Document

FOR IMMEDIATE RELEASE

AMERICAN COASTAL INSURANCE CORPORATION REPORTS FINANCIAL RESULTS

FOR ITS SECOND QUARTER ENDED JUNE 30, 2024

Company to Host Quarterly Conference Call at 5:00 P.M. ET on August 7, 2024

The information in this press release should be read in conjunction with an earnings presentation that is available on the Company's website at investors.amcoastal.com/Presentations.

St. Petersburg, FL - August 7, 2024: American Coastal Insurance Corporation (Nasdaq: ACIC) ("ACIC" or the "Company"), a property and casualty insurance holding company, today reported its financial results for the second quarter ended June 30, 2024. On May 9, 2024, the Company entered into a Stock Purchase Agreement (the "Sale Agreement") with Forza Insurance Holdings, LLC ("Forza") in which ACIC will sell and Forza will acquire 100% of the issued and outstanding stock of the Company's subsidiary, Interboro Insurance Company ("IIC"). As such, prior year financial results have been recast to reflect the activity of IIC within discontinued operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands, except for per share data) |

Three Months Ended |

|

Six Months Ended |

| June 30, |

|

June 30, |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Gross premiums written |

$ |

229,449 |

|

|

$ |

236,822 |

|

|

(3.1) |

% |

|

$ |

414,050 |

|

|

$ |

413,463 |

|

|

0.1 |

% |

| Gross premiums earned |

$ |

155,450 |

|

|

$ |

149,837 |

|

|

3.7 |

% |

|

$ |

315,720 |

|

|

$ |

287,812 |

|

|

9.7 |

% |

| Net premiums earned |

$ |

63,381 |

|

|

$ |

78,014 |

|

|

(18.8) |

% |

|

$ |

126,012 |

|

|

$ |

162,655 |

|

|

(22.5) |

% |

| Total revenue |

$ |

68,656 |

|

|

$ |

73,542 |

|

|

(6.6) |

% |

|

$ |

135,254 |

|

|

$ |

160,617 |

|

|

(15.8) |

% |

| Income from continuing operations, net of tax |

$ |

19,073 |

|

|

$ |

21,244 |

|

|

(10.2) |

% |

|

$ |

42,782 |

|

|

$ |

52,809 |

|

|

(19.0) |

% |

| Income (loss) from discontinued operations, net of tax |

$ |

(19) |

|

|

$ |

(3,465) |

|

|

99.5 |

% |

|

$ |

(129) |

|

|

$ |

232,250 |

|

|

NM |

| Consolidated net income |

$ |

19,054 |

|

|

$ |

17,779 |

|

|

7.2 |

% |

|

$ |

42,653 |

|

|

$ |

285,059 |

|

|

(85.0) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to ACIC stockholders per diluted share |

|

|

|

|

|

|

|

|

|

|

|

| Continuing Operations |

$ |

0.39 |

|

|

$ |

0.49 |

|

|

(20.4) |

% |

|

$ |

0.87 |

|

|

$ |

1.21 |

|

|

(28.1) |

% |

| Discontinued Operations |

$ |

— |

|

|

$ |

(0.08) |

|

|

100.0 |

% |

|

— |

|

|

5.31 |

|

|

(100.0) |

% |

| Total |

$ |

0.39 |

|

|

$ |

0.41 |

|

|

(4.9) |

% |

|

$ |

0.87 |

|

|

$ |

6.52 |

|

|

(86.7) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of net income to core income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Plus: Non-cash amortization of intangible assets and goodwill impairment |

