- 1 - Please note that the following is an English translation of the original Japanese version, prepared only for the convenience of shareholders residing outside Japan. In the case of any discrepancy between the translation and the Japanese original, the latter shall prevail. TAKEDA PHARMACEUTICAL COMPANY LIMITED (“TAKEDA”) HEREBY DISCLAIMS ALL REPRESENTATIONS AND WARRANTIES WITH RESPECT TO THIS TRANSLATION, WHETHER EXPRESS OR IMPLIED INCLUDING, BUT WITHOUT LIMITATION TO, ANY REPRESENTATIONS OR WARRANTIES WITH RESPECT TO ACCURACY, RELIABILITY OR COMPLETENESS OF THIS TRANSLATION. IN NO EVENT SHALL TAKEDA BE LIABLE FOR ANY DAMAGES OF ANY KIND OR NATURE INCLUDING, BUT WITHOUT LIMITATION TO, DIRECT, INDIRECT, SPECIAL, PUNITIVE, CONSEQUENTIAL OR INCIDENTAL DAMAGES ARISING FROM OR IN CONNECTION WITH THIS TRANSLATION. Other items which are provided electronically 1. Notes to the Consolidated Financial Statements ………………………………1 2. Notes to the Unconsolidated Financial Statements ………………………………22 Takeda Pharmaceutical Company Limited (the “Company”)

- 2 - CONSOLIDATED FINANCIAL STATEMENTS Notes to the Consolidated Financial Statements [Notes for Items that Form the Basis of Preparing Consolidated Financial Statements] 1. Accounting Standards of Consolidated Financial Statements The consolidated financial statements are prepared in accordance with International Financial Reporting Standards ("IFRS"), in compliance with Article 120, Paragraph 1 of the Regulation on Corporate Accounting. In compliance with the second sentence of the same paragraph, certain disclosures required under IFRS are omitted. 2. Scope of Consolidation (1) Number of consolidated subsidiaries: 169 Names of major consolidated subsidiaries: Takeda Pharmaceuticals U.S.A., Inc., Dyax Corp., Baxalta US Inc., Biolife Plasma Services LP, Shire Human Genetic Therapies, Inc., Takeda Manufacturing U.S.A., Inc., Takeda Pharmaceuticals International AG, Takeda GmbH, Shire Pharmaceuticals International Unlimited Company, Shire Ireland Finance Trading Limited, Takeda Canada Inc., Takeda (China) International Trading Co., Ltd. (2) Increase and decrease of consolidated subsidiaries: Increase : 5 (due to acquisitions and establishment) Decrease : 16 (due to merger, liquidation and divestiture) 3. Application of the Equity Method (1) Number of associates accounted for using the equity method: 16 (2) Increase and decrease of associates accounted for using the equity method: Increase : 4 (mainly due to a change in the ownership ratio) Decrease : 5 (mainly due to a change in the ownership ratio) 4. Material Accounting Policies (1) Valuation Standards and Methods for Major Assets (excluding Financial Instruments) 1) Property, Plant and Equipment Property, plant and equipment are measured using the cost model and is stated at cost less accumulated depreciation and accumulated impairment loss. Acquisition cost includes mainly the costs directly attributable to the acquisition and the initial estimated dismantlement, removal, and restoration costs associated with the asset. 2) Goodwill Goodwill arising from business combinations is stated at its cost less accumulated impairment losses. Goodwill is not amortized. Goodwill is allocated to cash-generating units or groups of cash-generating units based on expected synergies and tested for impairment annually and whenever there is any indication of impairment. Impairment losses on goodwill are recognized in the consolidated statements of profit or loss and no subsequent reversal will be made. 3) Intangible Assets Intangible assets are measured by using the cost model and are stated at cost less accumulated amortization and accumulated impairment losses. Takeda enters into collaboration and in-license agreements with third parties for products and compounds for research and development projects. Payments for collaboration agreements generally take the form of subsequent development milestone payments. Payments for in-license agreements generally take the form of up-front payments and subsequent development milestone payments. Up-front payments for in-license agreements are capitalized upon commencement of the in-license agreements, and development milestone payments are capitalized when the milestone is achieved.

- 3 - If and when Takeda obtains approval for the commercial application of a product in development, the related in-process research and development assets will be reclassified to intangible assets associated with marketed products and amortized over its estimated useful life from marketing approval. 4) Impairment of Non-financial Assets Takeda assesses whether there is any indication of impairment for non-financial assets at the end of each reporting period, excluding inventories, deferred tax assets, assets held for sale, and assets arising from employee benefits. If any such indication exists, or in cases in which an impairment test is required to be performed each year, the recoverable amount of the asset is estimated. In cases in which the recoverable amount cannot be estimated for each asset, they are estimated at the cash-generating unit level. The recoverable amount of an asset or a cash-generating unit is determined at the higher of its fair value less cost of disposal, or its value in use. In determining the value in use, the estimated future cash flows are discounted to their present value using a discount rate that reflects the time value of money and the risks specific to the asset. If the carrying amount of the asset or cash-generating unit exceeds the recoverable amount, impairment loss is recognized in profit or loss and the carrying amount is reduced to the recoverable amount. An asset or a cash-generating unit other than goodwill, for which impairment losses were recognized in prior years, is assessed at the end of the reporting period to determine whether there is any indication that the impairment loss recognized in prior periods may no longer exist or may have decreased. If any such indication exists, the recoverable amount of the asset or cash-generating unit is estimated. In cases in which the recoverable amount exceeds the carrying amount of the asset or cash-generating unit, the impairment loss is reversed up to the lower of the estimated recoverable amount or the carrying amount that would have been determined if no impairment loss had been recognized in prior years. The reversal of impairment loss is immediately recognized in profit or loss. 5) Inventories Inventories are measured at the lower of cost and net realizable value. The cost of inventories is determined mainly using the weighted-average cost formula. The cost of inventories includes purchase costs, costs of conversion, and other costs incurred in bringing the inventories to the present location and condition. Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. (2) Depreciation and Amortization Methods of Assets 1) Property, Plant and Equipment Except for assets that are not subject to depreciation, such as land and construction in progress, assets are depreciated mainly using the straight-line method over the estimated useful life of the asset. Right-of- use assets are depreciated using the straight-line method over the shorter of the lease term or the estimated useful life unless it is reasonably certain that Takeda will obtain ownership by the end of the lease term. The depreciation of these assets begins when they are available for use. The estimated useful life of major asset items is as follows: Buildings and structures 3 to 50 years Machinery and vehicles 2 to 20 years Tools, furniture and fixtures 2 to 20 years 2) Intangible Assets An intangible asset associated with a product (an intangible asset associated with a marketed product) is amortized on a straight-line basis over the estimated useful life, which is based on expected patent life, and/or other factors depending on the expected economic benefits of the asset, ranging from 3 to 20 years. Software is amortized on a straight-line basis over the expected useful life. The useful life used for this purpose is 3 to 10 years. (3) Valuation Standards and Methods for Financial Instruments 1) Financial Assets (i) Initial Recognition and Measurement • Investments in debt instruments measured at amortized cost: Assets such as trade and other receivables that are held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and whose contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding are measured at amortized cost. Trade receivables are initially recognized at their invoiced amounts,

- 4 - including any related sales taxes less adjustments for estimated deductions such as impairment loss allowance and cash discounts. • Investments in debt instruments measured at fair value through other comprehensive income ("FVTOCI"): Assets that are held within a business model objective whose objective is achieved by both collecting contractual cash flows and selling financial assets whose contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding are measured at FVTOCI. • Investments in debt Instruments measured at fair value through net profit or loss ("FVTPL"): Assets that do not meet the criteria for amortized cost or FVTOCI are measured at FVTPL. • Equity instruments measured at FVTOCI: On initial recognition, Takeda makes an irrevocable FVTOCI election (on an instrument-by-instrument basis) to present the subsequent changes in the fair value of equity instruments in other comprehensive income for certain equity instruments held for the long term for strategic purposes. At the reporting date, Takeda designates all of its equity instruments as financial assets measured at FVTOCI. (ii) Subsequent Measurement and Derecognition • Investments in debt Instruments measured at amortized cost: These assets are subsequently measured at amortized cost using the effective interest method. The amortized cost is reduced by impairment losses. Interest income, foreign exchange gains and losses and impairment are recognized in profit or loss. Any gain or loss on derecognition is recognized in profit or loss. • Investments in debt instruments measured at FVTOCI: These assets are subsequently measured at fair value. Interest income calculated using the effective interest method, foreign exchange gains and losses and impairment are recognized in profit or loss. Other net gains and losses arising from changes in fair value are recognized in other comprehensive income. Upon derecognition of the investments, the gains and losses accumulated in other comprehensive income related to the investments are reclassified to profit or loss. • Investments in debt instruments measured at FVTPL: These assets are subsequently measured at fair value, and a gain or loss on debt instruments that is subsequently measured at FVTPL is recognized in net profit or loss. • Equity Instruments measured at FVTOCI: These assets are subsequently measured at fair value. Dividends are recognized as income in profit or loss unless the dividend clearly represents a recovery of part of the cost of the investment. Other net gains and losses are recognized in other comprehensive income and are never reclassified to profit or loss. Upon derecognition of the investments, the amounts in other comprehensive income related to the investments are reclassified within equity to retained earnings. (iii) Impairment Loss allowances for trade receivables are established using an Expected Credit Loss ("ECL") model. The provisions are based on a forward-looking ECL, which includes possible default events on the trade receivables over the entire holding period of the trade receivables. Takeda has elected to measure provisions for trade receivables, contract assets, and lease receivables at an amount equal to lifetime ECL. Takeda uses a provisions matrix based on historical loss rates adjusted for forward looking information to calculate ECL. These provisions represent the difference between the contractual amount of the trade receivables, contract assets, and the lease receivables in the consolidated statements of financial position and the estimated collectible net amount. 2) Financial Liabilities (i) Initial Recognition and Measurement Financial liabilities are recognized in the consolidated statements of financial position when Takeda becomes a party to the contract of financial instruments. Financial liabilities are classified, at initial recognition, as financial liabilities measured at FVTPL, bonds and loans, or payables. Financial liabilities, except for those measured at FVTPL, are initially measured at fair value less transaction costs that are directly attributable to the issuance. (ii) Subsequent Measurement • Financial liabilities measured at FVTPL: Financial liabilities measured at FVTPL are subsequently measured at fair value, and any gains or losses arising on re-measurement are recognized in profit or loss. Financial liabilities measured at FVTPL include derivatives and the financial liabilities associated with contingent consideration arrangements .

- 5 - • Other financial liabilities, including bonds and loans: Other financial liabilities are measured at amortized cost mainly using the effective interest method. (iii) Derecognition Takeda derecognizes a financial liability only when the obligation specified in the contract is discharged, canceled, or expires. On derecognition of a financial liability, the difference between the carrying amount and the consideration paid or payable is recognized in profit or loss. 3) Derivatives Takeda hedges the risks arising mainly from its exposure to fluctuations in foreign currency exchange rates and interest rates using derivatives such as foreign exchange forward contracts, currency options, interest rate swaps, cross currency interest rate swaps and interest rate future. In addition, Takeda hedges the risks arising from its exposure to fluctuations in prices of renewable energy using forward contracts. Takeda does not enter into derivative transactions for trading or speculative purposes. Derivatives are measured at FVTPL unless the derivative contracts are designated as hedging instruments. The gains and losses on derivatives that are not designed as hedging instruments are recognized in profit or loss. 4) Hedge Accounting For foreign currency exposure as a result of translation risk, Takeda designates certain non-derivatives, such as foreign currency denominated debt and certain derivatives such as foreign currency forwards, as net investment hedges of foreign operations. For foreign currency exposure due to foreign currency denominated transactions, Takeda designates certain derivatives, such as foreign currency forwards, currency options and cross currency interest rate swaps, as cash flow hedges of forecasted transactions. For interest risk exposure, Takeda designates derivatives such as interest and cross currency interest rate swaps and forward rate agreements, as cash flow hedges of forecasted transactions. Within the designation documentation at inception, Takeda documents the risk management objective, nature of the risk being hedged, and relationship between hedging instruments and hedged risk based on the strategy for undertaking the hedging relationships. At inception and on a quarterly basis, Takeda also assesses whether the hedging instruments are highly effective in offsetting changes in the hedged transactions or net investment. • Cash flow hedges: the effective portion of changes in the fair value of derivatives designated and qualifying as cash flow hedges is recognized in other comprehensive income. The gain or loss relating to the ineffective portion is recognized immediately in profit or loss. The cumulative gain or loss that was previously recognized in other comprehensive income is reclassified to profit or loss in the same period when the cash flows of the hedged items are recognized in profit or loss and in the same line item in the consolidated statements of profit or loss. The currency basis spread and the time value of the foreign currency options are accounted for and presented as hedging cost under other components of equity separately from cash flow hedges. • Net investment hedges in foreign operations: the gain or loss on hedging instruments in foreign operations is recognized in other comprehensive income. At the time of disposal of the foreign operations, the cumulative gain or loss recognized in other comprehensive income is reclassified to profit or loss. Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated or exercised, or when the hedge no longer qualifies for hedge accounting. (4) Provisions Takeda recognizes rebates and return reserves if Takeda receives consideration from a customer and expects to refund some or all of that consideration to the customer. In addition, Takeda recognizes provisions when Takeda has present legal or constructive obligations as a result of past events, it is probable that outflows of resources embodying economic benefits will be required to settle the obligations and reliable estimates can be made of the amount of the obligations. Takeda’s provisions consist primarily of rebates and return reserves, as well as provisions for litigation and restructuring. 1) Rebates and Return Reserves Takeda has recognized a provision related mainly to sales rebates and returns for products and merchandises, including for U.S. government health programs such as the U.S. Medicaid Drug Rebate Program, the U.S. Medicare Part-D Rebate Program and the U.S. Commercial Managed Care Program. 2) Provisions for Litigation Provisions for litigation are recorded, after taking appropriate legal and other specialist advice, where an outflow of resources is considered probable and a reliable estimate can be made of the likely outcome of

- 6 - the dispute. For certain product liability claims, Takeda will record a provision where there is sufficient history of claims made and settlements to make a reliable estimate of the provision required to cover unasserted claims. 3) Provisions for Restructuring Takeda establishes a provision for restructuring costs when it has developed a detailed formal plan for the restructuring and, through an execution of the plan or an announcement of its main features to those affected by it, a valid expectation has been raised in those affected by the plan that the plan will be implemented. Takeda records the provision and associated expenses based on estimated costs associated with the plan. (5) Post-Employment Benefit Takeda sponsors lump-sum payments on retirement, pensions and other plans such as post- retirement medical care as post- employment benefit plans. They are classified into defined benefit plans and defined contribution plans, depending on the characteristics of the plans. 1) Defined Benefit Plans Takeda uses the projected unit credit method to determine the present value, the related current service cost, and the past service cost by each defined benefit obligation. The discount rate is determined by reference to market yields on high quality corporate bonds at the end of the reporting period. The net defined benefit liabilities (assets) in the consolidated statements of financial position are calculated by deducting the fair value of the plan assets from the present value of the defined benefit obligations. If the defined benefit plan has a surplus, the net defined benefit asset is limited to the present value of any future economic benefits available in the form of refunds from the plan or reductions in future contributions to the plan. Past service cost defined as the change in the present value of the defined benefit obligation resulting from a plan amendment or curtailment is recognized in profit or loss upon occurrence of the plan amendment or curtailment. Re-measurement of net defined benefit plans is recognized in full as other comprehensive income and transferred to retained earnings in the period in which they are recognized. 2) Defined contribution plans The costs for defined contribution plans are recognized as expenses when the employees render the related service. (6) Revenue and expenses (Revenue recognition) Takeda’s revenue is primarily related to the sale of pharmaceutical products and is generally recognized when control of the products is passed to the customer in an amount that reflects the consideration to which Takeda expects to be entitled in exchange for those products. Control is generally transferred at the point in time of shipment to or receipt of the products by the customer, or when the services are performed. The amount of revenue to be recognized is based on the consideration Takeda expects to receive in exchange for its goods or services. If a contract contains more than one contractual promise to a customer (performance obligation), the consideration is allocated based on the standalone selling price of each performance obligation. The consideration Takeda receives in exchange for its goods or services may be fixed or variable. Variable consideration is only recognized to the extent it is highly probable that a significant reversal will not occur. Takeda’s gross sales are subject to various deductions, which are primarily composed of rebates and discounts to retail customers, government agencies, wholesalers, health insurance companies and managed healthcare organizations. These deductions represent estimates of the related obligations, requiring the use of judgment when estimating the effect of these sales deductions on gross sales for a reporting period. These adjustments are deducted from gross sales to arrive at net sales. Takeda monitors the obligation for these deductions on at least a quarterly basis and records adjustments when rebate trends, rebate programs and contract terms, legislative changes, or other significant events indicate that a change in the obligation is appropriate. Historically, adjustments to rebate accruals have not been material to net earnings. The United States (the “U.S.”) market has the most complex arrangements related to revenue deductions. The following summarizes the nature of the most significant adjustments to revenue: • U.S. Medicaid: The U.S. Medicaid Drug Rebate Program is administered by state governments using state and federal funds to provide assistance to certain qualifying individuals and families, who cannot finance their own medical expenses. Calculating the rebates to be paid related to this program involves interpreting relevant regulations, which are subject to challenge or change in interpretative guidance by government authorities. Provisions for Medicaid rebates are estimated based upon identifying the products subject to a rebate, historical experience, patient demand, product pricing and

