Document

Kennedy-Wilson Holdings, Inc.

Supplemental Financial Information

For the Quarter Ended March 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Earnings Release |

|

|

News Release |

|

|

Consolidated Balance Sheets (unaudited) |

|

|

Consolidated Statements of Operations (unaudited) |

|

|

Non-GAAP Metrics (unaudited) |

|

|

|

|

|

| Supplemental Financial Information (unaudited) |

|

|

Capitalization Summary |

|

|

| Components of Value |

|

|

Components of Value Summary |

|

|

|

|

|

|

|

|

Multifamily Portfolio |

|

|

| Office Portfolio |

|

|

| Industrial Portfolio |

|

|

| Loan Investments Portfolio |

|

|

| Retail, Hotel, Residential & Other Investment Portfolio |

|

|

| Lease-up Portfolio |

|

|

| Development Projects |

|

|

Debt Schedule |

|

|

Investment Management |

|

|

| Other Portfolio and Financial Information |

|

|

Same Property - Multifamily |

|

|

|

|

|

| Real Estate Investment Transactions |

|

|

EBITDA by Segment (Non-GAAP) |

|

|

Pro-rata Financial Information |

|

|

Appendix |

|

|

Certain terms used in this release are defined below under the caption "Common Definitions". Certain information included in

this release constitutes non-GAAP financial measures. For a definition of the non-GAAP financial measures used in this release, see "Common Definitions" below, and for a reconciliation of those measures to their most comparable GAAP measure, see the tables set forth in the Company's supplemental financial information available at www.kennedywilson.com.

KENNEDY WILSON REPORTS FIRST QUARTER 2024 RESULTS

Beverly Hills, California (May 8, 2024) - Kennedy-Wilson Holdings, Inc. (NYSE: KW), a leading global real estate investment company with $25 billion in AUM across its real estate equity and debt investment portfolio, today reported results for Q1-2024:

Financial Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions, except per share data) |

|

|

Q1 |

| GAAP Results |

|

|

|

|

2024 |

|

2023 |

| GAAP Net Income (Loss) to Common Shareholders |

|

|

|

|

$26.9 |

|

|

($40.8) |

|

| Per Diluted Share |

|

|

|

|

0.19 |

|

|

(0.30) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

|

Q1 |

| Non-GAAP Results |

|

|

|

|

2024 |

|

2023 |

| Adjusted EBITDA |

|

|

|

|

$203.2 |

|

|

$90.9 |

|

| Adjusted Net Income |

|

|

|

|

70.5 |

|

|

5.3 |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA - Key Components (at KW share) |

|

|

|

|

|

|

Baseline EBITDA: Property NOI, loan income, and inv. mgt fees

(net of compensation and general and administrative expenses) |

|

|

|

|

$ |

103.1 |

|

|

$ |

95.5 |

|

| Realized gain on the sale of real estate |

|

|

|

|

108.3 |

|

|

15.0 |

|

| Change in the fair value of the Co-investment portfolio |

|

|

|

|

(10.1) |

|

|

(10.9) |

|

| Other income/(loss) |

|

|

|

|

1.9 |

|

|

(8.7) |

|

| Adjusted EBITDA |

|

|

|

|

$ |

203.2 |

|

|

$ |

90.9 |

|

"We had an excellent quarter as reflected in the significant growth of our adjusted net income and the continued growth of our investment management business, which reported a 94% increase in fee income," said William McMorrow, Chairman and CEO of Kennedy Wilson. "At the same time, we completed several large multifamily construction projects on schedule and on budget which will contribute in a meaningful way to our future net operating income. We also continued to recycle capital from non-core asset sales which will be used to grow our core businesses and reduce leverage on our balance sheet."

Investment Management Business

•94% Growth in Investment Management Fees: Investment Management fees grew by 94% to $21 million in Q1-24 (vs Q1-23) driven by higher levels of Fee-Bearing Capital and $719 million of new originations from the Company's Debt Investment Platform.

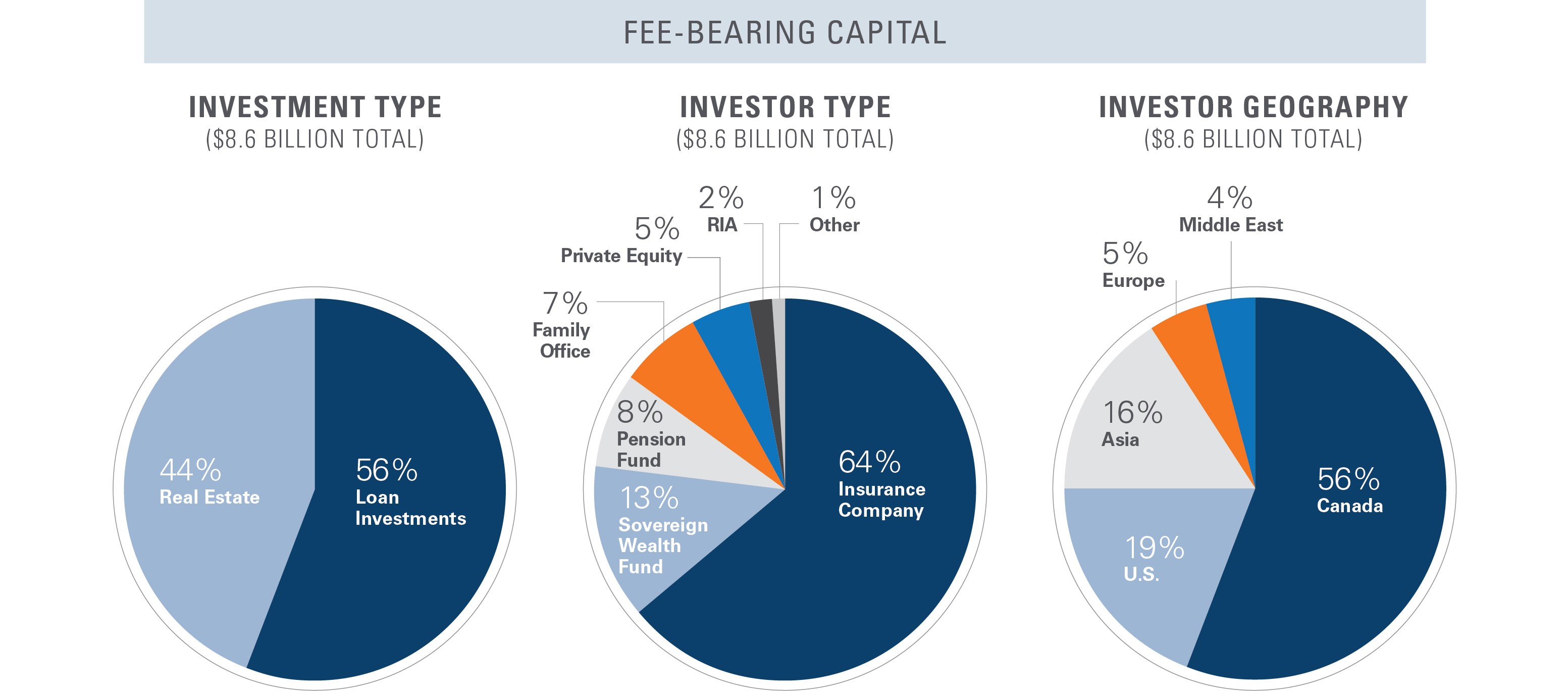

•Fee-Bearing Capital Grew to a Record $8.6 billion in Q1-24:

◦In addition to the $8.6 billion in Fee-Bearing Capital, the Company has an incremental $4.3 billion in non-discretionary capital with certain strategic partners that is currently available for investment. Additionally, the Company's debt investment platform has approximately $2.2 billion in future funding committments.

