Corporate Governance Report December 14, 2023 Takeda Pharmaceutical Company Limited https://www.takeda.com I. Basic Views on Corporate Governance and Basic Information on Capital Structure, Corporate Profile and Other Matters 1. Basic Views In line with the Company’s purpose “Better Health for People, Brighter Future for the World,” the Company continues to strive for a business management structure appropriate for a global, values-based, R&D-driven, biopharmaceutical company. The Company is strengthening its internal controls, including thorough compliance and risk management, and establishing a structure that enables agile, sound, and transparent decision-making. These measures will further improve the Company’s corporate governance and maximize its corporate value. [Reasons for Non-compliance with the Principles of the Corporate Governance Code] The Company is in compliance with all of the principles of the Corporate Governance Code (effective as of June 11, 2021). [Disclosure Based on the Principles of the Corporate Governance Code] Update This report covers every principle that should be disclosed under the Corporate Governance Code and addresses each principle according to its item number. (1) Company objectives, business strategies, and business plans a. Company objectives and business strategies - Principle 3.1 (i) Information on the Company’s corporate philosophy consisting of “purpose, values, vision and imperatives” can be found in the Corporate Philosophy section of the Company’s website. For details on the Company’s business strategies, please refer to the quarterly results and other materials available in the Investors section of the Company’s website. ➢ Corporate Philosophy: https://www.takeda.com/about/our-company/corporate-philosophy/ ➢ Investors: https://www.takeda.com/investors/financial-results/quarterly-results/ b. Business plans - Principle 3.1 (i) Please refer to the quarterly results and other materials in the Investor Relations section of the Company’s website (link above) for the latest information on the fiscal year 2023 Management Guidance (Core Revenue change, Core Operating Profit change, and Core EPS change). c. Basic views and guidelines on corporate governance - Principle 3.1 (ii) Please refer to “Basic Views” in Part I section 1 of this report. (2) Securing the Rights and Equal Treatment of Shareholders d. General shareholders meeting • The Company sends a notice of convocation of its Ordinary General Meeting of Shareholders three weeks prior to the day of the meeting, and, in advance of the date of dispatch, discloses it on its corporate website and the website of the Tokyo Stock Exchange (TSE) so that the shareholders will have sufficient time to review the agenda of the General Meeting of Shareholders. • The Company translates the notice of convocation into English and discloses it on its website. The Company also utilizes an electronic platform for voting so that institutional and foreign investors can exercise their voting rights. e. Cross-Shareholdings - Principle 1.4 • The Company only holds shares of other companies with which it has business relationships and seeks to minimize the number of shares. In relation to such shareholdings, the Company determines and assesses whether or not each shareholding contributes to the corporate value of the Company Group by considering the Company’s mid-to-long term business strategy, and comparing the benefits of such ownership (dividends, business transactions, expected returns from strategic alliance, etc.) with the Company's cost of capital. As a result of the review, the Company divests shares from shareholdings that are deemed to be of little significance after taking the financial strategy and market environment into consideration. • The Company decides whether to exercise its voting rights on cross-shareholdings after conducting a comprehensive review on whether a relevant proposal makes a positive contribution to shareholder value as well as the value of the issuing companies. The Company will object to any proposals that are deemed detrimental to shareholder value or the corporate governance of the issuing companies.

2 f. Related Party Transactions - Principle 1.7 • With regard to transactions with directors and their close relatives, the Company conducts various investigations on the existence of such transactions, including confirming directly with the directors themselves. • The Company has procedures in place that comply with the provisions of the Companies Act on competitive and conflict-of- interest transactions conducted by a director. In addition, transactions involving the Company and a director’s close family members or the Takeda Executive Team (TET) member (which consists of the President & Chief Executive Officer (CEO) and the function heads of the Takeda Group who report directly to the President & CEO) and their close family members require the approval of the Board of Directors (BOD). • Investments, loans and guaranties provided to subsidiaries/affiliated companies require the approval of the Business & Sustainability Committee (BSC) or other decision-making bodies depending on the amount of the investment, loan, or guarantee. • In addition to the above, the Company will investigate any unusual transaction between the Company and its affiliated companies. It will consider the accounting treatment and disclosure of such transaction in advance, confirm whether the value of the transaction is significant, and where the amounts are significant, monitor the content and conditions of such transaction on a quarterly basis. • As stipulated in the Financial Instruments and Exchange Act, the Company considers any shareholder who holds 10% or more of the voting rights of all shareholders (excluding those specified by the Cabinet Office Ordinance) as a “major shareholder.” The Company currently has no major shareholders but will apply the above procedures to any major shareholders in the future. (3) Appropriate Cooperation with Stakeholders other than Shareholders • The Company considers the interests of not only shareholders, but various stakeholders including patients, healthcare professionals, employees, clients such as suppliers and vendors, creditors and local communities in order to strengthen long- term corporate value. g. Ensuring diversity in the promotion of core human resources - Supplementary Principle 2.4.1 • The Company operates in approximately 80 countries and regions worldwide and recognizes the importance of having a diverse workforce that reflects the communities and patients it serves. To achieve this, the Company has made promoting Diversity, Equity, and Inclusion (DE&I) as a pillar of its HR strategy. It aims to create a collaborative working environment where employees can contribute, perform, and grow as individuals. The Company is also committed to embracing the unique differences of each employee, unlocking their potential, and nurturing their growth. The same principles apply to managers as core human resources. In Japan, the ratio of female managers, non-Japanese managers, and mid-career managers (excluding employment through merger and acquisition, re-employment, and promotion to permanent employees and dispatch from the domestic affiliated companies) are 19%, 4%, and 42%, respectively (as of March 31, 2023). The Company will continue its efforts to promote diversity among employees in Japan, including those in management positions. The Company discloses other DE&I information on the following section of the Company website (Japanese site only). ➢ Takeda’s DE&I: https://www.takeda.com/ja-jp/recruitment/dei/ • Approximately 90% of Takeda group’s global workforce is based in countries and regions outside of Japan. In addition, the percentage of women in management positions globally is 42% (as of March 31, 2023). For further information on DE&I, policies related to talent development, and internal work environment to support the progress on DE&I, please refer to “Other” in Part III section 3 of this report and the 2023 Annual Integrated Report (page 31-37). ➢ 2023 Annual Integrated Report: https://www.takeda.com/corporate-responsibility/reporting-on-sustainability/annual- integrated-report/ (4) Ensuring Appropriate Information Disclosure and Transparency • The Company makes timely and appropriate disclosures in a fair, detailed, and understandable manner to keep all shareholders informed in accordance with applicable laws, including the Companies Act, the Financial Instruments and Exchange Act and the U.S. Securities Exchange Act, as well as the Financial Instruments Exchange rules in Japan and rules and regulations of the U.S. Securities and Exchange Commission (SEC) and New York Stock Exchange’s Listed Company Manual. • In addition to disclosures required by law, the Company promptly discloses on a voluntary basis, certain financial and non- financial information that it considers beneficial to its stakeholders such as shareholders, in a timely manner. • The Company’s timely disclosure system, including the operation of the Disclosure Committee, is described further in Part V section 2 of this report. In addition, to ensure the accuracy and consistency of its sustainability-related disclosures, the Company has established a Sustainability/ESG (Environment, Social and Governance) External Disclosure Committee. This committee reviews non-financial data and information before they are disclosed externally. h. Initiatives on Sustainability - Supplementary Principle 3.1.3 ■ Initiatives on sustainability • At the Company, sustainability is about creating sustained growth through our enduring values. It’s about operationalizing our

