California |

001-33572 | 20-8859754 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

504 Redwood Blvd., Suite 100, Novato, CA |

94947 | ||||

| (Address of principal executive office) | (Zip Code) | ||||

| Check the appropriate box below if the Form 8-K filing is to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | |||||

☐ Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

|||||

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|||||

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|||||

☐ Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

|||||

| Securities registered pursuant to 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common stock, no par value | BMRC | The Nasdaq Stock Market | ||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |||||

Emerging growth company ☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |||||

| Exhibit No. | Description |

Page Number | ||||||

| 99.1 | 1-12 | |||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) | |||||||

| Date: | July 28, 2025 | BANK OF MARIN BANCORP | ||||||||||||

| By: | /s/ David Bonaccorso | |||||||||||||

| David Bonaccorso | ||||||||||||||

| Executive Vice President | ||||||||||||||

| and Chief Financial Officer | ||||||||||||||

|

|||||

| FOR IMMEDIATE RELEASE | MEDIA CONTACT: | ||||

| Yahaira Garcia-Perea | |||||

| Marketing & Corporate Communications Manager | |||||

| 916-823-7214 | YahairaGarcia-Perea@bankofmarin.com | |||||

| Three months ended | Six months ended | ||||||||||||||||

(in thousands, except per share amounts; unaudited) |

June 30, 2025 | March 31, 2025 | June 30, 2025 | June 30, 2024 | |||||||||||||

Pre-tax, pre-provision net (loss) income |

|||||||||||||||||

Pre-tax, pre-provision net (loss) income (GAAP) |

$ | (11,199) | $ | 6,556 | $ | (4,643) | $ | (24,903) | |||||||||

Comparable pre-tax, pre-provision net income (non-GAAP) |

7,537 | 6,556 | 14,093 | 7,639 | |||||||||||||

| Net (loss) income | |||||||||||||||||

Net (loss) income (GAAP) |

(8,536) | 4,876 | (3,660) | (18,980) | |||||||||||||

| Comparable net income (non-GAAP) | 4,662 | 4,876 | 9,538 | 3,942 | |||||||||||||

Diluted (loss) earnings per share |

|||||||||||||||||

Diluted (loss) earnings per share (GAAP) |

(0.53) | 0.30 | (0.23) | (1.18) | |||||||||||||

| Comparable diluted earnings per share (non-GAAP) | 0.29 | 0.30 | 0.59 | 0.24 | |||||||||||||

| See complete Reconciliation of GAAP and Non-GAAP Financial Measures below | |||||||||||||||||

Related tax benefit calculated using blended statutory rate of 29.5636% |

|||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

(in thousands, except per share amounts; unaudited) |

June 30, 2025 | March 31, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||

| Return on average assets | ||||||||||||||||||||

| Return on average assets (GAAP) | (0.92) | % | 0.53 | % | (2.35) | % | (0.20) | % | (1.01) | % | ||||||||||

| Comparable return on average assets (non-GAAP) | 0.50 | % | 0.53 | % | 0.11 | % | 0.52 | % | 0.21 | % | ||||||||||

| Return on average equity | ||||||||||||||||||||

| Return on average equity (GAAP) | (7.80) | % | 4.52 | % | (20.36) | % | (1.68) | % | (8.79) | % | ||||||||||

| Comparable return on average equity (non-GAAP) | 4.26 | % | 4.52 | % | 0.95 | % | 4.39 | % | 1.83 | % | ||||||||||

| Efficiency ratio | ||||||||||||||||||||

| Efficiency ratio (GAAP) | 208.81 | % | 76.44 | % | (300.37) | % | 112.18 | % | 237.13 | % | ||||||||||

| Comparable efficiency ratio (non-GAAP) | 74.03 | % | 76.44 | % | 86.70 | % | 75.21 | % | 84.93 | % | ||||||||||

| See complete Reconciliation of GAAP and Non-GAAP Financial Measures below | ||||||||||||||||||||