$ |

609 |

|

|

$ |

811 |

|

|

(24.9) |

% |

|

$ |

1,421 |

|

|

$ |

1,623 |

|

|

(12.4) |

% |

| Less: Income (loss) from discontinued operations, net of tax |

$ |

(19) |

|

|

$ |

(3,465) |

|

|

99.5 |

% |

|

$ |

(129) |

|

|

$ |

232,250 |

|

|

NM |

| Less: Net realized losses on investment portfolio |

$ |

(121) |

|

|

$ |

(6,708) |

|

|

98.2 |

% |

|

$ |

(121) |

|

|

$ |

(6,791) |

|

|

98.2 |

% |

| Less: Unrealized gains (losses) on equity securities |

$ |

49 |

|

|

$ |

141 |

|

|

(65.2) |

% |

|

$ |

(1) |

|

|

$ |

615 |

|

|

NM |

Less: Net tax impact (1) |

$ |

143 |

|

|

$ |

1,549 |

|

|

(90.8) |

% |

|

$ |

324 |

|

|

$ |

1,638 |

|

|

(80.2) |

% |

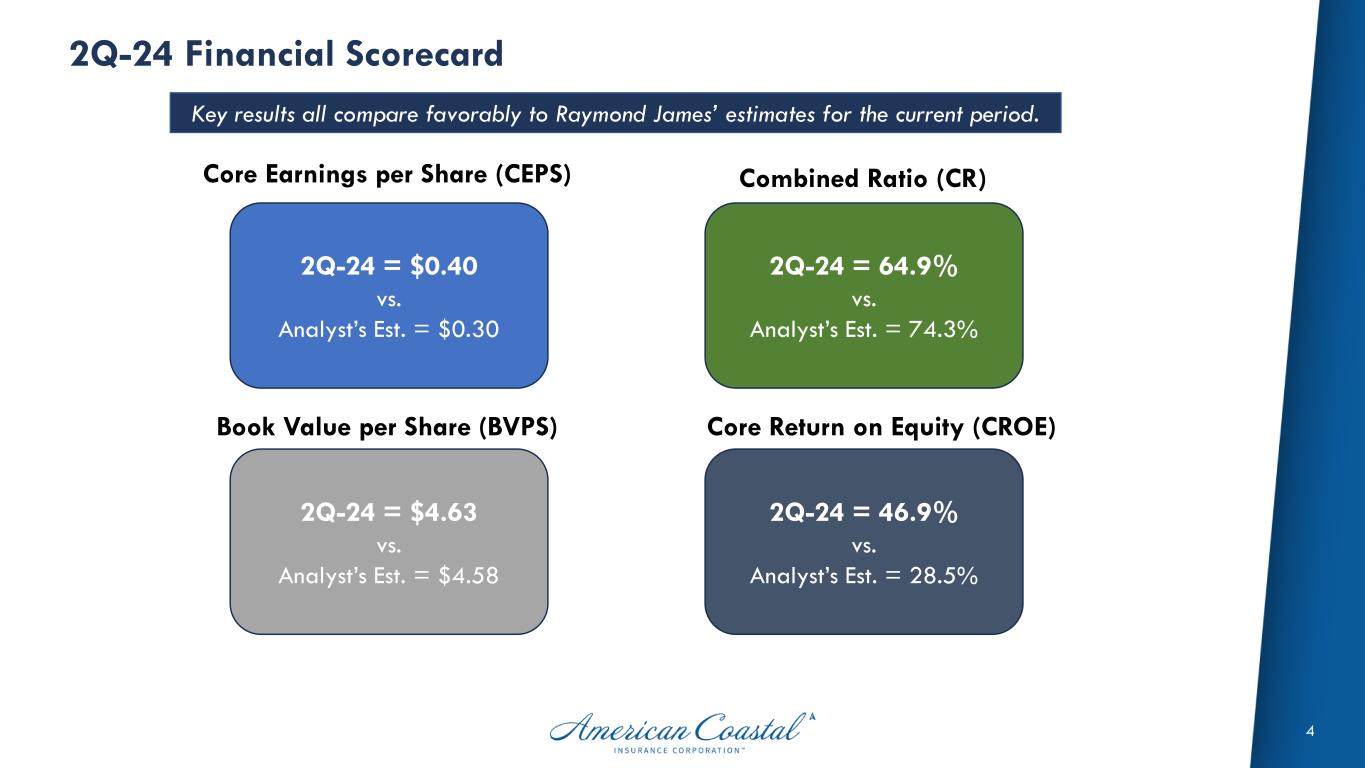

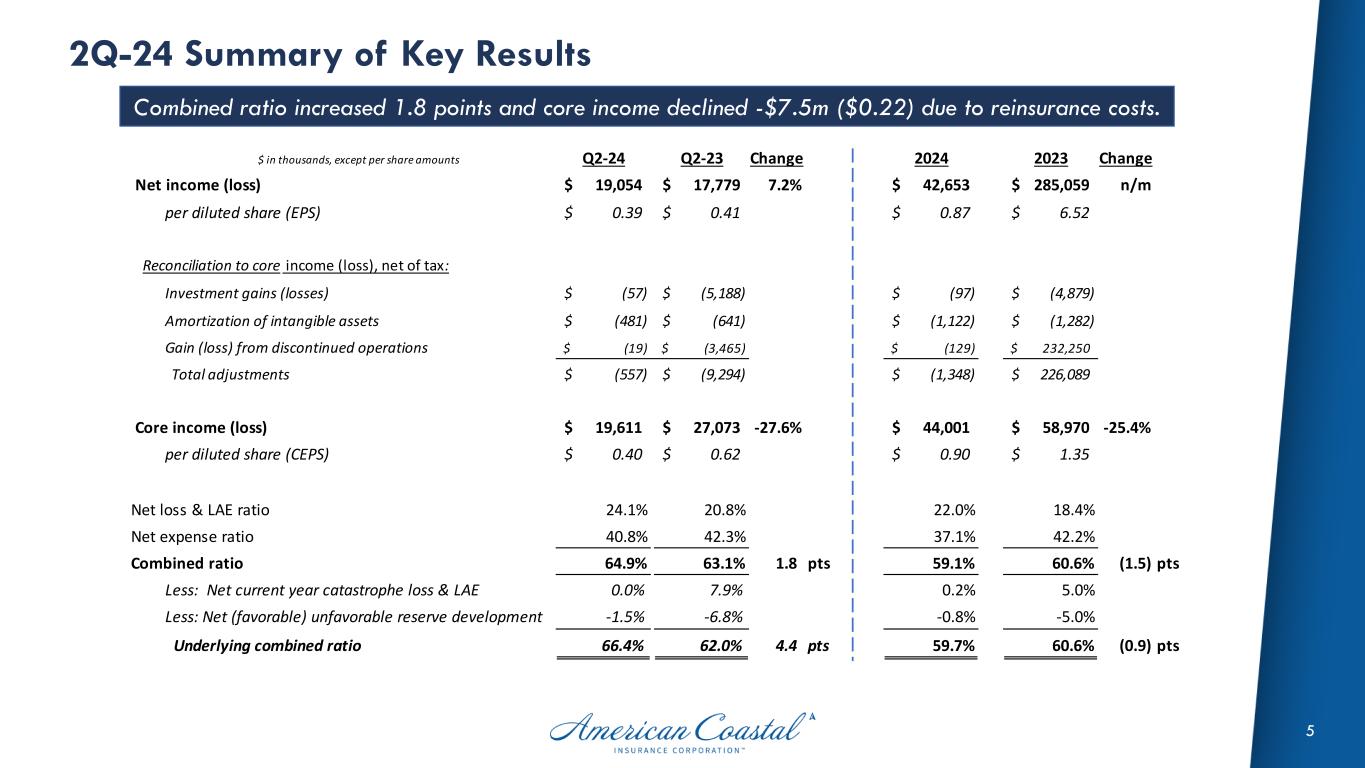

Core income(2) |

$ |

19,611 |

|

|

$ |

27,073 |

|

|

(27.6) |

% |

|

$ |

44,001 |

|

|

$ |

58,970 |

|

|

(25.4) |

% |

Core income per diluted share (2) |

$ |

0.40 |

|

|

$ |

0.62 |

|

|

(35.5) |

% |

|

$ |

0.90 |

|

|

$ |

1.35 |

|

|

(33.3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per share |

|

|

|

|

|

|

$ |

4.63 |

|

|

$ |

2.59 |

|

|

78.8 |

% |

NM = Not Meaningful

(1) In order to reconcile net income to the core income measures, the Company included the tax impact of all adjustments using the 21% federal corporate tax rate.

(2) Core income and core income per diluted share, both of which are measures that are not based on GAAP, are reconciled above to net income and net income per diluted share, respectively, the most directly comparable GAAP measures. Additional information regarding non-GAAP financial measures presented in this press release can be found in the "Definitions of Non-GAAP Measures" section, below.

