Document

ONE SANTANA WEST

OFFICE LEASE AGREEMENT

BETWEEN

SR WINCHESTER, LLC, LANDLORD

AND

CALIX, INC., TENANT

DATE: December 16, 2024

Table of Contents

|

|

|

|

|

|

|

|

|

| ARTICLE I |

REFERENCE PROVISIONS, DEFINITIONS AND EXHIBITS |

Page 1 |

| Section 1.01 |

Reference Provisions |

Page 1 |

| Section 1.02 |

Definitions |

Page 3 |

| ARTICLE II |

LEASED PREMISES |

Page 5 |

| ARTICLE III |

TERM |

Page 5 |

| Section 3.01 |

Term |

Page 5 |

| Section 3.02 |

End of Term |

Page 6 |

| Section 3.03 |

Holding Over |

Page 6 |

| ARTICLE IV |

USE AND OPERATION OF THE LEASED PREMISES |

Page6 |

| Section 4.01 |

Use |

Page 6 |

| Section 4.02 |

Signs and Advertising |

Page 8 |

| ARTICLE V |

RENT |

Page 8 |

| Section 5.01 |

Rent Payable |

Page 8 |

| ARTICLE VI |

COMMON AREAS |

Page 9 |

| Section 6.01 |

Use of Common Areas |

Page 9 |

| Section 6.02 |

Management and Operations of Common Areas |

Page 10 |

| Section 6.02 |

Tenant’s Share of Operating Costs and Taxes |

Page 10 |

| ARTICLE VII |

SERVICES AND UTILITIES |

Page 15 |

| Section 7.01 |

Services Provided by Landlord |

Page 15 |

| Section 7.02 |

Landlord’s Access to Leased Premises |

Page 16 |

| Section 7.03 |

Utilities |

Page 17 |

| Section 7.04 |

LEED Standard |

Page 17 |

| Section 7.05 |

Amenities |

Page 17 |

| ARTICLE VIII |

INDEMNITY AND INSURANCE |

Page 19 |

| Section 8.01 |

Indemnity |

Page 19 |

| Section 8.01 |

Landlord Not Responsible for Acts of Others |

Page 19 |

| Section 8.03 |

Tenant’s Insurance |

Page 19 |

| Section 8.04 |

Tenant’s Contractor’s Insurance |

Page 20 |

| Section 8.05 |

Policy Requirements |

Page 21 |

| Section 8.06 |

Increase in Insurance Premiums |

Page 21 |

| Section 8,07 |

Waiver of Right of Recovery |

Page 22 |

| Section 8.08 |

Landlord’s Insurance |

Page 22 |

| ARTICLE IX |

CONSTRUCTION AND ALTERATIONS |

Page 22 |

| Section 9.01 |

Condition of Leased Premises Upon Delivery |

Page 22 |

| Section 9.02 |

Tenant Improvements |

Page 23 |

| Section 9.03 |

Alterations |

Page 24 |

| Section 9.04 |

Work Requirements |

Page 24 |

| Section 9.05 |

Ownership of Improvements |

Page 24 |

| Section 9.06 |

Removal of Tenant’s Property |

Page 25 |

| Section 9.07 |

Mechanic’s Liens |

Page 25 |

| Section 9.08 |

Cabling; Rooftop Installations |

Page 25 |

| Section 0.09 |

Tenant Security Systems |

Page 27 |

| ARTICLE X |

REPAIRS, MAINTENANCE, AND LANDLORD’S ACCESS |

Page 27 |

| Section 10.01 |

Repairs by Landlord |

Page 27 |

| Section 10.02 |

Repairs and Maintenance by Tenant |

Page 28 |

| Section 10.03 |

Inspections, Access and Emergency Repairs by Landlord |

Page 28 |

| Section 10.04 |

California Accessibility Compliance |

Page 28 |

| ARTICLE XI |

CASUALTY |

Page 29 |

| Section 11.01 |

Fire or Other Casualty |

Page 29 |

| Section 11.02 |

Right to Terminate |

Page 29 |

| Section 11.03 |

Landlord’s Duty to Reconstruct |

Page 29 |

| Section 11.04 |

Tenant’s Duty to Reconstruct |

Page 30 |

| Section 11.05 |

Insurance Proceeds |

Page 30 |

| Section 11.06 |

Landlord Not Liable for Business Interruption |

Page 30 |

|

|

|

|

|

|

|

|

|

| Section 11.07 |

Rent Abatement |

Page 31 |

| Section 11.08 |

Casualty Prior to Term Commencement Date |

Page 31 |

| Section 11.09 |

Waiver |

Page 31 |

| ARTICLE XII |

CONDEMNATION |

Page 31 |

| Section 12.01 |

Taking of Leased Premises |

Page 31 |

| Section 12.02 |

Taking of Building |

Page 31 |

| Section 12.03 |

Condemnation Award |

Page 32 |

| Section 12.04 |

Waiver of CCP § 1265.130 |

Page 32 |

| ARTICLE XIII |

PARKING GARAGE, PARKING RIGHTS & BUILDING AMENITIES |

Page 32 |

| Section 13.01 |

Parking Rights |

Page 32 |

| Section 13.02 |

Parking Rules and Conditions |

Page 33 |

| ARTICLE XIV |

SUBORDINATION AND ATTORNMENT |

Page 33 |

| Section 14.01 |

Subordination |

Page 33 |

| Section 14.02 |

Attornment |

Page 33 |

| Section 14.03 |

Estoppel Certificate |

Page 33 |

| Section 14.04 |

Quiet Enjoyment |

Page 33 |

| ARTICLE XV |

ASSIGNMENT AND SUBLETTING |

Page 34 |

| Section 15.01 |

Landlord’s Consent Required |

Page 34 |

| Section 15.02 |

Tenant Remedies |

Page 36 |

| Section 15.03 |

Intentionally omitted |

Page 36 |

| Section 15.04 |

Landlord Consent Not Required |

Page 36 |

| ARTICLE XVI |

DEFAULT AND REMEDIES |

Page 36 |

| Section 16.01 |

Default |

Page 36 |

| Section 16.02 |

Remedies and Damages |

Page 37 |

| Section 16.03 |

Remedies Cumulative |

Page 38 |

| Section 16.04 |

Waiver |

Page 38 |

| ARTICLE XVII |

MISCELLANEOUS PROVISIONS |

Page 39 |

| Section 17.01 |

Notices |

Page 39 |

| Section 17.02 |

Recording |

Page 39 |

| Section 17.03 |

Interest and Administrative Costs |

Page 39 |

| Section 17.04 |

Legal Expenses |

Page 39 |

| Section 17.05 |

Successors and Assigns |

Page 40 |

| Section 17.06 |

Limitation on Right of Recovery Against Landlord; Transfer of Landlord’s Interest |

Page 40 |

| Section 17.07 |

Security Deposit; Letter of Credit |

Page 40 |

| Section 17.08 |

Entire Agreement; No Representations; Modification |

Page 44 |

| Section 17.09 |

Severability |

Page 44 |

| Section 17.10 |

Joint and Several Liability |

Page 44 |

| Section 17.11 |

Broker’s Commission |

Page 44 |

| Section 17.12 |

No Option; Irrevocable Offer |

Page 44 |

| Section 17.13 |

Inability to Perform |

Page 44 |

| Section 17.14 |

Survival |

Page 45 |

| Section 17.15 |

Corporate Tenants |

Page 45 |

| Section 17.16 |

Construction of Certain Terms |

Page 45 |

| Section 17.17 |

Showing of Leased Premises |

Page 45 |

| Section 17.18 |

Relationship of Parties |

Page 45 |

| Section 17.19 |

Rule Against Perpetuities |

Page 46 |

| Section 17.20 |

Choice of Law |

Page 46 |

| Section 17.21 |

Choice of Forum |

Page 46 |

| Section 17.22 |

Hazardous Substances |

Page 46 |

| Section 17.23 |

OFAC Certification |

Page 47 |

| Section 17.24 |

Time is of the Essence |

Page 47 |

| Section 17.25 |

Counterparts; Electric Signature |

Page 47 |

| Section 17.26 |

Confidentiality |

Page 47 |

| Section 17.27 |

Right of First Offer to Lease |

Page 47 |

| Section 17.28 |

Future Development |

Page 49 |

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (this “Lease”) is made this 16th day of December, 2024 (the “Effective Date”), by and between SR WINCHESTER, LLC, a Delaware limited liability company, by its managing member, STREET RETAIL, INC., a Maryland corporation (“Landlord”), and CALIX, INC., a Delaware corporation (“Tenant”).

IN CONSIDERATION of the payments of rents and other charges provided for herein and the covenants and conditions hereinafter set forth, Landlord and Tenant hereby covenant and agree as follows:

ARTICLE I

REFERENCE PROVISIONS, DEFINITIONS AND EXHIBITS

As used in this Lease, the following terms shall have the meanings set forth in Sections 1.01 and 1.02 below.

Section 1.01. Reference Provisions.