Related tax benefit calculated using blended statutory rate of 29.5636% |

||||||||||||||||||||

|

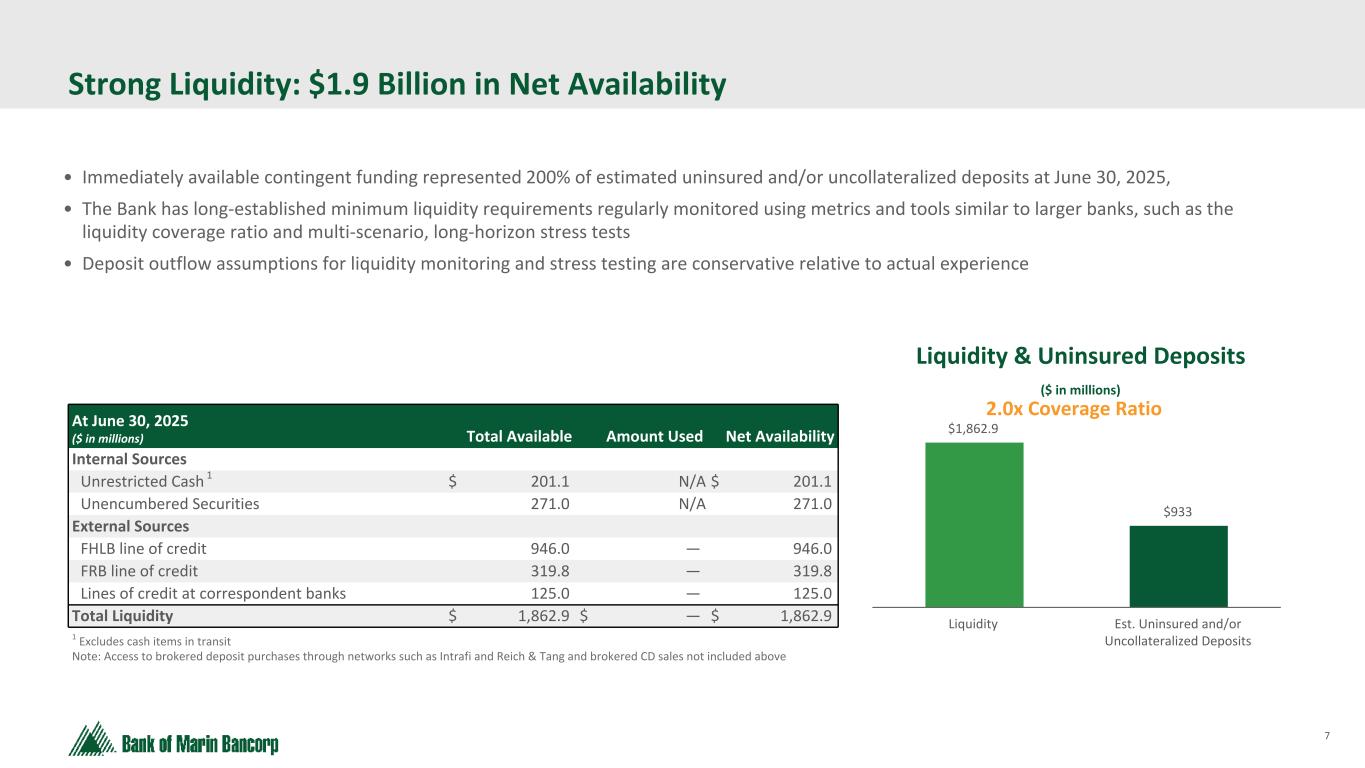

(in millions) |

Total Available | Amount Used | Net Availability | ||||||||

| Internal Sources | |||||||||||

Unrestricted cash 1 |

$ | 201.1 | $ | — | $ | 201.1 | |||||

| Unencumbered securities at market value | 271.0 | — | 271.0 | ||||||||

| External Sources | |||||||||||

| FHLB line of credit | 946.0 | — | 946.0 | ||||||||

| FRB line of credit | 319.8 | — | 319.8 | ||||||||

| Lines of credit at correspondent banks | 125.0 | — | 125.0 | ||||||||

| Total Liquidity | $ | 1,862.9 | $ | — | $ | 1,862.9 | |||||

(in thousands, except per share amounts; unaudited) |

June 30, 2025 | March 31, 2025 | December 31, 2024 | |||||||||||

| Tangible Common Equity - Bancorp | ||||||||||||||

| Total stockholders' equity | $ | 438,538 | $ | 439,566 | $ | 435,407 | ||||||||

| Goodwill and core deposit intangible | (75,098) | (75,319) | (75,546) | |||||||||||

| Total TCE | a | 363,440 | 364,247 | 359,861 | ||||||||||

Unrealized losses on HTM securities, net of tax1 |

(74,625) | (77,768) | (89,171) | |||||||||||

Unrealized losses on HTM securities included in AOCI, net of tax 2 |

7,205 | 7,462 | 7,701 | |||||||||||

| TCE, net of unrealized losses on HTM securities (non-GAAP) | b | $ | 296,020 | $ | 293,941 | $ | 278,391 | |||||||

| Total assets | $ | 3,726,193 | $ | 3,784,243 | $ | 3,701,335 | ||||||||

| Goodwill and core deposit intangible | (75,098) | (75,319) | (75,546) | |||||||||||

| Total tangible assets | c | 3,651,095 | 3,708,924 | 3,625,789 | ||||||||||

Unrealized losses on HTM securities, net of tax1 |

(74,625) | (77,768) | (89,171) | |||||||||||

| Unrealized losses on HTM securities included in AOCI, net of tax | 7,205 | 7,462 | 7,701 | |||||||||||

| Total tangible assets, net of unrealized losses on HTM securities (non-GAAP) | d | $ | 3,583,675 | $ | 3,638,618 | $ | 3,544,319 | |||||||

| Bancorp TCE ratio | a / c | 10.0 | % | 9.8 | % | 9.9 | % | |||||||

| Bancorp TCE ratio, net of unrealized losses on HTM securities (non-GAAP) | b / d | 8.3 | % | 8.1 | % | 7.9 | % | |||||||

