Delaware |

001-34568 |

20-8744739 |

||||||||||||

|

(State or other jurisdiction

of incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

||||||||||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.01 per share | KAR | New York Stock Exchange | ||||||||||||

| Dated: May 7, 2025 | OPENLANE, Inc. | ||||

| /s/ CHARLES S. COLEMAN | |||||

|

Charles S. Coleman

Executive Vice President, Chief Legal Officer and Secretary

|

|||||

| EARNINGS RELEASE | ||

|

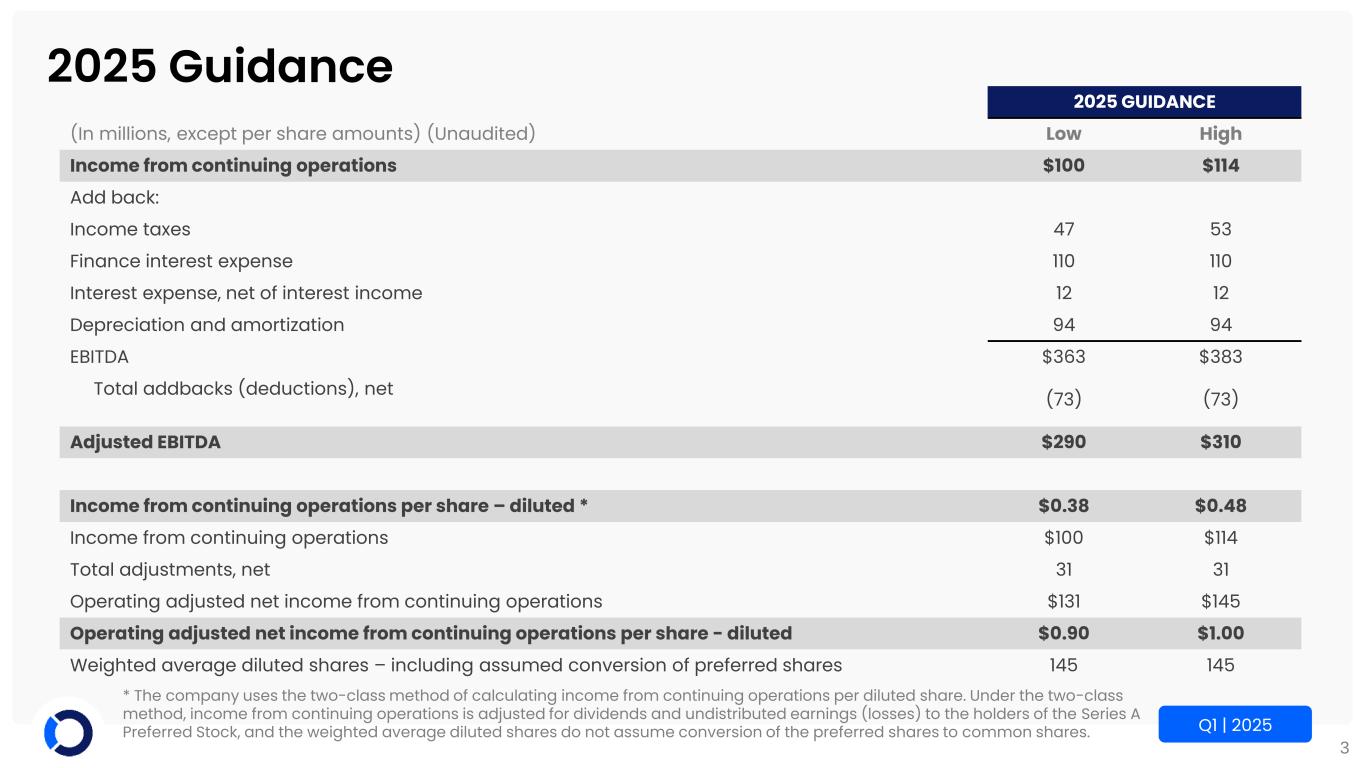

Annual

Guidance

|

|||||

Income from continuing operations (in millions) |

$100 - $114 | ||||

Adjusted EBITDA (in millions) |

$290 - $310 | ||||

| Income from continuing operations per share - diluted * | $0.38 - $0.48 | ||||

| Operating adjusted net income from continuing operations per share - diluted | $0.90 - $1.00 | ||||

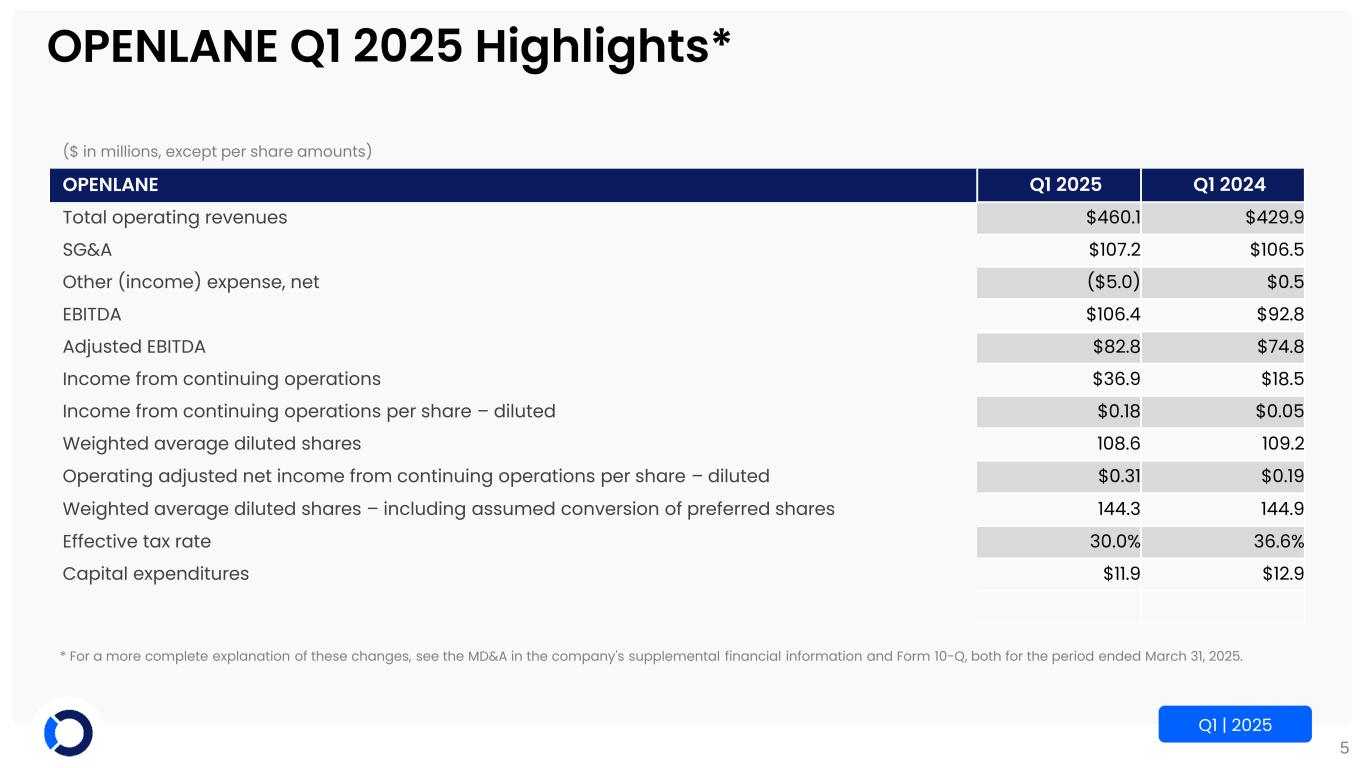

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Operating revenues | |||||||||||

