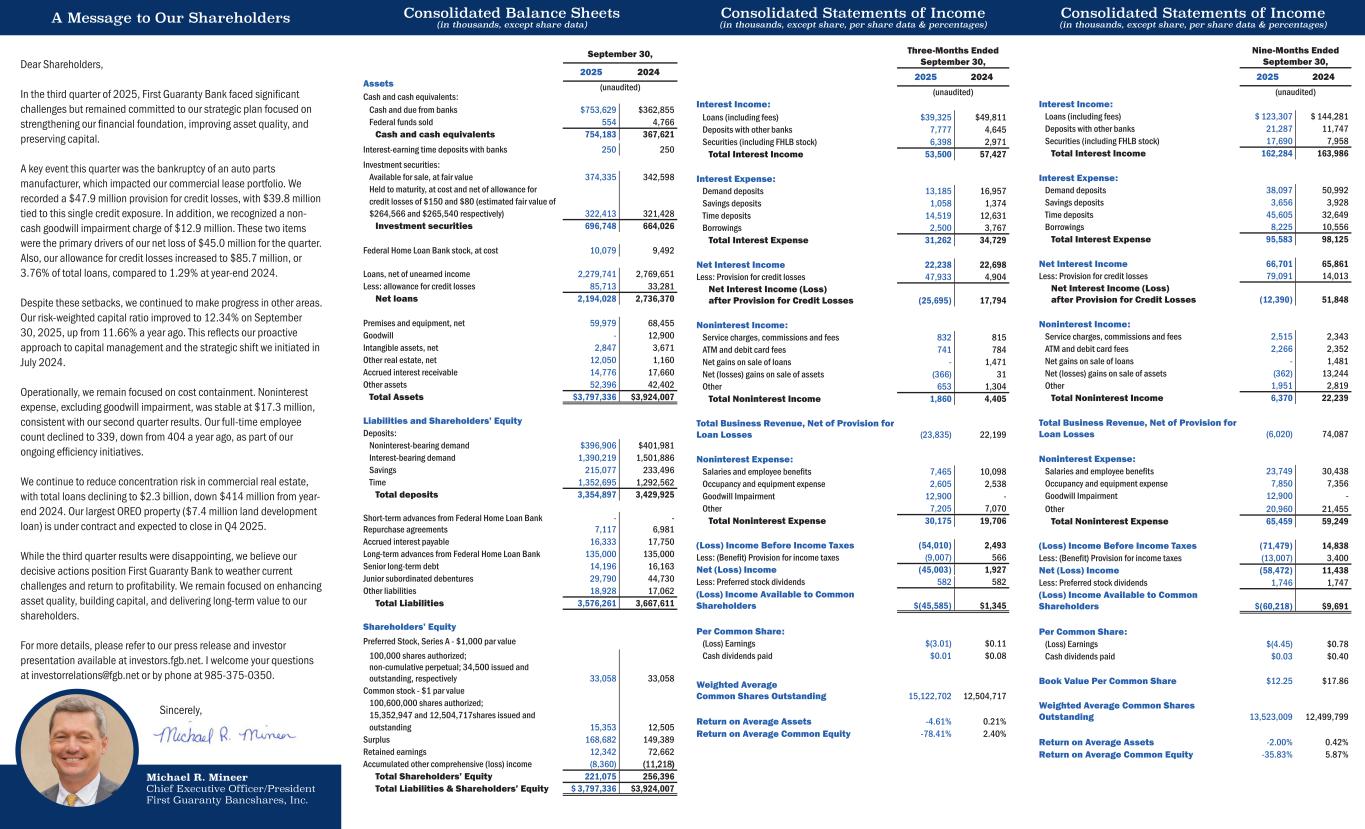

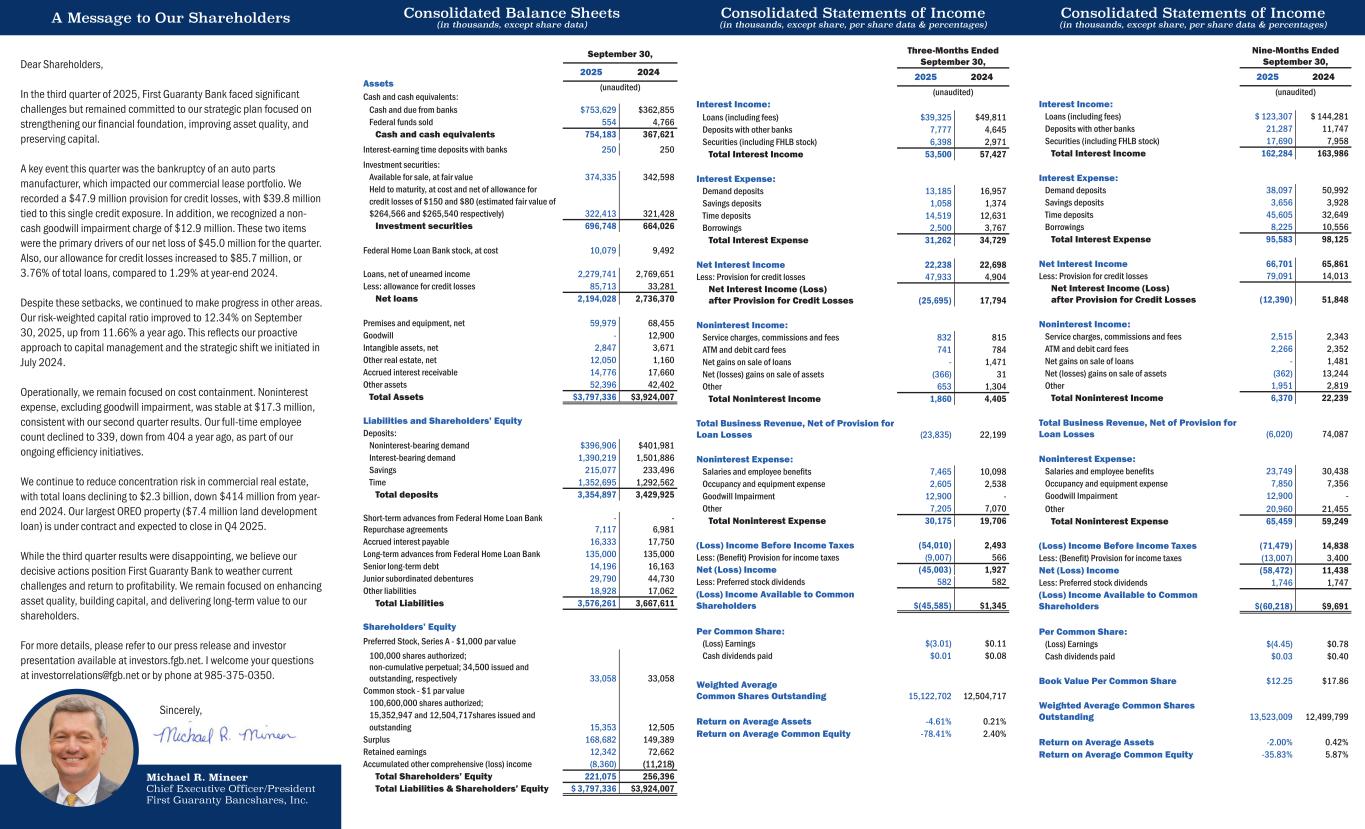

A Message to Our Shareholders Consolidated Balance Sheets (in thousands, except share data) Consolidated Statements of Income (in thousands, except share, per share data & percentages) Consolidated Statements of Income (in thousands, except share, per share data & percentages) Nine-Months Ended September 30, 2025 2024 (unaudited) Interest Income: Loans (including fees) $ 123,307 $ 144,281 Deposits with other banks 21,287 11,747 Securities (including FHLB stock) 17,690 7,958 Total Interest Income 162,284 163,986 Interest Expense: Demand deposits 38,097 50,992 Savings deposits 3,656 3,928 Time deposits 45,605 32,649 Borrowings 8,225 10,556 Total Interest Expense 95,583 98,125 Net Interest Income 66,701 65,861 Less: Provision for credit losses 79,091 14,013 Net Interest Income (Loss) after Provision for Credit Losses (12,390) 51,848 Noninterest Income: Service charges, commissions and fees 2,515 2,343 ATM and debit card fees 2,266 2,352 Net gains on sale of loans - 1,481 Net (losses) gains on sale of assets (362) 13,244 Other 1,951 2,819 Total Noninterest Income 6,370 22,239 Total Business Revenue, Net of Provision for Loan Losses (6,020) 74,087 Noninterest Expense: Salaries and employee benefits 23,749 30,438 Occupancy and equipment expense 7,850 7,356 Goodwill Impairment 12,900 - Other 20,960 21,455 Total Noninterest Expense 65,459 59,249 (Loss) Income Before Income Taxes (71,479) 14,838 Less: (Benefit) Provision for income taxes (13,007) 3,400 Net (Loss) Income (58,472) 11,438 Less: Preferred stock dividends 1,746 1,747 (Loss) Income Available to Common Shareholders $(60,218) $9,691 Per Common Share: (Loss) Earnings $(4.45) $0.78 Cash dividends paid $0.03 $0.40 Book Value Per Common Share $12.25 $17.86 Weighted Average Common Shares Outstanding 13,523,009 12,499,799 Return on Average Assets -2.00% 0.42% Return on Average Common Equity -35.83% 5.87% Three-Months Ended September 30, 2025 2024 (unaudited) Interest Income: Loans (including fees) $39,325 $49,811 Deposits with other banks 7,777 4,645 Securities (including FHLB stock) 6,398 2,971 Total Interest Income 53,500 57,427 Interest Expense: Demand deposits 13,185 16,957 Savings deposits 1,058 1,374 Time deposits 14,519 12,631 Borrowings 2,500 3,767 Total Interest Expense 31,262 34,729 Net Interest Income 22,238 22,698 Less: Provision for credit losses 47,933 4,904 Net Interest Income (Loss) after Provision for Credit Losses (25,695) 17,794 Noninterest Income: Service charges, commissions