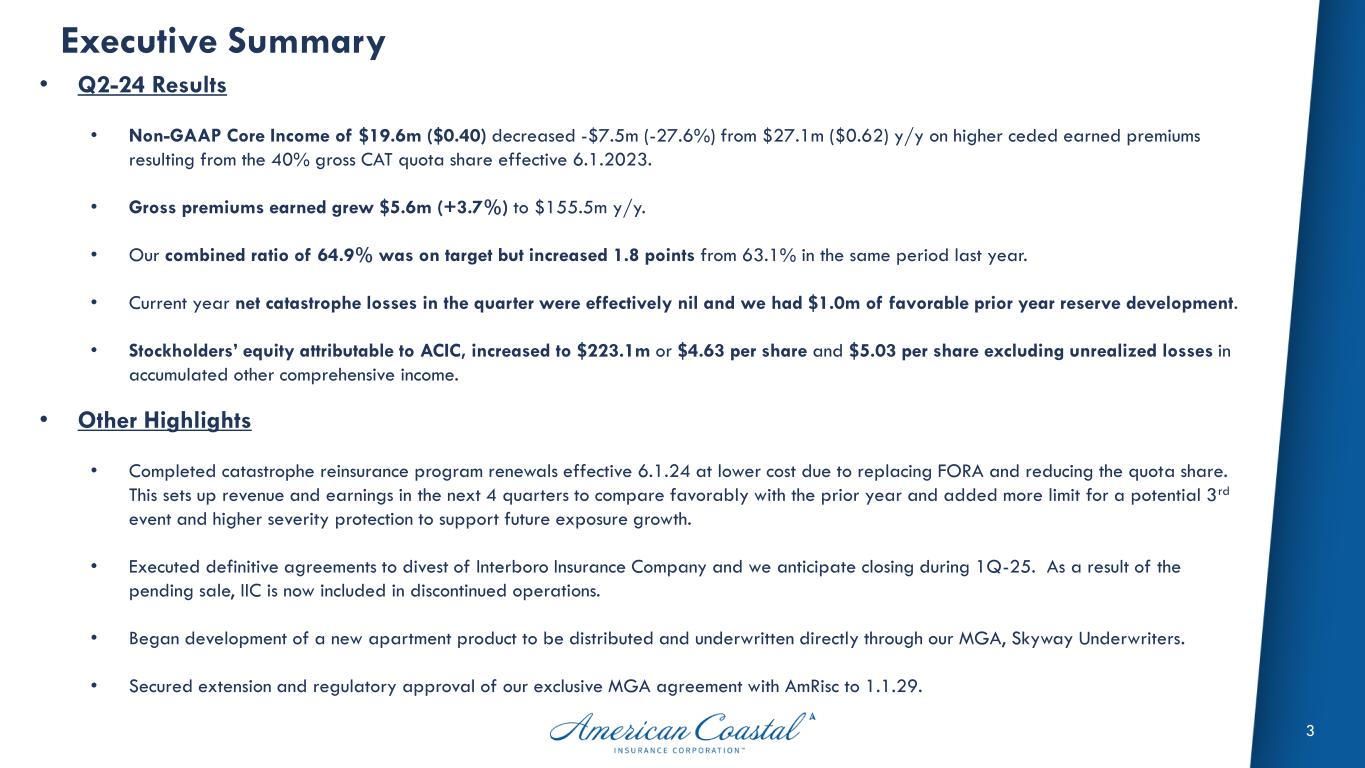

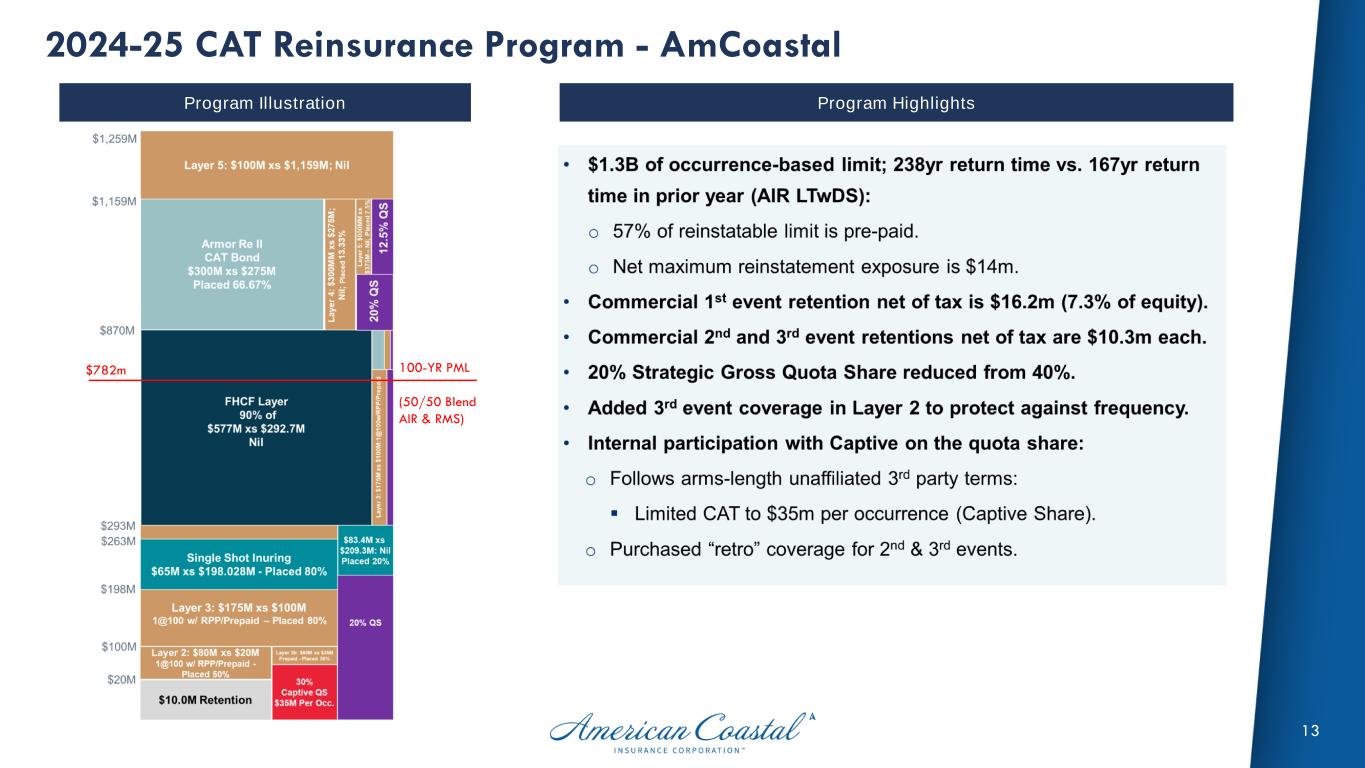

Comments from Chief Executive Officer, Dan Peed: “During the second quarter of 2024, we recorded yet another profitable period for American Coastal. We also successfully placed our core catastrophe reinsurance program, increasing the exhaustion point of the program from the prior year period and meeting our goal of limiting American Coastal’s retention to less than one quarter’s pre-tax earnings. Moreover, we executed on the final phase of our multi-year strategy to phase out our personal lines operations by signing definitive agreements for the sale of Interboro Insurance Company. We remain focused on delivering long-term shareholder value over time and will continue to explore further opportunities to expand our product offering to meet the needs of the market.”

Return on Equity and Core Return on Equity

The calculations of the Company's return on equity and core return on equity are shown below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Three Months Ended |

|

Six Months Ended |

| June 30, |

|

June 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Income from continuing operations, net of tax |

$ |

19,073 |

|

|

$ |

21,244 |

|

|

$ |

42,782 |

|

|

$ |

52,809 |

|

Return on equity based on GAAP income from continuing operations, net of tax (1) |

45.6 |

% |

|

228.9 |

% |

|

51.1 |

% |

|

284.5 |

% |

|

|

|

|

|

|

|

|

| Income (loss) from discontinued operations, net of tax |

$ |

(19) |

|

|

$ |

(3,465) |

|

|

$ |

(129) |

|

$ |

232,250 |

Return on equity based on GAAP income (loss) from discontinued operations, net of tax (1) |

— |

% |

|

(37.3) |

% |

|

(0.2) |

% |

|

NM |

|

|

|

|

|

|

|

|

| Consolidated net income attributable to ACIC |

$ |

19,054 |

|

|

$ |

17,779 |

|

|

$ |

42,653 |

|

$ |

285,059 |

Return on equity based on GAAP net income (1) |

45.6 |

% |

|

191.6 |

% |

|

51.0 |

% |

|

NM |

|

|

|

|

|

|

|

|

| Core income |

$ |

19,611 |

|

$ |

27,073 |

|

|

$ |

44,001 |

|

$ |

58,970 |

Core return on equity (1)(2) |

46.9 |

% |

|

291.7 |

% |

|

52.6 |

% |

|

317.7 |

% |

(1) Return on equity for the three and six months ended June 30, 2024 and 2023 is calculated on an annualized basis by dividing the net income or core income for the period by the average stockholders' equity for the trailing twelve months.

(2) Core return on equity, a measure that is not based on GAAP, is calculated based on core income, which is reconciled on the first page of this press release to net income, the most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures presented in this press release can be found in the "Definitions of Non-GAAP Measures" section below.