Tangible Book Value Per Share |

||||||||||||||

Common shares outstanding |

e |

16,116 | 16,203 | 16,089 | ||||||||||

Book value per share |

$ | 27.21 | $ | 27.13 | $ | 27.06 | ||||||||

Tangible book value per share |

a / e |

$ | 22.55 | $ | 22.48 | $ | 22.37 | |||||||

|

1 Unrealized losses on held-to-maturity securities as of June 30, 2025, March 31, 2025 and December 31, 2024 of $105.9 million, $110.4 million and $126.6 million, respectively, including the unrealized losses that resulted from the transfer of securities from AFS to HTM, net of an estimated $31.3 million, $32.6 million and $37.4 million, respectively, in deferred tax benefits based on a blended state and federal statutory tax rate of 29.56%.

2 The remaining unrealized losses that resulted from the transfer of securities from AFS to HTM, as of June 30, 2025, March 31, 2025 and December 31, 2024, net of an estimated $3.0 million, $3.1 million and $3.2 million, respectively, in deferred tax benefits based on a blended state and federal statutory tax rate of 29.56% are added back as they are already included in AOCI.

| ||||||||||||||

(in thousands, except per share amounts; unaudited) |

Three months ended | Six months ended | ||||||||||||||||||

Pre-tax, pre-provision net (loss) income |

June 30, 2025 | March 31, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||

| (Loss) income before (benefit from) provision for income taxes | $ | (11,199) | $ | 6,481 | $ | (34,382) | $ | (4,718) | $ | (30,453) | ||||||||||

| Provision for credit losses on loans | — | 75 | 5,200 | 75 | 5,550 | |||||||||||||||

Pre-tax, pre-provision net (loss) income (GAAP) |

(11,199) | 6,556 | (29,182) | (4,643) | (24,903) | |||||||||||||||

| Adjustments: | ||||||||||||||||||||

| Losses on sale of investment securities from portfolio repositioning | 18,736 | — | 32,542 | 18,736 | 32,542 | |||||||||||||||

Comparable pre-tax, pre-provision net income (non-GAAP) |

$ | 7,537 | $ | 6,556 | $ | 3,360 | $ | 14,093 | $ | 7,639 | ||||||||||

Net (loss) income |

||||||||||||||||||||

Net (loss) income (GAAP) |

$ | (8,536) | $ | 4,876 | $ | (21,902) | $ | (3,660) | $ | (18,980) | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Losses on sale of investment securities from portfolio repositioning | 18,736 | — | 32,542 | 18,736 | 32,542 | |||||||||||||||

Related income tax benefit1 |

(5,538) | — | (9,620) | (5,538) | (9,620) | |||||||||||||||

| Adjustments, net of taxes | 13,198 | — | 22,922 | 13,198 | 22,922 | |||||||||||||||

| Comparable net income (non-GAAP) | $ | 4,662 | $ | 4,876 | $ | 1,020 | $ | 9,538 | $ | 3,942 | ||||||||||

Diluted (loss) earnings per share |

||||||||||||||||||||

| Weighted average diluted shares | 15,989 | 16,002 | 16,108 | 15,983 | 16,095 | |||||||||||||||

Diluted (loss) earnings per share (GAAP) |

$ | (0.53) | $ | 0.30 | $ | (1.36) | $ | (0.23) | $ | (1.18) | ||||||||||

| Comparable diluted earnings per share (non-GAAP) | $ | 0.29 | $ | 0.30 | $ | 0.06 | $ | 0.60 | $ | 0.24 | ||||||||||

| Return on average assets | ||||||||||||||||||||

| Average assets | $ | 3,737,794 | $ | 3,728,066 | $ | 3,751,159 | $ | 3,732,957 | $ | 3,781,214 | ||||||||||

| Return on average assets (GAAP) | (0.92) | % | 0.53 | % | (2.35) | % | (0.20) | % | (1.01) | % | ||||||||||

| Comparable return on average assets (non-GAAP) | 0.50 | % | 0.53 | % | 0.11 | % | 0.52 | % | 0.21 | % | ||||||||||

| Return on average equity | ||||||||||||||||||||

| Average stockholders' equity | $ | 439,187 | $ | 437,176 | $ | 432,962 | $ | 438,187 | $ | 434,332 | ||||||||||

| Return on average equity (GAAP) | (7.80) | % | 4.52 | % | (20.36) | % | (1.68) | % | (8.79) | % | ||||||||||

| Comparable return on average equity (non-GAAP) | 4.26 | % | 4.52 | % | 0.95 | % | 4.39 | % | 1.83 | % | ||||||||||