and fees 832 815 ATM and debit card fees 741 784 Net gains on sale of loans - 1,471 Net (losses) gains on sale of assets (366) 31 Other 653 1,304 Total Noninterest Income 1,860 4,405 Total Business Revenue, Net of Provision for Loan Losses (23,835) 22,199 Noninterest Expense: Salaries and employee benefits 7,465 10,098 Occupancy and equipment expense 2,605 2,538 Goodwill Impairment 12,900 - Other 7,205 7,070 Total Noninterest Expense 30,175 19,706 (Loss) Income Before Income Taxes (54,010) 2,493 Less: (Benefit) Provision for income taxes (9,007) 566 Net (Loss) Income (45,003) 1,927 Less: Preferred stock dividends 582 582 (Loss) Income Available to Common Shareholders $(45,585) $1,345 Per Common Share: (Loss) Earnings $(3.01) $0.11 Cash dividends paid $0.01 $0.08 Weighted Average Common Shares Outstanding 15,122,702 12,504,717 Return on Average Assets -4.61% 0.21% Return on Average Common Equity -78.41% 2.40% Michael R. Mineer Chief Executive Officer/President First Guaranty Bancshares, Inc. Dear Shareholders, In the third quarter of 2025, First Guaranty Bank faced significant challenges but remained committed to our strategic plan focused on strengthening our financial foundation, improving asset quality, and preserving capital. A key event this quarter was the bankruptcy of an auto parts manufacturer, which impacted our commercial lease portfolio. We recorded a $47.9 million provision for credit losses, with $39.8 million tied to this single credit exposure. In addition, we recognized a non- cash goodwill impairment charge of $12.9 million. These two items were the primary drivers of our net loss of $45.0 million for the quarter. Also, our allowance for credit losses increased to $85.7 million, or 3.76% of total loans, compared to 1.29% at year-end 2024. Despite these setbacks, we continued to make progress in other areas. Our risk-weighted capital ratio improved to 12.34% on September 30, 2025, up from 11.66% a year ago. This reflects our proactive approach to capital management and the strategic shift we initiated in July 2024. Operationally, we remain focused on cost containment. Noninterest expense, excluding goodwill impairment, was stable at $17.3 million, consistent with our second quarter results. Our full-time employee count declined to 339, down from 404 a year ago, as part of our ongoing efficiency initiatives. We continue to reduce concentration risk in commercial real estate, with total loans declining to $2.3 billion, down $414 million from year- end 2024. Our largest OREO property ($7.4 million land