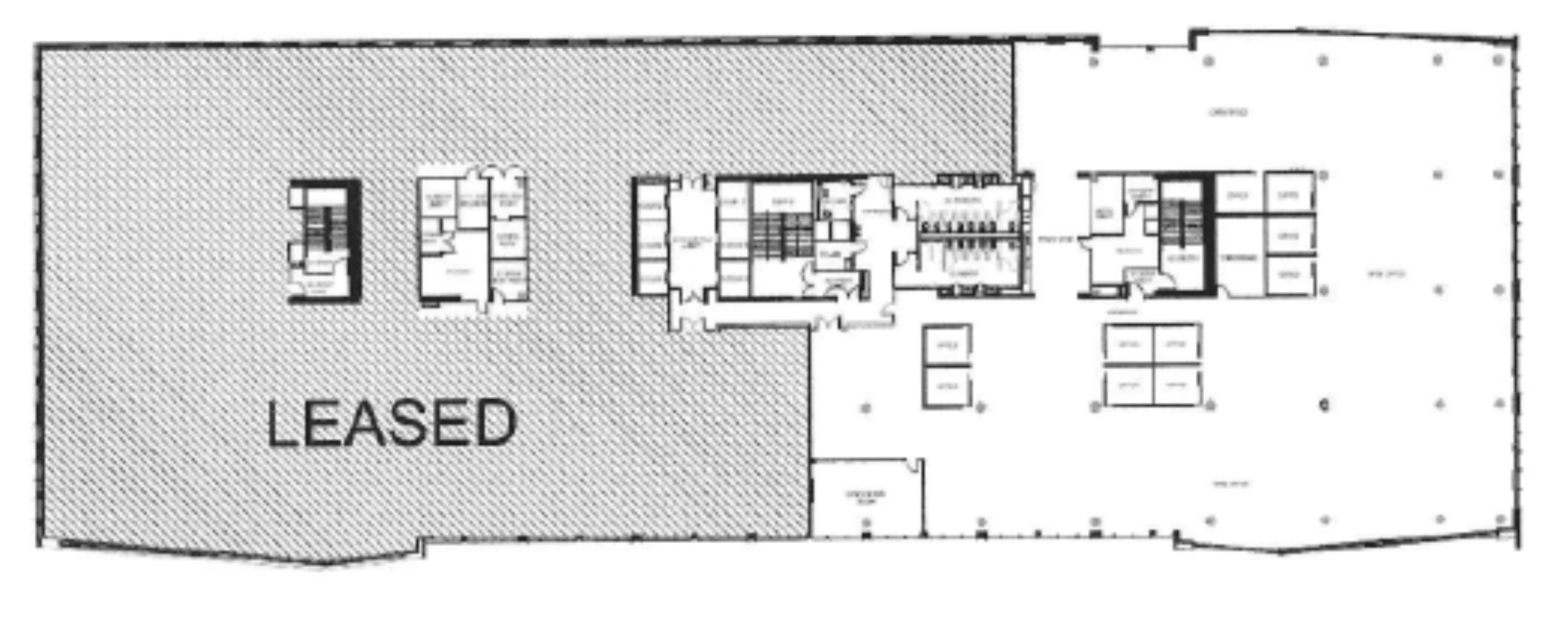

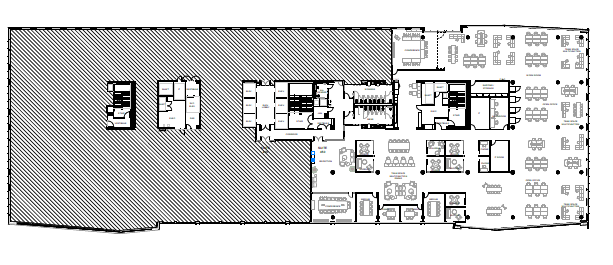

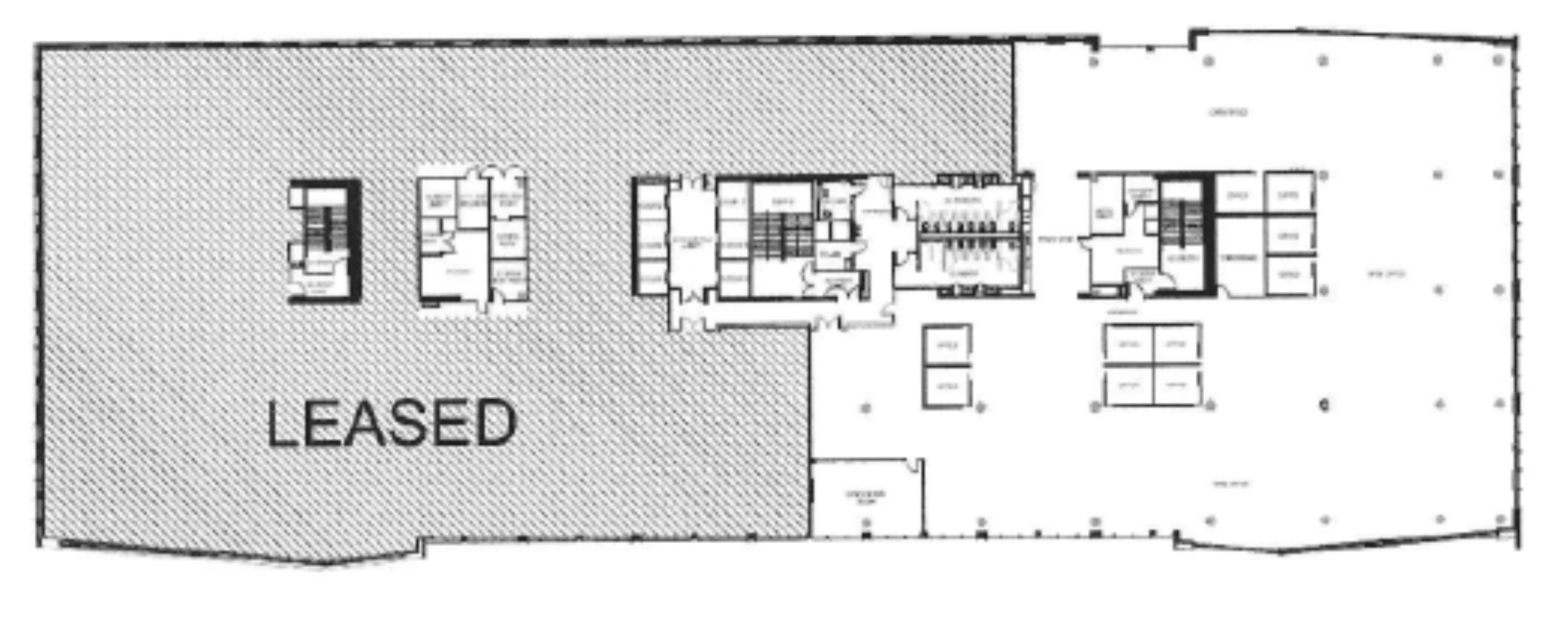

A. Leased Premises: That portion of the Building described in Section 1.01.J, containing approximately 22,990 square feet of Floor Area and consisting of that portion of the fourth (4th) designated as Suite 450 and depicted on Exhibit A-2 attached hereto.

B. Term: Commencing on the Term Commencement Date and continuing for ninety (90) months, subject to extension pursuant to Exhibit F hereto.

C. Delivery Date: Subject to the terms, conditions and adjustments set forth in Section 9.01 below, the date of delivery of the Leased Premises (the “Delivery Date”) shall be the date Landlord delivers the Leased Premises with the Tenant Work Substantially Complete (as defined in Exhibit B hereto), less such number of days of Tenant Delay (as defined in Exhibit B hereto) as offset by any number of days of Landlord Delay (as defined in Exhibit B here). It is estimated that the Delivery Date will occur no later than August 1, 2025, subject to day-for-day extension for delays resulting from Force Majeure Delay (as defined in Exhibit B hereto) or Tenant Delay (as may be extended, the “Anticipated Delivery Date”).

D. Term Commencement Date: The date (the “Term Commencement Date”) shall be the later of (i) the Delivery Date and (ii) the date that a non-disturbance agreement (the “Ground Lessor Non-Disturbance Agreement”) in the form of Exhibit J hereto executed by Landlord and Ground Lessor (as defined below) has been delivered to Tenant (collectively, the “Delivery Condition”).

E. Rent Commencement Date: The Term Commencement Date.

F. Termination Date: The date that is (i) the last day of the Term, or (ii) any earlier date on which this Lease is terminated in accordance with the provisions hereof.