- 7 - the mix of contracts and specific terms in the individual state agreements. The provisions for Medicaid rebates are recorded in the same period that the corresponding revenues are recognized; however, the Medicaid rebates are not fully paid until subsequent periods. There is often a time lag of several months between Takeda recording the revenue deductions and Takeda’s final accounting for Medicaid rebates. These expected product specific assumptions relate to estimating which of Takeda’s revenue transactions will ultimately be subject to the U.S. Medicaid program. • U.S. Medicare: The U.S. Federal Medicare Program, which funds healthcare benefits to individuals age 65 or older and certain disabilities, provides prescription drug benefits under Part D section of the program. This benefit is provided and administrated through private prescription drug plans. Provisions for Medicare Part D rebates are calculated based on the terms of individual plan agreements, patient demand, product pricing and the mix of contracts. The provisions for Medicare Part D rebates are recorded in the same period that the corresponding revenues are recognized; however, the Medicare Part D rebates are not fully paid until subsequent periods. There is often a time lag of several months between Takeda recording the revenue deductions and Takeda’s final accounting for Medicare Part D rebates. These expected product specific assumptions relate to estimating which of the Takeda’s revenue transactions will ultimately be subject to the U.S. Medicare program. • Customer rebates: Customer rebates including commercial managed care in the U.S. are offered to purchasing organizations, health insurance companies, managed healthcare organizations, and other direct and indirect customers to sustain and increase market share, and to ensure patient access to Takeda’s products. Since rebates are contractually agreed upon, the related provisions are estimated based on the terms of the individual agreements, historical experience, and patient demand. The provisions for commercial managed care rebates in the U.S. are recorded in the same period that the corresponding revenues are recognized; however, commercial managed care rebates in the U.S. are not fully paid until subsequent periods. There is often a time lag of several months between Takeda recording the revenue deductions and Takeda’s final accounting for commercial managed care rebates in the U.S. These expected product specific assumptions relate to estimating which of Takeda’s revenue transactions will ultimately be subject to the commercial managed care in the U.S. • Wholesaler chargebacks: Takeda has arrangements with certain indirect customers whereby the customer is able to buy products from wholesalers at reduced prices. A chargeback represents the difference between the invoice price to the wholesaler and the indirect customer’s contractual discounted price. Provisions for estimating chargebacks are calculated based on the terms of each agreement, historical experience and product demand. Takeda has a legally enforceable right to set off the trade receivables and chargebacks and it intends either to settle them on a net basis or to realize the asset and settle the liability simultaneously. Thus the provision for chargebacks are recorded as a deduction from trade receivables on the consolidated statements of financial position. • Return reserves: When Takeda sells a product providing a customer with the right to return, Takeda records a provision for estimated sales returns based on its sales return policy and historical return rates. Takeda estimates the proportion of recorded revenue that will result in a return by considering relevant factors, including past product returns activity, the estimated level of inventory in the distribution channel and the shelf life of products. Because the amounts are estimated, they may not fully reflect the final outcome, and the amounts are subject to change dependent upon, amongst other things, expected product specific assumptions used in estimating which of Takeda’s revenue transactions will ultimately be subject to the respective programs. Takeda generally receives payments from customers within 90 days after the point in time when goods are delivered to the customers. Takeda usually performs those transactions as a principal, but Takeda also sells products on behalf of others in which case revenue is recognized at an amount of sales commission that Takeda expects to be entitled as an agent. Takeda also generates revenue in the form of royalty payments, upfront payments, and milestone payments from the out-licensing and sale of intellectual property (“IP”). Royalty revenue earned through a license is recognized when the underlying sales have occurred. Revenue from upfront payment is generally recognized when Takeda provides a right to use IP. Revenue from milestone payments is recognized at the point in time when it is highly probable that the respective milestone event criteria is met, and a significant reversal in the amount of revenue recognized will not occur. Revenue from other services such as R&D of compounds that are out-licensed is recognized over the service period. Takeda generally receives payments from customers within 60 days after entering into out-licensing contracts or confirmation by customers that conditions for the milestone payments are met. Takeda licenses its own intellectual property rights to customers and performs those transactions as a principal. Takeda also provides other services as a principal or an agent.

- 8 - Takeda identifies a contract modification in case of a change in the scope or price (or both) of a contract. If a contract modification is not accounted for as a separate contract, both of the revenue recognized before and after contract modification is presented in the same categories of the disaggregation of revenue information. (7) Other Significant Accounting Policies for the Consolidated Financial Statements (Stated Amount) All amounts shown are rounded to the nearest million Japanese Yen ("JPY"). [Notes for Changes in Accounting Policies] During the year ended March 31, 2024, Takeda has adopted the following new accounting standards and interpretations: (The Adoption of IAS 12 Income Taxes) On May 23, 2023, amendments to IAS 12 Income Taxes (“IAS12”) were issued to clarify requirements relating to the International Tax Reform - Pillar Two model rules. As required by the amended IAS12, Takeda adopted immediately and retrospectively the exception to neither recognize nor disclose information about deferred tax assets and liabilities related to Pillar Two model rules. The amended IAS12 requirements to provide new disclosures regarding the exposure of Pillar Two model rules to the consolidated financial statements have been incorporated starting from the fiscal year ended March 31, 2024. Takeda has performed an assessment of its potential exposure to Pillar Two income taxes based on the most recent tax filings, country-by-country reporting and financial statements for the constituent entities in the group. Based on this assessment, Takeda expects that the top-up tax related to Pillar Two will only arise in a limited number of jurisdictions and the amount of additional tax charge will not be material. [Notes for Accounting Estimates and Assumptions] The items which were recorded on the consolidated financial statements as of this fiscal year end using accounting estimates or assumptions and could have a material impact on the consolidated financial statements as of March 31, 2025 are described below. Provisions for Contractual and Statutory Rebates Payable under Commercial Healthcare Provider Contracts and U.S. State and Federal Government Health Programs JPY 253,832 million. In order to estimate provisions for contractual and statutory rebates payable under Commercial healthcare provider contracts and U.S. state and Federal government health programs such as U.S. Medicaid as well as U.S. commercial managed care programs, expected product specific assumptions are used in estimating which of Takeda’s revenue transactions will ultimately be subject to the respective programs. The change in the product specific assumptions could have a significant impact on the amount of provisions to be recorded on the consolidated financial statements as of March 31, 2025. Goodwill JPY 5,410,067 million, Intangible Assets JPY 4,274,682 million Goodwill and Intangible assets are generally considered impaired when their balance sheet carrying amount exceeds their estimated recoverable amount. The recoverable amount of an intangible asset is estimated for each individual asset or at the larger cash generating unit (CGU) level when cash is generated in combination with other assets. Takeda's cash generating units or group of cash generating units are identified based on the smallest identifiable group of assets that generate independent cash inflows. Goodwill is tested for impairment at the single operating segment level (one CGU), which is the level at which goodwill is monitored for internal management purpose. The estimation of the recoverable value requires us to make a number of assumptions including: • amount and timing of projected future cash flows; • behavior of competitors (launch of competing products, marketing initiatives, etc.); • probability of obtaining regulatory approvals; • future tax rates; • terminal growth rate; and • discount rate. The significant assumptions used in estimating the amount and timing of future cash flows are the probability of technical and regulatory success related to in-process research and development (IPR&D) projects and the sales forecast of the products. The sales forecast related to certain products is one of the significant assumptions used in estimating the recoverable amount of goodwill. Events that may result in a change in the

- 9 - assumptions include IPR&D projects that are not successfully developed, fail during development, are abandoned or subject to significant delay or do not receive the relevant regulatory approvals, and/or lower sales projections of certain commercially marketed products typically due to launch of newly competing products, and supply constraints. If these events were to occur, Takeda may not recover the value of the initial or subsequent R&D investments made subsequent to acquisition of the asset project nor realize the future cash flows that Takeda has estimated. These events could have a significant impact on the amount of goodwill and intangible assets to be recorded on the consolidated financial statements as of March 31, 2025. Provision for Litigation JPY 22,342 million The factors Takeda considers in developing the provision for litigation and other contingent liability amounts include the merits and jurisdiction of the litigation, the nature and the number of other similar current and past litigation cases, the nature of the product and the current assessment of the science subject to the litigation, and the likelihood of settlement and current state of settlement discussions, if any. In addition, Takeda records a provision for product liability claims incurred, but not filed, to the extent Takeda can formulate a reasonable estimate of their costs based primarily on historical claims experience and data regarding product usage. In cases Takeda may become involved in significant legal proceedings for which it is not possible to make a reliable estimate of the expected financial effect, if any, which may result from ultimate resolution of the proceedings, no provision is recognized for such cases. The estimates of these provisions and contingent liabilities are dependent upon the outcome of litigation proceedings, investigations and possible settlement negotiations, and therefore could have a significant impact on the amount of provisions to be recorded on the consolidated financial statements as of March 31, 2025. Income Taxes Payable JPY 109,906 million, Deferred Tax Assets JPY 393,865 million Takeda prepares and files the tax returns based on an interpretation of tax laws and regulations, and records estimates based on these judgments and interpretations. In the normal course of business, Takeda’s tax returns are subject to examination by various tax authorities, which may result in additional tax, interest or penalty assessment by these authorities. Inherent uncertainties exist in estimates of many uncertain tax positions due to changes in tax law resulting from legislation, regulation, and/or as concluded through the various jurisdictions’ tax court systems. When Takeda concludes that it is not probable that a tax authority will accept an uncertain tax position, Takeda recognizes the best estimate of the expenditure required to settle a tax uncertainty. The amount of unrecognized tax benefits is adjusted for changes in facts and circumstances. For example, adjustments could result from significant amendments to existing tax law, the issuance of regulations or interpretations by the tax authorities, new information obtained during a tax examination, or resolution of a tax examination. These adjustment could have a significant impact on the amount of income tax payable to be recorded on the consolidated financial statements as of March 31, 2025. Takeda also assesses deferred tax assets to determine the realizable amount at the end of each period. In assessing the recoverability of deferred tax assets, Takeda considers the scheduled reversal of taxable temporary differences, projected future taxable profits, and tax planning strategies. Future taxable profits according to profitability are estimated based on Takeda’s business plan. The change in judgment upon determining the revenue forecast related to certain products used for Takeda’s business plan could have a significant impact on the amount of the deferred tax assets to be recorded on the consolidated financial statements as of March 31, 2025. Provisions for Restructuring JPY 12,102 million Takeda incurs restructuring costs associated with planned initiatives to reduce the costs. Takeda’s most significant restructuring costs are severance payments. Takeda establishes a provision for restructuring costs when it has developed a detailed formal plan for the restructuring and, through an execution of the plan or an announcement of its main features to those affected by it, a valid expectation has been raised in those affected by the plan that the plan will be implemented. The recognition of restructuring provision requires estimates including timing of payments and the number of individuals impacted by the restructuring. As a result of these estimates, the actual restructuring costs may differ from the estimates, and therefore the difference, if any, could have a significant impact on the amount of the provisions to be recorded on the consolidated financial statements as of March 31, 2025. [Additional Information] In March 2024, the Board of Directors approved the issuance of subordinated JPY Hybrid Bonds (“the 2nd Hybrid Bonds”) with a maturity of up to 60 years in the form of a public offering in Japan. The proceeds of the 2nd Hybrid Bonds will be used to replace the 1st Hybrid Bonds of JPY 500 billion that were issued on June 6, 2019, with any shortfall on the replacement value being delivered by the proceeds of appropriately approved Hybrid Loans

- 10 - containing similar terms to the 2nd Hybrid Bonds. The 2nd Hybrid Bonds are expected to be priced and issued in mid-2024 subject to market conditions and investor demand. [Notes on Consolidated Statement of Profit or Loss] Amortization and Impairment Losses on Intangible Assets Associated with Products The impairment losses were JPY 130,592 million, which primarily include JPY 73,979 million impairment charges for ALOFISEL (for complex Crohn's perianal fistulas) following topline results of phase 3 ADMIRE-CD II trial and JPY 28,477 million impairment charges for EXKIVITY (for the treatment of non-small cell lung cancer) following a decision to initiate a voluntary withdrawal globally, and impairment charges for certain assets related to in-process R&D assets including those related to TAK-007 and modakafusp alfa (TAK-573) in Oncology as results of decisions to terminate those programs. These impairment charges were partially offset by a reversal of impairment loss in an amount of JPY 35,686 million related to the approval of EOHILIA, therapy eosinophilic esophagitis (EoE), by U.S. Food and Drug Administration (FDA) in February 2024. Other Operating Expenses Other operating expenses were JPY 206,527 million, which included the restructuring expenses of JPY 81,358 million, additional losses recorded for the supply agreement litigation with AbbVie, Inc. ("AbbVie") of JPY 26,405 million in the fiscal year ended March 31, 2024 and loss from changes in the fair value of financial assets and liabilities associated with contingent consideration arrangements primarily from XIIDRA and EOHILIA of JPY 20,755 million. Income Tax Benefit Takeda recorded income tax benefit of JPY 91,406 million. Shire received a tax assessment from the Irish Revenue Commissioners (“Irish Revenue”) on November 28, 2018 for EUR 398 million. This assessment relates to the tax treatment of the USD 1,635 million break fee Shire received from AbbVie in connection with the terminated offer to acquire Shire made by AbbVie in 2014. Shire was acquired by Takeda in January 2019. Takeda appealed the assessment to the Tax Appeals Commission (“TAC”) and the appeal was heard by the TAC in late 2020. On July 30, 2021, Takeda received a ruling on the matter from the TAC, with the TAC ruling in favor of the Irish Revenue and recorded an income taxes payable for the case. Subsequently, on October 17, 2023, Takeda agreed with the Irish Revenue to settle the tax assessment for EUR 130 million including interest and without penalties, as a full and final settlement of all liabilities in relation to the receipt of the break fee. As a result, Takeda reversed its income taxes payable in excess of the settlement amount of EUR 130 million and recorded JPY 63,547 million reduction to tax expenses for the fiscal year ended March 31, 2024. Takeda made a payment in the settlement in the fiscal year ended March 31, 2024. The tax reduction described above and R&D and Orphan Drug Credits were offset by the tax charges from legal entity restructuring. [Notes on Consolidated Statement of Financial Position] 1. Accumulated Depreciation on Assets (including Accumulated Impairment Losses) Property, plant and equipment JPY 1,220,701 million Investment property JPY 13,689 million 2. Impairment Loss Allowance Directly Deducted from Trade and Other Receivables Trade and other receivables JPY 8,376 million 3. Contingent Liabilities Litigation Takeda is involved in various legal and administrative proceedings. The most significant matters are described below. Takeda may become involved in significant legal proceedings for which it is not possible to make a reliable estimate of the expected financial effect, if any, which may result from ultimate resolution of the proceedings. In these cases, appropriate disclosures about such cases would be included in this note, but no provision would be made for the cases. With respect to each of the legal proceedings described below, other than those for which a provision has been made, Takeda is unable to make a reliable estimate of the expected financial effect at this stage. This is due to a number of factors, including, but not limited to, the stage of proceedings, the entitlement of parties to appeal a decision, if any, and lack of clarity as to the merits of theories of liability, the merits of Takeda’s defenses, the amount and recoverability of damages and/or governing law.