•Debt Investment Platform Grew By 10% to $7.3 billion in Q1-24:

◦Q1-24 Investment Activity: Originated $719 million in new construction loans, completed $210 million in additional fundings on existing loans, and realized $56 million in repayments.

◦Debt Platform grew to $7.3 billion in loans (including $5.1 billion in outstanding loans and $2.2 billion of future funding commitments) in which the Company has an average ownership interest of 5%.

◦The Debt Investment Platform totals $4.8 billion of Fee-Bearing Capital at quarter-end with $3 billion of new origination capacity.

Real Estate Investment Activity

•$94 million in Gross Acquisitions ($7 million at share):

◦Co-Investment Acquisitions: Completed $94 million in gross real estate acquisitions, including $90 million invested in two multifamily properties in the Pacific Northwest. The Company had a 8% ownership interest in these Q1-24 acquisitions.

• $357 million in Gross Dispositions ($346 million at share):

◦Consolidated Portfolio: Sold non-core hotel, office, and retail assets for a total of $329 million. The dispositions generated $236 million of cash to KW and a gain on sale of $106 million (net of $14 million of impairments).

◦Co-Investment Portfolio: Sold $24 million of non-income producing real estate investments. KW's average ownership in these assets was 55%.

Portfolio Update

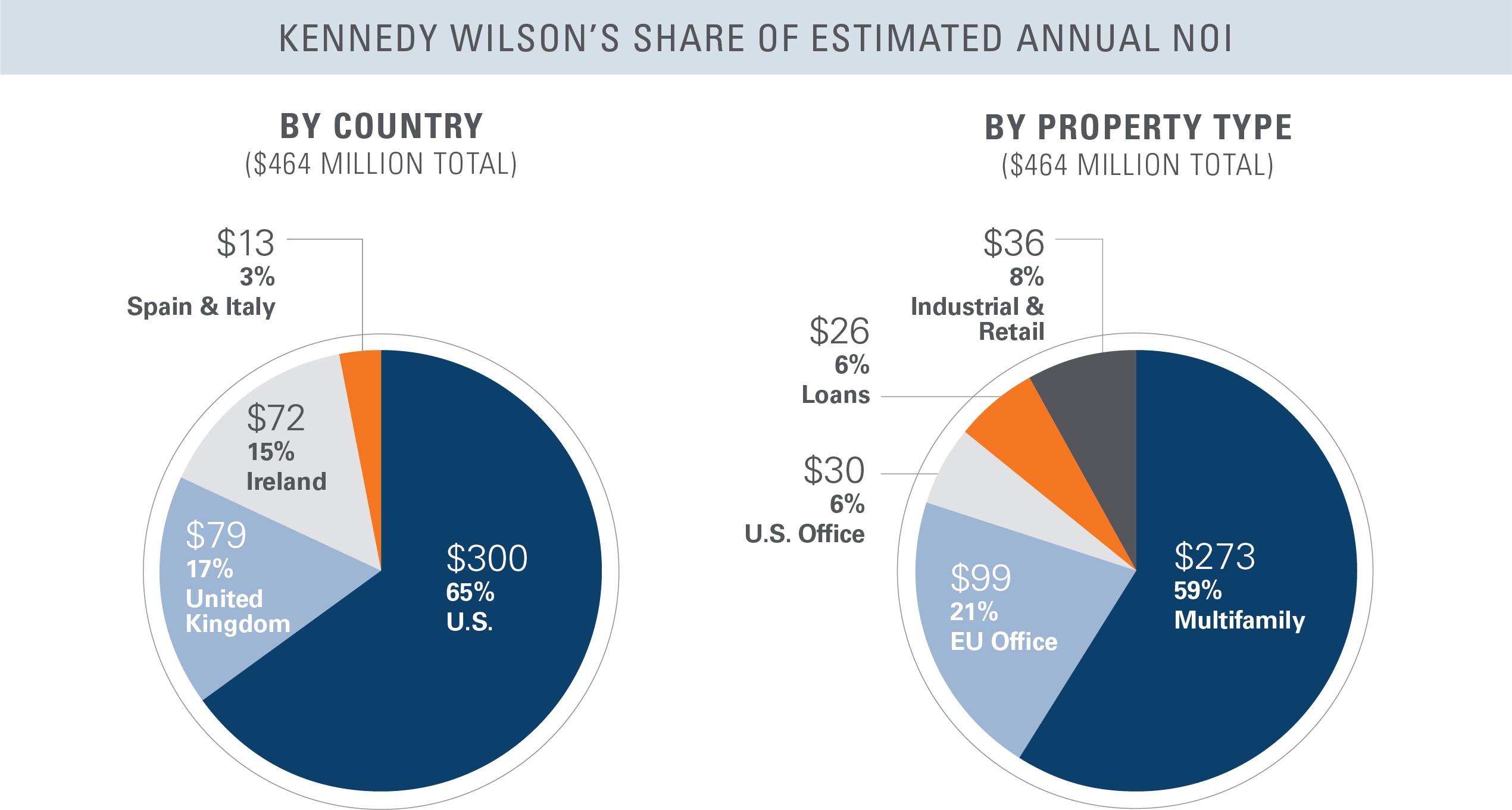

•Estimated Annual NOI of $464 million and Fee-Bearing Capital of $8.6 billion:

◦Potential for an incremental $89-$94 million in Estimated Annual NOI to come from development and lease-up portfolio and an incremental $6.5 billion of potential Fee-Bearing Capital to come from announced platforms and follow-on funding (before any asset sales or loan repayments):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Est. Annual NOI To KW

($ in millions) |

|

Fee-Bearing Capital

($ in billions) |

| As of Q1-23 |

|

|

$496 |

|

|

$6.0 |

|

| As of Q4-23 |

|

|

$492 |

|

|

$8.4 |

|

| Gross acquisitions and loan investments |

|

|

1 |

|

|

0.2 |

|

Gross dispositions and loan repayments1 |

|

|

(28) |

|

|

— |

|

|

|

|

|

|

|

| Operations |

|

|

2 |

|

|

— |

|

| FX and other |

|

|

(3) |

|

|

— |

|

| Total as of Q1-24 |

|

|

$464 |

|

$8.6 |

1Primarily relates to non-core asset sales that produced $236 million in cash to KW and $106 million in net gains

•Development and Lease-up Portfolio To Add $89-$94 million in Estimated Annual NOI:

◦Near Term Stabilization Expectation: $25 million to stabilize by YE-24, $39 million in 2025

◦Multifamily Delivers 814 Units: Completed construction of the 172-unit 38° North Phase II community in Northern California, 240-unit Dovetail multifamily project in the Mountain West, 170-unit Vintage at Anacapa Canyon senior living community in Southern California, and the 232-unit Cornerstone multifamily community in Dublin.

◦Market-rate Apartments on Track to Stabilize: The Company is 68% leased across its four recently completed multifamily communities, Coopers Cross Resi and Grange West in Dublin, 38° North Phase II in Northern California, and Dovetail in the Mountain West (as of May 3, 2024), totaling 1,170 units, with lease-up performing ahead of business plan. These assets are expected to stabilize in Q2/Q3-24 and add $17 million in Estimated Annual NOI.

◦Vintage: The Vintage affordable housing platform has 1,604 multifamily units under development or in lease-up, which upon completion is expected to add $8 million to Estimated Annual NOI and grow the Vintage platform to approximately 12,000 stabilized units.

•Multifamily Same Property Performance(1) :

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 - 2024 vs. Q1 - 2023 |

|

|

Avg Occupancy % Q1-24 |

|

Occupancy |

|

Revenue |

|

Expenses |

|

NOI (Net Effective) |

|

|

|

|

|

|

|

| Multifamily - Market Rate |

93.9 |

% |

|

0.1% |

|

3.0% |

|

4.3% |

|

2.4% |

|

|

|

|

|

|

|

| Multifamily - Affordable |

94.6 |

% |

|

(2.0)% |

|

4.0% |

|

11.6% |

|

0.2% |

|

|

|

|

|

|

|

| Total |

94.1 |

% |

|

(0.4)% |

|

3.2% |

|

5.5% |

|

2.1% |

|

|

|

|

|

|

|

(1) Excludes minority-held investments and assets under going development or lease-up.

