Document

EXHIBIT 99.1

JULY 23, 2024

NEWS FOR IMMEDIATE RELEASE

CONTACT: ERIC J. DOSCH, CFO

985.375.0308

First Guaranty Bancshares, Inc. Announces Key Developments and Second Quarter 2024 Financial Results

Hammond, Louisiana, July 23, 2024 – First Guaranty Bancshares, Inc. ("First Guaranty") (NASDAQ: FGBI), the holding company for First Guaranty Bank, announced its key developments and unaudited financial results for the second quarter and six months ending June 30, 2024.

Key developments are as follows:

•First Guaranty is initiating changes to its business strategy. The changes include slowing the trajectory of the bank’s asset growth, further increasing the capital position, and working with leaner staff while utilizing automation and technological advances. First Guaranty has reduced staff by 71 positions. This reduction represents approximately 15% of the bank’s workforce. Each of the affected employees will receive 60 days of pay, payment for their unused vacation time, their elected healthcare coverage through September 30, 2024, and will have the opportunity to apply for open positions within the bank. First Guaranty will continue its other noninterest expense reductions previously undertaken earlier in the year.

•First Guaranty anticipates that the change to the business strategy will generate a reduction in noninterest expense of approximately $12.0 million pre-tax on an annual basis which includes the reduction in staff. The cost savings are anticipated to impact the fourth quarter of 2024 by about $2.0 million pre-tax. It is anticipated that about $3.0 million in pre-tax savings will be realized per quarter for 2025.

•First Guaranty’s Board of Directors anticipates paying a quarterly cash dividend of $0.08 per share for the third and fourth quarters of 2024.

•As previously announced, on June 28, 2024, the Bank consummated a sale-leaseback transaction relating to two stand-alone branches and a portion of the headquarters building which also contains a branch (collectively, the “Properties”). The aggregate cash purchase price was $14.7 million. The sale-leaseback transaction resulted in a pre-tax gain of approximately $13.2 million, or $10.4 million after tax. Aggregate first full year of rent expense under the Lease Agreements will be approximately $1.3 million pre-tax, or $1.0 million after tax.

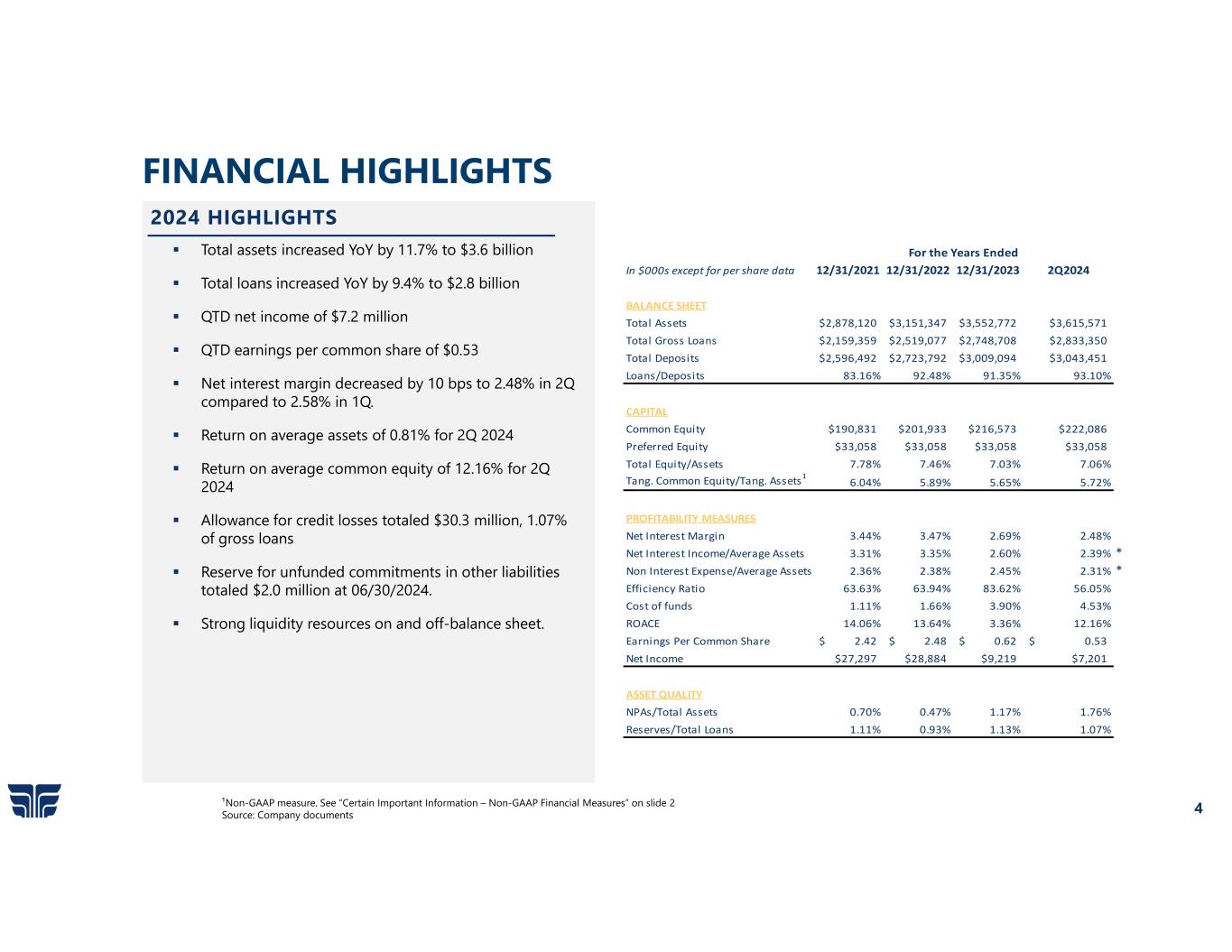

Financial Highlights for the second quarter and six months ended June 30, 2024, are as follows:

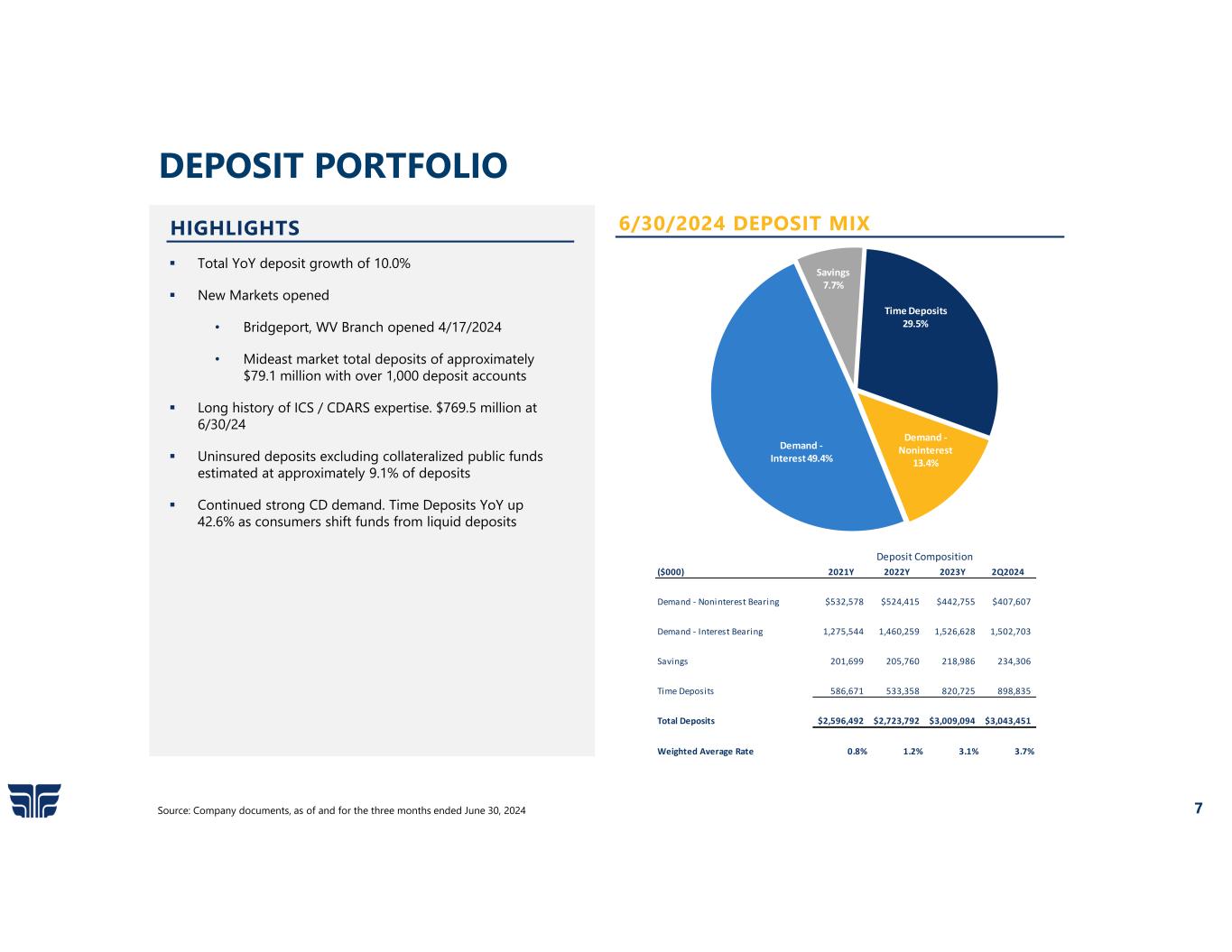

•Total assets increased $62.8 million and were $3.6 billion at June 30, 2024 and December 31, 2023. Total loans at June 30, 2024 were $2.8 billion, an increase of $84.6 million, or 3.1%, compared with December 31, 2023. Total deposits were $3.0 billion at June 30, 2024, an increase of $34.4 million, or 1.1%, compared with December 31, 2023. Retained earnings were $72.3 million at June 30, 2024, an increase of $4.3 million compared to $68.0 million at December 31, 2023. Shareholders' equity was $255.1 million and $249.6 million at June 30, 2024 and December 31, 2023, respectively.

•Net income for the second quarter of 2024 and 2023 was $7.2 million and $2.7 million, respectively, an increase of $4.5 million or 169.1%. Net income for the six months ended June 30, 2024 and 2023 was $9.5 million and $6.1 million, respectively, an increase of $3.4 million or 54.8%.

•Earnings per common share were $0.53 and $0.19 for the second quarter of 2024 and 2023, respectively, and $0.67 and $0.46 for the six months ended June 30, 2024 and 2023, respectively. Total weighted average shares outstanding were 12,504,717 and 10,913,029 for the second quarter of 2024 and 2023, respectively, and 12,497,313 and 10,815,454 for the six months ended June 30, 2024 and 2023, respectively. The change in shares was due to the issuance of 44,341 and 29,293 shares of common stock under the Equity Bonus Plan during the fourth quarter of 2023 and the first quarter of 2024, respectively, and the issuance of 1,714,287 shares of common stock under private placement in 2023.

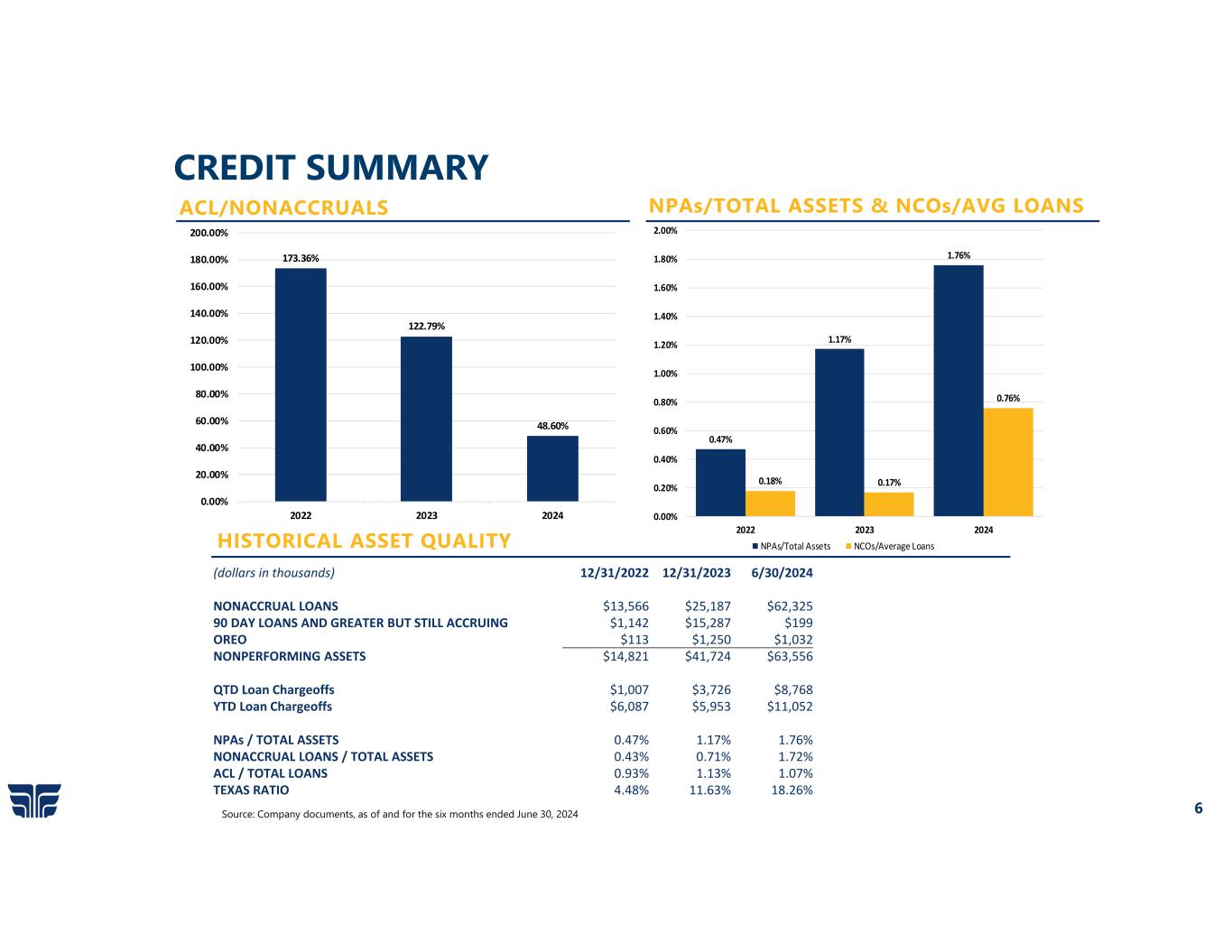

•The allowance for credit losses was 1.07% of total loans at June 30, 2024 compared to 1.13% at December 31, 2023.