development loan) is under contract and expected to close in Q4 2025. While the third quarter results were disappointing, we believe our decisive actions position First Guaranty Bank to weather current challenges and return to profitability. We remain focused on enhancing asset quality, building capital, and delivering long-term value to our shareholders. For more details, please refer to our press release and investor presentation available at investors.fgb.net. I welcome your questions at investorrelations@fgb.net or by phone at 985-375-0350. Sincerely, Assets Cash and cash equivalents: Cash and due from banks $753,629 $362,855 Federal funds sold 554 4,766 Cash and cash equivalents 754,183 367,621 Interest-earning time deposits with banks 250 250 Investment securities: Available for sale, at fair value 374,335 342,598 Held to maturity, at cost and net of allowance for credit losses of $150 and $80 (estimated fair value of $264,566 and $265,540 respectively) 322,413 321,428 Investment securities 696,748 664,026 Federal Home Loan Bank stock, at cost 10,079 9,492 Loans, net of unearned income 2,279,741 2,769,651 Less: allowance for credit losses 85,713 33,281 Net loans 2,194,028 2,736,370 Premises and equipment, net 59,979 68,455 Goodwill - 12,900 Intangible assets, net 2,847 3,671 Other real estate, net 12,050 1,160 Accrued interest receivable 14,776 17,660 Other assets 52,396 42,402 Total Assets $3,797,336 $3,924,007 Liabilities and Shareholders’ Equity Deposits: Noninterest-bearing demand $396,906 $401,981 Interest-bearing demand 1,390,219 1,501,886 Savings 215,077 233,496 Time 1,352,695 1,292,562 Total deposits 3,354,897 3,429,925 Short-term advances from Federal Home Loan Bank Repurchase agreements - 7,117 - 6,981 Accrued interest payable 16,333 17,750 Long-term advances from Federal Home Loan Bank 135,000 135,000 Senior long-term debt 14,196 16,163 Junior subordinated debentures 29,790 44,730 Other liabilities 18,928 17,062 Total Liabilities 3,576,261 3,667,611 Shareholders’ Equity Preferred Stock, Series A - $1,000 par value 100,000 shares authorized; non-cumulative perpetual; 34,500 issued and outstanding, respectively 33,058 33,058 Common stock - $1 par value 100,600,000 shares authorized; 15,352,947 and 12,504,717shares issued and outstanding 15,353 12,505 Surplus 168,682 149,389 Retained earnings 12,342 72,662 Accumulated other comprehensive (loss) income (8,360) (11,218) Total Shareholders’ Equity 221,075 256,396 Total Liabilities & Shareholders’ Equity $ 3,797,336 $3,924,007 September 30, 2025 2024 (unaudited)