Balance Sheet and Liquidity

•Cash and Line of Credit Availability: As of March 31, 2024, Kennedy Wilson had a total of $542 million(1) in cash and cash equivalents and $248 million drawn on its $500 million revolving credit facility.

•Debt Profile: Kennedy Wilson's share of debt had a weighted average effective interest rate of 4.5% per annum and a weighted average maturity of 5.2 years as of March 31, 2024. Approximately 98% of the Company's debt is either fixed or hedged with interest rate hedges. The Company's interest rate hedges have a weighted average maturity of 1.4 years.

•Dividend: Declared a quarterly dividend of $0.12 per share (or $0.48 per share annually) to common shareholders of record as of June 28, 2024, with a payment date of July 5th, 2024. The resized dividend rate will allow the Company to retain $66 million per year, strengthening the Company's ability to grow its investment management business, repurchase securities, and reduce leverage.

•Share Repurchases: The Company repurchased 1.1 million shares in Q1-24 at a weighted average price of $8.76. As of the Q1-24, the Company has used $385 million of its $500 million share repurchase authorization since 2018.

Subsequent Events

The Company paid down its line of credit by $60 million in April 2024.

________________________________________________________________________________________

Footnotes

(1) Represents consolidated cash ($342 million of which is in foreign currencies of the EUR or the GBP) and includes $105 million of restricted cash, which is included in cash and cash equivalents and primarily relates to lender reserves associated with consolidated mortgages that we hold on properties. These reserves typically relate to interest, tax, insurance and future capital expenditures at the properties. Additionally, we are subject to withholding taxes to the extent we repatriate cash from certain of our foreign subsidiaries. Under the KWE Notes covenants we have to maintain certain interest coverage and leverage ratios to remain in compliance (see "Indebtedness and Related Covenants" for more detail on KWE Notes in the Company's quarterly report). Due to these covenants, we evaluate the tax and covenant implications before we distribute cash, which could impact the availability of funds at the corporate level. The Company's share of cash, including unconsolidated joint-ventures, totals $637 million.

Conference Call and Webcast Details

Kennedy Wilson will hold a live conference call and webcast to discuss results at 9:00 a.m. PT/ 12:00 p.m. ET on Thursday, May 9. The direct dial-in number for the conference call is (844) 340-4761 for U.S. callers and (412) 717-9616 for international callers. A replay of the call will be available for one week beginning one hour after the live call and can be accessed by (877) 344-7529 for U.S. callers and (412) 317-0088 for international callers. The passcode for the replay is 8726858.

The webcast will be available at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=7dzFxkA0. A replay of the webcast will be available one hour after the original webcast on the Company’s investor relations web site for three months.

About Kennedy Wilson

Kennedy Wilson (NYSE:KW) is a leading global real estate investment company. We own, operate, and invest in real estate through our balance sheet and through our investment management platform in the United States, United Kingdom, and Ireland. We primarily focus on multifamily and office properties as well as industrial and debt investments in our investment management business. For further information on Kennedy Wilson, please visit www.kennedywilson.com.

Kennedy-Wilson Holdings, Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2024 |

|

December 31,

2023 |

| Assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

541.9 |

|

|

$ |

313.7 |

|

| Accounts receivable |

|

42.5 |

|

|

57.3 |

|

Real estate and acquired in place lease values (net of accumulated depreciation and amortization of $906.0 and $957.8) |

|

4,603.5 |

|

|

4,837.3 |

|

Unconsolidated investments (including $1,917.6 and $1,927.0 at fair value) |

|

2,059.6 |

|

|

2,069.1 |

|

| Other assets |

|

182.4 |

|

|

187.5 |

|

| Loan purchases and originations |

|

250.4 |

|

|

247.2 |

|

| Total assets |

|

$ |

7,680.3 |

|

|

$ |

7,712.1 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Accounts payable |

|

$ |

15.5 |

|

|

$ |

17.9 |

|

| Accrued expenses and other liabilities (including $252.2 and $234.4 of deferred tax liabilities) |

|

562.8 |

|

|

597.8 |

|

| Mortgage debt |

|

2,773.1 |

|

|

2,840.9 |

|

| KW unsecured debt |

|

2,032.5 |

|

|

1,934.3 |

|

| KWE unsecured bonds |

|

511.5 |

|

|

522.8 |

|

| Total liabilities |

|

5,895.4 |

|

|

5,913.7 |

|

| Equity |

|

|

|

|

| Cumulative perpetual preferred stock |

|

789.9 |

|

|

789.9 |

|

| Common stock |

|

— |

|

|

— |

|

| Additional paid-in capital |

|

1,706.5 |

|

|

1,718.6 |

|

| Retained (deficit) earnings |

|

(347.1) |

|

|

(349.0) |

|

| Accumulated other comprehensive loss |

|

(406.7) |

|

|

(404.4) |

|

| Total Kennedy-Wilson Holdings, Inc. shareholders’ equity |

|

1,742.6 |

|

|

1,755.1 |

|

| Noncontrolling interests |

|

42.3 |

|

|

43.3 |

|

| Total equity |

|

1,784.9 |

|

|

1,798.4 |

|

| Total liabilities and equity |

|

$ |

7,680.3 |

|

|

$ |

7,712.1 |

|

Kennedy-Wilson Holdings, Inc.

Consolidated Statements of Operations

(Unaudited)

(Dollars in millions, except share amounts and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

|

2024 |

|

2023 |

| Revenue |

|

|

|

|

|

|

|

|

| Rental |

|

|

|

|

|

$ |

97.4 |

|

|

$ |

106.6 |

|

| Hotel |

|

|

|

|

|

9.3 |

|

|

10.6 |

|

| Investment management fees |

|

|

|

|

|

21.3 |

|

|

11.0 |

|

| Loans |

|

|

|

|

|

8.1 |

|

|

3.7 |

|

| Other |

|

|

|

|

|

0.3 |

|

|

0.3 |

|

| Total revenue |

|

|

|

|

|

136.4 |

|

|

132.2 |

|

|

|

|

|

|

|

|

|

|

| (Loss) income from unconsolidated investments |

|

|

|

|

|

|

|

|

| Principal co-investments |

|

|

|

|

|

9.7 |

|

|

16.4 |

|

| Performance allocations |

|

|

|

|

|

(16.4) |

|

|

(10.7) |

|

| Total (loss) income from unconsolidated investments |

|

|

|

|

|

(6.7) |

|

|

5.7 |

|

|

|

|

|

|

|

|

|

|

| Gain on sale of real estate, net |

|

|

|

|

|

106.4 |

|

|

19.2 |

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

| Rental |

|

|

|

|

|

37.2 |

|

|

36.6 |

|

| Hotel |

|

|

|

|

|

7.6 |

|

|

7.9 |

|

Compensation and related (including $5.2 and $7.1 of share-based compensation) |

|

|

|

|

|

27.6 |

|

|

30.6 |

|

| Performance allocation compensation |

|

|

|

|

|

(5.5) |

|

|

1.6 |

|

| General and administrative |

|

|

|

|

|

8.3 |

|

|

8.4 |

|

| Depreciation and amortization |

|

|

|

|

|

38.9 |

|

|

39.4 |

|

| Total expenses |

|

|

|

|

|

114.1 |

|

|

124.5 |

|

| Interest expense |

|

|

|

|

|

(64.7) |

|

|

(62.3) |

|

| Loss on early extinguishment of debt |

|

|

|

|

|

0.3 |

|

|

0.1 |

|

| Other income (loss) |

|

|

|

|

|

6.8 |

|

|

(3.0) |

|

| Income (loss) before provision for income taxes |

|

|

|

|

|

64.4 |

|

|

(32.6) |

|

| (Provision for) benefit from income taxes |

|

|

|

|

|

(26.7) |

|

|

3.9 |

|

| Net income (loss) |

|

|

|

|

|

37.7 |

|

|

(28.7) |

|

| Net loss (income) attributable to noncontrolling interests |

|

|

|

|

|

0.1 |

|

|

(4.2) |

|

Preferred dividends |

|

|

|

|

|

(10.9) |

|

|

(7.9) |

|

| Net income (loss) attributable to Kennedy-Wilson Holdings, Inc. common shareholders |