G. Minimum Rent:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Months: |

Monthly Minimum Rent Per Square Foot of Floor Area: |

Monthly

Minimum Rent:

|

Annual Minimum Rent:

|

| 1-12* |

$49.80 |

$95,408.50 |

$1,144,902.00* |

|

| 13-24 |

$51.29 |

$98,270.76 |

$1,179,249.06 |

|

| 25-36 |

$52.83 |

$101,218.88 |

$1,214,626.53 |

|

| 37-48 |

$54.42 |

$104,255.44 |

$1,251,065.33 |

|

| 49-60 |

$56.05 |

$107,383.11 |

$1,288,597.29 |

|

| 61-72 |

$57.73 |

$110,604.60 |

$1,327,255.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 75-84 |

$59.46 |

$113,922.74 |

$1,367,072.87 |

|

| 85-90 |

$61.25 |

$117,340.42 |

$1,408,085.06 |

|

*Notwithstanding the foregoing, Minimum Rent shall be abated during the first six (6) full calendar months of the initial Lease Year following the Rent Commencement Date (the “Abatement Period”). Notwithstanding such abatement of Minimum Rent, all other sums due under this Lease including, without limitation, Tenant’s Share of Operating Costs and Taxes (as defined below), shall be payable as provided in this Lease from and after the Rent Commencement Date. The amount of Minimum Rent conditionally abated for the Abatement Period (which Landlord and Tenant hereby agree shall in no event exceed the aggregate total of Five Hundred Seventy-Two Thousand Four Hundred Fifty-One and 00/100 Dollars ($572,451.00)), shall be referred to herein as the “Abated Minimum Rent”. The Abated Minimum Rent is conditioned upon Tenant’s full and timely performance of all of its material obligations under this Lease. If at any time during the initial Term of the Lease a Default (as defined below) by Tenant occurs and this Lease is terminated as a result thereof, then the Abated Minimum Rent shall immediately become void, and Tenant shall promptly pay to Landlord, in addition to all other amounts due to Landlord under this Lease, the unamortized amount of the Abated Minimum Rent (which amount shall be amortized on a straight-line basis without interest over the initial Term of the Lease).

H. Security Deposit: The sum of Two Hundred Eighty-Six Thousand Two Hundred Twenty Five and 50/100ths Dollars ($286,225.50), subject to reduction in accordance with Section 17.07 of this Lease.

I. Rent Payments: Except to the extent Tenant is required to make such payments electronically in the manner set forth in Section 5.01 of this Lease, Rent payments due herein shall be made payable to Landlord at the following address:

SR Winchester, LLC

c/o Federal Realty Investment Trust

P.O. Box 846073

Los Angeles, CA 90084-6073

J. Notice Addresses:

TO LANDLORD:

SR Winchester, LLC

c/o Federal Realty Investment Trust

909 Rose Avenue, Suite 200

North Bethesda, MD 20852

Attention: Legal Department

TO TENANT:

Prior to the Term Commencement Date:

Calix, Inc.

2777 Orchard Parkway

San Jose, CA 95134

Attention: General Counsel

After the Term Commencement Date:

Calix, Inc.

1 Santana West

3155 Olsen Drive

Suite 450

San Jose, CA 95117

Attention: General Counsel

With a copy of Default notices to:

Nossaman LLP

50 California Street

Floor 34

San Francisco, CA 94111

Attention: Simon T. Adams, Eq.

K. Building: That certain building located at 1 Santana West - 3155 Olsen Drive, San Jose, California and marked as the “Building” on Exhibit A-1, including two (2) subterranean floors (the “Tower Parking Garage”) containing approximately three hundred fifty (350) parking spaces, a bicycle storage room and certain other improvements. The Building contains approximately 365,968 square feet of Floor Area.

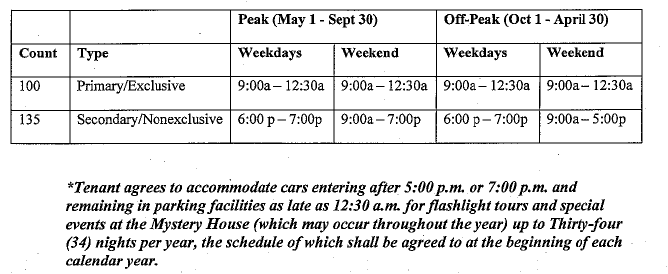

L. Parking Spaces: 3 parking spaces per 1,000 square feet of Floor Area (i.e., 69 spaces), approximately 0.8 parking spaces per 1,000 square feet of Floor Area (i.e., initially, 18 spaces) of which shall be located on the Tower Parking Garage and 2.2 parking spaces per 1,000 square feet of Floor Area (i.e., initially, 51 spaces) of which shall be located in the certain parking garage marked as “Common Parking Garage” on Exhibit A-1 (the “Common Parking Garage”), all of which shall be provided at no additional charge to Tenant during the Term of this Lease, including any extension of the Term for any Option Period.

M. Renewal Options: See Exhibit F.

N. Prepaid Rent: Contemporaneously with Tenant’s execution and delivery of this Lease, Tenant shall pay Landlord one (1) month of the monthly Minimum Rent chargeable hereunder during the first Lease Year, and the Security Deposit.

O. Schedules and Exhibits: The schedules and exhibits listed below are attached to this Lease and are hereby incorporated in and made a part of this Lease.

Exhibit A-1 Site Plan

Exhibit A-2 Leased Premises

Exhibit B Work Agreement

Exhibit B-1 Space Plan

Exhibit C Rules and Regulations

Exhibit D Rules for Tenant’s Contractors

Exhibit E Rooftop Rules and Regulations

Exhibit F Options To Extend

Exhibit G Tenant’s Approved Monument Locations

Exhibit H Office Tenant Sign Criteria

Exhibit I Form of Letter of Credit

Exhibit J Form of Ground Lessor Non-Disturbance Agreement

Exhibit K Ground Lessor Retained Property

Section 1.02. Definitions. In addition to the definitions set forth in Section 1.01, above, the following additional defined terms shall apply to the interpretation of this Lease.

A. Additional Rent: All sums payable by Tenant to Landlord under this Lease, other than Minimum Rent.

B. Building Hours: 7:00 a.m. until 6:00 p.m. on weekdays (excluding holidays) and from 8:00 a.m. until 1:00 p.m. on Saturdays (excluding holidays).

C. Business Day: Monday through Friday other than holidays observed by the State of California or the United States Federal Government.

D. Common Areas: (i) Any existing or future improvements, equipment, areas and/or spaces utilized for “Common Areas” in and around the Project and the Leased Premises which are for the non-exclusive, common and joint use or benefit of Landlord, Tenant and other tenants, occupants and users of the Project, as determined by Landlord, and (ii) the Parking Garage. The Common Areas include, without limitation, walkways; roofs; drains, gutters and downspouts; patio and seating areas; landscaped areas; utility and other building systems and/or maintenance areas, including equipment storage; and parking areas, drive aisles, and the parking islands within the Parking Garage. For the avoidance of doubt, the Common Areas exclude the outdoor terraces/decks on the 2nd, 7th and 8th floors of the Building (each a “Outdoor Deck” and, collectively, the “Outdoor Decks”).

E. Floor Area: When used with respect to the Leased Premises, the number of square feet set forth in Section 1.01.A, above, subject to adjustment as provided herein, which the Leased Premises shall be deemed to contain. The Floor Area of the Leased Premises was calculated by Landlord’s architect based on the Building Plans (as defined in Exhibit B) in accordance with a modified BOMA 2017 for Office Buildings: Standard Methods of Measurement Method A (ANSI/BOMA Z65.1-2017) whereby the Floor Area of the Building excludes the Outdoor Decks (the “Modified BOMA Standard”).

F. Interest: A rate per annum of the lesser of (i) ten percent (10%), or (ii) the maximum permitted by law.

G. Lease Year: Each twelve (12) month period beginning with the Term Commencement Date, and each anniversary thereof, if the Term Commencement Date occurs on the first day of a month. If the Term Commencement Date occurs on a day other than the first day of a month, then the first Lease Year shall begin on the Term Commencement Date and shall terminate on the last day of the twelfth (12th) full calendar month after the Term Commencement Date. Each subsequent Lease Year shall commence on the date immediately following the last day of the preceding Lease Year and shall continue for a period of twelve (12) full calendar months, except that the last Lease Year of the Term shall terminate on the date this Lease expires or is otherwise terminated.

H. Operating Year: Each calendar year or part thereof during the Term of this Lease or any renewal thereof, or at Landlord’s option, any other twelve (12) month period or part thereof designated by Landlord.

I. Parking Garage: Collectively, the Tower Parking Garage defined in Section 1.01.K above and the Common Parking Garage defined in Section 1.01.L above.

J. Parking Hours: 7:00 a.m. until 5:00 p.m. on each Business Day during the Term (for the Parking Garage).

K. Partial Lease Year: Any period during the Term which is less than a full Lease Year.

L. Person: Any individual, firm, partnership, association, corporation, limited liability company, or any other legal entity.

M. Project: That certain project known as Santana West located in San Jose, California.

N. Rent: Minimum Rent plus Additional Rent.

O. Tenant’s Share: A proportion determined as follows: (a) with respect to the calculation of Operating Costs (including Insurance Costs, as defined below), except as provided in Section 6.03 with respect to Cost Pools or otherwise provided in this Lease, a fraction, the numerator of which is the Floor Area of the Leased Premises and the denominator of which is the total Floor Area of the Building (i.e., 6.28%); and (b) with respect to the cost of providing the services described in Sections 7.01.E and 7.01.F to the Parking Garage and the cost of cleaning, sweeping, trash removal, resurfacing and restriping of or in the Parking Garage and other general upkeep of (1) the Tower Parking Garage, Tenant’s Operating Cost Share shall be 6.28%, and (2) of the Common Parking Garage, Tenant’s Operating Cost Share shall be 6.28% of 57.36% (i.e., 3.60%).