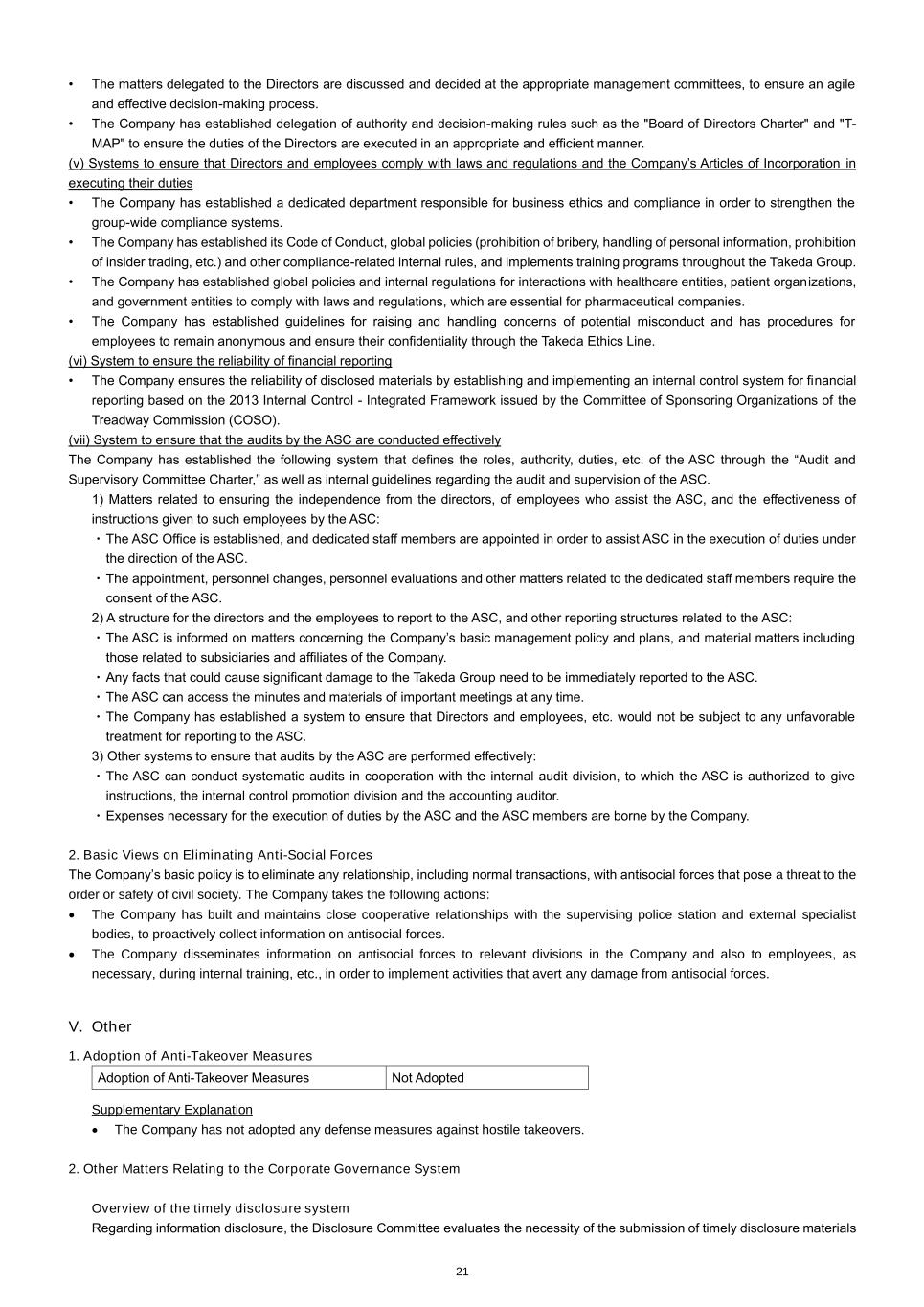

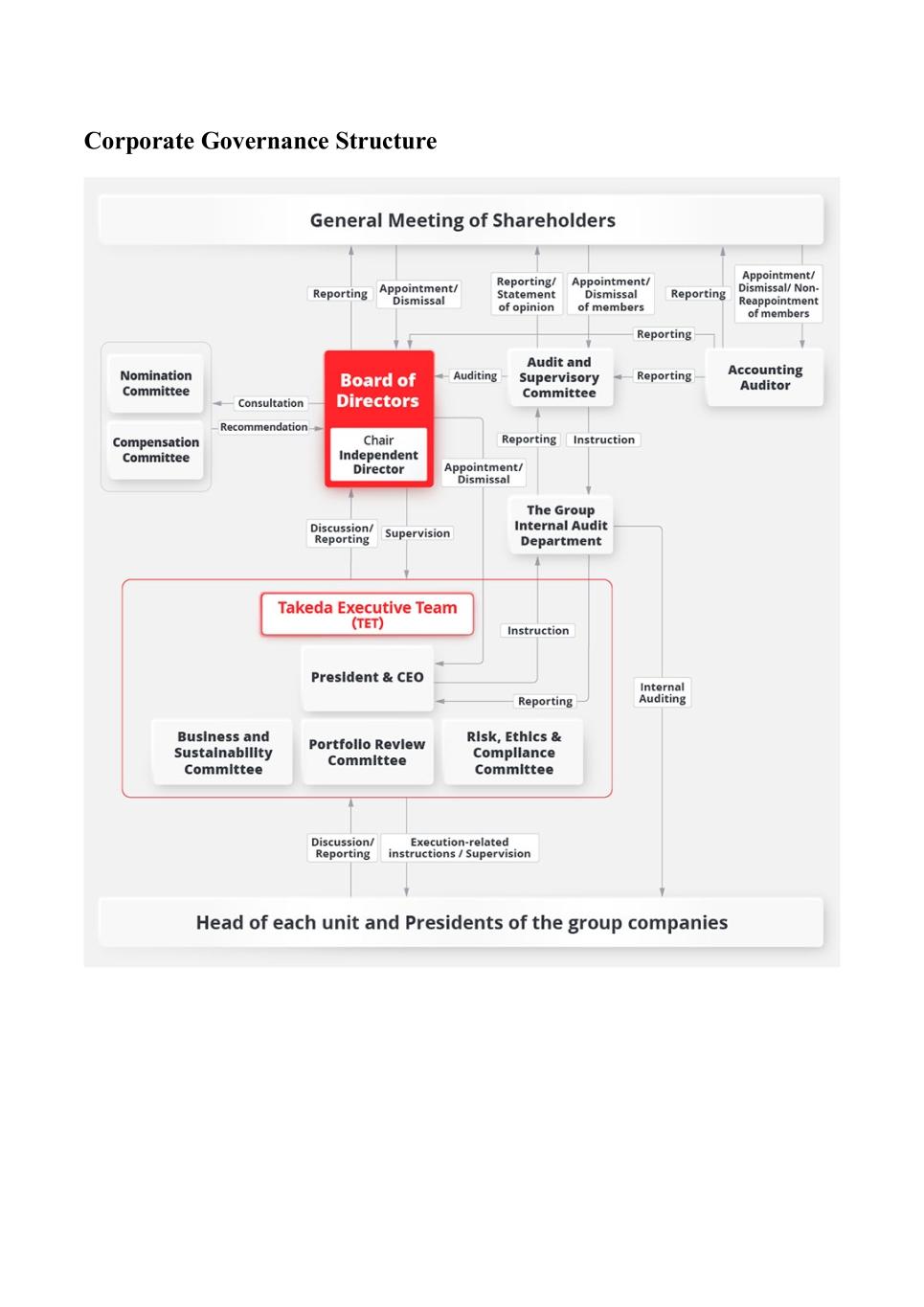

3 corporate philosophy to create value for stakeholders including shareholders. The Company engages a wide range of stakeholders to understand and address societal issues to create long-term value. The Board of Directors reviews the Company’s sustainability strategy and initiatives, and the Business & Sustainability Committee deliberates and approves on the Company’s sustainability programming. • The Company’s imperatives and priorities of the corporate philosophy direct where the Company must focus to deliver on its vision and purpose. To measure the progress towards these imperatives, the Company developed corporate philosophy metrics and disclosed the results in the 2023 Annual Integrated Report. • The Company is committed to transparently disclosing the impacts of climate change on its business. As a supporter of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD), the Company published the “Takeda TCFD Report 2022.” This report includes the Company’s initial assessment of risks and opportunities associated with climate change. The Company also published its first annual update to the report in the 2023 Annual Integrated Report. In addition, the Company discloses its climate change strategy, initiatives, and impacts every year through annual participation in the CDP disclosure system (formerly known as the Carbon Disclosure Project). ➢ 2023 Annual Integrated Report: https://www.takeda.com/corporate-responsibility/reporting-on-sustainability/annual- integrated-report/ ➢ 2022 TCFD report: https://www.takeda.com/siteassets/system/corporate-responsibility/reporting-on-sustainability/tcfd.pdf ■ Investment in human capital • The Company prioritizes attracting and developing highly skilled talent and invests in creating a diverse, equitable and inclusive workplace that supports employees’ flexible ways of working and well-being. This approach is aligned with one of its Corporate Philosophy, “People” pillar. For details, please refer to its 2023 Annual Integrated Report described above. ■ Investment in intellectual property • The Intellectual Property Department supports the Company’s overall intellectual property strategy by focusing efforts on the following three main themes. o maximization of the value of products and research pipeline and protection of related rights aligned to the strategies of the therapeutic area units o promotion of proactive incorporation of external innovation by supporting partner alliances o securing and protection of intellectual property rights around the world, including in emerging markets • The Company has internal processes in place to manage patents and other intellectual properties. This process includes both remaining vigilant against patent infringement by others as well as exercising caution, starting at the R&D stage, to ensure that the Company’s products and activities do not infringe on intellectual property rights held by others. • Please refer to the Annual Securities Report and Annual Report on Form 20-F for details on the investments in intellectual property, including the status of the pipeline, the establishment of research platforms for the future, strengthening of collaboration in R&D, and information on partners in major licensing and business alliance agreements. ➢ The Annual Securities Report for the 146th fiscal year: https://assets-dam.takeda.com/image/upload/v1687937183/Global/Investor/ASR/E_FY22_ASR.pdf ➢ Annual Report on Form 20-F: https://www.takeda.com/investors/sec-filings-and-security-reports/ (5) Responsibilities of the Board of Directors i. Roles of the Board of Directors - Supplementary Principle 4.1.1 • The BOD’s primary responsibility is to observe and oversee business execution as well as make decisions on strategic or particularly important matters regarding company management. In addition, the BOD delegates the responsibilities for decision-making with respect to some of the important business decisions to management under the Company's Articles of Incorporation. The Board of Directors Charter provides the matters for resolution by the BOD. In addition to the deliberation and resolution of matters, the BOD is responsible for the supervision of the business executed by the Directors. The Company has disclosed the “Board of Directors Charter” in the Corporate Governance section of the Company website. ➢ Charters and Reports: https://www.takeda.com/about/corporate-governance/charters-and-reports/ • Matters delegated to management as described above, are delegated to the Business & Sustainability Committee (which is responsible for corporate / business development matters and sustainability-related matters), the Portfolio Review Committee (which is responsible for R&D and product-related matters), and the Risk, Ethics and Compliance Committee (which is responsible for risk management, business ethics and compliance matters). The BOD supervises management's execution of these matters through the reports of these committees. • Matters not requiring the approval of the aforementioned committees are delegated to the TET based on the Takeda Group’s Management Policy (T-MAP) to ensure agile and efficient decision-making across the group. j. Composition of the Board - Principle 4.8, Supplementary Principle 4.11.1 • In order to strengthen supervisory functions and make deliberations more objective and transparent, Independent External Directors comprise a majority of the Company’s BOD. The Company has 15 Directors (including four Directors who are Audit

