Document

EXHIBIT 99.2

OPENLANE, Inc.

Third Quarter 2025 Supplemental Financial Information

November 5, 2025

OPENLANE, Inc.

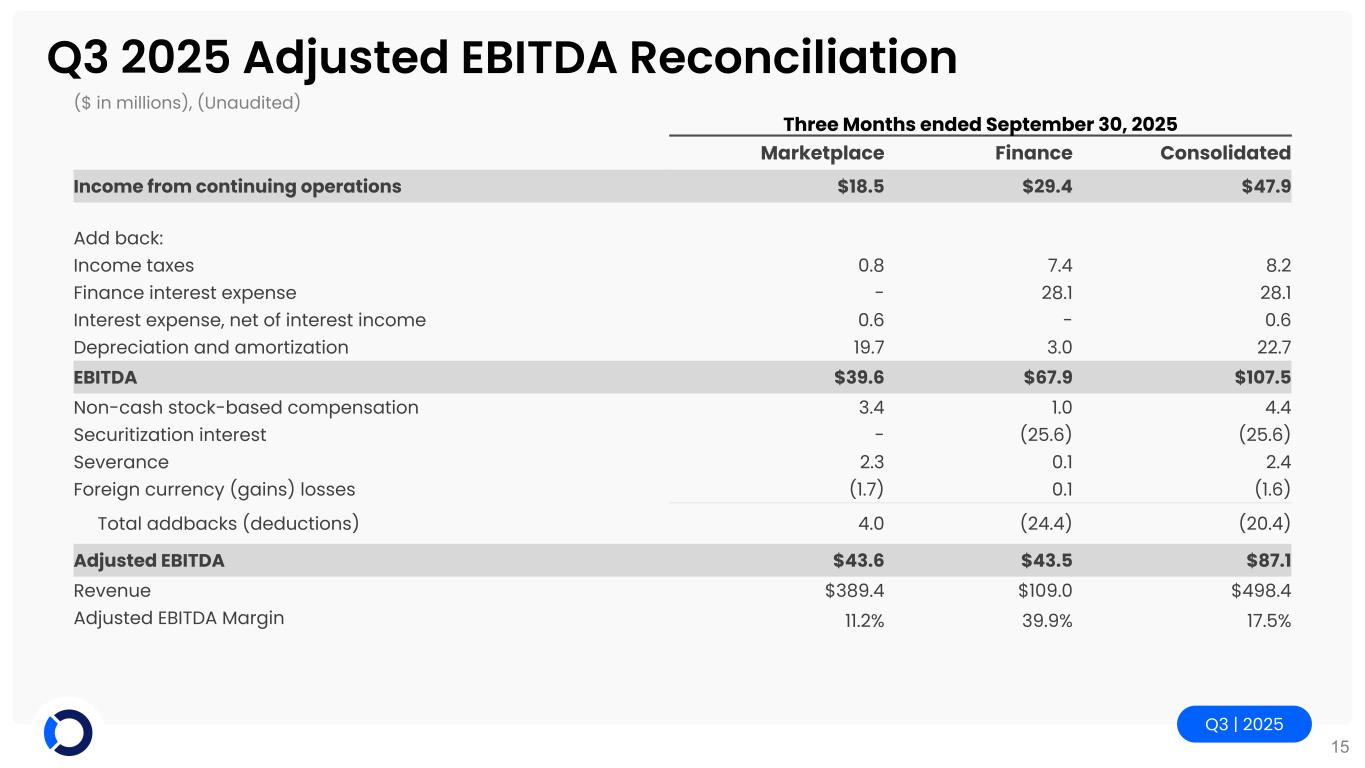

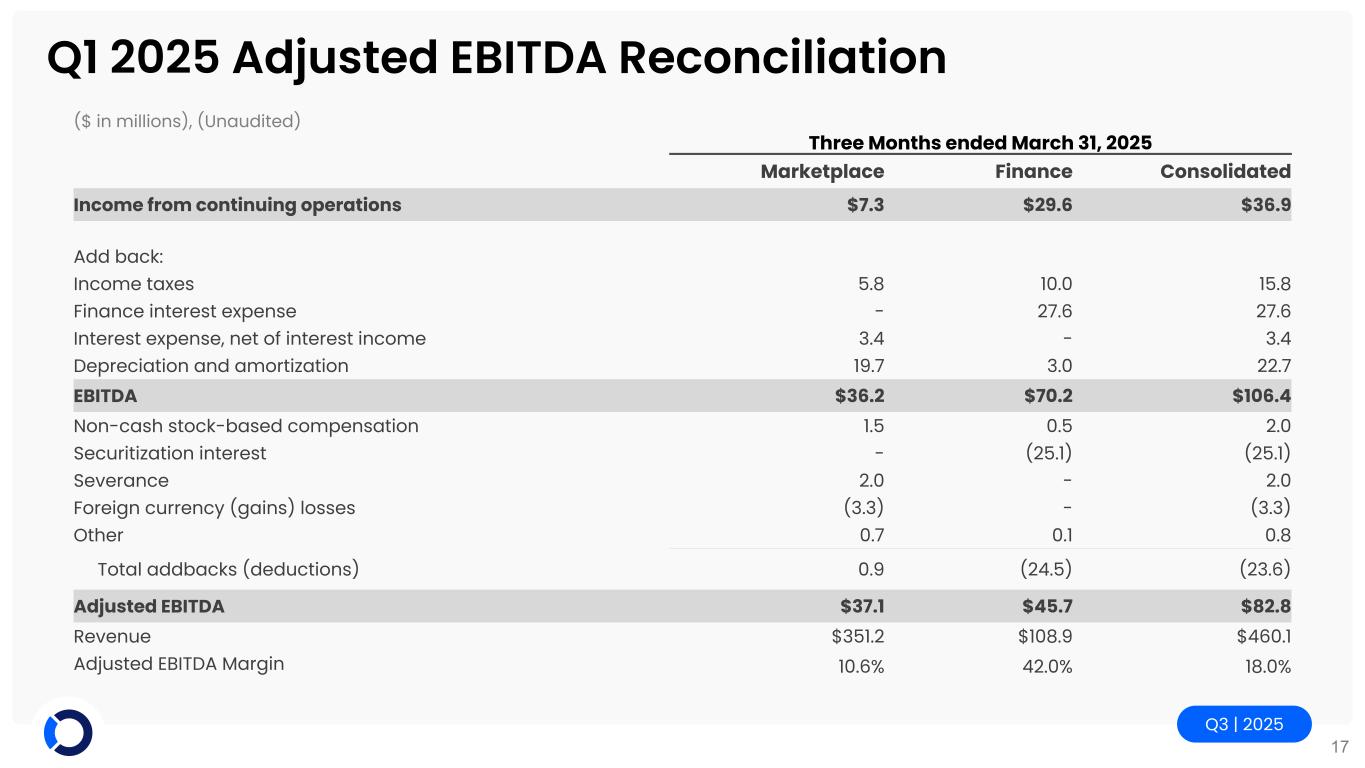

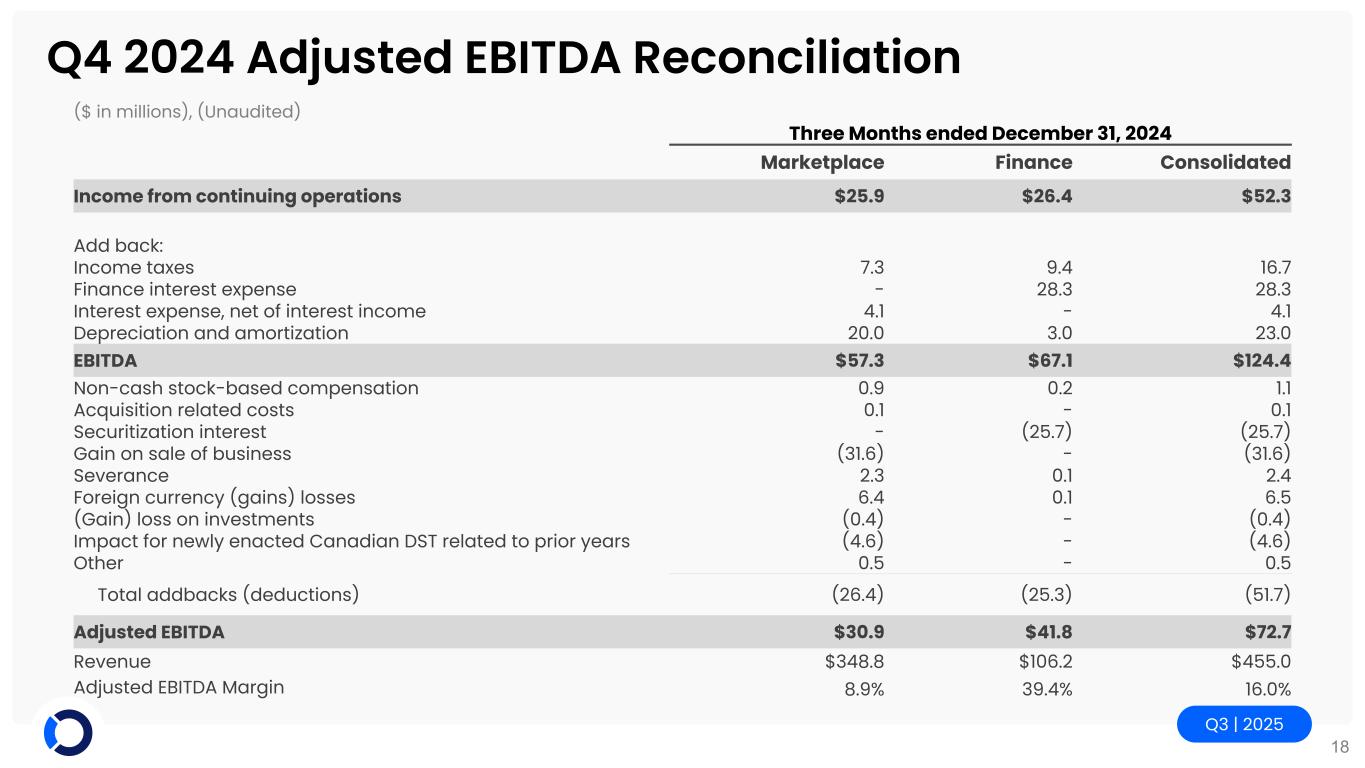

EBITDA and Adjusted EBITDA Measures

EBITDA and Adjusted EBITDA as presented herein are supplemental measures of our performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP.

