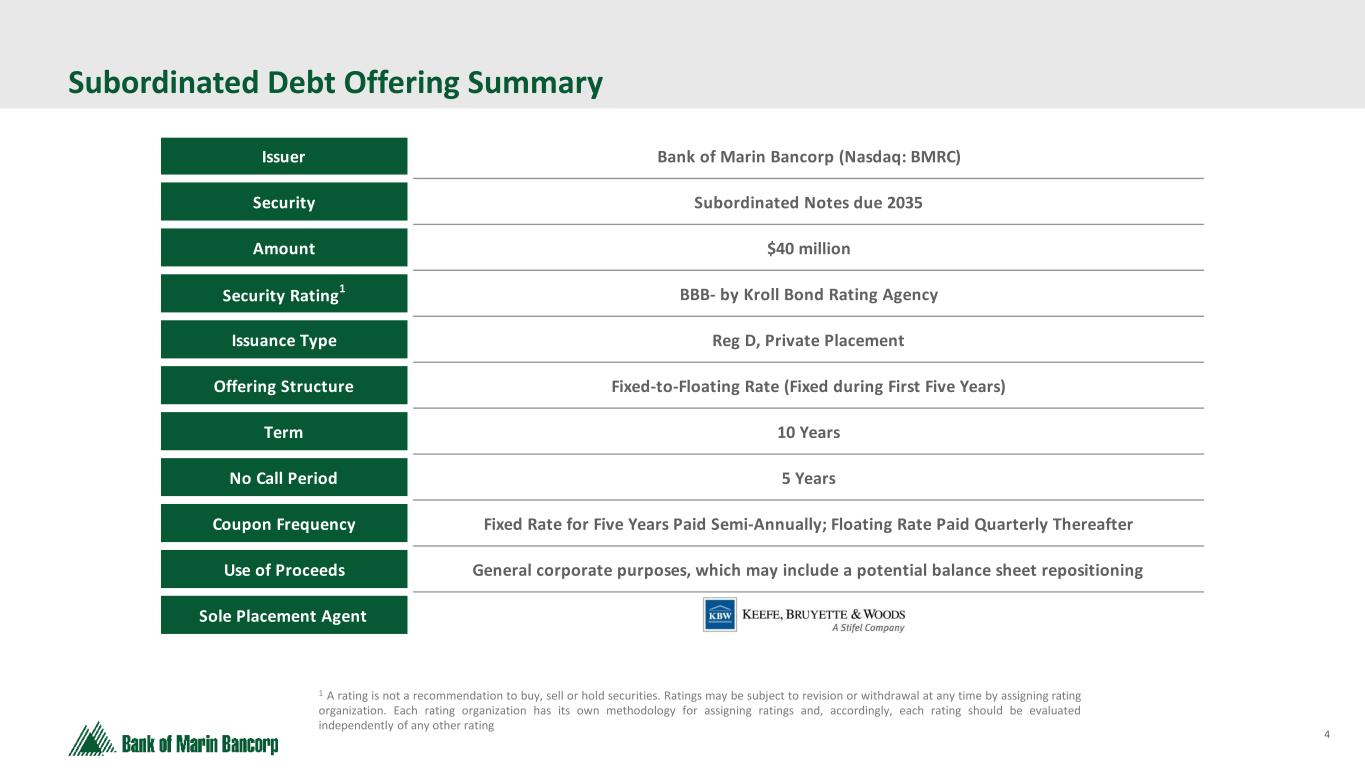

SUBORDINATED NOTE PURCHASE AGREEMENT This SUBORDINATED NOTE PURCHASE AGREEMENT (this “Agreement”) is dated as of November 19, 2025 and is made by and between Bank of Marin Bancorp, a California corporation (the “Company”), and the purchaser of Subordinated Notes (as defined herein) identified on the signature page hereto (the “Purchaser”). RECITALS WHEREAS, the Company has requested that certain purchasers (including the Purchaser) purchase from the Company up to $45,000,000 in aggregate principal amount of Subordinated Notes (the “Aggregate Subordinated Note Amount”), which aggregate amount is intended to qualify as Tier 2 Capital (as defined herein); WHEREAS, the Company has engaged Keefe, Bruyette & Woods, Inc. as its exclusive placement agent (the “Placement Agent”) for the offering of the Subordinated Notes; WHEREAS, each purchaser of Subordinated Notes (including the Purchaser) is an institutional “accredited investor,” as such term is defined in Rule 501(a)(1)-(3) and (7) of Regulation D (“Regulation D”) promulgated under the Securities Act of 1933, as amended (the “Securities Act”) or a QIB (as defined herein); WHEREAS, the offer and sale of the Subordinated Notes by the Company is being made in reliance upon the exemptions from registration available under Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D; and WHEREAS, the Purchaser is willing to purchase from the Company Subordinated Notes in the principal amount set forth on the Purchaser’s signature page hereto (the “Subordinated Note Amount”) in accordance with the terms, subject to the conditions and in reliance on, the recitals, representations, warranties, covenants and agreements set forth in the Transaction Documents (as defined herein). NOW, THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows: AGREEMENT 1. DEFINITIONS; INTERPRETATIONS; EXHIBITS INCORPORATED. 1.1 Definitions. The capitalized terms used in the Transaction Documents (as defined herein) have the meanings set forth below or may be defined in the stated sections of the Transaction Documents. Certain other capitalized terms used only in specific sections of this Agreement may be defined in such sections.

2 “Affiliate(s)” means, with respect to any Person, such Person’s immediate family members, partners, members or parents and Subsidiaries, and any other Person directly or indirectly controlling, controlled by, or under common control with said Person and its respective Affiliates. “Agreement” has the meaning set forth in the preamble hereto. “Anti-Money Laundering Laws” means the money laundering statutes of all applicable jurisdictions, the rules and regulations thereunder and any related or similar applicable rules, regulations or guidelines, issued, administered or enforced by any Governmental Agency. “Applicable Procedures” means, with respect to any creation, transfer or exchange of or for beneficial interests in any Subordinated Note represented by a global certificate, the rules and procedures of DTC that apply to such transfer or exchange. “Bank” means Bank of Marin, a California banking corporation and wholly-owned Subsidiary of the Company. In the event that subsequent hereto the Company acquires or otherwise establishes any other FDIC-insured depository subsidiaries, the term “Bank” will be deemed to include each such additional FDIC-insured depository institution, as applicable. “Business Day” means any day other than a Saturday, Sunday or any other day on which banking institutions in the State of California are permitted or required by any applicable law or executive order to close. “Bylaws” means the Amended and Restated Bylaws of the Company, as in effect on the Closing Date. “Charter” means the Certificate of Incorporation of the Company, as amended and as in effect on the Closing Date. “Closing” has the meaning set forth in Section 2.5. “Closing Date” means November 19, 2025. “Company” has the meaning set forth in the preamble hereto and shall include any successors to the Company. “Company Covered Person” has the meaning set forth in Section 4.2.3. “Company’s Reports” means (i) the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as filed with the SEC (as defined below) on March 14, 2025, including the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2024 contained therein; (ii) the Company’s Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2025, as filed with the SEC on May 12, 2025, for the fiscal quarter ended June 30, 2025, as filed with the SEC on August 8, 2025, and for the fiscal quarter ended September 30, 2025, as filed with the SEC on November 7, 2025, including the unaudited consolidated financial statements of the Company for the fiscal quarters contained therein; (iii) the Company’s Current Reports on Form 8-K, as filed with the SEC on January 2, 2025, January 27,

3 2025, February 25, 2025, April 28, 2025, May 22, 2025, June 6, 2025, July 1, 2025, and July 28, 2025 (SEC Accession Nos. 0001403475-25-000051 and 0001403475-25-000052); (iv) the Company’s Definitive Proxy Statement, as filed with the SEC April 16, 2025; and (iv) the Bank’s public reports for the year ended December 31, 2024 and the periods ended March 31, 2025, June 30, 2025 and September 30, 2025, as filed with the FRB and FDIC as required by regulations of the FRB and FDIC, respectively. “Control” (including the terms “controlling,” “controlled by” and “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise. “Disbursement” has the meaning set forth in Section 3.1. “Disqualification Event” has the meaning set forth in Section 4.2.3. “DTC” means The Depository Trust Company. “Equity Interest” means any and all shares, interests, participations or other equivalents (however designated) of capital stock of a corporation, any and all equivalent ownership interests in a Person which is not a corporation, and any and all warrants, options or other rights to purchase any of the foregoing. “Event of Default” has the meaning set forth in the Subordinated Notes. “Exchange Act” means the Securities Exchange Act of 1934, as amended. “FDIC” means the Federal Deposit Insurance Corporation. “FRB” means the Board of Governors of the Federal Reserve System. “GAAP” means generally accepted accounting principles in effect from time to time in the United States of America. “Global Note” has the meaning set forth in Section 3.1. “Governmental Agency(ies)” means, individually or collectively, any arbitrator, court, federal, state, county or local governmental body, department, commission, board, regulatory authority or agency (including, without limitation, each applicable Regulatory Agency) with jurisdiction over the Company or any of its Subsidiaries. “Governmental Licenses” has the meaning set forth in Section 4.3. “Hazardous Materials” mean chemicals, pollutants, contaminants, flammable explosives, asbestos, urea formaldehyde insulation, polychlorinated biphenyls, radioactive materials, hazardous wastes or substances, toxic or contaminated substances, petroleum or petroleum products, asbestos-containing materials, mold, or similar materials, including, without limitation, any substances which are “hazardous substances,” “hazardous wastes,” “hazardous materials” or