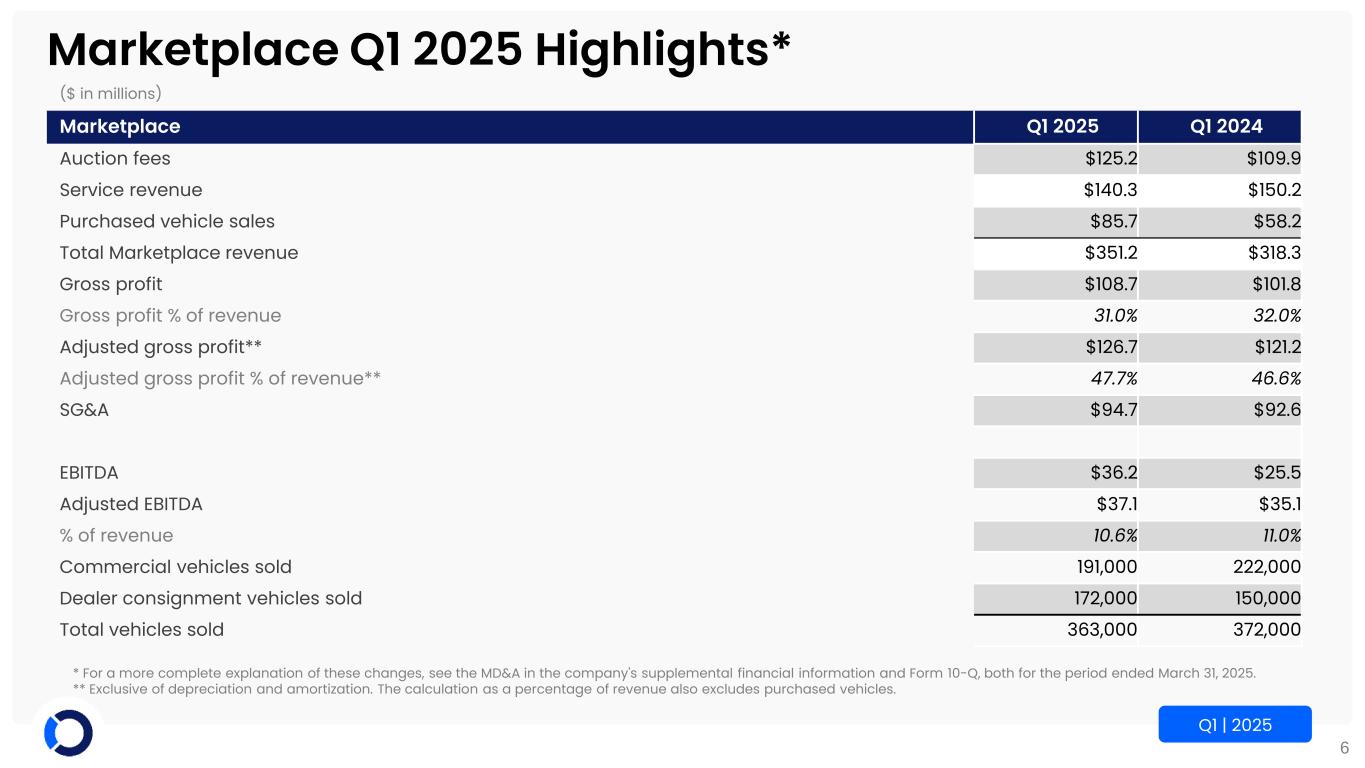

| Auction fees | $ | 125.2 | $ | 109.9 | |||||||

| Service revenue | 140.3 | 150.2 | |||||||||

| Purchased vehicle sales | 85.7 | 58.2 | |||||||||

| Finance revenue | 108.9 | 111.6 | |||||||||

| Total operating revenues | 460.1 | 429.9 | |||||||||

| Operating expenses | |||||||||||

| Cost of services (exclusive of depreciation and amortization) | 241.6 | 213.9 | |||||||||

| Finance interest expense | 27.6 | 32.6 | |||||||||

| Provision for credit losses | 9.3 | 15.8 | |||||||||

| Selling, general and administrative | 107.2 | 106.5 | |||||||||

| Depreciation and amortization | 22.7 | 24.3 | |||||||||

| Total operating expenses | 408.4 | 393.1 | |||||||||

| Operating profit | 51.7 | 36.8 | |||||||||

| Interest expense | 4.0 | 7.1 | |||||||||

| Other (income) expense, net | (5.0) | 0.5 | |||||||||

| Income from continuing operations before income taxes | 52.7 | 29.2 | |||||||||

| Income taxes | 15.8 | 10.7 | |||||||||

| Income from continuing operations | 36.9 | 18.5 | |||||||||

| Income from discontinued operations, net of income taxes | — | — | |||||||||

| Net income | $ | 36.9 | $ | 18.5 | |||||||

| Net income per share - basic | |||||||||||

| Income from continuing operations | $ | 0.18 | $ | 0.05 | |||||||

| Income from discontinued operations | — | — | |||||||||

| Net income per share - basic | $ | 0.18 | $ | 0.05 | |||||||

| Net income per share - diluted | |||||||||||

| Income from continuing operations | $ | 0.18 | $ | 0.05 | |||||||

| Income from discontinued operations | — | — | |||||||||

| Net income per share - diluted | $ | 0.18 | $ | 0.05 | |||||||

| March 31, 2025 |

December 31, 2024 |

||||||||||

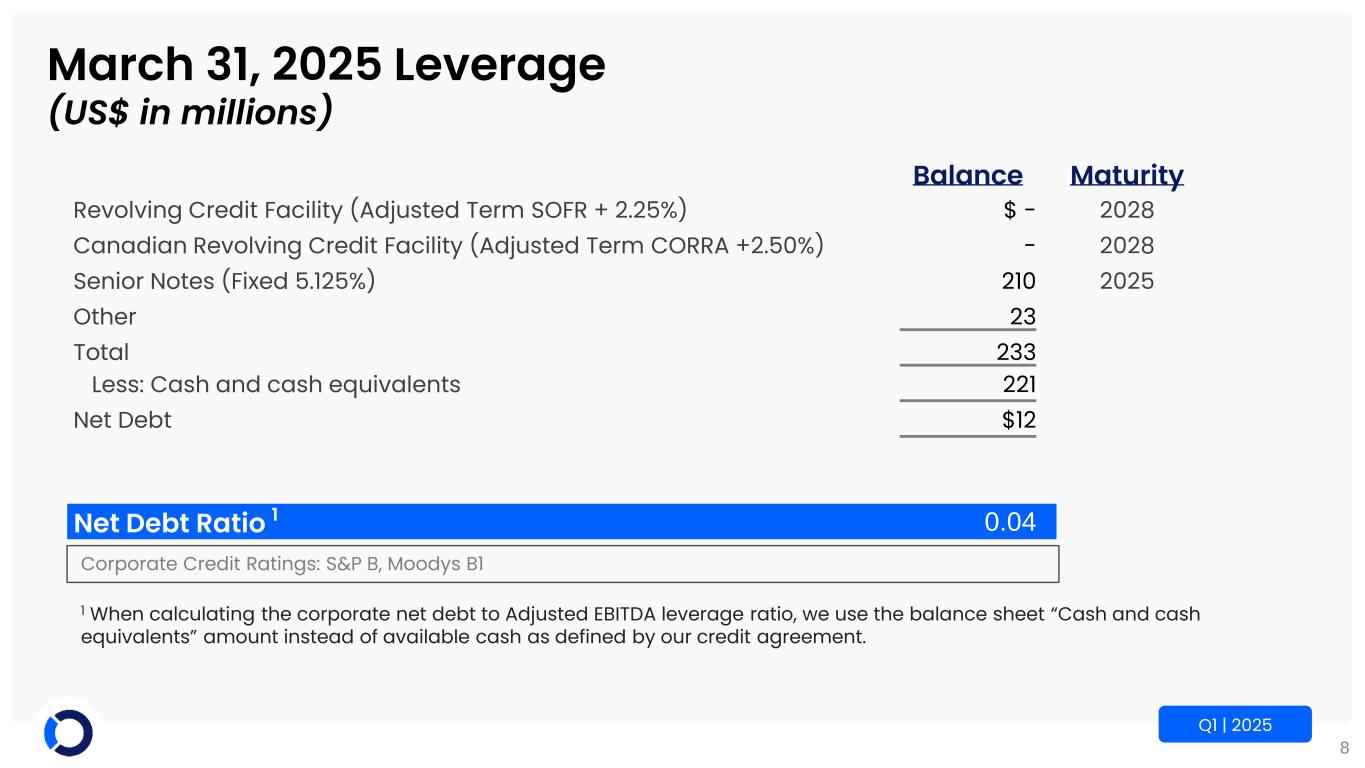

| Cash and cash equivalents | $ | 220.5 | $ | 143.0 | |||||||

| Restricted cash | 36.0 | 40.7 | |||||||||

| Trade receivables, net of allowances | 345.4 | 248.2 | |||||||||

| Finance receivables, net of allowances | 2,333.2 | 2,322.7 | |||||||||

| Other current assets | 110.5 | 96.9 | |||||||||

| Total current assets | 3,045.6 | 2,851.5 | |||||||||

| Goodwill | 1,228.0 | 1,222.9 | |||||||||

| Customer relationships, net of accumulated amortization | 113.8 | 117.7 | |||||||||

| Operating lease right-of-use assets | 64.9 | 67.1 | |||||||||

| Property and equipment, net of accumulated depreciation | 146.8 | 149.3 | |||||||||

| Intangible and other assets | 207.3 | 213.8 | |||||||||

| Total assets | $ | 4,806.4 | $ | 4,622.3 | |||||||

| Current liabilities, excluding obligations collateralized by finance receivables and current maturities of debt |

$ | 835.4 | $ | 682.7 | |||||||

| Obligations collateralized by finance receivables | 1,659.5 | 1,660.3 | |||||||||

| Current maturities of debt | 225.8 | 222.5 | |||||||||

| Total current liabilities | 2,720.7 | 2,565.5 | |||||||||

| Long-term debt | — | — | |||||||||

| Operating lease liabilities | 58.2 | 60.4 | |||||||||

| Other non-current liabilities | 42.6 | 41.2 | |||||||||

| Temporary equity | 612.5 | 612.5 | |||||||||

| Stockholders’ equity | 1,372.4 | 1,342.7 | |||||||||

| Total liabilities, temporary equity and stockholders’ equity | $ | 4,806.4 | $ | 4,622.3 | |||||||

|

Three Months Ended

March 31,

|

|||||||||||

| 2025 | 2024 | ||||||||||

| Operating activities | |||||||||||

| Net income | $ | 36.9 | $ | 18.5 | |||||||

| Net income from discontinued operations | — | — | |||||||||

Adjustments to reconcile net income to net cash provided by operating activities: |

|||||||||||

| Depreciation and amortization | 22.7 | 24.3 | |||||||||

| Provision for credit losses | 9.3 | 15.8 | |||||||||

| Deferred income taxes | 2.4 | (1.5) | |||||||||

| Amortization of debt issuance costs | 2.2 | 2.2 | |||||||||

| Stock-based compensation | 1.7 | 6.6 | |||||||||

| Other non-cash, net | 0.2 | 0.1 | |||||||||

Changes in operating assets and liabilities, net of acquisitions: |

|||||||||||

| Trade receivables and other assets | (109.3) | (113.6) | |||||||||

| Accounts payable and accrued expenses | 156.5 | 147.8 | |||||||||

| Net cash provided by operating activities - continuing operations | 122.6 | 100.2 | |||||||||