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in our senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by our creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate our performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies.

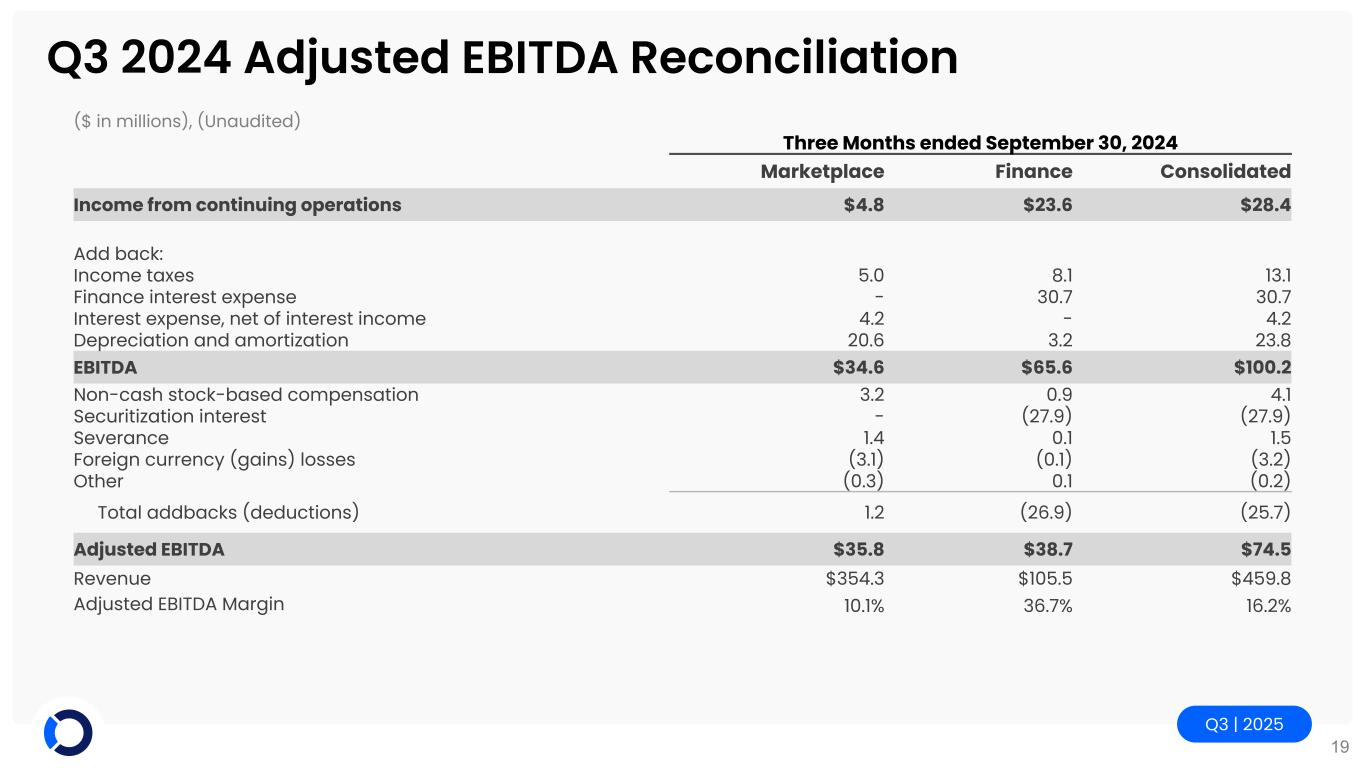

The following tables reconcile income (loss) from continuing operations to EBITDA and Adjusted EBITDA for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2025 |