4 “toxic substances” under the Hazardous Materials Laws and/or other applicable environmental laws, ordinances or regulations. “Hazardous Materials Laws” mean any laws, regulations, permits, licenses or requirements pertaining to the protection, preservation, conservation or regulation of the environment which relates to real property, including, but not limited to: the Clean Air Act, as amended, 42 U.S.C. Section 7401 et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. Section 1251 et seq.; the Resource Conservation and Recovery Act of 1976, as amended, 42 U.S.C. Section 6901 et seq.; the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (including the Superfund Amendments and Reauthorization Act of 1986), 42 U.S.C. Section 9601 et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. Section 2601 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. Section 651, the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. Section 11001 et seq.; the Mine Safety and Health Act of 1977, as amended, 30 U.S.C. Section 801 et seq.; the Safe Drinking Water Act, 42 U.S.C. Section 300f et seq.; and all comparable state and local laws, laws of other jurisdictions or orders and regulations. “Indebtedness” means (i) all obligations in respect of indebtedness for borrowed money that, according to GAAP as in effect from time to time, would be included in determining total liabilities as shown on the consolidated balance sheet of the Company; and (ii) all obligations for indebtedness of the type referred to in the preceding clause (i) of persons other than the Company or any of Subsidiaries, secured by any lien on property owned by the Company or any Subsidiary whether or not such obligations shall have been assumed (it being understood that the amount of such obligations described in clause (ii), for the purposes of this definition, shall be the lesser of the aggregate principal amount of such obligations and the fair market value (as determined by the Company in good faith) of the property of the Company or any Subsidiary securing such obligations); provided, however, Indebtedness shall not include deposits or other indebtedness created, incurred or maintained in the ordinary course of the Company’s or the Bank’s business (including, without limitation, federal funds purchased, advances from any Federal Home Loan Bank, secured deposits of municipalities, letters of credit issued by the Company or the Bank or any other Subsidiary, repurchase arrangements and derivatives transactions) and consistent with customary banking practices and applicable laws and regulations. “Investor Presentation” has the meaning set forth in Section 4.6.8. “Leases” means all leases, licenses or other documents providing for the use or occupancy of any portion of any Property, including all amendments, extensions, renewals, supplements, modifications, sublets and assignments thereof and all separate letters or separate agreements relating thereto. “Material Adverse Effect” means any effect, change, event, circumstance, condition, occurrence or development that has had or would reasonably be expected to have a material adverse effect on (i) the condition, financial or otherwise, results of operations, business affairs or prospects of the Company and each of its Subsidiaries, taken as a whole, whether or not arising in the ordinary course of business, or (ii) the ability of the Company to enter into and perform its obligations under, or consummate the transactions contemplated in, the Transaction Documents; provided, however, that “Material Adverse Effect” shall not be deemed to include the impact of

5 (1) changes after the date of this Agreement in banking and similar laws, rules or regulations of general applicability or interpretations thereof by Governmental Agencies, (2) changes after the date of this Agreement in GAAP or regulatory accounting requirements applicable to financial institutions in the United States and their holding companies generally, (3) changes after the date of this Agreement in general economic or capital market conditions affecting financial institutions or their market prices generally and not specifically related to the Company or the Bank, including changes in interest rates, (4) direct effects of compliance with this Agreement on the operating performance of the Company or the Bank, including expenses incurred by the Company, the Bank or the Purchaser in consummating the transactions contemplated by this Agreement, (5) the effects of any action or omission taken by the Company with the prior written consent of the Purchaser, and vice versa, or as otherwise contemplated by the Transaction Documents, (6) changes in national or international political or social conditions, including the engagement by the United States in hostilities, whether or not pursuant to the declaration of a national emergency or war, or by the occurrence of any military or terrorist attack upon or within the United States; and (7) the effects of any natural disasters or other force majeure events or any epidemic, pandemic or disease outbreak, or continuation or extension of any epidemic, pandemic or disease outbreak, affecting the United States, except, in the case of the foregoing clauses (1), (2), (3), (6) or (7) to the extent that the Company is disproportionately adversely affected thereby relative to other financial institutions with similar operations. “Maturity Date” means December 1, 2035. “OFAC” means the Office of Foreign Assets Control. “Paying Agent” means U.S. Bank Global Corporate Trust Services, as paying agent and registrar under the Paying Agent Agreement (as defined herein), or any successor in accordance with the applicable provisions of the Paying Agent Agreement. “Paying Agent Agreement” means the Paying Agency and Registrar Agreement dated as of November 19, 2025, by and between the Company and U.S. Bank Global Corporate Trust Services, as Paying Agent, as amended, modified or restated from time to time. “Person” means an individual, a corporation (whether or not for profit), a partnership, a limited liability company, a joint venture, an association, a trust, an unincorporated organization, a government or any department or agency thereof (including a Governmental Agency) or any other entity or organization. “Placement Agent” has the meaning set forth in the Recitals. “Property” means any real property owned or leased by the Company or any Affiliate of the Company. For avoidance of doubt, Property includes, without limitation, property repossessed or foreclosed in connection with lending activities of Bank. “Purchaser” has the meaning set forth in the preamble hereto. “QIB” means a “qualified institutional buyer” as defined in Rule 144A under the Securities Act.

6 “Regulation D” has the meaning set forth in the Recitals. “Regulatory Agency” means any federal or state agency charged with the supervision or regulation of depository institutions or holding companies of depository institutions, or engaged in the insurance of depository institution deposits, or any court, administrative agency or commission or other authority, body or agency having supervisory or regulatory authority with respect to the Company, the Bank, or any of their Subsidiaries. “SEC” means the U.S. Securities and Exchange Commission. “Secondary Market Transaction” has the meaning set forth in Section 5.5. “Securities Act” has the meaning set forth in the Recitals. “Subordinated Notes” means the 6.750% Fixed-to-Floating Rate Subordinated Notes due December 1, 2035 in the form attached as Exhibit A hereto, as amended, restated, supplemented or modified from time to time and each Subordinated Note delivered in substitution, subdivision or exchange for such Subordinated Note. “Subordinated Note Amount” has the meaning set forth in the Recitals. “Subsidiar(y)(ies)” means with respect to any Person, any other Person in which a majority of the outstanding voting shares of Equity Interest entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees or equivalent Person or body thereof, is directly or indirectly owned by such Person. “Tier 2 Capital” has the meaning given to the term “Tier 2 capital” in 12 C.F.R. Part 217, as amended, modified and supplemented and in effect from time to time or any replacement thereof. “Transaction Documents” means this Agreement, the Paying Agent Agreement, the Subordinated Notes and any ancillary documents required to consummate the transaction contemplated herein. “Trust Indenture Act” means the Trust Indenture Act of 1939, as amended, and the rules and regulations of the SEC thereunder. 1.2 Interpretations. The foregoing definitions are equally applicable to both the singular and plural forms of the terms defined. The words “hereof”, “herein” and “hereunder” and words of the like shall refer to this Agreement as a whole and not to any particular provision of this Agreement. The word “including” when used in this Agreement without the phrase “without limitation,” shall mean “including, without limitation.” All references to time of day herein are references to Eastern Time, unless otherwise specifically provided. All references to the Transaction Documents shall be deemed to be to such documents as amended, modified or restated from time to time. With respect to any reference in this Agreement to any defined term, (i) if such defined term refers to a Person, then it shall also mean all heirs, legal representatives, permitted successors and assignees of such Person, and (ii) if such defined term refers to a document,