4 and Supervisory Committee (ASC) Members), of which 12, the majority, are Independent External Directors (including four Independent External Directors who are ASC Members). The BOD meeting is chaired by an Independent External Director. • The Company makes appropriate Director appointments, and constitutes the BOD based on the following principles: o The Company is committed to appointing individuals from inside and outside the Company by keeping balance of nationality, gender, work history, age, race, ethnicity, and cultural background, after identifying the skills of knowledge, experience and capability required for the Company’s global management and business strategy. The BOD is fully equipped with the skills necessary for advising and supervising the Company, which enables effective discussions in the BOD meeting. The Company disclosed the skills matrix in the Governance Structure section of the Company website: https://www.takeda.com/about/corporate-governance/governance-structure/ o The size of the BOD is designed to enable efficient and agile decision-making and appropriate management supervision. The Company's Articles of Incorporation limit the maximum number of Directors who are not ASC Members to 12 and Directors who are ASC Members to four. k. Policies and procedures nomination of candidates for Directors - Principle 3.1 (iv)(v) • When nominating candidates for Directors, the Company takes into consideration various factors, such as whether the candidate has appropriate experience and expertise to either complement or supplement the current capabilities in the BOD. In addition, the Company considers whether the candidate has the gravitas and reputation required for directorship of a large pharmaceutical company or high-level performance required of business managers and has deep understanding of the Company’s corporate philosophy. • The Nomination Committee (a voluntary advisory committee to the BOD), chaired by an External Director and composed entirely of External Directors, ensures the appropriateness of the candidate, and the BOD selects the candidates who will become members of the BOD. Candidates for External Directors are elected based on the “Internal criteria for independence of External Directors” (Refer to “Independent Directors” in Part II section 1 of this report). Candidates for Directors who are ASC Members are nominated by the BOD, after obtaining the agreement of the ASC. • When giving consent to the selection of candidates for Directors who are ASC Members and in the involvement in the policy for selecting candidates for ASC Members, the ASC carefully examines their eligibility as an ASC Member. They take into consideration various factors such as the candidate’s ability to maintain independence from the managing directors, their capacity to maintain a fair and impartial attitude, and their proficiency in making appropriate management evaluations based on their finance and accounting knowledge. • The Company has established criteria for not nominating current Directors for reappointment. If the criteria are met, the BOD will consult with and receive recommendations from the Nomination Committee, before determining not to reappoint the Director. In addition, the Company will consider dismissal of a director in the event of misconduct or any other event that would make it difficult for the Director to fully perform the responsibilities of their duties. • The biographies of the nominated Director candidates and the reason for their nomination are disclosed in the Notice of Convocation of Ordinary General Meeting of Shareholders and the Annual Securities Report. l. Remuneration of the Directors, etc. – Principle 3.1 (iii) • Please refer to “Policies determining the amount of remuneration or the method for calculating remuneration” in Part II section 1 of this report. m. Independent External Directors – Principle 4.9, Supplementary Principle 4.11.2 • The Company has internal criteria for assessing External Director’s independence and ability to act in the common interest of shareholders. • Please refer to “Internal Criteria for Independence of External Directors of the Company” under the title of “Independent Directors” in Part II section 1 of this report. • The concurrent director positions of External Directors at other organizations are stated in the Notice of Convocation of Ordinary General Meeting of Shareholders and the Annual Securities Report. In addition, the Company believes the status of such concurrent positions does not prevent External Directors from allocating the time and effort needed to properly fulfil their roles and responsibilities. n. Nomination Committee and Compensation Committee - Supplementary Principle 4.10.1 • The Company has established the Nomination Committee and the Compensation Committee as a voluntary advisory committee to the BOD. Both Committees are comprised entirely of External Directors, including the Committee chairpersons, to enhance their independence and objectivity. For more details, please refer to “Committee’s Name, Composition, and Attributes of the Chairperson” of Part II section 1 “[Directors]” of this report. The Company has disclosed the Nomination and Compensation Committee Charters in the Charters and Reports section of the Company website. ➢ Charters and Reports: https://www.takeda.com/about/corporate-governance/charters-and-reports/

5 o. Director Training - Supplementary Principle 4.14.2 • When Directors are appointed, the Company provides them with necessary information about the Company, including its corporate philosophy (consisting of “purpose,” “vision,” “values” and “imperatives”), governance, business strategies, industry trends and legal responsibilities (duty of care, duty of loyalty, etc.). The Company also continues to offer valuable information and learning opportunities, etc. to Directors even after they assume their roles. • In addition to the above, the Company provides information about the Company and the pharmaceutical industry when External Directors (including Directors who are ASC Members) take office. Even after their appointment, the Company provides such information to them on an ongoing basis, as well as opportunities for study sessions and site visits, as necessary. • The Company bears the expenses for all the training mentioned above. p. Analysis and Evaluation of Board Effectiveness - Supplementary Principle 4.11.3 • An evaluation of the performance and effectiveness of the BOD is conducted once a year by third party organizations in such a way that the individual opinions of the Directors are efficiently obtained. Each Director completes a questionnaire and/or is individually interviewed. Based on the results of the evaluation, the BOD analyzes and evaluates their effectiveness and acts on any opportunities for improvement. • In fiscal year 2022, an evaluation of the performance and effectiveness of the BOD was conducted by third party organizations through a questionnaire and subsequent individual interviews of all the Directors. The questionnaire focused on “Strategic Alignment & Engagement,” “Composition & Structure,” “Processes & Practices,” “Management Oversight,” and “Board Culture and Dynamics” as key evaluation items, and Directors were also requested to make self-evaluations about the “Oversight by ASC and Nomination Committee.” After incorporating the analysis and recommendations made by the third-party organization, the overall evaluation result was explained by the third-party organization and discussed by all Directors. In fiscal year 2022, the Compensation Committee members conducted a self-evaluation on the “Effectiveness of the Compensation Committee” by receiving support from the third-party organization on the creation of questionnaires. The Compensation Committee reported to the BOD about the results of the self-evaluation and actions for improvement. During the discussion, it was concluded that the BOD was working effectively, confirming that (i) there were no new material concerns which were pointed out (ii) there is strong leadership in management and the BOD and, (iii) governance is working robustly, especially as the reporting from the advisory committees to the BOD was strengthened. In addition, the BOD confirmed certain improvements from the previous fiscal year concerning “content of Board discussions and practice of Board meeting” and “optimal Board composition.” These were matters that were pointed out in previous fiscal year evaluations and continued to be prioritized as important matters this fiscal year. The BOD also confirmed the effectiveness of the ASC, Nomination Committee and Compensation Committee and their contributions to the robust corporate governance of the Company. (6) Dialogue with Shareholders - Principle 5.1 • The Company is structured to continue a “purposeful dialogue” with its shareholders on topics including corporate governance, environmental and social initiatives, corporate and financial strategy, research and development, capital policy, business performance, and business risk, each from a short-term and medium-to-long-term perspective. This dialogue is conducted with transparency, and in adherence to the Fair Disclosure Rules, to enable the Company to build strong relationships of trust with its shareholders, who share with the Company the common interest of realizing “sustainable growth of corporate value.” o The Chief Financial Officer (CFO) is responsible for the overall engagement with shareholders, and the Global Head of Investor Relations (IR) in the Global Finance division is accountable for the operational IR activities. When planning and conducting meetings with shareholders, the Global Head of IR determines the meeting style, discussion points and participants from management (which may include the President & CEO, the CFO, or other senior management members), taking into consideration the objectives and impact of the meeting, and the characteristics of each shareholder. o The IR team promotes dialogue with shareholders by collecting necessary information from various internal divisions such as finance, R&D, and commercial, and endeavors to find ways to communicate concisely and effectively with shareholders through close collaboration with these divisions. o The Company continues to enhance its activities to deepen shareholders' understanding of topics including the Company's management policy, sustainability matters, managerial and financial strategies, research and development, capital policy, financial performance, and risks. With respect to engagement with institutional investors and security analysts, in addition to one-on-one meetings, the Company holds quarterly earnings conferences and hosts multiple IR events that focus on topics of high shareholder interest. Information about earnings announcements and IR events is disclosed externally through postings on the Investors section of the corporate website, and the Company also holds corporate presentations specifically for individual investors. A video recording of the presentation given by the President & CEO at the Annual Shareholders Meeting and a letter to shareholders are also posted on the website to report on the Company’s management policy and financial performance. o The senior management understand shareholders' interests and concerns, which are raised during dialogues with the Company, and utilize them for business analysis, for business strategy planning, and for considering the optimal way of disclosing information. o Based on the feedback received from shareholders, the Company started disclosing individual product revenues and cash

6 flow forecasts in financial statements from fiscal year 2019, and disclosing performance against KPIs and the individual compensation of Directors from fiscal year 2020. In addition, the Company started holding group meetings on a regular basis with Independent External Directors as an opportunity for direct dialogue between institutional shareholders and the Company from fiscal year 2020. o When communicating with shareholders, the Company appropriately manages insider information in compliance with internal rules and applicable regulatory requirements and discloses that information in a fair and timely manner. In advance of earnings announcements, the Company implements a "silent period," during which no communication with shareholders regarding earnings information is permitted. o Please refer to “IR Activities” in Part III section 2 of this report for the disclosure status of dialogue with shareholders including detailed IR activities (7) Company's measures with respect to the Corporate Pension Funds as the Managing Organization - Principle 2.6 • The Takeda Pharmaceutical Pension Association is administered by designated or selected expert staff mainly from the areas of HR and finance, who are knowledgeable about corporate pension and pension fund management. Taking into consideration the importance of securing long-term pension payment for employees, the Association incorporates expert knowledge and consulting from external specialists in its pension fund management policy. In addition, the actual management of the pension fund investment is outsourced to an external consigned institution so that conflicts of interest which could arise between pension fund beneficiaries and companies are appropriately managed. The Company should not be involved in directing pension fund investments or exercising voting rights. The investment is monitored regularly by the Asset Management Committee, changing the portfolio strategy as necessary. The committee takes into consideration the maximizing of benefits to the participants and beneficiaries of the Company’s corporate pension program, paying close attention to the potential impact to the Company’s financial conditions at the same time. • The Company will continue to pay close attention to the importance that the pension fund management plays in potentially impacting employees’ stable asset formation and the Company’s financial conditions. The Company continues to strengthen its systems to fulfil its responsibilities as the asset owner. (8) [Actions to implement management that is conscious of cost of capital and stock price] - Principle 5.2 • Please refer to “Views on Cost of Capital and Market Valuation” in the “Stock Information & Shareholder Returns” section of the Company website. ➢ Views on Cost of Capital and Market Valuation: https://www.takeda.com/investors/stock-information/ 2. Capital Structure Foreign Shareholding Ratio: 30% or more (as of end of March 2023) [Status of Major Shareholders] Name Number of Shares Owned Percentage (%) The Master Trust Bank of Japan, Ltd. (Trust account) 261,557,600 16.77 Custody Bank of Japan, Ltd. (Trust account) 87,646,400 5.62 THE BANK OF NEW YORK MELLON AS DEPOSITARY BANK FOR DEPOSITARY RECEIPT HOLDERS 69,831,996 4.47 JP Morgan Chase Bank 385632 58,526,032 3.75 State Street Bank West Client-Treaty 505234 28,560,898 1.83 Nippon Life Insurance Company 28,288,385 1.81 JP Morgan Securities Japan Co., Ltd. 25,622,220 1.64 SSBTC CLIENT OMNIBUS ACCOUNT 21,859,563 1.40 JP Morgan Chase Bank 385781 20,172,220 1.29 Takeda Science Foundation 17,911,856 1.14 Controlling Shareholder (except for Parent Company): None Parent Company: N/A 3. Corporate Attributes Listed Stock Market and Market Section Tokyo Prime Market, Nagoya Premier Market, Sapporo Existing Market, Fukuoka Existing Market Fiscal Year-End End of March Type of Business Pharmaceuticals Number of Employees (consolidated) as of the End of the Previous Fiscal Year More than 1,000 persons Sales (consolidated) as of the End of the Previous Fiscal Year More than 1 trillion Yen