|

|

|

|

|

$ |

26.9 |

|

|

$ |

(40.8) |

|

| Basic earnings (loss) per share |

|

|

|

|

|

|

|

|

| Earnings (loss) per share |

|

|

|

|

|

$ |

0.19 |

|

|

$ |

(0.30) |

|

| Weighted average shares outstanding |

|

|

|

|

|

138,472,579 |

|

|

137,949,018 |

|

| Diluted earnings (loss) share |

|

|

|

|

|

|

|

|

| Earnings (loss) per share |

|

|

|

|

|

$ |

0.19 |

|

|

$ |

(0.30) |

|

| Weighted average shares outstanding |

|

|

|

|

|

138,628,139 |

|

|

137,949,018 |

|

| Dividends declared per common share |

|

|

|

|

|

$ |

0.24 |

|

|

$ |

0.24 |

|

Kennedy-Wilson Holdings, Inc.

Adjusted EBITDA

(Unaudited)

(Dollars in millions)

The table below reconciles net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders to Adjusted EBITDA, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

|

|

2024 |

|

2023 |

| Net income (loss) attributable to Kennedy-Wilson Holdings, Inc. common shareholders |

|

|

|

|

|

$ |

26.9 |

|

|

$ |

(40.8) |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Add back (Kennedy Wilson's Share)(1): |

|

|

|

|

|

|

|

|

| Interest expense |

|

|

|

|

|

95.2 |

|

|

81.5 |

|

| Loss on early extinguishment of debt |

|

|

|

|

|

(0.3) |

|

|

(0.1) |

|

Depreciation and amortization |

|

|

|

|

|

38.4 |

|

|

39.0 |

|

| Provision for (benefit from) income taxes |

|

|

|

|

|

26.9 |

|

|

(3.7) |

|

| Preferred dividends |

|

|

|

|

|

10.9 |

|

|

7.9 |

|

| Share-based compensation |

|

|

|

|

|

5.2 |

|

|

7.1 |

|

| Adjusted EBITDA |

|

|

|

|

|

$ |

203.2 |

|

|

$ |

90.9 |

|

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

Adjusted Net Income

(Unaudited)

(Dollars in millions, except share data)

The table below reconciles net income attributable to Kennedy-Wilson Holdings, Inc. common shareholders to Adjusted Net Income, using Kennedy Wilson’s pro-rata share amounts for each adjustment item.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

|

|

2024 |

|

2023 |

| Net income (loss) attributable to Kennedy-Wilson Holdings, Inc. common shareholders |

|

|

|

|

|

$ |

26.9 |

|

|

$ |

(40.8) |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Add back (Kennedy Wilson's Share)(1): |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

|

|

|

38.4 |

|

|

39.0 |

|

| Share-based compensation |

|

|

|

|

|

5.2 |

|

|

7.1 |

|

| Adjusted Net Income |

|

|

|

|

|

$ |

70.5 |

|

|

$ |

5.3 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding for diluted |

|

|

|

|

|

138,628,139 |

|

|

137,949,018 |

|

(1) See Appendix for reconciliation of Kennedy Wilson's Share amounts.

Forward-Looking Statements

Statements made by us in this report and in other reports and statements released by us that are not historical facts constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are necessarily estimates reflecting the judgment of our senior management based on our current estimates, expectations, forecasts and projections and include comments that express our current opinions about trends and factors that may impact future operating results. Disclosures that use words such as "believe," "anticipate," "estimate," "intend," "may," "could," "plan," "expect," "project" or the negative of these, as well as similar expressions, are intended to identify forward-looking statements. These statements are not guarantees of future performance, rely on a number of assumptions concerning future events, many of which are outside of our control, and involve known and unknown risks and uncertainties that could cause our actual results, performance or achievement, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties may include the factors and the risks and uncertainties described elsewhere in this report and other filings with the Securities and Exchange Commission (the "SEC"), including the Item 1A. "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2023, as amended by our subsequent filings with the SEC. Any such forward-looking statements, whether made in this report or elsewhere, should be considered in the context of the various disclosures made by us about our businesses including, without limitation, the risk factors discussed in our filings with the SEC. Except as required under the federal securities laws and the rules and regulations of the SEC, we do not have any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events, changes in assumptions, or otherwise.

Common Definitions

· “KWH,” "KW," “Kennedy Wilson,” the "Company," "we," "our," or "us" refers to Kennedy-Wilson Holdings, Inc. and its wholly-owned subsidiaries.

· “Adjusted EBITDA” represents net income before interest expense, loss (gain) on early extinguishment of debt, our share of interest expense included in unconsolidated investments, depreciation and amortization, our share of depreciation and amortization included in unconsolidated investments, provision for (benefit from) income taxes, our share of taxes included in unconsolidated investments, share-based compensation for the Company, and EBITDA attributable to noncontrolling interests.

Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com. Our management uses Adjusted EBITDA to analyze our business because it adjusts net income for items we believe do not accurately reflect the nature of our business going forward or that relate to non-cash compensation expense or noncontrolling interests. Such items may vary for different companies for reasons unrelated to overall operating performance. Additionally, we believe Adjusted EBITDA is useful to investors to assist them in getting a more accurate picture of our results from operations. However, Adjusted EBITDA is not a recognized measurement under GAAP and when analyzing our operating performance, readers should use Adjusted EBITDA in addition to, and not as an alternative for, net income as determined in accordance with GAAP. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not remove all non-cash items or consider certain cash requirements such as tax and debt service payments. The amount shown for Adjusted EBITDA also differs from the amount calculated under similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges and are used to determine compliance with financial covenants and our ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

· "Adjusted Fees" refers to Kennedy Wilson’s gross investment management and property services fees adjusted to include Kennedy Wilson's share of fees eliminated in consolidation, and performance fees included in unconsolidated investments. Our management uses Adjusted fees to analyze our investment management and business because the measure removes required eliminations under GAAP for properties in which the Company provides services but also has an ownership interest. These eliminations understate the economic value of the investment management and property services fees and makes the Company comparable to other real estate companies that provide investment management but do not have an ownership interest in the properties they manage. Our management believes that adjusting GAAP fees to reflect these amounts eliminated in consolidation presents a more holistic measure of the scope of our investment management and real estate services business.

· "Adjusted Net Income" represents net income (loss) before depreciation and amortization, Kennedy Wilson's share of depreciation and amortization included in unconsolidated investments, share-based compensation, and excluding net income attributable to noncontrolling interests, before depreciation and amortization and preferred dividends. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Baseline EBITDA" represents total consolidated revenues, total consolidated rental and hotel expenses, and KW’s share of net operating income from its unconsolidated investments, excluding share-based compensation and net of non-controlling interest.

· "Cap rate" represents the net operating income of an investment for the year preceding its acquisition or disposition, as applicable, divided by the purchase or sale price, as applicable. Capitalization ("Cap") rates discussed in this report only include data from income-producing properties. The Company calculates cap rates based on information that is supplied to it during the acquisition diligence process. This information is not audited or reviewed by independent accountants and may be presented in a manner that is different from similar information included in the Company's financial statements prepared in accordance with GAAP. In addition, cap rates represent historical performance and are not a guarantee of future net operating income ("NOI"). Properties for which a cap rate is discussed may not continue to perform at that cap rate.