| Net cash used by operating activities - discontinued operations | — | — | |||||||||

| Investing activities | |||||||||||

| Net increase in finance receivables held for investment | (19.8) | (26.4) | |||||||||

| Purchases of property, equipment and computer software | (11.9) | (12.9) | |||||||||

| Investments in securities | (0.6) | (0.4) | |||||||||

| Proceeds from the sale of property and equipment | 0.4 | — | |||||||||

| Net cash used by investing activities - continuing operations | (31.9) | (39.7) | |||||||||

| Net cash provided by investing activities - discontinued operations | — | — | |||||||||

| Financing activities | |||||||||||

| Net (decrease) increase in book overdrafts | (5.0) | 17.0 | |||||||||

| Net borrowings from (repayments of) lines of credit | 1.7 | (33.2) | |||||||||

| Net decrease in obligations collateralized by finance receivables | (2.2) | (32.8) | |||||||||

| Payments for debt issuance costs/amendments | (0.1) | (1.9) | |||||||||

| Payments on finance leases | — | (0.3) | |||||||||

| Issuance of common stock under stock plans | 2.1 | 0.4 | |||||||||

| Tax withholding payments for vested RSUs | (4.2) | (1.7) | |||||||||

| Repurchase and retirement of common stock | (0.1) | — | |||||||||

| Dividends paid on Series A Preferred Stock | (11.1) | (11.1) | |||||||||

| Net cash used by financing activities - continuing operations | (18.9) | (63.6) | |||||||||

| Net cash provided by financing activities - discontinued operations | — | — | |||||||||

| Net change in cash balances of discontinued operations | — | — | |||||||||

| Effect of exchange rate changes on cash | 1.0 | (4.9) | |||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 72.8 | (8.0) | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 183.7 | 158.9 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 256.5 | $ | 150.9 | |||||||

| Cash paid for interest | $ | 26.1 | $ | 36.2 | |||||||

| Cash paid for taxes, net of refunds - continuing operations | $ | 18.1 | $ | 15.4 | |||||||

| Cash paid for taxes, net of refunds - discontinued operations | $ | (1.5) | $ | 0.2 | |||||||

| Three Months Ended March 31, |

|||||||||||

(In millions), (Unaudited) |

2025 | 2024 | |||||||||

| Income from continuing operations | $ | 36.9 | $ | 18.5 | |||||||

| Add back: | |||||||||||

| Income taxes | 15.8 | 10.7 | |||||||||

| Finance interest expense | 27.6 | 32.6 | |||||||||

| Interest expense, net of interest income | 3.4 | 6.7 | |||||||||

| Depreciation and amortization | 22.7 | 24.3 | |||||||||

| EBITDA | 106.4 | 92.8 | |||||||||

| Non-cash stock-based compensation | 2.0 | 7.0 | |||||||||

| Acquisition related costs | — | 0.3 | |||||||||

| Securitization interest | (25.1) | (29.9) | |||||||||

| Severance | 2.0 | 1.7 | |||||||||

| Foreign currency (gains)/losses | (3.3) | 2.0 | |||||||||

| Professional fees related to business improvement efforts | — | 0.8 | |||||||||