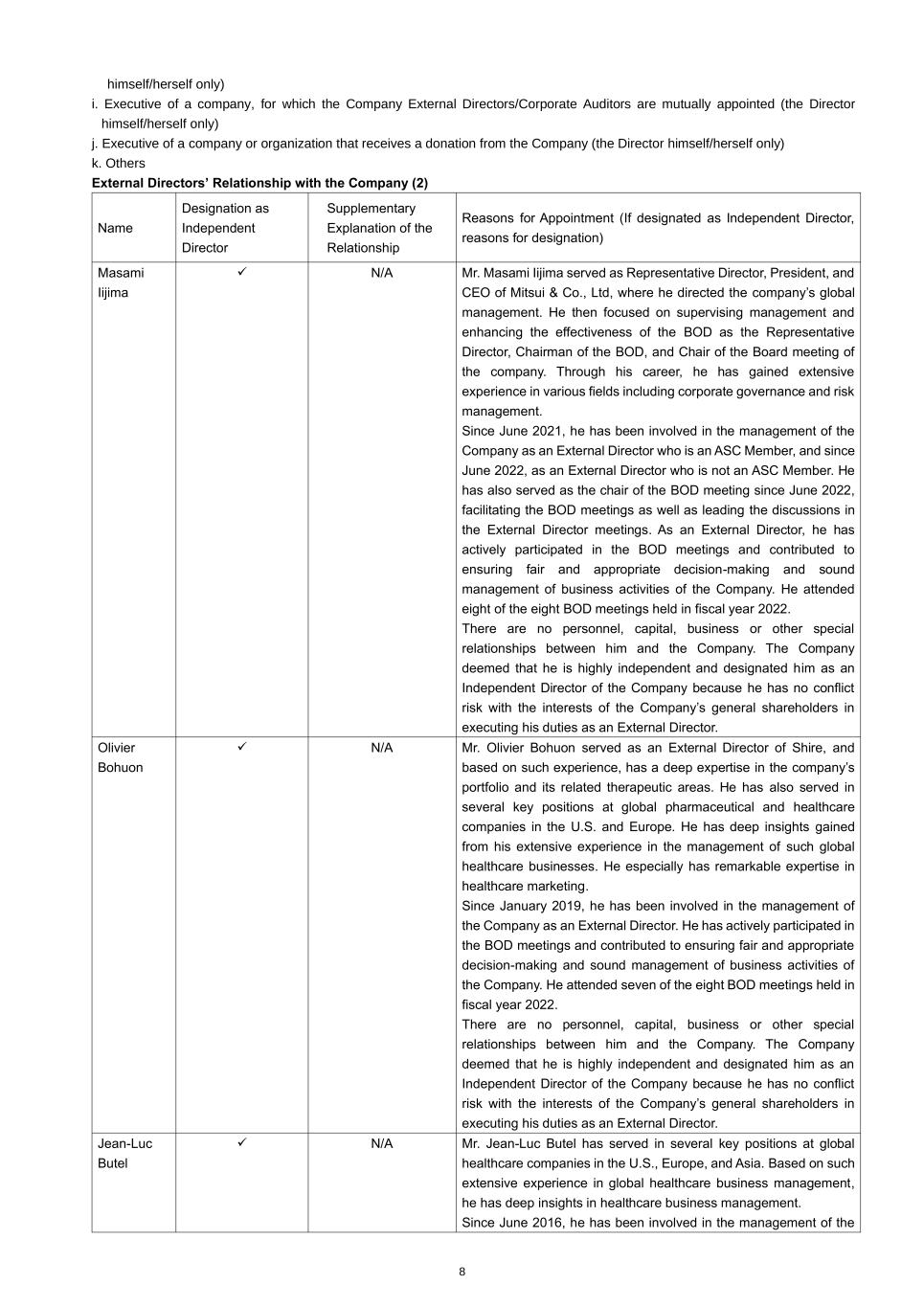

7 Number of Consolidated Subsidiaries as of the End of the Previous Fiscal Year More than 100 and less than 300 4. Policy on Measures to Protect Minority Shareholders when Conducting Transactions with Controlling Shareholders ― 5. Other Special Circumstances which may have a Material Impact on Corporate Governance ― II. Business Management Organization and Other Corporate Governance Systems regarding Decision- making, Execution of Business, and Oversight in Management 1. Organizational Composition and Operation Organization Form: Company with Audit and Supervisory Committee [Directors] Maximum Number of Directors Stipulated in the Articles of Incorporation 16 persons Term of Office Stipulated in the Articles of Incorporation (Directors who are members of the ASC) two years Term of Office Stipulated in the Articles of Incorporation (Directors who are NOT members of the ASC) one year Chair of the Board Meeting Independent External Director Number of Directors 15 persons Election of External Directors Elected Number of External Directors 12 persons Number of Independent Directors 12 persons External Directors’ Relationship with the Company (1) Name Attribute Relationship with the Company (*1) a b c d e f g h i j k Masami Iijima Coming from another company Olivier Bohuon Coming from another company Jean-Luc Butel Coming from another company Ian Clark Coming from another company Steven Gillis Coming from another company John Maraganore Coming from another company Michel Orsinger Coming from another company Miki Tsusaka Coming from another company Koji Hatsukawa Certified public accountant Yoshiaki Fujimori Coming from another company Emiko Higashi Coming from another company Kimberly A. Reed Coming from another company *1 Categories for “Relationship with the Company”: a. Executive of the Company or its subsidiaries b. Non-executive Director or executive of a parent company of the Company c. Executive of a fellow subsidiary company of the Company d. A party whose major client or supplier is the Company or an executive thereof e. Major client or supplier of a listed company or an executive thereof f. Consultant, accountant or legal professional who receives a large amount of monetary consideration or other property from the Company besides compensation as a Director/Auditor g. Major shareholder of the Company (or an executive of the said major shareholder if the shareholder is a legal entity) h. Executive of a client or supplier company of the Company (which does not correspond to any of d, e, or f) (the Director

8 himself/herself only) i. Executive of a company, for which the Company External Directors/Corporate Auditors are mutually appointed (the Director himself/herself only) j. Executive of a company or organization that receives a donation from the Company (the Director himself/herself only) k. Others External Directors’ Relationship with the Company (2) Name Designation as Independent Director Supplementary Explanation of the Relationship Reasons for Appointment (If designated as Independent Director, reasons for designation) Masami Iijima ✓ N/A Mr. Masami Iijima served as Representative Director, President, and CEO of Mitsui & Co., Ltd, where he directed the company’s global management. He then focused on supervising management and enhancing the effectiveness of the BOD as the Representative Director, Chairman of the BOD, and Chair of the Board meeting of the company. Through his career, he has gained extensive experience in various fields including corporate governance and risk management. Since June 2021, he has been involved in the management of the Company as an External Director who is an ASC Member, and since June 2022, as an External Director who is not an ASC Member. He has also served as the chair of the BOD meeting since June 2022, facilitating the BOD meetings as well as leading the discussions in the External Director meetings. As an External Director, he has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended eight of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Olivier Bohuon ✓ N/A Mr. Olivier Bohuon served as an External Director of Shire, and based on such experience, has a deep expertise in the company’s portfolio and its related therapeutic areas. He has also served in several key positions at global pharmaceutical and healthcare companies in the U.S. and Europe. He has deep insights gained from his extensive experience in the management of such global healthcare businesses. He especially has remarkable expertise in healthcare marketing. Since January 2019, he has been involved in the management of the Company as an External Director. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended seven of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Jean-Luc Butel ✓ N/A Mr. Jean-Luc Butel has served in several key positions at global healthcare companies in the U.S., Europe, and Asia. Based on such extensive experience in global healthcare business management, he has deep insights in healthcare business management. Since June 2016, he has been involved in the management of the