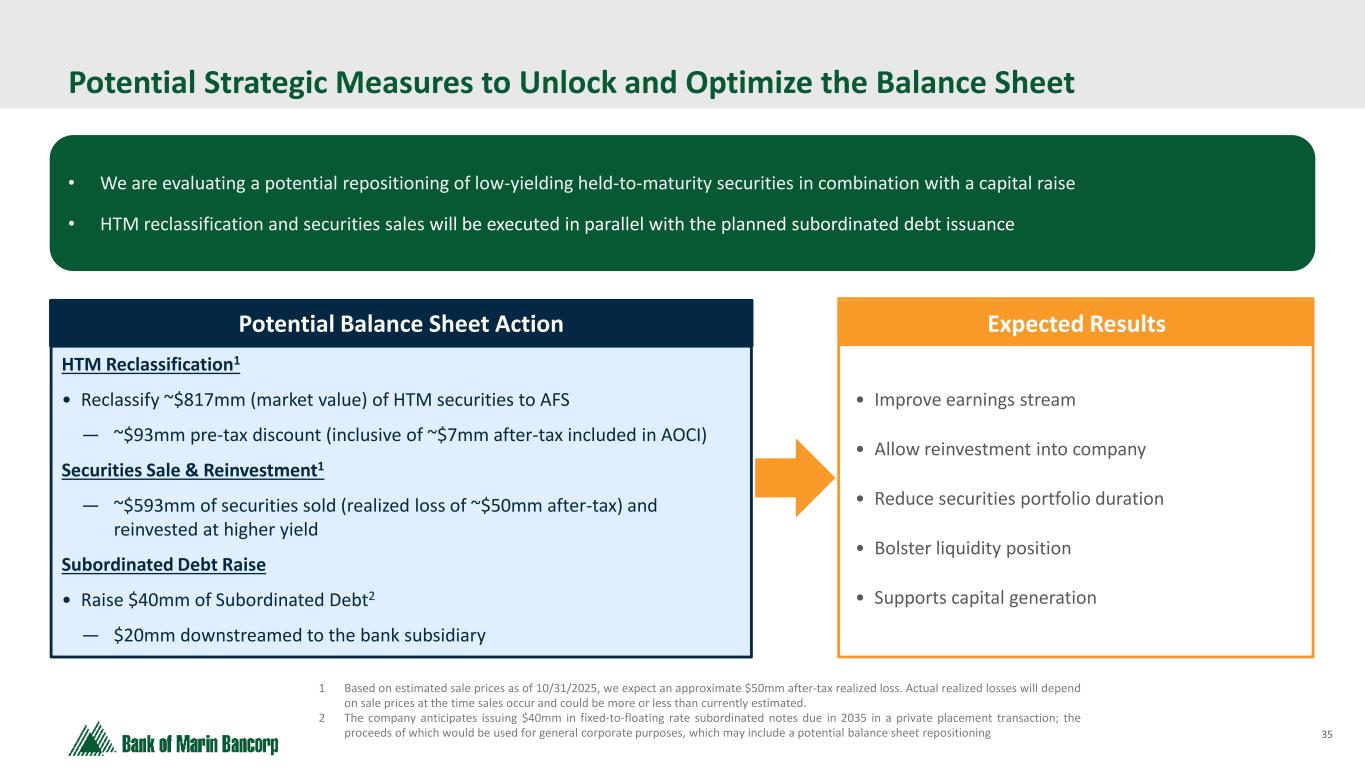

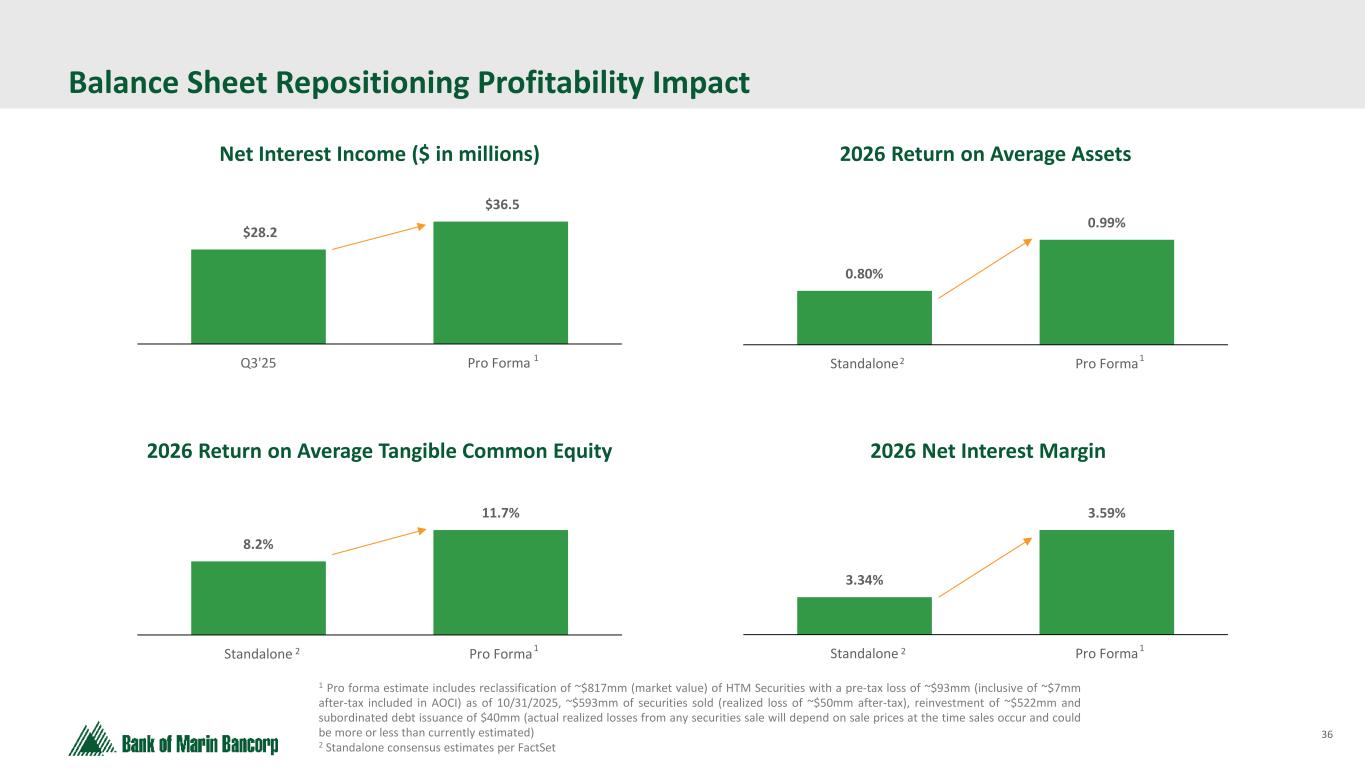

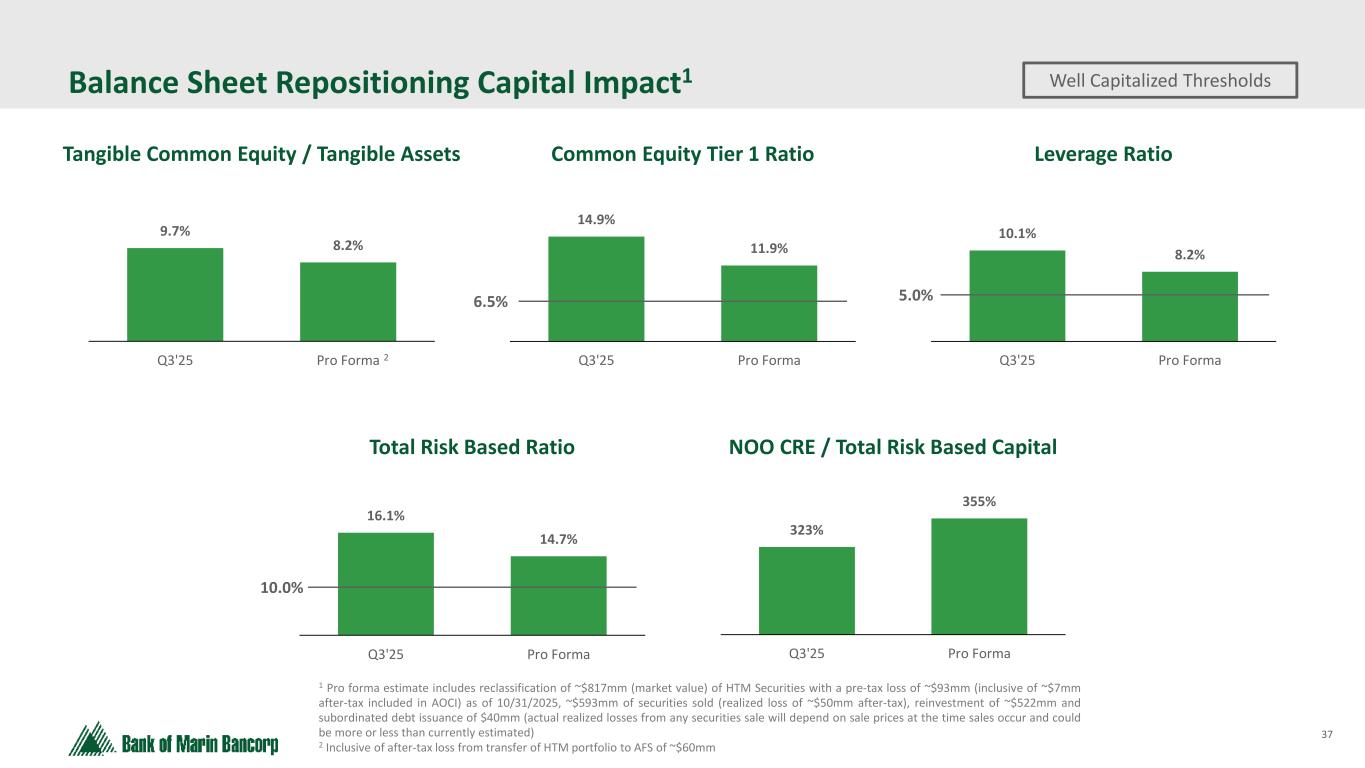

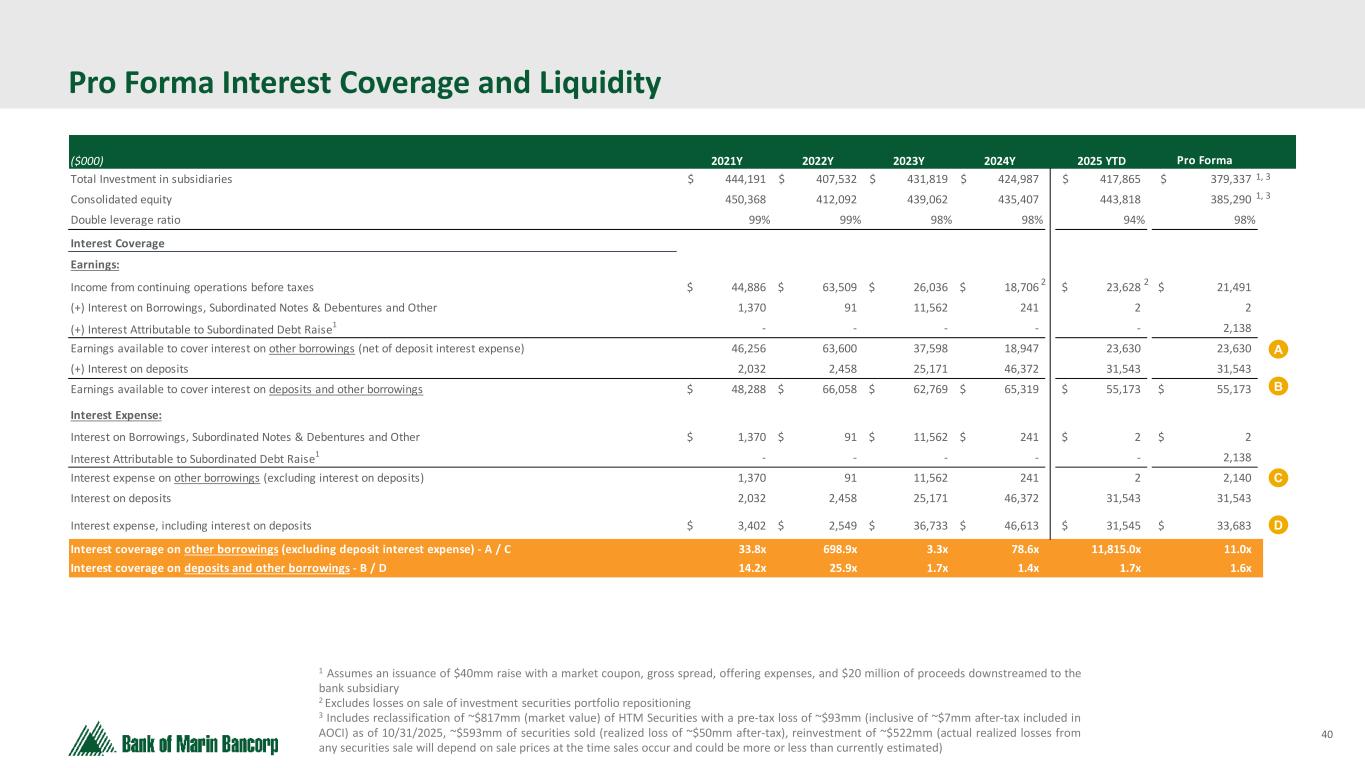

7 instrument or agreement, then it shall also include any amendment, replacement, extension or other modification thereof. 1.3 Exhibits Incorporated. All Exhibits and Schedules attached hereto are hereby incorporated into this Agreement. 2. SUBORDINATED DEBT. 2.1 Certain Terms. Subject to the terms and conditions contained herein, the Company proposes to issue and sell to the purchasers of the Subordinated Notes (including the Purchaser), severally and not jointly, Subordinated Notes in an aggregate principal amount equal to the aggregate of the Subordinated Note Amounts. The Purchaser, severally and not jointly with each other purchaser of Subordinated Notes, agrees to purchase the Subordinated Notes from the Company in an amount equal to the Subordinated Note Amount from the Company on the Closing Date in accordance with the terms of, and subject to the conditions and provisions set forth in, the Transaction Documents. The Subordinated Note Amount shall be disbursed in accordance with Section 3.1. 2.2 The Closing. The execution and delivery of the Transaction Documents and the closing of the sale and purchase of the Subordinated Notes (the “Closing”) shall occur remotely via electronic or other exchange of documents and signature pages, at 10:00 a.m. (New York City Time) on the Closing Date, or at such other place or time or on such other date as the parties hereto may agree. 2.3 No Right of Offset. The Purchaser hereby expressly waives any right of offset it may have against the Company or any of its Affiliates. 2.4 Use of Proceeds. The Company shall use the net proceeds from the sale of the Subordinated Notes for general corporate purposes and to support regulatory capital ratios for growth initiatives, which may include securities portfolio repositioning. 2.5 Subordination. The Subordinated Notes shall be subordinated in accordance with the subordination provisions set forth therein. 2.6 Unsecured Obligations. The obligations of the Company to the Purchasers under the Subordinated Notes shall be unsecured. 2.7 Payments. The Company agrees that matters concerning payments and application of payments shall be as set forth in this Agreement and in the Subordinated Notes. 3. DISBURSEMENT. 3.1 Disbursement. On the Closing Date, assuming all of the terms and conditions set forth in Section 3.2 have been satisfied by the Company or waived by the Purchaser, and the Company has executed and delivered to the Purchaser the Transaction Documents and any other related documents in form and substance reasonably satisfactory to the Purchaser, the Purchaser shall disburse to the Company in immediately available funds the Subordinated Note Amount in exchange for (a) a Subordinated Note with a principal amount equal to such Subordinated Note

8 Amount or (b) an electronic securities entitlement to be credited to the Purchaser’s account (or the account of the Purchaser’s securities intermediary) through the facilities of DTC in accordance with the Applicable Procedures of DTC with a principal amount equal to such Subordinated Note Amount, as applicable (the “Disbursement”). The Company will deliver (i) to the Paying Agent, a global certificate representing the Subordinated Notes issued to Purchasers who are QIBs (the “Global Note”), registered in the name of Cede & Co., as a nominee for DTC, (ii) to each applicable Purchaser of the Subordinated Notes not represented by the Global Note, such Purchaser’s Subordinated Note in definitive form (or evidence of the same electronically with the original to be delivered by the Company by overnight delivery on the next Business Day in accordance with the delivery instructions of the Purchaser), and (iii) to the Paying Agent, a list of Purchasers receiving the Subordinated Notes in Disbursement under clause (ii) above. 3.2 Conditions Precedent to Disbursement. 3.2.1 Conditions to the Purchaser’s Obligation. The obligation of the Purchaser to consummate the purchase of the Subordinated Notes to be purchased by the Purchaser at Closing and to effect the Disbursement is subject to the satisfaction of or delivery by or at the direction of the Company to the Purchaser (or, with respect to the Paying Agent Agreement, the Paying Agent, and with respect to the opinion(s) of counsel, the Placement Agent and counsel to the Placement Agent), on or prior to the Closing Date, each of the following (unless the Purchaser shall have waived such satisfaction or delivery): 3.2.1.1 Transaction Documents. The Transaction Documents, duly authorized and executed by the Company and, in the case of the Subordinated Note, authenticated by the Paying Agent. 3.2.1.2 Authority Documents. (a) With respect to the Company: (i) a certified copy of the Charter of the Company issued by the Secretary of State of the State of California; (ii) the Bylaws of the Company, certified as of the date hereof by the Secretary of the Company; (iii) the resolutions adopted by the Board of Directors of the Company and any committee thereof authorizing the offer and sale of the Subordinated Note, certified as of the date hereof by the Secretary of the Company; (iv) a Certificate of Good Standing issued by the Secretary of State of the State of California, dated within two (2) days of Closing;