| Other | 0.8 | 0.1 | |||||||||

| Total addbacks (deductions) | (23.6) | (18.0) | |||||||||

| Adjusted EBITDA | $ | 82.8 | $ | 74.8 | |||||||

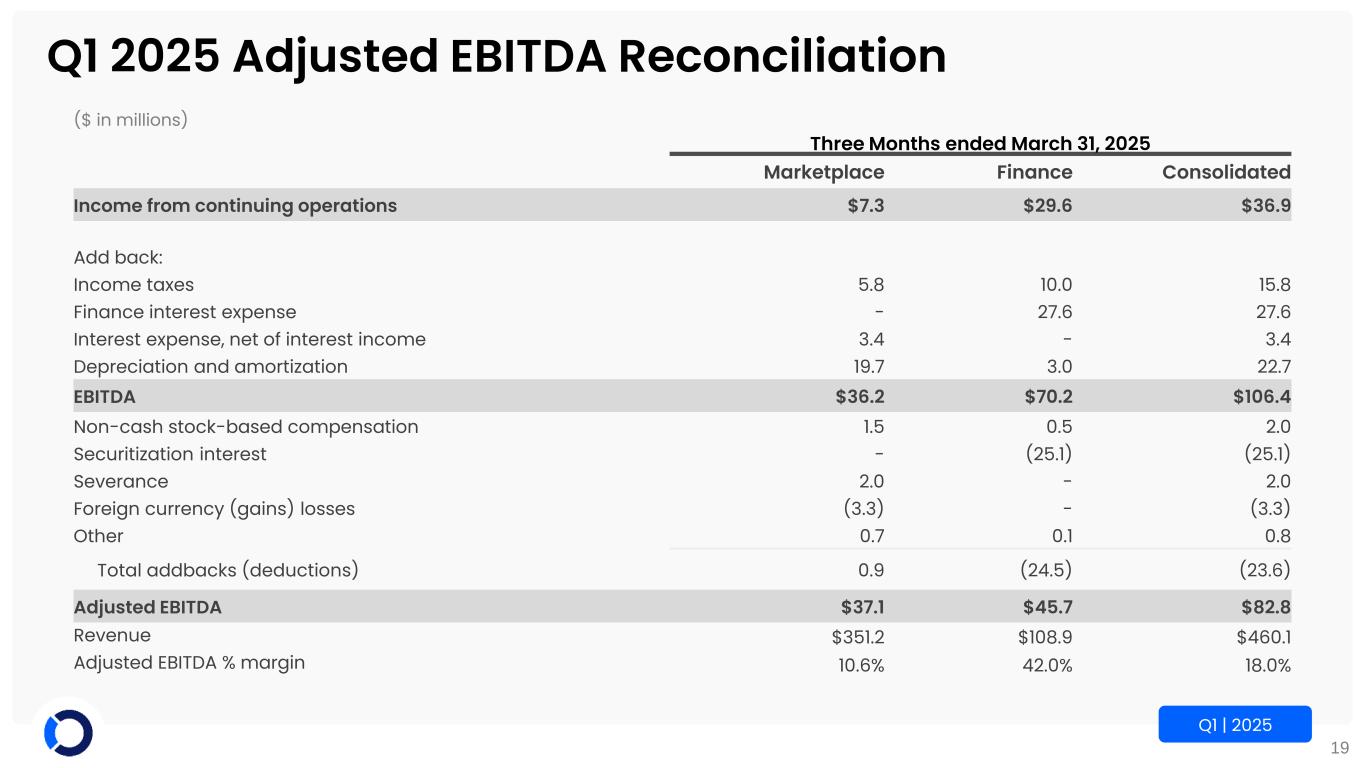

| Three Months Ended March 31, 2025 | |||||||||||||||||

(Dollars in millions), (Unaudited) |

Marketplace | Finance | Consolidated | ||||||||||||||

Income from continuing operations |

$ | 7.3 | $ | 29.6 | $ | 36.9 | |||||||||||

| Add back: | |||||||||||||||||

| Income taxes | 5.8 | 10.0 | 15.8 | ||||||||||||||

| Finance interest expense | — | 27.6 | 27.6 | ||||||||||||||

| Interest expense, net of interest income | 3.4 | — | 3.4 | ||||||||||||||

| Depreciation and amortization | 19.7 | 3.0 | 22.7 | ||||||||||||||

| EBITDA | 36.2 | 70.2 | 106.4 | ||||||||||||||

| Non-cash stock-based compensation | 1.5 | 0.5 | 2.0 | ||||||||||||||

| Securitization interest | — | (25.1) | (25.1) | ||||||||||||||

| Severance | 2.0 | — | 2.0 | ||||||||||||||

| Foreign currency (gains) losses | (3.3) | — | (3.3) | ||||||||||||||

Other |

0.7 | 0.1 | 0.8 | ||||||||||||||

| Total addbacks (deductions) | 0.9 | (24.5) | (23.6) | ||||||||||||||

| Adjusted EBITDA | $ | 37.1 | $ | 45.7 | $ | 82.8 | |||||||||||

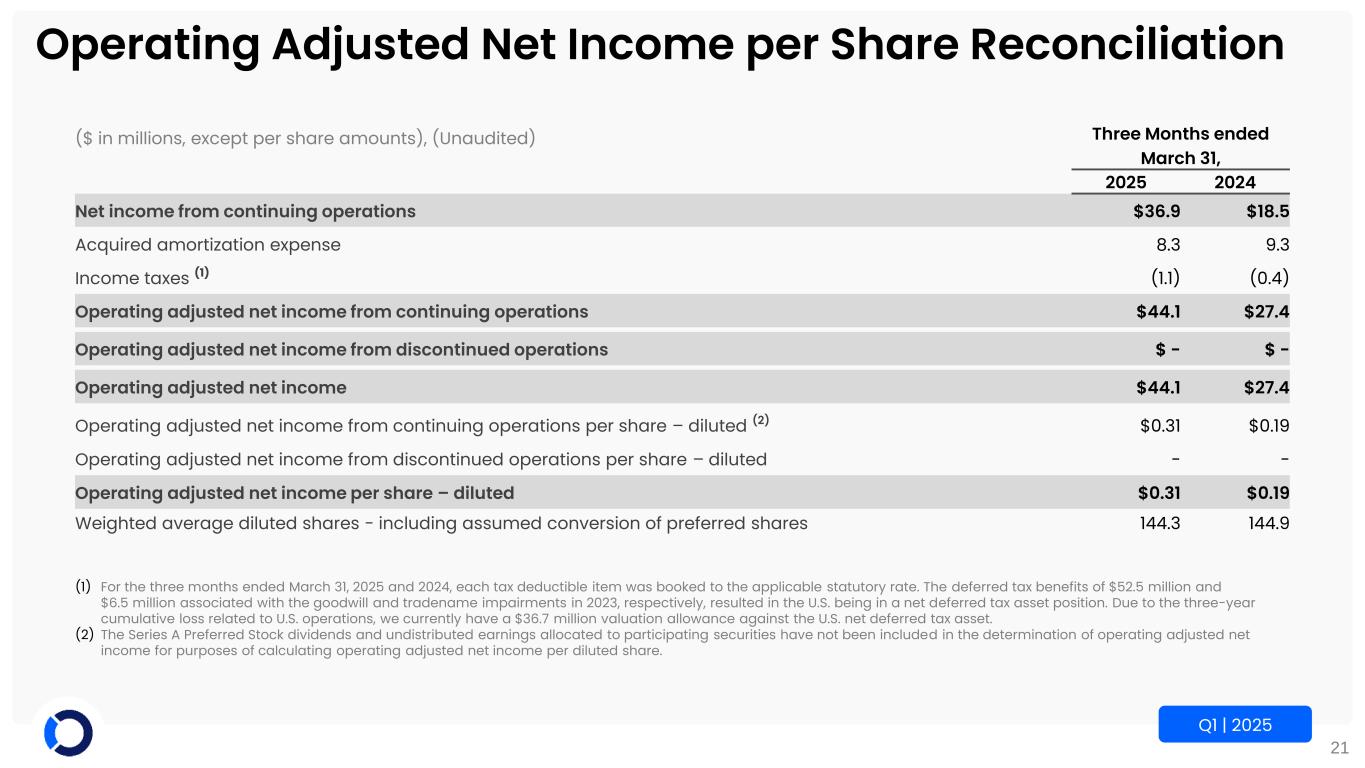

| Three Months Ended March 31, |

|||||||||||

(In millions, except per share amounts), (Unaudited) |

2025 | 2024 | |||||||||

Net income from continuing operations |

$ | 36.9 | $ | 18.5 | |||||||

| Acquired amortization expense | 8.3 | 9.3 | |||||||||

Income taxes (1) |

(1.1) | (0.4) | |||||||||

| Operating adjusted net income from continuing operations | $ | 44.1 | $ | 27.4 | |||||||

| Operating adjusted net income from discontinued operations | $ | — | $ | — | |||||||

| Operating adjusted net income | $ | 44.1 | $ | 27.4 | |||||||

Operating adjusted net income from continuing operations per share - diluted (2) |

$ | 0.31 | $ | 0.19 | |||||||

| Operating adjusted net income from discontinued operations per share - diluted | — | — | |||||||||

| Operating adjusted net income per share - diluted | $ | 0.31 | $ | 0.19 | |||||||

Weighted average diluted shares - including assumed conversion of preferred shares |

144.3 | 144.9 | |||||||||

| 2025 Guidance | |||||||||||

(In millions), (Unaudited) |

Low | High | |||||||||

| Income from continuing operations | $ | 100 | $ | 114 | |||||||

| Add back: | |||||||||||

| Income taxes | 47 | 53 | |||||||||

| Finance interest expense | 110 | 110 | |||||||||

| Interest expense, net of interest income | 12 | 12 | |||||||||

| Depreciation and amortization | 94 | 94 | |||||||||

| EBITDA | 363 | 383 | |||||||||

| Total addbacks (deductions), net | (73) | (73) | |||||||||

| Adjusted EBITDA | $ | 290 | $ | 310 | |||||||

| 2025 Guidance | |||||||||||

(In millions, except per share amounts), (Unaudited) |

Low | High | |||||||||

| Income from continuing operations | $ | 100 | $ | 114 | |||||||

Total adjustments, net |

31 | 31 | |||||||||

| Operating adjusted net income from continuing operations | $ | 131 | $ | 145 | |||||||

| Operating adjusted net income from continuing operations per share – diluted | $ | 0.90 | $ | 1.00 | |||||||

| Weighted average diluted shares - including assumed conversion of preferred shares | 145 | 145 | |||||||||

| Three Months Ended March 31, 2025 | |||||||||||||||||

(Dollars in millions), (Unaudited) |

Marketplace | Finance | Consolidated | ||||||||||||||

Income from continuing operations |

$ | 7.3 | $ | 29.6 | $ | 36.9 | |||||||||||

| Add back: | |||||||||||||||||

| Income taxes | 5.8 | 10.0 | 15.8 | ||||||||||||||

| Finance interest expense | — | 27.6 | 27.6 | ||||||||||||||

| Interest expense, net of interest income | 3.4 | — | 3.4 | ||||||||||||||

| Depreciation and amortization | 19.7 | 3.0 | 22.7 | ||||||||||||||

| EBITDA | 36.2 | 70.2 | 106.4 | ||||||||||||||

| Non-cash stock-based compensation | 1.5 | 0.5 | 2.0 | ||||||||||||||

| Securitization interest | — | (25.1) | (25.1) | ||||||||||||||

| Severance | 2.0 | — | 2.0 | ||||||||||||||

| Foreign currency (gains) losses | (3.3) | — | (3.3) | ||||||||||||||

Other |

0.7 | 0.1 | 0.8 | ||||||||||||||

| Total addbacks (deductions) | 0.9 | (24.5) | (23.6) | ||||||||||||||

| Adjusted EBITDA | $ | 37.1 | $ | 45.7 | $ | 82.8 | |||||||||||

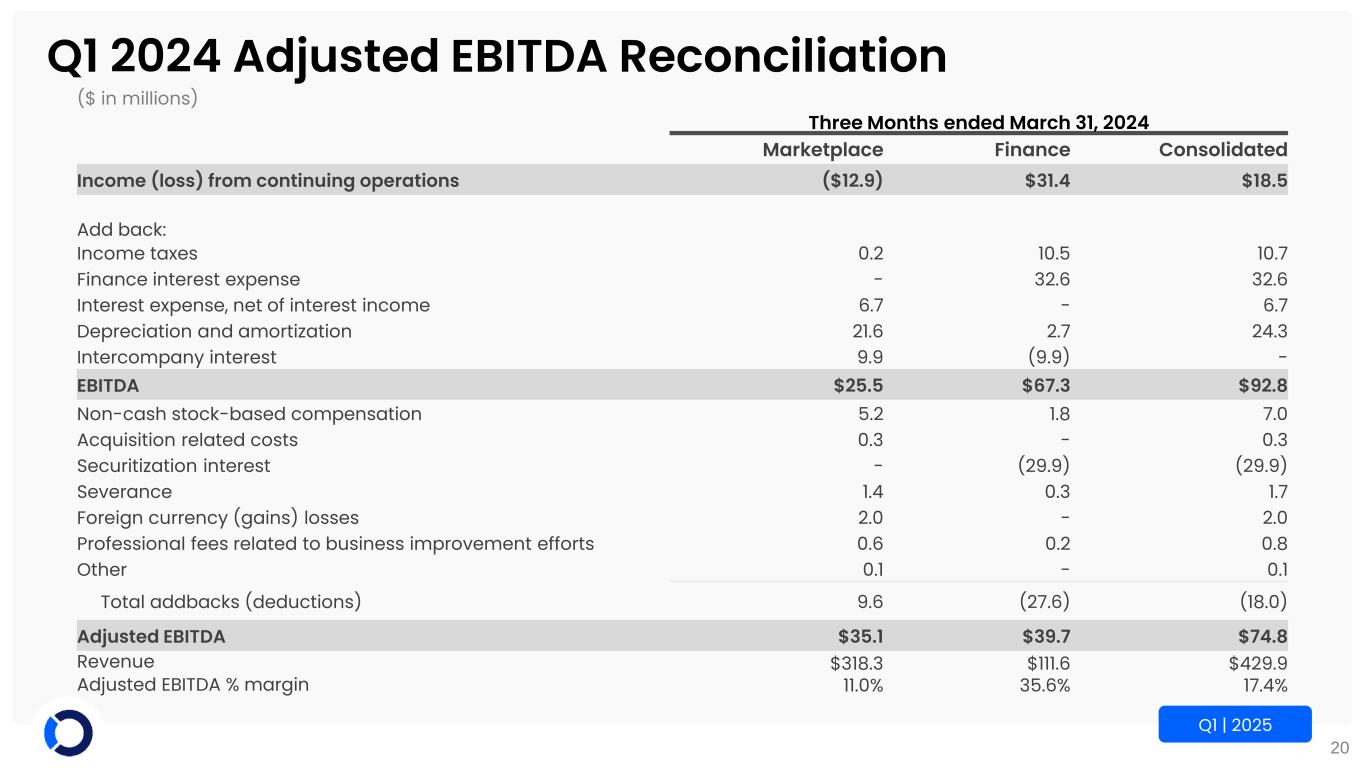

| Three Months Ended March 31, 2024 | |||||||||||||||||

(Dollars in millions), (Unaudited) |

Marketplace | Finance | Consolidated | ||||||||||||||

Income (loss) from continuing operations |

$ | (12.9) | $ | 31.4 | $ | 18.5 | |||||||||||

| Add back: | |||||||||||||||||

| Income taxes | 0.2 | 10.5 | 10.7 | ||||||||||||||

| Finance interest expense | — | 32.6 | 32.6 | ||||||||||||||

| Interest expense, net of interest income | 6.7 | — | 6.7 | ||||||||||||||

| Depreciation and amortization | 21.6 | 2.7 | 24.3 | ||||||||||||||

| Intercompany interest | 9.9 | (9.9) | — | ||||||||||||||

| EBITDA | 25.5 | 67.3 | 92.8 | ||||||||||||||

| Non-cash stock-based compensation | 5.2 | 1.8 | 7.0 | ||||||||||||||

| Acquisition related costs | 0.3 | — | 0.3 | ||||||||||||||

| Securitization interest | — | (29.9) | (29.9) | ||||||||||||||

| Severance | 1.4 | 0.3 | 1.7 | ||||||||||||||

| Foreign currency (gains) losses | 2.0 | — | 2.0 | ||||||||||||||

| Professional fees related to business improvement efforts | 0.6 | 0.2 | 0.8 | ||||||||||||||