| Efficiency ratio | ||||||||||||||||||||

| Non-interest expense | $ | 21,490 | $ | 21,264 | $ | 21,894 | $ | 42,754 | $ | 43,063 | ||||||||||

| Net interest income | $ | 25,912 | $ | 24,946 | $ | 22,467 | $ | 50,858 | $ | 45,161 | ||||||||||

| Non-interest income (GAAP) | $ | (15,621) | $ | 2,874 | $ | (29,755) | $ | (12,747) | $ | (27,001) | ||||||||||

| Losses on sale of investment securities from portfolio repositioning | 18,736 | — | 32,542 | 18,736 | 32,542 | |||||||||||||||

| Non-interest income (non-GAAP) | $ | 3,115 | $ | 2,874 | $ | 2,787 | $ | 5,989 | $ | 5,541 | ||||||||||

| Efficiency ratio (GAAP) | 208.81 | % | 76.44 | % | (300.37) | % | 112.18 | % | 237.13 | % | ||||||||||

| Comparable efficiency ratio (non-GAAP) | 74.03 | % | 76.44 | % | 86.70 | % | 75.21 | % | 84.93 | % | ||||||||||

1Related tax benefit calculated using blended statutory rate of 29.5636% |

||||||||||||||||||||

| BANK OF MARIN BANCORP FINANCIAL HIGHLIGHTS | ||||||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||||||

| (in thousands, except per share amounts; unaudited) | June 30, 2025 | March 31, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||

| Selected operating data and performance ratios: | ||||||||||||||||||||

| Net income (loss) | $ | (8,536) | $ | 4,876 | $ | (21,902) | $ | (3,660) | $ | (18,980) | ||||||||||

| Diluted earnings (loss) per common share | $ | (0.53) | $ | 0.30 | $ | (1.36) | $ | (0.23) | $ | (1.18) | ||||||||||

| Return on average assets | (0.92) | % | 0.53 | % | (2.35) | % | (0.20) | % | (1.01) | % | ||||||||||

| Return on average equity | (7.80) | % | 4.52 | % | (20.36) | % | (1.68) | % | (8.79) | % | ||||||||||

| Efficiency ratio | 208.81 | % | 76.44 | % | (300.37) | % | 112.18 | % | 237.13 | % | ||||||||||

Tax-equivalent net interest margin |

2.93 | % | 2.86 | % | 2.52 | % | 2.90 | % | 2.51 | % | ||||||||||

| Cost of deposits | 1.28 | % | 1.29 | % | 1.45 | % | 1.28 | % | 1.41 | % | ||||||||||

Cost of funds |

1.28 | % | 1.29 | % | 1.46 | % | 1.28 | % | 1.42 | % | ||||||||||

Net charge-offs (recoveries) |

$ | 52 | $ | 825 | $ | 26 | $ | 877 | $ | 47 | ||||||||||

Net charge-offs to average loans |

NM | 0.04 | % | NM | 0.04 | % | NM | |||||||||||||

| (in thousands; unaudited) | June 30, 2025 | March 31, 2025 | December 31, 2024 | ||||||||

| Selected financial condition data: | |||||||||||

| Total assets | $ | 3,726,193 | $ | 3,784,243 | $ | 3,701,335 | |||||

| Loans: | |||||||||||

| Commercial and industrial | $ | 154,576 | $ | 147,291 | $ | 152,263 | |||||

| Real estate: | |||||||||||

| Commercial owner-occupied | 320,439 | 319,112 | 321,962 | ||||||||

| Commercial non-owner occupied | 1,285,803 | 1,292,281 | 1,273,596 | ||||||||

| Construction | 25,018 | 25,745 | 36,970 | ||||||||

| Home equity | 95,242 | 89,240 | 88,325 | ||||||||

| Other residential | 127,946 | 133,960 | 143,207 | ||||||||

| Installment and other consumer loans | 64,614 | 65,919 | 66,933 | ||||||||

| Total loans | $ | 2,073,638 | $ | 2,073,548 | $ | 2,083,256 | |||||

Non-accrual loans: 1 |

|||||||||||

| Commercial and industrial | $ | 2,793 | $ | 2,845 | $ | 2,845 | |||||

| Real estate: | |||||||||||

| Commercial owner-occupied | 1,554 | 1,493 | $ | 1,537 | |||||||

| Commercial non-owner occupied | 26,012 | 26,826 | 28,525 | ||||||||

| Home equity | 1,456 | 1,353 | 752 | ||||||||

| Other residential | 282 | 206 | — | ||||||||

| Installment and other consumer loans | 375 | 198 | 222 | ||||||||

| Total non-accrual loans | $ | 32,472 | $ | 32,921 | $ | 33,881 | |||||

| Non-accrual loans to total loans | 1.57 | % | 1.59 | % | 1.63 | % | |||||

| Classified loans (graded substandard and doubtful) | $ | 61,090 | $ | 57,435 | $ | 45,104 | |||||

| Classified loans as a percentage of total loans | 2.95 | % | 2.77 | % | 2.17 | % | |||||

| Total accruing loans 30-89 days past due | $ | 2,702 | $ | 5,965 | $ | 2,231 | |||||