9 (v) bank holding company status letter regarding the Company from the Federal Reserve Bank of San Francisco; (vi) an incumbency certificate of the Secretary of the Company, dated as of the Closing Date, certifying the names of the officer(s) of the Company authorized to sign the Transaction Documents and the other documents provided for in this Agreement; and (vii) the opinion of Stuart | Moore | Staub, counsel to the Company, dated as of the Closing Date, substantially in the form set forth as Exhibit B addressed to the Purchaser and the Placement Agent. (b) With respect to the Bank: (i) a Certificate of Good Standing issued by the Secretary of State of the State of California, dated within two (2) days of Closing; (ii) FDIC’s BankFind website screenshot dated as of the Closing Date, regarding the Bank’s FDIC insured status; (iii) a certified copy of the Articles of Incorporation of the Bank; and (iv) the Bylaws of the Bank, certified as of the date hereof by the Secretary of the Bank. 3.2.1.3 Other Documents. The Company shall deliver to the Purchaser, in form and substance satisfactory to the Purchaser, such other information, certificates, affidavits, schedules, resolutions, notes and/or other documents that are provided for hereunder, or as the Purchaser may reasonably request. 3.2.2 Conditions to the Company’s Obligation. 3.2.2.1 The obligation of the Company to consummate the offer and sale of the Subordinated Notes to the Purchaser, and to effect the delivery of the Subordinated Notes to the Purchaser at Closing, is subject to each of the following, on or prior to the Closing Date (unless the Company shall have waived such satisfaction or delivery):

10 (a) the delivery of this Agreement and any other Transaction Documents to which the Purchaser is a party to the Company and the Placement Agent, duly authorized and executed by the Purchaser; and (b) the Disbursement to the Company, in immediately available funds, of the Subordinated Note Amount set forth on the Purchaser’s signature page to this Agreement. 4. REPRESENTATIONS AND WARRANTIES OF THE COMPANY. The Company hereby represents and warrants to the Purchaser, as of the date hereof, as follows: 4.1 Organization and Authority. 4.1.1 Organization Matters of the Company and Its Subsidiaries. 4.1.1.1 The Company is a duly organized corporation, is validly existing and in good standing under the laws of the State of California and has all requisite corporate power and authority to conduct its business and activities as presently conducted, to own its properties, and to perform its obligations under the Transaction Documents. The Company is duly qualified as a foreign corporation to transact business and is in good standing in each jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure to be in good standing would not reasonably be expected to result in a Material Adverse Effect. The Company is duly registered as a bank holding company under the Bank Holding Company Act of 1956, as amended. 4.1.1.2 The entities listed on Schedule A attached hereto are the only direct or indirect Subsidiaries of the Company as of the date hereof. Each Subsidiary of the Company (other than the Bank) has been duly organized and is validly existing, or, in the case of the Bank, has been duly chartered and is validly existing as a California state chartered bank, in each case in good standing under the laws of the jurisdiction of organization, has the corporate or similar power and authority to own, lease and operate its properties and to conduct its business and is duly qualified as a foreign corporation to transact business and is in good standing in each jurisdiction in which such qualification is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure to so qualify or to be in good standing would not reasonably be expected to result in a Material Adverse Effect. All of the issued and outstanding shares of capital stock or other Equity Interests in each Subsidiary of the Company have been duly authorized and validly issued, and are fully paid and non-assessable and are owned by the Company, directly or through Subsidiaries of the Company, free and clear of any security interest, mortgage, pledge, lien, encumbrance or claim. None of the outstanding shares of capital stock of, or other Equity Interests in, any of the Company’s Subsidiaries were issued in violation of the preemptive or similar rights of any security holder of such Subsidiary of the Company or any other entity. 4.1.1.3 The Bank is a California banking corporation. The deposit accounts of the Bank are insured by the FDIC up to the FDIC’s applicable limits. The Bank has not received any notice or other information indicating that the Bank is not an “insured depository