Combined Ratio and Underlying Ratio

The calculations of the Company's combined ratio and underlying combined ratio on a consolidated basis and attributable to IIC, captured within discontinued operations, are shown below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Three Months Ended |

|

Six Months Ended |

| June 30, |

|

June 30, |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Consolidated |

|

|

|

|

|

|

|

|

|

|

|

Loss ratio, net(1) |

24.1 |

% |

|

20.8 |

% |

|

3.3 |

pts |

|

22.0 |

% |

|

18.4 |

% |

|

3.6 |

pts |

Expense ratio, net(2) |

40.8 |

% |

|

42.3 |

% |

|

(1.5) |

pts |

|

37.1 |

% |

|

42.2 |

% |

|

(5.1) |

pts |

Combined ratio (CR)(3) |

64.9 |

% |

|

63.1 |

% |

|

1.8 |

pts |

|

59.1 |

% |

|

60.6 |

% |

|

(1.5) |

pts |

| Effect of current year catastrophe losses on CR |

— |

% |

|

7.9 |

% |

|

(7.9) |

pts |

|

0.2 |

% |

|

5.0 |

% |

|

(4.8) |

pts |

| Effect of prior year favorable development on CR |

(1.5) |

% |

|

(6.8) |

% |

|

5.3 |

pts |

|

(0.8) |

% |

|

(5.0) |

% |

|

4.2 |

pts |

Underlying combined ratio(4) |

66.4 |

% |

|

62.0 |

% |

|

4.4 |

pts |

|

59.7 |

% |

|

60.6 |

% |

|

(0.9) |

pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IIC |

|

|

|

|

|

|

|

|

|

|

|

Loss ratio, net(1) |

91.4 |

% |

|

90.6 |

% |

|

0.8 |

pts |

|

74.3 |

% |

|

91.6 |

% |

|

(17.3) |

pts |

Expense ratio, net(2) |

37.4 |

% |

|

46.9 |

% |

|

(9.5) |

pts |

|

45.7 |

% |

|

60.4 |

% |

|

(14.7) |

pts |

Combined ratio (CR)(3) |

128.8 |

% |

|

137.5 |

% |

|

(8.7) |

pts |

|

120.0 |

% |

|

152.0 |

% |

|

(32.0) |

pts |

| Effect of current year catastrophe losses on CR |

2.5 |

% |

|

6.6 |

% |

|

(4.1) |

pts |

|

5.6 |

% |

|

10.9 |

% |

|

(5.3) |

pts |

| Effect of prior year favorable development on CR |

(1.7) |

% |

|

3.6 |

% |

|

(5.3) |

pts |

|

(3.9) |

% |

|

(2.7) |

% |

|

(1.2) |

pts |

Underlying combined ratio(4) |

128.0 |

% |

|

127.3 |

% |

|

0.7 |

pts |

|

118.3 |

% |

|

143.8 |

% |

|

(25.5) |

pts |

(1) Loss ratio, net is calculated as losses and loss adjustment expenses (LAE), net of losses ceded to reinsurers, relative to net premiums earned.

(2) Expense ratio, net is calculated as the sum of all operating expenses, less interest expense relative to net premiums earned.

(3) Combined ratio is the sum of the loss ratio, net and expense ratio, net.

(4) Underlying combined ratio, a measure that is not based on GAAP, is reconciled above to the combined ratio, the most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures presented in this press release can be found in the "Definitions of Non-GAAP Measures" section, below.

Combined Ratio Analysis

The calculations of the Company's loss ratios and underlying loss ratios are shown below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Three Months Ended |

|

Six Months Ended |

| June 30, |

|

June 30, |

| 2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Loss and LAE |

$ |

15,277 |

|

|

$ |

16,245 |

|

|

$ |

(968) |

|

|

$ |

27,751 |

|

|

$ |

30,146 |

|

|

$ |

(2,395) |

|

| % of Gross earned premiums |

9.8 |

% |

|

10.8 |

% |

|

(1.0) |

pts |

|

8.8 |

% |

|

10.5 |

% |

|

(1.7) |

pts |

| % of Net earned premiums |

24.1 |

% |

|

20.8 |

% |

|

3.3 |

pts |

|

22.0 |

% |

|

18.4 |

% |

|

3.6 |

pts |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

| Current year catastrophe losses |

$ |

(8) |

|

|

$ |

6,201 |

|

|

$ |

(6,209) |

|

|

$ |

203 |

|

|

$ |

8,298 |

|

|

$ |

(8,095) |

|

| Prior year reserve favorable development |

(968) |

|

|

(5,334) |

|

|

4,366 |

|

|

(1,022) |

|

|

(8,107) |

|

|

7,085 |

|

Underlying loss and LAE (1) |

$ |

16,253 |

|

|

$ |

15,378 |

|

|

$ |

875 |

|

|

$ |

28,570 |

|

|

$ |

29,955 |

|

|

$ |

(1,385) |

|

| % of Gross earned premiums |

10.5 |

% |

|

10.3 |

% |

|

0.2 |

pts |

|

9.0 |

% |

|

10.4 |

% |

|

(1.4) |

pts |

| % of Net earned premiums |

25.6 |

% |

|

19.7 |

% |

|

5.9 |

pts |

|

22.7 |

% |

|

18.4 |

% |

|

4.3 |

pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Underlying loss and LAE is a non-GAAP financial measure and is reconciled above to loss and LAE, the most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures presented in this press release can be found in the "Definitions of Non-GAAP Measures" section, below.

The calculations of the Company's expense ratios are shown below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

Three Months Ended |

|

Six Months Ended |

| June 30, |

|

June 30, |

| 2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Policy acquisition costs |

$ |

13,939 |

|

|

$ |

23,526 |

|

|

$ |

(9,587) |

|

|

$ |

23,534 |

|

|

$ |

48,692 |

|

|

$ |

(25,158) |

|

| Operating and underwriting |

2,040 |

|

|

3,046 |

|

|

(1,006) |

|

|

4,377 |

|

|

4,881 |

|

|

(504) |

|

| General and administrative |

9,898 |

|

|

6,414 |

|

|

3,484 |

|

|

18,813 |

|

|

15,025 |

|

|

3,788 |

|

| Total Operating Expenses |

$ |

25,877 |

|

|

$ |

32,986 |

|

|

$ |

(7,109) |

|

|

$ |

46,724 |

|

|

$ |

68,598 |

|

|

$ |

(21,874) |

|

% of Gross earned premiums |

16.6 |

% |

|

22.0 |

% |

|

(5.4) |

pts |

|

14.8 |

% |

|

23.8 |

% |

|

(9.0) |

pts |

% of Net earned premiums |

40.8 |

% |

|

42.3 |

% |

|

(1.5) |

pts |

|

37.1 |

% |

|

42.2 |

% |

|

(5.1) |

pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarterly Financial Results

Net income for the second quarter of 2024 was $19.1 million, or $0.39 per diluted share, compared to $17.8 million, or $0.41 per diluted share, for the second quarter of 2023. Of this income, $19.1 million is attributable to continuing operations for the three months ended June 30, 2024, a decrease of $2.1 million from net income of $21.2 million for the same period in 2023. Quarter-over-quarter revenues decreased, driven by an increase in ceded premiums earned, partially offset by an increase in gross premiums earned. This was offset by lower expenses quarter-over-quarter, driven by a decrease in policy acquisition costs and operating expenses, partially offset by increased administrative expenses. In addition, the Company's provision for income taxes increased quarter-over-quarter. The continuing operations changes were partially offset by a decrease in the Company's loss from discontinued operations, which decreased $3.5 million quarter-over-quarter, as the deconsolidation of UPC is not impacting the Company in 2024.