(Dollars in millions), (Unaudited) |

Marketplace |

|

Finance |

|

Consolidated |

Income from continuing operations |

$ |

18.5 |

|

|

$ |

29.4 |

|

|

$ |

47.9 |

|

| Add back: |

|

|

|

|

|

| Income taxes |

0.8 |

|

|

7.4 |

|

|

8.2 |

|

| Finance interest expense |

— |

|

|

28.1 |

|

|

28.1 |

|

| Interest expense, net of interest income |

0.6 |

|

|

— |

|

|

0.6 |

|

| Depreciation and amortization |

19.7 |

|

|

3.0 |

|

|

22.7 |

|

| EBITDA |

39.6 |

|

|

67.9 |

|

|

107.5 |

|

| Non-cash stock-based compensation |

3.4 |

|

|

1.0 |

|

|

4.4 |

|

| Securitization interest |

— |

|

|

(25.6) |

|

|

(25.6) |

|

| Severance |

2.3 |

|

|

0.1 |

|

|

2.4 |

|

| Foreign currency (gains) losses |

(1.7) |

|

|

0.1 |

|

|

(1.6) |

|

Total addbacks (deductions) |

4.0 |

|

|

(24.4) |

|

|

(20.4) |

|

| Adjusted EBITDA |

$ |

43.6 |

|

|

$ |

43.5 |

|

|

$ |

87.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

(Dollars in millions), (Unaudited) |

Marketplace |

|

Finance |

|

Consolidated |

Income from continuing operations |

$ |

4.8 |

|

|

$ |

23.6 |

|

|

$ |

28.4 |

|

| Add back: |

|

|

|

|

|

| Income taxes |

5.0 |

|

|

8.1 |

|

|

13.1 |

|

| Finance interest expense |

— |

|

|

30.7 |

|

|

30.7 |

|

| Interest expense, net of interest income |

4.2 |

|

|

— |

|

|

4.2 |

|

| Depreciation and amortization |

20.6 |

|

|

3.2 |

|

|

23.8 |

|

| EBITDA |

34.6 |

|

|

65.6 |

|

|

100.2 |

|

| Non-cash stock-based compensation |

3.2 |

|

|

0.9 |

|

|

4.1 |

|

| Securitization interest |

— |

|

|

(27.9) |

|

|

(27.9) |

|

| Severance |

1.4 |

|

|

0.1 |

|

|

1.5 |

|

| Foreign currency (gains) losses |

(3.1) |

|

|

(0.1) |

|

|

(3.2) |

|

| Other |

(0.3) |

|

|

0.1 |

|

|

(0.2) |

|

Total addbacks (deductions) |

1.2 |

|

|

(26.9) |

|

|

(25.7) |

|

| Adjusted EBITDA |

$ |

35.8 |

|

|

$ |

38.7 |

|

|

$ |

74.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2025 |

(Dollars in millions), (Unaudited) |

Marketplace |

|

Finance |

|

Consolidated |

Income from continuing operations |

$ |

34.4 |

|

|

$ |

83.8 |

|

|

$ |

118.2 |

|

| Add back: |

|

|

|

|

|

| Income taxes |

14.1 |

|

|

28.2 |

|

|

42.3 |

|

| Finance interest expense |

— |

|

|

82.6 |

|

|

82.6 |

|

| Interest expense, net of interest income |

5.3 |

|

|

— |

|

|

5.3 |

|

| Depreciation and amortization |

59.3 |

|

|

9.1 |

|

|

68.4 |

|

| EBITDA |

113.1 |

|

|

203.7 |

|

|

316.8 |

|

| Non-cash stock-based compensation |

8.3 |

|

|

2.5 |

|

|

10.8 |

|

| Securitization interest |

— |

|

|

(75.1) |

|

|

(75.1) |

|

| Loss on sale of property |

7.0 |

|

|

— |

|

|

7.0 |

|

| Severance |

6.6 |

|

|

0.2 |

|

|

6.8 |

|

| Foreign currency (gains) losses |

(10.5) |

|

|

— |

|

|

(10.5) |

|

Other |

0.7 |

|

|

0.1 |

|

|

0.8 |

|

Total addbacks (deductions) |

12.1 |

|

|

(72.3) |

|

|

(60.2) |

|

| Adjusted EBITDA |

$ |

125.2 |

|

|

$ |

131.4 |

|

|

$ |

256.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

(Dollars in millions), (Unaudited) |

Marketplace |

|

Finance |

|

Consolidated |

Income (loss) from continuing operations |

$ |

(24.2) |

|

|

$ |

81.8 |

|

|

$ |

57.6 |

|

| Add back: |

|

|

|

|

|

| Income taxes |

4.0 |

|

|

27.3 |

|

|

31.3 |

|

| Finance interest expense |

— |

|

|

95.2 |

|

|

95.2 |

|

| Interest expense, net of interest income |

16.1 |

|

|

— |

|

|

16.1 |

|

| Depreciation and amortization |

63.3 |

|

|

8.9 |

|

|

72.2 |

|

| Intercompany interest |

13.3 |

|

|

(13.3) |

|

|

— |

|

| EBITDA |

72.5 |

|

|

199.9 |

|

|

272.4 |

|

| Non-cash stock-based compensation |

12.0 |

|

|

2.8 |

|

|

14.8 |

|

| Acquisition related costs |

0.5 |

|

|

— |

|

|

0.5 |

|

| Securitization interest |

— |

|

|

(87.0) |

|

|

(87.0) |

|

| Severance |

8.2 |

|

|

1.0 |

|

|

9.2 |

|

| Foreign currency (gains) losses |

(0.6) |

|

|

(0.1) |

|

|

(0.7) |

|

| Professional fees related to business improvement efforts |

1.2 |

|

|

0.3 |

|

|

1.5 |

|

| Impact for newly enacted Canadian DST related to prior years |

10.0 |

|

|

— |

|

|

10.0 |

|

Other |

(0.2) |

|

|

0.2 |

|

|

— |

|

Total addbacks (deductions) |

31.1 |

|

|

(82.8) |

|

|

(51.7) |

|

| Adjusted EBITDA |

$ |

103.6 |

|

|

$ |

117.1 |

|

|

$ |

220.7 |

|

Certain of our loan covenant calculations utilize financial results for the most recent four consecutive fiscal quarters. The following table reconciles EBITDA and Adjusted EBITDA to net income for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

(Dollars in millions),

(Unaudited)

|

December 31,

2024 |

|

March 31,

2025 |

|

June 30,

2025 |

|

September 30,

2025 |

|

September 30,

2025 |

Net income |

$ |

52.3 |

|

|

$ |

36.9 |

|

|

$ |

33.4 |

|

|

$ |

47.9 |

|

|

$ |

170.5 |

|

| Less: Income from discontinued operations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Income from continuing operations |

52.3 |

|

|

36.9 |

|

|

33.4 |

|

|

47.9 |

|

|

170.5 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

| Income taxes |

16.7 |

|

|

15.8 |

|

|

18.3 |

|

|

8.2 |

|

|

59.0 |

|

| Finance interest expense |

28.3 |

|

|

27.6 |

|

|

26.9 |

|

|

28.1 |

|

|

110.9 |

|

| Interest expense, net of interest income |

4.1 |

|

|

3.4 |

|

|

1.3 |

|

|

0.6 |

|

|

9.4 |

|

| Depreciation and amortization |

23.0 |

|

|

22.7 |

|

|

23.0 |

|

|

22.7 |

|

|

91.4 |

|

| EBITDA |

124.4 |

|

|

106.4 |

|

|

102.9 |

|

|

107.5 |

|

|

441.2 |

|

| Non-cash stock-based compensation |

1.1 |

|

|

2.0 |

|

|

4.4 |

|

|

4.4 |

|

|

11.9 |

|

| Acquisition related costs |

0.1 |

|

|

— |

|

|

— |

|

|

— |

|

|

0.1 |

|

| Securitization interest |

(25.7) |

|

|

(25.1) |

|

|

(24.4) |

|

|

(25.6) |

|

|

(100.8) |

|

| Loss on sale of property |

— |

|

|

— |

|

|

7.0 |

|

|

— |

|

|

7.0 |

|

| Gain on sale of business |

(31.6) |

|

|

— |

|

|

— |

|

|

— |

|

|

(31.6) |

|

| Severance |

2.4 |

|

|

2.0 |

|

|

2.4 |

|

|

2.4 |

|

|

9.2 |

|

| Foreign currency losses (gains) |

6.5 |

|

|

(3.3) |

|

|

(5.6) |

|

|

(1.6) |

|

|

(4.0) |

|

| Gain on investments |

(0.4) |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.4) |

|

Impact for newly enacted Canadian DST related to prior years |

(4.6) |

|

|

— |

|

|

— |

|

|

— |

|

|

(4.6) |

|

| Other |

0.5 |

|

|

0.8 |

|

|

— |

|

|

— |

|

|

1.3 |

|

Total addbacks (deductions) |

(51.7) |

|

|

(23.6) |

|

|

(16.2) |

|

|

(20.4) |

|

|

(111.9) |

|

Adjusted EBITDA |

$ |

72.7 |

|

|

$ |

82.8 |

|

|

$ |

86.7 |

|

|

$ |

87.1 |

|

|

$ |

329.3 |

|

Results of Operations

OPENLANE Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| (Dollars in millions except per share amounts) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues |

|

|

|

|

|

|

|

| Auction fees |

$ |

136.3 |

|

|

$ |

113.2 |

|

|

$ |

396.4 |

|

|

$ |

331.8 |

|

| Service revenue |

144.2 |

|

|

148.1 |

|

|

426.6 |

|

|

445.4 |

|

| Purchased vehicle sales |

108.9 |

|

|

93.0 |

|

|

293.1 |

|

|

231.4 |

|

| Finance revenue |

109.0 |

|

|

105.5 |

|

|

324.1 |

|

|

324.9 |

|

| Total operating revenues |

498.4 |

|

|

459.8 |

|

|

1,440.2 |

|

|

1,333.5 |

|

| Operating expenses |

|

|

|

|

|

|

|

| Cost of services (exclusive of depreciation and amortization) |

270.2 |

|

|

252.0 |

|

|

766.2 |

|

|

711.8 |

|

| Finance interest expense |

28.1 |

|

|

30.7 |

|

|

82.6 |

|

|

95.2 |

|

| Provision for credit losses |

11.5 |

|

|

13.1 |

|

|

29.5 |

|

|

42.2 |

|

| Selling, general and administrative |

110.9 |

|

|

97.7 |

|

|

332.4 |

|

|

308.9 |

|

| Depreciation and amortization |

22.7 |

|

|

23.8 |

|

|

68.4 |

|

|

72.2 |

|

| Loss on sale of property |

— |

|

|

— |

|

|

7.0 |

|

|

— |

|

| Total operating expenses |

443.4 |

|

|

417.3 |

|

|

1,286.1 |

|

|

1,230.3 |

|

| Operating profit |

55.0 |

|

|

42.5 |

|

|

154.1 |

|

|

103.2 |

|

| Interest expense |

1.1 |

|

|

4.6 |

|

|

8.2 |

|

|

17.2 |

|

| Other income, net |

(2.2) |

|

|

(3.6) |

|

|

(14.6) |

|

|

(2.9) |

|

| Income from continuing operations before income taxes |

56.1 |

|

|

41.5 |

|

|

160.5 |

|

|

88.9 |

|

| Income taxes |

8.2 |

|

|

13.1 |

|

|

42.3 |

|

|

31.3 |

|

| Income from continuing operations |

47.9 |

|

|

28.4 |

|

|

118.2 |

|

|

57.6 |

|

| Income from discontinued operations, net of income taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net income |

$ |

47.9 |

|

|

$ |

28.4 |

|

|

$ |

118.2 |

|

|

$ |

57.6 |

|

| Income from continuing operations per share |

|

|

|

|

|

|

|

| Basic |

$ |

0.26 |

|

|

$ |

0.12 |

|

|

$ |

0.59 |

|

|

$ |

0.17 |

|

| Diluted |

$ |

0.25 |

|

|

$ |

0.12 |

|

|

$ |

0.59 |

|

|

$ |

0.17 |

|

Overview of OPENLANE Results for the Three Months Ended September 30, 2025 and 2024