•Net interest income for the second quarter of 2024 was $21.2 million compared to $20.9 million for the same period in 2023. Net interest income for the six months ended June 30, 2024 was $43.2 million compared to $43.2 million for the six months ended June 30, 2023.

•The provision for credit losses for the second quarter of 2024 was $6.8 million compared to $0.5 million for the same period in 2023. The provision for credit losses for the six months ended June 30, 2024 was $9.1 million compared to $0.9 million for the six months ended June 30, 2023.

•First Guaranty had $1.0 million of other real estate owned as of June 30, 2024 compared to $1.3 million at December 31, 2023.

•The net interest margin for the three months ended June 30, 2024 was 2.48% which was a decrease of 26 basis points from the net interest margin of 2.74% for the same period in 2023. The net interest margin for the six months ended June 30, 2024 was 2.53% which was a decrease of 33 basis points from the net interest margin of 2.86% for the same period in 2023. First Guaranty attributed the decrease in the net interest margin to the increase in market interest rates that began in 2022 and continued through 2023 that increased the cost of liabilities. Loans as a percentage of average interest earning assets decreased to 81.1% at June 30, 2024 compared to 83.6% at June 30, 2023.

•Investment securities totaled $358.6 million at June 30, 2024, a decrease of $45.6 million when compared to $404.1 million at December 31, 2023. At June 30, 2024, available for sale securities, at fair value, totaled $37.4 million, a decrease of $46.1 million when compared to $83.5 million at December 31, 2023. The decrease in available for sale securities was primarily due to the maturity of low yielding Treasury securities of which the proceeds were subsequently reinvested in higher yielding loans and or cash equivalents. At June 30, 2024, held to maturity securities, at amortized cost and net of the allowance for credit losses totaled $321.2 million, an increase of $0.5 million when compared to $320.6 million at December 31, 2023. The allowance for credit losses for HTM securities was $0.1 million at June 30, 2024 and December 31, 2023.

•Total loans net of unearned income were $2.8 billion at June 30, 2024, a net increase of $84.6 million from December 31, 2023. Total loans net of unearned income are reduced by the allowance for credit losses which totaled $30.3 million at June 30, 2024 and $30.9 million at December 31, 2023, respectively.

•Nonaccrual loans increased $37.1 million to $62.3 million at June 30, 2024 compared to $25.2 million at December 31, 2023. The increase in total nonaccrual loans was concentrated primarily in one commercial real estate relationship that totaled $36.9 million. This relationship is comprised of five loans secured by real estate located in the Midwest. $13.9 million of this relationship was previously reported in 90 day plus but still accruing at December 31, 2023.

•At June 30, 2024, our largest non-performing assets were comprised of the following nonaccrual loans: (1) $36.9 million non-farm non-residential loan relationship comprised of five loans; (2) a $2.0 million loan relationship that is classified as purchased credit deteriorated; (3) a commercial lease loan that totaled $1.8 million; (4) a construction and land development loan that totaled $1.7 million; (5) a commercial lease loan that totaled $1.7 million; and (6) a $1.3 million one- to four-family loan relationship.

•First Guaranty charged off $8.8 million in loan balances during the second quarter of 2024. The details of the $8.8 million in charged-off loans were as follows:

1.First Guaranty charged off $0.5 million in consumer loans during the second quarter of 2024. The consumer loan charge offs included $0.1 million of loans secured by automobiles or equipment and $0.4 million in unsecured loans.

2.First Guaranty charged off $3.8 million on a loan relationship associated with a restaurant supply business located in Louisiana during the second quarter of 2024. This loan was secured by real estate, equipment, and inventory. This loan had a previous specific reserve of $2.5 million as of March 31, 2024. This loan had no remaining principal balance at June 30, 2024.

3.First Guaranty charged off a $1.8 million commercial and industrial loan that was originated under the Main Street Lending Program during the second quarter of 2024. The $1.8 million was the unguaranteed retained portion of the loan. This loan had a previous allocation in the reserve of $1.8 million at March 31, 2024. This loan had no remaining principal balance at June 30, 2024.

4.First Guaranty charged off $0.6 million on a real estate secured loan located in Louisiana during the second quarter of 2024. This was an acquired loan from the Union Bank acquisition and was secured by rental properties. This loan had a remaining principal balance of $0.4 million at June 30, 2024.

5.First Guaranty charged off $0.4 million on a commercial and industrial SBA loan relationship during the second quarter of 2024. This relationship had a remaining principal balance of $0.6 million at June 30, 2024.

6.First Guaranty charged off $0.3 million on a real estate secured SBA loan during the second quarter of 2024. This loan had a remaining principal balance of $0.9 million at June 30, 2024.

7.Smaller loans and overdrawn deposit accounts comprised the remaining $1.4 million of charge-offs for the second quarter of 2024.

•Return on average assets for the three months ended June 30, 2024 and 2023 was 0.81% and 0.34%, respectively. Return on average assets for the six months ended June 30, 2024 and 2023 was 0.54% and 0.39%, respectively. Return on average common equity for the three months ended June 30, 2024 and 2023 was 12.16% and 4.19%, respectively. Return on average common equity for the six months ended June 30, 2024 and 2023 was 7.66% and 4.99% respectively. Return on average assets is calculated by dividing annualized net income by average assets. Return on average common equity is calculated by dividing annualized net income by average common equity.

•Book value per common share was $17.76 as of June 30, 2024 compared to $17.36 as of December 31, 2023. The increase was due primarily to the recent issuance of new shares and changes in accumulated other comprehensive income ("AOCI"). AOCI is comprised of unrealized gains and losses on available for sale securities, including unrealized losses on available for sale securities at the time of transfer to held to maturity.

•First Guaranty's Board of Directors declared cash dividends of $0.16 per common share in the second quarter of 2024 and 2023. First Guaranty has paid 124 consecutive quarterly dividends as of June 30, 2024.

•First Guaranty paid preferred stock dividends of $1.2 million during the first six months of 2024 and 2023.

About First Guaranty

First Guaranty Bancshares, Inc. is the holding company for First Guaranty Bank, a Louisiana state-chartered bank. Founded in 1934, First Guaranty Bank offers a wide range of financial services and focuses on building client relationships and providing exceptional customer service. First Guaranty Bank currently operates thirty-five locations throughout Louisiana, Texas, Kentucky and West Virginia. First Guaranty’s common stock trades on the NASDAQ under the symbol FGBI. For more information, visit www.fgb.net.

Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to the financial condition, liquidity, results of operations, and future performance of the business of First Guaranty Bancshares, Inc. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond our control). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” We caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. These forward-looking statements are subject to a number of factors and uncertainties, including, without limitation, the “Risk Factors” referenced in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and other risks and uncertainties listed from time to time in our reports and documents filed with the Securities and Exchange Commission. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

No Offer or Solicitation

This release does not constitute or form part of any offer to sell, or a solicitation of an offer to purchase, any securities of First Guaranty. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST GUARANTY BANCSHARES, INC. AND SUBSIDIARY |

| CONSOLIDATED BALANCE SHEETS (unaudited) |

|

|

|

|

|

| (in thousands, except share data) |

|

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

| Cash and cash equivalents: |

|

|

|

|

| Cash and due from banks |

|

$ |

298,574 |

|

|

$ |

286,114 |

|

| Federal funds sold |

|

392 |

|

|

341 |

|

| Cash and cash equivalents |

|

298,966 |

|

|

286,455 |

|

|

|

|

|

|

| Investment securities: |

|

|

|

|

| Available for sale, at fair value |

|

37,403 |

|

|

83,485 |

|

| Held to maturity, at cost and net of allowance for credit losses of $80 (estimated fair value of $251,247 and $253,584 respectively) |

|

321,164 |

|

|

320,638 |

|

| Investment securities |

|

358,567 |

|

|

404,123 |

|

|

|

|

|

|

| Federal Home Loan Bank stock, at cost |

|

12,204 |

|

|

13,390 |

|

| Loans held for sale |

|

— |

|

|

— |

|

|

|

|

|

|

| Loans, net of unearned income |

|

2,833,350 |

|

|

2,748,708 |

|

| Less: allowance for credit losses |

|

30,287 |

|

|

30,926 |

|

| Net loans |

|

2,803,063 |

|

|

2,717,782 |

|

|

|

|

|

|

| Premises and equipment, net |

|

69,439 |

|

|

69,792 |

|

| Goodwill |

|

12,900 |

|

|

12,900 |

|

| Intangible assets, net |

|

3,881 |

|

|

4,298 |

|

| Other real estate, net |

|

1,032 |

|

|

1,250 |

|

| Accrued interest receivable |

|

18,137 |

|

|

15,713 |

|

| Other assets |

|

37,382 |

|

|

27,069 |

|

| Total Assets |

|

$ |

3,615,571 |

|

|

$ |

3,552,772 |

|

|

|

|

|

|

| Liabilities and Shareholders' Equity |

|

|

|

|

| Deposits: |

|

|

|

|

| Noninterest-bearing demand |

|

$ |

407,607 |

|

|

$ |

442,755 |

|

| Interest-bearing demand |

|

1,502,703 |

|

|

1,526,628 |

|

| Savings |

|

234,306 |

|

|

218,986 |

|

| Time |

|

898,835 |

|

|

820,725 |

|

| Total deposits |

|

3,043,451 |

|

|

3,009,094 |

|

|

|

|

|

|

| Short-term advances from Federal Home Loan Bank |

|

60,000 |

|

|

50,000 |

|

| Short-term borrowings |

|

— |

|

|

10,000 |

|

| Repurchase agreements |

|

6,971 |

|

|

6,297 |

|

| Accrued interest payable |

|

12,991 |

|

|

11,807 |

|

| Long-term advances from Federal Home Loan Bank |

|

155,000 |

|

|

155,000 |

|

| Senior long-term debt |

|

17,156 |

|

|

39,099 |

|

| Junior subordinated debentures |

|

44,715 |

|

|

15,000 |

|

| Other liabilities |

|

20,143 |

|

|

6,844 |

|

| Total Liabilities |

|

3,360,427 |

|

|

3,303,141 |

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

|

| Preferred stock, Series A - $1,000 par value - 100,000 shares authorized |

|

|

|

|

| Non-cumulative perpetual; 34,500 issued and outstanding |

|

33,058 |

|

|

33,058 |

|

| Common stock, $1 par value - 100,600,000 shares authorized; 12,504,717 and 12,475,424 shares issued and outstanding |

|

12,505 |

|

|

12,475 |

|

| Surplus |

|

149,389 |

|

|

149,085 |

|

| Retained earnings |

|

72,317 |

|

|

67,972 |

|

| Accumulated other comprehensive (loss) income |

|

(12,125) |

|

|

(12,959) |

|

| Total Shareholders' Equity |

|

255,144 |

|

|

249,631 |

|

| Total Liabilities and Shareholders' Equity |

|

$ |

3,615,571 |

|

|

$ |

3,552,772 |

|

| See Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST GUARANTY BANCSHARES, INC. AND SUBSIDIARY |

| CONSOLIDATED STATEMENTS OF INCOME (unaudited) |

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (in thousands, except share data) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Interest Income: |

|

|

|

|

|

|

|

|

| Loans (including fees) |

|

$ |

47,552 |

|

|

$ |

40,290 |

|

|

$ |

94,470 |

|

|

$ |

78,439 |

|

| Deposits with other banks |

|

3,626 |

|

|

1,071 |

|

|

7,102 |

|

|

1,822 |

|

| Securities (including FHLB stock) |

|

2,473 |

|

|

2,420 |

|

|

4,987 |

|

|

4,807 |

|

| Total Interest Income |

|

53,651 |

|

|

43,781 |

|

|

106,559 |

|

|

85,068 |

|

|

|

|

|

|

|

|

|

|

| Interest Expense: |

|

|

|

|

|

|

|

|

| Demand deposits |

|

17,059 |

|

|

15,036 |

|

|

34,035 |

|

|

28,085 |

|

| Savings deposits |

|

1,327 |

|

|

838 |

|

|

2,554 |

|

|

1,417 |

|

| Time deposits |

|

10,446 |

|

|

5,224 |

|

|

20,018 |

|

|

8,800 |

|

| Borrowings |

|

3,577 |

|

|

1,770 |

|

|

6,789 |

|

|

3,552 |

|

| Total Interest Expense |

|

32,409 |

|

|

22,868 |

|

|

63,396 |

|

|

41,854 |

|

|

|

|

|

|

|

|

|

|

| Net Interest Income |

|

21,242 |

|

|

20,913 |

|

|

43,163 |

|

|

43,214 |

|

| Less: Provision for credit losses |

|

6,805 |

|

|

548 |

|

|

9,109 |

|

|

862 |

|

| Net Interest Income after Provision for Credit Losses |

|

14,437 |

|

|

20,365 |

|

|

34,054 |

|

|

42,352 |

|

|

|

|

|

|

|

|

|

|

| Noninterest Income: |

|

|

|

|

|

|

|

|

| Service charges, commissions and fees |

|

795 |

|

|

818 |

|

|

1,528 |

|

|

1,603 |

|

| ATM and debit card fees |

|

804 |

|

|

828 |

|

|

1,568 |

|

|

1,653 |

|

| Net gains on securities |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net gains on sale of loans |