- 11 - Takeda does not believe that information about the amount sought by the plaintiffs, if that is known, is, by itself, meaningful in every instance with respect to the outcome of those legal proceedings. Legal expenses incurred and charges related to legal claims are recorded in selling, general and administrative expenses. Provisions are recorded, after taking appropriate legal and other specialist advice, where an outflow of resources is considered probable and a reliable estimate can be made of the likely outcome of the dispute. The factors Takeda considers in developing a provision include the merits and jurisdiction of the litigation, the nature and the number of other similar current and past litigation, the nature of the product and the current assessment of the science subject to the litigation, and the likelihood of settlement and current state of settlement discussions, if any. As of March 31, 2024, Takeda’s aggregate provisions for legal and other disputes were JPY 22,342 million. The ultimate liability for legal claims may vary from the amounts provided and is dependent upon the outcome of litigation proceedings, investigations and possible settlement negotiations. Unless otherwise stated below, Takeda is unable to predict the outcome or duration of these matters at this time. Takeda’s position could change over time, and, therefore, there can be no assurance that any losses that result from the outcome of any legal proceedings will not exceed, by a material amount, the amount of the provisions reported in these consolidated financial statements. Matters that were previously disclosed may no longer be reported because, as a result of rulings in the case, settlements, changes in our business or other developments, in our judgment, they are no longer material to our financial condition or operating results. Product Liability and Related Claims Pre-clinical and clinical trials are conducted during the development of potential products to determine the safety and efficacy of products for use by humans following approval by regulatory bodies. Notwithstanding these efforts, when drugs and vaccines are introduced into the marketplace, unanticipated safety issues may become, or be claimed by some to be, evident. Takeda is currently a defendant in a number of product liability lawsuits related to its products. For the product liability lawsuits and related claims, other than those for which a provision has been made, Takeda is unable to make a reliable estimate of the expected financial effect at this stage. Takeda’s principal pending legal and other proceedings are disclosed below. The outcomes of these proceedings are not always predictable and can be affected by various factors. For those legal and other proceedings for which it is considered at least reasonably possible that a loss has been incurred, Takeda discloses the possible loss or range of possible loss in excess of the recorded loss contingency provision, if any, where such excess is both material and estimable. ACTOS Economic Loss Cases Takeda has been named in ACTOS-related lawsuits brought by plaintiffs who do not assert any claims for personal injuries. Instead plaintiffs claim they suffered an economic loss by paying for ACTOS prescriptions that allegedly would not have been written had Takeda provided additional information about the alleged risks of bladder cancer associated with ACTOS in its US product label. A putative class of third party payors and consumers brought suit against Takeda in the U.S. District Court for the Central District of California. Proton Pump Inhibitor (“PPI”) Product Liability Claims As of March 31, 2024, more than 6,100 product liability lawsuits related to the use of PREVACID and DEXILANT have been filed against Takeda in U.S. federal and state courts. Most of these cases are pending in U.S. federal court and are consolidated for pre-trial proceedings in a multi-district litigation in federal court in New Jersey. The plaintiffs in these cases allege they developed kidney injuries or, in some cases, gastric cancer as a result of taking PREVACID and/or DEXILANT, and that Takeda failed to adequately warn them of these potential risks. Similar cases were filed against other manufacturers of drugs in the same PPI class as Takeda’s products, including AstraZeneca plc (“AstraZeneca”), Procter & Gamble Company (“Procter & Gamble”) and Pfizer Inc. (“Pfizer”). Outside the U.S., one proposed class action is pending in Canada (Saskatchewan). The defendants include Takeda, AstraZeneca, Janssen Pharmaceutical Companies (“Janssen”) and several generic manufacturers. In April 2024, Takeda has reached an agreement in principle to resolve the U.S. cases for a non- material amount. The settlement has no material impact on Takeda’s consolidated statements of profit or loss. Intellectual property Intellectual property claims include challenges to the validity and enforceability of Takeda’s patents on various products or processes as well as assertions of non-infringement of those patents. A loss in any

- 12 - of these cases could result in loss of patent protection for the product at issue. The consequences of any such loss could be a significant decrease in sales of that product and could materially affect future results of operations for Takeda. TRINTELLIX Takeda has received notices from sixteen generic pharmaceutical companies that they have submitted ANDAs with paragraph IV certifications seeking to sell generic versions of TRINTELLIX. Takeda filed patent infringement lawsuits against the ANDA filers in federal court in Delaware. Lawsuits against ten ANDA filers were resolved before trial. A trial took place from January 15 to January 28, 2021 with six ANDA filers, including Alembic Pharmaceuticals Limited and Alembic Pharmaceuticals, Inc., Lupin Limited and Lupin Pharmaceuticals, Inc. (“Lupin”), Macleods Pharmaceuticals Ltd., Sigmapharm Laboratories, LLC, Sandoz, Inc., and Zydus Pharmaceuticals (USA) Inc. and Cadila Healthcare Limited. The Court issued its decision on September 30, 2021 and found that US Patent 7,144,884, which covers vortioxetine (the active ingredient in Trintellix), is valid. For the rest of the asserted patent, only US Patent 9,101,626, which covers processes for synthesizing vortioxetine, was found to be infringed by Lupin. Other patents (including crystalline form and certain method of use patents) were found to be valid but not infringed by any of the defendants. Takeda filed a notice of appeal on November 24, 2021. Lupin filed a notice of appeal on November 29, 2021 and other defendants filed a notice of appeal on December 8, 2021. Oral argument at the Federal Circuit took place on September 8, 2023. On December 7, 2023, the Federal Circuit Court affirmed the district court decision that the method of use patents are valid but not infringed and the process patent is infringed by Lupin. Takeda did not appeal to the Supreme Court (petition for the Supreme Court to grant a writ of certiorari). Lupin did not appeal to the Supreme Court by the deadline of March 6. The impact of this decision was not material to Takeda’s consolidated statements of profit or loss. Other In addition to the individual cases described above, there are no other patent litigations that have a material impact on Takeda’s consolidated financial statements as of and for the year ended March 31, 2024. Sales, Marketing, and Regulation Takeda has other litigations related to its products and its activities, the most significant of which are describe below. ACTOS Antitrust Litigation In December 2013, the first of two antitrust class action lawsuits was filed against Takeda in the U.S. District Court for the Southern District of New York by a putative class of patients who were prescribed ACTOS. The second class action was filed against Takeda in the same court in April 2015 by a putative class of wholesalers that purchased ACTOS from Takeda. In both actions, plaintiffs allege, inter alia, that Takeda improperly characterized certain patents for ACTOS in the FDA Orange Book, which they claim imposed requirements on generic companies that filed Abbreviated New Drug Applications and, in turn, resulted in delayed market entry for generic forms of ACTOS. In October 2019, the District Court denied Takeda’s motion to dismiss. Takeda subsequently sought an interlocutory appeal of the District Court’s decision, which was denied. INTUNIV Antitrust Litigation In January 2017, an antitrust class action was filed against Shire plc, Shire LLC, and Shire U.S. Inc. (collectively, “Shire”) in the U.S. District Court for the District of Massachusetts. The plaintiffs, a putative class of wholesalers, allege that Shire’s settlement in 2013 of patent litigation claims against Actavis Elizabeth LLC related to its generic formulation of INTUNIV constituted an anticompetitive “reverse payment.” In May 2024, Takeda has reached an agreement-in-principle to resolve the matter on a class basis for an amount that is immaterial. The final settlement, once consummated, will be subject to court approval. The settlement has no material impact on Takeda’s consolidated statements of profit or loss. AMITIZA Antitrust Litigation In August 2021, an antitrust class action was filed against Takeda Pharmaceuticals U.S.A., Inc. (“Takeda”) in the U.S. District Court for the District of Massachusetts. The plaintiffs, a putative class of wholesalers, allege that a settlement that Takeda and Sucampo Pharmaceuticals, Inc. entered into in 2014 with Par Pharmaceutical, Inc. (“Par”) to resolve patent litigation claims related to Par’s generic formulation of AMITIZA were anticompetitive. In December 2023 and in January 2024, additional

- 13 - complaints were filed in the U.S. District Court for the District of Massachusetts by a health insurer plaintiff as well as by individual retail pharmacies plaintiffs. COLCRYS Antitrust Litigation In September 2021, an antitrust class action was filed against Takeda Pharmaceuticals U.S.A., Inc. (“Takeda”) in the U.S. District Court for the Eastern District of Pennsylvania. The plaintiffs, a putative class of wholesalers, allege that settlements that Takeda entered into in 2015 and 2016 to resolve patent litigation claims against several generic drug manufacturers related to generic formulations of COLCRYS were anticompetitive. In September 2023, Takeda reached an agreement in principle to resolve the antitrust matter for an amount that is immaterial, which was fully executed in December 2023. The settlement had no material impact on Takeda’s consolidated statements of profit or loss. In November 2023, a subsequent antitrust class action challenging the same settlements was filed in the U.S. District Court for the Southern District of New York by plaintiffs seeking to represent a putative class of end payors. AbbVie Supply Agreement Litigation In November 2020, AbbVie brought suit against Takeda Pharmaceutical Company Limited (“Takeda”) in Delaware Chancery Court alleging Takeda breached its agreement with AbbVie related to the supply of LUPRON in the U.S. due to shortages arising from quality issues the U.S. Food & Drug Administration identified concerning Takeda’s production facility in Hikari, Japan as part of a Form 483 issued in November 2019 and a Warning Letter issued in June 2020. In the litigation, AbbVie sought both preliminary injunctive relief and monetary damages. In September 2021, the court issued an order denying AbbVie’s request for injunctive relief. The court subsequently issued a decision finding Takeda in breach of the supply agreement. In September 2023, the court issued a decision regarding the quantification of AbbVie’s monetary damages and subsequently entered judgment in December 2023. In accordance with the judgment, Takeda paid USD 505 million, including interest, in March 2024 with a total financial impact of JPY 26,405 million loss in other operating expenses and JPY 7,141 million in finance expenses for the interest for the fiscal year ended March 31, 2024. Investigation of Patient Assistance Programs In November 2016, the U.S. Department of Justice (“DOJ”) (through the U.S. Attorneys’ Office in Boston) issued a subpoena to Ariad Pharmaceuticals, Inc. (“Ariad”), which was acquired by Takeda during the year ended March 31, 2017, seeking information from January 2010 to the present relating to Ariad’s donations to 501(c) (3) co-payment foundations, financial assistance programs, and free drug programs available to Medicare beneficiaries and the relationship between these co-payment foundations and specialty pharmacies, hubs or case management programs. Takeda is cooperating with the investigation. In June 2019, the DOJ (through the U.S. Attorney’s Office in Boston) issued a subpoena to Shire Pharmaceuticals LLC, which was acquired by Takeda during the year ended March 31, 2019 (through Takeda’s acquisition of Shire plc). The subpoena generally seeks information about Shire’s interactions with 501(c)(3) organizations that provide financial assistance to Medicare patients taking Shire drugs, including the hereditary angioedema medications FIRAZYR and CINRYZE. Takeda cooperated with the investigation and in December 2023, Takeda reached a settlement for an amount that is immaterial. The settlement had no material impact on Takeda’s consolidated statements of profit or loss. Department of Justice Civil Investigative Demands On February 19, 2020, Takeda received a Civil Investigative Demand (“CID”) from the DOJ (through its office in Washington, DC). The CID seeks information as part of an investigation of possible off-label promotion and violations of the Anti-Kickback Statute in connection with the promotion and sale of TRINTELLIX. Takeda is cooperating with the DOJ’s investigation. On February 28, 2020, Takeda received a CID from the DOJ (through its office in Washington, DC). The CID seeks information as part of an investigation of possible kickbacks to a Florida allergy center in connection with the promotion and sale of Takeda’s subcutaneous IG products, CUVITRU, HYQVIA and GAMMAGARD. Takeda is cooperating with the DOJ’s investigation. Brazilian Investigation Related to ELAPRASE and REPLAGAL On November 30, 2021, the Brazilian federal authorities executed a search warrant at Takeda offices in Brazil. The warrant sought records about information Takeda received from the Brazilian National Sanitary Surveillance Agency (AVISA) as well as any records related to donations made to charitable organizations which provide funding to patients who are pursuing claims for reimbursement from the

- 14 - Brazilian government for prescriptions of ELAPRASE and REPLAGAL. Takeda is cooperating with the investigation. [Notes on Consolidated Statement of Changes in Equity] 1. Class and total number of shares issued as of March 31, 2024 Common Stock 1,582,419 thousand shares 2. Dividends (1) Amount of dividends paid Resolution Class of Shares Total dividends Dividends per share Record date Effective date Ordinary General Meeting of Shareholders Common Stock JPY 140,475 million JPY 90.00 March 31, 2023 June 29, 2023 (June 28, 2023) Meeting of Board of Directors Common Stock JPY 148,037 million JPY 94.00 September 30,2023 December 1, 2023 (October 26, 2023) Total JPY 288,512 million (2) Dividends declared whose record date falls in the fiscal year ended March 31, 2024 and the effective date falls in the following fiscal year Matters with respect to dividends on shares of common stock will be proposed at the Ordinary General Meeting of Shareholders to be held on June 26, 2024 as follows: (i) Total dividends JPY 148,041 million (ii) Dividends per share JPY 94.00 (iii) Record date March 31, 2024 (iv) Effective date June 27, 2024 Dividends will be paid from retained earnings. 3. Class and number of shares underlying stock acquisition rights as of March 31, 2024 (excluding rights whose exercise period has yet to begin) Common stock 2,495,700 shares [Per Share Information] 1. Equity attributable to owners of the Company per share JPY 4,635.56 2. Basic earnings per share JPY 92.09 [Notes on Financial Instruments] 1. Overview of Financial Instruments Takeda promotes risk management to reduce the financial risks arising from business operations. The principal risks to which Takeda is exposed include market risk, counterparty credit risk, and liquidity risk caused by changes in the market environment such as fluctuations in foreign exchange rates, interest rates and market prices of commodities and other financial holdings. Each of these risks is managed in accordance with Takeda’s policies. (1) Market Risk Major market risks to which Takeda is exposed are 1) foreign currency risk, 2) interest rate risk and 3) price fluctuation risk. Financial instruments affected by market risk include loans and borrowings, deposits, equity investments and derivative financial instruments. 1) Foreign Currency Risk Takeda’s exposure to the risk of changes in foreign exchange rates primarily relates to its operations (when revenue or expense is denominated in a foreign currency) and Takeda’s net investments in foreign subsidiaries.