Total accruing loans 90+ days past due 1 |

$ | — | $ | — | $ | — | |||||

| Allowance for credit losses to total loans | 1.44 | % | 1.44 | % | 1.47 | % | |||||

| Allowance for credit losses to non-accrual loans | 0.92x | 0.91x | 0.90x | ||||||||

| Total deposits | $ | 3,245,048 | $ | 3,301,971 | $ | 3,220,015 | |||||

| Loan-to-deposit ratio | 63.90 | % | 62.80 | % | 64.70 | % | |||||

| Stockholders' equity | $ | 438,538 | $ | 439,566 | $ | 435,407 | |||||

| Book value per share | $ | 27.21 | $ | 27.13 | $ | 27.06 | |||||

Tangible book value per share |

$ | 22.55 | $ | 22.48 | $ | 22.37 | |||||

Tangible common equity to tangible assets - Bank |

9.09 | % | 9.66 | % | 9.64 | % | |||||

Tangible common equity to tangible assets - Bancorp |

9.95 | % | 9.82 | % | 9.93 | % | |||||

| Total risk-based capital ratio - Bank | 15.00 | % | 16.45 | % | 16.13 | % | |||||

| Total risk-based capital ratio - Bancorp | 16.25 | % | 16.69 | % | 16.54 | % | |||||

| Full-time equivalent employees | 302 | 291 | 285 | ||||||||

1 There were no non-performing loans over 90 days past due and accruing interest as of June 30, 2025, March 31, 2025 and December 31, 2024. | |||||||||||

NM - Not meaningful | |||||||||||

|

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF CONDITION

| ||

| (in thousands, except share data; unaudited) | June 30, 2025 | March 31, 2025 | December 31, 2024 | ||||||||

| Assets | |||||||||||

| Cash, cash equivalents and restricted cash | $ | 228,863 | $ | 259,924 | $ | 137,304 | |||||

| Investment securities: | |||||||||||

Held-to-maturity, at amortized cost (net of zero allowance for credit losses at June 30, 2025, March 31, 2025 and December 31, 2024) |

823,314 | 834,640 | 879,199 | ||||||||

Available-for-sale (at fair value; amortized cost of $402,205, $434,479 and $419,292 at June 30, 2025, March 31, 2025 and December 31, 2024, respectively; net of zero allowance for credit losses at June 30, 2025, March 31, 2025 and December 31, 2024) |

391,985 | 406,009 | 387,534 | ||||||||

| Total investment securities | 1,215,299 | 1,240,649 | 1,266,733 | ||||||||

| Loans, at amortized cost | 2,073,638 | 2,073,548 | 2,083,256 | ||||||||

| Allowance for credit losses on loans | (29,854) | (29,906) | (30,656) | ||||||||

| Loans, net of allowance for credit losses on loans | 2,043,784 | 2,043,642 | 2,052,600 | ||||||||

| Goodwill | 72,754 | 72,754 | 72,754 | ||||||||

| Bank-owned life insurance | 70,432 | 71,066 | 71,026 | ||||||||

| Operating lease right-of-use assets | 18,316 | 19,076 | 19,025 | ||||||||

| Bank premises and equipment, net | 7,472 | 6,824 | 6,832 | ||||||||

| Core deposit intangible, net | 2,344 | 2,565 | 2,792 | ||||||||

| Interest receivable and other assets | 66,929 | 67,743 | 72,269 | ||||||||

| Total assets | $ | 3,726,193 | $ | 3,784,243 | $ | 3,701,335 | |||||

| Liabilities and Stockholders' Equity | |||||||||||

| Liabilities | |||||||||||

| Deposits: | |||||||||||

| Non-interest bearing | $ | 1,379,814 | $ | 1,426,446 | $ | 1,399,900 | |||||

| Interest bearing: | |||||||||||

| Transaction accounts | 180,444 | 184,322 | 198,301 | ||||||||

| Savings accounts | 221,172 | 228,038 | 225,691 | ||||||||

| Money market accounts | 1,246,013 | 1,246,739 | 1,153,746 | ||||||||

| Time accounts | 217,605 | 216,426 | 242,377 | ||||||||

| Total deposits | 3,245,048 | 3,301,971 | 3,220,015 | ||||||||

| Borrowings and other obligations | 77 | 116 | 154 | ||||||||

| Operating lease liabilities | 20,668 | 21,497 | 21,509 | ||||||||

| Interest payable and other liabilities | 21,862 | 21,093 | 24,250 | ||||||||

| Total liabilities | 3,287,655 | 3,344,677 | 3,265,928 | ||||||||

| Stockholders' Equity | |||||||||||

|

Preferred stock, no par value,

Authorized - 5,000,000 shares, none issued

|

— | — | — | ||||||||

|

Common stock, no par value,

Authorized - 30,000,000 shares; issued and outstanding - 16,116,470, 16,202,869 and