The Company's total gross written premium decreased by $7.4 million, or 3.1%, to $229.4 million for the second quarter of 2024, from $236.8 million for the second quarter of 2023. The breakdown of the quarter-over-quarter changes in both direct written and assumed premiums by state and gross written premium by line of business are shown in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

Three Months Ended June 30, |

|

|

|

|

|

|

2024 |

|

2023 |

|

Change $ |

|

Change % |

| Direct Written and Assumed Premium by State |

|

|

|

|

|

|

|

|

| Florida |

|

$ |

229,449 |

|

|

$ |

236,766 |

|

|

$ |

(7,317) |

|

|

(3.1) |

% |

| New York |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total direct written premium by state |

|

229,449 |

|

|

236,766 |

|

|

(7,317) |

|

|

(3.1) |

|

| Assumed premium |

|

— |

|

|

56 |

|

|

(56) |

|

|

(100.0) |

|

| Total gross written premium by state |

|

$ |

229,449 |

|

|

$ |

236,822 |

|

|

$ |

(7,373) |

|

|

(3.1) |

% |

|

|

|

|

|

|

|

|

|

| Gross Written Premium by Line of Business |

|

|

|

|

|

|

|

|

| Commercial property |

|

$ |

229,449 |

|

|

$ |

236,822 |

|

|

$ |

(7,373) |

|

|

(3.1) |

% |

| Personal property |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total gross written premium by line of business |

|

$ |

229,449 |

|

|

$ |

236,822 |

|

|

$ |

(7,373) |

|

|

(3.1) |

% |

Loss and LAE decreased by $900 thousand, or 5.6%, to $15.3 million for the second quarter of 2024, from $16.2 million for the second quarter of 2023. Loss and LAE expense as a percentage of net earned premiums increased 3.3 points to 24.1% for the second quarter of 2024, compared to 20.8% for the second quarter of 2023. Excluding catastrophe losses and reserve development, the Company's gross underlying loss and LAE ratio for the second quarter of 2024 would have been 10.5%, an increase of 0.2 points from 10.3% during the second quarter of 2023.

Policy acquisition costs decreased by $9.6 million, or 40.9%, to $13.9 million for the second quarter of 2024, from $23.5 million for the second quarter of 2023, primarily due to an increase in reinsurance ceding commission income, driven by our commercial lines quota share coverage effective June 1, 2023. In addition, agent commission expense decreased, driven by the collection of agent commissions that previously had a valuation allowance booked against them.

Operating and underwriting expenses decreased by $1.0 million, or 33.3%, to $2.0 million for the second quarter of 2024, from $3.0 million for the second quarter of 2023, driven by decreased underwriting costs and decreased overhead costs such as rent, utilities and computer software and services.

General and administrative expenses increased by $3.5 million, or 54.7%, to $9.9 million for the second quarter of 2024, from $6.4 million for the second quarter of 2023, driven by increased external service costs, such as legal and audit fees. In addition, salary related expenses increased quarter-over-quarter.

IIC Results Highlights

Net losses attributable to IIC totaled $1.0 million for the second quarter of 2024 compared to $900 thousand for the second quarter of 2023. Drivers of the quarter-over-quarter increase included: an increase in loss and LAE incurred of $1.3 million due to increased current year non-catastrophe losses, partially offset by increased revenue of $1.2 million driven by both an increase in gross premiums earned of $300 thousand, as a result of rate increases and decrease in ceded premiums earned of $900 thousand driven by changes made to the reinsurance program in 2024. All other IIC expenses remained relatively flat quarter-over-quarter.

Reinsurance Costs as a Percentage of Gross Earned Premium

Reinsurance costs as a percentage of gross earned premium in the second quarter of 2024 and 2023 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

| Non-at-Risk |

(0.2) |

% |

|

(0.4) |

% |

| Quota Share |

(26.4) |

% |

|

(15.2) |

% |

| All Other |

(32.7) |

% |

|

(32.3) |

% |

| Total Ceding Ratio |

(59.3) |

% |

|

(47.9) |

% |

Ceded premiums earned related to the Company's catastrophe excess of loss contracts remained relatively flat. The Company's utilization of quota share reinsurance coverage resulted in less excess of loss coverage needed for the 2023-2024 catastrophe year. The cost associated with this reduction in necessary coverage was offset by rate increases on catastrophe excess of loss coverage for the 2023-2024 catastrophe year. The utilization of quota share reinsurance coverage, as described below, increased the Company's ceding ratio overall.

Reinsurance costs as a percentage of gross earned premium in the second quarter of 2024 and 2023 for IIC, captured within discontinued operations, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IIC |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Non-at-Risk |