- 15 - Takeda manages foreign currency risks in a centralized manner using derivative financial instruments. Takeda’s policy does not permit the use of speculative foreign currency financial instruments or derivatives. Takeda uses forward exchange contracts, currency swaps, and currency options to hedge individually significant foreign currency transactions. Takeda has also designated loans and bonds denominated in the US dollar and Euro and certain forward exchange contracts as hedging instruments of net investments in foreign operations. 2) Interest Rate Risk Takeda’s exposure to the risk of changes in benchmark interest rates and foreign exchange rate relates to the outstanding debts with floating interest rates as well as the trade and other receivables due from customers that Takeda has the option to factor. Takeda uses interest rate swaps, forward interest rate contracts, and cross currency interest rate swaps that fix the amount of future payments to manage interest and foreign exchange rate risks through cash flow hedge strategies. 3) Price Fluctuation Risk Management Commodity Price Risk For its business operations, Takeda is exposed to risks from commodity price fluctuations. Takeda manages this risk primarily by utilizing fixed price contracts but may also use financial instruments to lock in a fixed price. Market Price Risk Market pricing and valuations of Takeda’s fixed-income financial assets and liabilities are impacted by changes in currency rates, interest rates and credit spreads, which are managed as described above. For equity instruments, Takeda manages the risk of price fluctuations in the instruments by regularly reviewing share prices and financial positions of the issuers. (2) Credit Risk Takeda is exposed to credit risk from its operating activities (primarily trade receivables) and from its financing activities, including deposits with banks and financial institutions, foreign exchange transactions, and other financial instruments. The maximum exposure to credit risk, without taking into account any collateral held at the end of the reporting period, is represented by the carrying amount of the financial instruments which is exposed to credit risk on the consolidated statements of financial position. 1) Customer Credit Risk Trade and other receivables are exposed to customer credit risk. Takeda monitors the status of overdue balances, reviews outstanding balances for each customer and regularly examines the credibility of major customers in accordance with Takeda’s policies for credit management to facilitate the early evaluation and the reduction of potential credit risks. In parallel, Takeda utilizes programs to sell certain trade and other receivables due from certain customers to a select group of banks on a non-recourse basis which in turn minimizes the credit risk associated with such customers. If necessary, Takeda obtains rights to collateral or guarantees on the receivables. 2) Other Counterparty Credit Risk Cash reserves of Takeda are concentrated mostly with Takeda and entities acting as the cash pool leader in the United States and Europe. These cash reserves are managed exclusively by investments in highly rated short- term bank deposits and bonds of highly rated issuers within the investment limits determined by reviewing the investment ratings and terms under Takeda’s policies for fund management, resulting in limited credit risk. Cash reserves, other than those subject to the group cash pooling system, are managed by each consolidated subsidiary in accordance with Takeda’s fund management policies. For derivatives, Takeda enters into contracts only with financial counterparties rated investment grade or higher in order to minimize counterparty risk. (3) Liquidity Risk Takeda manages liquidity risk and establishes an adequate management framework for liquidity risk to secure stable short-, mid-, and long-term funds and sufficient liquidity for operations. Takeda manages liquidity risk by monitoring forecasted cash flows and actual cash flows on an ongoing basis. In addition, Takeda has commitment lines with some counterparty financial institutions to manage liquidity risk. Takeda strives to maximize the available liquidity with a combination of liquid short-term investments and committed credit lines with strong rated counterparties. The objective is to maintain levels in excess of project cash needs to mitigate the risk of contingencies. (4) Capital Management