Overview

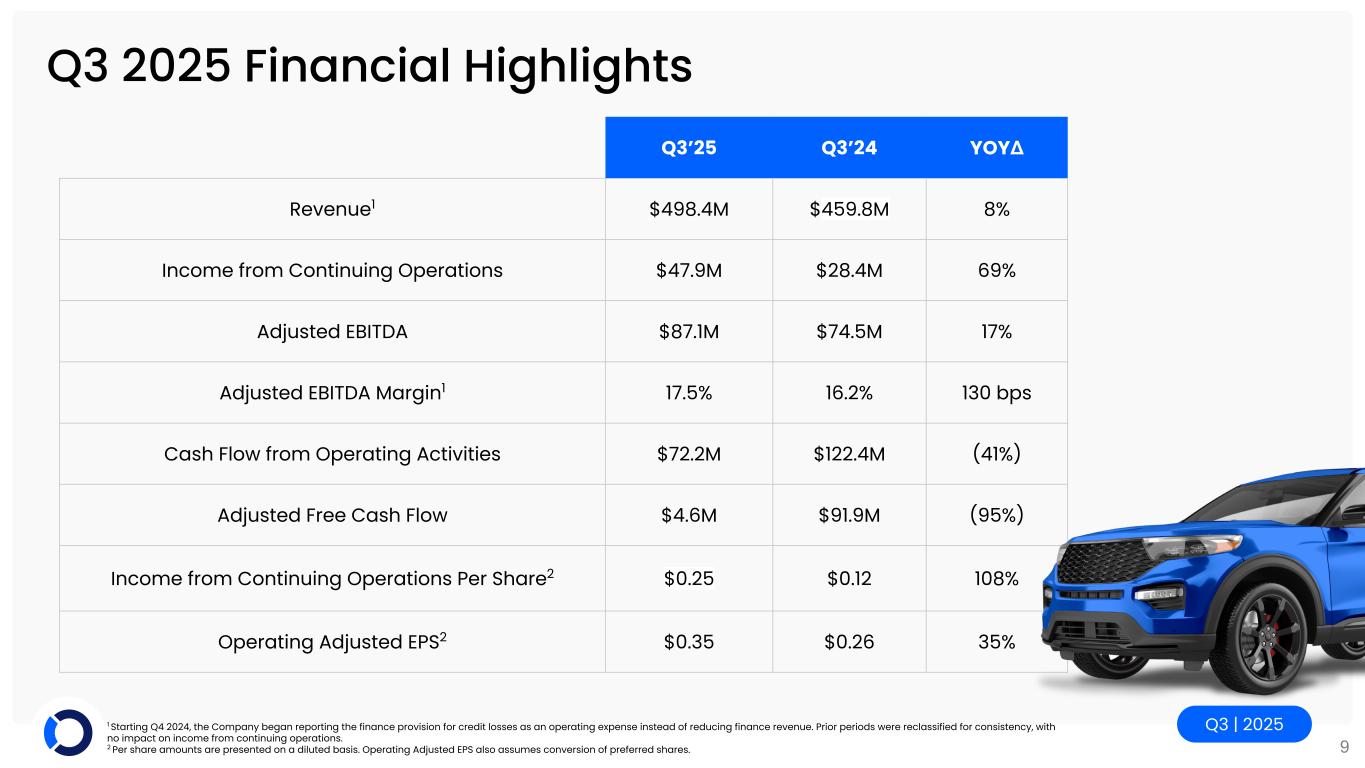

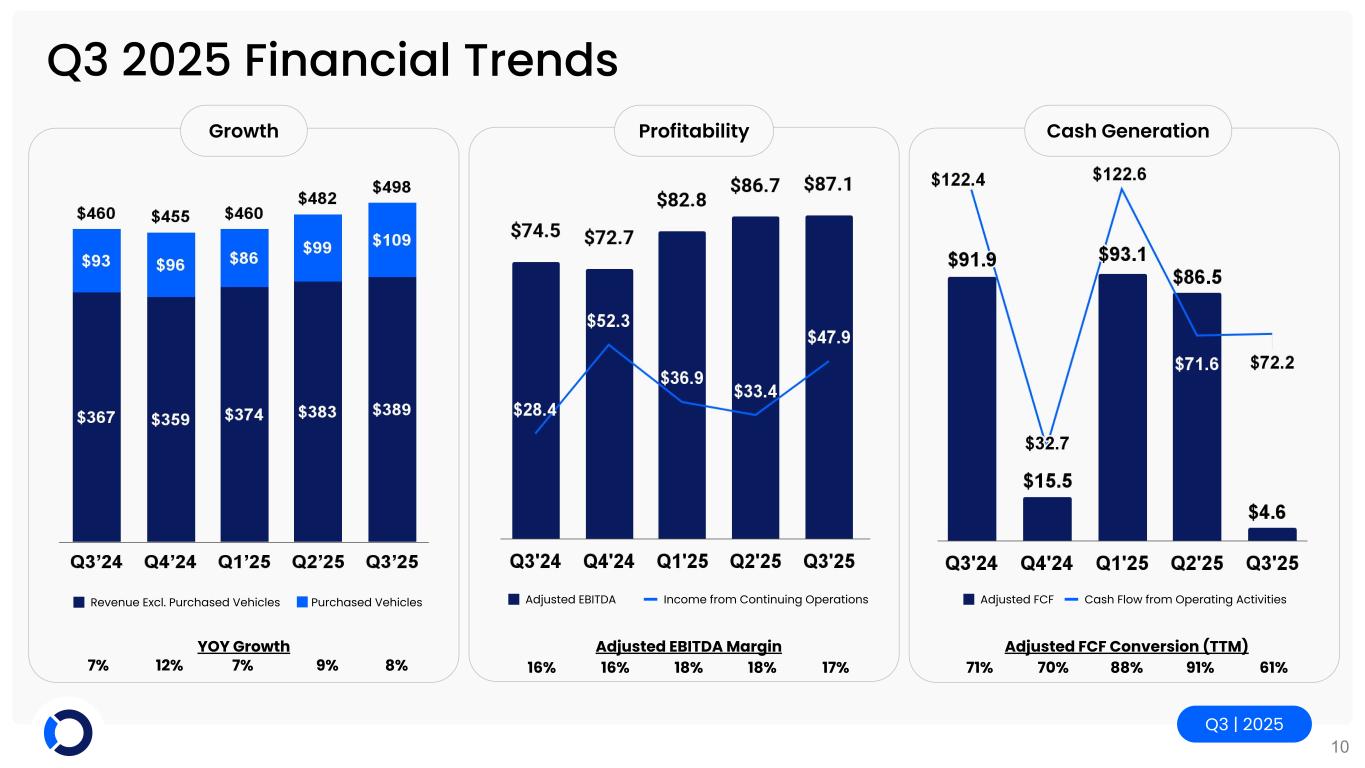

For the three months ended September 30, 2025, we had revenue of $498.4 million compared with revenue of $459.8 million for the three months ended September 30, 2024, an increase of 8%. For a further discussion of our operating results, see the segment results discussions below.

Depreciation and Amortization

Depreciation and amortization decreased $1.1 million, or 5%, to $22.7 million for the three months ended September 30, 2025, compared with $23.8 million for the three months ended September 30, 2024. The decrease in depreciation and amortization was primarily the result of assets that have become fully amortized and depreciated.

Interest Expense

Interest expense decreased $3.5 million, or 76%, to $1.1 million for the three months ended September 30, 2025, compared with $4.6 million for the three months ended September 30, 2024. The decrease in interest expense was primarily the result of the repayment of the senior notes in the second quarter of 2025 and a decrease in the borrowings on lines of credit.

Other Income, Net

For the three months ended September 30, 2025, we had other income of $2.2 million compared with $3.6 million for the three months ended September 30, 2024. The decrease in other income was primarily attributable to foreign currency gains on intercompany balances of $1.6 million for the three months ended September 30, 2025, compared with foreign currency gains on intercompany balances of $3.2 million for the three months ended September 30, 2024. The decrease in foreign currency gains on intercompany balances was partially offset by a net increase in other miscellaneous income aggregating $0.2 million.

Income Taxes

We had an effective tax rate of 14.6% for the three months ended September 30, 2025, compared with an effective tax rate of 31.6% for the three months ended September 30, 2024. The effective tax rate for the three months ended September 30, 2025 was favorably impacted by a decrease in the valuation allowance related to 2025 current year movement of the adjusted U.S. net deferred tax asset primarily attributable to the application of new tax legislation, the One Big Beautiful Bill Act. The effective tax rate for the three months ended September 30, 2024 was unfavorably impacted by an increase in the valuation allowance related to 2024 current year movement of the adjusted U.S. net deferred tax asset.

We recorded a $34.6 million and $35.8 million valuation allowance against the U.S. net deferred tax asset at September 30, 2025 and December 31, 2024, respectively. The realization of the net deferred tax assets is dependent on our ability to generate sufficient future taxable income to utilize these assets. Depending on our current and anticipated future earnings, we may release a significant portion of our valuation allowance in a future period if there is sufficient positive evidence which would result in a corresponding decrease to income tax expense in such period. The actual timing and amount of the valuation allowance to be released is uncertain.

Additionally, the Organization for Economic Cooperation and Development has published a proposal to establish a new global minimum corporate tax rate of 15%, commonly referred to as Pillar Two. While the U.S. has not adopted the Pillar Two framework into law, numerous countries in which we operate have enacted tax legislation based on the Pillar Two framework with certain components of the minimum tax rules effective beginning in 2024 and further rules becoming effective beginning in 2025 and subsequent years. On June 26, 2025, the U.S. Treasury Department announced an agreement with the G7 that would exclude U.S. parented groups from some taxes imposed by Pillar Two. This agreement allows for the U.S. international tax rules and Pillar Two to operate in parallel. These rules, as well as potential changes due to the agreement, are not expected to materially impact the Company's consolidated financial statements. The Company will continue to monitor U.S. and global legislative action related to Pillar Two for potential impacts.

On July 4, 2025, the United States enacted budget reconciliation bill H.R. 1, referred to as the One Big Beautiful Bill Act ("OBBBA"). The Act includes a broad range of tax reform provisions, including extending and modifying various provisions of the Tax Cuts and Jobs Act and expanding certain incentives in the Inflation Reduction Act while accelerating the phase-out of other incentives. The legislation has multiple effective dates, with certain provisions effective in 2025 and other provisions effective in 2026 and subsequent years. OBBBA provisions include the restoration of the current deductibility for domestic research expenditures beginning in 2025, with transition options for previously capitalized amounts. OBBBA’s changes to the deductibility of domestic research and experimental expenditures decreased our deferred tax asset position and related valuation allowance in the third quarter of 2025, as a change in tax law is accounted for in the period of enactment.

Impact of Foreign Currency

For the three months ended September 30, 2025 compared with the three months ended September 30, 2024, the change in the euro exchange rate increased revenue by $6.2 million, operating profit by $0.5 million and net income by $0.3 million. For the three months ended September 30, 2025 compared with the three months ended September 30, 2024, the change in the Canadian dollar exchange rate decreased revenue by $1.1 million, operating profit by $0.3 million and net income by $0.2 million.

Overview of OPENLANE Results for the Nine Months Ended September 30, 2025 and 2024

Overview

For the nine months ended September 30, 2025, we had revenue of $1,440.2 million compared with revenue of $1,333.5 million for the nine months ended September 30, 2024, an increase of 8%. For a further discussion of our operating results, see the segment results discussions below.