11 institution” as defined in 12 U.S.C. Section 1813, nor has any event occurred which could reasonably be expected to adversely affect the status of the Bank as an FDIC-insured institution. 4.1.2 Capital Stock and Related Matters. The Charter of the Company authorizes the Company to issue 30,000,000 shares of common stock, no par value per share, and 5,000,000 shares of preferred stock. As of the Closing Date, there will be 16,094,636 shares of the Company’s common stock issued and outstanding, and no shares of the Company’s preferred stock issued and outstanding. All of the outstanding capital stock of the Company has been duly authorized and validly issued and is fully paid and non-assessable, and are owned of record and beneficially by the Company, free and clear of all encumbrances, except for restrictions on transfer imposed by applicable securities laws. Except pursuant to the Company’s equity incentive plans duly adopted by the Company’s Board of Directors, there are, as of the date hereof, no outstanding options, rights, warrants or other agreements or instruments obligating the Company to issue, deliver or sell, or cause to be issued, delivered or sold, additional shares of the capital stock of the Company or obligating the Company to grant, extend or enter into any such agreement or commitment to any Person other than the Company. 4.2 No Impediment to the Transaction. 4.2.1 Transaction is Legal and Authorized. The issuance of the Subordinated Notes, the borrowing of the Aggregate Subordinated Note Amount, the execution of the Transaction Documents and compliance by the Company with all of the provisions of the Transaction Documents are within the corporate powers of the Company. 4.2.2 Execution of the Transaction Documents is Legal and Authorized. The Transaction Documents have been duly authorized, executed and delivered by the Company, and, assuming due authorization, execution and delivery by the Purchaser and each other purchaser of the Subordinated Notes, constitutes the legal, valid and binding obligation of the Company, enforceable against the Company in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles. 4.2.3 Subordinated Notes. The Subordinated Notes issued on the Closing Date have been duly authorized by the Company and when duly executed by the Company and issued by the Company and delivered to and paid for by the purchasers of such Subordinated Notes (including the Purchaser) in accordance with the terms of the Transaction Documents, will have been duly executed, authenticated, issued and delivered, and will constitute legal, valid and binding obligations of the Company, and enforceable against the Company in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles. 4.2.4 Exemption from Registration. Neither the Company, nor any of its Subsidiaries or Affiliates, nor any Person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (as defined in Regulation D) in connection with the offer or sale of the Subordinated Notes. Assuming the accuracy of the representations and warranties of the Purchaser set forth in this Agreement, each other purchaser of Subordinated Notes set forth in

12 each such purchaser’s applicable Subordinated Note Purchase Agreement, the Subordinated Notes will be issued in a transaction exempt from the registration requirements of the Securities Act. No “bad actor” disqualifying event described in Rule 506(d)(1)(i)-(viii) of Regulation D (a “Disqualification Event”) is applicable to the Company or, to the Company’s knowledge, any Person described in Rule 506(d)(1) of Regulation D (each, a “Company Covered Person”). The Company has exercised reasonable care to determine whether any Company Covered Person is subject to a Disqualification Event. The Company has complied, to the extent applicable, with its disclosure obligations under Rule 506(e) of Regulation D. 4.2.5 No Defaults or Restrictions. Neither the execution and delivery of the Transaction Documents by the Company nor the compliance by the Company with their respective terms and conditions will (whether with or without the giving of notice, lapse of time, or both) (i) violate, conflict with or result in a breach of, or constitute a default under: (1) the Charter or Bylaws of the Company; (2) any of the terms, obligations, covenants, conditions or provisions of any corporate restriction or of any contract, agreement, indenture, mortgage, deed of trust, pledge, bank loan or credit agreement, or any other agreement or instrument to which the Company or Bank, as applicable, is now a party or by which it or any of its properties may be bound or affected; (3) any judgment, order, writ, injunction, decree or demand of any court, arbitrator, grand jury, or Governmental Agency applicable to the Company or the Bank; or (4) any statute, rule or regulation applicable to the Company, except, in the case of items (2), (3) or (4), for such violations and conflicts, breaches and defaults that would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect, or (ii) result in the creation or imposition of any lien, charge or encumbrance of any nature whatsoever upon any property or asset of the Company or its Subsidiaries. Neither the Company nor the Bank is in default in the performance, observance or fulfillment of any of the terms, obligations, covenants, conditions or provisions contained in any indenture or other agreement creating, evidencing or securing Indebtedness of any kind or pursuant to which any such Indebtedness is issued, or any other agreement or instrument to which the Company or the Bank, as applicable, is a party or by which the Company or the Bank, as applicable, or any of its properties may be bound or affected, except, in each case, for defaults that would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. The Bank is not a party to, or otherwise subject to, any legal restriction or any agreement (other than customary limitations imposed by corporate or banking law statutes, banking regulations or other regulatory requirements) restricting the ability of the Bank to pay dividends or make any other distributions to the Company. 4.2.6 Governmental Consent. No governmental orders, permissions, consents, approvals or authorizations are required to be obtained by the Company that have not been obtained, and no registrations or declarations are required to be filed by the Company that have not been filed in connection with or in contemplation of, the execution and delivery of, and performance under, the Transaction Documents, except for such consents, approvals, authorizations, orders or qualifications that are required or permitted to be made or obtained after the date hereof and applicable requirements, if any, of the Securities Act, the Exchange Act or state securities laws or “blue sky” laws of the various states and any applicable federal or state banking laws and regulations. 4.3 Possession of Licenses and Permits. The Company and each of its Subsidiaries (i) possess such permits, licenses, approvals, consents and other authorizations (collectively,

13 “Governmental Licenses”) issued by the appropriate Governmental Agencies necessary to conduct the business(es) operated by them, except where the failure to possess such Governmental Licenses would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect on the Company or such applicable Subsidiary; and (ii) are in compliance with the terms and conditions of all such Governmental Licenses, except where the failure to so comply would not reasonably be expected to, individually or in the aggregate, result in a Material Adverse Effect on the Company or such applicable Subsidiary. All of the Governmental Licenses are valid and are in full force and effect, except where the invalidity of such Governmental Licenses or the failure of such Governmental Licenses to be in full force and effect would not reasonably be expected to result in a Material Adverse Effect on the Company or such applicable Subsidiary. Neither the Company nor any of its Subsidiaries have received any notice of proceedings relating to the revocation or modification of any such Governmental Licenses. 4.4 Financial Condition. 4.4.1 Company Financial Statements. The financial statements of the Company included in the Company’s Reports (including the related notes, where applicable), which have been provided to the Purchaser (i) have been prepared from, and are in accordance with, the books and records of the Company; (ii) fairly present, in all material respects, the results of operations, cash flows, changes in stockholders’ equity and the financial position of the Company and its consolidated Subsidiaries, for the respective fiscal periods or as of the respective dates set forth therein (subject in the case of unaudited statements to recurring year-end audit adjustments normal in nature and amount), as applicable; (iii) complied as to form, as of their respective dates of filing in all material respects with applicable accounting and banking requirements as applicable, with respect thereto; and (iv) have been prepared in accordance with GAAP consistently applied during the periods involved, except, in each case, as indicated in such statements or in the notes thereto. The books and records of the Company have been, and continue to be, maintained in all material respects in accordance with GAAP and any other applicable legal and accounting requirements. The Company does not have any material liability of any nature whatsoever (whether absolute, accrued, contingent or otherwise, whether due or to become due), except for those liabilities that are reflected or reserved against on the consolidated balance sheet of the Company contained in the Company’s Reports for the Company’s most recently completed quarterly or annual fiscal period, as applicable, and for liabilities incurred in the ordinary course of business consistent with past practices or in connection with the transaction contemplated by the Transaction Documents. 4.4.2 Absence of Default and Certain Changes. (a) Since the end of the Company’s last fiscal year for which audited financial statements have been included in the Company’s Reports, no event has occurred which either of itself or with the lapse of time or the giving of notice or both, would give any creditor of the Company the right to accelerate the maturity of any material Indebtedness of the Company. Neither the Company nor any Subsidiary is in default under any Lease, agreement or instrument, or any law, rule, regulation, order, writ, injunction, decree, determination or award, except for such defaults that would not

14 reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. (b) After giving effect to the consummation of the transactions contemplated by the Transaction Documents, the Company remains solvent, possesses sufficient capital to carry on its business and is able to pay its debts as they mature. (c) Since the end of the Company’s last fiscal year for which audited financial statements have been included in the Company’s Reports, the Company has conducted its business in the ordinary course of business consistent with past practice, and there has not been, with respect to the Company or any of its Subsidiaries, any: (i) entry of a decree or order for relief in respect of the Company by a court having jurisdiction in the premises in an involuntary case or proceeding under any applicable bankruptcy, insolvency, or reorganization law, now or hereafter in effect of the United States or any political subdivision thereof, and such decree or order will have continued unstayed and in effect for a period of ninety (90) consecutive calendar days; (ii) commencement by the Company of a voluntary case under any applicable bankruptcy, insolvency or reorganization law, now or hereafter in effect of the United States or any political subdivision thereof, or the consent by the Company to the entry of a decree or order for relief in an involuntary case or proceeding under any such law; (iii) (A) indication of insolvency or other reason to be that the Company is unable to pay its debts as they mature or does not possesses sufficient capital to carry on its business, (B) assignment for the benefit of creditors, (C) admission in writing regarding the Company’s inability to pay its debts as they mature, (D) transfer of property and no Indebtedness is being incurred in connection with the transaction contemplated hereby, with the intent to hinder, delay or defraud either present or future creditors of the Company or any of its Subsidiaries, or (E) notification that the Company ceases to be a bank or financial holding company under the Bank Holding Company Act of 1956, as amended; or (iv) liquidation of the Company (for the avoidance of doubt, “liquidation” does not include any merger, consolidation, sale of equity or assets or reorganization (exclusive of a