|

10 |

|

|

— |

|

|

10 |

|

|

12 |

|

| Net gains on sale of assets |

|

13,207 |

|

|

7 |

|

|

13,213 |

|

|

18 |

|

| Other |

|

710 |

|

|

1,159 |

|

|

1,515 |

|

|

2,230 |

|

| Total Noninterest Income |

|

15,526 |

|

|

2,812 |

|

|

17,834 |

|

|

5,516 |

|

|

|

|

|

|

|

|

|

|

| Total Business Revenue, Net of Provision for Credit Losses |

|

29,963 |

|

|

23,177 |

|

|

51,888 |

|

|

47,868 |

|

|

|

|

|

|

|

|

|

|

| Noninterest Expense: |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

10,440 |

|

|

9,932 |

|

|

20,340 |

|

|

19,936 |

|

| Occupancy and equipment expense |

|

2,547 |

|

|

2,219 |

|

|

4,818 |

|

|

4,421 |

|

| Other |

|

7,622 |

|

|

7,584 |

|

|

14,385 |

|

|

15,544 |

|

| Total Noninterest Expense |

|

20,609 |

|

|

19,735 |

|

|

39,543 |

|

|

39,901 |

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes |

|

9,354 |

|

|

3,442 |

|

|

12,345 |

|

|

7,967 |

|

| Less: Provision for income taxes |

|

2,153 |

|

|

766 |

|

|

2,834 |

|

|

1,823 |

|

| Net Income |

|

7,201 |

|

|

2,676 |

|

|

9,511 |

|

|

6,144 |

|

| Less: Preferred stock dividends |

|

582 |

|

|

582 |

|

|

1,164 |

|

|

1,164 |

|

| Net Income Available to Common Shareholders |

|

$ |

6,619 |

|

|

$ |

2,094 |

|

|

$ |

8,347 |

|

|

$ |

4,980 |

|

|

|

|

|

|

|

|

|

|

| Per Common Share: |

|

|

|

|

|

|

|

|

| Earnings |

|

$ |

0.53 |

|

|

$ |

0.19 |

|

|

$ |

0.67 |

|

|

$ |

0.46 |

|

| Cash dividends paid |

|

$ |

0.16 |

|

|

$ |

0.16 |

|

|

$ |

0.32 |

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

| Weighted Average Common Shares Outstanding |

|

12,504,717 |

|

|

10,913,029 |

|

|

12,497,313 |

|

|

10,815,454 |

|

| See Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST GUARANTY BANCSHARES, INC. AND SUBSIDIARY |

| CONSOLIDATED AVERAGE BALANCE SHEETS (unaudited) |

|

|

|

|

|

| |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

| (in thousands except for %) |

|

Average Balance |

|

Interest |

|

Yield/Rate (5) |

|

Average Balance |

|

Interest |

|

Yield/Rate (5) |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning deposits with banks |

|

$ |

271,113 |

|

|

$ |

3,626 |

|

|

5.38 |

% |

|

$ |

90,388 |

|

|

$ |

1,071 |

|

|

4.75 |

% |

| Securities (including FHLB stock) |

|

370,926 |

|

|

2,473 |

|

|

2.68 |

% |

|

407,689 |

|

|

2,420 |

|

|

2.38 |

% |

| Federal funds sold |

|

627 |

|

|

— |

|

|

— |

% |

|

410 |

|

|

— |

|

|

— |

% |

| Loans held for sale |

|

— |

|

|

— |

|

|

— |

% |

|

— |

|

|

— |

|

|

— |

% |

| Loans, net of unearned income (6) |

|

2,807,234 |

|

|

47,552 |

|

|

6.81 |

% |

|

2,568,051 |

|

|

40,290 |

|

|

6.29 |

% |

| Total interest-earning assets |

|

3,449,900 |

|

|

$ |

53,651 |

|

|

6.25 |

% |

|

3,066,538 |

|

|

$ |

43,781 |

|

|

5.73 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

20,264 |

|

|

|

|

|

|

18,443 |

|

|

|

|

|

| Premises and equipment, net |

|

70,790 |

|

|

|

|

|

|

59,924 |

|

|

|

|

|

| Other assets |

|

30,854 |

|

|

|

|

|

|

28,958 |

|

|

|

|

|

| Total Assets |

|

$ |

3,571,808 |

|

|

|

|

|

|

$ |

3,173,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

|

$ |

1,519,363 |

|

|

$ |

17,059 |

|

|

4.52 |

% |

|

$ |

1,458,353 |

|

|

$ |

15,036 |

|

|

4.14 |

% |

| Savings deposits |

|

231,166 |

|

|

1,327 |

|

|

2.31 |

% |

|

214,055 |

|

|

838 |

|

|

1.57 |

% |

| Time deposits |

|

885,871 |

|

|

10,446 |

|

|

4.74 |

% |

|

631,605 |

|

|

5,224 |

|

|

3.32 |

% |

| Borrowings |

|

239,114 |

|

|

3,577 |

|

|

6.02 |

% |

|

122,969 |

|

|

1,770 |

|

|

5.77 |

% |

| Total interest-bearing liabilities |

|

2,875,514 |

|

|

$ |

32,409 |

|

|

4.53 |

% |

|

2,426,982 |

|

|

$ |

22,868 |

|

|

3.78 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

|

420,957 |

|

|

|

|

|

|

496,209 |

|

|

|

|

|

| Other |

|

23,342 |

|

|

|

|

|

|

17,366 |

|

|

|

|

|

| Total Liabilities |

|

3,319,813 |

|

|

|

|

|

|

2,940,557 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

251,995 |

|

|

|

|

|

|

233,306 |

|

|

|

|

|

| Total Liabilities and Shareholders' Equity |

|

$ |

3,571,808 |

|

|

|

|

|

|

$ |

3,173,863 |

|

|

|

|

|

| Net interest income |

|

|

|

$ |

21,242 |

|

|

|

|

|

|

$ |

20,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest rate spread (1) |

|

|

|

|

|

1.72 |

% |

|

|

|

|

|

1.95 |

% |

| Net interest-earning assets (2) |

|

$ |

574,386 |

|

|

|

|

|

|

$ |

639,556 |

|

|

|

|

|

| Net interest margin (3), (4) |

|

|

|

|

|

2.48 |

% |

|

|

|

|

|

2.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest-earning assets to interest-bearing liabilities |

|

|

|

|

|

119.98 |

% |

|

|

|

|

|

126.35 |

% |

(1)Net interest rate spread represents the difference between the yield on average interest-earning assets and the cost of average interest-bearing liabilities.

(2)Net interest-earning assets represents total interest-earning assets less total interest-bearing liabilities.

(3)Net interest margin represents net interest income divided by average total interest-earning assets.

(4)The tax adjusted net interest margin was 2.47% and 2.74% for the above periods ended June 30, 2024 and 2023 respectively. A 21% tax rate was used to calculate the effect on securities income from tax exempt securities for the above periods ended June 30, 2024 and 2023 respectively.

(5)Annualized.

(6)Includes loan fees of $2.0 million and $1.4 million for the three months ended June 30, 2024 and 2023 respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FIRST GUARANTY BANCSHARES, INC. AND SUBSIDIARY |

| CONSOLIDATED AVERAGE BALANCE SHEETS (unaudited) |

|

|

|

|

|

| |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

| (in thousands except for %) |

|

Average Balance |

|

Interest |

|

Yield/Rate (5) |

|

Average Balance |

|

Interest |

|

Yield/Rate (5) |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning deposits with banks |