P. Tenant’s Tax Share: Shall mean a fraction, the numerator of which is the Floor Area of the Leased Premises and the denominator of which is the total Floor Area of the Building (i.e., 6.28%).

Q. Tenant Work Allowance: See Exhibit B.

ARTICLE II

LEASED PREMISES

Landlord demises and leases to Tenant, and Tenant leases and takes from Landlord, the Leased Premises together with the right to use for ingress to and egress from the Leased Premises, in common with others, the Common Areas. Except as expressly set forth to the contrary in this Lease, including, without limitation the exterior sign rights provided herein, Landlord has the exclusive right to (i) use the exterior faces of all perimeter walls of the Building, the roof and all air space above the Building, and (ii) install, maintain, use, repair and replace pipes, ducts, cables, conduits, plumbing, vents, utility lines and wires to, in, through, above and below the Leased Premises and other parts of the Building.

The parties acknowledge that this Lease is a sublease which shall, at all times during the Term, be subject and subordinate to the terms, covenants and conditions of that certain Ground Lease dated as of March 14, 2014 as amended from time to time (as amended, the “Ground Lease”), by and between Winchester Investments, LLC, a California limited liability company (“Ground Lessor”), as landlord, and Landlord, as tenant (the “Ground Lease”) and to all matters to which the Ground Lease is subject and subordinate. Tenant acknowledges and agrees that it has received a copy of the Ground Lease prior to the date hereof. Landlord and Tenant agree not to take any action or perform any act or fail to perform any act which would reasonably result in the violation or breach of any of the covenants, agreements, terms, or obligations under the Ground Lease on the part of the Landlord as tenant thereunder. Except as otherwise set forth in the Ground Lessor Non-Disturbance Agreement, this Lease shall automatically expire on or prior to the expiration or earlier termination of the Ground Lease, and Ground Lessor shall have no obligation to Tenant under this Lease.

As between the parties hereto only, in the event of a conflict between the terms of the Ground Lease and the terms of this Lease, then the terms of this Lease shall control.

Landlord represents and warrants that to the best of Landlord’s knowledge and belief the Landlord is not in default under the terms and conditions of the Ground Lease and that no notice from the Ground Lessor of a default has been received by Landlord, and that no event or circumstance exists that with the passage of time or notice from Ground Lessor would become a default under the terms of the Ground Lease.

Landlord represents and warrants that to the best of Landlord’s knowledge and belief the real property and the improvements and buildings and structures are not subject to any loan, mortgage or other security provided to the Landlord, the foreclosure of which would terminate this Lease.

ARTICLE III

TERM

Section 3.01. Term.

A. The Term shall commence on the Term Commencement Date specified in Section 1.01.D above, and shall be for the period of time specified in Section 1.01.B above, and expire on the Termination Date specified in Section 1.01.F above. Notwithstanding the foregoing, all obligations of the parties, as set forth in this Lease, shall be binding as of the date hereof. Notwithstanding the foregoing, all obligations of the parties, as set forth in this Lease, shall be binding as of the date hereof. Landlord shall use commercially reasonable efforts to deliver possession of the Leased Premises to Tenant by the Anticipated Delivery Date. If, despite such efforts, the Delivery Date has not occurred by Anticipated Delivery Date, Landlord shall not be subject to any liability therefor, nor shall such failure affect the validity of this Lease or the obligations of Tenant hereunder, however, if the Term Commencement Date has not occurred on or before thirty (30) days after the Anticipated Delivery Date, Tenant shall be entitled to a day for day Minimum Rent credit for each day of delay commencing on the thirty-first (31st) day after the Anticipated Delivery Date and continuing until the Term Commencement Date occurs, which rent credit shall be applied after the expiration of the Abatement Period. Notwithstanding the foregoing, if the Term Commencement Date has not occurred on or before the one hundred twentieth (120th) day after the Anticipated Delivery Date (the “Outside Date”), Tenant may elect to terminate this Lease by written notice to Landlord not later than thirty (30) business days following the Outside Date. Tenant shall not, however, be obligated to pay Minimum Rent or perform any other obligation of Tenant under the terms of this Lease (except to the extent required under Section 8 of the Work Agreement attached hereto as Exhibit B, as applicable) until Landlord delivers possession of the Leased Premises to Tenant, and any period of rent abatement that Tenant would otherwise have enjoyed shall run from the date of delivery of possession and continue for a period equal to what Tenant would otherwise have enjoyed under the terms hereof.

Section 3.02. End of Term.

This Lease shall terminate on the Termination Date without the necessity of Notice from either Landlord or Tenant. Upon the Termination Date, Tenant shall quit and surrender to Landlord the Leased Premises broom-clean, in good order and condition, ordinary reasonable wear and tear and damage by casualty not required to be repaired by Tenant or condemnation excepted, and shall surrender to Landlord all keys and access cards, if applicable, to or for the Leased Premises. In addition, Tenant shall remove Tenant’s Property (as defined below) in accordance with and subject to the provisions of Sections 9.05 and 9.06 hereof (the foregoing, collectively, the “Required Condition”).

Section 3.03. Holding Over.

A. Tenant agrees that it will not occupy or retain or allow occupancy or retention by any subtenant of possession of the Leased Premises at any time after the Termination Date. If Tenant fails to vacate the Leased Premises and deliver Landlord possession of the Leased Premises in the Required Condition on the Termination Date, then Landlord shall have the benefit of all provisions of law respecting the speedy recovery of possession of the Leased Premises (whether by summary proceedings or otherwise). In addition to and not in limitation of the foregoing, occupancy subsequent to the Termination Date (“Holdover Occupancy”) shall be a tenancy at sufferance. Holdover Occupancy shall be subject to all terms, covenants, and conditions of this Lease (including those requiring payment of Additional Rent), except that the Minimum Rent for each day that Tenant holds over (“Holdover Minimum Rent”) shall be equal to one and one-half (1-1/2) times the per diem Minimum Rent payable in the last Lease Year for the first one hundred twenty (120) days and two (2) times the per diem Minimum Rent payable in the last Lease Year thereafter, and any right or option to extend or renew the Lease or to lease any other space or Leased Premises in the Building or Project shall be void and of no effect.

B. Subject to the terms hereof, Landlord shall also be entitled to recover all damages, including lost business profits and loss opportunity regarding any prospective tenant(s) for the Leased Premises, suffered by Landlord as a result of Tenant’s Holdover Occupancy provided that the Landlord has given Tenant notice of entry in to a new lease for all or a portion of the Leased Premises. Tenant acknowledges and agrees that Landlord may undertake a renovation or redevelopment of the Leased Premises or Building and/or lease the Leased Premises (in whole or in part) to another tenant immediately after the Termination Date and that any breach or other violation of the provisions of this Section 3.03 may result in material damages to Landlord (including without limitation, any damages to Landlord in connection with renovation or redevelopment activities or its reletting of the Leased Premises or any part thereof). Further, Tenant agrees to indemnify, hold harmless and defend Landlord for, from and against any and all claims, causes of action, suits, proceedings, demands, damages, losses (including, without limitation, lost rentals and lost business opportunities), liabilities, expenses and costs (including, without limitation, reasonable experts’, consultants’, attorneys’ and court fees and costs) suffered or incurred by Landlord as a result of Tenant’s Holdover Occupancy except in the instance of Landlord’s negligence or willful misconduct related to the matter in dispute. For the sake of clarity, nothing in this Subsection B shall limit Tenant’s obligation to pay any Holdover Minimum Rent during any Holdover Occupancy or constitute Landlord’s consent to any Holdover Occupancy. The preceding indemnification and hold harmless shall survive the Termination Date and any Holdover Occupancy to the extent applicable.

ARTICLE IV

USE AND OPERATION OF THE LEASED PREMISES

Section 4.01. Use.

A. Tenant shall use the Leased Premises solely for general office, administration, training, research and development, sales and marketing, visitor presentations and meetings, and reasonably ancillary and lawful uses consistent with all recorded matters and in conformity with municipal zoning requirements of the City of San Jose, California; other applicable statues, laws, rules, orders, regulations and ordinates (collectively, “Laws”); and the Operating Standard (as defined in Exhibit F) (the “Permitted Use”), and for no other purpose. Tenant shall comply with all Laws affecting the Leased Premises or relating to the use, occupancy or alteration thereof and all the orders or reasonable recommendations of any insurance underwriters, and safety engineers as may from time to time be consulted by Landlord. Without limiting the terms and conditions of Section 6.03.B, below, in addition, if Landlord makes any alteration to any part of the Building or Project as a result of any damage or alteration to the Leased Premises caused or made after the Term Commencement Date by or on behalf of Tenant or in order to comply with any requirement of any Laws applicable to Tenant’s particular use of the Leased Premises (and not office use of the Leased Premises, generally), then Tenant shall reimburse Landlord within thirty (30) days after demand (which demand will include a reasonable substantiation of the cost of the relevant improvements and the reason such improvements are necessary), for the actual out of pocket cost thereof. Tenant acknowledges and agrees that Tenant is solely responsible for determining if its business complies with the applicable zoning regulations, and that Landlord makes no representation (explicit or implied) concerning such zoning regulations.