Depreciation and Amortization

Depreciation and amortization decreased $3.8 million, or 5%, to $68.4 million for the nine months ended September 30, 2025, compared with $72.2 million for the nine months ended September 30, 2024. The decrease in depreciation and amortization was primarily the result of assets that have become fully amortized and depreciated.

Interest Expense

Interest expense decreased $9.0 million, or 52%, to $8.2 million for the nine months ended September 30, 2025, compared with $17.2 million for the nine months ended September 30, 2024. The decrease in interest expense was primarily the result of a decrease in the borrowings on lines of credit and the repayment of the senior notes in the second quarter of 2025.

Other Income, Net

For the nine months ended September 30, 2025, we had other income of $14.6 million compared with $2.9 million for the nine months ended September 30, 2024. The increase in other income was primarily attributable to foreign currency gains on intercompany balances of $10.5 million for the nine months ended September 30, 2025, compared with foreign currency gains on intercompany balances of $0.7 million for the nine months ended September 30, 2024. The remaining increase was attributable to a net increase in other miscellaneous income aggregating $1.9 million.

Income Taxes

We had an effective tax rate of 26.4% for the nine months ended September 30, 2025, compared with an effective tax rate of 35.2% for the nine months ended September 30, 2024. The effective tax rate for the nine months ended September 30, 2025 was not significantly impacted by the valuation allowance due to the decrease of the adjusted U.S. net deferred tax asset attributable to application of new tax legislation, the One Big Beautiful Bill Act, offsetting the increase related to all other 2025 current year movement of the adjusted U.S. net deferred tax asset. The effective tax rate for the nine months ended September 30, 2024 was unfavorably impacted by an increase in the valuation allowance related to 2024 current year movement of the adjusted U.S. net deferred tax asset.

We recorded a $34.6 million and $35.8 million valuation allowance against the U.S. net deferred tax asset at September 30, 2025 and December 31, 2024, respectively. The realization of the net deferred tax assets is dependent on our ability to generate sufficient future taxable income to utilize these assets. Depending on our current and anticipated future earnings, we may release a significant portion of our valuation allowance in a future period if there is sufficient positive evidence which would result in a corresponding decrease to income tax expense in such period. The actual timing and amount of the valuation allowance to be released is uncertain.

Additionally, the Organization for Economic Cooperation and Development has published a proposal to establish a new global minimum corporate tax rate of 15%, commonly referred to as Pillar Two. While the U.S. has not adopted the Pillar Two framework into law, numerous countries in which we operate have enacted tax legislation based on the Pillar Two framework with certain components of the minimum tax rules effective beginning in 2024 and further rules becoming effective beginning in 2025 and subsequent years. On June 26, 2025, the U.S. Treasury Department announced an agreement with the G7 that would exclude U.S. parented groups from some taxes imposed by Pillar Two. This agreement allows for the U.S. international tax rules and Pillar Two to operate in parallel. These rules, as well as potential changes due to the agreement, are not expected to materially impact the Company's consolidated financial statements. The Company will continue to monitor U.S. and global legislative action related to Pillar Two for potential impacts.

On July 4, 2025, the United States enacted budget reconciliation bill H.R. 1, referred to as the One Big Beautiful Bill Act ("OBBBA"). The Act includes a broad range of tax reform provisions, including extending and modifying various provisions of the Tax Cuts and Jobs Act and expanding certain incentives in the Inflation Reduction Act while accelerating the phase-out of other incentives. The legislation has multiple effective dates, with certain provisions effective in 2025 and other provisions effective in 2026 and subsequent years. OBBBA provisions include the restoration of the current deductibility for domestic research expenditures beginning in 2025, with transition options for previously capitalized amounts. OBBBA’s changes to the deductibility of domestic research and experimental expenditures decreased our deferred tax asset position and related valuation allowance in the third quarter of 2025, as a change in tax law is accounted for in the period of enactment.

Impact of Foreign Currency

For the nine months ended September 30, 2025 compared with the nine months ended September 30, 2024, the change in the Canadian dollar exchange rate decreased revenue by $8.7 million, operating profit by $2.3 million and net income by $1.1 million. For the nine months ended September 30, 2025 compared with the nine months ended September 30, 2024, the change in the euro exchange rate increased revenue by $8.5 million, operating profit by $0.6 million and net income by $0.4 million.

Marketplace Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

(Dollars in millions, except GMV) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Auction fees |

$ |

136.3 |

|

|

$ |

113.2 |

|

|

$ |

396.4 |

|

|

$ |

331.8 |

|

| Service revenue |

144.2 |

|

|

148.1 |

|

|

426.6 |

|

|

445.4 |

|

| Purchased vehicle sales |

108.9 |

|

|

93.0 |

|

|

293.1 |

|

|

231.4 |

|

| Total Marketplace revenue |

389.4 |

|

|

354.3 |

|

|

1,116.1 |

|

|

1,008.6 |

|

| Cost of services* |

270.0 |

|

|

253.8 |

|

|

767.4 |

|

|

718.4 |

|

| Gross profit |

119.4 |

|

|

100.5 |

|

|

348.7 |

|

|

290.2 |

|

| Provision for credit losses |

1.8 |

|

|

1.7 |

|

|

2.3 |

|

|

5.2 |

|

| Selling, general and administrative |

97.6 |

|

|

86.0 |

|

|

292.2 |

|

|

271.3 |

|

| Depreciation and amortization |

1.8 |

|

|

2.0 |

|

|

5.1 |

|

|

6.3 |

|

| Loss on sale of property |

— |

|

|

— |

|

|

7.0 |

|

|

— |

|

| Operating profit |

$ |

18.2 |

|

|

$ |

10.8 |

|

|

$ |

42.1 |

|

|

$ |

7.4 |

|

|

|

|

|

|

|

|

|

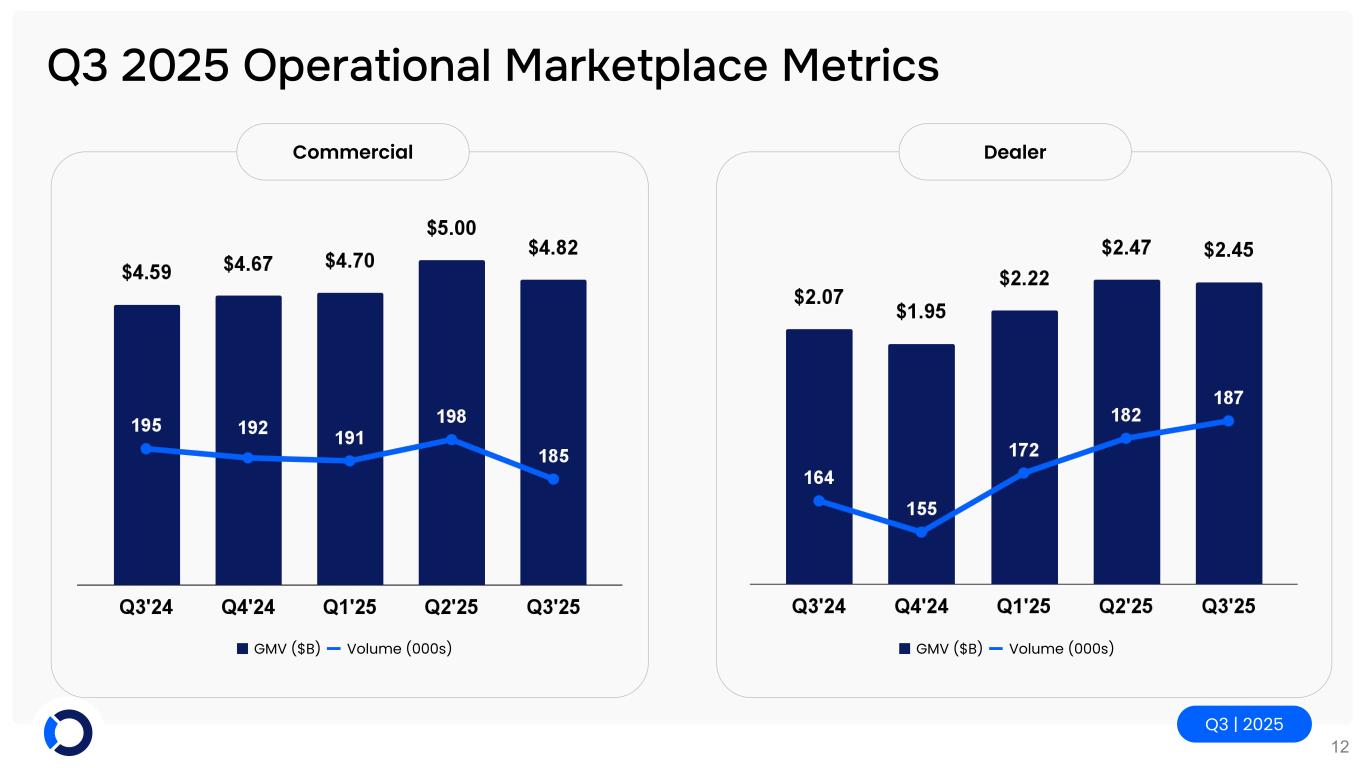

| Commercial vehicles sold |

185,000 |

|

|

195,000 |

|

|

574,000 |

|

|

634,000 |

|

| Dealer consignment vehicles sold |

187,000 |

|

164,000 |

|

|

541,000 |

|

|

465,000 |

|

| Total vehicles sold |

372,000 |

|

359,000 |

|

1,115,000 |

|

1,099,000 |

|

|

|

|

|

|

|

|

Gross merchandise value ("GMV") (in billions) |

$ |

7.3 |

|

|

$ |

6.7 |

|

|

$ |

21.7 |

|

|

$ |

20.5 |

|

* Includes depreciation and amortization

Overview of Marketplace Results for the Three Months Ended September 30, 2025 and 2024

Total Marketplace Revenue

Revenue from the Marketplace segment increased $35.1 million, or 10%, to $389.4 million for the three months ended September 30, 2025, compared with $354.3 million for the three months ended September 30, 2024. The increase in revenue was partially attributable to the 14% increase in the number of dealer consignment vehicles sold. For the three months ended September 30, 2025, there was an increase in auction fees and an increase in purchased vehicle sales, partially offset by a decrease in service revenue (discussed below). The change in revenue included the impact of a net increase in revenue of $5.3 million due to fluctuations in the euro and Canadian dollar exchange rates.