| Other | 0.1 | — | 0.1 | ||||||||||||||

| Total addbacks (deductions) | 9.6 | (27.6) | (18.0) | ||||||||||||||

| Adjusted EBITDA | $ | 35.1 | $ | 39.7 | $ | 74.8 | |||||||||||

| Three Months Ended | Twelve Months Ended | ||||||||||||||||||||||||||||

|

(Dollars in millions),

(Unaudited)

|

June 30, 2024 |

September 30, 2024 |

December 31, 2024 |

March 31, 2025 |

March 31, 2025 |

||||||||||||||||||||||||

Net income |

$ | 10.7 | $ | 28.4 | $ | 52.3 | $ | 36.9 | $ | 128.3 | |||||||||||||||||||

| Less: Income from discontinued operations | — | — | — | — | — | ||||||||||||||||||||||||

Income from continuing operations |

10.7 | 28.4 | 52.3 | 36.9 | 128.3 | ||||||||||||||||||||||||

| Add back: | |||||||||||||||||||||||||||||

| Income taxes | 7.5 | 13.1 | 16.7 | 15.8 | 53.1 | ||||||||||||||||||||||||

| Finance interest expense | 31.9 | 30.7 | 28.3 | 27.6 | 118.5 | ||||||||||||||||||||||||

| Interest expense, net of interest income | 5.2 | 4.2 | 4.1 | 3.4 | 16.9 | ||||||||||||||||||||||||

| Depreciation and amortization | 24.1 | 23.8 | 23.0 | 22.7 | 93.6 | ||||||||||||||||||||||||

| EBITDA | 79.4 | 100.2 | 124.4 | 106.4 | 410.4 | ||||||||||||||||||||||||

| Non-cash stock-based compensation | 3.7 | 4.1 | 1.1 | 2.0 | 10.9 | ||||||||||||||||||||||||

| Acquisition related costs | 0.2 | — | 0.1 | — | 0.3 | ||||||||||||||||||||||||

| Securitization interest | (29.2) | (27.9) | (25.7) | (25.1) | (107.9) | ||||||||||||||||||||||||

| Gain on sale of business | — | — | (31.6) | — | (31.6) | ||||||||||||||||||||||||

| Severance | 6.0 | 1.5 | 2.4 | 2.0 | 11.9 | ||||||||||||||||||||||||

| Foreign currency (gains) losses | 0.5 | (3.2) | 6.5 | (3.3) | 0.5 | ||||||||||||||||||||||||

| (Gain) loss on investments | — | — | (0.4) | — | (0.4) | ||||||||||||||||||||||||

| Professional fees related to business improvement efforts | 0.7 | — | — | — | 0.7 | ||||||||||||||||||||||||

Impact for newly enacted Canadian DST related to prior years |

10.0 | — | (4.6) | — | 5.4 | ||||||||||||||||||||||||

| Other | 0.1 | (0.2) | 0.5 | 0.8 | 1.2 | ||||||||||||||||||||||||

| Total addbacks (deductions) | (8.0) | (25.7) | (51.7) | (23.6) | (109.0) | ||||||||||||||||||||||||

| Adjusted EBITDA from continuing operations | $ | 71.4 | $ | 74.5 | $ | 72.7 | $ | 82.8 | $ | 301.4 | |||||||||||||||||||

| Three Months Ended March 31, | |||||||||||

| (Dollars in millions except per share amounts) | 2025 | 2024 | |||||||||

| Revenues | |||||||||||

| Auction fees | $ | 125.2 | $ | 109.9 | |||||||

| Service revenue | 140.3 | 150.2 | |||||||||

| Purchased vehicle sales | 85.7 | 58.2 | |||||||||

| Finance revenue | 108.9 | 111.6 | |||||||||

| Total operating revenues | 460.1 | 429.9 | |||||||||

| Operating expenses | |||||||||||

| Cost of services (exclusive of depreciation and amortization) | 241.6 | 213.9 | |||||||||

| Finance interest expense | 27.6 | 32.6 | |||||||||

| Provision for credit losses | 9.3 | 15.8 | |||||||||

| Selling, general and administrative | 107.2 | 106.5 | |||||||||

| Depreciation and amortization | 22.7 | 24.3 | |||||||||

| Total operating expenses | 408.4 | 393.1 | |||||||||

| Operating profit | 51.7 | 36.8 | |||||||||

| Interest expense | 4.0 | 7.1 | |||||||||

| Other (income) expense, net | (5.0) | 0.5 | |||||||||

| Income from continuing operations before income taxes | 52.7 | 29.2 | |||||||||