· "Equity partners" refers to non-wholly-owned subsidiaries that we consolidate in our financial statements under U.S. GAAP and third-party equity providers.

· "Estimated Annual NOI" is a property-level non-GAAP measure representing the estimated annual net operating income from each property as of the date shown, inclusive of rent abatements (if applicable). The calculation excludes depreciation and amortization expense, and does not capture the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures, tenant improvements, and leasing commissions necessary to maintain the operating performance of our properties. For assets wholly-owned and fully occupied by KW, the Company provides an estimated NOI for valuation purposes of $4.3 million, which includes an assumption for applicable market rents. Any of the enumerated items above could have a material effect on the performance of our properties. Also, where specifically noted, for properties purchased in 2024, the NOI represents estimated Year 1 NOI from our original underwriting. Estimated year 1 NOI for properties purchased in 2024 may not be indicative of the actual results for those properties. Estimated annual NOI is not an indicator of the actual annual net operating income that the Company will or expects to realize in any period. Please also see the definition of "Net operating income" below. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Fee-Bearing Capital" represents total third-party committed or invested capital that we manage in our joint-ventures and commingled funds that entitle us to earn fees, including without limitation, asset management fees, construction management fees, acquisition and disposition fees and/or promoted interest, if applicable.

· "Gross Asset Value” refers to the gross carrying value of assets, before debt, depreciation and amortization, and net of noncontrolling interests.

· "Net operating income" or "NOI” is a non-GAAP measure representing the income produced by a property calculated by deducting certain property expenses from property revenues. Our management uses net operating income to assess and compare the performance of our properties and to estimate their fair value.

Net operating income does not include the effects of depreciation or amortization or gains or losses from the sale of properties because the effects of those items do not necessarily represent the actual change in the value of our properties resulting from our value-add initiatives or changing market conditions. Our management believes that net operating income reflects the core revenues and costs of operating our properties and is better suited to evaluate trends in occupancy and lease rates. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Noncontrolling interests" represents the portion of equity ownership in a consolidated subsidiary not attributable to Kennedy Wilson.

· "Performance allocations” relates to allocations to the Company of Kennedy Wilson's co-investments it invests in and manages based on the cumulative performance of the fund or investment vehicle, as applicable, and are subject to preferred return thresholds of the limited partners.

· "Performance allocation compensation” - the compensation committee of the Company’s board of directors approved and reserved between twenty percent (20%) and thirty-five percent (35%) of any performance allocation earned by certain commingled funds and separate account investments to be allocated to certain non-NEO employees of the Company.

· "Principal co-investments” consists of the Company’s share of income or loss earned on investments in which the Company can exercise significant influence but does not have control. Income from unconsolidated investments includes income from ordinary course operations of the underlying investment, gains on sale, fair value gains and losses.

· "Pro-Rata" represents Kennedy Wilson's share calculated by using our proportionate economic ownership of each asset in our portfolio. Please also refer to the pro-rata financial data in our supplemental financial information.

· "Property NOI" or "Property-level NOI" is a non-GAAP measure calculated by deducting the Company's Pro-Rata share of rental and hotel property expenses from the Company's Pro-Rata rental, hotel and loans and other revenues. Please also see the reconciliation to GAAP in the Company’s supplemental financial information included in this release and also available at www.kennedywilson.com.

· "Real Estate Assets under Management" ("AUM") generally refers to the properties and other assets with respect to which the Company provides (or participates in) oversight, investment management services and other advice, and which generally consist of real estate properties or loans, and investments in joint ventures. AUM is principally intended to reflect the extent of the Company's presence in the real estate market, not the basis for determining management fees. AUM consists of the total estimated fair value of the real estate properties and other real estate related assets either owned by third parties, wholly-owned by the Company or held by joint ventures and other entities in which its sponsored funds or investment vehicles and client accounts have invested. The estimated value of development properties is included at estimated completion cost. The accuracy of estimating fair value for investments cannot be determined with precision and cannot be substantiated by comparison to quoted prices in active markets and may not be realized in a current sale or immediate settlement of the asset or liability (particularly given the ongoing macroeconomic conditions such as, but not limited to, elevated levels of inflation and interest rates, banks' ability and willingness to lend, recent adverse developments affecting regional banks and other financial institutions, currency fluctuations and ongoing military conflicts around the world, continue to fuel recessionary fears and create volatility in Kennedy Wilson's business results and operations). Recently, there has also been a lack of liquidity in the capital markets as well as limited transactions which has had an impact on the inputs associated with fair values. Additionally, there are inherent uncertainties in any fair value measurement technique, and changes in the underlying assumptions used, including capitalization rates, discount rates, liquidity risks, and estimates of future cash flows could significantly affect the fair value measurement amounts. All valuations of real estate involve subjective judgments.

· "Same property" refers to stabilized consolidated and unconsolidated properties in which Kennedy Wilson has an ownership interest during the entire span of both periods being compared. This analysis excludes properties that during the comparable periods (i) were acquired, (ii) were sold, (iii) are either under development or undergoing lease up or major repositioning as part of the Company’s asset management strategy, (iv) were investments in which the Company holds a minority ownership position, and (v) certain non-recurring income and expenses. The analysis only includes Office, Multifamily and Hotel properties, where applicable. To derive an appropriate measure of operating performance across the comparable periods, the Company removes the effects of foreign currency exchange rate movements by using the reported period-end exchange rate to translate from local currency into the U.S. dollar, for both periods. Amounts are calculated using Kennedy Wilson’s ownership share in the Company’s consolidated and unconsolidated properties. Management evaluates the performance of the operating properties the Company owns and manages using a “same property” analysis because the population of properties in this analysis is consistent from period to period, which allows management and investors to analyze (i) the Company’s ongoing business operations and (ii) the revenues and expenses directly associated with owning and operating the Company’s properties and the impact to operations from trends in occupancy rates, rental rates and operating costs. Same property metrics are widely recognized measures in the real estate industry, however, other publicly-traded real estate companies may not calculate and report same property results in the same manner as the Company. Please also see “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Certain Non-GAAP Measures and Reconciliations” for a reconciliation of “same property” results to the most comparable measure reported under GAAP.

Note about Non-GAAP and certain other financial information included in this presentation

In addition to the results reported in accordance with U.S. generally accepted accounting principles ("GAAP") included within this presentation, Kennedy Wilson has provided certain information, which includes non-GAAP financial measures (including Adjusted EBITDA, Adjusted Net Income, Net Operating Income, and Adjusted Fees, as defined above). Such information is reconciled to its closest GAAP measure in accordance with the rules of the SEC, and such reconciliations are included within this presentation. These measures may contain cash and non-cash acquisition-related gains and expenses and gains and losses from the sale of real-estate related investments. Consolidated non-GAAP measures discussed throughout this report contain income or losses attributable to non-controlling interests. Management believes that these non-GAAP financial measures are useful to both management and Kennedy Wilson's shareholders in their analysis of the business and operating performance of the Company. Management also uses this information for operational planning and decision-making purposes. Non-GAAP financial measures are not and should not be considered a substitute for any GAAP measures. Additionally, non-GAAP financial measures as presented by Kennedy Wilson may not be comparable to similarly titled measures reported by other companies. Annualized figures used throughout this release and supplemental financial information, and our estimated annual net operating income metrics, are not an indicator of the actual net operating income that the Company will or expects to realize in any period.

|

|

|

|

|

|

| Investor Relations |

Corporate Headquarters |

| Daven Bhavsar, CFA |

151 S. El Camino Drive |

| (310) 887-6400 |

Beverly Hills, CA 90212 |

| dbhavsar@kennedywilson.com |

www.kennedywilson.com |

|

KW-IR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Financial Information |

|

|

|

|

|

|

Kennedy-Wilson Holdings, Inc.