The 4% increase in the number of vehicles sold was comprised of a 14% increase in dealer consignment volumes and a 5% decrease in commercial volumes. The GMV of vehicles sold for the three months ended September 30, 2025 and 2024 was approximately $7.3 billion and $6.7 billion, respectively.

Auction Fees

Auction fees increased $23.1 million, or 20%, to $136.3 million for the three months ended September 30, 2025, compared with $113.2 million for the three months ended September 30, 2024. Auction fees per vehicle sold for the three months ended September 30, 2025 increased $51, or 16%, to $366, compared with $315 for the three months ended September 30, 2024. The increase in auction fees per vehicle sold reflects the mix of vehicles sold in the third quarter of 2025 and the impact of price increases.

Service Revenue

Service revenue decreased $3.9 million, or 3%, to $144.2 million for the three months ended September 30, 2025, compared with $148.1 million for the three months ended September 30, 2024, primarily as a result of a decrease in revenue of $9.8 million as a result of the sale of our automotive key business in 2024, and decreases in inspection revenue of $1.6 million and other miscellaneous service revenues aggregating approximately $0.4 million, partially offset by increases in transportation revenue of $6.2 million and reconditioning revenue of $1.7 million.

Purchased Vehicle Sales

The entire selling and purchase price of the vehicle is recorded as revenue and cost of services for purchased vehicles sold, which represent approximately 2% of total vehicles sold. Purchased vehicle sales increased $15.9 million, or 17%, to $108.9 million for the three months ended September 30, 2025, compared with $93.0 million for the three months ended September 30, 2024, primarily as a result of an increase in the average selling price of purchased vehicles sold in Europe and an increase in the number of purchased vehicles sold in the U.S. marketplace, partially offset by a decrease in the number of purchased vehicles sold in Europe.

Gross Profit

For the three months ended September 30, 2025, gross profit from the Marketplace segment increased $18.9 million, or 19%, to $119.4 million, compared with $100.5 million for the three months ended September 30, 2024. Gross profit improvements were driven by a $12.9 million increase from pricing, a $4.0 million increase resulting from a higher mix of dealer consignment vehicles, a $3.4 million net increase in auction and service volumes and a $0.7 million benefit from lower depreciation and amortization. These improvements were partially offset by a decrease in other miscellaneous items aggregating $2.1 million.

Gross profit from the Marketplace segment was 30.7% of revenue for the three months ended September 30, 2025, compared with 28.4% of revenue for the three months ended September 30, 2024. Gross profit as a percentage of revenue increased for the three months ended September 30, 2025 as compared with the three months ended September 30, 2024, primarily due to increased prices and increased volumes, partially offset by an increase in purchased vehicle sales.

On June 28, 2024, Canada enacted a new 3% Digital Services Tax (“Canadian DST”) on certain online revenues, including online marketplace service revenues, of companies with consolidated revenues of at least €750 million. On June 29, 2025, the Canadian government announced that it plans to rescind the Canadian DST as part of trade negotiations with the United States. The Company continues to record Canadian DST expense until the Canadian DST is officially rescinded by an act of Parliament. The Company recorded $1.4 million of Canadian DST in the third quarter of 2025, compared with $1.2 million in the third quarter of 2024. In total, the Company recorded Canadian DST related to the periods 2022 through 2024 of $10.2 million in 2024. The Company will reverse these expenses in the period the Canadian DST is officially rescinded.

Provision for Credit Losses

Provision for credit losses from the Marketplace segment increased $0.1 million, or 6%, to $1.8 million for the three months ended September 30, 2025, compared with $1.7 million for the three months ended September 30, 2024.

Selling, General and Administrative

Selling, general and administrative expenses from the Marketplace segment increased $11.6 million, or 13%, to $97.6 million for the three months ended September 30, 2025, compared with $86.0 million for the three months ended September 30, 2024, primarily as a result of increases in incentive-based compensation of $5.5 million, sales-related expenses of $2.6 million, compensation expense of $2.0 million, severance of $0.9 million, travel expenses of $0.6 million and other miscellaneous expenses aggregating $0.7 million, partially offset by $0.7 million related to costs incurred by the Company's automotive key business prior to its sale in the fourth quarter of 2024.

Overview of Marketplace Results for the Nine Months Ended September 30, 2025 and 2024

Total Marketplace Revenue

Revenue from the Marketplace segment increased $107.5 million, or 11%, to $1,116.1 million for the nine months ended September 30, 2025, compared with $1,008.6 million for the nine months ended September 30, 2024. The increase in revenue was partially attributable to the 16% increase in the number of dealer consignment vehicles sold. For the nine months ended September 30, 2025, there was an increase in auction fees and an increase in purchased vehicle sales, partially offset by a decrease in service revenue (discussed below). The change in revenue included the impact of a net increase in revenue of $1.6 million due to fluctuations in the euro and Canadian dollar exchange rates.

The 1% increase in the number of vehicles sold was comprised of a 16% increase in dealer consignment volumes and a 9% decrease in commercial volumes. The GMV of vehicles sold for the nine months ended September 30, 2025 and 2024 was approximately $21.7 billion and $20.5 billion, respectively.

Auction Fees

Auction fees increased $64.6 million, or 19%, to $396.4 million for the nine months ended September 30, 2025, compared with $331.8 million for the nine months ended September 30, 2024. Auction fees per vehicle sold for the nine months ended September 30, 2025 increased $54, or 18%, to $356, compared with $302 for the nine months ended September 30, 2024. The increase in auction fees per vehicle sold reflects the mix of vehicles sold in the first nine months of 2025 and the impact of price increases.

Service Revenue

Service revenue decreased $18.8 million, or 4%, to $426.6 million for the nine months ended September 30, 2025, compared with $445.4 million for the nine months ended September 30, 2024, primarily as a result of a decrease in revenue of $29.7 million as a result of the sale of our automotive key business in 2024, and decreases in repossession revenue of $7.1 million, inspection revenue of $4.3 million and other miscellaneous service revenues aggregating approximately $1.7 million, partially offset by increases in transportation revenue of $21.3 million and reconditioning revenue of $2.7 million.

Purchased Vehicle Sales

The entire selling and purchase price of the vehicle is recorded as revenue and cost of services for purchased vehicles sold, which represent approximately 2% of total vehicles sold. Purchased vehicle sales increased $61.7 million, or 27%, to $293.1 million for the nine months ended September 30, 2025, compared with $231.4 million for the nine months ended September 30, 2024, primarily as a result of an increase in the number of purchased vehicles sold in the U.S. marketplace and in Europe and an increase in the average selling price of purchased vehicles sold in Europe, partially offset by a decrease in the average selling price of purchase vehicles sold in the U.S. marketplace.

Gross Profit

For the nine months ended September 30, 2025, gross profit from the Marketplace segment increased $58.5 million, or 20%, to $348.7 million, compared with $290.2 million for the nine months ended September 30, 2024. Gross profit improvements were driven by a $30.8 million increase from pricing, a $19.6 million increase resulting from a higher mix of dealer consignment vehicles, an $8.9 million benefit from lower Canadian DST, a $2.8 million benefit from lower depreciation and amortization and a $2.6 million net increase in auction and service volumes. These improvements were partially offset by a decrease in other miscellaneous items aggregating $6.2 million.

Gross profit from the Marketplace segment was 31.2% of revenue for the nine months ended September 30, 2025, compared with 28.8% of revenue for the nine months ended September 30, 2024. Gross profit as a percentage of revenue increased for the nine months ended September 30, 2025 as compared with the nine months ended September 30, 2024, primarily due to the benefit of lower Canadian DST and increased prices, partially offset by an increase in purchased vehicle sales.

On June 28, 2024, Canada enacted a new 3% Digital Services Tax (“Canadian DST”) on certain online revenues, including online marketplace service revenues, of companies with consolidated revenues of at least €750 million. On June 29, 2025, the Canadian government announced that it plans to rescind the Canadian DST as part of trade negotiations with the United States. The Company continues to record Canadian DST expense until the Canadian DST is officially rescinded by an act of Parliament.

The Company recorded $4.3 million of Canadian DST in the first nine months of 2025, compared with $13.2 million in the first nine months of 2024 (of which $10 million related to prior years). In total, the Company recorded Canadian DST related to the periods 2022 through 2024 of $10.2 million in 2024 (estimates were revised in the fourth quarter of 2024). The Company will reverse these expenses in the period the Canadian DST is officially rescinded.