|

$ |

266,547 |

|

|

$ |

7,102 |

|

|

5.36 |

% |

|

$ |

81,497 |

|

|

$ |

1,822 |

|

|

4.51 |

% |

| Securities (including FHLB stock) |

|

381,570 |

|

|

4,987 |

|

|

2.63 |

% |

|

417,104 |

|

|

4,807 |

|

|

2.32 |

% |

| Federal funds sold |

|

478 |

|

|

— |

|

|

— |

% |

|

421 |

|

|

— |

|

|

— |

% |

| Loans held for sale |

|

— |

|

|

— |

|

|

— |

% |

|

— |

|

|

— |

|

|

— |

% |

| Loans, net of unearned income (6) |

|

2,784,384 |

|

|

94,470 |

|

|

6.82 |

% |

|

2,548,446 |

|

|

78,439 |

|

|

6.21 |

% |

| Total interest-earning assets |

|

3,432,979 |

|

|

$ |

106,559 |

|

|

6.24 |

% |

|

3,047,468 |

|

|

$ |

85,068 |

|

|

5.63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

19,650 |

|

|

|

|

|

|

18,853 |

|

|

|

|

|

| Premises and equipment, net |

|

70,445 |

|

|

|

|

|

|

59,043 |

|

|

|

|

|

| Other assets |

|

29,345 |

|

|

|

|

|

|

27,854 |

|

|

|

|

|

| Total Assets |

|

$ |

3,552,419 |

|

|

|

|

|

|

$ |

3,153,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

|

$ |

1,530,063 |

|

|

$ |

34,035 |

|

|

4.47 |

% |

|

$ |

1,473,147 |

|

|

$ |

28,085 |

|

|

3.84 |

% |

| Savings deposits |

|

227,562 |

|

|

2,554 |

|

|

2.26 |

% |

|

209,190 |

|

|

1,417 |

|

|

1.37 |

% |

| Time deposits |

|

868,292 |

|

|

20,018 |

|

|

4.64 |

% |

|

596,575 |

|

|

8,800 |

|

|

2.97 |

% |

| Borrowings |

|

233,635 |

|

|

6,789 |

|

|

5.84 |

% |

|

121,892 |

|

|

3,552 |

|

|

5.88 |

% |

| Total interest-bearing liabilities |

|

2,859,552 |

|

|

$ |

63,396 |

|

|

4.46 |

% |

|

2,400,804 |

|

|

$ |

41,854 |

|

|

3.52 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

|

420,437 |

|

|

|

|

|

|

503,216 |

|

|

|

|

|

| Other |

|

20,258 |

|

|

|

|

|

|

15,071 |

|

|

|

|

|

| Total Liabilities |

|

3,300,247 |

|

|

|

|

|

|

2,919,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

252,172 |

|

|

|

|

|

|

234,127 |

|

|

|

|

|

| Total Liabilities and Shareholders' Equity |

|

$ |

3,552,419 |

|

|

|

|

|

|

$ |

3,153,218 |

|

|

|

|

|

| Net interest income |

|

|

|

$ |

43,163 |

|

|

|

|

|

|

$ |

43,214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest rate spread (1) |

|

|

|

|

|

1.78 |

% |

|

|

|

|

|

2.11 |

% |

| Net interest-earning assets (2) |

|

$ |

573,427 |

|

|

|

|

|

|

$ |

646,664 |

|

|

|

|

|

| Net interest margin (3), (4) |

|

|

|

|

|

2.53 |

% |

|

|

|

|

|

2.86 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest-earning assets to interest-bearing liabilities |

|

|

|

|

|

120.05 |

% |

|

|

|

|

|

126.94 |

% |

(1)Net interest rate spread represents the difference between the yield on average interest-earning assets and the cost of average interest-bearing liabilities.

(2)Net interest-earning assets represents total interest-earning assets less total interest-bearing liabilities.

(3)Net interest margin represents net interest income divided by average total interest-earning assets.

(4)The tax adjusted net interest margin was 2.53% and 2.86% for the above periods ended June 30, 2024 and 2023 respectively. A 21% tax rate was used to calculate the effect on securities income from tax exempt securities for the above periods ended June 30, 2024 and 2023 respectively.

(5)Annualized.

(6)Includes loan fees of $4.0 million and $2.8 million for the six months ended June 30, 2024 and 2023 respectively.

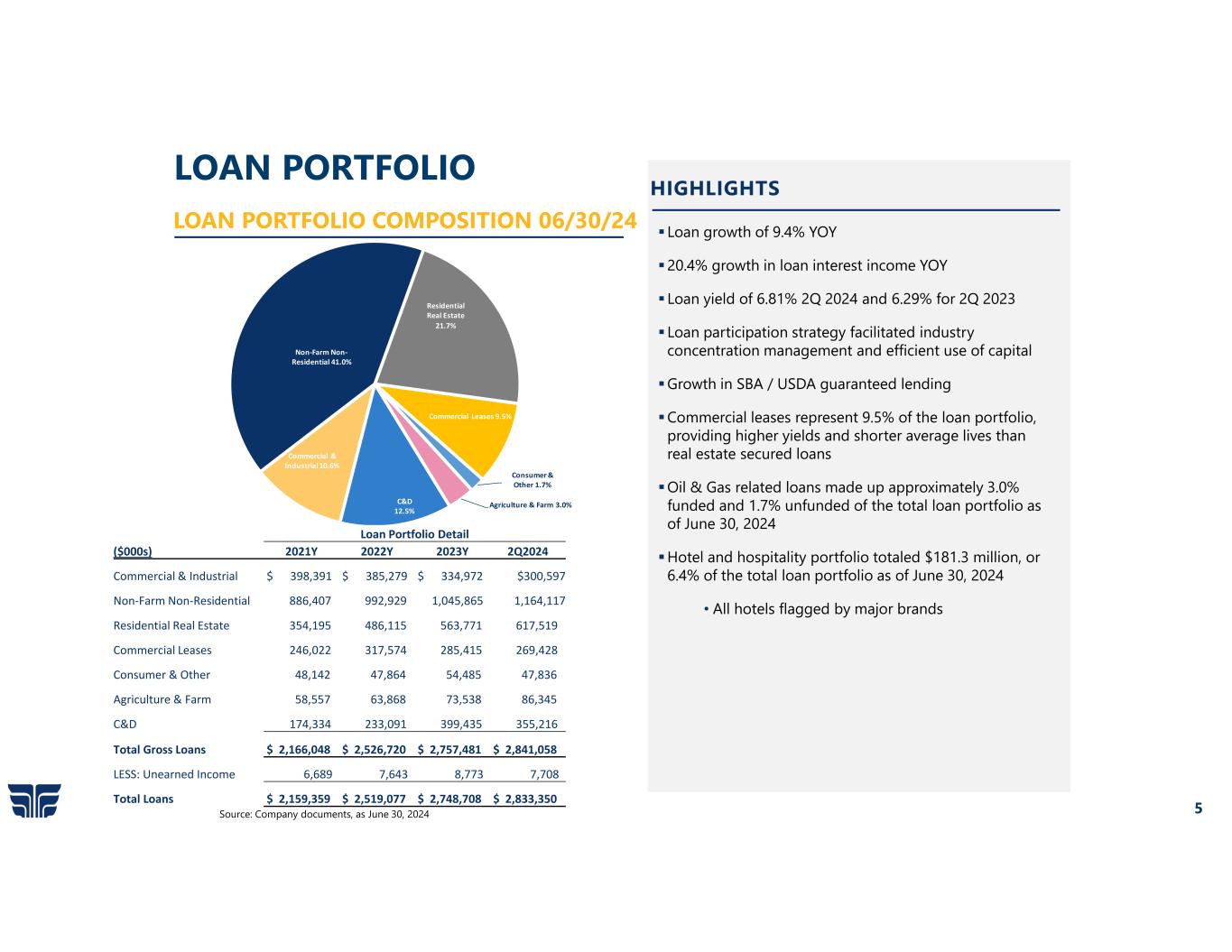

The following table summarizes the components of First Guaranty's loan portfolio as of June 30, 2024, March 31, 2024, December 31, 2023, and September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

|

|

|

| (in thousands except for %) |

|

Balance |

|

As % of Category |

|

Balance |

|

As % of Category |

|

Balance |

|

As % of Category |

|

Balance |

|

As % of Category |

|

|

|

|

| Real Estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Construction & land development |