9 Company as an External Director who is an ASC Member, and since June 2019, as an External Director who is not an ASC Member. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended seven of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Ian Clark ✓ N/A Mr. Ian Clark served as an External Director of Shire, and based on such experience, has a deep expertise in the company’s portfolio and its related therapeutic areas. He has also served in several key positions at global healthcare companies in Europe and Canada. He has gained deep insights through such extensive experience in the management of global healthcare business. He especially has remarkable expertise in oncology marketing and managing the biotechnology division of healthcare companies. Since January 2019, he has been involved in the management of the Company as an External Director. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended eight of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Steven Gillis ✓ N/A Mr. Steven Gillis served as an External Director of Shire, and based on such experience, has deep expertise in the company’s portfolio and its related therapeutic areas. He has a Ph.D. in biology and has served in several key positions at global healthcare companies in the U.S. and Europe. He also has extensive experience in global healthcare business management and especially has significant expertise in immune-related healthcare business. Since 2019, he has been involved in the management of the Company as an External Director. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended seven of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. John Maraganore ✓ N/A Mr. John Maraganore has a wide experience in the pharmaceutical industry for more than 30 years. He served as the Director and CEO of Alnylam Pharmaceuticals for around 20 years and retired at the end of 2021. Prior to that, he served as an officer and a member of the management team at Millennium Pharmaceuticals. Since June 2022, he has been involved in the management of the Company as an External Director. He has actively participated in the

10 BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended seven of the seven BOD meetings held after his appointment in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Michel Orsinger ✓ N/A Mr. Michel Orsinger has served in several key positions at global healthcare companies in the U.S. and Europe. He has gained deep insights from extensive experience in global healthcare business management. He has been involved in the management of the Company as an External Director who is not an ASC Member since June 2016, as an External Director who is an ASC Member since June 2019 and as an External Director who is not an ASC Member since June 2022. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He attended eight of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Miki Tsusaka ✓ N/A Ms. Miki Tsusaka has exceptional leadership skills and wide expertise in global business & strategy and data & digital, and deep insights in driving innovation and creating value by technology utilization. She is also well-versed in global market trends and insights, having worked with companies across Asia, Europe, and North America. She also has deep knowledge and a wide variety of experience working in a global environment across various industries. In June 2023, she was appointed as an External Director with the aim of supporting the Company’s continuous growth and success, promoting sustainable development, giving appropriate oversight of the management and ensuring sound management of the business. There are no personnel, capital, business or other special relationships between her and the Company. The Company deemed that she is highly independent and designated her as an Independent Director of the Company because she has no conflict risk with the interests of the Company’s general shareholders in executing her duties as an External Director. Koji Hatsukawa ✓ N/A Mr. Koji Hatsukawa has extensive experience and expertise in the areas of corporate finance and accounting as a certified public accountant. He has also held top management positions, including serving as representative and CEO of an auditing firm. Since June 2016, he has been involved in the management of the Company as an External Director who is an ASC Member, and since June 2019, he has been serving as the head of the ASC. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He has also contributed to the realization of the ASC’s vision of ensuring sound and continuous growth of the Company, creating mid- and long-term

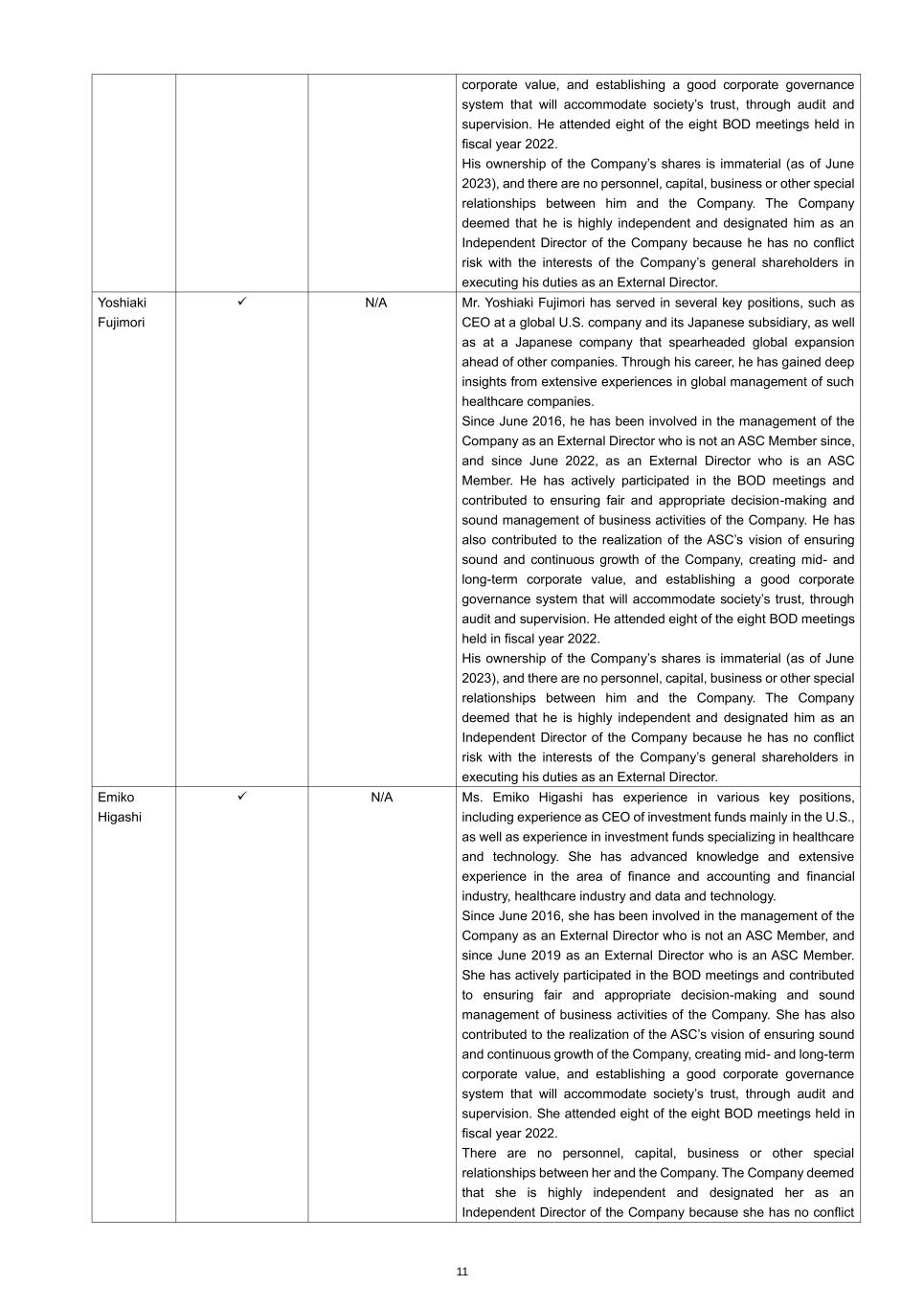

11 corporate value, and establishing a good corporate governance system that will accommodate society’s trust, through audit and supervision. He attended eight of the eight BOD meetings held in fiscal year 2022. His ownership of the Company’s shares is immaterial (as of June 2023), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Yoshiaki Fujimori ✓ N/A Mr. Yoshiaki Fujimori has served in several key positions, such as CEO at a global U.S. company and its Japanese subsidiary, as well as at a Japanese company that spearheaded global expansion ahead of other companies. Through his career, he has gained deep insights from extensive experiences in global management of such healthcare companies. Since June 2016, he has been involved in the management of the Company as an External Director who is not an ASC Member since, and since June 2022, as an External Director who is an ASC Member. He has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. He has also contributed to the realization of the ASC’s vision of ensuring sound and continuous growth of the Company, creating mid- and long-term corporate value, and establishing a good corporate governance system that will accommodate society’s trust, through audit and supervision. He attended eight of the eight BOD meetings held in fiscal year 2022. His ownership of the Company’s shares is immaterial (as of June 2023), and there are no personnel, capital, business or other special relationships between him and the Company. The Company deemed that he is highly independent and designated him as an Independent Director of the Company because he has no conflict risk with the interests of the Company’s general shareholders in executing his duties as an External Director. Emiko Higashi ✓ N/A Ms. Emiko Higashi has experience in various key positions, including experience as CEO of investment funds mainly in the U.S., as well as experience in investment funds specializing in healthcare and technology. She has advanced knowledge and extensive experience in the area of finance and accounting and financial industry, healthcare industry and data and technology. Since June 2016, she has been involved in the management of the Company as an External Director who is not an ASC Member, and since June 2019 as an External Director who is an ASC Member. She has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. She has also contributed to the realization of the ASC’s vision of ensuring sound and continuous growth of the Company, creating mid- and long-term corporate value, and establishing a good corporate governance system that will accommodate society’s trust, through audit and supervision. She attended eight of the eight BOD meetings held in fiscal year 2022. There are no personnel, capital, business or other special relationships between her and the Company. The Company deemed that she is highly independent and designated her as an Independent Director of the Company because she has no conflict

12 risk with the interests of the Company’s general shareholders in executing her duties as an External Director. Kimberly A. Reed ✓ N/A Ms. Kimberly A. Reed was the first woman to serve as Chairman of the Board of Directors, President, and CEO of the Export-Import Bank of the United States (EXIM), —the nation’s official $135 billion export credit agency—where she helped companies succeed in the competitive global marketplace. She has extensive domestic and international experience, including as CEO and Senior Advisor at the highest levels of the U.S. Government; President of an organization that focused on nutrition, health, and agriculture and worked with global companies on science-based communication strategies; and Counsel with the U.S. Congress. She is a Council on Competitiveness Distinguished Fellow and has served on numerous nonprofit Boards of Directors and Advisory Committees, including the Alzheimer’s Association and Indiana University-Bloomington School of Public Health. Her leadership and wide expertise has enabled her to successfully navigate geopolitical, regulatory, international business, and public policy environments; address ESG; conduct oversight and investigations; and plan for future challenges. Since June 2022, she has been involved in the management of the Company as an External Director who is an ASC Member. She has actively participated in the BOD meetings and contributed to ensuring fair and appropriate decision-making and sound management of business activities of the Company. She has also contributed to the realization of the ASC’s vision of ensuring sound and continuous growth of the Company, creating mid- and long-term corporate value, and establishing a good corporate governance system that will accommodate society’s trust, through audit and supervision. She attended seven of the seven BOD meetings held after her appointment in fiscal year 2022. There are no personnel, capital, business or other special relationships between her and the Company. The Company deemed that she is highly independent and designated her as an Independent Director of the Company because she has no conflict risk with the interests of the Company’s general shareholders in executing her duties as an External Director. Voluntary Establishment of Committee(s) Corresponding to the Nomination Committee or Remuneration Committee: Established Committee’s Name, Composition, and Attributes of the Chairperson: • Nomination Committee Name Nomination Committee Number 5 Chairperson External Director Member 4 External Directors • Compensation Committee Name Compensation Committee Number 4 Chairperson External Director Member 3 External Directors Supplementary Explanation The Nomination Committee and the Compensation Committee were established as voluntary advisory bodies to the BOD. The committees serve to ensure transparency and objectivity in decision-making processes and results relating to personnel matters of the Directors (diversity of the BOD, appointment and reappointment of directors, and succession planning), as well as the compensation system for Directors (the level of compensation, compensation mix and setting targets of performance-based