16,089,454 at June 30, 2025, March 31, 2025 and December 31, 2024, respectively

|

214,713 | 216,263 | 215,511 | ||||||||

| Retained earnings | 238,225 | 250,815 | 249,964 | ||||||||

| Accumulated other comprehensive loss, net of taxes | (14,400) | (27,512) | (30,068) | ||||||||

| Total stockholders' equity | 438,538 | 439,566 | 435,407 | ||||||||

| Total liabilities and stockholders' equity | $ | 3,726,193 | $ | 3,784,243 | $ | 3,701,335 | |||||

|

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| ||

| Three months ended | Six months ended |

||||||||||||||||

| (in thousands, except per share amounts; unaudited) | June 30, 2025 | March 31, 2025 | June 30, 2025 | June 30, 2024 | |||||||||||||

| Interest income | |||||||||||||||||

| Interest and fees on loans | $ | 25,861 | $ | 25,183 | $ | 51,044 | $ | 50,129 | |||||||||

| Interest on investment securities | 8,423 | 8,261 | 16,684 | 17,104 | |||||||||||||

| Interest on federal funds sold and due from banks | 2,004 | 1,795 | 3,799 | 1,245 | |||||||||||||

| Total interest income | 36,288 | 35,239 | 71,527 | 68,478 | |||||||||||||

| Interest expense | |||||||||||||||||

| Interest on interest-bearing transaction accounts | 351 | 343 | 694 | 535 | |||||||||||||

| Interest on savings accounts | 587 | 533 | 1,120 | 882 | |||||||||||||

| Interest on money market accounts | 7,878 | 7,626 | 15,504 | 17,090 | |||||||||||||

| Interest on time accounts | 1,559 | 1,790 | 3,349 | 4,571 | |||||||||||||

| Interest on borrowings and other obligations | 1 | 1 | 2 | 239 | |||||||||||||

| Total interest expense | 10,376 | 10,293 | 20,669 | 23,317 | |||||||||||||

| Net interest income | 25,912 | 24,946 | 50,858 | 45,161 | |||||||||||||

| Provision for credit losses on loans | — | 75 | 75 | 5,550 | |||||||||||||

| Net interest income after provision for credit losses | 25,912 | 24,871 | 50,783 | 39,611 | |||||||||||||

| Non-interest income | |||||||||||||||||

| Earnings on bank-owned life insurance, net | 667 | 544 | 1,211 | 856 | |||||||||||||

| Wealth management and trust services | 612 | 563 | 1,175 | 1,138 | |||||||||||||

| Service charges on deposit accounts | 550 | 548 | 1,098 | 1,070 | |||||||||||||

| Debit card interchange fees, net | 410 | 396 | 806 | 852 | |||||||||||||

| Dividends on Federal Home Loan Bank stock | 362 | 375 | 737 | 743 | |||||||||||||

| Merchant interchange fees, net | 90 | 96 | 186 | 177 | |||||||||||||

| Losses on sale of investment securities | (18,736) | — | (18,736) | (32,542) | |||||||||||||

| Other income | 424 | 352 | 776 | 705 | |||||||||||||

| Total non-interest income | (15,621) | 2,874 | (12,747) | (27,001) | |||||||||||||

| Non-interest expense | |||||||||||||||||

| Salaries and related benefits | 12,045 | 12,050 | 24,095 | 24,448 | |||||||||||||

| Occupancy and equipment | 2,226 | 2,106 | 4,332 | 4,018 | |||||||||||||

| Deposit network fees | 1,054 | 932 | 1,986 | 1,761 | |||||||||||||

| Data processing | 1,041 | 1,136 | 2,177 | 2,075 | |||||||||||||

| Professional services | 908 | 937 | 1,845 | 2,121 | |||||||||||||

| Information technology | 563 | 413 | 976 | 850 | |||||||||||||

| Federal Deposit Insurance Corporation insurance | 421 | 388 | 809 | 861 | |||||||||||||

| Depreciation and amortization | 320 | 322 | 642 | 767 | |||||||||||||

| Directors' expense | 279 | 304 | 583 | 623 | |||||||||||||

| Amortization of core deposit intangible | 220 | 227 | 447 | 497 | |||||||||||||

| Charitable contributions | 116 | 403 | 519 | 617 | |||||||||||||

| Other expense | 2,297 | 2,046 | 4,343 | 4,425 | |||||||||||||

| Total non-interest expense | 21,490 | 21,264 | 42,754 | 43,063 | |||||||||||||

| (Loss) income before (benefit from) provision for income taxes | (11,199) | 6,481 | (4,718) | (30,453) | |||||||||||||