Capitalization Summary

(Unaudited)

(Dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

| Market Data |

|

|

|

|

Common stock price per share |

|

$ |

8.58 |

|

|

$ |

12.38 |

|

| Common stock and convertible preferred stock |

|

|

|

|

| Common stock shares outstanding |

|

138,095,244 |

|

|

138,727,521 |

|

Shares of common stock underlying convertible perpetual preferred stock and warrants(1)(2)(3) |

|

37,478,315 |

|

|

37,468,568 |

|

| Total Common stock outstanding and underlying convertible perpetual preferred stock and warrants |

|

175,573,559 |

|

|

176,196,089 |

|

|

|

|

|

|

| Equity Market Capitalization |

|

$ |

1,506.4 |

|

|

$ |

2,181.3 |

|

|

|

|

|

|

| Kennedy Wilson's Share of Debt |

|

|

|

|

| Kennedy Wilson's share of property debt |

|

5,443.8 |

|

|

5,538.8 |

|

| Senior notes payable |

|

1,800.0 |

|

|

1,800.0 |

|

| Kennedy Wilson Europe bonds |

|

512.7 |

|

|

524.3 |

|

Credit Facility(4) |

|

247.9 |

|

150.4 |

|

| Total Kennedy Wilson's share of debt |

|

8,004.4 |

|

|

8,013.5 |

|

| Total Capitalization |

|

$ |

9,510.8 |

|

|

$ |

10,194.8 |

|

| Less: Kennedy Wilson's share of cash |

|

(637.0) |

|

|

(403.0) |

|

| Total Enterprise Value |

|

$ |

8,873.8 |

|

|

$ |

9,791.8 |

|

(1) Assumes conversion of $300 million of our Series A convertible perpetual preferred stock based on current conversion price of $24.80 per share. The Series A preferred stock is callable by Kennedy Wilson on and after October 15, 2025.

(2) Assumes exercise of warrants based on current conversion price of $23.00 per share, which were issued along with $300 million Series B perpetual preferred stock. The Series B preferred stock is callable by Kennedy Wilson at any time.

(3) Assumes exercise of warrants based on current conversion price of $16.21 per share, which were issued along with $200 million Series C perpetual preferred stock. The Series C preferred stock is callable by Kennedy Wilson at any time.

(4) The Company paid down its line of credit by $60 million in April 2024.

Kennedy-Wilson Holdings, Inc.

Components of Value Summary

As of March 31, 2024

(Unaudited, Dollars in millions)

Below are key valuation metrics provided to assist in the calculation of a sum-of-the-parts valuation of the Company as of March 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kennedy Wilson's Share |

|

|

| Investments |

|

Description |

|

Occupancy |

|

Est. Annual NOI(1) |

|

Page # |

| Income Producing Assets |

|

|

|

|

|

|

|

|

| 1 |

Multifamily(2) |

|

34,170 units |

|

93.7% |

|

$ |

272.9 |

|

|

|

| 2a |

EU Office |

|

2.5 million consolidated square feet

1.0 million co-investment square feet

|

|

94.2% |

|

99.0 |

|

|

|

| 2b |

U.S. Office |

|

0.8 million consolidated square feet

4.4 million co-investment square feet

|

|

85.1% |

|

29.6 |

|

|

|

| 3 |

Industrial |

|

11.1 million co-investment square feet |

|

98.5% |

|

16.4 |

|

|

|

| 4 |

Loan Investments |

|

109 loan investments

KW Loan balance of $271.0 million

|

|

N/A |

|

25.5 |

|

|

|

| 5 |

Retail |

|

2.9 million square feet |

|

91.7% |

|

20.4 |

|

|

|

|

Total Estimated Annual NOI |

|

|

|

|

|

$ |

463.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease-up, Development, and Non-income Producing Assets |

|

|

|

KW Gross Asset Value |

|

|

| 6 |

Lease-up Portfolio(3)(4) |

|

Est. Annual NOI at stabilization: $63-$68 million |

|

26.6% |

|

$ |

1,325.0 |

|

|

|

| 7 |

Development Projects(3)(4) |

|

Est. Annual NOI at stabilization: $25 million |

|

N/A |

|

485.3 |

|

|

| 8 |

Residential and other(3) |

|

11 investments |

|

N/A |

|

222.7 |

|

|

|

Total KW Gross Asset Value |

|

|

|

|

|

$ |

2,033.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment Management |

|

Fee-Bearing Capital |

|

Total |

|

|

| 9 |

Investment management |

|

Asset management and origination fees (T-12)(5) |

|

$8,600 |

|

$ |

72.6 |

|

|

|

| 10 |

Investment management |

|

Accrued performance allocations receivable, net |

|

|

|

$ |

43.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Debt, Hedging and KW Share Count |

|

|

|

|

|

Total |

|

|

| 11 |

KW Share of Debt |

|

Secured and Unsecured Debt |

|

|

|

$ |

8,004.4 |

|

|

|

| 12 |

KW Share of Cash |

|

Cash |

|

|

|

(637.0) |

|

|

|

|

Total Net Debt |

|

|

|

|

|

$ |

7,367.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13 |

KW Share of Interest Rate and Currency Hedging Contracts(6) |

|

Corporate and Property Level |

|

|

|

$ |

33.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common stock outstanding and underlying convertible preferred stock |

|

175,573,559 |

|

|

|

(1) Based on weighted average ownership figures held by KW.

(2) Includes 10,367 affordable units the Company owns through its Vintage Housing Holdings platform. Kennedy Wilson's equity investment in Vintage Housing Holdings has a fair value of $285.0 million as of March 31, 2024.

(3) See additional detail related to Lease-up, Development, and Non-income Producing Assets, as of March 31, 2024. KW Share of Debt below is included in the Net Debt amounts within the Components of Value Summary above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KW Gross Asset Value |

|

KW Share of Debt |

|

Investment Account

(GAV - share of debt)

|

| Lease-up - Multifamily and Commercial |

|

$ |

1,325.0 |

|

|

$ |

501.1 |

|

|

$ |

823.9 |

|

| Development - Multifamily and Commercial |

|

485.3 |

|

|

142.2 |

|

|

343.1 |

|

Residential and other |

|

222.7 |

|

|

20.1 |

|

|

202.6 |

|

| Lease-up, Development, and Non-income Producing Assets |

|

$ |

2,033.0 |

|

|

$ |

663.4 |

|

|

$ |

1,369.6 |

|

(4) Includes $128.7 million of gross asset value related to development that the Company owns through its investment Vintage Housing Holdings as of March 31, 2024.

(5) TTM figures are representative of the trailing 12 months and are not indicators of the actual results that the Company will or expects to realize in any period.

(6) Includes $15.3 million included within net Other Assets and $17.7 million within Unconsolidated investments on the Company's Consolidated Balance Sheet .

Kennedy-Wilson Holdings, Inc.