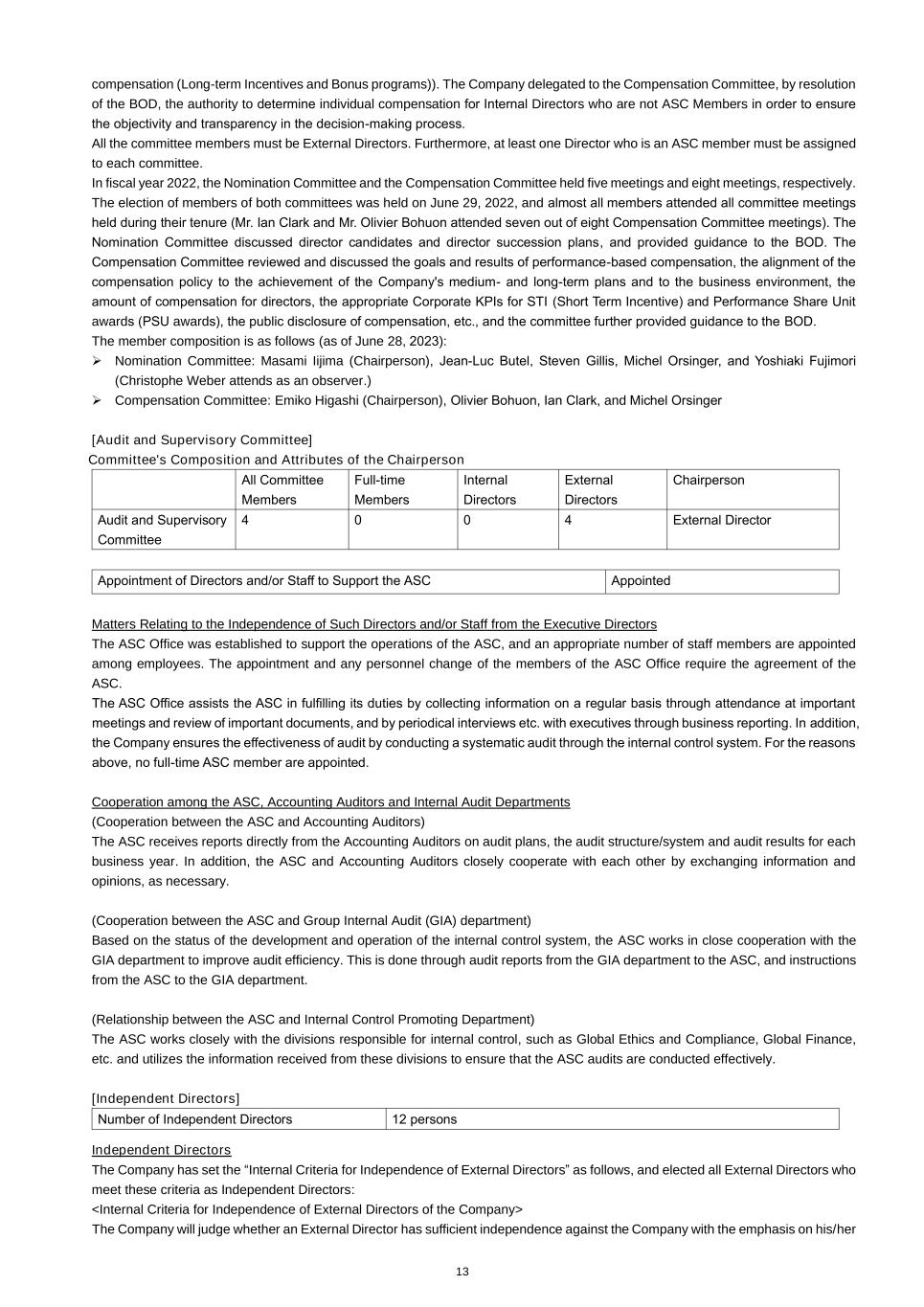

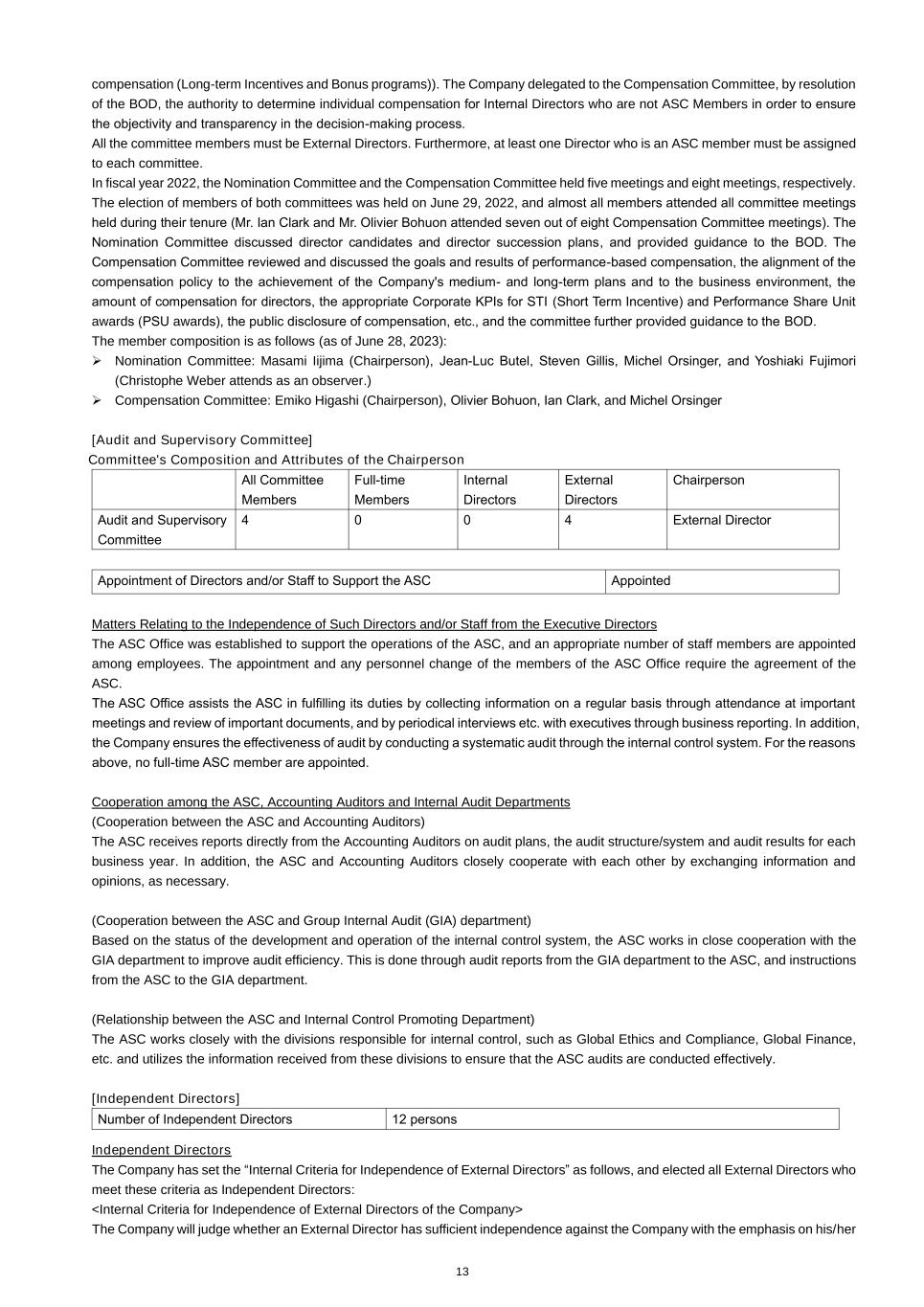

13 compensation (Long-term Incentives and Bonus programs)). The Company delegated to the Compensation Committee, by resolution of the BOD, the authority to determine individual compensation for Internal Directors who are not ASC Members in order to ensure the objectivity and transparency in the decision-making process. All the committee members must be External Directors. Furthermore, at least one Director who is an ASC member must be assigned to each committee. In fiscal year 2022, the Nomination Committee and the Compensation Committee held five meetings and eight meetings, respectively. The election of members of both committees was held on June 29, 2022, and almost all members attended all committee meetings held during their tenure (Mr. Ian Clark and Mr. Olivier Bohuon attended seven out of eight Compensation Committee meetings). The Nomination Committee discussed director candidates and director succession plans, and provided guidance to the BOD. The Compensation Committee reviewed and discussed the goals and results of performance-based compensation, the alignment of the compensation policy to the achievement of the Company's medium- and long-term plans and to the business environment, the amount of compensation for directors, the appropriate Corporate KPIs for STI (Short Term Incentive) and Performance Share Unit awards (PSU awards), the public disclosure of compensation, etc., and the committee further provided guidance to the BOD. The member composition is as follows (as of June 28, 2023): ➢ Nomination Committee: Masami Iijima (Chairperson), Jean-Luc Butel, Steven Gillis, Michel Orsinger, and Yoshiaki Fujimori (Christophe Weber attends as an observer.) ➢ Compensation Committee: Emiko Higashi (Chairperson), Olivier Bohuon, Ian Clark, and Michel Orsinger [Audit and Supervisory Committee] Committee's Composition and Attributes of the Chairperson All Committee Members Full-time Members Internal Directors External Directors Chairperson Audit and Supervisory Committee 4 0 0 4 External Director Appointment of Directors and/or Staff to Support the ASC Appointed Matters Relating to the Independence of Such Directors and/or Staff from the Executive Directors The ASC Office was established to support the operations of the ASC, and an appropriate number of staff members are appointed among employees. The appointment and any personnel change of the members of the ASC Office require the agreement of the ASC. The ASC Office assists the ASC in fulfilling its duties by collecting information on a regular basis through attendance at important meetings and review of important documents, and by periodical interviews etc. with executives through business reporting. In addition, the Company ensures the effectiveness of audit by conducting a systematic audit through the internal control system. For the reasons above, no full-time ASC member are appointed. Cooperation among the ASC, Accounting Auditors and Internal Audit Departments (Cooperation between the ASC and Accounting Auditors) The ASC receives reports directly from the Accounting Auditors on audit plans, the audit structure/system and audit results for each business year. In addition, the ASC and Accounting Auditors closely cooperate with each other by exchanging information and opinions, as necessary. (Cooperation between the ASC and Group Internal Audit (GIA) department) Based on the status of the development and operation of the internal control system, the ASC works in close cooperation with the GIA department to improve audit efficiency. This is done through audit reports from the GIA department to the ASC, and instructions from the ASC to the GIA department. (Relationship between the ASC and Internal Control Promoting Department) The ASC works closely with the divisions responsible for internal control, such as Global Ethics and Compliance, Global Finance, etc. and utilizes the information received from these divisions to ensure that the ASC audits are conducted effectively. [Independent Directors] Number of Independent Directors 12 persons Independent Directors The Company has set the “Internal Criteria for Independence of External Directors” as follows, and elected all External Directors who meet these criteria as Independent Directors: <Internal Criteria for Independence of External Directors of the Company> The Company will judge whether an External Director has sufficient independence against the Company with the emphasis on his/her

14 meeting the following quality requirements, on the premise that he/she meets the criteria for independence established by the financial instruments exchanges. The Company believes that such persons will truly meet the shareholders' expectations as the External Directors of the Company, i.e., the persons who can exert strong presence among the diversified members of the Directors and of the Company by proactively continuing to inquire the nature of, to encourage improvement in and to make suggestions regarding the important matters of the Company doing pharmaceutical business globally, for the purpose of facilitating impartial and fair judgment on the Company's business and securing sound management of the Company. The Company requires such persons to meet two or more of the following four quality requirements to be an External Director: (1) He/She has advanced insights based on the experience of corporate management; (2) He/She has a high level of knowledge in the area requiring high expertise such as accounting and law; (3) He/She is well versed in the pharmaceutical and/or global business; and (4) He/She has advanced linguistic skill and/or broad experience which enable him/her to understand diverse values and to actively participate in discussion with others. [Incentives] Incentive Policies for Directors Adoption of a performance-based remuneration system The Company introduced, as an incentive compensation for Internal Directors who are not ASC Members, an annual "Bonus (short- term incentive compensation)” to be paid based on financial and other performance results for each fiscal year and a ”long-term Incentive Plan (stock compensation)” linked with long-term company performance results over a 3-year period and with Takeda's share price. Please refer to “Directors’ Compensation Policy” attached at the end of this report. [Director Remuneration] Disclosure of Individual Directors’ Remuneration All disclosed individually Means of Disclosure: Annual Securities Report of the 146th fiscal year As for the total amount of Directors’ remuneration, the total amount of remuneration by type (cost postings relating to base salary, performance-based compensation (bonus and performance share unit awards), and non-monetary remuneration (restricted stock unit awards)), and the amount of remuneration for each Director for the fiscal year 2022, please refer to the following report: ➢ The Annual Securities Report for the 146th fiscal year (page 100 to 109) https://assets-dam.takeda.com/image/upload/v1687937183/Global/Investor/ASR/E_FY22_ASR.pdf Policies determining the amount of remuneration or the method for calculating the remuneration Existing Details of policies disclosed determining the amount of remuneration or the method for calculating remuneration The