B. Tenant shall, at its sole expense: (i) keep the portions of the Leased Premises that Tenant is obligated to maintain under this Lease in a good order and condition consistent with the operation of a Class A institutional quality office building that is part of a mixed use project (the “Operating Standard”); (ii) pay before delinquency any and all taxes, assessments and public charges levied, assessed or imposed upon Tenant’s business, upon the leasehold estate created by this Lease or upon Tenant’s fixtures, furnishings or equipment in the Leased Premises; (iii) not use or permit or suffer the use of any portion of the Leased Premises for any unlawful purpose; (iv) not use the plumbing facilities for any purpose other than that for which they were constructed, or dispose of any foreign substances therein; (v) not place a load on any floor exceeding the floor load per square foot which such floor was designed to carry in accordance with the plans and specifications of the Building, and not install, operate or maintain in the Leased Premises any heavy item of equipment except in such manner as to achieve a proper distribution of weight; (vi) not strip, overload, damage or deface the Leased Premises, or the hallways, stairways, elevators of the Building, the Tower Parking Garage, the Common Parking Garage, the Common Areas or the fixtures therein or used therewith, nor permit any hole to be made in any of the same; (vii) not move any furniture or equipment into or out of the Leased Premises except at such reasonable times and in such reasonable manner as Landlord may from time to time reasonably designate; (viii) not install or operate in the Leased Premises any electrical heating, air conditioning or refrigeration equipment, or other equipment not shown on approved plans which will increase the amount of electricity required for use of the Leased Premises as general office space (other than ordinary office equipment such as personal computers, printers, copiers and the like), without first obtaining the written consent of Landlord, which will not be unreasonably withheld or delayed; and (ix) not install any other equipment of any kind or nature which will or may necessitate any changes, replacements or additions to, or in the use of, the water, heating, plumbing, air conditioning or electrical systems of the Leased Premises or the Building, without first obtaining the written consent of Landlord, which will not be unreasonably withheld or delayed.

C. In addition to and not in limitation of the other restrictions on use of the Leased Premises set forth in this Section 4.02, Tenant hereby agrees that the following uses of the Leased Premises shall not be considered permitted: (1) any use of the Leased Premises by an organization or Person enjoying sovereign or diplomatic immunity (the foregoing will not be deemed to prohibit invitees who are representatives or officials of any U.S., state or foreign government); (2) any use of the Leased Premises by or for an employment agency or bureau (other than Tenant’s normal recruitment activities); (3) any use of the Leased Premises for classroom purposes; (4) any use of the Leased Premises by or for any user which distributes governmental or other payments, benefits or information to Persons who are required to personally appear at the Leased Premises to collect such benefits; (5) any laboratory use that requires the handling of Hazardous Substances (as defined below); (6) any medical use involving the treatment of patients or handling of medical waste and/or Hazardous Substances in the Building, other than employee first aid; (7) retail sales of merchandise to members of the public; (8) any use that interferes with, injures or unreasonably annoys other occupants of the Project; (9) any use that constitutes a nuisance; (10) any use that involves the presence, use, release or discharge of Hazardous Substances; provided, however, that Tenant may handle, store, use and dispose of products containing small quantities of Hazardous Substances for general office purposes (such as toner for copiers and standard cleaning solvents and chemicals found in office cleaning supplies and reasonable quantities of other substances that Tenant may store as required to fulfill Tenant’s maintenance obligations under this Lease), to the extent customary and necessary for the Permitted Use of the Leased Premises, so long as Tenant always handles, stores, uses, and disposes of any such Hazardous Substances in a safe and lawful manner and does not allow such Hazardous Substances to contaminate the Leased Premises, Building, or Project or surrounding land or environment; (11) any use that could reasonably be expected to have a material adverse effect on the utility, use, appearance or value of the Building, the Project, or any portion thereof; and (12) any other use of the Leased Premises by any user that is not otherwise permitted in this Lease and will attract a volume, frequency or type of visitor to the Leased Premises which is not consistent with the Operating Standard, or that will in any way impose an excessive demand or use on the facilities or services of the Leased Premises or the Building.

Section 4.02. Signs and Advertising.

Tenant shall not inscribe, paint, affix, or otherwise display any sign, advertisement or notice on any part of the outside of the Leased Premises, other than signs permitted hereunder; provided, however, that Tenant shall be entitled to standard suite entry signage at the entrance to the Leased Premises, and a name plate designating Tenant on the main directory for the Building on the first floor of the Building and on the glass/window line in the lobby entrance in a location to be determined by Landlord after consultation with Tenant, and monument signage for the Building or Project, all to be affixed by Landlord at Tenant’s sole cost and expense. Prior to the Term Commencement Date, Landlord shall advise Tenant of exterior Building signage available to Tenant, the location and the cost associated with the same. Upon Tenant’s election Landlord shall install such exterior Building signage within sixty (60) days of receipt of Tenant’s signage election notice. All such signs shall be reasonably acceptable to Landlord, comply with Landlord’s office sign criteria attached hereto as Exhibit H (the “Office Building Sign Criteria”) and all other matters contained in the public records, including any applicable Laws. The material, typeface, graphic format and proportions of Tenant’s signage, as well as the precise location of such signage and method of installation, shall be subject to Landlord’s approval, which shall not be unreasonably withheld or delayed. Nothing contained herein shall obviate the need for Tenant to obtain any necessary approvals and permits for such signage from the City of San Jose (the “City”), which permits and approvals Tenant shall obtain at Tenant’s sole cost. The failure of Tenant to obtain such approvals shall not release Tenant from any of its obligations under this Lease. Tenant, at its sole expense, shall maintain Tenant’s signs in accordance with the Operating Standard during the Term. Tenant, at its sole cost and expense, shall remove all such signs by the Termination Date or any earlier termination of this Lease. Such installations and removals shall be made in such manner as to avoid injury to or defacement of the Building and any improvements contained therein and the monument, and Tenant shall reasonably repair any injury or defacement including, without limitation, discoloration caused by such installation or removal to an appearance consistent with the Operating Standard. At such time that Tenant, a Permitted Transferee or another Transferee by assignment or sublease approved by Landlord no longer leases and occupies the Leased Premises, Tenant’s right to maintain the foregoing signage shall terminate within thirty (30) days after Landlord provides Notice of the failure of the foregoing condition. If any of Tenant’s signs, advertisements or notices are painted, affixed, or otherwise displayed without the prior written approval of Landlord and not in compliance with the foregoing, then, without limiting Landlord’s other rights hereunder, Landlord shall have the right after ten (10) Business Days prior Notice to Tenant, to remove the same, and Tenant shall be liable for any and all costs and expenses incurred by Landlord in such removal.

ARTICLE V

RENT

Section 5.01. Rent Payable.

A. Commencing on the Rent Commencement Date, Tenant shall pay all Rent owing from time to time to Landlord, without prior Notice or demand and without offset, deduction or counterclaim whatsoever, in the amounts, at the rates and times set forth herein, in the manner set forth in this Section 5.01.A. Tenant agrees to (i) promptly execute any and all agreements and authorizations, and supply any and all information necessary to Tenant’s bank, to initiate automatic monthly payments of Minimum Rent and the monthly payments of estimated Tenant’s Share of Operating Costs and Taxes (“Standing Order Transfers”) from Tenant’s bank account to Landlord’s bank account for such monthly payments of Minium Rent and monthly payments of Tenant’s Share of Operating Costs due under this Lease; and (ii) take all actions necessary on Tenant’s part to insure that all such payments will be received by the Landlord’s bank account by the first (1st) day of each calendar month. Except for the first month’s Rent and Security Deposit, the monthly payments of Minimum Rent and monthly payments of estimated Tenant’s Share of Operating Costs and Taxes shall be paid by Standing Order Transfer. All payments of Rent not made by Standing Order Transfer shall be made via a company check delivered to the place set forth in Section 1.01.I or as Landlord may otherwise designate by Notice to Tenant at least thirty (30) days prior to the effective date of any change. Landlord shall confirm in writing the Landlord’s bank account details for Tenant’s payments to Landlord with not less than thirty (30) days advance notice in writing from Landlord regarding any change to be made to the same.

B. If Tenant fails to make any payment of Rent by the date such Rent is due, Tenant shall pay Landlord a late payment charge equal to the greater of (i) five percent (5%) of such payment of Rent, or (ii) Twenty Dollars ($20.00) per day from the due date until the date of receipt by Landlord. Payment of such late charge shall not excuse or waive the late payment of Rent. Tenant acknowledges and agrees that such late charge is a reasonable estimate of the damages Landlord may incur as a result of Tenant’s late payment of Rent, and that it would be impracticable or extremely difficult to determine Landlord’s actual damages.

C. If Landlord receives within a twelve (12) month period two (2) or more checks from Tenant that are dishonored by Tenant’s bank, all checks for Rent thereafter shall be bank certified and Landlord shall not be required to accept checks except in such form. Tenant shall pay Landlord any bank service charges resulting from dishonored checks, plus Five Hundred Dollars ($500.00) for each dishonored check as compensation to Landlord for the additional cost of processing such check.