15 reorganization in bankruptcy) of the Company or any of its Subsidiaries). 4.4.3 Ownership of Property. The Company and each of its Subsidiaries possess good and marketable title to all real property and assets owned by the Company and each of its Subsidiaries in the conduct of their business, whether such assets and properties are real or personal, tangible or intangible, including assets and property reflected in the most recent balance sheet contained in the Company’s Reports or acquired subsequent thereto (except to the extent that such assets and properties have been disposed of in the ordinary course of business, since the date of such balance sheet), subject to no encumbrances, liens, mortgages, security interests or pledges, except (i) those items which secure liabilities for public or statutory deposits, obligations or any discount with, borrowing from or other obligations to the Federal Home Loan Bank, the FRB, inter-bank credit facilities, reverse repurchase agreements or any transaction by the Bank acting in a fiduciary capacity, (ii) statutory liens for amounts not yet due or delinquent or which are being contested in good faith; and (iii) such as would not reasonably be expected to result, individually or in the aggregate, in a Material Adverse Effect. The Company and each of its Subsidiaries, as lessee, have the right under valid and existing Leases of real and personal properties, as applicable, in the conduct of its business to occupy or use all such properties as presently occupied and used by it. Such existing Leases and commitments to Lease constitute or will constitute operating Leases for both tax and financial accounting purposes except as otherwise disclosed in the Company’s Reports and the Lease expense and minimum rental commitments with respect to such Leases and Lease commitments are as disclosed in all material respects in the Company’s Reports. 4.5 No Material Adverse Effect. Since the end of the Company’s last fiscal year for which audited financial statements have been included in the Company’s Reports, there has been no development or event that has had or would reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. 4.6 Legal Matters. 4.6.1 Compliance with Law. The Company and each of its Subsidiaries have complied with (and (x) are not under investigation, have not been threatened to be charged with, or (y) given any notice of any material violation of), any applicable statutes, rules, regulations, orders and restrictions of any domestic or foreign government, or any instrumentality or agency thereof, having jurisdiction over the conduct of its business or the ownership of its properties, including, but not limited to, the reporting requirements of Section 13 or Section 15(d), as applicable, of the Exchange Act, any applicable fair lending laws and regulations such as the Fair Housing Act (42 U.S.C. § 3601 et seq.), the Equal Credit Opportunity Act (15 U.S.C. § 1691 et seq.), and any implementing regulations, except where any such failure to comply or violation would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. The Company and each of its Subsidiaries are in compliance with, and at all times prior to the date hereof, have been in compliance with (i) all statutes, rules, regulations, orders and restrictions of any domestic or foreign government, or any Governmental Agency, applicable to it, and (ii) its own privacy policies and written commitments to customers, consumers and employees, concerning data protection, the privacy and security of personal data, and the nonpublic personal information of its customers, consumers and employees, in each case except where any such failure to comply would not reasonably be expected to, individually or in the

16 aggregate, result in a Material Adverse Effect. At no time during the two (2) years prior to the date hereof have the Company or any of its Subsidiaries received any written notice asserting any violations of any of the foregoing. 4.6.2 Regulatory Enforcement Actions. The Company, the Bank, and each of the Company’s and the Bank’s Subsidiaries are in compliance in all material respects with all laws administered by and regulations of any Governmental Agency applicable to it or to them, except where the failure to comply would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. None of the Company, the Bank, nor any of the Company’s or the Bank’s Subsidiaries (nor any of their officers or directors), is now operating under any restrictions, agreements, memoranda, commitment letter, supervisory letter or similar regulatory correspondence, or other commitments (other than restrictions of general application) imposed by any Governmental Agency, nor are, to the Company’s knowledge (i) any such restrictions threatened, (ii) any agreements, memoranda or commitments being sought by any Governmental Agency, or (iii) any material legal or regulatory violations previously identified by, or material penalties or other remedial action previously imposed by, any Governmental Agency remaining unresolved. Notwithstanding the foregoing, nothing in this Section 4.6.2 or this Agreement shall require the Company or any of its Subsidiaries to provide any confidential regulatory or supervisory information of the Company or any of its Subsidiaries. 4.6.3 Pending Litigation. There are no actions, suits, proceedings or written agreements pending, or, to the Company’s knowledge, threatened or proposed, against the Company or any of its Subsidiaries at law or in equity before or by any Governmental Agency, that would reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect, or materially and adversely affect the issuance or payment of the Subordinated Notes. Neither the Company nor any of its Subsidiaries are a party to or named as subject to the provisions of any order, writ, injunction, or decree of, or any written agreement with, any court or Governmental Agency, that would reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. 4.6.4 Environmental. Except as would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect, no Property is or, to the Company’s knowledge, has been a site for the use, generation, manufacture, storage, treatment, release, threatened release, discharge, disposal, transportation or presence of any Hazardous Materials and neither the Company nor any of its Subsidiaries has engaged in such activities. There are no claims or actions pending or, to the Company’s knowledge, threatened against the Company or any of its Subsidiaries by any Governmental Agency or by any other Person relating to any Hazardous Materials or pursuant to any Hazardous Materials Law. 4.6.5 Brokerage Commissions. Except for commissions paid or payable to the Placement Agent, neither the Company nor any Affiliate of the Company is obligated to pay any brokerage commission, placement agent or finder’s fee to any Person in connection with the transactions contemplated by the Transaction Documents. 4.6.6 Investment Company Act. Neither the Company nor any of its Subsidiaries is an “investment company” or a company “controlled” by an “investment company,” within the meaning of the Investment Company Act of 1940, as amended.

17 4.6.7 Reporting Compliance. The Company is in compliance with the reporting requirements of Section 13 or Section 15(d), as applicable, of the Exchange Act. No Subsidiary is subject to the reporting requirements of Section 13 or Section 15(d), as applicable, of the Exchange Act. 4.6.8 No Misstatement. None of the representations, warranties or statements made in (i) the Transaction Documents, (ii) that certain “Bank of Marin Bancorp Fixed Income Investor Presentation, November 2025” presentation (the “Investor Presentation”) used in connection with the offering of the Subordinated Notes, (iii) in any certificate delivered to the Purchaser or the Placement Agent by the Company on or prior to the Closing Date, contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein not misleading in light of the circumstances in which they were made. 4.7 Internal Accounting Controls. The Company and the Bank have established and maintain a system of internal control over financial reporting that pertains to the maintenance of records that accurately and fairly reflect the transactions and dispositions of the Company’s assets (on a consolidated basis), provides reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that the Company’s and the Bank’s receipts and expenditures are being made only in accordance with authorizations of the Company’s management and Board of Directors, and provides reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of assets of the Company on a consolidated basis that could reasonably be expected to result in a Material Adverse Effect. Such internal control over financial reporting is effective to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with GAAP. Since the conclusion of the Company’s last completed fiscal year, there has not been and there currently is not (i) any significant deficiency or material weakness in the design or operation of its internal control over financial reporting which is reasonably likely to adversely affect its ability to record, process, summarize and report financial information, or (ii) any fraud, whether or not material, that involves management or other employees who have a role in the Company’s or the Bank’s internal control over financial reporting. The Company (x) has implemented and maintains disclosure controls and procedures reasonably designed and maintained to ensure that material information relating to the Company is made known to the Chief Executive Officer and the Chief Financial Officer of the Company by others within the Company and (y) has disclosed, based on its most recent evaluation prior to the date hereof, to the Company’s outside auditors and the audit committee of the Company’s Board of Directors any significant deficiencies and material weaknesses in the design or operation of internal controls over financial reporting which are reasonably likely to adversely affect the Company’s internal controls over financial reporting. Such disclosure controls and procedures are in effect for the purposes for which they were established. 4.8 Exempt Offering. Assuming the accuracy of the representations and warranties of each purchaser of the Subordinated Notes (including the Purchaser) set forth in the applicable Subordinated Note Purchase Agreement (including this Agreement), no registration under the Securities Act is required for the offer and sale of the Subordinated Notes by the Company to the Purchaser.

18 4.9 Tax Matters. The Company, the Bank and each other Subsidiary of the Company have (i) filed all material foreign, U.S. federal, state and local tax returns, information returns and similar reports that are required to be filed (taking into account any extensions), and all such tax returns are true, correct and complete in all material respects, and (ii) paid all material taxes required to be paid by it and any other material assessment, fine or penalty levied against it other than taxes (x) currently payable without penalty or interest, or (y) being contested in good faith by appropriate proceedings. 4.10 Insurance. The Company and each Subsidiary of the Company is insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which they are engaged; in the past three years, neither the Company nor any of its Subsidiaries has been refused any insurance coverage sought or applied for; and the Company and each of its Subsidiaries have no reason to believe that they will not be able to renew existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue their business at a cost that would not have a Material Adverse Effect on the Company. 4.11 Representations and Warranties Generally. The representations and warranties of the Company set forth in this Agreement that do not contain a “Material Adverse Effect” qualification are true and correct in all material respects (i) as of the Closing Date and (ii) as otherwise specifically provided herein. The representations and warranties of the Company set forth in this Agreement that contain a “Material Adverse Effect” qualification or any other express materiality or similar qualification are true and correct (x) as of the Closing Date and (y) as otherwise specifically provided herein. 5. GENERAL COVENANTS, CONDITIONS AND AGREEMENTS. The Company hereby further covenants and agrees with the Purchaser as follows: 5.1 Compliance with Transaction Documents. The Company shall comply with, observe and timely perform each and every one of its covenants, agreements and obligations under the Transaction Documents. 5.2 Affiliate Transactions. The Company shall not itself, nor shall it cause, permit or allow any of its Subsidiaries, to enter into any transaction, including, the purchase, sale or exchange of property or the rendering of any service, with any Affiliate upon terms inconsistent with applicable laws, regulations, and market standards, which would be considered less favorable to the Company or any of its Subsidiaries, than if such transaction was an arm’s length transaction with a Person that was not an Affiliate. 5.3 Compliance with Laws. 5.3.1 Generally. The Company, the Bank, and each of the Company’s other Subsidiaries shall comply with all applicable statutes, rules, regulations, orders and restrictions in respect of the conduct of its business and the ownership of its properties, including, but not limited to, any applicable fair lending laws and regulations such as the Fair Housing Act (42 U.S.C. § 3601 et seq.), the Equal Credit Opportunity Act (15 U.S.C. § 1691 et seq.), Anti-Money