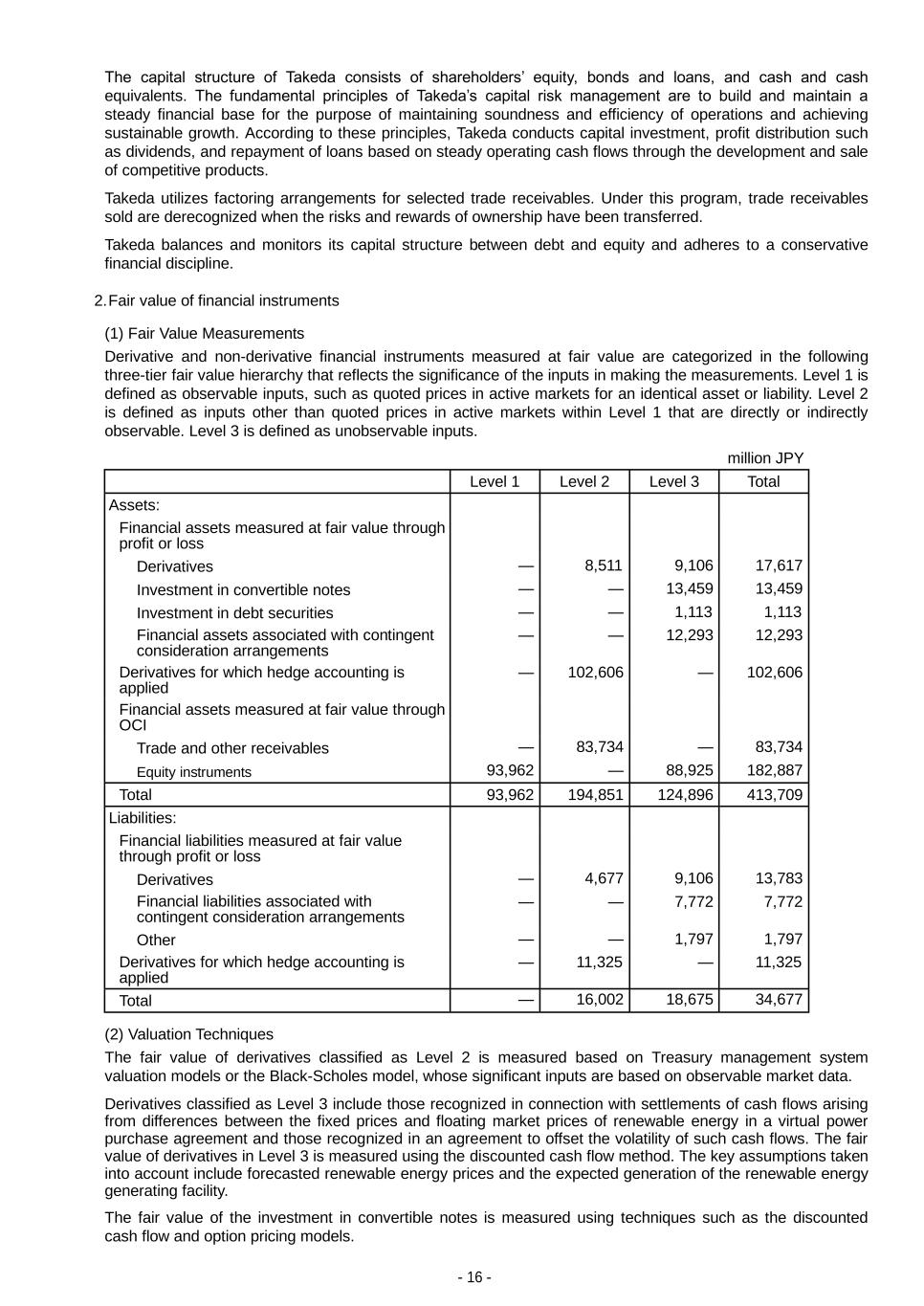

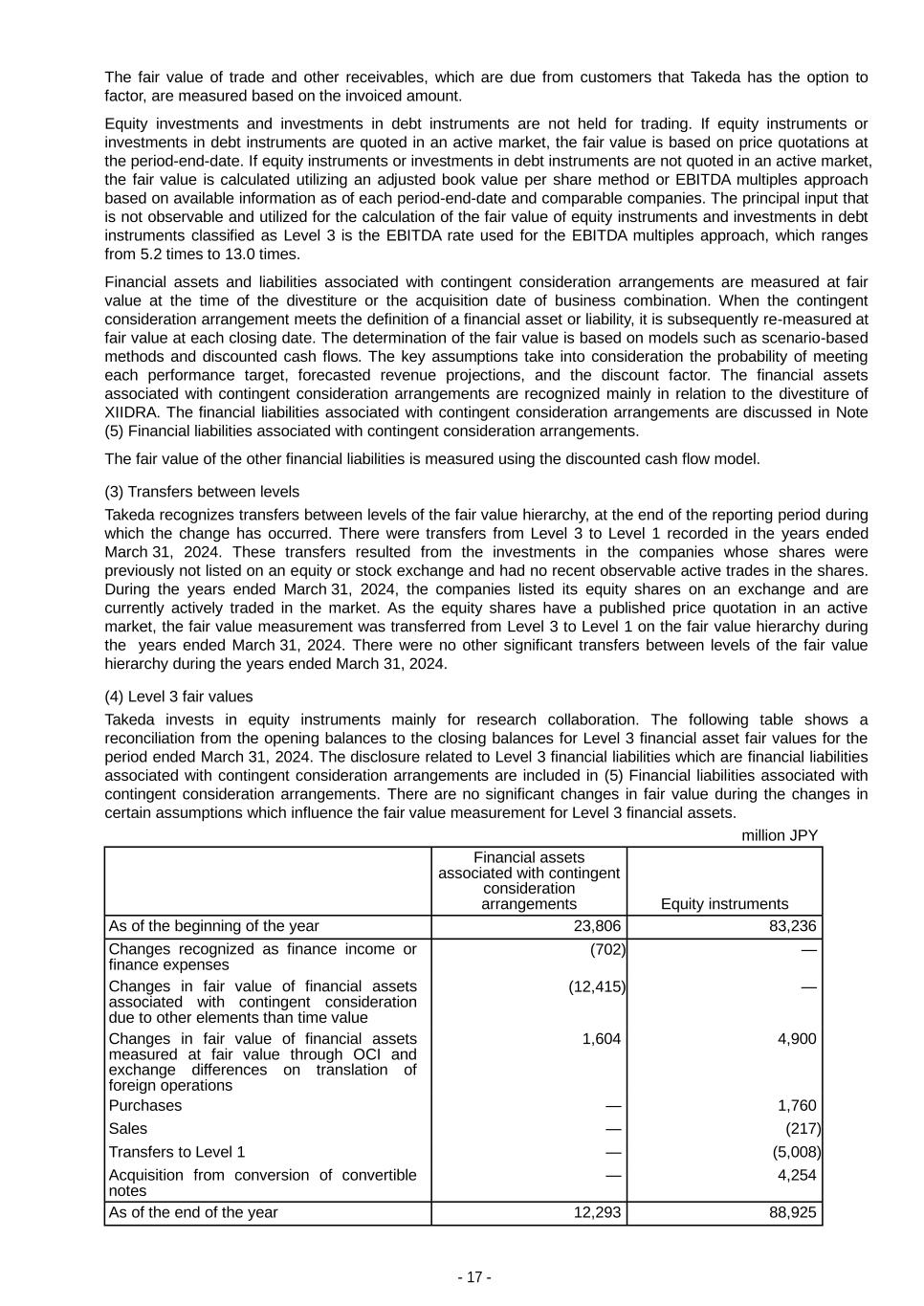

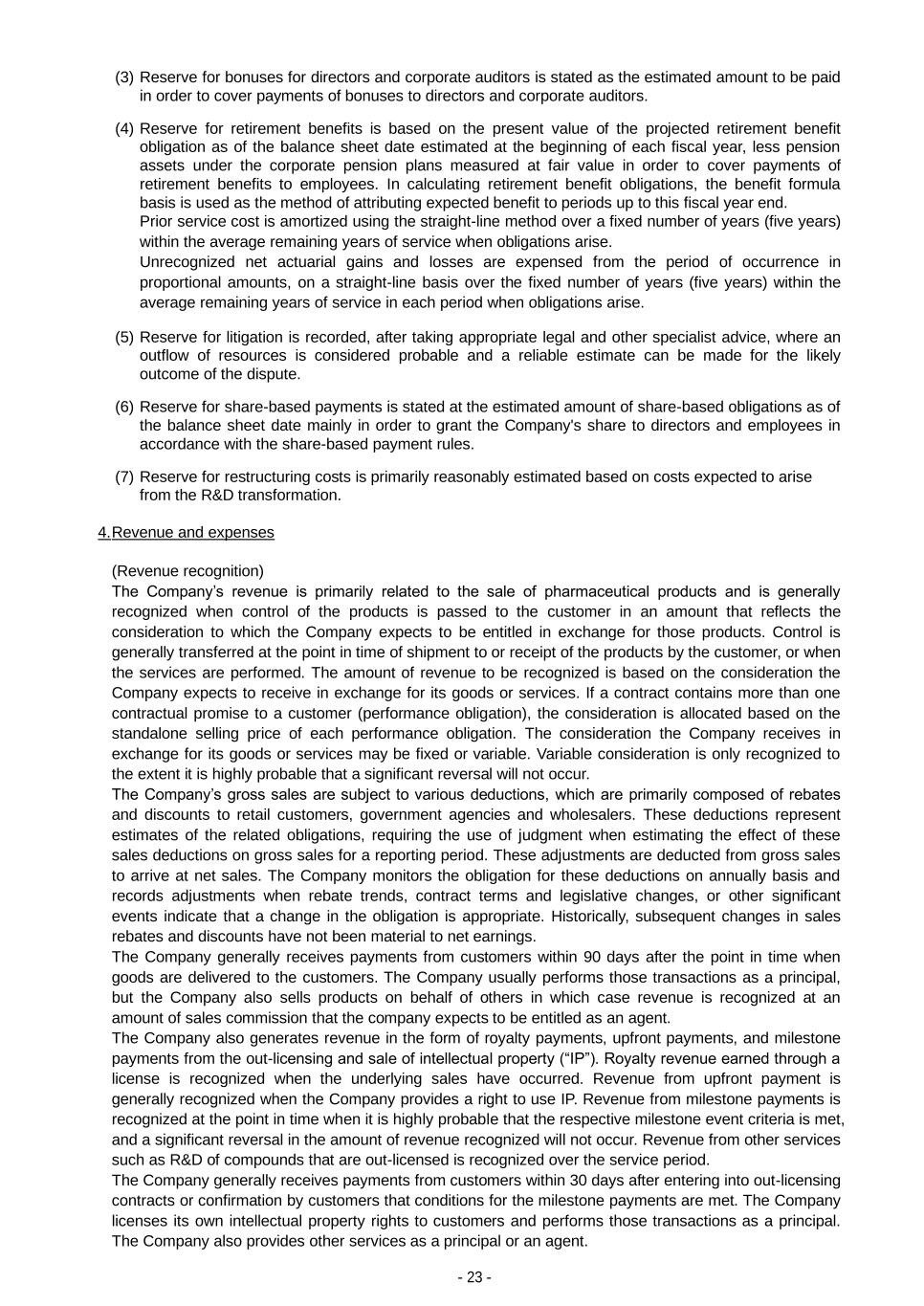

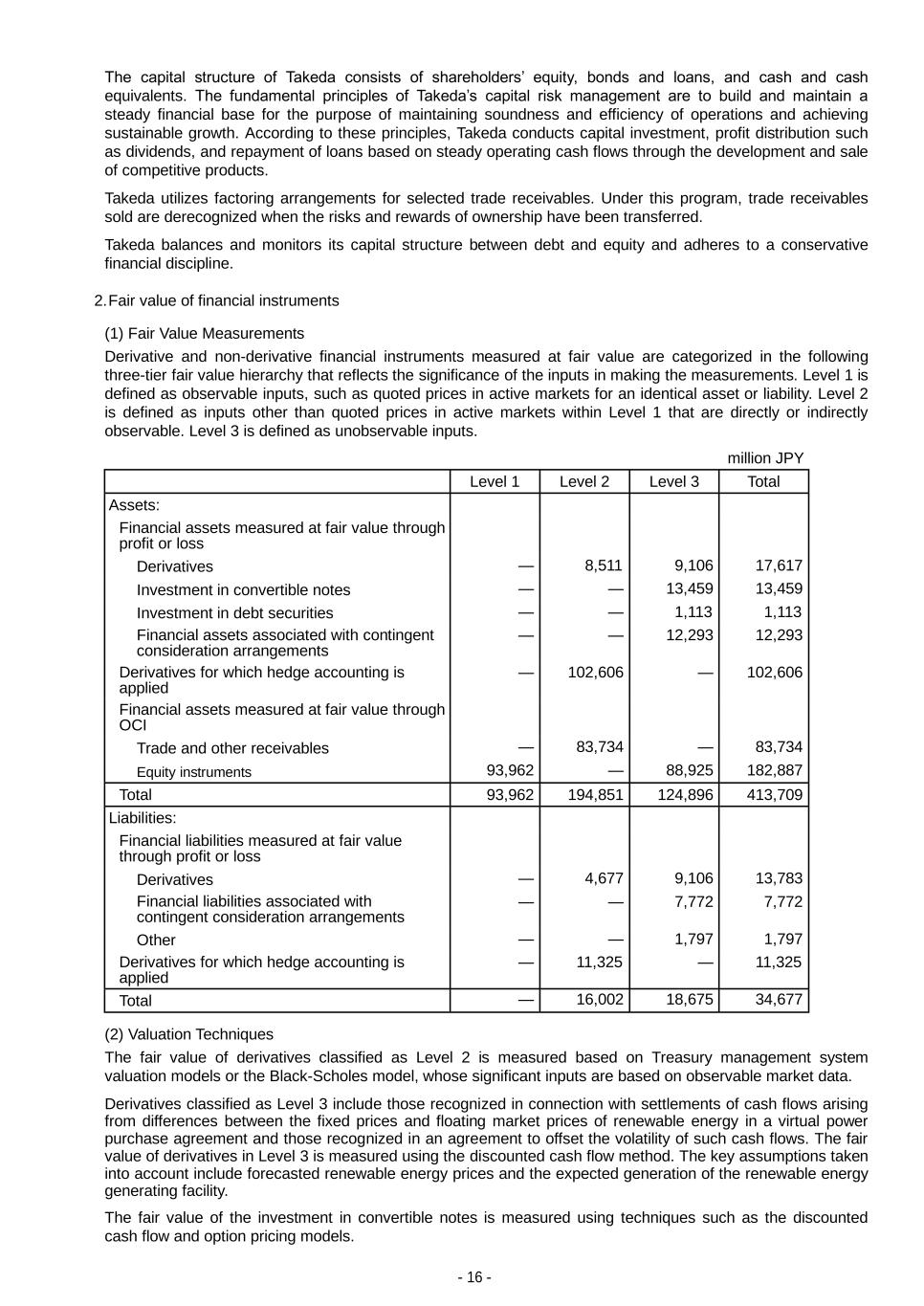

- 16 - The capital structure of Takeda consists of shareholders’ equity, bonds and loans, and cash and cash equivalents. The fundamental principles of Takeda’s capital risk management are to build and maintain a steady financial base for the purpose of maintaining soundness and efficiency of operations and achieving sustainable growth. According to these principles, Takeda conducts capital investment, profit distribution such as dividends, and repayment of loans based on steady operating cash flows through the development and sale of competitive products. Takeda utilizes factoring arrangements for selected trade receivables. Under this program, trade receivables sold are derecognized when the risks and rewards of ownership have been transferred. Takeda balances and monitors its capital structure between debt and equity and adheres to a conservative financial discipline. 2. Fair value of financial instruments (1) Fair Value Measurements Derivative and non-derivative financial instruments measured at fair value are categorized in the following three-tier fair value hierarchy that reflects the significance of the inputs in making the measurements. Level 1 is defined as observable inputs, such as quoted prices in active markets for an identical asset or liability. Level 2 is defined as inputs other than quoted prices in active markets within Level 1 that are directly or indirectly observable. Level 3 is defined as unobservable inputs. million JPY Level 1 Level 2 Level 3 Total Assets: Financial assets measured at fair value through profit or loss Derivatives — 8,511 9,106 17,617 Investment in convertible notes — — 13,459 13,459 Investment in debt securities — — 1,113 1,113 Financial assets associated with contingent consideration arrangements — — 12,293 12,293 Derivatives for which hedge accounting is applied — 102,606 — 102,606 Financial assets measured at fair value through OCI Trade and other receivables — 83,734 — 83,734 Equity instruments 93,962 — 88,925 182,887 Total 93,962 194,851 124,896 413,709 Liabilities: Financial liabilities measured at fair value through profit or loss Derivatives — 4,677 9,106 13,783 Financial liabilities associated with contingent consideration arrangements — — 7,772 7,772 Other — — 1,797 1,797 Derivatives for which hedge accounting is applied — 11,325 — 11,325 Total — 16,002 18,675 34,677 (2) Valuation Techniques The fair value of derivatives classified as Level 2 is measured based on Treasury management system valuation models or the Black-Scholes model, whose significant inputs are based on observable market data. Derivatives classified as Level 3 include those recognized in connection with settlements of cash flows arising from differences between the fixed prices and floating market prices of renewable energy in a virtual power purchase agreement and those recognized in an agreement to offset the volatility of such cash flows. The fair value of derivatives in Level 3 is measured using the discounted cash flow method. The key assumptions taken into account include forecasted renewable energy prices and the expected generation of the renewable energy generating facility. The fair value of the investment in convertible notes is measured using techniques such as the discounted cash flow and option pricing models.

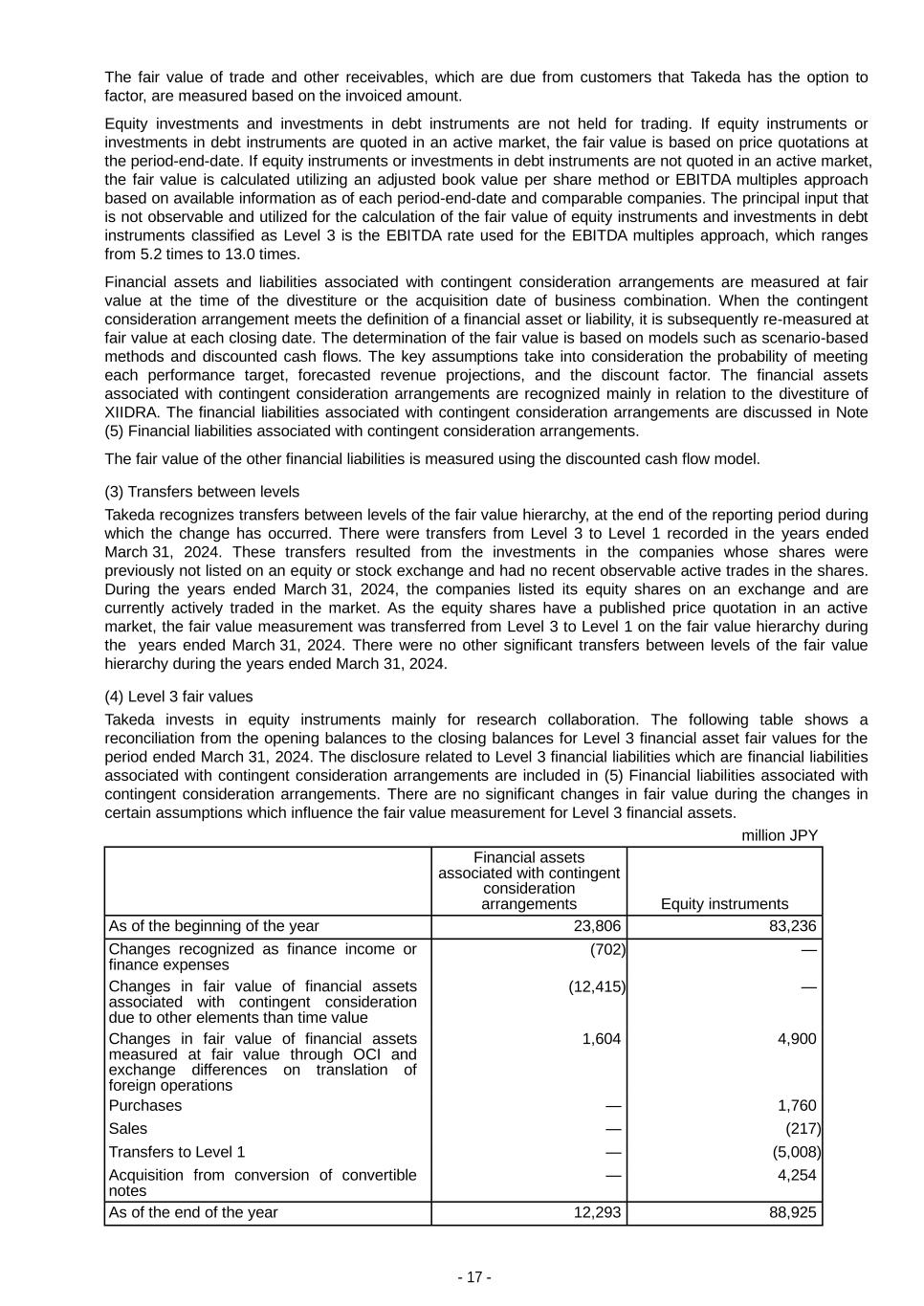

- 17 - The fair value of trade and other receivables, which are due from customers that Takeda has the option to factor, are measured based on the invoiced amount. Equity investments and investments in debt instruments are not held for trading. If equity instruments or investments in debt instruments are quoted in an active market, the fair value is based on price quotations at the period-end-date. If equity instruments or investments in debt instruments are not quoted in an active market, the fair value is calculated utilizing an adjusted book value per share method or EBITDA multiples approach based on available information as of each period-end-date and comparable companies. The principal input that is not observable and utilized for the calculation of the fair value of equity instruments and investments in debt instruments classified as Level 3 is the EBITDA rate used for the EBITDA multiples approach, which ranges from 5.2 times to 13.0 times. Financial assets and liabilities associated with contingent consideration arrangements are measured at fair value at the time of the divestiture or the acquisition date of business combination. When the contingent consideration arrangement meets the definition of a financial asset or liability, it is subsequently re-measured at fair value at each closing date. The determination of the fair value is based on models such as scenario-based methods and discounted cash flows. The key assumptions take into consideration the probability of meeting each performance target, forecasted revenue projections, and the discount factor. The financial assets associated with contingent consideration arrangements are recognized mainly in relation to the divestiture of XIIDRA. The financial liabilities associated with contingent consideration arrangements are discussed in Note (5) Financial liabilities associated with contingent consideration arrangements. The fair value of the other financial liabilities is measured using the discounted cash flow model. (3) Transfers between levels Takeda recognizes transfers between levels of the fair value hierarchy, at the end of the reporting period during which the change has occurred. There were transfers from Level 3 to Level 1 recorded in the years ended March 31, 2024. These transfers resulted from the investments in the companies whose shares were previously not listed on an equity or stock exchange and had no recent observable active trades in the shares. During the years ended March 31, 2024, the companies listed its equity shares on an exchange and are currently actively traded in the market. As the equity shares have a published price quotation in an active market, the fair value measurement was transferred from Level 3 to Level 1 on the fair value hierarchy during the years ended March 31, 2024. There were no other significant transfers between levels of the fair value hierarchy during the years ended March 31, 2024. (4) Level 3 fair values Takeda invests in equity instruments mainly for research collaboration. The following table shows a reconciliation from the opening balances to the closing balances for Level 3 financial asset fair values for the period ended March 31, 2024. The disclosure related to Level 3 financial liabilities which are financial liabilities associated with contingent consideration arrangements are included in (5) Financial liabilities associated with contingent consideration arrangements. There are no significant changes in fair value during the changes in certain assumptions which influence the fair value measurement for Level 3 financial assets. million JPY Financial assets associated with contingent consideration arrangements Equity instruments As of the beginning of the year 23,806 83,236 Changes recognized as finance income or finance expenses (702) — Changes in fair value of financial assets associated with contingent consideration due to other elements than time value (12,415) — Changes in fair value of financial assets measured at fair value through OCI and exchange differences on translation of foreign operations 1,604 4,900 Purchases — 1,760 Sales — (217) Transfers to Level 1 — (5,008) Acquisition from conversion of convertible notes — 4,254 As of the end of the year 12,293 88,925

- 18 - (5) Financial liabilities associated with contingent consideration arrangements Financial liabilities associated with contingent consideration arrangements represent consideration related to business combinations or license agreements that are payable only upon future events such as the achievement of development milestones and sales targets, including pre-existing contingent consideration arrangements of the companies that are acquired by Takeda. At each reporting date, the fair value of financial liabilities associated with contingent consideration arrangements is re-measured based on risk-adjusted future cash flows discounted using an appropriate discount rate. As of March 31, 2024, the balance primarily relates to pre-existing contingent consideration arrangements from historical acquisition. The fair value of financial liabilities associated with contingent consideration arrangements could increase or decrease due to changes in certain assumptions which underpin the fair value measurements. The assumptions include probability of milestones being achieved. The fair value of financial liabilities associated with contingent consideration arrangements are classified as Level 3 in the fair value hierarchy. The following table shows a reconciliation from the opening balances to the closing balances for financial liabilities associated with contingent consideration arrangements for the year ended March 31, 2024. There are no significant changes in fair value during the changes in significant assumptions which influence the fair value measurement for financial liabilities associated with contingent consideration arrangements. million JPY As of the beginning of the year 8,139 Changes in the fair value during the period 8,678 Settled and paid during the period (9,032) Foreign currency translation differences (13) As of the end of the year 7,772 (6) Financial instruments not measured at fair value The carrying amount and fair value of financial instruments that are not measured at fair value in the consolidated statements of financial position are as follows. Fair value information is not provided for financial instruments, if the carrying amount is a reasonable estimate of fair value due to the relatively short period of maturity of these instruments. million JPY Carrying amount Fair value Bonds 3,775,879 3,420,668 Long-term loans 750,622 746,831 Long-term financial liabilities are recognized at their carrying amount. The fair value of bonds is measured at quotes whose significant inputs to the valuation model used are based on observable market data. The fair value of loans is measured at the present value of future cash flows discounted using the applicable market rate on the loans in consideration of the credit risk by each group classified in a specified period. The fair value of bonds and long-term loans are classified as Level 2 in the fair value hierarchy. [Revenue Recognition] 1. Disaggregation of revenue information Takeda’s revenue from contracts with customers is comprised of the following: Revenue by Type of Good or Service million JPY Sales of pharmaceutical products 4,163,652 Out-licensing and service income 100,110 Total 4,263,762