D. Any payment by Tenant of less than the total Rent due shall be treated as a payment on account. Acceptance of any check bearing an endorsement, or accompanied by a letter stating, that such amount constitutes “payment in full” (or terms of similar import) shall not be an accord and satisfaction or a novation, and such statement shall be given no effect. Landlord may accept any check without prejudice to any rights or remedies which Landlord may have against Tenant.

E. For any portion of a calendar month at the beginning of the Term, Tenant shall pay in advance the pro-rated amount of the Rent for each day included in such portion of the month.

Section 5.02. Payment of Minimum Rent.

Tenant shall pay Landlord the Minimum Rent set forth in Section 1.01.G, above, in equal monthly installments, in advance, commencing on the Rent Commencement Date, subject only to the express abatement rights provided in this Lease (including, without limitation, Section 1.01.G, above), and on the first day of each calendar month thereafter throughout the Term. An amount equal to the Prepaid Minimum Rent shall be paid in advance in accordance with Section 1.01.N, above, and credited toward the first payment of Minimum Rent due hereunder.

ARTICLE VI

COMMON AREAS

Section 6.01. Use of Common Areas.

During the Term, Tenant shall have a non-exclusive license to use the Common Areas for ingress to and egress from the Leased Premises, and the non-exclusive right to use any portion of the Common Areas designated for parking, including, without limitation, the Tower Parking Garage and the Common Parking Garage, subject to (i) the exclusive control and management of Landlord and the rights of Landlord, and (ii) to the extent of any such Common Areas are shared with other tenants, the rights of other tenants. Tenant shall comply with the Rules attached hereto as Exhibit C and such other reasonable non-discriminatory rules and regulations as Landlord may prescribe regarding use of the Leased Premises, the Building, Tower Parking Garage, Common Parking Garage, and/or Common Areas; provided, however, that such rules and regulations shall be consistent with the Operating Standard. Tenant shall not use the Common Areas for any sales or display purposes, or for any purpose which would impede or create hazardous conditions for the flow of pedestrian or other traffic. The Common Areas shall at all times be subject to the exclusive control and management of Landlord.

Section 6.02. Management and Operation of Common Areas.

Landlord shall operate, repair, equip and maintain the Common Areas in a manner consistent with the Operating Standard and shall have the exclusive right and authority to employ and discharge personnel with respect thereto (provided Landlord will endeavor to respond, subject to Landlord’s customary employment practices and applicable employment Laws, to any reasonable complaints of Tenant regarding the behavior of specific personnel who interact with Tenant or its employees or invitees).

Without limiting the foregoing, so long as such use is consistent with the Operating Standard, Landlord may (i) use the Common Areas from time to time for short term promotions, exhibits and displays, outdoor seating, food facilities and any other use which benefits the Project, or any part thereof that are consistent with the Operating Standard; (ii) grant the temporary right to conduct sales in the Common Areas; (iii) erect, remove and lease kiosks, planters, pools, sculptures and other improvements within the Common Areas; (iv) enter into, modify and terminate easements and other agreements pertaining to the use and maintenance of the Project, or any part thereof that do not materially and adversely affect access to the Leased Premises pursuant to the entrances to the Building or the use of the Leased Premises for the Permitted Use or Tenant’s parking rights, or the visibility of Tenant’s Exterior Signs; (v) construct, maintain, operate, replace and remove lighting, equipment, and signs on all or any part of the Common Areas; (vi) provide security personnel for the Tower Parking Garage, Common Parking Garage, and/or other Common Areas; and (vii) subject to Tenant’s express parking rights hereunder, restrict parking in the Tower Parking Garage and Common Parking Garage. Subject to Tenant’s express parking rights in Section 13.01 hereof, Landlord reserves the right at any time and from time to time to change or alter the location, layout, nature or arrangement of the Common Areas or any portion thereof, so long as such changes do not unreasonably interfere with access to the Leased Premises via the entrances to the Building or the use of the Leased Premises for the Permitted Use. Landlord shall have the right to close temporarily all or any portion of the Common Areas to such extent as may, in the reasonable opinion of Landlord, be necessary for repairs, replacements or maintenance to the Common Areas, provided such repairs, replacements or maintenance are performed expeditiously and in such a manner so as not to deprive Tenant of access to the Leased Premises or Tenant’s parking rights in the parking facilities (provided that such parking access will be deemed satisfied if Landlord provides reasonable alternative parking facilities during such time) and Landlord otherwise uses reasonable efforts to minimize any interference with access to the Leased Premises via the entrances to the Building, or use of the Leased Premises for the Permitted Use, or efforts to minimize any interference with access and availability to the Common Area parking facilities and are made in good faith and not with the intent to interfere with the visibility of Tenant’s signs. Any diminution or shutting off of light, air or view by any structure which may be erected on lands adjacent to or in the vicinity of the Building shall in no way affect this Lease or impose any liability on Landlord.

Section 6.03. Tenant’s Share of Operating Costs and Taxes.

A. For each Operating Year, Tenant shall pay to Landlord, in the manner provided herein, Tenant’s share of Operating Costs and Taxes (“Tenant’s Share of Operating Costs and Taxes”). The applicable percentage to be applied to each element of Operating Costs and Taxes will be determined in accordance with Sections 1.02(N) and (O) provided, however, that for the Operating Years during which the Term begins and ends, Tenant’s Share of Operating Costs and Taxes shall be prorated based upon the actual number of days Tenant occupied, or could have occupied based on the Term of this Lease, the Leased Premises during each such Operating Year.

B. Tenant’s Share of Operating Costs and Taxes shall be paid, in advance, without Notice, demand, abatement (except as otherwise specifically provided in this Lease), deduction or set-off, on the first day of each calendar month during the Term, said monthly amounts to be determined on the basis of reasonable estimates prepared by Landlord on an annual basis (each an “Operating Costs Statement”) and delivered to Tenant prior to the commencement of each Operating Year. If, however, Landlord fails to furnish any such estimate prior to the commencement of an Operating Year, then (a) until the first day of the month following the month in which such estimate is furnished to Tenant, Tenant shall pay to Landlord on the first day of each month an amount equal to the monthly sum payable by Tenant to Landlord under this Section 6.03 in respect of the last month of the preceding Operating Year; (b) promptly after such estimate is furnished to Tenant, Landlord shall give Notice to Tenant whether the installments of Tenant’s Share of Operating Costs and Taxes paid by Tenant for the current Operating Year have resulted in a deficiency or overpayment compared to payments which would have been paid under such estimate, and Tenant, within thirty (30) days after receipt of such estimate, shall pay any deficiency to Landlord and any overpayment shall at the option of Tenant be credited against future payments required by Tenant, or paid to Tenant within thirty (30) days; and (c) on the first day of the month following the month in which such estimate is furnished to Tenant and monthly thereafter throughout the remainder of the Operating Year, Tenant shall pay to Landlord the monthly payment shown on such estimate. Landlord may one (1) time during the Operating Year where reasonably necessary furnish to Tenant a revised estimate of Tenant’s Share of Operating Costs and Taxes for such Operating Year, and in such case, Tenant’s monthly payments shall be adjusted and paid or credited, as the case may be,