19 Laundering Laws, sanctions administered by OFAC, the Community Reinvestment Act, the Bank Secrecy Act of 1970, the USA PATRIOT Act, and any implementing regulations, except, in each case, where such noncompliance would not reasonably be expected to, singularly or in the aggregate, result in a Material Adverse Effect. 5.3.2 Regulated Activities. The Company shall not itself, nor shall it cause, permit or allow the Bank or any of its other Subsidiaries to (i) engage in any business or activity not permitted by all applicable laws and regulations, except where such business or activity would not reasonably be expected to result in a Material Adverse Effect, or (ii) make any loan or advance secured by the capital stock of another bank or depository institution, or acquire the capital stock, assets or obligations of or any interest in another bank or depository institution, in each case other than in accordance with applicable laws and regulations and safe and sound banking practices. 5.3.3 Taxes. The Company shall and shall cause the Bank and each of the Company’s other Subsidiaries to timely pay and discharge all taxes, assessments and other governmental charges imposed upon the Company, the Bank, and each of the Company’s other Subsidiaries or upon the income, profits, or property of the Company, the Bank, or each of the Company’s other Subsidiaries and all claims for labor, material or supplies which, if unpaid, might by law become a lien or charge upon the property of the Company, the Bank, or any of the Company’s other Subsidiaries. Notwithstanding the foregoing, none of the Company, the Bank, and each of the Company’s other Subsidiaries shall be required to pay any such tax, assessment, charge or claim, so long as the validity thereof shall be contested in good faith by appropriate proceedings, and appropriate reserves therefore shall be maintained on the books of the Company, the Bank, and each of the Company’s other Subsidiaries, as the case may be. 5.3.4 Corporate Existence. The Company, the Bank, and each of the Company’s other Subsidiaries shall do or cause to be done all things reasonably necessary to maintain, preserve and renew its corporate existence and its and their rights and franchises, and comply in all material respects with all related laws applicable to the Company, the Bank, and each of the Company’s other Subsidiaries; provided, however, that the Company may consummate a merger in which (i) the Company is the surviving entity or (ii) if the Company is not the surviving entity, the surviving entity assumes, by operation of law or otherwise, all of the obligations of the Company under the Transaction Documents. 5.3.5 Dividends, Payments, and Guarantees During Event of Default. Upon the occurrence of an Event of Default (as defined under the Subordinated Notes), until such Event of Default is cured by the Company or waived by the Purchaser in accordance with the terms of the Subordinated Notes and except as required by any federal or state Governmental Agency, the Company shall not (a) declare or pay any dividends or distributions on, or redeem, purchase, acquire or make a liquidation payment with respect to, any of its capital stock; (b) make any payment of principal of, or interest or premium, if any, on, or repay, repurchase or redeem any of the Company’s Indebtedness that ranks equal with or junior to the Subordinated Notes; or (c) make any payments under any guarantee that ranks equal with or junior to the Subordinated Notes, other than (i) any dividends or distributions in shares of, or options, warrants or rights to subscribe for or purchase shares of, any class of the Company’s common stock; (ii) any declaration of a non- cash dividend in connection with the implementation of a shareholders’ rights plan, or the issuance of stock under any such plan in the future, or the redemption or repurchase of any such rights

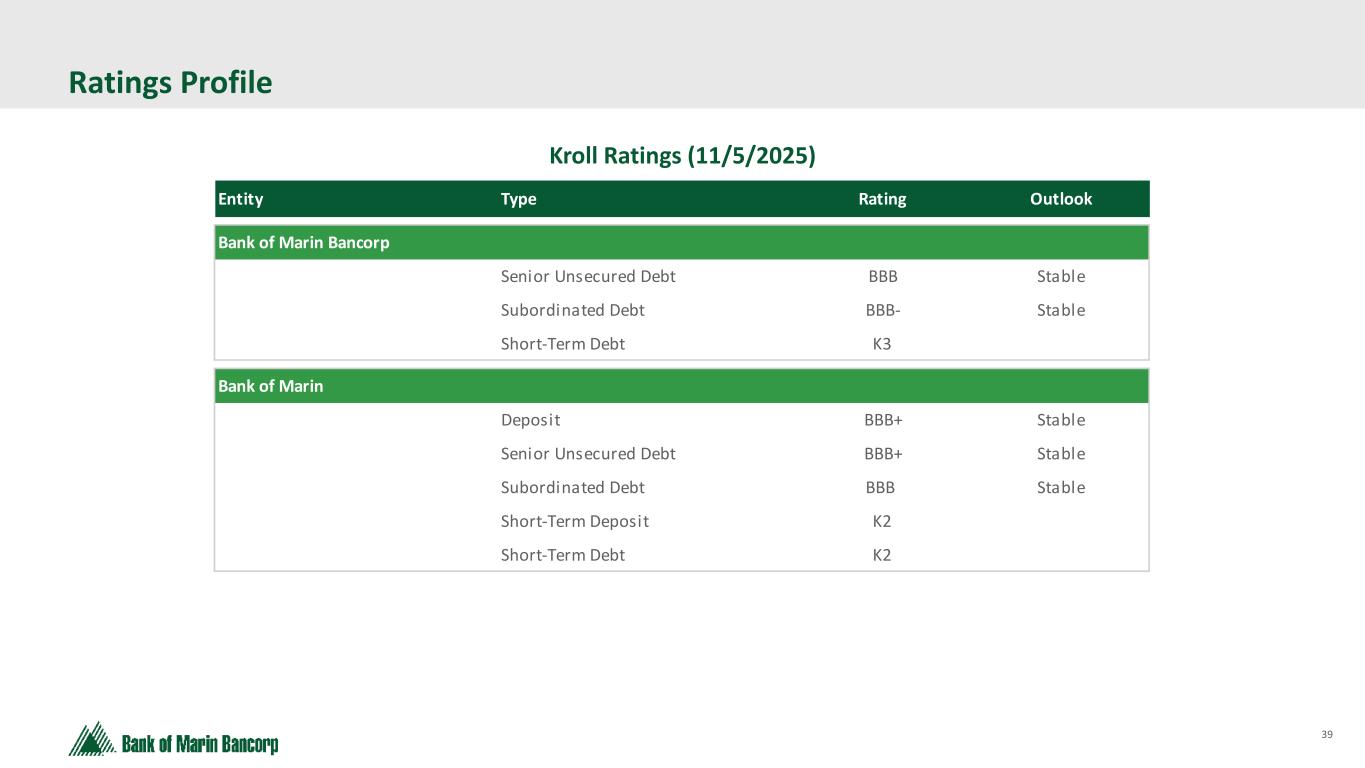

20 pursuant thereto; (iii) as a result of a reclassification of the Company’s capital stock or the exchange or conversion of one class or series of the Company’s capital stock for another class or series of the Company’s capital stock; (iv) the purchase of fractional interests in shares of the Company’s capital stock pursuant to the conversion or exchange provisions of such capital stock or the security being converted or exchanged; or (v) purchases of any class of the Company’s common stock related to or from any benefit plans for the Company’s directors, officers or employees or any of the Company’s dividend reinvestment plans. 5.3.6 Tier 2 Capital. If all or any portion of the Subordinated Notes ceases to be eligible, or there is a material risk that all or any portion of the Subordinated Notes will cease to be eligible to qualify as Tier 2 Capital, other than due to the limitation imposed on the capital treatment of subordinated debt during the five (5) years immediately preceding the Maturity Date of the Subordinated Notes, the Company will immediately notify the Noteholders (as defined in the Subordinated Notes), and thereafter the Company and the Noteholders (as defined in the Subordinated Notes) will work together in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Subordinated Notes to be eligible to qualify as Tier 2 Capital; provided, however, that nothing contained in this Agreement shall limit the Company’s right to redeem the Subordinated Notes upon the occurrence of a Tier 2 Capital Event as described in the Subordinated Notes. 5.4 Absence of Control. It is the intent of the parties to this Agreement that in no event shall the Purchaser, by reason of any of the Transaction Documents, be deemed to control, directly or indirectly, the Company or the Bank, and the Purchaser shall not exercise, or be deemed to exercise, directly or indirectly, a controlling influence over the management or policies of the Company or the Bank. 5.5 Secondary Market Transactions. To the extent and so long as not in violation of Section 6.4 (Purchase for Investment), the Purchaser shall have the right at any time and from time to time to securitize its Subordinated Notes or any portion thereof in a single asset securitization or a pooled loan securitization of rated single or multi-class securities secured by or evidencing ownership interests in the Subordinated Notes (each such securitization is referred to herein as a “Secondary Market Transaction”). In connection with any such Secondary Market Transaction, the Company shall, at the Company’s expense, cooperate with the Purchaser and otherwise reasonably assist the Purchaser in satisfying the market standards to which the Purchaser customarily adheres or which may be reasonably required in the marketplace or by applicable rating agencies in connection with any such Secondary Market Transaction, but in no event shall the Company be required to incur (without reimbursement) any material costs or expenses in connection therewith. Subject to any written confidentiality obligation, including the terms of any non- disclosure agreement between the Purchaser and the Company, all information regarding the Company may be furnished to any Person reasonably deemed necessary by the Purchaser in connection with participation in such Secondary Market Transaction. All documents, financial statements, appraisals and other data relevant to the Company or the Subordinated Notes may be retained by any such Person, subject to the terms of any nondisclosure agreement between the Purchaser and the Company. 5.6 Bloomberg. The Company shall use commercially reasonable efforts to cause, or to assist the placement agent to cause the Subordinated Notes to be quoted on Bloomberg.

21 5.7 Rule 144A Information. While any Subordinated Notes remain “restricted securities” within the meaning of the Securities Act, the Company will make available, upon request, to any seller of such Subordinated Notes the information specified in Rule 144A(d)(4) under the Securities Act, unless the Company is then subject to Section 13 or 15(d) of the Exchange Act. 5.8 Redemption. Any redemption made pursuant to the terms of the Subordinated Notes shall be made on a pro rata basis, and, for purposes of a redemption processed through DTC, in accordance with its rules and procedures, as a “Pro Rata Pass-Through Distribution of Principal.” 5.9 Rating. So long as any Subordinated Notes remain outstanding, the Company will use commercially reasonable efforts to maintain a rating by a nationally recognized statistical rating organization. 5.10 DTC Registration. Provided that applicable depository eligibility requirements are met, upon the request of a holder of a Subordinated Note that is a QIB, the Company shall use commercially reasonable efforts to cause the Subordinated Notes held by such QIB to be registered in the name of Cede & Co. as nominee of DTC or a nominee of DTC. 5.11 Insurance. At its sole cost and expense, the Company shall maintain, and shall cause each Subsidiary to maintain, bonds and insurance to such extent, covering such risks as is required by law or as is usual and customary for owners of similar businesses and properties in the same general area in which the Company or any of its Subsidiaries operates. All such bonds and policies of insurance shall be in a form, in an amount and with insurers recognized as adequate by prudent business persons. 6. REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE PURCHASER. The Purchaser hereby represents and warrants to the Company, and covenants with the Company as follows: 6.1 Legal Power and Authority. The Purchaser has all necessary power and authority to execute, deliver and perform the Purchaser’s obligations under this Agreement and to consummate the transactions contemplated herein. The Purchaser is an entity duly organized, validly existing and in good standing under the laws of its jurisdiction of organization. 6.2 Authorization and Execution. The execution, delivery and performance of this Agreement has been duly authorized by all necessary action on the part of the Purchaser. This Agreement has been duly executed and delivered by the Purchaser. Assuming due authorization, execution and delivery by the Company, this Agreement is a legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with its terms, except as enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting creditors’ rights generally or by general equitable principles.