(2.6) |

% |

|

(2.9) |

% |

|

|

|

|

| Quota Share |

— |

% |

|

— |

% |

|

|

|

|

| All Other |

(23.8) |

% |

|

(35.4) |

% |

|

|

|

|

| Total Ceding Ratio |

(26.4) |

% |

|

(38.3) |

% |

|

|

|

|

Investment Portfolio Highlights

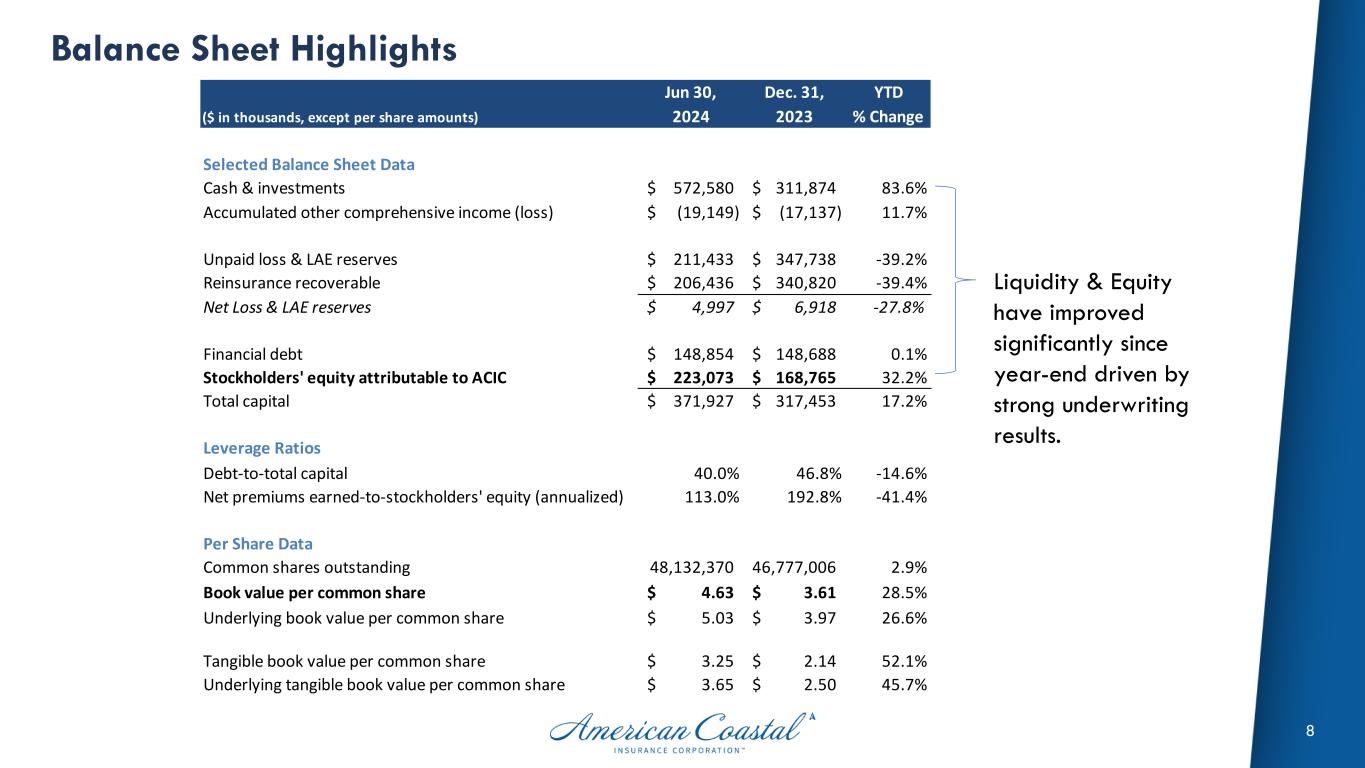

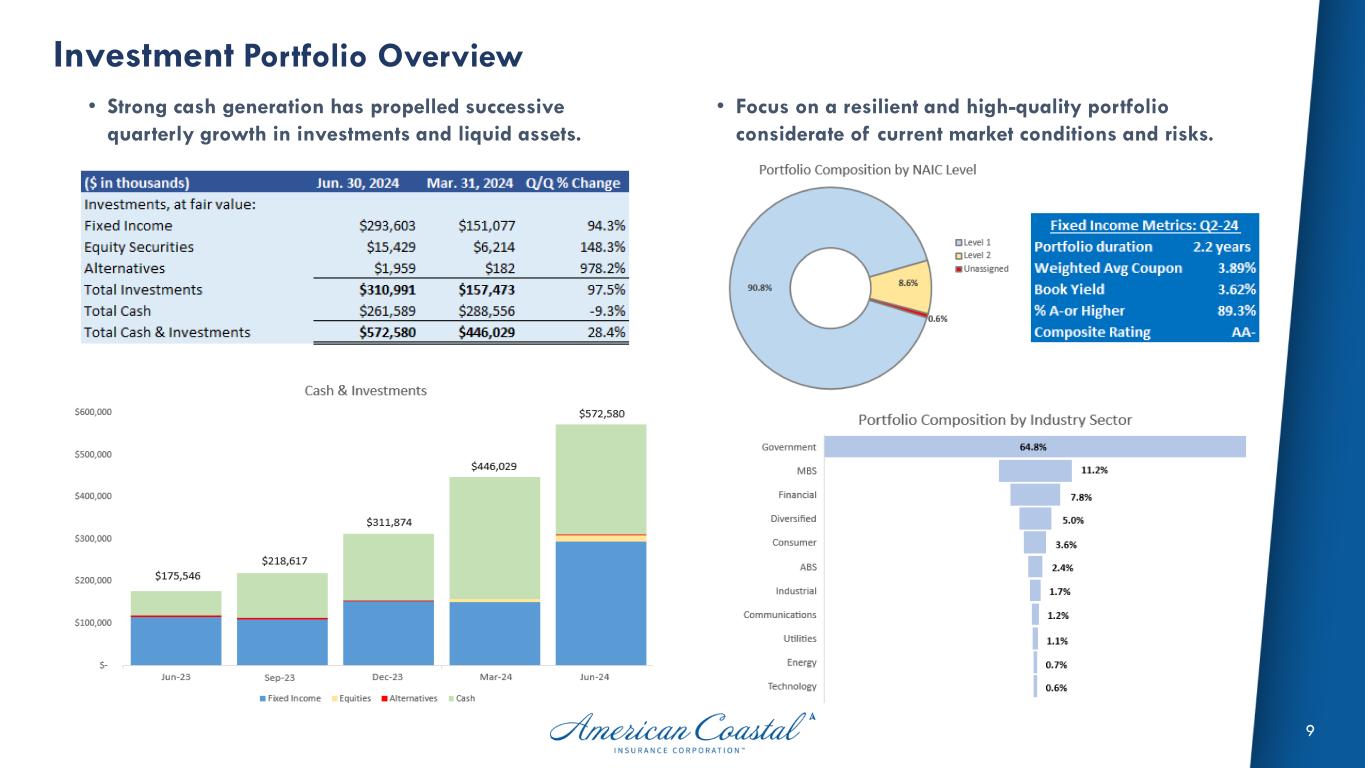

The Company's cash, restricted cash and investment holdings increased from $311.9 million at December 31, 2023 to $572.6 million at June 30, 2024. This increase is driven by our cash flows from operations which have been positive during the first half of 2024. The Company's cash and investment holdings consist of investments in U.S. government and agency securities, corporate debt and investment grade money market instruments. Fixed maturities represented approximately 85.0% of total investments at June 30, 2024 compared to 89.4% of total investments at December 31, 2023. The Company's fixed maturity investments had a modified duration of 2.4 years at June 30, 2024, compared to 3.4 years at December 31, 2023.

Book Value Analysis

Book value per common share increased 28.3% from $3.61 at December 31, 2023, to $4.63 at June 30, 2024. Underlying book value per common share increased 26.7% from $3.97 at December 31, 2023 to $5.03 at June 30, 2024. An increase in the Company's retained earnings as the result of net income in the first six months of 2024, drove the increase in the Company's book value per share. As shown in the table below, removing the effect of AOCI, caused by unfavorable capital market conditions, increases the Company's book value per common share at June 30, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands, except for share and per share data) |

|

June 30, 2024 |

|

December 31, 2023 |

|

|

|

| Book Value per Share |

|

|

|

|

| Numerator: |

|

|

|

|

| Common stockholders' equity |

|

$ |

223,073 |

|

|

$ |

168,765 |

|

| Denominator: |

|

|

|

|

| Total Shares Outstanding |

|

48,132,370 |

|

|

46,777,006 |

|

| Book Value Per Common Share |

|

$ |

4.63 |

|

|

$ |

3.61 |

|

|

|

|

|

|

| Book Value per Share, Excluding the Impact of Accumulated Other Comprehensive Income (AOCI) |

|

|

|

|

| Numerator: |

|

|

|

|

| Common stockholders' equity |

|

$ |

223,073 |

|

|

$ |

168,765 |

|

| Less: Accumulated other comprehensive loss |

|

(19,149) |

|

|

(17,137) |

|

| Stockholders' Equity, excluding AOCI |

|

$ |

242,222 |

|

|

$ |

185,902 |

|

| Denominator: |

|

|

|

|

| Total Shares Outstanding |

|

48,132,370 |

|

|

46,777,006 |

|

Underlying Book Value Per Common Share(1) |

|

$ |

5.03 |

|

|

$ |

3.97 |

|

(1) Underlying book value per common share is a non-GAAP financial measure and is reconciled above to book value per common share, the most directly comparable GAAP measure. Additional information regarding non-GAAP financial measures presented in this press release can be found in the "Definitions of Non-GAAP Measures" section below.

Conference Call Details

Date and Time: August 7, 2024 - 5:00 P.M. ET

Participant Dial-In: (United States): 877-445-9755

(International): 201-493-6744

Webcast: To listen to the live webcast, please go to https://investors.amcoastal.com and click on the conference call link at the top of the page or go to: https://event.webcasts.com/starthere.jsp?ei=1678464&tp_key=7e632cd730

An archive of the webcast will be available for a limited period of time thereafter.

Presentation: The information in this press release should be read in conjunction with an earnings presentation that is available on the Company's website at investors.amcoastal.com/Presentations.

