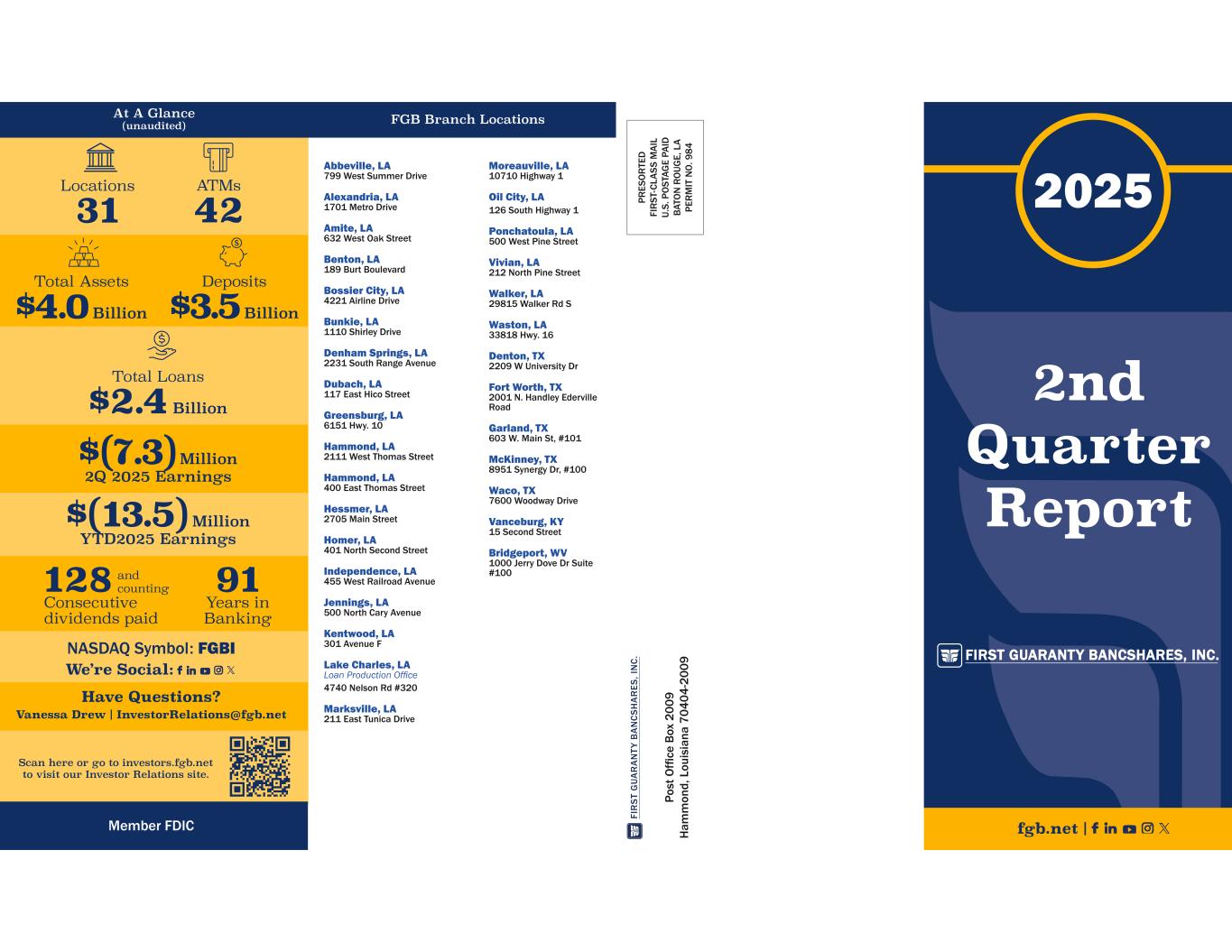

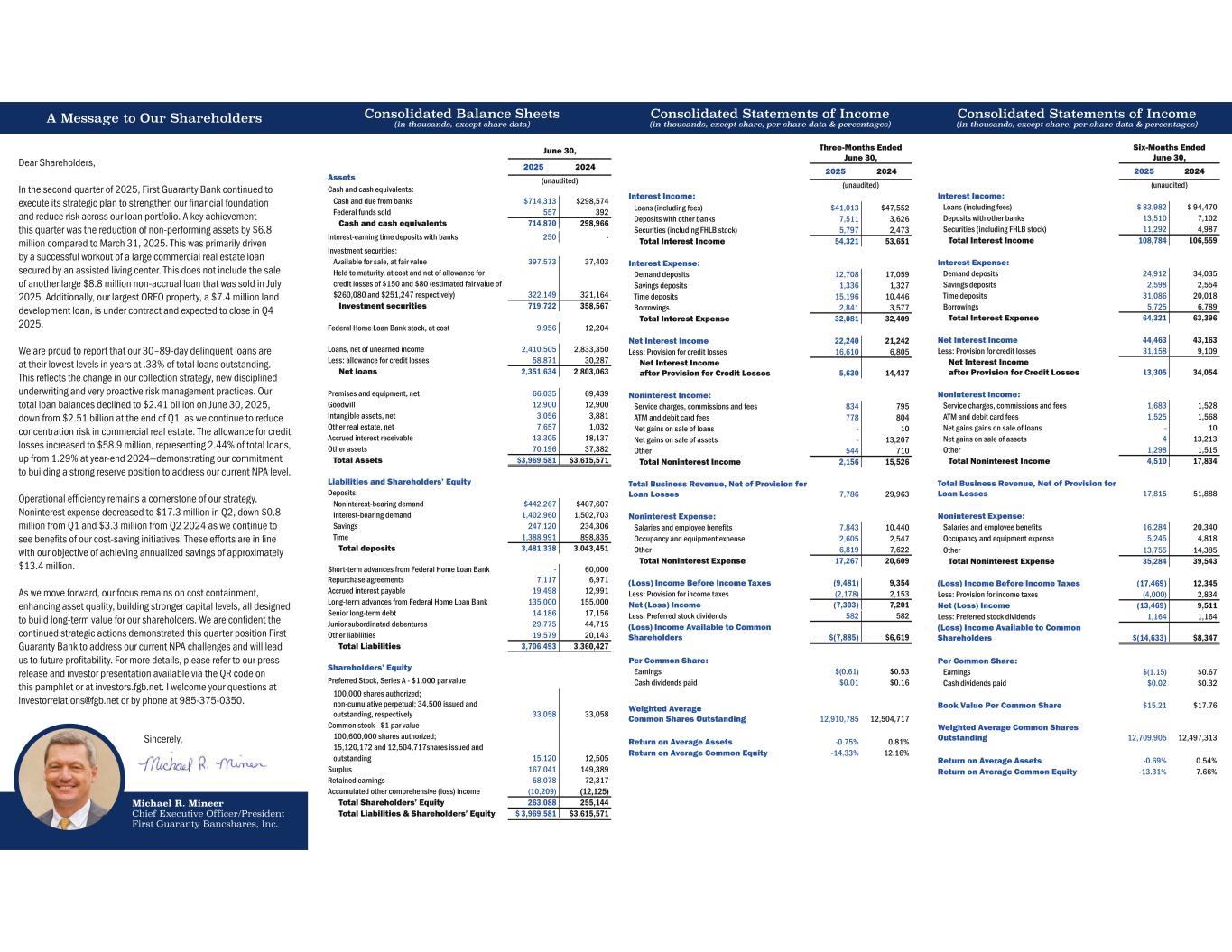

A Message to Our Shareholders Consolidated Balance Sheets (in thousands, except share data) Consolidated Statements of Income (in thousands, except share, per share data & percentages) Consolidated Statements of Income (in thousands, except share, per share data & percentages) Six-Months Ended June 30, 2025 2024 (unaudited) Interest Income: Loans (including fees) $ 83,982 $ 94,470 Deposits with other banks 13,510 7,102 Securities (including FHLB stock) 11,292 4,987 Total Interest Income 108,784 106,559 Interest Expense: Demand deposits 24,912 34,035 Savings deposits 2,598 2,554 Time deposits 31,086 20,018 Borrowings 5,725 6,789 Total Interest Expense 64,321 63,396 Net Interest Income 44,463 43,163 Less: Provision for credit losses 31,158 9,109 Net Interest Income after Provision for Credit Losses 13,305 34,054 Noninterest Income: Service charges, commissions and fees 1,683 1,528 ATM and debit card fees 1,525 1,568 Net gains gains on sale of loans - 10 Net gains on sale of assets 4 13,213 Other 1,298 1,515 Total Noninterest Income 4,510 17,834 Total Business Revenue, Net of Provision for Loan Losses 17,815 51,888 Noninterest Expense: Salaries and employee benefits 16,284 20,340 Occupancy and equipment expense 5,245 4,818 Other 13,755 14,385 Total Noninterest Expense 35,284 39,543 (Loss) Income Before Income Taxes (17,469) 12,345 Less: Provision for income taxes (4,000) 2,834 Net (Loss) Income (13,469) 9,511 Less: Preferred stock dividends 1,164 1,164 (Loss) Income Available to Common Shareholders $(14,633) $8,347 Per Common Share: Earnings $(1.15) $0.67 Cash dividends paid $0.02 $0.32 Book Value Per Common Share $15.21 $17.76 Weighted Average Common Shares Outstanding 12,709,905 12,497,313 Return on Average Assets -0.69% 0.54% Return on Average Common Equity -13.31% 7.66% Three-Months Ended June 30, 2025 2024 (unaudited) Interest Income: Loans (including fees) $41,013 $47,552 Deposits with other banks 7,511 3,626 Securities (including FHLB stock) 5,797 2,473 Total Interest Income 54,321 53,651 Interest Expense: Demand deposits 12,708 17,059 Savings deposits 1,336 1,327 Time deposits 15,196 10,446 Borrowings 2,841 3,577 Total Interest Expense 32,081 32,409 Net Interest Income 22,240 21,242 Less: Provision for credit losses 16,610 6,805 Net Interest Income after Provision for Credit Losses 5,630 14,437 Noninterest Income: Service charges, commissions and fees 834 795 ATM and debit card fees 778 804 Net gains on sale of loans - 10 Net gains on