| (Benefit from) provision for income taxes | (2,663) | 1,605 | (1,058) | (11,473) | |||||||||||||

| Net (loss) income | $ | (8,536) | $ | 4,876 | $ | (3,660) | $ | (18,980) | |||||||||

| Net (loss) income per common share | |||||||||||||||||

| Basic | $ | (0.53) | $ | 0.31 | $ | (0.23) | $ | (1.18) | |||||||||

| Diluted | $ | (0.53) | $ | 0.30 | $ | (0.23) | $ | (1.18) | |||||||||

| Weighted average shares: | |||||||||||||||||

| Basic | 15,989 | 15,977 | 15,983 | 16,095 | |||||||||||||

| Diluted | 15,989 | 16,002 | 15,983 | 16,095 | |||||||||||||

| Comprehensive income: | |||||||||||||||||

| Net (loss) income | $ | (8,536) | $ | 4,876 | $ | (3,660) | $ | (18,980) | |||||||||

| Other comprehensive income: | |||||||||||||||||

| Change in net unrealized gains or losses on available-for-sale securities | (486) | 3,289 | 2,803 | (4,009) | |||||||||||||

| Reclassification adjustment for realized losses on available-for-sale securities in net income | 18,736 | — | 18,736 | 32,542 | |||||||||||||

| Reclassification adjustment for gains or losses on fair value hedges | — | — | — | 1,499 | |||||||||||||

| Amortization of net unrealized losses on securities transferred from available-for-sale to held-to-maturity | 365 | 340 | 705 | 764 | |||||||||||||

| Other comprehensive income, before tax | 18,615 | 3,629 | 22,244 | 30,796 | |||||||||||||

| Deferred tax expense | 5,503 | 1,073 | 6,576 | 9,097 | |||||||||||||

| Other comprehensive income, net of tax | 13,112 | 2,556 | 15,668 | 21,699 | |||||||||||||

| Total comprehensive income | $ | 4,576 | $ | 7,432 | $ | 12,008 | $ | 2,719 | |||||||||

| BANK OF MARIN BANCORP | ||

| AVERAGE STATEMENTS OF CONDITION AND ANALYSIS OF NET INTEREST INCOME | ||

| Three months ended | Three months ended | |||||||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | |||||||||||||||||||||||||

| Interest | Interest | |||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||

| (in thousands) | Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

Interest-earning deposits with banks 1 |

$ | 180,730 | $ | 2,004 | 4.39 | % | $ | 163,446 | $ | 1,795 | 4.39 | % | ||||||||||||||

Investment securities 2, 3 |

1,266,317 | 8,495 | 2.68 | % | 1,273,422 | 8,331 | 2.62 | % | ||||||||||||||||||

Loans 1, 3, 4, 5 |

2,073,110 | 25,965 | 4.95 | % | 2,073,739 | 25,289 | 4.88 | % | ||||||||||||||||||

Total interest-earning assets 1 |

3,520,157 | 36,464 | 4.10 | % | 3,510,607 | 35,415 | 4.04 | % | ||||||||||||||||||

| Cash and non-interest-bearing due from banks | 37,721 | 37,493 | ||||||||||||||||||||||||

| Bank premises and equipment, net | 7,259 | 6,831 | ||||||||||||||||||||||||

| Interest receivable and other assets, net | 172,657 | 173,135 | ||||||||||||||||||||||||

| Total assets | $ | 3,737,794 | $ | 3,728,066 | ||||||||||||||||||||||

| Liabilities and Stockholders' Equity | ||||||||||||||||||||||||||

| Interest-bearing transaction accounts | $ | 187,297 | $ | 351 | 0.75 | % | $ | 191,089 | $ | 343 | 0.73 | % | ||||||||||||||

| Savings accounts | 222,524 | 587 | 1.06 | % | 227,098 | 533 | 0.95 | % | ||||||||||||||||||

| Money market accounts | 1,227,506 | 7,878 | 2.57 | % | 1,192,956 | 7,626 | 2.59 | % | ||||||||||||||||||

| Time accounts including CDARS | 218,150 | 1,559 | 2.87 | % | 228,018 | 1,790 | 3.18 | % | ||||||||||||||||||

Borrowings and other obligations 1 |

91 | 1 | 3.39 | % | 130 | 1 | 2.86 | % | ||||||||||||||||||

| Total interest-bearing liabilities | 1,855,568 | 10,376 | 2.24 | % | 1,839,291 | 10,293 | 2.27 | % | ||||||||||||||||||

| Demand accounts | 1,398,570 | 1,406,648 | ||||||||||||||||||||||||

| Interest payable and other liabilities | 44,469 | 44,951 | ||||||||||||||||||||||||

| Stockholders' equity | 439,187 | 437,176 | ||||||||||||||||||||||||

| Total liabilities & stockholders' equity | $ | 3,737,794 | $ | 3,728,066 | ||||||||||||||||||||||