About American Coastal Insurance Corporation

American Coastal Insurance Corporation (amcoastal.com) is the holding company of the insurance carrier, American Coastal Insurance Company, which was founded in 2007 for the purpose of insuring Condominium and Homeowner Association properties, and apartments in the state of Florida. American Coastal Insurance Company has an exclusive partnership for distribution of Condominium Association properties in the state of Florida with AmRisc Group (amriscgroup.com), one of the largest Managing General Agents in the country specializing in hurricane-exposed properties. American Coastal Insurance Company has earned a Financial Stability Rating of “A”, Exceptional’ from Demotech, and maintains an “A-” insurance financial strength rating with a Stable outlook by Kroll. ACIC maintains a ‘BB+’ issuer rating with a Stable outlook by Kroll.

|

|

|

| Contact Information: |

| Alexander Baty |

| Vice President, Finance & Investor Relations, American Coastal Insurance Corp. |

| investorrelations@amcoastal.com |

| (727) 425-8076 |

|

| Karin Daly |

| Investor Relations, Vice President, The Equity Group |

| kdaly@equityny.com |

| (212) 836-9623 |

Definitions of Non-GAAP Measures

The Company believes that investors' understanding of ACIC's performance is enhanced by the Company's disclosure of the following non-GAAP measures. The Company's methods for calculating these measures may differ from those used by other companies and therefore comparability may be limited.

Net income (loss) excluding the effects of amortization of intangible assets, income (loss) from discontinued operations, realized gains (losses) and unrealized gains (losses) on equity securities, net of tax (core income (loss)) is a non-GAAP measure that is computed by adding amortization, net of tax, to net income (loss) and subtracting income (loss) from discontinued operations, net of tax, realized gains (losses) on the Company's investment portfolio, net of tax, and unrealized gains (losses) on the Company's equity securities, net of tax, from net income (loss). Amortization expense is related to the amortization of intangible assets acquired, including goodwill, through mergers and, therefore, the expense does not arise through normal operations. Investment portfolio gains (losses) and unrealized equity security gains (losses) vary independent of the Company's operations. The Company believes it is useful for investors to evaluate these components both separately and in the aggregate when reviewing the Company's performance. The most directly comparable GAAP measure is net income (loss). The core income (loss) measure should not be considered a substitute for net income (loss) and does not reflect the overall profitability of the Company's business.

Core return on equity is a non-GAAP ratio calculated using non-GAAP measures. It is calculated by dividing the core income (loss) for the period by the average stockholders’ equity for the trailing twelve months (or one quarter of such average, in the case of quarterly periods). Core income (loss) is an after-tax non-GAAP measure that is calculated by excluding from net income (loss) the effect of income (loss) from discontinued operations, net of tax, non-cash amortization of intangible assets, including goodwill, unrealized gains or losses on the Company's equity security investments and net realized gains or losses on the Company's investment portfolio. In the opinion of the Company’s management, core income (loss), core income (loss) per share and core return on equity are meaningful indicators to investors of the Company's underwriting and operating results, since the excluded items are not necessarily indicative of operating trends. Internally, the Company’s management uses core income (loss), core income (loss) per share and core return on equity to evaluate performance against historical results and establish financial targets on a consolidated basis. The most directly comparable GAAP measure is return on equity. The core return on equity measure should not be considered a substitute for return on equity and does not reflect the overall profitability of the Company's business.

Combined ratio excluding the effects of current year catastrophe losses and prior year reserve development (underlying combined ratio) is a non-GAAP measure, that is computed by subtracting the effect of current year catastrophe losses and prior year development from the combined ratio. The Company believes that this ratio is useful to investors, and it is used by management to highlight the trends in the Company's business that may be obscured by current year catastrophe losses and prior year development. Current year catastrophe losses cause the Company's loss trends to vary significantly between periods as a result of their frequency of occurrence and severity and can have a significant impact on the combined ratio. Prior year development is caused by unexpected loss development on historical reserves. The Company believes it is useful for investors to evaluate these components both separately and in the aggregate when reviewing the Company's performance. The most directly comparable GAAP measure is the combined ratio. The underlying combined ratio should not be considered as a substitute for the combined ratio and does not reflect the overall profitability of the Company's business.

Net loss and LAE excluding the effects of current year catastrophe losses and prior year reserve development (underlying loss and LAE) is a non-GAAP measure that is computed by subtracting the effect of current year catastrophe losses and prior year reserve development from net loss and LAE. The Company uses underlying loss and LAE figures to analyze the Company's loss trends that may be impacted by current year catastrophe losses and prior year development on the Company's reserves. As discussed previously, these two items can have a significant impact on the Company's loss trends in a given period. The Company believes it is useful for investors to evaluate these components both separately and in the aggregate when reviewing the Company's performance. The most directly comparable GAAP measure is net loss and LAE. The underlying loss and LAE measure should not be considered a substitute for net loss and LAE and does not reflect the overall profitability of the Company's business.

Book value per common share, excluding the impact of accumulated other comprehensive loss (underlying book value per common share), is a non-GAAP measure that is computed by dividing common stockholders' equity after excluding accumulated other comprehensive income (loss), by total common shares outstanding plus dilutive potential common shares outstanding.

The Company uses the trend in book value per common share, excluding the impact of accumulated other comprehensive income (loss), in conjunction with book value per common share to identify and analyze the change in net worth attributable to management efforts between periods. The Company believes this non-GAAP measure is useful to investors because it eliminates the effect of interest rates that can fluctuate significantly from period to period and are generally driven by economic and financial factors that are not influenced by management. Book value per common share is the most directly comparable GAAP measure. Book value per common share, excluding the impact of accumulated other comprehensive income (loss), should not be considered a substitute for book value per common share and does not reflect the recorded net worth of the Company's business.

Discontinued Operations

On May 9, 2024, the Company entered into the Sale Agreement with Forza in which ACIC will sell and Forza will acquire 100% of the issued and outstanding stock of the Company's subsidiary, IIC. In addition, on February 27, 2023, the Florida Department of Financial Services was appointed as receiver of the Company's former subsidiary, United Property & Casualty Insurance Company ("UPC"). As such, prior year financial results and Consolidated Balance Sheet components have been reclassified to reflect continuing and discontinued operations appropriately.

Forward-Looking Statements

Statements made in this press release, or on the conference call identified above, and otherwise, that are not historical facts are “forward-looking statements”. The Company believes these statements are based on reasonable estimates, assumptions and plans. However, if the estimates, assumptions, or plans underlying the forward-looking statements prove inaccurate or if other risks or uncertainties arise, actual results could differ materially from those expressed in, or implied by, the forward-looking statements. These statements are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements do not relate strictly to historical or current facts and may be identified by their use of words such as “may,” “will,” “expect,” "endeavor," "project," “believe,” "plan," “anticipate,” “intend,” “could,” “would,” “estimate” or “continue” or the negative variations thereof or comparable terminology. Factors that could cause actual results to differ materially may be found in the Company's filings with the U.S. Securities and Exchange Commission, in the “Risk Factors” section in the Company's most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Forward-looking statements speak only as of the date on which they are made, and, except as required by applicable law, the Company undertakes no obligation to update or revise any forward-looking statements.