sale of assets - 13,207 Other 544 710 Total Noninterest Income 2,156 15,526 Total Business Revenue, Net of Provision for Loan Losses 7,786 29,963 Noninterest Expense: Salaries and employee benefits 7,843 10,440 Occupancy and equipment expense 2,605 2,547 Other 6,819 7,622 Total Noninterest Expense 17,267 20,609 (Loss) Income Before Income Taxes (9,481) 9,354 Less: Provision for income taxes (2,178) 2,153 Net (Loss) Income (7,303) 7,201 Less: Preferred stock dividends 582 582 (Loss) Income Available to Common Shareholders $(7,885) $6,619 Per Common Share: Earnings $(0.61) $0.53 Cash dividends paid $0.01 $0.16 Weighted Average Common Shares Outstanding 12,910,785 12,504,717 Return on Average Assets -0.75% 0.81% Return on Average Common Equity -14.33% 12.16% Michael R. Mineer Chief Executive Officer/President First Guaranty Bancshares, Inc. Dear Shareholders, In the second quarter of 2025, First Guaranty Bank continued to execute its strategic plan to strengthen our financial foundation and reduce risk across our loan portfolio. A key achievement this quarter was the reduction of non-performing assets by $6.8 million compared to March 31, 2025. This was primarily driven by a successful workout of a large commercial real estate loan secured by an assisted living center. This does not include the sale of another large $8.8 million non-accrual loan that was sold in July 2025. Additionally, our largest OREO property, a $7.4 million land development loan, is under contract and expected to close in Q4 2025. We are proud to report that our 30–89-day delinquent loans are at their lowest levels in years at .33% of total loans outstanding. This reflects the change in our collection strategy, new disciplined underwriting and very proactive risk management practices. Our total loan balances declined to $2.41 billion on June 30, 2025, down from $2.51 billion at the end of Q1, as we continue to reduce concentration risk in commercial real estate. The allowance for credit losses increased to $58.9 million, representing 2.44% of total loans, up from 1.29% at year-end 2024—demonstrating our commitment to building a strong reserve position to address our current NPA level. Operational efficiency remains a cornerstone of our strategy. Noninterest expense decreased to $17.3 million in Q2, down $0.8 million from Q1 and $3.3 million from Q2 2024 as we continue to see benefits of our cost-saving initiatives. These efforts are in line with our objective of achieving annualized savings of approximately $13.4 million. As we move forward, our focus remains