|

$ |

355,216 |

|

|

12.5 |

% |

|

$ |

328,090 |

|

|

11.9 |

% |

|

$ |

399,435 |

|

|

14.5 |

% |

|

$ |

342,246 |

|

|

12.6 |

% |

|

|

|

|

| Farmland |

|

38,493 |

|

|

1.3 |

% |

|

37,534 |

|

|

1.3 |

% |

|

32,530 |

|

|

1.2 |

% |

|

31,361 |

|

|

1.1 |

% |

|

|

|

|

| 1- 4 Family |

|

457,263 |

|

|

16.1 |

% |

|

456,659 |

|

|

16.5 |

% |

|

444,850 |

|

|

16.1 |

% |

|

419,045 |

|

|

15.5 |

% |

|

|

|

|

| Multifamily |

|

160,256 |

|

|

5.6 |

% |

|

165,148 |

|

|

6.0 |

% |

|

118,921 |

|

|

4.3 |

% |

|

121,206 |

|

|

4.5 |

% |

|

|

|

|

| Non-farm non-residential |

|

1,164,117 |

|

|

41.0 |

% |

|

1,133,516 |

|

|

41.1 |

% |

|

1,045,865 |

|

|

37.9 |

% |

|

1,052,750 |

|

|

38.9 |

% |

|

|

|

|

| Total Real Estate |

|

2,175,345 |

|

|

76.5 |

% |

|

2,120,947 |

|

|

76.8 |

% |

|

2,041,601 |

|

|

74.0 |

% |

|

1,966,608 |

|

|

72.6 |

% |

|

|

|

|

| Non-Real Estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Agricultural |

|

47,852 |

|

|

1.7 |

% |

|

43,422 |

|

|

1.6 |

% |

|

41,008 |

|

|

1.5 |

% |

|

47,949 |

|

|

1.8 |

% |

|

|

|

|

Commercial and industrial(1) |

|

300,597 |

|

|

10.6 |

% |

|

293,292 |

|

|

10.6 |

% |

|

334,972 |

|

|

12.1 |

% |

|

354,836 |

|

|

13.1 |

% |

|

|

|

|

| Commercial leases |

|

269,428 |

|

|

9.5 |

% |

|

253,016 |

|

|

9.2 |

% |

|

285,415 |

|

|

10.4 |

% |

|

292,208 |

|

|

10.8 |

% |

|

|

|

|

| Consumer and other |

|

47,836 |

|

|

1.7 |

% |

|

49,458 |

|

|

1.8 |

% |

|

54,485 |

|

|

2.0 |

% |

|

46,068 |

|

|

1.7 |

% |

|

|

|

|

| Total Non-Real Estate |

|

665,713 |

|

|

23.5 |

% |

|

639,188 |

|

|

23.2 |

% |

|

715,880 |

|

|

26.0 |

% |

|

741,061 |

|

|

27.4 |

% |

|

|

|

|

| Total loans before unearned income |

|

2,841,058 |

|

|

100.0 |

% |

|

2,760,135 |

|

|

100.0 |

% |

|

2,757,481 |

|

|

100.0 |

% |

|

2,707,669 |

|

|

100.0 |

% |

|

|

|

|

| Unearned income |

|

(7,708) |

|

|

|

|

(7,905) |

|

|

|

|

(8,773) |

|

|

|

|

(8,276) |

|

|

|

|

|

|

|

| Total loans net of unearned income |

|

$ |

2,833,350 |

|

|

|

|

$ |

2,752,230 |

|

|

|

|

$ |

2,748,708 |

|

|

|

|

$ |

2,699,393 |

|

|

|

|

|

|

|

(1) Includes PPP loans fully guaranteed by the SBA of $2.3 million, $2.6 million, $2.8 million, and $3.1 million at June 30, 2024, March 31, 2024, December 31, 2023, and September 30, 2023, respectively.

The table below sets forth the amounts and categories of our nonperforming assets at the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

June 30, 2024 |

|

March 31, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

| Nonaccrual loans: |

|

|

|

|

|

|

|

|

| Real Estate: |

|

|

|

|

|

|

|

|

| Construction and land development |

|

$ |

2,314 |

|

|

$ |

598 |

|

|

$ |

530 |

|

|

$ |

664 |

|

| Farmland |

|

666 |

|

|

903 |

|

|

836 |

|

|

874 |

|

| 1- 4 family |

|

7,900 |

|

|

8,157 |

|

|

6,985 |

|

|

6,827 |

|

| Multifamily |

|

537 |

|

|

537 |

|

|

537 |

|

|

537 |

|

| Non-farm non-residential |

|

41,626 |

|

|

9,733 |

|

|

9,740 |

|

|

8,403 |

|

| Total Real Estate |

|

53,043 |

|

|

19,928 |

|

|

18,628 |

|

|

17,305 |

|

| Non-Real Estate: |

|

|

|

|

|

|

|

|

| Agricultural |

|

1,379 |

|

|

1,658 |

|

|

1,369 |

|

|

1,378 |

|

| Commercial and industrial |

|

4,084 |

|

|

4,691 |

|

|

1,581 |

|

|

2,827 |

|

| Commercial leases |

|

3,552 |

|

|

1,799 |

|

|

1,799 |

|

|

1,799 |

|

| Consumer and other |

|

267 |

|

|

530 |

|

|

1,810 |

|

|

2,246 |

|

| Total Non-Real Estate |

|

9,282 |

|

|

8,678 |

|

|

6,559 |

|

|

8,250 |

|

| Total nonaccrual loans |

|

62,325 |

|

|

28,606 |

|

|

25,187 |

|

|

25,555 |

|

|

|

|

|

|

|

|

|

|

| Loans 90 days and greater delinquent & accruing: |

|

|

|

|

|

|

|

|

| Real Estate: |

|

|

|

|

|

|

|

|

| Construction and land development |

|

— |

|

|

— |

|

|

— |

|

|

182 |

|

| Farmland |

|

— |

|

|

— |

|

|

— |

|

|

2,693 |

|

| 1- 4 family |

|

77 |

|

|

— |

|

|

124 |

|

|

593 |

|

| Multifamily |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Non-farm non-residential |

|

122 |

|

|

14,600 |

|

|

14,711 |

|

|

956 |

|

| Total Real Estate |

|

199 |

|

|

14,600 |

|

|

14,835 |

|

|

4,424 |

|

| Non-Real Estate: |

|

|

|

|

|

|

|

|

| Agricultural |

|

— |

|

|

58 |

|

|

57 |

|

|

61 |

|

| Commercial and industrial |

|

— |

|

|

— |

|

|

395 |

|

|

3,659 |

|

| Commercial leases |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Consumer and other |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total Non-Real Estate |

|

— |

|

|

58 |

|

|

452 |

|

|

3,720 |

|

| Total loans 90 days and greater delinquent & accruing |

|

199 |

|

|

14,658 |

|

|

15,287 |

|

|

8,144 |

|

|

|

|

|

|

|

|

|

|

| Total non-performing loans |

|

62,524 |

|

|

43,264 |

|

|

40,474 |

|

|

33,699 |

|

|

|

|

|

|

|

|

|

|

| Real Estate Owned: |

|

|

|

|

|

|

|

|

| Real Estate Loans: |

|

|

|

|

|

|

|

|

| Construction and land development |

|

201 |

|

|

282 |

|

|

251 |

|

|

251 |

|

| Farmland |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| 1- 4 family |

|

141 |

|

|

312 |

|

|

309 |

|

|

194 |

|

| Multifamily |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Non-farm non-residential |