Consolidated Statements of Comprehensive Income

In thousands, except share and per share amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| REVENUE: |

|

|

|

|

|

|

|

|

| Gross premiums written |

|

$ |

229,449 |

|

|

$ |

236,822 |

|

|

$ |

414,050 |

|

|

$ |

413,463 |

|

| Change in gross unearned premiums |

|

(73,999) |

|

|

(86,985) |

|

|

(98,330) |

|

|

(125,651) |

|

| Gross premiums earned |

|

155,450 |

|

|

149,837 |

|

|

315,720 |

|

|

287,812 |

|

| Ceded premiums earned |

|

(92,069) |

|

|

(71,823) |

|

|

(189,708) |

|

|

(125,157) |

|

| Net premiums earned |

|

63,381 |

|

|

78,014 |

|

|

126,012 |

|

|

162,655 |

|

| Net investment income |

|

5,347 |

|

|

2,095 |

|

|

9,364 |

|

|

4,138 |

|

| Net realized investment losses |

|

(121) |

|

|

(6,708) |

|

|

(121) |

|

|

(6,791) |

|

| Net unrealized gains (losses) on equity securities |

|

49 |

|

|

141 |

|

|

(1) |

|

|

615 |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

68,656 |

|

|

$ |

73,542 |

|

|

$ |

135,254 |

|

|

$ |

160,617 |

|

| EXPENSES: |

|

|

|

|

|

|

|

|

| Losses and loss adjustment expenses |

|

15,277 |

|

|

16,245 |

|

|

27,751 |

|

|

30,146 |

|

| Policy acquisition costs |

|

13,939 |

|

|

23,526 |

|

|

23,534 |

|

|

48,692 |

|

| Operating expenses |

|

2,040 |

|

|

3,046 |

|

|

4,377 |

|

|

4,881 |

|

| General and administrative expenses |

|

9,898 |

|

|

6,414 |

|

|

18,813 |

|

|

15,025 |

|

| Interest expense |

|

3,426 |

|

|

2,719 |

|

|

6,145 |

|

|

5,438 |

|

| Total expenses |

|

44,580 |

|

|

51,950 |

|

|

80,620 |

|

|

104,182 |

|

| Income before other income |

|

24,076 |

|

|

21,592 |

|

|

54,634 |

|

|

56,435 |

|

| Other income |

|

811 |

|

|

806 |

|

|

1,621 |

|

|

1,394 |

|

| Income before income taxes |

|

24,887 |

|

|

22,398 |

|

|

56,255 |

|

|

57,829 |

|

| Provision for income taxes |

|

5,814 |

|

|

1,154 |

|

|

13,473 |

|

|

5,020 |

|

| Income from continuing operations, net of tax |

|

$ |

19,073 |

|

|

$ |

21,244 |

|

|

$ |

42,782 |

|

|

$ |

52,809 |

|

| Income (loss) from discontinued operations, net of tax |

|

(19) |

|

|

(3,465) |

|

|

(129) |

|

|

232,250 |

|

| Net income |

|

$ |

19,054 |

|

|

$ |

17,779 |

|

|

$ |

42,653 |

|

|

$ |

285,059 |

|

| OTHER COMPREHENSIVE INCOME (LOSS): |

|

|

|

|

|

|

|

|

| Change in net unrealized gains (losses) on investments |

|

73 |

|

|

(2,168) |

|

|

(125) |

|

|

2,063 |

|

| Reclassification adjustment for net realized investment losses |

|

121 |

|

|

6,725 |

|

|

121 |

|

|

6,808 |

|

| Income tax benefit related to items of other comprehensive income (loss) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total comprehensive income |

|

$ |

19,248 |

|

|

$ |

22,336 |

|

|

$ |

42,649 |

|

|

$ |

293,930 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

47,821,115 |

|

|

43,229,416 |

|

|

47,572,236 |

|

|

43,178,758 |

|

| Diluted |

|

49,398,463 |

|

|

43,805,217 |

|

|

49,162,233 |

|

|

43,690,435 |

|

|

|

|

|

|

|

|

|

|

| Earnings available to ACIC common stockholders per share |

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.40 |

|

|

$ |

0.49 |

|

|

$ |

0.90 |

|

|

$ |

1.22 |

|

| Discontinued operations |

|

— |

|

|

(0.08) |

|

|

— |

|

|

5.37 |

|

| Total |

|

$ |

0.40 |

|

|

$ |

0.41 |

|

|

$ |

0.90 |

|

|

$ |

6.59 |

|

| Diluted |

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

0.39 |

|

|

$ |

0.49 |

|

|

$ |

0.87 |

|

|

$ |

1.21 |

|

| Discontinued operations |

|

— |

|

|

(0.08) |

|

|

— |

|

|

5.31 |

|

| Total |

|

$ |

0.39 |

|

|

$ |

0.41 |

|

|

$ |

0.87 |

|

|

$ |

6.52 |

|

|

|

|

|

|

|

|

|

|

| Dividends declared per share |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Consolidated Balance Sheets

In thousands, except share amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

| Investments, at fair value: |

|

|

|

|

| Fixed maturities, available-for-sale |

|

$ |

264,446 |

|

|

$ |

138,387 |

|

| Equity securities |

|

15,429 |

|

|

— |

|

| Other investments |

|

31,116 |

|

|

16,487 |

|

| Total investments |

|

$ |

310,991 |

|

|

$ |

154,874 |

|

| Cash and cash equivalents |

|

229,431 |

|

|

138,930 |

|

| Restricted cash |

|

32,158 |

|

|

18,070 |

|

| Accrued investment income |

|

4,722 |

|

|

1,767 |

|

| Property and equipment, net |

|

9,096 |

|

|

3,658 |

|

| Premiums receivable, net |

|

52,873 |

|

|

45,924 |

|

| Reinsurance recoverable on paid and unpaid losses |

|

206,436 |

|

|

340,820 |

|

| Ceded unearned premiums |

|

260,852 |

|

|

155,301 |

|

| Goodwill |

|

59,476 |

|

|

59,476 |

|

| Deferred policy acquisition costs |

|

51,423 |

|

|

21,149 |

|

| Intangible assets, net |

|

7,127 |

|

|

8,548 |

|

| Other assets |

|

12,995 |

|

|

36,718 |

|

| Assets held for sale |

|

73,705 |

|

|

77,143 |

|

| Total Assets |

|

$ |

1,311,285 |

|

|

$ |

1,062,378 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

| Unpaid losses and loss adjustment expenses |

|

$ |

211,433 |

|

|

$ |

347,738 |

|

| Unearned premiums |

|

374,487 |

|

|

276,157 |

|

| Reinsurance payable on premiums |

|

226,508 |

|

|

— |

|

| Payments outstanding |

|

580 |

|

|

706 |

|

| Accounts payable and accrued expenses |

|

75,530 |

|

|

74,783 |

|

| Operating lease liability |

|

67 |

|

|

739 |

|

| Other liabilities |

|

713 |

|

|

672 |

|

| Notes payable, net |

|

148,854 |

|

|

148,688 |

|

| Liabilities held for sale |

|

50,040 |

|

|

44,130 |

|

| Total Liabilities |

|

$ |

1,088,212 |

|

|

$ |

893,613 |

|

| Commitments and contingencies |

|

|

|

|

| Stockholders' Equity: |

|

|

|

|

| Preferred stock, $0.0001 par value; 1,000,000 authorized; none issued or outstanding |

|

— |

|

|

— |

|

Common stock, $0.0001 par value; 100,000,000 shares authorized; 48,344,453 and 46,989,089 issued, respectively; 48,132,370 and 46,777,006 outstanding, respectively |

|

5 |

|

|

5 |

|

| Additional paid-in capital |

|

436,383 |

|

|

423,717 |

|

| Treasury shares, at cost; 212,083 shares |

|

(431) |

|

|

(431) |

|

| Accumulated other comprehensive loss |

|

(19,149) |

|

|

(17,137) |

|

| Retained earnings (deficit) |

|

(193,735) |

|

|

(237,389) |

|

| Total Stockholders' Equity |

|

$ |

223,073 |

|

|

$ |

168,765 |

|

| Total Liabilities and Stockholders' Equity |

|

$ |

1,311,285 |

|

|

$ |

1,062,378 |

|