substantially in the same manner as provided in the preceding sentence. Each Operating Costs Statement provided by Landlord shall be conclusive and binding upon Tenant unless, within one hundred twenty (120) days after receipt thereof, Tenant notifies Landlord that it disputes the correctness thereof, specifying those respects in which Tenant claims the Operating Costs Statement to be incorrect. After the expiration of each Operating Year, Landlord shall submit to Tenant a statement showing the determination of Tenant’s Share of Operating Costs and Taxes (the “Reconciliation Statement”). If such statement shows that the total of Tenant’s monthly payments pursuant to this Section 6.03 exceed Tenant’s Share of Operating Costs and Taxes, then Landlord will credit such refund to the next payment(s) coming due or, at the election of Tenant, refund such monies to Tenant; provided, however, that no such refund shall be made while Tenant is in Default of any provision of this Lease and such Default shall continue. If such Reconciliation Statement shows that Tenant’s Share of Operating Costs and Taxes exceeded the aggregate of Tenant’s monthly payments pursuant to this Section 6.03 for the applicable Operating Year, then Tenant shall, within thirty (30) days after receiving the statement, pay such deficiency to Landlord. Each Reconciliation Statement provided by Landlord shall be conclusive and binding upon Tenant unless within six (6) months after receipt thereof, Tenant notifies Landlord that it disputes the correctness thereof. Tenant or its agent (which, in either event, shall be an accountant experienced in conducting such audits that is not paid on a contingency basis) shall have the right, during the six (6) month period following delivery of a Reconciliation Statement, at Tenant’s sole cost to review, in Landlord’s offices or in the offices of Landlord’s property manager in the Project, Landlord’s records of Operating Costs and Taxes for the subject Operating Year during normal business hours and upon at least ten (10) Business Days prior Notice to Landlord (“Audit”). No Audit shall in any way delay or excuse Tenant’s obligation to pay any deficiency referenced in the Reconciliation Statement within the time period stated above. If Tenant does not complete its Audit and object in writing to the Reconciliation Statement within the six (6) month period of its receipt of such Reconciliation Statement, then such Reconciliation Statement shall be deemed final and binding on Landlord and Tenant. Tenant and its agents shall keep any information and copies of documents gained from its Audit of Landlord’s books and records confidential and shall not disclose any such information to any other party, except (x) as required by applicable Laws, including securities Laws, or to Tenant’s lawyers and accountants (y) in any litigation or dispute resolution process to resolve any disputed amounts with Landlord (provided such disclosure shall be limited to matters relating to such dispute), or (z) as otherwise required by law in response to a court order or legal process; provided, however, that in the event disclosure is required under this clause (z), Tenant shall provide Landlord with prompt notice of any such disclosure requirement so that Landlord may seek an appropriate protective order and/or waive Landlord’s compliance with such requirement. Subject to the foregoing, Landlord may require that Tenant and/or its auditor execute a commercially reasonable non-disclosure agreement prior to making any records available for review. Only one (1) Audit may be performed with respect to each Operating Year. Tenant shall promptly provide Landlord with a full and complete copy of any Audit. If such Audit discloses a liability for a refund by Landlord and if Landlord agrees with the analysis provided in Tenant’s Audit, then Landlord shall remit such refund to Tenant within thirty (30) days; provided, however, that Landlord shall have the right, without the obligation, to elect within ten (10) Business Days to apply all or any portion of such refund to remedy any monetary Default by Tenant occurring hereunder. If such Audit discloses a liability for a payment by Tenant, then Tenant shall remit such payment to Landlord within thirty (30) days. Further, if such Audit establishes (either by agreement with Landlord or determination by the Audit Professionals (as defined below)) that the Reconciliation Statement overstated the total amount owed by Tenant by more than four percent (4%), then Landlord shall be responsible for the reasonable, out-of-pocket expenses paid by Tenant to third parties in connection with such Audit up to Seven Thousand Five Hundred Dollars ($7,500) per Audit. Except as provided in the preceding sentence, Tenant shall be responsible for all costs and expenses associated with such Audit. Notwithstanding the foregoing, in the event Landlord disputes the findings of an Audit and the parties are unable to resolve such dispute within thirty (30) days, then Landlord and Tenant agree to submit any disputed items to a firm of real estate audit professionals mutually acceptable to Landlord and Tenant (“Audit Professionals”) for resolution (as provided below) and any payment or refund shall not become effective until ten (10) Business Days after the determination of the Audit Professionals. If Landlord and Tenant cannot agree on Audit Professionals within fifteen (15) days of the expiration of such thirty (30) day period, then Landlord and Tenant shall each, within ten (10) days of the expiration of such fifteen (15) day period, select one (1) independent firm of Audit Professionals, and such two (2) Audit Professionals shall together select a third Audit Professional, which third firm shall be the Audit Professional who shall resolve the dispute.

The third Audit Professional shall be entitled to review all records relating to the disputed items. The determination of the third Audit Professional shall be final and binding upon both Landlord and Tenant and the third Audit Professional’s expenses shall be borne by the party against whom the decision is rendered. Notwithstanding any contrary provision hereof, Tenant may not examine Landlord’s records or dispute any Annual Statement if there is an uncured Default that is continuing. No assignee of Tenant’s interest in this Lease or the Leased Premises shall have the right to review Landlord’s records or dispute any Reconciliation Statement for any period during which such transferee was not in possession of the Leased Premises, and no sublessee of Tenant shall have the right to review Landlord’s records or dispute any Reconciliation Statement. Landlord shall not seek to avoid an Audit by bad faith delivery of a notice of default and demand for cure.

C. “Operating Costs” means all expenses and costs which Landlord shall pay or become obligated to pay because of or in connection with owning, operating, managing, painting, repairing, insuring and cleaning the Building, the Parking Garage and Project, including without limitation:

(i) a property management fee equal to three percent (3%) of annual Minimum Rent (it being agreed that during the Abatement Period, such property management fee shall be based on the Minimum Rent shown on the Minimum Rent schedule set forth in Section 1.01, above, without considering the abatement of Minimum Rent during such period);

(ii) the cost of all insurance coverage, including self-insurance, for the Building, the Common Areas and the Parking Garage including but not limited to the costs of premiums for insurance with respect to personal injury, bodily injury, including death, property damage (including, without limitation, coverage for earthquake and flood), business interruption, workmen’s compensation insurance covering personnel and such other insurance as Landlord shall deem reasonably necessary and is permitted to maintain under this Lease, which insurance Landlord may maintain under policies covering other properties owned by Landlord in which event the premium shall be reasonably allocated among all properties covered by such insurance (collectively, the “Insurance Costs”);

(iii) the cost of providing the services described in Sections 7.01 below, except as otherwise expressly provided therein, or unless the service is directly metered and paid to the relevant utility;

(iv) cost of all supplies and materials used, and labor charges incurred, in the operation, maintenance, decoration, repairing and cleaning of the Building, including janitorial service for all Floor Area leased to tenants;

(v) cost of removal of trash, rubbish, garbage and other refuse from the Building as well as removal of ice and snow from the sidewalks on or adjacent to the Building;

(vi) wages, salaries and related expenses of all on-site agents or employees engaged in the operation, maintenance, security and management of the Building; provided, however, the wages, salaries and related expenses of any agents or employees not exclusively engaged in the operation, maintenance, security and management of the Building shall be reasonably apportioned;

(vii) cost of all maintenance and service agreements for the Building and the equipment therein, including, without limitation, alarm service, security service, window cleaning, and elevator maintenance;

(viii) any and all Common Area maintenance, repair or redecoration (including repainting) and exterior and interior landscaping;

(ix) the cost of providing security services to the Project, including, without limitation, a lobby attendant pursuant to Section 7.01.F below;

(x) the cost of performing Landlord’s obligations under Section 10.01 below, subject to the exclusions set forth herein, including cost of repairs, replacements and general maintenance to the Building;

(xi) except as otherwise expressly provided herein, all costs of operating any amenities provided to the tenants and occupants of the Building;

(xii) any other cost set forth in this Lease that is expressly states to be included in Operating Costs;

(xiii) Commissioning and certification costs incurred in connection with obtaining and maintaining any LEED or similar certifications for the Project; and

(xiv) any other costs incurred by Landlord in connection with the ownership, management, maintenance, repair and operation of the Leased Premises, Building, Parking Garage and Common Areas except as otherwise expressly provided in this Lease.

Landlord shall have the right, from time to time, to equitably allocate any Operating Costs applicable to the Project among different portions or occupants of the Project (the “Cost Pools”); provided, however, in no event shall the use of such Cost Pools result in a duplication of Operating Costs and all such allocations will be made in accordance with sound property management practices and general in accord with the practices of similar landlords of similar projects. Such Cost Pools shall be reasonable such that there is no material cross-subsidy or underpayment of Operating Cost contribution by any user in relation to the services consumed by any such user. The Operating Costs allocated to any such Cost Pool shall be allocated and charged to the tenants and occupants within such Cost Pool in otherwise in an equitable manner, in Landlord’s reasonable discretion.

If for any period during the Term less than ninety-five percent (95%) of the Floor Area of the Building is occupied by tenants, then, in calculating Operating Costs that vary based upon occupancy for such period, Landlord may increase those components of Operating Costs that vary based upon occupancy that Landlord reasonably believes would have been incurred during such period had the Building been ninety-five percent (95%) occupied. In addition, if for any period during the Term any part of the Building is leased to a tenant who, in accordance with the terms of its lease, provides its own cleaning services, electricity, and/or any other services otherwise included in Operating Costs, then Operating Costs for such period shall be increased by the additional costs for cleaning, electricity, and/or such other applicable expenses that Landlord reasonably estimates would have been incurred by Landlord if Landlord had furnished and paid for cleaning and/or such other services for the space occupied by such tenant.