| Income taxes | 15.8 | 10.7 | |||||||||

| Income from continuing operations | 36.9 | 18.5 | |||||||||

| Income from discontinued operations, net of income taxes | — | — | |||||||||

| Net income | $ | 36.9 | $ | 18.5 | |||||||

| Income from continuing operations per share | |||||||||||

| Basic | $ | 0.18 | $ | 0.05 | |||||||

| Diluted | $ | 0.18 | $ | 0.05 | |||||||

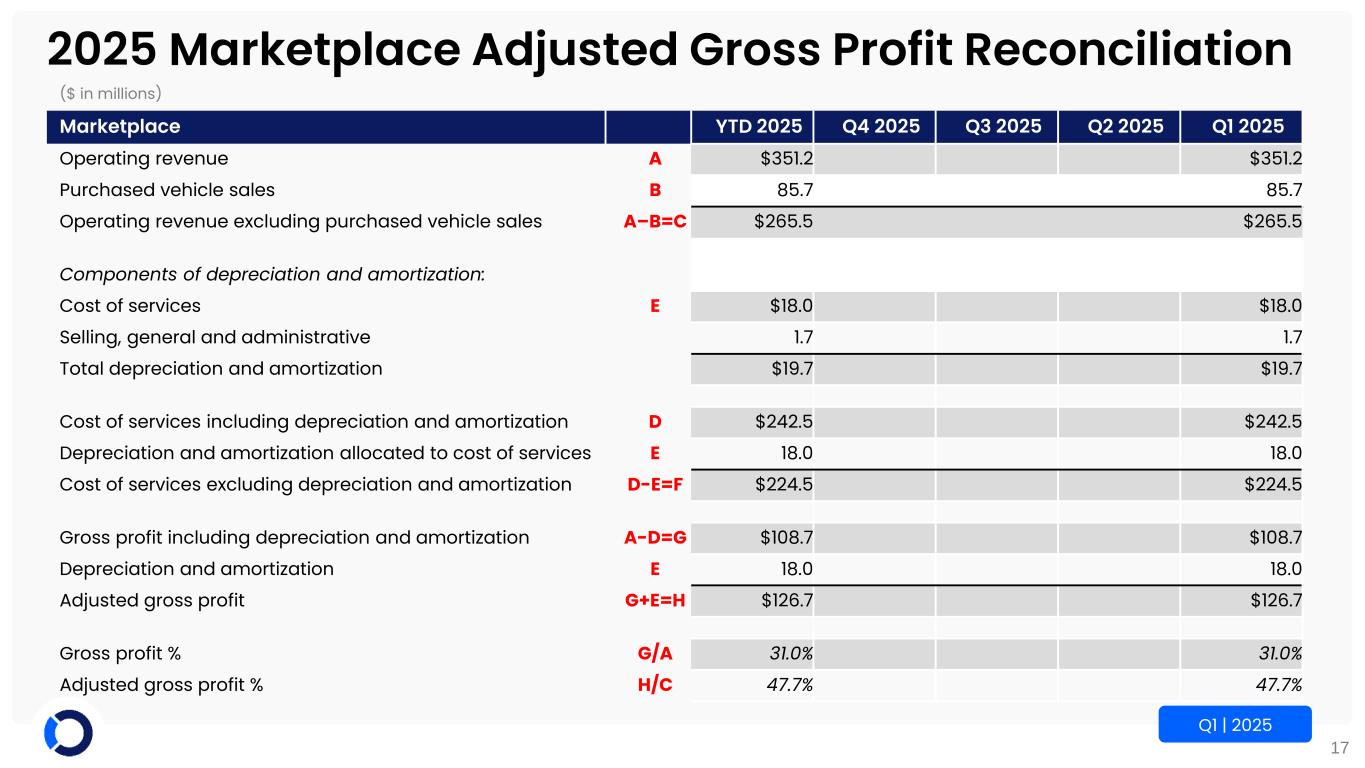

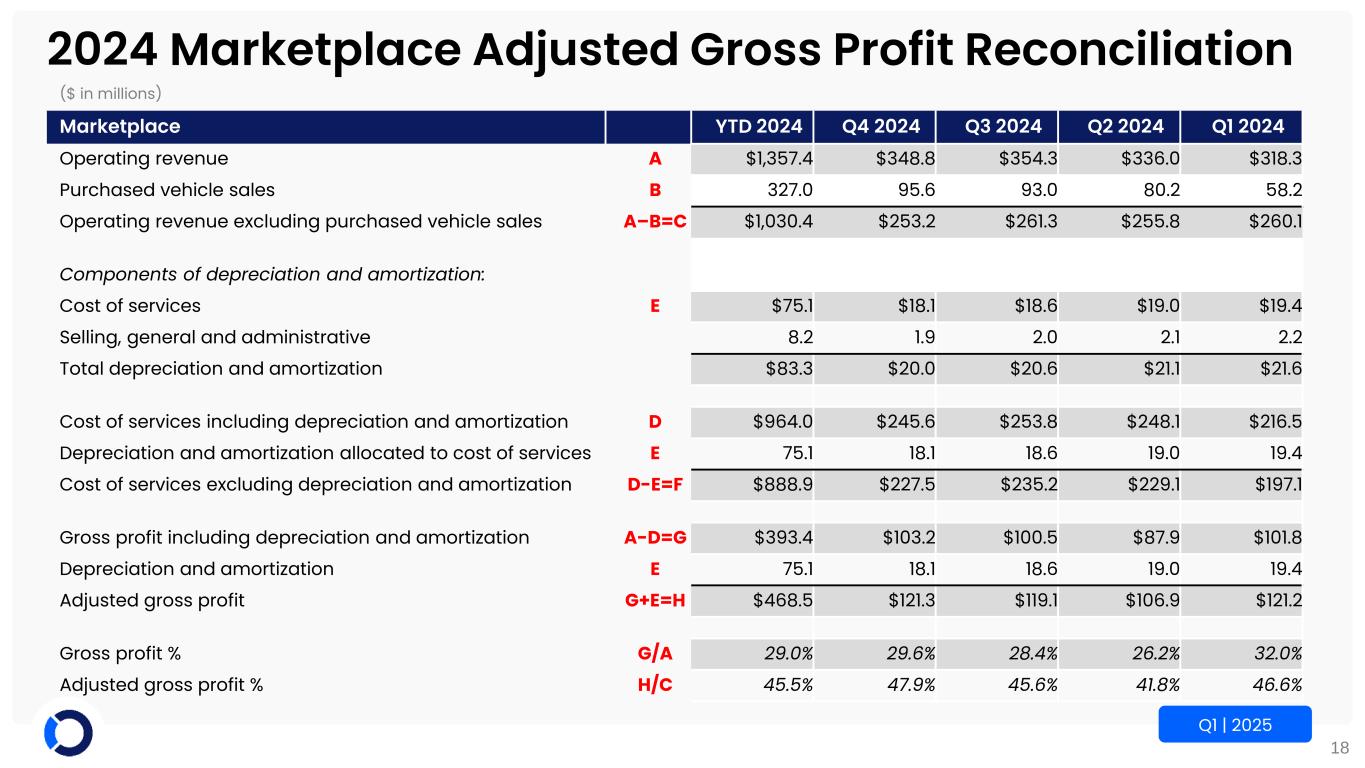

| Three Months Ended March 31, | |||||||||||

| (Dollars in millions) | 2025 | 2024 | |||||||||

| Auction fees | $ | 125.2 | $ | 109.9 | |||||||

| Service revenue | 140.3 | 150.2 | |||||||||

| Purchased vehicle sales | 85.7 | 58.2 | |||||||||

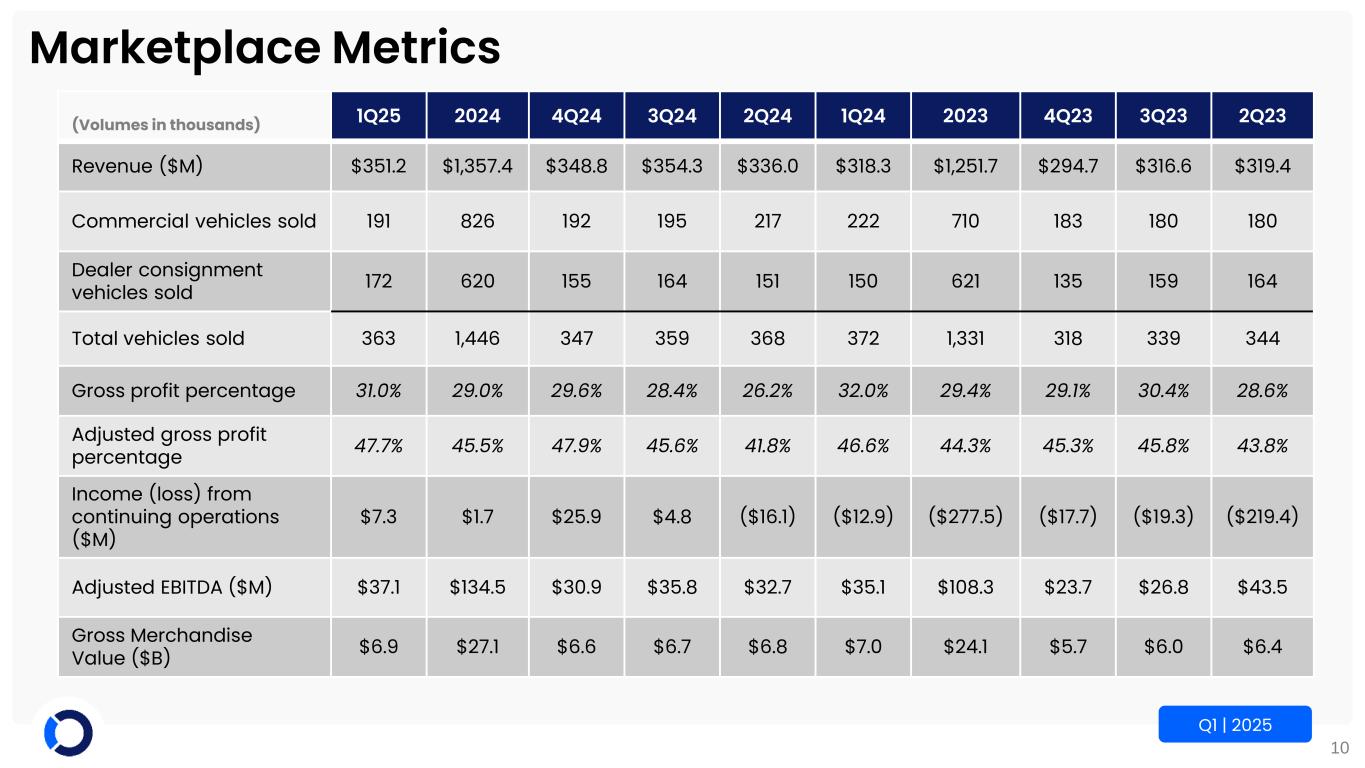

| Total Marketplace revenue | 351.2 | 318.3 | |||||||||

| Cost of services* | 242.5 | 216.5 | |||||||||

| Gross profit | 108.7 | 101.8 | |||||||||

| Provision for credit losses | 0.3 | 2.2 | |||||||||

| Selling, general and administrative | 94.7 | 92.6 | |||||||||

| Depreciation and amortization | 1.7 | 2.2 | |||||||||

| Operating profit | $ | 12.0 | $ | 4.8 | |||||||

| Commercial vehicles sold | 191,000 | 222,000 | |||||||||

| Dealer consignment vehicles sold | 172,000 | 150,000 | |||||||||

| Total vehicles sold | 363,000 | 372,000 | |||||||||

| As of and for the Three Months Ended March 31, |

|||||||||||

| (Dollars in millions) | 2025 | 2024 | |||||||||

| Finance revenue | |||||||||||

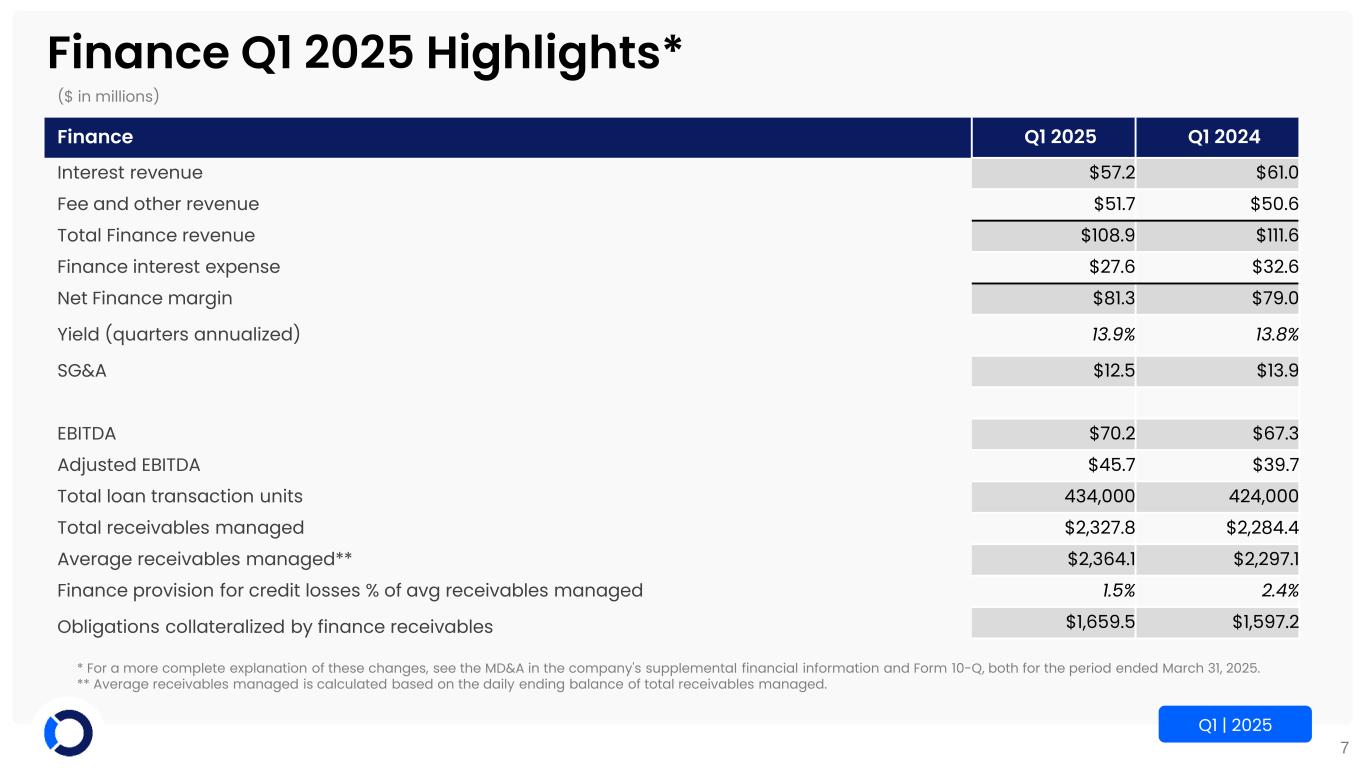

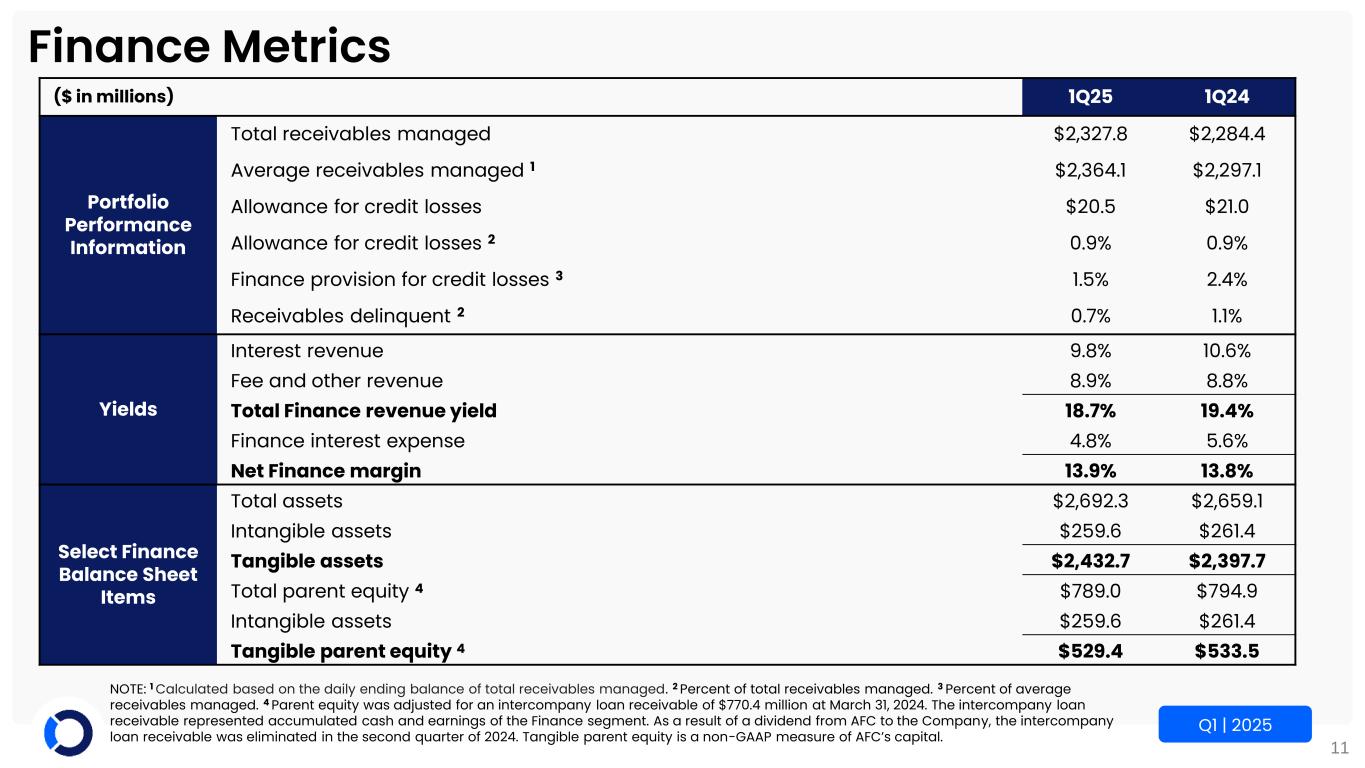

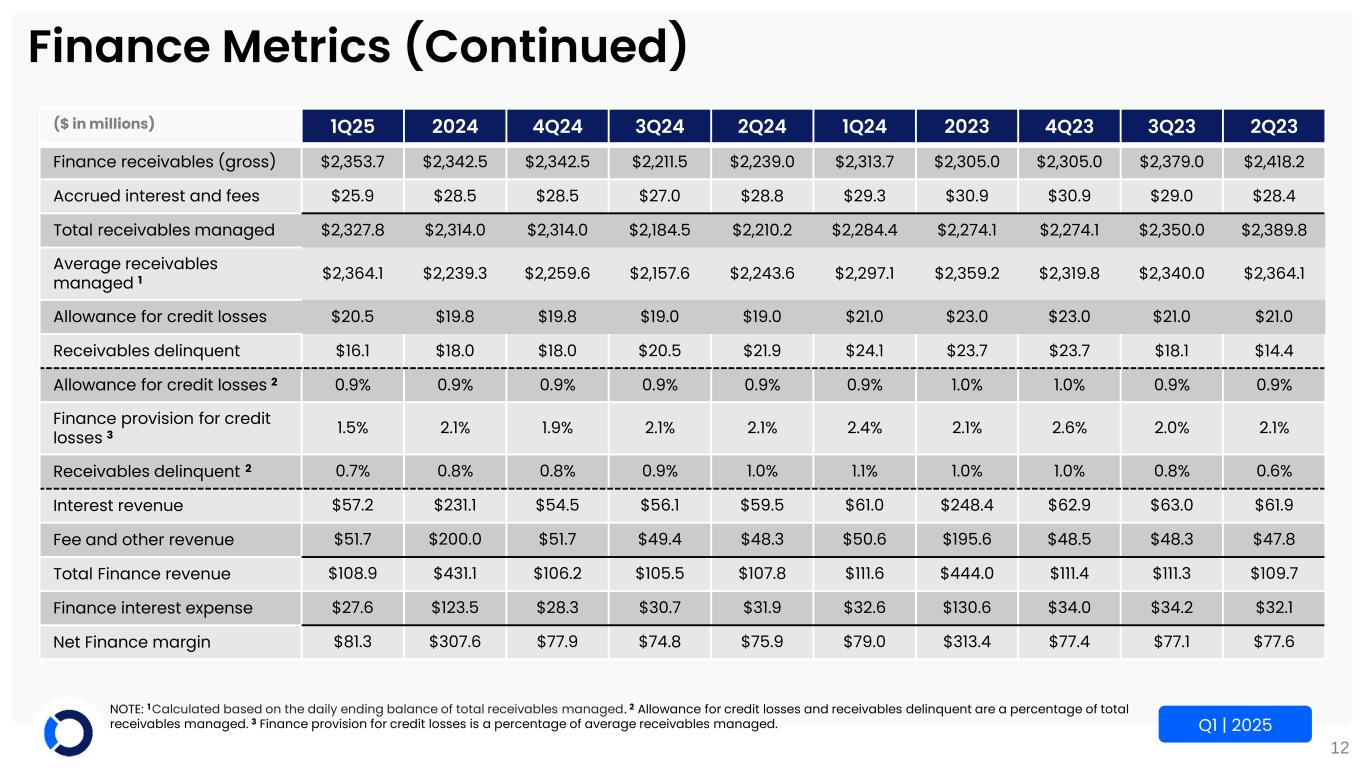

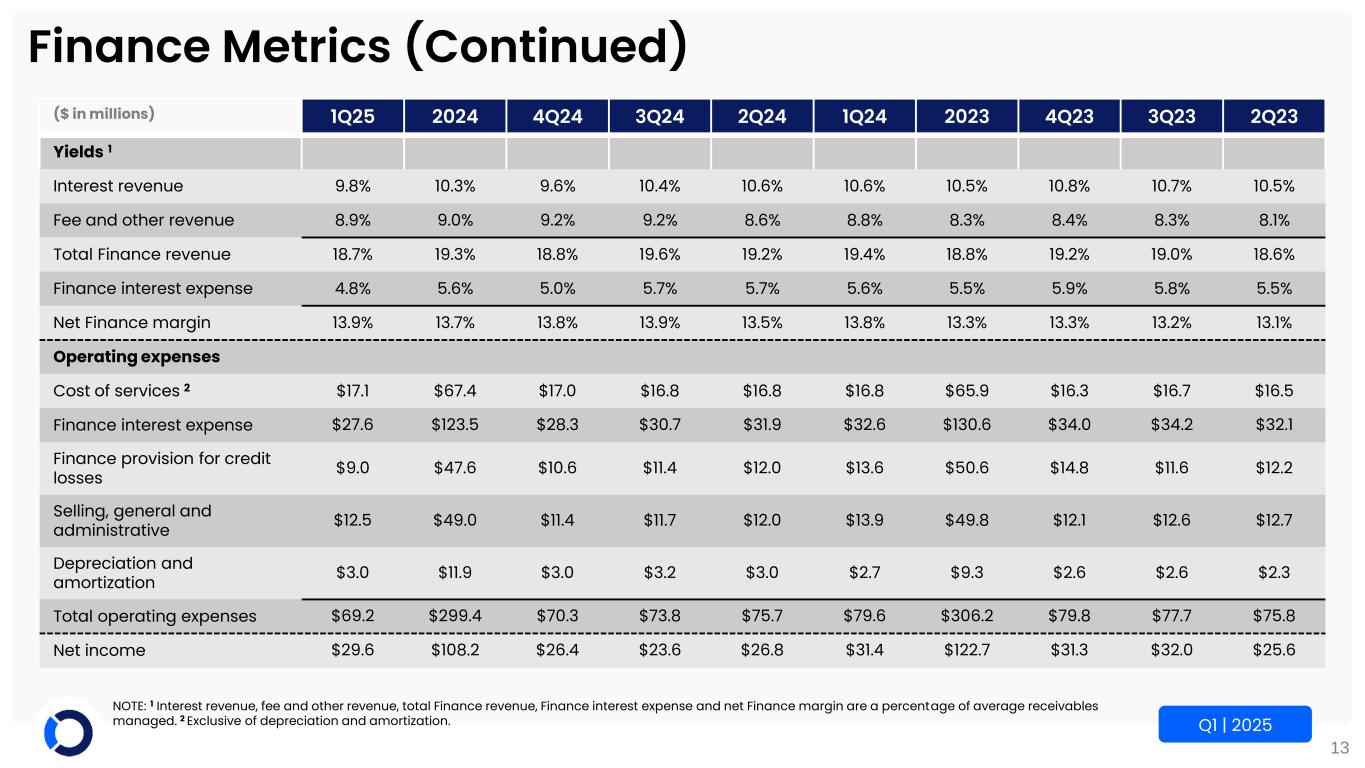

| Interest revenue | $ | 57.2 | $ | 61.0 | |||||||

| Fee and other revenue | 51.7 | 50.6 | |||||||||