|

690 |

|

|

690 |

|

|

690 |

|

|

690 |

|

| Total Real Estate |

|

1,032 |

|

|

1,284 |

|

|

1,250 |

|

|

1,135 |

|

| Non-Real Estate Loans: |

|

|

|

|

|

|

|

|

| Agricultural |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Commercial and industrial |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Commercial leases |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Consumer and other |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total Non-Real Estate |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total Real Estate Owned |

|

1,032 |

|

|

1,284 |

|

|

1,250 |

|

|

1,135 |

|

|

|

|

|

|

|

|

|

|

| Total non-performing assets |

|

$ |

63,556 |

|

|

$ |

44,548 |

|

|

$ |

41,724 |

|

|

$ |

34,834 |

|

|

|

|

|

|

|

|

|

|

| Non-performing assets to total loans |

|

2.24 |

% |

|

1.62 |

% |

|

1.52 |

% |

|

1.29 |

% |

| Non-performing assets to total assets |

|

1.76 |

% |

|

1.25 |

% |

|

1.17 |

% |

|

1.02 |

% |

| Non-performing loans to total loans |

|

2.21 |

% |

|

1.57 |

% |

|

1.47 |

% |

|

1.25 |

% |

| Nonaccrual loans to total loans |

|

2.20 |

% |

|

1.04 |

% |

|

0.92 |

% |

|

0.95 |

% |

| Allowance for credit losses to nonaccrual loans |

|

48.60 |

% |

|

109.94 |

% |

|

122.79 |

% |

|

124.97 |

% |

| Net loan charge-offs to average loans |

|

0.76 |

% |

|

0.29 |

% |

|

0.17 |

% |

|

0.05 |

% |

The following table presents, for the periods indicated, the major categories of other noninterest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in thousands) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Other noninterest expense: |

|

|

|

|

|

|

|

|

| Legal and professional fees |

|

$ |

1,504 |

|

|

$ |

1,358 |

|

|

$ |

2,477 |

|

|

$ |

3,534 |

|

| Data processing |

|

406 |

|

|

531 |

|

|

783 |

|

|

1,062 |

|

| ATM fees |

|

394 |

|

|

426 |

|

|

813 |

|

|

823 |

|

| Marketing and public relations |

|

370 |

|

|

481 |

|

|

703 |

|

|

1,009 |

|

| Taxes - sales, capital, and franchise |

|

607 |

|

|

545 |

|

|

1,211 |

|

|

1,105 |

|

| Operating supplies |

|

105 |

|

|

202 |

|

|

206 |

|

|

440 |

|

| Software expense and amortization |

|

1,367 |

|

|

1,164 |

|

|

2,620 |

|

|

2,404 |

|

| Travel and lodging |

|

260 |

|

|

387 |

|

|

487 |

|

|

788 |

|

| Telephone |

|

137 |

|

|

84 |

|

|

242 |

|

|

169 |

|

| Amortization of core deposit intangibles |

|

174 |

|

|

174 |

|

|

348 |

|

|

348 |

|

| Donations |

|

108 |

|

|

256 |

|

|

183 |

|

|

426 |

|

| Net costs from other real estate and repossessions |

|

179 |

|

|

92 |

|

|

383 |

|

|

119 |

|

| Regulatory assessment |

|

989 |

|

|

946 |

|

|

1,922 |

|

|

1,436 |

|

| Other |

|

1,022 |

|

|

938 |

|

|

2,007 |

|

|

1,881 |

|

| Total other noninterest expense |

|

$ |

7,622 |

|

|

$ |

7,584 |

|

|

$ |

14,385 |

|

|

$ |

15,544 |

|

Non-GAAP Financial Measures

Our accounting and reporting policies conform to accounting principles generally accepted in the United States, or GAAP, and the prevailing practices in the banking industry. However, we also evaluate our performance based on certain additional metrics. Tangible book value per share and the ratio of tangible equity to tangible assets are not financial measures recognized under GAAP and, therefore, are considered non-GAAP financial measures.

Our management, banking regulators, many financial analysts and other investors use these non-GAAP financial measures to compare the capital adequacy of banking organizations with significant amounts of preferred equity and/or goodwill or other intangible assets, which typically stem from the use of the purchase accounting method of accounting for mergers and acquisitions. Tangible equity, tangible assets, tangible book value per share or related measures should not be considered in isolation or as a substitute for total shareholders' equity, total assets, book value per share or any other measure calculated in accordance with GAAP. Moreover, the manner in which we calculate tangible equity, tangible assets, tangible book value per share and any other related measures may differ from that of other companies reporting measures with similar names.

The following table reconciles, as of the dates set forth below, shareholders' equity (on a GAAP basis) to tangible equity and total assets (on a GAAP basis) to tangible assets and calculates our tangible book value per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At June 30, |

|

At December 31, |

| (in thousands except for share data and %) |

|

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

| Tangible Common Equity |

|

|

|

|

|

|

|

|

|

|

| Total shareholders' equity |

|

$ |

255,144 |

|

|

$ |

249,631 |

|

|

$ |

234,991 |

|

|

$ |

223,889 |

|

|

$ |

178,591 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

| Preferred |

|

33,058 |

|

|

33,058 |

|

|

33,058 |

|

|

33,058 |

|

|

— |

|

| Goodwill |

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

| Acquisition intangibles |

|

3,310 |

|

|

3,658 |

|

|

4,355 |

|

|

5,051 |

|

|

5,815 |

|

| Other intangibles |

|

100 |

|

|

100 |

|

|

— |

|

|

— |

|

|

— |

|

| Tangible common equity |

|

$ |

205,776 |

|

|

$ |

199,915 |

|

|

$ |

184,678 |

|

|

$ |

172,880 |

|

|

$ |

159,876 |

|

Common shares outstanding |

|

12,504,717 |

|

|

12,475,424 |

|

|

10,716,796 |

|

|

10,716,796 |

|

|

10,716,796 |

|

Book value per common share |

|

$ |

17.76 |

|

|

$ |

17.36 |

|

|

$ |

18.84 |

|

|

$ |

17.81 |

|

|

$ |

16.66 |

|

Tangible book value per common share |

|

$ |

16.46 |

|

|

$ |

16.03 |

|

|

$ |

17.23 |

|

|

$ |

16.13 |

|

|

$ |

14.92 |

|

| Tangible Assets |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

3,615,571 |

|

|

$ |

3,552,772 |

|

|

$ |

3,151,347 |

|

|

$ |

2,878,120 |

|

|

$ |

2,473,078 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

|

12,900 |

|

| Acquisition intangibles |

|

3,310 |

|

|

3,658 |

|

|

4,355 |

|

|

5,051 |

|

|

5,815 |

|

| Other intangibles |

|

100 |

|

|

100 |

|

|

— |

|

|

— |

|

|

— |

|

| Tangible Assets |

|

$ |

3,599,261 |

|

|

$ |

3,536,114 |

|

|

$ |

3,134,092 |

|

|

$ |

2,860,169 |

|

|

$ |

2,454,363 |

|

| Tangible common equity to tangible assets |

|

5.72 |

% |

|

5.65 |

% |

|

5.89 |

% |

|

6.04 |

% |

|

6.51 |

% |