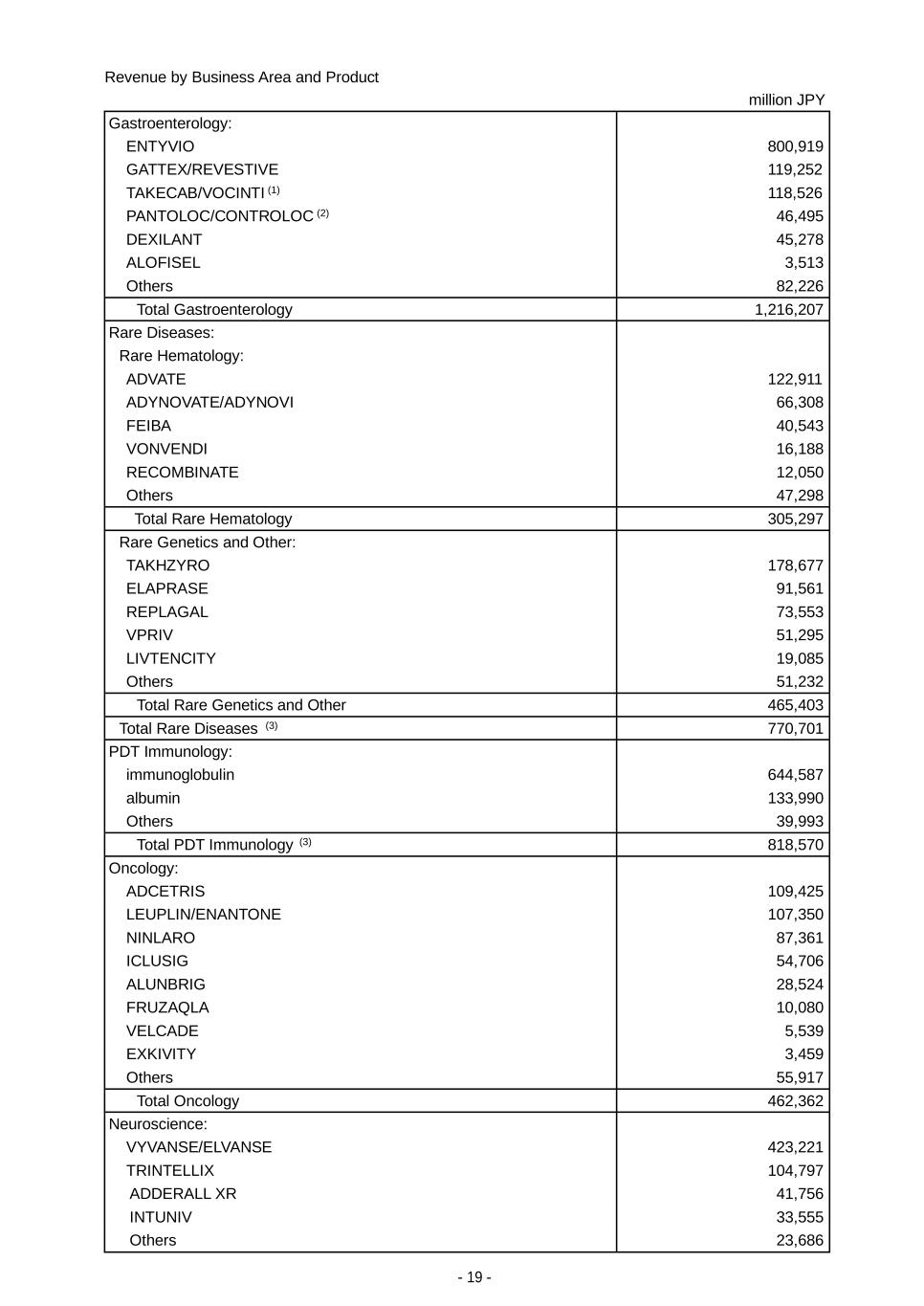

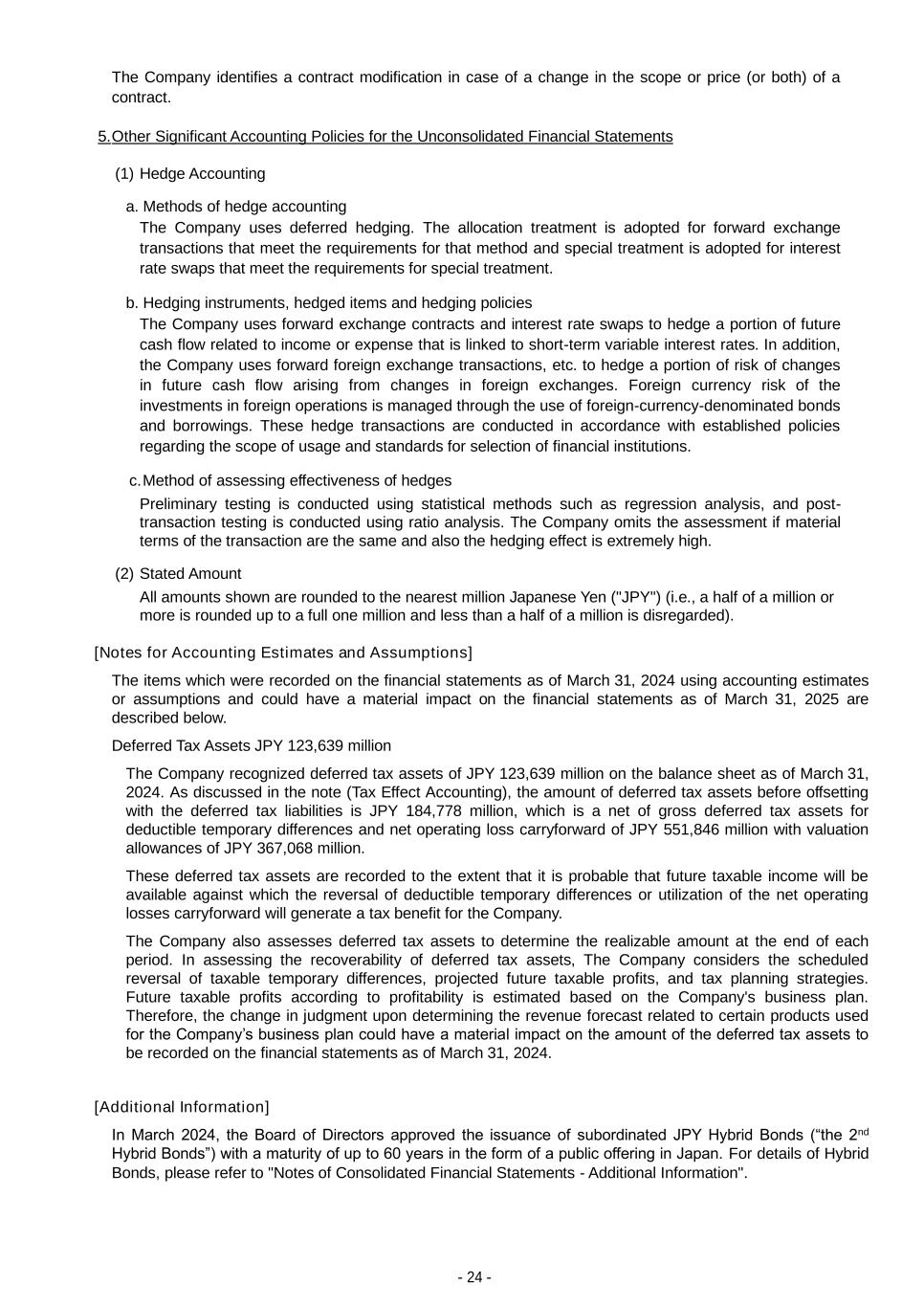

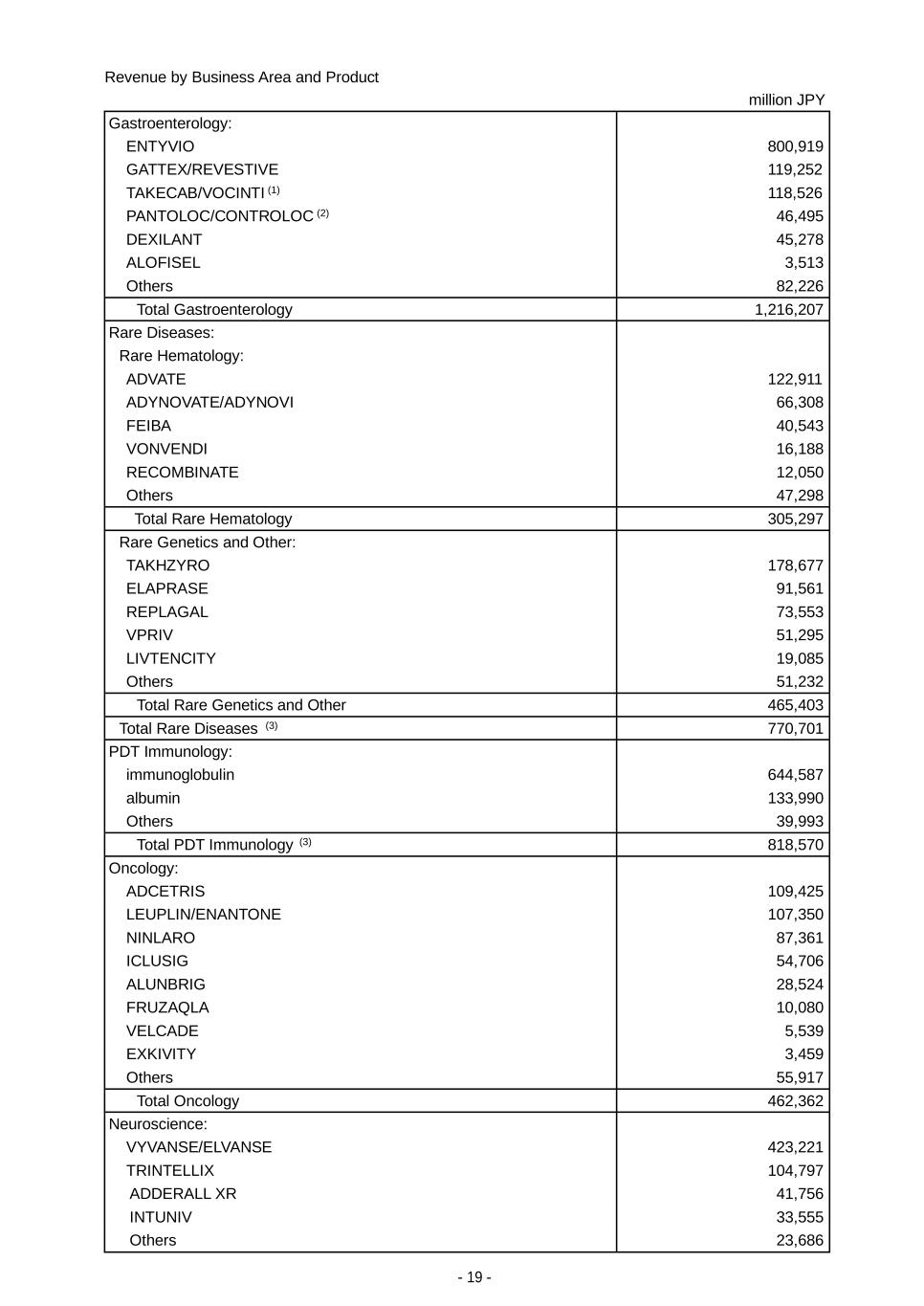

- 19 - Revenue by Business Area and Product million JPY Gastroenterology: ENTYVIO 800,919 GATTEX/REVESTIVE 119,252 TAKECAB/VOCINTI (1) 118,526 PANTOLOC/CONTROLOC (2) 46,495 DEXILANT 45,278 ALOFISEL 3,513 Others 82,226 Total Gastroenterology 1,216,207 Rare Diseases: Rare Hematology: ADVATE 122,911 ADYNOVATE/ADYNOVI 66,308 FEIBA 40,543 VONVENDI 16,188 RECOMBINATE 12,050 Others 47,298 Total Rare Hematology 305,297 Rare Genetics and Other: TAKHZYRO 178,677 ELAPRASE 91,561 REPLAGAL 73,553 VPRIV 51,295 LIVTENCITY 19,085 Others 51,232 Total Rare Genetics and Other 465,403 Total Rare Diseases (3) 770,701 PDT Immunology: immunoglobulin 644,587 albumin 133,990 Others 39,993 Total PDT Immunology (3) 818,570 Oncology: ADCETRIS 109,425 LEUPLIN/ENANTONE 107,350 NINLARO 87,361 ICLUSIG 54,706 ALUNBRIG 28,524 FRUZAQLA 10,080 VELCADE 5,539 EXKIVITY 3,459 Others 55,917 Total Oncology 462,362 Neuroscience: VYVANSE/ELVANSE 423,221 TRINTELLIX 104,797 ADDERALL XR 41,756 INTUNIV 33,555 Others 23,686

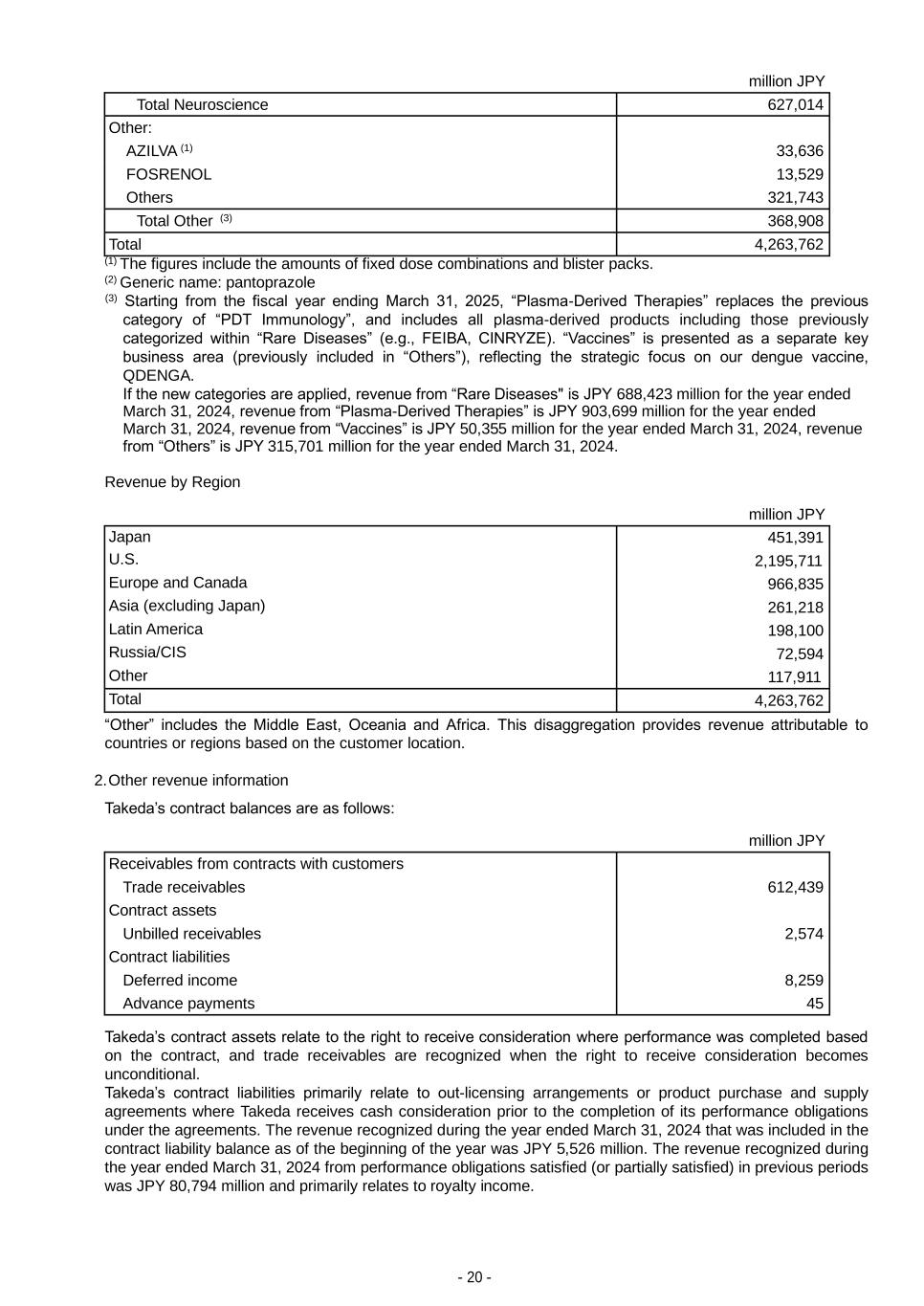

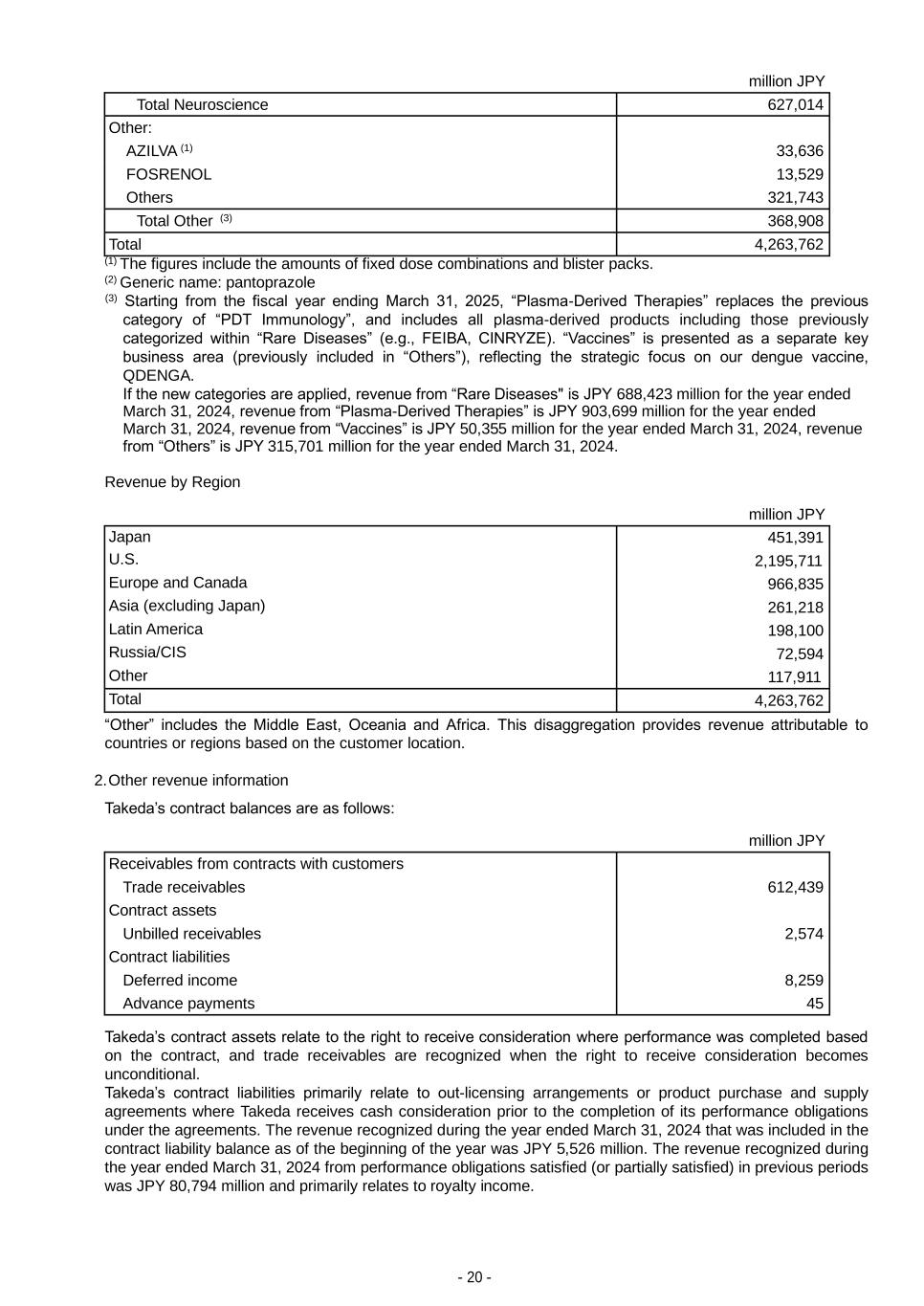

- 20 - million JPY Total Neuroscience 627,014 Other: AZILVA (1) 33,636 FOSRENOL 13,529 Others 321,743 Total Other (3) 368,908 Total 4,263,762 (1) The figures include the amounts of fixed dose combinations and blister packs. (2) Generic name: pantoprazole (3) Starting from the fiscal year ending March 31, 2025, “Plasma-Derived Therapies” replaces the previous category of “PDT Immunology”, and includes all plasma-derived products including those previously categorized within “Rare Diseases” (e.g., FEIBA, CINRYZE). “Vaccines” is presented as a separate key business area (previously included in “Others”), reflecting the strategic focus on our dengue vaccine, QDENGA. If the new categories are applied, revenue from “Rare Diseases" is JPY 688,423 million for the year ended March 31, 2024, revenue from “Plasma-Derived Therapies” is JPY 903,699 million for the year ended March 31, 2024, revenue from “Vaccines” is JPY 50,355 million for the year ended March 31, 2024, revenue from “Others” is JPY 315,701 million for the year ended March 31, 2024. Revenue by Region million JPY Japan 451,391 U.S. 2,195,711 Europe and Canada 966,835 Asia (excluding Japan) 261,218 Latin America 198,100 Russia/CIS 72,594 Other 117,911 Total 4,263,762 “Other” includes the Middle East, Oceania and Africa. This disaggregation provides revenue attributable to countries or regions based on the customer location. 2. Other revenue information Takeda’s contract balances are as follows: million JPY Receivables from contracts with customers Trade receivables 612,439 Contract assets Unbilled receivables 2,574 Contract liabilities Deferred income 8,259 Advance payments 45 Takeda’s contract assets relate to the right to receive consideration where performance was completed based on the contract, and trade receivables are recognized when the right to receive consideration becomes unconditional. Takeda’s contract liabilities primarily relate to out-licensing arrangements or product purchase and supply agreements where Takeda receives cash consideration prior to the completion of its performance obligations under the agreements. The revenue recognized during the year ended March 31, 2024 that was included in the contract liability balance as of the beginning of the year was JPY 5,526 million. The revenue recognized during the year ended March 31, 2024 from performance obligations satisfied (or partially satisfied) in previous periods was JPY 80,794 million and primarily relates to royalty income.