| Total Finance revenue | 108.9 | 111.6 | |||||||||

| Finance interest expense | 27.6 | 32.6 | |||||||||

| Net Finance margin | 81.3 | 79.0 | |||||||||

| Finance provision for credit losses | 9.0 | 13.6 | |||||||||

| Cost of services (exclusive of depreciation and amortization) | 17.1 | 16.8 | |||||||||

| Selling, general and administrative | 12.5 | 13.9 | |||||||||

| Depreciation and amortization | 3.0 | 2.7 | |||||||||

| Operating profit | $ | 39.7 | $ | 32.0 | |||||||

| Portfolio Performance Information | |||||||||||

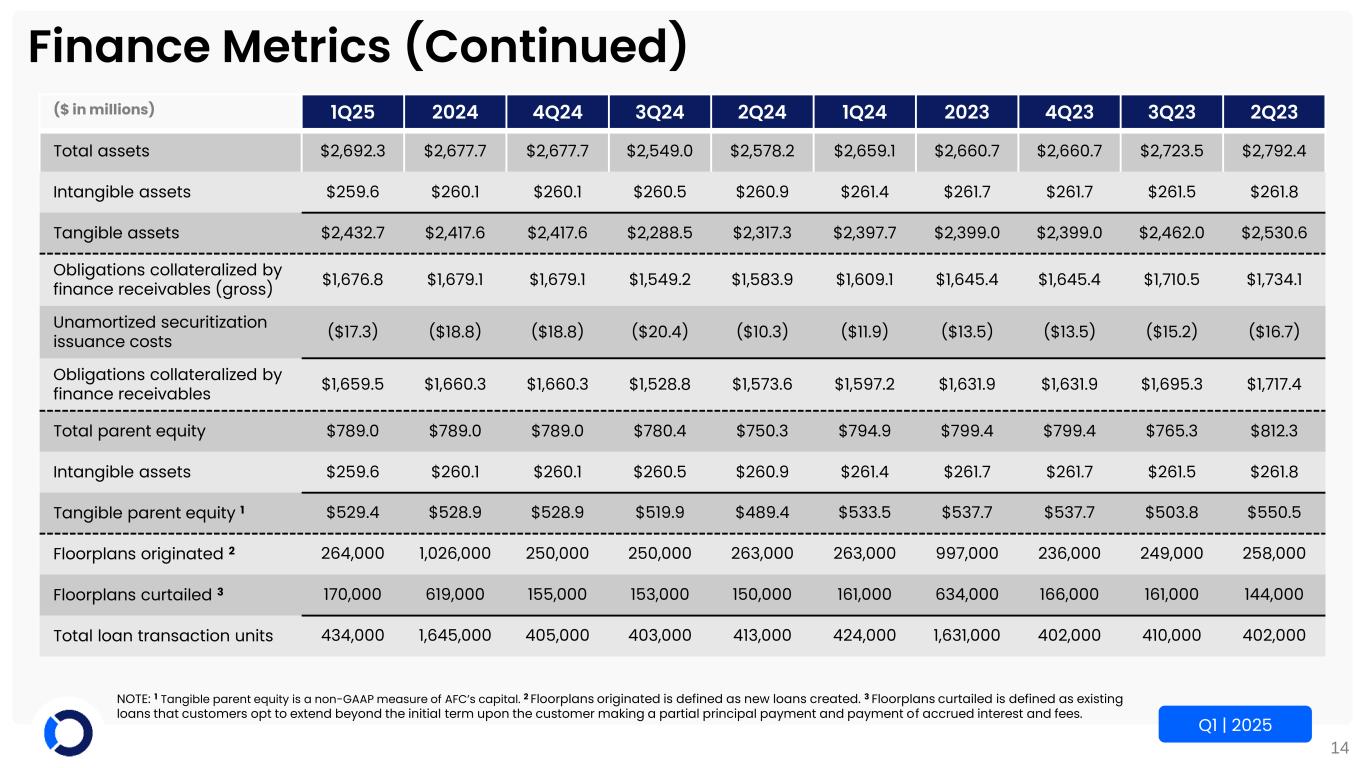

| Floorplans originated | 264,000 | 263,000 | |||||||||

| Floorplans curtailed* | 170,000 | 161,000 | |||||||||

| Total loan transaction units | 434,000 | 424,000 | |||||||||

| Total receivables managed | $ | 2,327.8 | $ | 2,284.4 | |||||||

| Average receivables managed** | $ | 2,364.1 | $ | 2,297.1 | |||||||

| Allowance for credit losses | $ | 20.5 | $ | 21.0 | |||||||

| Allowance for credit losses as a percentage of total receivables managed | 0.9 | % | 0.9 | % | |||||||

| Annualized finance provision for credit losses as a percentage of average receivables managed | 1.5 | % | 2.4 | % | |||||||

| Receivables delinquent as a percentage of total receivables managed | 0.7 | % | 1.1 | % | |||||||

| Yields (Annualized) | Three Months Ended March 31, |

||||||||||

| % of Average Receivables Managed | 2025 | 2024 | |||||||||

| Finance revenue yield | |||||||||||

| Interest revenue | 9.8 | % | 10.6 | % | |||||||

| Fee and other revenue | 8.9 | % | 8.8 | % | |||||||

| Total Finance revenue yield | 18.7 | % | 19.4 | % | |||||||

| Finance interest expense | 4.8 | % | 5.6 | % | |||||||

| Net finance margin | 13.9 | % | 13.8 | % | |||||||

| March 31, | December 31, | ||||||||||