Notwithstanding the foregoing, Operating Costs will in no event include the following: (1) costs paid directly by Tenant; (2) depreciation on the Building; (3) debt service and any mortgage or other loan payments of the Landlord; (4) rental under any ground or underlying lease including, without limitation, the Ground Lease; (5) interest unless expressly recoverable under this Lease, (6) attorneys’ fees and expenses or other costs, including brokers’ commissions incurred in connection with lease negotiations or lease disputes with prospective, current or past Building tenants, including the negotiation of letters of intent or leases; (7) the cost of any improvements, equipment or tools that would be properly classified as capital expenditures under generally accepted accounting principles except that the following capital costs may be included in Operating Costs: (i) costs which are intended to effect economies in the operation or maintenance of the Project, or any portion thereof, or to reduce current or future Operating Costs or to enhance the safety or security of the Project or its occupants, (ii) costs are required to comply with present or anticipated LEED, “green” “recycling” or other conservation programs, (iii) costs that are replacements or modifications of nonstructural items located in the Common Areas required to keep the Common Areas in good order or condition, (iv) costs that are required by Law or insurance requirement, or (v) costs to replace items which Landlord is obligated to maintain under this Lease; provided, however, in each instance such capital expenditure shall be amortized over the useful life thereof (as reasonably determined by Landlord to be in accordance with generally accepted industry standards for operation of Class A office buildings), together with interest on the unamortized balance at a rate per annum equal to the actual rate of interest paid by Landlord on funds borrowed for the purpose of constructing or acquiring such capital improvements or capital assets as reasonably documented by Landlord (and if Landlord does not borrow funds for such construction or acquisition, then interest at the rate of one percent (1%) above the prime rate of Wells Fargo Bank, N.A. or such successor national bank selected by Landlord then in force (the “Imputed Interest Rate”); provided, further, however, that with respect to capital expenditures referenced in subclause (i), above, Landlord may include as an Operating Cost in any calendar year an amount equal to Landlord’s estimate of the amount of reduction of other Operating Costs in such year resulting from such capital expenditure if such amount is greater than the amortization provided above); (8) the cost of decorating, improving for tenant occupancy, painting or redecorating portions of the Building to be demised to tenants; (9) costs of utilities for any tenant’s leased premises if separately metered, (10) costs incurred in connection with the original construction of the Building or Project or in connection with any major change in the Building that is not made at the request of Tenant, or any change to the Building or Project that is required to correct any violation of law not caused by Tenant existing on the Rent Commencement Date, or a breach by Landlord of the Lease; (11) costs for which Landlord is fully reimbursed by any tenant or occupant of the Building or by insurance by its insurance carrier or any tenant’s insurance carrier or by anyone else; (12) any bad debt loss, rent loss, or reserves for bad debts or rent loss; (13) costs associated with the operation of the business of the partnership or limited liability company or other entity that may from time to time constitute Landlord, as the same are distinguished from the costs of operation of the Building or Project, including accounting and legal matters, costs of defending any lawsuits with any Mortgagee (as defined in Section 14.01, below) (except as the actions of Tenant may be the issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of Landlord’s interest in the Building or Project (including, without limitation, attorneys’ fees and costs), costs (including, without limitation, attorneys’ fees and costs of settlement, judgments and payments in lieu thereof) arising from claims, disputes or potential disputes in connection with potential or actual claims, litigation or arbitrations respecting Landlord and/or the Building or Project; (14) the wages and benefits of any employee who does not devote substantially all of his or her time to the Building or Project, unless such wages and benefits are prorated to reflect time spent by any such employee on maintaining, securing, repairing, operating or managing the Building or Project vis-a-vis the total time spent by any such employee on matters unrelated to such activities, and in any case no wages or benefits of any employee of Landlord above Building manager will be included in Operating Costs; (15) costs paid to Landlord or to affiliates of Landlord for services in the Building or Project to the extent the same materially exceed or would materially exceed the costs for such services if rendered by first class unaffiliated third parties on a competitive basis; (16) costs arising from Landlord’s political or charitable contributions; (17) costs for sculpture, paintings or other objects of art; (18) Landlord’s general corporate overhead; (19) costs of removal or remediation of Hazardous Substances (except to the extent or treatment, removal or disposal of de minimis amounts of Hazardous Substances common in the operation of an office building project, such as automotive fluid deposits occurring in parking facilities, removal and disposal of clean products, cleansers, office supplies and the like); (20) the cost of rental for items (except when needed in connection with normal repairs and maintenance or keeping permanent systems in operation while repairs are being made) which if purchased, rather than rented, would constitute a capital improvement or expense except to the extent permitted above; (21) expenses directly resulting from defaults by or the gross negligence or willful misconduct of Landlord, its agents, servants or employees; (22) penalties, fines and late charges resulting from Landlord’s failure to make payments when required under applicable law, unless resulting from the failure of Tenant to pay Rental as and when required herein; (23) costs arising from latent defects in any portion of the Premises Base Building Specifications and Tenant Work described in Exhibit B for a period of one (1) year after Substantial Completion; (24) cost, fees and expenses related to any development of the Project and installation of a new building or improvements as generally shown as the location for a future development of a building on Exhibit A-1 Site Plan attached to this Lease; and (25) self-insured retention and deductibles in cumulative amount in excess of Two Hundred Thousand Dollars ($200,000) in any calendar year.

D. “Taxes” means all governmental or quasi-governmental real estate taxes, fees, charges, impositions and assessments (whether general, special, ordinary, or extraordinary) applicable to the Building and/or Project (including without limitation any assessments or charges by any business improvement district), together with all reasonable costs and fees

(including reasonable appraiser, consultant and attorney’s fees) incurred by Landlord in any tax contest, appeal or negotiation. “Taxes” shall also include that portion of any ground rent payments made by Landlord that represent the pass-through of real estate taxes from any ground lessor to Landlord and all rent or services taxes and/or so-called “gross receipts” or “receipts” taxes (including, but not limited to, any rent, business license, sales, use or similar taxes) whether or not enacted in addition to, in lieu of or in substitution for any other tax. “Taxes” shall also include any personal property taxes incurred on Landlord’s personal property used in connection with the Building. “Taxes” shall not include personal income taxes, personal property taxes, inheritance taxes, or franchise taxes levied against the Landlord, and not directly against said property, even though such taxes might become a lien against said property. If Landlord receives a refund of Taxes for any Lease Year during the Term as result of a reassessment of the Building pursuant to Section 51(a)(2) of the California Revenue and Taxation Code (“Proposition 8”), then Landlord shall credit against subsequent payments of Taxes due hereunder, an amount equal to Tenant’s Proportionate Share of Taxes of any such refund, net of any reasonable out of pocket expenses incurred by Landlord in achieving such refund. Nothing contained herein shall require Landlord to seek any reduction in the Building’s assessed value pursuant to Proposition 8 or otherwise. Taxes also shall not include real estate taxes attributable to construction of a new building at the Project that increases the real estate tax assessment for the Project during the Term.

ARTICLE VII

SERVICES AND UTILITIES

Section 7.01. Services Provided by Landlord.

So long as Tenant is not in Default under this Lease, Landlord shall provide the following facilities and services to Tenant as part of Operating Costs (except as otherwise provided herein), consistent with the Operating Standard:

A. Access to the Building, Tower Parking Garage, and Common Parking Garage, (subject to the rights of other users of the Parking Garage after the Parking Hours) twenty-four (24) hours per day, seven (7) days per week subject only to closures for casualty or public disturbance;

B. Normal and usual janitorial services on Business Days (provided, however, that if Tenant may elect, by delivery of not less than thirty (30) days written notice, to take over the obligation to provide such janitorial services within the Leased Premises, at Tenant’s sole cost and expense by a service provider reasonably acceptable to Landlord, in which event, upon such takeover by Tenant, Landlord shall no longer be required to provide such services within the Leased Premises and such charges for janitorial services within the Leased Premises and incurred by Tenant shall be deducted from Operating Costs which Tenant is required to pay at its sole cost and expense);

C. Rest room facilities and necessary lavatory supplies, including running water at the points of supply, as provided for the general use of all tenants in the Building, and routine maintenance, painting, and electric lighting service for all Common Areas of the Building in such manner as Landlord deems reasonable and necessary in order to meet the Operating Standard;

D. Maintenance of electric bulbs and other lighting elements for Building standard light fixtures in the Common Areas and Parking Garage;

E. Provision of a lobby attendant on Business Days from 6:00 AM through 6:00 PM local time;

F. During Building Hours, central heating and air conditioning to the Operating Standard. Capacity of Building HVAC system will be sized in accordance with cooling and heating load calculation procedures established by ASHRAE and local climatic conditions, and the HVAC system will comply with state and local building codes. Systems for the introduction of outside air for ventilation shall be designed, maintained and operated to meet or exceed the requirements of ASHRAE Standard 62.1-2007, unless local requirements are more demanding.

At a minimum, the system shall provide 1 ton of cooling for every 340 USF and 1.0 CFM per 1 RSF of air circulation capacity, based on a 55°F supply air temperature;

G. Tenant acknowledges, agrees and covenenats that all Tenant lighting within the Leased Premises is required to comply with the prescriptive requirements defined in Table 140.6-C of the 2019 California Energy Code (Title 24 Part 6). Landlord shall ensure that all lighting within the Leased Premsies as of the Term Commencement Date complies with such Title 24 Part 6 standard. Subject to the availability of electricity from Pacific Gas & Electric (or other applicable electrical utilities provider), Landlord shall provide electricity for normal office purposes during normal business hours, including task and task ambient lighting systems, normal office equipment, including, but not limited to, copy machines, computers, terminals, communications and audiovisual equipment, vending machines, and kitchen equipment. Landlord shall furnish to Tenant wattage and electricity up to an amount necessary to operate its business and all equipment of not less than 6.5 watts per usable square foot; and

H. Provision of security services to the Building, Common Areas, Tower Parking Garage, and Common Parking Garage in a manner consistent with those employed by owners of Comparison Buildings (as defined in Exhibit F below), including a manned security desk weekdays from 6am–6pm and 24-hour-per-day periodic patrol and CCTV observation service. Landlord will provide Tenant’s employees RF programmable key fobs that will be used to access Building and Building elevators, which Fobs can be programmed to restrict access to different floors based on Tenant’s direction.

Section 7.02. Landlord’s Access to Leased Premises.