Stabilized Portfolio

As of March 31, 2024

(Unaudited, Dollars in millions)

The following information reflects Kennedy Wilson's Pro-rata share of Estimated Annual NOI (from income-producing assets) by geography and property type, as of March 31, 2024, of which 54% is derived from consolidated assets.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pacific Northwest |

Southern California |

Northern California |

Mountain West |

Other U.S. |

U.K. |

Ireland |

Italy |

Spain |

Total |

| Multifamily - Market Rate |

$ |

52.5 |

|

$ |

28.2 |

|

$ |

21.6 |

|

$ |

92.7 |

|

$ |

— |

|

$ |

— |

|

$ |

30.4 |

|

$ |

— |

|

$ |

— |

|

$ |

225.4 |

|

| Multifamily - Affordable |

30.4 |

|

4.4 |

|

3.3 |

|

9.4 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

47.5 |

|

| Office |

3.4 |

|

15.2 |

|

8.5 |

|

2.5 |

|

— |

|

57.5 |

|

34.5 |

|

7.0 |

|

— |

|

128.6 |

|

| Industrial |

— |

|

— |

|

1.0 |

|

1.5 |

|

— |

|

12.1 |

|

1.5 |

|

— |

|

0.3 |

|

16.4 |

|

| Retail |

— |

|

0.7 |

|

— |

|

0.8 |

|

— |

|

7.6 |

|

5.2 |

|

— |

|

6.1 |

|

20.4 |

|

| Loans |

1.1 |

|

6.9 |

|

4.6 |

|

2.8 |

|

8.8 |

|

1.3 |

|

— |

|

— |

|

— |

|

25.5 |

|

| Total Estimated Annual NOI |

$ |

87.4 |

|

$ |

55.4 |

|

$ |

39.0 |

|

$ |

109.7 |

|

$ |

8.8 |

|

$ |

78.5 |

|

$ |

71.6 |

|

$ |

7.0 |

|

$ |

6.4 |

|

$ |

463.8 |

|

Kennedy-Wilson Holdings, Inc.

Segment Investment Summary

As of March 31, 2024

(Unaudited)

(Dollars in millions, except Fee-Bearing Capital)

The following summarizes Kennedy Wilson's income-producing portfolio by segment. Excluded below are lease-up, development, and residential and other investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stabilized Portfolio |

| KW Segment |

Description |

Balance Sheet Classification |

Multifamily Units |

Commercial Rentable Sq. Ft. |

Loan Investments |

KW Share of Est. Annual NOI |

Fee-Bearing Capital(1) ($bn) |

KW Gross Asset Value |

Ownership(2) |

| 1) Consolidated |

Consists primarily of wholly-owned real estate investments |

Consolidated |

9,230 |

4.7 |

— |

$252.3 |

N/A |

$4,642.7 |

97% |

|

|

|

|

|

|

|

|

|

|

| 2) Co-investment Portfolio: |

|

|

|

|

|

|

|

|

| ~50% owned |

Consists primarily of 50/50 investments with partners and our Vintage Housing joint-venture |

Unconsolidated |

19,820 |

1.0 |

— |

149.7 |

1.2 |

2,748.6 |

49% |

| Minority-held |

Includes fund investments, loans, and other minority-held investments |

Unconsolidated |

5,120 |

17.0 |

109 |

61.8 |

7.4 |

939.2 |

9% |

| Co-investment Portfolio |

|

24,940 |

18.0 |

109 |

$211.5 |

$8.6 |

$3,687.8 |

21% |

|

|

|

|

|

|

|

|

|

|

| Total Stabilized Portfolio |

|

|

34,170 |

22.7 |

109 |

$463.8 |

$8.6 |

$8,330.5 |

37% |

(1) Includes Fee-Bearing Capital related to lease-up, development, and non-income producing assets.

(2) Weighted average ownership figures based on the Company’s share of NOI and are presented on a pre-promote basis.

Kennedy-Wilson Holdings, Inc.

Multifamily Portfolio

As of March 31, 2024

(Unaudited)

(Dollars in millions, except average rents per unit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

Co-Investment (Unconsolidated) |

|

|

|

|

|

|

|

|

|

|

| Multifamily |

# of Assets |

|

Market-Rate

Units |

|

Market-Rate

Units |

VHH Affordable Units (5) |

Total

# of Units |

|

Market-Rate Occupancy (Asset Level) |

|

Market-Rate

Occupancy (KW Share) |

VHH Affordable

Occupancy |

Total Occupancy (KW Share) |

Average Rent(1)(2)(3) |

|

KW Share

of Estimated Annual NOI(4)

|

| Mountain West |

45 |

|

|

5,712 |

|

|

4,210 |

|

2,425 |

|

12,347 |

|

|

93.8 |

% |

|

93.7 |

% |

94.3 |

% |

93.8 |

% |

$ |

1,603 |

|

|

$ |

102.1 |

|

| Pacific Northwest |

55 |

|

|

1,544 |

|

|

4,349 |

|

6,562 |

|

12,455 |

|

|

94.3 |

|

|

93.8 |

|

94.7 |

|

94.1 |

|

2,066 |

|

|

82.9 |

|

| Southern California |

13 |

|

|

846 |

|

|

2,131 |

|

704 |

|

3,681 |

|

|

92.9 |

|

|

93.3 |

|

94.4 |

|

93.5 |

|

2,271 |

|

|

32.6 |

|

| Northern California |

9 |

|

|

1,128 |

|

|

1,357 |

|

676 |

|

3,161 |

|

|

91.8 |

|

|

90.1 |

|

96.9 |

|

91.3 |

|

2,183 |

|

|

24.9 |

|

| Total Western U.S. |

122 |

|

|

9,230 |

|

|

12,047 |

|

10,367 |

|

31,644 |

|

|

93.7 |

% |

|

93.3 |

% |

94.7 |

% |

93.6 |

% |

$ |

1,854 |

|

|

$ |

242.5 |

|

Ireland(4) |

10 |

|

|

— |

|

|

2,526 |

|

— |

|

2,526 |

|

|

97.6 |

|

|

97.6 |

|

— |

|

97.6 |

|

2,614 |

|

|

30.4 |

|

| Total Stabilized |

132 |

|

|

9,230 |

|

|

14,573 |

|

10,367 |

|

34,170 |

|

|

93.9 |

% |

|

93.7 |

% |

94.7 |

% |

93.9 |

% |

$ |

1,922 |

|

|

$ |

272.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease-up Assets |

6 |

|

|

412 |

|

|

990 |

|

170 |

|

1,572 |

|

|

See Page 25 for more information |

|

|

| Development Projects |

14 |

|

|

550 |

|

|

556 |

|

1,434 |

|

2,540 |

|

|

See Page 26 for more information |

|

|

| Total |

20 |

|

|

962 |

|

|

1,546 |

|

1,604 |

|

4,112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Multifamily |

152 |

|

|

10,192 |

|

|

16,119 |

|

11,971 |

|

38,282 |

|

|

|

|

|

|

|

|

|

|

(1) Average Monthly Rents Per Unit is defined as the total potential monthly rental revenue (actual rent for occupied units plus market rent for vacant units) divided by the number of units, and are weighted averages based on the Company's ownership percentage in the underlying properties.

(2) Average Monthly Rents Per Market Rate Unit for the market rate portfolio based on Kennedy Wilson's share of units. Average Monthly Rents Per Unit for the affordable portfolio are $1,420 per month, including $1,265, $1,446, $1,714, and $1,418 for Mountain West, Pacific Northwest, Southern California and Northern California, respectively.

(3) Excludes 642 units related to investment in Langdon Park Capital.

(4) Estimated foreign exchange rates are €1.00 = $1.08 USD, and £1.00 = $1.26 USD related to NOI.

(5) The Company has a 45% economic ownership interest in its Vintage Housing affordable portfolio.

Kennedy-Wilson Holdings, Inc.