on cost containment, enhancing asset quality, building stronger capital levels, all designed to build long-term value for our shareholders. We are confident the continued strategic actions demonstrated this quarter position First Guaranty Bank to address our current NPA challenges and will lead us to future profitability. For more details, please refer to our press release and investor presentation available via the QR code on this pamphlet or at investors.fgb.net. I welcome your questions at investorrelations@fgb.net or by phone at 985-375-0350. Sincerely, Assets Cash and cash equivalents: Cash and due from banks $714,313 $298,574 Federal funds sold 557 392 Cash and cash equivalents 714,870 298,966 Interest-earning time deposits with banks 250 - Investment securities: Available for sale, at fair value 397,573 37,403 Held to maturity, at cost and net of allowance for credit losses of $150 and $80 (estimated fair value of $260,080 and $251,247 respectively) 322,149 321,164 Investment securities 719,722 358,567 Federal Home Loan Bank stock, at cost 9,956 12,204 Loans, net of unearned income 2,410,505 2,833,350 Less: allowance for credit losses 58,871 30,287 Net loans 2,351,634 2,803,063 Premises and equipment, net 66,035 69,439 Goodwill 12,900 12,900 Intangible assets, net 3,056 3,881 Other real estate, net 7,657 1,032 Accrued interest receivable 13,305 18,137 Other assets 70,196 37,382 Total Assets $3,969,581 $3,615,571 Liabilities and Shareholders’ Equity Deposits: Noninterest-bearing demand $442,267 $407,607 Interest-bearing demand 1,402,960 1,502,703 Savings 247,120 234,306 Time 1,388,991 898,835 Total deposits 3,481,338 3,043,451 Short-term advances from Federal Home Loan Bank Repurchase agreements - 7,117 60,000 6,971 Accrued interest payable 19,498 12,991 Long-term advances from Federal Home Loan Bank 135,000 155,000 Senior long-term debt 14,186 17,156 Junior subordinated debentures 29,775 44,715 Other liabilities 19,579 20,143 Total Liabilities 3,706.493 3,360,427 Shareholders’ Equity Preferred Stock, Series A - $1,000 par value 100,000 shares authorized; non-cumulative perpetual; 34,500 issued and outstanding, respectively 33,058 33,058 Common stock - $1 par value 100,600,000 shares authorized; 15,120,172 and 12,504,717shares issued and outstanding 15,120 12,505 Surplus 167,041 149,389 Retained earnings 58,078 72,317 Accumulated other comprehensive (loss) income (10,209) (12,125) Total Shareholders’ Equity 263,088 255,144 Total Liabilities & Shareholders’ Equity $ 3,969,581 $3,615,571 June 30, 2025 2024 (unaudited)