Company established the “Directors’ Compensation Policy (attached at the end of the report),” which sets forth the following policies and the decision-making process and Directors' compensation level and mix are determined based on this policy. ➢ Policies regarding calculation formula and determination of individual remuneration for Directors ➢ Policies regarding Key Performance Indicators (KPI) for performance-based compensation (bonus and performance share unit awards) and the determination of the calculation formula for such remuneration ➢ Policies regarding the calculation formula and the determination of non-monetary remuneration (restricted stock unit awards) ➢ Policies regarding the determination of remuneration mix for individual Directors ➢ Policies regarding the determination of conditions for payment of remuneration ➢ Means of the determination regarding individual remuneration for Directors Please refer to the relevant page of the Annual Securities Report for the 146th fiscal year for more details. The Company has also implemented an executive compensation recoupment policy (clawback policy). Please refer to the “Directors' Compensation Policy” to confirm the contents thereof. [Supporting System for External Directors] The Company provides, in a timely manner, relevant information about important management-related matters to External Directors to help them make informed decisions. The agenda of the BOD meetings are shared in advance. Explanations of the summary of topics to be discussed at board meetings are also provided in advance. The BOD & CEO Office is responsible for the coordination with External Directors who are not ASC Members. The ASC Office is responsible for supporting the operation of External Directors who are ASC Members. They serve as the secretariat for the ASC and shares the necessary information for auditing and other duties at the ASC. [Status of persons who have retired from positions, such as Representative Director and President] Name and details of Corporate Counselors, Advisors, etc., who formerly served in posts such as Representative Director and President, etc. of the Company

15 Name Title/ Position Duties Work Form/ Conditions (Full-time/ Part-time, Remunerated or not etc.) Date of retirement as President, etc. Term - - - - - - Total Number of Corporate Counselors, Advisors, etc., who formerly served in posts such as Representative Director and President, etc. of the Company 0 persons Other Matters The Company abolished the advisor system in July 2017 and corporate counselor system in March 2021, respectively. 2. Matters on Functions of Business Execution, Auditing, Oversight, Nomination and Remuneration Decisions (Overview of Current Corporate Governance System) At the Company, the BOD determines the fundamental policies for the group, and the TET executes the management and business operations in accordance with such decisions. The External Directors of the Board are all qualified individually and with a diverse and relevant experience as a group. The ASC, which is composed entirely of External Directors, audits and supervises the execution of directors from an independent standpoint and contributes to proper governance and decision-making of the Board. Moreover, in order to respond to management tasks that continue to diversify, the Company has established the TET, as well as the Business & Sustainability Committee (which is responsible for corporate / business development matters and sustainability-related matters), the Portfolio Review Committee (which is responsible for R&D and products related matters), and the Risk, Ethics & Compliance Committee (which is responsible for risk management, business ethics and compliance matters). These committees review important matters to ensure the agility and flexibility of business execution and ensure greater coordination among the various functions. Matters not requiring the approval of the aforementioned committees are delegated to the TET stipulated in the Takeda Group’s Management Policy (T-MAP). The Company aims for agile and efficient decision-making across the group. Board of Directors The Company has given its BOD the primary function of observing and overseeing business execution as well as decision-making for strategic or particularly important matters regarding company management. The BOD is operated by the “Board of Directors Charter.” The BOD consists of 15 Directors (including three females), including 12 External Directors, five Japanese and 10 non- Japanese, and meets in principle eight times per year to make resolutions and receive reports on important matters regarding management. In fiscal year 2022, the BOD discussed and made decisions on particularly important matters including the convocation and proposal matters of the General Meeting of Shareholders, revision of the T-MAP, enterprise risk assessments, annual and mid- range business plan, interim financial results, quarterly financial results, financial statements, business report, as well as important business execution matters such as the acquisition of Nimbus Therapeutics’ TYK2 program subsidiary and new manufacturing facility for plasma-derived therapies in Japan. In addition, the BOD had a strategic session to focus on the discussion about long-term business forecasts, R&D pipeline strategy and global business strategy, etc., as well as an executive session for discussion among only External Directors. Eight BOD meetings were held in fiscal year 2022 and all Internal Directors who took office at the end of fiscal year 2022 attended all meetings. (Please refer to the Table “External Directors’ Relationship with the Company (2)” in [Directors], Part II, section 1 of this report about the attendance of External Directors.) The BOD meeting is chaired by an Independent External Director to increase the independence of the BOD. To ensure the validity and transparency of the decision-making process for the election of Director candidates and compensation of Directors, the Company established a Nomination Committee and a Compensation Committee, all the members of which are External Directors and both of which are chaired by External Directors, as advisory committees to the BOD. Audit and Supervisory Committee The ASC ensures its independence and effectiveness in line with the ASC Charter and Internal Guidelines on Audit and Supervision of ASC. The Committee conducts audits of the Directors’ performance of duties and performs any other duties stipulated under laws and regulations and the Articles of Incorporation. From June 2021, the ASC has consisted only of External Directors to further enhance the independence of the Committee. The Company has disclosed ASC Charter in the Charters and Reports section of the Company website. ➢ Charters and Reports: https://www.takeda.com/about/corporate-governance/charters-and-reports/ Internal Audit The GIA department, comprising 53 members, the Corporate Environment, Health and Safety (EHS) department in the Global Manufacturing & Supply division, and Global Quality conduct regular internal audits for each division of the Company and each Group company using their respective guiding documents, the “Group Internal Audit Charter,” the “Global Environment, Health and Safety Policy and Position,” and the “Global Quality Policy.”