| (Dollars in millions) | 2025 | 2024 | |||||||||

| Tangible Assets | |||||||||||

| Total assets | $ | 2,692.3 | $ | 2,677.7 | |||||||

| Intangible assets | 259.6 | 260.1 | |||||||||

| Tangible assets | $ | 2,432.7 | $ | 2,417.6 | |||||||

| Tangible parent equity | |||||||||||

| Total parent equity*** | $ | 789.0 | $ | 789.0 | |||||||

| Intangible assets | 259.6 | 260.1 | |||||||||

| Tangible parent equity*** | $ | 529.4 | $ | 528.9 | |||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| (Dollars in millions) | 2025 | 2024 | 2024 | ||||||||||||||

| Cash and cash equivalents | $ | 220.5 | $ | 143.0 | $ | 105.2 | |||||||||||

| Working capital | 324.9 | 286.0 | 384.6 | ||||||||||||||

| Amounts available under the Revolving Credit Facilities | 403.9 | 397.9 | 307.6 | ||||||||||||||

| Cash provided by operating activities for the three months ended | 122.6 | 100.2 | |||||||||||||||

| Three Months Ended March 31, |

|||||||||||

| (Dollars in millions) | 2025 | 2024 | |||||||||

| Net cash provided by (used by): | |||||||||||

| Operating activities - continuing operations | $ | 122.6 | $ | 100.2 | |||||||

| Operating activities - discontinued operations | — | — | |||||||||

| Investing activities - continuing operations | (31.9) | (39.7) | |||||||||

| Investing activities - discontinued operations | — | — | |||||||||

| Financing activities - continuing operations | (18.9) | (63.6) | |||||||||

| Financing activities - discontinued operations | — | — | |||||||||

| Net change in cash balances of discontinued operations | — | — | |||||||||

| Effect of exchange rate on cash | 1.0 | (4.9) | |||||||||

Net increase (decrease) in cash, cash equivalents and restricted cash |

$ | 72.8 | $ | (8.0) | |||||||