Provision for Credit Losses

Provision for credit losses from the Marketplace segment decreased $2.9 million, or 56%, to $2.3 million for the nine months ended September 30, 2025, compared with $5.2 million for the nine months ended September 30, 2024, primarily as a result of initiatives implemented to reduce risk in the marketplace and initiatives to decrease bad debt expense.

Selling, General and Administrative

Selling, general and administrative expenses from the Marketplace segment increased $20.9 million, or 8%, to $292.2 million for the nine months ended September 30, 2025, compared with $271.3 million for the nine months ended September 30, 2024, primarily as a result of increases in incentive-based compensation of $17.7 million, sales-related expenses of $6.2 million, compensation expense of $4.4 million, marketing costs of $2.0 million, travel expenses of $1.2 million and other miscellaneous expenses aggregating $1.5 million, partially offset by decreases in stock-based compensation of $3.6 million, $2.6 million related to costs incurred by the Company's automotive key business prior to its sale in the fourth quarter of 2024, information technology costs of $2.5 million, fluctuations in the Canadian exchange rate of $2.0 million and severance of $1.4 million.

Loss on Sale of Property

In April 2025, the Company closed on the sale of excess property in Montreal that was originally purchased as part of the December 2023 Manheim Canada acquisition. This transaction resulted in a loss on sale of approximately $7.0 million in the second quarter of 2025.

Finance Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the

Three Months Ended September 30, |

|

As of and for the

Nine Months Ended September 30, |

| (Dollars in millions) |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Finance revenue |

|

|

|

|

|

|

|

| Interest revenue |

$ |

57.9 |

|

$ |

56.1 |

|

$ |

170.3 |

|

$ |

176.6 |

| Fee and other revenue |

51.1 |

|

49.4 |

|

153.8 |

|

148.3 |

| Total Finance revenue |

109.0 |

|

105.5 |

|

324.1 |

|

324.9 |

| Finance interest expense |

28.1 |

|

30.7 |

|

82.6 |

|

95.2 |

| Net Finance margin |

80.9 |

|

74.8 |

|

241.5 |

|

229.7 |

| Finance provision for credit losses |

9.7 |

|

11.4 |

|

27.2 |

|

37.0 |

| Cost of services (exclusive of depreciation and amortization) |

18.1 |

|

16.8 |

|

53.0 |

|

50.4 |

| Selling, general and administrative |

13.3 |

|

11.7 |

|

40.2 |

|

37.6 |

| Depreciation and amortization |

3.0 |

|

3.2 |

|

9.1 |

|

8.9 |

| Operating profit |

$ |

36.8 |

|

$ |

31.7 |

|

$ |

112.0 |

|

$ |

95.8 |

| Portfolio Performance Information |

|

|

|

|

|

|

|

| Floorplans originated |

265,000 |

|

250,000 |

|

793,000 |

|

776,000 |

| Floorplans curtailed* |

160,000 |

|

153,000 |

|

475,000 |

|

464,000 |

| Total loan transaction units |

425,000 |

|

403,000 |

|

1,268,000 |

|

1,240,000 |

| Total receivables managed |

$ |

2,489.3 |

|

$ |

2,184.5 |

|

$ |

2,489.3 |

|

$ |

2,184.5 |

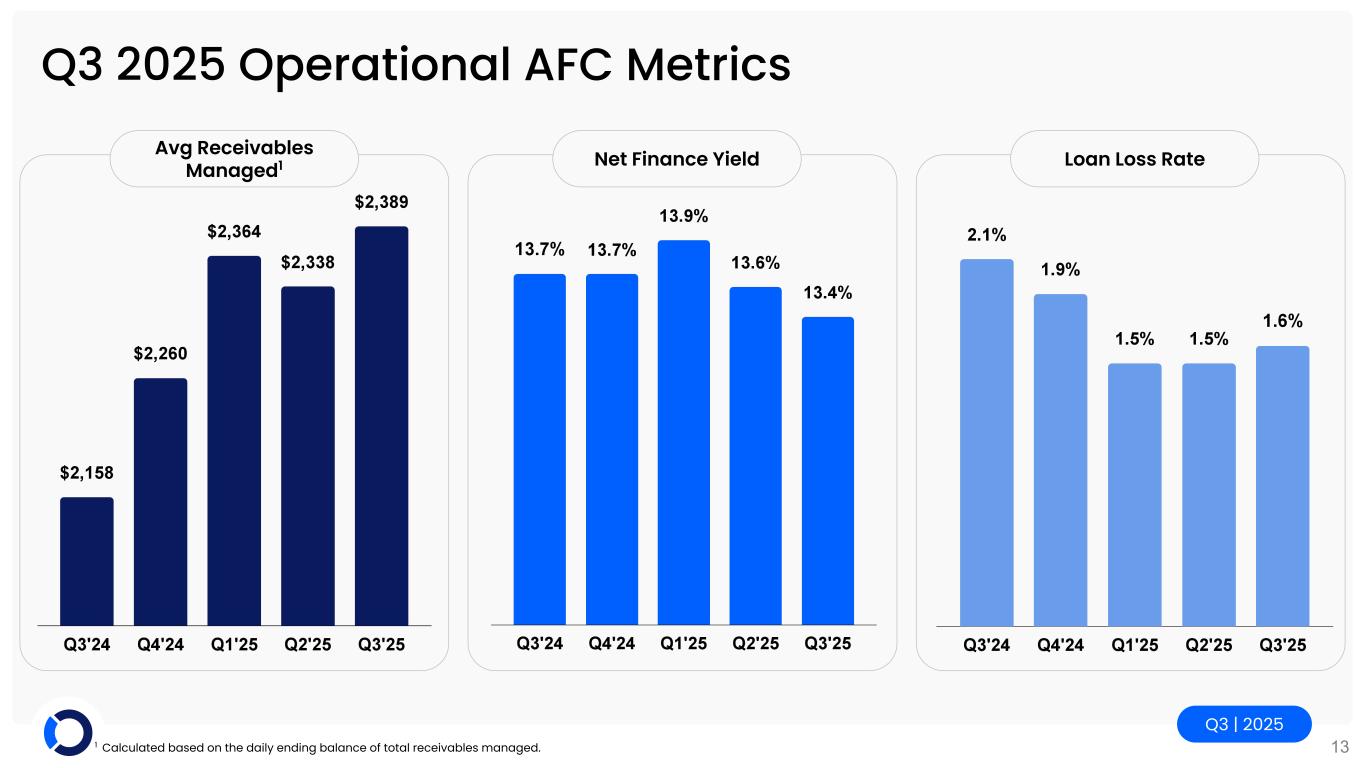

| Average receivables managed** |

$ |

2,389.2 |

|

$ |

2,157.6 |

|

$ |

2,363.9 |

|

$ |

2,232.5 |

| Allowance for credit losses |

$ |

23.0 |

|

$ |

19.0 |

|

$ |

23.0 |

|

$ |

19.0 |

| Allowance for credit losses as a percentage of total receivables managed |

0.9 |

% |

|

0.9 |

% |

|

0.9 |

% |

|

0.9 |

% |

| Annualized finance provision for credit losses as a percentage of average receivables managed |

1.6 |

% |

|

2.1 |

% |

|

1.5 |

% |

|

2.2 |

% |

| Receivables delinquent as a percentage of total receivables managed |

0.3 |

% |

|

0.9 |

% |

|

0.3 |

% |

|

0.9 |

% |

* Floorplans curtailed represent existing loans that customers opt to extend beyond the initial term upon the customer making a partial principal payment and payment of accrued interest and fees.

** Average receivables managed is calculated based on the daily ending balance of total receivables managed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Yields (Annualized) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| % of Average Receivables Managed |

2025 |

|

2024 |

|

2025 |

|

2024 |

| Finance revenue yield |

|

|

|

|

|

|

|

| Interest revenue |

9.6 |

% |

|

10.3 |

% |

|

9.6 |

% |

|

10.5 |

% |

| Fee and other revenue |

8.5 |

% |

|

9.1 |

% |

|

8.7 |

% |

|

8.9 |

% |

| Total Finance revenue yield |

18.1 |

% |

|

19.4 |

% |

|

18.3 |

% |

|

19.4 |

% |

| Finance interest expense |

4.7 |

% |

|

5.7 |

% |

|

4.6 |

% |

|

5.7 |

% |

| Net finance margin |

13.4 |

% |

|

13.7 |

% |

|

13.7 |

% |

|

13.7 |

% |

Overview of Finance Results for the Three Months Ended September 30, 2025 and 2024

Revenue

For the three months ended September 30, 2025, the Finance segment revenue increased $3.5 million, or 3%, to $109.0 million, compared with $105.5 million for the three months ended September 30, 2024. The increase in revenue was primarily the result of a 5% increase in loan transaction units (vehicle finance transactions) and an increase in loan values, partially offset by decreases in interest yields driven by a decrease in prime rates.

Finance Interest Expense

For the three months ended September 30, 2025, finance interest expense decreased $2.6 million, or 8%, to $28.1 million, compared with $30.7 million for the three months ended September 30, 2024. The decrease in finance interest expense was attributable to an approximately 1.5% decrease in the average interest rate on the securitization obligations, partially offset by an increase in the average balance on the AFC securitization obligations.

Net Finance Margin (Annualized)

For the three months ended September 30, 2025 and 2024, the net Finance margin percent was approximately 13.4% and 13.7%, respectively. The net interest yield was approximately 4.9% and 4.6% for the three months ended September 30, 2025 and 2024, respectively. The decrease in the net Finance margin percent was primarily attributable to a decrease in fee and other fee yield driven by increasing loan values, partially offset by higher net interest yields.