16 Takeda Executive Team The TET consists of the President & CEO and function heads of the Takeda Group who report directly to the President & CEO. Please refer to the Leadership section of the Company website. ➢ Takeda Executive Team: https://www.takeda.com/about/leadership/ Business & Sustainability Committee The Business & Sustainability Committee consists of TET members. In principle, it holds a meeting twice a month to discuss and make decisions on important execution of corporate/business development matters and sustainability-related matters. Portfolio Review Committee The Portfolio Review Committee (PRC) consists of TET members and the heads of the R&D core functions. In principle, it holds a meeting two to three times a month. The PRC is responsible for ensuring that the Company’s portfolio is optimized to achieve the organization’s strategic objectives and determines the composition of the portfolio by reviewing and approving R&D investments in portfolio assets. In addition to determining which assets and projects will be funded, the PRC defines how investments will be resourced. Risk, Ethics & Compliance Committee The Risk, Ethics & Compliance Committee consists of TET members. In principle, it holds a meeting once every quarter to discuss and make decisions on important matters concerning risk management, business ethics and compliance matters, and the risk mitigation measures. Accounting Audit KPMG AZSA LLC was appointed as the Accounting Auditor of the Company at the Company’s general shareholders meeting, consecutive auditing period of 16 years. The Company’s accounting was audited by the following three certified public accountants from KPMG AZSA LLC: Mr. Masahiro Mekada (consecutive auditing period: four years), Mr. Kotetsu Nonaka (consecutive auditing period: five years) and Mr. Hiroaki Namba (consecutive auditing period: three years). These three certified public accountants were supported by 36 other certified public accountants and 72 other individuals. The ASC makes the decision on the reappointment or non-reappointment of the Accounting Auditor after assessing the audit quality, quality control and independence of the Accounting Auditor. Liability Limitation Agreement The Company has executed agreements with Non-Executive Directors stating that the maximum amount of their liabilities for damages as set forth in Article 423, Paragraph 1 of the Companies Act shall be the amount provided by law. 3. Reasons for the Adoption of the Current Corporate Governance System The Company is a company with an Audit and Supervisory Committee, which enables the BOD to delegate a substantial part of their decision-making authority of important business executions to management, and to enhance the separation of business execution and supervision. The governance structure allows the Company to further expedite the decision-making process and enables the BOD to focus more on discussions on business strategies and, particularly important business matters. The Company is aiming to increase transparency and independence of the BOD and further enhancing its corporate governance, by establishing systems of audit and supervision conducted by the ASC, and increasing the proportion of the number of External Directors and the diversity of the BOD. III. Implementation of Measures for Shareholders and Other Stakeholders 1. Measures to Vitalize the General Shareholders Meetings and Ensure the Smooth Exercise of Voting Rights Early Notification of General Shareholders Meeting The notice of convocation is dispatched three weeks prior to the day of the meeting. In addition, the Company discloses the notice earlier than the dispatch on the Company’s corporate website and the TSE website. Scheduling Annual General Shareholders Meetings and Avoiding Peak Days The Company tries to avoid holding its Ordinary General Meeting of Shareholders on a date that is chosen by many Japanese companies. Nevertheless, the meeting date is eventually decided based on the availability of the venue as well as the administrative schedule. Allowing Electronic Exercise of Voting Rights The Company’s shareholders have been able to exercise their voting rights by electronic means since the Ordinary General Meeting of Shareholders held in June 2007.

17 Participation in the Electronic Voting Platform The Company has been utilizing an electronic voting platform operated by Investors Communications Japan, Inc. (ICJ) since the Ordinary General Meeting of Shareholders held in June 2007. Providing Convocation Notice in English To encourage shareholders to vote, the Company publishes the Japanese and English versions of the notice of convocation on its website and other websites, including on the website of the administrator of the shareholder’s register, Mitsubishi UFJ Trust and Banking Corporation. Other The Company organizes the Ordinary General Meeting of Shareholders using presentation materials displayed in a format that is easy for shareholders to understand, including the use video presentations by the President & CEO to explain performance and business policies. The Company has held the General Meeting of Shareholders as a hybrid meeting which enables direct and online participations, since 2020. In addition, the Company has the provisions in the Articles of Incorporation that a General Meeting of Shareholders may be held without specifying a venue when the BOD decides that, considering the interests of shareholders, it is not appropriate to hold the General Meeting of Shareholders with a specified venue in situations such as the spread of an infectious disease or the occurrence of a natural disaster The Company has disclosed the Articles of Incorporation and Company Share Policy in the Charters and Reports section of the Company website. Charters and Reports: https://www.takeda.com/about/corporate-governance/charters-and-reports/ 2. IR Activities Supplementary Explanation Presentation made by senior management Preparation and Publication of Disclosure Policy The disclosure of year-end and quarterly financial results requires the approval of the BOD, and other disclosure materials require the approval of the Business & Sustainability Committee. The approval authority for certain disclosures is delegated by the Business & Sustainability Committee to the CFO and the Chief Global Corporate Affairs & Sustainability Officer (“CGCASO”). The Disclosure Committee comprehensively reviews the requirements for timely disclosures to the TSE and SEC, and reports and proposes its conclusions to the CFO and the CGCASO. The “Standard Operating Procedure for Timely Disclosure and Disclosure Committee Review” was established as a rule for the Disclosure Committee. Furthermore, the Company established an “External Engagement Standard Operating Procedure (SOP)” as a guideline for external engagement, and a “Global Press Release and Statement Standard Operating Procedure” that specifies the functions within the Company with responsibility for press releases and statement disclosures, and the relevant communication channels and procedures, respectively. Regular Investor Briefings for Individual Investors In fiscal year 2022, the Company continued to engage proactively with retail investors, distributing content via e-mail to subscribers of its retail investor newsletter and press release alerts. In addition, the Company participated in two briefing events for retail investors in Japan. No Regular Investor Briefings for Analysts and Institutional Investors The Company holds earnings release conferences (conference calls and video meetings) on the same days as each quarterly results announcement. These events include an explanation of the financial results and a Q&A session in which participants can address questions directly to senior management. Additionally, the Company held virtual or face to face IR events in October and December of 2022 and February and March (twice) of 2023, which focused on explaining topics including the Company’s strategic updates and long-term financial outlook, its products, its pipeline, and access to medicine initiatives. Conference calls for earnings announcements and multiple IR events are held in Japanese and English so that both Japan domestic and overseas investors can join simultaneously. The Company posts on-demand webcasts to its website for those investors who are unable to join live and wish to learn the contents of the events. Yes

18 Regular Investor Briefings for Overseas Investors All earnings release conferences (conference calls and video meetings) and IR events are held in Japanese and English to provide information to both Japan domestic and overseas investors simultaneously. Furthermore, the Company takes into consideration time zone differences when deciding the timing of IR events, to allow as many overseas investors to participate as possible. Yes Posting of IR Materials on the Website URL:https://www.takeda.com/investors/overview/ 1TU1T Materials available on the website: Annual Securities Report (Quarterly Securities Report), Quarterly financial statements, Quarterly Financial Report, presentation materials used in earnings release conferences, Annual Integrated Reports, notices of convocation of Ordinary General Meetings of shareholders, IR conference materials, notices of resolutions, video messages from senior management, and others. Establishment of Department and/or Manager in Charge of IR Department responsible for IR: Global Finance, IR 3. Measures to Ensure Due Respect for Stakeholders Supplemental Explanation Stipulation of Internal Rules for Respecting the Position of Stakeholders The Company’s purpose is to provide “Better Health for People, Brighter Future for the World.” This expresses the Company’s vision to discover and deliver life-transforming treatments, guided by its commitment to Patients, People and the Planet. The Company’s Values, Takeda-ism, which incorporate Fairness, Honesty and Perseverance and Integrity at the core, are brought to life through actions based on, “Patient (putting the patient first) –Trust (building trust with society) – Reputation (reinforcing reputation) and Business (developing a sustainable business),” in that order. Together, they represent who we are and how we act, helping us make decisions we can be proud of today and in the future. They clearly indicate the Company’s emphasis on the importance of addressing the needs of a variety of its stakeholders, including patients. In addition, the Company implements measures to instill its Values internally, such as the “Value Ambassadors Program,” an initiative to encourage employees to instill and continuously practice the Values, and the “Global Induction Forum” (hosted by the President & CEO) aimed at cultivating the understanding of the Company including its Values and a sense of responsibility among senior leaders who have joined the Company from other companies. Moreover, the Takeda Global Code of Conduct provides ethical guidelines for employees to respect the perspectives of stakeholders. Implementation of Environmental Activities, CSR Activities, etc. [Environmental Activities] The Company focuses on three interrelated environmental sustainability programs, “Climate Action”, “Natural Resource Conservation” and “Sustainability by Design.” The Climate Action program has the overarching goal of achieving net-zero greenhouse gas emissions from the Company’s operations before 2035 and across its value chain before 2040 The Natural Resource Conservation program aims to minimize environmental impacts of the Company’s operations and conserve natural resources, with goals to achieve zero waste to landfill by fiscal year 2030, and to reduce global freshwater withdrawal by 5% by fiscal year 2025 from a 2019 fiscal year baseline The Sustainability by Design program strives to design products and services to minimize their environmental impact throughout their life cycle. The program aims to achieve a target of 50% of paper and paperboard in secondary and tertiary packaging by weight, to be made from recycled content or certified forest sustainable by fiscal year 2025 For more detailed information, please refer to “Our Commitment to the Planet” of the corporate website: https://www.takeda.com/about/corporate-responsibility/corporate-sustainability/sustainability- approach/planet/ [CSR, Philanthropy activities] The Company’s Global CSR’s philanthropic activities prioritize tangible and a long-term partnership with NPO and international organizations encouraging innovation beyond commercial products in order to support sustainable, resilient health systems for all people, everywhere. Since the launch of its Global CSR Program in fiscal year 2016, which has been decided by employee vote, the Company has provided JPY 19.7 billion (approximately USD 140.7 million) to 24