22 6.3 No Conflicts. Neither the execution, delivery or performance of the Transaction Documents nor the consummation of any of the transactions contemplated thereby will conflict with, violate, constitute a breach of or a default (whether with or without the giving of notice or lapse of time or both) under (i) the Purchaser’s organizational documents, (ii) any agreement or instrument to which the Purchaser is a party, (iii) any law, rule or regulation applicable to the Purchaser; or (iv) any order, writ, judgment, injunction, decree, determination or award binding upon or affecting the Purchaser. 6.4 Purchase for Investment. The Purchaser is purchasing the Subordinated Notes for its own account and not with a view to distribute and with no present intention of reselling, distributing or otherwise disposing of the same. The Purchaser has no present or contemplated agreement, undertaking, arrangement, obligation, Indebtedness or commitment providing for, or which is likely to compel, a disposition of the Subordinated Notes in any manner. 6.5 Institutional Accredited Investor; Qualified Institutional Buyer. The Purchaser is and will be on the Closing Date either (i) an institutional “accredited investor” as such term is defined in Rule 501(a) of Regulation D and as contemplated by subsections (1)-(3) and (7) of Rule 501(a) of Regulation D, and has no less than $5,000,000 in total assets, or (ii) a QIB. 6.6 Financial and Business Sophistication. The Purchaser has such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of the prospective investment in the Subordinated Notes. The Purchaser has relied solely upon its own knowledge of, and/or the advice of its own legal, financial, tax or other advisors with regard to, the legal, financial, tax and other considerations involved in deciding to invest in the Subordinated Notes. 6.7 Ability to Bear Economic Risk of Investment. The Purchaser recognizes that an investment in the Subordinated Notes is a speculative investment that involves substantial risk, including risks related to the Company’s business, operating results, financial condition and cash flows, which risks it has carefully considered in connection with making an investment in the Subordinated Notes. It has the ability to bear the economic risk of the prospective investment in the Subordinated Notes, including the ability to hold the Subordinated Notes indefinitely, and further including the ability to bear a complete loss of all of its investment in the Company. 6.8 Information. The Purchaser acknowledges that (i) it is not being provided with the disclosures that would be required if the offer and sale of the Subordinated Notes were registered under the Securities Act, nor is it being provided with any offering circular, private placement memorandum or prospectus prepared in connection with the offer and sale of the Subordinated Notes or any other securities of the Company; (ii) it has conducted its own examination of the Company and the terms of the Subordinated Notes to the extent it deems necessary to make its decision to invest in the Subordinated Notes; (iii) it has availed itself of publicly available financial and other information concerning the Company to the extent it deems necessary to make its decision to purchase the Subordinated Note (including meeting with representatives of the Company); (iv) the Company, the Bank, and the Company’s Subsidiaries may possess material non-public information that is not known to the Purchaser, and that will not be disclosed to the Purchaser; (v) it understands, based on its experience, the disadvantage to which the Purchaser is subject due to the disparity of information between the Company and the

23 Purchaser; and (vi)it has not received nor relied on any form of general solicitation or general advertising (within the meaning of Regulation D), from the Company in connection with the offer and sale of the Subordinated Notes. The Purchaser has reviewed the information set forth in the Company’s Reports (including the exhibits and schedules thereto), the Transaction Documents (including the exhibits and schedules thereto and hereto), and the Investor Presentation, in connection with the transaction contemplated by the Transaction Documents. 6.9 Access to Information. The Purchaser acknowledges that it and its advisors have (i) been furnished with all materials relating to the business, finances and operations of the Company that have been reasonably requested by it or its advisors, and (ii) have been given the opportunity to request documents from and to ask questions of, and to receive answers from, persons acting on behalf of the Company concerning terms and conditions of the transactions contemplated by the Transaction Documents, in order to make an informed and voluntary decision to enter into this Agreement. 6.10 Investment Decision. The Purchaser has made its own investment decision based upon its own judgment, due diligence and advice from such advisors as it has deemed necessary and not upon any view expressed by any other Person, including the Company of the Placement Agent. Neither such inquiries nor any other due diligence investigations conducted by the Purchaser or its advisors or representatives, if any, shall modify, amend or affect its right to rely on the Company’s representations and warranties contained herein. The Purchaser is not relying upon, and has not relied upon, any advice, statement, representation or warranty made by any Person by or on behalf of the Company, including, without limitation, the Placement Agent, except for the express statements, representations and warranties of the Company made or contained in this Agreement. Furthermore, the Purchaser acknowledges that (i) the Placement Agent has not performed any due diligence review on behalf of it or otherwise acted on behalf of or for the benefit of the Purchaser and (ii) nothing in this Agreement or any other materials presented by or on behalf of the Company to it in connection with the purchase of the Subordinated Notes constitutes legal, tax or investment advice. 6.11 Private Placement; No Registration; Restricted Legends. The Purchaser understands and acknowledges that the Subordinated Notes are characterized as “restricted securities” under the Securities Act and its implementing regulations and are being sold by the Company without registration under the Securities Act in reliance on one or more of the exemptions from federal and state registration set forth in Section 4(a)(2) of the Securities Act, Rule 506(b) of Regulation D promulgated under Section 4(a)(2) of the Securities Act, Section 18 of the Securities Act, and any applicable state securities laws, and accordingly, may be resold, pledged or otherwise transferred only in compliance with the registration requirements of federal and state securities laws or if exemptions from the Securities Act and applicable state securities laws are available to it. The Purchaser is not subscribing for the Subordinated Note as a result of or subsequent to any general solicitation or general advertising, in each case within the meaning of Rule 502(c) of Regulation D, any advertisement, article, notice or other communication published in any newspaper, magazine or similar media or broadcast over television or radio, or presented at any seminar or meeting. The Purchaser has not been solicited with respect to investment in the Subordinated Notes, except in the jurisdiction of its address appearing on the Purchaser’s signature page to this Agreement. The Purchaser further acknowledges and agrees that all certificates or other instruments representing the Subordinated Notes will bear the restrictive

24 legend set forth in the form of Subordinated Note. The Purchaser further acknowledges its primary responsibilities under the Securities Act and, accordingly, will not sell or otherwise transfer the Subordinated Notes or any interest therein without complying with the requirements of the Securities Act and the rules and regulations promulgated thereunder and the requirements set forth in this Agreement. Neither the Placement Agent nor the Company has made or is making any representation, warranty or covenant, express or implied, as to the availability of any exemption from registration under the Securities Act or any applicable state securities laws for the resale, pledge or other transfer of the Subordinated Notes, or that the Subordinated Notes purchased by the Purchaser will ever be able to be lawfully resold, pledged or otherwise transferred. 6.12 Placement Agent. The Purchaser will purchase the Subordinated Notes directly from the Company and not from the Placement Agent and understands that neither the Placement Agent nor any other broker or dealer has any obligation to make a market in the Subordinated Notes. 6.13 Physical Settlement of Subordinated Notes. Notwithstanding anything in this Agreement to the contrary, if the Purchaser is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D), and is not also a QIB, the Purchaser acknowledges that its Subordinated Notes shall be physically delivered to such Purchaser and registered in the name of such Purchaser, and the Purchaser agrees to such physical settlement of its Subordinated Notes. 6.14 Foreign Investors. If the Purchaser is not a United States person (as defined by Section 7701(a)(30) of the Internal Revenue Code of 1986, as amended), the Purchaser herby represents that it has satisfied itself as to the full observance of the laws of its jurisdiction in connection with any invitation to subscribe for the Subordinated Notes or any use of this Agreement, including (i) the legal requirements within its jurisdiction for the purchase of the Subordinated Notes, (ii) any foreign exchange restrictions applicable to such purchase, (iii) any governmental or other consents that may need to be obtained, and (iv) the income tax and other tax consequences, if any, that may be relevant to the purchase, holding, redemption, sale, or transfer of the Subordinated Notes. The Purchaser’s subscription and payment for and continued beneficial ownership of the Subordinated Notes will not violate any applicable securities or other laws of the Purchaser’s jurisdiction. 6.15 Tier 2 Capital. If the Company provides notice as contemplated in Section 5.3.6 of the occurrence of the event contemplated in such section, thereafter the Company and the Purchasers will work together in good faith to execute and deliver all agreements as reasonably necessary in order to restructure the applicable portions of the obligations evidenced by the Subordinated Notes to be eligible to qualify as Tier 2 Capital; provided, however, that nothing contained in this Agreement shall limit the Company’s right to redeem the Subordinated Notes upon the occurrence of a Tier 2 Capital Event as described in the Subordinated Notes. 6.16 Not Debt of the Bank; Not Savings Accounts, Etc. The Purchaser acknowledges that the Company is a bank holding company and the Company’s rights and the rights of the Company’s creditors, including, the Noteholders (as defined in the Subordinated Notes), to participate in the assets of any of the Company’s Subsidiaries during its liquidation or reorganization are structurally subordinate to the prior claims of the Subsidiary’s creditors. The Purchaser acknowledges and agrees that the Subordinated Notes are not a savings account or a