Office Portfolio

As of March 31, 2024

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq. ft.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

Co-Investment (Unconsolidated) |

|

|

|

|

|

|

|

|

|

| Office |

# of Assets |

|

Rentable Sq. Ft. |

|

Rentable Sq. Ft. |

Total

Rentable Sq. Ft. |

|

Occupancy (Asset Level) |

|

Occupancy (KW Share) |

|

Average Annual Rent per Sq. Ft.(1) |

|

Kennedy Wilson's Share of

Estimated Annual NOI |

| Pacific Northwest |

2 |

|

|

— |

|

|

0.6 |

|

0.6 |

|

|

98.0 |

% |

|

98.8 |

% |

|

$ |

31.3 |

|

|

$ |

3.4 |

|

Southern California(2) |

6 |

|

|

0.5 |

|

|

0.9 |

|

1.4 |

|

|

78.1 |

|

|

82.7 |

|

|

50.4 |

|

|

15.2 |

|

| Northern California |

5 |

|

|

0.3 |

|

|

1.2 |

|

1.5 |

|

|

84.9 |

|

|

84.8 |

|

|

36.0 |

|

|

8.5 |

|

| Mountain West |

5 |

|

|

— |

|

|

1.7 |

|

1.7 |

|

|

86.2 |

|

|

86.3 |

|

|

20.4 |

|

|

2.5 |

|

| Total Western U.S. |

18 |

|

|

0.8 |

|

|

4.4 |

|

5.2 |

|

|

84.9 |

% |

|

85.1 |

% |

|

$ |

40.2 |

|

|

$ |

29.6 |

|

United Kingdom(3) |

9 |

|

|

1.3 |

|

|

0.5 |

|

1.8 |

|

|

89.7 |

|

|

91.9 |

|

|

43.2 |

|

|

57.5 |

|

Ireland(3)(4) |

9 |

|

|

0.6 |

|

|

0.5 |

|

1.1 |

|

|

95.3 |

|

|

94.6 |

|

|

48.3 |

|

|

34.5 |

|

Italy(3) |

6 |

|

|

0.6 |

|

|

— |

|

0.6 |

|

|

100.0 |

|

|

100.0 |

|

|

13.5 |

|

|

7.0 |

|

Total Europe(3) |

24 |

|

|

2.5 |

|

|

1.0 |

|

3.5 |

|

|

93.2 |

% |

|

94.2 |

% |

|

$ |

38.3 |

|

|

$ |

99.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Stabilized |

42 |

|

|

3.3 |

|

|

5.4 |

|

8.7 |

|

|

88.2 |

% |

|

91.4 |

% |

|

$ |

38.8 |

|

|

$ |

128.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease-up Assets |

9 |

|

|

0.9 |

|

|

1.1 |

|

2.0 |

|

|

See page 25 for more information |

|

|

| Development Projects |

2 |

|

|

0.1 |

|

|

— |

|

0.1 |

|

|

See page 26 for more information |

|

|

| Total |

11 |

|

|

1.0 |

|

|

1.1 |

|

2.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Office |

53 |

|

|

4.3 |

|

|

6.5 |

|

10.8 |

|

|

|

|

|

|

|

|

|

(1) Average Annual Rent per Sq. Ft. represents contractual rents as in-place as of March 31, 2024 and are weighted averages based on the Company's ownership percentage in the underlying properties.

(2) Includes our corporate headquarters wholly-owned by KW comprising 58,000 sq. ft., 100% occupancy, and $3.0 million in Estimated Annual NOI.

(3) Estimated foreign exchange rates are €1.00 = $1.08 USD, and £1.00 = $1.26 USD related to NOI.

(4) Includes our Irish headquarters wholly-owned by KW comprising 19,000 sq. ft., 100% occupancy, and $1.3 million in Estimated Annual NOI.

Kennedy-Wilson Holdings, Inc.

Industrial Portfolio

As of March 31, 2024

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq. ft.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-Investment (Unconsolidated) |

|

|

|

|

|

|

|

|

|

| Industrial |

# of Assets |

|

|

Rentable Sq. Ft. |

|

|

Occupancy

(Asset Level) |

|

Occupancy

(KW Share) |

|

Average Annual Rent per Sq. Ft.(1) |

|

Kennedy Wilson's Share of

Estimated Annual NOI |

| Mountain West |

5 |

|

|

|

1.0 |

|

|

|

100.0 |

|

|

100.0 |

|

|

$ |

11.2 |

|

|

$ |

1.5 |

|

| Northern California |

2 |

|

|

|

1.0 |

|

|

|

100.0 |

|

|

100.0 |

|

|

5.4 |

|

|

1.0 |

|

| Total Western U.S. |

7 |

|

|

|

2.0 |

|

|

|

100.0 |

% |

|

100.0 |

% |

|

$ |

8.1 |

|

|

$ |

2.5 |

|

United Kingdom(2) |

77 |

|

|

|

8.1 |

|

|

|

97.3 |

|

|

98.2 |

|

|

8.8 |

|

|

12.1 |

|

Ireland(2) |

21 |

|

|

|

0.8 |

|

|

|

97.4 |

|

|

97.2 |

|

|

9.9 |

|

|

1.5 |

|

Spain(2) |

3 |

|

|

|

0.2 |

|

|

|

100.0 |

|

|

100.0 |

|

|

5.4 |

|

|

0.3 |

|

Total Europe(2) |

101 |

|

|

|

9.1 |

|

|

|

97.3 |

% |

|

98.2 |

% |

|

$ |

8.8 |

|

|

$ |

13.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Stabilized |

108 |

|

|

|

11.1 |

|

|

|

97.8 |

% |

|

98.5 |

% |

|

$ |

8.7 |

|

|

$ |

16.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease-up Assets |

3 |

|

|

|

0.4 |

|

|

|

See page 25 for more information |

|

|

| Development Projects |

5 |

|

|

|

TBD |

|

|

See page 26 for more information |

|

|

| Total |

8 |

|

|

|

0.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Industrial |

116 |

|

|

|

11.5 |

|

|

|

|

|

|

|

|

|

|

(1) Average Annual Rent per Sq. Ft. represents contractual rents as in-place as of March 31, 2024 and are weighted averages based on the Company's ownership percentage in the underlying properties.

(2) Estimated foreign exchange rates are €1.00 = $1.08 USD, and £1.00 = $1.26 USD related to NOI.

Kennedy-Wilson Holdings, Inc.

Loan Investment Portfolio

As of March 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan Investment |

# of Loans |

|

Average Interest Rate (KW Share) |

|

Loan Balance (KW Share) |

Kennedy Wilson's Share

of Annual Interest Income |

| Southern California |

23 |

|

|

9.2 |

% |

|

$ |

71.5 |

|

$ |

6.9 |

|

| Northern California |

18 |

|

|

8.5 |

% |

|

50.6 |

|

4.6 |

|

| Mountain West |

17 |

|

|

7.9 |

% |

|

31.9 |

|

2.8 |

|

| Pacific Northwest |

7 |

|

|

4.5 |

% |

|

23.6 |

|

1.1 |

|

| Other U.S. |

40 |

|

|

8.8 |

% |

|

81.5 |

|

8.8 |

|

| Total U.S. |

105 |

|

|

8.3 |

% |

|

$ |

259.1 |

|

$ |

24.2 |

|

United Kingdom(1) |

4 |

|

|

10.9 |

% |

|

11.9 |

|

1.3 |

|

| Total Loan Investment |

109 |

|

|

8.4 |

% |

|

$ |

271.0 |

|

$ |

25.5 |

|

(1) Estimated foreign exchange rate is £1.00 = $1.26 USD related to Loan Balance and Annual Interest Income.

|

|

|

|

|

|

| Q1-24 Loan Originations |

|

| # of Loans |

9 |

| Gross Origination Commitment |

$ |

719.4 |

|

| KW Share of Commitment (2.5%) |

18.0 |

| KW Origination Fee |

7.2 |

|

|

|

|

|

|

|

|

|

|

|

|

| Q1-24 Fundings and Repayments |

Investment Level |

|

KW Share |

| Loan Fundings |

$ |

209.8 |

|

|

$ |

10.0 |

|

| Repayments |

56.4 |

|

2.8 |

Kennedy-Wilson Holdings, Inc.

Other Investments

As of March 31, 2024

(Unaudited)

(Dollars and Square Feet in millions, except average rent per sq. ft.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|