Tax-equivalent net interest income/margin 1 |

$ | 26,088 | 2.93 | % | $ | 25,122 | 2.86 | % | ||||||||||||||||||

Reported net interest income/margin 1 |

$ | 25,912 | 2.91 | % | $ | 24,946 | 2.84 | % | ||||||||||||||||||

| Tax-equivalent net interest rate spread | 1.86 | % | 1.77 | % | ||||||||||||||||||||||

| Six months ended | Six months ended | |||||||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | |||||||||||||||||||||||||

| Interest | Interest | |||||||||||||||||||||||||

| Average | Income/ | Yield/ | Average | Income/ | Yield/ | |||||||||||||||||||||

| (in thousands) | Balance | Expense | Rate | Balance | Expense | Rate | ||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

Interest-earning deposits with banks 1 |

$ | 172,136 | $ | 3,799 | 4.39 | % | $ | 45,613 | $ | 1,245 | 5.40 | % | ||||||||||||||

Investment securities 2, 3 |

1,269,850 | 16,821 | 2.65 | % | 1,480,462 | 17,247 | 2.33 | % | ||||||||||||||||||

Loans 1, 3, 4, 5 |

2,073,423 | 51,254 | 4.92 | % | 2,063,351 | 50,346 | 4.83 | % | ||||||||||||||||||

Total interest-earning assets 1 |

3,515,409 | 71,874 | 4.07 | % | 3,589,426 | 68,838 | 3.79 | % | ||||||||||||||||||

| Cash and non-interest-bearing due from banks | 37,608 | 36,275 | ||||||||||||||||||||||||

| Bank premises and equipment, net | 7,046 | 7,564 | ||||||||||||||||||||||||

| Interest receivable and other assets, net | 172,894 | 147,949 | ||||||||||||||||||||||||

| Total assets | $ | 3,732,957 | $ | 3,781,214 | ||||||||||||||||||||||

| Liabilities and Stockholders' Equity | ||||||||||||||||||||||||||

| Interest-bearing transaction accounts | $ | 189,182 | $ | 694 | 0.74 | % | $ | 206,268 | $ | 535 | 0.52 | % | ||||||||||||||

| Savings accounts | 224,798 | 1,120 | 1.00 | % | 228,559 | 882 | 0.78 | % | ||||||||||||||||||

| Money market accounts | 1,210,327 | 15,504 | 2.58 | % | 1,152,492 | 17,090 | 2.98 | % | ||||||||||||||||||

| Time accounts including CDARS | 223,057 | 3,349 | 3.03 | % | 262,598 | 4,571 | 3.50 | % | ||||||||||||||||||

Borrowings and other obligations 1 |

110 | 2 | 3.08 | % | 9,116 | 239 | 5.18 | % | ||||||||||||||||||

| Total interest-bearing liabilities | 1,847,474 | 20,669 | 2.26 | % | 1,859,033 | 23,317 | 2.52 | % | ||||||||||||||||||

| Demand accounts | 1,402,587 | 1,440,114 | ||||||||||||||||||||||||

| Interest payable and other liabilities | 44,709 | 47,735 | ||||||||||||||||||||||||

| Stockholders' equity | 438,187 | 434,332 | ||||||||||||||||||||||||

| Total liabilities & stockholders' equity | $ | 3,732,957 | $ | 3,781,214 | ||||||||||||||||||||||

Tax-equivalent net interest income/margin 1 |

$ | 51,205 | 2.90 | % | $ | 45,521 | 2.51 | % | ||||||||||||||||||

Reported net interest income/margin 1 |

$ | 50,858 | 2.88 | % | $ | 45,161 | 2.49 | % | ||||||||||||||||||

| Tax-equivalent net interest rate spread | 1.81 | % | 1.27 | % | ||||||||||||||||||||||

1 Interest income/expense is divided by actual number of days in the period times 360 days to correspond to stated interest rate terms, where applicable. | ||||||||||||||||||||||||||

2 Yields on available-for-sale securities are calculated based on amortized cost balances rather than fair value, as changes in fair value are reflected as a component of stockholders' equity. Investment security interest is earned on 30/360 day basis monthly. | ||||||||||||||||||||||||||

3 Yields and interest income on tax-exempt securities and loans are presented on a taxable-equivalent basis using the Federal statutory rate of 21 percent. | ||||||||||||||||||||||||||

4 Average balances on loans outstanding include non-performing loans. The amortized portion of net loan origination fees is included in interest income on loans, representing an adjustment to the yield. | ||||||||||||||||||||||||||

5 Net loan origination costs in interest income totaled $399 thousand and $364 thousand for the three months ended June 30, 2025 and March 31, 2025, and totaled $764 thousand and $811 thousand for the six months ended June 30, 2025 and 2024, respectively. | ||||||||||||||||||||||||||