Finance Provision for Credit Losses

For the three months ended September 30, 2025, the finance provision for credit losses decreased $1.7 million, or 15%, to $9.7 million, compared with $11.4 million for the three months ended September 30, 2024. The provision for credit losses decreased to 1.6% of the average receivables managed for the three months ended September 30, 2025 from 2.1% for the three months ended September 30, 2024. The provision for credit losses is expected to be approximately 2% or under, on a long-term basis, of the average receivables managed balance. However, the actual losses in any particular quarter or year could deviate from this range.

Cost of Services

For the three months ended September 30, 2025, cost of services for the Finance segment increased $1.3 million, or 8%, to $18.1 million, compared with $16.8 million for the three months ended September 30, 2024. The increase in cost of services was primarily the result of increases in compensation expense of $0.9 million and incentive-based compensation of $0.8 million, partially offset by a decrease in inventory audit expense of $0.4 million.

Selling, General and Administrative

Selling, general and administrative expenses for the Finance segment increased $1.6 million, or 14%, to $13.3 million for the three months ended September 30, 2025, compared with $11.7 million for the three months ended September 30, 2024 primarily as a result of increases in incentive-based compensation of $1.1 million, postage expense of $0.2 million and other miscellaneous expenses aggregating $0.3 million.

Overview of Finance Results for the Nine Months Ended September 30, 2025 and 2024

Revenue

For the nine months ended September 30, 2025, the Finance segment revenue decreased $0.8 million, or less than 1%, to $324.1 million, compared with $324.9 million for the nine months ended September 30, 2024. The decrease in revenue was primarily the result of decreases in interest yields driven by a decrease in prime rates, partially offset by an increase in loan values and a 2% increase in loan transaction units (vehicle finance transactions).

Finance Interest Expense

For the nine months ended September 30, 2025, finance interest expense decreased $12.6 million, or 13%, to $82.6 million, compared with $95.2 million for the nine months ended September 30, 2024. The decrease in finance interest expense was attributable to an approximately 1.6% decrease in the average interest rate on the securitization obligations, partially offset by an increase in the average balance on the AFC securitization obligations.

Net Finance Margin (Annualized)

For the nine months ended September 30, 2025 and 2024, the net Finance margin percent was approximately 13.7%. The net interest yield was approximately 5.0% and 4.8% for the nine months ended September 30, 2025 and 2024, respectively.

Finance Provision for Credit Losses

For the nine months ended September 30, 2025, the finance provision for credit losses decreased $9.8 million, or 26%, to $27.2 million, compared with $37.0 million for the nine months ended September 30, 2024. The provision for credit losses decreased to 1.5% of the average receivables managed for the nine months ended September 30, 2025 from 2.2% for the nine months ended September 30, 2024. The provision for credit losses is expected to be approximately 2% or under, on a long-term basis, of the average receivables managed balance. However, the actual losses in any particular quarter or year could deviate from this range.

Cost of Services

For the nine months ended September 30, 2025, cost of services for the Finance segment increased $2.6 million, or 5%, to $53.0 million, compared with $50.4 million for the nine months ended September 30, 2024. The increase in cost of services was primarily the result of increases in incentive-based compensation of $1.6 million and compensation expense of $1.4 million, partially offset by decreases in credit checks and filing fees of $0.3 million and other miscellaneous expenses aggregating $0.1 million.

Selling, General and Administrative

Selling, general and administrative expenses for the Finance segment increased $2.6 million, or 7%, to $40.2 million for the nine months ended September 30, 2025, compared with $37.6 million for the nine months ended September 30, 2024 primarily as a result of increases in incentive-based compensation of $2.6 million, postage expense of $0.6 million and other miscellaneous expenses aggregating $0.2 million, partially offset by a decrease in severance of $0.8 million.

Select Finance Balance Sheet Items

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

| (Dollars in millions) |

2025 |

|

2024 |

| Tangible Assets |

|

|

|

| Total assets |

$ |

2,831.7 |

|

|

$ |

2,677.7 |

|

| Intangible assets |

258.7 |

|

|

260.1 |

|

| Tangible assets |

$ |

2,573.0 |

|

|

$ |

2,417.6 |

|

|

|

|

|

| Tangible parent equity |

|

|

|

| Total parent equity*** |

$ |

775.4 |

|

|

$ |

789.0 |

|

| Intangible assets |

258.7 |

|

|

260.1 |

|

| Tangible parent equity*** |

$ |

516.7 |

|

|

$ |

528.9 |

|

*** Parent equity represents OPENLANE's net investment in AFC. Tangible parent equity is a non-GAAP measure of AFC's capital.

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2025, our sources of liquidity consisted of cash on hand, working capital and amounts available under our Revolving Credit Facilities. Our principal ongoing sources of liquidity consist of cash generated by operations and borrowings under our Revolving Credit Facilities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

September 30, |

| (Dollars in millions) |

2025 |

|

2024 |

|

2024 |

| Cash and cash equivalents |

$ |

119.3 |

|

|

$ |

143.0 |

|

|

$ |

132.1 |

|

| Working capital |

428.5 |

|

286.0 |

|

199.5 |

| Amounts available under the Revolving Credit Facilities |

408.1 |

|

397.9 |

|

349.3 |

| Cash provided by operating activities for the nine months ended |

266.4 |

|

|

|

260.1 |

We regularly evaluate alternatives for our capital structure and liquidity given our expected cash flows, growth and operating capital requirements as well as capital market conditions.

Summary of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

| (Dollars in millions) |

2025 |

|

2024 |

| Net cash provided by (used by): |

|

|

|

| Operating activities - continuing operations |

$ |

266.4 |

|

|

$ |

260.1 |

|

| Operating activities - discontinued operations |

— |

|

|

(1.4) |

|

| Investing activities - continuing operations |

(195.5) |

|

|

10.4 |

|

| Investing activities - discontinued operations |

— |

|

|

— |

|

| Financing activities - continuing operations |

(119.9) |

|

|

(264.3) |

|

| Financing activities - discontinued operations |

— |

|

|

— |

|

| Net change in cash balances of discontinued operations |

— |

|

|

— |

|

| Effect of exchange rate on cash |

11.7 |

|

|

(3.1) |

|

| Net (decrease) increase in cash, cash equivalents and restricted cash |

$ |

(37.3) |

|

|

$ |

1.7 |

|

Cash flow from operating activities (continuing operations) Net cash provided by operating activities (continuing operations) was $266.4 million for the nine months ended September 30, 2025, compared with $260.1 million for the nine months ended September 30, 2024. Cash provided by continuing operations for the nine months ended September 30, 2025 consisted primarily of cash earnings and an increase in accounts payable and accrued expenses, partially offset by an increase in trade receivables and other assets. Cash provided by continuing operations for the nine months ended September 30, 2024 consisted primarily of cash earnings and an increase in accounts payable and accrued expenses, partially offset by an increase in trade receivables and other assets. The increase in operating cash flow was primarily attributable to increased profitability, partially offset by changes in operating assets and liabilities as a result of the timing of collections and the disbursement of funds to consignors for marketplace sales held near period-ends.

Changes in AFC’s accounts payable balance are presented in cash flows from operating activities, while changes in AFC’s finance receivables are presented in cash flows from investing activities and changes in AFC's obligations collateralized by finance receivables are presented in cash flows from financing activities. Variations in these balances can lead to significant fluctuations across operating, investing and financing cash flows. Growth and contraction in AFC’s finance receivables portfolio can result in significant swings in cash flows in a given period as approximately 70% to 75% of AFC’s finance receivables portfolio is funded through its securitization facilities with the remainder funded through other sources of liquidity including cash on hand and working capital.

Cash flow from investing activities (continuing operations) Net cash used by investing activities (continuing operations) was $195.5 million for the nine months ended September 30, 2025, compared with net cash provided by investing activities of $10.4 million for the nine months ended September 30, 2024. The cash used by investing activities for the nine months ended September 30, 2025 was primarily from an increase in finance receivables held for investment and purchases of property and equipment, partially offset by proceeds from the sale of property. The cash provided by investing activities for the nine months ended September 30, 2024 was primarily from a decrease in finance receivables held for investment, partially offset by purchases of property and equipment.

Cash flow from financing activities (continuing operations) Net cash used by financing activities (continuing operations) was $119.9 million for the nine months ended September 30, 2025, compared with $264.3 million for the nine months ended September 30, 2024. The cash used by financing activities for the nine months ended September 30, 2025 was primarily due to payments on long-term debt, repurchases and retirement of common stock and dividends paid on the Series A Preferred Stock, partially offset by a net increase in obligations collateralized by finance receivables and a net increase in book overdrafts. The cash used by financing activities for the nine months ended September 30, 2024 was primarily due to a net decrease in obligations collateralized by finance receivables, repayments on lines of credit, dividends paid on the Series A Preferred Stock, repurchases and retirement of common stock and payments for debt issuance costs.

Cash flow from operating activities (discontinued operations) There were no operating activities (discontinued operations) for the nine months ended September 30, 2025, compared with net cash used by operating activities of $1.4 million for the nine months ended September 30, 2024. The cash used by operating activities for the nine months ended September 30, 2024 was primarily attributable to the payment of an accrued obligation.

Cash flow from investing activities (discontinued operations) There were no investing activities (discontinued operations) for the nine months ended September 30, 2025 and 2024.

Cash flow from financing activities (discontinued operations) There were no financing activities (discontinued operations) for the nine months ended September 30, 2025 and 2024.