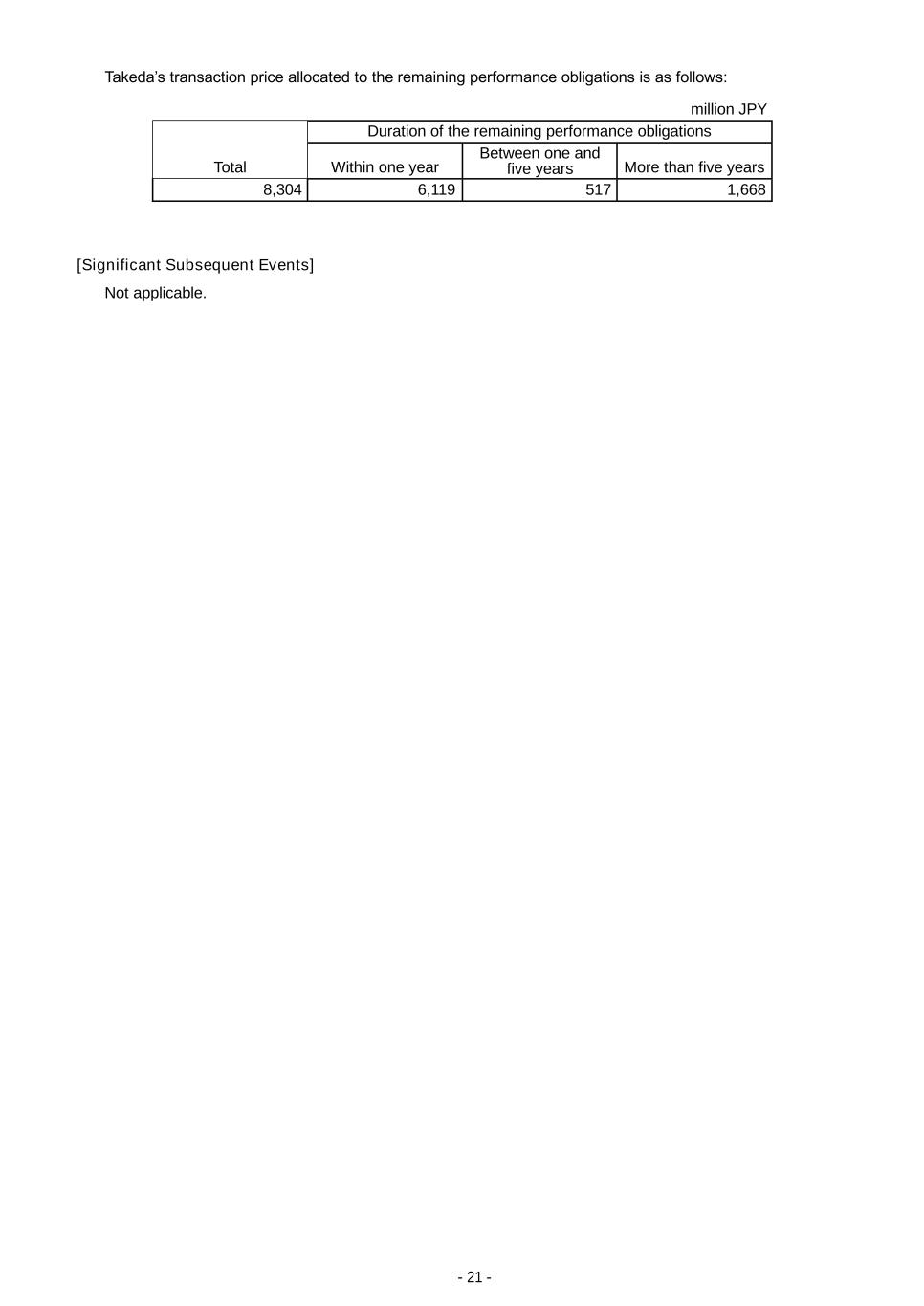

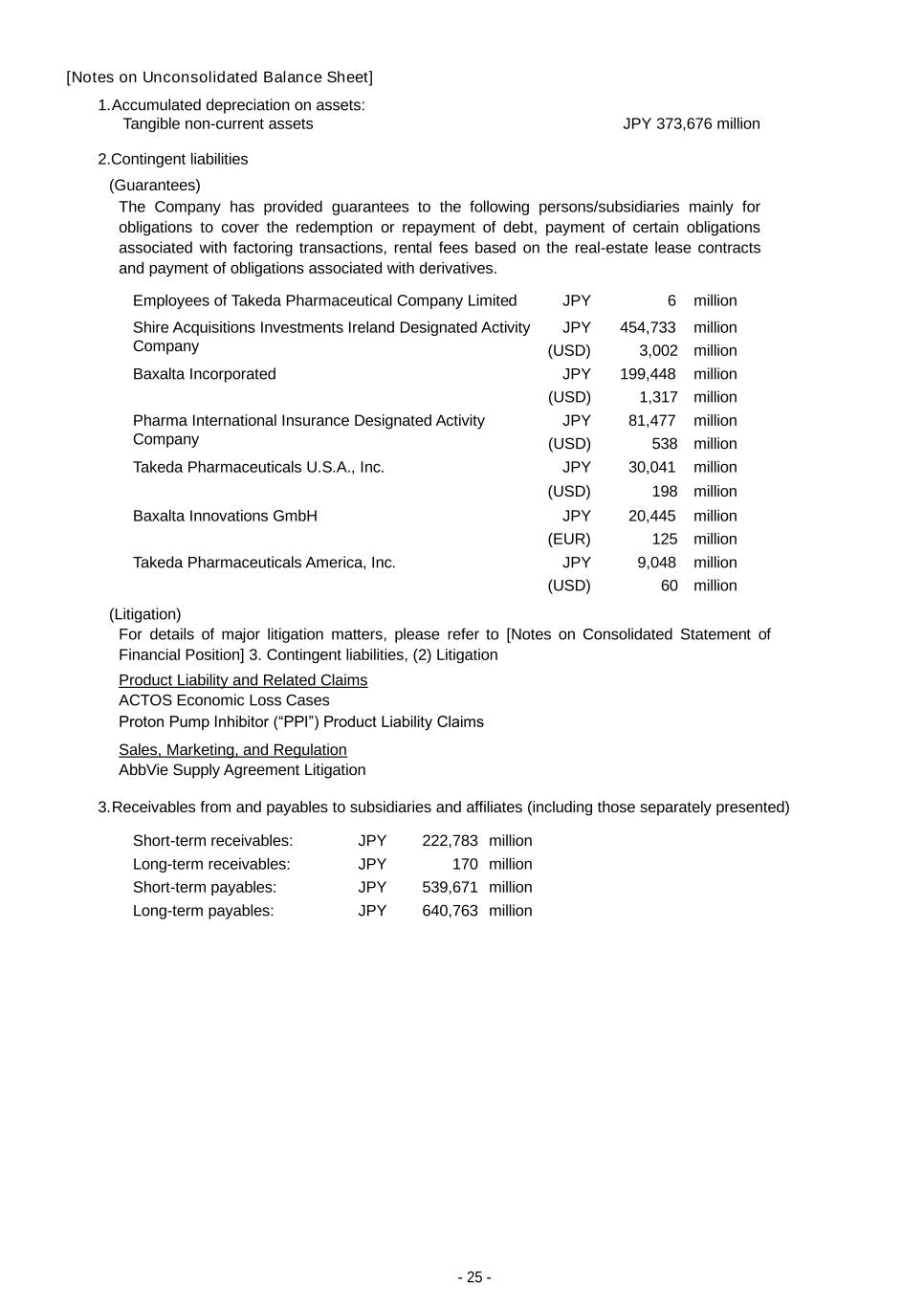

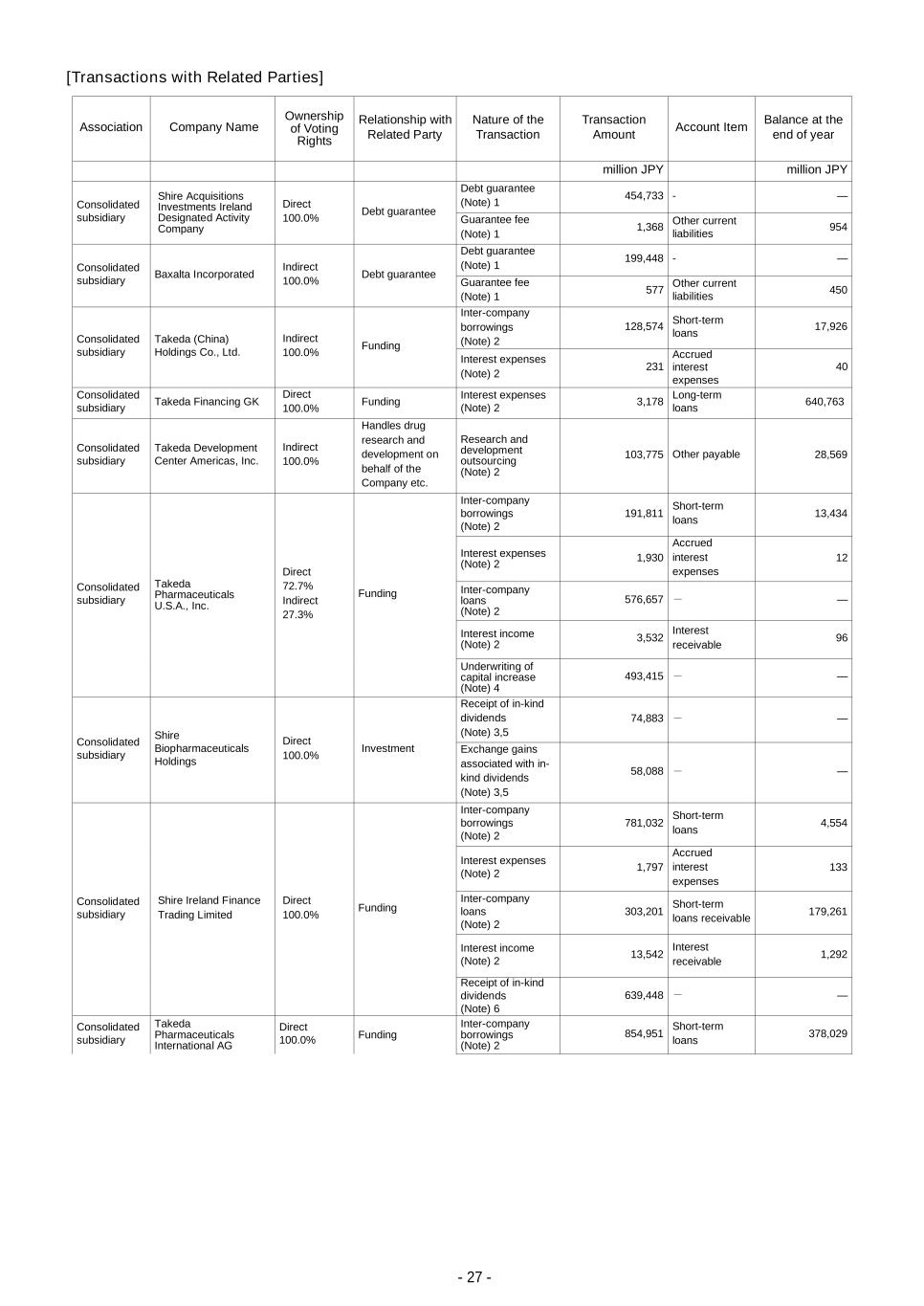

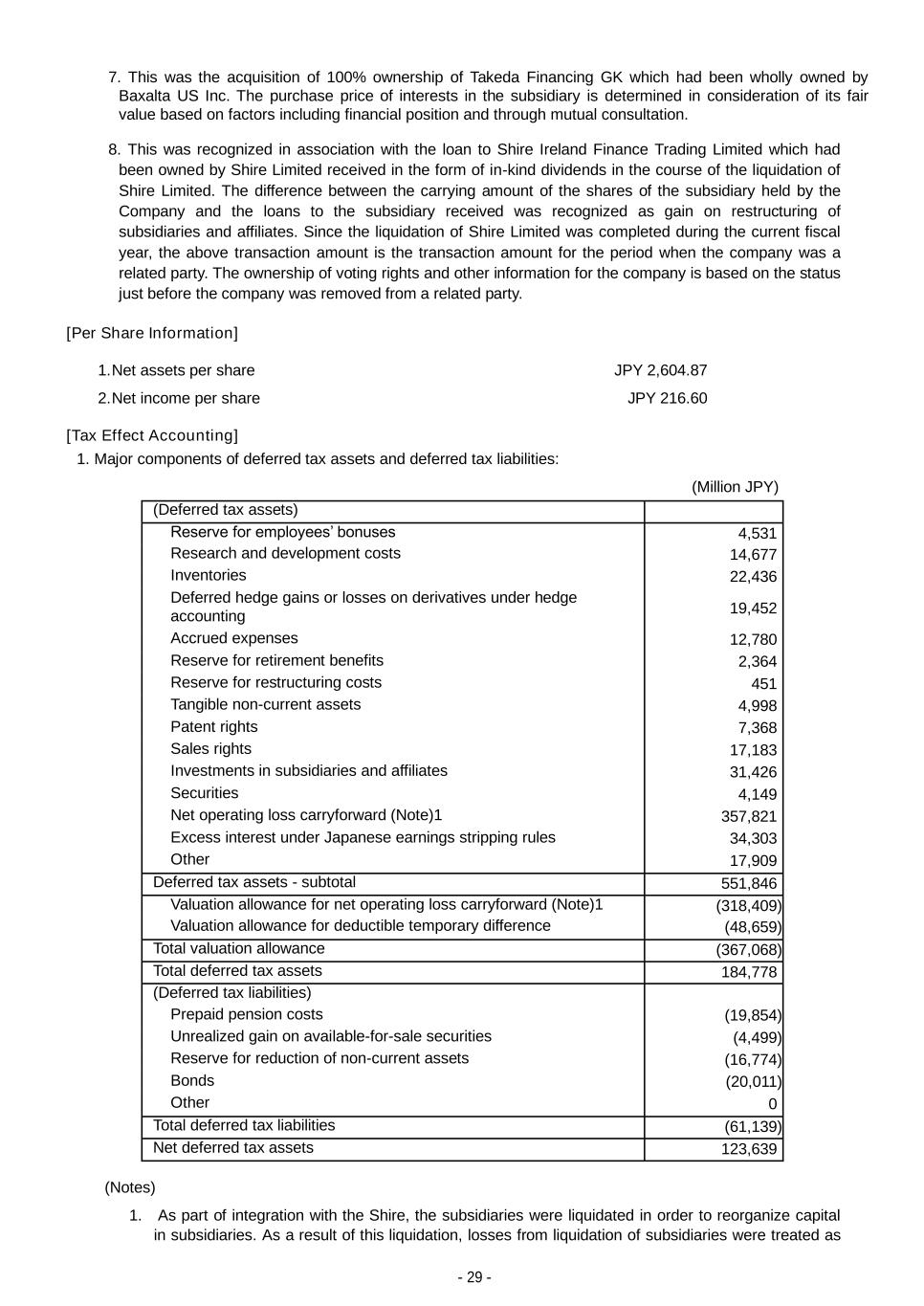

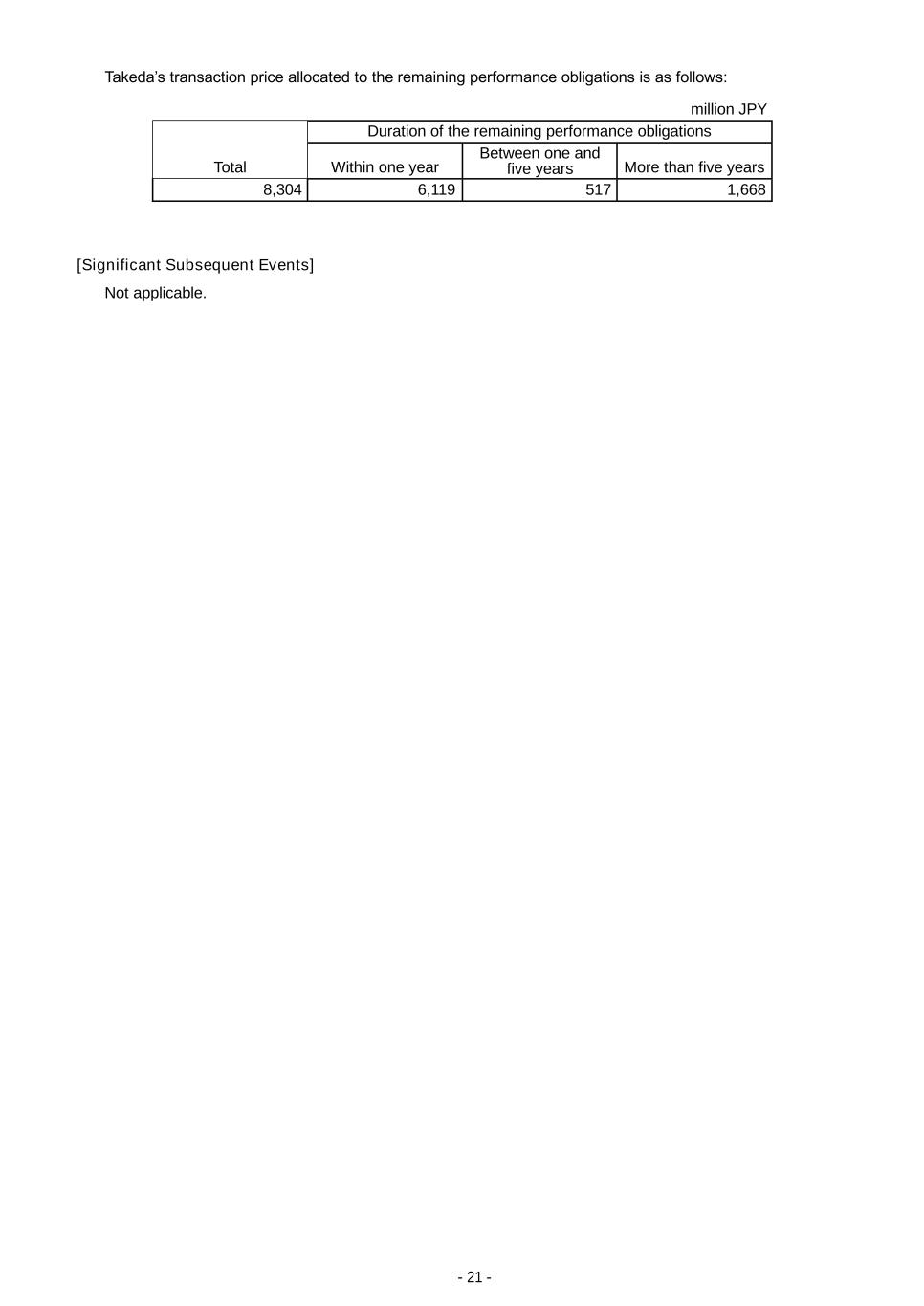

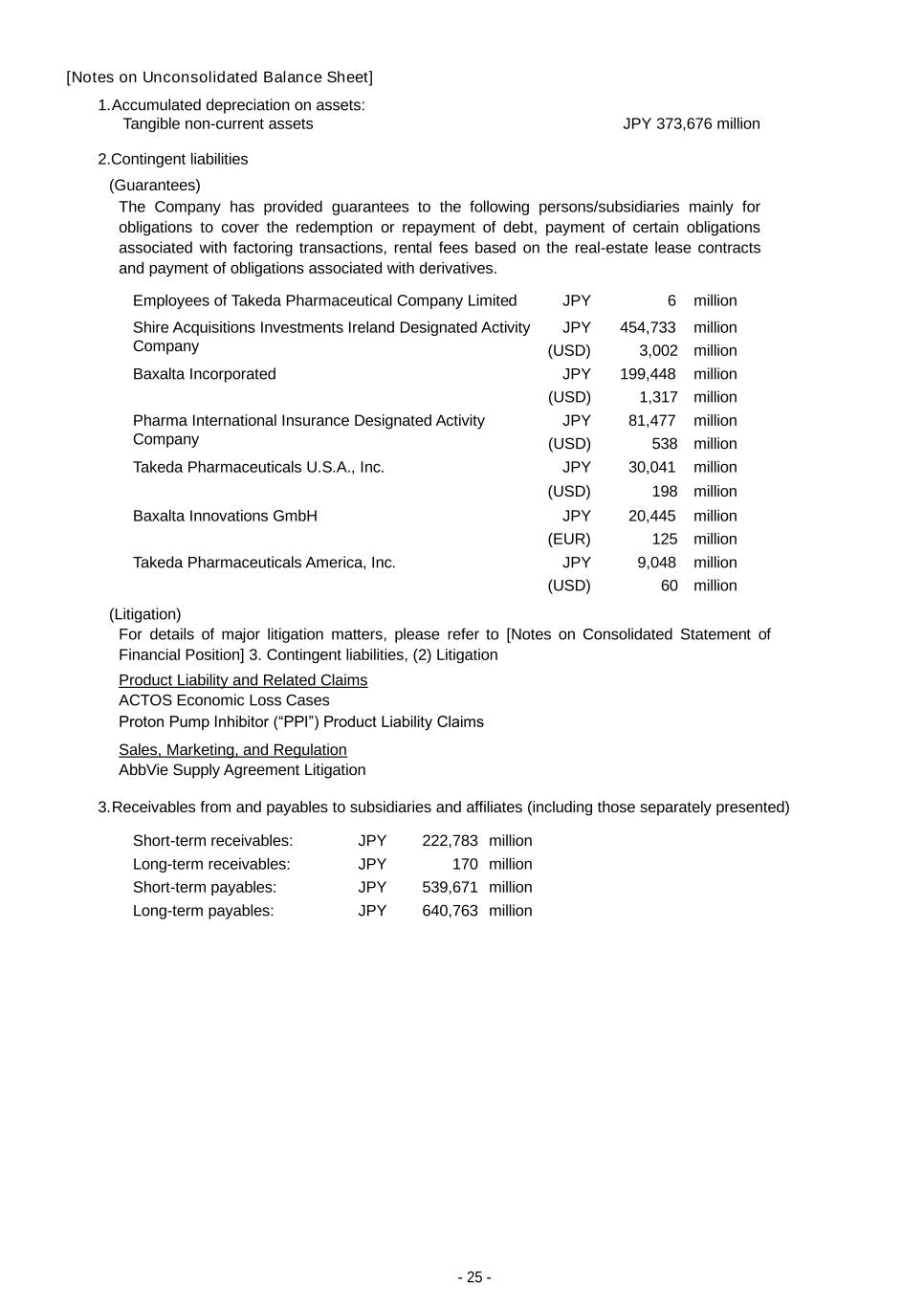

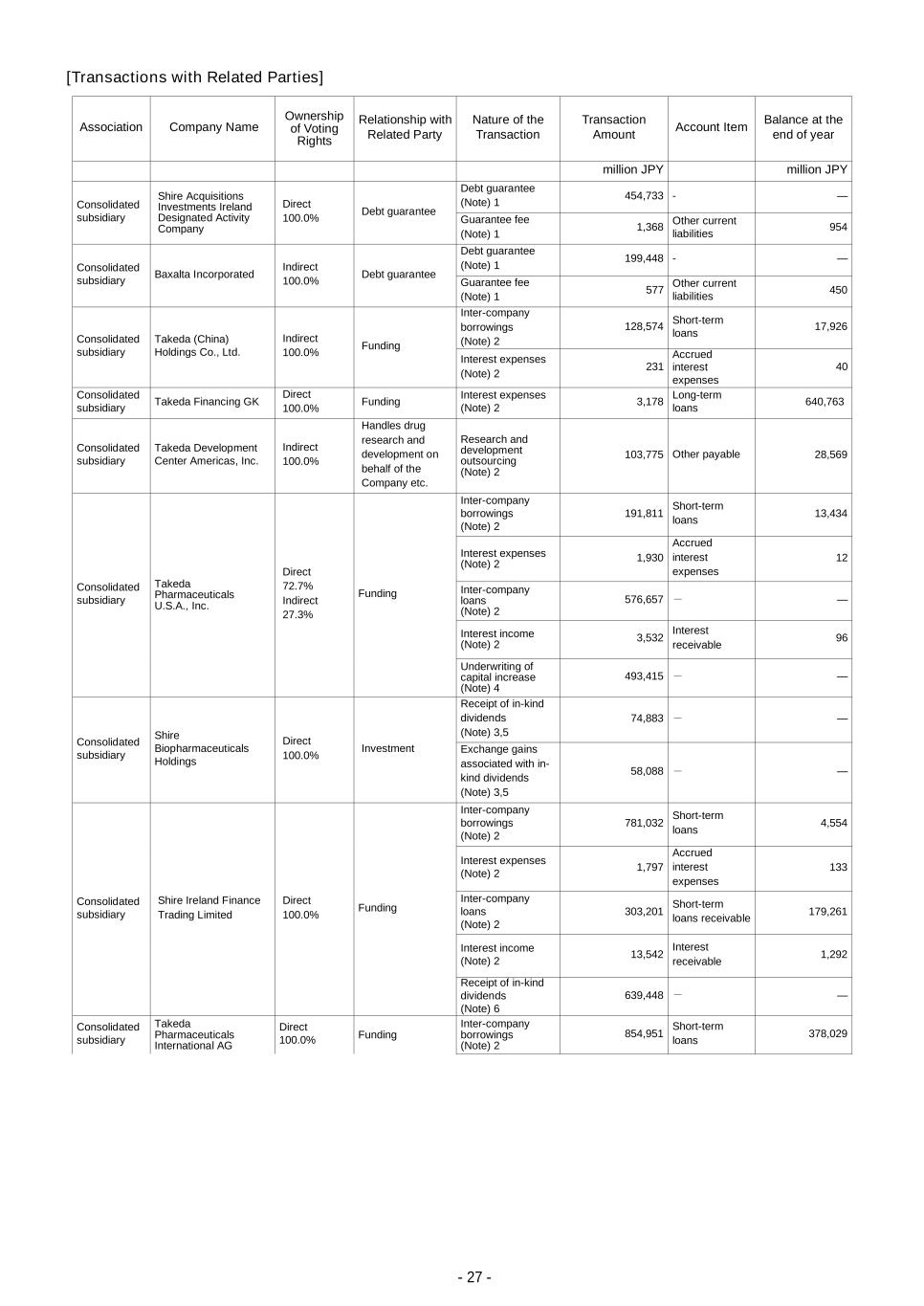

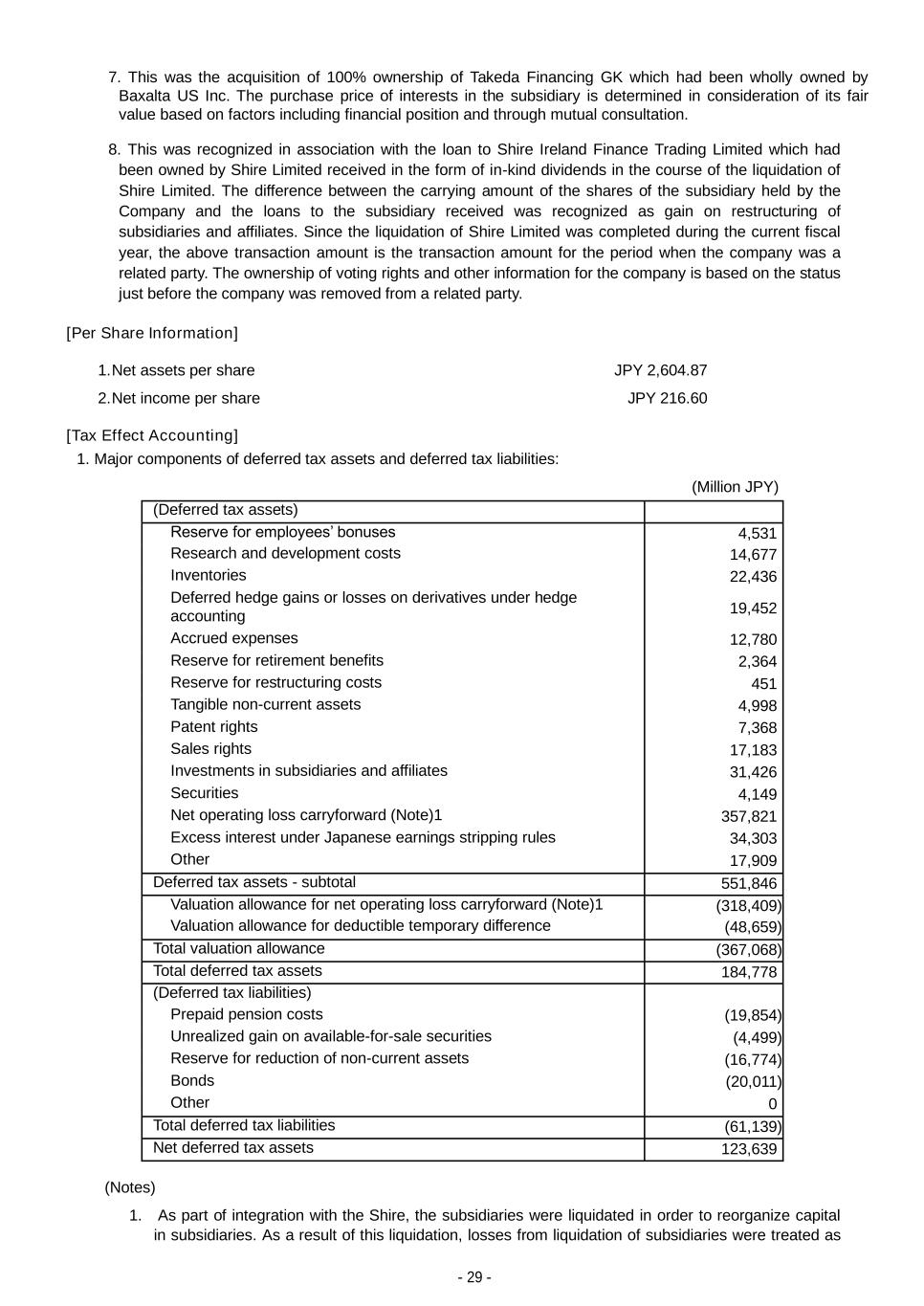

- 21 - Takeda’s transaction price allocated to the remaining performance obligations is as follows: million JPY Total Duration of the remaining performance obligations Within one year Between one and five years More than five years 8,304 6,119 517 1,668 [Significant Subsequent Events] Not applicable.